Gold World News Flash |

- Great News For Gold Bugs: The COT Report Is Playing Out As Usual, Which Means Lower – Then Much Higher – Prices Coming

- Gold Price Closed at $1248.90 Down -0.90 or -0.1%

- New WIKILEAKS DUMP Oct 7: Reveals 1000s of Emails from Clinton Campaign Chair Podesta

- Obama's Illusionary Recovery Is Being Ripped Apart

- Black Swans: 9 Recent Events That Changed Finance Forever

- GATA Chairman Murphy interviewed by Proven & Probable

- Gold Daily and Silver Weekly Charts - 'Goldilocks' and The Recovery®

- Gold’s, Miners’ Stops Run

- Bush DID 9/11: George Bush's Role in 9/11 EXPOSED (Mini Documentary)

- Why PUTIN is the TRAITOR of the NEW WORLD ORDER!!?? (2016 DOLLAR COLLAPSE and tension on SYRIA !

- BREAKING : "Can The World Survive The Apocalypse"?

- TF Metals Report: Multiple part-time jobs and central bank lies

- Dr Paul Craig Roberts : Real Possibility of Armagedon

- The Three Threats Converging Now

- 3 Junior Miners Attracting Interest as Gold and Silver Finds Support at 200 Day Moving Average

- Want to Lose Money? Just Buy “Safe” Stocks Like These…

- Lawrie Williams: How long for gold market to be controlled by paper non-transactions?

- What Tools Does the Fed Have Left and How Could They Affect the Gold Market?

- Pound Sterling Flash Crashes. Is the SPX Next?

- Sterling Gold Surges 5% In One Minute “Flash Crash†– Up 1.7% In Week As Gilts Sell Off

- Uranium miner Aura spies a sideline in gold

- Breaking News And Best Of The Web

- Gold Prices Regain 'Key' 200-Day Moving Average After Weak US Jobs Data

- Gold Below $1,250 is a ‘Strategic Buying Opportunity’

- Gold’s Second Waterfall Drop this Week

| Posted: 07 Oct 2016 07:35 PM PDT This year's recovery in precious metals prices – and the sudden spike in gold/silver mining stocks – convinced a lot of people that a new bull market had begun. Last week's brutal smack-down scared the hell out of many of the same folks. The latest commitment of traders (COT) report implies that we should all […] The post Great News For Gold Bugs: The COT Report Is Playing Out As Usual, Which Means Lower – Then Much Higher – Prices Coming appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1248.90 Down -0.90 or -0.1% Posted: 07 Oct 2016 05:35 PM PDT

If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: http://goldprice.org/franklin-sanders | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New WIKILEAKS DUMP Oct 7: Reveals 1000s of Emails from Clinton Campaign Chair Podesta Posted: 07 Oct 2016 05:00 PM PDT New WikiLeaks DumpOct 7: Reveals 1000s of Emails from Clinton Campaign Chair Podesta. Wikileaks today released over 2,000 emails from Hillary Clinton's campaign chairman John Podesta. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Obama's Illusionary Recovery Is Being Ripped Apart Posted: 07 Oct 2016 03:56 PM PDT Someone dumped 2 billion of notional gold onto the market to bring the gold price down. Unemployment rises to 5.0%. The economic recovery illusion is being ripped apart. People are now getting 1,2 part-time jobs to make up for their full time job they lost. Labor participation rate increases as... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Black Swans: 9 Recent Events That Changed Finance Forever Posted: 07 Oct 2016 02:40 PM PDT Almost every market participant out there has at least one horrific war story on a crash that profoundly affected their portfolio or world view. For example, one unnamed stock broker I know had himself and his clients in a soaring gold stock called Bre-X in 1997. There was way less connectivity at this time, and this person was on a trip to Vegas for some sun and fun. Staying at Caesar’s Palace, he went out for a short while as the stock was trading near its highs of $286.50 per share. When he got back to the hotel, he found out that news had already spread quickly: during a due diligence test, mining company Freeport had twinned seven drill holes, finding not even a trace of economic gold. The deposit was not real, and panic swept the market. His hotel phone had been ringing off the hook for three hours but he missed all the calls. Shares plummeted 83% that day, but he was already too late to get out of the stock. It’s easy to rationalize the series of events that led to the fall of Bre-X in hindsight, but as Visual Capitalist's Jeff Desjardin notes, at the time many traders and experts like this broker were caught by surprise. A company worth around $4.5 billion basically went to zero almost overnight as its claim of 70 million ounces of gold vanished into thin air. That’s a “black swan”, and this one in particular changed the mining and finance industries forever. BLACK SWANS: 9 RECENT EVENTS THAT CHANGED FINANCE FOREVERThe following infographic comes to us from Call Levels, and it highlights nine other recent “black swan” events that will have a lasting impact on how investors approach markets. These events range from the Asian financial crisis of 1997 to the more recent Brexit panic that occurred in June 2016. Courtesy of: Visual Capitalist | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GATA Chairman Murphy interviewed by Proven & Probable Posted: 07 Oct 2016 02:39 PM PDT 5:42p ET Friday, October 7, 2016 Dear Friend of GATA and Gold: Maurice Jackson of the Proven & Probable internet site has interviewed GATA Chairman Bill Murphy about gold and silver market manipulation. The interview is 19 minutes long and can be heard here: http://www.provenprobable.com/blog/interview-bill-murphy-its-bigger-than... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT ..... BEAT THE BANKERS AT THEIR OWN GAME ..... A free Webinar gives you all the details. Just click here: http://tinyurl.com/z4dj89k Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - 'Goldilocks' and The Recovery® Posted: 07 Oct 2016 01:27 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Oct 2016 12:56 PM PDT Gold, silver, and their miners’ stocks plummeted out of the blue this week, shattering their bull-market uptrends. Gold-futures speculators had been holding excessive long positions for months, weathering all kinds of selling catalysts. But once gold slipped through key support, long-side futures stop losses started to trigger unleashing cascading selling. Understanding this event and its implications is crucial for traders. This week’s precious-metals carnage was a big surprise, erupting suddenly with no technical warning. Gold had been faring quite well after hitting its latest interim high of $1365 in early July. That was driven by heavy fund buying of gold-ETF shares in the wake of late June’s unexpected pro-Brexit vote. After those big capital inflows dried up, gold consolidated high. At worst by late August it had pulled back 4.1% to $1308. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bush DID 9/11: George Bush's Role in 9/11 EXPOSED (Mini Documentary) Posted: 07 Oct 2016 12:30 PM PDT The meme is "Bush did 9/11". As many other memes, this one is true. This video shows what George Bush's role was in the 9/11 false flag attacks. Also jet fuel doesn't melt steel beams, thermite does. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why PUTIN is the TRAITOR of the NEW WORLD ORDER!!?? (2016 DOLLAR COLLAPSE and tension on SYRIA ! Posted: 07 Oct 2016 12:00 PM PDT PUTIN exposes USA! All American People Need to see this! Please share with urgency. This is very important to share! TV News is showing more proof! This is TV News! This is real facts. The power of Internet/YouTube is helping American people! The Financial Armageddon Economic... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING : "Can The World Survive The Apocalypse"? Posted: 07 Oct 2016 11:02 AM PDT This is Obama's plan B ....couldn't get the people to be out of control so let's poke the bear and start a war to delay election The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: Multiple part-time jobs and central bank lies Posted: 07 Oct 2016 09:18 AM PDT 12:20p ET Friday, October 7, 2016 Dear Friend of GATA and Gold: The TF Metals Report's Turd Ferguson today explains why the latest U.S. employment report signifies a weakening economy, not a strengthening one. His analysis is headlined "Multiple Part-Time Jobs and Central Bank Lies" and it's posted here: http://www.tfmetalsreport.com/blog/7907/multiple-part-time-jobs-and-cent... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Gold Standard Continues to Expand North Dark Star High-Grade Deposit Company Announcement VANCOUVER, British Columbia, Canada -- Gold Standard Ventures Corp. (TSXV: GSV; NYSE MKT:GSV) today announced assay results from two holes, DS16-21 and DS16-04, at the recently discovered North Dark Star oxide gold deposit on its fully-owned and controlled Railroad-Pinion Project in Nevada's Carlin Trend. Results from DS16-21 have increased the width of the deposit and, more importantly, have confirmed that higher-grade oxide mineralization projects up-dip to more shallow depths to the east of DS16-08. The primary objective of this year's drill program at North Dark Star was to expand the high-grade zone discovered in core hole DS15-13 (15.4 meters of 1.85 gold grams per tonne and 97 meters of 1.61 gold grams per tonne) at the end of last year's drill program. ... ...For the remainder of the announcement: https://goldstandardv.com/news/2016/expansion-gold-standards-north-dark-... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dr Paul Craig Roberts : Real Possibility of Armagedon Posted: 07 Oct 2016 08:51 AM PDT Dr Paul Craig Roberts WE ALL MIGHT BE DEAD SOONDr Paul Craig Roberts: The latest events in Syria and real possibility of armagedon WashingtonDC is under Royal Corporate Command +Control 1871 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Three Threats Converging Now Posted: 07 Oct 2016 08:47 AM PDT This post The Three Threats Converging Now appeared first on Daily Reckoning. After covering the three risks converging on us right now: excessive debt, lower productivity, and the absence of central bank policy options (seen in the article here) – there more to the story. Let's consider specific threats to your wealth that emanate from these risks: systemic collapse, asset bubbles, and lost confidence in the ability of central banks to respond to crises.

Threat 1: Systemic CollapseThe prospect of systemic collapse or economic instability is being driven by a global dollar shortage. This sounds strange at first. How can there be a dollar "shortage" when the Fed has printed trillions of fresh new dollars in the past eight years? The answer is that dollar debt has expanded even faster than dollar printing. Every dollar printed by the Fed has been leveraged into twenty dollars of new debt by global markets. (You can take a dive on the dollar shortage here) The Fed put new money printing on hold with the end of QE3 in November 2014. Since then the dollar has grown stronger partly because of the end of new money printing. But, the dollar-denominated debt is still growing in the oil patch and emerging markets, and in U.S. student loans, car loans, credit cards and other obligations. A stronger dollar and disinflation make this debt more onerous and harder to repay. We're already seeing periodic earthquakes resulting from this dollar shortage, including the October 2014 "flash crash" in Treasury yields, and the August 2015 shock devaluation by China. It won't be long before an even bigger earthquake is unleashed. The Fed could address this with more money printing. In fact, I expect to see a program of QE4 sometime in 2017. But, of course, that just feeds the asset bubbles, which are a separate source of systemic risk. Threat 2: Asset BubblesWhen investors ask, "Where's the inflation after all this money printing?" my answer is, "Don't look at the supermarket shelf; look at the stock market." In other words, we have not had much consumer price inflation, but we have had huge asset price inflation. The printed money has to go somewhere. Instead of chasing goods, investors have been chasing yield. Part of this asset bubble inflation has to do with a flawed theory of bond/equity "parity." The theory says that once you adjust for credit risk and term premium, bonds and stocks should yield about the same. Right now, safe ten-year Treasury notes yield about 1.65%. Many stocks have dividend yields of 3% to 5%. Investors know that stocks are riskier than safe bonds, but how much riskier? Under the parity theory, investors can keep bidding up the price of stocks until their divided yields get closer to 2%, leaving a small margin over bond yields to cover "risk." There are many flaws in this theory (including the fact that companies go bankrupt all the time, and boards of directors can and do cut dividends in recessions). But one of the biggest flaws is the complete disconnect between what's driving bond yields in the first place. If bond yields are falling because deflation is ruining the Fed's plans to reflate the economy, is that a reason for stocks to go up? If bond yields are signaling recession, should you really be bidding up stock prices to extreme levels based on a theory of yield "parity?" This behavior defies common sense and economic history, but it's exactly what we're seeing in the markets today. At some point, probably sooner than later, the reality of central bank impotence and looming recession will sink in and stock valuations will collapse. The drop will be violent, perhaps 30% or more in a few months. You don't want to be over-allocated to stocks when that happens. This analysis applies to more than just stocks. It applies to a long list of risky assets including residential real estate, commercial real estate, emerging markets securities, junk bonds and more. It only takes a crash in one market to spread contagion to all of the others. Threat 3: Lost ConfidenceFinally we come to the greatest threat of all — the inability of central banks to deal with crisis and the complete loss of confidence by investors in the efficacy of central bank policy. The last two global liquidity panics were 1998 (caused by emerging markets currencies, Russia, and Long-Term Capital Management) and 2008 (caused by sub-prime mortgages, Lehman Brothers and AIG). Another smaller liquidity panic arose in 2010 due to problems in Middle Eastern and European sovereign debt (caused by Dubai, Greece, Cyprus and the European periphery). In all three cases, central bank money printing combined with government and IMF bail-outs were enough to restore calm. But these bailouts came at a high cost. Central banks have no room to cut rates or print money in a future crisis. Taxpayers are in full revolt against more bailouts. Governments are experiencing political polarization and there's political gridlock around the world. There is simply no will and no ability to deal with the next panic or recession when it hits. This loss of confidence is plainly revealed in the following chart. It shows that consumer inflation expectations have fallen to the lowest level since late 2010 (not long after the last crisis) and the trend is clearly down, toward levels not seen since the depths of the panic in 2008: The world is moving toward a sovereign debt crisis because of too much debt and not enough growth. Declining productivity is the last nail in the coffin in terms of countries' ability to deal with the debt. Inflation would help diminish the real value of the debt, but central banks have proved impotent at generating inflation. Now central banks face the prospect of recession and more deflation without any policy options to fight it. The impact of deflation and the strong dollar have caused a shortage of liquidity around the world. Since private debt has expanded faster than central bank balance sheets, a dollar shortage has arisen as debtors scramble for dollars to pay back debts. This raises the prospect of a new liquidity crisis and financial panic worse than 2008. Persistent low rates have not caused inflation, but they have caused asset bubbles, which threaten to pop and unleash a financial panic on their own — independent of tight financial conditions. When this new panic hits (either from a liquidity shortage or bursting asset bubbles), investors will have no confidence in the ability of central banks to truncate the panic. Regards, Jim Rickards Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE.

The post The Three Threats Converging Now appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 Junior Miners Attracting Interest as Gold and Silver Finds Support at 200 Day Moving Average Posted: 07 Oct 2016 08:32 AM PDT

Due to Hurricane Matthew and the Jewish New Year I was unable to post updates on the current gold market. However, it is important to note some important developments in our sector. It appears that there was distribution in the precious metals this week during light holiday trading with Hurricane Matthew affecting the Southeastern US

I expect to see a basing around the 200 Day Moving Average which gold and silver have been hitting. This could be great news as that may signal a major secondary buy point for what I believe could be the next major bull market in precious metals fueled by a weak slowing economy combined with soaring government debts and negative interest rates. 1)For weeks I highlighted a small cap new gold miner about to go into production which attracted some of the top minds in the industry such as Pan American Silver’s (PAAS) Ross Beaty. I just received news that the company just started production and that concentrate shipments could start in November. Production could reach 52k ounces of gold annually. Management is critical in this business and congratulations goes to the team who acquired the asset from Barrick during the depths of the bear market and put it back into production sooner than expected without increasing the budget in what could be the early stages of a new bull market in gold. 2)I just received the news that one of our top development stories in the Golden Triangle in British Columbia just closed on approximately $9 million CAD. This will certainly help the company get its Feasibility Study completed on one of the top high grade projects in Canada where we have seen so much M&A activity in the past year. The company is having a great summer attracting a lot of capital after publishing an updated PEA in July which showed low cost underground production and capital costs. However, one of the areas which could be improved is mine life where a larger resource is required to be taken out by a mid-tier producer. It seems management has addressed that issue with the drill discovering new high grade gold zones with consistent and impressive high grade drill results which should be continuing through this Autumn. There are few high quality near term producers in Canada and especially in BC’s Golden Triangle. 3)For years I have watched this small cap stock blossom from an obscure little Nevada junior to becoming one of the best sponsored gold explorers in Nevada. I had faith in the asset and technical team led by top explorers and financiers. Years ago I highlighted to my subscribers what I believed was the next big discovery on the Cortez Trend which hosts Barrick’s most profitable mines in the world. Now amazingly four years later, the company is backed by Barrick, OceanaGold and Toqueville Gold Fund. Those are some of the top sponsors to have as long term shareholders who now control around 100 million shares. I just saw the news that this company arranged a $9 million CAD financing this week which will expand their exploration program with increased rigs on their 38 sq mile land position in the Cortez Trend next to Barrick. Disclosure: I own securities in these three linked companies and they are all website sponsors. Owning securities and receiving compensation is a conflict of interest as I could personally benefit from a price/volume increase. Please do your own due diligence as this is not financial advice! See my full disclosure by clicking on the following link: http://goldstocktrades.com/blog/featured-companies-on-gold-stock-trades/ Investing in junior mining stocks and precious metals is very risky and could result in losing money. Buyer Section 17(b) provides that: "It shall be unlawful for any person, by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication, which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof." I am biased towards my sponsors (Featured Companies) and get paid in either cash or securities for an advertising sponsorship. You must do your own due diligence and realize that small cap stocks is an extremely high risk area. Please do your own due diligence! | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

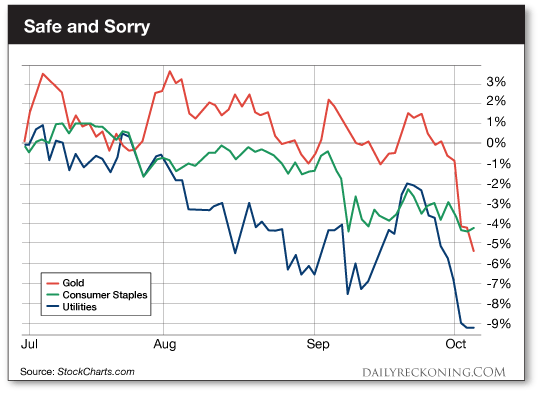

| Want to Lose Money? Just Buy “Safe” Stocks Like These… Posted: 07 Oct 2016 08:31 AM PDT This post Want to Lose Money? Just Buy “Safe” Stocks Like These… appeared first on Daily Reckoning. Choppy October trading is one of the easiest ways to spook investors. Stocks are just barely in the red for the week after some back-and-forth action. And everywhere we turn, the news is downright ominous. Head on over to your favorite financial news site and take a gander at the headlines. You can read all about Deutsche Bank struggling to raise capital and last night's British Pound flash crash. If you're searching for bullish news, you won't find anything substantial. Beyond the headlines, October is also a statistically difficult months for stocks. Sparkfin's Brain Lund reminds us that nine of the 20 biggest daily percentage losses in the Dow happened in October. Same with half of the 20 largest intraday point swings. "In addition, more bear markets have begun in October than in any other month," Lund says. With October's appetite for market destruction and nothing but bad news making the rounds, investors should eagerly snatch up every last safety trade on the market, right? Not exactly… The news has remained the same—but the market's mood has shifted dramatically over the past couple of months. Here's the deal: Investors gobbled up every utility, consumer staple, and gold stock on the market during the first six months of the year. Everyone went safety crazy. Utilities alone rose more than 21% during the first half of 2016. That's the sector's best performance in over 25 years. Consumer staples names jumped nearly 10% over the same timeframe. That's nutty—especially when you consider that the major averages barely squeezed out a gain over that 6-month period. Back in the summer, we told you that this flight to safety wouldn't continue much longer if the major averages broke out and posted new highs. Why? Because in more favorable market conditions, investors will only be willing to pay growth-stock prices for actual growth stocks That's exactly what's happening right now. While the financial media frets about a potential October crash, investors are ditching their favorite safety trades. "Some say this trade has been driven by investors calling the bluff of the Fed raising interest rates," explains David Fabian of FMD Capital Management. "Others may point to bearish sentiment or momentum as a primary driver of asset flows. Whatever the case may be, these individual sectors became extremely crowded near the middle of the third quarter and we are now starting to see some of that strength unwind."

Gold is off by almost 6% since July 1st. Miners have fared even worse The VanEck Gold Miners ETF has cratered nearly 18% over the same timeframe. Staples are down more than 4%. Now, utilities are finally feeling the heat. After a brief dead cat bounce in September, this group has crashed below its 200-day moving average for the first time this year. The Utilities Select Sector SPDR Fund has finished lower for the past 10 trading days. That's a major change in character for a sector that was leading the market just a few short months ago. If you only followed the headlines, you would assume the "safest" plays in the world would be ripping higher right now. But actions speak louder than words. The market is shifting to "risk-on" mode while most investors are cowering the corner… Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Never miss another buy signal. Click here now to sign up for FREE. The post Want to Lose Money? Just Buy “Safe” Stocks Like These… appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lawrie Williams: How long for gold market to be controlled by paper non-transactions? Posted: 07 Oct 2016 07:13 AM PDT 10:17a ET Friday, October 7, 2016 Dear Friend of GATA and Gold: Sharps Pixley gold market analyst Lawrie Williams this week moved even deeper into the manipulation camp. He wrote thusly of the smashing of gold futures prices: "We somehow doubt that the timing of the takedown -- designed to trigger stop–loss sales in today's computer-dominated trading systems -- will have been coincidental. Those who have the capability of so doing very definitely manipulate the markets (not just in gold and the other precious metals) to their advantage and can make huge financial killings on turns in the markets. See also Ted Butler's damning commentary, 'The World's Biggest Financial and Trading Scandal' -- http://www.silverseek.com/commentary/biggest-scandal-15982 http://www.24hgold.com/english/news-gold-silver-the-biggest-scandal.aspx... "Thus the gold market -- or any other market -- is not a place for the unwary unless they can predict what the big money (or central banks and governments, if one takes this to the extreme) may do to move the markets every which way. And this latest move was probably predictable -- it's just getting the timing right that is the difficulty. But a week-long Chinese holiday when we feel that the new Shanghai Gold Exchange pricing benchmark had been bringing a degree of stability to the markets -- See 'Is China Trying to Stabilize the Gold Price?': http://news.sharpspixley.com/article/lawrie-williams-is-china-trying-to-... -- provided perhaps an ideal opportunity for a takedown without any Chinese interference." Williams' commentary is headlined "How Long for Gold Market to Be Controlled by Paper Gold Non-Transactions?" and it's posted at Sharps Pixley here: http://news.sharpspixley.com/article/lawrie-williams-how-long-for-gold-m... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Bullion Star Plans Seminar in Singapore on October 19; Bullion Star will hold a precious metals seminar at 7:30 p.m. Wednesday, October 19, in its bullion center at 45 New Bridge Road in Singapore. The event will feature Bullion Star CEO Torgny Persson and the company's market analyst, Ronan Manly. Topics to be discussed include "The Race for Gold, West vs. East," "Bullion Banking 101, and "The Gold Market -- Where Transparency means Secrecy." All attendees will receive a voucher for a Silver Maple coin. To learn more about the event and to register for it, please visit: https://www.bullionstar.com/buy/product/preciousmetalsseminar Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Tools Does the Fed Have Left and How Could They Affect the Gold Market? Posted: 07 Oct 2016 05:31 AM PDT Although the U.S. economy is currently expanding, we cannot rule out the possibility of a significant slowdown in the next few years. Some analysts argue that the Fed would be out of ammunition during the next crisis. Is that true? “Not necessarily,” as it turns out – the whole issue is a bit more complicated. We will now analyze what monetary weapons could the Fed use to stimulate the economy when the next recession strikes. The table below presents a short summary of available tools. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pound Sterling Flash Crashes. Is the SPX Next? Posted: 07 Oct 2016 05:25 AM PDT Good Morning! Last night’s flash crash in the Pound Sterling should not take us by surprise. It was merely fulfilling its Bearish Pennant objectives. In addition, it was within a Wave 3 of (3) scenario, which would tell us that there would be large gaps in trading as it descends. ZeroHedge reports, “U.S. equity index futures fell, with European, Asian stocks also declining before the September payrolls data, following the stunning 2-minute "flash crash" meltdown in sterling which plunged as much as 6.1%, the most since Brexit and is set for its biggest weekly loss since 2009. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sterling Gold Surges 5% In One Minute “Flash Crash†– Up 1.7% In Week As Gilts Sell Off Posted: 07 Oct 2016 05:18 AM PDT Sterling gold surged 5% in less than a minute overnight in Asia with prices rising from £994/oz to £1,043.40/oz as sterling had a massive “flash crash.” Sterling plummeted in the second biggest fall in its history – only slightly less than the collapse after the Brexit vote. Despite gold’s peculiar, sharp fall in dollar terms on Tuesday and 4.1% loss for the week, sterling gold is another 1.7% higher this week – from £1,010/oz to £1,027/oz – again showing gold’s importance in hedging against currency devaluation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Uranium miner Aura spies a sideline in gold Posted: 07 Oct 2016 04:33 AM PDT This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 06 Oct 2016 05:37 PM PDT Another pretty good US jobs headline. Deutsche Bank is planning to raise capital. Global debt soars. Wells Fargo draws abuse for consumer fraud. Capital outflows from Italian banks accelerate. Gold and silver down hard on stronger dollar. OPEC agrees to output cut, oil price jumps. Tax evasion becomes campaign issue. Post-debate polls give Clinton an […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Prices Regain 'Key' 200-Day Moving Average After Weak US Jobs Data Posted: 06 Oct 2016 05:00 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Below $1,250 is a ‘Strategic Buying Opportunity’ Posted: 06 Oct 2016 03:00 PM PDT Gold Stock Bull | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold’s Second Waterfall Drop this Week Posted: 06 Oct 2016 09:38 AM PDT We do not often find ourselves jogging the same track as the redoubtable Dennis Gartman who commands untold premiums for his advice, but now, it seems, he is verifying our suspicion of two days ago (Please see “Gold’s waterfall drop might be associated with the big drop in British sterling”) that something is amiss in London gold trading circles. Here is today’s chart – a second waterfall move in the gold market coincident with a second swan dive for the pound and Gartman’s take (snipped from ZeroHedge). |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

where there are a lot of precious metal investors which exacerbated losses taking gold, silver and the junior miners to oversold levels like we have not seen since late 2015.

where there are a lot of precious metal investors which exacerbated losses taking gold, silver and the junior miners to oversold levels like we have not seen since late 2015.

No comments:

Post a Comment