saveyourassetsfirst3 |

- MASSIVE RAID On Gold & Silver – Just the Beginning?

- Breaking News And Best Of The Web

- WARNING: Period of Political Turmoil Ahead Will Resemble the FRENCH REVOLUTION

- On the use of gold coins as money

- This Is What Gold Does In A Currency Crisis, Brexit Edition

- Gold Price – First 20 Day Average Touch This Month

- Will a Rising US Dollar Crush Gold’s Fledgling Bull?

| MASSIVE RAID On Gold & Silver – Just the Beginning? Posted: 13 Nov 2016 07:01 AM PST The crooks supplied 10 billion dollars worth of gold contracts early in Friday’s session, and that was all that was necessary to implode gold and silver. The volumes were IMMENSE: $10 BILLION DOLLARS WORTH OF PAPER GOLD SOLD AT THE COMEX: MASSIVE RAID ON BOTH GOLD AND SILVER/HUGE WITHDRAWALS OF 13.35 TONNES OF GOLD FROM […] The post MASSIVE RAID On Gold & Silver – Just the Beginning? appeared first on Silver Doctors. |

| Breaking News And Best Of The Web Posted: 13 Nov 2016 01:37 AM PST Political class still searching for an explanation. Stocks and dollar rise, bonds and gold fall but inflation fears begin to dominate global markets. Anti-Trump protests erupt with occasional violence. Best Of The Web The cognitive dissonance cluster bomb – Dilbert Get ready… change is upon us – Peak Prosperity Trump won yet gold is […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| WARNING: Period of Political Turmoil Ahead Will Resemble the FRENCH REVOLUTION Posted: 12 Nov 2016 06:00 PM PST DollarCollapse’s John Rubino Joins Us To Break Down the Political & Market Impacts of Trump’s Stunning Win. Rubino Presents A TERRIFYING Scenario: But This Is Paradise for Precious Metals… Rubino Warns $1 TRILLION In Infrastructure Spending Will Cause Interest Rates To Spike, Which Will BLOW UP the Financial System We DODGED A BULLET! Hillary’s NeoCons […] The post WARNING: Period of Political Turmoil Ahead Will Resemble the FRENCH REVOLUTION appeared first on Silver Doctors. |

| On the use of gold coins as money Posted: 12 Nov 2016 03:00 PM PST Plata.com.mx |

| This Is What Gold Does In A Currency Crisis, Brexit Edition Posted: 26 Oct 2016 10:45 AM PDT In June the UK shocked the world – or at least the world's elites – by voting to pull out of the European Union. Economists predicted disaster, EU leaders threatened pain for British exporters and tourists, and the media settled in to watch the UK shrivel and die. Four months later, the appropriate response is […] The post This Is What Gold Does In A Currency Crisis, Brexit Edition appeared first on DollarCollapse.com. |

| Gold Price – First 20 Day Average Touch This Month Posted: 25 Oct 2016 01:33 PM PDT |

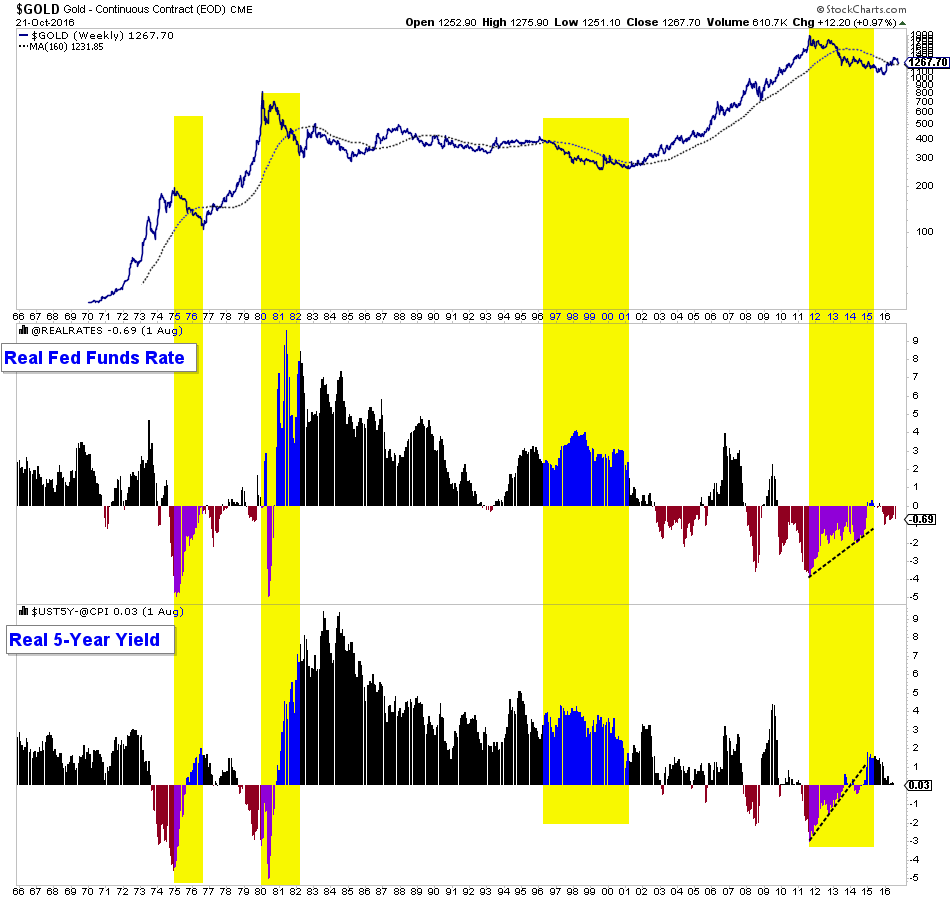

| Will a Rising US Dollar Crush Gold’s Fledgling Bull? Posted: 21 Oct 2016 11:25 PM PDT Gold and gold stocks have stabilized after forming a short-term low and even held up well while the US$ index pushed to an 8-month high. Conventional wisdom would tell us with the US$ index nearing a major breakout, Gold and gold stocks would be vulnerable to further losses. However, many astute analysts and traders believe that Gold and the US$ index can rise together and we note that the trend in the US$ index while important, is not the primary driver of Gold. Ultimately, as long as Gold's fundamental driver, declining or negative real rates remain in place, then the fledgling bull market will remain on track. First, take a look at what I like to call my master chart for Gold's fundamentals. We plot Gold, the real fed funds rate and the real 5-year yield. We highlight the major bear markets in Gold which occurred when real rates were rising or were strongly positive. Since the middle of 2015 real rates have declined and that explains the sustained recovery in Gold this year.  Gold & Real Interest Rates

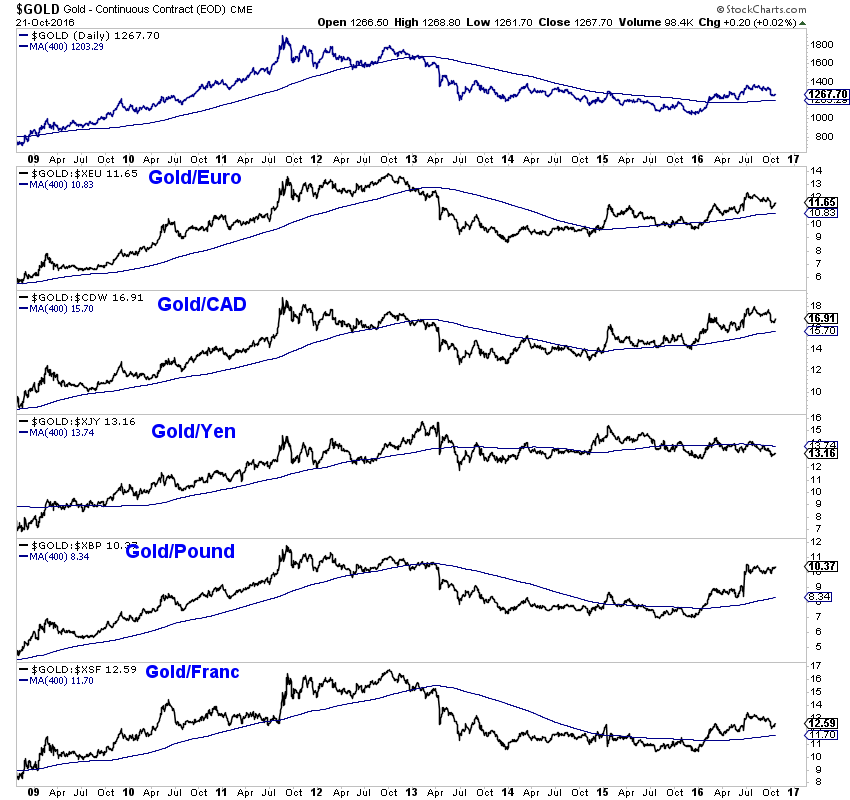

Although the Federal Reserve could raise rates, inflation is ticking higher and recent market action argues that inflation and inflation expectations will rise into 2017. Inflation metrics such as the sticky CPI and core CPI are showing inflation well above 2% without higher energy prices which could be on the way in the months ahead. Oil closed the week at a 15-month high and in recent weeks surged above important moving averages such as the 200 and 400-day. In other words, the potential coming rise in inflation figures to dwarf a measly quarter point rate hike. Recall the mid 2000s and the 1970s. Inflation rose faster than interest rates and so Gold performed well. The Fed raises rates when inflation rises but the Fed is almost certain to remain behind the curve and let inflation run. That is bullish for Gold in US$ terms, even if the US$ index is performing well. Another thing to keep an eye on is Gold's performance against foreign currencies. Below we plot Gold priced in a number of different currencies and the corresponding 400-day moving average. Other than in Yen terms, Gold is in an uptrend against every major currency and remains above rising 400-day moving averages.  Gold in various currencies

Ultimately, the single most important driver of Gold is negative or declining real interest rates and with inflation poised to rise, real rates are likely to decline further in 2017. If the US$ index is rising then that certainly puts some cap on Gold's performance in US$ terms. However, the presence of negative real rates combined with continued outperformance in foreign currency terms would sustain the bull market. Moreover, precious metals already experienced a vicious multi-year bear market. You don't get that kind of buying opportunity twice but the recent correction in the sector has created a lower risk buying opportunity. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform into 2017. Jordan Roy-Byrne, CMT, MFTA

The post Will a Rising US Dollar Crush Gold's Fledgling Bull? appeared first on The Daily Gold. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment