Gold World News Flash |

- The Chartology of Gold

- Gold: It’s All About the US Dollar

- Military Miscalculations

- Currency Chaos Continues As Gold Tops $1300 Again, Nasdaq Futures Tumble Below Key Support

- Why The U.S. Presidential Election Has The Entire World Confused

- Relax, Lay Back, and Watch Gold Set New Records

- GOLD PRICE Shot Up $20.40 or 1.6% to Close at $1,306.80 on Comex

- “The Dam Is Breaking”

- Hillary’s Just The Beginning Of Crooked

- Bitcoin Price Soars on Its Eighth Birthday

- We Are Systematically Being Culled Like A Herd: Statistics Show Americans Are Dying Younger

- “Trump Might Actually Win†- This Is What Gold and Silver Do In A Political Crisis

- Anonymous ALERT America You Have Been WARNED!

- ANONYMOUS exposes: Hillary Clinton is hiding Parkinson's disease! All USA people need to see this!

- Gold Daily and Silver Weekly Charts - Much Ado About Nothing

- Jim Rickards: The Next Step Will Be Financial Repression

- Jim Fetzer - Clinton Campaign is Falling Apart

- This Is What Gold Does In A Political Crisis, “Trump Might Actually Win” Edition

- BREAKING: Coup is underway in USA, Hillary Clinton ambition to take control of United States

- Peter Schiff : SHOCKING NEWS ! The Fed & Stock Market Crash in November 2016

- 9/11 3D Analysis - 2016 Update

- David Stockman: This is Mutant Capitalism

- JIM WILLIE Sounds the Alarm Dollar Collapse Ahead!

- Diwali, Gold and India – Spiritual, Religious Gold Buying Over?

- Gold on Steroids: The Perfect Election Trade

- Diwali, Gold and India – Is Love Affair Over?

- Silver Price Is Looking Really Bullish In Dollars, Euros and Rands

- Regardless of Who Wins the US Election, Confidence in Washington DC Is ALREADY Shattered

- Breaking News And Best Of The Web

- Precious Metals Stocks May Be Poised for a Major Upswing

- The Lithium Boom Has a New Player in Argentina

| Posted: 02 Nov 2016 11:49 PM PDT Tonight I would like to look at some gold charts as it has been showing some relative strength since October. We can even go back to February of this year which shows a possible big diamond consolidation pattern building out. Regardless of whatever trading discipline one uses the last nine months of price action has been difficult at best to read. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold: It’s All About the US Dollar Posted: 02 Nov 2016 11:28 PM PDT Kelsey Williams writes: The relationship between gold and the US dollar is similar to that between bonds and interest rates. Gold and the US dollar move inversely. So do bonds and interest rates. If you own bonds, then you know that if interest rates are rising, the value of your bonds is declining. And, conversely, if interest rates are declining, the value of your bonds is rising. One does not ’cause’ the other. Either result is the actual inverse of the other. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

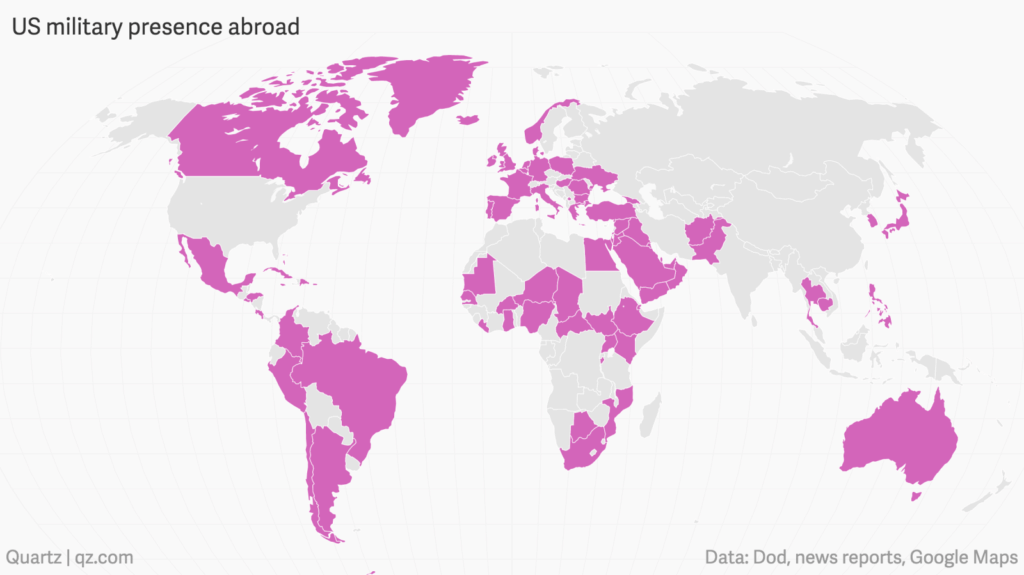

| Posted: 02 Nov 2016 11:20 PM PDT By Chris at www.CapitalistExploits.at Market dislocations occur when financial markets, operating under stressful conditions, experience large widespread asset mispricing. Welcome to this week's edition of "World Out Of Whack" where every Wednesday we take time out of our day to laugh, poke fun at and present to you absurdity in global financial markets in all its glorious insanity. While we enjoy a good laugh, the truth is that the first step to protecting ourselves from losses is to protect ourselves from ignorance. Think of the "World Out Of Whack" as your double thick armour plated side impact protection system in a financial world littered with drunk drivers. Selfishly we also know that the biggest (and often the fastest) returns come from asymmetric market moves. But, in order to identify these moves we must first identify where they live. Occasionally we find opportunities where we can buy (or sell) assets for mere cents on the dollar - because, after all, we are capitalists. In this week's edition of the WOW we're covering military miscalculationsWhen it comes to the stock and bond markets, the mandate's pretty simple. Deny, then inflate another bubble. The central banks will continue to do this until the market takes their ability to do so away. It's going to be quite something to witness. What about geopolitics, though? This is a bit trickier to determine, though for anyone with a history book or two thumbs and a search engine we know it can affect asset prices and global capital flows in ways that central bankers only wished they could. NATO's biggest buildup on Russia's borders since the cold war. That's what the Guardian's calling it.

NATO is already wobblier than a 2 year old without trainer wheels, and EU disintegration will continue to accelerate as nationalistic parties are elected across Europe. With an increasing focus on protecting their self interests rather than that of Europe, NATO's days are probably numbered. Germany, the strongest military power in Europe will remain reluctant to "lead the charge" due to it's ...ahem history, and the Brits reeling from Brexit have little appetite for military aggression, and that really leaves the empire. You see Europe is going to continue building walls. That's defensive not aggressive. Then of course there is the South China sea dispute.

Gone are the days when challenging the empire was a no-no. Tis no trivial matter. China will continue to flex its muscles. After all its achilles heel is that its access to global sea lanes is blocked by a ring of small islands. Controlling these is both militarily strategic as well as economically strategic. America will increasingly be put to the test. The Empire's InvolvementLet me be clear. America is not threatened in any way. No foreign power will attack the US. But then they don't need to. Osama Bin Liner did more damage with a rag tag army of sandal-wearing goat herders than any nation state has managed to do since WWII. Like all empires in their final years, the threat comes from within. Washington doing what Washington does: something incredibly stupid. Which of course brings us to crook vs jerk. It's one reason the American elections actually matter this time around, which makes this Presidential election unusual. Trump wants to "make America great". War with Russia appears thankfully not to have crossed his mind. My guess is he'd rather build a new hotel in Moscow and bring reality TV to the White House than sit in Hillary, on the other hand, is all for it. Her military understanding being that of steamed spinach, and being surrounded by an entire cadre of imbeciles who've gone before her: Bush, Cheney, Obama, that guy Bill. In a recent speech she made her stance very clear:

Oh, you mean like the power vacuums in the middle east now filled by ISIS? And this doozy:

Surely she can't be referring to her push to take down Libyan leader Muammar Gaddafi. That gambit left Libya in absolute chaos, resulting in the terror group Daesh rising in power and displacing an estimated 400,000 people, all of them mad at America and Europeans and now targeting them in their home towns. She seems eager to step up the game from her predecessors who made a habit of only attacked small third world countries with sand.

Russia, sweetheart, is a nuclear power. China, a nuclear power. Iran and North Korea? Look cupcake, if you can't control a tiny pile of sand like Iraq, pray tell how you're going to go after Iran. The voting populace doesn't want it. "Let me just relax and watch gratuitous violence on Netflix, dammit. And I don't give a hoot about Afghanistan, Iraq, Syria, or Yemen and I sure as hell don't want to pay for it." Even those who can't read (a substantial and growing number) question why on earth US troops loiter in far flung places being terribly unsuccessful - repeatedly.

The shortlist of active candidates doesn't look pretty either:

I could list many more but you get the picture. In fact, the US has over 1,400 military bases in over 120 countries. Not bad for a country which is importing capital rather than exporting it. And while this is happening, the rest of the world pivots. Russia is getting chummy with Iran, China, and now Turkey, which for scholars of history is the pivotal access point for both Europe and the Arab world. The Asian countries increasingly move East towards China, the latest being Duterte of the Philippines who has promised to kick the US out.

Maybe it's just me but "go to hell you son of a whore" sounds awfully like Asia pivoting away from the US. Puts a bit of a spanner in the Obama administrations "Pivot Asia" foreign policy plan. Some Troubling SignsWhat has been troubling to watch from afar and as a non-American who typically doesn't care who wins most elections, is the very obvious prepping of war Hillary's camp has been doing over the last few months. The Russians are hacking the election, they're dangerous, they're expanding, they're killing It stands to reason: after all, Bill managed to distract an easily distracted electorate from his affair with Monica Lewinsky by launching missiles at Sudan. Why not threaten Russia to distract from the now daily barrage of revelations about the Clinton crime syndicate? Peter Thiel stated the threat lucidly in his recent address at the National Press club:

Trump is a blowhard and Hillary part of the deep state. Happy days! And now it seems that the outcome rests on a large swathe of the electorate drunk on football, Kim Kardashian's latest antics, and prime time TV. Geopolitical knowledge? Not featuring so much. The risk is that Washington in desperation does something phenomenally stupid rather than simply dumb which it's proven itself quite adept at. The empire will continue to lose its grip but if history is any indication (and it is) then it may not do so quietly. QuestionCast your vote here and also see what others the biggest threat is Know anyone that might enjoy this? Please share this with them.Investing and protecting our capital in a world which is enjoying the most severe distortions of any period in mans recorded history means that a different approach is required. And traditional portfolio management fails miserably to accomplish this. And so our goal here is simple: protecting the majority of our wealth from the inevitable consequences of absurdity, while finding the most asymmetric investment opportunities for our capital. Ironically, such opportunities are a result of the actions which have landed the world in such trouble to begin with. - Chris "Military intelligence is a contradiction in terms." — Groucho Marx -------------------------------------- Liked this article? Don't miss our future missives and podcasts, and get access to free subscriber-only content here. -------------------------------------- | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Currency Chaos Continues As Gold Tops $1300 Again, Nasdaq Futures Tumble Below Key Support Posted: 02 Nov 2016 08:39 PM PDT While Facebook's after-hours demise weighed on stock indices (Nasdaq futures broke key 100-DMA support), the overnight action in Asia is centered on currency turmoiling... Facebook's plunge is hammering the NASDAQ but that drop accelerate as currencies snapped in AsiaPac...

Pushing Nasdaq futures below the key 100-day moving-average...

But the real fun is in Currencies tonight... USDJPY broke below its 100-DMA, having fallen (Yen strength) non-stop since The BoJ...

Plunging through 103.00 stops...

And the Mexican Peso pounding continues, testing to 19.50..

With the USD Index extending its losses to three-week lows...

Sending Bitcoin soaring..

And the Long Bond is ripping higher (yields lower)...

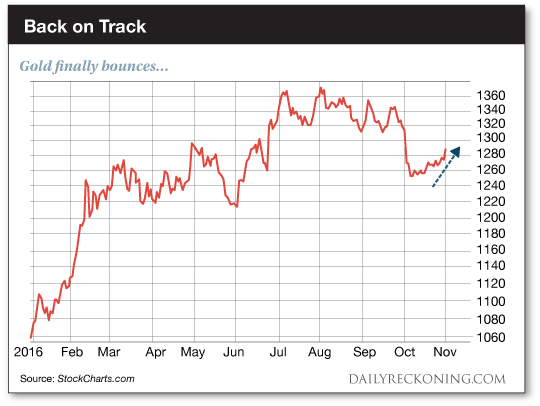

And safe haven bids have pushed gold back above $1300... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why The U.S. Presidential Election Has The Entire World Confused Posted: 02 Nov 2016 06:25 PM PDT Submitted by Brandon Smith via Alt-Market.com, Well, everyone thought it was a sure thing — Hillary Clinton had the White House in the bag; the entire political system from the DNC to the RNC and the mainstream media had already called the election over and done. Online gambling sites listed Clinton as a sure bet and Irish site Paddy Power even paid out one million dollars on the assumption of a Clinton win. And then, one Weiner ruined everything — Anthony Weiner. The revelation of an October surprise re-opening of the FBI’s investigation into Hillary Clinton’s misuse of classified data on private and vulnerable email servers does not come as a shock to me, but it certainly does to many people around the world. Hundreds of mainstream outlets are scrambling to spin the news as misconduct by the FBI rather than a victory for the halls of justice. Numerous alternative media analysts are rushing to cover their butts and admit that there is now a “chance” of a Trump win. Confusion reigns supreme as the weirdest election in U.S. history continues to bewilder observers. The first issue that needs to be addressed is the lack of an open mind displayed by some when it comes to the real purpose behind this election. The second issue here, of course, is one of timing. Through the majority of this election cycle the public consensus has been that Clinton will win. Some argued that Trump would not be able to compete with the leftist media empire standing against him, while others have argued that the entire system including the Republican establishment would ensure that Trump would fail. The alternative media has in the past simply pointed out that elections have always been rigged, either by the elites playing both sides of the competition, or through outright voter fraud. They have assumed that the elites want Clinton, and therefore, the election has already been decided. I tend to agree with the latter point of view, though I disagree with the conclusion. U.S. elections are indeed controlled, and have been for decades, primarily through the false left/right paradigm. However, as I have been pointing out since I correctly predicted the success of the Brexit referendum, I don’t think that Clinton is the choice of the elites. I outline my reasons for this conclusion in-depth in articles like '2016 Will End With Economic Instability And A Trump Presidency', published in August. For the past several months it seems as though I have been the only person holding the view that Trump will be president. Only in the past few days have I received emails from readers stating that they used to think I was probably crazy, but now they aren’t so sure… To be clear, my position is that Trump is slated to take the White House and that this is by design. This has been my position since before Trump won the Republican Primaries, it was my position when the election cycle began, it has never changed, nor have my views on the reasons for this outcome ever changed. Of course, the election is not over yet, and if Clinton ends up soiling the already thoroughly soiled Oval Office with her presence, then everyone can color me confused as well. That said, here are some issues that I think many people are overlooking when coming to conclusions on the election and the events surrounding it. Clinton Is The Worst Candidate The Elites Could Have ChosenI have been studying the activities and behaviors of establishment elites for over a decade and I have to say… they are not stupid. They certainly have hubris, and I would not call them “wise,” but they are definitely devious. They know how to rig a game. They know how to play both sides. They know how to cheat to get what they want when it comes to politics and how to manufacture consent from portions of the public. They’ve been doing it a long time. They have mastered it. So, in my view it is rather insane for the elites to field a candidate such as Hillary Clinton IF the entirety of their globalist empire hangs in the balance (I don't think it does). Though she is fond of BleachBit, the woman is unbleachable. With a decades-long rap sheet from her work at Rose Law Firm (in which document destruction and “misplacement” was apparently routine) to her interference with investigations into Bill Clinton’s sexual indiscretions, to the strange odyssey surrounding her lies on the Benghazi attack, as well as her rampant mishandling of classified documents as head of the State Department, not to mention the Clinton Foundation’s pay to play scandals, it is impossible to endear her to the masses. Her dismal crowd turnouts are rather indicative of this. On top of all this, Clinton’s anti-Russia rhetoric is coming off as absolutely crazy, and I think this is by design. Many in the alternative media, while assuming that Clinton is paving the way for WWIII, forget that the average person may not be up to speed on the same information we are, but most of them aren’t ignorant. Clinton’s ravings on Russian hacking and potential war are even putting liberals off rather than inspiring their confidence. One would think that if the elites have their veritable pick of any politician to represent their interests in the White House and convince the American public to go along for the ride, Clinton would be the worst choice. Even if the intention were to rig the election in favor of Clinton, she would be a lame-duck president the second she took office, and, her mere presence would galvanize conservatives to the point of mass rebellion. This is not generally how the elites play the game. Instead, they prefer co-option to direct confrontation. Which President Is Better For The Elites During An Economic Breakdown?If you consider the premise that Clinton is NOT the chosen one, and that the entire election is theater, the situation changes rather drastically. Those that follow the underlying economic data that the mainstream tends to ignore know that large swaths of the global financial system are not long for this world. With Europe’s banking system plunging towards a Lehman-style event, the OPEC production freeze deal ready to fall apart yet again, and the Federal Reserve threatening to raise rates into recessionary conditions in December, our already floundering fiscal structure is approaching another crisis. My question has always been who would the elites rather have in office when this crisis occurs? I’ve said it a hundred times before and I’ll say it again here: with Clinton in office, globalists and international financiers get the blame for any economic downturn. With Trump in office, conservative movements will be blamed. In fact, I suggest anyone who doubts this scenario watch stock market reactions every time Trump rises in the polls or Clinton faces renewed scandal. The narrative is already being prepared — a Trump win equals a market loss. For those that think it outlandish that the public could be tricked into blaming Trump and conservatives for an economic crisis, I suggest they consider that possession is nine-tenths of the law in the minds of many. People can also be irrational when facing financial ruin. I would remind readers that history is written by the victors. The globalists plan to be victorious in the dismantling of America and our founding principles. Whether or not they succeed is really up to average conservatives and liberty proponents, not Trump. The FBI’s Move Prepares The Way For TrumpClinton and the DNC argue that FBI Director James Comey’s announcement of a re-opened investigation is politically motivated. And they are right, sort of. The real motivation, I believe, is that Clinton was never meant to win the election in the first place, and that the elites want Trump placed in power during the final hours of the U.S. economy. Everything else is just a Kabuki dance. The democrats are crying foul and accusing Comey of “working with Putin,” or working with the alt-right. The nefarious Harry Reid has even accused the FBI of hiding Trump’s supposed ties to the Russian government and violating the Hatch Act. I think much of this outrage is real, as I believe much of the mainstream media attacks on Trump are coming from people who really think they are waging a propaganda war to get Hillary Clinton elected. This, however, does not mean that the elites plan to install Clinton. Some might see my position as bizarre. I understand. But equally bizarre to me are some of the rationalizations people attempt to argue when dealing with the Comey revelation. For example, the argument that the entire re-opening of the investigation is a complex ploy designed by the establishment to distract away from the Wikileaks data dumps. This makes little sense. If anything, the re-opening investigation is only bringing MORE attention to the Wikileaks data, not less. If the elites were hoping to create a distraction, they failed miserably. The FBI’s announcement ONLY harms the Clinton campaign. Period. Even if it fizzles out, even if they announce that nothing was found, the investigation hitting the news streams so close to election day refocuses all public attention back on Clinton’s corruption and will continue to do so for the next week at least. The idea that the elites hope to use it to help Clinton is nonsensical. I have also seen the argument that Comey is acting to cover his own posterior, perhaps because of a fear that Trump may steal away a victory. I find this equally absurd. Months back the consensus among alternative analysts was that Comey (placed in the FBI by Obama) was a traitor and the FBI was a puppet agency of the establishment. Now, suddenly, Comey is worried about a possible Trump win and so takes an action which might self-fulfill the prophecy? Comey does what he is told. The FBI is an owned and operated elitist franchise. They do not go rogue. If the rogue FBI narrative were true and Comey actually feels the need to cover his bases with Trump, then it is only because he knows something the rest of us do not. With Clinton in office, his goose would be cooked after this little incident. Comey only gains an advantage if Trump is slated to win. Trump May Or May Not Be Aware Of The PlanThe bottom line, according to the evidence I have seen in terms of elitists influence over U.S. elections, is that if Trump wins it will only be because they wanted him to win. The FBI firestorm this past week appears to support my view and we still have another week left for further Clinton ugliness to be revealed. I also expect that if Trump wins, the reaction from conservatives and liberty activists will be that the event was a “miracle,” a shocking upset against the establishment. Much like the reaction to the Brexit referendum. I continue to hold that conservatives and sovereignty champions in Europe and America are being set up to take the fall for a coming global destabilization. I have not taken this position just to be contrary. If I think about it honestly, my position is truly a losing position. If I am mistaken and Clinton wins on the 8th then I’ll probably never hear the end of it, but that’s a risk that has to be taken, because what I see here is a move on the chess board that others are not considering. If I’m wrong, then I’m wrong. That said, if I am right, then I still lose, because Trump supporters and half the liberty movement will be so enraptured that they will probably ignore the greater issue — that Trump is the candidate the elites wanted all along. If I am right, I cannot say either way if Trump is aware that he will be a potential scapegoat for the elites. With Trump on the way to the White House I can guarantee a Fed rate hike in December. Imagine what a staged war between Trump and the Federal Reserve will do to the U.S. dollar? What a way to destroy the currency's world reserve status and make way for the IMF's Special Drawing Rights! I also suspect that widespread rioting is on the schedule as well from various social justice mobs; a perfect excuse for expansive martial law measures, don’t you think? The point is, as horrifying as a Clinton presidency might be to conservatives (or to everyone), don’t get too comfortable under Trump. The party is just getting started and our vigilance must be even greater with a conservative White House, because, like it or not, everything Trump does is going to reflect on us. We can no more allow unconstitutional activities under Trump than we could under Clinton. If you think the election has been chaotic and confusing so far, just wait until after it is over. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Relax, Lay Back, and Watch Gold Set New Records Posted: 02 Nov 2016 05:31 PM PDT Dear CIGAs, Relax, lay back, and watch gold set new records with some temporary heart grabbing reactions. The reason I am sending you past tapes is so far in my career I have not had one bad long term call. I say to my naysayers they are all are paid hacks and in need of... Read more » The post Relax, Lay Back, and Watch Gold Set New Records appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GOLD PRICE Shot Up $20.40 or 1.6% to Close at $1,306.80 on Comex Posted: 02 Nov 2016 04:04 PM PDT

Today is one of those days when events force me to suspect that my cynicism is way too optimistic. Are any rational or semi-intelligent people fooled by the miasmic word-fog that comes from the Fed and Janet Yellen? We're gonna raise rates, we're not gonna raise rates, employment is rising, employment is fallling, economy is heating up/frosting over, just yak out all the self-contradictory nonsense you can imagine. These folks couldn't beat out a straight answer with a ball peen hammer and a crowbar, because they have no clue what the answer is, what's happening, or how to pour water out of a boot with instructions on the heel. Why in the world does anybody listen to these fools? I reckon cause they're bigger fools than the Fed fools. Boy howdy, they are gonna be some kind of mad when they figure out how the Fed has scammed 'em! Gonna be decorating lampposts with central bankers. Stocks broke down today. Dow closed below 18,000 at 17,959.64, down 77.46 and a new low close. S&P500 sank beneath 2,100 to 2,097.94 (down 13.78). Beneath what is there? Only air. Serious avalanching starts soon. Mercy! GOLD PRICE shot up $20.40 (1.6%) to close at $1,306.80 on Comex. That's not a typo. Silver rose 27.5 (1.5%) to 1866¢. GO feast your eyes on the gold chart, http://schrts.co/pbxEDM First look at this: It shot clean through the 50 day moving average and closed above that $1,300 resistance. It has traded back up into the trading channel from which it fell out. (There's a better construction in that sentence somewhere, but durned if I can pull it out.) The MACD is in upward mode and has lots of room to move up. So is the RSI. Volume is good, rising with price. Hellery Clinton's emails are GOOD for gold. This rally will run further. Silver price chart's here, http://schrts.co/o96FnV Silver cleared its 50 DMA and has set its sights on that top trading channel boundary. Volume was a little lower today, but was huge yesterday, signifying folks climbing aboard. RSI & MACD still have a ways to run. About the 8th of November there's a little cyclical top due, which might mark the limit of this run & beginning of a small correction. Regardless, silver & gold prices have begun their next rally, will end the year higher, and will jump into 2017. Better buy. Argentum et aurum comparanda sunt — Silver and gold must be bought. — Franklin Sanders, The Moneychanger  Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 Nov 2016 03:22 PM PDT This post "The Dam Is Breaking" appeared first on Daily Reckoning. "We got the bearish signal… The dam is breaking. You can feel it.” The ursine signal, according to bond fund manager Jeffrey Gundlach: The S&P 500 slipped below 2,130 on Monday and the previous Friday. Then it closed at 2,111 yesterday. It's down another thirteen points today, we add en passant. If Gundlach is right and the dam's about to break, it could break hardest on Hillary. The S&P's performance between July 31 and Oct. 31 has proven a reliable crystal ball on elections since WWII. “Going back to World War II," notes Sam Stovall, chief investment strategist at CFRA, "the S&P 500 performance between July 31 and Oct. 31 has accurately predicted a challenger victory 86% of the time when the stock market performance has been negative.” And the crystal ball's showing a Trump win… The S&P ended July at 2,173. It ended October at 2,126… 47 points lower. More omens gathering for Trump: Gold's soared over 2% since FBI director James Comey’s announcement last Friday. It spiked almost $18 today alone, to $1,309. Many consider a vote for gold a vote for Trump. And the Mexican peso — another Trump fortune teller — is getting shellacked today. It plunged to its lowest level in over a month. The very stars and planets can be seen aligning for Trump… Yesterday's ABC News tracking poll gave Trump a one-point lead over Hillary nationwide. That's the first time he's posted a lead in that poll since May. Meanwhile, the RealClearPolitics average of recent polls now has Trump just 2.2 points behind. Hillary had a seven point lead only two weeks ago. Pat Caddell is a veteran Democratic pollster. And sticking to today's dam metaphor, he sees a lot of aqua in Hillary's future: "This dam is about to break," he told Fox News. Caddell's predicting Trump by landslide (or deluge?). He sees this election much like the 1980 campaign when Reagan came from behind late to win. Jim Rickards is also calling the election for Trump — with a caveat: "Our expectation is that Trump will win the election on Nov. 8. However, that forecast is a close call. The election will be close, and Clinton could win despite our expectation." Whoever wins, WikiLeaks really flustered the fish with its job on Hillary… The CBOE Volatility Index — VIX, or the market's "fear gauge" — has risen each of the past six trading sessions alone, advancing on the surging tide of electoral uncertainty. It spiked at 20.43 yesterday, before settling down to end at 19.32 today. The last time the fear gauge closed that high: June 27. Four days after Brexit. On Oct. 18, Jim warned, "any indication that Trump is pulling even — due to Clinton email leaks, health issues or a final debate stumble — will send the stock market into a tailspin." Seems Jim's got his own crystal ball polished up nice and shiny. We see the Fed punted on a rate hike today — to the shock of someone, somewhere, maybe. But they meet again next month. And Fed fund futures are now predicting a 78% chance of a hike — up from 60% before today's yawner. Interesting fact: When Yellen raised rates last December, stocks sank 10% over the next two months. Sticking with today's metaphor, we don't know if the dam is going to break tomorrow… next week… or over the next few months. Or if it's going to break at all, for the matter of that. But it sure seems the pressure's building… and by the day, too. Just ask investors. Just ask Hillary. Regards, Brian Maher Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post "The Dam Is Breaking" appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hillary’s Just The Beginning Of Crooked Posted: 02 Nov 2016 03:05 PM PDT This post Hillary’s Just The Beginning Of Crooked appeared first on Daily Reckoning. If Hillary survives WikiLeaks and stumbles across the line ahead of Donald Trump next week, she won't be the only crooked thing afflicting the nation during the next four years. The crooked stock market is fixing to deliver some punishing blows, too. That’s because the stock averages are now floating precariously in the nosebleed section of historical valuation, waiting for an unexpected shock to send them spiraling downward. Indeed, I believe the market could drop 40% or more from current levels, and that it could happen in a sudden violent plunge. That's a reflection of just how absurdly overvalued the stock market has become under the Fed’s mutant regime of bubble finance. The S&P 500 closed yesterday at 2,111, about 50 points lower than where it stood approximately 90 days ago after the post-Brexit dead cat bounce. Still, Wall Street prefers to believe that once this short-term election-centered uncertainty fades, the long awaited outbreak of “escape velocity” is still just around the corner, and that when it finally materializes it will fuel a sharp reacceleration of earnings growth. But that’s an exercise in eyes-wide-shut optimism. There is no basis whatsoever for it in current trends or any plausible scenario for the next year or two. The starting point is the inertial forces already in play, which are all in the wrong direction. Back in September 2014, for example, reported earnings came in at $106 per share. Well, Goldman Sachs has now reverted its projections for the year downward from $110 per share to $105. They also dropped their 2017 target to $116 from $123. So reported earnings aren't inspiring much confidence. But there is hardly a stock research analyst or strategist on Wall Street who makes allowance for even the possibility of a soft-patch — like the 1.3% average growth in real GDP that we’ve actually had for the past four quarters running — let alone an outright recession. So you’d think they are smoking something down in the canyons of Wall Street! In fact, they are. It amounts to the delusionary perception that the machinery of the bailout state is still in good working order, and that even if the economy should stumble, Washington will be at the ready with emergency fire hose in hand. Stated differently, the apparent complacency about recession risk on Wall Street is rooted in the view that recessions are short-lived and Washington has your back with whatever stimulus it takes to reflate the economy and financial markets. So the real smart thing to do is look through any transient business cycle fluctuations and base valuations on the long run. I think that assumption is profoundly wrong, and may well constitute the true black swan of the coming financial bust. That is say, the market is blithely expecting another reflation party in the event of a rough patch. After all, for three times during the last 25-years, speculators have been massively rewarded for buying busted stocks, junk bonds and real estate loans or related options and derivatives at the bottom of the cycle. It happened in 1991 when speculators scooped-up hundreds of billions of financial debris from the busted S&Ls for cents on the dollar. And that became the prototype for similar bottom fishing expeditions after the crashes of 2000-2001 and 2008-2009. Indeed, while the idea of the “Big Short” has been popularized by the spectacular returns earned by a few intrepid traders who saw the sub-prime securitization fiasco coming in 2006 and 2007, the multi-billion winnings of Michael Burry, Steve Eisman, Gregg Lippmann and John Paulson were actually small potatoes compared to the windfalls captured by the Big Longs during the last three cycles. What will be very different this time is that there will be no quick Washington-driven artificial reflation of the financial markets. The early birds are going to choke on the false lures, not feast on the bottom crawlers… Even as the FBI’s probe of Huma/Weiner’s laptop was happening behind the scenes during the last several weeks, an even more important eruption was quietly gathering steam in the world’s bond markets. The casino gamblers who have made a killing front-running the central banks have begun to fade the trade. That’s a financial Rubicon. It marks the beginning of the end of central bank omnipotence. It also coincides with the other vector of market-threatening development — the post-election paralysis of Imperial Washington and it’s incapacity this time around to bail out Wall Street when the next black swan arrives. Indeed, the catalyst for the next stock market crash will surely, and ironically, be the fracturing of the world’s monumental bond bubble. It was the massive and sustained repression of sovereign bond rates by QE-addicted central banks that set off the stampede for yield and return among fund managers. That the Fed is out of dry powder and marooned on the zero bound is evident enough. But maybe the real black swan shock is going to arrive on the fiscal front… You can’t find hardly a single pop-up portfolio manager on bubble vision these days who does not expect a “hand-off” from the Fed to a giant infrastructure and fiscal stimulus package early in the next administration. That new outpouring of Keynesian goodness, in turn, is projected to restart the lagging wheels of corporate CapEx and revive animal spirits in the C-suites. I have a newsflash. The Imperial City will soon descend into dysfunction and paralysis like never before. When the current Presidential campaign reaches the bottom of the gutter, America will be virtually ungovernable. So when the next financial crisis comes along, Washington’s response will be the very opposite of the panicked “stick save” which happened in September-October 2008. Right now there are two crucial features to keep in mind. The first is that Donald Trump is quickly proving himself to be the most spectacular unguided missile ever to hit American politics. He's run such a scorched earth campaign that even if Hillary wins, she'll be bruised, battered, blooded and delegitimized in the eyes of a huge slice of the electorate. At the same time, Speaker Paul Ryan has moved swiftly to disavow the GOP standard bearer and save the House Republican majority. He is rather certain to be successful in that endeavor because the overwhelming share of House elections are not won based on today’s voter sentiments — especially among the so-called battleground constituencies — but on yesterday’s state house gerrymanders. So if Hillary wins, she'll go to the Oval Office in a giant cloud of disrepute and with no mandate whatsoever; and a GOP majority back to Capitol Hill bent on endless investigations, complete legislative obstruction and ready for an Impeachment trial at the earliest excuse. So there will be no Wall Street bailouts coming out of the Imperial City’s killing fields. That much is real certain. Regards, David Stockman P.S. The election's just six days away. So I really want to get my message out there as loudly and as widely as I can. As I said yesterday and the day before, Trumped! A Nation on the Brink of Ruin… And How to Bring It Back wasn't a book I intended to write. But I had to. Let me repeat: America faces impending dangers that every voter should know about before the presidential election just six days from today. Whether you love or hate Donald Trump or Hillary Clinton, every American deserves to know the truth about the imminent dangers facing their wealth. That's why I'm holding a FREE copy of my new book in your name. If you haven't gotten yours yet, I just need your permission (and a valid U.S. postal address) to drop it in the mail. This special edition has important material not available anywhere else in the world. Not online through Amazon. And not in any brick-and-mortar bookstore. Click here to fill out your address and contact info. The book will arrive at your doorstep in just a week or two. And please share it with friends and family. It's that important. Thanks for reading. The post Hillary’s Just The Beginning Of Crooked appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bitcoin Price Soars on Its Eighth Birthday Posted: 02 Nov 2016 02:30 PM PDT As of yesterday it was eight years to the day since Bitcoin’s initial white paper was posted to the internet. And what a birthday party it had, soaring from $614 on October 1st to around $728 today with gold and silver also rocketing higher, with silver up more than 3% today. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| We Are Systematically Being Culled Like A Herd: Statistics Show Americans Are Dying Younger Posted: 02 Nov 2016 02:30 PM PDT Get your head out of the sand People. Big Government, Big pharma and Obamacare wants your money. They don't care a hoot about your life. yes we all need to investigate this.. How much longer are we going to ignore this. The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| “Trump Might Actually Win†- This Is What Gold and Silver Do In A Political Crisis Posted: 02 Nov 2016 02:24 PM PDT A week ago it looked like the US government was destined to end up firmly – maybe even more firmly — in the hands of the banks, public sector unions and defense contractors. Trump was imploding and the markets were basking in the prospect of never-ending liquidity from a re-energized Fed. And safe-haven assets like gold were being dumped in favor of growth stocks and the like. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Anonymous ALERT America You Have Been WARNED! Posted: 02 Nov 2016 02:00 PM PDT Anonymous Message 2016 - You have to watch this! This is the latest Anonymous message to the US public. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ANONYMOUS exposes: Hillary Clinton is hiding Parkinson's disease! All USA people need to see this! Posted: 02 Nov 2016 01:30 PM PDT ANONYMOUS exposes: Hillary Clinton is hiding Parkinson's disease! All USA people need to see this! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Much Ado About Nothing Posted: 02 Nov 2016 01:21 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rickards: The Next Step Will Be Financial Repression Posted: 02 Nov 2016 01:04 PM PDT This post Jim Rickards: The Next Step Will Be Financial Repression appeared first on Daily Reckoning. In a can't miss conversation Jim Rickards joins Dr. Ron Paul on the Liberty Report to discuss his latest book The Road to Ruin. The two economic maven's cover currency wars and when the looming financial crisis will be, what to expect… and most importantly, how to prepare. Jim Rickards is a New York Times best selling author, economist and lawyer who has worked on Wall Street and advised the U.S federal government on international economic issues and financial threats. Dr. Paul began the discussion with a pivotal question on timing and what's in store for the dollar. Rickards remarked that, "The reason we haven't had a big spike in interest rates is because the US banking system is now captive to the Federal Reserve. For every seller there is a buyer. The banks are being forced to pick up the slack. They are the buyers of last resort.” “In 2008, the big banks were bailed out and the bankers couldn’t believe their luck. They said ‘you saved my stock, you saved my bank… and I can still keep my million dollar bonus.’ They felt they got a free pass. What they didn't realize is they were now working for the government." Jim Rickards told Dr. Paul, "One manipulation leads to another. Once you go down that path – holding interest rates low and playing the federal reserve balance sheet, you have to keep going down. The next step will be financial repression where the banks are forced buyers of treasury securities." Rickards directed attention to the next crash and why financial repression is looming saying, "In 2008, the central banks bailed out out Wall Street. I take the story forward ten years later to 2018, but that is just an estimate. This is something that could happen tomorrow… In 2018, if not sooner, who is going to bailout the central banks? They haven't normalized their balance sheets. They haven't undone the money printing they did in 2008.” “They no longer have the capacity to save the system. The next bailout is going to come from the International Monetary Fund (IMF) with their world money, the special drawing rights (SDR). They have got the only clean balance sheet left. They are going to flood the world with trillions of SDR's. They'll finally get the inflation that they have been wanting to have all these years." To watch the full interview on the Ron Paul Liberty Report click here. To find Jim Rickards latest book The Road to Ruin: The Global Elites’ Secret Plan for the Next Financial Crisis click here. Regards, Craig Wilson, @craig_wilson7 Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post Jim Rickards: The Next Step Will Be Financial Repression appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Fetzer - Clinton Campaign is Falling Apart Posted: 02 Nov 2016 01:00 PM PDT Jeff Rense & Jim Fetzer - Clinton Campaign is Falling Apart Clip from October 31, 2016 - guest Jim Fetzer on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Is What Gold Does In A Political Crisis, “Trump Might Actually Win” Edition Posted: 02 Nov 2016 10:42 AM PDT A week ago it looked like the US government was destined to end up firmly – maybe even more firmly — in the hands of the banks, public sector unions and defense contractors. Trump was imploding and the markets were basking in the prospect of never-ending liquidity from a re-energized Fed. And safe-haven assets like […] The post This Is What Gold Does In A Political Crisis, "Trump Might Actually Win" Edition appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING: Coup is underway in USA, Hillary Clinton ambition to take control of United States Posted: 02 Nov 2016 10:00 AM PDT Hillary and Bill Clinton are attempting a takeover of the United States and will stop at nothing. A coup d'état of this magnitude has never been affected in such a subtly calculated way. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peter Schiff : SHOCKING NEWS ! The Fed & Stock Market Crash in November 2016 Posted: 02 Nov 2016 09:30 AM PDT Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. what morons would ever invest in the stock market when any little thing can take it down??? I mean that's your blood sweat and tears and they are... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9/11 3D Analysis - 2016 Update Posted: 02 Nov 2016 09:00 AM PDT This proves that Planes did not cause this! Some unknown Technology is responsible and People will just argue without lifting a Finger to bring these atrocities to Justice! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| David Stockman: This is Mutant Capitalism Posted: 02 Nov 2016 07:52 AM PDT This post David Stockman: This is Mutant Capitalism appeared first on Daily Reckoning. [Editorial Note: The nation's future hangs in the balance this election. That's why I'm on a mission to send my new book TRUMPED! A Nation on the Brink of Ruin… and How to Bring It Back to every American who responds, absolutely free. Click here for more details.] David Stockman joins Michael Covel on Trend Following Radio for his second ever appearance on the show to discuss the economy and his latest book Trumped! Click here to catch the full interview. In the episode the two economic heavyweights dive deep into topics ranging from Glass Steagall, the Clinton and Trump campaigns and even unpack the recent Deutsche Bank debacle. Stockman when asked about the Federal Reserve and its economic largesse responded, "The idea that you can operate a giant hedge fund (trading operation) inside a bank and that it is the job of the central bank to backstop the asset base, and the financial foundation of that kind of operation does not make any sense. It is not necessary for a healthy economy. It is completely foreign to what people had in mind when the Federal Reserve was established over a century ago. It is a lesson learned from the crisis in 2008 that needs to be implemented." He goes on to note that, "The idea that we can't reform and stabilize (or at least domesticate) the banking system because we need more debt is a non-starter." David Stockman is a two time US congressman who also served in the Reagan Administration as the Director of The Office of Management and Budget. His latest book "Trumped: A Nation on the Brink of Ruin… And How to Bring it Back" is out now and reports directly on how the US arrived at this fractured economic state, and what it must do to climb out. When Covel asked the best selling author on the recent news from Deutsche Bank and Europe he noted, "I think the Deutsche Bank crisis is only the opening event of what's going to be a worsening and continuing crisis in the European Banking system. This was brought even further by Draghi himself when he became convinced about all of this nonsense about "whatever it takes" mentality and driving interest rates lower and lower until he got into the "sub zero zone." He continued expanding the balance sheet of the ECB beyond all recognition. All of this has taken, not only the ECB to a dead end, but it has destroyed whatever viability was left in the big banks in Europe." He went on to say that, "There are hundreds of trillions of risky assets on the balance sheets of European banks, including Deutsche Bank, that are counted as zero in their risk asset base "reckoning" because of these convenient – but nonsensical rules. Covel pressed Stockman, asking what the fallout from election 2016 will be? Stockman left nothing on the table saying, "There will be a recession. There will be a market crash regardless of which candidate wins. All of that will then begin to raise basic questions about whether this was just a fantasy. [People will then think] Why did we believe that you could do all of the unsound things over the last two to three decades? In some ways this wild and woolly presidential campaign is just a warmup for the next phase of political and economic life in the United States – and around the world." For the complete conversation click here. If you would like to have a copy of Stockman's latest book, Trumped! Sent directly to your door – CLICK HERE to learn more. Regards, David Stockman P.S. I've gone ahead and reserved a free autographed copy of my book TRUMPED! A Nation on the Brink of Ruin… and How to Bring It Back for you. Click right here to learn how to claim it. Inside, you'll learn…

Click here to fill out your address and contact info. If you accept the terms, the book will arrive at your doorstep in just a few weeks. The post David Stockman: This is Mutant Capitalism appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JIM WILLIE Sounds the Alarm Dollar Collapse Ahead! Posted: 02 Nov 2016 07:49 AM PDT Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. Do you want to be informed with Max Keiser, Alex Jones, Gerald Celente, Peter Schiff, Marc Faber, Ron Paul,Jim Willie, V Economist, and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diwali, Gold and India – Spiritual, Religious Gold Buying Over? Posted: 02 Nov 2016 07:41 AM PDT I live in Dubai where Diwali has been the focus for many this weekend. With Diwali comes not just fantastic light displays and celebrations but also huge adverts for Hindus to buy gold for their loved ones in India and throughout the world. Buying gold at Diwali is a religious or spiritual act and it is considered auspicious and thought to bring good fortune and prosperity. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold on Steroids: The Perfect Election Trade Posted: 02 Nov 2016 06:41 AM PDT This post Gold on Steroids: The Perfect Election Trade appeared first on Daily Reckoning. What's a better scenario for gold… President Trump? Or President Clinton? Either way, we're screwed. But gold stands to make a run no matter which candidate takes the White House. In fact, the election doesn't matter one bit, according to HSBC. Whether The Donald wins or Crooked Hillary takes the race next week, gold is set to jump at least 8%… "Both candidates have espoused trade policies that could stimulate demand, with gold offering a potential protection against protectionism," HSBC Chief Precious Metals Analyst James Steel tells Bloomberg. "Even the relatively more internationalist Democratic candidate has argued for the renegotiation of longstanding free-trade agreements. That’s positive for gold — even if not on the scale of Mr. Trump's agenda." Meanwhile, investors are selling stocks with both hands as the race heats up. The S&P 500 just logged a six-day losing streak, breaking down below key support. The Dow shed more than 100 points. The stock market loves the status quo. As Trump gained in the polls earlier this week, investors ran for the hills. King Dollar is also retreating this week, capping off a rally that shot the U.S. Dollar Index to seven-month highs… Add it all up and you get a strong rally in precious metals. Gold settled nearly $15 higher at $1,288 on Tuesday. Silver popped 3.5%. That puts this group in the perfect position to make its first meaningful run since the second quarter.

Gold is knocking on $1,300's door early this morning. That gives you a chance to grab the tiger by the tail precious metals start to shine again this month. The market's giving you the opportunity to play gold on steroids for quick, powerful gains right now. More on how in just a minute… First, it's important to know what gold's first-half comeback tells us about this new rally… We watched precious metals and miners vault to two-year highs just a few months ago as the Fed backed off a summer rate hike and world markets shook in fear of the Brexit vote. But gold's trajectory changed dramatically over the summer. While the major averages chopped along, gold couldn't attract any attention. By the time the dust settled, gold had coughed up every ounce of its summer rally as it dropped toward 4-month lows. As short-term traders, we've patiently waited on the sidelines ever since gold's summer rally started running out of steam. Just last month, we told you we needed to see signs that gold was ready to halt its slide before dipping our toes in the water. That's when gold's do-or-die moment came into play. We needed to see the yellow metal bounce at its 200-day moving average. If gold had any shot at finishing what it started in January, it needed to halt its slide. After flirting with its long-term moving average for nearly a month, yesterday's rally hands us the breakout we've been waiting for… As the fast money roars back into the gold trade, we want to harness a short-term play that will offer up quick gains. Our best bet at finding this trade heading into the election is to follow the miners. Gold miners always offer up the potential to post massive moves when gold hits these crucial pivot points. While gold rallied a little more than 1% yesterday, the VanEck Vectors Gold Miners ETF (NYSE:GDX) jumped by more than 2.5%. Let's take a shot at a gold on steroids play and grab some shares of the miners today. With a wild election breathing down our backs and a frantic media stirring up more controversy every day, you have a shot at booking fast, double-digit gains over the next couple of weeks… Sincerely, Greg Guenthner P.S. Profit from battered down stocks — sign up for my Rude Awakening e-letter, for FREE, right here. Never miss another buy signal. Click here now to sign up for FREE. The post Gold on Steroids: The Perfect Election Trade appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diwali, Gold and India – Is Love Affair Over? Posted: 02 Nov 2016 06:03 AM PDT gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Price Is Looking Really Bullish In Dollars, Euros and Rands Posted: 02 Nov 2016 05:02 AM PDT Silver in South African Rand The South African rand is often a leading indicator for where silver (in dollars) is going, as previously explained. Furthermore, the chart of the silver price in rands can often provide very clear signals or patterns of what might happen to price. Currently, the silver price in rands provides the clearest signal (in my opinion) that silver is going to go very high in price. Below is a silver chart in South African rands: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Regardless of Who Wins the US Election, Confidence in Washington DC Is ALREADY Shattered Posted: 02 Nov 2016 04:46 AM PDT It just doesn't matter much whether Hillary Clinton or Donald Trump wins the election, at least in terms of gold and silver market fundamentals. That said, the contest itself is signaling something important precious metals investors should be watching intently. This campaign is dragging whatever prestige is still associated with the Office of President into the mud. Few voters on either side bother to spend much time arguing the greatness of their candidate. When both Trump and Clinton carry more baggage than American Airlines, it's easier to focus on their opponent's shortcomings. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 02 Nov 2016 02:37 AM PDT Private sector jobs growth disappoints, auto sales slip. US GDP, consumer spending up strongly, will be revised downward after the election. Deluge of earnings last week, with Apple, Amazon and health care companies disappointing while Google and the big banks did better than expected. The dollar is rising and so is inflation. FBI probing new […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Precious Metals Stocks May Be Poised for a Major Upswing Posted: 01 Nov 2016 11:36 AM PDT Technical analyst Clive Maund outlines why he believes the correction in gold and precious metals stocks is coming to an end. It now looks like gold's correction is done and its intermediate base pattern is completing. If so, then we are at an excellent entry point for many better precious metals (PM) stocks, which have been savagely beaten down over the past several months—a necessary correction following their outsized run-up earlier in the year. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Lithium Boom Has a New Player in Argentina Posted: 01 Nov 2016 01:00 AM PDT Bob Moriarty of 321 Gold discusses a company that has hit the ground running in Argentina's lithium triangle. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment