Gold World News Flash |

- The End Of A Great Industrial Power: French Car Production Has Collapse Since Joining The Euro

- What A Hillary Presidency Would Bring

- Hillary's #1 aide Huma Abedin: Undeniable ties to terrorists & 9/11 funders (Watch before voting!)

- No End to Hillary’s Nightmares: Ex-CIA Officer Reveals Hillary's Crimes!

- Here's What Makes Elliott Waves a Useful Forex Tool

- Hillary Is The Ultimate Insider

- Before You Vote Watch This Video ✪ Blow Your Mind ✪

- NYP Exposes Hillary Clinton Crimes, Drudge Eases Resistance

- Anonymous: Last And Only Hope. America You Have Been Warned.

- Stock Market Reaches Deadly 7 Straight Days of Losses As Catholic Jubilee Year End Day Approaches

- Turkish Police Raid Opposition Headquarters, Arrest Pro-Kurdish Party Leaders

- Full Speech: Donald Trump Rally in Concord, NC 11/3/16

- FBI Sources Believe CLINTON FOUNDATION "INDICTMENT is LIKELY" - Bret Baier

- Breaking: FBI Is Going After Bill Clinton Too, Not Just Hillary! Here Are The Details!

- The Agony Of 5 Years' Gold Price Correction Is Behind Us, The Ecstasy Of Another 5 Or 6 Year Bull Run In Front Of Us

- Decoding the Gold Cycle

- Anonymous | Declassified

- Gold Daily and Silver Weekly Charts - Markets Flight to Safety From Election Overhang

- Canada's CBC wastes taxpayer dollars mocking Trump

- Leak! HILLARY CLINTON exposed with Signs Of Parkinsons Disease and spiritual possession!! (2016)

- Jim Rickards: Hyperinflation Coming

- Russian bank aims to double its gold trade in three years

- Here’s What’s Wrong with Gold

- Fosun in exclusive talks to buy stake in Russian gold miner Polyus, Reuters says

- Unlock Gold Cycle Gains

- Ronan Manly: Private-equity investors to acquire Swiss gold refiner Argor-Heraeus

- Will London Gold Market Self Destruct? Ripe For China Take-over?

- Randgold profits surge as gold production gets back on track

- The London Gold Market – ripe for take-over by China?

- Swiss gold refinery Argor-Heraeus to be acquired by Private Equity investors

- Breaking News And Best Of The Web

- The Chartology of Gold

- Gold: It’s All About the US Dollar

- Podcast: Instability On The Horizon

- Gold Prices Sink, Down 3% vs Surging Pound as UK High Court Says Parliament Must Get 'Article 50' Vote Before Brexit

- Bitcoin Price Soars on Its Eighth Birthday

- “Trump Might Actually Win†- This Is What Gold and Silver Do In A Political Crisis

| The End Of A Great Industrial Power: French Car Production Has Collapse Since Joining The Euro Posted: 04 Nov 2016 12:30 AM PDT For many people, the automotive sector is a determinant of a country’s economic power. If you do not produce car brands that are known worldwide, then you mean nothing. France, once a global leader in car manufacturing, may soon fall out from the elite, as its contribution to the world’s automotive market is dramatically decreasing. It is one of the many signs how weak French economy has become with the euro adoption. A dying industry can be a spark that will set on fire the whole country; or the European Union. Industry is one of economy’s pillars and it has become clear that we cannot create national welfare without it. It is industry where innovations are developed and real growth is achieved; growth based on real wealth, not financial operations. It has also turned out that a strong manufacturing sector prevents an economy from deeper stagnation, which happened to France. French industry has been contracting since the adoption of the euro. It was not able to recover after either of the 2001 or 2008 crises because the euro, a currency stronger than the French franc would be, has become a burden to France’s economy. The floating exchange rate works like an indicator of the strength of the economy and like an automatic stabilizer. A weaker currency helps to regain competitiveness during a crisis, while a stronger currency supports consumption of foreign goods. China has been accused of artificial devaluation of its currency to prop up exports, while the ECB’s policy has had an opposite effect for the economy of France and some South European countries: the euro has become too strong; whereas for Germany’s it has become too weak. That is why the common currency has increased consumption and imports in less productive countries and strengthened German competitiveness and exports. Because of the euro France could not regain international competitiveness in the world’s market after the 2001 crisis, so its industry has been slowly dying ever since. What we are saying is not that weakening your currency is a solution to boost a never-ending growth. The floating exchange rate is a great tool for bad times, which is excellently known in Poland, where there was no recession because of, among others, a temporarily weaker national currency. France and South European countries have just given this tool over to the ECB and they were not able to have a quick recovery. Just like Germany has had with an undervalued euro in their case. Read more: No industry, no growth: Southern Europe’s production start declining after euro adoption Today, according to the Eurostat, industry (except construction) makes up 14.1% of the French total gross value added, while in 1995 it was 19.2%. The EU’s average is still 19.3%, but in Germany 25.9%. Moreover, the share of industry in total employment in France is only 11.9%, also under the EU’s average (15.4%) and the German level (18.8%). One of the imprints of the dying French manufacturing under the ECB rules is automotive sector collapse. According to OICA data, the world’s car production almost doubled in the years 1997-2015 from 53 million vehicles produced yearly to 90 million. At the same time, Germany increased its car production by 20% from 5 to 6 million. What happened in France, once the proud producer of beautiful and modern vehicles? Not surprisingly, car production in France almost halved from nearly 4 million to less than 2 million. And again, stagnation and collapse occurred just after euro adoption. Obviously, France has been pursuing a very social policy and its market is highly constrained by the excessive legal regulations. However, trade unions in Germany are also very strong and yet the manufacturing sector has not collapsed. A dying industry is a huge problem not only for French economy but also for society. The strong revolutionary sentiment may spark off extreme riots, also with a racial background. France has one of Europe’s largest Muslim immigrant populations from Africa that is still growing. Without jobs in the industry France will not be able to offer these people any perspective. The longer the industrial stagnation lasts, the bigger the chances are that France will one of these days destroy the common currency union. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What A Hillary Presidency Would Bring Posted: 03 Nov 2016 11:00 PM PDT Bolsheviks 2.0 if that witch gets in, and even if Trump wins they will make life hell, probably crash the economy and blame it on Trump, and Israel will launch terror attacks against America. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hillary's #1 aide Huma Abedin: Undeniable ties to terrorists & 9/11 funders (Watch before voting!) Posted: 03 Nov 2016 10:30 PM PDT Hillary's #1 aide Huma Abedin: Undeniable ties to terrorists & 9/11 funders (Watch before voting!)Credit: Video, script, animation & voice created by Leaked Uploads. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No End to Hillary’s Nightmares: Ex-CIA Officer Reveals Hillary's Crimes! Posted: 03 Nov 2016 10:00 PM PDT There Is No End For Hillary's Nightmares: Ex-CIA Officer Comes Forward With Chilling Hillary Revelation! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Here's What Makes Elliott Waves a Useful Forex Tool Posted: 03 Nov 2016 09:59 PM PDT Some Elliott wave forex traders do watch the news -- but for different reasons Last Friday, EURUSD rallied strongly. Said Reuters: "The U.S. dollar tumbled against a basket of major currencies...on U.S. political uncertainty after the FBI said it would review more emails related to Democratic presidential candidate Hillary Clinton's private email use." It's true that the euro rallied after Friday’s news. But we pointed out in our October 21 story that Elliott wave patterns had already been calling for a bottom, if only a temporary one. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hillary Is The Ultimate Insider Posted: 03 Nov 2016 09:30 PM PDT Hillary Clinton is the personification of everything wrong with politics and government in the United States. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Before You Vote Watch This Video ✪ Blow Your Mind ✪ Posted: 03 Nov 2016 09:00 PM PDT Before You Vote Watch This Video ✪ Blow Your Mind ✪ The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NYP Exposes Hillary Clinton Crimes, Drudge Eases Resistance Posted: 03 Nov 2016 08:30 PM PDT Alex Jones covers what will be happening these next few days until the election is done with and we know whether or not Hillary will succeed in stealing the election. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Anonymous: Last And Only Hope. America You Have Been Warned. Posted: 03 Nov 2016 08:00 PM PDT Anonymous America You Have Been Warned.We Are Anonymous.We Are Legion.We Do Not Forgive.We Do Not Forget.United As One. Divided By Zero. Expect Us. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock Market Reaches Deadly 7 Straight Days of Losses As Catholic Jubilee Year End Day Approaches Posted: 03 Nov 2016 07:30 PM PDT Stock Market Reaches Deadly 7 Straight Days of Losses As Catholic Jubilee Year End Day Approaches The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Turkish Police Raid Opposition Headquarters, Arrest Pro-Kurdish Party Leaders Posted: 03 Nov 2016 07:18 PM PDT Back in May, just two months before the Turkish "coup", we reported that the puppet parliament of Turkish president Erodgan agreed to strip its members of immunity, a move which we predicted would "be used by Erdogan to prosecute members of the pro-Kurdish HDP, parliament's third-biggest party, as well as anyone else he choose to take down." Six months, and one fake coup which concentrated virtually all domestic political power in Erdogan's hands later, we were proven right, when overnight two co-leaders of Turkey's pro-Kurdish, People's Democratic Party (HDP) and at least 11 more MPs were detained overnight as police raided homes in Ankara and eastern Kurdish-majority areas. Local media reported that other than in Ankara and Diyarbakir, the arrests have been made in the eastern and southeastern Turkish cities of Hakkari, Mardin and Batman. The arrests are linked to "terrorist propaganda" cases, Reuters said.

Turkish police raided the Ankara house of co-leader Selahattin Demirtas and the house of co-leader Figen Yuksekdag in Diyarbakir, the largest city in Turkey's mainly Kurdish southeast, the party's lawyers told Reuters. "HDP call international community to react against Erdogan Regime's coup," the party said on Twitter, referring to President Tayyip Erdogan.

Police also raided and searched the party's head office in central Ankara. Television images showed party officials quarreling with police during the raid, and a Reuters witness said many police cars and armed vehicles had closed the entrances to the street of the HDP headquarters.

Selahattin Demirtas and Figen Yuksekdag were detained at their respective homes as part of a "counter-terrorism inquiry", security sources quoted by Anadolu news agency said. At least nine other HDP MPs were also taken into custody. The lawmakers were detained after "failing to appear for a summons to testify as part of a counter-terrorism investigation," Anadolu state news agency reported.

The testimonies are connected to "terrorist propaganda" probes related to the Kurdish militant group PKK, and to the pro-Kurdish protests with violent clashes of October 2014, which HDP co-chair Demirtas is accused of inciting. The MPs were required to show up for testimonies after their parliamentary immunity was lifted thanks to the abovementioned law passed earlier this year. The two HDP leaders reportedly vowed not to testify. Police broke into the home of HPD co-leader Figen Yüksekda? in Diyarbakir and detained her early Friday, while Selahattin Demirtas was detained in his Ankara house The party's lawyers told Reuters that 11 other HDP parliamentarians were also arrested in the raids, with two more wanted for arrest. Local media reported that other than in Ankara and Diyarbakir, the arrests have been made in the eastern and southeastern Turkish cities of Hakkari, Mardin and Batman. Those detained included HDP's deputy speaker in the Turkish parliament, RIA Novosti reported. "Deputy speaker of parliament Pervin Buldan has also been detained in Ankara," the HDP representative was quoted as saying.

The HDP, which is in strong opposition to President Recep Tayyip Erdogan's government and supports the Kurdish- and other minorities, has been accused of having links to PKK, which Ankara considers a terrorist organization. Meanwhile social networks could not be accessed from inside Turkey. Twitter, Facebook, YouTube and Whatsapp were inaccessible, even when users tried to circumvent restrictions using a virtual private network (VPN). Mr Demirtas had tweeted about his arrest before the sites were restricted. Another MP from the party who is currently abroad, Ertugrul Kurkcu, told the BBC that the detentions were "totally unlawful". He said: "This crackdown tonight is nothing to do with procedural law, criminal law, any law whatsoever or the constitution. This is an unlawful hijacking of HDP parliamentarians. "The Turkish government is heading towards a dictatorship of Nazi style [sic]. "Will the Turkish government abide by the internationally accepted standards of parliamentary democracy? This is the basic question." Turkey claims that the HDP has links to the Kurdistan Workers' Party (PKK), a militant group, but the party strongly denies this. The PKK is deemed a terrorist organisation by the US, the European Union and Turkey. Turkey remains under a state of emergency that was imposed after a failed coup in July. The emergency allows President Recep Tayyip Erdogan and his cabinet to bypass parliament when drafting new laws and to restrict or suspend rights and freedoms. About 100,000 public sector employees with alleged links to the coup's alleged mastermind were subsequently purged from their jobs. The HDP entered the Turkish parliament for the first time last year, when it won 59 seats and became the country's third-largest party. It had done so after at least two people died in explosions at one of its rallies. But just three months later, against a backdrop of rising violence between Turkish forces and the PKK, a crowd attacked the HDP's offices in Ankara. The next day, Mr Demirtas accused the ruling party of orchestrating nationalist attacks. Turkish politicians normally have immunity from prosecution, but this was removed from the HDP earlier this year. The take home message: after cracking down on the rank and file, the police, army, the state workers in the aftermath of July's "failed coup", Erdogan has now gone after the third largest political party in Turkey, and his on his way to becoming a full-fledged dictator, and all thoughout the humanitarian,democratic western powers sit back and pretend not to see Turkey's collapse into a dictatorial power. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full Speech: Donald Trump Rally in Concord, NC 11/3/16 Posted: 03 Nov 2016 06:30 PM PDT Thursday, November 3, 2016: Donald J. Trump will hold a rally at the Cabarrus Arena in Concord, NC at 4:00 PM ET.LIVE Stream: Donald Trump Rally in Concord, NC 11/3/16 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FBI Sources Believe CLINTON FOUNDATION "INDICTMENT is LIKELY" - Bret Baier Posted: 03 Nov 2016 05:30 PM PDT FBI Sources Believe Clinton Foundation Case Moving Towards "Likely an Indictment" - Bret Baier Fox News video. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking: FBI Is Going After Bill Clinton Too, Not Just Hillary! Here Are The Details! Posted: 03 Nov 2016 05:00 PM PDT Breaking: FBI Is Going After former US POTUS Bill Clinton Too. – Here Are The Details! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Nov 2016 04:18 PM PDT

On the front page of her journal on 2 April 2016 my dear Susan wrote this, whether quoting someone or inventing, I know not: "Faith is the deliberate confidence in the character of God, whose ways I may not understand at the time." Amen, Susan. I was disappointed but not too surprised to discover today that UK courts are apparently as pliable as US courts. All the politicians & globalists chatter & natter about "democracy," but whenever the "democracy" votes against them, they go to court with a "friendly" judge or make people disappear down manholes to defeat the people's will. The UK High Court ruling says that parliament must vote to leave the EU, & it's a lot easier to jimmy the votes of a few dozen parliamentarians than 64 million fractious (God bless 'em!) English, Scots, & Northern Irish. The globalist Insiders just don't get it. A world wide revulsion of the "democracy" has arrived, and will not be turned aside by corrupt judges and political trickery. Brexit will happen, & more Brexits. The great stone of social mood has rolled over from Centralization (for 350 years) to Decentralization. They can't stop it, and it will roll over them & flatten them. US dollar index continues to tumble, most likely projecting the pound sterling's fate after Brexit onto the US dollar after Trump whups Hellery. Sank another 22 basis points (0.22%) to 97.20 today. Hath now ruptured support at 97.75 & is sinking toward its intrinsic value -- zero, or the value of a sixth of a piece of paper. Yen & Euro profit from the dollar's wounds: yen rose 0.36% to 97.14 while the euro rose 0.7% to $1.1106. Stocks remind me of those classic Warner Brother's Wile E. Coyote cartoons. The coyote would chase the road runner and the roadrunner would lure him to run off the edge of a cliff. He would hesitate a minute, look down, pop a sign out from behind his back that said, "Good-bye," then zwoosh! down he went. Stocks have run off the cliff edge, they are merely at that moment of hesitation before the gravity suddenly taketh hold. Dow lost 28.97 (0.16%) to 17,930.67. S&P500 lost 0.49% or 9.28 to 2,088.66. Lower prices ahead, as the market expects Trump to be elected, for stocks America's Brexit. The real story about stocks is told in this chart of the Dow in gold, http://schrts.co/8Sv0tc and this chart of the Dow in Silver, http://schrts.co/ohwLZP Both indicators experienced a rally as stocks rallied and silver & gold corrected. However, the rally peaked in October & has since collapsed. Both are perched on the lip of a spectacular breakdown. SILVER and GOLD PRICES, some will complain, sank today. Well, yes, but let's look closer. Comex silver price fell 27.7¢ or 1.5% to 1838.3¢, wiping out all yesterday's gains -- boo hoo. The Gold Price backed up $4.70 (0.4%) to $1,302.10. So what? Gold now has under its belt a two-day close over $1,300. It has beaten that resistance. It remains above the 50 day moving average ($1,300.28). Next gold price steps will be big ones. Sellers knocked the silver price down today below 1800¢, to 1795¢, but before they could kick her in the teeth, she popped up and never stopped climbing. Sellers lost. Silver wants to hit the top channel line at 1930¢ before it pauses for breath, let alone stops. As I said yesterday, a little pause in this upswing is coming, probably next week, but after that the rest of the year ought to see silver & gold steadily rising. The agony of 5 years' GOLD PRICE correction is behind us, the ecstasy of another 5 or 6 year bull run in front of us. Y'all gonna run with the bulls, or waste away watching from the sidewalk? SPECIAL OFFER: Gold Dutch 10 guilders One of the most common gold coins in the world is the Netherlands ten guilders, thanks to the Dutch empire built on raw guts, daring, & spices. In 1818 they began minting the gold Ten Gulden (10 Guilder) coin in 90% fine gold (21.6 karat), containing 0.1947 troy ounce of fine gold. When I first went into business 36 years ago, a lot of Dutch 10 guilders were traded but we don't often get them today. Back then they traded at premiums above 15%, like British sovereigns & French 20 francs. When the US and other countries began minting gold coins, that competition drove down premiums. Today the Dutch 10 guilder is about as low-cost a small gold coin as you can find anywhere - way cheaper than American Eagles. We will price these at the spot gold price current when you order, but here's an example. With spot gold at $1,302.10, Dutch 10 guilders would cost $265.00 each, a premium of 4.5% over the gold value. But as I said -- now pay close attention -- we will price them at the spot gold price current when I enter your order. If the spot price is $1,275, they'll cost 259.40; if spot is $1,325, they'll run $261.85. Here's the offer: Ten (10) each Dutch 10 guilder gold coins, all minted before 1934, kings or queen, for 4.5% over spot gold. Here's an example: With spot gold at $1,302.10, ten Dutch 10 guilders at $265.00 would cost $2,650 + $35 shipping for a total of $2,685. How do you order? Send us an email at offers@the-moneychanger.com (not the same as the address on this commentary!) YOU MUST INCLUDE YOUR NAME, ADDRESS, PHONE, and how many ten coin lots you want. You can order multiple lots, but the MINIMUM lot is 10 coins. I only have a limited number of coins available at this low premium, and this is a first-come, first served offer. Once we run through our stock, there will be no more available at this price. Special Conditions: First come, first served, and no re-orders at these prices. I will write orders based on the time I receive your e-mail. Sorry, we will not take orders for less than the minimum shown above. All sales on a strict "no-nag" basis. We will ship as soon as your check clears, but we allow Two weeks (14 days) for your check to clear. Calls looking for your order two days after we receive your check will be politely and patiently rebuffed. ORDERING INSTRUCTIONS: 1. You may order by e-mail only to offers@the-moneychanger.com. No phone orders, please. Please do NOT order by replying to THIS email, because it will delay your email. Your email must include your complete name, address, & phone number. We cannot ship to you without your address. Sorry, we cannot ship outside the United States or to Tennessee. 2. When you buy from us, we cannot later change or cancel the trade. We are giving you our word that we will sell at that price, & you are giving us your word that you will buy at that price, regardless what later happens in the market, up or down. If you break your word to us, we will never again do business with you. 3. "First come, first-served" means that we will enter the orders in the order that we receive them by e-mail, till supply is exhausted. 4. If your order is filled, we will e-mail you a confirmation. If you do not receive a confirmation, your order was not filled. 5. You must send payment by personal check or bank wire (either one is fine) within 48 hours. It just needs to be in the mail, not in our hands, in 48 hours. Sorry, no credit cards. 7. "No Nag Basis" means that we allow fourteen (14) days for personal checks to clear before we ship. 8. Please mention goldprice.org in your email. Want your order faster? Send a bank wire, but that's not required. Once we ship, the post office takes four to fourteen days to get the registered mail package to you. All in all, you'll see your order in about one month if you send a check. Argentum et aurum comparanda sunt — Silver and gold must be bought. — Franklin Sanders, The Moneychanger  Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Nov 2016 03:28 PM PDT This post Decoding the Gold Cycle appeared first on Daily Reckoning. Janet Yellen and her pirate crew left rates intact yesterday. That leaves December. As we said yesterday, fed futures are now flashing a 78% chance of a hike — up from 60% pre- announcement. Higher interest rates should equal a stronger dollar. Which in turn equals lower gold. So is gold in for a good walloping if the Fed raises next month? Don't count on it. Not if history has a say… Truewealth Publishing studied the case of gold v. interest rates, 1976-2016. That 40-year span covers seven periods of significant interest rate hikes. The results? A draw: For three of those periods, gold prices dropped for roughly the two years after the rate hikes began. During one set of hikes, gold prices stayed relatively flat. And during the three other periods, gold prices increased along with interest rates. Gold even managed a 118% run in the two years after the Fed began its series of rate hikes in the late 1970s, notes Truewealth. Its final verdict: "The correlation between gold prices and the federal funds rate is weak." Now there's a slap across the face of conventional wisdom. And — and — that correlation might even be negative. At least since 1986… Adrian Ash is an old Daily Reckoning hand. He's presently captain of the research desk at BullionVault. And if you can believe it, he says gold usually rises on rate hikes: Gold prices rose more often on Fed interest-rate hikes than on cuts for the last 30 years. More: "Longer term, in fact, a rate rise has also been followed by much stronger gold gains than a cut, and more frequently too." Another slap across the kisser. What the deuce explains it? Adrian says it's all about… anticipation: "Both short and long term, it looks to be anticipation — first of the Fed decision itself, but more deeply of inflation." Here he puts some meat on the bones: Selling in advance works to depress gold prices before the Fed makes its announcement (just like buying before a rate cut pushes it higher). And brought forward in time, this self-fulfillment cracks open a gap between what intuition says gold should do when the Fed raises (or cuts) and what actually happens after the fact. It's the yap about a hike… not the hike itself. Adrian mentions inflation expectations. And here's where it gets interesting: When the Fed raises rates, all other things equal, it’s because the central bank smells inflation ahead… gold’s strong 2016 gains to date show a sniff of inflation, at least amongst professional investors and traders. We've been squeaking lately about the possible of inflation ahead. Just a rumor now, there are straws in the wind… Oil's creeping higher. So are health care costs. Key indicators are showing the all-important service sector is building steam. That bit's got Business Insider hollering today that "Inflation is here and the most important part of the U.S. economy just proved it." Famous hedge fund manager Paul Singer must be reading the same news: “This may seem like a strange thing to worry about under the current circumstances, but the tide toward inflation could turn rather abruptly.” This Singer fellow must also be reading Jim Rickards. Inflation's lain dormant for years. But it can spark a fire when least expected, says Jim. Then it can spread. Fast: Inflation can really spin out of control very quickly. If it happens, it will happen very quickly. We would see a struggle from 2% to 3%, and then a jump to 6% and then a jump to 9% or 10%. Auntie Janet's been gumming about the virtues of a "high-pressure economy" lately. That's where she lets inflation jump ahead of her precious 2% target. It might boost growth, she says. But as Jim hints above, Yellen plays with matches. She just wants a cozy little fire to thaw the economic spirits. But if she's not careful, she could end up burning down the house. Regards, Brian Maher Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post Decoding the Gold Cycle appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Nov 2016 03:00 PM PDT Since their conception in 2003, Anonymous have hacked their way to mainstream notoriety. But are they a real force for social change or just mischief makers? Find out more about Anonymous in this episode of Declassified. The Financial Armageddon Economic Collapse Blog tracks trends... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Markets Flight to Safety From Election Overhang Posted: 03 Nov 2016 01:26 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Canada's CBC wastes taxpayer dollars mocking Trump Posted: 03 Nov 2016 11:31 AM PDT Ezra Levant of TheRebel.media says the CBC's "government comedians" are singling out one US presidential candidate (and his voters) for abuse. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Leak! HILLARY CLINTON exposed with Signs Of Parkinsons Disease and spiritual possession!! (2016) Posted: 03 Nov 2016 10:53 AM PDT HILLARY Exposed! All American People Need to see this! Please share with urgency. This is very important to share! TV News is showing more proof! This is TV News! This is real facts. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rickards: Hyperinflation Coming Posted: 03 Nov 2016 10:24 AM PDT This post Jim Rickards: Hyperinflation Coming appeared first on Daily Reckoning. Jim Rickards joins Greg Hunter at USA Watchdog to discuss his analysis on hyperinflation coming with a massive economic meltdown on the horizon. Rickards highlights his forthcoming book, The Road to Ruin and clears through the financial jargon to give a full synopsis of what he views as the next crisis… And what you can do to prepare. In the discussion he highlights his research on the global elites’ and the plan for the next financial crisis. Rickards reveals, "Where will the liquidity come from in the next liquidity crisis? The answer is the International Monetary Fund (IMF). They have a printing press. The Fed has a printing press, they can print dollars. The European Central Bank can print the euro. The IMF has a printing press, they can print special drawing rights (SDRs). It is a funny name, but just think of it as ‘world money.’ The IMF is the central bank of the world… They can print world money, and they will by the tens of trillions." "The central banks have been trying to get inflation for eight years. It is not a secret. They all have 2% inflation goals. None of them have come close. None of them can get the inflation goals they are aiming for. At the end of the day the SDR will be that hyperinflationary event that they have failed to get so far." Jim Rickards has advised the US government’s intelligence community on international economic issues and is an economist, lawyer and former Wall Street negotiator. He is also a New York Times best selling author. Rickards spoke about China entering the “world money” club by nothing that, "October 1st was a big deal. That’s the day they included the Chinese Yuan in the special drawing rights. The SDR, this world money, is not backed by anything. There is a set of currencies, you can call it a "basket" if you want. That is used mathematically to determine the value of the SDR." "Until September 30 there were four major currencies used in the SDR formula that included the US dollar, British sterling, European Union's euro and the Japanese yen… There is no way that the Chinese yuan is ready to be a reserve currency. It does not meet the IMF's criteria for reserve currency status. The IMF bent the rules for political reasons to include the Chinese yuan." "When you have to flood the zone with SDRs, and you have to print (an estimated) five trillion SDRs to reliquify the world in the next crisis, you're going to need approval from China. China is the world's second largest economy. They are 15% of global GDP. They are getting an increasing voice in the IMF. There is no way the IMF executive committee is going to approve this unless China agrees. China is saying, ‘why should we approve it if we are not in the club?’ So now China is in the club, on board, and a part of this world money club." The interview goes on to explain what to do in best positioning yourself in the event of the next financial liquidity crisis. To get the full scoop, check out the interview by clicking here. To find Jim Rickards book The Road To Ruin: The Global Elites' Plan For The Next Financial Crisis, click here. Regards, Craig Wilson, @craig_wilson7 Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post Jim Rickards: Hyperinflation Coming appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Russian bank aims to double its gold trade in three years Posted: 03 Nov 2016 08:21 AM PDT By Katya Golubkova MOSCOW -- VTB Capital, the investment banking arm of Russia's second-biggest bank, plans to double its gold-trading volumes over the next three years from around 110-150 tonnes a year currently, Atanas Djumaliev, head of global commodities at the firm, told Reuters. VTB is one of the biggest players in the Russian gold market alongside Sberbank, Russia's biggest lender. "In Russia we currently trade 70-90 tonnes a year. In the international market, another 40 to 60 tonnes, so our volumes are between 110 and 150 tonnes a year currently," said Djumaliev, who previously worked at Goldman Sachs. "We are looking to double this amount over the next three years mostly by growing our international operations." VTB Capital provides finance to gold producers in Russia, getting some of their gold output in return. VTB has to offer gold produced at home to the Russian central bank first, its biggest customer, before exporting it. ... ... For the remainder of the report: http://in.reuters.com/article/russia-vtb-gold-idINKBN12Y19L ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

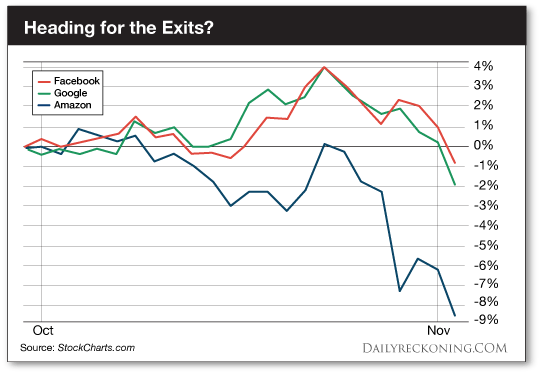

| Posted: 03 Nov 2016 08:13 AM PDT This post Here’s What’s Wrong with Gold appeared first on Daily Reckoning. What the heck happened to the bounce? The stock market has leaked like a broken faucet for more than a week now. In fact, the S&P 500 just logged its first seven-day losing streak in five years, LPL Financial's Ryan Detrick reminds us. "Over the last 20 years the S&P 500 index has only recorded a seven-day losing streak on three separate occasions," Bloomberg reports. "The first was in 2008 after Lehman Brothers collapsed, while the other two were during Europe’s 2011 debt crisis." But here's the thing… This week's "Lehman moment" is missing its punch. During our current seven-day slouch, the S&P hasn't lost more than 1% on any given day. That's a far cry from the nasty, gut-wrenching crashes of 2008 and 2011. Overall, the S&P has coughed up less than 2.5% during the current losing streak. Sure, it's been a shallow drop. But one more day in the dumps will match a gloomy record we'd sooner forget… "The index’s longest-ever run of losses was eight days, matched at the height of the financial crisis in October 2008," Bloomberg reports. "The S&P 500 started falling on Monday September 29 and saw lower closes at the end of every trading day until October 10, in what was its worst week in history." Yikes… Judging by how investors have reacted to news events over the past couple of weeks, it won't take much to drag the major averages lower today. Even relatively mundane news items like obscure, localized election polls are receiving a ton of attention. The presidential election has officially put everyone in the country on edge. No one knows how to position their investments ahead of the big event. We briefly discussed the market's waning breadth earlier this week. Fewer and fewer stocks are propping up the averages. We've already seen small-caps, biotechs, and other speculative names hit the skids. Now the big household names are starting to slip… Look no further than FANG for proof. The famous FANG foursome – Facebook, Amazon, Netflix, Google—has found itself at the forefront of most major market moves over the past 24 months. And unless you're allergic to banking gains, you've probably owned each of these stocks at some point over the past few years. But the market's poor performance is finally beginning to catch up with the leaders. Amazon shares dropped more than 2.5% yesterday to close near their September lows. Google stock lost more than 2%, posting its worst day since June. Even Facebook shares slid almost 2% on Wednesday. After an earnings report after the bell failed to impress investors, we can expect to see some more downside action in this stock today.

Keep in mind that these are the big, popular stocks that have stayed strong since the winter market swoon. If these names can't find a floor soon, we could be in for a rough month. As it stands this morning, the S&P 500 is just a breath from its 200-day moving average. If you're keeping score at home, you know that the S&P has only spent about 24 hours below this level since crossing above the long-term trend indicator in March. That move turned out to be the Brexit Bottom that helped shoot stocks off their lows back in late June. While we can't guarantee a big oversold bounce will spark a similar market rally here, we need to closely monitor how stocks and the major averages act as we charge toward Election Day. Buckle up. It's gonna be a wild ride… Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Never miss another buy signal. Click here now to sign up for FREE. The post Here’s What’s Wrong with Gold appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fosun in exclusive talks to buy stake in Russian gold miner Polyus, Reuters says Posted: 03 Nov 2016 07:49 AM PDT By Julie Zhu and Polina Devitt Fosun International Ltd, is in exclusive talks to buy a large minority stake in Russia's biggest gold miner, Polyus, three sources with knowledge of the matter told Reuters, in what would be the Chinese group's maiden Russian deal. Fosun, an aggressive buyer known internationally for its purchase of French resort operator Club Med, is keen to invest in Russia and other emerging markets such as India, as it moves away from Europe and developed markets. Reuters reported in August that Fosun is also in talks to buy a minority stake in Russian investment bank Renaissance Capital. Fosun's interest in Polyus comes as other Chinese companies also have been targeting gold mine acquisitions to meet domestic demand amid a recovery in prices. State-controlled Zijin Mining Group Co Ltd and state-backed Shandong Gold Mining Co. Ltd. held separate talks with Canada's Barrick Gold Corp to buy a 50 percent stake in an Argentinian gold mine, Reuters reported last month. China, the world's top consumer, producer and importer of gold, has ambitions to be a global price setter. ... ... For the remainder of the report: http://www.reuters.com/article/us-fosun-russia-idUSKBN12Y06B ADVERTISEMENT K92 Mining Begins Gold Production at Kainantu Mine Company Announcement K92 Mining Inc. is pleased to announce that gold production has commenced from the Irumafimpa gold deposit. Ian Stalker, K92 Chief Executive Officer, says: "This milestone is highly significant for our company, and for this region of Papua New Guinea. A great deal of thanks goes to the entire team on site in PNG in achieving production ahead of schedule and on budget. The rehabilitation of the Irumafimpa gold mine, process plant, and associated infrastructure commenced in late March and is now complete. As an enhancement of the processing facility, we are also pleased to note that the installation of a new drum scrubber is also nearing completion and commissioning of this will be completed by the end of the month. ..." ...For the remainder of the announcement: http://www.k92mining.com/2016/10/6077/ Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Nov 2016 07:48 AM PDT This post Unlock Gold Cycle Gains appeared first on Daily Reckoning. We'll soon experience profound problems with the U.S. dollar. I expect to see inflation in some areas, deflation in others. On the world stage, we could see anything up to and including a full-fledged currency crisis. Collapse is a calamitous process that destroys wealth like a tsunami hitting a seacoast. We'll see several stages of the collapse play out in any event, because central banks are out of room to steer monetary policy outside of a very narrow channel. The Fed didn't raise interest rates in 2010–11, when it should have bitten down on the proverbial bullet. Now, as the world economy teeters on the edge of major breakdown, the Fed can't cut rates to boost the economy. Even if the Fed's traditional rate-cutting medicine worked — and it doesn't always work — that bottle of economic snake oil is nearly empty. Aside from the Fed, other central banks around the world are in even worse shape. Many of them participated in the failed negative interest rate experiment. We can't look to them for any help at all. Sauve qui peut! This will put increased importance on special drawing rights (SDRs), or world money, and gold as possible tools with which to truncate the next collapse. I expect that many nations will use SDRs as a method to protect themselves — certainly the U.S. But if you're not a country plugged into the central bank, what's left for us mere mortals? Your best option is to use gold. Gold Over the Last YearIn the middle of last December, the Fed hiked interest rates by a quarter-point. One way or another — and there are many viewpoints on this — the Fed move triggered this year's rally in gold prices and mining shares. Here's a chart showing a year's worth of London gold fix, along with moving averages. After the Fed hike last December, the 200-day average turned upward by February, and has been climbing ever since: Throughout 2016, gold has benefited from the Fed's choice to raise rates just a smidge last December. However, that choice tanked the stock market when it occurred. Now we are looking at another very possible stock market repeat. The Fed is doing everything it can to prepare for another December rate hike in 2016. We expect this to trigger market repricing again, or Stage 1 of the Financial Collapse. That's why it's important for you to understand how gold prices move during each stage. If you can gauge which stage of collapse is occurring, then you can predict what will happen with gold. This is especially important during the early stages of acceleration and transmission. The Stages of GoldLet's take a deeper dive into history, using the 1920s and 1930s — the "Roaring Twenties" boom, followed by the Great Depression — as an example. Here's a chart that tracks the Dow Jones average, as a representative of the economy, against the share price of the old Homestake Mining Co., as a representative for gold:

Starting in the mid-1920s, both the Dow and Homestake shares trended up. Then came a sharp spike down in both Homestake and the Dow during the 1929 crash. After that, the Dow continued down, while Homestake/gold began a recovery. Homestake quickly achieved its former high and then, after a period of consolidation, took off upward. Homestake had a powerful run from 1929–1936, doubling three times during that period. Now let's apply this example of gold moves during a collapse. In essence, we'll have a market sell-off. These days, it might be one or two thousand Dow points. People will sell stocks in an attempt to minimize loses. Some people will likely sell gold and good-quality mining shares because they want to book what gains are on the table and gold is liquid. Expect gold to reprice more or less along with broad markets. Repricing becomes even worse as the downside opens up into a canyon of loss. People will get hit with margin calls. Leverage will become a dangerous tool that drives many account holders broke. Liquidity will dry up. Gold and shares will likely sell down more but then find a floor. This is because there is inherent value in gold — "gold as money" — which overcomes the desire to sell, sell, sell. So while the market heads down, gold and the best of the mining shares level off. The rush to the exits jumps from one market to another and then others. Everyone wants their money back, but the realization kicks in that it can't happen. People will want some semblance of security and in turn begin to deploy funds toward gold gains and strong mining shares. This is when people panic. They will sell everything they can. And this is when you'll want to have cash on hand. You can buy gold and high-quality mining shares for literally pennies on the dollar. Strange as it may seem, gold and good-quality mining shares will begin to creep back up. People hate the markets, they hate stocks, they hate companies and management teams. It'll be near-impossible to give away shares for many firms. And gold and well-regarded mining shares will begin to resurrect from the ashes. Sometimes bankers and politicians will "successfully" stop financial distress from escalating. But as Nomi Prins has explained, this just pushes the problem farther into the future and does nothing to fix the root of these problems. This means that, eventually, we are likely to see a full blown collapse. When that happens, you'll want to have gold in your possession. It will be one of the first assets to bounce back – look for gold gains. Gold Recovers Faster After TruncationAt some point, the economy will begin to recover. I suspect that it will not be bankers and politicians behind the magic, though. It'll be natural market forces putting money into ideas where there's prospect of growth and return, versus casting more good money down a bad hole. History indicates that gold is the first asset to recover. That's why it's important for you to hold cash and buy gold when prices drop during the Transmission and Irrationality stages. Look back at the Great Recession of 2008. The chart below shows the ratio of the S&P 500 market index to the price of gold. The blue line shows you how many ounces of gold it would take to buy the S&P 500 on any given month. This means that when the line moves lower, gold increases purchasing power, because it takes fewer ounces of gold to purchase the S&P 500:

Looking at the last 10 years, you can see that gold's purchasing power against the S&P 500 peaked in 2011. From the sell-off in 2008 (during the Acceleration and Transmission stages), gold hit a low of $725.8/oz. However, gold gains recovered to $1809.9/oz by September 2011. That's a 150% recovery in under three years. To see how the rest of the market did, we'll go back to the Dow as a stand-in for the market. Over roughly the same period of time, the Dow Jones Industrial Average (DJIA) regained only 36%. This is why you'll want to have cash available to purchase gold when everyone else is forced to sell. In addition to the historical pattern, gold's fundamentals are solid, while we know that stocks are overinflated right now. This means that when stocks fall, they will likely fall further than they did in 2008. However, I don't think gold will have to fall far to find its floor. When the collapse is truncated and recovery begins, gold (and silver) will be one of the first assets to bounce back. Regards, Byron King Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post Unlock Gold Cycle Gains appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ronan Manly: Private-equity investors to acquire Swiss gold refiner Argor-Heraeus Posted: 03 Nov 2016 07:10 AM PDT By Ronan Manly News has just emerged in the gold market that the giant Swiss precious metals refiner, Argor-Heraeus, has held discussions to be acquired and that the likely outcome is an acquisition by a private equity group. This private equity group is believed to be London-based WRM CapInvest, part of Zurich-headquartered WRM Capital. Other interested buyers are also believed to have examined a bid for Argor-Heraeus, including Japanese refining group Asahi and Swiss refining group MKS-PAMP. However, neither of these are thought to be in the running at this stage. Since this news is developing, details of the discussions and potential acquisition are still thin on the ground. If Argor-Heraeus is acquired, it will mean that three of the four giant Swiss gold refineries will have been taken over within less than a year and a half of each other. ... ... For the remainder of the report: https://www.bullionstar.com/blogs/ronan-manly/swiss-gold-refinery-argor-... ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will London Gold Market Self Destruct? Ripe For China Take-over? Posted: 03 Nov 2016 06:41 AM PDT London Gold Market has been unchallenged for nearly 100 years So opaque that quotes of its $5 trillion size are estimates Five new offerings are set to appear in the market in the next six months Increased fragmentation set to reduce liquidity A share of gold price discovery is ripe to be taken by China Disruption in the London Gold Market gives opportunity to the East to take more control of the market. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Randgold profits surge as gold production gets back on track Posted: 03 Nov 2016 06:27 AM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The London Gold Market – ripe for take-over by China? Posted: 03 Nov 2016 06:01 AM PDT gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Swiss gold refinery Argor-Heraeus to be acquired by Private Equity investors Posted: 03 Nov 2016 03:16 AM PDT Bullion Star | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 03 Nov 2016 02:37 AM PDT Private sector jobs growth disappoints, auto sales slip. US GDP, consumer spending up strongly, will be revised downward after the election. Facebook shares fall on weak guidance. The dollar is rising and so is inflation. FBI probing new Clinton emails, polls tightening. Best Of The Web The clear and present danger list for the […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 Nov 2016 08:49 PM PDT Tonight I would like to look at some gold charts as it has been showing some relative strength since October. We can even go back to February of this year which shows a possible big diamond consolidation pattern building out. Regardless of whatever trading discipline one uses the last nine months of price action has been difficult at best to read. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold: It’s All About the US Dollar Posted: 02 Nov 2016 08:28 PM PDT Kelsey Williams writes: The relationship between gold and the US dollar is similar to that between bonds and interest rates. Gold and the US dollar move inversely. So do bonds and interest rates. If you own bonds, then you know that if interest rates are rising, the value of your bonds is declining. And, conversely, if interest rates are declining, the value of your bonds is rising. One does not ’cause’ the other. Either result is the actual inverse of the other. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Podcast: Instability On The Horizon Posted: 02 Nov 2016 05:09 PM PDT Between political instability and financial misrule, 2017 looks ripe for another financial crisis. Gold is the best protection. The post Podcast: Instability On The Horizon appeared first on DollarCollapse.com. This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 Nov 2016 05:00 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bitcoin Price Soars on Its Eighth Birthday Posted: 02 Nov 2016 10:30 AM PDT As of yesterday it was eight years to the day since Bitcoin’s initial white paper was posted to the internet. And what a birthday party it had, soaring from $614 on October 1st to around $728 today with gold and silver also rocketing higher, with silver up more than 3% today. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| “Trump Might Actually Win†- This Is What Gold and Silver Do In A Political Crisis Posted: 02 Nov 2016 10:24 AM PDT A week ago it looked like the US government was destined to end up firmly – maybe even more firmly — in the hands of the banks, public sector unions and defense contractors. Trump was imploding and the markets were basking in the prospect of never-ending liquidity from a re-energized Fed. And safe-haven assets like gold were being dumped in favor of growth stocks and the like. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment