Gold World News Flash |

- The New 'Too Big To Fail' - EU Proposes Taxpayer-Funded Derivatives System Bailout

- The Noose Is Tightening Quickly On The Global Economy

- Elizabeth Holmes To Shut Theranos' Core Operations, Fire 40% Of Workers

- The London Gold Float Estimates Updated

- Gold Price Closed at $1265.20 Down $1.10 or 0.09%

- Roger Stone: Why Assange Didn't Release Hillary Bombshell

- NSA contractor ‘secretly’ arrested after FBI found highly classified info at home

- John Embry Says Maguire Is Right, Gold & Silver Smash Was Orchestrated To Bailout Shorts

- Gold Daily and Silver Weekly Charts - Oversold

- China’s Hidden Plan to Accumulate Gold

- Mike Kosares: When markets go bump in the night

- Gold smash was a Western central bank operation, Embry tells KWN

- Ronan Manly: London got some metal back but still supports lots more 'paper gold'

- Judge's decision in gold market-rigging case is an invitation to journalism

- LIVE Stream: Donald Trump Rally in Henderson, NV 10/5/16

- FLASH: Market-rigging lawsuit against London gold fix banks can proceed

- A Quick Look At the Gold and Silver Technical Indicators - London Calling

- UK consumers snap up physical gold after price slides under 1,000 pounds/oz

- Don’t Get Caught in the U.S-China Crossfire – Game of Thrones Part I

- Worldwide Collapse And Prices For Gold & Silver That Are Unimaginable Today

- Deutsche Bank strategist says gold will keep crashing. (But then what about DB itself?)

- Avery Goodman: Market manipulators choose Chinese holiday to smash gold

- TNX, USD and SPX Meet their Respective Turning Points

- GOLD CRASHES: Here’s Everything You Need to Know…

- Gold Buying ‘Opportunity’ After Surprise 3.4% Drop

- Gerald Celente - Presidential Election Will Not Affect Economy. What Will? - (9/28/2016)

- Breaking News And Best Of The Web

- Gold: Is the Bull Market Over?

| The New 'Too Big To Fail' - EU Proposes Taxpayer-Funded Derivatives System Bailout Posted: 05 Oct 2016 11:00 PM PDT It would appear the powers-that-be have just stumbled on to the ugly fact that all the bailed-in depositor money in the world won't stop the novated, rehypothecated, collateral chain collapse contagion that Deutsche Bank's $40 trillion-plus derivatives book's Damocles sword hangs over the status quo. However, being the problem-solving types, the European technocrats have a 'fair-share' solution - back a derivative clearing-house with taxpayer money to solve the new too-biggest-to-fail problem "that no one saw coming." While the "rules" right nbow are that everyone from shareholders, bondholders, and depositors alike on up the capital structure are supposedly "bailed-in" to save an ailing bank, this problem is just way too big. Here's the problem... in 3 charts... Derivatives book - yuuge...

Global contagion - yuuger...

Counterparty risk - yuugest...

And so, as Bloomberg reports, the dear old European taxpayer is about to save the world... The European Union plans to give authorities sweeping powers to tackle ailing derivatives clearinghouses to prevent their failure from wreaking havoc throughout the financial system.

Governments around the world were spooked by the damage inflicted by derivatives trades that went awry during the financial crisis. Since then, they’ve taken steps to ensure trading in the contracts is reported and centrally cleared. Clearinghouses stand between the two sides of a derivative wager and hold collateral, known as margin, from both in case a member defaults.

And here is the kicker... guess who foots the bill when the fecal matter really strikes the rotating object...

So the US DoJ decision to retaliate for EU's Apple decision has boomerang'd right back at the EU taxpayer - who ultimately will bailout the new too-biggest-to-fail entities. Italeave? Portugone? Fruckoff? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

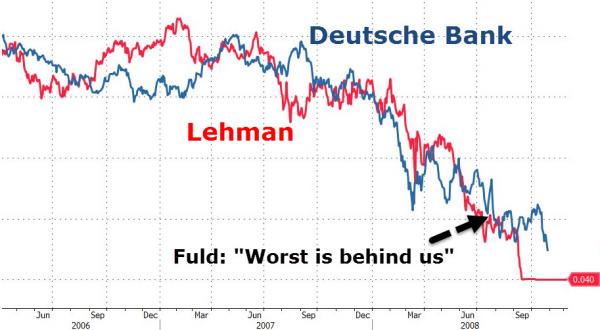

| The Noose Is Tightening Quickly On The Global Economy Posted: 05 Oct 2016 07:40 PM PDT Submitted by Brandon Smith via Alt-Market.com, The investment world has an embarrassingly short attention span. But frankly, it is a necessity. If daytraders, hedge funds and other horses in the carousel actually had to look beyond the next week of market activity or study back on market history in comparison to today, then they would not be able to retain their blind optimism, which is exactly what is necessary for them to continue functioning. If they were all to examine the global financial situation with any honesty, the entire facade would collapse tomorrow. At bottom, it is not central bank stimulus and intervention alone that drives equities and bond markets; it is the naive faith and willful ignorance of average market participants. There is a problem with this kind of economic model, however. Reality is never kept in check indefinitely. Fiscal truths will be exposed, one way or another. How does one know when this full spectrum shift in awareness will occur? Well, there’s no science that can help us with that. While basic economics is subject to the forces of supply, demand and mathematical inevitability, it is also subject to human psychology, which is another matter entirely. In the past I have made a point to outline similarities in responses to various economic crises. For example, the media response and public perception at the onset of the Great Depression was a highly unfortunate exercise in false optimism. The response just before the credit crash of 2008 by the media and the masses was much the same. It is interesting to note in particular that the mainstream media tends to become more over-the-top in its certainty of economic stability the closer the system comes to collapse. That is to say, the nearer we edge towards financial calamity, the more violently the mainstream media attacks people who suggest that danger is on the horizon. First, take a look at the following attempts by the media to embarrass or silence analysts like Peter Schiff just before the crash of 2007/2008: Now, watch this attempt by CNBC to attack Bill Fleckenstein for having the audacity to question the validity of current stock values and pointing out that the Federal Reserve is destroying the economy rather than repairing it: Notice any striking similarities between the mainstream rhetoric of 2006/2007 and the mainstream rhetoric of today? Notice how emotionally aggressive and almost desperate the media becomes when maintaining market faith, rather than looking at the situation objectively as the fundamentals begin to overwhelm investor complacency? To be clear, while mainstream economists are almost always wrong, independent analysts are not prophets. We usually cannot provide the exact timing for the economic shifts we see coming. All we can do is provide a general window in which the events are likely to take place. Peter Schiff’s predictions on how the housing bubble and the credit crisis would play out were absolutely correct, even though he was about six months to eight months off his timing. Again, this is not an exact science, and human psychology has the ability to offset market fundamentals for months. The supposed “catalyst” for the 2008 crash is primarily attributed to the fall of Lehman Brothers. I highly recommend any of the “bullish” economists out there arguing today that the central banks intend to prolong a stock rally indefinitely examine the statements made in the mainstream about Lehman and by Lehman leading up to their eventual death rattle. Then, absorb and really think on some of the recent statements and tactics used by Germany’s Deutsche Bank. Specifically, note Lehman’s use of accounting and derivatives gimmicks and the cycling of funds through various accounts in order to make the company appear solvent. Then, take a look at revelations coming out of places like Italy that Deutsche Bank has been using the same model of false accounts and market manipulation, once again, with derivatives as a main tool for fraud. Also notice the same outright dismissals of all pertinent evidence that Deutsche Bank might be suffering a capital shortfall, as Chief Executive John Cryan blames “speculators” for the companies losses. Lehman’s Dick Fuld and Bear Stearns’ Jimmy Cain both blamed “speculators” and “rumors and conspiracies” for the fall of their companies during the derivatives debacle eight years ago. It would seem that history doesn’t just rhyme, it sometimes repeats exactly. Below is a rather revealing chart from the folks at Zero Hedge comparing the collapse of Lehman Brothers stock value to the steady decline of Deutsche Bank. Check it out:

To be clear, Lehman was no catalyst. It was only a litmus test for a system completely devoid of tangible value and drowning in toxic debt. Lehman was a part of a much larger problem, it was not the cause of the problem. The same is true for Deutsche Bank. The panic growing around Germany’s second largest financial institution, Commerzbank, as it moves to lay off nearly 10,000 employees and suspend its dividend is another crisis indicator separate from Deutsche Bank. The clear solvency issues in Italy’s major banks, including Monte dei Paschi, are yet another explosive element. Keep in mind that when these edifices begin to crumble and Europe enters a state of financial emergency, the mainstream media and numerous governments will continue to blame speculators. They will also claim that the entire disaster was set in motion through a “domino effect”; the first domino probably being Deutsche Bank. This will be a lie. There is no line of dominoes. One bank will not be bringing down the other banks — yes, there is terrible interdependency, but the real issue is that ALL of these banks are falling due to their own cancerous behaviors. The very system they are built around is a corrupt and unsustainable model, and I hold that this is by design. International financiers do not want the general public to look at the validity of the system, they want the public to view collapse events as an oversimplified case of cause and effect. If the public were to understand that the global banking model is a destructive one (for the public, not for the elites), then they might demand the erasure of the model and its institutions entirely. The elites don’t want that. What they want is to be free to conjure crisis after crisis after crisis; to have the option to collapse the system only to replace it with something identical in nature but even more oppressive in its function. They want to create chaos today so that greater centralization can be purchased in the future through mass fear. I continue to maintain as I always have that central banks around the world are shifting strategies and will do very little to intervene from this point on in the propping up of insolvent banking groups or equities markets. It is very unlikely that Germany or the European Central Bank, for example, will move to infuse Deutsch Bank with capital (at least, not until the damage has already been done). It is also unlikely that any central bank will move to openly stimulate markets until an equities crash has run its course. In fact, some central banks including the Federal Reserve may act to expedite a stock crash — watch for this to occur if Donald Trump attains the White House. This has all happened before. It happened in 2008 when the Federal Reserve stepped back and allowed Lehman Brothers to go bankrupt. It will probably happen again when the German government and the ECB refuse to back Deutsche Bank. The noose is tightening on the global economy and, once again, the mainstream media is too biased or too dumb to see it. They’ll accuse the alternative media of crying “doom and gloom,” and perhaps our timing will be off. But exact timing will not really matter once the house of cards begins to topple. If we stick to our positions and refuse to be intimidated by rhetoric, the time will come when people will only remember that we were right for the most part and that the mainstream media was incompetent or dishonest. In the meantime, we have a whole swarm of other trigger events before the end of the year. I predicted in my article The World Is Turning Ugly As 2016 Winds Down that the Saudi 9/11 bill might be vetoed by Obama and that the veto would be overturned by the Senate. This has now taken place, which means increased Saudi tensions with the U.S. resulting in the eventual demise of the dollar’s petro-currency status. Watch the coming Italian constitutional referendum which could pave the way for conservative movements to initiate an Italian version of the Brexit. Also keep an eye on Syria yet again as diplomatic conflict flares between the U.S. and Russia (gee, who didn’t see that coming?). And, of course, the U.S. presidential election which appears to be culminating into the most divisive political event in America in decades. Ignore the delusional positivism of the mainstream media and a large part of the equities trading community. Their fantasies only grow more elaborate the closer we get to a market heart attack. And remember, economic collapse is a process, not an overnight affair. The progression of global decline should be apparent to anyone paying attention since 2008. The only question is, when will the average citizen become aware? My feeling according to current trends is, very soon. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Elizabeth Holmes To Shut Theranos' Core Operations, Fire 40% Of Workers Posted: 05 Oct 2016 06:24 PM PDT The death of Theranos has been long coming ever since the WSJ' John Carreyrou did a phenomenal job, starting about one year ago, of exposing the fraud that is Clinton Global Initiative-darling Elizabeth Holmes, but as of this evening it is largely official. In an "open letter" just posted on the company's website, Holmes said Theranos would shut down its blood-testing clinical labs and fire 340 of approximately 790 full time employees, roughly 40% of its entire workforce. As the WSJ, whose story this has been from day one writes, "the moves mark a dramatic retreat by the Palo Alto company and founder Elizabeth Holmes from their core strategy of offering a long menu of low-price blood tests directly to consumers. Those ambitions already were endangered by crippling regulatory sanctions that followed revelations by The Wall Street Journal of shortcomings in Theranos’s technology and operations." Still, while Theranos' official closure, and still long-overdue criminal raid, should have taken place long ago (we wonder if Holmes' proximity to the Clinton Foundation may be a mitigating factor) in a testament to just how much dumb money there really is, the company will still continue to operate, even if under a severely scaled down, "post-pivot" business model. As Holmes writes, "we will return our undivided attention to our miniLab platform. Our ultimate goal is to commercialize miniaturized, automated laboratories capable of small-volume sample testing, with an emphasis on vulnerable patient populations, including oncology, pediatrics, and intensive care." Holmes announced in August a new blood-testing device called miniLab, which is about the size of a printer but hasn’t been approved by regulators. The shutdowns and layoffs could help the closely held company minimize its cash burn in its attempt to accelerate the development of products that could be sold to outside laboratories, although it is unclear who would want to buy them. Her full - and perhaps final - letter is below:

According to the WSJ, a retreat from the strategy that won the company a valuation of $9 billion in 2014 could make it less complicated for Ms. Holmes, to keep running Theranos as chief executive if the a ban sought by regulators to prevent her from owning any lab for two years is imposed. She also controls a majority voting stake in the company and can’t be easily removed from her position, according to people familiar with the matter. As for the new product, we doubt it will get a billion, or even a million dollar valuation: "The miniLab was unveiled at a conference of lab scientists, and Ms. Holmes said it could run accurate tests from a few drops of blood. Theranos sought emergency clearance of Zika-virus blood test but then withdrew its request after federal regulators found that the company didn’t include proper patient safeguards in a study of the new test." Oops. But while Holmes downfall, while fascinating, was predictable the far bigger question is how she managed to get to the top in the first place. The answer: a relent barrage of sycophants, paving her way from day one, instead of asking probing questions for some reason we hope to uncover one day. Here is a sample of everyone in the press who probably should be fired, courtesy of Bruce Quinn. August 30, 2013 September 8, 2013 The pivotal Wall Street Journal article, by Joseph Rago. Here A Stanford dropout is bidding to make tests more accurate, less painful - and at a fraction of the current price. September 9, 2013 "Secretive Theranos emerging partly from shadows." SF BizJournal, SF/Biotech, by Ron Leuty, subtitled, "The biggest biotech you've never heard of." Here. October 9, 2013 November 6, 2013 "What Heath Care Needs is a Real Time Snapshot of You." WIRED, By Daniela Hernandez. Here. November 13, 2013. November 18, 2013 MedPageToday. By Eric Topol. Here. February 18, 2014 "This Woman Invented a Way to Run 30 Lab Tests on Only One Drop of Blood." WIRED again, by Caitlin Roper. Here. WIRED revisits Holmes, with an interview. February 28, 2014 "Stanford Dropout Revolutionizes Blood Tests" Take Part, by Liana Aghajanian. Here. June, 2014 Hematology Reports (Open Access Journal). Full article PDF: Here. Chan SM, Chadwick J, Young DL, Holmes E, & Gotlib J (2014). Intensive serial biomarker profiling for the prediction of neutropenic fever with hematologic malignancies undergoing therapy: a pilot study. Hematology Reports 6(2). Pubmed Central, here. June 12, 2014 "This CEO is Out for Blood." June 17, 2014 "Elizabeth Holmes, Who Wants To Shake Up The Blood Testing Industry, Is A Billionaire At 30." Forbes [blog], by - Zina Moukheiber. Here. July 2, 2014 "Bloody Amazing." Forbes [blog 7/2, and Issue, 7/21], by Mathew Herper. Here. June 3, 2014 US Patent: "Systems and Methods of Sample Processing and Fluid Control in a Fluidic System." PDF, Patent 8,742,230 B2, 80 pp.. Here. "This invention is in the field of medical devices...portable medical devices that allow real-tie detection of analytes from a biological fluid...for providing point-of-care testing for a variety of medical applications." June 20, 2014 "Theranos: Small Sample, Big Opportunity." Decibio [Consultancy blog]. By Eric Lakin. Here. July 8, 2014 "Nanotainer Revolutionizes Blood Testing." VIDEO USA TODAY. Here. July 15, 2014 "Meet Elizabeth Holmes, Silicon Valley's Latest Phenomenon" San Jose Mercury News, by Michelle Quinn. Here. July 15, 2014 "Theranos bringing 500 new jobs to Scottsdale's SkySong." Phoenix Business Journal. By Angela Gonzales. Here. [SkySong is an ASU-affiliated tech park]. July 21, 2014 "Meet Elizabeth Holmes, the Youngest Female Self-made Billionaire Changing the World with Medical Technology." Women's ILAB, by Katherine Melescuic. Here. August 11, 2014 "Ignoring Lab Industry, Theranos Goes Its Way." "My Visit to Walgreens for Theranos Lab Tests." DARK REPORT (Paper by subscription only). Table of contents here. September 8, 2014 September 8, 2014 "Elizabeth Holmes takes Theranos' blood test to tech movers, shakers." Biotech SF / Bizjournals - by Ron Leuty. Discussion of TechCrunch presentation. Here. September 29, 2014 "This Woman's Revolutionary Idea Made Her A Billionaire — And Could Change Medicine." Business Insider. By Kevin Loria. Here. See also June 4, 2015. September 30, 2014 "Queen Elizabeth: Mystique of Theranos founder grows with Forbes' richest ranking." Biotech SF / Bizjournals - by Ron Leuty. Here. October, 2014 "Health Plans Deploy New Systems to Control Use of Lab Tests." Managed Care. By Joseph Burns. Here. Does not directly cite Theranos. Cites contrasting viewpoints on the value of direct easy inexpensive test access: October 1, 2014 "How One Entrepreneur is Transforming Blood Testing." Slate - by Kevin Loria. Here. [Reprint from Business Insider, 9/29, above.] October 16, 2014 October 27, 2014 November 7, 2014 TEDMED - Youtube - Elizabeth Holmes at TEDMED. VIDEO. Here.,For further details, see here. November 7, 2014 December 8, 2014 Fortune/Youtube - Theranos Billionaire Founder Talks Growth. VIDEO. Video interview with Pattie Sellers. Here. December 8, 2014 December 8, 2014 December 12, 2014 December 14, 2014 January 28, 2015 "Elizabeth Holmes, Theranos: Transforming Healthcare by Embracing Failure." Youtube. Stanford Graduate School of Business. Here. February, 2015 "Top 10 Most Innovative Companies in Health Care, 2015: #7, Theranos" Fast Company (staff), here. February, 2015 "Vetting Theranos" Laboratory Economics [trade journal, subscription]. By JonDavid Kipp. Here. February 2, 2015. "CEO Q&A: Craig Hall." Real Estate Daily. By Christina Perez. Hall was early investor in Theranos. Here. February 3, 2015 "Breakthrough Branding: Theranos, with Walgreens, Revolutionizes Healthcare." Brand Channel. By Sheila Shayon. Here. February 3, 2015 "Will Theranos Turn the Lab Industry Upside Down?" February 6, 2015 "Ten Things to Know about America's Youngest Female Billionaire." Business Insider. By Koa Beck. Here. February 5, 2015 "Disruptive Technology Main Focus at Clinton Health Conference." | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The London Gold Float Estimates Updated Posted: 05 Oct 2016 05:46 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1265.20 Down $1.10 or 0.09% Posted: 05 Oct 2016 05:23 PM PDT

FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Roger Stone: Why Assange Didn't Release Hillary Bombshell Posted: 05 Oct 2016 04:18 PM PDT Roger Stone explains why Julian Assange didn't release the bombshell information he has on Hillary Clinton. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NSA contractor ‘secretly’ arrested after FBI found highly classified info at home Posted: 05 Oct 2016 03:00 PM PDT The FBI "secretly arrested" a National Security Agency contractor on suspicion of stealing and revealing malware the NSA used to hack foreign governments. RT America's Alexey Yaroshevsky reports. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| John Embry Says Maguire Is Right, Gold & Silver Smash Was Orchestrated To Bailout Shorts Posted: 05 Oct 2016 02:43 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Oversold Posted: 05 Oct 2016 01:44 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China’s Hidden Plan to Accumulate Gold Posted: 05 Oct 2016 01:00 PM PDT This post China's Hidden Plan to Accumulate Gold appeared first on Daily Reckoning. China wants to do what the U.S. has done, which is to remain on a paper currency standard but make that currency important enough in world finance and trade to give China leverage over the behavior of other countries. The best way to do that is to increase its voting power at the IMF and have the yuan included in the IMF basket for determining the value of the special drawing right. Getting those two things required the approval of the United States because the U.S. has veto power over important changes at the IMF. The U.S. can stand in the way of Chinese ambitions. China accomplished that last November when the IMF agreed to include the yuan in its basket of currencies. That officially happened just a few days ago, Sept. 30. The rules of the game also say you need a lot of gold to play, but you don't recognize the gold or discuss it publicly. Above all, you do not treat gold as money, even though gold has always been money. The members of the club keep their gold handy just in case, but otherwise, they publicly disparage it and pretend it has no role in the international monetary system. China is expected to do the same. It's important to note that China will not act in the best interests of gold investors; it will act in the best interests of China. Right now, China officially does not have enough gold to have a "seat at the table" with other world leaders. Think of global politics as a game of Texas Hold'em. What do want in a poker game? You want a big pile of chips. Gold serves as political chips on the world's financial stage. It doesn't mean that you automatically have a gold standard, but that the gold you have will give you a voice among major national players sitting at the table. For example, Russia has one-eighth the gold of the United States. It sounds like they're a small gold power — but their economy's only one-eighth as big. So, they have about the right amount of gold for the size of their economy. And Russia has ramped up its gold purchases recently. The U.S. gold reserve at the market rate is under 3% of GDP. That number varies because the price of gold varies. For Russia, it's about the same. For Europe, it's even higher — over 4%. In China, that number is about 0.7% officially. Unofficially, if you give them credit for having, let's say, 4,000 tons, it raises them up to the U.S. and Russian level. But they want to actually get higher than that because their economy is still growing, even if it's at a much lower rate than before. Here's the problem: If you took the lid off of gold, ended the price manipulation and let gold find its level, China would be left in the dust. It wouldn't have enough gold relative to the other countries, and because the price of gold would be skyrocketing, they could never acquire it fast enough. They could never catch up. All the other countries would be on the bus while the Chinese would be off. When you have this reset, and when everyone sits down around the table, China's the second largest economy in the world. They have to be on the bus. That's why the global effort has been to keep the lid on the price of gold through manipulation. I tell people, if I were running the manipulation, I'd be embarrassed because it's so obvious at this point. The price is being suppressed until China gets the gold that they need. Once China gets the right amount of gold, then the cap on gold's price can come off. At that point, it doesn't matter where gold goes because all the major countries will be in the same boat. As of right now, however, they're not, so China has though to catch-up. There is statistical, anecdotal and forensic evidence piling up for this. All of it is very clear. I've also spoken to members of Congress, the intelligence community, the defense community and very senior people at the IMF about it. China is our largest trading partner. It's the second largest economy in the world. The U.S. would like to maintain the dollar standard. I've described some catastrophic scenarios where the world switches to SDRs or goes to a gold scenario, but at least for the time being, the U.S. would like to maintain a dollar standard. Meanwhile, China feels extremely vulnerable to the dollar. If we devalue the dollar, that's an enormous loss to them. That's why, behind the scenes, the U.S. needs to keep China happy. One way to do that is to let China get the gold. That way, China feels comfortable. If China has all paper and no gold, and we inflate the paper, they lose. But if they have a mix of paper and gold, and we inflate the paper, they'll make it up on the gold. So they have to get to that hedged position. Gold is liquid, but it's a fairly thin market. If I call JP Morgan and say, "Hey, I want to buy 500 tons of gold," I can't do it. That would be a huge order. An order like that has to be worked between countries and central banks behind the scenes. It's done at the BIS, the Bank for International Settlements, in Basel, Switzerland. They're the acknowledged intermediary for gold transactions among major central banks and private commercial banks. That's not speculation. It's in the footnotes of the annual BIS report. I understand it's geeky, but it's there. They have to acknowledge that because they actually get audited. Unlike the Fed and unlike Fort Knox, the BIS gets audited, and they have to disclose those kinds of things. The evidence is there. China is saying, in effect, "We're not comfortable holding all these dollars unless we can have gold. But if we are transparent about the gold acquisition, the price will go up too quickly. So we need the western powers to keep the lid on the price and help us get the gold, until we reach a hedged position. At that point, maybe we'll still have a stable dollar." The point is that is that there is so much instability in the system with derivatives and leverage that we're not going to get from here to there. We're not going to have a happy ending. The system's going to collapse before we get from here to there. At that point, it's going to be a mad scramble to get gold. Gold is still the safest asset, and every investor should have some in their portfolio. The price of gold will go significantly higher in the years ahead. But contrary to what you read in the blogs, gold won't go higher because China is confronting the U.S. or launching a gold-backed currency. It will go higher when all central banks, China's and the U.S.' included, confront the next global liquidity crisis, worse than the one in 2008, and individual citizens stampede into gold to preserve wealth in a world that has lost confidence in all central banks. When that happens, physical gold may not be available at all. The time to build your personal gold reserve is now. Regards, Jim Rickards Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post China's Hidden Plan to Accumulate Gold appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mike Kosares: When markets go bump in the night Posted: 05 Oct 2016 12:28 PM PDT 3:30p ET Wednesday, October 5, 2016 Dear Friend of GATA and Gold: Mike Kosares of USAGold in Denver writes today that Deutsche Bank's troubles may have the same sort of effect on the world financial system that those of Lehman Brothers had in 2008 and thus may remind the world of the virtues of gold. Kosares' analysis is headlined "When Markets Go Bump in the Night" and it's posted at USAGold here: http://www.usagold.com/cpmforum/2016/10/05/when-markets-go-bump-in-the-n... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT K92 Mining Shows What 'Fast Track' Really Means Company Announcement "Fast-tracking" is an overused phrase in the mining sector. But K92 Mining Inc. (TSX.V: KNT) has demonstrated exactly what that concept means. Less than four months after going public on May 25, the company has completed additional financings totaling $18.5 million. It also refurbished the mill and mine facilities with enhanced processing capacity and has two drills turning onsite. With all this accomplished, production looks to be just days away. "The technical team on site has done an excellent job with the production restart, and we are on schedule and on budget," says Director and Chief Operating Officer John Lewins. "With that focus on track, and with the enhanced financial flexibility resulting from our recent financings, we are now looking to target a resource expansion that we believe exists." K92 has under-promised and over-delivered. ... ... For the remainder of the announcement: http://www.bnn.ca/k92-shows-what-fast-track-really-means-1.568196 Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold smash was a Western central bank operation, Embry tells KWN Posted: 05 Oct 2016 12:10 PM PDT 3:10p ET Wednesday, October 5, 2016 Dear Friend of GATA and Gold: Tuesday's smashing of gold was a Western central bank operation, Sprott Asset Management's John Embry tells King World News today. The world financial system, Embry says, "is being held together by constant central bank intervention, unsustainably low interest rates, and an unwarranted degree of public confidence. If gold and silver were to trade freely, their rapid price rises would quickly expose the true fragility of the system, and the ensuing interest rate rise would seriously threaten if not destroy the banking system. Thus the relentless suppression of gold and silver continues." Embry's comments are posted at KWN here: http://kingworldnews.com/john-embry-says-maguire-is-right-gold-silver-sm... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT ..... BEAT THE BANKERS AT THEIR OWN GAME ..... A free Webinar gives you all the details. Just click here: http://tinyurl.com/z4dj89k Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ronan Manly: London got some metal back but still supports lots more 'paper gold' Posted: 05 Oct 2016 11:52 AM PDT 2:53p ET Wednesday, October 5, 2016 Dear Friend of GATA and Gold: Gold researcher Ronan Manly reports today that gold supplies held by the Bank of England and the London bullion banks seem to have increased in recent months but are still part of a juggling act in which they support much larger quantities of "paper gold" not directly backed by metal. Manly's analysis is headlined "Tracking the Gold Held in London: An Update on ETF and BoE Holdings" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/ronan-manly/tracking-gold-held-london-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Judge's decision in gold market-rigging case is an invitation to journalism Posted: 05 Oct 2016 11:30 AM PDT 2:31p ET Wednesday, October 5, 2016 Dear Friend of GATA and Gold: Regarding disclosure today that the class-action anti-trust lawsuit against the London gold price-fixing banks, brought in U.S. District Court in Manhattan, has been allowed to proceed: 1) This is only a finding that there is enough evidence to continue the lawsuit, not a finding of market manipulation. Still, it may be very damaging to the bullion bank defendants because it clears the way for discovery and deposition -- that is, clears the way for compelling the bullion banks to produce documentation and give testimony prior to trial. I have always suspected that if any market-manipulation lawsuit got past summary judgment dismissal, as this lawsuit apparently has done, the defendants would offer a lot of money to settle the lawsuit privately rather than give the world a look at their business practices. Such a look might risk incriminating many other institutions and government agencies and risk revealing more offenses. ... Dispatch continues below ... ADVERTISEMENT NewCastle Gold's New CEO, Gerald Panneton, Hits the Ground Running By Tommy Humphreys Mining entrepreneur Gerald Panneton took a few years off after building one of Canada's largest gold miners, Detour Gold. He raced performance cars in his down time, and conducted due diligence on various mining assets to potentially back. This summer, the geologist set his sights on NewCastle Gold (TSXV:NCA), owner of a past-producing gold mine in California with similarities to Detour Gold in its early days. ... ... For the remainder of the report: https://ceo.ca/@tommy/new-newcastle-gold-ceo-gerald-panneton-hits-the-gr... Since this lawsuit is a class action and the nominal plaintiffs are numerous, maybe there is less chance that they can be bought off in exchange for secrecy. But at the moment there is no guarantee that the public will ever get a full accounting of any misconduct that has been going on in the gold market. 2) At least the decision to let the suit proceed should awaken the monetary metals mining industry to the issue of gold market manipulation. The industry has been catatonic, apparently too scared of the bullion banks and its own lending banks and too scared of the governments and central banks standing behind them. The industry still must decide whether it wants to die on its knees from price suppression or risk dying on its feet by struggling for free and transparent markets. 3) The decision also should awaken mainstream financial news organizations and financial market analysts to the gold market rigging issue. Gold market rigging -- that is, gold price suppression -- is the prerequisite for the rigging of ALL markets and it has facilitated the destruction of market economies everywhere. It has been perpetrated largely as a matter of the longstanding but surreptitious policies of Western governments, as documented by GATA. A summary of that documentation is here: http://www.gata.org/node/14839 Yet as far as GATA can determine, no mainstream financial news organizations or even gold market analysts have ever tried putting to any central bank a critical question about its surreptitious involvement in the gold market. The decision is another reason for news organizations and market analysts to attempt journalism. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LIVE Stream: Donald Trump Rally in Henderson, NV 10/5/16 Posted: 05 Oct 2016 10:53 AM PDT Wednesday, October 5, 2016: Live stream coverage of the Donald Trump for President rally in Henderson, NV at Henderson Pavilion. The event will begin at 11:30 AM PT. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FLASH: Market-rigging lawsuit against London gold fix banks can proceed Posted: 05 Oct 2016 10:01 AM PDT 1p ET Wednesday, October 5, 2016 Dear Friend of GATA and Gold: The financial news internet site Market Slant reports today that the federal judge handling the class-action anti-trust lawsuit against the banks that operated the daily London gold price fixing system from 2006 to 2012 has ordered the lawsuit to proceed, denying the defendants' request for dismissal. Market Slant says the judge's decision cites Deutsche Bank's confession to gold market manipulation in collusion with other bullion banks. Market Slant's report is posted here: http://www.marketslant.com/articles/exclusive-judge-rules-london-gold-fi... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Gold Standard Continues to Expand North Dark Star High-Grade Deposit Company Announcement VANCOUVER, British Columbia, Canada -- Gold Standard Ventures Corp. (TSXV: GSV; NYSE MKT:GSV) today announced assay results from two holes, DS16-21 and DS16-04, at the recently discovered North Dark Star oxide gold deposit on its fully-owned and controlled Railroad-Pinion Project in Nevada's Carlin Trend. Results from DS16-21 have increased the width of the deposit and, more importantly, have confirmed that higher-grade oxide mineralization projects up-dip to more shallow depths to the east of DS16-08. The primary objective of this year's drill program at North Dark Star was to expand the high-grade zone discovered in core hole DS15-13 (15.4 meters of 1.85 gold grams per tonne and 97 meters of 1.61 gold grams per tonne) at the end of last year's drill program. ... ...For the remainder of the announcement: https://goldstandardv.com/news/2016/expansion-gold-standards-north-dark-... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Quick Look At the Gold and Silver Technical Indicators - London Calling Posted: 05 Oct 2016 09:44 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| UK consumers snap up physical gold after price slides under 1,000 pounds/oz Posted: 05 Oct 2016 08:53 AM PDT By Jan Harvey LONDON -- Physical gold demand in London jumped after this week's price drop, dealers said today, as consumers were tempted back to the market by the metal's technically-driven slide through 1,000 pounds an ounce. Online gold trading platform BullionVault.com saw its heaviest trading day on Tuesday since its all-time record on June 24, the day of the UK referendum result on European Union membership, head of research Adrian Ash said. Other bullion dealers also reported higher sales following the fall, sparked by a bounce in the dollar that pushed the metal though key technical support at $1,300 an ounce. "We have an awful lot of clients who were waiting for a pullback in gold, so the phones have been busy here," Sharps Pixley Chief Executive Ross Norman said. "We're close to 1,000 pounds an ounce. People want to get in at these levels." ... ... For the remainder of the report: http://www.lse.co.uk/ukMoneyNews.asp?code=l7c4xmml&headline=UK_consumers... ADVERTISEMENT K92 Mining Shows What 'Fast Track' Really Means Company Announcement "Fast-tracking" is an overused phrase in the mining sector. But K92 Mining Inc. (TSX.V: KNT) has demonstrated exactly what that concept means. Less than four months after going public on May 25, the company has completed additional financings totaling $18.5 million. It also refurbished the mill and mine facilities with enhanced processing capacity and has two drills turning onsite. With all this accomplished, production looks to be just days away. "The technical team on site has done an excellent job with the production restart, and we are on schedule and on budget," says Director and Chief Operating Officer John Lewins. "With that focus on track, and with the enhanced financial flexibility resulting from our recent financings, we are now looking to target a resource expansion that we believe exists." K92 has under-promised and over-delivered. ... ... For the remainder of the announcement: http://www.bnn.ca/k92-shows-what-fast-track-really-means-1.568196 Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Don’t Get Caught in the U.S-China Crossfire – Game of Thrones Part I Posted: 05 Oct 2016 08:22 AM PDT This post Don't Get Caught in the U.S-China Crossfire – Game of Thrones Part I appeared first on Daily Reckoning. "When you play the Game of Thrones, you win or you die." – Cersei Lannister I was late to Season 6 of Game of Thrones (while buried in writing my next book Artisans of Money.) If you have never watched Game of Thrones, a) do so immediately and b) here's the nutshell. The show, based on the book series, depicts a land in which several kingdoms are duking it out for the Iron Throne, the symbol of absolute power. Think the board game "Risk" except with dragons, magic, an army of the dead, and lots of blood. While I was watching the show, I couldn't help realizing that this backdrop is a dead ringer for central banks' strategy. The Fed clings to status quo. Other central banks are vying to knock it down. But the Fed behaves as if it has no idea there are other powerful central banks in the world that want to grab and harness its power. It carries on refusing to acknowledge that there may come a time, sooner rather than later, where its power is attacked. The ramifications of such an attack will impact the standing of the U.S. in the world and your investments. The Fed can carry on being oblivious, but you need to be prepared. Game of Thrones is the perfect illustration for the struggles we see playing out right now. In the Game of Thrones world, an emerging queen, Daenerys Targaryen is biding her time and building and army. She is creating alliances in Meereen, an ancient powerful country in the East (her awesome fire-breathing dragons in tow). She's figured out how to play the long game and is strategically planning when to elevate the fight against the ruling power in the West, Cersei Lannister. The most important part of Daenerys' story is not that she is determined to rule the seven kingdoms and take possession of the Iron Throne. It's that she knows she can't do it alone. So she aligns reinforcements, smaller power bases. These smaller partners may or may not have allegiance to her based on the legitimacy of her claim to power — but they have all been wronged by the Lannister's. This family, currently led by Cersei Lannister, is extremely wealthy and powerful, but hasn't managed to lead the western kingdom, Westeros, to wealth and power. In fact, the people in Westeros are becoming increasingly frustrated and scared of their rulers. (You see the similarities?) The Fed's StateObviously in this situation, the Lannisters are representing the U.S. and the Fed specifically. The Fed remains in denial about the true state of the domestic and global economies. In its realm of hubris, it has no idea of the steps other central banks are taking, or want to take, to reduce their exposure and reliance on not just the U.S. dollar, but on U.S. political, monetary, financial and regulatory policy in general. Case in point. The Dow dropped 250 points on September 9th. On September 12th, Asian markets nose-dived on the possibility that the Fed might raise rates (though it said nothing of the sort — the "rate tease" is a manifestation of deliberate Fed obfuscation and media boredom). This is a pattern that plays out every month, with varying degrees of intensity, or volatility. Enter three of the Fed's giants, led by Lael Brainnard. During her speech at the Chicago Council on Global Affairs, she backtracked on any tightening talk saying, "the case to tighten policy preemptively is less compelling." That calmed markets. That day. It reminded them nothing is changing any time soon. U.S. stock markets rejoiced. Bubble-baiters bought. The Dow soared 1.3%. Elsewhere in the world though, no one wants their market whipsawed by Fed speak. Certainly not the People's Bank of China. The PBoC's approach has been to send out anti-Fed policy sound-bites through elite officials. These clips are picked up by national and international media and then spread to the general public. On September 13th, for instance, Yi Gang, a deputy governor from the PBoC, told a central banking conference in Vienna, "We're still very cautious on this (zero-interest rate) monetary policy." He added going in for the kill, "We have to be very careful and look at the limitations and uncertainty of a zero-interest rate policy, because in China we still have a decent growth rate." Subtle. What he basically said was "the Fed's policy is a joke and we're not laughing." In The Game of Monetary Policy, the Fed whacked the idea of "free markets" in the face. The ECB chucked an arrow in its heart. The BOJ sliced off its head. Markets are sustained artificially. The Fed has become, as you'll read more about in my book, the chief Artisan of Money. Central banks are bankrupt of new ideas to keep the system afloat. Or are they? While the Fed cut rates to zero, bloated its book to $4.5 trillion, and pressed the rest of the developed world to follow, global skepticism bubbled over. First the Chinese, then Latin America. Then the IMF. Then the Chinese again. Central bank elite took turns bashing Fed policy and calling for an alternative to the U.S. dollar associated with it. This is the equivalent of financial warfare. The U.S. and Fed struck first. It will take time, but the blowback is in motion. The U.S. dollar was attached to a financial crisis fueled by big bank recklessness and Fed apathy, followed by a Fed policy that devalued money itself. Many other countries had no choice but to follow the Fed's lead and directives, but that doesn't mean they were happy about it. As in Game of Thrones, the choice going forward is to forge strategic alliances with other houses or be slaughtered. The IMF is one of the houses who will be a crucial player in the new power constructs. The IMF Power PlayThe IMF, created by the U.S. and Europe, has been seeking a broader role in the monetary politics wars. For all the media dissection of every word Janet Yellen utters about rates, the IMF knows the Fed is lost. Its policy hasn't worked. It ignored this and raised rates last December, despite warnings from managing director, Christine Lagarde. Market punishment was swift and the damage was global. It caused renewed fear and anger from nations that had already suffered at the hands of the Fed and the U.S. banks it sustains. The U.S. has the largest voting block within the IMF, which is located blocks away from the White House, but IMF leadership understands how the winds of change are blowing. If the BRICS and a few more developed states were to act as a voting block (or increase their voting power, as they're attempting), they could potentially dislodge the strong influence that the U.S. has within the IMF. It was the U.S. voting block that gave Lagarde her job in 2011, and allowed Europe to maintain its 70-year stronghold on the IMF. As a result, Lagarde's opposition, Augustin Carstens, head of the Central Bank of Mexico, lost that country's first bid for the role. In Game of Thrones, this is the story of Tyrion Lannister. He's Cersei's brother, but has been loudly critical of her leadership. Originally, he tried to guide his sister towards better practices. She didn't listen to him. Now, he has joined forces with Daenerys and is helping her rise to power. His loyal alliance with Daenerys has led him to ascend the ranks again, from another angle. He is well-connected throughout the seven kingdoms. He is strategic. He knows the strengths and weaknesses of all the players. He is formidable despite his size (or in central bank terms, the volume of reserves). This is the Fed and the IMF. That entity was spawned to augment U.S. central bank and government power in the wake of WWII. Powerful, but not as powerful. Since the financial crisis, the IMF has been strategically chipping away at the Fed's power base. Like the PBoC, the IMF has been both criticizing and warning about the impact of Fed policy on other nations. By disparaging the Fed, it is amassing its own power. Its international influence has never been higher. Under Lagarde, the IMF is doing more than funding development projects and supplying overall currency directives to the world, as was its original mandate. It is reconstructing new alliances amongst countries not involved in its creation. In doing so, it is building its own power by elevating their allies. On October 1, for the first time in 43 years, the IMF will add China's currency, the Renminbi (denominated in yuan), into its Special Drawing Rights basket (SDR), or world money. In doing so, the IMF, at the zenith of its own power, has tipped the scales away from the U.S. and the Bretton Woods crew that created it in 1969. The expanding SDR basket (new world money) is as much a political power play as it is about increasing the number of reserve currencies for central banks. Stay tuned for Part II. Regards, Nomi Prins Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post Don't Get Caught in the U.S-China Crossfire – Game of Thrones Part I appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Worldwide Collapse And Prices For Gold & Silver That Are Unimaginable Today Posted: 05 Oct 2016 07:59 AM PDT Worldwide Collapse And Prices For Gold & Silver That Are Unimaginable Today | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deutsche Bank strategist says gold will keep crashing. (But then what about DB itself?) Posted: 05 Oct 2016 07:44 AM PDT Deutsche Bank Strategist Says the Gold Crash Is Just Getting Started By Narae Kim It has been a good ride for gold holders this year, as bullion posted its best first half performance in almost four decades. With global interest rates hovering at record lows, investors have piled into the precious metal. Meanwhile, political uncertainty from Britain's vote to leave the European Union and the looming U.S. presidential election also fanned demand, sending prices to almost $1,400 per ounce over the summer. But the shine is coming off amid the prospect of higher rates and reduced monetary stimulus. Bullion tumbled 3.3 percent on Tuesday, the most since July 2015, breaching below $1,300 an ounce for the first time since June. But this could be a prelude to a bigger selloff, according to Deutsche Bank AG Chief Global Strategist Binky Chadha. "The way we think about it is, gold looks to be 20 to 25 percent overvalued," Chadha said in an interview with Bloomberg TV on Tuesday. "Positioning is very, very long." ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-10-05/gold-looks-25-overvalu... ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Avery Goodman: Market manipulators choose Chinese holiday to smash gold Posted: 05 Oct 2016 07:23 AM PDT 10:25a ET Wednesday, October 5, 2016 Dear Friend of GATA and Gold: Colorado securities lawyer (and novelist) Avery Goodman today provides excellent analysis of yesterday's smashing of monetary metals futures prices. He suspects a desire by bullion banks, the agents of central banks, to cover their enormous short positions. The timing of the smash, during a weeklong market holiday in China, deepens such suspicion. Goodman also suspects the imminence of an event like a major bank failure that could explode monetary metals prices. In these circumstances,Goodman writes, he does not expect lower prices to last long. His commentary is headlined "Market Manipulators Choose a Chinese Holiday to Massively Attack Gold Prices" and it's posted at his internet site here: http://averybgoodman.com/myblog/2016/10/05/why-gold-prices-dropped-so-dr... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT NewCastle Gold's New CEO, Gerald Panneton, Hits the Ground Running By Tommy Humphreys Mining entrepreneur Gerald Panneton took a few years off after building one of Canada's largest gold miners, Detour Gold. He raced performance cars in his down time, and conducted due diligence on various mining assets to potentially back. This summer, the geologist set his sights on NewCastle Gold (TSXV:NCA), owner of a past-producing gold mine in California with similarities to Detour Gold in its early days. ... ... For the remainder of the report: https://ceo.ca/@tommy/new-newcastle-gold-ceo-gerald-panneton-hits-the-gr... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TNX, USD and SPX Meet their Respective Turning Points Posted: 05 Oct 2016 07:21 AM PDT Bond yields spiked this morning in a retracement of the decline from the September 13 high in an 89.5% retracement to the 2-hour Cycle Top. ZeroHedge comments, “"Soft" survey data from ISM appears to have trumped "hard" data from construction spending and factory orders, juicing expectations for a rate-hike in November to around 30% - the highest since The Fed began its so-called normalization cycle. The USD Index and bond yields are jumping on the news, stocks are unclear, and silver and gold are slipping further. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

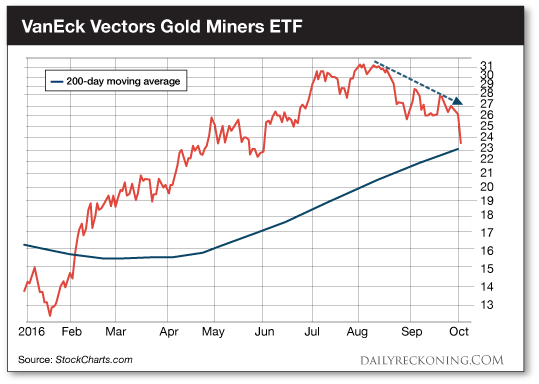

| GOLD CRASHES: Here’s Everything You Need to Know… Posted: 05 Oct 2016 07:20 AM PDT This post GOLD CRASHES: Here’s Everything You Need to Know… appeared first on Daily Reckoning. Tuesday trading was another bumpy ride for stocks. But it was gold that took the biggest beating, sending traders running as it crashed below key support. Tongue wagging from Team Fed and a rising dollar helped slap gold below $1,300 for the first time in more than three months as investors begin to comes to grips with a potential December rate hike. The Midas Metal smashed through the lower end of its trading range, shedding more than $25 before lunch on Thursday while the U.S. Dollar index stampeded higher. It was the most dramatic gold move we've witnessed since the Brexit vote aftermath— the last time the metal traded below the $1,300 level. The selling was relentless. By late afternoon, gold had shed $43 and was sitting at three-month lows. When the dust finally cleared, the yellow metal posted its biggest daily loss in nearly three years, according to data from Bloomberg. If you ever needed an excuse to start following the charts of your favorite assets, yesterday's crash was you wake up call. For the first six months of 2016, gold plays were our most profitable trades of the year. But there's a reason we haven't touched any precious metal trades lately… Markets move fast. After a rip-roaring first half, gold started to stall out. Just a few months ago, we were watching precious metals and miners vault to two-year highs as the Fed backed off on a summer rate hike and world markets shook in fear of the Brexit vote. This morning, we're watching the metal's halfhearted attempt at an oversold bounce. The fast money moved on to newer and better trades week ago. We warned you back in August that a lot of folks would attempt to hang onto their metal and mining plays as they stumble toward Labor Day. But as traders, we can't ignore what price is telling us. Let's break it down… First, check out this chart:

You can clearly see how $1,300 has become a pivotal level in gold. As precious metals started to lose momentum in early August, it was only a matter of time before traders would test this level. Now that sellers are in control, recovering $1,300 will be an uphill battle. Then there are the miners. These stocks were our first "tell" back in the summer that gold's monster move was in for more than just a short break. These volatile stocks had already broken below critical near-term support levels two months ago. Miners are now readying for an important test of the sector's 200-day moving average. This is an area we will watch carefully for any signs of a sustained bounce.

You might be tempted to snag some shares of your favorite miner after this sharp pullback. But I must warn you: the risks of being early on a play like this far exceed the potential rewards. Don't be a dummy! Wait for some confirmation that we're going to get a sustained bounce before gambling on higher prices. I'll keep an eye on gold and the mining sector as it attempts to recover from yesterday's crash. If gold and the miners reverse course and blast higher, I'll gladly get us back into some potentially profitable trades. But for now, the right move with gold and gold miners is to wait on the sidelines for more favorable trading conditions. We also have to deal with other outside forces pulling at gold as we head toward the end of the year. Rate hike roulette is going to be a fun game leading up to the December Fed meeting… "The odds of tightening at the next central bank meeting on Nov. 1-2, the week before Americans head to the polls in the presidential election, is just 19.3 percent," Bloomberg reports. "Still, the probability of a move in December is now 61.8 percent, up from less than 40 percent two months ago." Right now, the market is telling us investors are trying to come to grips with a December hike. We could spend all day speculating about whether or not the Fed will actually raise rates and how this will impact gold in the long-term. But we have to remember that price is king. Gold could continue to break down, regardless of what happens with the Fed. Those are the facts… Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Never miss another buy signal. Click here now to sign up for FREE. The post GOLD CRASHES: Here’s Everything You Need to Know… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Buying ‘Opportunity’ After Surprise 3.4% Drop Posted: 05 Oct 2016 06:46 AM PDT “Gold rebounded after the biggest drop in more than a year as investors reminded themselves of a world that’s beset by risk, from the prospect of further currency weakness to the final stretch of the U.S. presidential election,” according to Bloomberg today. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gerald Celente - Presidential Election Will Not Affect Economy. What Will? - (9/28/2016) Posted: 05 Oct 2016 05:28 AM PDT "The newest Trend Alert is released, OPEC reaches an agreement to oil prices & "America's military has had it with nation building". Occupy Peace!" The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 04 Oct 2016 05:37 PM PDT Stocks fall on renewed Deutsche Bank fears. Commerzbank to cut 9,600 jobs, suspend dividend. Wells Fargo draws abuse for consumer fraud. Capital outflows from Italian banks accelerate. Gold and silver down hard on stronger dollar. US GDP revised slightly higher, consumer spending softens. OPEC agrees to output cut, oil price jumps. Tax evasion becomes campaign […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold: Is the Bull Market Over? Posted: 04 Oct 2016 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment