saveyourassetsfirst3 |

- Silver Eagle Coin Demand Returns With A VENGEANCE!

- Speculators Sell While Gold Rallies, A Rare Event - Here's What Happened The Following Week

- Golden Cross In Dollar Index Is The Deadman's Cross In The Euro

- Commercials Having Trouble Covering Their HUGE Short Position! | Harvey Organ

- The Shovel and Hole Maneuver For Hiding Gold, Guns and Other Assets

- Podcast: Iceland – Offshorisation, Collapse and Recovery. What Are the Lessons?

- Will a Rising US Dollar Crush Gold’s Fledgling Bull?

- Currency Economic Collapse Inevitable OCTOBER? | Jim Willie

- Executive Order Hints At Devastating Space Event: “Could Disable Large Portions Of The Electrical Power Grid… Cause Cascading Failures”

- “We Bottomed In Silver”: Why Record Demand For Silver May Not Lead To A Shortage

- Your Attention Please: Phase Two of the Gold and Silver Train is Now Leaving the Station

- Stocks Telling Us Orchestrated Gold and Silver Sell-Off Coming to An END! | Eric Sprott

- AN EVEN BIGGER THREAT? NO ESCAPE FROM DEBT COLLAPSE | John Rubino

- EXODUS of Gold From the COMEX! – Harvey Organ

- Rob Kirby Provides the TIMELINE OF COLLAPSE

| Silver Eagle Coin Demand Returns With A VENGEANCE! Posted: 22 Oct 2016 01:00 PM PDT American Silver Eagle Coin Demand Is BACK… From SRSRocco: U.S. Mint Silver Eagle sales surged in the first half of October due to increased turmoil in the political system and economic markets. Silver Eagle sales were strong in the first five months of the year, but weakened in the summer due to several factors. […] The post Silver Eagle Coin Demand Returns With A VENGEANCE! appeared first on Silver Doctors. |

| Speculators Sell While Gold Rallies, A Rare Event - Here's What Happened The Following Week Posted: 22 Oct 2016 09:10 AM PDT |

| Golden Cross In Dollar Index Is The Deadman's Cross In The Euro Posted: 22 Oct 2016 07:48 AM PDT |

| Commercials Having Trouble Covering Their HUGE Short Position! | Harvey Organ Posted: 22 Oct 2016 06:00 AM PDT Conclusion: Commercials go net long by 1520 contracts and they STILL are having trouble trying to cover their YUUUGE short position… Buy Gold Bars at the Best Price Online As Low As $9.99/oz Over Spot! THE DAILY GOLD FIX REPORT FROM SHANGHAI AND LONDON . The Shanghai fix is at 10:15 pm est and 2:15 […] The post Commercials Having Trouble Covering Their HUGE Short Position! | Harvey Organ appeared first on Silver Doctors. |

| The Shovel and Hole Maneuver For Hiding Gold, Guns and Other Assets Posted: 22 Oct 2016 03:00 AM PDT Shtfplan |

| Podcast: Iceland – Offshorisation, Collapse and Recovery. What Are the Lessons? Posted: 22 Oct 2016 02:57 AM PDT A discussion of the role that offshore played in Iceland's banking bubble and implosion, plus a high level corruption scandal in Spain. This posting includes an audio/video/photo media file: Download Now |

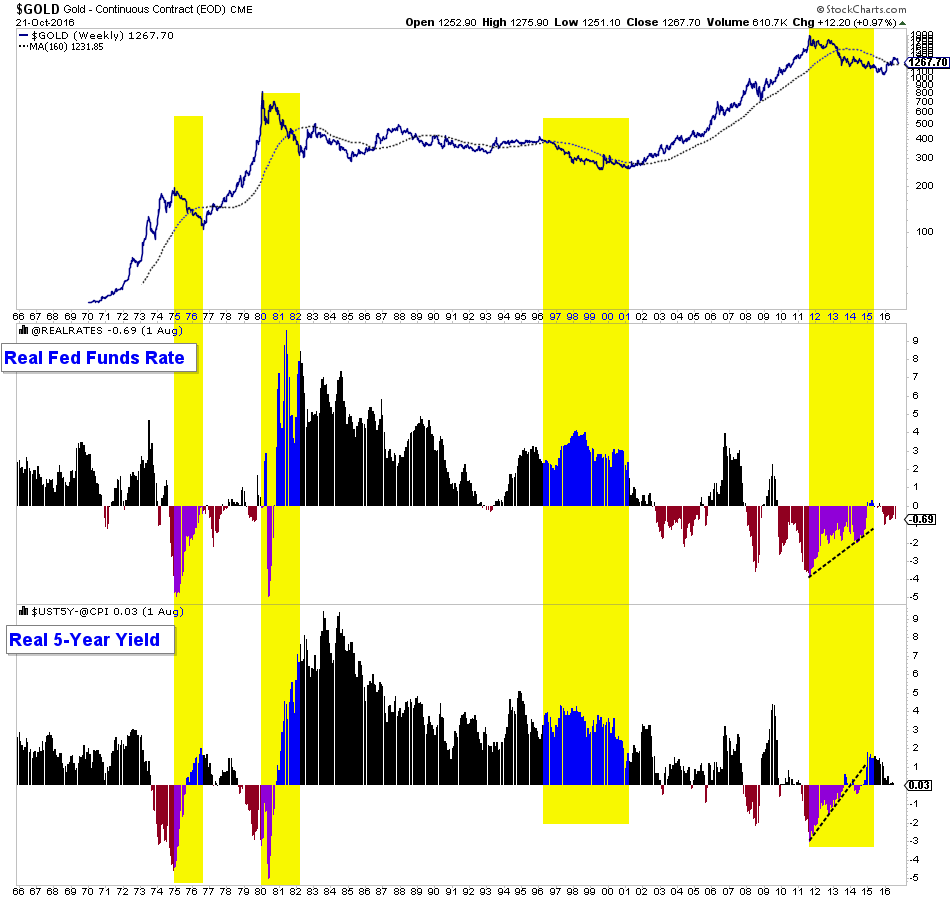

| Will a Rising US Dollar Crush Gold’s Fledgling Bull? Posted: 21 Oct 2016 11:25 PM PDT Gold and gold stocks have stabilized after forming a short-term low and even held up well while the US$ index pushed to an 8-month high. Conventional wisdom would tell us with the US$ index nearing a major breakout, Gold and gold stocks would be vulnerable to further losses. However, many astute analysts and traders believe that Gold and the US$ index can rise together and we note that the trend in the US$ index while important, is not the primary driver of Gold. Ultimately, as long as Gold's fundamental driver, declining or negative real rates remain in place, then the fledgling bull market will remain on track. First, take a look at what I like to call my master chart for Gold's fundamentals. We plot Gold, the real fed funds rate and the real 5-year yield. We highlight the major bear markets in Gold which occurred when real rates were rising or were strongly positive. Since the middle of 2015 real rates have declined and that explains the sustained recovery in Gold this year.  Gold & Real Interest Rates

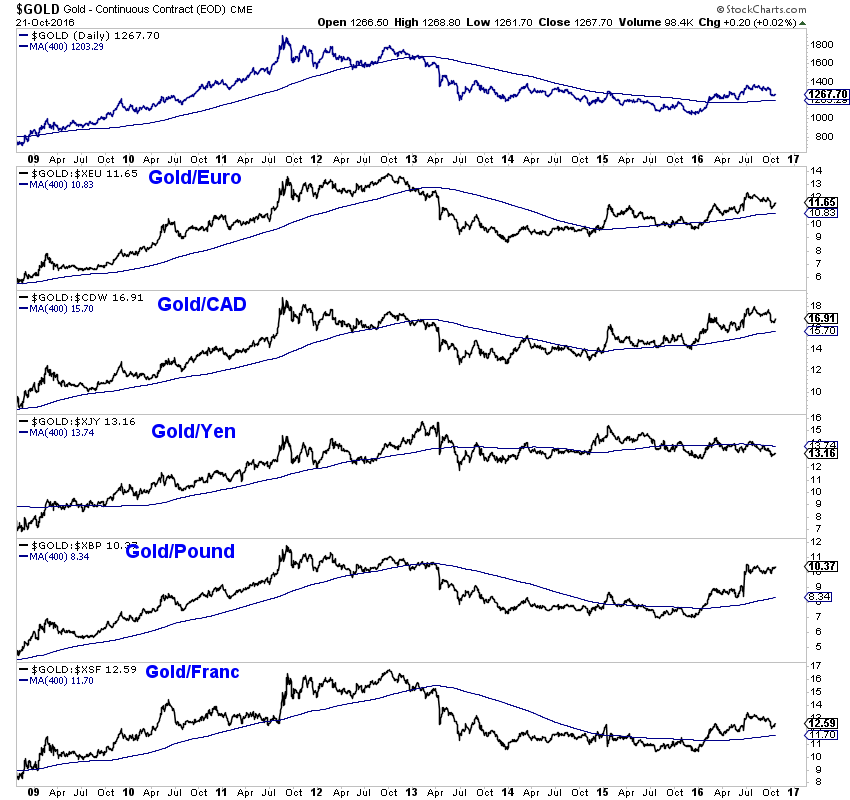

Although the Federal Reserve could raise rates, inflation is ticking higher and recent market action argues that inflation and inflation expectations will rise into 2017. Inflation metrics such as the sticky CPI and core CPI are showing inflation well above 2% without higher energy prices which could be on the way in the months ahead. Oil closed the week at a 15-month high and in recent weeks surged above important moving averages such as the 200 and 400-day. In other words, the potential coming rise in inflation figures to dwarf a measly quarter point rate hike. Recall the mid 2000s and the 1970s. Inflation rose faster than interest rates and so Gold performed well. The Fed raises rates when inflation rises but the Fed is almost certain to remain behind the curve and let inflation run. That is bullish for Gold in US$ terms, even if the US$ index is performing well. Another thing to keep an eye on is Gold's performance against foreign currencies. Below we plot Gold priced in a number of different currencies and the corresponding 400-day moving average. Other than in Yen terms, Gold is in an uptrend against every major currency and remains above rising 400-day moving averages.  Gold in various currencies

Ultimately, the single most important driver of Gold is negative or declining real interest rates and with inflation poised to rise, real rates are likely to decline further in 2017. If the US$ index is rising then that certainly puts some cap on Gold's performance in US$ terms. However, the presence of negative real rates combined with continued outperformance in foreign currency terms would sustain the bull market. Moreover, precious metals already experienced a vicious multi-year bear market. You don't get that kind of buying opportunity twice but the recent correction in the sector has created a lower risk buying opportunity. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform into 2017. Jordan Roy-Byrne, CMT, MFTA

The post Will a Rising US Dollar Crush Gold's Fledgling Bull? appeared first on The Daily Gold. |

| Currency Economic Collapse Inevitable OCTOBER? | Jim Willie Posted: 21 Oct 2016 02:50 PM PDT Are We About to Experience A Different Sort of “October Surprise”? Jim Willie Returns for a Crucial Interview with Elijah Johnson: Best Tasting GMO-Free Long Term Storage Food With Organic Ingredients! The post Currency Economic Collapse Inevitable OCTOBER? | Jim Willie appeared first on Silver Doctors. |

| Posted: 21 Oct 2016 02:40 PM PDT Do government officials know that a life-threatening solar event is becoming increasingly more probable? Or is the Obama administration simply taking proactive steps to prepare? From Mac Slavo, SHTFPlan: Once considered a fringe conspiracy theory, it appears that the Obama administration is now actively preparing for a massive solar event that could wipe out […] The post Executive Order Hints At Devastating Space Event: "Could Disable Large Portions Of The Electrical Power Grid… Cause Cascading Failures" appeared first on Silver Doctors. |

| “We Bottomed In Silver”: Why Record Demand For Silver May Not Lead To A Shortage Posted: 21 Oct 2016 02:30 PM PDT The Newest Member of the SD Team Joins Us This Week As We Break Down Gold & Silver Just Ahead of the US Election: Eric Explains Why We Bottomed In Silver 2 Weeks Ago! Will Current Record Silver Demand Lead to Another Wholesale Shortage? Why A Trump Victory Is Closer Than You Think If Trump […] The post “We Bottomed In Silver”: Why Record Demand For Silver May Not Lead To A Shortage appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Your Attention Please: Phase Two of the Gold and Silver Train is Now Leaving the Station Posted: 21 Oct 2016 02:30 PM PDT All aboard!!… Submitted by Peter Degraaf: Phase One began in January 2016, and slowed down from July until early October. (Charts in this commentary are courtesy Stockcharts.com, unless indicated). The first sign of a turnaround can be seen in this chart: Featured is PHYS the Sprott Gold Trust. Price produced an Upside Reversal (blue […] The post Your Attention Please: Phase Two of the Gold and Silver Train is Now Leaving the Station appeared first on Silver Doctors. |

| Stocks Telling Us Orchestrated Gold and Silver Sell-Off Coming to An END! | Eric Sprott Posted: 21 Oct 2016 01:30 PM PDT The Admiral of the Silver Market Eric Sprott Returns for a Critical Market Update on Gold and Silver. Has the 4 Month Sell-Off in Gold, Silver, and the Shares Finally Come to an END? From SprottMoney: Buy Gold Bars Online at the Best Price The post Stocks Telling Us Orchestrated Gold and Silver Sell-Off Coming to An END! | Eric Sprott appeared first on Silver Doctors. |

| AN EVEN BIGGER THREAT? NO ESCAPE FROM DEBT COLLAPSE | John Rubino Posted: 21 Oct 2016 12:33 PM PDT With a derivative book bigger than the entire European economy, if Deutsche bank goes, it takes Europe down with it, Says Dollar Collapse’s John Rubino. But could Deutsche bank be a distraction from an EVEN BIGGER threat? Find out in this interview… John Rubino from DollarCollapse.com joins Silver Doctors to expose the fact that deficit spending […] The post AN EVEN BIGGER THREAT? NO ESCAPE FROM DEBT COLLAPSE | John Rubino appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| EXODUS of Gold From the COMEX! – Harvey Organ Posted: 21 Oct 2016 12:20 PM PDT An ALL-OUT EXODUS OF GOLD CONTINUES FROM THE COMEX… ALMOST 28 TONNES OF GOLD STANDING FOR OCTOBER/EXODUS OF GOLD CONTINUES FROM THE COMEX/SHANGHAI CONTINUES TO LEAD IN THE PRICING OF GOLD AS DUBAI AGREES TO USE THE SHANGHAI FIX AND NOT THE LONDON FIX/DONALD TRUMP INDICATES THAT HE MAY NOT ACCEPT ELECTION DECISION/EXISTING HOME SALES […] The post EXODUS of Gold From the COMEX! – Harvey Organ appeared first on Silver Doctors. |

| Rob Kirby Provides the TIMELINE OF COLLAPSE Posted: 21 Oct 2016 12:15 PM PDT In this Exclusive SD Interview, Derivatives Expert Rob Kirby warns the system is headed toward Global Reset… Rob Kirby joins Silver Doctors to discuss the deteriorating political system and the collapsing economy. Kirby says the presidential election is turning into a dark Pythonesque comedy show. The Republican Party seems to be sabotaging their nominee's campaign, Wikileaks […] The post Rob Kirby Provides the TIMELINE OF COLLAPSE appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment