Gold World News Flash |

- The push to parity continues: Euro tumbles to 20-month low as dollar surges on solid US data

- "A Million Dollars Ain't Worth What It Used To Be..."

- China Press Lashes Out - It's The Dollar, Not The Yuan That Threatens Global Stability

- Order Out Of Chaos: The Defeat Of The Left Comes With A Cost

- Stocks, the Politically-Driven S.O.D. to Lose Again

- A little perspective on the post-election Gold market

- Another US Election Year, Another Bunch Of Fake Economic Growth Numbers

- Startling Look At How Much Money Food Stamp Recipients Spend On Junk Food

- Truth in Numbers- Bad math as a propaganda and sales tool

- The Shocking Prophecy for America by Elder St. Paisius the Athonite.

- Half Of The Population Of The World Is Dirt Poor - And The Global Elite Want To Keep It That Way

- George Soros Exposed

- Russia Is Reviving Soviet Era ICBM-Carrying "Nuclear Trains"

- Trump gives Hillary a free pass !?

- Draining the Swamp 2.0: Trump Versus Reagan

- Gold Seeker Closing Report: Gold and Silver Fall Almost 2%

- The Gold Bears Are in For a Massive Surprise

- Gerald Celente -- Markets Hit New Highs; A Famous Day Forgotten

- Miningscout Interview with Bill Holter

- Market report: Gold skids to nine-month low as dollar extends gains

- There Is No Plan To Pursue Hillary Clinton - What Really Happened (FULL SHOW)

- Warnings: Iranian General Predicts Israel Will Be Gone in 10 Years

- Mike Kosares: A little perspective on the gold market

- A little perspective on the gold market

- THE MADNESS OF A LOST SOCIETY 2: FINAL WARNINGS

- How Much Gold Is There in India?

- Louis Cammarosano: Interconnectedness of Silver Eagles and India’s War on Cash - Rory Hall

- Politically-Driven S.O.D. (sons of Druckenmiller) to Lose Again

- Rothschild, The Hidden Hand -- David Icke

- EXCLUSIVE: My Conversation With Jim Rickards

- Another Election Year, Another Bunch Of Fake Growth Numbers

- Gold and Monetary Populism: The Oligarchs’ Mortal Enemies – The Peoples’ Salvation

- Russia Gold Buying In October Is Biggest Monthly Allocation Since 1998

- What to Watch For: Cashless Society, World Money and More

- Gold and Monetary Populism: The Oligarchs’ Mortal Enemies – The Peoples’ Salvation

- Hugo Salinas Price: How much gold is there in India? Enough to support a gold standard

- Paper gold is the elephant in the room

- A short-term bear

- Time For The Gold Bulls To Step Up – If There Are Any Left

- Rickards: Elements For Financial Lockdown Are In Place

- Chinese Renminbi Amid US Dollar’s Global Risk

- Rising US Dollar, Rising Global Risks

- Austin Reed to return to UK high street months after collapse

- Gold Price Closed at $1211 UP $1.40 or 0.12%

- Breaking News And Best Of The Web

| The push to parity continues: Euro tumbles to 20-month low as dollar surges on solid US data Posted: 24 Nov 2016 01:33 AM PST This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| "A Million Dollars Ain't Worth What It Used To Be..." Posted: 24 Nov 2016 12:00 AM PST Being a millionaire is overrated, according to Visual Capitalist's Jeff Desjardins. The term itself has quite a few connotations, including many that have been ingrained in us since we were children. Becoming a “millionaire” meant being set for life, and not having to worry about things like personal finances again. After all, millionaires are supposed to be destined for early retirement, right? That was then, and this is now. Time magazine recently estimated that for a millennial with 40 years until retirement, $1 million in savings is not likely sufficient. Taking into account 3% inflation over that time period, it would be worth just $306,000 in today’s dollars. That’s a pretty questionable nest egg for a “millionaire”. HOW MUCH IS A MILLION DOLLARS?The infographic from Carson Wealth shows that things have changed over time, and that a million dollars of wealth ain’t what it used to be. Fun facts: the preferred car for millionaires is actually a Ford, and the majority of millionaires envision working all the way until their retirement. Courtesy of: Visual Capitalist In today’s world, reaching the magical “millionaire” mark of a $1 million net worth is less meaningful than it used to be. In fact, roughly 9% of households in the United States have “millionaires” living in them – this is a record amount, caused partially through the devaluation of currency over time. That said, there are many cities (San Francisco, Vancouver, New York, London, Melbourne, Tokyo, etc.) where even a million dollars isn’t even enough to purchase a home. The “millionaire” case is a stark example of the erosion of a dollar’s purchasing power over time. To get a full sense, take a look at some historical numbers:

For more perspective on the topic, see how much money exists with this video from The Money Project: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Press Lashes Out - It's The Dollar, Not The Yuan That Threatens Global Stability Posted: 23 Nov 2016 11:00 PM PST Originally posted at ChinaDaily.com, Recently, the Chinese currency fell to its lowest level since late 2008. The renminbi has been trading around 6.92 to the US dollar. The plunge is typically explained with the anticipated US Federal Reserve rate increase in December and president-elect Donald Trump's threat to label China a currency manipulator and slap tariffs on Chinese exports. In reality, there is much more to the story.

In the long term, China's growth will translate to currency power in foreign-exchange markets. In October, the renminbi officially joined the International Monetary Fund's currency reserve basket, known as Special Drawing Rights. In the coming decade, the renminbi will expand rapidly through the IMF reserve basket, the allocations of central banks, and those of public, private, sovereign and individual investors. After summer, the renminbi's fundamentals improved thanks to positive spillover effects from overcapacity reduction, fiscal stimulus and a boost to export competitiveness, due to weaker exchange rate. In the fourth quarter, the Chinese currency will also feel the adverse impact of a mild correction of property prices. The renminbi's short-term volatility is also compounded by the tumultuous global environment and the US dollar. Along with other emerging market currencies, the renminbi must cope with the US dollar, which recently hit a 14-year high, driven by rising US bond yields, expectations of a Trump fiscal stimulus and the impending Fed rate hike. In the process, other Asian currencies?the Japanese yen, Indian rupees, Korean won, Indonesian rupiah and the Malaysian ringgit?suffered a sell-off. In the long term, the spillovers from the US and Chinese financial markets are likely to have a different impact on financial markets in the Asia-Pacific region. Studies conducted by central banks suggest that in normal times China's influence in the equity has risen close to the US' level, although the relative impact of the US has been stronger during crisis periods. The influence of China is based on a regional pull, while that of the US reflects a global push. The current crisis favors the dollar, but over time stability will support the renminbi. Unfortunately, the renminbi, along with other emerging market currencies, must also cope with the dollar's growing risk in the world economy. Before the 2008-09 global financial crisis struck, there was a close correlation between leverage and the volatility index (VIX). When the VIX was low, the appetite for borrowing went up, and vice-versa. That correlation no longer prevails, due to years of ultra-low rates and rounds of quantitative easing by advanced economies' central banks. Recently, the Bank for International Settlements reported that the US dollar has replaced the volatility index as the new fear index. As the VIX's predictive power has diminished, the dollar has become the indicator of risk appetite and leverage. This dynamic has distressing implications, because it has pushed international borrowers and investors toward the dollar. And yet, as the dollar's appreciation is exposing borrowers and lenders to valuation changes, the US' fundamentals are eroding, as president-elect Trump himself has acknowledged. The US' sovereign debt has soared to $19.9 trillion. And in the past year, foreign central banks sold almost $375 billion in US Treasuries. In these conditions, the Fed rate hikes could boost the US dollar as a kind of global Fed funds rate, which would result in dollar tightening and deflationary constraints?which, in turn, could impair emerging economies that today fuel global growth prospects.

It is not the renminbi but the US dollar that today poses the greatest risk to the global economy and serves as its fear gauge.

* * * Authored by Dan Steinbock, the founder of Difference Group and has served as research director at the India, China and America Institute (USA) and visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Center (Singapore). | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Order Out Of Chaos: The Defeat Of The Left Comes With A Cost Posted: 23 Nov 2016 07:30 PM PST Submitted by Brandon Smith via Alt-Market.com, As I noted in my last article World Suffers From Trump Shellshock - Here’s What Happens Next, there are two primary consequences of a Trump presidency that actually serve globalists and elites in the long run. The first is the consequence of a perfect scapegoat for the economic crisis which the elites have been gestating since 2008. Trump enters the White House with a clear political mandate, a mandate that supposedly gives conservatives more power than at any other time in U.S. history. This mandate might seem like a miracle, a free hand of power to sovereignty and liberty champions to defeat the collectivist tyranny of cultural Marxists on the Left once and for all. However, it could also backfire, because under this mandate EVERYTHING bad that happens under Trump’s watch can be blamed on Trump and his followers. Conservatives have been given almost absolute influence over government (or apparent influence); by extension, they also inherit absolute responsibility, whether they like it or not. I examined this first consequence in detail in numerous articles leading up to the 2016 election. In fact, it is the primary reason why I was so certain Trump would be president. He is the perfect scapegoat, or the perfect conduit. Under Trump, the last stage of economic collapse can finally be initiated by the financial elites and most of the world including half the population of the U.S. will immediately and without question blame conservatism, nationalism, sovereignty advocates and Trump for the disaster. They won’t think twice about looking in the direction of global bankers. For those that immediately scoff at such a notion, I highly recommend they research the concept of 4th Generation Warfare. I also highly recommend study into a Department of Defense paper called 'From Psyop To Mindwar: The Psychology Of Victory', written by Major Michael Aquino (a self proclaimed “satanist”) and Colonel Paul Vallely (today a self proclaimed liberty champion). I would also compel people to read 'The Art Of War' by Sun Tzu, the same manuscript that all recruits of the CIA are required to read. The essence of the most advanced form of warfare is the ability to defeat an opponent, or a population, without having to fight at all. Instead, the master tactician seeks to influence his opponent to surrender without fighting, or, to influence his opponent to destroy himself. This is accomplished primarily through propaganda, subversion, asymmetric warfare (terrorism and insurgency) and most importantly, co-option. As I noted in my last article, if you want to be able to accurately predict future events, you must understand the minds of the people with the most influence over those events. The financial elites, highly motivated and highly organized, are the single most important gatekeepers to geopolitical change today. Know their mind, and you will know the general path tomorrow will take. This is not to say that the elites are “omnipotent.” Frankly, they don’t need to be. With the utter lack of vigilance and awareness within our society, the elites only need to be relatively intelligent and exceedingly morally bankrupt to manipulate the masses. When skeptics argue with me that the elites would “have to be omnipotent to influence the social narrative in the manner I describe,” I have to laugh. Any person of above-average intelligence and unlimited capital (as the financial elites have) can do considerable damage to a society, bring empires to their knees and condition the populace to think and react in a specific fashion. If I had the same resources at my disposal as the elites have (and the same lack of conscience), I could probably do a far better job than they when manipulating geopolitical outcomes. They make numerous mistakes if you pay close attention to their actions. I hardly consider myself the smartest person around, let alone “omnipotent.” This is a silly notion. The reality is, the more ignorant the population, the easier it is to control and misdirect them. To the ignorant, the elites might seem “omnipotent.” They aren’t; they merely have more-intelligent-than-average people at their disposal and printing presses to pay for everything they want. The smarter and more vigilant any given population, the more difficult it is to influence them through deception. This is very simple. To put it even more bluntly, the elites get away with subversive tyranny because there are too many willfully stupid people. Following this line of thinking, there is a second consequence of Election 2016 that greatly concerns me — the potential for co-option of the Liberty Movement, the only existing opposing force to globalism. Co-option requires the centralization of a group in thought and deed under the influence of a small number of hands, or a single white knight figure. As I noted in my article Will A Trump Presidency Really Change Anything For The Better?, published in March of this year:

The unmitigated horror inherent in the prospect of a Hillary Clinton presidency is like adding jet fuel to the Trump campaign. (And yes, I am assuming according to the results of the primaries so far that the final election will be between Trump and Clinton). And, as I explained in my article Clinton Versus Trump And The Co-Option Of The Liberty Movement published in September:

The co-option of the liberty movement is not necessarily direct. It can be achieved through what I call “absorption.” Take note that the mainstream media and elitists avoid using the label “liberty movement” at all costs because this is something we labeled ourselves many years ago. Instead, they seek to control what we are called; labeling us “populists” of the “Alt-Right.” The liberty movement has been fighting the globalists in the information war for a long time. The average conservative Republican is new to this party, and yet the liberty movement is being called the “Alt-Right?” Even Bloomberg pointed out with relative glee that the Tea Party (liberty movement), a movement which leftists despise with every fiber of their being, could be devoured by Trump’s campaign and reconstituted into something else. Read their editorial The Tea Party Meets Its Maker, but only if you have a strong stomach. In the battle against the Marxist left, it is important that we do not lose track of our original identity, or the elites at the top of the pyramid. Also important is that we do not forsake our original principles in order to achieve “victory” over our adversaries. This is a very difficult problem to discuss when you consider who we are fighting against. I have always said that it was the social justice cult and their zealotry that drove the rise of Trump. It was they that created the public firestorm with their open contempt for our right to free thought and free expression. But keep in mind, this has all happened before, and with terrible results. In Europe during the 1920s and early 1930s, the overall rise of Fascism was in direct response to economic crisis and the insurgency of communism. Communism is essentially collectivism on the far left side of the political spectrum. Fascism is a collectivist trap the "Right" sometimes falls into. Both lead to centralization and tyranny. Communism is tyranny in the name of undermining the strong and independent in order to make room for the weak. Fascism is tyranny in the name of routing out the weak to make room for the strong. It is these two political extremes that the elites have used over the past century to dominate geopolitical outcomes. Again, for those who are skeptical I highly recommend the extensive research and evidence presented by Antony Sutton, who outlined succinctly the FACT that both the Bolshevik Revolution and the rise of the Third Reich were funded and managed by Wall Street moguls and international banking interests. The elites are notorious for playing the extreme left against the right in order to drive conservatives to the opposite extreme. My concern is not only that through Trump the elites can easily scapegoat conservative movements for a global economic crisis, but also that through the intense vitriol of the social justice left, infuriated by their loss to Trump in the election, conservatives may be driven to abandon their constitutional ideals and become the monster they hoped to destroy. Carroll Quigley, CFR elitist and mentor to Bill Clinton, was highly open about the plans of globalists to establish one world governance in his book “Tragedy And Hope.” The following quote from Carroll Quigley’s Dissent: Do We Need It? could be taken as anti-right propaganda, but I take it as a warning that the elites see potential exploitation of the political right in America:

Again, the liberty movement cannot be defeated by the globalists directly. If the fight comes down to an open confrontation between freedom versus globalism, the globalists will inevitably lose. Instead, it appears to me that the globalists are more than happy to either allow Trump into the White House, or to install him in the White House as a means to rewrite the liberty movement into a villainous character, rather than the rebellious hero of our story. So far it would seem that the temptations to revert to fascism are many. Set aside the threat of ISIS terrorism and think about the insanity showcased by the Left. When I mentioned in my last article the crippling of social justice, I did not mention that this could have some negative reverberations. With Trump and conservatives taking near-total power after the Left had assumed they would never lose again, their reaction has been to transform. They are stepping away from the normal activities and mindset of cultural Marxism and evolving into full blown communists. Instead of admitting that their ideology is a failure in every respect, they are doubling down. When this evolution is complete, the Left WILL resort to direct violent action on a larger scale, and they will do so with a clear conscience because, in their minds, they are fighting fascism. Ironically, it will be this behavior by leftists that may actually push conservatives towards a fascist model. Conservatives might decide to fight crazy with more crazy. The mainstream media and popular media largely controlled by leftist elements are only pouring gasoline on the fire, with major pundits and media personalities steadily hinting at “revolution” in the face of a “Trumpist” America. But here is the thing, these people are kidding themselves. The alternative media is eclipsing corporate media today. Their time is coming to an end. Leftists including groups like Black Lives Matter are also ill equipped to violently combat a conservative movement with a lifetime of experience in arms and the will to use them. If the Left leaps into the realm of violent Marxist revolution, they will lose in America. That said, there is a cost. The cost could very well be the heritage of freedom that conservatives desire to protect. The alternative media may overrun the corporate media, but will we become the corporate media in the process? If under Trump conservatives fall to temptation and exploit the “ring of power” that is government to exert dominance in the name of stopping the Left, then they will ultimately be destroyed as well. In this case history will not remember conservatives as freedom fighters rebelling against globalist machinations, but as evil “populists” that caused global economic collapse and the re-establishment of the institution of fascism. The globalists can swoop in after the dust has settled and use the American collapse fable as a story to tell children for the next century. A reminder that nationalism and sovereignty are harbingers of war and death. Conservatism will be abhorred as “deplorable,” an ugly ideal akin to Nazism. At this point, the globalists will have won, for no other philosophy contrary to globalism will ever exist again. No one would want to associate themselves with historical “villains” and bogeymen. As I have mentioned consistently, I have no idea whether or not Donald Trump is aware of this potential trap. I also have no idea if he was sincere in his campaign or simply telling people what they wanted to hear. At this time, his consideration of neo-con political elites and Goldman Sachs bankers for cabinet positions does not leave a positive impression. And, his seeming refusal to commit to prosecution of Hillary Clinton (which I also predicted) for her obvious crimes is a warning bell of liberty advocates. My position is that the Liberty Movement must always remain the Liberty Movement if conservatives and sovereignty proponents want a chance to survive. We have to be willing remain just as watchful and critical of Trump as we would have been with Hillary Clinton. And, if he breaks his promises or goes against his oath to the constitution, we must be willing to go to war with him, just as we would have with Clinton. This puts us in a tenuous position — fighting the Left is bad enough. Going against Trump if he steps out of line is worse, because then we can be labeled leftists as well. This is the essence of 4th Generation warfare — cornering an opponent so that each move he makes is a sacrifice. If the opponent is not careful, he might just destroy himself. There is a way to undermine this strategy by the elites; as conservatives we must treat Trump like a new employee. We have to put him on probation and watch him, not give him the keys to the store on the first day. We must also continue to educate fellow conservatives (and any on the Left that have the sense to listen) that this fight is FAR from over. In fact, it has just begun. In the end, our strategy must be for the Liberty Movement to absorb the "Alt-Right", instead of being absorbed. And, we must focus our efforts and actions against top globalists and their organizations rather than only focusing on the regressive left. People must understand that the real threat in all of this has been and always will be the globalists. Instead of fighting each other in a futile theater of the absurd, we must fight and remove them from the chess board, wherever and whenever they show their faces in the daylight. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stocks, the Politically-Driven S.O.D. to Lose Again Posted: 23 Nov 2016 07:11 PM PST You know who they are; they are the ones who denied and denied the ginned up bull market in US stocks that nearly tripled under the socialist regime, circa 2009-2016. They are the ones who clung to gold well past the caution point last summer. They are (yes, it’s another snappy buzz phrase to either entertain, bore or annoy you… ) the S.O.D., AKA the Sons of Druckenmiller, AKA politically biased and newly activated market participants. Reference… | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| A little perspective on the post-election Gold market Posted: 23 Nov 2016 07:04 PM PST Most of gold’s downside is geared not to the financial decisions of millions of investors around the globe, as the mainstream media would have you believe, but rather to linear computer algorithms geared to the dollar index. The trading part of the software has been told to automatically place trades at certain correlated price levels and that is why we get these waterfall drops. The rocket launch trajectories to the upside come when the trading function is told to buy and cover the previous shorts. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Another US Election Year, Another Bunch Of Fake Economic Growth Numbers Posted: 23 Nov 2016 07:00 PM PST Some pretty good economic reports have energized various parts of the financial markets lately. Consumer spending is up, GDP is exceeding expectations and even factory orders, that perennial downer, popped this morning. In response the dollar is soaring and interest rates are at breaking out of their multi-decade down-channel. The economy is clearly recovering, implying a return to normality. Right? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Startling Look At How Much Money Food Stamp Recipients Spend On Junk Food Posted: 23 Nov 2016 06:40 PM PST A new study just released by the USDA, offers a very detailed look at exactly how participants in the "Supplemental Nutrition Assistance Program" (SNAP, aka Food Stamps) spend their taxpayer-funded subsidies. Unfortunately for taxpayers, the amount of money spent on soft drinks and other unnecessary junk foods/drinks is fairly staggering. But, we suppose it's a nice taxpayer funded subsidy for the soda industry...so score one for Warren Buffett and the Coca Cola lobbyists. Per the study, nearly $360mm, or 5.4% of the $6.6BN of food expenditures made by SNAP recipients, is spent on soft drinks alone. In fact, soft drinks represent the single largest "commodity" purchased by SNAP participants with $100mm more spent on sodas than milk and $150mm more than beef.

Even worse, when we added up all of the commodities that would typically be considered "junk food" (i.e. soft drinks, candy, cakes, energy drinks, etc.), we found that roughly $950mm, or just over 14% of the aggregate $6.6BN of food expenditures made by SNAP recipients, is spent on unnecessary, unhealthy products.

As CNS News points out, the study was conducted by IMPAQ international and analyzed the sales of a single national retail chain back in 2011.

It's a good thing democrats re-branded Food Stamps as the "Supplemental Nutrition Assistance Program"....otherwise we would have confused it for a blatant waste of taxpayer money on sodas and energy drinks. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Truth in Numbers- Bad math as a propaganda and sales tool Posted: 23 Nov 2016 06:16 PM PST It's no surprise that the largest employer of mathematicians in the United States is the National Security Agency. These jobs are not all 'codebreakers' – why does the NSA employ so many mathematicians, second only to Wall St.? The biggest secret propaganda and sales tool used by experts in the modern world is the deliberate twisting and false presentation of data, specifically – numbers and 'statistics.' They do so in such a subtle way, that the argument leads into a heated debate about the inference of the obvious conclusions – NOT the calculation of the numbers themselves! Very rarely are the methods of statistical calculations, data collection, formulations, and other operations ever questioned. This is used by governments, to paint a picture they want, in the case of the military, to 'sell war' – as outlined eloquently by mathematician Nassim Taleb:

(In case you haven't heard of Nassim Taleb this book is a MUST READ as a primer for any trader or investor to understand MATH as it pertains to the MARKETS: Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets. Taleb is no academic he runs a multi-billion dollar hedge fund). Inflated numbers of enemy casualties, or deflated numbers of aggressor casualties, pose an obvious example of why such agencies would use bad math to display data in such a way as to further their argument, for one side or another. But what other examples? Why would Wall St. use such a strategy, considering their entire business is numbers? Consider the example of the Fed and interest rate policy. If the current interest rates are 1%, and the Fed hikes to 2%, that's a 1% increase but in percentage terms, it's a 100% increase! If you had interest rate derivatives, you could with no leverage potentially earn a 100% return on your money, in a day (supposing it was a surprise and the market wasn't already pricing in the hike). Another popular statistical misconception, is that of loss recovery. Recovering from a loss is not linear. For example, if your fund has a 10% loss, you need 11.11% just to break even. This becomes more extreme, the deeper the loss hole. If you start with 100 units, lose 10% of them – you have 90. But to increase from 90 back to your original starting 100, you need 11.11 units, which is 11% just to get back your lost 10 units. Yes! And speaking about performance, let's knock the industry standard performance capsule and its big gaping hole. According to most reporting standards, such as prescribed by NFA, FINRA, and many others – funds report monthly performance based on a 'snapshot' of performance during that month. This sounds reasonable until you actually calculate monthly performance numbers and see that it's really only performance based on a 1 or 2 day period intra-month. If there was a big profit or a big loss on the days taken as 'snapshots' that's what will show in the capsule. What's misleading about this, it doesn't represent to investors what happened DURING the month. For many strategies, this is not relevant – but for some strategies, it is very relevant. For example, imagine a scenario where there was a huge 30% loss and then recovery, and the month ended up being 2% positive. It would seem to be a low-volatility fund, and likely attract conservative investors, like Pension funds. They wouldn't know about the intra-month risk, unless the manager told them (but why would they, it's not in the required documents, and maybe THEY don't even know about it). However you add it up, the difference between balance and equity can be misleading. Skipping the monthly performance capsules that 99% of Wall St. uses, if one has access to it, one can compare the balance and equity curves over time. For those who don't know, balance is closed positions, equity includes live trades. So if a position is still open, the floating profit or loss will show up in the equity. Take a look at this discrepancy: The red line is the balance, yellow/orange line is the equity. These lines must separate when trades are placed, otherwise an account would never lose or gain. But how wide are these gaps, how frequent are they? Absent of rigorous statistical analysis as done by Taleb in his war casualties paper, comparing these 2 lines is the most basic form of drawdown analysis. What caused the lines to diverge? What dates did they diverge on, and what forces caused them to converge? These are questions astute investors should be asking. For a full education on statistical analysis, checkout Fortress Capital's Introduction to Foreign Exchange. For a pocket guide designed to make you a due diligence expert, checkout Splitting Pennies – Understanding Forex for only $6.11 on kindle, or get some awesome financial books here.  | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Shocking Prophecy for America by Elder St. Paisius the Athonite. Posted: 23 Nov 2016 04:52 PM PST The Shocking Prophecy of Elder Paisius for America by St. Paisius the Athonite during discussion after Holy Liturgy. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Half Of The Population Of The World Is Dirt Poor - And The Global Elite Want To Keep It That Way Posted: 23 Nov 2016 04:30 PM PST Submitted by Michale Snyder via The Economic Collapse blog, Could you survive on just $2.50 a day? According to Compassion International, approximately half of the population of the entire planet currently lives on $2.50 a day or less. Meanwhile, those hoarding wealth at the very top of the global pyramid are rapidly becoming a lot wealthier. Don’t get me wrong – I am a very big believer in working hard and contributing something of value to society, and those that work the hardest and contribute the most should be able to reap the rewards. In this article I am in no way, shape or form criticizing true capitalism, because if true capitalism were actually being practiced all over the planet we would have far, far less poverty today. Instead, our planet is dominated by a heavily socialized debt-based central banking system that systematically transfers wealth from hard working ordinary citizens to the global elite. Those at the very top of the pyramid know that they are impoverishing everyone else, and they very much intend to keep it that way. Let’s start with some of the hard numbers. According to Zero Hedge, Credit Suisse had just released their yearly report on global wealth, and it shows that 45.6 percent of all the wealth in the world is controlled by just 0.7 percent of the people…

And since this is a yearly report, we can go back and see how things have changed over time. When Zero Hedge did this, it was discovered that the wealth of those at the very top “has nearly doubled” over the past six years, and meanwhile the poor have gotten even poorer…

If these trends continue at this pace, it won’t be too long before the global elite have virtually all of the wealth and the rest of us have virtually nothing. Perhaps you are fortunate enough to still have a good job, and you live in a large home and you will sleep in a warm bed tonight. Well, you should consider yourself to be very blessed, because that is definitely not the case for most of the rest of the world. The following 11 facts about global poverty come from dosomething.com, and I want you to really let these numbers sink in for a moment…

So how did we get here? Debt is the primary mechanism that takes wealth from ordinary people like you and me and puts it into the hands of the global elite. In my recent article entitled “Why Donald Trump Must Shut Down The Federal Reserve And Start Issuing Debt-Free Money“, I discussed how the Federal Reserve was designed to entrap the U.S. government in an endless debt spiral from which it could never possibly escape. And that is precisely what has happened, as the U.S. national debt has gotten more than 5000 times larger since the Federal Reserve was created in 1913. In that very same year, the federal income tax was instituted, and that is a key part of the program for the global elite. You see, the income tax is how wealth is transferred from us to the government. And then a continuously growing national debt is how that wealth is transferred from the government to the elite. It is a very complicated system, but at the end of the day it is all about taking money from us and getting it into their pockets. And at this point more than 99.9 percent of the population of the world lives in a country with a central bank, and almost every nation on the planet has some form of income tax. It is a global system that is designed to create as much debt as possible, and I recently shared with my readers that the total amount of debt in the world has hit a staggering all-time record high of 152 trillion dollars. The borrower is the servant of the lender, and the global elite have used various forms of debt to turn the rest of the planet into their debt slaves. As debt levels race higher and higher all over the planet, the elite are using the magic of compound interest to grab a bigger and bigger share of the pie. Given enough time, those at the very top would have virtually everything and the rest of us would have virtually nothing. The middle class is shrinking all over the globe, and the gap between the wealthy and the poor continues to grow at an astounding pace. But the vast majority of people out there have no idea how money, debt, taxes and central banks really work, and so they have no idea that this is purposely being done to them. The truth is that we don’t have to have this much global poverty, and if we correctly identify the root causes of this poverty we can start working on some real solutions. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 23 Nov 2016 04:25 PM PST George Soros: The Billionaire Who Built In Chaos The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Russia Is Reviving Soviet Era ICBM-Carrying "Nuclear Trains" Posted: 23 Nov 2016 04:01 PM PST Russia has conducted successful intercontinental ballistic missile tests intended for its Barguzin "nuclear-train" program. The tests for Russia's "railway-based combat rocket system" took place on Plesetsk cosmodrone two weeks ago, Interfax reports and were "fully successful" according to a military source, which would "pave the way for further flight tests." The tests were held to test the missiles' launch readiness, Russian press added.

The mobile weapons platform, made up of several train carriages designed to conceal the launchers of six Yars or Yars-M thermonuclear ICBMs and their command units, are expected to enter service between 2018 and 2020. After first announcing the return of the nuclear trains, which had previously been banned, in 2014 Russia's military then confirmed the trains are expected to be put into service in 2019. The nuclear trains, dubbed Berguzin after the strong eastern wind that blows over the Lake Baikal, aim to counter US's Conventional Prompt Global Strike project, which would give the Pentagon the capability of launching attacks and precision strikes at any target in the world in one hour. The Berguzins, which act as mobile platforms to transport and launch nuclear missiles, will be able carry up to 6 RS-24 Yars missiles, the International Business Times reported. According to RT, Yars missiles can reportedly carry four warheads for a total yield of between 0.4 and 1.2 megatons. While the missiles are less destructive than their predecessors, the Molodets missiles, they are more accurate, have a greater range and weigh roughly half as much. The lighter weight means that trains on which they are loaded do not require reinforced wheel-sets to carry the load. This makes it harder for enemy spy satellites to identify the trains, as the carriages can be easily disguised as refrigerator cars. Once the trains are deployed, Russia will be in possession of 36 megatons of mobile and ready-to-fire nuclear missiles. The commander of the Strategic Missile Forces, Colonel-General Sergei Karakayev, said the state-of-the-art Barguzin complex would outstrip its Soviet predecessor in all respects, including accuracy and range. Once launched, the complex will be in service until 2040. During Soviet times, the Strategic Missile Forces had three divisions of rail-mobile missile systems "Molodets" (NATO reporting name SS-24 "Scalpel"). They were stationed in the Kostroma, Perm and Krasnoyarsk regions. There were 12 "nuclear trains" in total, each carrying three missiles. The complexes entered service in 1987, just a few years prior the collapse of the USSR. The West dubbed the Soviet weapon "ghost trains." The rail mobile missile complexes were disposed of from 2003 to 2005 without extending their life. The "Molodets" nuclear trains were part of the START-2 Treaty for arms reductions. The new Barguzin project does not have a goal to revive the erstwhile Soviet military project. This is an entirely new development. One of the obvious advantages of Barguzin trains is their mobility, although Soviet rail-mobile missile complexes were too heavy. It is worthy of note that the development of such systems does not come contrary to the START-3 agreement. Russia's latest advancement in its nuclear weapons technology comes shortly after the Kremlin announced the deployment of nuclear-capable missiles to the Kaliningrad exclave, as was reported previously. President Vladimir Putin's spokesman, Dmitry Peskov, told reporters that the Russian military needs to respond to what he described as Nato's aggressive moves. "Russia is doing what is necessary to protect itself amid Nato's expansion toward its borders," Mr Peskov said adding that "the alliance is a truly aggressive bloc, so Russia does what it has to do. It has every sovereign right to take necessary measures throughout the territory of the Russian Federation." According to overnight press reports, Moscow also deployed new anti-ship missiles on Pacific islands controlled by Russia but also claimed by Japan. Bal and Bastion missile systems have been stationed on the islands, called the southern Kurils by Russia and the Northern Territories by Japan, the Boyevaya Vakhta (Combat Duty) newspaper of Russia's Pacific Fleet reports. The disagreement over the islands, seized by the Soviet Union at the end of World War II, has kept the two countries from signing a peace treaty formally ending their wartime hostilities. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trump gives Hillary a free pass !? Posted: 23 Nov 2016 01:30 PM PST 'Lock Her Up': Untold Story of Hillary Clinton's Disgrace in Haiti Is Trump letting Clinton get off scot free? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

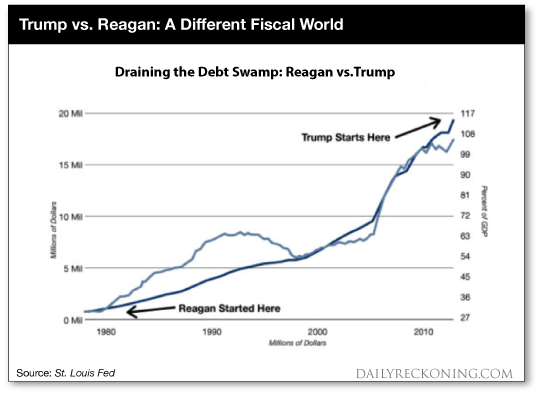

| Draining the Swamp 2.0: Trump Versus Reagan Posted: 23 Nov 2016 01:23 PM PST This post Draining the Swamp 2.0: Trump Versus Reagan appeared first on Daily Reckoning. There's a sudden rage for the idea that Donald Trump is the second coming of Ronald Reagan and that a booming economy and roaring bull market in stocks is just around the corner. There are even wizened old supply siders still around, like Stephen Moore, who insist that Trumpenomics will cause the U.S. economy to rear up on its hind legs and burst into an explosion of growth. You might expect Wall Street stock peddlers to wax idiotically about such a fanciful prospect, but it’s downright embarrassing when it comes from an alleged pro-capitalist free market man like Moore. The growth that did occur during the Reagan era was in significant degree a result of cheating history. It was fueled by a massive expansion of the public debt followed by an even worse sin against the laws of sound finance. Namely, the Greenspan money printing regime which egregiously monetized the public debt, thereby killing off the bond vigilantes and deferring the ultimate anti-growth “crowding out” effect of soaring public borrowing to the indefinite future. Ironically, in fact, that debt-choked future has now arrived in spades. It means that Donald Trump cannot possibly do today what Reagan shouldn’t have done back then. That is, enable the U.S. economy to borrow and print its way to a false prosperity that sooner or later must result in economic dysfunction and payback. The Reagan recovery occurred on the back of a relatively clean national balance sheet. At the time of his inauguration the public debt stood at $980 billion or just 31% of GDP. By the end of the Reagan-Bush era it was nearly $4 trillion, representing an outbreak of peacetime public borrowing that had never before been witnessed in American history. I have documented at length in both The Great Deformation and Trumped! that the “payback” for this insensible and unjustifiable spree of public borrowing would have occurred long ago — save for the fact that the lapsed gold bug Ronald Reagan appointed to the Fed in 1987 discovered the printing press in the basement of the Eccles Building at the time of the stock market crash in October 1987. Greenspan soon found that cheap credit and an ample flow of liquidity to the stock market made him the toast of the town. So for 19 years he inflated the monetary system and financial markets like never before, thereby essentially parking the massive Reagan-Bush deficits on the balance sheet of the Fed and other central banks around the world. Indeed, the other major central banks came to believe that they had no choice except to reciprocate the Fed’s vast monetary inflation. The alternative would have been soaring exchange rates and a massive blow to the export mercantilism on which the economies of most of Asia and the EM came to depend, as well as the petro-states and other raw material suppliers. But as Herb Stein famously observed, every unsustainable trend sooner or later tends to stop. In that respect, the public debt will surely cross the $20 trillion mark before Donald Trump takes the oath (it's already above $19.8 trillion). That means it will hit 105% of GDP, crystallizing the fact that we are in a totally different ball game in 2017 compared to 1981.

In essence, Ronald Reagan sowed the wind and Donald Trump is inheriting the whirlwind. Back in 1981 there was still massive available runway on Uncle Sam’s balance sheet, but now that has been exhausted — both politically and financially. In this context, I must remind about the elephant in the room: The Fed is out of dry powder. During three decades of egregiously expanding its balance sheet and monetizing the public debt, its footings expanded from $200 billion in 1981 to $4.4 trillion today. That’s a 22X increase in the monetary fuel during a span in which the nominal GDP grew by only 5X. Trump’s election will mean a complete breakdown of the monetary and fiscal “stimulus regime” that has fueled a failing, debt-saturated false prosperity on main street and an insane inflation of financial asset values on Wall Street. I welcome that prospect, of course, because the existing Wall Street/Washington ruling class has brought the nation to the brink of ruin. This mutant regime of casino capitalism, beltway racketeering, imperial aggression and debt-based entitlements and entertainments for the masses, however, will not go quietly into the good night. So it must have a crash landing first in order for its statist policies to be thoroughly discredited and for the elites who control the levers of power to be tarred, feathered and run out of town on a rail. Donald Trump called this draining the swamp, and there couldn’t have been a more apt disrupter. But the incorrigible Wall Street gamblers have come up with a 11th hour stick save: The so-called Trumpflation or presumed massive new round of fiscal stimulus via tax cuts and public works. So my purpose in the weeks ahead will be to smother that bit of idiocy in the biggest wet blanket I can muster. The great Trumpian fiscal stimulus will never happen because the bond vigilantes have arisen from their multi-decade slumber. That’s owing to the prospect that the Fed is done monetizing the public debt, meaning that front-running the bond market has been suddenly transformed from a highly lucrative spectator sport into a financial death trap. Upwards of $2 trillion has already been lost in the world’s bond markets since November 8, and the toll is just beginning — as is the implosion of FEDs (financial explosive devices) that had been implanted all over the global financial system by drastic central bank financial repression and falsification of interest rates. Contrary to the momentary Wall Street euphoria about fiscal stimulus, what is coming down the pike is a fiscal bloodbath. And there is no escaping this fate via the silly hypothetical 4% growth fantasy cited above by Stephen Moore — a view that unfortunately infects the entire Trump team of Wall Streeters and re-tread supply side economists. In fact, all the economic growth that is possible in an economy freighted down with $64 trillion of public and private debt is already built into the Congressional Budget Office baseline. In the interim, it is well to recall that Ronald Reagan tried to drain the swamp in 1981, but that he failed completely. The government spending share of GDP never really declined, the Welfare State was left fully intact and the Warfare State grew by leaps and bounds. But the Gipper got away with failure because Washington kicked the can — by borrowing and printing money — for the next 35 years. Donald Trump, by contrast, does not even have a vague program to drain the swamp — just a Twitter slogan. He has already declared $3.6 trillion of the $4.2 trillion budget he will inherit — that is to say, 86% of the “swamp” — to be off limits. What’s going to happen this time, therefore, is that the swamp is going to win again, and very quickly. And with the Imperial City in chaos and the lie put to the ballyhooed “fiscal stimulus” of the last two weeks — only one result is possible. That fantastically inflated financial bubble which has been building since January 1981 will finally implode. And this time it will stay imploded because the monetary and fiscal branches of the state have fully and finally exhausted their capacity to defy the fundamental laws of economics and sound finance. Regards, David Stockman The post Draining the Swamp 2.0: Trump Versus Reagan appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver Fall Almost 2% Posted: 23 Nov 2016 01:23 PM PST Gold fell $29.82 to $1182.18 in late morning New York trade before it bounced back higher into the close, but it still ended with a loss of 1.93%. Silver slipped to as low as $16.18 and ended with a loss of 1.86%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Bears Are in For a Massive Surprise Posted: 23 Nov 2016 01:00 PM PST If you're serious about making money from investing in the financial markets, you need to be able to read the crowd… and go against it. Let me give you an example… Currently one of the consensus views is that the Gold rally is over and gold is dead as an investment. Right off the bat, you know this sentiment is at an extreme. Despite its recent sell-off, Gold is still crushing stocks in terms of performance year to date. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gerald Celente -- Markets Hit New Highs; A Famous Day Forgotten Posted: 23 Nov 2016 11:57 AM PST Gerald Celente - Trends In The News - "Markets Hit New Highs; A Famous Day Forgotten" The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Miningscout Interview with Bill Holter Posted: 23 Nov 2016 11:53 AM PST Dear CIGAs, Please check out and share this Miningscout Interview with Bill Holter at the 2016 Precious Metal Trade Fair in Munich (German webpage, interview is conducted in English). http://www.miningscout.de/blog/2016/11/23/miningscout-interview-mit-dem-goldexperten-bill-holter-ueber-gold-papiergold-und-fiatwaehrungen/ The post Miningscout Interview with Bill Holter appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market report: Gold skids to nine-month low as dollar extends gains Posted: 23 Nov 2016 11:17 AM PST This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| There Is No Plan To Pursue Hillary Clinton - What Really Happened (FULL SHOW) Posted: 23 Nov 2016 11:00 AM PST President-Elect Donald Trump promised the American people that if he were President of The United States, Hillary Clinton would be in jail. What will Trump supporters think? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Warnings: Iranian General Predicts Israel Will Be Gone in 10 Years Posted: 23 Nov 2016 10:30 AM PST Iran General Predicts the destruction of Israel in 10 years The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mike Kosares: A little perspective on the gold market Posted: 23 Nov 2016 10:10 AM PST 1:13p ET Wednesday, November 23, 2016 Dear Friend of GATA and Gold: With another smashing of the monetary metals in the futures markets underway today, USAGold proprietor Mike Kosares tries to offer some perspective -- that the markets are being whipsawed by computer trading programs, that government currencies (including the U.S. dollar) are in long-term downtrends, that gold is in a long-term uptrend, and that gold and silver are still up substantially for this year. Kosares' analysis is headlined "A Little Perspective on the Gold Market" and it's posted at USAGold's internet site here: http://www.usagold.com/cpmforum/2016/11/23/a-little-perspective-on-the-g... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Canadian Government Issues Key Water License Company Announcement TORONTO -- Seabridge Gold Inc. (TSX: SEA) (NYSE:SA) announced today it has received a license from the Government of Canada required for the construction, operation, and maintenance of the water storage facility and associated ancillary water works at its 100 percent-owned KSM Project in northwestern British Columbia. The license, as authorized within the International Rivers Improvement Act, regulates all structures and activities situated on transboundary waters shared with the United States that have the potential to affect water quality and quantity. The Water storage facility and its ancillary water works (water diversion ditches and tunnels) are the primary water management control systems for the KSM Project. These facilities separate water that has not contacted mined material from so-called contact water originating from disturbed areas of the mine site and then contain the contact water prior to treatment and eventual release to the receiving environment. These facilities are situated on Mitchell and Sulphurets creeks, tributaries of the transboundary Unuk River system that flows into Alaska. The license was granted for a term of 25 years under the International Rivers Improvements Regulations as administered by Environment and Climate Change Canada. ... ... For the remainder of the announcement: http://seabridgegold.net/News/Article/642/federal-government-issues-key-... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| A little perspective on the gold market Posted: 23 Nov 2016 10:09 AM PST Most of gold's downside is geared not to the financial decisions of millions of investors around the globe, as the mainstream media would have you believe, but rather to linear computer algorithms geared to the dollar index. The trading part of the software has been told to automatically place trades at certain correlated price levels and that is why we get these waterfall drops. The rocket launch trajectories to the upside come when the trading function is told to buy and cover the previous shorts. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE MADNESS OF A LOST SOCIETY 2: FINAL WARNINGS Posted: 23 Nov 2016 10:00 AM PST Predictions are futile. No one knows what will happen next. But yes, the culture has no moorings and things will only get worse. Just remember, you get the leaders you deserve. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Much Gold Is There in India? Posted: 23 Nov 2016 10:00 AM PST Those interested in gold are always on the lookout for news regarding the amounts of gold held by Central Banks around the world. Abundant gold held by Central Banks is generally supposed to further the cause of a return to the gold standard, but strong Central Banks only represent a stronger hold of bankers upon the populations which they have been exploiting; the driving interest of the top bankers in the world is to retain their unwarranted privileges: the public interest is not a priority by any means. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Louis Cammarosano: Interconnectedness of Silver Eagles and India’s War on Cash - Rory Hall Posted: 23 Nov 2016 09:47 AM PST Sprott Money | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Politically-Driven S.O.D. (sons of Druckenmiller) to Lose Again Posted: 23 Nov 2016 09:47 AM PST I am not telling anyone to run out and short the market right now (I have zero short positions and still hold hopefully well-selected longs), but I am telling them that this is not going to end well. People managing the markets through a political lens are going to get a double whammy. Using Druckenmiller as a blueprint, they will suck on stocks hook, line and sinker and puke up gold. It will be exactly opposite to their stance last summer. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rothschild, The Hidden Hand -- David Icke Posted: 23 Nov 2016 09:30 AM PST Rothschild, The Hidden Hand - David Icke The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| EXCLUSIVE: My Conversation With Jim Rickards Posted: 23 Nov 2016 09:21 AM PST This post EXCLUSIVE: My Conversation With Jim Rickards appeared first on Daily Reckoning. Thousands of headlines have been written and millions of words put to paper to explain why Donald Trump won. But it's all been wasted effort… Trump's triumph can be credited to something very simple: The American people said enough is enough. They didn't trust what was happening with the ruling elites in the cesspool of Washington D.C. So they rolled the dice and gave Trump a chance. What that means for our future, nobody knows. But what is certain is the elites haven't given up the fight… In fact, according to former CIA insider and bestselling author Jim Rickards, what they have in store for us is the greatest single power grab the world has ever seen… Out of AmmoI spoke with Rickards recently about his latest book, The Road to Ruin: The Global Elites’ Secret Plan for the Next Financial Crisis, (click here to claim a free copy) on my Trend Following Radio podcast. He made clear that the ruling elites he speaks of aren't a deep, dark conspiracy of nefarious actors like you'd see in a James Bond movie. Instead, they're names you know very well: Fed chair Janet Yellen, European Central Bank president Mario Draghi, International Monetary Fund chief Christine Lagarde, former Treasury Secretary Larry Summers, et al… These are the world's central bankers, finance chiefs and high-level political operatives who meet regularly at tony events like the Aspen Ideas Festival and Davos. Together, they've crafted the policies and infrastructure that form the core of the church of globalization and modern finance. But here's the thing… Their inept policies have failed miserably. Under their leadership we have experienced years of economic stagnation, multiple economic crises and bubbles, record debt levels, stagnant wages and almost all of the income going to one group – the ruling class. The bottom line is that regular people have lost confidence in the elites. And the funny thing is that the elites have lost confidence in their own blather. Their policies have led to crisis after crisis. And they realize that they've run out of rescue options… You see, during the 1998 Long-Term Capital Management collapse, Wall Street had the resources to rescue a hedge fund whose collapse almost closed down every market in the world. In the financial crisis of 2008-09, global central banks had the wherewithal to rescue Wall Street. But when the next crisis hits, who's going to bail out the central banks? The Fed's balance sheet has gone from $800 billion to $4 trillion since the financial crisis. Rates are near zero. There's no ammunition left. And the markets know it. That leads us to the ruling elites' new scheme… An Insidious PlanAs Rickards sees it, the next crisis is going to be unlike anything we've ever seen. He sees collapses as natural disasters, like earthquakes. In a natural system, you can't stop the process of an earthquake. The energy is built up over time and needs to be released… so it is. If it continued to build up, the natural system would only become more unstable. And the eventual quake would be unfathomably destructive. But that's just what's happening in our global financial system… Reckless central bankers have repeatedly prevented systemic excess from being purged during each new crisis. Now these excesses have built up to a point where they're going to be devastatingly destructive when they explode. And when that happens, the global elites will employ one last-ditch plan to save the day for their interests – not ours. It's an insidious plan to seize the assets of hard-earned savers like you and me. And the truly scary part is the infrastructure for this scheme is already in place. You just aren't aware of it yet. Rickards reveals the startling details of this new scheme in his latest book, The Road to Ruin: The Global Elites’ Secret Plan for the Next Financial Crisis. I've secured a free copy for you. Click here to claim it. Please send your comments to me at coveluncensored@agorafinancial.com. Let me know what you think of today’s issue. Regards, Michael Covel The post EXCLUSIVE: My Conversation With Jim Rickards appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Another Election Year, Another Bunch Of Fake Growth Numbers Posted: 23 Nov 2016 09:01 AM PST Some pretty good economic reports have energized various parts of the financial markets lately. Consumer spending is up, GDP is exceeding expectations and even factory orders, that perennial downer, popped this morning. In response the dollar is soaring and interest rates are at breaking out of their multi-decade down-channel. The economy is clearly recovering, implying […] The post Another Election Year, Another Bunch Of Fake Growth Numbers appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Monetary Populism: The Oligarchs’ Mortal Enemies – The Peoples’ Salvation Posted: 23 Nov 2016 08:49 AM PST Desperation is setting in. The blatant attacks on gold are occurring almost exclusively during the Comex floor-trading hours now. Every night gold pushes higher as Asia’s appetite is seemingly voracious. The two most systemically dangerous banks right now, it was revealed according to the IMF, are JP Morgan and Citibank. I’m sure part of the smash is in response to that. All this action between gold and the dollar means is that the counter-force reaction to what the Fed is doing is going to be even more forceful. They already can’t control the dollar and the strong dollar is going to decimate Q4 revenues and earnings. Give it 6 months and I bet they start talking about the need to print more money. Gold will sniff that out well ahead of time. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Russia Gold Buying In October Is Biggest Monthly Allocation Since 1998 Posted: 23 Nov 2016 08:42 AM PST Russia gold buying accelerated in October with the Russian central bank buying a very large 48 metric tonnes or 1.3 million ounces of gold bullion. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| What to Watch For: Cashless Society, World Money and More Posted: 23 Nov 2016 08:36 AM PST This post What to Watch For: Cashless Society, World Money and More appeared first on Daily Reckoning. Here are the five stories to watch this week and going forward. Included is the latest news out of the Brexit efforts, how a cashless society is already in the works and what moves world money and the SDRs have made now that China is in the currency basket. 1. Heavyweight Brexiteers Among 60 Tory MPs to Demand Clean Break From the EU (Telegraph) A total of sixty members of the UK parliament, including seven former Cabinet ministers, have recently demanded that Theresa May remove Britain from the single economic market of the EU and its customs agreements amid fears that the current PM's position on Brexit could be weakened considerably. Currently, there is much debate in the UK parliament on whether its MP's must vote before invoking article 50, the EU mechanism required to leave the Union. To read the full article by the Telegraph click here. 2. Sweden's Riksbank Eyes Digital Currency (Financial Times) Mike Milne wrote in the Financial times that "The world's oldest central bank — it was the first to issue paper banknotes in the 1660s — is launching a project to examine what a central bank-backed digital currency would look like and what challenges it would pose. It hopes to take a decision on whether to start issuing what it calls an ekrona in the next two years." As physical currency becomes more rare, this story shows government shift to a cashless society – more will surely fall behind in a growing trend to kill cash. To read the full Financial Times article, click here. 3. Oil Climbs to Three-Week High as Dollar, Yields Dip (Reuters) The price of oil hit a near three-week high today after a weakening US dollar and a full range of inflationary talk hit the euro zone causing the currency to also rise to its highest level in almost 10 months. Oil prices rose to three-week highs on Monday, supported by a weak dollar and helping to nudge a gauge of inflation expectations in the euro zone to its highest since January. Reuters noted that the move was a response to "signs that OPEC was moving closer to a deal to cut output when it meets next week." This news is important for an incoming white house administration and the likeliness of increased oil activity over the coming years. To read the full article by Reuters click here. 4. Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash” (ZeroHedge) As Tyler Durden writes, "In an interview with Swiss Sonntags Blick titled appropriately enough “A Recession Is Sometimes Necessary”, the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks and their 'supremacy over the markets and other banks'. The former chief executive officer claimed that the use of negative interest rates and huge positive balance sheets represent 'weapons of mass destruction'. He calls for an end to the use of negative interest rates." This news comes as eye opening from a former insider who can see that the economic standing that currently exists could, and very well should, be in for a bumpy road ahead. To read the full article from ZeroHedge click here. 5. One Currency to Link Them All: The Rise of the Renminbi (Bangkok Post) According to the Thailand editorial that quoted an HSBC adviser stating, “I would say the renminbi will be more widely recognised as an international currency after five to 10 years,” he said, noting that the renminbi could emerge as one of the four most used currencies in…" The story notes that use of Chinese currency is expected to go global and be a top competitor with the US dollar and UK pound sterling. As world money continues to rise out of the halls of the IMF, watching the currency war unfold is an important byline to pay attention to. To read the full article from the Bangkok Post, click here. And because Thanksgiving has arrive, here is a bit of food for thought to think over… Ready to Travel? Nearly 49 million Americans Planning Thanksgiving Travel (WaPo) Good news is, the weather should hold up. Bad news is, there are going to be a lot of folks out on the road. According to AAA 2016 should have more people traveling for the holiday week than has been seen in the past nine years. What does that mean? Well, expect lines, traffic and some extra stuffing on the side. To read the full WaPo article, click here. And just for a little laugh as you eat your pie… Financial Regulators Scramble to Complete Postcrisis Rules (WSJ) After the surprising win of president-election Trump, the US government has seen its financial regulators begin to hastily act in order to complete a series of regulations set to "reign in" Wall Street. As President Obama's last term in office comes to an end, Republicans have begun to urge congressional members to hold off on regulation until the next round of white house leadership is in place. Happy Thanksgiving, Regards, Craig Wilson, @craig_wilson7 Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE.

The post What to Watch For: Cashless Society, World Money and More appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Monetary Populism: The Oligarchs’ Mortal Enemies – The Peoples’ Salvation Posted: 23 Nov 2016 08:23 AM PST Desperation is setting in. The blatant attacks on gold are occurring almost exclusively during the Comex floor-trading hours now. Every night gold pushes higher as Asia's appetite is seemingly voracious. The two most systemically dangerous banks right now, it was revealed according to the IMF, are JP Morgan and Citibank. I'm sure part of the smash is in response to that. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hugo Salinas Price: How much gold is there in India? Enough to support a gold standard Posted: 23 Nov 2016 08:10 AM PST 11:13a ET Wednesday, November 23, 2016 Dear Friend of GATA and Gold: Hugo Salinas Price, president of the Mexican Civic Association for Silver, writes today that India may be most ready of all nations for a gold standard currency system, since so much gold is in the hands of the people rather than the government. Indeed, GATA's objective long has been to get central banks out of the gold business, even as they conceal their interventions in the gold market and other markets. Salinas Price's commentary is headlined "How Much Gold Is There in India?" and it's posted at the association's internet site, Plata.com, here: http://plata.com.mx/Mplata/articulos/articlesFilt.asp?fiidarticulo=301 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Golden Predator Finds New Veins of up to 30.8 g/t Gold; Company Announcement VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V:GPY, OTCQX:NTGSF) is pleased to announce additional surface exploration results and the results of airborne geophysical surveys from ongoing work at the 3 Aces project in southeastern Yukon, Canada. Highlights include: -- Seven of Spades: Newly discovered zone with stacked flat lying quartz veins returning values up to 18.55 g/t gold. -- Queen of Spades: Newly discovered zone with values up to 30.8 g/t gold. -- Jack of Spades: Additional results from continuous panel sampling of a second higher bench returned 20 meters of 7.62 g/t gold including 11.7 g/t gold over 12.4 meters and 37.9 g/t gold over 1.7 meters. -- Three of Spades: Additional assays have increased strike length of vein with returns including 6.95 g/t gold. ... ... For the remainder of the announcement: http://goldenpredator.com/_resources/news/nr_2016_11_21.pdf Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||