Gold World News Flash |

- From Unloved & Unwanted to George Washington on Steroids: The U.S. Dollar

- URGENT: JULIAN ASSANGE "PROOF OF LIFE" Dec 15 2016, Sean Hannity - on DNC Leaks.

- Beware The 'Quad Witch' , It Has Arrived, Prepare Accordingly

- 2016 Facts And Figures Quiz

- URGENT: Julian Assange Is BACK! He Just Destroyed Russia Hack LIES with Just One Sentence…

- BREAKING: Major Economic Warning Sign COLLAPSE in EUROPE -Euro is Parity With USD.

- "When Gold Goes Above 1430 We Whack It"

- BREAKING: The Establishment’s Plan To Divide - Donald Trump, Fake News & Russia

- Fake News is a CIA Psyop -- Jim Fetzer

- Gold Seeker Weekly Wrap-Up: Gold and Silver Fall Over 2% and 4% on the Week

- Isolating Russia: A Fool’s Errand

- COT Gold, Silver and US Dollar Index Report - December 16, 2016

- Harry Dent: "Gold to go down in 2017"

- Doug Pollitt: 'Tinfoil hat crowd' was right, and gold mining executives are saps

- Jim’s Mailbox

- High gold premiums in China are demand-driven, Maguire tells KWN

- Ron Paul ~ Future Of The FED

- TF Metals Report: Silver price manipulation continues

- Silver Price Manipulation Continues In 2016

- The Alarming Truth About the Fed’s Rate Hike

- Who Controls The World?

- Radical Gold Underinvestment 3

- Agenda 21 Documentary Anonymous

- Flation And The Surge Of Silver

- Doug Pollitt: 'Tinfoil hat crowd' was right, and gold mining executives are saps

- Martin Armstrong, 2010-2011

- Radical Gold Under Investment

- Bitcoin's rally crushed every other currency in 2016

- Financial Meltdown Around The Corner? – Jim Rickards’ 2017 Outlook

- Gold premiums in China at 3-year high as Indian demand stays weak

- Gold & Miners Bottoming Signs

- Trump Making Deficits and Public Debt Great Again

- Breaking News And Best Of The Web

| From Unloved & Unwanted to George Washington on Steroids: The U.S. Dollar Posted: 16 Dec 2016 09:26 PM PST From Unloved & Unwanted to George Washington on Steroids: The U.S. Dollar Chart of the Day | ||||

| URGENT: JULIAN ASSANGE "PROOF OF LIFE" Dec 15 2016, Sean Hannity - on DNC Leaks. Posted: 16 Dec 2016 07:30 PM PST HUGE: JULIAN ASSANGE PROOF OF LIFE Dec 15 2016, Sean Hannity Show - on DNC Leaks.~~ The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||

| Beware The 'Quad Witch' , It Has Arrived, Prepare Accordingly Posted: 16 Dec 2016 07:00 PM PST More proof that gold is completely manipulated. The traders even picked amount where they will not allow gold to go above. Housing starts, permits collapse. Nowcast is now predicting that GDP will drop to 1.7% for the 4th Quarter. The Dow is overbought, we haven't seen this since the tech... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||

| Posted: 16 Dec 2016 06:30 PM PST As Nick Colas writes, one thing is certain: 2016 was a truly historic year. From Donald Trump's unorthodox but successful campaign for President to the Brexit vote, popular votes shifted the course of global politics in ways very few could have imagined a year ago. Here is a brief quiz that highlights the year's politics, developments in technology, and changes in the U.S. labor market/economic policy. The idea here, Colas writes, is to (hopefully) shed a little light and (more importantly) humor on the events of 2016 and what they might mean for 2017. Which stock has most contributed to the Dow's move this year to 20,000? How's the FANG thing working these days? And how has a "Real" (60/40 stock/bond) investor done since Election Day (not great actually…). Read on for the answers and a few other questions about the year. From Convergex' Nick Colas I am a big fan of the weekly National Public Radio show "Wait, Wait, Don't Tell Me." It is, by NPR standards, a nonpartisan news quiz show that uses humor to inform. If you don't know the show, check it out. If you do, you'll recognize the spirit of the questions below. The idea here is to highlight the most notable events of 2016 and place them into a greater context. In conversations with scores of clients and friends in the last few weeks one theme comes up repeatedly: 2016 has been a truly momentous year. Sometimes the years go by quickly because nothing much new happens. This one is the opposite - 2016 feels like "You are there" history in the making. Today we will cover Trump/Brexit, and bit of technology and economics. We'll finish off tomorrow with a few other subjects. Topic #1: Donald Trump Question 1: President Elect Trump uses social media to deliver his message directly to his supporters. How many tweets/retweets has he sent since setting up his @realDonaldTrump Twitter account in March 2009?

Answer: D. As of this Monday, Trump had sent a total of 34,121 tweets/retweets. That is an average of 12 messages per day, every day. And if you put this in historical context, not all that surprising. FDR had his fireside chats using the then-relatively new medium of radio. JFK's good looks played well with television audiences. Politicians understand that "The medium is the message". Question 2: While Mr. Trump has over 17 million Twitter followers, he himself only follows 40 accounts. Which one of these people is on that select list?

Answer: All of the above. Having the President-Elect follow you on Twitter is essentially the most exclusive club in the world. By comparison, Augusta National Golf Club has more members, at about 300 currently. Question #3: Which one of these is listed as a "Signature cocktail" at the bar at Trump Tower NYC? (check all that apply).

Answer: A & D. Worth noting: Mr. Trump himself does not drink alcohol. And if you want to try any of these cocktails, be ready for a wait. Trump Tower is locked down tight at the moment, as anyone who has been to 56th and 5th can tell you. * * * Topic #2: Technology Question #4: On July 22, 2016, a Japanese company made the very last unit of a product that profoundly changed the way the world consumed entertainment and information. What was it?

Answer: C (VCR machine). Phillips made the first mass market video cassette recorder available in 1972. The product started to gain broad appeal in the late 1970s as popular movies became available for purchase or rental, allowing consumers to view content at home. From there it is a straight line to Netflix streaming, Hulu and Apple TV. And the global long term success of the VCR – 40-plus years in constant production – is a record that will likely never be broken. For reference, consider that the iPhone is 9 years old. Only 31 years to go…. * * * Topic #3: Brexit Question #5: What do Boston (England, not MA) and Gibraltar have in common when it comes to the Brexit vote?

Answer: B (the two extremes). The town of Boston voted 76% to "Leave", while Gibraltar polled 96% to remain, representing the extremes of the Brexit vote. Also among the areas with a predominant "Remain" vote; many of the well-known cities in the U.K., including the City of London (75% Remain), Oxford (70%), Cambridge (74%), and Edinburgh (745). "Remain", however, only managed to win in three areas: Scotland (62%), London (60%) and Northern Ireland (56%). In what is, I think, the deepest commonality with the U.S. Presidential election, Secretary Clinton also handily won most of the large American urban centers. These include Manhattan (90%), Boston (85%), Cook County Chicago (78%), San Francisco (90%) and Los Angeles (75%). The populist schism that has punched its hallmark into 2016 is most easily understood as a divide between urban/non-urban dweller, which makes it difficult to see how this social rift begins to mend itself. * * * Topic #4: Economics Question #6: Who mused in a recent public speech about the merits of a "High pressure economy" where everything runs a little hotter than usual (wages, employment, inflation) to overcome the last vestiges of the Great Recession, and even cited their spouse to defend the merits of "Running hot"?

Answer: B (Janet Yellen, in a speech titled Macroeconomic Research After the Crisis). The key question of 2017 will, of course, be just how much "High pressure" the Fed Chair is willing to accommodate. The U.S. central bank may finally get the fiscal stimulus it has requested for years, thanks to Mr. Trump's plans to cut taxes, reduce regulation and spur infrastructure spending. Will Chair Yellen and the Fed allow the U.S. economy to run hotter than normal in 2017/2018, or will they work to tamp down the animal spirits that President Trump and Congress want to encourage? Question #7: By some measures, the U.S. labor market is back to essentially full employment. But by others, it still shows troubling signs. Which one of these issues still plagues the domestic labor market?

Answer: C (Average time spent unemployed is 26 weeks as of November 2016, still far worse than any post-World War II recession). If you have a friend who has been unemployed for more than a few months, you know this is true. Perhaps their skills don't meet what employers need. Or perhaps there is a negative bias to the long term unemployed. Whatever the reason, there are still 1.9 million people in the U.S. who have been unemployed longer than 6 months and still want a job. In every prior recovery, it has taken them less time to get back to work. * * * Topic #5: Markets Question #1: You probably know that Energy (up 29%) and Health Care (down 3%) are the best and worst performing large cap sectors in the S&P 500. But what are the second best and worst sectors in terms of price performance? Answer: Industrials take silver with a 20% price return YTD, and Consumer Staples (up 4%) get the steak knives for second worst. Question #2: The Dow Jones Industrial Average is knocking at the door of 20,000. What stock has contributed the most this year to getting the Dow to this level? Answer: Goldman Sachs (GS) represents 440 points of the Dow's 2,480 point move this year, or 18% of the total. Other major contributors: UnitedHealth (340 points), Caterpillar (230 points) and IBM (220 points). Goldman now has an 8.2% weighting in the Dow, the largest of any of the 30 components, so watch that name in the final sprint to 20,000. And in case you were wondering, Apple's move this year (up 9%) only adds about 60 points to the Dow.

Answer: The average return for the FANG portfolio is 11.2% YTD, spot on the price return for the S&P 500) of 11.1%. Question #4: The S&P 500 is up 6.2% from Election Day, but how much is the classic 60/40 stock/bond portfolio up over the same period? Answer: It depends on which bond proxy you use in the calculation, but a reasonable answer is a 2.6% return. That is based on a broad bond market index, which is down 3% on a price basis since Election Day. If you were only in long dated Treasuries over this period (down 9.2% since Election Day), you are actually flat.

Answer: The ETF with the largest outflows is the Wisdom Tree Europe Hedged Equity Fund ($8.1 billion out). Other ETFs with more than $5 billion of outflows this year to date: Deutsche X-trackers MSCI Currency Hedged Equity Fund ($5.6 billion), PowerShares QQQ ($5.6 billion), WisdomTree Japan Hedged Equity ($5.8 billion) and iShares MSCI EMU ETF ($6.7 billion). Don't take that as any measure of investment merit, of course – this is a data point about investment themes. Question #6: The long run average of the CBOE VIX is 20. How many days in 2016 has the VIX closed higher than that? Answer: If you guessed less than 20, you are wrong (41 days is the answer). But the error is understandable, because during the second half of the year the VIX has only closed above 20 on 2 days (November 3 and 4).

Answer: Sector weightings go a long way to explaining the disparity. For example, the S&P Small Cap Index has a 19% weighting to Industrials, where the Russell is only 15% exposed to that strongly performing sector.

Answer: Hard to say. The stock is down 16.3% year to date, so draw your own conclusions.

Answer: It's not even close. Silver is up 22% and gold is only up 9%. Earlier in the year (August) silver was up close to 50% and gold was 28% higher.

Answer: An easy one to close things out, because I am pretty sure everyone knows it was President-Elect Donald Trump. Total return for the S&P 500 since that story ran: 11.3%, with more than half of that return coming since Election Day. Now, I suspect everyone (including Mr. Trump) hopes he is wrong. Or at least that his future policies will "Make US stocks Great Again".

| ||||

| URGENT: Julian Assange Is BACK! He Just Destroyed Russia Hack LIES with Just One Sentence… Posted: 16 Dec 2016 06:00 PM PST URGENT: Julian Assange Is BACK! He Just Destroyed Russia Hack LIES with Just One Sentence…~~ The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||

| BREAKING: Major Economic Warning Sign COLLAPSE in EUROPE -Euro is Parity With USD. Posted: 16 Dec 2016 05:30 PM PST BREAKING: Major Economic Warning Sign COLLAPSE in EUROPE - The Euro is Heading For Parity With The U.S. Dollar. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||

| "When Gold Goes Above 1430 We Whack It" Posted: 16 Dec 2016 05:10 PM PST Submitted by Allan Flynn via ComexWeHaveAProblem blog, As it goes in silver, so it goes in gold. In London at least. In a bid to have UBS reinstated as a defendant in a London Gold Fix antitrust lawsuit, plaintiffs documents submitted to a New York Court last week include explosive chat room transcripts of UBS and traders from different banks encouraging each other to “push,” “smack,” and “whack” gold prices. The transcripts are equally as startling as those described of banks of the London Silver Fix and UBS given to the court the previous day and described last week in this article. On December 6th attorneys for plaintiffs in a consolidated class action against banks of the London Gold Fix and UBS, asked the court for leave to amend with a Third Amended Complaint. The TAC includes additional facts based on a “limited set of cooperation materials” produced by former defendant Deutsche Bank, as part of a settlement agreement and further statistical analysis. Supporting documents say the amended complaint addresses the Court’s October finding that the previous complaint failed to plausibly plead firstly that UBS was part of the antitrust conspiracy, and secondly that the conspiracy existed prior to 2006. Also, for the first time a gold producer has been added to the class action of those claiming losses in gold trading due to the manipulation. Compania Minera Dayton, SCM the Chilean subsidiary of Australian resources company Lachlan Star is said to have “sold gold on many of the specific days on which Plaintiffs demonstrated manipulation of gold investments” totaling $287.4 million over the period 2004 to 2013. In support of allegations that UBS shared customer order information and executed coordinated trades to manipulate gold markets, samples of “dozens” of chat room messages between UBS and Deutsche Bank are contained in the revised document indicating "many efforts to artificially suppress gold prices, and to manipulate gold prices at the time of the Fixing.” Filings include the following script reminiscent of an 1980’s arcade game scene. Rather than competing for business in the marketplace, supposed competitors UBS and Deutsche Bank however are seen coordinating tactics as they anticipate the most illiquid of days to jointly execute their sell orders for greatest negative impact on the market.

One chat see's a Deutsche Bank trader confirming with a UBS trader his trading had indeed influenced the Gold Fix: “u just said u sold on fix.” The UBS traded replied “yeah,” “we smashed it good.” The secret associations between traders appear to be close knit, with the members willing to assist their opposite numbers at every chance: UBS “im feeling helpful to ubs today.” The UBS trader then said “need to push this back wer,” to which the Deutsche Bank trader replied “ok,” and “lets do it.” Counter-intuitively, the banks special penchant to suppress the price of gold is repeated throughout the examples. As the gold ticker rose on this occasion the indignant traders teamed up to push it back down, commending themselves sarcastically meanwhile.

Not only are they pushing the market down but also there appears to be intent to harm client interests as the November 2014 FINMA investigation loosely reported. Here a UBS trader gives information to a Deutsche Bank trader about a client’s order query on Nov 16th 2010, and strategizes to punish them by whacking the price lower if purchased from another party.

Bank of China, one of the largest state-owned commercial banks in China, and which offers customers “a wide range of gold investments in gold bars and gold bullion coins” have yet to respond to this author’s query if the bank could be the buyer referred to as “BOC” in the above conversation. A central tenant of this lawsuit is that the banks have chosen one particular part of the trading day to act secretly. The strategy of banks that "colluded around the PM Fixing to ensure prices moved the direction they wanted, when they wanted," was enabled in this case by the same Deutsche Bank trader who appears in multiple chats over a period of years with various others sharing their presumably winning strategies around the afternoon benchmark. 2007During a trading day which had been less successful the Deutsche Bank trader assured his opposite trader from Bank of Nova Scotia that “at least the fix will be fun . . . make it all back there!!!!!! : ?”

Another day the Deutsche Bank trader remarked to a different trader at Bank of Nova Scotia “hahahahaha, we were all short going into that fix.” 2008The Deutsche Bank trader was informed by a HSBC trader: “i kick some out and take it back after the fix,” describing a tactic to sell gold high before the fix and buy it back after the fix at a lower price. Plaintiffs say the traders knew it would nearly always be cheaper after the fix. The Deutsche Bank trader replied ironically: “ yeah no one else is thinking that : - ?.” 2011The Deutsche Bank trader this time to another HSBC trader: “everyone shrt into the fix i swear it’s the only time ppl trade,” to which the opposite party at HSBC replied “hahahhahahahahahahahha shocking absolutely shocking.” 2012The Deutsche Bank trader said to his opposite number at Barclays, “im glad u are now interbank.” Barclays trader: "Why?" Deutsche Bank trader: “it’s a good alliance.” That day the Deutsche Bank trader informed another trader at Barclays, “im a tiny buyer at the mom.” Barclays trader: “think im buyer too,” Deutsche Bank trader: “means we fix lower.” An example of further statistical analysis from plaintiff's Third Amended Complaint, TAC is a chart showing UBS spot gold price quotes over the period 2004-2012. The complaint says the bank "used its transactions and substantial presence in the gold market to drive prices downward, thus playing a key role in the conspiracy." Deutsche Bank's proposed settlement of the London Gold Fix class action amounting to $60 million including the provision of cooperation materials was given the Court's preliminary approval on December 9th subject to a Fairness Hearing. This follows the non-UBS defendant banks of the London Gold Fix; Bank of Nova Scotia, Barclays, HSBC, and Société Générale being ordered in October to face charges in the lawsuit along with London Gold Market Fixing Limited, LGMF a private company owned by the five banks. Deutsche Bank's settlement offer of $38 million including cooperation materials in a similar antitrust lawsuit involving the banks of the London Silver Fix was given the court's preliminary approval earlier. OpinionThe new chat evidence in silver and gold described in this and other articles provides the missing narrative to the volumes of statistical analysis incorporated in the original and amended complaints closely scrutinized by court and counsel at the April hearings. It lifts the curtain for once and all on the dirty role of bank suppression in gold and silver markets, and its not just the London Fix. The Court has already acknowledged plaintiffs evidence of symbiosis between the London Fixes and the pricing of other silver and gold products. The Court's preliminary approval of the Deutsche Bank settlements may provide for class claims in bullion, coins, options, futures, spot and other markets including exchange traded funds, ETF's within the US. The collective evidence also neatly deals with the court's October supposition that further amending the complaint would be "futile." Given the damming nature of material against UBS particularly, it remains all the more mystifying why the 2014 Swiss Supervisory Market Authority FINMA report into foreign exchange and precious metals trading at UBS said so little comparatively about UBS' precious metals trading misconduct, and specifically nothing about gold trading misconduct. As discussed in an earlier article, the word “gold” is conspicuously absent from the 2014 report. Were it not for the early moral act of Deutsche Bank in providing the cooperation materials, which presumably gave them a settlement advantage, UBS directors might be sleeping much easier this week. If the remaining non-UBS defendants agree to settle, which is an increasing likelihood, there will be no need for the court discovery scheduled for 2017 and civil trial beyond. In the meantime we wait to see how long UBS hangs in there. The appearance of a precious metals producer among the class of plaintiffs will also see shareholders and directors reaching for the calculator. SCM is but one of thousands of producers who have sold precious metal in the US throughout the period and like any other plaintiff if the case is successful could be entitled to treble damages with interest if granted standing. Plaintiffs analysis indicates that manipulation of the London Gold Fix led to average losses of up to four basis points or four hundredths of a percentage point in the gold price on the days affected. Therefore, a small gold producer similiar to SCM with say $500 million of gold sales over 8 years could tally treble claims of $600,000 plus interest. Supposing as statute 28 U.S.C. 1961 directs, the present Treasury constant maturities nominal- 1-year interest rate currently at 0.83% is applied to this figure over an average sale date midway through the class period of say December 2008, and an optimistic successful conclusion of the lawsuit comes a year from now. Interest then of $54,793.64 could bring a theoretical claim of $654,793.64 for just one class member like this. In this context Deutsche Bank's $60 million, plus the cooperation materials supplied, appear to be money well spent. | ||||

| BREAKING: The Establishment’s Plan To Divide - Donald Trump, Fake News & Russia Posted: 16 Dec 2016 05:00 PM PST BREAKING: The Establishment's Plan To Divide - Donald Trump, Fake News, And Russia. The American people don't care what the establishment wants the American voted Donald as our president The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||

| Fake News is a CIA Psyop -- Jim Fetzer Posted: 16 Dec 2016 04:00 PM PST Jeff Rense & Jim Fetzer - Fake News is a CIA Psyop Clip from December 14, 2016 - guest Jim Fetzer on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||

| Gold Seeker Weekly Wrap-Up: Gold and Silver Fall Over 2% and 4% on the Week Posted: 16 Dec 2016 01:16 PM PST Gold gained $8.64 to $1136.04 in London before it fell back to $1127.80 at about 11AM EST, but it then jumped up to $1141.03 in the next hour of trade and ended with a gain of 0.54%. Silver rose to as high as $16.25 and ended with a gain of 0.56%. | ||||

| Isolating Russia: A Fool’s Errand Posted: 16 Dec 2016 01:00 PM PST This post Isolating Russia: A Fool’s Errand appeared first on Daily Reckoning. [Ed. Note: Jim Rickards latest New York Times best seller, The Road to Ruin: The Global Elites' Secret Plan for the Next Financial Crisis (claim your free copy here) goes beyond the election and prepares you for the next crisis] President Obama has conducted the most deleterious foreign policy of any U.S. president since Woodrow Wilson. This is not due just to a dead ambassador on the streets of Benghazi, a phony red line in Syria which led to 400,000 dead, 2 million wounded, and two million refugees, losing Egypt to Islamic radicals, or empowering a terrorist regime in Iran. Those developments alone are enough to rank Obama among the worst foreign policy presidents. Obama's most egregious error is far worse — his inability to grasp the balance-of-power dynamics among the U.S., Russia and China. Yet Obama's blunder is Trump's opening to rescue U.S. foreign policy from grave weakness, and restore U.S. leadership to the world. There are three primary powers in the world — the U.S., Russia, and China. All other nations are secondary allies, or tertiary powers. In a three-power system, the object of foreign policy for a primary power is to align with one of others to the detriment of the third. A great power that does not pursue this policy becomes the victim of an alliance between the remaining two. Such an alliance need not be permanent; it can shift, as was the case with Nixon's opening to China, which put Russia on the defensive and led eventually to the downfall of the Soviet Union. This dynamic is not difficult to grasp. Adults playing the board game Risk know that while the game begins with six players, it quickly evolves to three survivors. At that point, it is imperative for two of the players to align and destroy the third by systematically attacking it, and refraining from attacking each other. The victim is quickly wiped from the board. Of course, geopolitics is more complex than Risk. Players are rarely removed from the board; they are just temporarily advantaged or disadvantaged in pursuing their national goals. But, the three-power dynamics of two-against-one are fundamentally the same. Bismarck knew this. Kissinger knows it today. Obama does not. Obama subscribed to a post-national globalist ideology, which finds no correlative in the real world outside of faculty lounges and Georgetown salons. In Obama's worldview, nation states are a problem, not a solution. Global goals on issues like climate change, trade, the OECD's world tax program, and the IMFs world money program require global institutions. Nation states are temporary impediments until global governance can be built through non-democratic transnational institutions. Meanwhile, Russia and China never lost sight of their national interests. While their leaders dutifully attend the same multilateral venues as Obama, such as the G20, IMF, and regional summits, they persistently put Russia and China first. For Russia and China, the world is a dangerous place in which national interest is advanced ruthlessly; not Obama's Kumbaya-laced globalist fantasy of one world order. This hard-edged realism by Russia and China combined with a lack of realism by Obama has led to the worst possible outcome for the United States. Russia and China have become deeply intertwined and are building a durable alternative to the post-war dollar-based system dominated by the U.S. These Russia-China initiatives include deepening cooperation through the BRICS, the Shanghai Cooperation Organisation, the Asia Infrastructure and Investment Bank, the New Silk Road, and joint efforts in weapons systems and space. Most threatening is that in the past ten years, Russia increased its gold reserves 203%, and China increased its gold reserves an estimated 570%. Such gold accumulations have no purpose other than to lay the foundation for a non-dollar based international monetary system. No great power has prevailed long without a great currency. When confidence in the dollar fails, U.S. power will fail with it. Obama blundered because he allowed Russia and China to pursue the two-against-one dynamic leaving the U.S. as the odd man out. Fortunately it is not too late to reverse this dynamic. Signs from the new Trump administration are encouraging. Trump's early actions and appointments suggest he understands the precarious position of the U.S., and is already moving to change the status quo. Russia is a more natural ally of the U.S. than China. Russia is a parliamentary system, albeit with autocratic overtones; China is a Communist dictatorship. Russia has empowered the Orthodox Church in recent decades, while China is officially atheistic. Russia is encouraging population growth while China's one child policy and sex-selective abortions resulted in the deaths of over twenty million girls. These cultural aspects — elections, Christianity, and family formation — provide Russia with a natural affinity to western nations. Russia is also superior to China militarily despite recent Chinese advances. That makes Russia the more desirable ally in any two-against-one scenario. The most powerful argument for embracing Russia to checkmate China is energy. The U.S. and Russia are the two largest energy producers in the world. U.S. energy production is set to expand with the support of the Trump administration. Russian production will expand also based in part on initiatives led by Rex Tillerson of Exxon, soon to be Secretary of State. China has few oil and natural gas reserves and relies heavily on dirty forms of coal and some hydropower. The remainder of China's energy needs is met through imports. An energy alliance between the U.S. and Russia, supported by Saudi Arabia, could leave the Chinese economy and, by extension, the standing of the Communist Party of China, in jeopardy. That threat is enough to insure Chinese compliance with U.S. aims. An emerging U.S.-Russian entente could also lead to the alleviation of western economic sanctions on Russia. This would open the door to an alliance between Germany and Russia. Those two economies have near perfect complementarity since Germany is technology rich and natural resource poor, while Russia is the opposite. Isolation of Russia is a fool's errand. Russia is the twelfth largest economy in the world, has the largest landmass of any country in the world, is a nuclear power, has abundant natural resources, and is a fertile destination for direct foreign investment. The Russian culture is highly resistant to outside pressure, but open to outside cooperation. Just as fifty years of U.S. sanctions failed to change Cuban behavior, U.S. sanctions will not change Russian behavior except for the worse. Engagement, not confrontation is the better course. The new Trump administration gets this. U.S. voices such as John McCain, Mitch McConnell and Lindsey Graham are quick to say, "Russia is not our friend." Why not? Could it be because President Obama publicly humiliated Vladimir Putin by saying he was, "like a bored kid in the back of the classroom"? Could it be because Obama proclaimed that Russia under Putin is "on the wrong side of history." In fact, Putin's sense of history goes back to Peter the Great. Obama's does not seem to go back further than 1991. Most of the tension in U.S. — Russia relations today stems from Russia's invasions of Crimea and eastern Ukraine in 2014. But, Russia's Crimean invasion should have come as no surprise. U.S. and British intelligence services and foreign NGOs destabilized the pro-Russian elected government in Kiev in early 2014 causing Ukrainian President Yanukovych to flee into exile in Russia. Ukraine was always a bridge too far for NATO and EU membership. Better to leave Ukraine as quasi-neutral buffer between east and west than put its status in play. Ukraine has always been culturally divided. Now it is politically divided as well. Russia's hand in Ukraine was forced by the shortsighted western interventions of Obama and David Cameron. Obama will soon leave the scene; Cameron already has. Putin is the last man standing, unsurprising for a man whose pursuits include martial arts and chess. Fortunately it's not too late to reestablish a balance of power that favors the United States. China is a rising regional hegemon that should be constrained. Russia is a natural ally that should be empowered. The U.S. has blundered in its foreign policy for the past eight years. A new Trump administration has an opportunity to reverse those blunders by building bridges to Russia, and it seems to be moving in that direction. Regards, Jim Rickards The post Isolating Russia: A Fool’s Errand appeared first on Daily Reckoning. | ||||

| COT Gold, Silver and US Dollar Index Report - December 16, 2016 Posted: 16 Dec 2016 12:30 PM PST COT Gold, Silver and US Dollar Index Report - December 16, 2016 | ||||

| Harry Dent: "Gold to go down in 2017" Posted: 16 Dec 2016 11:30 AM PST Harry Dent on why the US Dollar surge is bad for the value of Gold. Dent foresees deflationary environment, which will not be profitable for commodities The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||

| Doug Pollitt: 'Tinfoil hat crowd' was right, and gold mining executives are saps Posted: 16 Dec 2016 11:19 AM PST 2:21p ET Friday, December 16, 2016 Dear Friend of GATA and Gold: Responding to the documentation just disgorged by Deutsche Bank in federal court in New York, Doug Pollitt of investment house Pollitt & Co. in Toronto today declares victory for the "tinfoil hat crowd" in the contest over manipulation of the monetary metals markets. But more important, Pollitt chides the gold mining industry for playing saps for the banks that buy and rig the price of the industry's product. "The organizations the gold mining industry depends upon to market its metal did not have their clients' best interests in mind," Pollitt writes. "This may still be the case. Perhaps a gold mining company (or two) will read this note and if they do, by the time they are done, they may well think that there may be a better way to get their product into the hands of the people who want it. ... "Gold is down $200 in five weeks and some equities are back where they started from. Yet the sector's survival instinct remains difficult to discern. Maybe they don't feel ... that they can do anything about it. Maybe price-taker mentality is burned into their collective brain. N.M. Rothschild's walked away from the fix in 2004. After almost a hundred years of operation, maybe it is time the gold producers showed a bit of pride and did so too." With Pollitt's kind permission his letter is posted at GATA's internet site here -- http://www.gata.org/files/PollittMarketLetter-Dec2016.pdf -- where gold mining company investors who are not yet completely demoralized might obtain copies to bludgeon company chief executives with. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Golden Predator Finds New Veins of up to 30.8 g/t Gold; Company Announcement VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V:GPY, OTCQX:NTGSF) is pleased to announce additional surface exploration results and the results of airborne geophysical surveys from ongoing work at the 3 Aces project in southeastern Yukon, Canada. Highlights include: -- Seven of Spades: Newly discovered zone with stacked flat lying quartz veins returning values up to 18.55 g/t gold. -- Queen of Spades: Newly discovered zone with values up to 30.8 g/t gold. -- Jack of Spades: Additional results from continuous panel sampling of a second higher bench returned 20 meters of 7.62 g/t gold including 11.7 g/t gold over 12.4 meters and 37.9 g/t gold over 1.7 meters. -- Three of Spades: Additional assays have increased strike length of vein with returns including 6.95 g/t gold. ... ... For the remainder of the announcement: http://goldenpredator.com/_resources/news/nr_2016_11_21.pdf Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:

This posting includes an audio/video/photo media file: Download Now | ||||

| Posted: 16 Dec 2016 10:40 AM PST Dear all, Competitive currency devaluations and stronger dollar!! The economy in the us will come to a grinding halt. Another point of observation when the 10y breaks the 3% the biggest danger from subsequent huge moves will be the interest rate derivatives to the tune of $500-750bn (billion) that can’t be reset when the moves... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | ||||

| High gold premiums in China are demand-driven, Maguire tells KWN Posted: 16 Dec 2016 10:37 AM PST 1:37p ET Friday, December 16, 2016 Dear Friend of GATA and Gold: Premiums on gold in China are high not because of tight supply, as is being reported, but because of huge demand as investors realize that the wars on cash and gold are related and that gold is the only exit from the financial system, London metals trader Andrew Maguire tells King World News today. These wars, Maguire adds, are being run from the headquarters of the Bank for International Settlements in Basel, Switzerland. Maguire's comments are posted at KWN here: http://kingworldnews.com/whistleblower-andrew-maguire-exposes-the-real-r... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Posted: 16 Dec 2016 09:30 AM PST Ron Paul is an American author, physician, and former politician. He was formerly the U.S. Representative for Texas' 14th and 22nd congressional districts The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||

| TF Metals Report: Silver price manipulation continues Posted: 16 Dec 2016 09:16 AM PST 12:13p ET Friday, December 16, 2016 Dear Friend of GATA and Gold: Despite exposure in federal court in New York, the TF Metals Report's Craig Hemke (aka Turd Ferguson) writes today, manipulation of the silver market by bullion banks continues in the open. The only counter to it, he says, is to purchase real metal on a cost-averaging basis and wait for the scheme to explode. His commentary is headlined "Silver Price Manipulation Continues in 2016" and it's posted at the TF Metals Report here: http://www.tfmetalsreport.com/blog/8049/silver-price-manipulation-contin... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Canadian Government Issues Key Water License Company Announcement TORONTO -- Seabridge Gold Inc. (TSX: SEA) (NYSE:SA) announced today it has received a license from the Government of Canada required for the construction, operation, and maintenance of the water storage facility and associated ancillary water works at its 100 percent-owned KSM Project in northwestern British Columbia. The license, as authorized within the International Rivers Improvement Act, regulates all structures and activities situated on transboundary waters shared with the United States that have the potential to affect water quality and quantity. The Water storage facility and its ancillary water works (water diversion ditches and tunnels) are the primary water management control systems for the KSM Project. These facilities separate water that has not contacted mined material from so-called contact water originating from disturbed areas of the mine site and then contain the contact water prior to treatment and eventual release to the receiving environment. These facilities are situated on Mitchell and Sulphurets creeks, tributaries of the transboundary Unuk River system that flows into Alaska. The license was granted for a term of 25 years under the International Rivers Improvements Regulations as administered by Environment and Climate Change Canada. ... ... For the remainder of the announcement: http://seabridgegold.net/News/Article/642/federal-government-issues-key-... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Silver Price Manipulation Continues In 2016 Posted: 16 Dec 2016 09:00 AM PST So we wait and watch...seriously, what else can we do? It has now been proven and admitted that teams of traders at The Bullion Banks actively collude to manage and manipulate price. (See here: http://www.goldchartsrus.com/chartstemp/MarketManipulation.php) And it's obvious that The Criminals are still at it when you examine the silver chart over the past 90 days. Three massive raids have been staged to inflict devastating, technical damage. | ||||

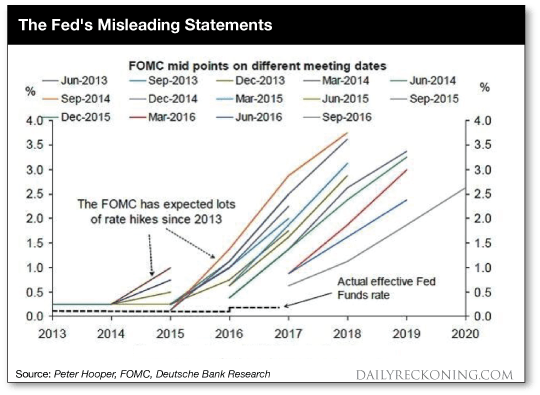

| The Alarming Truth About the Fed’s Rate Hike Posted: 16 Dec 2016 09:00 AM PST This post The Alarming Truth About the Fed's Rate Hike appeared first on Daily Reckoning. After holding off on an interest rate hike pre-election to help Clinton, Yellen finally pulled the trigger on Wednesday… For the first time in a year, the Federal Reserve raised the federal funds rate a quarter of a percentage point to 0.50%. The stock market game didn't like the news. The Dow Jones closed down 118 points for the day. And predictably, market "experts" drew all the wrong conclusions from the Fed's move. The Fed's RevelationThe rate hike wasn't a surprise. Everyone with a pulse knew it was 100% priced in beforehand. But what did shock and unnerve assorted "analysts" were the Fed's rate projection talking points for 2017. CNBC noted: Now, a plurality of the Fed's rate-setting committee believes the central bank will raise rates three times next year, compared with two hikes expected in the batch of projections released in September. The possibility of accelerated interest rate increases caused the dollar to soar against all major currencies. (The higher interest rate that can be earned from the dollar increases its demand and value.) And it caused gold to take it on the chin, hitting a 9-month low. (The dollar is more attractive in times of rising rates as it's an interest-bearing asset, as opposed to gold.) But let's unpack this… The negative market reaction happened because the Fed indicated it anticipated raising rates three times in 2017 instead of its previous statement of two. Well, after the Fed raised interest rates for the first time in a decade in December 2015, Fed politicians projected four hikes for 2016. But there was only one. Not even close. Knowing this, who in their right mind would pay attention to such forward "guidance" for next year, or any year for that matter? To be fair, maybe last year's ridiculously bad Fed projection was just an outlier. Yeah, not so much… Useless AdviceTo see how misleading the Fed's interest rate hike projections have been in recent years, have a look at the chart below.

As you can see, projected interest rate hikes compared to actual rate hikes differ drastically. I don't know what's worse… the Fed's forward guidance track record or the people who actually trade on that guidance. Yet there I was on Wednesday night watching a Harvard-educated "analyst" on Fox News telling "Special Report" anchor Brett Baier that the most important thing investors needed to be concerned with was the Fed's plan to raise rates three times in 2017. That's utterly worthless advice. Hold on. I am being kind. That's moronic advice. The data clearly shows that the Fed doesn't do what is says it's going to do. Look, does anyone not sniffing bath salts believe the Fed is going to continue raising rates on schedule if the U.S. stock market craters… or if Europe implodes… or if China's credit bubble bursts? Please. There are countless Fed "variables" it will use to justify altering its plan… as it has in years past. The bottom line is the only thing of value we learned from the Fed this week is they raised rates on Wednesday. That's it. What it does in 2017 has no relation to its stated projections, just as was the case in 2013, 2014, 2015 and 2016. Worrying about the implications of the Fed's rate hike timetable is a time-sucking charade designed to bleed you dry. The Fed and the media are never on your side. Focus on the only truth you know, and that is the price action of all markets. Let the price action dictate your actions, your buys and sells. That's what winners do. Please send me your comments to coveluncensored@agorafinancial.com. Let me know what you think of today's issue. Regards, Michael Covel The post The Alarming Truth About the Fed's Rate Hike appeared first on Daily Reckoning. | ||||

| Posted: 16 Dec 2016 09:00 AM PST We are Anonymous.We are Legion.We do not forgive.We do not forget.Expect us. When you take away the power of money, you take away the power from those who have it. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||

| Radical Gold Underinvestment 3 Posted: 16 Dec 2016 08:53 AM PST Gold was again blasted to new post-election lows this week, further trashing contrarian sentiment. The Fed proved more hawkish than expected in its rate-hike-trajectory forecast, unleashing heavy selling in gold futures. This catapulted gold bearishness back up to extremes not seen in a year. Investors are once again convinced gold is doomed, and thus radically underinvested. That's actually super-bullish for gold. | ||||

| Agenda 21 Documentary Anonymous Posted: 16 Dec 2016 08:30 AM PST We are Anonymous.We are Legion.We do not forgive.We do not forget.Expect us. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||

| Flation And The Surge Of Silver Posted: 16 Dec 2016 08:17 AM PST Flation And The Surge Of Silver | ||||

| Doug Pollitt: 'Tinfoil hat crowd' was right, and gold mining executives are saps Posted: 16 Dec 2016 08:12 AM PST Responding to the documentation just disgorged by Deutsche Bank in federal court in New York, Doug Pollitt of investment house Pollitt And Co. in Toronto today declares victory for the "tinfoil hat crowd" in the contest over manipulation of the monetary metals markets. But more important, Pollitt chides the gold mining industry for playing saps for the banks that buy and rig the price of the industry's product. | ||||

| Posted: 16 Dec 2016 08:04 AM PST In an effort to put the Martin Armstrong saga to bed, I post below quotes and links to two articles he put out in 2010 and 2011 just before being released from prison. Please read not just the quotes provided but his full articles as they are both excellent in content and logic. His 2010 article sounds a lot like "Bill Holter" as I have done this math and logic several times for readers over the years. Back then he said "$5,000 gold is "VERY CONSERVATIVE" ...while he now says it will be as high as gold can go. In the second article he takes on "manipulation" which he has since changed his tune on. | ||||

| Posted: 16 Dec 2016 07:52 AM PST Gold was again blasted to new post-election lows this week, further trashing contrarian sentiment. The Fed proved more hawkish than expected in its rate-hike-trajectory forecast, unleashing heavy selling in gold futures. This catapulted gold bearishness back up to extremes not seen in a year. Investors are once again convinced gold is doomed, and thus radically underinvested. That’s actually super-bullish for gold. It certainly wasn’t the Fed’s second rate hike in 10.5 years this week that hammered gold. Actually that was universally expected. Federal-funds-futures traders had assigned it an average 96% probability in the two weeks leading up to that rate hike. If the Fed had simply raised its federal-funds rate by 25 basis points to a 0.50%-to-0.75% range, gold-futures speculators would’ve likely yawned. They knew it was coming. | ||||

| Bitcoin's rally crushed every other currency in 2016 Posted: 16 Dec 2016 07:31 AM PST By Olga Kharif Bitcoin, that nebulous digital currency that trades in cyberspace and is "mined" by code-cracking computers, emerged as a better bet this year than every major foreign-exchange trade, stock index and commodity contract. The electronic coin that trades and is regulated like oil and gold surged 79 percent since the start of 2016 to $778, its highest level since early 2014, data compiled by Bloomberg shows. That's four times the gains posted by Russia's ruble and Brazil's real, the world's top two hard currencies. After its 2008 creation, enthusiasts hailed bitcoin as the next big thing in foreign exchange markets and an obvious monetary evolution in an increasingly digital world. But by 2014 its value tumbled 58 percent as governments cracked down on its use and a major exchange lost account-holders' funds. ... ... For the remainder of the report: https://www.bloomberg.com/news/articles/2016-12-16/bitcoin-s-rally-crush... ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Financial Meltdown Around The Corner? – Jim Rickards’ 2017 Outlook Posted: 16 Dec 2016 07:30 AM PST Could the next financial crisis be just around the corner? The signs of a looming meltdown are 'unmistakable,' this according to best-selling author Jim Rickards. Giving his 2017 outlook to Kitco News, he said the next crisis would be far worse than any previous one markets have experienced.... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||

| Gold premiums in China at 3-year high as Indian demand stays weak Posted: 16 Dec 2016 07:27 AM PST By Sethuraman N. .R and Rajendra Jadhav Gold premiums in China surged to their highest in nearly three years this week on fears of limited supply of the metal, while demand in India remained weak amid low prices due to a severe cash crunch following the government's demonetisation move. The supply shortage, traders said, was due to Beijing's efforts to restrict import licenses. The import curbs may be part of China's efforts to limit yuan outflows after the currency's slide to its weakest in more than eight years, traders said. China allows only 13 banks, including three foreign lenders, to import gold, according to the Shanghai Gold Exchange. "The drag on supply is having an impact on pricing," said Cameron Alexander, an analyst with Thomson Reuters-owned metals consultancy GFMS. Gold premiums in China against the international benchmark rose to over $40 an ounce this week, the highest since January 2014, according to Thomson Reuters data. Last week, premiums were quoted around $28-$30. ... ... For the remainder of the report: http://www.reuters.com/article/asia-gold-demand-idUSL4N1EB2U8 ADVERTISEMENT Market Analyst Fabrice Taylor Expects K92 Shares to Rise Interviewed on Business News Network in Canada, market analyst and financial letter writer Fabrice Taylor said shares of K92 Mining (TSXV:KNT) are likely to rise, even amid declining gold prices, because the company has begun producing gold at its mine in Papua New Guinea: http://www.bnn.ca/video/fabrice-taylor-discusses-k92-mining~1008356 Taylor cited the company's announcement here: http://www.k92mining.com/2016/11/6114/ Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Posted: 16 Dec 2016 05:53 AM PST A couple of months from now are traders going to look back and wonder how they could have ignored the bottoming signs? | ||||

| Trump Making Deficits and Public Debt Great Again Posted: 16 Dec 2016 03:36 AM PST Trump’s economic agenda consists of foreign policy, fiscal policy and regulatory policy. We have already commented a bit about Trump’s imprint on geopolitics and uncertainty in the context of the gold market. Now, let’s focus on the domestic policies. First, Trump wants to reduce regulations hampering business. During the campaign he called for a moratorium on new financial regulations and for a 70 percent reduction in regulations. Importantly, in his 100-day action plan, the president-elect proposed that for every new federal regulation, two existing regulations must be eliminated. Deregulation should stimulate economic growth and the stock market, which is not good for the yellow metal. | ||||

| Breaking News And Best Of The Web Posted: 16 Dec 2016 01:37 AM PST US stocks, interest rates, dollar continue their ascent. US housing starts plunge as higher mortgage rates begin to bite. Italian banks restructuring and raising capital as government begins bail-out. Gold and silver fall hard on Fed decision. The “fake news”/Russian hacking debate intensifies. Best Of The Web Are you "living in a death spiral"? […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment