Gold World News Flash |

- Doug Casey On "Quitaly" & The Collapse Of The EU

- Pension Benefits In Tiny California Town To Be Slashed As "Ponzi Scheme" Is Exposed

- Is A Short Squeeze Coming From This?

- In The News Today

- Bracing for “Extreme Moves”

- It's getting harder to deny intervention against gold, Embry tells KWN

- Infrastructure Spending and Helicopter Money: Two Hideous Ideas

- You’re Getting Older — Here’s Who’s Profiting From It

- Gold and Crude Oil - General Stock Market Links

- WikiLeaks Drops NEW BOMBSHELL! - Assange CONFIRMS Hillary Sold Weapons to …

- Will a Trump Victory Cause a Market Crash?

- Jim’s Mailbox

- And You Thought the Silver Market was Rigged

- The Current Gold Price Is A Gift

- Is the Market Suffering From Rate Hike Fever?

- LBMA chooses tech firms for new trade reporting

- Gold Trade Reporting Coming to London 2017

- Gold and Silver Metals Show Strength Relative to the USD Index

- Breaking News And Best Of The Web

| Doug Casey On "Quitaly" & The Collapse Of The EU Posted: 13 Oct 2016 01:00 AM PDT Submitted by Nick Giambruno via InternationalMan.com, Nick Giambruno: Doug, you predicted the fall of the European Union a few years ago. What has changed since then? Doug Casey: Well, what's changed is that the entire situation has gotten much worse. The inevitable has now become the imminent. The European Union evolved, devolved actually, from basically a free trade pact among a few countries to a giant, dysfunctional, overreaching bureaucracy. Free trade is an excellent idea. However, you don't need to legislate free trade; that’s almost a contradiction in terms. A free trade pact between different governments is unnecessary for free trade. An individual country interested in prosperity and freedom only needs to eliminate all import and export duties, and all import and export quotas. When a country has duties or quotas, it’s essentially putting itself under embargo, shooting its economy in the foot. Businesses should trade with whoever they want for their own advantage. But that wasn't the way the Europeans did it. The Eurocrats, instead, created a treaty the size of a New York telephone book, regulating everything. This is the problem with the European Union. They say it is about free trade, but really it’s about somebody’s arbitrary idea of “fair trade,” which amounts to regulating everything. In addition to its disastrous economic consequences, it creates misunderstandings and confusion in the mind of the average person. Brussels has become another layer of bureaucracy on top of all the national layers and local layers for the average European to deal with. The European Union in Brussels is composed of a class of bureaucrats that are extremely well paid, have tremendous benefits, and have their own self-referencing little culture. They’re exactly the same kind of people that live within the Washington, D.C. beltway. The EU was built upon a foundation of sand, doomed to failure from the very start. The idea was ill-fated because the Swedes and the Sicilians are as different from each other as the Poles and the Irish. There are linguistic, religious, and cultural differences, and big differences in the standard of living. Artificial political constructs never last. The EU is great for the “elites” in Brussels; not so much for the average citizen. Meanwhile, there’s a centrifugal force even within these European countries. In Spain, the Basques and the Catalans want to split off, and in the UK, the Scots want to make the United Kingdom quite a bit less united. You've got to remember that before Garibaldi, Italy was scores of little dukedoms and principalities that all spoke their own variations of the Italian language. And the same was true in what’s now Germany before Bismarck in 1871. In Italy 89% of the Venetians voted to separate a couple of years ago. The Italian South Tyrol region, where 70% of the people speak German, has a strong independence movement. There are movements in Corsica and a half dozen other departments in France. Even in Belgium, the home of the EU, the chances are excellent that Flanders will separate at some point. The chances are better in the future that the remaining countries in Europe are going to fall apart as opposed to being compressed together artificially. And from strictly a philosophical point of view, the ideal should not be one world government, which the “elite” would prefer, but about seven billion small individual governments. That would be much better from the point of view of freedom and prosperity. Nick Giambruno: How does the recent Brexit vote affect the future of the European Union? Doug Casey: Well, it's the beginning of the end. The inevitable has now become the imminent. Britain has always been perhaps the most different culture of all of those in the European Union. They entered reluctantly and late, and never seriously considered losing the pound for the euro. You're going to see other countries leaving the EU. The next one might be Italy. All of the Italian banks are truly and totally bankrupt at this point. Who's going to kiss that and make it better? Is the rest of the European Union going to contribute hundreds of billions of dollars to make the average Italian depositor well again? I don't think so. There’s an excellent chance that Italy is going to get rid of the euro and leave the EU. Nick Giambruno: Why should Americans care about this? Doug Casey: Well, just as the breakup of the Soviet Union had a good effect for both the world at large and for Americans, the breakup of the EU should be viewed in the same light. Freeing an economy anywhere increases prosperity and opportunity everywhere. And it sets a good example. So Americans ought to look forward to the breakup of the EU almost as much as the Europeans themselves. Unfortunately, most Americans are quite insular. And Europeans are so used to socialism that they have even less grasp of economics than Americans. But it’s going to happen anyway. Nick Giambruno: What are some investment implications? Doug Casey: Initially there's going to be some chaos, and some inconvenience. Conventional investors don’t like wild markets, but turbulence is actually a good thing from the point of view of a speculator. It’s a question of your psychological attitude. Understanding psychology is as important as economics. They’re the two things that make the markets what they are. Volatility is actually your friend in the investment world. People are naturally afraid of upsets. They're afraid of any kind of a crisis. This is natural. But it's only during a crisis that you can get a real bargain. You have to look at the bright side and take a different attitude than most people have. Nick Giambruno: If you position yourself on the right side of this thing, do you think you'll be able to make some big profits on the collapse of the EU? Doug Casey: Yes. Once the EU falls apart, there are going to be huge investment opportunities. People forget how cheap markets can become. I remember in the mid 1980s, there were three markets in the world in particular I was very interested in: Hong Kong, Belgium, and Spain. All three of those markets had similar characteristics. You could buy stocks in those markets for about half of book value, about three or four times earnings, and average dividend yields of their indices were 12–15%—individual stocks were sometimes much more—and of course since then, those dividends have gone way up. The stock prices have soared. So I expect that that's going to happen in the future. In one, several, many, or most of the world’s approximately 40 investable markets. Right now, however, we're involved in a worldwide bubble in equities. It can go the opposite direction. People forget how cheap stocks can get. I think we're headed into very bad times. Chances are excellent you're going to see tremendous bargains. People are chasing after stocks right now with 1% dividend yields and 30 times earnings, and they want to buy them. At some point in the future these stocks are going to be selling for three times earnings and they’re going to be yielding five, maybe ten percent in dividends. But at that point most people will be afraid to buy them. In fact, they won't even want to know they exist at that point. I’m not a believer in market timing. But, that said, I think it makes sense to hold fire when the market is anomalously high. The chaos that’s building up right now in Europe can be a good thing—if you're well positioned. You don't want to go down with the sinking Titanic. You want to survive so you can get on the next boat taking you to a tropical paradise. But right now you're entering the stormy North Atlantic. A few months after the stunning Brexit vote, there’s even more turmoil ahead for the European Union… with potentially severe consequences in the currency and stock markets. Doug Casey and his team just released a new video that reveals how a financial shock far greater than 2008 could strike America on December 4, 2016, as Italian voters decide the fate of the European Union itself. Click here to watch it now. |

| Pension Benefits In Tiny California Town To Be Slashed As "Ponzi Scheme" Is Exposed Posted: 13 Oct 2016 12:00 AM PDT For the tiny little town of Loyalton, California, with a population of only 700, a failure of city council members to understand the difference between the calculation a regular everyday pension liability and a "termination liability" has left 4 residents at risk of losing their pensions from Calpers. According to the New York Times, the town of Loyalton decided to drop out of Calpers back in 2012 in order to save some money but what they got instead was a $1.6mm bill which was more than their annual budget. For those who aren't familiar with pension accounting, we can shed some light on the issue faced by Loyalton. There are two different ways to calculate the present value of pension liabilities. One methodology applies to "solvent", fully-functioning pension funds (we call this the "Ponzi Methodology") and the other applies to pensions that are being terminated (we call this one "Reality"). Under the "Ponzi Methodology," pension funds, like Calpers, discount their future liabilities at 7.5% in order to keep the present value of their liabilities artificially low. That way, pension funds can maintain the illusion that they're solvent and the Ponzi scheme can continue on so long as there are enough assets to cover annual benefit payments. Now, the managers of the pension funds aren't actually dumb enough to believe that the "Ponzi Methodology" accurately reflects the true present value of future liabilities because they know that, particularly in light of current Central Banking policies around the world, their actual long-term returns will be much lower than 7.5%. Therefore, they have a completely separate, special calculation that applies when towns, like Loyalton, want to exit their plan. This "termination liability", or what we refer to as "Reality", uses a discount rate closer to or even below risk-free rates which means the present value of the future liabilities is much higher. As a quick example, lets just assume that Loyalton's 4 pensioners draw $225,000 per year, in aggregate pension benefits, and enjoy a 2% annual inflation adjustment. Assuming a 7.5% discount rate, the present value of that liability stream is about $2.9mm. However, if the discount rate drops to 2%, the present value of those liabilities surges to $4.5mm...hence the $1.6mm bill sent to the Loyalton City Council. Of course the 4 residents of Loyalton currently drawing a pension were outraged by the discovery that their monthly benefits may be slashed.

As Calpers's chief of public affairs points out "the State of California is not responsible for a public agency's unfunded liabilities." And since Calpers knows that the "Ponzi Methodology" is not an accurate reflection of their true liabilities, towns like Loyalton must pay the difference between the "Ponzi Methodology" and "Reality" when they choose to withdraw.

Mr. Davis, the Calpers spokesman, said that since 2011, Calpers had been giving its member municipalities a "hypothetical termination liability" in their annual actuarial reports, so there was little excuse for not knowing that a payment would be due upon exit. But the former Mayor of Loyalton said the paperwork was simply too confusing.

While Whitley was right that her town was trapped in a "Ponzi Scheme," she failed to recognize the critical fact that only willing participants get to participate in the Ponzi...for everyone else, we have to continue living in "Reality." |

| Is A Short Squeeze Coming From This? Posted: 12 Oct 2016 10:54 PM PDT By Chris at www.CapitalistExploits.at Market dislocations occur when financial markets, operating under stressful conditions, experience large widespread asset mispricing. Welcome to this week's edition of "World Out Of Whack" where every Wednesday we take time out of our day to laugh, poke fun at and present to you absurdity in global financial markets in all it's glorious insanity.

While we enjoy a good laugh, the truth is that the first step to protecting ourselves from losses is to protect ourselves from ignorance. Think of the "World Out Of Whack" as your double thick armour plated side impact protection system in a financial world littered with drunk drivers. Selfishly we also know that the biggest (and often the fastest) returns come from asymmetric market moves. But, in order to identify these moves we must first identify where they live. Occasionally we find opportunities where we can buy (or sell) assets for mere cents on the dollar - because, after all, we are capitalists. In this week's edition of the WOW we're covering volatility ETPs (Exchange Traded Products)Before we get into what exactly is Out Of Whack with volatility linked ETPs let's cover what the heck a volatility ETP actually is. What are Volatility ETPs? Since it's probably the most commonly known animal in the zoo we'll turn to the iPath S&P 500 VIX Short-Term Futures ETN (VXX) for an explanation:

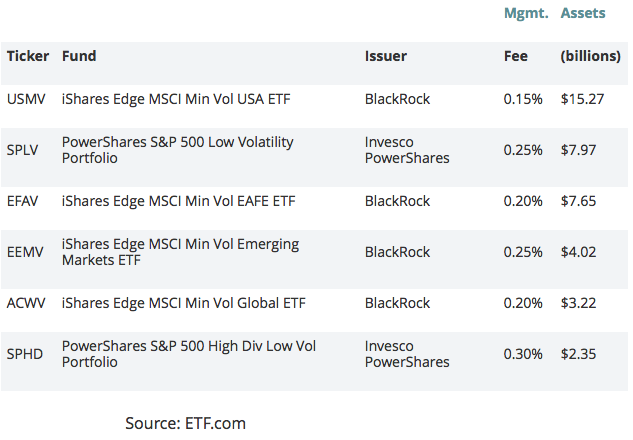

In English now: Any ETP including VXX is a derivative of some underlying asset so let's take a look at the underlying "asset". In this case it's the VIX futures. The VIX itself is actually a calculation based on the implied volatility of a basket of options on the S&P 500. Included in the calculations are options which are about to expire and those with 30 days to expiry. The net result is what amounts to a best guess as to what the market believes is in store for the next 30 days trading. Attentive readers will realise that the VIX is therefore not the actual volatility of the S&P 500, but rather a forward looking best guess of what it is. For example it's possible for actual volatility of the S&P to be low while traders are freaking out about something they see in a months time which would send VIX higher. You can buy futures contracts on the price of VIX and they're actively traded but like any futures contract you're betting on a where a price lands on a future date, in this case 30 days out. Volatility ETFs are particularly strange animals since you're buying a derivative (ETF) on a derivative (the futures contract) which itself is based on a derivative (the implied volatility of options) and those options themselves of course are derivatives which themselves are based on the S&P 500. So what's going on with Volatility ETPs? Volatility ETPs can provide investors the ability to be bullish or bearish. In other words those expecting low volatility can buy something like the ProShares S&P 500 Low Volatility Portfolio (SPLV) and those expecting high volatility can buy something like the VXX mentioned above. It's one thing that investors are expecting continued complacency and thus buying the low volatility ETPs but there is a perverse craziness that makes it all the more dangerous (more on that in a moment). To explain why there has been such a rise in the popularity of low volatility ETPs just imagine driving the Eyre highway which takes you across the Nullarbor plain in Australia. For those unfamiliar with what this is, it's a 1,675km stretch of road that is pretty much dead straight and has nothing to see - nada. It is I assure you, more boring than watching grass grow and takes 2 days at high speed.

The thing is you land up clocking speeds that would get you arrested anyplace else, in large part because it doesn't feel like you're going that fast and certainly doesn't feel like you're getting anywhere at all. It's why when accidents happen on the Eyre highway they're more often than not fatal. Every 50km or so the road kinks a little and so one minute you're hurtling along and the next thing you know, the roads not there anymore and you've got to control a ton of metal and rubber screaming through the outback at 180km/h. The rental car guy I spoke to told me that about 10% of all his cars are never resold, they're rolled. What does this have to do with volatility ETF's? Everything. Long periods of complacency are often interspersed with brief but frightening jolts of "holy sh** where did that come from?" Betting on increased volatility has been a losing bet. Below is the VXX in blue (long Volatility) vs SPLV in red (Short Volatility).

VXX in Blue and SPLV in green/red Now there are structural reasons why VXX is such a pig of a long term ETF to buy, and I'll cover why that is in a future article but the point I want to make is that going short volatility has been a winning trade. I've written about this so much that my fingers are going to bleed, more recently when discussing how bonds no longer trade based on yield but based on a future price but the hunt for yield has created some truly amazing set of circumstances and this brings us squarely to low volatility ETF's. Enter the beast - When the Cure Becomes the Poison As reported recently by Market Watch:

Now this is where the perverse part comes in. Bear with me on this - it's important. Every time you sell volatility you get paid by the counter-party who is typically hedging the volatility (going long) of a particular position and paying you for the privilege. This is not unlike paying a home insurance premium where the insurer takes the ultimate risk of your house burning down and you pay them for the privelage. The difference however between selling volatility in order to protect against an underlying position and selling volatility in order to receive the yield created is enormous. And yet this is the game being played. The central banks have managed to create a sense of calm in the markets exhibited by record lows in volatility and for their part Joe Sixpack investor has used linear thinking extrapolated well into the future assuming ever greater risk ignoring market cycles and extremes at their peril. -------------------------------------- -------------------------------------- Two things are happening here:

Traders are aggressively hunting for yield and finding it in selling volatility. This works wonderfully... until it doesn't. Remember equities are something like 7x more volatile than bonds (depending on what you're looking at) and these ETPs are inherently more volatile than the underlying equities upon which they're ultimately priced. Treating them like bonds and buying them for yield is quite simply INSANE. What's interesting is that the VIX is trading near all time lows at the same time that short interest on low volatility ETFs is at record highs. While I'm not predicting it though we are due a recession purely based on the business cycle, a market crash would almost certainly wipe out the entire low volatility ETP complex, and a market correction (overdue) will see a scramble amongst those who've been treating an ETP as a bond. It could be more entertaining to watch than the current The question is:

Know anyone that might enjoy this? Please share this with them.Investing and protecting our capital in a world which is enjoying the most severe distortions of any period in mans recorded history means that a different approach is required. And traditional portfolio management fails miserably to accomplish this. And so our goal here is simple: protecting the majority of our wealth from the inevitable consequences of absurdity, while finding the most asymmetric investment opportunities for our capital. Ironically, such opportunities are a result of the actions which have landed the world in such trouble to begin with. - Chris "To buy when others are despondently selling and sell when others are greedily buying requires the greatest fortitude and pays the greatest reward." — Sir John Templeton -------------------------------------- Liked this article? Don't miss our future missives and podcasts, and get access to free subscriber-only content here. -------------------------------------- |

| Posted: 12 Oct 2016 04:45 PM PDT Jim Sinclair's Commentary Some day these knuckle head lawyers will figure out how to win these suits as they are winnable. Scotiabank Pushed To Reveal Internal Emails In Gold Fixing CaseOctober 11, 2016 Canada's Bank of Nova Scotia, one of the five banks said to have manipulated the gold market, which is worth trillions of... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Posted: 12 Oct 2016 02:28 PM PDT This post Bracing for "Extreme Moves" appeared first on Daily Reckoning. After a September scare, a calm runs through the markets again. An eerie calm. A calm that can't last. The Dow tumbled 200 points yesterday, setting off a minor wave of volatility as measured by the CBOE Volatility Index — the VIX. But it's still not much in the scheme of last year – or, for that matter, a month ago…

"The VIX trades roughly in the range of 0–100," explains Jim Rickards, "although, as a practical matter, it never reaches either extreme. "A volatility index level of 80 would be associated with something like the Panic of 2008. An index level of 10 would be associated with an unusually calm period of smooth sailing in financial markets. Most of the time, the index trades between those levels. "When you trade volatility," Jim goes on, "you are not betting on the direction of markets — you are betting on whether or not extreme moves are in store. "Those extreme moves could be up or down for a variety of market measures. When you have a 'long' position in volatility, you don't care if a certain market goes up or down, you just care that markets are jumpy and moving in some unexpected or extreme way. "When markets are already nervous, the price of volatility (reflected in the index level) skyrockets. The way to profit is to buy volatility when it's cheap and then reap rewards when volatility suddenly skyrockets due to the occurrence of a market or political shock." Which is what the market is teeing up right now: Jim calls it "one of the most compelling investment opportunities we've ever come across." The VIX sits at low levels "in a world waiting to explode with volatility due to unstable currency exchange rates, bank liquidity crises, geopolitical uncertainty and a wild U.S. election cycle. "One or more of these potential sources of instability are ready to pop up on the markets like a tightly jammed jack-in-the-box when someone unlocks the lid. The key to profits is to understand how to use volatility as a trading strategy. If you act now, you could reap huge rewards in a matter of weeks." With that in mind, let's examine the chart above in a little more depth. Yesterday's bump up in volatility has stretched into today, and the VIX rests near 16. That's still 11% lower than the most recent peak a month ago. "That mid-September peak," Jim reminds us, "was associated with market uncertainty involving Deutsche Bank liquidity problems; the Clinton health scare of Sept. 11; uncertainty in the run-up to the Fed meeting on Sept. 21; and a Trump surge prior to the first presidential debate, on Sept. 26." But even that spike last month is child's play compared with other episodes in recent market history, Jim points out…

Now think for a moment: How likely is it the VIX won't spike to last June's levels before the end of the year? Consider all the turmoil of recent weeks: The "flash crash" in the British pound last Friday. The looming threat to the financial system posed by Deutsche Bank. The election campaign, likely to deliver a few more surprises even if David Stockman is right and Hillary Clinton has it sewn up. And the threat of a new cold war between the United States and Russia turning hot. The setup in the VIX right now is an "asymmetric" trade — Jim's favorite kind. "VIX is unlikely to go much lower, because it is already at an unusually low level relative to its longer-term behavior. Conversely, the VIX could easily spike based on one or more new shocks, or shocks from already known problems like Deutsche Bank that are dormant but could re-emerge at any moment. "In summary, the odds of losing money on a properly constructed volatility trade are low, and the odds of making huge gains are high." Regards, Dave Gonigam Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post Bracing for "Extreme Moves" appeared first on Daily Reckoning. |

| It's getting harder to deny intervention against gold, Embry tells KWN Posted: 12 Oct 2016 02:02 PM PDT 5:03p ET Wednesday, October 12, 2016 Dear Friend of GATA and Gold: It's becoming difficult if not impossible for a rational observer to deny government intervention against gold and silver in the monetary metals markets, Sprott Asset Management's John Embry tells King World News today. An excerpt from the interview is posted at KWN here: http://kingworldnews.com/john-embry-the-imfs-warning-desperate-bullion-b... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT ..... BEAT THE BANKERS AT THEIR OWN GAME ..... A free Webinar gives you all the details. Just click here: http://tinyurl.com/z4dj89k Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Infrastructure Spending and Helicopter Money: Two Hideous Ideas Posted: 12 Oct 2016 01:34 PM PDT This post Infrastructure Spending and Helicopter Money: Two Hideous Ideas appeared first on Daily Reckoning. The key to restoring Main Street prosperity is not launching an infrastructure financing bank as the Beltway bandits keep insisting and even Donald Trump has advocated. That will result in waste of capital, malinvestments, reduced economic efficiency and an even more bloated public sector than we already have. The bank that needs addressing, in fact, is the nation's central bank. Until the Fed's massive intrusion in financial markets is eliminated via abolishing the Federal Open Market Committee and government-debt purchases, there is virtually no prospect of reigniting capitalist vigor and growth in the United States. What that means, therefore, is that a half-trillion-dollar infrastructure spree like the one The Donald pulled out from under his comb-over represents a very dangerous idea. It would add measurably to the $35 trillion of public debt that is already baked into the cake, and put the politicians of the Imperial City knee-deep in the distribution of prodigious amounts of pork barrel. In fact, they desperately need to get on with the opposite — a painful process of fiscal retrenchment that is unavoidable if national bankruptcy is to be prevented. Worse still, adding to the nation's monumental debt pile in the face of nominal GDP growth that is stuck under the 3% barrier would be nearly suicidal. It would raise the ratio of public debt to national income — which is already on a path toward 150% — to even more crushing levels. At the end of the day, Donald Trump knows a lot about debt, and its dangers when it gets out of hand, and almost nothing about the economics of growth and public infrastructure. He should be sounding the alarm about the former. The public infrastructure crusade, by contrast, is just another Beltway boondoggle of the kind that he has loudly condemned and which have already brought Flyover America to the brink of ruin. Nor is so-called helicopter money any kind of answer. "Helicopter money" isn't some kind of new wrinkle in monetary policy, at all. It's an old-as-the-hills rationalization for monetization of the public debt — that is, purchase of government bonds with central bank credit conjured from thin air. It's the ultimate in "something for nothing" economics. That's because those government bonds originally funded the purchase of real economic resources such as labor hours, contract services or dams and aircraft carriers. As a technical matter, helicopter money is exactly the same thing as QE. But that's not the real reason why helicopter money policy is so loathsome. The unstated essence of it is that our monetary politburo would overtly conspire and coordinate with the White House and Capitol Hill to bury future generations in crushing public debts. They would do this by agreeing to generate incremental fiscal deficits — as if Uncle Sam's current $19 trillion isn't enough debt — which would be matched dollar for dollar by an increase in the Fed's bond-buying, or monetization rate. That amounts not only to teaching children how to play with matches; it's tantamount to setting fiscal forest fires across the land. There are a few additional meaningless bells and whistles to the theory, but its essential crime against democracy and economic rationality should be made very explicit. It would amount to a central bank power grab like no other because it insinuates our unelected central bankers into the very heart of the fiscal process. Needless to say, the framers delegated the powers of the purse — spending, taxing and borrowing — to the elected branch of government, and not because they were wild-eyed idealists smitten by a naïve faith in the prudence of the demos. To the contrary, they did so because the decision to spend, tax and borrow is the very essence of state power. There is no possibility of democracy — for better or worse — if these fundamental powers are removed from popular control. Yet that's exactly what helicopter money policy would do. Based on Keynesian gobbledygook about the purported gap between full-employment or "potential GDP" and actual output and employment, the FOMC would essentially set a target for the federal deficit. At one level, of course, it is to be expected that the people's elected representatives would relish this "expert" cover for ever-bigger deficits and the opportunity to wallow in the pork barrel allocation of the targeted tax cuts and spending increases. There is surely not a single hard-core New Dealer turning in his grave who could have imagined a better scheme for priming the pump. Yet helicopter money turns the inherently dangerous idea of fiscal borrowing in a democracy into an outright monetary fraud, and that prospect is sure to kindle vestigial fears of the public debt even among today's politicians At the end of the day, "helicopter money" is just a desperate scam emanating from the world's tiny fraternity of central bankers who have walked the financial system to the brink, and are now trying to con the casino into believing they have one more magic rabbit to pull out of the hat. They don't. That's because helicopter money will not pass the laugh test even in the Imperial City, and, more importantly, because it takes two branches of the state to tango in the process of implementation. Unlike ZIRP and QE, helicopter money requires the peoples' elected representatives to play, and to do so on an expedited basis. Congress and the White House must generate large incremental expansions of the fiscal deficit — so that the central bankers can buy it directly from the U.S. Treasury, and then credit the government's accounts at the Federal Reserve with funds conjured from thin air. But this assumes there is still a functioning government in Washington and that politicians have been 100% cured of their lingering fears of the public debt. But what is going to cause helicopter money to be a giant dud — at least in the U.S. — is that neither of these conditions are extant. Regardless of whether the November winner is Hillary or The Donald, there is one thing certain. There will be no functioning government come 2017. Washington will be the site of a political brawl of deafening and paralyzing aspect — like none in U.S. history, or ever. The reality of rapidly swelling deficits even before enactment of a massive helicopter money fiscal stimulus program will scare the wits out of conservative politicians, and much of the electorate, too. What fools like Bernanke haven't reckoned with is that sheer common sense has not yet been driven from the land. In fact, outside of the groupthink of a few dozen Keynesian academics and central bankers, the very idea of helicopter money strikes most sensible people as preposterous, offensive and scary. Even if Wall Street talks it up, there will be massive, heated, extended and paralyzing debate in Congress and the White House about it for months on end. There is virtually no chance that anything that even remotely resembles the Bernanke version of helicopter money could be enacted into law and become effective before 2018. If Trump is elected the fiscal process will lapse into confrontation and paralysis for an indefinite spell. And if Hillary is elected, the Republican House will become a killing field for almost anything she proposes, and most especially the rank Keynesian apostasy of outright and massive debt monetization. Yet absent a massive new round of monetary juice like helicopter money, the stock market will not be able to avoid its Wile E. Coyote moment. Regards, David Stockman Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post Infrastructure Spending and Helicopter Money: Two Hideous Ideas appeared first on Daily Reckoning. |

| You’re Getting Older — Here’s Who’s Profiting From It Posted: 12 Oct 2016 11:57 AM PDT This post You're Getting Older — Here's Who's Profiting From It appeared first on Daily Reckoning. Baby Boomers. It's the generation that turned popular culture and societal norms upside down. It's the generation that led the charge in a period of dramatic change — fighting war, racial, gender and economic inequality. The 1960s, especially, saw social values shift widely, fueled by mega protests that brought turmoil, disorder and change. But aging boomers eventually shed their rebellious nature, settling into the material comforts of modern life. The first wave of baby boomers, about 2.4 million of them born in 1946, turned 70 in 2016. Now, they confront the rigors of growing old, face life-and-death decisions, and grapple with difficult lifestyle choices. With increasing frequency, boomers enter a state of declining health while — courtesy of Big Pharma and the vast Medical Industrial Complex — they're able to live longer by reaching for a pill or hooking up to a machine. As our population ages, major retailers, Big Pharma and the Medical Industrial Complex will dominate market share and profitability. But wide gaps are opening for entrepreneurs with good ideas, an open heart, community sensibilities and the business acumen to attack the opportunities above. The comfortable lifestyle that many boomers had settled into morphed, for many, into a financially challenged retirement. The Panic of '08 and the subsequent and yet-to-recover ruptures in the economy means aging boomers are working longer or having to return to the workforce. According to a BlackRock survey this year, boomers ages 55–65 have saved $136,200 for retirement, sans any Social Security or pension income. That's about $9,129 a year in retirement income. Older boomers, especially those turning 70 this year, are in even worse shape because their savings or 401K accounts were wiped out and their income streams dried up following the economic downturn. Moreover, some are responsible for stay-at-home kids and grandkids who couldn't find work. And others are combating the ills of aging. Add rapidly rising health care costs to already debt-ridden boomers, and the classic portrait of easy living in the Golden Years is shattered. But it's not all doom and gloom. Of all the trends I forecast, the way we age is a megatrend in the making that still lurks under the mainstream radar. Trends are born, they grow, mature, reach old age and die… a natural organic process. How to stay healthy and live longer is a trend still in its infancy. Businesses and service providers who target these true quality-of-life issues will find the gold. We're seeing growing examples of this "young" trend. Among the cutting-edge trendsetters will be the boomers who revisit and redefine the adventuresome spirit they displayed in their youth… They want to be around activities and opportunities that give meaning and enjoyment to their lives. They want to travel more, learn more, experience more… and live more. While European and Asian cities provide rich, historic settings for these opportunities, America isn't as ideally suited. Nonetheless, small American cities like Providence, Rhode Island, Columbus, Ohio, Athens, Georgia, and Bellingham, Washington, are attracting older boomers who want to work, play and live in vibrant, active communities. Old, decaying manufacturing plants are being repurposed into living spaces shared by millennial hipsters, who increasingly are leaving for the confines of their tiny-home safe havens, and older boomers. Elsewhere, longevity centers and community-wellness groups featuring natural living and healing practices for aging adults are sprouting in the long shadow of the dominant medical industrial complex. These healing emporiums will continue to grow steadily. And even health and fitness practitioners are beginning to develop products that stress enhancing quality of life above "coping with life." Vigorous workout programs uniquely tailored for active, healthy-minded boomers are saturating the infomercial circuit where, just a year ago, they were barely noticed. As the swell of population moves into their 60s and 70s, their aging bodies are being welcomed by Big Pharma and a corporate medical empire bombarding them with an endless menu of pharmaceutical and high-tech medical wonders. Today, the lion's share of lifetime medical costs pile up during a person's final five years of life. As new technologies emerge, those costs will extend healthy, active lifespans and fuel even more rapid changes to society. In the big picture, it's easy to see how Baby Boomers will be part of changing America and the world one more time. The investing trends we'll generate from this growing theme are immense. And it's the strongest case imaginable for why you should have breakthrough medical and biotechnology stocks in your portfolio right now. Regards, Gerald Celente Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post You're Getting Older — Here's Who's Profiting From It appeared first on Daily Reckoning. |

| Gold and Crude Oil - General Stock Market Links Posted: 12 Oct 2016 10:58 AM PDT Without a doubt the most important event of the recent month (or even the recent years) was unexpected OPEC’s decision to limit its production to a range of 32.5-33.0 million barrels per day. The agreement reached in Algiers (which is expected to be implemented this year) improved oil investors’ sentiment and pushed the price of crude oil above the barrier of $50. But is it enough to break above the Jun peak? Is it possible that the relationships between crude oil, gold and the general stock market give us more clues about future crude oil’s moves? |

| WikiLeaks Drops NEW BOMBSHELL! - Assange CONFIRMS Hillary Sold Weapons to … Posted: 12 Oct 2016 10:32 AM PDT WikiLeaks Drops NEW BOMBSHELL! - Assange CONFIRMS Hillary Sold Weapons to … The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Will a Trump Victory Cause a Market Crash? Posted: 12 Oct 2016 09:00 AM PDT This post Will a Trump Victory Cause a Market Crash? appeared first on Daily Reckoning. With less than a month before election day, the Deep State fear machine is firing on all cylinders… Clinton supporter and reality show player Mark Cuban predicts a stock market decline if Trump gets elected. The Clinton News Network (CNN) also predicts a "dramatic" stock market drop if Trump wins. Of course, the stock market will soar if Clinton is elected. CNBC has even featured an "analyst" who went so far as to say a Trump White House equals a precise 50% collapse in the S&P 500. So will a President Trump really send the market into a nosedive? Morons Flailing AboutThe answer to that question is a resounding "Who the hell knows?" Cuban, CNN and CNBC's "analyst" don't have a clue. One can't know the unknowable. But that doesn't stop the so-called intelligentsia from trying… Take the CNBC analyst I reference. His name is Ian Winer. He works for a brokerage firm called Wedbush. Here's the crux of his enlightened analysis that made it necessary for him to be featured on CNBC's airwaves… Trump's call for tax cuts, along with increased military spending, mass deportation of illegal alien cheap labor and imposing tariffs on trading partners like China and Mexico will cause massive economic hardship. This will cause the price/earnings ratio (P/E) of the S&P 500 to decline to 11, or be cut in half. Look, there is no mathematical formula or algorithm on the planet that could possibly take the catalysts Winer mentions and accurately calculate a S&P P/E ratio of 11. So let me be clear, he pulled that number straight out of his ass. He also assumes every Trump campaign promise will be passed by Congress. Winer knows that's never going to happen. But if he acknowledged the truth, he wouldn't be able to make a moronic doomsday prediction to scare people over to his partisan position. This is what passes for "smart" media analysis these days. Abe Lincoln with a Comb-OverLook, I have no freaking clue what impact a Trump presidency is going to have on the stock market or the country. And neither does anyone else. He could be a grease fire or Abraham Lincoln with a comb-over. What I'm not buying is mass hysteria promoted by biased Deep State status-quo actors over the "uncertainty" and "risk" that a Trump presidency represents. Is Trump winning really going to produce any more "uncertainty" or "risk" than the negative interest rate policy causing a massive banking crisis in Europe that's about to implode Germany's largest bank? Is it worse than a $230 trillion artificially inflated debt bubble thrust upon us by central bank experiments? Is it more serious than a zero-interest-rate-induced asset bubble caused by desperate investors searching for yield? The answer to all is no. There's uncertainty and risk everywhere in today's world. Nobody knows when the shoe is going to drop, but there can be no doubt it will drop at some point. And any drop will happen regardless of who is President. That's why I'm glad I'm a trend follower. I can ignore the mainstream media's partisan political posturing masquerading as "analysis." And I can ignore the massive market distortions caused by our monetary overlords. As a trend follower, I don't need to know how any or all of that is going to shake out to make money in the markets. All I need to do is follow the price trends that markets create and ride those waves for gains. I want you to be able say that too. Please send your comments to me at coveluncensored@agorafinancial.com. Let me know what you think of today’s issue. Regards, Michael Covel Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post Will a Trump Victory Cause a Market Crash? appeared first on Daily Reckoning. |

| Posted: 12 Oct 2016 08:41 AM PDT Bill and Jim, I am sure the turn around on gold below the $1,250 – $1,275 level on Friday has not been lost on you two since you are much closer to this than most of us. Andy Mcquire, in his October 6th commentary on King World, mentions $1,275 as the price where there is... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. |

| And You Thought the Silver Market was Rigged Posted: 12 Oct 2016 07:52 AM PDT We live in a world where the yield-starved and tech-savvy conspire in the basement of the underground and unaccounted. While the rise of Bitcoin and the explosion of alternative currencies may become the new scapegoat of behavioral finance, there is nothing quite like the reality of trickle down finance gone wrong. Recently, EU officials called for putting safeguards on Internet currency. |

| The Current Gold Price Is A Gift Posted: 12 Oct 2016 07:20 AM PDT The Current Gold Price Is A Gift |

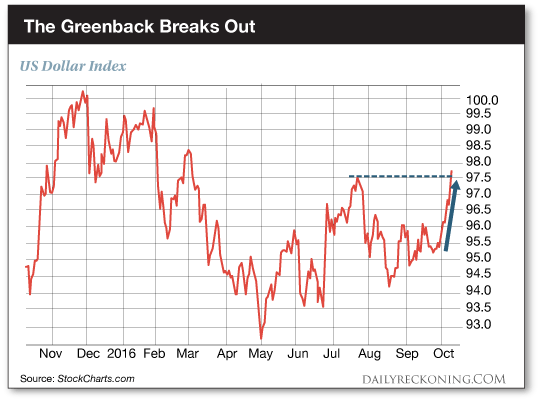

| Is the Market Suffering From Rate Hike Fever? Posted: 12 Oct 2016 07:00 AM PDT This post Is the Market Suffering From Rate Hike Fever? appeared first on Daily Reckoning. Stocks incinerated quicker than a Samsung smartphone yesterday. The Dow finished the session down 200 points. The S&P 500 and Nasdaq Composite lost 1.25% and 1.5%, respectively. When the dust settled, Tuesday went in the books as the worst day for the major averages since the early September drop that rattled stocks out of their tight August range. Yesterday's action also obliterated all of the behind-the-scenes progress stocks had made over the past few weeks. The market rounded up small-caps, biotechs, and other "risk-on" groups for the torture chamber. Each of these new market leaders was beaten senseless. After a quick attitude adjustment, the riskier stocks are now leading us lower… The VIX, harbinger of doom and volatility, has jumped 8% and is back above 15 for the first time this month. If you're searching for a silver lining after the drop, you won't find one. Every major sector took a hit… So is the election circus finally taking its toll on the markets? Or are bigger forces at work? The distractions are beginning to pile up. Earnings season is upon us and the early-reporting stocks are already getting slammed. Aluminum producer and former Dow component Alcoa missed expectations and lowered guidance yesterday. As a result, investors took the stock out to the woodshed. Alcoa shares finished the trading day down more than 11%. But the real action is happening in the currency markets. The entire world is showing symptoms of rate hike fever. The culprit? The U.S. Dollar continues to gain strength, sending the euro and yen spiraling lower.

After a brief summer drop, the U.S. Dollar Index continues to build strength as we barrel toward the end of the year. Yesterday, the index smashed through its July highs as traders anxiously prepare for a December rate hike. "That is the highest level for the gauge in more than 7 months, according to FactSet data. The dollar indicator is up 2.3% so far this month, putting it on track for its best monthly gain since May," MarketWatch reports. "However, the extended rise in the greenback may prove a headwind for major multinational companies that export products overseas, making their products more expensive to buyers using other monetary units. Technology companies, in particular, tend to draw the vast majority of their revenue overseas. Revenues in other currencies can be worth less when converted back into dollars." As traders, we have no choice but to pump the brakes. Market conditions are changing extremely fast. We can either adapt… or die. This isn't the type of environment where we can just sit on our hands and wish our positions higher. Not losing a bunch of money during any impending market mayhem is our No. 1 priority right now. Stay smart and we'll hit the ground running again tomorrow… Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Never miss another buy signal. Click here now to sign up for FREE. The post Is the Market Suffering From Rate Hike Fever? appeared first on Daily Reckoning. |

| LBMA chooses tech firms for new trade reporting Posted: 12 Oct 2016 05:28 AM PDT London Gold Market Boosts Transparency with New Platform By Henry Sanderson The London Bullion Market Association, which oversees the city's $5-trillion gold market, has named the financial technology firms that will run its electronic platform in an effort to bolster trading transparency for the precious metal. Starting in the first quarter of next year, physical gold trades by LBMA members will be reported to a platform run by Boat Services, a London-based company that provides financial trading technology, and its partner Autilla, another fintech start-up. The two companies have won the mandate over large exchange groups, including the London Metal Exchange, Intercontinental Exchange, and the CME Group, which also submitted proposals. ... ... For the remainder of the report: https://www.ft.com/content/3115c2d0-8fd1-11e6-a72e-b428cb934b78 ADVERTISEMENT A Lone Congressional Candidate Is Campaigning on the Gold Standard The New York Sun just endorsed Connecticut Republican congressional candidate Daria Novak, based on her support for restoring the gold standard: http://www.nysun.com/editorials/a-prosperity-heroine/89742/ Daria needs us to contribute $1,000, $500, $250, $100, $50, or whatever we can afford in the fiat money that is sleeping in our checkbooks. As the Sun wrote, "She vows to crusade" on the gold standard "as key to getting job creation, economic security, and upward mobility back at a sizzling rate." Novak has been endorsed by gold standard and sound money advocates George Gilder, Lawrence Kudlow, Jimmy Kemp (Jack Kemp's son), and Jeffrey Bell ... along with Steve Forbes, who calls Ms. Novak "the prosperity heroine." To donate to Daria's campaign, please visit: http://novakforcongress.org/donate/ Daria will personally thank all contributors. Daria Novak is gold's lonely champion. Give her your backing and put a voice for gold in Congress. This message was authorized by Daria Novak for Congress. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold Trade Reporting Coming to London 2017 Posted: 12 Oct 2016 04:08 AM PDT Bullion Vault |

| Gold and Silver Metals Show Strength Relative to the USD Index Posted: 12 Oct 2016 01:07 AM PDT Gold, silver and mining stocks moved higher yesterday, but the size of the rally was not huge and it was another day during which the PM sector didn’t decline. The back and forth movement and decreased volatility appear to be temporary as this kind of performance is something that we’ve seen during both consolidations and bottoms. Which way will the precious metals sector go? |

| Breaking News And Best Of The Web Posted: 11 Oct 2016 07:37 PM PDT Corporate earnings season off to a brutal start. Several banks now predicting recession. Deutsche Bank still trying to negotiate a lower fine with the US, may have to raise capital on extremely unfavorable terms. British pound plunges. Global debt soars. Gold and silver speculator longs continue to unwind. Trump threatens to jail Clinton if he […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment