Gold World News Flash |

- Precious Metals: Now What?

- What Silver Needs to Do

- Celebrities Unite to Ask Electors to Vote Against Trump on December 19th

- Gold and Silver Now What ?

- Financial Pressure Cooker Bomb Cooking Now -- Jim Sinclair

- Jill Stein Spends $1mm Of Recount Donations On "Staff, Admin and Consultants"

- Election Hackers Revealed As DHS Agents

- The Fed Just Signaled The Collapse Of The Economy, Brace For Impact

- Fleckenstein is surprised by gold's price action but he shouldn't be

- Is China launching a trade war with the U.S.?

- Gold is half of Indians' physical assets, ahead of real estate, study finds

- Gold moves lower as Fed hikes interest rates

- BREAKING: TRUMP BRINGS 25,000 NEW Jobs from IBM, Promise for New Jobs Under Trump Admin.

- India To CONFISCATE GOLD? -- Andy Hoffman

- HISTORIC speech of PUTIN on NEW WORLD ORDER!! (Maybe TRUMP was hired to work for him!!) 2016

- Don’t Forget About Deutsche Bank

- Gold Seeker Closing Report: Gold and Silver Fall After Fed Rate Hike

- Is Trump Starting a War with China? | China Uncensored

- How To Hack the U.S. Election

- LIVE coverage of the Fed rate decision

- Warning: Fed Interest Rate Hike Could Trigger Stock, Financial Markets Meltdown

- The Silver Tsunami

- Jim’s Mailbox

- The Silver Tsunami

- Money Under Fire

- NEW WORLD ORDER and The ILLUMINATI tried to kill PUTIN on recent Plane crashes! 2016

- War On Cash - $100 Note Ban Considered In Australia

- Forget about Fake News – Worry about Fake Money

- Another social cost of gold price suppression: Ruined environment

- All that glitters is gold in Indian city famous for jewellery craftsmanship

- Finance titans face off over $5 trillion London gold market

- Allan Flynn: 'When gold goes above 1430, we whack it'

- The Coming War On China

- Forget about Fake News – Worry about Fake Money

- Shariah Gold Standard Is “Revolutionary” – Mobius

- Take Advantage of Gold, Silver, Platinum and Palladium Different Seasonal Trends

- Global Chaos And The Road To $1,000 Silver

- Shariah Gold Standard Is “Revolutionary†– Mark Mobius

- Why Market, Economic Collapse isn't on the Menu

- Technician: Bursting Bond Bubble Greatest Risk to Secular Bull Market

| Posted: 15 Dec 2016 07:10 AM PST I had a completely different post in mind for tonight, but the action in the PM complex has changed my mind. Since the US elections the PM complex has had a hard go of it trapping many bulls in their long positions. The magnitude of this decline especially in gold has been unrelenting in nature, which is how a bull trap is set. Just a short five weeks ago all looked good for this sector as it had one of the biggest rallies in history off the January low for the PM stocks. There wasn't anything to suggest that five weeks ago the plunge was coming, but since then, there have been many clues that all was not right with the PM sector. |

| Posted: 15 Dec 2016 07:03 AM PST Several feints higher in the last week have done little more than trap bulls looking for a breakout. None of the rallies exceeded the two external peaks labeled in the chart, casting doubt on the enthusiasm and buying power of bulls. This is no problem that yet another flurry of buying wouldn't cure, but until it happens we should reconcile ourselves to more humdrum price action — or possibly the futures taking the path of less resistance and heading lower. Were that to occur, we could expect March Silver to fall to at least 15.995 before finding traction for a reversal attempt. |

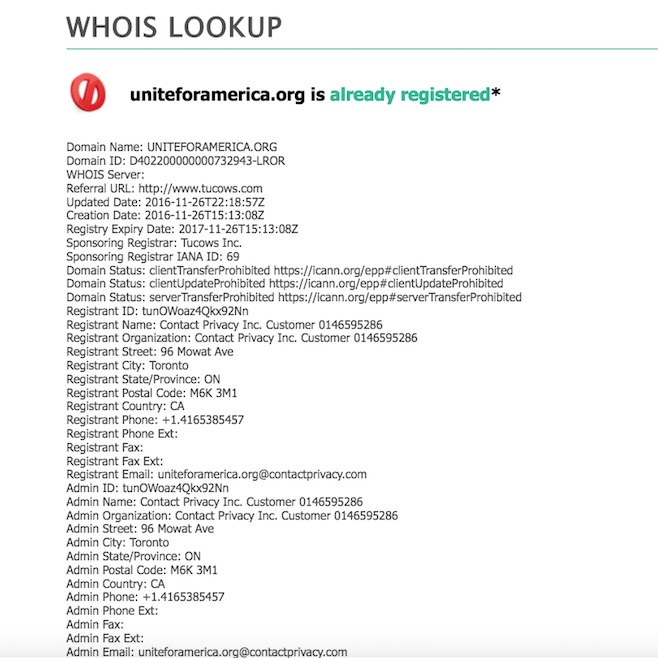

| Celebrities Unite to Ask Electors to Vote Against Trump on December 19th Posted: 14 Dec 2016 09:18 PM PST The fuckery is indeed very real. The fervor and energetic effort into preventing Trump from taking the Presidency, has taken on new levels of lunacy by the left -- who are absurdly panicked and beguiled by paranoia to the point of making themselves into carnivale clown jackasses -- all but assuring the reelection of Trump in 2020 and the Silver Fox in 2024. Springboarding off the hysterical media and their Russian fairytales of election tampering and raging Putin vendettas, a new organization has appeared -- seemingly out of nowhere. They call themselves United For America and they are cucks. Here is their mission statement. According to their Whois data, the website was launched shortly after Thanksgiving, suggestive that plans to deny Trump the Presidency has been in motion for at least three weeks. Here is their sparsely followed Twitter account -- again indicative of their irrelevancy and newness to the 2016 elections. And here is their video, a plea for help from the electors -- practically begging them to ignore the will of the people and to vote against Trump on 12/19, saying they'd make history doing so and would be considered heroes for 'voting their conscience', somehow suggesting that the electors don't really want to vote for Trump -- but only do so because he won the god damned elections. This video shall forever immortalize the emotional collapse of the left -- bedraggled snowflakes, crestfallen, deep in a stupor of their own making. Acceptance is the final stage of grief, something the illiberal left will soon be forced to endure -- whether they want to or not.

Content originally generated at iBankCoin.com |

| Posted: 14 Dec 2016 09:10 PM PST I had a completely different post in mind for tonight, but the action in the PM complex has changed my mind. Since the US elections the PM complex has had a hard go of it trapping many bulls in their long positions. The magnitude of this decline especially in gold has been unrelenting in nature, which is how a bull trap is set. Just a short five weeks ago all looked good for this sector as it had one of the biggest rallies in history off the January low for the PM stocks. There wasn’t anything to suggest that five weeks ago the plunge was coming, but since then, there have been many clues that all was not right with the PM sector. |

| Financial Pressure Cooker Bomb Cooking Now -- Jim Sinclair Posted: 14 Dec 2016 09:00 PM PST Renowned gold expert Jim Sinclair says, "You have a pressure cooker bomb cooking like the terrorists use. It's cooking, and it makes gold a storehouse of value and not a currency. It's just a storehouse of value. It turns it into a savings account. The only one that will work. The only... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Jill Stein Spends $1mm Of Recount Donations On "Staff, Admin and Consultants" Posted: 14 Dec 2016 08:30 PM PST After promising to spend "every dollar" of the donations she raised from disaffected Hillary supporters on recount efforts, Jill Stein has just released the following budget which reveals that over $1mm (or nearly 15% of the total $7.3mm raised) was used to fund her "staff payroll," "consultants," "administrative expenses," and "compliance costs." This looks eerily similar to some Clinton Foundation budgets we recently reviewed which claimed to have spent "every dollar" of their donations on "charity work."

Of course, to add insult to injury, Stein's efforts in Wisconsin actually widened Trump's margin of victory while recount efforts in Michigan and Pennsylvania were shut down by courts based on merit. Therefore, given that Wisconsin's net votes changed by a grand total of 131, Stein effectively paid $56,759 for each changed vote. And while that may sound like a complete failure to most of us, Stein, in a press release posted to her website, was a bit more upbeat describing the recounts as a "resounding success."

So congrats on the "resounding success" young Hillary voters! You spent $7.3mm to widen Trump's margin of victory and didn't even "get a lousy hat." |

| Election Hackers Revealed As DHS Agents Posted: 14 Dec 2016 08:30 PM PST After exposing a massive cyberattack of Georgia's state elections network, the Secretary of State confirms the IP address of the hacker leads back to the DHS. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| The Fed Just Signaled The Collapse Of The Economy, Brace For Impact Posted: 14 Dec 2016 08:00 PM PST The British member of parliament has now pushed the idea that the BREXIT was influenced by a Russian hack. Retail sales much lower than expected, during the holiday season which included black Friday and cyber Monday. Mortgage applications continue to decline, more people do not have the... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Fleckenstein is surprised by gold's price action but he shouldn't be Posted: 14 Dec 2016 07:22 PM PST 10:25p ET Wednesday, December 14, 2016 Dear Friend of GATA and Gold: Interviewed by King World News, money manager Bill Fleckenstein of Fleckenstein Capital acknowledges being confused by today's price action in gold and silver. "As for the metals," Fleckenstein says, "I'm kind of surprised they were hit as hard as they were. ... I don't really see why gold should act so terribly." On his company's internet site -- https://www.fleckensteincapital.com/faq.aspx -- Fleckenstein responds this way to a question asking whether there is a "plunge protection team" and whether the stock market is manipulated: "The Working Group on Financial Markets (a.k.a the 'PPT') does exist. But the thesis that it or any other part of government somehow manipulates the stock market on a day-to-day basis is not credible, largely because there are too many adversarial moving parts and keeping such activities a secret with so many people involved over the years would be impossible." ... Dispatch continues below ... ADVERTISEMENT Canadian Government Issues Key Water License Company Announcement TORONTO -- Seabridge Gold Inc. (TSX: SEA) (NYSE:SA) announced today it has received a license from the Government of Canada required for the construction, operation, and maintenance of the water storage facility and associated ancillary water works at its 100 percent-owned KSM Project in northwestern British Columbia. The license, as authorized within the International Rivers Improvement Act, regulates all structures and activities situated on transboundary waters shared with the United States that have the potential to affect water quality and quantity. The Water storage facility and its ancillary water works (water diversion ditches and tunnels) are the primary water management control systems for the KSM Project. These facilities separate water that has not contacted mined material from so-called contact water originating from disturbed areas of the mine site and then contain the contact water prior to treatment and eventual release to the receiving environment. These facilities are situated on Mitchell and Sulphurets creeks, tributaries of the transboundary Unuk River system that flows into Alaska. The license was granted for a term of 25 years under the International Rivers Improvements Regulations as administered by Environment and Climate Change Canada. ... ... For the remainder of the announcement: http://seabridgegold.net/News/Article/642/federal-government-issues-key-... Yes, keeping market manipulation on such a scale a secret may be impossible. Maybe that's why it's not a secret at all. But Fleckenstein sounds as if he hasn't been following the financial news for a few years, not even for the last few days, during which the already infamous Deutsche Bank transcripts of market rigging were reported. As for rigging of the gold market by government, that hasn't been a secret for a long time either. Indeed, too many people have been involved for it to stay secret, and many official documents of that rigging have been compiled by GATA here: http://www.gata.org/node/14839 So why is Fleckenstein confused and surprised about the gold price? Gold never does what it is supposed to do because central banks are intervening in the gold market, to use the words of the director of market operations of the Banque de France, Alexandre Gautier, "nearly on a daily basis": http://www.gata.org/node/13373 Because Fleckenstein doesn't know something doesn't make it a secret. It could just make him ignorant. His comments to King World News today can be found here: http://kingworldnews.com/bill-fleckenstein-on-the-fed-decision-and-the-w... CHRIS POWELL, Secretary/Treasurer Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Is China launching a trade war with the U.S.? Posted: 14 Dec 2016 07:00 PM PST Trump Economic Advisor Steve Moore weighs in on the potential consequences if China decides to penalize a U.S. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Gold is half of Indians' physical assets, ahead of real estate, study finds Posted: 14 Dec 2016 06:22 PM PST Indians Still Fancy Gold, Study Says By a Special Correspondent The total wealth held by individuals in India rose 8.5 percent to Rs.304 lakh crore in the financial year 2015-16 and is expected to further increase to Rs.558 lakh crore over the next five years, according to the India Wealth Report 2016 by Karvy Private Wealth. According to the study, individual wealth in physical assets stood at Rs.132 lakh crore, having grown 10.32 percent in fiscal 2016 compared to a 2 percent decline in fiscal 2015. Gold accounted for a 49.83 percent share among physical assets, followed by real estate at 41.94 percent and diamonds at 6.07 percent. Among financial assets, Indian individuals preferred the safe avenues of fixed deposits and bonds with a 21.40 percent share, followed by direct equity (17.23 percent), insurance (14.81 percent), savings deposits (12.55 percent), and cash (9.67 percent). ... ... For the remainder of the report: http://www.thehindu.com/business/Indians-still-fancy-gold-land-says-stud... ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold moves lower as Fed hikes interest rates Posted: 14 Dec 2016 04:36 PM PST |

| BREAKING: TRUMP BRINGS 25,000 NEW Jobs from IBM, Promise for New Jobs Under Trump Admin. Posted: 14 Dec 2016 04:30 PM PST BREAKING: TRUMP BRINGS IN 25,000 NEW Jobs - IBM Boss Promises 25,000 New American Jobs Under Trump Administration. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| India To CONFISCATE GOLD? -- Andy Hoffman Posted: 14 Dec 2016 04:00 PM PST Is India PROOF Elites Want To CONFISCATE GOLD? -- Andy Hoffman Andy Hoffman from Miles Franklin is back to help us break down REAL NEWS from the world of economics and precious metals. We examine the tyrannical moves in India to ban cash and SEIZE gold from citizens. Is this the model the... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| HISTORIC speech of PUTIN on NEW WORLD ORDER!! (Maybe TRUMP was hired to work for him!!) 2016 Posted: 14 Dec 2016 03:30 PM PST TV NEWS: PUTIN exposes USA! Important News!! How to survive on 2016/2017 event! Gold Tips! Very important Information! Please take a look and Share... Share... because this video must be shared with max number of people! make your part now, please share it! Because the Government Cover-up!... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Don’t Forget About Deutsche Bank Posted: 14 Dec 2016 02:04 PM PST This post Don't Forget About Deutsche Bank appeared first on Daily Reckoning. [Ed. Note: Jim Rickards latest New York Times best seller, The Road to Ruin: The Global Elites' Secret Plan for the Next Financial Crisis (claim your free copy here) goes beyond the election and prepares you for the next crisis] The banking crisis in Italy has gotten all the attention lately, but one of the biggest banks in the world is still a serious potential problem. The bank in question is Deutsche Bank. It's the largest bank in Germany, by far, and one of the twelve largest in the world. It is difficult to overstate the importance of Deutsche Bank not only to the global economy, but also in terms of its vast web of off-balance-sheet derivatives, guarantees, trade finance, and other financial obligations on five continents. It's well known that Deutsche Bank is the "sick man" of European banking. Deutsche Bank is certainly in the "too big to fail" category. Therefore it won't be allowed to fail. Germany will intervene as needed to prop up the bank. The problems at Deutsche Bank are well-known. They have suffered through bad debt write-offs and mark-to-market trading losses just like many of their big bank peers. But, the problems go deeper. Deutsche Bank's capital has barely been adequate under generous ECB "stress tests," and is completely inadequate under real world scenarios involving a global liquidity crisis of the kind we saw in 2008. This summer, the U.S. Department of Justice announced that it was seeking $14 billion to settle charges that Deutsche Bank engaged in misleading sales practices with regard to residential mortgage backed securities between 2005 and 2007. Of course, that was just a claim. But, even if Deutsche Bank settles the case for a fraction of that amount, say $5 billion, it will significantly impair an already weak capital base. Not surprisingly, Deutsche Bank's stock suffered enormously as a result. From a pre-Lehman interim high of €104 per share, it fell to €34 per share by early 2015. That's a 68% decline, mostly driven by the global financial crisis of 2007-08 and the European sovereign debt crisis of 2011-2015. Just when investors thought things could not get worse, they did. From the €34 per share level in 2015, Deutsche Bank stock fell again to €10.25 per share in September. That was a massive decline off the lower 2015 base. Its stock has since bounced back. But it's still afflicted with bad debts, high expenses and inadequate capital. Management is trying to remedy the situation, but it's clear that massive amounts of added capital will be needed. Many potential investors have not wanted to buy in until they are certain that all of the bad debts have been recognized. Yet the process of writing off debts impairs capital further and makes a run on the bank more likely. Under G-20 rules approved at the Brisbane Summit in November 2014, governments are no longer allowed to bail out banks with taxpayer money. Instead, they must "bail in" the banks by taking capital from stockholders, depositors and bondholders of the bank itself. This is another dynamic that makes raising funds more difficult. Potential investors worry about dilution of their investment if the bank has to raise more capital in the future. Deutsche Bank is heading for a funding crisis and a further plunge in its share value, probably to €1.00 per share. This story is quiet for the moment but may return with a vengeance later this month or after the new year. I use a method called causal inference to make forecasts about events arising in complex systems such as capital markets. Causal inference methodology is based on Bayes' Theorem, an early 19th century formula first discovered by Thomas Bayes. This is the same method we used to correctly forecast the outcome of the Brexit vote and the election of Donald Trump. Now we're using it to forecast the chances of a Deutsche Bank stock collapse in the next few months. What signals are we getting that indicate a collapse is possible? The strongest signal is not coming from Germany — it's coming out of from Italy… The Banca Monte dei Paschi di Siena (BMP) is the world's oldest bank still in operation, founded in 1472. BMP will require a capital injection if it's to be saved. And time is running short. What do the travails of BMP have to do with Deutsche Bank? Both banks are too-big-to-fail and are failing, but BMP is closer to the brink. It's the "canary in the coal mine" for Deutsche Bank. Italy wants to bail-out BMP with taxpayer money. That's the standard playbook that governments used in 2008. But the rules have changed. At the G20 Leaders' Summit in Brisbane in 2014, it was decided that bailouts would be replaced by "bail-ins." In a bail-in taxpayer money is not used to recapitalize the sick bank. Instead bondholders and depositors take haircuts and are involuntarily converted into equity holders. Imagine if you had $500,000 on deposit at the bank and you got a notice in the mail that said your deposit was now $250,000 (the insured amount) and the other $250,000 had been converted into stock in a "bad bank," which might or might not produce returns in the future. That's what happens in a bail-in. The German government under Angela Merkel has told the previous Italian government that they cannot bail-out BMP; they have to use the new bail-in rules instead. But what's sauce for the goose is sauce for the gander. If Germany forces Italy to bail-in BMP, then Italy will insist that Germany also bail-in Deutsche Bank when the time comes. Germany won't like that, but if they don't bail-in Deutsche Bank, the European Union will come apart because of acrimony between Italy and Germany. Compared to this dispute, UK Brexit is a sideshow. Greece is a sideshow of a sideshow. Italy is the real deal. If Germany and Italy can't cooperate, then there is no European Union. Markets won't wait while German and Italian politicians tiptoe around the bail-in question. They will draw their own conclusions and possibly start a run on Deutsche Bank. In the event of a stock collapse, the German government will let Deutsche Bank stock fall to €2 before they intervene. That's how existing stockholders make their "contribution" to the bail-in. Deutsche Bank won't fail and the stock won't go to zero. But this story is far from over. Regards, Jim Rickards The post Don't Forget About Deutsche Bank appeared first on Daily Reckoning. |

| Gold Seeker Closing Report: Gold and Silver Fall After Fed Rate Hike Posted: 14 Dec 2016 01:19 PM PST Gold gained $6.32 to $1164.92 in early New York trade, but it then fell markedly after the fed announced an expected interest rate hike and ended near its last minute low of $1139.65 with a loss of 1.38%. Silver slipped to as low $16.745 and ended with a loss of 0.65%. |

| Is Trump Starting a War with China? | China Uncensored Posted: 14 Dec 2016 01:00 PM PST Things heat up between Trump and the People's Republic. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Posted: 14 Dec 2016 12:00 PM PST Faith Goldy and Lauren Southern from TheRebel.media reveal exclusive footage out of Russia! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| LIVE coverage of the Fed rate decision Posted: 14 Dec 2016 11:02 AM PST FOMC Press Conference, December 14, 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Warning: Fed Interest Rate Hike Could Trigger Stock, Financial Markets Meltdown Posted: 14 Dec 2016 10:54 AM PST The big day has finally arrived. The Fed adjourns its two day FOMC meeting today. At 2PM Fed Chair Janet Yellen is expected to announce that the Fed is raising rates again. If the Fed does hike as 100% of analysts expect, it will be the first hike in 12 months and only the second in this tightening cycle. |

| Posted: 14 Dec 2016 10:47 AM PST At this point in the cycle, the silver market should be relatively easy for the average person to enter. Prices are beginning to move back toward natural supply and demand equilibrium, as large disruptions are occurring between the positioning of dominant futures speculators that have kept futures prices entrapped for nearly 6 years. |

| Posted: 14 Dec 2016 10:37 AM PST Jim, This is not just in Dallas; Fort Worth employees' pension plans are also in deep trouble. It is reported that they are underfunded by 38% whilst assuming returns of 8%. Can you tell what a disaster this will be? Only gold and silver will maintain their purchasing power. CIGA Gijsbert Not Just Dallas; Fort... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. |

| Posted: 14 Dec 2016 10:33 AM PST At this point in the cycle, the silver market should be relatively easy for the average person to enter. Prices are beginning to move back toward natural supply and demand equilibrium, as large disruptions are occurring between the positioning of dominant futures speculators that have kept futures prices entrapped for nearly 6 years. |

| Posted: 14 Dec 2016 10:02 AM PST This is the critical takeaway from all of the math above: For the Fed to achieve anything even close to the historical rate of credit growth, the dollar will have to lose a tremendous amount of its purchasing power. I truly believe this is the Fed's grand plan, if we may call it that, and it has nothing to do with what's best for the people of this land. Instead, it's entirely about keeping the financial system primed with sufficient new credit to prevent it from imploding. |

| NEW WORLD ORDER and The ILLUMINATI tried to kill PUTIN on recent Plane crashes! 2016 Posted: 14 Dec 2016 10:00 AM PST TV NEWS: PUTIN exposes USA! Important News!! How to survive on 2016/2017 event! Gold Tips! Very important Information! Please take a look and Share... Share... because this video must be shared with max number of people! make your part now, please share it! Because the Government Cover-up!... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| War On Cash - $100 Note Ban Considered In Australia Posted: 14 Dec 2016 09:30 AM PST RTD News keeps you up to date on what's happening around the globe and in the news. Information to help you become more Monetarily Aware. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Forget about Fake News – Worry about Fake Money Posted: 14 Dec 2016 09:13 AM PST Post-election airwaves and publications today are filled with bad news, good news, and fake news. The bad news is 'fake news' is very real. The good news is fake news is nothing new. The even better news for gold and silver stackers is they have learned to live with decades of fake news about sound money. You already know all about fake news. It used to go by other names – lies, propaganda, false advertising, and brainwashing, to name a few. Now we can add polling results and agenda-driven predictions to that list. |

| Another social cost of gold price suppression: Ruined environment Posted: 14 Dec 2016 08:54 AM PST 11:54a ET Wednesday, December 14, 2016 Dear Friend of GATA and Gold: Another huge social cost of gold price suppression can be seen in an illustrated essay posted this week by the internet magazine Sapiens about the environmental damage done by wildcat gold mining in the Amazon River rainforest. That is, environmental remediation is always a big cost of responsible gold mining. But when the gold price is pushed below the point where environmentally responsible mining can be done profitably, controlled by governments and major corporations, which can be held to account, wildcat miners take over and mine without remediation, extracting the natural wealth while failing to repair the damage they do. Governments that are usually pretty weak to begin with may be able to hold corporations to account but are not able to police thousands of wildcatters, who can vanish quickly. The illustrated essay is headlined "Gold Glimmers in the Amazon" and it's posted at Sapiens here: http://www.sapiens.org/culture/amazon-gold-mining/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Market Analyst Fabrice Taylor Expects K92 Shares to Rise Interviewed on Business News Network in Canada, market analyst and financial letter writer Fabrice Taylor said shares of K92 Mining (TSXV:KNT) are likely to rise, even amid declining gold prices, because the company has begun producing gold at its mine in Papua New Guinea: http://www.bnn.ca/video/fabrice-taylor-discusses-k92-mining~1008356 Taylor cited the company's announcement here: http://www.k92mining.com/2016/11/6114/ Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| All that glitters is gold in Indian city famous for jewellery craftsmanship Posted: 14 Dec 2016 08:30 AM PST By A. Shrikumar MADURAI, India -- Behind the glitzy facade of showrooms at Madurai's age-old jewellery bazaar, a labyrinth of narrow alleys leads to dingy workshops where traditional goldsmiths sit by a sizzling stove, melting and shaping the yellow metal into enviable ornaments. The Tamil epic Silpathikaram says how Kannagi and Kovalan reached the temple town from faraway Poompuhar. It was by selling the legendary emerald anklet of Kannagi in the famous jewellery market of Madurai that Kovalan was to fund their new life. The tragic turn the epic takes is another story, but it's a vital record that the city's goldsmiths and the jewellery market were always something illustrious. More than 5,000 small and big showrooms selling gold jewellery line the long stretch of South Avani Moola Street today and the bazaar is said to be one of the biggest in the region. But behind the thriving gold business are the hard work, perseverance, and hopes of thousands of goldsmiths who sweat it out all day inside the numerous "pattarai" that dot the area. ... ... For the remainder of the report: http://www.thehindu.com/society/All-that-glitters-is-gold-here/article16... ADVERTISEMENT Golden Predator Finds New Veins of up to 30.8 g/t Gold; Company Announcement VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V:GPY, OTCQX:NTGSF) is pleased to announce additional surface exploration results and the results of airborne geophysical surveys from ongoing work at the 3 Aces project in southeastern Yukon, Canada. Highlights include: -- Seven of Spades: Newly discovered zone with stacked flat lying quartz veins returning values up to 18.55 g/t gold. -- Queen of Spades: Newly discovered zone with values up to 30.8 g/t gold. -- Jack of Spades: Additional results from continuous panel sampling of a second higher bench returned 20 meters of 7.62 g/t gold including 11.7 g/t gold over 12.4 meters and 37.9 g/t gold over 1.7 meters. -- Three of Spades: Additional assays have increased strike length of vein with returns including 6.95 g/t gold. ... ... For the remainder of the announcement: http://goldenpredator.com/_resources/news/nr_2016_11_21.pdf Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Finance titans face off over $5 trillion London gold market Posted: 14 Dec 2016 08:15 AM PST By Eddie Van Der Walt Some of the biggest names in finance are fighting for control of the London gold market -- a $5 trillion, three-century-old trading hub that is being forced to adapt to a digital age. As the London Bullion Market Association revamps over-the-counter trades that are the market's major pricing benchmark, new ways of buying and selling precious metals are set to start next year from CME Group Inc., Intercontinental Exchange Inc., and the London Metal Exchange. Some big banks have stakes in the outcome, including Goldman Sachs Group, HSBC Holdings, and JPMorgan Chase. "There are four weddings, and we have to dance at all of them, because we don't know which marriage will last," said Adrien Biondi, the global head of precious metals at Commerzbank AG in Luxembourg. "Only one will win." ... ... For the remainder of the report: https://www.bloomberg.com/news/articles/2016-12-13/titans-of-finance-fac... ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Allan Flynn: 'When gold goes above 1430, we whack it' Posted: 14 Dec 2016 08:01 AM PST 11:07a ET Wednesday, December 14, 2016 Dear Friend of GATA and Gold: Gold researcher Allan Flynn today examines the electronic exchanges of bullion bank traders plotting their manipulation of the gold market, exchanges recently disgorged by Deutsche Bank to settle the anti-trust lawsuit against it in federal court in New York. Flynn notes what seems to be a reference in the exchanges to the Bank of China, a government-owned operation. Flynn also finds it curious that while the exchanges disgorged by Deutsche Bank powerfully incriminate Union Bank of Switzerland, a 2014 Swiss government report about misconduct in the currency market by UBS overlooked the gold market. There would be a more than plausible explanation for these angles: that, as GATA long has maintained, governments and central banks are the real parties in interest in rigging the gold and currency markets and so have been giving a pass to bullion banks and investment banks, which borrow gold from central banks for trading purposes, as long as the bullion banks and investment banks push the markets where governments and central banks want them to go. Surreptitious trading by governments and central banks, direct and indirect, is the far bigger issue here, since governments and central banks are authorized to create infinite money and maintain the capacity for totalitarianism. Flynn's analysis is headlined "'When Gold Goes Above 1430, We Whack It'" and it's posted at his internet site, Comex, We Have a Problem, here: http://comexwehaveaproblem.blogspot.com.au/2016/12/when-gold-goes-above-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Canadian Government Issues Key Water License Company Announcement TORONTO -- Seabridge Gold Inc. (TSX: SEA) (NYSE:SA) announced today it has received a license from the Government of Canada required for the construction, operation, and maintenance of the water storage facility and associated ancillary water works at its 100 percent-owned KSM Project in northwestern British Columbia. The license, as authorized within the International Rivers Improvement Act, regulates all structures and activities situated on transboundary waters shared with the United States that have the potential to affect water quality and quantity. The Water storage facility and its ancillary water works (water diversion ditches and tunnels) are the primary water management control systems for the KSM Project. These facilities separate water that has not contacted mined material from so-called contact water originating from disturbed areas of the mine site and then contain the contact water prior to treatment and eventual release to the receiving environment. These facilities are situated on Mitchell and Sulphurets creeks, tributaries of the transboundary Unuk River system that flows into Alaska. The license was granted for a term of 25 years under the International Rivers Improvements Regulations as administered by Environment and Climate Change Canada. ... ... For the remainder of the announcement: http://seabridgegold.net/News/Article/642/federal-government-issues-key-... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 14 Dec 2016 07:59 AM PST Thom talks with author and filmmaker John Pilger about his new documentary "The Coming War On China" and the military escalation that could lead World War III. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] |

| Forget about Fake News – Worry about Fake Money Posted: 14 Dec 2016 07:25 AM PST Post-election airwaves and publications today are filled with bad news, good news, and fake news. The bad news is ‘fake news’ is very real. The good news is fake news is nothing new. The even better news for gold and silver stackers is they have learned to live with decades of fake news about sound money. You already know all about fake news. It used to go by other names – lies, propaganda, false advertising, and brainwashing, to name a few. Now we can add polling results and agenda-driven predictions to that list. |

| Shariah Gold Standard Is “Revolutionary” – Mobius Posted: 14 Dec 2016 06:22 AM PST gold.ie |

| Take Advantage of Gold, Silver, Platinum and Palladium Different Seasonal Trends Posted: 14 Dec 2016 06:15 AM PST Prices in financial and commodity markets are exhibiting seasonal trends. This applies to the precious metals gold, silver, platinum and palladium as well. The chart below depicts the seasonal trends of the gold price over a time period of 45 years. |

| Global Chaos And The Road To $1,000 Silver Posted: 14 Dec 2016 04:50 AM PST Global Chaos And The Road To $1,000 Silver |

| Shariah Gold Standard Is “Revolutionary†– Mark Mobius Posted: 14 Dec 2016 04:37 AM PST One of the world’s leading investors, Mark Mobius told a gold conference in Dubai that the new ‘Shariah Gold Standard’ is both “innovative and revolutionary” and importantly will bring “transparency” to the physical gold market which suffers from a lack of trust. |

| Why Market, Economic Collapse isn't on the Menu Posted: 14 Dec 2016 03:11 AM PST The word "collapse" instantly conjures primal feelings of both fear and excitement whenever we hear it. We fear it because it evokes our collective belief that collapse is fatal and final, yet it excites our imagination to the possibility, however, remote, that perhaps we'll be among the lucky few to survive and even prosper from it. Whether in reference to a financial market crash or the collapse of government, the very idea has given birth to a plethora of writings on the subject. Indeed, some of the top selling books in the financial literature category in recent years have had collapse as the subject matter, for writers instinctively know they can always count on a visceral reaction from their readers whenever they write of it. |

| Technician: Bursting Bond Bubble Greatest Risk to Secular Bull Market Posted: 13 Dec 2016 04:00 PM PST |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment