Gold World News Flash |

- The Spreading Bondfire and the Rising Price of Gold

- Michael Pento Exclusive: Trump Honeymoon Won’t Last, 2017 Crash Likely

- FX Markets Signal Brexit-Like Disruption As Italy Referendum Looms

- A Message from President Elect Donald J Trump 11/21/2016

- Stock and Bond Markets Outlook For 2017

- TRUMP Goes OFF ON MEDIA ELITE, Main Stream MEDIA FACE TO FACE!

- Gold Price Forecast: Nasty Naughty November Gold Price Trend

- Red Alert -- Tsunami Hits Japan After Strong 6.9 Earthquake Strikes Near Fukushima

- Tsunami Warning Issued as Quake Strikes Off Fukushima

- Gold demand is strong as currencies keep sinking, Turk tells KWN

- Gold Price Closed at $1209.60 Up $1.10 or 0.09%

- ANONYMOUS - The NEW WORLD ORDER is COMING TO USA (WARNING)

- JFK Vs. Nixon = Gold Vs. NGDP Targeting

- Wall Street booming thanks to Trump?

- GREGORY MANNARINO - GLOBAL DEBT SET TO EXPLODE HIGHER

- BREAKING! 7.3.EARTHQUAKE HITS JAPAN! TSUNAMI WARNING ISSUED!

- Alert -- MASSIVE Earthquake Strikes Near FUKUSHIMA -- Tsunami Warning Issued

- Two Billion-Dollar Buzz Saws

- Gold Daily and Silver Weekly Charts - Risk On Trump

- Gold Seeker Closing Report: Gold and Silver Gain With Stocks and Oil

- BREAKING: "Chelsea Clinton Begging Trump To Stop HILLARY PROBE!" - Alex Jones

- ALERT Our Economy Will Collapse At The End Of 2016

- In The News Today

- Arrest The Bankers -- Bank Fraud Bust in Iceland : Max Keiser

- The N.W.O. Tried To Assassinate PUTIN!

- SWOT Analysis: Where Will Gold Go From Here?

- This Past Week in Gold

- Silver Is Not Real Money

- An Honest Look at Gold Chartology

- Breaking News And Best Of The Web

| The Spreading Bondfire and the Rising Price of Gold Posted: 22 Nov 2016 07:14 AM PST Today's rising interest rates not only predict higher borrowing costs for sovereign bonds but also the long-awaited and final breakout of gold. After gold's spectacular rise in the summer of 2011 during the EU sovereign bond crisis, central bankers moved to ensure that gold did not threaten their ponzi-scheme of credit and debt; and with a combination of negative gold lease rates and paper gold futures, central banks drove down the price of gold down from its September 2011 high of $1920 to its 2015 low of $1150. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Michael Pento Exclusive: Trump Honeymoon Won’t Last, 2017 Crash Likely Posted: 22 Nov 2016 07:06 AM PST It is my privilege now to welcome in Michael Pento, president and founder of Pento Portfolio Strategies and author of the book The Coming Bond Market Collapse: How to Survive the Demise of the U.S. Debt Market. Michael is a money manager who ascribes to the Austrian School of Economics and has been a regular guest on CNBC, Bloomberg, Fox Business News, and also the Money Metals Podcast. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX Markets Signal Brexit-Like Disruption As Italy Referendum Looms Posted: 22 Nov 2016 01:15 AM PST FX traders are pricing in as big a potential disruption event for Italy's referendum as they did (correctly) for the Brexit vote. So-called 'currency-vigilantes' are buying EURUSD protection across the Dec 4th date of the vote in size as Italian bond spreads (over Bunds) push to 30-month highs. Anticipated euro-dollar price swings for the period of the Italian vote surged. Two-week implied volatility climbed to 12.5 percent, approaching the highest since the aftermath of the Brexit vote in June... and the premium for that protection across the referendum date is now at its highest since Brexit...

As Bloomberg reports, selling the euro before Italy's vote "makes a lot of sense given the potential for more expansionary fiscal and tighter monetary policy in the U.S., coupled with the increased focus on political risk and the increased likelihood of more policy from the ECB," said James Athey, a money manager in London at Aberdeen Asset Management Plc, which oversees more than $400 billion. "For FX, politics is the new economics," HSBC Holdings Plc analysts including David Bloom wrote in a note last week. "QE has constrained the bond market, distorted equity prices and narrowed yield differentials. This means FX is uniquely placed to reflect political developments." Trump's election has boosted speculation that Italians will reject the reforms on which Renzi has staked his political future. Deutsche Bank AG economists say there's a 60 percent chance the vote will fail, while political risk-advisory firm Eurasia Group changed its call this month, and now assigns a 55 percent probability to a "no" vote. "Markets are anticipating two risks at the moment: reflation and populism in Europe," said Marc Chandler, head of currency strategy at Brown Brothers Harriman & Co. in New York. "If one thinks that the Italian referendum is going to be lost, and it's not priced in, selling the euro -- which is also being weighed down by other factors -- seems the path of least resistance compared with a rate position." | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Message from President Elect Donald J Trump 11/21/2016 Posted: 21 Nov 2016 09:00 PM PST Transition 2017 Donald is WAY ahead of schedule and very organized. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock and Bond Markets Outlook For 2017 Posted: 21 Nov 2016 07:37 PM PST We have discussed at length different forecasts for 2017. All our calls, so far, seem to be spot-on. Think of our bullish call for financial stocks in 2017 and bearish gold price forecast 2017. In this article we explain our broad markets outlook for 2017. Many investors look for leading indicators. Some look at the volatility index (VIX), others at the U.S. dollar or inflation expectations (TIPS). Some believe that reading the news will be helpful to understand where markets are going. The truth of the matter is that none of all that is helpful whatsoever. Most sources are only noise, and that is the reason why only 10% of investors are successful. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TRUMP Goes OFF ON MEDIA ELITE, Main Stream MEDIA FACE TO FACE! Posted: 21 Nov 2016 07:30 PM PST President-elect Donald Trump exploded at media bigs in an off-the-record Trump Tower powow on Monday, sources told The Post. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Forecast: Nasty Naughty November Gold Price Trend Posted: 21 Nov 2016 07:24 PM PST As all are well aware the price of gold initiated a new bull market since December 2015 (rising from $1,050 to its $1,376 peak in early July this year. Indeed it was a spectacular bull price run where gold soared more than +30% in only six months. Indeed spectacular! Subsequently, the bull trend petered out in early July. Since then the price of gold has been steadily declining. Moreover, there are several reasons for this on-going price consolidation…and why it has yet to put in a bottom: 3-Month T-Bill Yield Soaring US$ Index Surges US$ vs 3-Month T-Bill Weekly $UST1Y vs USD Chart Point&Figure Projections (Gold, USD and Silver) Traditional November Gold Price Decline | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Red Alert -- Tsunami Hits Japan After Strong 6.9 Earthquake Strikes Near Fukushima Posted: 21 Nov 2016 06:30 PM PST The cooling system of the third reactor at the crippled Fukushima nuclear power plant has stopped circulating water following a powerful 7.3 offshore earthquake. TEPCO said it managed to restart the system some 90 minutes after the failure. The Financial Armageddon Economic Collapse... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tsunami Warning Issued as Quake Strikes Off Fukushima Posted: 21 Nov 2016 06:00 PM PST Nov.21 -- A magnitude 7.3 earthquake struck Japan off the coast of Fukushima, home to the nuclear power plant badly damaged in a March 2011 quake, triggering a tsunami alert. Bloomberg's Rosalind Chin reports on "What'd You Miss?" The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold demand is strong as currencies keep sinking, Turk tells KWN Posted: 21 Nov 2016 05:26 PM PST 8:27p ET Monday, November 21, 2016 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk tells King World News today gold prices are in backwardation and stabilizing amid strong physical demand, even as government currencies are doing terribly. Even the U.S. dollar, adjusted for long-term inflation, is falling sharply and taking U.S. living standards down with it, Turk says. An excerpt from the interview is posted at KWN here: http://kingworldnews.com/this-is-the-real-reason-why-the-public-is-broke... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Golden Predator Finds New Veins of up to 30.8 g/t Gold; Company Announcement VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V:GPY, OTCQX:NTGSF) is pleased to announce additional surface exploration results and the results of airborne geophysical surveys from ongoing work at the 3 Aces project in southeastern Yukon, Canada. Highlights include: -- Seven of Spades: Newly discovered zone with stacked flat lying quartz veins returning values up to 18.55 g/t gold. -- Queen of Spades: Newly discovered zone with values up to 30.8 g/t gold. -- Jack of Spades: Additional results from continuous panel sampling of a second higher bench returned 20 meters of 7.62 g/t gold including 11.7 g/t gold over 12.4 meters and 37.9 g/t gold over 1.7 meters. -- Three of Spades: Additional assays have increased strike length of vein with returns including 6.95 g/t gold. ... ... For the remainder of the announcement: http://goldenpredator.com/_resources/news/nr_2016_11_21.pdf Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1209.60 Up $1.10 or 0.09% Posted: 21 Nov 2016 05:22 PM PST

Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ANONYMOUS - The NEW WORLD ORDER is COMING TO USA (WARNING) Posted: 21 Nov 2016 04:30 PM PST Anonymous Updates presents to you a video showing you the signs of the new world order in the United States of America. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JFK Vs. Nixon = Gold Vs. NGDP Targeting Posted: 21 Nov 2016 04:03 PM PST New World Economics | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wall Street booming thanks to Trump? Posted: 21 Nov 2016 04:00 PM PST University of Maryland economist Peter Morici and FBN's Ashley Webster discuss how Wall Street has reacted to President-elect Donald Trump. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GREGORY MANNARINO - GLOBAL DEBT SET TO EXPLODE HIGHER Posted: 21 Nov 2016 03:00 PM PST Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. Do you want to be informed with Max Keiser, Alex Jones, Gerald Celente, Peter Schiff, Marc Faber, Ron Paul,Jim Willie, V Economist, and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING! 7.3.EARTHQUAKE HITS JAPAN! TSUNAMI WARNING ISSUED! Posted: 21 Nov 2016 02:30 PM PST BREAKING! 7.3.EARTHQUAKE HITS JAPAN! TSUNAMI WARNING ISSUED! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alert -- MASSIVE Earthquake Strikes Near FUKUSHIMA -- Tsunami Warning Issued Posted: 21 Nov 2016 02:00 PM PST MASSIVE Earthquake Strikes Near FUKUSHIMA... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

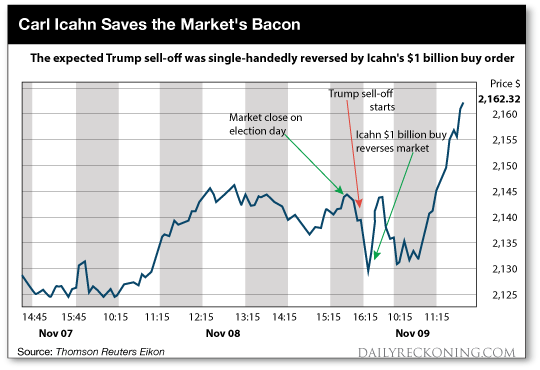

| Posted: 21 Nov 2016 01:25 PM PST This post Two Billion-Dollar Buzz Saws appeared first on Daily Reckoning. What an amazing month. Not only did Donald Trump win the U.S. presidential election two weeks ago (something I predicted in advance would happen), but markets exhibited wild swings. Investors got whiplash based on secret middle-of-the night trades by two of the richest men in the world. Carefully constructed election trading strategies ran into a pair of billion-dollar buzz saws, wielded by legendary stock trader Carl Icahn and hedge fund maven Stan Druckenmiller. Their combined predawn raid on the markets produced shocking results. When the dust settled, the stock market was in an expected place by an unexpected path, and gold was in an unexpected place. The good news is that with these shocks behind us, we have much greater clarity on the path ahead. In fact, the opportunities for profit, especially in precious metals, are the best since late 2015. A review of the price dynamics of the past two weeks will explain why. Going into Election Day, Nov. 8, I said the following: "Trump would win despite overwhelming odds and universal opinion to the contrary; stocks would sell off on the Trump victory, but then bounce back based on consideration of his pro-growth policies; and gold would surge and hold those gains at a new, higher level." The trading strategy I recommended for my readers was to buy a put option on the S&P 500 with a quick exit and a call option on gold. Most of this played out exactly as I expected. Trump did win the election. Stocks did sink and then bounce back. Gold did surge. But there were two trading shocks that frustrated the expected profit opportunity. The first shock was that legendary stock trader Carl Icahn, a close friend of Donald Trump, left the Trump victory party in the middle of the night and ordered his traders to buy $1 billion of stocks even as the stock index futures were plunging. Here's the story as reported by Bloomberg: As Donald Trump celebrated his surprise election win over Hillary Clinton and equity futures swooned in response, billionaire investor and Trump supporter Carl Icahn headed home to start trading. Icahn, 80, left President-elect Trump's victory party in the early hours of the morning to bet about $1 billion on U.S. equities, he said Wednesday in a telephone interview on Bloomberg TV. "I would have tried to put a lot more to work, but I couldn't put more than about $1 billion to work, and then the market got away. But I'm still happy about it,'' Icahn said. "The S&P was so liquid — it was unbelievably liquid — the world was going nuts. Last night it was amazing, the world was going into a panic…" S&P 500 futures fell as much as 5% overnight, triggering trading curbs that prevent further declines. Contracts on the benchmark index all but erased that decline by the time markets opened at 9:30 a.m. in New York, and the benchmark index rose as much as 1.4% Wednesday. Here's a chart of the SPX (ticker for the S&P 500 index) that shows the beginning of the Trump sell-off. That turned on a dime when Icahn put in his $1 billion buy order:

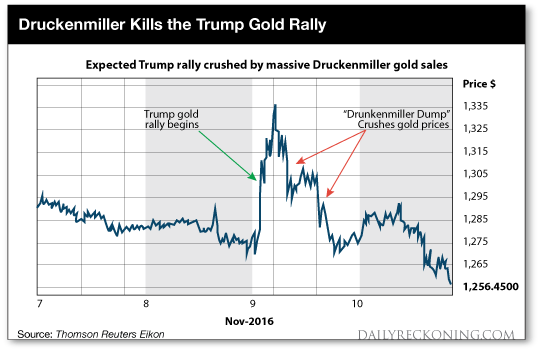

I expected stocks to sell off at first and then rally back once investors had time to consider Trump's low-tax, big-spending, light-regulation policies. Normally, it would have taken a day or two for large institutions to digest the policies and pivot to a stock market rally. That would have been enough time to exit the initial put option position I recommended. But Icahn is not an institution — he's a maverick individual, a Trump insider and one of the few traders in the world with enough fire power to single-handedly reverse market momentum. Icahn compressed the reversal into a matter of hours, not days, and did so in the middle of the night before other investors could profit. Something equally extraordinary happened in the gold market at about exactly the same time. Gold prices surged late on Nov. 8 and into the early morning hours of Nov. 9 as a Trump victory became clear. This was exactly in line with my expectations. Based on sentiment and momentum, gold should have held those gains. Instead, one of the largest and most visible individual gold investors, Stan Druckenmiller, decided to liquidate his entire gold position in the middle of the night. Druckenmiller told CNBC: "I sold all my gold on the night of the election… All the reasons I have owned it for the last couple of years, it seems to me they may be ending. And by the way, they're ending globally." We don't know the exact size of Druckenmiller's gold sales, but given his total fund size, outspoken support for gold and potential leverage, an estimate of a $1 billion gold dump is not unreasonable. This was the second "billion-dollar buzz saw" that cut up the recommendations I made for my readers. Here's a chart of the gold price action showing the strong rally immediately after the Trump victory became clear and a sharp reversal as Druckenmiller dumped his position:

I expected a stock reversal, but I did not expect a gold reversal. I expected gold to hold onto its post-Trump gains. The "Druckenmiller Dump" put an end to the rally. The decline in gold continued into the following day, Nov. 10. That action was based on a change in sentiment and "me too" sales by weak hands who were piggybacking on Druckenmiller all along. That's what happened two weeks ago. Where do we go from here? Where are the new opportunities to profit now that the election week shocks are behind us? For now, the best advice in the stock market is "Don't fight the tape." Markets have a view that bank stocks will go up because of a steepening yield curve, construction and transportation stocks will go up because of higher infrastructure spending, pharmaceutical stocks will go up because of reduced regulation and defense stocks will go up because of increased defense spending. Thanks to Donald Trump's presumed policies, many sectors are surging. There are many reasons to doubt this narrative, but for now the approach I recommend is just to stand aside and not fight the view that "Happy Days Are Here Again." Gold is more interesting. I can't read Stan Druckenmiller's mind, but his stated reasons for dumping gold don't make sense. In fact, he may just be a trader who had a good run, made substantial profits over the past year (perhaps $200 million) and decided to take his money off the table. That's fine, as it's his money. But when Druckenmiller says, "The reasons I have owned [gold] for the last couple of years… may be ending," that's demonstrably incorrect. The reasons to own gold are insurance against extreme risk, as a hedge against inflation, and as a sound form of money in a world where central banks are losing control. All of those reasons still apply. In fact, the reasons for owning gold are more urgent than before Trump's victory. Trump's big spending plans will blow a hole in the budget deficit. If the Fed accommodates the deficit with "helicopter money," inflation will surge. If the Fed leans against the big deficits with rate hikes, this will cause a stronger dollar and lead to a global liquidity crisis in emerging markets. If bank regulation is eased, banks can be relied upon to leverage up with risky derivatives, which will make the next financial crisis more, not less, likely. Druckenmiller's stated reasons for selling gold are equivalent to saying, "I cancelled my fire insurance because now that Trump is president, we won't have any more fires." Don't count on it. Trump himself was the first presidential candidate since Ronald Reagan to speak favorably about the role of gold in the monetary system. That does not mean there's an imminent return to the gold standard, but it does mean we can expect to hear more discussion about the monetary uses of gold in the months ahead. Whenever gold is considered as money, the necessity for much higher gold prices to support the existing paper money supply quickly becomes apparent. Druckenmiller has given gold investors a gift. By single-handedly taking down the gold markets, he has given investors an excellent entry point for new positions in precious metals. The gold and silver stories are still intact, with or without Druckenmiller's participation. Who knows, he may even tiptoe back into the market — that's what hedge fund guys do. Going forward, I expect to see gains in precious metals that will more than offset any losses from those two "billion-dollar buzz saws" that were out on election night. Regards, Jim Rickards The post Two Billion-Dollar Buzz Saws appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Risk On Trump Posted: 21 Nov 2016 01:22 PM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver Gain With Stocks and Oil Posted: 21 Nov 2016 01:15 PM PST Gold gained $9.25 to $1217.55 in London before it chopped back lower in New York, but it still ended with a gain of 0.34%. Silver rose to as high as $16.746 and ended with a gain of 0.06%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING: "Chelsea Clinton Begging Trump To Stop HILLARY PROBE!" - Alex Jones Posted: 21 Nov 2016 12:35 PM PST BREAKING: "Chelsea Clinton Begging Trump To Stop HILLARY PROBE!" - Alex Jones The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ALERT Our Economy Will Collapse At The End Of 2016 Posted: 21 Nov 2016 11:30 AM PST Current Economic Collapse News Brief - Episode 1102 US Government Is Backed Into A Corner On All Fronts, One Option Left To Activate - Episode 1103b Desperate Elite Push For WWIII // Trump Surging: 10/16/16 Full Show Economic Collapse Countdown | Peter Schiff and Stefan Molyneux "You Blew It"... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Nov 2016 11:27 AM PST Jim Sinclair's Commentary My God, someone poured their coffee on the HFT Algo execution computers! Pull our the damn plugs. Shut off the main power! “What The F**k Was That?” Currency Traders Reeling Amid Sterling, Yen, Gold ChaosNovember 21, 2016 Shortly after 0826ET, with Cable trading at 1.2400, ‘someone’ decided to back up the truck... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Arrest The Bankers -- Bank Fraud Bust in Iceland : Max Keiser Posted: 21 Nov 2016 10:30 AM PST Iceland has jailed members of the new world order! This is a great moment in human history! Iceland Has Jailed Members Of The New World Order! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The N.W.O. Tried To Assassinate PUTIN! Posted: 21 Nov 2016 07:47 AM PST The new world order has been trying to assassinate Putin because he is going to lock them up!Please share this video so other people can WAKE UP TO THE TRUTH!Thank you for watching, and God bless this great nation! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SWOT Analysis: Where Will Gold Go From Here? Posted: 21 Nov 2016 06:45 AM PST According to Bloomberg calculations, mine supply may fall about a third in the 10 years to 2025, with the number of newly discovered primary gold deposits already falling to three in 2014 from 37 in 1987, writes Mark O'Byrne. CEO of Randgold Resources, Mark Bristow, says gold production may peak in the next three years as miners fail to replace their reserves. The silver market is in the same boat, reports Reuters, with 2016 marking the fourth consecutive year in which the market has realized a physical shortfall. In Russia, in fact, silver production fell 9.4 percent year-over-year from January to September, and gold output declined 1.4 percent. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Nov 2016 03:20 AM PST Technical analyst Jack Chan charts the latest movements in the gold and silver markets, and shows why investors can expect lower prices overall. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Nov 2016 03:05 AM PST Is silver real money? I don’t think so. But I know that my proclamation will likely draw vociferous contradictions from others who consider themselves “hard-money advocates”. That’s okay. Let’s look at the facts. And in order to be consistent with the introduction of my companion article GOLD IS REAL MONEY, let’s start similarly here. In this case though, I will list what silver is rather than what it is not. Silver is: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| An Honest Look at Gold Chartology Posted: 21 Nov 2016 03:03 AM PST For the last two weeks, since the US elections, we’ve been discussing the possibility of strong inflection points building out on many different areas of the markets. These are areas where the markets can turn on a dime leaving those folks looking one way while the markets go the opposite way. Important inflection points are more of a price thing than a time thing. An inflection point can last days or weeks before they finally resolve themselves. Lets start by looking at the US dollar, as it plays such a key role in so many markets. Below is a three year daily chart which shows its major impulse leg up out of the mid 2014 low, and topped out in the spring of 2015. For just under two years the US dollar has been chopping out a sideways trading range, rectangle consolidation pattern, and closed above the top rail this week. The breakout is not actually confirmed yet as the price action would have to close above the 103 area and then a backtest to the top rail around 100 would have to hold. For the time being, we have to give the benefit of a doubt, to the US dollar bulls until proven otherwise. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 21 Nov 2016 01:37 AM PST US dollar soaring, now at highest level of the year. Interest rates rising, bond prices falling. Mortgage rates up. Gold and silver correcting, setting the stage for the next bull market. Political class still searching for an explanation (see “Best of the Web”). Trump’s cabinet takes shape, with mostly old and a few new faces. […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment