Gold World News Flash |

- The Carnage in the Gold Sector Could Be Over

- Black Friday, Fake News and Gold

- Peak Silver And Continued Supply Deficits Warn Of Future Higher Prices

- Has GATA's work made any difference? Will it ever?

- Royal Mint offers gold trading based on blockchain

- Mugabe's "Last Gamble" - Zimbabwe Unleashes Newly-Printed 'Bond Notes' Pegged To The Dollar

- Asian Metals Market Update: November-29-2016

- Sixteen European States Led By Germany Want Arms Control Agreement With Russia

- Worried You Are Putin's Pawn? Mainstream Media's Checklist For Avoiding Fake News

- Pollitically Correct Idiots Love Fidel Castro

- Be Prepared

- Gold Price Closed at $1190.80 Up $12.40 or 1.05%

- TORNADO WARNINGS IN THE SOUTH EAST!!

- BREAKING TRUMP HAS JUST ANNOUNCED THE PROSECUTION IS MOVING FORWARD

- The Carnage in the Gold Sector Could Be Over

- Jim Rickards on The U S Dollar, Interest Rates & Donald Trump

- CRIMINAL: JILL STEIN & HILLARY CLINTON’S REAL STRATEGY for VOTE RECOUNT

- OH NO A CASHLESS SOCIETY!!!! By Gregory Mannarino

- The Bond Vigilantes Will Stop Trumponomics

- The Truth About “Fake News” and “Useful Idiots”

- Gold Seeker Closing Report: Gold and Silver Gain About 1% While Stocks and Dollar Fall

- Has GATA's work made any difference? Will it ever?

- Gold Resource Corporation Declares Year-End Special Dividend

- Islamic finance body approves standard for gold-based products

- Here’s When the Trump Market Rally Will End…

- Hillary Clinton Backers Threaten Electoral College Voters

- The U.S. Silver Market Experienced Two Signficant Developments

- We Could See $1,400 Gold by March 2017

- Trump Goes Public, “I Won Popular Vote” / Talks 9/11 Truth

- Stockman: Careful, Donald. They Rigged A Debt Bomb for March 15th.

- DOLLAR COLLAPSE 2017 - CHINA AND RUSSIA DROP DOLLAR

- These 3 Market Lies Are Costing You a Fortune…

- Could President Trump Use Reagan’s Playbook?

- Breaking News And Best Of The Web

| The Carnage in the Gold Sector Could Be Over Posted: 29 Nov 2016 07:10 AM PST The gold and silver producers made a blistering start to the year; however, the second half of the year has been a totally different story. The chart below depicts the rise and fall of the gold producers which make up the Gold Bugs Index the HUI. This Index has now fallen 60% from its recent high of 282 which suggests to us that the selling pressure should be just about exhausted. Overall the HUI remains some 72.2% off its high (630-175) made in 2011, so there is plenty of room for the stocks to rise once gold resumes its bull market. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Black Friday, Fake News and Gold Posted: 29 Nov 2016 07:09 AM PST Black Friday and "Black Friday" weekend have largely become irrelevant. Every retailer in the U.S., from auto dealers to furniture stores to online tennis apparel shops have been advertising "Black Friday" sales since November 1st. We have no doubt that the Census Bureau will concoct phony holiday sales for November (reported December 14) and December (reported in January). But the truth – the non-Russian influenced truth – is that retail sales spending per capita this holiday on an inflation-adjusted basis is going to be less than in 2015. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peak Silver And Continued Supply Deficits Warn Of Future Higher Prices Posted: 29 Nov 2016 07:07 AM PST What is interesting here, is that GFMS forecasts the number one silver producer, Mexico, to be down in 2016 by more than 6 Moz. Last year, I forecasted that global silver production would likely be lower in 2015. I was going by data by the "World Metals Statistics." However, Mexico's INEGI (government agency) considerably revised their figures higher for 2015. While I have seen revisions take place, the revisions by Mexico's INEGI for 2015 were quite substantial. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Has GATA's work made any difference? Will it ever? Posted: 29 Nov 2016 07:04 AM PST Yes, GATA has not yet wiped the tyranny of central banking from the face of the earth. But we have exposed to a wide audience -- an audience including at least two major governments -- the part of that tyranny that rigs the gold and currency markets, and have explained how this ultimately rigs all markets for totalitarian and imperialistic purposes. We have evidence that people are acting on this knowledge and that our work has forced the market riggers to expend even more resources and become even more obvious. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Royal Mint offers gold trading based on blockchain Posted: 29 Nov 2016 12:01 AM PST This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mugabe's "Last Gamble" - Zimbabwe Unleashes Newly-Printed 'Bond Notes' Pegged To The Dollar Posted: 28 Nov 2016 11:45 PM PST One might think that after 92 years, some wisdom may have leaked into the brain of Zimbabwean president Robert Mugabe. But no. As the world's oldest head of state, he has overseen the demise from a post-colonial success to a pariah state wrecked by hyperinflation. However, having apparently learned no lesson from his prior experiences, The Reserve Bank of Zimbabwe has decided to print a new national currency for the first time since 2009. As Simon Black pointed out a month ago, some people just don’t learn.

And so, as RT reports, The Reserve Bank of Zimbabwe has introduced a national currency for the first time since 2009 in an attempt to tackle a sharp shortfall of the US dollar, the country’s primary medium of trade. The new currency, called bond notes, is pegged at par with the US dollar and is backed by a $200 million bond facility with Afreximbank, according to the regulator.

Of course, as we pointed out previously, that’s the same thing they said 15 years ago. And it’s the same thing that every government and central bank says when they embark on an initiative to print money. This is such typical thinking, and sadly not limited to Zimbabwe... People in power across the world, including in North America and Europe, rely on this incredibly limited playbook. They think they can engineer prosperity by going into debt and conjuring money out of thin air. They think they can legislate and regulate their way to a quality healthcare or education system. And when the majority of their initiatives fail, or even have the exact opposite effect as intended, they don’t learn from their mistakes. They simply print more money, pass more laws, and go deeper into debt. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asian Metals Market Update: November-29-2016 Posted: 28 Nov 2016 11:04 PM PST If you look at the internet, I read some comments that gold is broken and that it can never recover. Hyper bearish stooges giving comments not to invest in gold. I have always emphasized on the need to invest in physical gold for the long term and never in ETF's or futures. In India the government announced a demonetization scheme (I personally support the scheme) and people were out of cash suddenly. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sixteen European States Led By Germany Want Arms Control Agreement With Russia Posted: 28 Nov 2016 11:00 PM PST Submitted by Peter Korzun via Strategic-Culture.org, Fifteen European states have supported Germany’s initiative to launch discussions with Russia on a new arms control agreement. «Europe's security is in danger», German Foreign Minister Frank-Walter Steinmeier told Die Welt newspaper in an interview published on November 25. «As difficult as ties to Russia may currently be, we need more dialogue, not less». Steinmeier, a Social Democrat nominated to become German president next year, first called for a new arms control deal with Russia in August to avoid an escalation of tensions in Europe. Fifteen other members of the Organization for Security and Cooperation in Europe (OSCE) - have since joined Steinmeier's initiative: France, Italy, Austria, Belgium, Switzerland, the Czech Republic, Spain, Finland, the Netherlands, Norway, Romania, Sweden, Slovakia, Bulgaria and Portugal. The group plans to discuss the issue on the sidelines of a December 8-9 ministerial level OSCE meeting in Hamburg. Germany is holding the rotating presidency of the organization. Mr. Steinmeier first floated the idea of an arms control agreement with Moscow in August amid rising tensions between Russia and NATO. He has also slammed NATO for «saber-rattling and war cries» and provocative military activities in the proximity of Russia’s borders. Russia withdrew from the original Treaty on Conventional Armed Forces in Europe (the CFE treaty) in 2015. Signed in 1990 by NATO and the Warsaw Pact, the agreement set ceilings for the level of conventional arms systems signatories were allowed to deploy and established verification and confidence-building measures. The treaty had long been undermined by NATO expansion, leading to imbalance of forces. The alliance has accepted 12 Eastern European countries since 1999 with Montenegro invited to join. In 1999, signatories agreed an adapted version, but this was never ratified because NATO insisted Russia had to withdraw all its troops from former Soviet territories such as Georgia, Abkhazia, South Ossetia and Transdniestria as a precondition for the ratification. Although Russia had withdrawn almost all its troops, there remained some insignificant contingents but the alliance stubbornly sought to pursue its line. According to the Adapted CFE, the quota for the number of forces practically did not change. The agreed limits for NATO exceeded three times the ones established for Russia. The flanking zone limitations for the Russian Federation were not reconsidered. The three Baltic States refused to join the treaty when they became NATO members. The adapted version of the treaty did not address the problem of NATO’s superiority in naval forces. A number of NATO countries have essentially breached its requirements, periodically refusing to provide information to the Russian side or allow inspections. The alliance has stepped up provocative activities near Russia’s borders. NATO failed to take into account Russia’s concern over ballistic missile defense (BMD) plans. This policy implemented by NATO actually finished off conventional arms control in Europe. In 2007, Moscow suspended its participation in the treaty to finally withdraw in 2015. As a result, the OSCE Vienna Document and the Treaty on Open Skies are the only mechanisms left in place but they are too limited in application to curb the rising tensions. The goal of creating a «Greater Europe» stretching from Lisbon to Vladivostok seemed to be achievable some years ago. Now it has become a far-fetched dream. A quarter of century has passed since the Soviet Union’s collapse. The Russia-West dialogue has failed to translate into some kind of strategic relationship. It’s important to note that the initiative to relaunch the negotiation process does not belong to Germany. The West has rejected Russia’s proposal to discuss a new European Security Treaty. The Russia-proposed draft document was published in 2009. In March 2015, Russia expressed its readiness for negotiations concerning a new agreement regarding the control of conventional weapons in Europe. It never rejected the idea of launching talks to address the problem. New security arrangements should take into consideration the realities of the fast changing world, including new technologies. Any arrangement should cover long range conventional strike capabilities, the weapons based on new physical principles, tactical nuclear weapons, the NATO’s naval and conventional superiority, the bloc’s further expansion and a host of other problems. No deal is possible without an agreement of NATO’s BMD program. The process should not be limited to weapons systems only. The confidence-building and security measures (CBSMs) contained in the Vienna Document should be further developed to reduce the risk of a new armed conflict sparked as a result of an accident – something NATO has refused to do so far. A new agreement should address the security agenda in a broader sense. The debate is long overdue. The problem should not boil down to bilateral Russia-NATO relationship. It should eventually feed into a broader conversation on the overall European security system based on a new architecture. Europe is facing a host of security challenges. Launching a meaningful discussion with Russia is logical step to take. Russia and the West have plenty of possibilities for cooperation besides arms control and military activities in Europe. The possible areas of cooperation include the fight against terrorism, especially the Islamic State group, Syria, Libya, Afghanistan, the Arctic, the proliferation of weapons of mass destruction and countering piracy to name a few. Respect for mutual concerns and interests is a prerequisite for success. With all the differences dividing Russia (the Soviet Union) and the West at the height of the Cold War, those days diplomacy worked well to prevent the worst. It can be done now. The significant support for the proposal launched by German Foreign Minister Frank-Walter Steinmeier provides a serious opportunity to turn the tide. This chance should not be missed. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Worried You Are Putin's Pawn? Mainstream Media's Checklist For Avoiding Fake News Posted: 28 Nov 2016 08:30 PM PST Submitted by Justin Raimondo via AntiWar.com, No one outside of a few obsessed cranks would’ve noticed it if the Washington Post hadn’t given it front page prominence last week: a formerly obscure web site, propornot.com, which purports to identify a “Russian active measures” campaign with some very specific goals in mind As Post “reporter” Craig Timberg put it:

While the Post piece doesn’t link directly to the propornot site – because doing so would’ve exposed its laughably amateurish “methodology” for all to see – Timberg does mention their list of online Boris Badenovs, including not only Antiwar.com but also the Drudge Report, WikiLeaks, David Stockman’s Contra Corner, the Ron Paul Institute, LewRockwell.com, Counterpunch, Zero Hedge, Naked Capitalism, Truthdig, Truth-out, and a host of others. These sites, according to the Post, not only promoted a barrage of “fake news” with the aim of defeating Mrs. Clinton, but they did so at the behest of a “centrally-directed” (per propornot) intelligence operation undertaken by the Russians. So what did this “fake news” consist of? Timberg “reports”:

Never mind that it was Hillary Clinton herself who heightened international tensions by threatening military retaliation against the Russians for supposedly unleashing via WikiLeaks a flood of embarrassing emails. In a speech touted as outlining her foreign policy platform, she railed:

According to the “experts” at propornot – granted anonymity by Timberg due to alleged fear of “Russian hackers” – to so much as note this clear threat is to brand oneself as a “Russian agent of influence.” And what about Mrs. Clinton’s health problems – was reporting on this driven by Russian spies embedded in the alternative media? Or was it occasioned by this video, which saw her falling to the ground after leaving the 9/11 ceremony early? Are the folks at propornot and their fans at the Washington Post saying the amateur videographer who took that footage is a Russian secret agent? Were the television networks and other outlets that showed the footage “useful idiots,” to employ a favorite cold war smear revived by propornot? Given their criteria for labeling people agents of the Kremlin, the answer to these questions has to be yes – and now we are falling down the rabbit hole, in a free-fall descent into lunacy. Propornot’s “criteria” for inclusion on their blacklist is actually an ideological litmus test: if you hold certain views, you’re in the pay of the Kremlin, or else an “unwitting agent” – as former CIA head Mike Morell said of Trump. If you say anything at all positive about Russia or Putin – or a long list of entities, like China or “radical political parties in the US or Europe” (does this include the GOP?) – it’s a dead giveaway. We’re told to “investigate this by searching for mentions of, for example, ‘russia’, on their site by Googling for ‘site:whateversite.com Russia’, and seeing what comes up.” If only Sherlock Holmes had had Google at his disposal, those detective stories would’ve been a lot shorter! The propornot site is filled with complex graphs, and the text is riddled with “scientific”-sounding phrases, but when you get right down to it their “methodology” boils down to this: if you don’t fit within a very narrow range of allowable opinion, either falling off the left edge or the right edge, you’re either a paid Russian troll or else you’re being “manipulated” by forces you don’t understand and don’t want to understand.

The Post piece also cites an article published on the “War On The Rocks” web site (which is exactly what it sounds like). The authors, a triumvirate of neocons, avers that they’ve been “tracking” “Russian propaganda” efforts since 2014, and they’ve concluded that the Grand Goal of the Russkies is to “Erode trust between citizens and elected officials and democratic institutions” – as if this process isn’t occurring naturally due to the depredations of a corrupt and arrogant political class. Another insidious theme of Russian “active measures” as identified by these geniuses is “Stoking fears over the national debt, attacking institutions such as the Federal Reserve, and attempts to discredit Western financial experts and business leaders.” So we mustn’t talk about the national debt – because to do so brands one as a cog in Putin’s propaganda machine. Gee, based on these criteria, we can only conclude that every vaguely conservative politician running for office in the last decade or so is part of the Vast Russian Conspiracy, not to mention numerous economists. And that’s not all – not by a long shot. Here’s a list of more Forbidden Topics we’re not supposed to discuss, except maybe in whispers in the privacy of our own homes: “Police brutality, racial tensions, protests, anti-government standoffs, online privacy concerns, and alleged government misconduct are all emphasized [by the Vast Russian Conspiracists – ed.] to magnify their scale and leveraged to undermine the fabric of society.” After all, Russia Today is “emphasizing” these issues – so mum’s the word! Yes, these people are serious – but why should anyone take them seriously? Why is the Washington Post “reporting” this nonsense – and putting it on the front page, no less? In short, what’s the purpose of this virulent propaganda campaign? After all, Hillary Clinton has been defeated, along with her campaign theme of “A vote for Trump is a vote for Putin.” What does a continuation of this losing mantra hope to accomplish? The folks at propornot are explicit about their goal: they want the government to step in. They want to close down these “agents of influence.” In their own words, they want the FBI and the Department of Justice to launch “formal investigations” of the sites on their blacklist on the grounds that “the kind of folks who make propaganda for brutal oligarchies are often involved in a wide range of bad business.” They accuse the proprietors of the listed web sites – including us, by the way – of having “violated the Espionage Act, the Foreign Agents Registration Act, and other related laws.” Oh, but they say they want to “avoid McCarthyism”! They just want to shut us down and shut us up. These people are authoritarians, plain and simple: under the guise of fighting authoritarianism, they seek to ban dissenting views, jail the dissenters, and impose a narrow range of permissible debate on the public discourse. They are dangerous, and they need to be outed and publicly shamed. To be included on their list of “subversives” is really a badge of honor. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pollitically Correct Idiots Love Fidel Castro Posted: 28 Nov 2016 06:30 PM PST The masses of braindead idiots have come out and begun expressing their love for Cuba's late dictator. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Nov 2016 05:54 PM PST My Dear Friends This article is extremely positive for the price gold and silver but you must take your time, reading it carefully therefore understanding it. GG, I and BH do and this must be studied so you will also see the new world we have fallen into. Dante would be proud Since there is... Read more » The post Be Prepared appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1190.80 Up $12.40 or 1.05% Posted: 28 Nov 2016 05:32 PM PST

Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TORNADO WARNINGS IN THE SOUTH EAST!! Posted: 28 Nov 2016 04:30 PM PST That red line is coming right at us. Got the closet ready for the kids. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING TRUMP HAS JUST ANNOUNCED THE PROSECUTION IS MOVING FORWARD Posted: 28 Nov 2016 03:30 PM PST Event Is Coming Soon - BREAKING TRUMP HAS JUST ANNOUNCED THE PROSECUTION IS MOVING FORWARD The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Carnage in the Gold Sector Could Be Over Posted: 28 Nov 2016 02:50 PM PST Background

The gold and silver producers made a blistering start to the year; however, the second half of the year has been a totally different story. The chart below depicts the rise and fall of the gold producers which make up the Gold Bugs Index the HUI. This Index has now fallen 60% from its recent high of 282 which suggests to us that the selling pressure should be just about exhausted. Overall the HUI remains some 72.2% off its high (630-175) made in 2011, so there is plenty of room for the stocks to rise once gold resumes its bull market.

The chart shows that a Cross of Death has........ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rickards on The U S Dollar, Interest Rates & Donald Trump Posted: 28 Nov 2016 02:48 PM PST Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| CRIMINAL: JILL STEIN & HILLARY CLINTON’S REAL STRATEGY for VOTE RECOUNT Posted: 28 Nov 2016 02:37 PM PST IS THIS JILL STEIN AND HILLARY CLINTON'S REAL STRATEGY FOR LAUNCHING THE VOTE RECOUNTS? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| OH NO A CASHLESS SOCIETY!!!! By Gregory Mannarino Posted: 28 Nov 2016 02:30 PM PST we are in cashless system, even the remaining $cash will be worthless as inflation destroy the remaining physical cash $100 is almost noting anymore soon we will be 99.9 % pure digital, (excluding gold and sliver ) The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Bond Vigilantes Will Stop Trumponomics Posted: 28 Nov 2016 01:32 PM PST This post The Bond Vigilantes Will Stop Trumponomics appeared first on Daily Reckoning. Yes, the bond vigilantes are back. I welcome the return of the bond vigilantes, and not just because they are the one force that can stop the mad dash toward a fiscal bloodbath that has been launched by Trump’s economics team. Their return also marks the end game of the drastic falsification of debt and other financial asset prices that has been carried out by the world’s central banks since the mid-1990s. What has actually happened since then is that the bond “vigilantes” of yore morphed into central bank “front runners” in recent years. That is, bond traders, who used to sell government securities when they sensed fiscal profligacy, switched to the “buy” side of the market as the age of massive central bank balance sheet expansion and the associated bond-buying sprees under quantitative easing (QE) unfolded. There was really no mystery about this — it was just the law of supply and demand at work. The central banks were relieving the markets of trillions of government debt, causing bond prices to rise and yields to fall steadily toward the zero bound. In that context, it goes without saying that traders buy what’s going up and expected to go up even more. At the same time, the central banks left no doubt that they could be counted upon because of their announced commitment to massive monthly purchase quotas. What this meant in practice is that the $20 trillion increase in central bank balance sheets during the last two decades was amplified by the former bond vigilantes who had morphed into “front-runners.” After all, quota based central bank bond-buying is fundamentally different than the action of traders on a free market. Indeed, central banks have the legal authority to commit what amounts to financial fraud day-in-and-day-out by funding their open market purchases of government bonds with credits confected from thin air. When these credits are injected into the banking system as valid payments to selling dealers, the price of government debt is falsely levitated higher and higher. Total holdings of the world’s central banks were about $2 trillion in the mid-1990’s when the bond vigilantes were last heard from. But beginning after 2000, the massive uptake in central bank balance sheets, and therefore artificial bid for government debt, converted them into “front-runners.” In that mode they pocketed literally hundreds of billions of windfall profits by buying government bonds on leverage and riding them to higher and higher prices. Speculators simply bought the bond and funded it in the zero cost money market with virtually no risk, thereby causing the bond market to function as an afterburner on the central bank bid. Bond traders have never made so much for doing so little, meaning that massive amounts of speculative capital was attracted into the government debt markets on a wholly unnatural and unsustainable basis. The irony of the current situation is well worth noting. The mother of all global bond bubbles has essentially been created by recycled bond vigilantes who got into the front-running business after Greenspan yelled “uncle” in 1994 when the marketplace rate of interest on the nation’s bulging public debt started to soar. As I have noted before, had the lapsed gold-bug and free market economist Ronald Reagan thought he appointed to the Fed retained his principles and integrity, the age of massive government debts would have been stopped then and there. A painful economic recession would have made it clear that the 12-year Reagan/Bush deficit spree — which took the public debt from $1 trillion to $4 trillion — had not been a free lunch. In fact, there was a price to pay in terms of far higher market-clearing interest rates. That, in turn, would have “crowded out” private investment in business capital and housing and precipitated a painful economic adjustment. Instead, Greenspan elected to nullify the honest verdict of the free market bond vigilantes and embark on the age of massive central bank balance sheet expansion and bond-buying. That horrifically wrong turn on the monetary road, of course, did defer the day of reckoning because it essentially allowed governments to park their debts for nearly free on the balance sheets of the global central banks. Indeed, when Greenspan euthanized the bond vigilantes in 1994, the balance sheet of the Fed was about $275 billion and footings for all the world’s major central banks combined was $2 trillion. Greenspan’s handiwork triggered an explosion of dollar liabilities among the balance of the world central banks. Had they not worked to cheapen their own currencies in response to the tsunami of Greenspan dollars, their currencies would have soared, thereby undermining the statist and mercantilist policies which were already in place in their respective countries. In any event, the bond vigilantes were buried by the central bank bond-buying explosion — only to re-emerge as central bank front-runners. They ended up capturing immense windfalls that had not even been imaginable during their days as honest disciplinarians of profligate governments and politicians. There is probably no way to quantify the impact of this double whammy — central banks plus front-runners — on the bond bid, but it had to be immense. That’s because there is no other rationale for the fact that has recently as August, some $13 trillion of the $42 trillion in outstanding global sovereign debt was trading at sub-zero rates and most of the remainder was in the +/- 1% zone. In short, the global bond market was being tortured by the most monumental one-way bid that has ever impacted any financial market in recorded history. The financial world was literally wobbling on its axis. By a great stroke of historical coincidence, however, the Keynesian central bankers regime is being brought to an abrupt end—-and much sooner than otherwise — by the prospect of Trumponomics and its massive add-ons to Uncle Sam’s already towering debts. That’s because it is euthanizing the bond market front-runners in almost an exact reverse of the process Greenspan set in motion in 1994. Donald Trump and his deficit-embracing economics team have caused the battle to create a false prosperity based on Keynesian money-pumping to be lost early. Accordingly, the bond vigilantes will now coming roaring back. That’s because without the Big Fat Bid of the central banks, profits are to be made by selling the sinking bonds, not buying the rising paper. The entire dynamic of the global bond market and financial system for the past two decades has been captured by the false bond price premiums being created by the massive central bank balance sheet expansion shown above. But when that’s gone, the front-runners will pivot with the alacrity of Donald Trump himself. In the midst of the fiscal bloodbath that is sure to follow, Trumponics is going to be ripped limb-for-limb, as it deserves to be. That a $1 trillion infrastructure program can help make America great again is just wrong-headed. It can only fill the Washington swamp with more interest group boodle and racketeering, and saddle the U.S. economy with wasteful pork barrels and public sector white elephants — like high speed rail — that it can’t afford and doesn’t need. This new reality will soon shatter the false post-election euphoria that has gripped the financial markets, and uncover the fiscal bloodbath that will confront the new Trump Administration when it attempts to pursue its economic program. In a word, rising interest rates, rising deficits and rampaging bond vigilantes are returning to the Imperial City for the first time in 25 years. The result will be a budgetary conflagration like nothing since the Reagan battles of 1981. But this time, Uncle Sam is dead broke and the central bank bond parking gambit is now over and done. Regards, David Stockman The post The Bond Vigilantes Will Stop Trumponomics appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Truth About “Fake News” and “Useful Idiots” Posted: 28 Nov 2016 01:26 PM PST This post The Truth About “Fake News” and "Useful Idiots" appeared first on Daily Reckoning. In the United States of late 2016, it's come to this: A patriot like our own David Stockman gets smeared as a "useful idiot" of Russian President Vladimir Putin on the front page of The Washington Post.

Regards, Dave Gonigam P.S. "Donald Trump is getting some extremely bad advice from his economics team," David Stockman writes today at his subscriber-only Contra Corner site. "The path of protectionism and mega fiscal stimulus they are recommending will not help Flyover America, where left-behind citizens in their tens of millions voted to impeach the Wall Street/Washington ruling elites on Nov. 8." We spoke earlier in today's episode of "forces arrayed against Trump." Those forces are now becoming clearer. And David anticipated those forces in his book Trumped! A Nation on the Brink of Ruin… and How to Bring It Back. It was published only weeks before the election, before the outcome was known. It's even more urgent now. Order your copy today for only $4.95 (the cost of shipping) and you'll get a free trial of David's Contra Corner site — you know, the one that anonymous cowards are dissing in The Washington Post as "Russian propaganda." Here's where to go. The post The Truth About “Fake News” and "Useful Idiots" appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver Gain About 1% While Stocks and Dollar Fall Posted: 28 Nov 2016 01:19 PM PST Gold gained $16.15 to $1197.55 in Asia before it fell back to $1183.24 by a little after 9:30AM EST, but it then rallied back higher into the close and ended with a gain of 1.02%. Silver rose to as high as $16.856 and ended with a gain of 0.85%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Has GATA's work made any difference? Will it ever? Posted: 28 Nov 2016 01:04 PM PST 4:05p ET Monday, November 28, 2016 Dear Friend of GATA and Gold: If you have made a donation by credit card in response to our appeal Sunday for financial support -- http://www.gata.org/node/16947 -- and have not received a personal note of thanks from your secretary/treasurer by e-mail, it's because I did not have or could not locate an e-mail address for you. Please do e-mail me to cite any donation made by credit card so that I can acknowledge it most gratefully. Our credit card donation mechanism does not make any provision for contact information and, for security reasons, provides us with little more information about donors than their name. If you make a donation by mailing a check, please include your e-mail address there too. This will save GATA the expense of regular postage in thanking you. ... Dispatch continues below ... ADVERTISEMENT K92 Mining Begins Gold Production at Kainantu Mine Company Announcement K92 Mining Inc. is pleased to announce that gold production has commenced from the Irumafimpa gold deposit. Ian Stalker, K92 Chief Executive Officer, says: "This milestone is highly significant for our company, and for this region of Papua New Guinea. A great deal of thanks goes to the entire team on site in PNG in achieving production ahead of schedule and on budget. The rehabilitation of the Irumafimpa gold mine, process plant, and associated infrastructure commenced in late March and is now complete. As an enhancement of the processing facility, we are also pleased to note that the installation of a new drum scrubber is also nearing completion and commissioning of this will be completed by the end of the month. ..." ...For the remainder of the announcement: http://www.k92mining.com/2016/10/6077/ Meanwhile, a devoted friend in Canada who long has been advocating for GATA conveys this criticism he got from an acquaintance: "GATA has been banging the drum for a long time now but what has it accomplished in a practical sense? GATA reveals information that is ignored. GATA appears before commodity market regulators who are indifferent to the evidence presented. GATA has been unable to sway the mining industry itself. This war has proven fruitless. Maybe it's time to accept that and move on. If GATA got and spent a million dollars in donations, there would be no appreciable effect. No one who profits from the game as it is now played is going to roll over and change based on any facts or exposure, and no entity with the authority to act is going to intervene. It's a captured market." This criticism is not entirely unfair. Yes, GATA has not yet wiped the tyranny of central banking from the face of the earth. But we have exposed to a wide audience -- an audience including at least two major governments -- the part of that tyranny that rigs the gold and currency markets, and have explained how this ultimately rigs all markets for totalitarian and imperialistic purposes. We have evidence that people are acting on this knowledge and that our work has forced the market riggers to expend even more resources and become even more obvious. If, as we believe, what they are doing is evil, it will break eventually and the ascent of man will continue. For as James Russell Lowell wrote in defiance when the Slave Power seemed to have a lock on America: Truth forever on the scaffold, Wrong forever on the throne -- In any case we know one thing: Doing nothing makes nothing happen. Yes, for those who believe in free markets, limited and accountable government, and individual liberty, these seem like our Valley Forge days, and of course many good causes are always failing from exhaustion. But what could be a grander cause than this one, a cause contending for the definitions of money and justice as they apply to all the capital, labor, goods, and services in the world? GATA is indeed an amateur operation, doing work that should be done by others, like the World Gold Council, which, as it turns out, exists only to ensure that there never is a world gold council. But until professionals who are willing to take on the work turn up, we mean to keep at it, with the hope and faith that Arthur Hugh Clough put in rhyme: Say not the struggle nought availeth, If hopes were dupes, fears may be liars; For while the tired waves, vainly breaking And not by eastern windows only, We still need your help: CHRIS POWELL, Secretary/Treasurer Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Resource Corporation Declares Year-End Special Dividend Posted: 28 Nov 2016 01:01 PM PST "I am very pleased that the Board of Directors continues to reward shareholders of Gold Resource Corporation with dividends, including this year-end special distribution which is equivalent to fifty percent of our instituted 2016 annual dividend," stated Mr. Jason Reid, CEO and President of Gold Resource Corporation. "We remain optimistic that the return of the precious metal bull market in 2016 will continue into 2017 and look forward to potential future dividends, both instituted and special. Earnings are opinion while cash is fact and we hope all our shareholders appreciate additional cash in their bank accounts as we close out the 2016 year." | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Islamic finance body approves standard for gold-based products Posted: 28 Nov 2016 11:56 AM PST By Bernardo Vizcaino The Bahrain-based Accounting and Auditing Organization for Islamic Financial Institutions said on Monday it had approved a sharia standard for gold-based products, a move aimed at expanding the use of bullion in Islamic finance. Traditionally, gold has been treated as a currency in Islamic finance which has confined its use to spot transactions, but fresh guidance from the accounting organization is expected to spawn a wave of product development in the industry. The organization approved the final version of the standard on gold and its trading controls during a meeting of its sharia board held last week, the industry body said in a statement seen by Reuters. ... ... For the remainder of the report: http://www.reuters.com/article/islamic-finance-gold-idUSL8N1DT0FL ADVERTISEMENT Canadian Government Issues Key Water License Company Announcement TORONTO -- Seabridge Gold Inc. (TSX: SEA) (NYSE:SA) announced today it has received a license from the Government of Canada required for the construction, operation, and maintenance of the water storage facility and associated ancillary water works at its 100 percent-owned KSM Project in northwestern British Columbia. The license, as authorized within the International Rivers Improvement Act, regulates all structures and activities situated on transboundary waters shared with the United States that have the potential to affect water quality and quantity. The Water storage facility and its ancillary water works (water diversion ditches and tunnels) are the primary water management control systems for the KSM Project. These facilities separate water that has not contacted mined material from so-called contact water originating from disturbed areas of the mine site and then contain the contact water prior to treatment and eventual release to the receiving environment. These facilities are situated on Mitchell and Sulphurets creeks, tributaries of the transboundary Unuk River system that flows into Alaska. The license was granted for a term of 25 years under the International Rivers Improvements Regulations as administered by Environment and Climate Change Canada. ... ... For the remainder of the announcement: http://seabridgegold.net/News/Article/642/federal-government-issues-key-... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Here’s When the Trump Market Rally Will End… Posted: 28 Nov 2016 09:28 AM PST This post Here's When the Trump Market Rally Will End… appeared first on Daily Reckoning. The Trump stock market rally surged even higher last week… Bloomberg reported that the four major benchmark indexes hit all-time highs. The Dow Jones Industrial Average hit a new record close, up 1.5% to 19,152. The S&P 500 Index was up 1.4%, while the Nasdaq jumped 1.5% and the Russell 2000 saw a stout 2.4% gain. The market's been on a three-week upward tear since Trump's election despite countless market "experts" who predicted a market collapse should he win. And now those same geniuses are predicting an impending decline. Here's how to know if they're right this time… Doom and Gloom

The crystal ball readers tell us that a number of fundamental factors signal the next market drop is just around the corner… Odds are in favor of an interest rate hike at the Federal Reserve meeting in mid-December. Analysts' conventional wisdom says the market will crater like it did after the last rate hike in December 2015. We've also seen companies reporting lower revenues, with many lowering their forward earnings guidance for 2017. Accepted wisdom says that bodes ill for stock prices in the near future. Then there are valuations… Mark Hulbert of Marketwatch reports: "Depending on which of six widely used valuation measures, the market currently is more overvalued than it was, at between 79% and 95% of the three dozen bull-market tops since 1900." What goes up must come down "they" say. There's also the threat of recession… According to the National Bureau of Economic Research, the average post-World War II expansion cycle lasts less than five years. We're now on 7 years without an official recession. The bottom line is we're overdue for the next rip-roaring downturn, the first signs of which should be a rally killer. The chattering clowns spread across financial media tell us that all of these fundamental red flags point to impending stock market danger. You get it: Be afraid, deathly afraid. Don't risk a penny on this predictive foolishness. Why Conventional Wisdom Sucks…

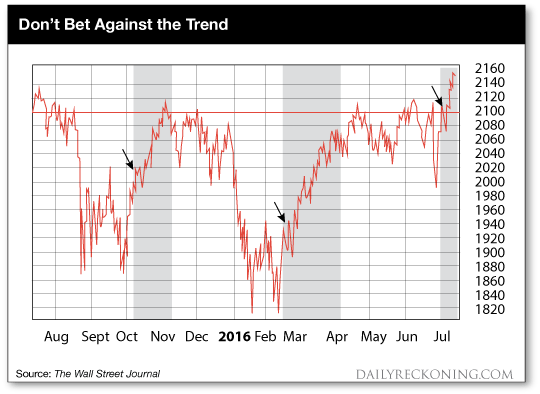

So how are you going to trade a warning sign like a Fed rate hike? The herd tells you that the stock market will decline when rates go up. And it might in the short run… or it might not. Historically, rising rates have actually tended to coincide with higher stock prices. Studies show the S&P generally earns between 8% and 10% annually when interest rates are moving higher. Or maybe you're going to bet on a market decline because valuations are too high? You're told the market is "overbought" and has run out of steam, even though no one seems to know what the hell "overbought" means. But let's stay practical. Have a look at the chart below. It shows three large rallies over the past year. The red arrows highlight when the S&P 500 first became overbought.

As you can see, the majority of the gains took place after entering overbought territory. This signals a market that's still in an uptrend. If you followed conventional fear mongering advice and bet against it, you got burned. Let me be blunt: You should never fight the price trend… especially not when based on "expert" analysis of what "should" happen – no matter how much your lizard brain thinks it makes sense. Sure, any of these warning signs can kill the Trump rally… or not. It's impossible to know what's going to happen next. But trying to outguess what the market price is actually doing will kill your account. Bottom line: Ignore "expert" warnings like the plague. If you follow the trend you will know when the Trump rally is officially done. Please send your comments to me at coveluncensored@agorafinancial.com. Let me know what you think of today’s issue. Regards, Michael Covel The post Here's When the Trump Market Rally Will End… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hillary Clinton Backers Threaten Electoral College Voters Posted: 28 Nov 2016 08:30 AM PST Mixed Messages - Hillary Clinton Backers Threaten Electoral College Voters - Fox & Friends The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The U.S. Silver Market Experienced Two Signficant Developments Posted: 28 Nov 2016 08:19 AM PST Gains Pains & Capital | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| We Could See $1,400 Gold by March 2017 Posted: 28 Nov 2016 08:12 AM PST This post We Could See $1,400 Gold by March 2017 appeared first on Daily Reckoning. By March 2017, I believe we could see gold move back up over $1,400 per ounce. The fact is that, President Donald Trump or no, come next January, the U.S. will still be firmly ensconced in an era of reckless monetary policy. It's no stretch to say that the current money system cannot sustain itself. Many years of low interest rates — and, more recently, negative real rates — have wrecked the financial future of a large portion of U.S. households. The breakdown in U.S. monetary policy is just a question of time. And we think the starting gun will go off this December, with a loud shot fired by the Federal Reserve. Last December, at the end of 2015, the Fed implemented a tiny, quarter-point interest rate increase. The dollar strengthened and investors fled the market, causing huge share price drops in January and February. Looking ahead, the Fed is likely to raise another quarter-point this December, repeating the mistake of December 2015: raising rates in a weak environment. The economy isn't strong enough to support the rate increase, tiny as it may be. But the Fed isn't increasing rates to cool off the economy. This is a tactical move to give the Fed more room to cut rates during the next recession. Fed policymakers have outright admitted that rates will probably plateau after December, meaning they'll remain far below historical norms. This also means that the Fed won't be able to cut rates far enough to truncate the next financial collapse. If the Fed and stocks repeat their December 2015 playbook, expect gold to repeat its 2016 trajectory as well: Let's look at a chart of the last two years of gold prices: Then as 2015 rolled over to 2016, the Fed raised rates, and gold took a big leg up in January and February, all while broad markets were tanking. Gold hit a first peak around March 2016. After June 23 and the Brexit vote, gold moved up another leg, hitting above $1350. Overall, gold made a $300 move upwards after the Fed raised rates last December. Since mid-August of this year, and as Brexit euphoria faded and U.S. elections heated up, gold has fallen hard below its 200-day moving average. In the next chart, the blue line starting in August represents the 200-day moving average of gold. After Trump's victory on Nov. 8, many other sectors across the markets firmed up solidly — like banking, infrastructure, aerospace and pharmaceuticals. But gold has been steadily down since its Election Night bounce (although it hasn't gotten close to the lows of December 2015). What's going on here, with the post-election gold price swoon? Strong Hands Smother Gold This downtrend is thanks in large part to Stanley Druckenmiller. Druckenmiller is a money titan, whose hedge fund used to boast annual returns over 30%. He recently sold off his gold holdings, worth approximately $1 billion. Druckenmiller declared during an interview on CNBC that "I sold all my gold on the night of the election… All the reasons I have owned it for the last couple of years, it seems to me they may be ending." "They may be ending"? That's a risky justification for selling $1 billion worth of gold. It's way beyond the old saw about buying on rumors and selling on news. I understand what Druckenmiller is saying — he's excited about Trump — but I don't understand why he says it just now. Consider that over many years, monetary policymakers have squashed interest rates. They have pushed legions of investors far out on the risk curve. From go-go hedge funds to greed-head bankers, from big, stodgy universities to retirees — most investors are forced to own high-risk stocks because there's no return down at the local bank. Then consider that the entire economy is a legacy of failed "stimulus programs." We're still stewing in much the same policy mix that handed the world the 2008 crash. All in all, we live in a monetary fog that has destroyed the U.S. economy and shaken its long-term stability. There's good news in this for us, though. And a way you could double your money in the coming months. $1,400 Gold by March 2017 As Jim Rickards noted recently, "The gold market will soon realize that Trump's economic plan is pure 'helicopter money.' [Trump] wants lower taxes and bigger spending. That means bigger deficits, and that's what helicopter money is. The Fed will have to put a lid on nominal rates to achieve negative real rates." That's called financial repression. Over time — sooner or later, and I think relatively soon — gold will continue to increase in price. It has to increase because of future inflation. The U.S. government, and governments around the world, are hamstrung by current debt and future obligations. When (not if), real interest rates rise, the cost of carrying that debt will move up fast. It'll kill many a national account. The Trump presidency will likely become a period of economic reflation. Trump may well begin to Make America Great Again (a Herculean task, to be sure). There's little doubt that we'll soon see massive fiscal stimulus via tax cuts, defense spending and renewing infrastructure. Down the line, the U.S. may begin to book economic growth rates of 3% or even 4%. Yet that would also lead to higher interest rates, because the deflation mindset will be gone. Looking ahead, I foresee negative real rates and higher inflation. It's a promising scenario for gold and gold miners. I believe gold prices, and prices for mining shares, will soar in the months ahead. It will be an almost exact replay of the gold rally from December 2015 through last summer. And with the higher lows and higher highs we've been seeing, I expect gold to perform again as it did earlier this year, with a possible $300 move upwards. I foresee gold moving at least back to its summer peak of $1350, and then moving along to hit $1400 per ounce in the first quarter of 2017. I believe that we're at a temporary post-election point of Trump-euphoria. It is pushing up the stock market. Meanwhile, distracted investors are blindly following the big gold sell-off from Druckenmiller. Buyers are shunning gold shares, which sets up an opportunity for an asymmetric trade — low risk to the downside, and strong potential gains to the upside. The U.S. economy — and the U.S. dollar — are far from being out of the woods. In December, we'll see a rate increase by the Fed, along with evidence of inflation across the economy and in gold prices. Buy on the current dip, and await the rebound. Regards, Byron King The post We Could See $1,400 Gold by March 2017 appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trump Goes Public, “I Won Popular Vote” / Talks 9/11 Truth Posted: 28 Nov 2016 07:43 AM PST Alex Jones told the Trump team that recount efforts should be taken seriously. The higher-ups know Trump is for real. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stockman: Careful, Donald. They Rigged A Debt Bomb for March 15th. Posted: 28 Nov 2016 07:37 AM PST This post Stockman: Careful, Donald. They Rigged A Debt Bomb for March 15th. appeared first on Daily Reckoning. Following the surprising shock of a Trump election victory, economist and best selling author David Stockman joined Fox Business to discuss what is to come in the first 100 days of the Trump administration. He expanded his analysis on the Federal Reserve policy, the U.S national debt bomb waiting to happen and why the market is running on a fool’s errand of hope. When asked what happens what happens when the new and incoming administration begins to pay off the national debt he responded, "There is a $20 trillion dollar ticking time bomb called the debt ceiling right in front of us, that will happen in March. The new Trump administration is going to inherit that mess. I call it a stink bomb left from last October when Boehner and Obama made that deal. For the new president it is going to consume the first 100 days trying to get that thing through. Republicans are not going to want to vote for a $20 trillion debt ceiling." David Stockman is a former Reagan administration official having worked as the director of the Office of Management and Budget. He also served in the United States Congress and followed that with working in Wall Street for multiple decades. His latest best seller, Trumped! A Nation on the Brink of Ruin… And How to Bring it Back, is out now – learn how to claim your free copy by clicking here. "The market was giddy on the view that Washington is coming to the rescue with a huge new fiscal stimulus and infrastructure plan. That is dead wrong. The news flash is that Washington is out of business. The imperial city is in smoking ruins. It will not function, confrontation, brinksmanship. That means we will hit the next recession with nothing to break the fall. The Fed is out of dry powder and Washington will be paralyzed." When prompted by the Fox Business reporter on whether the growth projections out there were realistic and his thoughts on GDP growth anticipation in the markets Stockman took direct aim. He responded, "That is the skunk in the woodpile. The growth in the baseline is totally unrealistic. The CBO baseline. It is a rosy scenario. If you did everything that Trump wants to do and it works as the supply siders say, you'll be lucky to get what is already assumed. There is no extra revenue. There is no deficit reduction. The CBO baseline assumes we are going to go for 208 months without recession which has never happened in human history." "We are entering a chaotic period of non-governance. Of a central bank that can't function anymore. There is nothing to rescue this economy. We are going to have a recession. I follow the IRS, not the BLS. The IRS tells me how much money they are collecting. It has been flat, and actually negative for the past several months. That means the economy is long in the tooth and slipping into a recession." In summary about his projection for President Trump in his first months in office he noted, "When the confrontation over the debt ceiling happens, when the disappointment over no traction on the Trump stimulus happens, we will be in recession. I will say in 6 months, the deficit will explode over a trillion dollars annually. They're not going to be in a position to do all of these huge things. I don't blame Donald Trump, he is inheriting a mess. A rigged system that is far worse than anything he imagined." Regards, Craig Wilson, @craig_wilson7 The post Stockman: Careful, Donald. They Rigged A Debt Bomb for March 15th. appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| DOLLAR COLLAPSE 2017 - CHINA AND RUSSIA DROP DOLLAR Posted: 28 Nov 2016 07:31 AM PST Dollar on fireThe U.S. dollar has been the world's strongest currency for decades. Recently, however, this exalted position has shown signs of weakening. A disturbing national debt situation and a sputtering economic recovery are the main reasons why Russia and China have each taken steps to... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://bobchapman.blogspot.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

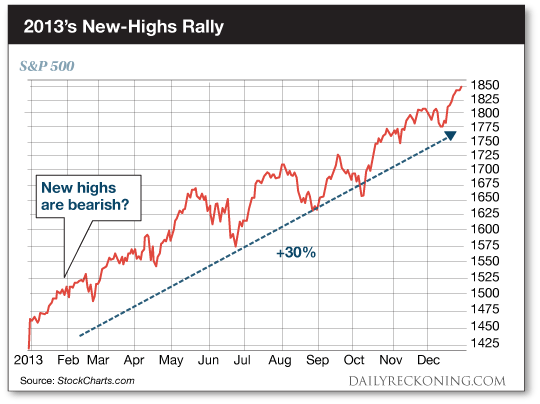

| These 3 Market Lies Are Costing You a Fortune… Posted: 28 Nov 2016 07:19 AM PST This post These 3 Market Lies Are Costing You a Fortune… appeared first on Daily Reckoning. The relentless rally marches on. The market melt-up has boosted everything from the biggest names in the world down to the small, forgotten stocks that are just now waking up from an ugly bear market. The Dow eclipsed 19,000 for the first time ever last week. Meanwhile, the small-cap Russell 2000 has finished higher for 14 trading days. That's its longest winning streak in more than 20 years. But no one's happy about any of this… The pundits and prognosticators were dead wrong. They told us we were in for a nasty crash to finish the year. The financial media all but guaranteed a post-election stock market meltdown followed by a rate-hike temper tantrum. Instead, we've witnessed a historic surge. So I have to ask… How the hell did everyone get it so wrong? Today, you're going to find out. I'm breaking down three biggest lies swirling around the market melt-up—and how they're costing you big bucks. Let's get started: 1. "Trump's win was good for stocks." Dow futures swooned 750 points on election night as a Trump win became apparent. The rogue candidate was going to tear down the establishment! The bull market would never survive a Trump presidency! But as stocks climbed out of the gutter the day after the election, the media quickly changed their tune… The headlines flipped as soon as stocks flashed green. Trump was no longer a threat to the markets. In fact, his election was positively bullish! Go figure… Despite what everyone told us before the election, a Trump win wasn't the final nail in the market's coffin. But his victory wasn't the bullish catalyst portrayed by the media. My best guess is the market would have posted a similar rally following a Clinton victory. Why? Because the outcome wasn't all that important. The market really wanted the election to just go away. As we told you time and again, strength in tech stocks, transports and small-caps were all hinting at a market melt-up weeks before the election came into play. With the uncertainty of a hotly contested presidential race out of the way, the market was free to build on the bullish activity that was setting up under the surfaces of the major averages. Simple as that. 2. "New all-time highs mean investors need to be cautious." I have no idea how this market meme got started, but fear of new all-time highs has dominated financial discourse since 2013. In case you've had internet connectivity issues for the past 36 months, 2013 was the year the S&P 500 posted its first new all-time high since the financial crisis. As soon as stocks finally got their collective act together, we began seeing dire warnings of an impending market crash. Of course, we all know how that turned out…

Last I checked, new highs were good for investors. Stocks leaping into uncharted territory is a hallmark of a bull market. Embrace it. Focus on strong sectors and the rally will reward you with winning trades. 3. "Stocks have moved too far, too fast." "This rally is overcooked" is the anthem of the bull that stayed behind. He received an invitation in the mail. But for whatever reason, he never made it to the party. That's when the whining starts… Of course, the market can't go up in a straight line forever. The branches are going to shake soon enough—and stocks will fall back to earth. That's perfectly normal. Just don't expect the financial media or the sold-out bulls to see it that way. Futures are in the red this morning. That means we could see our first broad market pullback since the election this week. I can all but guarantee we'll see reports that the sky is falling this week if we see some downside follow-through. Naturally, your best bet is to ignore this noise and focus on your trades. The market is prepared to hand out plenty of holiday gifts this season to anyone who can tune out the financial news and pull the trigger on some winning trades… Sincerely, Greg Guenthner The post These 3 Market Lies Are Costing You a Fortune… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Could President Trump Use Reagan’s Playbook? Posted: 28 Nov 2016 05:51 AM PST This post Could President Trump Use Reagan’s Playbook? appeared first on Daily Reckoning. Let's apply the Ronald Reagan administration as a frame of reference to examine and compare president-elect Trump. Doing so we can see what expectations might be for the economy going forward. Currently, the stock market is up and reaching all-time highs. Why is the stock market going up? Trump is a big spender. He said so. Banking stocks are going up because the incoming administration has talked about repealing Dodd-Frank. Construction stocks are going up at companies like Caterpillar and John Deere because they're anticipating the need for a lot of construction equipment to build all these roads. [Ed. Note: Jim Rickards expands on Federal Reserve policy, interest rates and the historic collapse that elites see coming. To equip yourself with the knowledge and preparation for financial turmoil, he is sending any American a free copy of his latest New York Times bestseller, The Road to Ruin. Click here to learn more.] In the 1980s, remember the US had a bull stock market and a bull bear market. Stocks and bonds were both going up. Stocks were going up because of real growth and bonds were going up because interest rates were coming down and inflation was coming down. Trump could have the opposite. Trump could have a collapsing bond market and see stocks run out of steam.

He's going to have interest rates going up. He doesn't have inflation coming down. He's going to have inflation going up. He doesn't have a low debt-to-GDP ratio. He has a high debt-to-GDP ratio.

We now have two outcomes here, recession or inflation. Neither one of them are good. It may have different origins, but the instability of the system and the potential for the collapse has not changed one bit because this is the snowflake avalanche. The snow on the mountainside is still there. Maybe with Trump, it's not snowing as hard, but the unstable mountainside is still there and it still only takes one snowflake. Regards, Jim Rickards

The post Could President Trump Use Reagan’s Playbook? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 28 Nov 2016 01:37 AM PST The political focus shifts to upcoming Italian, French and Austrian elections, all of which could go against the establishment. India’s war on cash may turn into war on gold. US Durable goods orders and service sector jump, home and car sales plunge. Black Friday store sales underwhelming. US dollar at highest level of the year. […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment