Gold World News Flash |

- Gold Miners’ Q3’16 Fundamentals

- The Central Bankers Make The Economy Look Great Right Before The System Crashes

- Gold Price Closed at $1208.50 Down $15 or -1.2% This Week

- Speculators Are Finally Bailing Out Of Gold – And That’s A Good Thing

- TRUMP CAN'T STOP DOLLAR COLLAPSE -- CRAIG HEMKE

- Surprising Move From Trump: You Won’t Believe His Choice For Secretary Of State!

- Feminist & Homosexual groups seek to delegitimize Trump Presidency

- Gerald Celente -- Strong Dollar, More Stimulus; Boom or Bust?

- GREAT INTERVIEW: Stephen Cohen Analyzes US Prospects with Russia after Trump's Win

- BREAKING: Secret Service Just Exposed What Really Happened With Hillary On Election Night!

- The “Trump Reflation Trade” Is For Chumps

- Gold Seeker Weekly Wrap-Up: Gold and Silver Fall About 2% and 4% on the Week

- The US could become Energy Independent after Huge Texas Discovery

- Why “Trumpflation” Might Not Happen

- COT Gold, Silver and US Dollar Index Report - November 18, 2016

- Trump Is In Mortal Danger!

- The New World Order Will Use Facial Recognition As An Entry Pass, Beginning in China

- Synthetic Gold Leasing: More Details Regarding The “Precious Metals” On Chinese Commercial Bank Balance Sheets.

- Koos Jansen: China's banks don't really have much gold

- Varney & Co. discuss their outlooks for U.S. Dollar Rates.

- Can California Actually Secede From The U.S.?

- In The News Today

- The Deep State Panic of 2016

- Donald Trump: U.S. Election Aftermath | Diamond and Silk

- Gold Miners’ Q3’16 Fundamentals

- Hillary and Soros launch America’s Purple Revolution

- Gold Mining Stocks Screaming Buy! Q3’16 Fundamentals

- Beans Blast Off: Here’s How to Play the New Coffee Rally

- Gold Sell Off On Fed Noise – “Interesting Times” To “Support Gold”

- Total 2016 Silver Demand Hits Record High

- Gold Sell Off On Fed Noise – “Interesting Times†To “Support Goldâ€

- Newmont gold mine opens in Suriname, seen boosting struggling economy

- India's income tax men may come calling on gold buyers

- May Never Get Another Opportunity to Buy Gold at this Level Again

- Breaking News And Best Of The Web

- Gold Prices Flirt with '$1200 Support' as Dollar Soars

- Islamic Gold – Vital New Dynamic In Physical Gold Market

| Gold Miners’ Q3’16 Fundamentals Posted: 18 Nov 2016 11:19 PM PST Zealllc | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Central Bankers Make The Economy Look Great Right Before The System Crashes Posted: 18 Nov 2016 06:30 PM PST Layoffs are continuing around the globe, Volkswagen will be laying off 30,000 employees. Obama will hit 20 Trillion in debt by Jan 2017. He increased the debt by 2.4 Trillion this year. The number look great right before we enter a collapse of the system. When Trump takes office he will be hit... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1208.50 Down $15 or -1.2% This Week Posted: 18 Nov 2016 06:18 PM PST

Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Speculators Are Finally Bailing Out Of Gold – And That’s A Good Thing Posted: 18 Nov 2016 06:03 PM PST All this talk of massive new infrastructure spending financed with a tsunami of newly created-currency should be lighting a fire under gold. That it hasn't is a testament to how out-of-whack the market had gotten during the first six months of this year. As gold went up, the futures contract traders whose games tend to […] The post Speculators Are Finally Bailing Out Of Gold – And That's A Good Thing appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TRUMP CAN'T STOP DOLLAR COLLAPSE -- CRAIG HEMKE Posted: 18 Nov 2016 06:00 PM PST The stock market is at all-time highs, but how long will the market stay up? Craig Hemke from TFMetalsReport says the stock market will experience pressure in the next couple weeks. Where are gold and silver headed? Hemke says precious metals are headed toward a possible 15% short term rally. The... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Surprising Move From Trump: You Won’t Believe His Choice For Secretary Of State! Posted: 18 Nov 2016 05:30 PM PST Surprising Move From Trump: You Won't Believe Who Is Going To Be His Choice For Secretary Of State! Mitt Romney. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Feminist & Homosexual groups seek to delegitimize Trump Presidency Posted: 18 Nov 2016 05:00 PM PST A propaganda movement by feminist and homosexual groups and the mainstream media is growing in the United Sates to undermine the presidency of Donald Trump, a former US Senate candidate says. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gerald Celente -- Strong Dollar, More Stimulus; Boom or Bust? Posted: 18 Nov 2016 04:00 PM PST Gerald Celente - Trends In The News - Strong Dollar, More Stimulus; Boom or Bust? About Gerald Celente : Founder of The Trends Research Institute in 1980, Gerald Celente is a pioneer trend strategist. He is author of the national bestseller Trends 2000: How to Prepare for and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GREAT INTERVIEW: Stephen Cohen Analyzes US Prospects with Russia after Trump's Win Posted: 18 Nov 2016 03:30 PM PST GREAT INTERVIEW: Stephen Cohen Analyzes US Prospects with Russia after Trump's Win The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING: Secret Service Just Exposed What Really Happened With Hillary On Election Night! Posted: 18 Nov 2016 03:00 PM PST BREAKING: Secret Service Just Exposed What Really Happened With Hillary On Election Night! See How She Went Insane! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The “Trump Reflation Trade” Is For Chumps Posted: 18 Nov 2016 01:58 PM PST This post The “Trump Reflation Trade” Is For Chumps appeared first on Daily Reckoning. If you need any evidence that the world’s central banks have destroyed honest price discovery in the financial markets, the last few days have provided it in spades. The nearly $2 trillion sell-off in the global bond markets since last Tuesday was warranted but happened for the wrong reasons, while the 600 point gain in the Dow index gives stupid a whole new definition. In fact, the whole preposterous episode reminds us once more of my watchwords at my Contra Corner blog: Sell the stocks, sell the bonds, buy some gold and get out of the casino! As Bob Dylan should have described it — a hard financial rain’s gonna fall. What we were told by the Wall Street snake oil peddlers, of course, was that it was all about the return of “good” inflation and fiscally-stimulated “growth.” Indeed, this blinding insight apparently struck at exactly 2:00 a.m. election night. That’s when the market suddenly discovered that Donald Trump’s shocking election victory would not be a disaster for stocks — which it flashed just 3 hours earlier by the 800 point sell-off in the futures market — but meant that it was time to back up the truck because a new mega-dose of stimulus juice was heading straight for the casino. That’s right. Donald Trump in cahoots with the Tea Party Republicans and the GOP establishment regulars led by Speaker Paul Ryan, who only 24 hours earlier had finally managed to mention the GOP presidential candidate’s name in public, would soon be flooding the economy with giant tax cuts and a huge infrastructure spending program. And that’s to say nothing of more defense, walls on the border and happy days of budgetary red ink all around. Folks, the whole Trump reflation trade is based on blithering nonsense. Uncle Sam will be stimulating exactly nothing in the years ahead because he is dead broke. Moreover, even before Barack Obama ambles out of the White House, suitcase in hand, the Trump/Ryan-regulars/Tea Party gang will soon be lined up in circular fashion firing furiously. But it won’t be at the ballyhooed stimulus. It will be at each other as the looming expiration (March 15) of the nation’s $20 trillion public debt ceiling crashes upon the smoldering ruins of the beltway establishment. In fact, the towering national debt and the exploding annual deficit are the twin elephants in the room. In fact, here is the bombshell that will hit Washington around February… Even without an assumed recession, the updated Congressional Budget Office (CBO) deficit projections will soar past $1 trillion annually by the later years of Trump’s (only) term. Once this becomes evident, the honeymoon will be over. Washington will descend into bitter clashes over every single aspect of fiscal policy — and the battle between stimulus and austerity will erupt like at no time since 1981. Under those circumstances, there will be no 100-Day plan to reflate the U.S. economy. They will not even be able to kick the debt ceiling can long enough to buy time to enact some kind of Trump tax cut/infrastructure/fiscal stimulus. Instead, the coming spring and summer will bring to the Potomac a recurring crisis of brinksmanship, government shutdowns and unprecedented, publicly-discussed uncertainties about what government bills will be paid and which will be stuffed in the drawer after the frozen March 15 debt ceiling has been breeched, and all the short-term accounting gimmicks have been used up. The summer of 2017 will make the crisis of 2011 look like a Sunday School picnic. Back then the markets got so rattled that they dropped by nearly 18% between May and the August bottom. But unlike the present, the debt ceiling crisis back then was finally resolved at a time when the so-called recovery was just getting started. There was still great confidence in the efficacy of the Fed’s giant QE stimulus and the just completed $800 billion Obama fiscal stimulus was thought to have turbo-charged the rebound. Under those circumstances, the debt ceiling compromise was seen as a legitimate exercise in “buying time” so that “growth” could eat away at, and presumably eliminate, the out-year deficits. As I have said repeatedly, however, that debt ceiling extension was not a “compromise.” It was a nasty fiscal stink-bomb put in place to ensure that within weeks of inauguration the next administration would be dutifully at its appointed job of raising the trillions of borrowing authority needed to keep the Washington leviathan — the Warfare State and the Welfare State — in business and fully funded. In that regard, the sheer naiveté of Team Trump is something to behold. They think they are heading to Washington to Drain the Swamp. Not a chance. They soon will be drowning in it. That kind of political chicanery embedded in the current debt ceiling stink bomb, of course, has long been par for the course on Capitol Hill, but here’s the thing. The Trump victory notwithstanding, the GOP back benchers and the Tea Party activists have now come to realize that the recurrent debt ceiling deals since 2011 have all been rank fiscal frauds. Not surprisingly, therefore, the House GOP voted 167-79 against the so-called Boehner-Obama deal in October 2015. The latter passed by virtue of a 187-0 vote among House Democrats, who were self-evidently expecting to retain the White House in 2016. Only the incredibly naïve can believe that any of these Democrats will vote for a Trump debt ceiling increase tied to a sweeping Trump tax reduction, which will provide half of its $300 billion per year benefits to the top 1% and nearly three-fourths to the top 5% of U.S. taxpayers. And that will be especially true of a shell-shocked Democratic party, which by then will have been taken over by the Sanders-Warren-progressive wing in a post-Clinton power struggle. At the same time, there is not a snowball’s chance that the Trump White House could get even half of the House GOP’s 241 members to vote for a multi-trillion national debt ceiling increase tied to a massive, Democrat-pleasing infrastructure bill, but one without major income tax reductions. And that’s especially the case because unlike the debt ceiling exercises since 2011, the deficit projections are now heading sharply higher — after rising 35% to nearly $600 billion in the fiscal year just ended. Stated differently, on the fiscal front there will be far fewer votes for kicking the can uphill. And that will be especially true now that the Fed has stopped monetizing incremental debt and the so-called “rising” dollar will be forcing the Bank of Japan, European Central Bank and People’s Printing Press of China to do the same. In short, the central banks are nearly out of business and that means the bond vigilantes are rising from their 25-year old grave. The drastic 4-month run-up of the 10-year U.S. Treasury yield from 1.35% at the post-Brexit bottom in July to nearly 2.3% Monday is only a foreshadowing of the bond bubble crash lurking just around the corner. With deficits and bond yield soaring and the bond vigilantes having an unexpected arrival in some kind of fiscal rapture, the GOP House is destined to become a killing field not only for the Trump fiscal stimulus, but for any form of orderly fiscal governance at all. Indeed, the current CBO baseline forecast projects $9.3 trillion of cumulative deficits over the next 10 years, but even that is phony baloney. It assumes no recession for 206 months running — an occurrence that has never occurred in human history. It also counts more than $2.5 trillion of out-year spending cuts and expiration of tax loopholes that Congress has no intention whatsoever of permitting to occur. If you simply substitute a replay for the last 10-years for the Rosy Scenario economic assumptions in the current CBO baseline and eliminate the phony deficit reducers embedded in the baseline budget, you end up with a minimum $15 trillion of additional public debt by 2026. That is, the U.S. already has objectively speaking a $35 trillion — not $20 trillion — national debt, which will amount to 145% of GDP by the middle of the next decade. So there will be no fiscal stimulus whatsoever. The ruling establishment which brought the nation to this sorry state has been repudiated, but not replaced. Even the day traders and robo-machines will soon recognize that the Fed is out of dry powder and that the fiscal branch of government is heading into unrelieved chaos. Accordingly, it is only a matter of weeks — or months at most — until the third great bubble collapse of this century begins in earnest. Regards, David Stockman The post The “Trump Reflation Trade” Is For Chumps appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Weekly Wrap-Up: Gold and Silver Fall About 2% and 4% on the Week Posted: 18 Nov 2016 01:36 PM PST Gold fell $14.50 to $1203.90 in Asia before it bounced back to $1215.82 in London, but it then drifted back lower in New York and ended with a loss of 0.83%. Silver slipped to as low as $16.44 and ended with a loss of 0.72%. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The US could become Energy Independent after Huge Texas Discovery Posted: 18 Nov 2016 01:00 PM PST Huge shale discovery in Texas Former Shell Oil President John Hofmeister on the large oil find in Texas. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why “Trumpflation” Might Not Happen Posted: 18 Nov 2016 12:38 PM PST This post Why "Trumpflation" Might Not Happen appeared first on Daily Reckoning. Oh, we needed a laugh to end the week.From the Financial Times: "Janet Yellen has stressed the importance of central bank independence in her first public remarks after Donald Trump's election victory… Ms. Yellen said it was 'critically important' that central banks had the freedom to make judgments about how best to pursue their goals. Her remarks followed attacks during the election campaign by Mr. Trump, who claimed the Fed had kept interest rates low to help the Obama administration." Heh… Anytime this topic comes up, we recall words attributed to the hapless Arthur Burns, who ran the Fed during the Nixon administration and set the stage for the near-hyperinflation of the late 1970s. The story goes that he was asked by a German reporter why he pursued such a reckless policy. His reply? A Fed chairman has to do what the president wants or else "the central bank would lose its independence." But as long as the topic of Trump and the Fed has come up, it's worth a few reflections going into the weekend… "Right now the world economy is on a knife edge," says Jim Rickards."Extreme inflation and deflation scenarios are equally probable depending on how Trump's economic policies are implemented, and on the Fed's policy reaction to those policies." Outlets have spilled a fair amount of digital ink in recent days on "Trumpflation" — the president-elect's colossal public-works spending proposal that would put Uncle Sam ever deeper in hock, with the Fed simply printing "helicopter money" to cover the new debt. "The Trump team," Jim explains, "claims this spending can be financed with higher growth from his proposed tax cuts and his plans to reduce regulation." So we're back to "supply side" economics and the "Laffer curve" — which tells us the deficit won't blow out as long as long as economic growth is strong enough to generate more tax revenue. But that didn't work out so well the last time it was tried, during the presidency of Bush the Younger. Remember the 2001 and 2003 tax cuts? They were supposed to generate so much growth and tax receipts that we wouldn't have to worry about the cost of the Iraq War or the Medicare prescription-drug program. Instead, Bush doubled the national debt to $10 trillion and consumer prices roared higher — before they crashed during the Panic of 2008. "Even if we get higher growth under the Trump plan, much higher deficits are inevitable," Jim says. "This comes at a time when higher deficits are in the cards anyway because of baby boom retirement claims for Social Security and Medicare. If the Fed accommodates higher deficits with easy money and negative interest rates — so-called 'helicopter money' — then inflation is a near certainty." But then there's the deflationary side of that knife edge.We caution that Trumpflation is no sure thing. The Fed might assert a bit of independence after all. "The deflation scenario," says Jim, "is based on the Fed leaning against higher deficits with higher interest rates and positive real rates. When interest rates are above the rate of inflation, real interest rates are positive. "It is also the case that higher government spending in the eighth year of a recovery with an initial 100% debt-to-GDP ratio will not produce much real growth. If the Fed reacts to deficits with high real rates, the U.S. economy could tip into a recession. There are already strong deflationary forces in the world arising from debt deleveraging, a dollar shortage, technology and demographics. "Also, a strong dollar resulting from higher rates will increase the foreign exchange value of the dollar, import deflation and make dollar-denominated debt owed by emerging markets unpayable. This could lead directly to an emerging-market debt default crisis worse than the 1980s crisis in Latin America." On the side of the deflationary argument are these facts:This morning, the dollar sits at another 13-year high… and yesterday, Ms. Yellen reiterated plans for an interest rate increase "relatively soon" — which nearly everyone interprets as "next month." But again, it could go either way. What to do? "Investors should use the 'barbell' strategy," says Jim. "This consists of inflation protection (gold, silver, natural resources, land and fine art) and deflation protection (10-year U.S. Treasury notes). The inflation and deflation portfolios are two ends of the barbell. "In between, investors should hold about 30% cash, which reduces overall portfolio volatility and gives the holder optionality to pivot one way or the other when visibility improves. The complete barbell would have 35% inflation protection, 35% deflation protection and 30% cash." Jim cautions this isn't a set-it-and-forget-it approach. "It requires continual monitoring and updating based on market developments. As visibility improves, the time will come to tilt toward inflation or deflation protection, but for now, the balanced approach is best." [Ed. note: We caution the barbell is a near-term thing. One of the highlights of Jim's new book, The Road to Ruin, is what he describes as "my frightening finding about what's coming for the economy and the market in 2017. The U.S. government granted me a special clearance to report, which led me to the terrible conclusion I reveal publicly for the first time on Page 98." As a reminder, if you order your copy through us, your copy comes with a bonus chapter spelling out Jim's favorite road map for the severe bear market he sees coming. The cost? All we ask is $4.95 for shipping (Click here to learn more). If you haven't claimed your copy yet, what are you waiting for?] The major U.S. stock indexes are treading water as the week winds down.The Dow is off about 30 points, back below 18,900. But small caps are powering ahead, the Russell 2000 up a quarter percent. Amid the aforementioned dollar strength, gold is sinking ever closer to $1,200 — $1,208 at last check. Crude is edging back toward $45.

In isolation, the number doesn't mean much, but on a four-year chart, it's apparent we're on the downslope of the post-2008 expansion… Regards, Dave Gonigam [Editor's note:] Because we have Jim in our stable of editors, we've arranged to publish a special edition of The Road to Ruin — unlike the one you'd get from Amazon or Barnes & Noble. It contains a bonus chapter about the No. 1 investment to own going into the crisis — something that's been available only for the last 16 years. If you act in the next 13 days, your copy will also be signed by Jim. But there's no reason to wait until the last minute — and every reason to start preparing your portfolio and your household for the crises ahead. And all you pay is a $4.95 charge for shipping the book. Claim your copy now at this link. Here's a hint of what you'll find inside: ➤The U.S. government's "ice-nine" plan to steal your wealth and prevent you from getting your cash. If you have a dollar to your name, you need to read Page 22 ➤The secret program for controlling citizens used by elites and leaders from Caesar and Napoleon to Rockefeller and Roosevelt… through both Bushes and Obama. If you think this is some conspiracy theory, you better see Page 58 ➤The exact date by which the elites will finally reach their goal of world money under their control. You MUST take immediate and specific action before that. Hurry to Page 186 ➤The institution that will decide what the dollar is worth in the near future. (Hint: It is NOT the Federal Reserve, Congress, the U.S. Treasury or the IMF.) Page 70 ➤The climate change "Trojan horse" the elites are using to mask a troubling plan for you and the world's taxpayers. Page 88. That's just the beginning. There's more. Lots more. Click here now to claim your free copy. This might be Jim's most important work to date. The post Why "Trumpflation" Might Not Happen appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| COT Gold, Silver and US Dollar Index Report - November 18, 2016 Posted: 18 Nov 2016 12:30 PM PST COT Gold, Silver and US Dollar Index Report - November 18, 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 18 Nov 2016 12:30 PM PST Trump Must Stay Safe Until Inauguration Day Because He Is In Mortal Danger! Donald Trump is not the president yet, and Barack Obama could still do an extraordinary amount of damage during his last two months in the White House. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The New World Order Will Use Facial Recognition As An Entry Pass, Beginning in China Posted: 18 Nov 2016 11:22 AM PST Nothing like being tracked every where you go. And, you can just have entry fee's and tickets charged to your account. not much different then a chip. unless you end up in the hospital with your face ripped off. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 18 Nov 2016 11:19 AM PST One of the topics about the Chinese gold market that has not been fully illuminated is the "gold" on the 16 Chinese commercial banks' balance sheets. At the end of 2015 the aggregated "precious metals assets" on the bank balance sheets accounted for 598 billion yuan (RMB), which translates into approximately 2,682 tonnes of gold – if all the precious metals were gold related, which is very likely. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: China's banks don't really have much gold Posted: 18 Nov 2016 10:56 AM PST 1:58p ET Friday, November 18, 2016 Dear Friend of GATA and Gold: Gold researcher Koos Jansen reports today that gold assets on the books of Chinese banks are largely illusory and cannot account for the "surplus" gold believed to reside in China. His analysis is headlined "Synthetic Gold Leasing: More Details Regarding the 'Precious Metals' on Chinese Commercial Bank Balance Sheets" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/koos-jansen/synthetic-gold-leasing-mor... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT K92 Mining Begins Gold Production at Kainantu Mine Company Announcement K92 Mining Inc. is pleased to announce that gold production has commenced from the Irumafimpa gold deposit. Ian Stalker, K92 Chief Executive Officer, says: "This milestone is highly significant for our company, and for this region of Papua New Guinea. A great deal of thanks goes to the entire team on site in PNG in achieving production ahead of schedule and on budget. The rehabilitation of the Irumafimpa gold mine, process plant, and associated infrastructure commenced in late March and is now complete. As an enhancement of the processing facility, we are also pleased to note that the installation of a new drum scrubber is also nearing completion and commissioning of this will be completed by the end of the month. ..." ...For the remainder of the announcement: http://www.k92mining.com/2016/10/6077/ Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Varney & Co. discuss their outlooks for U.S. Dollar Rates. Posted: 18 Nov 2016 10:00 AM PST Jamie Glazov of FrontPage Magazine talks to Tiffany Gabbay of TheRebel.media about the similarities between Soviet communists and anti-Trump protesters. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Can California Actually Secede From The U.S.? Posted: 18 Nov 2016 09:30 AM PST With the election of Donald Trump, calls for California to secede have grown strong. So how realistic is a Calexit? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 18 Nov 2016 09:15 AM PST Jim Sinclair's Commentary Think of India and then think of the recent various paper gold schemes over there. Trump Will Grow US Debt ExponentiallyNovember 18, 2016 There is a total misunderstanding of the role of gold and why it is so critical to own physical gold. Gold should not be bought or sold based on... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 18 Nov 2016 09:11 AM PST This post The Deep State Panic of 2016 appeared first on Daily Reckoning. On the heels of the Brexit vote in June, Trump's victory in the U.S. has the upper-crust elites in full diaper-change mode… As the recent Bloomberg headline declared: "Populism Takes Over the World." And the ruling class is whining that it's a dangerous thing… The Washington Post says "populist leaders undermine democracy." And the Guardian warns that "across the world, the rule of law is losing out to rule by the mob." The fact that large swaths of the unwashed masses around the world have revolted has sent global elites into a state of mass hysteria… A Vicious SmearPampered globalists and their mainstream media sycophants have characterized Brexit and the Trump tsunami as the distasteful resurgence of sexism, racism and xenophobia, along with a "regrettable" rise of nationalism. The media narrative positions simple-minded folk driven by jingoistic opposition to immigration and trade coming out to vote en masse. CNN presents these people as unknowing morons. That's exactly how you'd expect the "no skin in the game" weak chins to describe their loss of power. Demonizing the opposition is a cheap, transparent attempt to discredit it. But now the smear campaigns don't work… In Brexit, the Brits merely re-asserted their right to self-determination, kicking away the drunk "party boy" bureaucrats in Brussels. In the U.S, the working class voted against the oppressive federal government stranglehold that only works to get the upper crust richer and richer. Peggy Noonan described it best in The Wall Street Journal: The unprotected people of America, who have to live with Washington's policies, rebelled against the protected, who make and defend those policies and who care little if at all about the unprotected. In short, it's a populist uprising of epic proportions. The unprotected have told the protected that the rigged game is over, bend over… it's your turn. The Tip of the IcebergLook, despite self-interested press fear mongering, there is nothing wrong with populism. The assertion of the rights and power of the people in their struggles against the privileged elite is a noble endeavor. It's a natural reaction to economic decline and the reality of no longer being heard by politicians who are supposed to represent their interests. As Bernhard Klee wrote in the Daily Caller: Populism is a natural force that forces leaders that behave like kings to reconnect with their people. And there's nothing wrong with economic nationalism either. When one country sees another country benefiting at its expense, it fights back… or it dies. Much of the global angst we're seeing about Trump is the fact that the rest of the world is scared that if the U.S. sets its mind to becoming an inward-looking economic superpower again, they will suffer economically. But countries such as Switzerland, Singapore, Japan and many more are all expressly run for the benefit of their own people. And that's OK. It's OK for the U.S. too. So while the ruling class continues its propaganda campaign against popular sovereignty, this fierce pushback against their corrupt system of "globalization" is just getting started… Populist movements are gaining steam in Austria, Italy, the Netherlands, France and Germany as voters in Europe head to the polls in the coming months. That means you should expect the vitriol and propaganda campaigns against populism to pick up as the people attempt to take back power. The Deep State's supremacy is under attack. It's going to use every weapon at its disposal to keep its death grip on the levers of power. The war has just started. Trump was not a knockout punch. Fight the power! Please send your comments to me at coveluncensored@agorafinancial.com. Let me know what you think of today’s issue. Regards, Michael Covel The post The Deep State Panic of 2016 appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Donald Trump: U.S. Election Aftermath | Diamond and Silk Posted: 18 Nov 2016 09:00 AM PST Diamond and Silk join Stefan Molyneux to discuss the aftermath of the U.S. Presidential election, President-Elect Donald Trump and what the future holds for the United States of America. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Miners’ Q3’16 Fundamentals Posted: 18 Nov 2016 08:56 AM PST The gold miners just finished reporting their third-quarter results, which proved very impressive. While this small contrarian sector is now languishing in the doghouse following a brutal post-election selloff, the gold miners' fundamentals are strengthening. Lower costs and higher gold prices led to surging operating cash flows and profits. The major gold miners are great fundamental bargains for contrarians today. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hillary and Soros launch America’s Purple Revolution Posted: 18 Nov 2016 08:30 AM PST Hillary and Soros launch Mass Fake Protest to overthrow US Election Results The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Mining Stocks Screaming Buy! Q3’16 Fundamentals Posted: 18 Nov 2016 08:11 AM PST The gold miners just finished reporting their third-quarter results, which proved very impressive. While this small contrarian sector is now languishing in the doghouse following a brutal post-election selloff, the gold miners’ fundamentals are strengthening. Lower costs and higher gold prices led to surging operating cash flows and profits. The major gold miners are great fundamental bargains for contrarians today. Gold-stock bulls are among the largest ever seen in all the markets. The flagship HUI gold-stock index skyrocketed 1664% higher over 10.8 years ending in September 2011, trouncing general-stock-market losses of 14% per the S&P 500. Even this year between mid-January and early August, the HUI soared 182% in just 6.5 months! Radical wealth-multiplying upside like that is well worth any psychological price. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

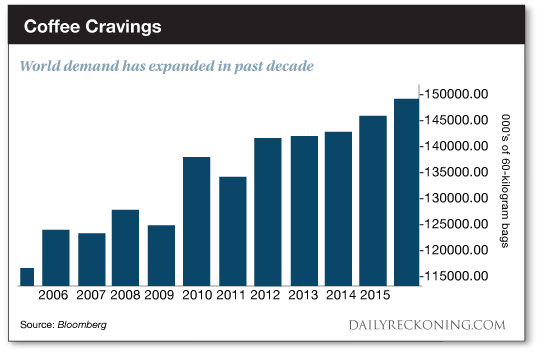

| Beans Blast Off: Here’s How to Play the New Coffee Rally Posted: 18 Nov 2016 07:18 AM PST This post Beans Blast Off: Here’s How to Play the New Coffee Rally appeared first on Daily Reckoning. Savor that morning cup of joe… Higher prices are in store for your favorite morning brew. But don't worry, you'll still be able to get your caffeine fix—especially if you know how to play this powerful new trend. In fact, disruptions in the market are setting up some lucrative trading opportunities for us. You just have to know how to play 'em… Here's what's happening: Coffee suppliers are having a pretty rough go of it this year. There are two main threats suppliers are facing right now… In the short-term, 2016 has been a terrible year for growing coffee beans. Between droughts in South America and rains in Asia, growers just can't seem to catch a break. All of this weather trouble may be much more than a seasonal problem. The ideal climate for growing coffee beans is in higher altitudes along the planet's equator. Temperate ranges of about 75 to 80 degrees… This also happens to be an area experiencing a particularly sharp change in temperature right now. That's right— the real silver bullet for the coffee industry might be climate change (just don't tell that to The Donald). Poor harvests, genetic engineering, and pests go hand in hand with rising temperatures. In short, rising temperatures lead to rising costs. The weather isn't the only force at play in the coffee market. Demand is also shooting through the roof. For this, we have those damn millennials to thank. Young adults are contributing to coffee's sharp increase in consumption. They're also drinking coffee at earlier and earlier ages. Bloomberg reports that a whopping 44% of the world's coffee is consumed by millennials. "Gains for demand mean that in the 12 months ended Sept. 30, world consumption outpaced production for a second straight season, according to the London-based International Coffee Organization," Bloomberg reports. "Coffee has posted the fifth-best return so far this year among the 22 raw materials tracked by Bloomberg Commodity Index."

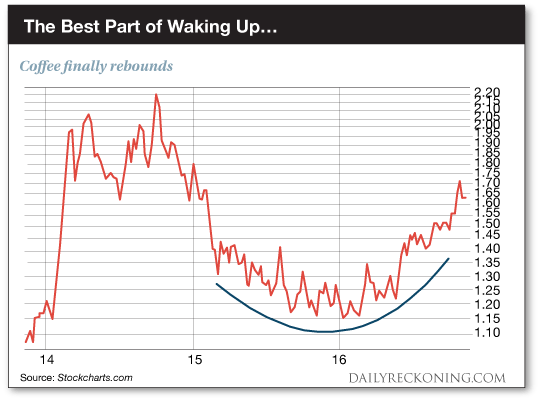

The result? The price of coffee beans has shot up by about 30% over the past six months due to weather difficulties in various growing regions and robust demand. That sets up a stellar trading opportunity for anyone paying attention. Turning to a longer-term view of coffee, you can clearly see how the commodity has put in a beautiful rounding bottom over the past 20 months. Remember, coffee prices had suffered since they topped out in 2014. By the time the price of coffee came to rest earlier this year, it had been chopped in half…

Now that coffee is moving in the right direction, you have a great shot at riding its next big spike to double-digit gains. Coffee is finally calming down after a posting a huge spike into early November. You can snag it here as it consolidates… Sincerely, Greg Guenthner The post Beans Blast Off: Here’s How to Play the New Coffee Rally appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Sell Off On Fed Noise – “Interesting Times” To “Support Gold” Posted: 18 Nov 2016 06:01 AM PST Yellen's prepared comments to U.S. lawmakers yesterday sent gold in dollar terms to its lowest finish since June 2, at $1,216.90 an ounce. It is worth noting that gold's weakness this week is very much a case of gold prices in dollar terms. Gold in euros has risen from €1,130/oz to €1,137/oz and is essentially flat in sterling pound terms. Gold has risen in Swiss francs, Japanese yen and Australian dollar terms. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total 2016 Silver Demand Hits Record High Posted: 18 Nov 2016 05:59 AM PST Bullion Vault | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Sell Off On Fed Noise – “Interesting Times†To “Support Gold†Posted: 18 Nov 2016 05:15 AM PST Gold prices in dollar terms came under renewed pressure today testing strong support at the $1,200/oz level. Gold dropped another 1% to near a 6 month low and is set for a second week of falls after the dollar soared again after Federal Reserve Chairwoman Janet Yellen suggested a U.S. interest-rate hike could come “relatively soon.” | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Newmont gold mine opens in Suriname, seen boosting struggling economy Posted: 18 Nov 2016 05:15 AM PST By Ank Kuipers MERIAN MINE, Suriname -- Suriname President Desi Bouterse and Newmont Mining Corp Chief Executive Gary Goldberg inaugurated Thursday the open-pit Merian gold mine, which is expected to give a boost to the small, economically struggling South American country. The mine has gold reserves of about 5.1 million ounces and its annual production is expected to average between 400,000 and 500,000 ounces during the first five full years of operation. Suriname's state-owned oil company, Staatsolie, has a 25 percent stake in the mine. "Never before did our country have the courage to participate as an equal partner in such a mining venture," Bouterse told hundreds of guests and mine employees at the opening ceremony. ... ... For the remainder of the report: http://www.reuters.com/article/us-suriname-mining-newmont-idUSKBN13D08Z ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| India's income tax men may come calling on gold buyers Posted: 18 Nov 2016 05:11 AM PST By Ram Sahgal MUMBAI -- The taxman may knock on your door if you bought gold immediately before or after high denomination currency notes were withdrawn -- even if you paid for the precious metal by cheque or credit card. Excise authorities have issued notices to 600 jewellers to give details of stocks and sales for each day from Nov 7, a day before the announcement, to Nov 10, the India Bullion & Jewellers Association told The Times. This might be one of the reasons to have caused jewellery and bullion demand to fall sharply in the days after the notices were issued last Friday. ... For the remainder of the report: http://economictimes.indiatimes.com/markets/stocks/news/-income-tax-men-... ADVERTISEMENT K92 Mining Begins Gold Production at Kainantu Mine Company Announcement K92 Mining Inc. is pleased to announce that gold production has commenced from the Irumafimpa gold deposit. Ian Stalker, K92 Chief Executive Officer, says: "This milestone is highly significant for our company, and for this region of Papua New Guinea. A great deal of thanks goes to the entire team on site in PNG in achieving production ahead of schedule and on budget. The rehabilitation of the Irumafimpa gold mine, process plant, and associated infrastructure commenced in late March and is now complete. As an enhancement of the processing facility, we are also pleased to note that the installation of a new drum scrubber is also nearing completion and commissioning of this will be completed by the end of the month. ..." ...For the remainder of the announcement: http://www.k92mining.com/2016/10/6077/ Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| May Never Get Another Opportunity to Buy Gold at this Level Again Posted: 18 Nov 2016 05:05 AM PST America has chosen Donald Trump to be its next President and the world markets, whether metals, gold, bonds, equities or Forex are all highly volatile. In fact, I got long GDX and NUGT last week for a quick 5% and 11% gain with gold miners, a get-in and get-out type of trade to take advantage of these extreme volatility levels. While the initial projections were for a Brexit type turmoil in most markets, those predictions did not prove to be correct. The markets quickly reversed course and gave a strong Thumbs up to Trump’s policies. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 18 Nov 2016 01:37 AM PST Interest rates becoming the main story. Bond yields and mortgage rates up, emerging market bonds and stocks down. Gold and silver stabilizing, mining stocks begin to recover. Political class still searching for an explanation (see “Best of the Web”). Trump’s cabinet takes shape, with mostly old and a few new faces. Best Of The […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Prices Flirt with '$1200 Support' as Dollar Soars Posted: 17 Nov 2016 04:00 PM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Islamic Gold – Vital New Dynamic In Physical Gold Market Posted: 17 Nov 2016 02:30 PM PST gold.ie |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment