Gold World News Flash |

- ECB's First Chief Economist Warns: The EU Is A "House Of Cards"

- Silver, Debt, and Deficits – From an Election Year Perspective

- URGENT: DONALD TRUMP JUST DEMANDED NEW RULE FOR 3RD DEBATE THAT HAS HILLARY HORRIFIED!

- Deutsche Bank to pay $38 million for rigging silver, encouraging other settlements

- The Real Humanitarian Crisis Is Not Aleppo

- Ford To Idle Four Factories Due To Slowing Car Demand, Rising Inventories

- Michael Savage Donald Trump FULL Interview - October 17, 2016

- Deutsche Bank Pays $38 Million To Settle Silver Manipulation Lawsuit

- The Benjamin Fulford Report, October 17, 2016

- It's Beginning to Look like Silver & Gold Prices Have Found Sound Footing

- Prepare For The Financial Meltdown 2016-2017,Look at Canada or Australia If You Don't Believe It

- Inflation Above Target For Five Straight Years and Counting

- Gold Daily and Silver Weekly Charts - The Status Is Quo

- Is the Stock Market Set for a Massive Rally?

- Financial War Conversation with America’s Top Spy

- Will Fantasy Beat Reality?

- Even insiders know that the EU is doomed, Turk tells KWN

- The Game of Power

- Reply to Ross Norman: Is GATA discouraging gold investment?

- 5 Things To Watch

- China, Singapore boost gold pricing campaign in push for Asia

- This Past Week in Gold and Silver

- Stock Market Bubble Has Run Out of Excuses and Time

- December Might Be the Next Buying Opportunity in Gold

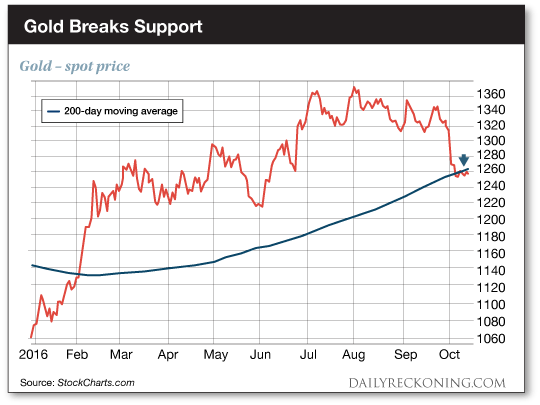

- It’s Do-Or-Die for Gold

- Singapore makes another bid for Asia to help set gold price

- Ross Norman: Central bank manipulation of gold wouldn't surprise me

- Gold Market in Crisis, Risks Collapse: LBMA

- Is Obama Juicing US Government Spending To Get Hillary Clinton Elected?

- Seek Your Independence: Anything Else Will Destroy You

- More Good News For Gold Bugs: The Bottom Is Getting Closer

- The Gold Manipulators Not Only Will Be Punished, They Have Been Punished

- Gold is Oversold on Misplaced Expectations of a 2016 Rate Hike

| ECB's First Chief Economist Warns: The EU Is A "House Of Cards" Posted: 18 Oct 2016 12:30 AM PDT Submitted by Mike Krieger via Liberty Blitzkrieg blog, None of the following about the EU will come as a surprise to most of you, but the language used by Otmar Issing is nevertheless pretty remarkable. The Telegraph reports:

Indeed, as I highlighted in last year’s post: German Study Proves It – 95% of Greek “Bailout” Money Went to the Banks.

The fact that some are actively considering this in the wake of all the populist movements tells on the continent, tells you just how disconnected many of these people are.

Of course, since most EU technocrats have virtually no capacity for introspection, there’s close to a zero percent chance they’ll do the right thing. Therefore, as I laid out in the post, It’s Not Just the UK – Widespread Support for EU Referendums Seen Across the Continent, here’s how I see things playing out:

For related articles, see: German Study Proves It – 95% of Greek “Bailout” Money Went to the Banks Does the Migrant Crisis Represent the End of the European Union? The EU Wants to Impose a Tax for Sharing Links on the Internet Head of the European Parliament Warns – EU at Risk of Falling Apart | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver, Debt, and Deficits – From an Election Year Perspective Posted: 17 Oct 2016 11:01 PM PDT It is an election year. We should anticipate 8 years of upcoming trauma, following nearly 8 years of "hope and change," after 8 years of "no nation building," after 8 years of "I did not have sexual... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| URGENT: DONALD TRUMP JUST DEMANDED NEW RULE FOR 3RD DEBATE THAT HAS HILLARY HORRIFIED! Posted: 17 Oct 2016 08:39 PM PDT Danny Gold for Liberty Writers reports, Whoooo Doggy! Donald Trump is back and better than ever, and now he is hitting Hillary Clinton right where it hurts… After all the non-stop abuse by the mainstream media who are trying to paint Trump to be a womanizing Coke head, Trump has made a demand... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deutsche Bank to pay $38 million for rigging silver, encouraging other settlements Posted: 17 Oct 2016 08:30 PM PDT Deutsche Bank to Pay $38 Million in U.S. Silver Price-Fixing Case By Nate Raymond NEW YORK -- Deutsche Bank AG has agreed to pay $38 million to settle U.S. litigation over allegations it illegally conspired with other banks to fix silver prices at the expense of investors, according to court papers filed today. The settlement, disclosed in papers filed in Manhattan federal court, came in one of many recent lawsuits in which investors have accused banks of conspiring to rig rates and prices in financial and commodities markets. The settlement had been expected since April, though terms had yet to be disclosed. In court papers, lawyers for the investors say the deal will likely be an "ice breaker" that will serve as a catalyst for other banks to settle. ... ... For the remainder of the report: http://www.reuters.com/article/us-deutsche-bank-settlement-silver-idUSKB... ADVERTISEMENT K92 Mining Begins Gold Production at Kainantu Mine Company Announcement K92 Mining Inc. is pleased to announce that gold production has commenced from the Irumafimpa gold deposit. Ian Stalker, K92 Chief Executive Officer, says: "This milestone is highly significant for our company, and for this region of Papua New Guinea. A great deal of thanks goes to the entire team on site in PNG in achieving production ahead of schedule and on budget. The rehabilitation of the Irumafimpa gold mine, process plant, and associated infrastructure commenced in late March and is now complete. As an enhancement of the processing facility, we are also pleased to note that the installation of a new drum scrubber is also nearing completion and commissioning of this will be completed by the end of the month. ..." ...For the remainder of the announcement: http://www.k92mining.com/2016/10/6077/ Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Real Humanitarian Crisis Is Not Aleppo Posted: 17 Oct 2016 07:35 PM PDT Authored by Paul Craig Roberts, Why do we hear only of the “humanitarian crisis in Aleppo” and not of the humanitarian crisis everywhere else in Syria where the evil that rules in Washington has unleashed its ISIL mercenaries to slaughter the Syrian people? Why do we not hear about the humanitarian crisis in Yemen where the US and its Saudi Arabian vassal are slaughtering Yemeni women and children? Why don’t we hear about the humanitarian crisis in Libya where Washington destroyed a country leaving chaos in its place? Why don’t we hear about the humanitarian crisis in Iraq, ongoing now for 13 years, or the humanitarian crisis in Afghanistan now 15 years old? The answer is that the crisis in Aleppo is the crisis of Washington losing its ISIL mercenaries to the Syrian army and Russian air force. The jihadists sent by Obama and the killer bitch Hillary (“We came, we saw, he died”) to destroy Syria are being themselves destroyed. The Obama regime and the Western presstitutes are trying to save the jihadists by covering them in the blanket of “humanitarian crisis.” Such hypocrisy is standard fare for Washington. If the Obama regime gave a hoot about “humanitarian crisis,” the Obama regime would not have orchestrated humanitarian crisis in Syria, Iraq, Afghanistan, Libya, and Yemen. We are in the middle of a presidential campaign in the US and no one has asked why the US is determined to overthrow a democratically elected Syrian government that is supported by the Syrian people. No one has asked why the White House Fool is empowered to remove the president of Syria by siccing US-supplied jihadists, which the presstitutes misrepresent as “moderate rebels,” on the Syrian people. Washington, of course, has no acceptable answer to the question, and that is why the question is not asked. The answer to the question is that Washington’s strategy for destabilizing Iran and then the Muslim provinces of the Russian Federation, former Soviet central Asia, and the Muslim province of China is to replace stable governments with the chaos of jihadism. Iraq, Libya, and Syria had stable secular societies in which the government’s strong hand was used to prevent sectarian strife between Muslim sects. By overthrowing these secular governments and the current effort to overthrow Assad, Washington released the chaos of terrorism. There was no terrorism in the Middle East until Washington brought it there with invasions, bombings, and torture. Jihadists such as those that Washington used to overthrow Gaddafi appeared in Syria when the British Parliament and the Russian government blocked Obama’s planned invasion of Syria. As Washington was prevented from directly attacking Syria, Washington used mercenaries. The prostitutes that pretend to be an American media obliged Washington with the propaganda that the jihadist terrorists are Syrian democrats rebelling against “the Assad dictatorship.” This transparant and blatant lie has been repeated so many times that it now is confused with truth. Syria has no connection whatsoever to Washington’s original justification for introducing violence into the Middle East. The original justification was 9/11 which was used to invade Afghanistan on the fabrication that the Taliban was shielding Osama bin Laden, the “mastermind,” who at the time was dying of renal failure in a Pakistani hospital. Osama bin Laden was a CIA asset who was used against the Soviets in Afghanistan. He was not the perpetrator of 9/11. And most certainly, neither were the Taliban. But the Western presstitutes covered up for the Bush regime’s lie, and the public was deceived with the phrase that we must “defeat them abroad before they attack us at home.” Of course, Muslims were not going to attack us at home. If Muslims are a threat, why does the US government keep bringing so many of them here as refugees from Washington’s wars against Muslims? 9/11 was the neoconservatives “new Pearl Harbor” that they wrote they needed in order to launch their wars in the Middle East. George W. Bush’s first Secretary of the Treasury said that the topic of Bush’s first cabinet meeting was the invasion of Iraq. This was prior to 9/11. In other words, Washington’s wars in the Middle East were planned prior to 9/11. The neoconservatives are zionists. By reducing the Middle East to chaos they achieve both of their goals. They remove organized opposition to Israeli expansion, and they create jihadism that can be used to destabilize countries such as Russia, Iran, and China that are in the way of their exercise of unilateral power, which, they believe, the Soviet collapse bequeathed to the “indispensable nation,” the USA. Osama bin Laden, the alleged 9/11 mastermind, was dying, not directing a terror war against the US from a cave in Afghanistan. The Taliban were focused on establishing their rule in Afghanistan, not on attacking the West. After blowing up weddings, funerals, and children’s soccer games, Washington moved on to Iraq. There was no sign of Iraqi belligerence toward the US. UN weapons inspectors said that there were no weapons of mass destruction in Iraq, but Washington did not hear. The whores who comprise the American media helped the Bush regime create the image of a nuclear mushroom cloud going up over America if the US did not invade Iraq. Iraq had no nuclear weapons and everyone knew it, but facts were irrelevant. There was an agenda at work, an undeclared agenda. To advance its agenda that the government did not dare reveal, the government used fear. “We have to kill them over there before they kill us over here.” So Iraq, a stable, progressive country was reduced to ruins. Libya was next. Gaddafi would not join Washington’s Africa Command. Moreover, China was developing the oil fields in eastern Libya. Washington was already troubled by Russia’s presence in the Mediterranean and did not want China there also. So Gaddafi had to go. Next Assad was set up with faked evidence that he had used chemical weapons against the rebellion that Washington had started. No one believed the transparent Washington lie, not even the British Parliament. Unable to find support to cover an invasion, Killary the Psychopath sent the jihadists Washington used to destroy Libya to overthrow Assad. The Russians, who until this point had been so naive and gullible as to trust Washington, finally figured out that the instability that Washington was brewing was directed at them. The Russian government decided that Syria was their red line and, at the request of the Syrian government, intervened against the Washington-supported jihadists. Washington is outraged and is now threatening to commit yet another criminal violation of the Nuremberg Standard with blatant aggression against Syria. Such an ill-advised step would bring Washington into military conflict with Russia and by implication with China. Before Europeans enable Washington to initiate such a dangerous conflict, they had best consider the warning from Sergey Karaganov, a member of the Russian Foreign Ministry’s Foreign Policy and Defense council: “Russia will never again fight on its own territory. If NATO initiates an encroachment against a nuclear power like ourselves, NATO will be punished.” That the government of the United States is criminally insane should frighten every person on earth. Killary-Hillary is committed to conflict with Russia. Regardless, Obama, the presstitutes, and the Democratic and Republican establishments are doing everything in their power to put into the Oval Office the person who will maximize conflict with Russia. The life of the planet is in the hands of the criminally insane. This is the real humanitarian crisis. Note: Lt. General Michael Flynn, director of the Pentagon’s Defense Intelligence Agency stated in an interview that the creation of ISIS was “a willful Washington decision.” See, for example: The DIA warned that ISIS would result in a Salafist principality over parts of Iraq and Syria. http://www.judicialwatch.org/wp-content/uploads/2015/05/Pg.-291-Pgs.-287-293-JW-v-DOD-and-State-14-812-DOD-Release-2015-04-10-final-version11.pdf The warning went unheeded as the neoconservative Obama regime saw ISIS as a strategic asset to be used against Syria. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ford To Idle Four Factories Due To Slowing Car Demand, Rising Inventories Posted: 17 Oct 2016 07:08 PM PDT Over the weekend we recapped some of the less than impressive moments in the recent US car industry history, which suddenly appears to be bombarded with a ...one would almost think that a respite from the bad news was in order. One would be wrong. As a result of slowing demand and declining US auto sales coupled with growing inventory, Ford Motor is halting one of two plants that builds its top-selling F-150 pickup as it idles four factories this month amid slowing U.S. auto sales. As Bloomberg reports, starting this week, Ford is shutting its Louisville, Kentucky, factory building the Escape and Lincoln MKC sport utility vehicles, as well as two plants in Mexico that make the Fusion sedan and Fiesta subcompact, according to an e-mailed statement. Next week, the second-largest U.S. automaker will close the F-150 factory near Kansas City for seven days. And starting Oct. 31, the Louisville plant will be idled for another week. The plant closings follow last week's shutdown of Ford's Mustang factory in Michigan after sales of the sports car plunged 32% in September. Contrary to the popular refrain of a strong economy, US auto sales are slowing as many analysts predict the industry won't match last year's record of 17.5 million cars and light trucks. As we reported recently, Ford CEO Mark Fields has said the U.S. auto market has plateaued and that showroom sales are weakening. "We said we expected the overall retail industry to decline in the second half of the year," Kelli Felker, a Ford spokeswoman, said in the statement. "We also said to expect to see some production adjustments in the second half -- this is one of them." At least they stick to their word. As a race to the bottom begins amogn the carmakers - F-series sales fell 2.6% last month as a pickup price war heated up - consumers will be the winners, able to pick up vehciles at increasingly lower prices. Escape sales dropped 12% in September as Ford faced competitive pressure from the Toyota RAV4 and Honda CR-V. Fusion sales plunged 18% and Fiesta was off 40% as car sales continue to languish with low fuel prices pushing buyers into trucks and SUVs. So far trucks, picksups and SUVs have been the silver lining in an other wise dreary automaker landscape, rising as the rest of the lightvehicle segment stagnated, However, should gasoline prices keep rising, that too is about to change in adverse direction. Meanwhile, Felker said Ford is trying to match production with demand. Inventories have been swelling on the models the automaker is idling. The company had 93 days supply of F-series pickups, which includes the F-150, at the end of September, up from 83 days a year earlier, according to researcher Autodata Corp. According to Bloomberg, Escape inventory grew to 64 days, from 50 a year earlier, while Lincoln MKC climbed to 96 days from 91 last year, according to Autodata. A 60-day supply is considered optimal. Ford had 72 days supply of Fusion sedans at the end of last month, up from 51 a year earlier, and it had enough inventory of the Fiesta to last 77 days, up from 56 in September of 2015, according to Autodata. Worst of all, while the rest of the US manufacturing sector has been in secular decline, the auto industry was perhaps the last shining light for battered US manufacturing during the past several years. However, if demand for cars continues to collapse, forcing supply to follow suit, it is only a matter of time before the US manufacturing recession returns with a vengeance, and at the worst possible time: when not even the US service sector can hinder the realization that the US economy is on the verge of contracting. Finally, here are some auto-related charts courtesy of Goldman Sachs.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Michael Savage Donald Trump FULL Interview - October 17, 2016 Posted: 17 Oct 2016 06:35 PM PDT Aired on October 17, 2016 - Michael Savage Donald Trump FULL Interview - The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deutsche Bank Pays $38 Million To Settle Silver Manipulation Lawsuit Posted: 17 Oct 2016 06:18 PM PDT 2016 is shaping up as the year when countless conspiracy theories will be confirmed to be non-conspiracy fact: from central bank rigging of capital markets, to political rigging of elections, to media rigging of public sentiment, and now, commercial bank rigging of silver. In short, tinfoil hat-wearing nutjobs living in their parents basement have been right all along. Two weeks ago we reported that "In A Major Victory For Gold And Silver Traders, Manipulation Lawsuit Against Gold-Fixing Banks Ordered To Proceed," however one bank was exempt: Deutsche Bank. The reason why was known since April, when we first reported that Deutsche Bank had agreed to settle the class action lawsuit filed in July 2014 accusing a consortium of banks of plotting to manipulate gold and silver. Among the charges that Deutsche Bank effectively refused to contest were the following:

Briganti's affidvait provides some more information on the settlement process:

There was just one thing missing: the settlement amount. This afternoon, that too was revealed when according to court filings, Deutsche Bank had agreed to pay $38 million to settle U.S. litigation over allegations it illegally conspired with other banks to fix silver prices at the expense of investors. The settlement, disclosed in papers filed in Manhattan federal court, concludes one of many recent lawsuits in which investors have accused banks of conspiring to rig the precious metal markets. However, until now there was never any formal closure. Today, that closure cost Deutsche Bank $38 million. While the amount is tiny for the German bank, now that it is enshrined in case law, it will unleash dozens of similar class action lawsuits, each tweaked a little, and each demanding tens of millions from the gold and silver rigging banks. As Reuters adds, the settlement had been expected since April, though terms had yet to be disclosed. In court papers, lawyers for the investors say the deal will likely be an "ice breaker" that will serve as a catalyst for other banks to settle. Vincent Briganti, a lawyer for the investors, said the deal provides "substantial monetary compensation plus cooperation from Deutsche Bank in the continued prosecution of this important case against the non-settling defendants." As a reminder, in the litigation profiled here most recently, investors claimed Deutsche Bank, HSBC Holdings Plc and Bank of Nova Scotia (ScotiaBank) rigged silver prices through a secret daily meeting called the Silver Fix, and accused UBS AG of exploiting that fix. The alleged conspiracy started by 1999, suppressed prices on roughly $30 billion of silver and silver financial instruments traded each year, and enabled the banks to pocket returns that could top 100 percent annualized, the investors said. Earlier this month, U.S. District Judge Valerie Caproni ruled the investors had sufficiently, "albeit barely," alleged that Deutsche Bank, HSBC and ScotiaBank violated U.S. antitrust law by conspiring to depress the Silver Fix from 2007 to 2013. At the same time, the judge dismissed UBS from the case, saying there was nothing showing it manipulated prices, even if it benefited from distortions. The Judge added that the investors could amend their complaint, including against UBS, and a lawyer for the investors has said they planned to do so. So who gets to benefit from the settlement?

The other beneficiary, of course, is the class of investors, people and "conspiracy theorists" who claimed all along that gold and silver were subject to rigging in various forms throughout the years. Well, you were right. However, we wouldn't hold much hope for getting any substantial monetary rewards. By the time the settlement is done, there will likely be a few hundred dollars per claimant. The good news, however, is that this will only unleash many more such lawsuits, now that the seal has been broken. As for the remaining two banks in the class action, HSBC and Bank of Nova Scotia, the next pretrial conference in that lawsuit which was greenlighted two weeks ago is scheduled for October 28, 2016. Those who wish to be present should appear at 3:00 p.m. in courtroom 443 of the Thurgood Marshall Courthouse, 40 Foley Square, New York, NY 10007. The Vincent Briganti Declaration is below

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Benjamin Fulford Report, October 17, 2016 Posted: 17 Oct 2016 05:42 PM PDT The Benjamin Fulford Report, October 17, 2016 October 17, 2016 by Benjamin Fulford benjaminfulford.net The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| It's Beginning to Look like Silver & Gold Prices Have Found Sound Footing Posted: 17 Oct 2016 05:39 PM PDT

Dear Friends: Susan and I spent so many decades together serving y'all that I am sure she'd be madder than a wet wasp if I lay down in the road & quit. Besides, my seven children are with me, hovering around as if I'm going to drown myself in the toilet or starve to death eating salads. I know they are doing it out of love, but I feel like I have to keep typing just so they'll know I still have two marbles to rub together. However, my meditations of the last few days have resulted in some advice for men, so hear my words: First, when you fill the saltshaker or change a light bulb, don't expect your wife to drop everything and praise you. Remember that she was probably so busy doing laundry, shopping, cooking, caring for kids and for others that she didn't have time for the saltshaker today. It probably wasn't that important. Look for something else to do for her, to lighten her load. And thank her, instead of expecting her to thank you. Praise her. Second, hug your wife. Tell her you love her. Mercy, women, hug your husbands, oto. Susan used to complain that I didn't know how to hug because I didn't hug hard enough or long enough. Go ahead, spend that extra nano- second hugging. You'll never miss it. And squeeze harder. My webmaster has posted Susan's picture and obituary as well as her eulogy from her funeral at http://bit.ly/2e2wSt5 I cannot even begin to thank y'all for your kind condolences. Thank you for helping us bear our burdens. MARKETS: For a week metals have trudged sideways while stocks broke down out of an even-sided triangle & continue to lose ground. US dollar index has reached 98, but backed off 12 basis points today to 97.88. Dollar index has crushed the euro, and steamrolled the yen. So trends are down for stocks, up for the US dollar index, sideways for gold & silver. But there's something mighty suspicious happening with silver & gold premiums. Week ending October 7th the wholesale US 90% silver coin premium reached 90¢ over spot silver, then last week 135¢. Now we are hearing noises of shortages of silver rounds. In itself that might not mean much, but the in the last few days premiums on gold have begun to rise as well. Buy side wholesale premium for Krugerrands went from 0.8% to 1.2%, for American Eagles from 2.5% lately to 3%, and Austrian 100 coronas and Mexican 50 pesos from 991% to 99.4%. It's the gold that makes a buzzing in my ear. The 90% premium alone implies greater demand at these prices is pushing up premiums, but when you add to that rising gold coin premiums, only very rarely seen, then it appears that very strong support stands under silver & gold. Today on Comex silver added a measly 3.3¢ to 1742.6¢. Gold bumped up $1.30 to $1,254.40. Ratio is 71.984. Both silver & gold have formed pennants, which might be downward sloping bullish flags. For the present, the 200 day moving average is supporting both metals. Gold chart is here, http://schrts.co/pbxEDM Y'all will immediately notice how oversold the RSI is, and that the MACD is trying to turn up. Here is silver, http://schrts.co/o96FnV Same oversoldness shows in the RSI, same desire to turn up in the MACD, same pennant formation, which will either be a reversal or continuation. It's beginning to look like silver & gold prices have found sound footing. Argentum et aurum comparanda sunt — Silver and gold must be bought. — Franklin Sanders, The Moneychanger  goldprice.org editors note: You may send emails for Franklin Sanders to : support@goldprice.com.hk All emails will be forwarded to the Sanders Family. ######### Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prepare For The Financial Meltdown 2016-2017,Look at Canada or Australia If You Don't Believe It Posted: 17 Oct 2016 02:33 PM PDT Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. Do you want to be informed with Max Keiser, Alex Jones, Gerald Celente, Peter Schiff, Marc Faber, Ron Paul,Jim Willie,Paul Craig Roberts, and arguments... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inflation Above Target For Five Straight Years and Counting Posted: 17 Oct 2016 01:56 PM PDT This post Inflation Above Target For Five Straight Years and Counting appeared first on Daily Reckoning. Ben Bernanke first set an official inflation target in January 2012, aiming at 2%. Since then the Fed has claimed that it would begin to normalize interest rates when the target was reached and unemployment fell below 5%. The latter goal has long been met, but what about the inflation target? Well, it depends on how you measure inflation. And I’m not talking about private measures that actually reflect reality like David Stockman’s Flyover CPI. I’m talking about official measures. There are many to choose from. Lo and behold, surprise surprise, the Fed has chosen the one that is most suppressed and furthest from the experience of most American households. That is the personal consumption expenditure (PCE), which has gone up by just 1% over the past year and has averaged. 1.2% over the past 5 years. So the Fed can pretend that inflation is “too low,” whatever that means. My favorite official measure of inflation, which the mainstream media never reports, is the Producer Price Index (PPI) for Finished Consumer Goods minus food and energy. It represents the price changes that retailers pay for their finished goods inventory. It has persistently outrun the widely followed consumer price index (CPI) and the Fed’s favorite, the PCE, by a wide margin ever since inflation began to rebound from the pits of the recession in 2009. The fall in energy prices in 2014 caused a big dip in total CPI, but the Core measure just kept trundling higher. It has been above the Fed’s target for the past 2 years while the Fed’s favorite, the PCE, stumbled along at less than half that over the past 2 years, and an average of 1.2% since 2011. The PPI for finished core consumer goods suffers from no such manipulation. However, it is not a perfect indicator of overall inflation since it includes only finished goods, and does not include either housing or services. Education and medical services, both of which seem to be almost constantly hyper inflating, are not included. But the PPI for finished consumer goods is a far more realistic representation of actual inflation than CPI. So where has all the Fed printed money gone? What kind of inflation has ZIRP stimulated? The answer is simple: asset inflation. But economists don’t count that. It’s crazy; anything that isn’t what they call a consumption good, simply doesn’t count. It’s not inflation. When asset prices rise, they call it “appreciation,” when it’s really a direct result of monetary inflation. When the Fed sets an inflation target, it has nothing to do with monetary inflation, which in classical economics is a sustained increase in the money supply. We have certainly had that. Since 2011, just before Ben Bernanke decided that we needed an inflation target of 2% in January 2012, until now, the M2 money supply has grown by a compound annual rate of 7.1%. That obviously exceeds the Fed’s target. But it doesn’t count. So the Fed has an excuse to keep printing money or to keep interest rates at zero. Meanwhile, headline CPI has grown at only 1.6% per year because the Bureau of Labor Statistics (BLS) under measures it. When housing is included in CPI at the correct rate, consumption inflation is around 2.5% to 3%. Yes, that’s above the Fed’s target, but the Fed doesn’t see it, and it’s still less than the rate of monetary inflation. So what happens when we continue to get 7% monetary inflation when the U.S. economy only grows at 1.5% to 2.5%? We get asset inflation. The Fed says that multifamily apartments, the quintessential real property investment asset have been inflating at 3.4% per year. That’s another piece of Fed BS. Freddie Mac said at the end of 2015 that multifamily properties had increased in value by 13-15% per year from 2009 to 2015. Harvard’s Joint Center For Housing Studies said that multifamily investment properties had “appreciated” by 40% in the 5 years through 2015. So who knows? One thing seems certain, like everything else the Fed measures inflation wise, its numbers are obviously too low. In the single family home market the Federal Housing Finance Agency (FHFA) says that prices are rising by 5.9% per year. FHFA uses an extremely conservative measurement where older homes are overweighted. The NAR’s unmassaged home price index shows prices up by 7% per year since 2011 exactly the same as the monetary inflation rate. Meanwhile the Census Bureau says that new home sale prices have risen by 5.2% per year, and that’s after a big slump over the past year that suggests that the housing market is weakening. Is the bloom off that rose? Is the Fed threatening to cause a mortgage rates to rise just when the housing market is beginning to show signs of weakness? It would not surprise any of us if the Fed has blundered yet again. Its timing has been atrocious ever since Greenspan took over after Volcker. This is likely to be just another massive blunder in its history of long term serial strategic blunders. Yes, rates need to rise if we are ever to return to a healthy economy with rational interest rates leading to rational investment returns and rational decision making, but the Fed waited far too long. It has left no escape route that doesn’t involve massive pain. It’s way too late for a soft landing. So the Fed focuses on consumption inflation, using suppression measures to massively understate PCE. At the same time, consumption inflation is rising faster than the official measures say, putting the squeeze on U.S. households. Consumption inflation has actually more than offset wage increases that have averaged 1.5-2.5% since 2011. If consumers aren’t earning more, they can’t drive consumption goods inflation higher because they just don’t have the money. Bankers and speculators have it, and they have made sure not to share any of it with workers scraping to get by. If wages aren’t rising, there’s no way for consumer prices to rise, not matter how much the Fed prints and no matter how long it keeps interest rates at zero. There’s an oversupply of labor, and businesses are reducing the need for labor by automating every workplace task imaginable. This is nothing new. Automation has been around forever. Unions collapsed years ago. Globalization has forced wages down. All these processes are structural. There will be no end to them. Aggressively easy monetary policy will never stimulate wage growth or consumer inflation. Every major central bank has tried this, in Japan’s case for decades, and it has never worked. It never will. Yet just Friday, Janet Yellen threatened to do more of that which has proven not to work. It’s insane. What we do get from all the easy money is asset inflation. That has put a patina of stability and good times on what is a dangerously unstable situation. A loss of confidence is brewing, and once it gets rolling it won’t be long until the margin man comes a knocking and asset prices collapse in a wave of liquidation and deleveraging that will be required to raise cash to pay off all the debt. Once that starts, there won’t be enough cash to meet those obligations, because margin calls will destroy it faster than it can be raised. Massive fire-sales of assets will lead to a deflationary collapse. What will the Fed do then? Buy everything? Don’t bet against it. But it will be too late. Regards, Lee Adler Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post Inflation Above Target For Five Straight Years and Counting appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - The Status Is Quo Posted: 17 Oct 2016 01:23 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is the Stock Market Set for a Massive Rally? Posted: 17 Oct 2016 01:00 PM PDT This post Is the Stock Market Set for a Massive Rally? appeared first on Daily Reckoning. Wall Street's getting panicky… HSBC recently issued a "Red Alert" about an "impending" and "severe" decline in the stock market. Citigroup warned that investors aren't prepared for current high market risk. And UBS said the S&P 500 has reached a top. In other words, there's nowhere to go but down—they say. With the S&P 500 down -1.6% for the month, market sentiment is poor. And conventional wisdom says a collapse is coming. But the stock market has a weird habit of doing the exact opposite of what everyone expects… October SurpriseThe Dow and the S&P 500 index are on verge of three straight months of declines. And October's on course for the worst monthly stock market performance since January's carnage after the Fed raised rates in December 2015. And according to Mark Hulbert at Marketwatch, that could mean stocks are about to soar: "Because by dropping in October, the stock market creates the preconditions for a significant rally through the end of the year. This year appears to be quite closely following at least the beginnings of that script." Hulbert reports that over the last 120 years, the Dow has gained an average of 6.8% from its lowest October close through December 31. That's roughly a 40% return on an annual basis. How to explain the outsized performance? Here's Hulbert again: "My hunch is that it's a disguised form of the better-known 'Halloween Indicator' seasonal pattern (also known as 'Sell in May and Go Away')… Some of the biggest gains following a monthly low occur during the favorable November-through-April period—and some of the smallest during the unfavorable summer months." Nobody has a crystal ball to see if this stock market history repeats itself this year. But are you prepared to catch big gains if it does? Profit From the UnexpectedLook, I understand if you are hunkered down sitting in cash preparing for a crash… We're in the midst of historic debt and asset bubbles. Economic growth is dismal. And the presidential race is a dumpster fire. Uncertainty and looming risk are off the charts. The market is reflecting that. But history shows us October weakness has led to big-time gains. And not everyone will capture that. Let me be clear: I'm not suggesting that you buy and hope for the best. The market could crash from here. You could get wiped out if you have no exit plan in place. My point is you should be protected against a market collapse AND be positioned to reap unexpected upside gains at the same time. Walk and chew gum at the same time? We must. And as Hulbert showed, just when everyone thinks stocks have nowhere to go but down, they often shoot higher… especially after October weakness. That's why trend following is specifically designed to keep you invested to ride these waves higher. That's what allows you to make the big bucks. But a trend following system also comes with a built-in, rigid exit plan that limits the downside risk. Investing without an exit plan is the quickest way to lose all your money. I know that deep in my bones. You must too. If your investment approach doesn't have you prepared for the unexpected in either direction, it's time for a new plan. Please send your comments to me at coveluncensored@agorafinancial.com. Let me know what you think of today’s issue. Regards, Michael Covel Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post Is the Stock Market Set for a Massive Rally? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial War Conversation with America’s Top Spy Posted: 17 Oct 2016 12:58 PM PDT This post Financial War Conversation with America's Top Spy appeared first on Daily Reckoning. Only one person has ever been Director of both the National Security Agency and the Central Intelligence Agency. That person is retired Four-Star General Michael Hayden. On June 1, 2015, I had the chance to talk to Mike Hayden on Capitol Hill in Washington, DC. We were both there as part of a conclave to discuss the status of Iran-U.S. negotiations on uranium enrichment and Iran's nuclear weapons program. We had a chance to talk one-on-one about my specialty, which is financial warfare, and the potential impact on investors. Needless to say, General Hayden's insights were fascinating. General Hayden's career as a military and intelligence officer spans four decades beginning with his commission as an Air Force officer in 1969. From 1980 to 1982 he was intelligence chief at Osan Air Force Base in Korea. From 1996 to 1997, he commanded the Air Intelligence Agency, today part of the Twenty-Fifth Air Force, which is one of the 17 separate agencies that make up the U.S. Intelligence Community.  Jim Rickards with General Michael Hayden on Capitol Hill in Washington D.C. on June 1, 2015 From 1999 to 2005, he was Director of the National Security Agency, NSA, based at Fort Meade, Maryland. The NSA is America's lead agency for electronic and technical spying. For many years, the mere existence of the NSA was classified information; intelligence community members said the acronym NSA stood for "No Such Agency." In response to the 9/11 attacks, the U.S. Congress in 2004 created the Office of the Director of National Intelligence with John Negroponte as its first Director. From 2005 to 2006, General Hayden was Principal Deputy Director of National Intelligence under DNI John Negroponte. Finally, in 2006, Hayden became the 20th Director of the CIA where he served until 2009. Given Mike Hayden's long career in military and civilian intelligence agencies, and his expertise in both electronic intelligence (ELINT) and human intelligence (HUMINT), it is no exaggeration to call him "America's Top Spy." This was not my first meeting with General Hayden. In an earlier meeting while he was still at CIA, he told a fascinating story about his time as a military attaché at the U.S. Embassy in the then People's Republic of Bulgaria during the Cold War. He would board a train and simply travel from one end of the country to the other making mental notes about armored vehicles seen at rail sidings, coal loadings, and other indications and warnings that provided insight into the state of the economy there. He looked for the presence of any Soviet troops. In one encounter, he was seated in a shared train compartment with three young Soviet soldiers. They saw his U.S. Air Force uniform and assumed he did not speak Russian. They proceeded to start drinking on the train and spoke in an unguarded manner among themselves becoming more animated and loquacious as the vodka flowed. Finally, just before disembarking, General Hayden greeted the Soviet soldiers in fluent Russian. Their faces turned white as they realized he understood every word they said. On other occasions, Hayden dressed in simple street clothes and listened in on conversations among construction workers to get an idea about consumer prices, food and fuel availability and other basic economic indicators. Often the best spies are not those in the glamorous James Bond mold, but those who patiently practice simple tradecraft combined with a good knowledge of foreign languages and culture. Mike Hayden was certainly helped in these efforts by his blue-collar roots in Pittsburgh including time as a taxi-driver working his way through college and graduate school. My conversation with General Hayden focused on my own specialty, market intelligence (MARKINT), and the ongoing financial wars between the U.S. and Russia and Iran. Hayden agreed with me that financial war will be a primary means of warfare in the twenty-first century. He referred to financial sanctions as "the PGMs of the twenty-first century;'" a reference to Precision Guided Munitions. In effect, asset freezes would replace cruise missiles as a way to disable an enemy. The U.S. was in a financial war with Iran from 2011 to 2013 prior to the start of formal negotiations with respect to Iran's uranium enrichment. Secret negotiations had been going on for years, but the U.S. wanted to bring pressure to accelerate the pace of negotiations and produce concrete results. The negotiations were intended to avert an attack either by Israel or the U.S. The U.S. first excluded Iran from the dollar payments system, but Iran simply switched its payments to euros, Swiss francs and other hard currencies. Next, the U.S. and its allies kicked Iran out of the global payments system, called the Society for Worldwide Interbank Financial Telecommunication, or "SWIFT." This meant that Iran could ship oil but could not get paid in hard currency. It also meant that Iran had to resort to gold and barter to obtain needed imports of gasoline and other essential goods. Exclusion from the global payments systems caused Iranians to withdraw their money from local banks so they could purchase smuggled dollars on the black market. This run on the banks forced the central bank of Iran to raise interest rates. The black market dollar exchange rate showed the Iranian currency had lost half its value. The result was hyperinflation in Iran. The combination of bank runs, inflation, currency collapse, sky-high interest rates, and shortages of imported products was highly destabilizing. At that point, the U.S. could have tightened sanctions ever further, possibly causing regime change in Iran. Instead, in December 2013, President Obama removed many of the sanctions in exchange for the start of formal negotiations on Iran's nuclear weapons program. Those negotiations have dragged on ever since and are nearing the point of a final deal that will be put to the Congress for consideration. The final deal has not yet been revealed but the broad outlines are known. General Hayden calls this a "bad deal" for America because it lacks verification procedures. He said that U.S. intelligence is good, but not good enough to know if Iran is trying to "break out" of the deal and race to a nuclear weapon. He told me, "Unilateral American intelligence is insufficient to verify compliance. Iran must agree to an intrusive inspection regime. American intelligence is good, it will tell you a lot, but it cannot verify compliance by Iran." America was winning its financial war with Iran, but then declared a truce before the job was done. Now we are facing an unverifiable nuclear deal with Iran. If the inspections regime breaks down, which it probably will, America may return to financial warfare with Iran. The procedure for reimposing financial sanctions if Iran does not live up to its obligations under a nuclear deal is called "snapback" authority. America is in another financial war with Russia in response to Russia's annexation of Crimea and its support for separatists in eastern Ukraine. Severe financial sanctions have been imposed on Russia including a ban on refinancing hard currency corporate debt in U.S. or European capital markets. The U.S. and its allies have not yet kicked Russia out of the SWIFT payments system, a process known in financial warfare circles as "de-swifting." The Russian Prime Minister, Dmitry Medvedev, has said that de-swifting Russia would be regarded as an "act of war" subject to military retaliation. Russia's ability to retaliate against the United States in a financial war is much greater than Iran's. Russia has a 6,000-member cyber-brigade who are capable of closing down U.S. stock exchanges and banks. Russia would not use these tactics casually, but would use them if U.S. economic pressure becomes too severe. Given this recent history of financial warfare with Iran and Russia, I asked General Hayden if the U.S. was possibly overusing its financial weapons. Today, these weapons are extremely powerful. But, the history of warfare reveals that every offensive weapon is first countered with strong defenses, and then eventually made obsolete by improved offensive weapons of the enemy. With the U.S. putting financial pressure on Iran, Russia, and China, wasn't it likely that these countries would create their own payments systems, develop their own banks and reserve currencies, and turn their back on the U.S. dollar system entirely? If Russia, Iran, China, Turkey and others no longer relied on U.S. dollars, then control of the dollar system would lose its potency as a weapon. Specifically, I asked if the U.S. was taking the dollar for granted as a source of strength in financial warfare. General Hayden agreed this is a problem, if not today, then in the not-too-distant future. He said, "The more you use sanctions, the less effective they become because you motivate your adversaries to develop alternative payment systems. I'm not sure if an alternative payment system will be built before we might want to snapback sanctions on Iran, but if it's not over this ridgeline, it's over the next one." General Hayden also alluded to what he called "The dynamic of the unpleasant fact." He said this happens when you have to deliver truly bad news to the president. He said a conversation might begin with, "Sir, that war we planned starts today…". In today's battlespace, that statement could just as well apply to cyber-attacks on stock exchanges as dropping bunker-busting bombs on Iran. For investors, the implications of this new age of financial warfare are profound. Stock and bond markets have always been affected by wars. But the wars were fought elsewhere — stocks and bonds merely adjusted in price to the new state of the world. Today, markets are not bystanders; they are ground zero. It's fascinating to meet brilliant military and intelligence officials like General Hayden who are rapidly absorbing the fact that wars are now fought in financial markets rather than on physical air, sea and land. The military and intelligence communities are absorbing the new reality, but most investors are still behind the curve. Traditional stocks and bonds are digital assets that can be hacked, wiped-out or frozen with a few keystrokes. It's important to allocate part of your portfolio to physical assets that cannot be wiped out in financial warfare. Regards, Jim Rickards Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post Financial War Conversation with America's Top Spy appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 Oct 2016 12:00 PM PDT This post Will Fantasy Beat Reality? appeared first on Daily Reckoning. It's athletic competition without ever breaking a sweat. And it may be edging out the real thing. Fantasy sports that mimic real-life sports such as football and boxing, are looking more and more like their real-life counterparts. Competitive sports in electronic arenas are becoming an accepted norm, especially among younger generations growing up in the era of blurred lines between reality and augmented reality. No need to train…learn skills…feel the pain of defeat or the joy of physically earning victory or even sweat… Perhaps half of all Americans play electronic sports. These include fantasy baseball or football, video games of death and conquest and e-sport games that mimic boxing or tennis. It's a multibillion-dollar industry. And growing. In September, seven e-sports teams formed the Professional eSports Association, the first professional video-game league. The league's first 10-week season will begin in January. Teams will vie for $500,000 in prize money in the game Counter-Strike: Global Offensive. "This will allow us to finally build a stable, healthy long-term environment for the players, the community, the media and the sponsors," the league commissioner says. There's even a Fantasy Sports Trade Association for people and companies that make and sell the tech, gear and venues. Sound familiar? With pro teams, celebrity players, seven-figure purses, discussions of pro players' welfare and cutthroat competition to buy media rights, this looks like any other pro sport. Only no one, not even the players, has to get off the couch. And big tech companies want in on the action. In summer 2014, Amazon paid $970 million to buy Twitch, a leading video-gaming platform and e-sport community center. This year, Twitch itself bought Curse, a company making games and products for e-gamers. In 2016, Microsoft gobbled up Beam, which developed a streaming technology that allows people watching a game to join in. The combination makes e-games "more social and fun" like being in an actual sports arena, Microsoft's announcement said. The purchase price wasn't disclosed. Gamurs, an online network for players and fans of the games League of Legends and Counter-Strike, went on an expansion spree of its own. Recently, it bought eSports Guru, eSports Nation and GoldPer10, an online fan community. Vulcan, backed by the giant Sequoia Capital venture firm, acquired TwitchAlerts, which lets gamers donate to streaming services that carry their games. As e-sports and fantasy games take on the trappings of traditional sports, it's not surprising that they deliver the same psychological satisfactions that real-life athletics do. First, they give us the thrill of victory and the agony of defeat. Psychologists tell us what we all have experienced: Competition is cathartic. It builds tension as we strive to best our rivals. The release of that tension as we win or lose can channel and vent general frustrations through a safe outlet. The possibility of winning lets us feel hope. And sports does all of this in an environment that doesn't put our lives, limbs, homes or families at stake. This tension and release activates dopamine in our brains. It's a neurochemical that motivates us to seek pleasure and reward. This explains why both physical and digital sports can be addictive. Because competition is an extrinsic motivator, the dopamine disappears along with the fun and thrills as soon as the game, season or championship is over. The memory of the excitement and possibility of new hope is what keeps dopamine primed — and keeps us coming back. Second, fandom is inherently social. Talking about sports is an icebreaker among strangers, a glue that coheres social groups that share our joys and heartbreak. Family members who find it hard to talk about difficult personal issues can still talk baseball. In these situations, sports can become a proxy by which relatives can communicate indirectly about issues that are touchy. Third, sports let us live exciting, if vicarious, lives. Some of us wish for fame or public admiration of a valued skill. By aligning ourselves with a team, we borrow a little of its reflected glory and feel part of something dynamic and exciting. Also, especially for young people, playing sports has always been a tool for personal development… It can help a person learn teamwork and discipline. It can help us learn to deal with loss and disappointment and use them as motivators to improve. Some high-tech employers now count e-gaming as a plus for job candidates, just as conventional sports have been in the past. E-sports is another example of the multi-billion dollar industry virtual reality is presenting to consumers and investors alike. And it's just getting started. We're barely scratching the number of different applications we will find for VR technology. Regards, Gerald Celente Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post Will Fantasy Beat Reality? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Even insiders know that the EU is doomed, Turk tells KWN Posted: 17 Oct 2016 11:33 AM PDT 2:35p ET Monday, October 17, 2016 Dear Friend of GATA and Gold: Interviewed today by King World News, GoldMoney founder and GATA consultant James Turk says that even members of the political and financial establishment understand that the European Union project has been botched and is doomed. An excerpt from the interview is posted at KWN here: http://kingworldnews.com/james-turk-the-coming-financial-storm-will-deva... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT A Lone Congressional Candidate Is Campaigning on the Gold Standard The New York Sun just endorsed Connecticut Republican congressional candidate Daria Novak, based on her support for restoring the gold standard: http://www.nysun.com/editorials/a-prosperity-heroine/89742/ Daria needs us to contribute $1,000, $500, $250, $100, $50, or whatever we can afford in the fiat money that is sleeping in our checkbooks. As the Sun wrote, "She vows to crusade" on the gold standard "as key to getting job creation, economic security, and upward mobility back at a sizzling rate." Novak has been endorsed by gold standard and sound money advocates George Gilder, Lawrence Kudlow, Jimmy Kemp (Jack Kemp's son), and Jeffrey Bell ... along with Steve Forbes, who calls Ms. Novak "the prosperity heroine." To donate to Daria's campaign, please visit: http://novakforcongress.org/donate/ Daria will personally thank all contributors. Daria Novak is gold's lonely champion. Give her your backing and put a voice for gold in Congress. This message was authorized by Daria Novak for Congress. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 Oct 2016 11:12 AM PDT This post The Game of Power appeared first on Daily Reckoning. Building from my latest Don't Get Caught in the U.S – China Crossfire – Game of Thrones Part I (click here) and Part II (click here) featured on The Daily Reckoning – find a Game of Thrones layout of the central banking game of power. The Fed, led by Janet Yellen, is acting as if it will retain its power forever simply because it's currently the most power player in the game of global monetary policy. As stated at the beginning of Part I, the Fed behaves as if it has no idea that there are other countries and central banks operating around the world which would love to claim the top power spot. The People's Bank of China (PBoC) doesn't have to convince these other central bankers that it is the best candidate to take over that top spot, it only has to be the best alternative to the Fed. Under the Fed's monetary lead, stock markets have reached historic highs on a steady diet of artificial money.

The global economy is in a danger zone. Contagion is real. The Fed sunk the global economy in 2008 and many countries are trying to prevent the same outcome this time around. The IMF, which will control the next global recovery with the issuance of SDRs, realizes that the Fed's days are numbered. With the inclusion of the yuan in SDRs on October 1st, the IMF begins a shift in the scales of power in China's favor. Japan itself is forging alliances with China right now, but the Bank of Japan is still following the Fed — for now. The ECB is also following the Fed, but it's president, Mario Draghi, is one of the few central bankers who "says little and does less" with monetary policy. In the aftermath of Brexit, the Bank of England could see its influence reduced even further. This means that the Fed's allies are becoming weaker as the PBoC's allies are becoming stronger. In the coming days and weeks, the yuan will join the SDR basket. As the world inches closer to a collapse and closer to reliance on SDRs for recovery, the yuan's inclusion will be even more critical to the PBoC's rise to power. We'll keep you posted on the latest developments as they arise. For now, get your wealth out of the line of fire and away from over-inflated stocks. Regards, Nomi Prins, @nomiprins Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post The Game of Power appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reply to Ross Norman: Is GATA discouraging gold investment? Posted: 17 Oct 2016 11:07 AM PDT 2:16p ET Monday, October 17, 2016 Dear Friend of GATA and Gold: Under the circumstances Ross Norman, CEO of London bullion dealer Sharps Pixley, was pretty heroic with his cordial reply today -- http://www.gata.org/node/16842 -- to the questions your secretary/treasurer publicly posed to him Saturday: http://www.gata.org/node/16839 That is, virtually alone in the bullion dealing and banking industry, Norman acknowledged the possibility that central banks are surreptitiously intervening in the gold market and manipulating the monetary metal's price. "I don't know for sure," Norman wrote, "but I would not be surprised." He added that central banks certainly have motives for rigging the gold market. While Norman declined your secretary/treasurer's invitation to review and challenge or accept the documents of that intervention summarized by GATA here -- http://www.gata.org/node/14839 -- no one has ever challenged them, presumably because they are genuine and support the conclusions GATA has drawn from them and because if Norman had lent any credibility to them he would be quickly ostracized from his industry. ... Dispatch continues below ... ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Having been pressing this issue for 17 years against what seems to be all the money and power in the world, GATA knows very well that this issue is essentially prohibited in polite company. After all, the world financial system now rests on the lies that markets are free and currency values true. If those lies are ever exposed and understood, all power arrangements on the planet will change. So let us be grateful for Norman's friendly hint that he knows better. Norman went on to counter with some questions and issues of his own, and while your secretary/treasurer is little more than a scribe and archivist, hardly a font of knowledge and wisdom, Norman answered and thus deserves answers in return. 1) Emphasizing that his interest is entirely in assuring that the daily London gold price fixing, the benchmark price, has integrity, Norman asks what your secretary/treasurer would recommend for a benchmarking process. The answer is: nothing. For the general sentiment in GATA long has been to wonder why the world needs any special gold benchmarking process in the first place. After all, there are no special benchmark prices for other commodities or currencies, and no benchmark prices for stocks and bonds. Rather, there are closing prices and daily continuous pricing charts, and the world seems to make do with them. The London gold fix is a very odd and inexplicably venerable duck. GATA long has suspected that the fix has endured mainly because it facilitates control of the gold price by governments and central banks. For if governments and central banks are represented at the fixes -- through bullion bank intermediaries, of course -- they may be less compelled to strive to influence the price by trading surreptitiously around the clock. 2) Norman asks why Deutsche Bank would admit involvement in rigging the gold and silver markets and agree to settle the lawsuits making such accusations. He suggests that such a settlement is only part of the bank's general inclination to confess to just about anything these days, to pay some big penalties, and to start fresh. Of course GATA doesn't know Deutsche Bank's motives and Deutsche Bank is not about to answer GATA's inconvenient questions any more than the Federal Reserve and Treasury Department are. But note that, unlike some of its other admissions, in the gold and silver rigging cases Deutsche Bank reportedly has agreed to provide evidence against other participants in the London gold fix. We will have to await developments, and we will await them eagerly insofar as the discovery and deposition process in the rigging cases may implicate central bank involvement. 3) Norman fears that GATA's complaining about market rigging in gold is discouraging investment. He has plenty of company in that fear. For the more GATA has proven that governments and central banks are rigging the monetary metals markets, the less popular GATA has become with people selling gold and gold-related products and investments. While some people still disparage GATA as a touter of gold, the organization now is generally regarded as being bad for business, since we warn investors of what they are up against even as we explain the potential consequences of the enormous naked short position in gold represented by "paper gold" and gold derivatives. The logic of GATA's case is that the monetary metals are grossly undervalued. But if, as GATA believes, surreptitious intervention by central banks is the primary determinant of the gold price and if the objective of that intervention is generally suppressive, would we help gold and free markets more by remaining silent about the intervention? Given their surreptitiousness and unaccountability in the gold market, central banks themselves plainly have concluded that exposure would demolish their policy, maybe even demolish central banking itself, and help gold. In this respect GATA agrees with central banks, so we persist, figuring that if we can't easily make friends in the monetary metals industry, then we can aim for something else: Fiat justitia ruat cælum. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 Oct 2016 09:38 AM PDT This post 5 Things To Watch appeared first on Daily Reckoning. Your time is valuable and there's even more to journey through in market and business news – so we are highlighting what to watch for this week. At the Daily Reckoning we have filtered through the noise and garbage so you don't have to. Here are the 5 things to watch this week. These points are brief in description and allow you to take on the news in review and decide exactly what to watch for going forward. 1. Yuan Set for Longest Losing Streak in Two Years Post-IMF Entry (Bloomberg)

To read more on the Chinese yuan post entrance onto the world money stage, click here. 2. The Oil Market is Bigger Than All Metal Markets Combined (Visual Capitalist)As OPEC is set to have its head of state meeting in November, oil prices continue to be unconventionally low across the globe. Jeff Desjardins noted, "Meanwhile, from a foreign policy angle, countries like Saudi Arabia and Russia wield additional geopolitical and economic power because of their natural resources. It's even arguable that everything from the Gulf War to the more recent Middle East interventions in Libya, Syria, and Iraq have been at least partially to do with oil." While the visualization below did leave out gold futures, alloy markets, etc. it offers a striking visual of just how impactful oil can be on your day-to-day outlook. Source: Jeff Desjardins via Visual Capitalist For more on the data and statistics of the oil market versus metal market, check out the Visual Capitalist here. 3. Euro ‘House of Cards’ to Collapse, Warns ECB Prophet (The Telegraph)“One day, the house of cards will collapse," said Professor Otmar Issing, the European Central Bank's (ECB) first chief economist and a towering figure in the construction of the single currency. As the Eurozone experiment continues to struggle, the ECB's first chief economist believes that the "Euro experiment" is set to fail. Pointing directly at the ECB the economist has indicated that the system was flawed from the beginning. “The Stability and Growth Pact has more or less failed. Market discipline is done away with by ECB interventions. So there is no fiscal control mechanism from markets or politics. This has all the elements to bring disaster for monetary union." The Telegraph offers even further insight into the former ECB prophet – click here for more. 4. The Fed, Like The BOJ, Is Now In The Curve Steepening Business: What That Means For Markets (Zero Hedge)Tyler Durden could not have been more spot on. The Zero Hedge writer noted, "Following Janet Yellen’s strange speech from Friday, titled “The Elusive ‘Great’ Recovery” in which a seemingly perturbed Yellen not only admitted that the Fed may have hit peak confusion and that 7 years after unleashing a global, multi-trillion asset reflation experiment, it has not only failed to reflate non-market assets (at least both bonds and stocks are near all time highs on central bank buying), but in which the Fed chair also admitted the Fed is not even sure it understands the phenomenon of inflation any more…" The piece really hits home on where the Federal Reserve is headed (or lack thereof) and guides an idea of what to expect going forward. Read the full piece from Tyler Durden’s mastery at Zero Hedge – click here. 5. Gold Prices Rise on Weaker Dollar (WSJ)As questions over the Federal Reserve raising interest rates and uncertainty around the U.S election cycle swirls, gold is on the move. The Wall Street Journal reports, "Gold prices are up nearly 18% since the beginning of the year." Although the piece does note that, "Expectations of higher rates tend to weigh on gold, as the metal struggles to compete with yield-bearing assets such as Treasurys when borrowing costs rise." The Wall Street Journal’s Georgi Kantchev and Ira Iosebashvili have the full scoop – click here. Stay tuned for another update next week on what to watch for. Until then we leave you with these words from Rudolf E. Havenstein's Twitter account:

Regards, Craig Wilson, @craig_wilson7 Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post 5 Things To Watch appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||