Gold World News Flash |

- Gold and Deflation

- As China Liquidates US Treasuries, It is "Gobbling" Up Japanese Government Bonds

- Silver Prices in an Exponential Financial System

- Washington's Struggle: Remaining Relevant

- Bullion Banks "pass the parcel" on El Salvador’s Gold Reserves

- SHOCK: WIKILEAKS Proof of 'EXECUTIVE ORDERS FOR SALE?' by HILLARY Camp - Podesta emails.

- How Half Of America Lost Its F**king Mind

- BREAKING: "Prophecy Revealed In Europe"

- All American people need to see this: MARTIAL LAW Agenda NEW WORLD ORDER! Evidences 2016

- Chinese miners in talks for stake in Barrick's Veladero mine, Reuters says

- The Stunning Magnitude of Clinton Crimes

- BREAKING - NEW Wikileak Emails - Cheryl Mills To Podesta "We Need To Clean This Up" BAM !!!!

- Gold Daily and Silver Weekly Charts - Dollar Looking Toppy - Hell Freezes Over

- BREAKING: RUSH LIMBAUGH TALKS WITH DONALD TRUMP

- ANONYMOUS Prelude to Operation Silence #OpSilence 2016

- Bullion Banks pass the parcel on El Salvador’s gold reserves

- New Allegations Hit Hillary Clinton Camp - The Kelly File (FULL SHOW 10/24/2016)

- Broken Central Banks: 4 Quick Pix

- GATA Chairman Bill Murphy interviewed by Dave Kranzler and Rory Hall

- China & Russia Prepare For Chaos: Buying Gold - Mike Maloney

- The Next Financial Crisis

- Gold And Central Bank Confidence

- IS THE ELECTION RIGGED? | Dave Kranzler

- Indian, Chinese love affairs with gold turn financial

- As yuan sinks, Goldman sees rising gold demand in China

- Ronan Manly: How central banks and bullion banks work together to create imaginary gold

- Price Premium Returns for Diwali But Indias Gold Industry Struggling

- Diamonds in the Gold and Silver Mining Stocks

- Breaking News And Best Of The Web

- Why Aren’t Global Markets Freaking Out Over China’s Currency?

- Shocking News About Social Security

- 3 Facebook Secrets That Will Hand You Huge Profits

| Posted: 26 Oct 2016 01:00 AM PDT GoldBroker |

| As China Liquidates US Treasuries, It is "Gobbling" Up Japanese Government Bonds Posted: 25 Oct 2016 11:43 PM PDT As we reported one week ago, the latest Treasury International Capital report revealed something disturbing: not only had foreign central banks sold a record amount of US Treasurys in the past 12 months, some $346 billion worth...

... but America's largest foreign creditor, China, sold a record $34 billion in US paper in the latest month, and bringing its total holdings to the lowest since 2012.

This led to an obvious question: is China dumping all of its foreign reserve holdings proportionately, or is Beijing strategically offloading its US paper, for financial, political reasons or otherwise, as it buys other foreign government bonds. The answer, at least according to the Nikkei, is the latter. As the Japanese owner of the Financial Times reports, China is on a shopping spree, and has been "gobbling" up Japanese government bonds, adding that Beijing bought close to a net 9 trillion yen ($86.6 billion) worth of JGBs in the January-August period, more than tripling the amount from the same period last year. Incidentally that's almost equivalent to the number of US Treasurys sold by China. A simple explanation for the shift is that the People's Bank of China has been reducing its holdings of U.S. Treasurys in anticipation of higher U.S. interest rates and shifting some of its money to JGBs, where higher rates - courtesy of 250% in debt/GDP - are largely guaranteed to never arrive. But more importantly, and this could explain the perplexing recent strength in the Yuan, this trend may be a reason behind the yen's appreciation in foreign exchange markets in recent months. According to Japan's Ministry of Finance, China invested 8.9 trillion yen in Japanese securities in net terms between January and August. Buying started to exceed selling more often on a monthly basis in the second half of 2015. In April, net buying surpassed 3 trillion yen. Curiously, China is not buying the Japanese bonds for the "yield", but rather for liquidity: most of the securities purchased by the PBOC are bonds with maturities of one year or less. Judging by the latest TIC data, China's selling of US paper is accelerating, which also suggests that just as China has been a factor pushing the Yuan higher, the dollar has been pressured lower by the ongoing Chinese liquidation. One wonders how much higher the USD will jump if and when China decides to halt its selling of US paper, and how much lower the Yuan will then tumble in response, leading to even faster capital outflows from China. |

| Silver Prices in an Exponential Financial System Posted: 25 Oct 2016 11:01 PM PDT Our financial systems create exponential increases in: Debt Prices for stocks Prices for commodities Currency in circulation Prices for gold and silver Why? Fractional reserve banking, central banks... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| Washington's Struggle: Remaining Relevant Posted: 25 Oct 2016 11:00 PM PDT Submitted by Federico Pieraccini via Strategic-Culture.org, The most important event of the past 70 years is the change in the international order, from a US unipolar domination to a new multipolar reality. The fundamental question lies in understanding how this transition is taking place, its consequences and root causes The transition in the international order, from a pre-WWI multipolar world to a post-WWII bipolar world, cost humanity a world war involving millions of deaths. The next stage, distinct from the conflicts between the USSR and the US, ended with the fall of the Berlin Wall in 1989, but without the tragedy of direct confrontation. This fundamental historical difference has its own intrinsic logic governing the relationship of forces between powers. The USSR was a country in decline, unable to continue its role on the international stage as the premier anti-hegemonic power. The transition from a bipolar to a unipolar reality could have had nuclear consequences, but an agreement between the powers avoided this danger. The upshot was an unconditional surrender of the USSR, with catastrophic consequences in economic and cultural terms for the superpower to come to terms with, but at least without the explosion of a large-scale conflict. With the end of the bipolar model, however, began what some historians declared to be the «end of history»: the transition from a multipolar world, to a bipolar world, to end in a unipolar world. From the point of view of Washington, the story ended with only one global power remaining, thereby granting the United States the power to decide matters for the whole world. The scenario in which we live today, in terms of international law and the balance of forces, is almost unprecedented in history if looked at in the present context. It is true that the current transition from a unipolar to a multipolar reality is something similar to what has been seen in previous decades, with the transition from British hegemony in the late-nineteenth century to a multipolar situation in the period preceding the two world wars. Nevertheless, resorting to this historical analogy is difficult, given the relative absence of international rules compared to a century ago. Therefore it is difficult to use the earlier transition period to make assumptions about future trends. The causes of changeThe attitude of the US over the last 25 years has been focused completely on the achievement of global hegemony. The dream of having control over every event, in every corner of the world, has ironically led to accelerating the end of America’s unipolar moment. Of course the deep meaning of the word "control" can be expanded upon, examining the merits of the cultural, economic and military impositions that result from a constant quest for global domination. The US has chosen an impassable road that is full of contradictions to justify their rise as a global power. In two decades we have witnessed the dismantling of all the key principles of the balance of power between Russia and the United States, necessitating the change in international relations from unipolar to multipolar. Similarly, the ratio of economic and military power between China and the United States has significantly worsened, culminating in the dangerous dispute over the South China Sea. The abandonment of the Kissinger doctrine governing relations with Beijing, and the failure of the Clinton reset with Moscow, have pushed two global powers, Russia and China, to forge an alliance that allows for a world where there are more powers on the international stage and not just Washington as the central focus of global relations. The failure of the foreign doctrine of the United States was a direct consequence of the arrogance and the utopia of being able to dominate the planet, seeking to extend indefinitely the unipolar moment and forging a worldwide system culturally and economically based on the will of Washington, reinforced by a power and military posture without precedent. ConsequencesHad Washington thought more carefully about the consequences of their actions, and thereby employed a more considered strategic vision, it would certainly have opted for different choices. As a demonstration of this, we note Washington’s attitude in the Middle East, the deciding ground for prospects of continued US global hegemony. Much of Washington’s remaining capacity to influence global decisions is attributable to the dollar and the trading of goods such as oil in that currency. With the appearance of a world with more regional or global powers, it is easy to guess that the rise of the Iranian Republic has consequences for the whole of the Middle East region. The odds are evident that Tehran, culturally, economically and militarily, will be the first regional power. Washington has realized this and has decided to reach an agreement with the Islamic Republic in order to remain relevant in the region and not to be cut off from future agreements. Washington also seeks, in doing so, to counterbalance the situation with her most influential regional allies, Saudi Arabia and Qatar. It is a strategy that in the Middle East has had a negative impact in the immediate present for Riyadh, Doha, and in some ways even Ankara, who have all opted for an autonomous and interventionist approach in the region without much consultation with Washington. Nevertheless, the choice to include Iran as a dialogue partner for the Middle East balance has allowed Washington to conserve the illusion that in the future it will maintain an important role in regional decisions. This is a decision that has created many problems with historic allies, but Washington hopes, with a view to the future, to have made an appropriate choice. This also explains why so many of the neoconservatives and liberals (the promoters of a prolonged unipolar doctrine, the cause of so many failures ) are clearly opposed to this agreement. Washington and its establishment have opted for a cultural and economic confrontation with Moscow, possibly militarily with Beijing in the South China Sea, in the process impelling the emergence of a multipolar world in which more powers have the ability, by joining together, to resist the will of the greater global power. In fact, it is easier to frame the international balance in a multipolar model that is slowly becoming bipolar. We consider that Russia and China (and to a lesser extent Iran) do not possess the military capability to successfully oppose American power in a conventional conflict on a grand scale. For this reason, it is easy to understand that shaping a multipolar international order perhaps remains quite optimistic at this time. It is similarly optimistic to maintain a unipolar world order that remains anchored in the illusions of the American elite. Reality rather shows us a bipolar world, where the alternative pole to the US is represented by the union and alliances (cultural, economic and military) of Beijing, Moscow and Tehran. And their partnership has resulted in a change in the pattern of international relations. The cause of this union is to be found in the will of the US elites to prolong their unipolar moment. Instead of opting for an agreement with another global power (probably China) and seal the international stage in a realistic model with two poles, facing no real opposition, Washington has exacerbated the differences by pushing countries like Russia, China, Iran and India closer and closer together, forging what currently might be termed a temporary bipolar model of world order. The certainty is that the future will turn fully into a multipolar model, and this obliges Washington to struggle in every way possible to remain relevant. To date, apart from nuclear agreements, every choice has been counterproductive and wrong. Will Washington’s elites ever learn, or will they eventually become irrelevant? |

| Bullion Banks "pass the parcel" on El Salvador’s Gold Reserves Posted: 25 Oct 2016 09:30 PM PDT Submitted by Ronan Manly, BullionStar.com Eighteen months ago I wrote a short synopsis of a gold sales transaction by the central bank of El Salvador wherein it had sold 80% (about 5.5 tonnes) of its official gold reserves. The title of the post was “El Salvador’s gold reserves, the BIS, and the bullion banks“. If you thought, why the focus on the Banco Central de Reserva de El Salvador (BCR), it’s not a major player on the world gold market, you’d be correct, it’s not in its own right that important. However, the point of the article was not to profile the gold transactions of a relatively obscure central bank in Central America, but to introduce the topic of central bank gold lending to LBMA bullion banks, and the use of short-term ‘gold deposits‘ offered by these bullion banks. The reason being is this is a very under-analysed topic and one which I will be devoting more time to in the future. Gold loans by central banks to bullion banks are one of the most opaque areas of the global gold market. The fact that I’m using the central bank of El Salvador as the example is immaterial, it’s just convenient since the BCR happens to report the details of its gold lending operations, unlike most central banks. A Quick RecapAt the end of September 2014, the BCR claimed to hold 223,113 ozs of gold (6.94 tonnes), of which 189,646 ozs (5.9 tonnes) was held in the form of “deposits of physical gold” with the Bank for International Settlements (BIS), and 33,467 ozs (1.04 tonnes) which was held as “time deposits” of gold (up to 31 days) with 2 commercial bullion banks, namelyBarclays Bank and the Bank of Nova Scotia. The following table and all similar tables below are taken from the BCR’s ‘Statement of Assets backing the Liquidity Reserve’, or ‘Estado de Los Activos Que Respaldan la Reserva de Liquidez’, which it publishes every 3 months.

BCR gold position as of 30 September 2014 In November 2014, the BCR executed a small sale of 5007 ozs of its gold from its quantity held with the BIS, leaving a holding of 218,106 ozs (6.784 tonnes) as of 31 December 2014, comprising 184,639 ozs held in “deposits of physical gold” with the BIS, and 33,467 ozs of “time deposits” (of between 2 and 14 days duration) with 2 bullion banks, namely BNP Paribas and the Bank of Nova Scotia. Notice that as of the end of 2014, BNP Paribas was now holding one of the time deposits of gold, and that Barclays was not listed.

BCR gold position as of 31 December 2014 Notice also in the above table the tiny residual time deposit gold holding attributed to Standard Chartered Bank Plc. Rewind for a moment to 30 June 2014. At the end of June 2014, the BCR’s gold deposits were placed with 3 LBMA bullion banks, namely, Barclays, Bank of Nova Scotia, and Standard Chartered. This is the way short-term gold deposit transactions work. A central bank places the short-term gold deposit with one of a small number of bullion banks, most likely at the Bank of England, and when the deposit expires after e.g. 1 month, the central bank places the deposit again, but not necessarily with the same bullion bank. The deposit rates on offer (by the bullion banks) and the placements by the central banks are communicated over a combination of Bloomberg terminals, or by phone and then the transactions are settled by Swift messages. More about the actual mechanics of this process in a future article.

BCR gold position as of 30 June 2014

BCR sold its gold at the BIS, put the rest on depositIn March 2015, the BCR sold 174,000 ozs (5.412 tonnes ) of gold, which left El Salvador with 44,000 ozs. When I wrote about this transaction 18 months ago I had speculated that: “Since the Salvadoreans had 189,646 ozs on deposit with the BIS and needed to sell 179,000 ozs, the gold sold was most definitely sold to the BIS or to another party with the BIS acting as agent. It would not make sense to sell some or all of the time deposits that are out with the bullion banks such as Barclays and Scotia, since a large chunk of the BCR gold at the BIS would have to be sold also. It would be far easier to just deal with one set of transactions at the BIS. The above would leave the time deposits of 33,467 ozs (and accrued interest) out with the bullion banks, rolling over each month as usual. The other roughly 11,000 ozs that the BCR held with the BIS could be left with the BIS,or else this too could be put out on deposit with the bullion banks.” This speculation turns out to have been correct. By 31 March 2015, the BCR held 10,639 ozs of gold “deposits of physical gold” with the BIS, and the same 33,467 ozs of “time deposits“, but this time split evenly between BNP Paribas and Barclays. The entire 174,000 ozs of gold sold came from the “deposits of physical gold” that El Salvador held with the BIS.

BCR gold position as of 30 March 2015 By 30 June 2015, the central bank of El Salvador had moved its remaining 10,639 ozs of “deposits of physical gold” from the BIS, and placed it into “time deposits” with bullion banks, with the entire 44,106 ozs being evenly split across Bank of Nova Scotia, BNP Parias and Standard Chartered, each holding 14,702 ozs.

BCR gold position as of 30 June 2015 Over the 12 months from end of June 2014 to 30 June 2015, a combination of at least 4 LBMA bullion banks, namely,Barclays, Bank of Nova Scotia, Standard Chartered and BNP Paribas were holding short-term gold deposits on behalf of the central bank of El Salvador. I say at least 4 banks, because there could have been more. The snapshots every 3 months only reveal which banks held gold deposits on those dates, not the full list of deposits that could have been placed and matured over each 3 month period. These time deposits are essentially obligations by the bullion bank in question to repay the central bank that amount of gold. The original gold which was first deposited into the LBMA system could have been sold, lent or otherwise encumbered. It has become a credit in the LBMA unallocated gold system. Ultimately it needs to be paid back to the central bank by whichever bullion bank holds the deposit when the central bank decides that it no longer wants to roll its short-term deposits. This is why the anology of pass the parcel is a suitable one. Looking at the more recent 3 monthly snapshots from September 2015 to June 2016, the same 4 LBMA bullion bank names were still holding the BCR’s gold deposits, namely Bank of Nova Scotia, Barclays, Standard Chartered and BNP Paribas. As of 30 September 2015 – Bank of Nova Scotia, Barclays and BNP Paribas, evenly split between the 3 of them.

BCR gold position as of 30 September 2015 On 31 December 2015 – Bank of Nova Scotia, BNP Paribas, and Standard Chartered, evenly split between the 3 of them.

BCR gold position as of 30 December 2015 On 30 March 2016 – Bank of Nova Scotia and BNP Paribas, evenly split between the 2 of them.

BCR gold position as of 30 March 2016 On 30 June 2016, the BCR gold deposits were held by Bank of Nova Scotia and BNP Paribas, evenly spilt between the 2. The 30 June 2016 file on the BCR website doesn’t open correctly so this data was taken from the Google cache of the file. IMF Reporting standardsFinally, let’s take a quick look at what monetary gold and gold deposits actually are, as defined by the International Monetary Fund (IMF). “Monetary gold is gold owned by the authorities and held as a reserve asset. Monetary Gold is a reserve asset for which there is no outstanding financial liability”, IMF Balance of Payments Manual (BPM) In April 2006, Hidetoshi Takeda, of the IMF Statistics Department published a short opinion paper on the ‘Treatment of Gold Swaps and Gold Deposits (loans)‘ on behalf of the Reserve Assets Technical Expert Group (RESTEG) of the IMF Committee on Balance of Payments (BoP) Statistics. The paper was called “Issues Paper (RESTEG) #11“. In the Issues paper, Takeda states: “monetary authority make gold deposits ‘to have their bullion physically deposited with a bullion bank, which may use the gold for trading purpose in world gold markets‘” “‘The ownership of the gold effectively remains with the monetary authorities, which earn interest on the deposits, and the gold is returned to the monetary authorities on maturity of the deposits'” ” Balance of Payments Manual, fifth Edition (BPM5) is silent on the treatment of gold deposits/loans. However, the Guidelines states that, “To qualify as reserve assets, gold deposits must be available upon demand to the monetary authorities” You can see from the above |

| SHOCK: WIKILEAKS Proof of 'EXECUTIVE ORDERS FOR SALE?' by HILLARY Camp - Podesta emails. Posted: 25 Oct 2016 08:00 PM PDT WIKILEAKS PODESTA EMAILS PROOF of Pay-to-Play Salling of Executive Orders of the US Government! - EXECUTIVE ORDERS FOR SALE? LEAKED EMAIL SHOWS HILLARY CAMP ANSWERING WEALTHY DONOR'S QUESTIONS ABOUT HOW EXECUTIVE ORDERS WORK. The Financial Armageddon Economic Collapse Blog tracks trends... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| How Half Of America Lost Its F**king Mind Posted: 25 Oct 2016 07:35 PM PDT Authored by David Wong, originally posted at Cracked.com, I'm going to explain the Donald Trump phenomenon in three movies. And then some text. There's this universal shorthand that epic adventure movies use to tell the good guys from the bad. The good guys are simple folk from the countryside ...

... while the bad guys are decadent assholes who live in the city and wear stupid clothes:

In Star Wars, Luke is a farm boy ...

... while the bad guys live in a shiny space station:

In Braveheart, the main character (Dennis Braveheart) is a simple farmer ...

... and the dastardly Prince Shithead lives in a luxurious castle and wears fancy, foppish clothes:

The theme expresses itself in several ways -- primitive vs. advanced, tough vs. delicate, masculine vs. feminine, poor vs. rich, pure vs. decadent, traditional vs. weird. All of it is code for rural vs. urban. That tense divide between the two doesn't exist because of these movies, obviously. These movies used it as shorthand because the divide already existed. We country folk are programmed to hate the prissy elites. * * * That brings us to Trump...Here are six reasons for the rise of Trump that no one is taking about

1. It's Not About Red And Blue States -- It's About The Country Vs. The City

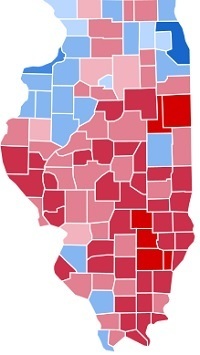

s I was born and raised in Trump country. My family are Trump people. If I hadn't moved away and gotten this ridiculous job, I'd be voting for him. I know I would. See, political types talk about "red states" and "blue states" (where red = Republican/conservative and blue = Democrat/progressive), but forget about states. If you want to understand the Trump phenomenon, dig up the much more detailed county map. Here's how the nation voted county by county in the 2012 election -- again, red is Republican:

Holy cockslaps, that makes it look like Obama's blue party is some kind of fringe political faction that struggles to get 20 percent of the vote. The blue parts, however, are more densely populated -- they're the cities. In the upper left, you see the blue Seattle/Tacoma area, lower down is San Francisco and then L.A. The blue around the dick-shaped Lake Michigan is made of cities like Minneapolis, Milwaukee, and Chicago. In the northeast is, of course, New York and Boston, leading down into Philadelphia, which leads into a blue band which connects a bunch of southern cities like Charlotte and Atlanta. Blue islands in an ocean of red. The cities are less than 4 percent of the land mass, but 62 percent of the population and easily 99 percent of the popular culture. Our movies, shows, songs, and news all radiate out from those blue islands. And if you live in the red, that fucking sucks. See, I'm from a "blue" state -- Illinois -- but the state isn't blue. Freaking Chicago is blue. I'm from a tiny town in one of the blood-red areas:

As a kid, visiting Chicago was like, well, Katniss visiting the capital. Or like Zoey visiting the city of the future in this ridiculous book. "Their ways are strange." And the whole goddamned world revolves around them. Every TV show is about LA or New York, maybe with some Chicago or Baltimore thrown in. When they did make a show about us, we were jokes -- either wide-eyed, naive fluffballs (Parks And Recreation, and before that, Newhart) or filthy murderous mutants (True Detective, and before that, Deliverance). You could feel the arrogance from hundreds of miles away.

"Nothing that happens outside the city matters!" they say at their cocktail parties, blissfully unaware of where their food is grown. Hey, remember when Hurricane Katrina hit New Orleans? Kind of weird that a big hurricane hundreds of miles across managed to snipe one specific city and avoid everything else. To watch the news (or the multiple movies and TV shows about it), you'd barely hear about how the storm utterly steamrolled rural Mississippi, killing 238 people and doing an astounding $125 billion in damage.

But who cares about those people, right? What's newsworthy about a bunch of toothless hillbillies crying over a flattened trailer? New Orleans is culturally important. It matters. To those ignored, suffering people, Donald Trump is a brick chucked through the window of the elites. "Are you assholes listening now?"

2. City People Are From A Different Goddamned Planet

"But isn't this really about race? Aren't Trump supporters just a bunch of racists? Don't they hate cities because that's where the brown people live?" Look, we're going to get actual Nazis in the comment section of this article. Not "calling them Nazis for argument points" Nazis, but actual "Swastikas in their avatars, rooted against Indiana Jones" Nazis. Those people exist. But what I can say, from personal experience, is that the racism of my youth was always one step removed. I never saw a family member, friend, or classmate be mean to the actual black people we had in town. We worked with them, played video games with them, waved to them when they passed. What I did hear was several million comments about how if you ever ventured into the city, winding up in the "wrong neighborhood" meant you'd get dragged from your car, raped, and burned alive. Looking back, I think the idea was that the local minorities were fine ... as long as they acted exactly like us.

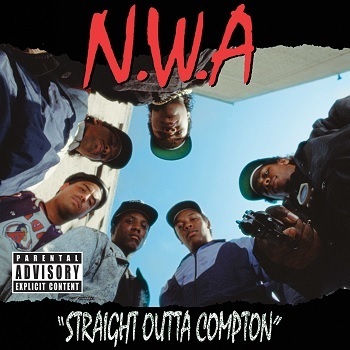

If you'd asked me at the time, I'd have said the fear and hatred wasn't of people with brown skin, but of that specific tribe they have in Chicago -- you know, the guys with the weird slang, music and clothes, the dope fiends who murder everyone they see. It was all part of the bizarro nature of the cities, as perceived from afar -- a combination of hyper-aggressive savages and frivolous white elites. Their ways are strange. And it wasn't like pop culture was trying to talk me out of it:

It's not just perception, either -- the stats back up the fact that these are parallel universes. People living in the countryside are twice as likely to own a gun and will probably get married younger. People in the urban "blue" areas talk faster and walk faster. They are more likely to be drug abusers but less likely to be alcoholics. The blues are less likely to own land and, most importantly, they're less likely to be Evangelical Christians.

In the small towns, this often gets expressed as "They don't share our values!" and my progressive friends love to scoff at that. "What, like illiteracy and homophobia?!?!" Nope. Everything.

3.Trends Always Start In The Cities -- And Not All Of Them Are Good

The cities are always living in the future. I remember when our little town got our first Chinese restaurant and, 20 years later, its first fancy coffee shop. All of this stuff had turned up in movies (set in L.A., of course) decades earlier. I remember watching '80s movies and mocking the "Valley Girl" stereotypes -- young girls from, like, California who would, like, say, "like" in between every third word. Twenty years later, you can hear me doing the same in every Cracked podcast. The cancer started in L.A. and spread to the rest of America. Well, the perception back then was that those city folks were all turning atheist, abandoning church for their bisexual sex parties. That, we were told, was literally a sign of the Apocalypse. Not just due to the spiritual consequences (which were dire), but the devastation that would come to the culture. I couldn't imagine any rebuttal. In that place, at that time, the church was everything. Don't take my word for it -- listen to the experts:

Church was where you made friends, met girls, networked for jobs, got social support. The poor could get food and clothes there, couples could get advice on their marriages, addicts could try to get clean. But now we're seeing a startling decline in Christianity among the general population, the godless disease having spread alongside Valley Girl talk. So according to Fox News, what's the result of those decadent, atheist, amoral snobs in the cities having turned their noses up at God? Drew Angerer/Getty Images, Scott Olson The fabric has broken down, they say, just as predicted. And what rural Americans see on the news today is a sneak peek at their tomorrow. The savages are coming. Blacks riot, Muslims set bombs, gays spread AIDS, Mexican cartels behead children, atheists tear down Christmas trees. Meanwhile, those liberal Lena Dunhams in their $5,000-a-month apartments sip wine and say, "But those white Christians are the real problem!" Terror victims scream in the street next to their own severed limbs, and the response from the elites is to cry about how men should be allowed to use women's restrooms and how it's cruel to keep chickens in cages.

Madness. Their heads are so far up their asses that they can't tell up from down. Basic, obvious truths that have gone unquestioned for thousands of years now get laughed at and shouted down -- the fact that hard work is better than dependence on government, that children do better with both parents in the picture, that peace is better than rioting, that a strict moral code is better than blithe hedonism, that humans tend to value things they've earned more than what they get for free, that not getting exploded by a bomb is better than getting exploded by a bomb. Or as they say out in the country, "Don't piss on my leg and tell me it's raining." The foundation upon which America was undeniably built -- family, faith, and hard work -- had been deemed unfashionable and small-minded. Those snooty elites up in their ivory tower laughed as they kicked away that foundation, and then wrote 10,000-word thinkpieces blaming the builders for the ensuing collapse.

4. The Rural Areas Have Been Beaten To Shit

Don't message me saying all those things I listed are wrong. I know they're wrong. Or rather, I think they're wrong, because I now live in a blue county and work for a blue industry. I know the Good Old Days of the past were built on slavery and segregation, I know that entire categories of humanity experienced religion only as a boot on their neck. I know that those "traditional families" involved millions of women trapped in kitchens and bad marriages. I know gays lived in fear and abortions were back-alley affairs. I know the changes were for the best. Try telling that to anybody who lives in Trump country.

They're getting the shit kicked out of them. I know, I was there. Step outside of the city, and the suicide rate among young people fucking doubles. The recession pounded rural communities, but all the recovery went to the cities. The rate of new businesses opening in rural areas has utterly collapsed.

See, rural jobs used to be based around one big local business -- a factory, a coal mine, etc. When it dies, the town dies. Where I grew up, it was an oil refinery closing that did us in. I was raised in the hollowed-out shell of what the town had once been. The roof of our high school leaked when it rained. Cities can make up for the loss of manufacturing jobs with service jobs -- small towns cannot. That model doesn't work below a certain population density. If you don't live in one of these small towns, you can't understand the hopelessness. The vast majority of possible careers involve moving to the city, and around every city is now a hundred-foot wall called "Cost of Living." Let's say you're a smart kid making $8 an hour at Walgreen's and aspire to greater things. Fine, get ready to move yourself and your new baby into a 700-square-foot apartment for $1,200 a month, and to then pay double what you're paying now for utilities, groceries, and babysitters. Unless, of course, you're planning to move to one of "those" neighborhoods (hope you like being set on fire!).

In a city, you can plausibly aspire to start a band, or become an actor, or get a medical degree. You can actually have dreams. In a small town, there may be no venues for performing arts aside from country music bars and churches. There may only be two doctors in town -- aspiring to that job means waiting for one of them to retire or die. You open the classifieds and all of the job listings will be for fast food or convenience stores. The "downtown" is just the corpses of mom and pop stores left shattered in Walmart's blast crater, the "suburbs" are trailer parks. There are parts of these towns that look post-apocalyptic. I'm telling you, the hopelessness eats you alive. And if you dare complain, some liberal elite will pull out their iPad and type up a rant about your racist white privilege. Already, someone has replied to this with a comment saying, "You should try living in a ghetto as a minority!" Exactly. To them, it seems like the plight of poor minorities is only used as a club to bat away white cries for help. Meanwhile, BREAKING: "Prophecy Revealed In Europe" Posted: 25 Oct 2016 07:00 PM PDT |

| All American people need to see this: MARTIAL LAW Agenda NEW WORLD ORDER! Evidences 2016 Posted: 25 Oct 2016 06:00 PM PDT MARTIAL LAW Exposed! Real Evidence! Very important information!!Pls share!! If you love USA pls share this important video! NWO - MARTIAL LAW and FEMA CAMPS Let's Share.. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Chinese miners in talks for stake in Barrick's Veladero mine, Reuters says Posted: 25 Oct 2016 05:01 PM PDT By John Tilak and Nicole Mordant China's Zijin Mining Group Co. Ltd. and Shandong Gold Mining Co. Ltd. have held separate talks with Barrick Gold Corp. to buy a 50-percent stake in its Veladero gold mine in Argentina, according to four sources with knowledge of the process. Veladero is one of Barrick's five core mines; all are in the Americas. It is expected to produce between 580,000 and 640,000 ounces of gold this year. The high quality of the mine, production capacity, and the prospect for geographical diversification have appealed to the state-owned Chinese suitors, said three of the sources, who requested anonymity because the matter is private. All spoke over the past week. ... ... For the remainder of the report: http://www.reuters.com/article/us-barrick-gold-argentina-idUSKCN12P2QD ADVERTISEMENT K92 Mining Begins Gold Production at Kainantu Mine Company Announcement K92 Mining Inc. is pleased to announce that gold production has commenced from the Irumafimpa gold deposit. Ian Stalker, K92 Chief Executive Officer, says: "This milestone is highly significant for our company, and for this region of Papua New Guinea. A great deal of thanks goes to the entire team on site in PNG in achieving production ahead of schedule and on budget. The rehabilitation of the Irumafimpa gold mine, process plant, and associated infrastructure commenced in late March and is now complete. As an enhancement of the processing facility, we are also pleased to note that the installation of a new drum scrubber is also nearing completion and commissioning of this will be completed by the end of the month. ..." ...For the remainder of the announcement: http://www.k92mining.com/2016/10/6077/ Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| The Stunning Magnitude of Clinton Crimes Posted: 25 Oct 2016 05:00 PM PDT Jonathan Emord in The Jeff Rense Show, October 24, 2016. Do you really even believe the vote is legitimate? If TPTB don't want Trump in office, he won't bee in office regardless of what 'We The Sheeple' want. The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| BREAKING - NEW Wikileak Emails - Cheryl Mills To Podesta "We Need To Clean This Up" BAM !!!! Posted: 25 Oct 2016 04:00 PM PDT SMOKING GUN -This is proof that President Obama KNEW about Clinton's home brew email server and did nothing about it. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Daily and Silver Weekly Charts - Dollar Looking Toppy - Hell Freezes Over Posted: 25 Oct 2016 01:16 PM PDT |

| BREAKING: RUSH LIMBAUGH TALKS WITH DONALD TRUMP Posted: 25 Oct 2016 01:00 PM PDT BREAKING: RUSH LIMBAUGH TALKS WITH DONALD TRUMP The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| ANONYMOUS Prelude to Operation Silence #OpSilence 2016 Posted: 25 Oct 2016 12:30 PM PDT ANONYMOUS Prelude to Operation Silence #OpSilence 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Bullion Banks pass the parcel on El Salvador’s gold reserves Posted: 25 Oct 2016 12:25 PM PDT Bullion Star |

| New Allegations Hit Hillary Clinton Camp - The Kelly File (FULL SHOW 10/24/2016) Posted: 25 Oct 2016 12:00 PM PDT Megyn Kelly on the Kelly File takes a look at the fake mainstream polls but more importantly she discusses the new wikileaks and other devastating news that came out regarding the Hillary Clinton camp. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Broken Central Banks: 4 Quick Pix Posted: 25 Oct 2016 11:57 AM PDT The Western central bank franchise system is totally broken, totally insolvent, and totally corrupt. It invites the Gold Standard return. The entire financial system is built upon a debt-based monetary system. The debt saturation process has run its full course. The central bank heads have been covering the sovereign debt for the last five years, having rendered their balance sheets as ruined. Debt is at obscene levels, like $19.7 trillion for the USGovt. No debt limits are in place anymore, a signal that most likely it has already defaulted. A hidden game is underway, with control lost to the creditors, even as they attempt to salvage their debt holdings. The major central banks continue to manage badly the great game, where money is fake phony and a farce. A titanic battle is underway, where the Eastern nations are discarding their USTreasury Bonds, and doing so in tremendous volume while they set up the many platforms and pieces to the Gold Standard. |

| GATA Chairman Bill Murphy interviewed by Dave Kranzler and Rory Hall Posted: 25 Oct 2016 10:30 AM PDT 12:30p CT Tuesday, October 25, 2016 Dear Friend of GATA and Gold: Interviewed by Dave Krazler of Investment Research Dynamics and Rory Hall of The Daily Coin, GATA Chairman Bill Murphy discusses the intervention by governments against the gold price and the developments that may overcome it. The interview is 26 minutes long and can be heard at the IRD internet site here: http://investmentresearchdynamics.com/bill-murphy-bill-murphy-the-fundam... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Ron Paul Endorses the Only Congressional Candidate Former U.S. representative, presidential candidate, and chairman of the House Subcommittee on Monetary Policy, fiat money's fiercest foe, Ron Paul, has endorsed Daria Novak, the Republican candidate for the U.S. House of Representatives in Connecticut's 2nd District. Paul said: "Daria Novak will be a forceful advocate for limited, constitutional government, individual liberty, and sound money on Capitol Hill. I am pleased to endorse her candidacy." Novak also has been endorsed by former presidential candidate and gold standard proponent Steve Forbes and by the New York Sun, among other friends of sound money. Novak also been endorsed by gold standard and sound-money advocates George Gilder, Lawrence Kudlow, Jimmy Kemp (Jack's son), and Jeffrey Bell. Forbes called Novak a "prosperity heroine." Contribute to Novak's campaign $500, $250, $100, $50, or whatever you can afford of the fiat money that is eroding in your checkbook. As the Sun wrote, "She vows to crusade" on the gold standard "as key to getting job creation, economic security, and upward mobility back at a sizzling rate." To donate to Novak's campaign, please visit: http://novakforcongress.org/donate/ Novak will personally thank all contributors. Give Daria your generous backing to put a voice for gold in Congress. This message was authorized by Daria Novak for Congress. Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| China & Russia Prepare For Chaos: Buying Gold - Mike Maloney Posted: 25 Oct 2016 09:00 AM PDT Mike Maloney has just posted his latest Insiders market update, which deals with gold and silver market technical analysis, and he interprets the latest Commitment Of Traders Report. This public version shows the last 3 minutes of the 12 minute video and shows the massive gold buying... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 25 Oct 2016 07:04 AM PDT This post The Next Financial Crisis appeared first on Daily Reckoning. In my forthcoming book The Road to Ruin: The Global Elites' Secret Plan for the Next Financial Crisis, I make a very simple point: In 1998 we were hours away from collapse and did everything wrong following that. In 2008, we were hours away from collapse and did the same thing. Each crisis is bigger than the one before. The stock market today is not very far from where it was in November 2014. The stock market has had big ups and downs. A big crash in August 2015, a big crash in January 2016. Followed by big rallies back both times because the Fed went back to "happy talk," but if you factor out that volatility, you're about where you were 2 years ago. People are not making any money in stocks. Hedge funds are not making money. Institutions are not making money. It's one of the most difficult investing environments that I've ever seen in a very long time. Again, the 2008 crisis is still fresh in people's minds. People know a lot less about 1998, partly because it was almost 20 years ago. was right in the middle of that crash. It was an international monetary crisis that started in Thailand in June of 1997, spread to Indonesia and Korea, and then finally Russia by August of '98. Everyone was building a firewall around Brazil. It was exactly like dominoes falling. Think of countries as dominoes where Thailand falls followed by Malaysia, Indonesia, Korea and then Russia. The next domino was going to be Brazil, and everyone (including the IMF and the United States) said, "Let's build a firewall around Brazil and make sure Brazil doesn't collapse." The Next DominoThen came Long-Term Capital Management. The next domino was not a country. It was a hedge fund, although it was a hedge fund that was as big as a country in terms of its financial footings. I was the general counsel of that firm. I negotiated that bailout. I think a many of my readers might be familiar with my role there. The importance of that role is that I had a front-row seat. I'm in the conference room, in the deal room, at a big New York law firm. There were hundreds of lawyers. There were 14 banks in the LTCM bailout fund. There were 19 other banks in a one billion dollar unsecured credit facility. Included were Treasury officials, Federal Reserve officials, other government officials, Long-Term Capital, our partners. It was a thundering herd of lawyers, but I was on point for one side of the deal and had to coordinate all that. It was a 4 billion dollar all-cash deal, which we put together in 72 hours with no due diligence. Anyone who's raised money for his or her company, or done deals can think about that and imagine how difficult it would be to get a group of banks to write you a check for 4 billion dollars in 3 days. Those involved can say they bailed out Long-Term capital. They really bailed out themselves. If Long-Term Capital had failed, and it was on the way to failure, 1.3 trillion dollars of derivatives would've been flipped back to Wall Street. The banks involved would've had to run out and cover that 1.3 trillion dollars in exposure, because they thought they were hedged. They had one side of the trade with Long-Term and had the other side of the trade with each other. When you create that kind of hole in everyone's balance sheets and everyone has to run and cover, every market in the world would've been closed. Not just bond markets or stock markets. Banks would've failed sequentially. It would've been what came close to happening in 2008. Very few people knew about this. There were a bunch of lawyers there, but we were all on 1 floor of a big New York law firm. The Fed was on the phone. We moved the money. We got it done. They issued a press release. It was like foaming an airport runway. You've got a jet aircraft with a lot of passengers and 4 engines on flames, and you foam the runways. The fire trucks are standing by, and somehow you land it and put out the fire. Life went on. Financial CrisisAfter that, the Federal Reserve cut interest rates twice, once at a scheduled FOMC meeting on September 29, 1998, and again at an unscheduled meeting. The Fed can do that. The Fed doesn't have to have a meeting. They can just do an executive committee-type meeting on the phone, and that's what they did. That was the last time, in October 15, 1998, that the Fed cut interest rates outside of a scheduled meeting. Though it was done to "put out the fire." Life went on. Then 1999 was one of the best years in stock market history, and it peaked in 2000 and then crashed again. That was not a financial panic. It was just a stock market crash. My point is that in 1998, we came within hours of shutting every market in the world. There were a set of lessons that should've been learned from that, but they were not learned. The government went out and did the opposite of what you would do if you were trying to prevent it from happening again. What they should've done was banned most derivatives, broken up big banks, had more transparency, etc. They didn't. They did the opposite. The government actually repealed swaps regulations, so you could have more derivative over-the-counter instead of trading them on exchanges. They repealed Glass-Steagall so the commercial banks could get into investment banking. The banks got bigger. The SEC changed the rules to allow more leverage by broker-dealers rather than less leverage. Then Basel 2, coming out of the Bank for International Settlements in Basel, Switzerland, changed the bank capital rules so they could use these flawed value-at-risk models to increase their leverage. Everything, if you had a list of things that you should've done to prevent crises from happening again, they did the opposite. They let banks act like hedge funds. They let everybody trade more derivatives. They allowed more leverage, less regulation, bad models, etc. I was sitting there in 2005, 2006, even earlier, saying, "This is going to happen again, and it's going to be worse." I gave a series of lectures at Northwestern University. I was an advisor to the McCain campaign. I advised the U.S. Treasury. I warned everybody I could find. This is all in the my upcoming book, The Road to Ruin. I don't like making claims like that without backing it up, so if you read the book, I tell the stories. Hopefully, it's an entertaining and readable, but it's serious in the sense that I could see it coming a mile away. Now, I didn't say, "Oh gee, it's going to be subprime mortgages here," the kind of thing you saw if you saw the movie "The Big Short." Obviously, there were some hedge fund operators who had sussed out the subprime mortgage. To me, it didn't matter. When I say it didn't matter, the point that I was looking at was the dynamic instability of the system as a whole. I was looking at the buildup of scale, the buildup of derivatives, the dynamic processes and the fact that one spark could set the whole forest on fire. It didn't matter what the spark was. It didn't matter what the snowflake was. I knew the whole thing was going to collapse. Too Big To FailThen, we come up to 2008. We were days, if not hours, from the sequential collapse of every major bank in the world. Think of the dominoes again. What had happened there? You had a banking crisis. It really started in the summer of '07 with the failure of a couple of Bear Stearns hedge funds, not Bear Stearns itself at that stage but these Bear Stearns hedge funds that started a search. There was one bailout by the sovereign wealth funds and the banks, but then beginning in March 2008, Bear Stearns failed. In June, July 2008, Fannie and Freddie failed. Followed by failures at Lehman and AIG. We were days away from Morgan Stanley being next, then Goldman Sachs, Citibank followed by Bank of America. JPMorgan might've been the last one standing, not to mention foreign banks (Deutsche Bank, etc.). They all would've failed. They all would've been nationalized. Instead, the government intervened and bailed everybody out. Again, for the second time in 10 years. We came hours or days away from closing every market and every bank in the world. For the everyday investor, what do you have? You've got a 401k. You've got a brokerage account. Maybe you're with E-Trade or Charles Schwab or Merrill Lynch or any of those names. You could run a pizza parlor, an auto dealer. You could be a dentist, a doctor, a lawyer, anyone with a small business. You could be a successful investor or entrepreneur. You've got money saved and you're looking at all of that wealth being potentially wiped out as it almost was in 1998 and in 2008. How many times do you want to roll the dice? It's just like playing Russian Roulette. One of these times, and I think it'll be the next time, it's going to be a lot bigger and a lot worse. To be specific, I said in 1998 the government, regulators and market participants on Wall Street did not learn their lesson. They did the opposite of what they should do. It was the same thing in 2008. Nobody learned their lesson. Nobody thought about what actually went wrong. What did they do instead? They passed Dodd-Frank, a 1,000-page monstrosity with 200 separate regulatory projects. They say Dodd-Frank ended "too big to fail." No, it didn't. It institutionalized "too big to fail." It made "too big to fail" the law of the land, because they haven't made the banks smaller. The 5 biggest banks in the United States today are bigger than they were in 2008. They have a larger percentage of the banking assets. They have much larger derivatives books, much greater embedded risk. People like to use the cliché "kick the can down the road." I don't like that cliché, but they haven't kicked the can down the road. They've kicked the can upstairs to a higher level. From hedge funds to Wall Street, now the risk is on the balance sheet of the central banks. World MoneyWho has a clean balance sheet? Who could bail out the system? There's only organization left. It's the International Monetary Fund (IMF). They're leveraged about 3 to 1. The IMF also has a printing press. They can print money called Special Drawing Rights (SDR), or world money. They give it to countries but don't give it directly to people. Then the countries can swap it for other currencies in the SDR basket and spend the money. Here's the difference. The next time there's a financial crisis they'll try to use SDR's. But they'll need time to do that. They're not going to do it in advance and they're not thinking ahead. They don't see this coming. What's going to come is a crisis, and it's going to come very quickly. They're not going to be able to re-liquefy the system, at least not easily. Regards, Jim Rickards Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post The Next Financial Crisis appeared first on Daily Reckoning. |

| Gold And Central Bank Confidence Posted: 25 Oct 2016 07:02 AM PDT Graceland Update |

| IS THE ELECTION RIGGED? | Dave Kranzler Posted: 25 Oct 2016 06:52 AM PDT Dave Kranzler from Investment Research Dynamics joins Silver Doctors to discuss the presidential election, precious metals, and the stock market.Kranzler says it is unconscionable that the two choices we have in this presidential election are a "flakey businessman" and a "criminal."... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Indian, Chinese love affairs with gold turn financial Posted: 25 Oct 2016 06:07 AM PDT By Henry Sanderson For Surender Kumar Jindal, one of the biggest sellers of gold and silver bars in India, this year has not been good for business. Gold may have rallied 20 per cent in US dollar terms, putting it on course for its first annual rise in four years. For the Indian market, though, that has contributed to a fall in demand for the physical metal. ... Lacklustre demand in India marks a fundamental change for the physical gold market. After prices dropped in 2013, hefty buying from India and China saw hundreds of tonnes of metal flow eastward from vaults in London. However, analysts say this does not mean the world's two largest consumers of the metal have lost their love for bullion, rather that the way people buy gold there is changing. In China, gold is becoming an increasingly popular investment product through platforms run by the country's state-owned banks that allow investments on the Shanghai Gold Exchange via smartphones and online. New financial investment products such as gold exchange traded funds have also started to see inflows. ... ... For the remainder of the report: https://www.ft.com/content/f04ef42a-96cd-11e6-a80e-bcd69f323a8b ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| As yuan sinks, Goldman sees rising gold demand in China Posted: 25 Oct 2016 05:59 AM PDT From Bloomberg News Further weakness in China's currency and investors' concerns over the outlook for the nation's property market may spur gold demand in Asia's top economy, according to Goldman Sachs Group Inc., which made the forecast as the offshore yuan sank to a record. "The potential drivers of increased Chinese physical buying include purchasing gold as a way to hedge for potential currency depreciation in the face of capital controls," analysts including Jeffrey Currie and Max Layton, wrote in a report dated Monday. Bullion consumption in China may also rise "as a way of diversifying away from the property market," they said. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-10-25/as-yuan-retreats-goldm... ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Ronan Manly: How central banks and bullion banks work together to create imaginary gold Posted: 25 Oct 2016 05:16 AM PDT 8:16a ET Tuesday, October 25, 2016 Dear Friend of GATA and Gold: Examining records of the small gold reserves held by El Salvador's central bank, gold researcher Ronan Manly today demonstrates how central banks, the International Monetary Fund, the Bank for International Settlements, and bullion banks work together to arrange for official gold reserves to multiply themselves on paper, residing on the books of many purported owners at the same time, creating a fractional-reserve bullion banking system. Manly's report is headlined "Bullion Banks Pass the Parcel on El Salvador's Gold Reserves" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/ronan-manly/bullion-banks-pass-parcel-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT 13.4 Trillion Reasons Why New BMG Silver BullionFund Company Announcement TORONTO, Ontario -- Bullion Management Group Inc., a Canadian pioneer in precious metals investing, has expanded its line of bullion funds with the launch of BMG Silver BullionFund. The new fund invests exclusively in physical silver bullion. It is designed for investors seeking to add silver to their precious metals investments that offer long-term security and potential capital growth. BMG Silver BullionFund is an open-end mutual fund trust that can be purchased and redeemed daily at net asset value and is eligible for TFSA, RRSP, and RESP investments. Nick Barisheff, president and CEO of BMG, believes that there are several important reasons why investors looking for a safe haven are adding bullion to their portfolios. He observes that $13.4 trillion of government bonds worldwide now offer yields below zero. ... For the remainder of the announcement: http://bmgbullion.com/13-4-trillion-reasons-new-bmg-silver-bullionfund-m... Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Price Premium Returns for Diwali But Indias Gold Industry Struggling Posted: 25 Oct 2016 03:10 AM PDT Bullion Vault |

| Diamonds in the Gold and Silver Mining Stocks Posted: 25 Oct 2016 02:45 AM PDT Back in September we looked at a possible morphing Diamond on the GDXJ in which the dashed trendlines were showing the original Diamond. When it started to morph into the bigger Diamond I added the two red circles that showed the false breakouts from the original dashed Diamond. As you can see the last two weeks produced a rally that so far has failed below the apex of the morphing Diamond. From a Chartology perspective the Diamond is a reversal pattern as it has five reversal points. |

| Breaking News And Best Of The Web Posted: 25 Oct 2016 02:37 AM PDT Good news from Europe sends stocks higher. The dollar is rising and so is inflation. Corporate debt and earnings becoming major near-term risks. China’s mortgage bubble is the biggest ever. US auto sales start to fall. Major cyber attack hits US east coast. Clinton way up in polls after final debate. Best Of The […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Why Aren’t Global Markets Freaking Out Over China’s Currency? Posted: 24 Oct 2016 05:00 PM PDT |

| Shocking News About Social Security Posted: 24 Oct 2016 09:47 AM PDT This post Shocking News About Social Security appeared first on Daily Reckoning. Last week, the Social Security Administration announced some really bad news for retirees… The 2017 Social Security Cost of Living Adjustment is going to be a paltry 0.3%. That's about $5 per month. That's far less than the current inflation rate of 1.5%, which is expected to move even higher. Plus, Medicare premiums are set to jump as high as 22% next year for many seniors. In short, Social Security recipients are getting the shaft. But that's just the tip of the iceberg. Things get really scary when you start digging into the numbers… The System Is BustFor years, the political establishment has been telling us that Social Security is doing gangbusters—it's awesome! Not. But propaganda spins nonetheless. Here's what Democrat Senator Harry Reid said on "Meet the Press" in 2011: "Social Security is a program that works. It’s fully funded for the next 40 years. Stop picking on Social Security." My most charitable reaction to that statement is to say Harry's full of crap. The "fully funded" lie is floated because the Social Security "trust fund" is supposed to have roughly $2.7 trillion to pay out as benefits. But there is no cash in the Social Security trust fund. There never has been. Here's the best description of the "trust fund" scheme by David C. John of The Heritage Foundation: "In short, the Social Security trust fund is really only an accounting mechanism. The trust fund shows how much the government has borrowed from Social Security, but it does not provide any way to finance future benefits. The money to repay the IOUs will have to come from taxes that are being used today to pay for other government programs. For that reason, the most important date for Social Security is 2018, when taxpayers must begin to repay the IOUs, not 2042, when the trust fund is exhausted." The bottom line is there's no chance that the government is going to be able to honor its existing Social Security commitments without radically raising taxes or drastically reducing benefits… and soon. The most likely outcome is a combination of both. The End of Retirement?Here's the harsh truth… If you're in your 60s, you're looking at a reduction in Social Security benefits. If you're in your 40s or 50s, you're looking at big benefits cuts and much higher taxes. If you're younger than that, well, who's kidding who, you won't get anything. Look, Social Security's reckoning day is coming no matter the carping and whining. The math no longer works. The program pays out roughly $70 billion more than it takes in each year. And that shortfall is only going to get worse as more baby boomers retire. If you think politicians will somehow magically fix Social Security without benefit cuts and tax increases, you're living in a fantasyland. Those charlatans still out there telling you it's a viable program? That's just the story they need to tell to ensure their own political power. They can't tell you the truth and remain in office. And they know most people are intravenously connected to the Matrix already—so sweet nothings on the end of a boot work well. The truth is you can't rely on anyone but yourself to prepare for a comfortable retirement. And the safest, most profitable way to do that is if you're simply following the trend. Look, nothing in life is easy. But the sooner you get off the passive investing, Social Security merry-go-round, the sooner you can find some real peace of mind… and some real money. Please send your comments to me at coveluncensored@agorafinancial.com. Let me know what you think of today’s issue. Regards, Michael Covel Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post Shocking News About Social Security appeared first on Daily Reckoning. |

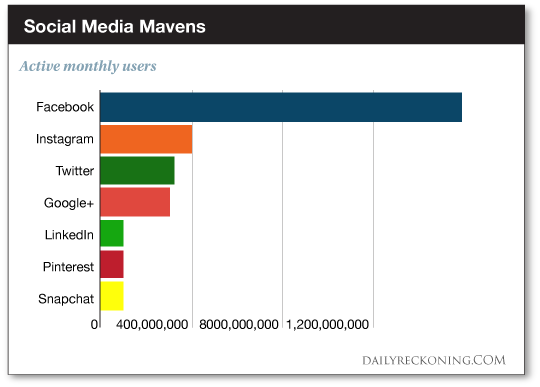

| 3 Facebook Secrets That Will Hand You Huge Profits Posted: 24 Oct 2016 07:34 AM PDT This post 3 Facebook Secrets That Will Hand You Huge Profits appeared first on Daily Reckoning. Big tech is soaring. Facebook Inc. (NASDAQ:FB) rocketed higher last week, spiking to new all-time closing highs on Friday. The social networking giant has cemented itself as an important market leader once again this year, blasting off its summer lows to help power the market higher into the fourth quarter. And it's just getting started… Our Facebook trade has already put double-digit gains in your pocket. Now we're seeing plenty of room for this stock to run much higher over the next several months—and beyond. Sure, Facebook has more than its fair share of detractors these days. The naysayers claim kids aren't using the platform anymore. Its ads aren't as effective as they could be. And the stock is just too damn expensive at current prices… We think that's a load of bunk. There's no way around it: Facebook is taking over the world. Here's how… 1. Facebook is acquiring and retaining active users. If you want something to be successful, people have to use it. It's a no-brainer. This is the secret Facebook has expertly cracked. Just check out their latest numbers for active monthly users…

Today's games are games of numbers, thousands, billions, and millions get thrown around all the time, even trillion lately (we'll touch on that a little later). We know the number 1.5 billion holds a lot of sway in the realm of social media. And we're not just talking monthly users either, Facebook is even garnering 1 billion-plus active daily users. Even their mobile messenger app has over a billion monthly users. A billion users and they are still waiting to monetize it. And we already know how good Facebook is at monetizing their products. Facebook might be the old man in the room compared to some of its newer competitors like Snapchat. But it just hasn't seen that flat-lining engagement trend that haunts most social media players in the market. With 85% of these user coming from outside the U.S. and Canada, Facebook has entered bidding war for the rights to broadcast cricket to their second largest market overall—India. With the craze we're seeing by other top dogs for payTV (Google, AT&T, etc.) this could be huge for Facebook. Which leads us to our next point… 2. Facebook is never going to be a one-trick pony We've seen social media platforms like Instagram reach crazy highs only to flat-line. But that's simply not the case for Facebook. Sure, Facebook has grabbed almost everyone on the Internet already (72% of Internet users in the U.S. alone). But Facebook continues to keep users coming back day after day with engaging new applications. Facebook isn't going to stop pumping out new updates for their day-to-day users as they made clear earlier this week… The company just announced that it is adding food delivery services that will work directly and seamlessly through the Facebook mobile app. That means more and more of Facebook's largest demographic (those garbage-eating millennials) will be adding a few daily visits to Facebook to get their fix. Yes, you can order pizza by tweeting an emoji—but we're betting Facebook comes out on top in the food delivery game. Facebook isn't just tackling mundane first-world problems like customized food delivery. It also has its hands in high-tech developments to help get its products in the hands of every person on the planet. Even virtual reality has become a huge interest for Facebook. Videos of Oculus Rift demos, Facebook's answer to VR competitors, have been circulating the web and there's no denying that VR is going to be huge. It already has the attention of everyone in health care and entertainment for applications in training and gaming. All of VR's applications are going to be incredibly lucrative and Facebook is going to be competing with the best as Oculus Rift garners more attention. It's clear that the company isn't going to stop pumping out updates and innovations that make it more useful to an already Facebook-crazed world… 3. The next trillion-dollar company? The race is on to see which company will be the first to earn a market value of $1 trillion… A few of the world's biggest public companies are steadily creeping toward the trillion-dollar mark. Facebook is one of 'em. Whether or not it's first across the finish line remains to be seen. But we can make a compelling case for the social networking king. Just take a look for yourself… Facebook is sitting just under Amazon at a $375 billion market cap and steadily gaining. Facebook is also going head-to-head with fellow $1 trillion-seeker Google. And if Facebook gets its way, it could be the next major search engine. Facebook has already indexed 2 trillion posts and is racking up posts at 1.5 billion per day. And it already accounts for 1 in 5 page views on the web today. One of the most important things to watch for in the race to $1 trillion is brand loyalty. When you couple Facebook's loyal following with Mark Zuckerberg's latest innovations and interests, you can bet we're going to see Facebook climb the rungs of this ladder to keep up with all the major runners in the race. If you're not focused on Facebook, you're missing one of the biggest growth opportunities in the world. Our little trade is already up double-digits. Watch it continue to post new highs (and shove more money in your pocket) as we race toward the new year… Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Never miss another buy signal. Click here now to sign up for FREE. The post 3 Facebook Secrets That Will Hand You Huge Profits appeared first on Daily Reckoning. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment