Gold World News Flash |

- Perpetual Black Friday

- Washington Post Spends Thanksgiving Lamenting Over Fake News and the Russian Scare

- Dollar Shortage Goes Mainstream: When Will The Fed Confess?

- The Perfect Storm Set To Pop Aussie Apartment Bubble Bringing The Economy Down With It

- October Was The Worst Month For Hedge Funds Yet This Year

- Did Trump Really Say he Won’t Prosecute Hillary Clinton or Foundation? His Answer

- BREAKING: What Soros Just Did for Hillary Will Leave You SICK! He's gotten Worse!

- Is WikiLeaks Founder Julian Assange Dead? The WEIRD Connection with Pamela Anderson !

- Silver Enters Bear Market As Hedgies Flee

- After Trump in America , Populism on the Rise in Europe

- A Lion in Fiji: Berukoff Touts Buried Gold, Out of Country - Peter Diekmeyer

- Chaos in America - Jim Fetzer

- BREAKING: MAG 7.0 EARTHQUAKE HITS OFF CENTRAL AMERICA

- The New World Order Conspiracy

- MI6 Order To Kill Trump - by Tim Rifat

- Obamas Ex-Boyfriend Blows Whistle! Michelle Is A Man & Obama Is Gay!! 2016

- Alasdair Macleod: The economic consequences of Mr. Modi

- The push to parity continues: euro tumbles to 20-month low as dollar surges on solid US data

- John Hathaway: What does Trump's victory mean for gold?

- Trump & Putin Will Destroy America Martial Law WW3 Dollar Collapse & Fema Camps

- Gold and Silver Market Morning: Nov-24-2016 -- Gold and Silver break down through support!

- The Gold Bears Are in For a Massive Surprise

- Breaking News And Best Of The Web

- Top Ten Videos — November 24

| Posted: 25 Nov 2016 01:00 AM PST Submitted by Mike Shedlock via MishTalk.com, Whatever numbers the retail association posts this weekend for Black Friday (typically overoptimistic assessments) are likely to be skewed this year even more. The New York Times expects a Less Frenzied Black Friday as Millennials opt to stay away.

Does Black Friday Make Sense? The notion of Black Friday no longer makes much sense. Now, there are “Black Friday doorbusters happening all week long” More and more stores will be open Thanksgiving. Wal-Mart and Target will open stores a 6:00 PM. Next year it will likely be noon. Amazon has Black Friday deals on a variety of toys, electronics, and home goods starting on Wednesday. JC Penney is promoting $500 coupons. Sorry, it’s one per store. One in 10 will get $100, and everyone else $10. Can JC Penney really afford losing $100 on 10% of its customers. We will find out. Maybe there is another catch. Black Friday Month A few years ago people were waiting in line hours to be the first in the door for blockbuster deals. Perhaps some still do. But why bother? BGR reports “Black Friday is no longer a day, it’s now a month-long event on Amazon that kicks off today and runs straight through Cyber Monday and all the way to December 22.” The “today” in that story was Friday, November 18, a week ahead of the presumed black Friday. On November 21, Aarons put out a press release announcing “7 Days of Black Friday“. Perpetual Black Friday? Why Not? Why not start in September? Why not Perpetual Black Friday? I just did a website search. The name PerpetualBlackFriday.Com was not taken. I snagged it for $15 on GoDaddy. Why not? |

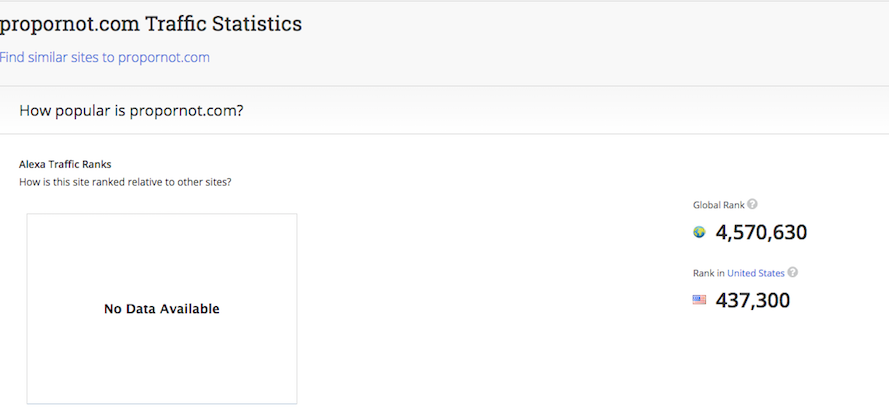

| Washington Post Spends Thanksgiving Lamenting Over Fake News and the Russian Scare Posted: 24 Nov 2016 09:56 PM PST Craig Timberg from Washington Post must be bored this Thanksgiving, spending his time concocting a rich and imaginative tale of fake news websites swaying the billion dollar Clinton campaign from no brainer win to a horrible loss. Here we are, once again, with the faux claims out of Washpo -- spreading their own ironic fake news of Russian hacking conspiracies and a furious -- and all of a sudden -- flood of fake news websites that worked in concert to elect Donald Trump. After all, how could anyone vote for a man who's credo was Americanism over globalism. Don't you like cheap prices at Walmart? To date, hard evidence of Russian interference in our elections has yet to materialize -- which was at the vanguard of the democrat response to embarrassing Wikileaks revelations that painted the party as wantonly corrupt and spirit cooking depraved. Since the election results shocked the establishment elite, there has been an absolute fervor across the media, led by Obama and his shills, to place the blame for Hillary's cosmically hilarious defeat on websites that challenge falsehoods and media cuckery . Washpo chimes in on the issue -- fueled by a McCarthy era styled list of Russian propaganda websites -- provided by shills at some bullshit website called ProporNot.

On ProporNot's list of websites to avoid, due to Russian propaganda risk, includes infowars.com, nakedcapitalism.com, wikileaks.org, zerohedge.com -- amongst many others. Propornot even provides their readers with a wonderful chrome browser extension to rout out these evil sites. Instead of reading propaganda, maybe you should read Snopes instead (serious eyeroll action). If you want to continue the discussion, go head on over to their Reddit page -- where another 26 people are interested in the complete shit they spew. According to recent Alexa rankings, these butthurt libtards are talking to themselves, literally, except for the moron singular shill from Washpo who wrote this absurd story. I can sit here and claim alt-left sites like MotherJones and DailyKos are merely Chinese shills, working in concert with the Democratic Party, in an effort to elect democrats in order to continue to pursue a brand of globalism that favors the hollowing out of America's middle class, transferring vast amounts of wealth from here to there. In spite of the fact that everything I just said, as a matter of policy, is 100% accurate -- the cucks from Daily Kos had little to do with it. The fake news conspiracy theories being promoted by very low and disingenuous news agencies, who've proven to be corrupted and co-opted by the Democratic Party, is embarrassing for the 4th estate. Instead of bucking up and dealing with their short comings, the fact that no one believes their shit anymore, they've gone apeshit hysterical over the success of Breitbart and other conservative leaning sites -- simply branding them as fake and actively working with Appnexus, Facebook and Google to demonetize them. Welcome to the Chinafication of the American media. Content originally generated at iBankCoin.com  |

| Dollar Shortage Goes Mainstream: When Will The Fed Confess? Posted: 24 Nov 2016 06:43 PM PST Last week we posted the report by ADM ISI's Paul Mylchreest "Dollar Liquidity Threat is Getting Critical and the Fed is M.I.A" which summarized some of the key points in the ongoing, second phase of global dollar shortage, profiled here first in the start of 2015 and validated recently by the BIS. We discussed the bitter (and all too predictable) irony that the Federal Reserve doesn't "get it", having recently declared that that liquidity in financial markets was "adequate." It isn't. More than 68,000 hits later, we suspect that many ZH readers are tracking the dollar liquidity crisis (and Fed ignorance) via the negativity in Cross Currency Basis Swaps (CCBS). The 3-month Yen/Dollar CCBS has made a new low of 81.75 bp (swapping Yen into dollars for 3 months costs 81.75bp annualised above covered interest parity) implying that the structural dollar shortage is deteriorating. While we've been writing about dollar shortages since the GFC, Mylchreest traced the timeline of the current shortage back to the first RMB devaluation in February 2014. He noted that it's the one thing that even the central banks struggle to control… think Swiss Franc peg (SNB), impact on carry trade and the Yen (BoJ) and the severe weakness that we're seeing in the RMB (PBoC). Indeed, a "glaring omission" is the failure of the Fed to set-up a dollar swap arrangement with the PBoC. Mainstream economists and media are playing catch-up. For example, Carmen Reinhart referenced the "dollar shortage" last month, as did Bloomberg, citing a new report by former Fed economist Zoltan Pozsar which summarizes everything we have said for years. In his latest "Global Money Notes" report, "From Exorbitant Privilege to Existential Dilemma", Credit Suisse's Zoltan Pozsar argues that "an FOMC determined to normalise interest rates has no choice but to become a Dealer of Last Resort in the FX swap market and provide qunatitative Eurodollar easing ("QEE") for the rest of the world through its dollar swap lines." According to Pozsar, Basel III and the money market reforms are tightening dollar funding markets causing an "existential trilemma" for the Fed in which "it is impossible to have constraints on bank balance sheets (restraining capital mobility in global money markets), a par exchange rate between onshore dollars and Eurodollars, and a domestically oriented monetary policy mandate. Something will have to give. It's either the cross-currency basis, the foreign exchange value of the dollar or the hiking cycle. It's either the Fed's regulatory and monetary objectives, or control over the Fed's balance sheet size. It's either quantities or prices…" In terms of CCBS, Pozsar expects "Cross-currency bases will have to go more negative before the Fed steps in, and -150bp on the three-month dollar-yen basis is not an unlikely target", which would probably lead to a severe bout of Yen weakness from here. The three month dollar-euro basis swap has declined to -43.9bp, closing in on its recent low of -58.8bp during the Deutsche Bank panic nearly two months ago. As an aside, it's telling that fears about European banks still cause a scramble for dollar liquidity in a deja vu all over again. Pozsar, like Mylchreest, highlights how a dollar funding crisis tightens monetary policy for the rest of the world and could shred the RMB as it means "tighter financial conditions for the rest of the world. In turn, tighter financial conditions point to slow, not faster global growth as foreign banks pass on higher costs to their customers or worse: de-lever their books…If the Fed leaves the intermediation of all of the rest of the world's marginal dollar needs to American bank's constrained balance sheets, offshore financial conditions may tighten and the dollar may strengthen to the point where they are no longer consistent with the path envisioned for the funds rate: rounds of RMB devaluation would follow which also won't help interest rate normalization." So, the rest of the world is left to hang around, waiting to see if the Federal Reserve wakes up to what's happening to dollar liquidity, and the threat it poses to the global economy and to its own (glacially slow) tightening cycle. And now that they may be finally catching on, we would like to see some economists or journalists sit Janet Yellen down and interrogate her about dollar funding markets. Although we doubt that they could extract a confession, it might be entertaining to watch. |

| The Perfect Storm Set To Pop Aussie Apartment Bubble Bringing The Economy Down With It Posted: 24 Nov 2016 06:10 PM PST Submitted by Guy Manno via Crush the Market The Aussie apartment boom that has turned into an epic bubble with record, sky-high prices, is showing all the signs for the perfect storm which will ultimately pop. With the popping of the apartment boom, it will simultaneously bring down the Australian economy, as the apartment market is set to have a sizeable correction in 2017 and 2018. A short Look At Australia's Real Estate Market Australian real estate prices have been going up for over 25 years with hardly a pause in between since the late 80's. The last time real estate prices fell considerably was when Australia last had an official economic recession back in 1987, when interest rates skyrocketed to around 17-18%. The chart below show the price growth of real estate, rents and CPI since mid 1987. Initially the price growth of Australia's real estate market climbed steadily taking 11 years to double in 1988. From there the price growth continued to accelerate with the next 100% increase in price taking 4.5 years to reach. An interesting observation on the chart below is that real estate prices have risen by over 700% since 1987, yet rents have risen just under 300% over the same period. This chart clearly shows that the majority of the price growth was not supported by a fundamental increase in rents to support the higher prices, but rather a massive surge in mortgage debt over the same period drove prices higher.

Rising Credit Leads To Booms & Contractions In Credit Lead to Busts Professor Steve Keen in the interview shown below highlights his own reasons why he sees a recession coming in 2017 for Australia. Steve highlights a number of reasons for his prediction, including deteriorating terms of trade, the ending of the mining investment boom, the Government's pursuit to cut spending and a reduction in foreign buyers for real estate, among others. However, the most important reason is a deceleration of credit / mortgage debt. Based on Steve's research and economic models the deceleration of mortgage debt growth is the leading cause for all economic downturns globally including the US, Japan and Europe economic recessions, with a correlation close to -1. What all his research shows is that the deceleration of mortgage debt growth leads to a collapse in real estate prices which then lead to an economic recession in those countries. Due to this research, Steve believes Australia will react the same way as other countries based on slowing growth in mortgage debt. Especially, as the conditions have already begun to slow based on the bank's tightening their standards overall. However, most of the lending restrictions imposed from the banks are for off the plan apartments and existing apartments within most major cities around Australia.

Given Australia was recently ranked number 4 in the world in the UBS global real estate bubble index, see: Australia's debt addiction fuels record real estate bubble, its easy to see that prices could fall over 20% as lending conditions continue to tighten and their effects take hold. Why Are Banks Tightening Lending Conditions With Record Real Estate Prices? The simple reason is that the banks do not want to be caught in a credit crunch like they faced back in 2008 and 2009 where they had to have the RBA and the US FED provide considerable financial assistance to keep them afloat. Right now the banks can see what everyone else can see if you look at all the data publicly available. Australia will face a major oversupply of apartment dwellings over the next 1 - 3 years from a major ramp up of approvals of apartments. The growth of approvals over the last 7 years which you can see in the chart below, is leading to a big jump in the construction of apartments with a number of them being competed in the next 18 months.

Due to the rapid increase in approvals, there has been a massive spike of cranes currently being deployed in Australia, to handle the apartment boom that is currently taking place. As you can see below in the chart Sydney and Melbourne are leading the way in Australia, dwarfing most major cities in the US including New York and LA.

With all the current construction for apartments taking place from the buildup of approvals, especially in the last 3 years, Australia is facing a glut of new apartments that are about to be completed in 2017 and 2018. Knowing the upcoming glut of apartment completions is about to come available on the market soon, the banks have taken action to protect their capital by providing most of their tightening around new and existing apartments within the CBD's of Sydney, Melbourne and Brisbane where most of the construction has taken place.

Highest Housing Completions = Biggest Housing Price Fall The chart below shows a comparison of house prices in Australia, UK, Spain, US and Ireland with an accompanying housing completions chart. The most obvious data from the chart is both Ireland and Spain had the biggest fall in prices during the GFC in 2008 relative to the other countries shown. Those 2 countries also had the largest ramp up of new housing completed from 2000 - 2007.

Surging Bond Yields Leads To Higher Mortgage Rates In Australia. Back in October US Government 10 yr bond yields were sitting at around 1.55%. Fast forward one month and rates are now sitting at around 2.3%. A 0.8% increase from the October levels (see chart below). The reason why this is a big deal, is that the US Government bond yields are what are utilized to benchmark most of the different types of retail and commercial loans. In Australia the banks also rely heavily on overseas markets and especially the US markets to provide the necessary funding to support their loan book. So as bond yields have skyrocketed in such a short period in the US, it has already led to the banks in Australia lifting rates by between 0.20% - 0.60% on their fixed loans as their funding costs have jumped dramatically. With mortgage rates rising and lending conditions being tightened its becoming more difficult for developers to sell their off the plan apartments as investors find it more difficult to access bank lending to finance their purchases, resulting in a slump in demand for off the plan apartments. Melbourne Developer Offers $21,000 To Encourage Buyers In an attempt to lure buyers to a new off the plan development in Melbourne, a large well known developer is now offering $21,000 to investors in an attempt to sell their $420,000 1 br apartments in Southbank Melbourne. The idea is to match the investor or first time buyer's 5% deposit of $21,000 to assist them in meeting a 10% deposit. The problem that this Melbourne developer and other developers will find, is even with this huge financial incentive, many of the banks in Australia have lifted their minimum deposit requirements for off the plan apartments in major cities to between 15% - 25%.

Apartment Bubble Bursting Leading To Australian Recession Similar to Professor Steve Keen's prediction that a recession is coming to Australia in 2017 or early 2018, I also believe that the perfect storm of conditions are developing that will soon pop the apartment bubble that has been taking place in Australia. When the correction in apartment prices takes hold, it will have a domino effect on the Australian economy, leading to a contraction in economic activity in Australia. The reason for this is because the real estate industry and related industries now has the largest contribution to GDP at around 28%. (See chart below) With record amount of apartment construction taking place over the last few years, fueling a considerable amount of GDP growth, I believe the slowing of the construction industry will start to subtract heavily on GDP growth in 2017 and 2018 leading to Australia's first recession in over 25 years. |

| October Was The Worst Month For Hedge Funds Yet This Year Posted: 24 Nov 2016 05:33 PM PST Another month, and the pain for the hedge fund industry just keeps getting more intense. According to the latest Evestment report, investors redeemed an estimated net $14.2 billion from hedge funds in October. Year-to-date, there has been a net $77.0 billion removed from the industry. October's outflow was the fourth month of redemptions in the last five and seventh in 2016. Due to the breadth of products experiencing outflows, and the persistence of redemptions outweighing new allocations, it is clear the industry is experiencing a crisis -like wave of negative investor sentiment. One almost wonders how much higher the market can keep rising with redemption requests flooding countless back offices. We hope to find out soon. Here are the rest of the details on the latest, ongoing, troubles facing the hedge fund industry which, unless something drastically changes soon may end up being a "zero hedge" industry:

There is a silver lining. Here is evestment's conclusion:

|

| Did Trump Really Say he Won’t Prosecute Hillary Clinton or Foundation? His Answer Posted: 24 Nov 2016 05:30 PM PST Did Trump really say he won't prosecute Hillary Clinton or the Foundation? The Answer was "NO" ... he did NOT say that! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| BREAKING: What Soros Just Did for Hillary Will Leave You SICK! He's gotten Worse! Posted: 24 Nov 2016 05:00 PM PST BREAKING: What George Soros, globalist, Just Did for Hillary Clinton, Will Leave You SICK! Just When You Thought He Couldn't Get Worse! Soros and overturn of election result. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Is WikiLeaks Founder Julian Assange Dead? The WEIRD Connection with Pamela Anderson ! Posted: 24 Nov 2016 04:30 PM PST Is WikiLeaks founder Julian Assange Dead? – The Weird Connection with Pamela Anderson ! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Silver Enters Bear Market As Hedgies Flee Posted: 24 Nov 2016 04:25 PM PST After tagging $19 the night of Trump's victory, Silver prices have tumbled 15% (the biggest drop since Summer 2013's taper tantrum). However, as large speculators dumped their longs en masse, this week also marked another milestone as Silver drops 24% from its post-Brexit peak (above $21) and entered a bear market once again. As the dollar surges, Bloomberg reports that gold and silver holdings in exchange-traded funds are set for the biggest monthly drop in more than three years.

And, just as we have seen in gold futures, hedge fund speculative longs in silver are also decling rapidly...

And this selling pressure has slammed Silver to six-month lows (down 24% from Brexit highs in June)...

But, as Dana Lyons' Tumblr explains, Silver prices are testing a confluence of potential support levels. We often get questions about our technical analysis on specific assets or securities, especially as it pertains to potential support or resistance levels on the chart. We don’t post many of those types of charts anymore but we present one today in the chart of the popular iShares Silver Trust, ticker, SLV. The impetus was partially because of the amount of attention on PM’s, but primarily due to a potential inflection point on the chart. Everyone asks “when is XYZ going to bottom”? There is no way to ever know for sure. The best thing you can do is identify the most likely points of support in order to put the best odds of success on your side. And the best setups are always when multiple key potential support levels line up in the same vicinity. Such a setup may be present now in the chart of SLV, in our view. So what are the potential support levels?:

As the chart shows, SLV is testing this level today. In fact, the low of the day was exactly 15.60.

So will this 15.60 level hold? Obviously nobody knows for sure. At least there are multiple key levels of potential support there, however. That puts decent odds of success with the silver bulls – as well as giving them a level with which to play off of. If SLV remains above there, it can bounce. If it closes below there without an immediate reversal, perhaps there is more downside to come for silver prices. How far will SLV bounce if it holds? Obviously, we can’t know that either. There appears to be considerable potential resistance near 16.80 and just above 18.00, if the SLV does bounce. So, that would be about 7-15% of upside – without even breaking the post-summer intermediate-term downtrend. It would take a lot more strength to convince us that the post-2015 uptrend is resuming. So, even holding this level doesn’t mean it’s up, up and away again for silver. For now, precious metals fans will have to be satisfied with, “Hi Ho Silver, A-Bounce!” * * * More from Dana Lyons, JLFMI and My401kPro. |

| After Trump in America , Populism on the Rise in Europe Posted: 24 Nov 2016 03:30 PM PST With the political establishment left shaken by Brexit and the surprise election of Donald Trump in America, RTS investigates the rise of right-wing populism in the West, asking why it has taken root and where it might triumph next. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| A Lion in Fiji: Berukoff Touts Buried Gold, Out of Country - Peter Diekmeyer Posted: 24 Nov 2016 03:30 PM PST Sprott Money |

| Posted: 24 Nov 2016 03:00 PM PST Jeff Rense & Jim Fetzer - Chaos in America Clip from November 22, 2016 - guest Jim Fetzer on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| BREAKING: MAG 7.0 EARTHQUAKE HITS OFF CENTRAL AMERICA Posted: 24 Nov 2016 02:30 PM PST Earthquake alert, Mag. 7.0 earthquake off coast of Central America... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The New World Order Conspiracy Posted: 24 Nov 2016 02:00 PM PST What is the New World Order? Who is involved in it? And what are their aims? Learn everything you need to know about the New World Order. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| MI6 Order To Kill Trump - by Tim Rifat Posted: 24 Nov 2016 12:30 PM PST MI6 has given the order to Kill Donald J Trump Tim Rifat on rense.com radio show 22nd November 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Obamas Ex-Boyfriend Blows Whistle! Michelle Is A Man & Obama Is Gay!! 2016 Posted: 24 Nov 2016 11:53 AM PST How much more proof do you need America? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Alasdair Macleod: The economic consequences of Mr. Modi Posted: 24 Nov 2016 10:50 AM PST 1:53p ET Thursday, November 24, 2016 Dear Friend of GATA and Gold: GoldMoney research director Alasdair Macleod writes today that India's repudiation of most of its outstanding paper currency will deepen distrust of that currency as well as of government generally and increase confidence in gold. Macleod's commentary is headlined "The Economic Consequences of Mr. Modi" and it's posted at GoldMoney here: https://wealth.goldmoney.com/research/goldmoney-insights/the-economic-co... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| The push to parity continues: euro tumbles to 20-month low as dollar surges on solid US data Posted: 24 Nov 2016 09:15 AM PST This posting includes an audio/video/photo media file: Download Now |

| John Hathaway: What does Trump's victory mean for gold? Posted: 24 Nov 2016 09:08 AM PST 12:10p ET Thursday, November 24, 2016 Dear Friend of GATA and Gold: In his latest market letter, Tocqueville Gold Fund manager John Hathaway notes that the smashing of gold after the U.S. presidential election involved the dumping of futures contracts nominally equivalent to two years of production. "We have observed on repeated occasions," Hathaway writes, "that purely speculative paper transactions distort the price of real-world physical goods. In our view, price-disruptive distortions of this sort (including commodities other than gold) are enabled and encouraged by the willingness of the Chicago Mercantile Exchange to promote high-frequency trading to build profitability." That seems to be as close as any respectable participant in the financial markets can get to the issue of manipulation of the gold market. Hathaway notes that the systemic risks to the world's economy have not vanished with the election and argues that "exposure" to gold "may make more sense than ever." His letter is headlined "Trump's Victory: What Does it Mean for Gold?" and it's posted at the Tocqueville internet site here: http://tocqueville.com/insights/trumps-victory-what-does-it-mean-gold CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT K92 Mining Begins Gold Production at Kainantu Mine Company Announcement K92 Mining Inc. is pleased to announce that gold production has commenced from the Irumafimpa gold deposit. Ian Stalker, K92 Chief Executive Officer, says: "This milestone is highly significant for our company, and for this region of Papua New Guinea. A great deal of thanks goes to the entire team on site in PNG in achieving production ahead of schedule and on budget. The rehabilitation of the Irumafimpa gold mine, process plant, and associated infrastructure commenced in late March and is now complete. As an enhancement of the processing facility, we are also pleased to note that the installation of a new drum scrubber is also nearing completion and commissioning of this will be completed by the end of the month. ..." ...For the remainder of the announcement: http://www.k92mining.com/2016/10/6077/ Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Trump & Putin Will Destroy America Martial Law WW3 Dollar Collapse & Fema Camps Posted: 24 Nov 2016 09:00 AM PST As Obama's administration continues to creep closer and closer to tyranny, one could only imagine how far he'd go before Americans started to revolt. Lucky for Obama, he's already begun plans to contain the situation, allowing him to progress with his agenda with as little resistance as... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold and Silver Market Morning: Nov-24-2016 -- Gold and Silver break down through support! Posted: 24 Nov 2016 07:23 AM PST Gold prices in Shanghai are $18 higher than New York's close and $22 higher than London's opening [allowing for the difference in the quality of gold priced in the different markets]. This demonstrates just how strong demand in China really is. What has to be seen in a physical gold market is the direct impact on the gold price physical demand and supply has. In a COMEX type market prices are much more volatile and easily moved by algorithm trading, just because no physical metal is involved. Inevitably physical gold will move to the market paying the most. |

| The Gold Bears Are in For a Massive Surprise Posted: 24 Nov 2016 03:59 AM PST If you’re serious about making money from investing in the financial markets, you need to be able to read the crowd… and go against it. Let me give you an example… Currently one of the consensus views is that the Gold rally is over and gold is dead as an investment. Right off the bat, you know this sentiment is at an extreme. Despite its recent sell-off, Gold is still crushing stocks in terms of performance year to date. |

| Breaking News And Best Of The Web Posted: 24 Nov 2016 01:37 AM PST Durable goods orders jump, home sales plunge. US dollar at highest level of the year. US stocks at record highs. Interest rates rising, bond prices falling. Mortgage rates up. Gold and silver correcting, setting the stage for the next bull market. Political class still searching for an explanation (see “Best of the Web”). Trump’s cabinet […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Posted: 23 Nov 2016 04:01 PM PST Money, inflation, geopolitics and gold under President Trump. The latest from Peter Schiff, David Morgan,Nomi Prins and Ron Paul. The post Top Ten Videos — November 24 appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment