Gold World News Flash |

- FTSE 100 surges towards 7,000 and dollar stabilises as dramatic Trump turnaround rally continues - markets live

- Gold Spikes Over $60 Before Pulling Back After Trump Upset Shocks The World! But Here Is The Real Shocker…

- Trump Is About To Learn That The Recovery Is Fake & The Economy Is About To Collapse

- Be Prepared – Precious Metals

- The Simpsons predicted Donald would become US President 16 yrs ago

- VIRAL: How the world sees Russia after Trump wins US Elections

- BREAKING: Obama's White House Doesn’t Rule Out "Pardoning Hillary Clinton"

- BREAKING: ELECTION RESULTS ARE IN! WAIT TIL YOU SEE WHO WON THE ELECTION

- America to Elites: YOU’RE FIRED!

- YOU’RE FIRED!

- RIGGED for HILLARY: Voters Horrified, EXTRA VOTES Inside 5+ Electronic VOTING MACHINES !

- IT'S OVER!!! NOW LET'S SEND HER TO PRISON! POST ELECTION SUPER SHOW

- Gold Daily and Silver Weekly Charts - Deny and Defy - The Newer of Two Evils

- Trump Unexpectedly Turned Over Mic at Victory Speech to Reince Preibus, RNC Chairman.

- Why Trump and not Paul?

- ALERT ALERT: MASSIVE BOND SELLOFF! BEWARE OF THIS STOCK MARKET. By Gregory Mannarino

- Brexit deja vu?: Markets having hard time handling US election result

- The Panic Has Begun! Economic Collapse Coming After The Election

- President-Elect Trump Rallies Biotech

- David Stockman: We Have A BREXIT On Steroids

- President Elect Trump – A New Era of Unpredictability Awaits

- Dow Futures Down 777 Points As Trump Is Selected During Jubilee Time Period

- The big scandal isn't government's market rigging but news media's ignoring it

- LIVE: Obama speaks on US presidential election results

- The Market is in Shambles, What’s Next Could be Worse

- HISTORY AND FUTURE OF TRUMP'S TRIUMPH OVER NASTY POWERS | Sheikh Imran Hosein

- Nigel Farage on President Trump - "2016 The Year of 2 Great Political Revolutions"

- President Trump’s Political Black Swan

- Canadian mint employee guilty of smuggling $138,000 of gold in rectum

- Dow Futures Down 777 Points As Trump Is Selected During Jubilee Time Period

- Before You Trade Trump, Read This…

- Gold Surges 5% After America Votes Trump President

- Uncertainty about OPEC and US Election Leads to Oil Price Drop

- America is The Poisoned Chalice

- Gold Has No Place In A Modern Monetary System

- BrExit Swing States Win Donald Trump the Presidential Election 2016 As Forecast

- Peak Gold Theory Strengthened as Q3 Marks Second Consecutive Quarter of Production Declines

- Credibility, Confidence, Chaos and GOLD! - Gary Christenson

| Posted: 10 Nov 2016 01:59 AM PST This posting includes an audio/video/photo media file: Download Now |

| Posted: 09 Nov 2016 09:58 PM PST |

| Trump Is About To Learn That The Recovery Is Fake & The Economy Is About To Collapse Posted: 09 Nov 2016 06:33 PM PST GM will be laying off 2000 employees. The corporate media is beginning to tell us how bad the economy is going to get. The housing market is declining rapidly. Wholesale misses expectations. Will trump get rid of Yellen or will he take the next step and get rid of the central bank. The election... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 09 Nov 2016 06:25 PM PST My Dear Extended Family and Friends, This article is about precious metals and their importance in preparedness. In this article, we are specifically referring to gold and silver when using the terms precious metals. These are not the only precious metals, but these are the metals familiar to most people and which are most likely... Read more » The post Be Prepared – Precious Metals appeared first on Jim Sinclair's Mineset. |

| The Simpsons predicted Donald would become US President 16 yrs ago Posted: 09 Nov 2016 05:30 PM PST Trump was the placeholder joke name... and that's still true': The Simpsons predicted Donald would become US President 16 years ago The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| VIRAL: How the world sees Russia after Trump wins US Elections Posted: 09 Nov 2016 04:30 PM PST WOW: Russians take to the streets after Donald Trump wins 45th US Presidential election The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| BREAKING: Obama's White House Doesn’t Rule Out "Pardoning Hillary Clinton" Posted: 09 Nov 2016 03:30 PM PST BREAKING: Obama's White House Doesn't Rule Out "Pardoning Hillary Clinton" The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| BREAKING: ELECTION RESULTS ARE IN! WAIT TIL YOU SEE WHO WON THE ELECTION Posted: 09 Nov 2016 03:00 PM PST Danny Gold for Liberty Writers reports, The most important election in US history is in full swing right now, but we just managed to get our hands on one of the BIGGEST results of the entire night! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

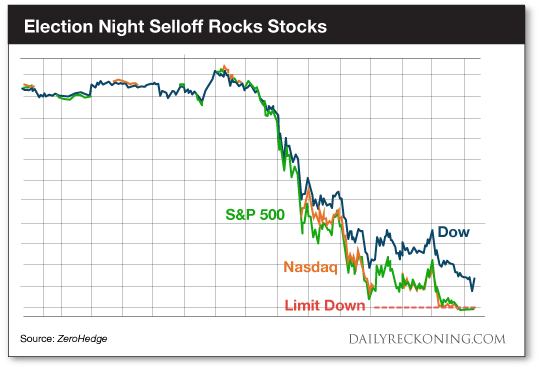

| America to Elites: YOU’RE FIRED! Posted: 09 Nov 2016 02:50 PM PST This post America to Elites: YOU’RE FIRED! appeared first on Daily Reckoning. Some hinge has given way, somewhere in the universal order… The Cubs just won the World Series. Bob Dylan just won a Nobel Prize. And Donald John Trump just won the White House. We try to reduce the thing to words… yet we try in vain. Trump's won the purple. The pundits… the polls… the stock market… the betting market. All got it wrong. Spectacularly, stupendously, gloriously… wrong. As late as 8:17 last night, PredictWise gave Trump a 7% chance. But who got it right? Jim Rickards — the Oracle at Delphi. First, he called Brexit in June… when all the "experts" heckled him off the stage. Now he's called last night's election, when all the same experts laughed him off again. From Jim's Twitter feed this morning, digging his thumbs in their eyes: "Anyone listening to mainstream media explain 'How Trump won,' after they told you for a year that he couldn’t win is beyond hope of rescue." Jim nailed it. Even after Sunday's green light from the FBI, when all the experts, all the polls, all the markets said Hillary… Jim stood solid on his bedrock. Monday's Daily Reckoning title, in 48-point font, bold: "Rickards: Trump Still Wins." But Jim's been whistling the same tune for weeks. Also from Monday: I first issued a forecast that Trump would win the election before the Oct. 28 announcement by the FBI that the Hillary email investigation was being reopened. How was Jim able to get Brexit and Trump right when everyone else got it wrong? Because of the fancy-shmancy analytical tools he uses. He's applied them to his intelligence work with the CIA and the Pentagon. These days, Jim uses them to forecast events in capital markets. One of his tools is something called Bayes' theorem. "This is the same method we used to correctly forecast the outcome of the Brexit vote," said Jim last week. "Now we're using it to forecast the likelihood of a stock collapse in the event of a victory by Donald Trump in the U.S. presidential election on Nov. 8." Jim warned that markets were pricing in a Hillary win and would "hit an air pocket" when Trump won. He was right. Dow futures plunged as much as 800 points in overnight trading. The S&P fell 5% overnight. That triggered a trading halt to stop the hemorrhaging. It's true, the market made good its losses today. And then some. Seems Trump's gentlemanly victory speech soothed the savages. That's our take, anyway. But brother, did it look hairy. Jim also said gold would go bonkers. Sure enough, gold was up over $50 at one point last night. Rickards Gold Speculator subscribers got an alert this morning advising them to take profits on certain positions. They were able to cash in to the tune of 66%, 81% and 117%. Here's what one happy reader wrote: "I bought gold after you explained the exit polls numbers yesterday, I made a nice profit, thank you." And as Jim said this morning, gold "will go much higher. Trump’s policy is 'helicopter money.'" Trump's no Larry Libertarian. He's promised a blizzard of infrastructure spending. The markets seemed to have found their footing in the meantime. But the earth could soon give way… Yes, Jim warned about the election. But he's also warning about a looming rate hike when the Fed meets next month: "If a Trump victory didn’t wreck the stock market," Jim tweeted this morning, "the Fed will. Rate hike still coming in December." Fed funds futures put a December rate hike above 85% before the election. The odds fell below 50% when the market was half out of its mind overnight. But now that the market's come to its sober senses, odds are back above 80%. “We think economic conditions and Fed rhetoric both point to going in December,” said Credit Suisse economist Jeremy Schwartz today. The market tanked 10% in the two months after last year's rate hike. And Janet Yellen used all her bullets to bring it back. She enters the next fight unarmed. But Yellen's a Democrat. And Trump threatened to dump her if elected. Maybe she'd like to leave him a nice little gift on the way out the door? Nothing like a market crash to welcome a new president. Yellen may be out of ammo. But she could still go out with a bang. David Stockman just wrote a book about the rise of Trump and his war against the establishment. Below, David shows you exactly what last night means for America. Read on. Regards, Brian Maher Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post America to Elites: YOU’RE FIRED! appeared first on Daily Reckoning. |

| Posted: 09 Nov 2016 02:13 PM PST This post YOU’RE FIRED! appeared first on Daily Reckoning. America’s voters fired their ruling elites last night. After 30 years of arrogant misrule and wantonly planting the seeds of economic and financial ruin throughout Flyover America, the Wall Street/Washington establishment and its mainstream media tools have been repudiated like never before in modern history. During the course of the past year, upwards of 70 million citizens — 59 million for Trump and 13 million for Bernie Sanders — have voted for dramatic change. That is, for an end to pointless and failed wars and interventions abroad and a bubble-based economic policy at home. The latter showered Wall Street and the bicoastal elites with vast financial windfalls — even as it left 90% of Flyover America behind, where households struggled with stagnant wages, vanishing jobs, soaring health costs, shrinking living standards and diminishing hope for the future. The voters also said in no uncertain terms that they are fed-up with a “rigged” system that has one set of rules for establishment insiders and another for everyone else. In essence, that’s what servergate, the Clinton Foundation pay-to-play scandals and the trove of Wikileaks DNC/Podesta hacks was all about. Indeed, in his brawling style, the Donald in effect convinced a huge slice of the electorate that the Clintons amounted to America’s leading crime family. And while he may have exaggerated the extent of their personal crimes and misdemeanors, the latter functioned as a proxy for the beltway racketeering that has become the modus operandi of the Imperial City. Stated differently, the people did connect the dots. There is a straight line from repeal of Glass-Steagall by the Rubin-Clinton democrats in the late 1990s through the resounding repudiations of the Clintons last night. This string includes the M&A roll-up of the giant Wall Street banks after 1998; the subprime mortgage scams, housing booms and subsequent crash during the next decade; the panicked multi-trillion bailouts of the Wall Street gambling houses in the fall of 2008 and the lunatic spree of central bank money pumping that followed; the soaring stock market fueled by the Fed’s free money that arose therefrom; and the egregious global fund-raising and shakedowns of the Clinton Foundation and personal wealth accumulations by the Clinton’s personally, capped by Hillary’s notorious $250,000 off-the-record speeches to Goldman Sachs. What happened was that during the eight Obama years, Washington essentially borrowed $10 trillion, or nearly as much as the first 43 presidents did over 220 years, while the Fed expanded its balance sheet by 5X more than had happened during its first 94 years of existence. This feckless resort to monumental public borrowing and money printing did generate a faux prosperity in the Imperial City and a $25 trillion gain in financial wealth among the gambling and financial asset owing classes at the top of the economic ladder. But the bicoastal elites in Washington, Wall Street and Silicon Valley and its environs, luxuriating in their good fortune, essentially assumed that all was fixed and all was forgotten from the dark days of the financial crisis. Not at all. The rubes remembered. No one in America supported the Wall Street bailouts except a few ten-thousands Wall Street operators, hedge funds and other gamblers; and the politicians and Keynesian policy apparatchiks who saw it as a new route to power and spoils. What happened last night — especially in the rust belt precincts where 70,000 factories have already closed and 6 million breadwinner jobs have disappeared — was nothing less than the third vote on TARP. Whereas the cowardly House GOP had capitulated to Wall Street and their spineless leaders on the second vote in late September 2008, the rank and file voters of Flyover America last night proclaimed loudly that it had not been done with their leave. Not at all. The resentments and anger on main street has not only been simmering for years; it’s inhabitants have also figured out that it was on their backs that Wall Street was rehabilitated and then inflated to hideous valuations that bear no relationship to the faltering economy of main street. Indeed, after getting a bailout they hated, main street then got a rogue central bank run by clueless Keynesian academics who deliberatively and callously savaged savers and retirees; and also tried purposefully to trash worker wages with even more inflation than what was already destroying their jobs and shrinking the purchasing power of their paychecks. We are now more convinced than ever that 2% inflation targeting is the greatest governmental assault on the working classes known to modern history. And the working classes of Flyover America — whose jobs are most exposed to the China Price on goods and the India Price on services—-finally said they are not going to take it any longer. That’s a start, but it’s way too late for orderly reform and incremental change. The essence of last night’s thunderbolt — Brexit 2.0 on steroids– is that the ruinous rule of the existing Wall Street/Washington establishment has been repudiated and ended. But there is nothing to replace it. Donald Trump has no coherent program at all — just a talent for name-checking the symptoms and rubbing them raw. So as I said on Fox Business last night at about 11:30 PM, when I called the election for Trump long before the networks could bring themselves to face the truth, the election is over and the nation’s long nightmare has just begun. For months and years to come, the Imperial City will be ungovernable and the nation will be racked with fiscal, financial, political and even constitutional crisis. By kicking the can in a ruinous direction for decades, America implicitly opted eventually for the bleeding cure. The giant stock market bubble will now crash. The stock-price obsessed C-suites of corporate America will now panic and begin pitching inventory and workers overboard. We will be in an official recession within 6 months. The Federal budget will plunge back into trillion dollar annual deficits very soon. Accordingly, Washington will descend into permanent warfare over the debt ceiling and an exploding $20 trillion public debt. Any notion of a Trump economic revival program — even if it could now be confected—will be stillborn in the financial and fiscal chaos ahead. And most important of all, the almighty Fed will be stranded high and dry — out of dry powder and under political attack like never before from angry politicians and citizens alike. The jig is up. Regards, David Stockman Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post YOU’RE FIRED! appeared first on Daily Reckoning. |

| RIGGED for HILLARY: Voters Horrified, EXTRA VOTES Inside 5+ Electronic VOTING MACHINES ! Posted: 09 Nov 2016 01:30 PM PST Voters Horrified When They Realize EXTRA VOTES Inside LA Voting Machine. 5+ Electronic voting machines in Louisiana were found to be "SPPUTING OUT VOTES FOR DEMOCRATIC PARTY" even though "they were NOT used yet." The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| IT'S OVER!!! NOW LET'S SEND HER TO PRISON! POST ELECTION SUPER SHOW Posted: 09 Nov 2016 01:24 PM PST clean out Guantanamo and all illegal prisons, we need room for the Clinton's and all their cronies. I know I'm just dreaming but wouldn't that be nice? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Daily and Silver Weekly Charts - Deny and Defy - The Newer of Two Evils Posted: 09 Nov 2016 01:23 PM PST |

| Trump Unexpectedly Turned Over Mic at Victory Speech to Reince Preibus, RNC Chairman. Posted: 09 Nov 2016 01:00 PM PST Trump Unexpectedly Turned Over Mic at Victory Speech to Reince Preibus, RNC Chairman. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 09 Nov 2016 12:32 PM PST Donald Trump led a gut-level attack on the Establishment. Listening to a Trump speech you didn't learn economics or the philosophy of liberty; you only heard what you already knew: you were getting the shaft from the elites. Ron Paul understands liberty and how it relates to economics, especially monetary theory, and attempted to educate Americans on some important points. Although his approach had strong appeal to young people it didn't wake up enough older Americans to create a major movement. And that was our loss. Is it too late? Maybe not. Ron Paul rightly made the Fed a campaign issue. As I understand him, he sees the Federal Reserve as the institution most responsible for the decline of our civilization. Aside from government itself, I agree. Main Street people don't understand the Federal Reserve. They sometimes confuse it with the Treasury if they think about it at all. They have no idea what the Fed really does, other than adjust interest rates somehow. To them the Fed is a big black box, but evidently an important one. The FOMC gets together every so often and issues statements that are meaningful to a handful of people. It is Greek to the rest. This is one way the Fed protects itself. If it were widely seen as a monopoly counterfeiter the legitimacy of government would collapse. You don't get big government without a means of funding it, and if you need money — lots of it — and have already raised taxes to their political limit, the government solution is to print it into existence. Think of a child playing make-believe. Long ago government counterfeiting often meant debasing the monetary gold or silver by mixing it with less valuable metals, but the citizens who were forced to use it could easily tell a fake from the real thing. They would hoard the latter and use them on the black market. With the invention of paper money the defense against bad money disappeared. One bill looked the same as the next. As the long as the paper was a substitute for a weight of gold or silver, though, people could always attempt to claim the coins the paper represented. Fractional reserve banking made this impossible for every note holder and caused crises when depositors showed up asking for their gold, which the banks didn't have. Bankers were not inclined to throw away a profitable practice like fractional reserve banking, even though it amounted to embezzlement. The solution was a central bank, but Americans were distrustful of centralized institutions. In the U.S. big bankers got together and devised a central bank so named as to appear not to be a central bank: The Federal Reserve System. It became law in 1913, along with the income tax amendment to the Constitution. As World War I proved conclusively, wars and welfare are much more affordable when governments can print the money for their undertaking. Under the new centralized system, the Fed coordinates member bank inflation, so that any one member can't over-inflate and cause a run on its reserves. But there was still a problem: Every dollar still had to be redeemable in gold coin. In 1933 President Roosevelt solved the problem by criminalizing the possession of gold coins. The floodgates were now open. Government could expand as it saw fit by borrowing the money it needed from the counterfeiter around the corner. After the 1930s Americans found their dollars gradually evaporating in purchasing power, as former Fed chief Alan Greenspan noted in 2002. As Keynes had warned earlier it is an insidious system that few can diagnose. Inflationary monetary policy became one of the twin fiscal engines driving pathological government expansion, the other being withholding. Does Donald Trump understand any of this? Does he care if he does? Is he motivated to find out if he doesn't? If he's concerned about the plight of the middle class, he should be. I think Austrian economists are in a strong position to influence the president-elect. Ron Paul and other Austrian economists forewarned the crash of 2007-2008. The Keynesians remained blissfully ignorant. The Austrians didn't just predict it, they explained why it would happen in terms of the Austrian Business Cycle Theory. The Austrians also warned against government interference with the recovery. Unsound institutions should be allowed to fail, regardless of size. Genuine recovery arrives sooner. As a model of how to proceed they pointed to the Depression of 1921 and to the hands-off approach during the 19th century. As a model of how not to proceed they referred to the Crash of 1929 and its long, bloody aftermath. And as a way of avoiding the business cycle altogether, they recommended removing the cause: Repeal of the Federal Reserve Act of 1913 and all legal tender laws. This may be too much for any president, even a maverick like Donald Trump. But he could take the first step by removing the Fed's note-issuing monopoly. Allow competition in money. And may the best money win. |

| ALERT ALERT: MASSIVE BOND SELLOFF! BEWARE OF THIS STOCK MARKET. By Gregory Mannarino Posted: 09 Nov 2016 12:30 PM PST On the Simpson when "Chump became president "selected" Lisa said/quoted something you mean the president trump who caused the economic crash. Plus puppet oBOMBa ain't done yet and is going to get WW3 popping before he so called leaves office. The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Brexit deja vu?: Markets having hard time handling US election result Posted: 09 Nov 2016 12:26 PM PST Crude prices stopped falling after Wednesday morning's sell-off, triggered by Donald Trump winning the US presidential election. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The Panic Has Begun! Economic Collapse Coming After The Election Posted: 09 Nov 2016 12:00 PM PST As the economy continues to deteriorates the labor market is showing signs of rolling over. Job hiring and payroll are starting to decline.Consumer credit and student loan debt hits all time highs, the Government is the primary source of consumer credit. After the elections the economic nightmare... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| President-Elect Trump Rallies Biotech Posted: 09 Nov 2016 12:00 PM PST This post President-Elect Trump Rallies Biotech appeared first on Daily Reckoning. The election is (finally) over. Maybe you're basking in the orange glow of President-Elect Trump. Maybe you're looking up the cheapest one-way ticket out of this country… But one thing is for sure: The markets looked downright scary last night. Futures began falling as the likelihood of Trump nabbing Florida became reality. They continued to trend lower until the Dow was off by 700+ points. Luckily, the market seemed stable when it opened this morning. In fact, one sector even rallied — biotech stocks took off! What had investors scrambling to buy in such an uncertain market? It's been an icey year for the biotech sector, made all the worse by constant talk of price-gouging on the campaign trail. In a tweet that roiled the market last year, Hillary Clinton recommended implementing pharmaceutical price controls, and continued to make it a political focus throughout her campaign. Naturally, fresh off the heels of a Trump win/Hillary loss, investors started snatching up shares in the biotech sector left and right. The Nasdaq Biotech Index was up 5% when markets opened this morning. Pharmaceutical price reform would, of course, probably control prices and cap biotech profits — a reason we've seen the selling in biotech names throughout 2016. It might satisfy a thirst for blood when one bad actor, like Martin Shkreli or Mylan Pharmaceuticals, games the system. But it would cost us far more in the long run. Frederic Bastiat, a famous 19th-century French political economist, described these consequences as the "unseen." A policy may be able to achieve a desired end but create far worse problems not immediately apparent. And that would be the case with price controls on new drugs as a means to control health care expenses. Despite popular misconceptions, prescription drugs are only a small slice of total health care spending. Sure, with price controls, we'll enjoy cheaper prices on existing drugs. That's the "seen" part of the equation Bastiat wrote about. But the "unseen" will emerge when there are fewer new ones. When it comes to lifesaving new drugs, our pharmacies will start to look bare. The incentives to develop new drugs will begin to evaporate. And we may even run into shortages of existing drugs. The rationale behind price controls for prescription drugs assumes that they can reduce the cost of health care. That's a big assumption. One 2002 paper published for the National Bureau of Economic Research found that every dollar spent on new drugs reduced other health expenditures from $7-8. In other words, breakthrough new drugs, on the whole, reduce overall health care costs. One good example are cholesterol-lowering statin drugs. These are among the best-selling drugs in history. Some statins have generated peak sales of over $10 billion a year… However, think of all the heart attacks and strokes they've prevented over the years, and the hospitalization and surgery costs that have been avoided. Some estimates put the price tag of a severe heart attack, including both direct and indirect costs, as high as $1 million. And then there's the benefit in terms of life. What's it worth for someone with cancer to be able to live for years longer than they would otherwise? It's hard to put a price tag on that. New drugs not only save money, they save lives. That's precisely why America needs more new drugs. Plus a business climate that rewards research and development. Finally, it's possible today's biotech pop is the beginning of a return to market sanity for the sector, and could signal more big moves in the months ahead. To a bright future, Ray Blanco Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post President-Elect Trump Rallies Biotech appeared first on Daily Reckoning. |

| David Stockman: We Have A BREXIT On Steroids Posted: 09 Nov 2016 11:53 AM PST This post David Stockman: We Have A BREXIT On Steroids appeared first on Daily Reckoning. "We have a thunderbolt. We have a Brexit on steroids." David Stockman joined the cast of Fox Business during Neil Cavuto's Coast to Coast coverage. In discussion the best selling author answers hard pressed questions on the economy, Trump, the Federal Reserve. He even breaks the election mystique and lays out the clear math for the TV commentators – quite literally calling the election before Fox Business had a chance. "The good news is, the night is almost over. The bad news is, the national nightmare starts tomorrow. The United States will become ungovernable for the next year. There will be chaos.” “We are going to have a debt ceiling expiration in March. There is no way they will extend it without a government shutdown time after time. Trump has no programs. He came in on the fact that the people are fed up with the establishment." David Stockman is a former Reagan White House official who worked on Wall Street for over two decades. His latest urgent call is within his new book, Trumped! A Nation on the Brink of Ruin… And How to Get it Back – out now. When asked about what to expect from the US central banking policy under the incoming Trump administration Stockman proclaimed, "The Fed is now going to be in the spotlight. Trump said that we have a huge bubble – that is fat, ugly and going to crash. He is right." The Fox Business panel then pressed the former Reagan insider on what to expect from the government and economy. David Stockman looked outright troubled noting, "We are going to have fiscal chaos. The market will be down several thousand points within the next couple of days. It will precipitate a recession. When we get a recession we are going to be back in the trillion dollar deficit. The point is, you have to face this. We have been living in a fantasy land. We are just going to begin to start reckoning with it." "We have got $20 trillion of debt now. When I was with Reagan and cutting taxes in 1981 we had $1 trillion of debt. It is a totally different world. We are in big time crisis." To see the full Fox Business election night interview with David Stockman and why he believes the Trump election is Brexit on steroids click here. Regards, Craig Wilson, @craig_wilson7 Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post David Stockman: We Have A BREXIT On Steroids appeared first on Daily Reckoning. |

| President Elect Trump – A New Era of Unpredictability Awaits Posted: 09 Nov 2016 11:30 AM PST nobody has any idea what Donald j Trump will do... he is the blank slate, he has no record or writings! all we know is what he's said, now we get to see what he will DO!!! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Dow Futures Down 777 Points As Trump Is Selected During Jubilee Time Period Posted: 09 Nov 2016 10:30 AM PST They didn't decide during the run that trump was gonna be it, this was already in the agenda decades ago that trump would become president in 2016. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The big scandal isn't government's market rigging but news media's ignoring it Posted: 09 Nov 2016 10:25 AM PST 1:29p ET Wednesday, November 9, 2016 Dear Friend of GATA and Gold: As Donald Trump's election as president of the United States became apparent last night, Dow futures collapsed as much as 800 points and gold rose more than $50. But by this afternoon the Dow was up about 1 percent and gold had fallen back to a gain of barely a dollar. What calmed things down so much? No one can be sure without gaining access to the trades undertaken surreptitiously by central banks in the last 12 hours or so, but the result was entirely predictable and indeed was predicted by your secretary/treasurer, among others, when GoldSeek asked for comment early this morning: http://news.goldseek.com/GoldSeek/1478703513.php "In the morning," your secretary/treasurer told GoldSeek, "the Fed, the Treasury, and the other Western central banks will still be operating in the currency, bond, commodity, stock, and, yes, the monetary metals markets. If he's elected, Trump won't be giving instructions to the Fed and Treasury until January, if he even has any idea by then of the market rigging the government does. If he ever finds out, he still would have to care about it before the possibility of change arose. He well could be talked out of caring." Similarly, GATA Chairman Bill Murphy linked the FBI's abrupt re-vindication of Hillary Clinton last week with the U.S. administration's desire to get the Dow back above 18,000 in advance of the election. That governments intervene secretly in markets and are thereby destroying market economies and cheating investors everywhere isn't even the big scandal anymore. The big scandal is that mainstream financial news organizations won't report this intervention even as it becomes not just more obvious but spectacularly so. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| LIVE: Obama speaks on US presidential election results Posted: 09 Nov 2016 10:15 AM PST US President Barack Obama is speaking on the results of the presidential election, which saw Donald Trump beating Hillary Clinton. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The Market is in Shambles, What’s Next Could be Worse Posted: 09 Nov 2016 10:05 AM PST This post The Market is in Shambles, What’s Next Could be Worse appeared first on Daily Reckoning. While the financial market might be all consumed by the chaos from the election, there is something even more perilous on the horizon and coming fast. It’s not Trump. It is, as G. Edward Griffin labeled it, The Creature From Jekyll Island. The US Federal Reserve has set the groundwork to raise interest rates in December, and potentially multiple times in the next year ahead. The market continues to have a persistent fear of interest rate hikes. The real issue that markets should be focusing on appears to be lost in the noise. What happens when the next crisis hits and a real recession recession is triggered in which global markets begin to crack again? Under such circumstances how far can the Fed actually cut rates if they are only at a laughable one or two percent? The U.S central bank has positioned itself into a very narrow corner. This could mean detrimental impacts on the longevity of cheap money afforded by the US central bank. It could impact the global fiat money culture that has permeated just under the surface in order for investors to have enough confidence to carry on. It could show that the house of cards of the economy is taking on water. While Fed Chair Janet Yellen indicated in her August speech that the Fed had the "authority to pay interest on excess reserves and our asset purchases" in its crisis toolkit – interest rates will always be the last line of attack. The Fed has traditionally stepped in when the economy is sinking and will purchase massive amounts of government or Wall Street debt. Interest rates matter under such circumstances because it would leave the US Central Bank in a vulnerable position to enormous losses. This could also send a global reaction for neighboring banks to immediately hike up their rates, ultimately dishing out the government with a higher bill to pay on its debt load. History and Interest Rate HikesThe last time interest rates were raised was in December 2015. The Federal Open Market Committee (FOMC) board members all voted in unison, though even some members publicly addressed varying concerns at the time. The Fed waited nearly 7 years to move. As it held rates it evolved into the most accommodative central bank for the stock market in history. The market could move on virtually free money. When the Central Bank finally chose to act, it only moved the rate from near zero up twenty five basis points. Since then, speculators have waited 12 months to once again wait, decipher and proceed. Last year in the midst of the December rate hike one chief economist strategist on Wall Street noted that, “If we go through 2016 where real growth doesn’t pick up but wage and price pressures do because we’re in full employment, that’s stagflationary.” The commentator could not be more right on a stagnant economy. But what he missed out on was exactly what the market was watching and what it wasn't. Both of the recent Fed Chairs (Ben Bernanke and Janet Yellen) that were in place through the current economic lull have had to maintain a facade of extended recovery. By dropping interest rates, pushing forward an Americanized quantitative easing program and maintaining policy to coddle Wall Street they have kept the system buoyant. The actions they took, including low-to-minimal rates, together with $3.7 trillion in QE printing was their attempt at a silver bullet for the financial markets. While dealing through the worst economic turmoil to hit the US and the global economy since the Great Depression, this approach seemed to be the greatest option that could be belted out. That type of an approach does not come without cost. As David Stockman writes, "We have a rogue Central Bank that's out of control in printing money. Ninety months of zero interest rates. A continued massive quantitative easing program." He points out that none of the actions taken by the Fed have actually translated to a "Flyover America" recovery. Main Street has bit hit as Wall Street has been given a free pass. Interest rate talk has come at the interest of everyday Americans. What Raising Rates Would Do?In the face of such lackluster growth, an inability to match inflationary targets and the sheer lack of bold action – the Fed has now decided that following the election would be an ideal time to again raise interest rates. Some have speculated that the Fed could simply raise its inflation rate targets in order to meet their goals. This action, it is assumed, would alleviate pressure on interest rate moves by the Fed and the market. However, these types of ad-hoc moves would significantly undermine central bank credibility and significance within the market. Considering that the past two decades have been consumed by an aim at delivering a 2% inflation rate, any manipulation of that target would hit long-term financial goals investments the world. What that all equates to is that if the Fed selects a different approach to the problems facing the economy, confidence could be spooked. The system could shake. The emperor would realize – he has no clothes. So now that Yellen has decided to take measures in order to raise interest rates, where does that leave the market? Even if the Fed was to raise rates all the way to a two or three percent interest rate setting – it still leaves minimal options in being cut during crisis. The Fed's strategy during the 2008 crisis was to lower interest rates and to pump money back into the private banking system. This time around, it has left a massive vulnerability gap in its toolkit to react and triage an economic spiral. Jim Rickards has correctly predicted Brexit, a Trump election victory and now has his eyes set on the Fed. He noted back in September of this year following meetings in Jackson Hole, "Yellen basically said that interest rate cuts, quantitative easing, interest on excess reserves and forward guidance were sufficient to pull the U.S. economy out of a future recession if needed. In short, Yellen said the Fed's existing toolkit is adequate, and is unwilling to consider more radical tools or remedies. If you like weak growth, money printing and market manipulation, get ready for more of the same." He even recently took to Twitter to draw attention to the threatening Fed action:

How to Play An Interest Rate HikeBuckle up. When the Federal Reserve raises rates just to cut them, that is when the real roller coaster is set to begin. After money spending, money printing and money manipulation are no longer on the table – either creative measures are implemented or a credibility shock sets in. Even Billionaire investment minds like Carl Icahn have noted that the writing’s on the walls. Earlier this year he addressed a conference suggesting that the Fed is running on fumes and that real trouble is on the horizon. While looking out at the attendees of the "Delivering Alpha" he professed that, "You look at the environment, and I think it's very dangerous. You're walking on a ledge and you might make it to the end, but you fall of that ledge and you're really going to see trouble." Jim Rickards warned last month on the Fed that, "With this as prelude, investors should hang onto short positions, build cash positions, reduce long equity bets and be prepared for continued strength in the dollar, at least through the end of the year." He goes on to note that "You should have some gold, land, and other hard assets to weather this storm. But, even with those hard assets, there's still room for a diversified portfolio. You should never go "all in" on any one asset class including gold, which is why I recommend putting only 10% of your investable assets in gold." While there may not be enough time between now and the next financial crisis for the Federal Reserve to adjust interest rates accordingly – and not to the market expectations – it does not mean you have to be left in the dark. Bold options, observant analysis and prudent preparations will secure your money and understanding of what is to come. Think the election shock was bad for the market – what is coming could very well be worse. The market very well could miss seeing the forrest and the trees. Regards, Craig Wilson, @craig_wilson7 Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post The Market is in Shambles, What’s Next Could be Worse appeared first on Daily Reckoning. |

| HISTORY AND FUTURE OF TRUMP'S TRIUMPH OVER NASTY POWERS | Sheikh Imran Hosein Posted: 09 Nov 2016 09:38 AM PST HISTORY AND FUTURE OF TRUMP'S TRIUMPH OVER NASTY POWER | Sheikh Imran Hosein Latest Donald Trump Wins USA Elections 2016 Donald Trump Becomes USA President USA Elections Live update Hillary Clinton Crying Over Defeat in USA Elections 2016 The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Nigel Farage on President Trump - "2016 The Year of 2 Great Political Revolutions" Posted: 09 Nov 2016 09:37 AM PST Nigel Farage discusses the result of the 2016 Presidential Election The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| President Trump’s Political Black Swan Posted: 09 Nov 2016 09:35 AM PST This post President Trump's Political Black Swan appeared first on Daily Reckoning. What the hell just happened? America just happened. Yes, it's the most astonishing political surprise of your lifetime if your last name was Clinton or Bush. In short, America just raised a giant middle finger to the bipartisan ruling class. Here's what it all means… What We Learned…Early on, here are things we learned on Election Day… Trump campaigned on the theme of draining the Deep State swamp in Washington. Mainstream Americans just gave him the green light to do just that. We also now know that pre-election polls were literally fake – big time… Most had Hillary Clinton leading by at least a few points before the election. Trump’s odds of winning were at 5/2 and Clinton’s were 2/5. I guess Nate Silver isn't a "boy genius" after all. Pundits like him and all of the hacks on CNN had Clinton already measuring the drapes in the Oval Office. Not gonna happen. The country also repudiated ruling class corruption. After thousands of documents dumped by Wikileaks, we learned about the rigging of the DNC primary, the Clinton email server cover up, mass Clinton Foundation malfeasance, etc. The American people had enough. And maybe the biggest loser of this election is the mainstream media. Beyond their startling display of rank partisanship, the world learned through Wikileaks that members of the mainstream media colluded with the Clinton campaign to rig the Democratic primary and planned to rig the presidential election. Whatever credibility the legacy media had left has been shredded. This much we know. The one thing we don't know at this moment is what kind of President Trump will be. And that had markets jittery… The World Didn't EndWhen Trump was on the precipice of victory early Wednesday morning, the markets were panicking… Dow Jones futures were down 720 points. Gold was up $45. Much like happened after Brexit, we witnessed a brief spasm. But the market has since recovered. The Dow is up 51 as I write. And gold is up $14. Look, Hillary's defeat is a fundamental shock to the globalists' rigged market system. It's shaken to them to their core. In the short-term, markets dislike uncertainty. And a Trump presidency definitely means uncertainty. The long-term reaction is far less clear. But this isn't about predictions. It's about following the trend. The bottom line is we need to take a collective deep breath. The world didn't end after Brexit. It won't end after a Trump victory. As trend followers, our approach remains the same. Our strategy is designed to succeed in market shocks like the one we're seeing. The American people have spoken. The world has turned upside down. The Deep State is in retreat. More change and turmoil are on deck. We're prepared for whatever comes our way. Please send your comments to me at coveluncensored@agorafinancial.com. Let me know what you think of today’s issue. Regards, Michael Covel Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post President Trump's Political Black Swan appeared first on Daily Reckoning. |

| Canadian mint employee guilty of smuggling $138,000 of gold in rectum Posted: 09 Nov 2016 09:32 AM PST From the Canadian Broadcasting Co., Toronto OTTAWA, Ontario, Canada -- A former Royal Canadian Mint employee has been found guilty of smuggling more than $100,000 worth of gold from the building on Sussex Drive -- apparently in his rectum, an Ottawa judge ruled this morning. Leston Lawrence "clearly had the opportunity" to steal the gold because he often worked alone and the security cameras would not have caught him slipping gold pucks into his pocket, Justice Peter Doody ruled. "His locker contained Vaseline and latex gloves, which could have been used to insert a puck into his rectum," he ruled, adding that there were no cameras in the locker room. ... ... For the remainder of the report: http://www.cbc.ca/news/canada/ottawa/ottawa-mint-gold-stolen-guilty-1.38... ADVERTISEMENT K92 Mining Begins Gold Production at Kainantu Mine Company Announcement K92 Mining Inc. is pleased to announce that gold production has commenced from the Irumafimpa gold deposit. Ian Stalker, K92 Chief Executive Officer, says: "This milestone is highly significant for our company, and for this region of Papua New Guinea. A great deal of thanks goes to the entire team on site in PNG in achieving production ahead of schedule and on budget. The rehabilitation of the Irumafimpa gold mine, process plant, and associated infrastructure commenced in late March and is now complete. As an enhancement of the processing facility, we are also pleased to note that the installation of a new drum scrubber is also nearing completion and commissioning of this will be completed by the end of the month. ..." ...For the remainder of the announcement: http://www.k92mining.com/2016/10/6077/ Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Dow Futures Down 777 Points As Trump Is Selected During Jubilee Time Period Posted: 09 Nov 2016 07:42 AM PST Donald Trump was selected as the new President of the US tonight and, just as we warned, markets are crashing. As I write, Dow futures are currently down 777 points, the Japanese Nikkei is currently down 5%, bitcoin is up 3% to $730, gold is up 4% to near $1330 and silver is up 3% to nearly $19. |

| Before You Trade Trump, Read This… Posted: 09 Nov 2016 07:08 AM PST This post Before You Trade Trump, Read This… appeared first on Daily Reckoning. "Aren't you excited for the first female president?" a reporter asked a little old lady in line at the polls yesterday. "No!" she shrieked. "I am," piped up her husband, who was standing just a few steps behind…

"Just tell me you're voting for Hillary and we can all go home…" The baffled, patronizing face of a reporter who just can't seem to figure out why voters won't follow his narrative perfectly sums up last night's election. The polls told him Hillary would win in a landslide. The folks who sign his paycheck assured him a Clinton victory was in the bag. But then the damn voters just had to show up yesterday and ruin everything. Why can't these cretins stick to the script we gave them? The real-time media train wreck that unfolded last night was truly something to behold. First there was stunned silence. Then came the panicked, half-baked scenarios that would keep Clinton in the race. Wolf Blitzer went through at least eight pairs of underwear before the clock struck midnight. Meanwhile, the stock market knew something was up before Wolf & Co. could pull their jaws from the studio floor. Futures began cratering a little after 9 p.m. as it became apparent that Florida would go to Trump. Then the battleground states began to fall. Futures cascaded lower until the Dow was off by a whopping 750 points. Both the major averages went limit down well before the election was even called last night.

On the other hand, gold rallied hard. It gave back some of its overnight gains this morning—yet remains above $1,300 heading into the market open. "Gold is having one of its heaviest trading days ever as investors rushed to havens on concern Trump's presidency will upend decades of U.S. economic and foreign policy. About 570,000 futures changed hands by 8:06 a.m. in New York, based on data using the most-active Comex contract," Bloomberg reports. "That's triple the full-day average this year and U.S. trading is just getting underway." As we mentioned yesterday, the stock market loves the status quo. Every analyst under the sun assumed Mr. Market would rather have a democratic president who gives 5-figure speeches to Goldman Sachs executives than an outsider republican who rallies a populist base. And the initial reaction we saw last night in stocks follows this script. But even this narrative is dying a quick death this morning… "Will a Clinton presidency actually prove better for the economy than a Trump administration?" we mused yesterday. "That's anyone's guess. But right now it doesn't matter. Raw emotion is taking control. So go the fickle markets…" The same emotions that fed last night’s crash are fueling a morning rally. It's not even 9:30 a.m. on the East Coast and stocks are already emerging from the wreckage. After giving back all of 2016's gains late last night, the S&P 500 is off by a little more than 1% as I type. Despite what everyone is telling us, a Trump win wasn't the biggest threat to stocks. It was the threat of an undecided outcome that really sank the markets. Now that folks are coming to grip with the results, the markets are already settling down. We're going to closely monitor the stocks and sectors in play this morning—including a surprise biotech rally. As the dust clears, we should have the opportunity to dive back into some new trades later this week… Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Never miss another buy signal. Click here now to sign up for FREE. The post Before You Trade Trump, Read This… appeared first on Daily Reckoning. |

| Gold Surges 5% After America Votes Trump President Posted: 09 Nov 2016 05:12 AM PST Gold surged over 5% – from $1,270/oz to $1,335/oz prior to profit taking Gold jumped to its highest level in six weeks on early reports that Trump had won the race to the White House; Largest gains since Brexit shock For the next few days, we can expect to follow the “Brexit playbook” “We are looking at very real prospects that the Fed would defer that rate hike into 2017…” Gold has surged more than 3% to over $1,300/oz today after the shock election of Donald J. Trump as the next President of the United States of America. At one stage gold was 5% higher having risen from $1,270/oz to $1,335/oz as the dollar and stocks globally saw sharp falls. |

| Uncertainty about OPEC and US Election Leads to Oil Price Drop Posted: 09 Nov 2016 04:41 AM PST During the third quarter of 2016, global gold production dropped by 0.5%. Miners brought 846.8t onto the market versus 851.2t during Q3 of 2015. While this isn’t a huge decline, it marks the second consecutive quarter that gold production was down versus the previous year. The overall trend of plateauing output remains in place and has increased the odds that we are approaching, or have already reached, peak gold. The chart of annual mine production is shown below. |

| America is The Poisoned Chalice Posted: 09 Nov 2016 04:34 AM PST Neither candidate in the US presidential election has had many specifics to offer on their economic ideas and projected policies, and that may be a smart move for both. If only because none of the two has indicated any real understanding of what awaits America as per November 9. And I don’t mean where the stock markets will be tomorrow morning, or the price of gold, though short term volatility is obviously certain. The November 7 rally on Wall Street made plenty clear where everyone’s bets are placed -on Hillary-, so much so that there’s not much of a rally left if she wins. A Trump win could well see some panic, downward pressure for the dollar and stocks, upward pressure for gold, but there’s no telling how long that would last. |

| Gold Has No Place In A Modern Monetary System Posted: 09 Nov 2016 04:06 AM PST Matterhorn AM |

| BrExit Swing States Win Donald Trump the Presidential Election 2016 As Forecast Posted: 08 Nov 2016 11:24 PM PST BREXIT! The pollsters, mainstream press pundits, analysts, markets and bookies ALL Got the US Presidential Election badly WRONG. This is the second time this year that they ALL got a major election badly wrong. Not even coming close to forecasting this election from the New York Times to Nate Silver downwards, thousands writing reams and reams of garbage presenting the view that Donald Trump cannot possibly win, right up to the close of the polls. |

| Peak Gold Theory Strengthened as Q3 Marks Second Consecutive Quarter of Production Declines Posted: 08 Nov 2016 04:17 PM PST Gold Stock Bull |

| Credibility, Confidence, Chaos and GOLD! - Gary Christenson Posted: 08 Nov 2016 04:00 PM PST Sprott Money |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment