Gold World News Flash |

- How December 4th Could Trigger The "Most Violent Economic Shock In History"

- Trump Confirms Retired Marine General "Mad-Dog" Mattis Will Be America's Next Secretary Of Defense

- WHY INDIA CAN’T HIDE ITS LOVE FOR ISRAEL ANYMORE

- Trump's Treasury Secretary Pick Is A Lucky Man... Very Lucky

- Not Zero Sum: World Bond Markets Endure $1.7 Trillion Sell Off; Equities Gain $635 Billion

- Max Igan - US Led Coalition Admits to Killing Civilians in Iraq, Syria

- China Buying the Dip - 28.652 Tonnes of Physical Gold Taken Off the Shanghai Gold Exchange In One Day

- Cosmic Top Secret Propulsion Documents Leaked! -- William Tompkins

- "Trump's Job is to Prepare America for War" ~ William Engdahl

- How To Win The “War On Gold”

- Lawrie Williams: Major gold price divergence between Shanghai and London

- Most Powerful Earthquake in the World Ever

- Indian ‘Gold Ban’ a Portent of Major Events? - Jeff Nielson

- President Trump works as a Waiter at his own Hotel

- Alasdair Macleod: Credit cycles and gold

- Anonymous - Million Mask March 2016

- Real Money and Why You Need It Now

- Gold Seeker Closing Report: Gold Ends Slightly Lower Before Jobs Day

- Gold Daily and Silver Weekly Charts - Non-Farm Payrolls Tomorrow

- BREAKING: "THE WORLD IS COMING TO A END"

- GoldSeek Radio's Chris Waltzek interviews Sprott's John Embry

- Saudi Arabia Warns President Trump: KNEEL OR ELSE

- Judge Napolitano ~ Chaos At Ohio State

- Pound surges to eight-week high against dollar after Brexit minister hints at EU market access

- EU Admits It Would Dissolve If People Had A Choice - #NewWorldNextWeek

- How To Win The “War On Gold”

- BREAKING: "Putin Wants To Get Along With Trump"

- The Challenge of Rolling Back NAFTA

- Goodbye, Gold: Here’s Why the Rally is Over

- Silver Prices and Interest Rates

- GoldSeek Radio Nugget: John Embry and Chris Waltzek

- Got Gold? This Guy Just Grabbed “$1.6 Million Pot of Gold” From a Security Truck And Walked Off

- Silver Prices And Interest Rates

- Gold and the Italian Vote

- Gold ETF Mechanics

- Blockchain Technology – What Is It and How Will It Change Your Life?

- China tightens gold import quotas to curb dollar outflow

- Blockchain Technology – What Is It and How Will It Change Your Life?

- Gold and Silver in Review

- Breaking News And Best Of The Web

- Site Visit Showcases Progress and Potential at Asanko Gold Mine

| How December 4th Could Trigger The "Most Violent Economic Shock In History" Posted: 02 Dec 2016 12:30 AM PST Submitted by Nick Giambruno via InternationalMan.com, It was the one moment that convinced Hitler suicide was better than surrendering. On the morning of April 29, 1945, the bodies of Italian dictator Benito Mussolini and his mistress were dumped like garbage into Milan’s Piazzale Loreto. A large mob of Italians quickly gathered. They pelted the former leader’s corpse with vegetables. They spat on it. They urinated on it. Some even emptied their pistols into his lifeless body. After a few hours, the crowd hung the bodies from a metal girder at a nearby gas station for all to see.

I walked through Piazzale Loreto during a recent trip to Italy, which is suffering its worst economic downturn since 1945. And I realized that Italians are angrier now than they’ve been since they hung Il Duce up by his heels. Italy has had no productive growth since 1999. Real GDP per person is smaller than it was at the turn of the century. That’s almost two decades of economic stagnation. By any measure, the Italian economy is in a deep depression. And things will probably get much worse. It’s no surprise Italians are in a revolutionary mood... The Five Star Movement (M5S) is Italy’s new populist political party. It’s anti-globalist, anti-euro, and vehemently anti-establishment. It doesn’t neatly fall into the left–right political paradigm. M5S has become the most popular political party in Italy. It blames the country’s chronic lack of growth on the euro currency. A large plurality of Italians agrees. M5S has promised to hold a vote to leave the euro and reinstate Italy’s old currency, the lira, as soon as it’s in power. That could be very soon. Given the chance, Italians probably would vote to return to the lira. If that happens, it would awaken a monetary volcano. The Financial Times recently put it this way: An Italian exit from the single currency would trigger the total collapse of the eurozone within a very short period. It would probably lead to the most violent economic shock in history, dwarfing the Lehman Brothers bankruptcy in 2008 and the 1929 Wall Street crash. If the FT is even partially right, it means a stock market crash of historic proportions could be imminent. It could devastate anyone with a brokerage account. Here’s how it could all happen… On December 4, Italian Prime Minister Matteo Renzi’s current pro-EU government is holding a referendum on changing Italy’s constitution. In effect, a “Yes” vote is a vote of approval for Renzi’s government. A “No” vote is a chance for the average Italian to give the finger to EU bureaucrats in Brussels. Given the intense anger Italians feel right now, it’s very likely they’ll do just that. According to the latest polls, the “No” camp has 54% support and all of the momentum. Even prominent members of Renzi’s own party are defecting to the “No” side. If the December 4 referendum fails, Renzi has promised to resign. Even if he doesn’t, the loss would politically castrate him. In all likelihood his government would collapse. (Italian governments have a short shelf life. There have been 63 since 1945. That’s almost a rate of a new government each year.) One way or another, M5S will come to power. It’s just a matter of when. If Renzi’s December 4 referendum fails—and it looks like it will—M5S will likely take over within months. Once it’s in power, M5S will hold a referendum on leaving the euro and returning to the lira. Italians will likely vote to leave. Italy is the third-largest member of the Eurozone. If it leaves, it will have the psychological effect of yelling “Fire!” in a crowded theater. Other countries—notably France—will quickly head for the exit and return to their national currencies. Think of the euro as the economic glue holding the EU together. Without it, economic ties weaken, and the whole EU project unravels. The EU is the world’s largest economy. If it collapses, it would trigger an unprecedented global stock market crash. That’s how important Italy’s December 4 referendum is. It would be the first domino to fall. December 4 referendum fails >> M5S comes to power >> Italians vote to leave the euro currency >> European Union collapses Almost no one else is talking about this. That’s why I just spent several weeks in Italy, taking the pulse of the country. Italy’s December 4 referendum could make or break your wealth this year. If it fails, the EU, which has the world’s largest economy, will likely fall apart… triggering an epic stock market crash. |

| Trump Confirms Retired Marine General "Mad-Dog" Mattis Will Be America's Next Secretary Of Defense Posted: 01 Dec 2016 08:55 PM PST Update: Speaking during an Ohio "thank you" rally, Donald Trump just confirmed that James "Mad Dog" Mattis will be America's next Secretary of Defense.

* * * President-elect Donald Trump has chosen 66-year-old retired Marine General James N. "Mad-Dog" Mattis to be secretary of defense, according to The Washington Post. An announcement is likely by early next week, according to the people familiar with the decision. Mattis declined to comment. Spokespersons for Trump's transition team did not respond to requests for comment. Mattis, 66, retired as the chief of U.S. Central Command in spring 2013 after serving more than four decades in the Marine Corps. He is known as one of the most influential military leaders of his generation, serving as a strategic thinker while occasionally drawing rebukes for his aggressive talk. Since retiring, he has served as a consultant and as a visiting fellow with the Hoover Institution, a think tank at Stanford University. Mattis has also gotten cheers from veterans and Trump supporters online, in the form of celebratory memes dubbing him the Patron Saint of Chaos (Chaos was Mattis’s call-sign in Iraq and Afghanistan), praising his lethal “double knife hands,” and saying that he “Puts the Laughter in Manslaughter.” Mattis gets the nod ahead of a notable group who were up for the top role..

His bio - as one would expect - is impressive...(apart from the Theranos aspect) (via The Intercept)

Finally, here are 16 quotes (via FreeBeacon) to get a better feel for "mad-dog"... 1. “I don’t lose any sleep at night over the potential for failure. I cannot even spell the word.”2. “The first time you blow someone away is not an insignificant event. That said, there are some assholes in the world that just need to be shot.”3. “I come in peace. I didn’t bring artillery. But I’m pleading with you, with tears in my eyes: If you fuck with me, I’ll kill you all.”4. “Find the enemy that wants to end this experiment (in American democracy) and kill every one of them until they’re so sick of the killing that they leave us and our freedoms intact.”5. “Marines don’t know how to spell the word defeat.”6. “Be polite, be professional, but have a plan to kill everybody you meet.”7. “The most important six inches on the battlefield is between your ears.”8. “You are part of the world’s most feared and trusted force. Engage your brain before you engage your weapon.”(Mattis’ Letter To 1st Marine Division) 9. “There are hunters and there are victims. By your discipline, cunning, obedience and alertness, you will decide if you are a hunter or a victim.”10. “No war is over until the enemy says it’s over. We may think it over, we may declare it over, but in fact, the enemy gets a vote.”11. “There is nothing better than getting shot at and missed. It’s really great.”12. “You cannot allow any of your people to avoid the brutal facts. If they start living in a dream world, it’s going to be bad.”13. “You go into Afghanistan, you got guys who slap women around for five years because they didn’t wear a veil. You know, guys like that ain’t got no manhood left anyway. So it’s a hell of a lot of fun to shoot them. Actually it’s quite fun to fight them, you know. It’s a hell of a hoot. It’s fun to shoot some people. I’ll be right up there with you. I like brawling.”(CNN) 14. “I’m going to plead with you, do not cross us. Because if you do, the survivors will write about what we do here for 10,000 years.”15. “Demonstrate to the world there is ‘No Better Friend, No Worse Enemy’ than a U.S. Marine.”(Mattis’ Letter To 1st Marine Division) 16. “Fight with a happy heart and strong spirit”(Mattis’ Letter To 1st Marine Division)

|

| WHY INDIA CAN’T HIDE ITS LOVE FOR ISRAEL ANYMORE Posted: 01 Dec 2016 08:30 PM PST Why the heck should India hide its preference for Israel? Does Saudi Arabia hide its preference for Pakistan or ISIS, OR China(in particular) hide its kid-gloves attitude with North Korea? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Trump's Treasury Secretary Pick Is A Lucky Man... Very Lucky Posted: 01 Dec 2016 07:50 PM PST Authored by Jesse Eisinger, originally posted at ProPublica.org, Steven Mnuchin has made a career out of being lucky. The former Goldman Sachs banker nominated to become Donald Trump’s treasury secretary had the perspicacity to purchase a collapsed subprime mortgage lender soon after the financial crisis, getting a sweet deal from the Federal Deposit Insurance Corporation. Now, if he’s confirmed, he will likely be able to take advantage of a tax perk given to government officials. Mnuchin was born into a family of Wall Street royalty. His father was an investment banker at Goldman Sachs for 30 years, serving in top management. He and his brother landed at the powerful firm, too. After making millions in mortgage trading, Mnuchin struck out on his own, creating a hedge fund and building a record of smart and well-timed investment moves. He dodged disaster when he inherited his mother’s portfolio. She was a longtime investor with Bernie Madoff, the largest Ponzi schemer in American history. After she died in early 2005, Mnuchin and his brother quickly liquidated her investments, making $3.2 million. The Madoff trustee, Irving Picard, sued to retrieve the money from the Mnuchins, as he did from other Ponzi scheme winners, contending that they were fake gains. A court ruled that Picard could only claw back money from those who had cashed out within two years before the collapse. The Mnuchins, having pulled out roughly three years before, got to keep their Madoff money. That something was dodgy about Madoff was an open secret on Wall Street. After the financial crisis, the FDIC seized IndyMac, whose irresponsible mortgage loans failed as the housing bubble burst. Desperate to offload the bank, the FDIC subsidized the takeover by sheltering Mnuchin and his team of investors, including hedge fund managers John Paulson and George Soros, from losses. The investors injected $1.55 billion into the bank in 2009. They changed the name to OneWest and five years later, sold it to lender CIT for more than $3 billion, doubling their investment. Mnuchin also benefited from what may have been a nice fluke a little later. He served as the co-chair of Relativity Media, a film and entertainment company, for about eight months until May 2015. Relativity filed for Chapter 11 bankruptcy in July 2015. Just before it collapsed, Relativity paid off a $50 million loan to Mnuchin’s bank, OneWest, in full. Paying off one creditor in full just before filing for bankruptcy looks questionable, especially when there is the appearance that such a deal isn’t at arm’s length. One Relativity investor cried fraud and sued in 2015, contending that Relativity used its loans for improper purposes, including to make payments to OneWest. Mnuchin’s lawyer called the claims preposterous and the suit was initially thrown out. A lawyer for the investor, a film financing company, told the Los Angeles Times that it planned to refile. Mnuchin was blessed again when the Obama administration did not crack down harder on foreclosure abuses. OneWest got a reputation among activists and borrowers as one of the more feckless banks, accused of throwing borrowers out of their homes, denying mortgage modifications, and targeting the elderly with reverse mortgages. The Office of the Comptroller of the Currency settled with OneWest, and over a dozen other banks and mortgage servicers, over its robosigning practices in 2011. That regulatory settlement, called the Independent Foreclosure Review, was an utter debacle, as ProPublica has detailed. Regulators set up a process for consultants to review how the servicers had handled modification reviews, which meant in effect that the banks were monitoring themselves. The regulators did not punish any top financial executives over foreclosure mistreatment. In a happy circumstance for Mnuchin, the Department of Justice and state attorneys general did not include OneWest in their subsequent and more punitive settlement over foreclosure bad behavior. Mnuchin was fortunate once more to pick the right candidate, Trump, early; most of Wall Street assumed that Hillary Clinton would win and bet accordingly with its political donations. What good happenstance, then, that Trump didn’t mean what he said about Wall Street on the campaign trail. On the stump, Trump said, “We will never be able to fix a rigged system by counting on the people who rigged it in the first place.” He attacked Goldman Sachs by name, saying that the bank “owns” Ted Cruz, whose wife worked at the firm. “I know the guys at Goldman Sachs,” he said, “They have total, total control over [Cruz]. Just like they have total control over Hillary Clinton.” Trump put an image of Goldman CEO and chairman Lloyd Blankfein, along with other Jewish figures in finance like George Soros and Janet Yellen, in a commercial late in the campaign that was widely decried as anti-Semitic. Trump did not feel such a strong antipathy for Goldman that he passed over a firm veteran to be his treasury secretary. Mnuchin still owned $97 million of CIT stock as of last February. The Treasury Department will likely require him to sell those shares, since it poses a conflict of interest for the treasury secretary to own a stake in a financial institution. But therein lies a final good break for Mnuchin: According to a provision of the tax code, he can defer taxes, as long as he complies with certain conditions. That benefit, available to all officials who are required to sell investments upon taking a government job, could be worth millions to Mnuchin. |

| Not Zero Sum: World Bond Markets Endure $1.7 Trillion Sell Off; Equities Gain $635 Billion Posted: 01 Dec 2016 07:06 PM PST According to Bloomberg, world equity markets gained $635b in market cap, while bonds lost $1.7t -- leaving a deficit of more than $1 trillion since the election. Much of those losses were absorbed by foreign governments, the cucks participating in never ending QE schemes. The balance sheets of the ECB and Federal Reserve are looking much worse now than just one month ago. source: Bloomberg

I think it's important to remind people that the stock market has been soaring on the hopes of rapid GDP growth under Trump -- who promised to build all sorts of stuff -- walls, tunnels, bridges etc. What people don't seem to grasp, unfortunately, is that in order to fund these projects the government needs to tap the bond markets. The 10yr bond yield has risen from 1.75% to 2.44% over the past month. The cost to service the national debt has skyrocketed -- making it increasingly difficult to enact ambitious fiscal stimulus. Couple that with the break-neck gains in the dollar, especially against our chief trading rivals (+14% v yen over the past month), and one can easily paint a picture that all of the recent grandeur in equity markets has only served to ingratiate the wealthiest in the country and have hampered the specter of any real fundamental change, via fiscal stimulus, promised by Trump -- which is central to his platform. Content originally generated at iBankCoin.com |

| Max Igan - US Led Coalition Admits to Killing Civilians in Iraq, Syria Posted: 01 Dec 2016 07:00 PM PST US Led Coalition Admits to Killing Civilians in Iraq, Syria - PressTV World News, Dec 1st, 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Posted: 01 Dec 2016 06:37 PM PST |

| Cosmic Top Secret Propulsion Documents Leaked! -- William Tompkins Posted: 01 Dec 2016 06:00 PM PST Jeff Rense & William Tompkins - Cosmic Top Secret Propulsion Documents Leaked! Clip from November 30, 2016 - guest William Tompkins on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| "Trump's Job is to Prepare America for War" ~ William Engdahl Posted: 01 Dec 2016 05:30 PM PST A different point of view by William Engdahl with Joyce Riley in The Power Hour, November 21, 2016. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Posted: 01 Dec 2016 04:11 PM PST Miles Franklin |

| Lawrie Williams: Major gold price divergence between Shanghai and London Posted: 01 Dec 2016 04:01 PM PST 7p ET Thursday, December 1, 2016 Dear Friend of GATA and Gold: Sharps Pixley gold market analyst Lawrie Williams today takes note of the increasing divergence between prices in London and Shanghai, where premiums recently have risen to astounding levels. Williams' commentary is headlined "Major Gold Price Divergence between Shanghai and London" and it's posted at Sharps Pixley's internet site here: http://news.sharpspixley.com/article/lawrie-williams-major-gold-price-di... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Most Powerful Earthquake in the World Ever Posted: 01 Dec 2016 04:00 PM PST Most Powerful Earthquake in the World Ever - Full Documentary But here's the million dollar question. knowing this goes on WHY BUILD SOMETHING SO IMPORTANT, YET DEADLY, HARMFUL, DISASTROUS IN THE AREA THAT IS GOING TO GET WIPED OUT AND CAN WIPE OUT EVERYTHING ELSE IN SUCH A HUGE RADIUS? WHY... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Indian ‘Gold Ban’ a Portent of Major Events? - Jeff Nielson Posted: 01 Dec 2016 03:37 PM PST Sprott Money |

| President Trump works as a Waiter at his own Hotel Posted: 01 Dec 2016 03:00 PM PST Donald Trump spending a day in the shoes of his employees at Trump Tower Chicago. Aired on the Oprah Winfrey show, 2011 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Alasdair Macleod: Credit cycles and gold Posted: 01 Dec 2016 02:55 PM PST By Alasdair Macleod The Trump shock produced some unexpected market reactions, partly explained by investors buying into a risk-on argument,equities over bonds and buying dollars by selling other currencies and gold. This is because President-elect Trump has stated he will implement infrastructure investment and tax-cut policies. If he pursues this plan, it will lead to larger fiscal deficits, and higher interest rates. The global aspect of the markets recalibration focuses on the strains between the dollar on one side, and the euro and the yen on the other, both still mired in negative interest rates. The capital flows obviously favor the dollar, and are putting the euro currency markets under considerable strain. ... ... For the remainder of the report: https://wealth.goldmoney.com/research/goldmoney-insights/credit-cycles-a... ADVERTISEMENT K92 Drilling Significantly Upgrades Predicted Grade Company Announcement K92 Mining (TSXV:KNT) is pleased to announce the initial results from the ongoing grade control drilling program at its high-grade Kainantu Gold Mine, which is currently in the start-up phase. The results have significantly increased both the predicted grade and contained gold ounces in the first two planned production stopes. Highlights include: -- A grade increase from 5.82 grams per tonne gold in the original AMDAD Stope Model to 9.21 grams per tonne. -- Combined ounces in the two stope designs increase from 1,550 ounces of gold to 2,390 ounces. -- Intercepts include 102 grams per tonne gold over 1.1 meters and 9.21 grams per tonne over 0.5 meters in GCDD 002, and 30.19 grams per tonne gold over 2.5 meters in GCDD 001. ... ...For the remainder of the announcement: http://www.k92mining.com/2016/11/6114/ Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Anonymous - Million Mask March 2016 Posted: 01 Dec 2016 02:00 PM PST Anonymous - Million Mask March 2016 "Anonymous Protest" Anonymous November 5th 2016 ProtestWe are Anonymous,We are Legion,We do not forgive,We do not forget,Expect us. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

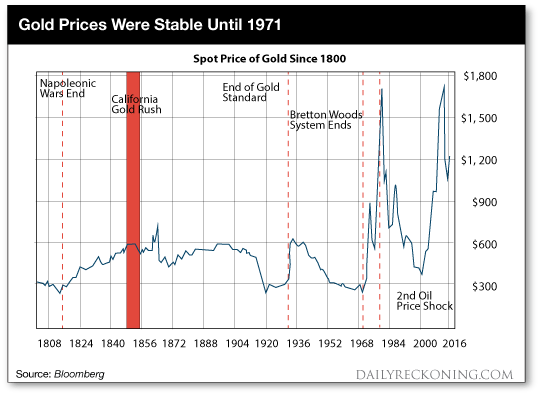

| Real Money and Why You Need It Now Posted: 01 Dec 2016 01:48 PM PST This post Real Money and Why You Need It Now appeared first on Daily Reckoning. Many years ago, before the invention of modern money or capitalism, people still had wealth – although limited. And they still had ways of keeping track of it. The principle of "fair trade" seems to be in our DNA. If you give something to your neighbor, you don't expect him to hit you over the head. You expect him to give you something back. And if you give him a whole cow and he gives you half of a rabbit, some instinct tells you it isn't "fair." Small communities could keep track of who owed what to whom. But as civilization evolved, a new kind of money was needed. In a group of related people in an isolated valley, you could remember that your cousin should give you something roughly equal in value to the wild pig you gave him… and that you should offer your son or daughter to the family from which you had gotten your wife… and so on. But as the group grew bigger, people needed a way to settle transactions without having to trust the people they were doing business with or remember who owed what to whom. When Aristotle described "money" he had our modern money in mind – something that is not wealth but acts as a placeholder for wealth. It is information; it tells you how much real wealth you can command. For the last 5,000 years, the best money has been gold (and to a lesser extent, silver). Gold is very useful as money. With it, you can do business with complete strangers. It can be used to stand in for almost any amount of wealth. Later, paper money – representing units of gold or silver – made commerce even easier. Without this modern money, an advanced economy wouldn't be possible. Real money permits an elaboration of the division of labor, and it provides the whole system with the information it needs to operate. You can't build an automobile, for example, without an extensive network of inputs – labor, steel, batteries, glass, rubber – from all over the world. And to put them together in any sensible way, you need to know what each of them costs. Getting your rubber from Malaysia will be a lot more efficient than trying to get it from Finnish suppliers; the price, expressed in units of money, will tell you that immediately. That's one reason high levels of inflation bring an economy to a halt. The placeholder loses its place. You just don't know what anything costs. And from one minute to the next, your place in line changes. Another important feature of modern money is that transactions are final. I give you a chicken… you give me a small gold coin. Done deal. I don't have to worry about what happens to you in the future. I've got my coin. I have no further claim against you. You've got no claim against me. Yes, there is always a chance that gold might lose value… that it might not hold its place in line very well. It is not a great concern, though. Prices go up and down. But according to The Golden Constant by Roy William Jastram, the value of gold today is about the same as it was – to the extent these things can be measured accurately – 500 years ago. And I don't have to worry about a third party because there's no third party, or counterparty, in the deal. Gold is a "trustless" money. We don't have to trust the guy we got it from. And it wasn't issued or created by some government agency, so we don't have to trust the feds to maintain its value. When the U.S. money system was changed in two moves – first when Lyndon Johnson asked Congress in 1968 to repeal the requirement for a gold reserve to back U.S. currency and second when Richard Nixon ended dollar convertibility to gold in 1971 – the U.S. government reintroduced a more primitive form of money. It also introduced a queer wrinkle.

With this new money, the U.S. economy – and, by extension, much of the world economy – has been shaped by credit above and beyond available savings. Trillions of dollars' worth of new hotels, houses, companies, malls, factories, dinners, drugs – and just about everything else – have been financed with this empty credit. Sooner or later, this debt must be reckoned with – either in deflation… or in inflation. But someone pays. With deflation, the creditor pays when his credit goes bad. With inflation, everyone pays as prices rise. So far, since 1971, the typical American's trust in the dollar has been rewarded with a huge loss – about 95% of the dollar's 1971 value has disappeared. As you would expect. This new money is no longer trustless. Every transaction involves a third party – the custodian of the currency. Say you build a business and sell it for $1 million. You know that you can exchange that money for a million dollars' worth of goods and services. The money represents a million dollars' worth of resources. It came from something with tangible value that was added to the economy. But if that million dollars was lent into existence by the bank or printed into existence by the central bank, rather than honestly earned and saved, there would be no corresponding addition to the world's supply of goods and services. This is just another way to look at the classic quantity theory of money. The supply of goods and services always has to be balanced against the available money. If the amount of available money (or credit) doubles and the supply of goods and services remains unchanged, prices should double, too. Not immediately. But often suddenly. Gold is distinct in that it cannot be mined easily. The costs of mining tend to increase with GDP and general price levels. So the supply of this type of money tends to rise more or less in line with the supply of goods and services. Prices remain roughly stable. There is no custodian you have to worry about. It is a trustless currency. You can see above how gold's dollar price remained fairly stable until the new money system was put into place in 1971. Since the custodian – the third party – came into the deal, the value of the greenback has fallen from $40 per ounce of gold to $1,200 per ounce. This is something to worry about, especially as debt levels are reaching new records and the custodian's commitment to maintain the value of the dollar is demonstrably weak. The feds actually want a weaker dollar and don't hesitate to say so. But at least that threat is understood, if not fully appreciated. It is "textbook." Add to the supply of money and, other things being equal, you will raise prices. You will not increase wealth levels nor GDP; you are only changing the relation of available goods and services to the available money. Also textbook is this: In an ideal, honest money system, you cannot lend money you don't have. You couldn't lend out gold unless you had gold to lend. No lending in excess of available savings = no artificial increase in the money supply = no price inflation (neither in assets nor in consumer goods and services). No artificial boom = no consequent bust. So, you see, there are obvious benefits to gold if you want to run an honest money system. And while the pre-1971 money system did not meet this ideal, the dramatic unreliability of the post-1971 money is well demonstrated in the chart above. Its dishonesty is illustrated by the amount of credit created since it began – about $59 trillion worth. This is textbook, too. This is credit in excess of available real savings. It is a fraud, and it produces fraudulent, unsustainable growth. Regards, Bill Bonner The post Real Money and Why You Need It Now appeared first on Daily Reckoning. |

| Gold Seeker Closing Report: Gold Ends Slightly Lower Before Jobs Day Posted: 01 Dec 2016 01:20 PM PST Gold fell $11.80 to $1161.20 in midmorning New York trade before it rose to see slight gains by midafternoon, but it then drifted back lower into the close and ended with a loss of 0.2%. Silver slipped to as low as $16.25 and ended unchanged on the day. |

| Gold Daily and Silver Weekly Charts - Non-Farm Payrolls Tomorrow Posted: 01 Dec 2016 01:17 PM PST |

| BREAKING: "THE WORLD IS COMING TO A END" Posted: 01 Dec 2016 12:28 PM PST "Best I can tell, the worlds going to hell, and we're sure gonna miss it a lot"................Willie Nelson The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| GoldSeek Radio's Chris Waltzek interviews Sprott's John Embry Posted: 01 Dec 2016 12:17 PM PST 3:15p ET Thursday, December 1, 2016 Dear Friend of GATA and Gold: Interviewed by GoldSeek Radio's Chris Waltzek, Sprott Asset Management's John Embry discusses the enormous amount of "paper gold" recently dumped on the futures market, the possibility that the bullion banks are trying to cover their short positions, and the Indian government's attempt to destroy the country's cash economy, among other topics. The interview is 14 minutes long and can be heard at GoldSeek here: http://radio.goldseek.com/nuggets.php CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Canadian Government Issues Key Water License Company Announcement TORONTO -- Seabridge Gold Inc. (TSX: SEA) (NYSE:SA) announced today it has received a license from the Government of Canada required for the construction, operation, and maintenance of the water storage facility and associated ancillary water works at its 100 percent-owned KSM Project in northwestern British Columbia. The license, as authorized within the International Rivers Improvement Act, regulates all structures and activities situated on transboundary waters shared with the United States that have the potential to affect water quality and quantity. The Water storage facility and its ancillary water works (water diversion ditches and tunnels) are the primary water management control systems for the KSM Project. These facilities separate water that has not contacted mined material from so-called contact water originating from disturbed areas of the mine site and then contain the contact water prior to treatment and eventual release to the receiving environment. These facilities are situated on Mitchell and Sulphurets creeks, tributaries of the transboundary Unuk River system that flows into Alaska. The license was granted for a term of 25 years under the International Rivers Improvements Regulations as administered by Environment and Climate Change Canada. ... ... For the remainder of the announcement: http://seabridgegold.net/News/Article/642/federal-government-issues-key-... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Saudi Arabia Warns President Trump: KNEEL OR ELSE Posted: 01 Dec 2016 11:00 AM PST The globalists are behind everything in my opinion. They are intentionally crashing the economy to bring in the cashless [RFID] system.The GLOBALIST controlled radical left are anti America and must be taken head on and defeated. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Judge Napolitano ~ Chaos At Ohio State Posted: 01 Dec 2016 10:30 AM PST Andrew Peter Napolitano is the Senior Judicial Analyst for Fox News Channel, commenting on legal news and trials, and is a syndicated columnist whose work appears in numerous publications, such as Fox News, The Washington Times, and Reason. The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Pound surges to eight-week high against dollar after Brexit minister hints at EU market access Posted: 01 Dec 2016 10:17 AM PST This posting includes an audio/video/photo media file: Download Now |

| EU Admits It Would Dissolve If People Had A Choice - #NewWorldNextWeek Posted: 01 Dec 2016 10:00 AM PST Welcome to New World Next Week — the video series from Corbett Report and Media Monarchy that covers some of the most important developments in open source intelligence news. In this week's episode: The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Posted: 01 Dec 2016 09:39 AM PST In a nutshell, the war on everything of value has commenced, via desperate government attempts to maintain power by propping the value of things with little or no value. Unquestionably, the world is on the cusp of political, economic, and monetary history. In which, if you simply hold physical gold and silver, you will be better positioned to "win" than perhaps 99% of the global population. |

| BREAKING: "Putin Wants To Get Along With Trump" Posted: 01 Dec 2016 09:30 AM PST Russian President Vladimir Putin tones down his anti-western rhetoric and wants to get along with President Elect Trump The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| The Challenge of Rolling Back NAFTA Posted: 01 Dec 2016 09:00 AM PST Stratfor examines the difficulties faced in unwinding the North American Free Trade Agreement (NAFTA).For more analysis, visit: https://www.stratfor.com/analysis/mex... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

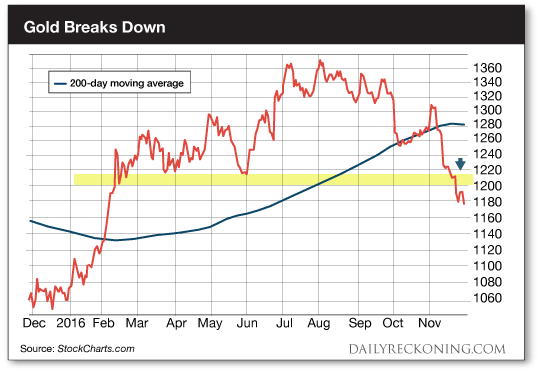

| Goodbye, Gold: Here’s Why the Rally is Over Posted: 01 Dec 2016 08:16 AM PST This post Goodbye, Gold: Here’s Why the Rally is Over appeared first on Daily Reckoning. Gold futures are quietly sinking below $1,170 this morning. The Midas Metal is breaking down. Now it runs the risk of coughing up every ounce of its comeback rally. The damage has been swift and brutal. Gold is now 14% off its summer peak. We watched precious metals and miners vault to two-year highs just a few months ago as the Fed backed off a summer rate hike and world markets shook in fear of the Brexit vote. But gold's trajectory changed dramatically during the third quarter. While the major averages chopped along, gold couldn't attract any attention. By the time the dust settled, gold had dropped toward 4-month lows. Now gold finds itself on the brink once again… "Gold has suffered its worst month since mid-2013, as the election of Donald Trump, the rising dollar and increased expectations of a US rate rise combined to send prices down 8.1% in November," The Financial Times reports. "The fall to $1,173.20 per troy ounce marked the steepest monthly sell-off since June 2013, when the precious metal lost 11% in the wake of the so-called taper tantrum. November's sell-off saw gold's year-to-date gains trimmed to 10.7%." As it turns out, a tumultuous election season turned into a last ditch effort to drum up gold buyers. It was a different world when we last updated you on gold in early November. We were days away from Hillary Clinton decisively winning the presidential election. The S&P 500 had just logged a six-day losing streak. The Dow had shed more than 100 points. And the Greenback was retreating, capping off a rally that propelled the U.S. Dollar Index to seven-month highs. That's when everything changed. Just a month later, Trump is the president-elect. The S&P 500 rests near its all-time highs after a historic run. And the Dollar Index is hitting levels we haven't seen since 2003. Each of these developments is bad news for gold. Just when it seemed like precious metals would gain some traction, the rally completely fell apart.

Gold's do-or-die moment came into play as it tested its 200-day moving average in October. It even managed to tease us with a sharp rally that briefly topped $1,300 early last month. But gold finally crashed through its 200-day moving average the day after the presidential election. And it hasn't looked back since. Now the metal has dropped below $1,200—a level that had held strong since gold's initial breakout last winter. That certainly isn't bullish… The chances for a meaningful gold rally into the holiday season just went from slim to none. Traders are looking for any reason at all to ditch their gold plays—and the financial media is offering up plenty of fodder. Fed fund futures show a 99% chance of an interest rate rise this month. That's a virtual lock—and considered by most to be bearish news for precious metals. Can gold rally in the face of higher rates? Sure. But that's not what the herd's expecting right now. Sentiment is turning incredibly negative. That's bearish for gold in the short-term. We'll continue to watch the gold breakdown for signs of a bottom. If precious metals can carve out support soon, we could see a tradable bounce. If not, gold could visit its 2015 lows in no time… Sincerely, Greg Guenthner The post Goodbye, Gold: Here’s Why the Rally is Over appeared first on Daily Reckoning. |

| Silver Prices and Interest Rates Posted: 01 Dec 2016 07:29 AM PST “History shows the only place for interest rates to go from here is higher.” Examine the above chart of interest rates for 200 years. Rates rise and fall in long cycles, 20 to 40 years from a peak to a trough. Important highs occurred in 1920 and 1981. Important lows occurred in 1946 and probably 2016. Current rates are the lowest in 200 years. Some analysts have said the lowest in 5,000 years. |

| GoldSeek Radio Nugget: John Embry and Chris Waltzek Posted: 01 Dec 2016 07:14 AM PST John Embry, Senior Strategist of Sprott Asset Management comments on the purported 8,000 tons of paper gold dropped on the market. 8,000 metric tons (2204 lbs.), 17.6 million lbs., 282 million ounces, were unleashed on the PMs sector, equivalent to a Tsunami of selling pressure. The institutions and big players are clearing their short positions in anticipation of an explosive move to the upside by gold / silver. |

| Got Gold? This Guy Just Grabbed “$1.6 Million Pot of Gold” From a Security Truck And Walked Off Posted: 01 Dec 2016 07:07 AM PST ShtfPlan |

| Silver Prices And Interest Rates Posted: 01 Dec 2016 07:03 AM PST Many hyperinflations have occurred in the past 100 years. Example: Argentina has devalued against the U.S. dollar by 10 trillion to one since about 1950. The continued devaluation of the U. S. dollar, loss of reserve currency status, and coming massive "stimulus" spending could result in hyperinflation in the United States. Silver will reach incredible prices in such a disastrous situation. Few if any will be pleased with the consequences of hyperinflation, but owning silver will help mitigate the trauma. |

| Posted: 01 Dec 2016 06:44 AM PST This brings us to next week's vote in Italy where they are worried about the possibility of a defeat for Prime Minister Matteo Renzi's constitutional reform referendum not going the Prime Ministers way. He has said that he would resign if he loses this referendum and if he does then an election would follow swiftly. According to the polls the populist Five Star Movement, led by Beppe Grillo, a famous comic, could win and become the new governing body. |

| Posted: 01 Dec 2016 06:41 AM PST Exchange traded investment vehicles backed by physical gold refer to a group of trusts, funds, or other legal entities which hold gold bars with a custodian in a vault and which issue securities, units or other fractional ownership claims against that gold. These securities are pitched and marketed as an alternative to direct ownership of gold bullion and these products have seen significant expansion and evolution over the last 10-12 years. |

| Blockchain Technology – What Is It and How Will It Change Your Life? Posted: 01 Dec 2016 05:54 AM PST Blockchain technology – What is it? Latest developments – Royal Mint Gold & CME, Goldman Sachs and Santander Why do we need it? It’s about value Blockchain is an extension of economics Blockchain allows us reduce uncertainty and risk How will it change your life? |

| China tightens gold import quotas to curb dollar outflow Posted: 01 Dec 2016 05:35 AM PST By Henry Sanderson and Lucy Hornby China has curbed gold imports in the wake of government attempts to clamp down on capital leaving the country, according to traders and bankers. Some banks with licenses have recently had difficulty obtaining approval to import gold, they said -- a move tied to China's attempts to stop a weakening renminbi by tightening outflows of dollars, the banks added. The hit to gold imports comes as China tightens restrictions on overseas deals by state-owned companies in an effort to limit capital outflows that has seen the renminbi fall to its lowest against the dollar in eight years. ... For the remainder of the report: https://www.ft.com/content/1cf17928-b706-11e6-961e-a1acd97f622d ADVERTISEMENT Golden Predator Finds New Veins of up to 30.8 g/t Gold; Company Announcement VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V:GPY, OTCQX:NTGSF) is pleased to announce additional surface exploration results and the results of airborne geophysical surveys from ongoing work at the 3 Aces project in southeastern Yukon, Canada. Highlights include: -- Seven of Spades: Newly discovered zone with stacked flat lying quartz veins returning values up to 18.55 g/t gold. -- Queen of Spades: Newly discovered zone with values up to 30.8 g/t gold. -- Jack of Spades: Additional results from continuous panel sampling of a second higher bench returned 20 meters of 7.62 g/t gold including 11.7 g/t gold over 12.4 meters and 37.9 g/t gold over 1.7 meters. -- Three of Spades: Additional assays have increased strike length of vein with returns including 6.95 g/t gold. ... ... For the remainder of the announcement: http://goldenpredator.com/_resources/news/nr_2016_11_21.pdf Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Blockchain Technology – What Is It and How Will It Change Your Life? Posted: 01 Dec 2016 05:02 AM PST gold.ie |

| Posted: 01 Dec 2016 03:52 AM PST Gecko Research reviews the past week in gold and charts their actions. Gold lost 1.9% or $23 last week to close on Friday at $1,184.10. Silver was, believe it or not, almost flat for the week as it closed at $16.51, down only 4c. The gold to silver ratio was 71.7 at the end of the week. |

| Breaking News And Best Of The Web Posted: 01 Dec 2016 01:37 AM PST OPEC agrees to cut output. Oil jumps, stocks rise, gold falls. The political focus shifts to upcoming Italian, French and Austrian elections, all of which could go against the establishment. India’s war on cash may turn into war on gold. Political class still searching for an explanation (see “Best of the Web”). Trump’s cabinet takes […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Site Visit Showcases Progress and Potential at Asanko Gold Mine Posted: 01 Dec 2016 12:00 AM PST Analysts following Asanko Gold came away from a recent site visit with positive expectations for the company's Asanko Gold Mine in Ghana. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment