Gold World News Flash |

- Gold Bull Still Intact, Use Pullback to Accumulate

- Gold Mining Shares in a World of Hurt

- How To Solve The Migrant Crisis (In 2 'Easy' Steps)

- BREAKING: Elite Admit Reality Is A Simulation

- 'Monster' Matthew could have 'catastrophic' impact on Florida & the Carolinas

- Top Gold Forecaster: “As Quickly As Gold Fell" May "Rally Back” on Global Risks

- Who's on your side and who's not

- Anonymous - Message to the United States Government 2016

- Gold Price Closed at $1249.80 Down $15.40 Or -1.22%

- Algos, Barriers, Rumors: Some Theories On What Caused The Pound Flash Crash

- Gold likely to rebound Monday when China resumes trading, Maguire says

- Gold likely to rebound when China resumes trading Monday, Maguire says

- Warning: Iceberg Dead Ahead!

- The “Risky Trinity”

- Gold’s Second Waterfall Drop this Week

- Gold Daily and Silver Weekly Charts - A Financial System Based On Fraud

- Don’t Get Caught in the U.S-China Crossfire – Game of Thrones Part II

- Alex Jones Show (VIDEO Commercial Free) Thursday 10/6/16: News & Commentary

- IMF’s $152 Trillion Global Debt Warning

- 'This storm will kill you': 2 million told to flee Hurricane Matthew

- Michael Kosares: Gold's waterfall drop might be associated with big drop in British sterling

- Central banks suppress gold to help China accumulate it, Rickards says

- In The News Today

- BREAKING: Storm of a biblical proportion headed for Florida

- Banks must face gold- and silver-rigging lawsuits

- CHINESE MAN DESTROYS GUN CONTROL DEBATE MUST WATCH!

- Gold Price to Rally $80 into October 14th?

- Why The Gold Bull Market is Just Starting

- Gold for When Markets Go Bump in the Night

- NOVAGOLD's Strong Cash Position Provides Protection for Weak Gold Prices

- New CUSIPS Remove Barriers for Traders in Physical Precious Metals

- Gold Bull Still Intact, Use Pullback to Accumulate

- Breaking News And Best Of The Web

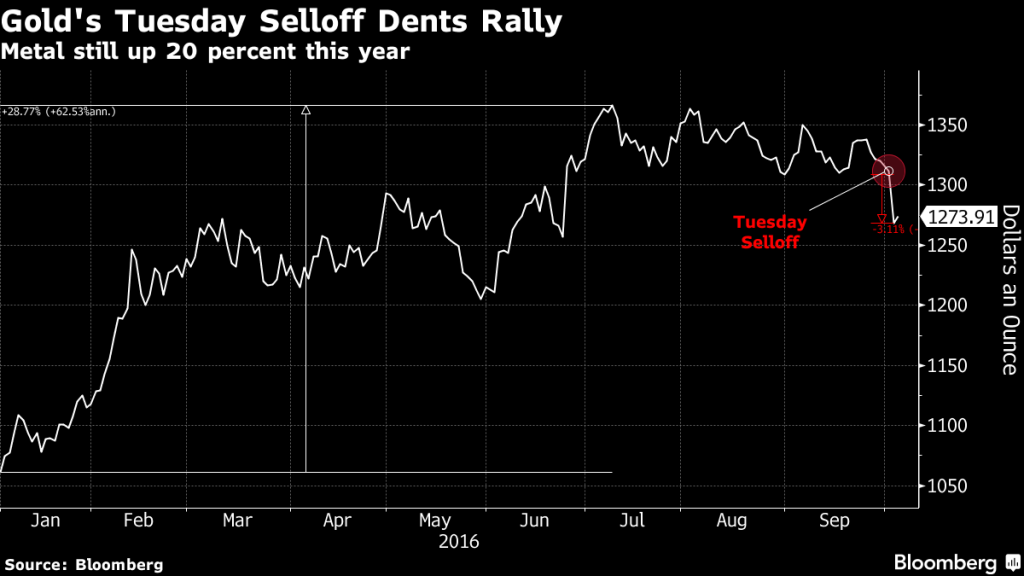

| Gold Bull Still Intact, Use Pullback to Accumulate Posted: 07 Oct 2016 01:30 AM PDT This week's drop in the gold price has spooked many investors, says money manager Adrian Day, who provides his perspective on the volatility. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Mining Shares in a World of Hurt Posted: 07 Oct 2016 01:26 AM PDT The HUI is coming unglued on the charts with the index falling below long term chart support at the 200 day moving average in today’s session. It had not been below that key technical indicator since early February of this year. We are also now seeing the 50 day moving average and the 100 day both moving lower. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How To Solve The Migrant Crisis (In 2 'Easy' Steps) Posted: 06 Oct 2016 11:00 PM PDT Submitted by Nick Giambruno via InternationalMan.com, Nick Giambruno: The migrant crisis is tearing Europe apart. What’s your take Doug? Doug Casey: I'm all for immigration and completely open borders to enable opportunity seekers from anyplace to move anyplace else. With two big, critically important, caveats:

In the absence of welfare benefits, immigrants are usually the best of people because you get mobile, aggressive, and opportunity-seeking people that want to leave a dead old culture for a vibrant new one. The millions of immigrants who came to the U.S. in the late 19th and early 20th centuries had zero in the way of state support. But what is going on in Europe today is entirely different. The migrants coming to Europe aren’t being attracted by opportunity in the new land so much as the welfare benefits and the soft life. For the most part they are unskilled and poorly educated. What we’re talking about here is the migration of millions of people of different language, different race, different religion, different culture, different mode of living. If you're an alien and you're 1 out of 10,000, or 1,000, or 100, you're a curiosity, an interesting outsider. But an influx of millions of migrants is only going to destroy the old culture, and guarantee antagonism—especially when the locals have to pay for it. In many ways, what’s happening now isn’t just comparable to what happened 2,000 years ago with the migration of the Germanic northern barbarians into the Roman Empire. It’s potentially much more serious. Nick Giambruno: I think pretty much anywhere in the world, whenever there’s an influx of foreigners to the degree that it changes the demographics or upsets the local economic applecart, it’s obviously going to cause problems. For example, the Chinese are wearing out their welcome in many parts of Africa. We saw this ourselves when we went to Zimbabwe earlier this year. Their numbers have grown so much that there are numerous Chinese mini cities within Zim. Many people in Zim aren’t too happy with the Chinese dumping cheap products and upsetting the local economy. When we asked our driver to take us through a rough neighborhood, all we saw was a seemingly endless market, as far as I can tell, completely filled with Chinese products. Doug Casey: Incidentally, it’s supposed to be official Chinese policy to migrate about 300 million Chinese to Africa in the years to come. They’re employed in building roads, mines, railroads, and other infrastructure. The Africans like the goodies, but don’t like the Chinese. It has the makings of a race war a generation or so in the future. Nick Giambruno: Getting back to the crisis in Europe… It’s well known the gigantic bureaucracy in Brussels produces ridiculous regulations and dictates. The EU has reduced the standard of living of the average European. Of course this is related to the migrant issue too. The EU has a quota system which is supposed to distribute migrants across the union. Not all EU countries are happy with this. For example, Hungary doesn’t believe it should have to accept any migrants if it doesn’t want to. Brussels disagrees and says Hungary is obligated to take in its “fair share” of migrants. Hungarian Prime Minister Viktor Orban recently said: “Hungary does not need a single migrant for the economy to work, or the population to sustain itself, or for the country to have a future… …This is why there is no need for a common European migration policy – whoever needs migrants can take them, but don't force them on us, we don't need them… …For us migration is not a solution but a problem… not medicine but a poison, we don't need it and won't swallow it.” The Eurocrats are furious with Orban. Luxembourg has called for Hungary to be expelled from the EU. It’s clear the migrant issue is fueling resentment to the EU. It was a major factor in the Brexit vote. The unprecedented inflow of migrants has also helped anti-EU political parties grow in popularity. This whole mess looks to me to be a self-inflicted wound. What do you think? Doug Casey: The EU is a huge aggravating factor with the migrant problem. Brussels is full of globalists and doctrinaire socialists who not only promote bad policies, but make the whole continent pay for the mistakes of its most misguided members. All Western European governments are massive welfare states that provide free food, housing, medical care, schooling, and living expenses for citizens. And even for residents who aren’t citizens. Benefits like these will naturally draw in poor people from poor countries. Millions of Africans will want to emigrate, especially to the homelands of their ex-colonial masters in Europe. The colonizers are now themselves being colonized. If I was an African from south of the Sahara, I'd absolutely try to get to Italy or Greece or France or Spain or on my way to Sweden to cash in on the largesse of these stupid Europeans. I’m a fan of what’s left of Western Civilization. I hate to see it washed away. But that’s what will happen if the floodgate is opened. Nick Giambruno: I really don’t feel that sorry for the Europeans either. They largely brought this mess upon themselves. It’s no coincidence that migrants are flowing to the countries with the most generous welfare benefits. If there weren’t so many freebies in these countries, there wouldn’t be so many migrants showing up to collect them. It’s obvious the welfare state plays a major role in this crisis. It’s also obvious that idiotic military interventions are a major factor. The Europeans were and are enthusiastic supporters of the U.S. military interventions in Syria, Iraq, Afghanistan—and perhaps most consequentially for them—Libya. Before his overthrow by NATO, Libyan leader Muammar Gaddafi had an agreement with Italy, which is directly to Libya’s north, across the Mediterranean Sea. Gaddafi agreed to prevent migrants heading for Europe from using Libya’s 1,100 miles of coastline as a transit point. It was an arrangement that worked. So it’s no shocker that when NATO helped overthrow the Gaddafi government in 2011, the migrant floodgates opened. Doug Casey: Unless the Europeans get in front of this situation, it’s not just some refugees from the Near East they’ll have to deal with. Especially with the economic chaos of The Greater Depression, it’s going to be millions from Africa, and then perhaps millions more from Central Asia, and even India and Bangladesh. The world is becoming a very small place. What will happen when scores of thousands of migrants set up a squatter camp someplace—with no food, shelter, or sanitary facilities. The situation is likely to be most stressful… Some will say, “But you have to be charitable, you can’t just let them starve because they’ve had some bad luck.” To that I’d say an individual, or a family, can have some bad luck. But the places these people come from have had “bad luck” for centuries. Their bad luck is the consequence of their political, economic, and social systems. It makes no sense, it’s idiotic, to import—at huge expense—masses of people that have a culture of “bad luck.” At the most, if someone wants to help them, they should help them with their own money. Nick Giambruno: Then there are the so-called economists and think tanks that say bringing in a bunch of migrants will “stimulate” the economy… Doug Casey: There are hundreds of think tanks in the U.S. alone, most located within the Washington Beltway who appear to believe that. They’re populated by partisan academics, ex-politicos, retired generals, and others circulating through the revolving doors of the military/industrial/political/academic complex. They’re really just propaganda outlets, funded by foundations and donors who want to give an intellectual patina to their views. Think tanks, and their cousins, the lobbyists and the NGOs, are mostly what I like to call Running Dogs, who act as a support system for the Top Dogs in the Deep State. Their product is “policy recommendations,” which influence how much tax you have to pay and how many new regulations you have to obey. Think tanks are populated almost exclusively by what have been called “useless mouths.” They’re no friends of the common man. The migration policies they’re promoting are creating chaos. Nick Giambruno: I just spent weeks on the ground in Italy, a frontline state in the migrant crisis. I was investigating the upcoming referendum and how it could be the first domino to fall in the collapse of the EU. I can say for sure that the migrant issue is one of the largest on the mind of the average Italian voter. Each day on average, a couple thousand migrants—sometimes many more—arrive in Italy. They’re mostly from Sub-Saharan Africa, but also a large number are from the Indian subcontinent. While I was in Rome I saw many. Lots of them aggressively beg and hawk trinkets. People now lock their doors to their homes when before they might not have. I witnessed, a number of times, young male migrants sitting in the handicap spot on trams, buses, and other public transportation, refusing to give up their seats for elderly Italian women. It’s anecdotal, but it's hard to think of a way to wear out your welcome faster than for regular Italians to see an elderly woman have to struggle to stand on a bus while a migrant, perfectly capable of standing, comfortably sits. While at the Milan train station I witnessed migrants shoving aside a clerk at the ticket check to forcibly board a train. I could see the look on the faces of the other Italian passengers. They were dumbfounded at how the migrants were blatantly choosing to not live by the rules of society and nobody was doing anything about it. Then in Como—one of the swankiest places in Italy and where George Clooney maintains a residence—I saw how many hundreds of migrants have turned the train station into a filthy makeshift camp. It was a bizarre blend of extreme poverty and extreme wealth. To say Italians are fed up is a gross understatement. Most feel Italy has enough problems without trying to solve the problems of the world. They wonder why they are forced to subsidize the migrants—who receive over $80 a month from the state, far more than their annual income in their home countries—while they are suffering under extreme economic hardship. Italians largely blame the EU and pro-EU politicians for this mess. So Doug, what should be done about this mess that doesn’t, at the same time, feed the growth of the State? Doug Casey: Immigration across political borders doesn't have to be a problem. It’s simply a matter of maintaining the property rights of all concerned. Let me repeat, and re-emphasize, what I said earlier. The free-market solution to the migrant situation is quite simple. If all the property of a country is privately owned, anyone can come and stay as long as he can pay for his accommodations. When even the streets and parks are privately owned, trespassers, beggars, squatters, migrants, vagrants, and the like have a problem. A country with 100% private property, and zero welfare, would only attract people who like those conditions. And they’d undoubtedly be welcome as individuals. But “migration” would be impossible. So, again, I'm all for open borders. Anybody should be able to go anywhere if they can support themselves. In a free market society, however, nobody's going to give you money just for existing. You have to produce goods and services in order to be able to buy food, shelter, and clothing. This is how the migration problem could be solved. You don't need the government. You don't need the army. You don't need visas or quotas. You don't need laws. You don't need treaties to solve the migration problem. All you need is privately owned property and the lack of welfare benefits. Nick Giambruno: I agree, but I doubt that is going to happen anytime soon, except in our dreams. What do you think are some likely outcomes? Doug Casey: Well, I agree; they’ll come up with some cockamamie political solution. But the good news is that it will speed up the disintegration of the EU. It never made sense from the beginning to try to get Swedes to live by the same rules as Sicilians, or Germans by the same rules as Portuguese. Not to mention that the rules are entirely arbitrary. Worse, almost all the rules result in economic transfers, with legislated winners and losers. Deals like that always lead to resentment, among both the winners and the losers. The euro, meanwhile, will approach its intrinsic value at an accelerating rate and eventually cease to exist. The Esperanto currency was doomed from the beginning. It was not just an “IOU nothing,” like the U.S. dollar, but a “Who owes you nothing” since it’s not even backed by a specific government’s taxing power. My prediction that the Continent will one day just be a giant petting zoo for the Chinese is intact—assuming the current wave of migrants approve. On the bright side, the collapse of the EU will accelerate the disintegration of nation-states everywhere. There are about 200 nation-states in the world. The international “elite,” the “intelligentsia,” the members of the Deep State everywhere, and organizations like the EU in Brussels, would like to see a much smaller number of more powerful states. Orwell anticipated just three mega-states in his dystopia, 1984. But the actual trend is in the opposite direction. It’s not just the UK seceding from the EU, but Scotland from the UK. The Basques and Catalans may eventually secede from Spain. Belgium, a totally artificial country, will eventually break up into Flemish-speaking Flanders and French-speaking Wallonia. France has half a dozen secession movements. Italy was only unified into its present form from scores of principalities, duchies, and baronies in 1861. It was the same with Germany until Bismarck in 1871. The break-up of the USSR in 1990 into 13 smaller states was a good start, but Russia itself is a small empire with dozens of distinct ethnic and linguistic groups. You will rarely hear about this in the mass media, but there are dozens of secession movements throughout Europe. There will be an exodus of capital and people from Europe to parts of Latin America, plus to the U.S., Canada, Australia, and New Zealand. This is, obviously, bad for Europe and good for the recipient countries, since the emigrants will be educated and affluent. In recent years, I might not have included Latin America, but things have changed. Argentina and Colombia are liberalizing economically. The continent isn’t involved in any entangling alliances, isn’t on the migration highway, and has low costs. Why a wealthy European would stay in that stagnant and unstable continent when he could live better, and mostly tax-free, at a fraction of the cost in Argentina is a mystery to me. If I was a European, I would be leaving Europe at this point. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING: Elite Admit Reality Is A Simulation Posted: 06 Oct 2016 08:27 PM PDT Alex Jones breaks down how global elite are coming forward and saying that our reality is a simulation. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 'Monster' Matthew could have 'catastrophic' impact on Florida & the Carolinas Posted: 06 Oct 2016 08:10 PM PDT 'Monster' Matthew could have 'catastrophic' impact on Florida and the Carolinas as power outages hit thousands and police use bullhorns to warn adamant homeowners who refuse to evacuate The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Top Gold Forecaster: “As Quickly As Gold Fell" May "Rally Back” on Global Risks Posted: 06 Oct 2016 07:00 PM PDT Top Gold Forecaster Says "As Quickly As Gold Fell" May "Rally Back" on Global Risks Gold's largest plunge in 14 months may soon reverse according to gold's top forecaster in Q3 according to Bloomberg:

Gold forecasting is a mugs game at the best of times but given the uncertain geo-political situation, the fragile banking system and the very strong fundamentals for gold, it is hard to argue with Barnabas Gan of OCBC or BMI. Gold should be meaningfully higher in the coming months and into 2017 as investors diversify into gold. Or rather we are likely to see dollars, euros, pounds and other fiat currencies continue to be devalued versus gold. Read full article here Gold and Silver Bullion - News and Commentary Wounded Gold Bull Market Steadies After Worst Slump in 3 Years (Bloomberg) Gold edges up as bargain hunters step in after falls (Reuters) Fed Hike Shouldn't Shake Investor Faith in Gold, Says Mine Chief (Bloomberg) Gold steadies after extending losses to lowest since June (Reuters) Banks must face U.S. gold rigging lawsuit (Reuters)

Video: Gold's "Path Of Least Resistance Is Up", Silver More Potential (Bloomberg) Deutsche Shows Banking Remains "Accident Waiting To Happen" - Wolf (IrishTimes) Deutsche Bank Brings Too-Big-to-Fail Quandary Home to Merkel (Bloomberg) Gundlach: "Deutsche Bank Will Be Bailed Out But What About Credit Suisse" (ZeroHedge) Gold & Silver Smash Was Orchestrated To Bailout Shorts (KingWorldNews) Gold Prices (LBMA AM) 06 Oct: USD 1,265.50, GBP 994.30 & EUR 1,131.23 per ounce Silver Prices (LBMA) 06 Oct: USD 17.76, GBP 13.98 & EUR 15.88 per ounce

- Gold Buying 'Opportunity' After Surprise 3.4% Drop Log In and Buy Now To Lock In Lower Gold and Silver Prices | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Who's on your side and who's not Posted: 06 Oct 2016 06:36 PM PDT I propose an experiment. Let all government employees go it alone completely segregated from the rest of us, and let the rest of us live our lives without the interference of government employees. Would the first group have to form a market? Would the second group have to form a state? My guess is the first group would hear the growling in their stomachs and cop out of the experiment. Plus they'd miss the fun of intimidating taxpayers, policing the world, hunting down and incarcerating people who ingest substances illegally made illegal, creating endless reams of red tape to bury in which to bury us, and spying on every last human on earth. Oh, yes, and imagine the poor FED printing money that bought exactly what it would be worth — nothing. The second group would continue to rely on production and trade — the free market — only more so because they'd have to fend off the attacks of the first group. What people need the market will provide, including defense. And they would do everything in their power to avoid forming a state. It's during election season especially that people tend to forget who their real friends are. You won't find your friends fighting for the levers of power or schmoozing those who are. In an attempt to refresh ourselves about who's on our side and who's not, I offer some excerpts from around the Web. All emphasis is mine. ****** Our DNA is as a consumer company - for that individual customer who's voting thumbs up or thumbs down. That's who we think about. And we think that our job is to take responsibility for the complete user experience. And if it's not up to par, it's our fault, plain and simply. — Steve Jobs ( BrainyQuote) Another critical divergence between market action and democratic voting is this: the voter has, for example, only a 1/50 millionth power to choose among his would-be rulers, who in turn will make vital decisions affecting him, unchecked and unhampered until the next election. In the market, on the other hand, the individual has the absolute sovereign power to make the decisions concerning his person and property, not merely a distant, 1/50 millionth power. On the market the individual is continually demonstrating his choice of buying or not buying, selling or not selling, in the course of making absolute decisions regarding his property. The voter, by voting for some particular candidate, is demonstrating only a relative preference over one or two other potential rulers; he must do this within the framework of the coercive rule that, whether or not he votes at all, one of these men will rule over him for the next several years. — Man, Economy, and State with Power and Market: The Scholar's Edition, Murray Rothbard Within the shop and factory the owner . . . is the boss. But this mastership is merely apparent and conditional. It is subject to the supremacy of the consumers. The consumer is king, is the real boss, and the manufacturer is done for if he does not outstrip his competitors in best serving consumers. It was this great economic transformation that changed the face of the world. It very soon transferred political power from the hands of a privileged minority into the hands of the people. Adult franchise followed in the wake of industrial enfranchisement. The common man, to whom the market process had given the power to choose the entrepreneur and capitalists, acquired the analogous power in the field of government. He became a voter. It has been observed by eminent economists, I think first by the late Frank A. Fetter, that the market is a democracy in which every penny gives a right to vote. It would be more correct to say that representative government by the people is an attempt to arrange constitutional affairs according to the model of the market, but this design can never be fully achieved. In the political field it is always the will of the majority that prevails, and the minorities must yield to it. — Liberty and Property, Ludwig von Mises Perhaps the fact that we have seen millions voting themselves into complete dependence on a tyrant has made our generation understand that to choose one's government is not necessarily to secure freedom. — Friedrich August von Hayek ( BrainyQuote) Voting has become a vague preference that politicians are only loosely obliged to follow, since there are no legal consequences for breaking an election promise. — Sukrit Sabhlok ("loosely"?) Government may pose as the savior of a group of voters they've impoverished, such as the elderly, by subsidizing their medical expenses. New entitlements create the need for more revenue, which fuels more inflation, pushing the dollar closer to a complete collapse. — The Jolly Roger Dollar: An Introduction to Monetary Piracy, George Ford Smith It is a common phenomenon that the individual in his capacity as a voter virtually contradicts his conduct on the market. Thus, for instance, he may vote for measures which will raise the price of one commodity or of all commodities, while as a buyer he wants to see these prices low. Such conflicts arise out of ignorance and error. — Human Action, Ludwig von Mises "You proclaim yourself unable to harness the forces of inanimate matter, yet propose to harness the minds of men who are able to achieve the feats you cannot equal. You proclaim that you cannot survive without us, yet propose to dictate the terms of our survival. You proclaim that you need us, yet indulge the impertinence of asserting your right to rule us by force— and expect that we, who are not afraid of that physical nature which fills you with terror, will cower at the sight of any lout who has talked you into voting him a chance to command us." — Atlas Shrugged, Ayn Rand "People don't talk seriously about the power company 'stealing' their money, so why should they talk that way about taxes and government deficits? To repeat, the dollars we withhold from your paychecks are rightfully ours. And the national debt we incur to cover our revenue shortfall is a wash because we owe it to ourselves. We don't need to turn the clock back, we don't need to throw government out the window, we need to support what we have because it works! And I know most Americans are with me because a majority of voters voted me into office." — The Flight of the Barbarous Relic, a work of fiction by George Ford Smith By the end of 2008, bailout of just the financial-services industry during the Bush Administration had reached over $7 trillion, which was ten times the amount originally estimated. It was more than twice the cost of World War II. Although this was many times greater than anything like it in history, it was considered to be a temporary solution, leaving final decisions for the incoming Obama Administration. Although many voters thought there would be a change under Obama, the handwriting was already on the wall: 90% of the donations to Obama's inauguration fund came from Wall Street firms that received billions in bailout and were anticipating more of the same. They were not to be disappointed. — The Creature from Jekyll Island: A Second Look at the Federal Reserve, G. Edward Griffin After the 2008 Crash, commentator Michael Barone noted that many people expected US voters to turn against "Big Business" and "market solutions" in favor of more "Big Government." But it is difficult to draw such distinctions when Big Business, Big Finance, Big Labor, Big Law, and Big Government all merge together into a single conglomerated entity, one that seems devoted to its own welfare rather than the public good. — Crony Capitalism in America: 2008-2012, Hunter Lewis "I have said this before, but I shall say it again and again and again: Your boys are not going to be sent into any foreign wars." — Franklin Roosevelt speaking on the campaign trail, October 30, 1940: PRESIDENT ROOSEVELT began gradually leaking the news of his new war plan, the Victory Program. One hundred billion dollars would go toward the building of 125,000 airplanes; half of the entire productive capacity of the United States would be devoted to the production of arms. "Tanks in what are described as unbelievable numbers are planned," The New York Times reported. It was October 18, 1941. Eugene Duffield, the head of The Wall Street Journal's Washington bureau, pondered the meaning of that many tanks, and he wrote a long story the next day. "By its emphasis on tanks and ordnance, the 'Victory Program' reveals that long-range bombing and ocean blockade no longer are counted on to subdue Germany," Duffield wrote. The program, he said, envisioned an American army composed of "o | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Anonymous - Message to the United States Government 2016 Posted: 06 Oct 2016 06:30 PM PDT Freedom or death! There's only a few that control us. Those few need to go. It time for those privileged to be arrested! NOW! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1249.80 Down $15.40 Or -1.22% Posted: 06 Oct 2016 06:10 PM PDT

FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Algos, Barriers, Rumors: Some Theories On What Caused The Pound Flash Crash Posted: 06 Oct 2016 05:44 PM PDT As reported moments ago, just around 7:07pm ET, cable snapped and plunged by what some say may have been as much as 1200 pips, dropping from 1.26 to as low as 1.14 according to some brokers, before snapping back up.

What caused the move? While nobody knows the catalyst behind the flash crash yet, Bloomberg has compiled several potential explanations.

Hopefully we will have a clear, official, and accurate answer from regulators for the crash soon: investors faith in broken markets is already non-existent as it is. However, if the May 2010 flash crash is any indication, the reason behind the collapse may not be forthcoming until 2021, and even then it will be blamed on some spoofer, living in his parents' basement. Another question: whether any FX brokerages will need a bailout a la the infamous FXCM, in the aftermath of the Swiss National Bank revaluation of January 2015, as clients find themselves margined out and underwater even as cable is steadily recovering most, if not all losses. Whatever the reason, however, Kuroda will take two.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold likely to rebound Monday when China resumes trading, Maguire says Posted: 06 Oct 2016 04:19 PM PDT 7:20p ET Thursday, October 6, 2016 Dear Friend of GATA and Gold: London metals trader Andrew Maguire tells King World News today that gold is likely to reverse upward Sunday night when Chinese trading reopens on the eve of a holiday in the United States. What happened to gold this week, Maguire says, "is the standard form of defensive attack that we see when serious cracks appear in the unallocated gold market delivery system. We saw it in April 2013 with ABN AMRO and we are seeing it again on a much larger scale now with Deutsche Bank." Maguire's comments are posted at KWN here: http://kingworldnews.com/andrew-maguire-this-gold-takedown-charade-is-ab... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Bullion Star Plans Precious Metals Seminar in Singapore on October 19 Bullion Star will hold a precious metals seminar at 7:30 p.m. Wednesday, October 19, in its bullion center at 45 New Bridge Road in Singapore. The event will feature Bullion Star CEO Torgny Persson and the company's market analyst, Ronan Manly. Topics to be discussed include "The Race for Gold, West vs. East," "Bullion Banking 101," and "The Gold Market -- Where Transparency Means Secrecy." All attendees will receive a voucher for a Silver Maple coin. To learn more about the event and to register for it, please visit: https://www.bullionstar.com/buy/product/preciousmetalsseminar Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold likely to rebound when China resumes trading Monday, Maguire says Posted: 06 Oct 2016 04:17 PM PDT 7:18p ET Thursday, October 6, 2016 Dear Friend of GATA and Gold: London metals trader Andrew Maguire tells King World News today that gold is likely to reverse upward Sunday night when Chinese trading reopens on the eve of a holiday in the United States. What happened to gold this week, Maguire says, "is the standard form of defensive attack that we see when serious cracks appear in the unallocated gold market delivery system. We saw it in April 2013 with ABN AMRO and we are seeing it again on a much larger scale now with Deutsche Bank." Maguire's comments are posted at KWN here: http://kingworldnews.com/andrew-maguire-this-gold-takedown-charade-is-ab... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Bullion Star Plans Precious Metals Seminar in Singapore on October 19 Bullion Star will hold a precious metals seminar at 7:30 p.m. Wednesday, October 19, in its bullion center at 45 New Bridge Road in Singapore. The event will feature Bullion Star CEO Torgny Persson and the company's market analyst, Ronan Manly. Topics to be discussed include "The Race for Gold, West vs. East," "Bullion Banking 101," and "The Gold Market -- Where Transparency means Secrecy." All attendees will receive a voucher for a Silver Maple coin. To learn more about the event and to register for it, please visit: https://www.bullionstar.com/buy/product/preciousmetalsseminar Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

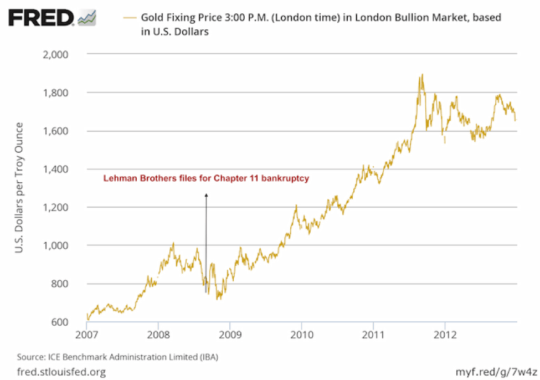

| Posted: 06 Oct 2016 02:52 PM PDT This post Warning: Iceberg Dead Ahead! appeared first on Daily Reckoning. What's the difference between a tragedy and a catastrophe, a wag once asked? A tragedy is a ship full of bankers sinking. A catastrophe is when they can swim. Deutsche Bank is no catastrophe, then. It can't swim. But it could become a tragedy and sink — dragging the whole financial system to the bottom. The potentially fatal gash below the waterline: Deutsche Bank's $47 trillion in derivatives. Jim Rickards says about Deutsche Bank's role in the world: "It is difficult to overstate the importance of Deutsche Bank not only to the global economy, but also in terms of its vast web of off-balance-sheet derivatives, guarantees, trade finance and other financial obligations on five continents." Housing-related derivatives sank S.S. Lehman Bros. in 2008. A whole range of derivatives could sink Deutsche Bank today. According to a recent Wall Street Journal story, "David Hendler of advisory firm Viola Risk Advisors said Deutsche Bank is developing a 'Lehman-like profile.'" And warns market analyst Chris Vermeulen, "A failure at Deutsche Bank will have catastrophic consequences for the banking system during 2016." Lehman sank, but the "too-big-to fail" banks were thrown a lifeline. Now they're bigger than ever. And Jim Rickards says, "We're set up for an even worse catastrophe than we had in 2008." We learned today that Deutsche Bank is slashing another 1,000 jobs, on top of the 3,000 it cut in June. Another straw in the wind, perhaps. If a "Lehman moment on steroids" (Jim's term) arrives, what does recent history teach? Simply, but deeply, this: Own gold. Here's a chart of gold's performance after the Lehman sinking:

Gold dipped briefly as investors dumped assets A to Z to raise cash. But then it soared as investors sought safety from the roiling surf. In the words of The Market Oracle: "It is important to note how the Lehman bankruptcy and subsequent systemic, financial and economic crises showed gold's importance as a safe haven asset and as financial insurance in a portfolio… This is an important lesson from the Lehman debacle. It is a lesson that if learned will protect investors from the coming financial, economic and likely currency crises. " Even a fairly limited allocation of gold could serve as "crisis insurance." Jim recommends up to 10% of investible assets. One difference between 2008 and the present day bodes well for gold, the safe harbor par excellence. Gillian Tett of Financial Times had this to say in 2013: The system depends more than ever on investor faith in central banks. One issue that caused the last credit bubble was excessive investor trust in the abilities of central bankers, both to keep inflation low and understand how financial innovation worked. Logic might suggest this blind faith should have wilted after Lehman Bros. failed. Not so; these days, all manner of asset prices are now being propped up by a sunny investor belief that central bankers know what they are doing with quantitative easing; even though nobody has tried it on this scale before, or knows how to exit.

But now, in 2016, that investor belief in central banks isn't half what it was — investors are beginning to think they're crammed aboard the Titanic, making 20 knots straight for the berg. And they see gold as a lifeboat. Trouble is, the lifeboats will fill up fast, and there won't be enough to go around when they need it. Now's the time to get gold, before the collision. Deutsche Bank may or may not be the iceberg that sinks the ship. But there are plenty others out there… Regards, Brian Maher Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post Warning: Iceberg Dead Ahead! appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Oct 2016 02:25 PM PDT This post The "Risky Trinity" appeared first on Daily Reckoning. Observers are focused on tick-by-tick action in markets, and bounce from one Fed headline to the next without stopping to reflect on what's really going on. Meanwhile, the long-term trends persist. These trends don't go away just because everyone in the marketplace seems distracted all the time. The impact of these trends will not be denied. The result of this short-term fixation is that a financial tsunami is about to overwhelm markets, while investors are asleep on the beach and don't see the wall of water bearing down on them. This is not speculation. These large trends and their deleterious impact on your wealth have been studied rigorously by official institutions with the best information and most qualified technical staff. Their reports are often lengthy and crammed with technical jargon and scores of pages of appendices, and technical footnotes. It's not easy reading but it has its rewards. Many official institutions either have obsolete models or political agendas that make some of their work unreliable. But there is one institution with extensive access to information and a good track record of sounding warnings in a timely way. That institution is the Bank for International Settlements (BIS). BIS may be part of the global financial elite of which we are rightly distrustful. Yet, they have taken it upon themselves to diverge from the happy talk coming from central banks. Their recent research output has used more advanced models that incorporate some of the complexity theory and behavioral psychology that we use at Strategic Intelligence. BIS has been unafraid to call out their central bank peers on the dangers of low rates, asset bubbles, and systemic risk. Let's take a look at what the BIS has to say about instability in the global financial system and the threat it poses to your wealth and net worth. The Bank for International Settlement (BIS) was established in 1930 by an inter-governmental agreement among the United States, UK, Germany, Belgium, Italy, France, Switzerland and Japan. The owners of the BIS are the central banks of the BIS members, with voting power skewed heavily in favor of a small number of the largest central banks. BIS is headquartered in Basel, Switzerland, but it operates under exemptions and immunities from the laws of Switzerland and its member countries. In practice, this means BIS is a law unto itself accountable only to its central bank members. The original purpose of BIS was to facilitate World War I reparations payments under the 1919 Treaty of Versailles. That purpose was made obsolete after the reparations process broke down in the early 1930s. But, the BIS quickly found a new mission as a meeting venue and operations center for transactions between central banks. If effect, the BIS is a central bank for central banks, offering clearing and settlement services. BIS also specializes in the purchase, sale and leasing of gold bullion among central banks. The BIS balance sheet footnotes reveal that it conducts gold transactions for its member central banks but offers no details on the particular parties or amounts involved. In effect, BIS offers central banks an anonymous way to trade gold.

The modern-styled headquarters building of the Bank for International Settlements, (BIS), in Basel, Switzerland. BIS operates outside the laws of any sovereign country. Heads of major central banks including the Fed, Bank of Japan, and ECB meet there monthly. No minutes of these secret meetings are made available to the public. Despite this secrecy and BIS's status at the top of the food chain of the global financial elite, BIS does maintain a website where it offers excellent financial data unavailable elsewhere, and independent research on the global monetary system. It also hosts seminars and symposia with leading central bankers and economists around the world. Proceedings of those meetings are available at the BIS website. (For an excellent history of the secrets of BIS, including its back-channel dealings in Nazi gold during World War Two, I recommend Tower of Basel, by Adam LeBor). Our interest in this issue is not the history or secrets of BIS, but rather what they are saying today about risk in the financial system. Because of its broad central bank membership, BIS researchers have better insight and better data from which to form risk assessments than any research department in the world. Their work deserves special attention. The latest reports from BIS say that the world is on the brink of another financial catastrophe worse than 2008. This is not the fever dream of some fringe website. This is the considered opinion of the most plugged-in financial institution in the world. These fears of systemic collapse were crystallized in a report by the General Manager of BIS, Jaime Caruana, delivered on June 26, 2016, just a few months ago. This report identified three major risks and three major threats arising from those risks. Caruana called these risks the "risky trinity." The three risks are excessive debt, lower productivity, and the absence of central bank policy options. The three threats to your wealth are systemic collapse, asset bubbles, and lost confidence in the ability of central banks to respond to crises. Today, we'll look at the risk excessive debt poses. Investors understand that excessive debt and leverage in the form of derivatives were a major cause of the Panic of 2008, along with banker fraud and government incompetence. Since then we've heard about the remedial steps regulators have been taking to make sure such a collapse does not happen again. The U.S. Congress passed the Volcker Rule to limit banks' derivatives exposure and risky trading. The Dodd-Frank legislation tightened up lending standards in mortgages requiring higher down payments and better loan underwriting. Bank examiners have poured over bank books questioning any loans that were not fully collateralized or backed up by prime credits. With all of this regulation and scrutiny, one would assume that the pre-crisis mountain of debt has been whittled down to size. Nothing could be further from the truth. In fact, debt and leverage in the system are much higher than they were in 2008, both in the U.S. and globally. The McKinsey Global Institute has provided a summary of increasing debt from 2007 through 2015. Their figures compare the periods 2000–07 and 2007–14, and break the debt into household, government, corporate, and financial (e.g. bank) sectors. Their data reveals that total debt increased by $57 trillion since 2007. Not only did the total debt increase, but the debt-to-GDP ratio increased from 269% to 286%. Debt-to-GDP is a critical measure of debt sustainability. If you are ever going to pay back or refinance your debt, you need economic growth to pay for it. When debt-to-GDP ratios go up, it means the debt is rising faster than the ability to pay. That's a recipe for global bankruptcy. Their data also reveals that government debt is growing faster than household, corporate, or financial debt. This reflects the fact that the government bailed out banks, corporations and consumers in the last panic. Total debt did not go down at all. The bail-out was simply a case of substituting government debt for other forms of debt — total debt in the system still rose. For that matter, consumer, corporate and financial debt rose also, just not as fast as in the pre-2007 period. Government debt increases more than picked up the slack. These figures from McKinsey do not reflect even greater debt accumulation since 2014. Trillions of dollars of additional debt have been incurred in the fracking industry and by emerging markets corporations. Some estimates show that total debt growth since 2007 has now exceeded $70 trillion. In addition, there has been little inflation since 2007. That means that debt burden is real, not just the result of dollars being worth less. On top of this balance sheet debt comes off-balance-sheet leverage in the form of derivatives, guarantees, and asset swaps of various kinds. Not only is the debt higher, but it is also held in fewer hands, making the concentration of this debt much greater. The five largest banks in the United States now own a larger percentage of the total assets of the banking system than they did in 2008. Everything that was too-big-to-fail in 2008 is bigger and riskier today. At the first sign of distress anywhere in the financial system, big banks will start to call in their loans from other big banks. The ability of financial institutions to rollover maturing liabilities will dry up. At that point, a financial panic bigger and more dangerous that 2008 will be underway. In the last panic, central banks rode to the rescue by printing tens of trillions of dollars of new money and guaranteeing tens of trillions of dollars more in bank deposits, and money market funds, and by engaging in international currency swaps. But, central banks have now lost their flexibility to reliquify the system as we explain below. The next financial panic will be much worse than the last one and will be essentially unstoppable except by the most draconian and confiscatory measures. Regards, Jim Rickards Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post The "Risky Trinity" appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold’s Second Waterfall Drop this Week Posted: 06 Oct 2016 01:38 PM PDT We do not often find ourselves jogging the same track as the redoubtable Dennis Gartman who commands untold premiums for his advice, but now, it seems, he is verifying our suspicion of two days ago (Please see “Gold’s waterfall drop might be associated with the big drop in British sterling”) that something is amiss in London gold trading circles. Here is today’s chart – a second waterfall move in the gold market coincident with a second swan dive for the pound and Gartman’s take (snipped from ZeroHedge). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - A Financial System Based On Fraud Posted: 06 Oct 2016 01:24 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Don’t Get Caught in the U.S-China Crossfire – Game of Thrones Part II Posted: 06 Oct 2016 01:14 PM PDT This post Don't Get Caught in the U.S-China Crossfire – Game of Thrones Part II appeared first on Daily Reckoning. To see part one of the piece, please select here. The SDR FactorChina's power ambitions go well beyond the Special Drawing Rights (SDR). They include international diplomacy, sustainable energy dominance, and becoming a focal point for alliances through Europe, Russia and the ASEAN states. The ASEAN–China Free Trade Area (ACFTA) is a prime example of why the SDR, or world money, for China and the region is important as China expands its influence. So are new trade and financial pacts with Russia where the yuan and ruble exchange in deals without involving U.S. dollars. In addition, Russia and China are both starting to amass gold which could return as the 6th component of the SDR someday. Jim Rickards has discussed the mechanical elements of the SDR at length, so I'll only underscore what's relevant to the elite power shift of this post-crisis resurrection of the SDR. When the SDR was created as a global reserve asset, it was to supplement the international supply of gold and the U.S. dollar. Once the gold standard was demolished and countries began accumulating international reserves, there was less of a need for this global reserve asset. It lay dormant, along with the power of the IMF. But in the wake of the financial crisis, it sprang back to life as another liquidity source for member countries. The IMF sprang back to power as well. The SDR was initially defined relative to gold (0.888671 grams of fine gold — the equivalent of one U.S. dollar.) After the collapse of the Bretton Woods system in 1973, the SDR was redefined as a weighted basket of four currencies — the U.S. dollar, euro, Japanese yen, and pound sterling. In 2015, when the yuan was approved, a new weighting formula was adopted. It assigns equal shares to the currency issuer's exports plus a composite financial indicator. That means the more prevalent the currency in the world, the bigger its weight. If more Yuan are used in the world, its position in the SDR grows. In a crisis, it could take on the U.S. dollar and Euro, and by extension the Fed. The SDR, also known as world money, held the weight of the yuan at just 10.92 percent compared to 41.73 percent for the U.S. dollar and 10.92 percent for the Euro. That's not a bad opening gambit. The next official weights review will be held on September 30, 2021. But in a crisis, there is latitude for it to happen much sooner. As China continues to play host to global events (Olympics, G20, etc.) it also is in pursuit of greater regional influence. With the largest economy, and now showing its capability as having a globally recognized reserve currency, China is adding another layer of strength to its position. While the associated confidence measure will not be the death of the dollar, it indicates that the dollar is not the only option to turn to in times of panic, or increased trade or financial growth. The intrinsic power of that position attacks not only the dollar but the overall power of the U.S. Competing Central Bank Kingdoms and their Power BasesCurrencies reflect both political and economic clout. Even if SDR's themselves aren't that voluminous yet, the shift in the make-up is meaningful. The Fed has already lost ground in the process. The IMF and PBoC have gained it. In the middle, there is an increasingly shaky, EU. The ECB was established after the creation of the Euro in 1998 to oversee other member European central banks. It has more power than any of them because it sets rates for the EU, which dictates the cost of their money and how it flows. Former Goldman Sachs executive and former Bank of Italy Governor, Mario Draghi is the current President of the ECB. He has followed the Fed's policy to a letter — despite grumblings from other EU power brokers that negative interest rates have solved nothing and instead aided to the fractiousness of the EU experiment itself. In 2012, facing an acute European debt crisis, he promised, "The ECB is ready to do whatever it takes to preserve the Euro." The Euro has fallen precipitously since. If Draghi's words are weak, his actions are weaker. The ECB is offering to pay banks that borrow money from it, plus, giving them 85 billion Euro each month through its ongoing QE program to purchase their debt. From a battleground standpoint, that smacks of desperation. The ECB just announced it would give banks three years to write off bad loans — meaning they have lots of bad loans. The ECB has failed to mitigate any risk. Its alliance with the Fed hasn't helped Draghi build his power, just retain it, and it certainly hasn't helped the EU as a whole. Within the wider European Area, the Bank of England, under Governor Mark Carney, retains legacy power. That power has waned though, and increasingly so since the Brexit vote. If Britain leaves the EU in more than name, then the Bank of England's actions are less relevant to the EU. This elevates the power of the ECB and the Euro. But as noted, those are already weak to begin with. If the Bank of England follows the course that Brexit has laid out, the SDR could see a further reduction of the pound weighting, and Euro weighting, which would push up the weighting of the yuan by sheer math. This shift is symbolic now, but power can start in that realm. The Bank of Japan, before Governor Haruhiko Kuroda took the helm, had run-ins with the Japanese minister of finance over its negative rate policy and bond-buying programs. The Japanese stock market lies in a constant state of tension. Because the BOJ is on the same monetary policy plane as the Fed, Japan's markets have similarly become used to monetary adrenalin shots. Globally, this has led capital, seeking a fix in times of instability, to Japan and to the yen. But lately Japan's markets have also been reacting more viciously whenever the possibility of a Fed tightening hits, or lack of fresh BOJ easing measures. The alliance of the BOJ and PBoC has not been fleshed out yet, but I believe that's only a matter of time. Old fights might be discarded if economic or financial survival is imperiled, which is what these sharper market moves foreshadow. People's Bank of China: Dragon Rising

Zhou Xiaochuan, Governor of People's Bank of China This dragon's about to take flight. The People's Bank of China governor is Zhou Xiaochuan, who has held that post longer than any other G20 central bank leader. The PBoC holds more U.S. treasuries than any other central bank and is ready to battle. Zhou understands global paradigm shifts. He's the only Chinese person on the G30 and on the board of the BIS. He's been the leading figure pushing the yuan into the SDR basket by slowly allowing it to float with the market, despite allegations of ongoing currency manipulation. As China's position has grown, so has Zhou's voice, albeit without giving too much away. "The central bank has a clear and strong desire to improve its communication with the public and market," he told Caixin, a major publication in China. "At the same time, it's not easy to do a good job in communication." China wants to keep internal inflation down. This is why it would prefer a strong currency. This negates the charge that China is trying to devalue or manipulate the yuan for better trade profits perpetuated by Donald Trump and Hillary Clinton. This is true to a minor extent due to economic pressures, but barely. The stronger the yuan, and the more prevalent it is globally, the more the PBoC challenges the Fed and the more control the China bloc gains over the U.S. In Chinese culture and the Game of Thrones, the Dragon symbolizes life and expansion. It's a fitting symbol for the rising power of China and the yuan. Regards, Nomi Prins, @nomiprins Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post Don't Get Caught in the U.S-China Crossfire – Game of Thrones Part II appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alex Jones Show (VIDEO Commercial Free) Thursday 10/6/16: News & Commentary Posted: 06 Oct 2016 01:00 PM PDT -- Date: October 06, 2016 -- Today on The Alex Jones Show On this Thursday, Oct. 6 edition of the Alex Jones Show, we discuss the ongoing collapse of the Clinton campaign, particularly how Bill Clinton was confronted with rape allegations during a campaign speech. We also look into the child actor... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| IMF’s $152 Trillion Global Debt Warning Posted: 06 Oct 2016 12:22 PM PDT Shaffer Asset Management's Dan Shaffer, Democratic Strategist Taryn Rosenkranz and GOP Strategist Cathy Lynn Taylor on how the global debt affects the U.S. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 'This storm will kill you': 2 million told to flee Hurricane Matthew Posted: 06 Oct 2016 10:53 AM PDT This storm will kill you': Traffic jams leave thousands in gridlock across the East Coast as two million are told to flee Hurricane Matthew as it kills 112 and stays on course to hit the US TODAY The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Michael Kosares: Gold's waterfall drop might be associated with big drop in British sterling Posted: 06 Oct 2016 09:57 AM PDT By Michael Kosares We do not often find ourselves jogging the same track as the redoubtable Dennis Gartman, who commands untold premiums for his advice, but now, it seems, he is verifying our suspicion of two days ago -- please see "Gold's Waterfall Drop Might Be Associated with the Big Drop in British Sterling") -- http://www.usagold.com/cpmforum/2016/10/04/golds-waterfall-drop-might-be... -- that something is amiss in London gold trading circles. We have a second waterfall move in the gold market coincident with a second swan dive for the pound and Gartman's take. ... ... For the remainder of the commentary: http://www.usagold.com/cpmforum/2016/10/06/todays-waterfall-on-gold-and-... ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central banks suppress gold to help China accumulate it, Rickards says Posted: 06 Oct 2016 09:41 AM PDT 12:48p ET Thursday, October 6, 2016 Dear Friend of GATA and Gold: Fund manager and newsletter writer James Rickards writes this week that central banks are working together to suppress the price of gold while redistributing official gold reserves in preparation for the devaluation of government currencies -- just what the economists and fund managers Paul Brodsky and Lee Quaintance wrote four years ago in analysis publicized by GATA: http://www.gata.org/node/11373 Rickards writes: "Here's the problem: If you took the lid off of gold, ended the price manipulation and let gold find its level, China would be left in the dust. It wouldn't have enough gold relative to the other countries, and because the price of gold would be skyrocketing, they could never acquire it fast enough. They could never catch up. All the other countries would be on the bus while the Chinese would be off. ... Dispatch continues below ... ADVERTISEMENT K92 Mining Begins Gold Production at Kainantu Mine Company Announcement K92 Mining Inc. is pleased to announce that gold production has commenced from the Irumafimpa gold deposit. Ian Stalker, K92 Chief Executive Officer, says: "This milestone is highly significant for our company, and for this region of Papua New Guinea. A great deal of thanks goes to the entire team on site in PNG in achieving production ahead of schedule and on budget. The rehabilitation of the Irumafimpa gold mine, process plant, and associated infrastructure commenced in late March and is now complete. As an enhancement of the processing facility, we are also pleased to note that the installation of a new drum scrubber is also nearing completion and commissioning of this will be completed by the end of the month. ..." ...For the remainder of the announcement: http://www.k92mining.com/2016/10/6077/ "When you have this reset, and when everyone sits down around the table, China's the second largest economy in the world. They have to be on the bus. That's why the global effort has been to keep the lid on the price of gold through manipulation. I tell people that if I were running the manipulation, I'd be embarrassed because it's so obvious at this point. "The price is being suppressed until China gets the gold they need. Once China gets the right amount of gold, then the cap on gold's price can come off. At that point, it doesn't matter where gold goes because all the major countries will be in the same boat. As of right now, however, they're not, so China has to catch up." Rickards' commentary is headlined "China's Hidden Plan to Accumulate Gold" and it's posted at the Daily Reckoning here: http://dailyreckoning.com/chinas-hidden-plan-accumulate-gold-2/ CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Oct 2016 09:40 AM PDT In Major Victory For Gold And Silver Traders, Manipulation Lawsuit Against Gold-Fixing Banks Ordered To ProceedOctober 5, 2016 Back in April, precious metal traders felt vindicated when Deutsche Bank agreed to settle a July 2014 lawsuit alleging precious metal manipulation by a consortium of banks. As a reminder, In July 2014 we reported that a... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING: Storm of a biblical proportion headed for Florida Posted: 06 Oct 2016 07:20 AM PDT The Storm of a biblical proportion headed for Florida BREAKING: "Hurricane Matthew Apocalyptic Arrival To Florida" The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Banks must face gold- and silver-rigging lawsuits Posted: 06 Oct 2016 05:32 AM PDT Banks Must Face U.S. Gold-Rigging Lawsuit; UBS Is Dismissed By Jonathan Stempel http://www.reuters.com/article/us-gold-lawsuit-decision-idUSKCN125292 A U.S. judge said gold investors may pursue much of their lawsuit accusing four major banks of conspiring for a decade to fix prices and exploit distortions at the expense of investors in global markets for the precious metal. Antitrust and manipulation claims can move forward against Barclays Plc, Bank of Nova Scotia ("ScotiaBank"), HSBC Holdings Plc, and Societe Generale, U.S. District Judge Valerie Caproni in Manhattan said in a decision made public on Tuesday. ... Dispatch continues below ... ADVERTISEMENT Gold Standard Continues to Expand North Dark Star High-Grade Deposit Company Announcement VANCOUVER, British Columbia, Canada -- Gold Standard Ventures Corp. (TSXV: GSV; NYSE MKT:GSV) today announced assay results from two holes, DS16-21 and DS16-04, at the recently discovered North Dark Star oxide gold deposit on its fully-owned and controlled Railroad-Pinion Project in Nevada's Carlin Trend. Results from DS16-21 have increased the width of the deposit and, more importantly, have confirmed that higher-grade oxide mineralization projects up-dip to more shallow depths to the east of DS16-08. The primary objective of this year's drill program at North Dark Star was to expand the high-grade zone discovered in core hole DS15-13 (15.4 meters of 1.85 gold grams per tonne and 97 meters of 1.61 gold grams per tonne) at the end of last year's drill program. ... ...For the remainder of the announcement: https://goldstandardv.com/news/2016/expansion-gold-standards-north-dark-... Investors allege that the banks conspired from 2004 to 2013 to fix prices. They did not estimate the size of the banks' gold portfolios, but said the gold derivatives market alone was as large as $650 billion during the class period. "From the gold plaintiffs' standpoint, it's a very substantial victory," Dan Brockett, a partner at Quinn Emanuel Urquhart & Sullivan representing the investors, said in a phone interview on Wednesday. Deutsche Bank AG settled related claims in April, and the investors plan to seek preliminary approval of a settlement, Brockett said. Terms have not been disclosed, but Deutsche Bank has put the expected payment in escrow, he said. In a separate case involving the silver market, Caproni said another group of investors may pursue market rigging claims against ScotiaBank and HSBC. Both decisions dismissed UBS Group AG as a defendant, saying there was nothing showing it manipulated prices, even if it benefited from market distortions. Barclays spokesman Andrew Smith, ScotiaBank spokesman Rick Roth, Societe Generale spokesman Jim Galvin, and Deutsche Bank spokeswoman Amanda Williams declined to comment. UBS spokeswoman Erica Chase said the bank is pleased with the decisions. HSBC had no immediate comment. Investors have several lawsuits before the Manhattan court accusing banks of conspiring to rig rates and prices in financial and commodities markets. In the gold case, investors said Barclays, Deutsche Bank, HSBC, ScotiaBank, and Societe Generale conspired to manipulate prices of gold, gold futures and options, and gold derivatives through twice-a-day meetings to set the London Gold Fixing. The investors said this conspiracy let the banks suppress prices and reduce risk at other investors' expense. In her 73-page decision, Caproni said the investors plausibly alleged that the five banks recklessly created "artificial price dynamics" for gold, and that their misconduct was the "proximate cause" of the distortions. She let the investors pursue antitrust claims for alleged unlawful restraint of trade from January 2006 to December 2012. The judge dismissed a claim for unjust enrichment. Caproni gave the investors 14 days to amend their complaint. The case is In re: Commodity Exchange Inc Gold Futures and Options Trading Litigation, U.S. District Court, Southern District of New York, No. 14-mc-02548. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CHINESE MAN DESTROYS GUN CONTROL DEBATE MUST WATCH! Posted: 06 Oct 2016 02:31 AM PDT He speaks the truth , Big Pharma has been able to legally drug school kids to the point that it changes their thought process and the gun problem in schools was born from that The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price to Rally $80 into October 14th? Posted: 06 Oct 2016 01:39 AM PDT I admit I missed the GDX move down to 22.93 today, but at the same time it has presented itself with a great opportunity. The chart below is predicting GDX 29.84 by October 14. I am now leveraged, extremely leveraged with options for a strong rally ahead in gold and GDX. A lot of negative bias now in the precious metals complex has me thinking the other way: and that is a massive short covering rally ahead. The e-wave look and cycles suggest the same. The "nonfarm payrolls report" on Friday could be (likely) the catalyst. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why The Gold Bull Market is Just Starting Posted: 06 Oct 2016 01:30 AM PDT Kitco | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold for When Markets Go Bump in the Night Posted: 06 Oct 2016 01:17 AM PDT “Gold has worked down from Alexander’s time. . .When something holds good for two thousand years, I do not believe it can be so because of prejudice or mistaken theory.” – Bernard Baruch We should not be surprised that the long-standing troubles at Deutsche Bank would appear to be coming to a head now. For global financial centers, October is often the cruellest month – a time when stock markets and whole economies have been known to go bump in the night. The Panic of 1907, the Crash of ’29, Black Monday 1987, the Friday the 13th crash 1989, the Asia Crisis of 1997, the downturn of 2002 and the launch to bear market in 2007 – all took place in the month of October. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NOVAGOLD's Strong Cash Position Provides Protection for Weak Gold Prices Posted: 06 Oct 2016 01:00 AM PDT NOVAGOLD's third quarter financial results show a balance sheet that should be sufficient to complete permitting of the Donlin Gold project in Alaska, according to National Bank Financial Analyst Raj Ray. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||