Gold World News Flash |

- Shanghai Gold Exchange Deliveries Have Their Biggest Day of the Year

- Aleppo Victory... US And Its Crime Partners Suffer "Meltdown Of Sanity"

- Fed Wants Banks To Pay 2 Billion A Year To Prop Up The System Against A Collapse

- WW3 has already Begun

- Silver Smoking Gun to Stop Dishonest Dealing

- Pathetic Liberal's Meltdown Continue

- What Is The Real Purpose Behind "Fake News" Propaganda?

- Wall Street is Overly Optimistic on Trump Presidency (Video)

- Anonymous: Clinton Is Using Islamic Law To Overturn Election

- Mike Maloney -- Fed Endgame Is Inflation

- Gold chart annotated with exchanges between market-manipulating traders

- Avery Goodman: The Trump administration looks friendly toward a gold standard

- End Times Headline News - December 15th, 2016

- Mass Mind Control & Cyber War -- Jeff Rense & Preston James -

- Six Hundred Million Ounces of Silver to be Consumed in Photovoltaics and Ethylene Oxide Production Through 2020

- LIVE Stream: President-Elect Donald Trump Rally in Hershey, PA 12/15/16

- Fed’s Hammer Delivers Another Blow To Gold – Has it Bottomed?

- Breaking: Obama Launching Coup To Install Hillary - 12/14/2016

- Gold Seeker Closing Report: Gold and Silver Fall Roughly 1% and 5% More

- Trump, the Fed and Systemic Risk

- Donald Trump Warning Of Economic Collapse In 2016 2017

- Ted Butler: The royal flush

- Euro tumbles to 14-year low against the dollar

- Fleckenstein dismissed as 'nonsense' the silver rigging Deutsche Bank has just admitted

- Seasonality Favors Gold, Silver and Junior Mining Stocks Going Into Year End

- Seasonality Favors Precious Metals and Junior Miners Going Into Year End

- Cancellation of currency notes suppresses gold demand in rural India

- Cash ban gives a boost to India's government-run banks

- Asias Gold Investing Support Goes AWOL: China

- The Only Chart “Trump Traders” MUST SEE

- Gold and Silver Market Morning: Dec 15 2016 - Gold and Silver thumped by Fed statement!

- Fed Raised Rates 0.25% – Rising Rates Positive For Gold

- SPX to Mop up Wave 2 Retracement

- Bron Suchecki: Silver smoking gun to stop dishonest dealing

- Fed Raised Rates 0.25% – Rising Interest Rates Positive For Gold

- Breaking News And Best Of The Web

- Columbus Gold Gains Attention with Montagne d'Or Takeover Potential and Nevada Upside

- Gold and Silver in Steep Decline as Dollar Surges to Multi-Year Highs

- Ari Wald: Bull Market Looking Healthy; Keep an Eye on the Dollar

| Shanghai Gold Exchange Deliveries Have Their Biggest Day of the Year Posted: 16 Dec 2016 01:02 AM PST |

| Aleppo Victory... US And Its Crime Partners Suffer "Meltdown Of Sanity" Posted: 15 Dec 2016 11:00 PM PST Submitted by Finian Cunningham via Strategic-Culture.org, The US and its terrorist-sponsoring partners are seeing their criminal regime-change project in ruins, as the Syrian army and its allies win a spectacular victory to retake the strategically important city of Aleppo. Western governments and their flunkies at the UN are cynically, perversely decrying a «meltdown of humanity». Closer to the truth is their own «meltdown of sanity». This is because the official Western narrative about the Syrian war is finally being exposed on a glaring scale. The exposure for the whole world to see is one of a systematic, fake propaganda cover that concealed a criminal enterprise – an enterprise involving terrorist proxies, or fake moderate rebels, whom the Western governments have sponsored for the past six years in a conspiracy to overthrow the government of Syria. The gravity of this systematic crime committed by Washington and its various partners is now unfolding. Unable to cope with their own cognitive dissonance over the criminality, the Western governments and their complicit corporate news media are resorting to outright denial and to compounding lies with even more lies. Instead of dealing with the reality that Syrian state forces have recaptured Aleppo from brutal, illegally armed groups, which the West and its regional clients have bankrolled and armed, the West distorts the dramatic victory as the «fall of Aleppo». One report on American channel CNN even referred to the victorious Syrian army and its allies as «persecutors». With typical unhinged emotion, US ambassador to the UN Samantha Power cited unverified reports of civilians being executed in Aleppo, and slammed Syria and its allies Russia and Iran for having «no shame». It is Power and her Western partners-in-crime, including top UN officials, who should be hanging their heads in shame. Among the hysterical soundbites about alleged atrocities and slaughter being lobbed around this week was this from UN «humanitarian» official Jens Laerke who said Aleppo was seeing a «meltdown of humanity». Catchy words, but divorced from reality. Western news media outlets were screaming headlines alleging summary executions of women and children by the Syrian army and its Russian, Iranian and Lebanese allies as they moved in to finally retake the whole of the northern city. Outgoing UN chief Ban Ki-Moon talked in disparaging tones about an «uncompromising military victory», while his underlings Rupert Colville and Jan Egeland decried «hellish» conditions and «war crimes» committed by Syria and Russia. The problem is that all these sensational, reckless assertions are based on unverified claims by anonymous «activists» or persons involved with militants – militants who are integrated with terror groups like Jaysh al Fatah, Jabhat al Nusra, Ahrar al Sham and Nour al din al Zenki. All of them affiliated with the internationally proscribed Al Qaeda terrorist network – which the Western governments claim to be at war with. It truly is a grotesque revelation when Western governments and UN officials publicly spout propaganda on behalf of terrorist groups. Samantha Power and her British counterpart at the UN Matthew Rycroft cited UN «reports» of 82 civilians being executed, including 11 women and 13 children, by the pro-government Syrian forces during the final hours of recapturing Aleppo. But the same UN «reports» were themselves based on unverified sources supposedly embedded among the terrorists. This is not reportage. It is simply recycling rumors aimed at saving the necks of terrorist groups. The simple fact of the information coming from unverified sources did not stop the UN, Power, Rycroft and the raft of Western media outlets, including the Washington Post, CNN, Guardian, Independent, France 24 etc, presenting the claims as if they were fact. Russia’s Foreign Minister Sergey Lavrov accused Western governments and their dutiful, unquestioning news media of spreading «fake news» about the dramatic events in Syria this week. Lavrov pointed out that none of the alleged atrocities were acknowledged by independent humanitarian groups. Syria’s ambassador to the UN Bashar al Jaafari also refuted the claims of atrocities that Western counterparts appeared to be so perplexed by. Western governments and media outlets persisted in their gory fantasies despite abundant video footage that even they themselves were broadcasting which showed thousands of civilians calmly walking away from militant-held pockets of Aleppo towards the Syrian state forces. Is that the behavior of people who are being massacred, summarily executed, slaughtered? One of the most absurd distortions was this from France 24. The state-owned broadcaster of one of the countries that has supplied weapons and propaganda cover to terrorists in Syria over the past six years described this week how «people in government-held areas of Aleppo were celebrating». Given that the Syrian government holds virtually all of Aleppo that means that the vast majority of Syrians were celebrating. Yet France 24 roils its words to contrive a false division between pro and anti-government populations. The more logical and truthful depiction is that Syrian civilians are at last able to flee from terror gangs that have held them under siege. But in reporting that the whole false Western narrative about what has been going on in Aleppo and Syria for the past six years would implode like a house of cards. Why aren’t the Western news media interviewing the tens of thousands of civilians who have now managed to flee from the defeated terrorist groups? Why don’t the Western media ask questions about the nature of their captivity? Such as, why could they not escape from militant-held eastern Aleppo until now? What do these civilians think of the Syrian army and its allies who have crushed the militants? The curious, gaping absence of any testimonies carried by the Western media from the thousands of liberated civilians in Aleppo is mirrored by the same curious, gaping absence of testimonies from thousands of civilians liberated elsewhere in Syria by the army over the past year. That’s because those civilians are telling media outlets which are willing to report, such as the Syrian state broadcaster SANA, as well as RT, Press TV and Al Manar, that their nightmare siege imposed by the Western-backed terrorists is over. If Western media outlets were to actually bother to conduct real journalism they would go into liberated areas of Aleppo and other towns and villages across Syria and report that life is returning to happy normalcy for these families and communities. The truth is Aleppo was invaded by Western-backed mercenaries in July 2012, who turned the eastern side of the city into a den ruled under a reign of terror. A twisted, demented caliphate run by head-chopping Wahhabi jihadists was imposed. Like Syria as a whole, these mercenaries were sanitized in the West as «moderate, pro-democracy rebels» – albeit somehow supposedly «intermingled» with jihadi extremists. If that were the case, then where are these supposed «moderates» now that the last den of the «rebels» in Aleppo has been routed? The stark absence of «moderate», «pro-democracy», «Western-value-supporting rebels» emerging from the ruins of Aleppo is as stark as the absence of petrified civilians denouncing Syrian army «atrocities» or Russian «war crimes». In one resounding moment this week, the Western narrative about Aleppo, and the Syrian war more generally, has collapsed in a pile of dust. No amount of denials and further distortions can hide the exposure of Western lies and propaganda fabrications. So ironically, Western media outlets have recently whipped up the phenomenon of «fake news» in the context of trying to discredit Russia over alleged electoral interference in the US and Europe. What Syria has demonstrated is that the real culprits of peddling false news, and more gravely false narratives, are the Western governments and their conceited, self-important news media. Unable to deal with the unbearable truth of criminal complicity, the official West is displaying a meltdown of sanity. Aleppo and Syria will one day emerge again from the present ruins. No such recovery from ruins will be made by the ignominious Western governments and their lying, criminally complicit media. |

| Fed Wants Banks To Pay 2 Billion A Year To Prop Up The System Against A Collapse Posted: 15 Dec 2016 10:00 PM PST Gold was suppressed by using future contracts that were worth 10 billion dollars. Freddie Mac issues warning about the real estate market. US manufacturing PMI the Empire Fed and Philly Fed surveys all of sudden surge. But the hard economic data show the opposite of what is happening. The Fed... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Posted: 15 Dec 2016 08:30 PM PST Why The World - W* 3 Will Surely Start on January 22, 2017 ? Last Warning To America The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Silver Smoking Gun to Stop Dishonest Dealing Posted: 15 Dec 2016 08:21 PM PST By Bron Suchecki Last week ZeroHedge reported on the amended London Silver Fixing Antitrust Litigation which included damaging chat logs provided by Deutsche Bank that reveal collusion between bullion bank traders to "shade", "blade", "muscle", "job", "spoof" and "snipe" the silver market. While the amended complaint only provides selected examples from the 350,000 pages of documents and 75 audio tapes that the plaintiffs received as part of the settlement with Deutsche Bank, what has been provided shows cliques of traders who worked together against the interests of their clients. Below is a network map of these cliques, which shows every trader mentioned in the complaint with the lines indicating who chatted with whom (view the map online here). The key ringleader is DB Trader-Submitter A (submitter refers to their role submitting orders into the London Fix) and this sort of hub and spoke model is common in social networks. The two persons with a slash and two banks in their name indicate that they moved banks during the period of the complaint. This is not uncommon in bullion banking since it is a small industry and would increase the risk of collusion between former workmates, something the management of the banks should have been alert to. The lack of connection between these groups is likely due to them being in different timezones. The group of four in the top left corner are most likely in Singapore, given the use of Singlish terms like "lah" in the chats. The larger group is based mostly in London with one in New York, based on references in the complaint. The group of three at the bottom may be in Dubai, although that is speculation. The chats have a jovial feel with traders calling each other "bro", "dude" and "mates" and show no care for clients on the other end of their schemes: for example, Deutsche Bank Trader B talks about "wanna ramp it up like really just buy at mmkt and fk everyone so bad". No doubt these chats will now be a lot more stilted as traders realise that collusive behaviour brings with it personal consequences like jail terms, as it did with LIBOR. Nick Laird at goldchartsrus.com has collated all the chats in chronological order here with a chart of the silver price underneath to help put the chats in context of market price action at the time. In general, the chat logs show collusion to tactically/short-term manipulate the London Silver Fix and spot market (curiously, there is no mention of Comex futures, but the plaintiffs are only giving us a sample in this complaint). With the Deutsche Bank chat logs showing a collusive network across banks, it would seem unlikely that the defendants will be able to refute the antitrust claim by the plaintiffs. The next question is that of damages. As it stands, the tactical nature of the manipulations means that the defendants are likely to argue that the members of the class action can only claim damages if they traded at the same time as the chat evidence shows market manipulation. To cover the entire class and increase the damages, the plaintiffs need to show that the traders' actions resulted in ongoing suppression of the silver price. In the chats the traders do not explicitly indicate any plans to suppress the price on an ongoing, multi-day/month/year basis or reference having to manage a large naked futures short position (which many have said is necessary for ongoing price suppression to exist). Monetary Metals have written on the naked short theory in the past, noting that it is not supported by observation of prices as contracts approach first notice day. To implement such an ongoing suppression using futures, the bullion banks would need to roll their oversized short position by purchasing the expiring contract and shorting the next contract. Such massive buying of an expiring contract would cause the basis to rise, yet the opposite occurs - see here for more details. Absent such explicit proof of suppression, the complaint masses a number of different econometric analyses to show that the London Silver Fix impacts other silver prices in the wider market. The analysis does not start off well where, on page 40, the plaintiffs fall for the "correlation proves causation" fallacy claiming that "the prices of COMEX silver futures contracts are directly impacted by changes in the Fix price, which determines the value of the physical silver underlying each COMEX silver futures contract" on the basis of a regression analysis between futures closing prices and the Silver Fix of 99.85%. The defendants will be able to rebut such claims by referring to papers like London or New York: where and when does the gold price originate? which show that neither London (spot) nor New York (futures) are dominant in terms of price and that the dominant market switches from time to time. We feel the plaintiffs are on stronger footing when comparing spot and futures price movements around the fix (see page 71 onwards, figures 24 to 28). The plaintiffs' show a few charts demonstrating a spot to futures linkage but we would suggest that to win the case the analysis would benefit from looking the spread between spot and futures markets, or the basis, which we report on each week. For an example of the application of basis to forensic price analysis, see our November 13 report where we show that the drop of $30 in the gold price around the London Fix on November 11 was driven by selling of futures as the gold basis began to fall before the price did (see below).

The final challenge for the plaintiffs is to prove that the impact of the banks' manipulative actions persisted "well beyond the end of the Fixing Member's daily conference call" (see pages 81-83). While the plaintiffs claim that this is proven because the mean of the cumulative unadjusted returns "on Down Days does not recover fully from the price drop that occurs at the start of the Silver Fix", the very wide confidence interval implies that on a number of days it did recover. It will be interesting to see how the defendants response to this crucial claim. The Deutsche Bank chat logs have enabled the plaintiffs to get over the first huge hurdle of showing antitrust behaviour. The focus of media reports to-date on the colorful chats gives the impression this is a closed case but the lack of explicit chats discussing management of a large naked futures short position and/or plans to supress the price over months is unusual. One would expect that managing such a large ongoing supression would be the main focus of discussions between traders. It is possible that the plaintiffs may have withheld this evidence for strategic purposes but if not, this case may end up turning into a battle of the bookworms with academics arguing econometrics and questioning what does the "mean of the cumulative unadjusted returns" really mean. Whichever way the case develops, bullion banks now have increased costs of supervising and managing the risks that precious metals trading desk "bros" might be looking to "fk" their clients. Combined with the potential that the "cost of doing business will jump – perhaps by 300% on one estimate" due to Basel 3 rules, some may decide to do a Deutsche Bank and pull out of the market. The result may be further consolidation in bullion banking and give regulators more justification to push those that remain out of "dark" OTC trading and on to "lit" exchanges.  |

| Pathetic Liberal's Meltdown Continue Posted: 15 Dec 2016 07:30 PM PST whether liberals want to admit it or not, and whether you like Trump or not, Trump won the election fair and square...despite a lot of the media trying to defame him while ignoring his opponent's flaws. To compare a man winning an election to Pearl Harbor simply because you don't like the guy who... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| What Is The Real Purpose Behind "Fake News" Propaganda? Posted: 15 Dec 2016 07:15 PM PST Submitted by Brandon Smith via Alt-Market.com, Here is the first problem with modern political discourse - too many people want to “win” arguments instead of getting to the greater truth of the matter. Discussions become brinkmanship. Opponents launch into immediate attacks instead of simply asking valid questions. They assert immediately that their position is the only valid position without verification. When confronted with rational responses and ample evidence, they dismiss everything instead of pondering what you have handed them. After this line is crossed, there is no point in continuing the debate. It will go on forever. This is one of the great tragedies of the Saul Alinsky method of political confrontation; it has bred entire generations of people who now believe that there is no objective truth. They think everything is relative. Because of this belief, they assume that there is no wrong or right side, no wrong or right goal. Instead, there are only goals that are MORE right than the goals of others. Everything boils down to a “lesser of two evils” mentality, and the ends therefore justify the means. Using dishonest measures to win the fight becomes acceptable. In the end, ideological combat actually prevents people from learning rather than helping them get to the root of the issue. We live in a world where truth is superfluous to the overall narrative. The only thing that is important is destroying your rivals. A classic strategy of dishonest debate and disinformation is to use every method possible to avoid confronting your ideological opponents legitimate arguments and to attack him personally. If you can’t beat him on fair ground using reason and evidence, then why not undermine his character so that the public will be influenced to avoid listening to him at all. This is sometimes called “inoculation.” At first glance, this is what the entire “fake news” meme supported by the mainstream media seems to be about. The MSM has proven itself utterly ineffective against the rise of the alternative media. And as I have explained in recent articles, there is a very good and obvious reason for this. The alternative media is the closest thing to a “free market” of ideas that the world has had in a very long time. Before web media, the public was strictly limited to a handful of corporate outlets that dictated information flow with an iron fist. If you wanted to learn anything beyond the mainstream narrative, you had to data mine at the library in an infinitely slower fashion, or try to personally seek out people who represented sources and witnesses. Today, data mining happens at light speed. Facts and evidence are uncovered in real time. Video interviews and transcripts can be achieved as quickly as a phone call. They can be examined and witnesses can be cited without traveling across the country. The prevalence of visual media also makes it difficult for witnesses to lie about their original claims later down the road. Beyond this, the alternative media offers something the masses have rarely ever had — choice. People can now look at all sides of an issue and all available evidence and decide for themselves what conclusions make the most sense. The mainstream media has only ever offered one side, with highly regulated information and cherry-picked evidence. The mainstream media’s purpose has never been to convey the unfettered “news.” Rather, their purpose has always been to manipulate public opinion, and we saw this revealed undeniably during the 2016 election as Wikileaks exposed journalist after journalist using their position of public trust as a weapon to influence the election outcome. Instead of admitting wrongdoing after this embarrassment, the MSM has decided to double down and escalate the accusation that the alternative media is “fake news.” Meaning, the MSM wants people to believe that we are liars and amateurs, that they are the “professionals,” and that the public should ignore everything the alternative media has to say from now on. I have to point out, though, that the narrative of mainstream news versus “fake news” seems a little thin to me. Meaning, I believe there is more going on here than the MSM simply trying to save itself. Call me a “conspiracy theorist,” but the elitist controlled mainstream media does little to help itself through this strategy. Think about it; the MSM is already clearly dying if one looks at the ever shrinking size of their audience and the loss of younger viewers and readers. They have been deteriorating for years, while the alternative media has been exploding in influence. The promotion of the fake news meme requires these mainstream media outlets to actually LIST which sources they believe represent fake news. This is what the Washington Post did with their promotion of liberal professor Melissa Zimdar’s list. So, forgive me if I am making too much of a leap here, but it seems that this tactic will only bring MORE web traffic to the sites listed, because the list does not really include any specific examples of “fake news” trespasses. People who are curious will be compelled to then visit the alternative sites to see what all the fuss is about. Perhaps many of them will find something they like, rather than something they hate. To me, the entire set-up of the fake news meme hurts the mainstream news more than it helps them. The next major story linked to fake news has been the assertion by some in government (including the CIA) that the alternative media is actually a front for Russian hacking and propaganda. I predicted this development two years ago in my article 'When War Erupts Patriots Will Be Accused Of Aiding “The Enemy.”' In that article, I argued that a war is being engineered between Eastern and Western powers (Russia and China vs. the U.S. and parts of Europe), and that this war will likely be an economic war. I also pointed out that such a conflict might be used by the elites in the West to rout out the alternative media as agents of Russian propaganda. Here’s a quote:

It would appear that everything I warned about two years ago is now happening. That said, I would amend my original viewpoint to include a new dynamic. The coming economic war will be based on a false paradigm — the false East/West paradigm. Over the years I have outlined in great detail the evidence that Eastern nations are just as controlled by central banking elites and globalist interests as Western nations, including evidence that Vladimir Putin is an avid supporter of the International Monetary Fund’s push for a single global currency system using the Special Drawing Rights basket as a bridge. He is also now suddenly a supporter of the UN’s climate change and carbon taxation agenda. I consistently warned analysts within the liberty movement to be careful about cheerleading too much for Russia and Putin, not only because he is controlled opposition, but because eventually we would be caught up in a media war that would label us as enemy conspirators. Remaining (rightly) critical of Putin was the best way to avoid being labeled as a member of the “fake news,” or a purveyor of Russian propaganda. It was my original belief that the elitist media would use the alternative media’s love affair with Putin as a means to undermine our credibility. However, today I would say that in a strange kind of way, the opposite is taking place. Confusing? Yes. Look at it this way; with the predominantly leftist mainstream media dying in an irreversible way, no amount of whining about “fake news” is going to save them. The rise of the “populists” is at hand, and as I have warned for the past year, this is by design. Just as conservative anti-establishment movements are rising in geopolitical influence, so to is the anti-establishment media. We are sort of a package deal. My belief is that conservative movements and the alternative media are being allowed into a position of cultural authority. The globalists are stepping out of the way (for now) as we grow in power. They are doing this in preparation for the final stage of an economic collapse they have been gestating since at least 2008. They are doing this because their goal is to set us up as scapegoats for a global disaster that will be remembered for centuries to come. I was able to predict the success of the Brexit Referendum, Donald Trump’s election win and the latest Federal Reserve rate hike based on this theory and I believe it will continue to prove itself. The globalists know that at this stage the fake news meme will only HELP US, rather than hurt us. That is to say, the elites are throwing the leftist media to the wolves and the Russian propaganda claims will only make the MSM look more ridiculous. The globalists see the writing on the wall — in fact, with the level of web analytics at their disposal, they can read and predict shifts in social consciousness before almost anyone else is aware of them. Instead of trying to obstruct us or fight us directly, I believe the elites plan to co-opt us or co-opt our image. That is to say, they will let us grow in apparent influence, trigger a crisis, and either use certain alternative outlets as the new mainstream, or simply paint all of us as complicit in the failures of conservative governments and nationalism. The end game here is to destroy the underlying principles of liberty movements; to make future generations reel in horror at the very mention of conservatives and national sovereignty. The elites are playing a very complex strategy of fourth-generation warfare. Nothing you see is exactly what it seems. The fake news label is not meant to disrupt the alternative media. In fact it will help us rise to a position in which we can be blamed for negative global influence. Some people will say I am reading too much into the situation, or that I am giving the elites “too much credit,” or attributing too much “omnipotence” to their position. They will probably reference the recent passage of the 'Countering Disinformation And Propaganda Act' and claim that this is clearly meant to take down the alternative media. I would ask these people to consider a question, though — who will really have control over this legislation in the near future? If I am right, and Trump enters the White House in January with a Republican majority in Congress and the Senate, will it not be Trump that most benefits from the legal framework? How then will it serve to undermine the alternative and conservative media? I predict, in fact, that conservatives are being given enough rope to hang themselves with. I predict that Trump will utilize this legislation to go after the mainstream media, not the alternative media, and that many conservatives will support him even though questions of constitutionality will increase. I believe the fake news meme will backfire and that the MSM will die off as a result. I believe that this is all part of a carefully crafted narrative in which the right wing gains unprecedented political sway, only to be met with economic and social disaster. I believe that the game is far from over in the fight between globalists and sovereignty activists. I believe they cannot defeat us directly, so they now hope to defeat us indirectly, or, trick us into defeating ourselves. In reality, the game is just beginning. |

| Wall Street is Overly Optimistic on Trump Presidency (Video) Posted: 15 Dec 2016 07:07 PM PST By EconMatters

We discuss some of the challenges Donald Trump has had in his past with just making good solid decisions, let alone being the savior that is currently priced into financial markets for the US Economy. The Stock Market is setup for a big letdown in 2017 if past performance of Donald Trump regarding his competency at doing anything right is analyzed in depth. I would really like to know how we are going to cut the corporate tax rate, and at the same time fund a large infrastructure project in a rising rate environment with a strong US Dollar and 20 Trillion Dollars in National Debt and climbing. Wall Street does understand that this is impossible and actually incompatible economic policy goals right?

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle |

| Anonymous: Clinton Is Using Islamic Law To Overturn Election Posted: 15 Dec 2016 07:00 PM PST I'm glad TRUMP has got people around him to stop this evil vile plan from The Democrats if they stop TRUMP they take our freedom. if you love your freedom then you WILL keep TRUMP safe.. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Mike Maloney -- Fed Endgame Is Inflation Posted: 15 Dec 2016 06:30 PM PST Gold and silver expert Mike Maloney says we have seeing bubbles in stocks, real estate and now in bonds. Maloney contends, "The bond market is in a 35 year bull market, and I don't know how this can continue on forever. . . . I am expecting when this next recession starts, it's going to be a... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Gold chart annotated with exchanges between market-manipulating traders Posted: 15 Dec 2016 06:14 PM PST 9:14p ET Thursday, December 15, 2016 Dear Friend of GATA and Gold: Having already done it for the silver market rigging documentation -- http://www.gata.org/node/16999 -- Nick Laird of Gold Charts R Us has annotated a gold price chart with excerpts from Deutsche Bank's transcripts of electronic exchanges between its traders and traders for other banks who colluded to manipulate the gold market. The annotated gold price chart is posted at his internet site here: http://www.goldchartsrus.com/chartstemp/GoldMarketManipulation.php CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Golden Predator Finds New Veins of up to 30.8 g/t Gold; Company Announcement VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V:GPY, OTCQX:NTGSF) is pleased to announce additional surface exploration results and the results of airborne geophysical surveys from ongoing work at the 3 Aces project in southeastern Yukon, Canada. Highlights include: -- Seven of Spades: Newly discovered zone with stacked flat lying quartz veins returning values up to 18.55 g/t gold. -- Queen of Spades: Newly discovered zone with values up to 30.8 g/t gold. -- Jack of Spades: Additional results from continuous panel sampling of a second higher bench returned 20 meters of 7.62 g/t gold including 11.7 g/t gold over 12.4 meters and 37.9 g/t gold over 1.7 meters. -- Three of Spades: Additional assays have increased strike length of vein with returns including 6.95 g/t gold. ... ... For the remainder of the announcement: http://goldenpredator.com/_resources/news/nr_2016_11_21.pdf Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Avery Goodman: The Trump administration looks friendly toward a gold standard Posted: 15 Dec 2016 05:41 PM PST 8:40p Thursday, December 15, 2016 Dear Friend of GATA and Gold: In spite of all the selections from Goldman Sachs, securities lawyer and market analyst Avery Goodman writes today, the Trump administration under construction looks awfully friendly to the idea of restoring a gold standard, starting with Vice President-elect Mike Pence, head of the new administration's transition team. Goodman's commentary is headlined "The Most Influential People in the Trump Administration Turn Out to Be Gold Standard Fans" and it's posted at Goodman's internet site here: http://averybgoodman.com/myblog/2016/12/09/the-most-influential-person-i... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| End Times Headline News - December 15th, 2016 Posted: 15 Dec 2016 05:30 PM PST Crazy days like always. Is everything as it appears or is everything a psyop like normal? The Bible tells us there is a great deception that will take most of us. What a time to be alive. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Mass Mind Control & Cyber War -- Jeff Rense & Preston James - Posted: 15 Dec 2016 05:00 PM PST Jeff Rense & Preston James - Mass Mind Control & Cyber War Clip from December 13, 2016 - guest Preston James on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Posted: 15 Dec 2016 04:01 PM PST Two segments of the silver industrial demand complex are poised to consume 600 million ounces of silver through 2020. Please click the link below for a report issued today entitled, “Prospects for silver demand in ethylene oxide and photovoltaics”, issued today by the Silver Institute.

There are many reasons to be positive about demand for silver in photovoltaic (PV) cells. |

| LIVE Stream: President-Elect Donald Trump Rally in Hershey, PA 12/15/16 Posted: 15 Dec 2016 03:30 PM PST Thursday, December 15, 2016: Join President-Elect Donald J. Trump and Vice President-Elect Mike Pence for the USA Thank You Tour 2016 at the Giant Arena in Hershey, PA. RSBN will be on scene and the rally will begin at 7:00 PM ET. The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Fed’s Hammer Delivers Another Blow To Gold – Has it Bottomed? Posted: 15 Dec 2016 02:02 PM PST Gold Stock Bull |

| Breaking: Obama Launching Coup To Install Hillary - 12/14/2016 Posted: 15 Dec 2016 01:30 PM PST It will not happen his legacy is over Hillary Diane Rodham Clinton political career is done The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Gold Seeker Closing Report: Gold and Silver Fall Roughly 1% and 5% More Posted: 15 Dec 2016 01:17 PM PST Gold fell $19.72 to $1122.88 in late morning New York trade before it bounced back higher in early afternoon trade, but it still ended with a loss of 1.33%. Silver slipped to as low as $15.879 and ended with a loss of 4.76%. |

| Trump, the Fed and Systemic Risk Posted: 15 Dec 2016 01:00 PM PST This post Trump, the Fed and Systemic Risk appeared first on Daily Reckoning. [Ed. Note: Jim Rickards latest New York Times best seller, The Road to Ruin: The Global Elites' Secret Plan for the Next Financial Crisis (claim your free copy here) goes beyond the election and prepares you for the next crisis] The most decisive factor in the implementation of the Trump economic plan is the reaction of the Federal Reserve. While a Fed rate hike in December was basically a certainty, the path of rates in 2017 following the December hike will be dispositive with regard to the success or failure of Trump's plans. The Fed can choose to be highly accommodative in the face of Trump's larger deficits. In effect, the Fed will not anticipate inflation, but will wait until it actually emerges. Actual inflation is still well below the Fed's target inflation rate of 2%. Since the Fed is targeting average inflation of 2%, it could allow inflation to run above 2% for a while, which would be consistent with 2% average inflation, given today's lower level. The Fed also seeks negative real rates as a kind of stimulus measure. Negative real rates exist when the rate of inflation is higher than the nominal interest rate. This condition can exist at any level of nominal rates. For example, inflation of 3% with nominal rates of 2.5% produces a negative real rate of 0.5%. Likewise, inflation of 4% with nominal rates of 3.5% produces the same negative real rate of 0.5%. No doubt the Fed does not want inflation of 3.5%. However, they can achieve negative real rates at any level by using financial repression to put a lid on nominal interest rates. This is done by forcing banks to buy Treasury notes even if the Fed's balance sheet is stretched. It amounts to a kind of "shadow QE" using the bank balance sheets to park bonds instead of the Fed's balance sheet. This kind of accommodation to higher deficits is also called "fiscal dominance," an idea sketched by former Fed governor Rick Mishkin and his colleagues in academic literature. The idea is that Fed independence is mostly a mirage and the Fed will do what is needed to facilitate the fiscal wishes of Congress despite protests to the contrary. Under fiscal dominance, low inflation is allowed to persist for an extended period of time. It will gradually erode the real value of the dollar and dollar-denominated Treasury debt. This is how the U.S. reduced its debt-to-GDP ratio from 1946 to 1970. The problem with this "high pressure" approach is that inflation is not purely a monetary phenomenon, but it is also a behavioral phenomenon. Money printing alone does not produce inflation. The money printing must be combined with the willingness of individuals to borrow, spend and invest. Such willingness is largely psychological — dependent on Keynes' animal spirits. However, once expectations shift from deflationary to inflationary scenarios, they are hard to shift back again. This could lead to a situation in which inflation expectations shift from 1% to 3%, but then shift quickly to 5% or higher. The Fed assumes they can dial-down inflationary expectations from, say, 3% to 2%. But that may be wishful thinking. Any effort to raise rates to deal with higher inflation expectations may have the opposite of the intended effect as consumers view higher rates as a validation that inflation is getting out of control. This is exactly what happened in 1974–81. The Fed started out behind the curve and stayed there until sitting Fed Chairman Paul Volcker's extreme measures in 1980–81. Alternatively, the Fed could choose to lean into prospective inflation from Trump's policies by aggressively raising rates in 2017. This policy would be based on Janet Yellen's reading of the Phillips Curve and the well-accepted notion that monetary policy acts with a lag. With unemployment at post-recession lows and initial claims for unemployment benefits at all-time lows, Yellen's analysis is that inflationary pressures from increasing wage demands are just a matter of time. Since monetary tightening works with a six-to-twelve month lag, it's important to raise rates now to keep ahead of that inflation. Independent of the state of the labor markets today, the Fed is desperate to raise rates as much as possible. This should allow it to have some dry powder available for rate cuts in the next recession. By Fed reckoning, the euphoria in the stock market after the election of Trump counts as an easing of financial conditions. Such easing is the perfect cover for an offsetting tightening by the Fed. The Fed will pursue a delicate balance between easing (from stocks) and tightening (from rates) that will allow it to achieve its rate normalization goal without putting the economy into a recession. The last wild card in this mix is the dollar. A tightening cycle by the Fed will make the dollar stronger. This is deflationary because the U.S. is a net importer and a stronger dollar makes imported goods cheaper for U.S. consumers and other participants in the global supply chain. The combination of a stronger dollar, imported deflation, and higher rates in an already weak economy could tip the U.S. into a recession. And some consideration must be given to the worst possible economic outcome: stagflation. That is the unhappy combination of higher inflation and low real growth or recession. Trump's big spending plans and animal spirits could produce the inflation while Yellen's rate hike and tight money produce the recession. A version of this played out in the United States from 1976–81. On top of the macroeconomic risks, systemic risk is as dangerous as ever. It could come to play a large and unexpected role in Trump's economic plans. Too-big-to-fail banks are bigger than ever, have a larger percentage of the total assets of the banking system, and have much larger derivatives books. In complex dynamic systems such as capital markets, risk is an exponential function of system scale. This means that the larger size of the system implies a future global liquidity crisis and market panic far larger than the Panic of 2008. The ability of central banks to deal with a new liquidity crisis is highly constrained by low interest rates and bloated balance sheets, which have not been normalized since the last crisis. In the next panic, which could come at any time, central banks will turn to the IMF to provide needed liquidity. That liquidity will take the form of the issuance of trillions of special drawing rights, SDRs (world money). This emergency SDR issuance will be highly inflationary, and effectively end the role of the U.S. dollar as the benchmark global reserve currency. There are many potential catalysts that could trigger such a crisis, including Deutsche Bank, failed gold deliveries, an emerging markets dollar-denominated debt crisis, a natural disaster, etc. The catalyst for such a panic is irrelevant — what matters is the instability of the system as a whole. When the catalyst is triggered and panic commences, impersonal dynamics take on a life of their own. These dynamics are indifferent to the political ideology or public policy of politicians. A Trump administration could quickly be overwhelmed by a global liquidity crisis as the Bush administration was in 2007-08. In such a case, the global elites operating through the IMF, BIS and G20 will dictate solutions since they control the remaining liquidity levers, especially SDRs. Trump could go along with the elite solution, which would involve cooperation with China, or he could fight the elites, in which case a new Great Depression could result. Taking these various vectors into account, this is the most accurate assessment: The global economy is poised on a knife-edge between inflation and deflation. The inflationary vector could dominate quickly, based on a combination of Trump deficits and Fed accommodation. Conversely, the deflationary vector could dominate based on fundamental factors such as a strong dollar, deleveraging, demographics and technology combined with premature Fed tightening. Waiting in the wings is a systemic crisis, which could result in inflation (due to massive SDR issuance) or deflation (due to lack of a coordinated global response). Regards, Jim Rickards The post Trump, the Fed and Systemic Risk appeared first on Daily Reckoning. |

| Donald Trump Warning Of Economic Collapse In 2016 2017 Posted: 15 Dec 2016 01:00 PM PST Hopefully, Trump can handle the weaknesses of the overall economics of the country and check the lackadaisical stance by the Federal Reserve. If Yellen is found to be using a Political facade, then she should be replaced. The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Posted: 15 Dec 2016 10:33 AM PST 1:30p ET Thursday, December 15, 2016 Dear Friend of GATA and Gold: Silver market analyst Ted Butler says JPMorganChase & Co. has cornered the silver market, accumulating a huge physical position even as it has been shorting the futures market, but won't let prices rise as long as it can keep building its inventory. (Does that sound like forever?) Butler's commentary is headlined "The Royal Flush" and it's posted at 24hGold here -- http://www.24hgold.com/english/news-gold-silver-the-royal-flush.aspx?art... -- and at GoldSeek's companion site, SilverSeek, here: http://www.silverseek.com/commentary/royal-flush-16185 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Canadian Government Issues Key Water License Company Announcement TORONTO -- Seabridge Gold Inc. (TSX: SEA) (NYSE:SA) announced today it has received a license from the Government of Canada required for the construction, operation, and maintenance of the water storage facility and associated ancillary water works at its 100 percent-owned KSM Project in northwestern British Columbia. The license, as authorized within the International Rivers Improvement Act, regulates all structures and activities situated on transboundary waters shared with the United States that have the potential to affect water quality and quantity. The Water storage facility and its ancillary water works (water diversion ditches and tunnels) are the primary water management control systems for the KSM Project. These facilities separate water that has not contacted mined material from so-called contact water originating from disturbed areas of the mine site and then contain the contact water prior to treatment and eventual release to the receiving environment. These facilities are situated on Mitchell and Sulphurets creeks, tributaries of the transboundary Unuk River system that flows into Alaska. The license was granted for a term of 25 years under the International Rivers Improvements Regulations as administered by Environment and Climate Change Canada. ... ... For the remainder of the announcement: http://seabridgegold.net/News/Article/642/federal-government-issues-key-... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Euro tumbles to 14-year low against the dollar Posted: 15 Dec 2016 08:45 AM PST This posting includes an audio/video/photo media file: Download Now |

| Fleckenstein dismissed as 'nonsense' the silver rigging Deutsche Bank has just admitted Posted: 15 Dec 2016 08:21 AM PST 11:24a ET Thursday, December 15, 2016 Dear Friend of GATA and Gold: Thanks to GATA's friend D.W. for noting today that your secretary/treasurer should have read deeper into money manager Bill Fleckenstein's internet site when criticizing him last night for his obliviousness to market manipulation: http://www.gata.org/node/17017 Fleckenstein not only dismissed the likelihood of market manipulation by government. He also dismissed as "nonsense" concerns about the possibility of "massive collusion to suppress silver prices." Toward the bottom of Fleckenstein's question-and-answer page -- https://www.fleckensteincapital.com/faq.aspx -- is this entry: "Q: Do you think the silver market is manipulated? "Fleck: No. Silver is a thin market, and it is possible to push the futures around to some degree (which does happen). Thus, silver is extremely volatile and always has the potential to go berserk -- in either direction. But massive collusion to suppress silver prices is nonsense -- not to mention, if it did exist, they have done a terrible job. 'But what about the Hunts?' The Hunts weren't stupid; they just got beaten. 'But what about JPM?' Silver is not where it is because JPM was short it. My silver buddy, who is very experienced as a silver trader, would tell you that story is nuts, as would my friend who in fact used to trade the silver book at JPM." Of course what Fleckenstein assures his readers and investors is "nonsense" has just cost Deutsche Bank $38 million to settle the anti-trust lawsuit against it for rigging the silver market. It also has cost Deutsche Bank the disgorgement of massive documentation of silver- and gold-market rigging by the bank's traders and traders for other investment banks, documentation of ... yes, "massive collusion." Will Fleckenstein correct the misinformation he is purveying? Will he examine the documentation of the market manipulation he is denying? Not if he wants to preserve his invitations to the banking industry's holiday parties and its patronage of his investment house. Everyone else should just keep trusting Fleckenstein's anonymous buddies. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Seasonality Favors Gold, Silver and Junior Mining Stocks Going Into Year End Posted: 15 Dec 2016 08:16 AM PST Summary Gold and silver could once again be ready to rally possibly starting in days or in the beginning of 2017. Precious Metals usually bottom at year end then have massive rallies in the New Year. Remember the lower it goes the higher it runs and the more gains made in the following year. |

| Seasonality Favors Precious Metals and Junior Miners Going Into Year End Posted: 15 Dec 2016 08:08 AM PST The junior mining sector and precious metals continue to be in a bear market due to this rising dollar and QE Taper since 2011 while other nations have been devaluing their currencies to ridiculous low levels such as the Yuan, Ruble and Rupee. The bear market in precious metals and junior miners appeared to end in the beginning of 2016 but was smacked down as the rise of Trump in the US has even pushed stocks and the US dollar even higher. Meanwhile precious metals and the miners remain dirt cheap testing major support. |

| Cancellation of currency notes suppresses gold demand in rural India Posted: 15 Dec 2016 07:59 AM PST Life in the Time of Demonetisation: Rural Gold Hubs Silent By Sutanuke Ghosel KOLKATA, India -- Jewellers and bullion dealers in India are refraining from buying gold despite the dip in price, thwarted by subdued demand in rural areas due to the demonetisation-induced cash crunch. Rural areas account for 60 percent of India's gold consumption, which has fallen after the government's demonetisation move. Although there are signs of a gradual recovery in urban demand, the sentiment remains negative because of patchy buying in rural areas, where purchases are in cash. "Traders are not buying gold. ... They continue to be on the sell side," said Prathamesh Mallya, chief analyst for non-agricultural commodities and currencies at Angel Broking. ... ... For the remainder of the report: http://economictimes.indiatimes.com/markets/commodities/news/life-in-the... ADVERTISEMENT Market Analyst Fabrice Taylor Expects K92 Shares to Rise Interviewed on Business News Network in Canada, market analyst and financial letter writer Fabrice Taylor said shares of K92 Mining (TSXV:KNT) are likely to rise, even amid declining gold prices, because the company has begun producing gold at its mine in Papua New Guinea: http://www.bnn.ca/video/fabrice-taylor-discusses-k92-mining~1008356 Taylor cited the company's announcement here: http://www.k92mining.com/2016/11/6114/ Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Cash ban gives a boost to India's government-run banks Posted: 15 Dec 2016 07:49 AM PST By Nupur Acharya and Santanu Chakraborty Shares of India's biggest state-run lenders are on a roll, thanks to a government ban on high-value notes that took almost four-fifths of the nation's currency out of circulation. ince the so-called demonetization policy was introduced on Nov. 8, State Bank of India and Bank of Baroda have risen at least 4 percent amid speculation they will benefit more than private-sector peers from the influx of deposits that followed the cash ban, according to IDBI Capital Market Services Ltd. Private-sector rivals HDFC Bank Ltd. and ICICI Bank Ltd. dropped 7 percent and 9 percent, respectively. The government's surprise move last month to invalidate old 500- and 1,000-rupee notes has driven millions of Indians to banks to deposit the currency or exchange them for new denominations. Lenders had taken in 12.4 trillion rupees ($183.6 billion) of deposits as of Dec. 10, out of the 15.6 trillion rupees of notes canceled, central bank figures show. "State-run banks are getting to generate a large float of low-cost current and saving account deposits after demonetization," A.K. Prabhakar, head of research at IDBI Capital in Mumbai, said by phone. ... ... For the remainder of the report: https://www.bloomberg.com/news/articles/2016-12-14/india-s-worthless-cas... ADVERTISEMENT Golden Predator Finds New Veins of up to 30.8 g/t Gold; Company Announcement VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V:GPY, OTCQX:NTGSF) is pleased to announce additional surface exploration results and the results of airborne geophysical surveys from ongoing work at the 3 Aces project in southeastern Yukon, Canada. Highlights include: -- Seven of Spades: Newly discovered zone with stacked flat lying quartz veins returning values up to 18.55 g/t gold. -- Queen of Spades: Newly discovered zone with values up to 30.8 g/t gold. -- Jack of Spades: Additional results from continuous panel sampling of a second higher bench returned 20 meters of 7.62 g/t gold including 11.7 g/t gold over 12.4 meters and 37.9 g/t gold over 1.7 meters. -- Three of Spades: Additional assays have increased strike length of vein with returns including 6.95 g/t gold. ... ... For the remainder of the announcement: http://goldenpredator.com/_resources/news/nr_2016_11_21.pdf Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Asias Gold Investing Support Goes AWOL: China Posted: 15 Dec 2016 07:16 AM PST Bullion Vault |

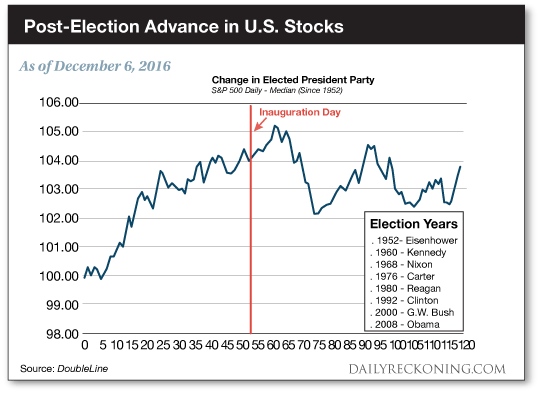

| The Only Chart “Trump Traders” MUST SEE Posted: 15 Dec 2016 06:32 AM PST This post The Only Chart “Trump Traders” MUST SEE appeared first on Daily Reckoning. If history is any guide, we know exactly when the Trump Bump will finally fizzle… In fact, the giddy market conditions we're experiencing right now will most likely disappear long before The Donald has a chance to redecorate the Oval Office. The election results were finalized over one month ago. But the powerful market move continues to baffle many of Wall Street's very serious strategists. In their never-ending quest to explain the stock market's every tick, they can't help but slap a gold plated TRUMP sign on this raging bull—and then pout when everything doesn't go exactly as planned… 'You don't have to call it a Trump rally," MarketWatch muses. "But some market specialists appear to be struggling to pin a name to the recent moves across global markets, which has pushed the S&P 500 index, Dow Jones Industrial Average, the Nasdaq Composite Index—and most recently the Dow Jones Transportation Average—into record territory since President-elect Donald Trump's Nov. 8 victory over rival Hillary Clinton." The wild moves continued today—this time to the downside. The Fed raised rates exactly as it said it would. The 25 basis-point hike was baked into the pie. But that didn't stop manic traders from pounding the sell button once the hike became official at 2 p.m. Is this the end of the line for the rally? At least one famous fund manager doesn't think the market's out of ammo just yet. DoubleLine Capital's Jeff Gundlach says the euphoria won't fizzle until just after the inauguration. When a political party reclaims the presidency, Gundlach notes that the post-election rally historically lasts until just after the inauguration in late January. That's when reality starts to creep back into the picture…

Remember, history doesn't repeat—but it does rhyme. Using past election cycles are our guide, we can expect a rabid market to chill out and drift sideways a bit once Trump takes the oath of office. But these observations aren't going to stop the gripes from the sold-out bulls… Ever since stocks started sprinting higher a few weeks ago, investors have complained that the market has risen too far, too fast. And they're probably right. But this is the nature of the beast. Markets will never trade at an ideal price. The animal spirits are simply too powerful. Crashes always end once investors start overacting to every little piece of bad news hitting the wire. On the other hand, rallies aren't exhausted until every last bear throws in the towel and joins the parade… Thankfully, we've been down this road before. This time ain't that much different from the last. This morning, markets continue to spin in reaction to the Fed's tightening schedule. The U.S. Dollar is ripping to highs we haven't experienced since early this century. Meanwhile, gold is down almost 3% as I type. The financial media will no doubt spend the day bickering about why this is all happening. On the other hand, we'll stay the course as the post-election melt up continues to pay dividends… Sincerely, Greg Guenthner The post The Only Chart “Trump Traders” MUST SEE appeared first on Daily Reckoning. |

| Gold and Silver Market Morning: Dec 15 2016 - Gold and Silver thumped by Fed statement! Posted: 15 Dec 2016 06:22 AM PST Shanghai prices held $33.94 higher levels than prices in New York. London opened at a higher discount to Shanghai of $39.74. In the last day London and New York gold prices have dropped in the dollar around 11% whereas Shanghai gold prices in the Yuan have dropped only 0.5%. This is an important point, we feel pointing to volatility in London and New York continuing then doing so both ways. i.e. Shanghai is implying that gold prices are falling too far too fast, despite the rising dollar. |

| Fed Raised Rates 0.25% – Rising Rates Positive For Gold Posted: 15 Dec 2016 06:17 AM PST The Federal Reserve increased interest rates by 0.25% as expected yesterday leading to gold falling to lows last seen in February 2016 and the dollar rising to its highest level against the euro in 14 years. Gold actually settled higher at $1,163.70 for the day yesterday. However gold futures slid to $1,156.70 an ounce in electronic trading on the rate decision at 1400 EST and soon gold was pushed down 1.3% to 10 month lows after the decision in less liquid after hour markets. |

| SPX to Mop up Wave 2 Retracement Posted: 15 Dec 2016 05:51 AM PST The SPX Premarket is lower, but hasn’t broken yesterday’s low as I write. That leaves the possibility of a second go at the trendline at the open. ZeroHedge reports, “This morning the world awakes to a landscape in which markets are frantically rushing to catch up to a suddenly hawkish Fed which not only hiked for the second time in a decade but, as per yesterday's Fed statement and Yellen press conference, realized it has been behind the curve all along, and the result has been a spike in the dollar across virtually all currency pairs with the USDJPY surging above 118.40, coupled with a jump in bond yields around the globe as bond (the US 10 Year is trading at 2.64%, the highest since September 2014) as traders dump any hint of duration.” |

| Bron Suchecki: Silver smoking gun to stop dishonest dealing Posted: 15 Dec 2016 05:17 AM PST 8:16a ET Thursday, December 15, 2016 Dear Friend of GATA and Gold: Bron Suchecki, formerly of the Perth Mint, now of Monetary Metals in Scottsdale, Arizona, writes this week that the evidence of silver market rigging disgorged by Deutsche Bank in federal court in New York raises new questions for the litigation, like whether the rigging extended specifically to futures trading on the New York Commodities Exchange. Suchecki speculates that the case may prompt bullion banks to withdraw from trading the monetary metals and push trading more out into the open on exchanges. Suchecki's analysis is headlined "Silver Smoking Gun to Stop Dishonest Dealing" and it's posted at the Monetary Metals internet site here: https://monetary-metals.com/silver-smoking-gun-to-stop-dishonest-dealing... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Fed Raised Rates 0.25% – Rising Interest Rates Positive For Gold Posted: 15 Dec 2016 03:47 AM PST The Federal Reserve increased interest rates by 0.25% as expected yesterday leading to gold falling to lows last seen in February 2016 and the dollar rising to its highest level against the euro in 14 years. Gold actually settled higher at $1,163.70 for the day yesterday. However gold futures slid to $1,156.70 an ounce in electronic trading on the rate decision at 1400 EST and soon gold was pushed down 1.3% to 10 month lows after the decision in less liquid after hour markets. |

| Breaking News And Best Of The Web Posted: 15 Dec 2016 01:37 AM PST Fed raises interest rate, promises more in 2017. US stocks fall but remain at record, dangerously-high levels, Treasury bond yields near their annual highs. Italian banks restructuring and raising capital. Gold and silver fall hard on Fed decision. The “fake news” debate intensifies. Best Of The Web Are you "living in a death spiral"? […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Columbus Gold Gains Attention with Montagne d'Or Takeover Potential and Nevada Upside Posted: 15 Dec 2016 12:00 AM PST Experts are speculating that Columbus Gold's Montagne d'Or project in French Guiana is a prime takeover target for Nord Gold, while the recently released maiden resource estimate for Eastside in Nevada underlines the potential for this early-stage development project. |

| Gold and Silver in Steep Decline as Dollar Surges to Multi-Year Highs Posted: 14 Dec 2016 04:00 PM PST |

| Ari Wald: Bull Market Looking Healthy; Keep an Eye on the Dollar Posted: 14 Dec 2016 04:00 PM PST |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment