Gold World News Flash |

- One Giant Powder Keg... And The Fuse Is Already Lit

- Collapsing Collateral, Derivatives, And Systemic Risks

- Understanding gold begins with realizing that its market isnt normal

- Illegal Clinton victory can mean USA Balkanization or Revolution

- Susan Sanders, wife of monetary metals advocate Franklin Sanders, dies

- Market Slant: What happens next in antitrust suit against London gold fix banks

- America’s “Ungovernable” Future

- Why Fiscal Stimulus Won’t Happen This Time Around

- Susan Sanders, passed suddenly into the arms of Jesus this morning

- Gold Daily and Silver Weekly Charts - La Douleur du Monde

- Understanding gold begins with realizing that its market isn't normal

- Dr PAUL CRAIG ROBERTS - Putin Says We Are On The Brink Of WW3

- The Federal Reserve’s Telltale Sign of Insanity

- Deutsche Bank Is On The Verge Of Collapse Andrew Hoffman

- The Current ECONOMIC CRASH and COLLAPSE OCT News !!!

- Gold fix banks will have to reveal correspondence for antitrust lawsuit

- The IPO Bear Market Ends Now

- FT laments the lack of the gold market information it won't report

- Gold Price Closed at $1257.50 Up $8.60 or 0.69%

- Presidential Election and Bear 'Super-Cycle' Stifle Growth in Markets

- What in the World Happened to Gold and Silver Prices Last Week?

- Breaking News And Best Of The Web

- Top Ten Videos — October 11

| One Giant Powder Keg... And The Fuse Is Already Lit Posted: 12 Oct 2016 01:00 AM PDT Submitted by Nick Giambruno via InternationalMan.com, Their mission was to capture—or more likely—kill. Dozens of renegade commandos in three Blackhawk helicopters swooped in on the holiday residence of the president. Immediately, they engaged in a fierce gun battle with the president’s bodyguards and killed a number of them. Tourists in a nearby five-star resort fled for their lives. Their idyllic vacations had turned into a warzone in the blink of an eye. The president, however, was nowhere to be found. He had been tipped off about the plot and made it to the safety of his private jet. He had cheated death by mere minutes. The renegade soldiers got wind of the escape. They commandeered a couple of F16 fighter jets and sent them to the skies to shoot down the presidential jet. Aware the rebel F16s were hunting them, the president’s pilots were able to obfuscate the identity of their aircraft by altering the jet’s transponder signal. The transponder is an electronic signal that shows an aircraft’s identity. It’s used by air traffic controllers to keep track of planes in the air. Somehow, the pilots of the presidential jet were able to set their transponder signal to make it appear as if they were instead a civilian passenger jet. The confused rebel fighter jets ran out of fuel and had to return to base before they figured out what happened. The president had cheated death for the second time that day. This story sounds like something out of a Tom Clancy novel or a Hollywood blockbuster. But it’s not… It happened in real life earlier this summer. In Turkey. The country is one giant powder keg… and the fuse is already lit. When the next global crisis explodes, there’s a good chance Turkey will be involved somehow. Turkey was founded from the ashes of the Ottoman Empire. It’s where Europe meets Asia. Today, it’s at the epicenter of many crises that are destabilizing the world… the migrant disaster in Europe, the ongoing carnage in Iraq and Syria, the battle with ISIS, a conflict with the Kurds, and the new Cold War with Russia. It could soon also play a big role in the collapse of the world’s largest economy, the European Union (EU)… It’s hard to think of another place that has more tripwires for a global meltdown. In light of all these potential triggers—as well as the recent failed military coup d’état that killed over 290 people—I thought it was time to take a closer look at Turkey. Doug Casey and I just returned from the crisis-stricken country, the latest destination we visited with (literal) blood in the streets. We put our boots on the ground in the same area where that hit squad of rebel soldiers nearly assassinated Recep Tayyip Erdogan—the Turkish president. (In addition to all of the crises listed above, the Turkish military had invaded northern Syria just before our arrival.) Perhaps most importantly, Turkey is at the heart of the migrant crisis that is tearing Europe apart. The migrant crisis will be one of the main issues on the minds of Italians as they vote in the upcoming referendum, which could very well decide the fate of the EU and the euro currency. That’s why I’ve spent weeks on the ground in Italy, watching these events unfold. The Financial Times commented on what would happen if the Italian referendum fails: It would probably lead to the most violent economic shock in history, dwarfing the Lehman Brothers bankruptcy in 2008 and the 1929 Wall Street crash. Like with the Brexit vote, the migrant issue—and by extension Turkey—may determine the outcome of the Italian referendum on December 4, 2016… Turkey Holds the Keys to the EU’s FutureParroting U.S. concerns about democracy and human rights, the EU has also harshly criticized Turkey’s response to the failed coup. This hasn’t endeared them to the Turkish government. It’s actually incredibly stupid for the Europeans. And by stupid I mean exactly that… an unwitting tendency toward self-destruction. The Europeans fail to see the indirect and delayed consequences of their decision to antagonize the Turkish government. That’s because the Turkish government holds the trump card on what is perhaps the most explosive political issue on the continent right now: the migrant crisis. Concerns about the unprecedented flow of migrants into Europe over the past couple of years played a key role in the Brexit vote. It’s also acting as a political accelerant to the rise of anti-EU parties all over Europe. It’s a simple relationship. The more migrants come to Europe, the more popular anti-EU political parties become, and the weaker the EU itself becomes. This is where Turkey holds the keys to the future political landscape of Europe. Turkey is a major transit point migrants use on their way to Europe. The Turkish government doesn’t want the migrants to stay in Turkey, so they haven’t really had much of a reason to stop them from leaving for Europe. They even enjoyed the situation because it gave them negotiating leverage with Brussels. The Turks essentially said “give us what we want or we’ll open the floodgates.” What the Turks want is lots of money and to join the Schengen visa-free zone, which allows unfettered access to most of Europe. Brussels partially gave in to the blackmail. They started giving the Turks money—to the tune of $6 billion—and agreed to hold talks about getting visa-free access to the continent. In return, the Turks would cut off the flow of migrants. For a while this arrangement worked. But after the attempted coup… and then the purge of suspected putschists, the EU cried foul. They deemed the purges to be an erosion of democracy and the rule of law. They basically told the Erdogan government it can forget about joining the Schengen zone. Unsurprisingly, the Turkish government not-so-subtly warned that if the EU walks away from its part of the deal, so will it. Specifically, the Turkish government has threatened to open the migrant floodgates… just in time for the Italian referendum and other key European elections. The Italian referendum could very well lead to the end of the euro and the EU itself, while triggering a global financial meltdown of historical proportions. Turkey sending a new wave of migrants into Europe just before this key vote will help seal its fate. There are potentially severe consequences in the currency and stock markets. That’s exactly why I recently visited Turkey and spent weeks on the ground in Italy. New York Times best-selling author Doug Casey and I just released an urgent video with all the details. Click here to watch it now. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Collapsing Collateral, Derivatives, And Systemic Risks Posted: 12 Oct 2016 12:27 AM PDT By Chris at www.CapitalistExploits.at Last week I published the first part of a conversation I had recorded with Daniel Want, the CIO at Prerequisite Capital Management. Today I have the second part of our conversation for you. In it Daniel and I dug into:

I invite you to listen to the second part here: (Click on the image to listen to the podcast) Enjoy! - Chris "Derivatives are like sex. It's not who we're sleeping with, it's who they're sleeping with that's the problem." ? Warren Buffett -------------------------------------- Liked this podcast? Don't miss our future articles and podcasts, and get access to free subscriber-only content here. -------------------------------------- | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Understanding gold begins with realizing that its market isnt normal Posted: 12 Oct 2016 12:01 AM PDT GATA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Illegal Clinton victory can mean USA Balkanization or Revolution Posted: 11 Oct 2016 07:14 PM PDT How quickly we are sliding down the rabbit hole! As we explain in Splitting Pennies - Understanding Forex - Forex is the means to which one can understand how the world works. This book isn't about FOREX so much as it's about the workings of the 'real world' - and no better time than now to understand these nuances! Scots refer to this time as "The Quickening:"

It seems that it's not possible to even digest and assimilate the information as quickly as it's passing now. Wikileaks released more HRC emails, of all people Bill OReilly exposes a massive conspiracy against Trump, A Libertarian tracking to get 10% of the vote, an election official was caught on camera saying 'the fix is in' for HRC, Russia is in fallout mode; whats next? I'll tell you what's next... First, a quick lesson.. The current social control paradigm doesn't control people 100%. It's not as if there's a button they can press in Washington, and Joe Plumber will lift his right arm and salute. It's an inefficient, outdated, but effective - propoganda system that functions on multiple levels. Television with its HZ waves, chemicals in the food, drugs like Prozac, Zoloft, Viagra, Valium, and now in the west Marijuana, all designed to make you very happy fat idiots. Well, not everyone is on prescription meds, and not everyone has a TV, so that's one proof that this 'system' isn't 100% effective! Also, even for those 'inside' the system, it doesn't control them 100%. It controls the 'group mind' or 'groupthink' - that means, in subtle ways, the establishment can be against TRUMP but in such a way that at first he's elected, but PENCE is the real play. This game scenario, pacifies the real 'awake' people, with a TRUMP victory, but having a real establishmentarian in the White House shortly after. Just sayin' - it's one of the possible considered scenarios - and you can bet the farm that the DOD's supercomputers are running at full capacity gaming this situation, because a failure to coalecse the people when they are angry and armed can mean one thing: REVOLUTION. Replace that word properly with ANARCHY or CHAOS because this isn't really a REVOLUTION, as the Bolshevik revolution which was planned and stood for intellectual concepts. This would be more of a REVOLT, against a broken establishmentarian system that hasn't evolved with the times, and has done a poor, poor, poor job of management. Note to Elite - if you want to engratiate yourselves, be sure to keep the people fat and happy completely, so they don't notice what you're doing. Happy people means people sheeple. The Establishment is so against Trump that it's scary. It's proof that he really is an independent 'candidate' and that he hasn't been 'bribed' by the powers to be. But in any case, even for fervent TRUMP supporters, an establishment HRC victory by election fraud as described by the election official 'busing around voters from voting booth to booth' might even be BETTER than a TRUMP victory. Because, TRUMP winning the election is the POSSIBILITY, not the GUARANTEE, of change. Once TRUMP is in the White House, they will do everything and anything to make his job impossible. It's not known how TRUMP would act in such situation - not even he knows. He thinks he knows - but he will encounter things that he didn't expect once he's there. Regardless of the outcome, it seems that if there is any funny business at election time, which it seems there most certainly will be, it will 'wake up' a huge amount of voters to the fact that America has long ago been bought and sold just like almost every other country on the planet. This may start them down a path where they may ask questions about the status quo, and it may change them. They may want to learn things, such as how the financial system works - where does all the 'money go' - why is our money less and less valuable each year? So, as hearbreaking as it may be to see a real swine steal the election via voter fraud, it certainly wouldn't be a first in America (see results of 2000 elections), and it might actually be a good thing, in the long run, as those who are naive who believe 'it can't happen in America' will be doused with a huge barrel of hot oil in the rest of the world they call 'reality.' BALKANIZATION Here's a topic that we should elaborate on so that people are prepared, those who are not aware of America's history, or the structure of law, and how the states have an elective relationship with the Federal Government. The United States of America is a superstate, it's not a country, like Switzerland is a country, it's a CORPORATION, a Federal multi-national conglomorate comprised of 50 primary dealer-states, and a few 'almost' shareholders that can vote but don't pay taxes or have Senators, like Puerto Rico. Due to the massive POWER enjoyed by the USA, this structure is thought of as strong, but do not confuse these traits. In fact, USAs history was very haphazard, it wasn't planned well, at least on a Federal level. Many aspects of how the USA operates happen as a 'problem-reaction-solution' and all of a sudden we have FEMA, an agency which many think is an Apocalyptic dark horse ready to administer end of times, when in the reality it's a welfare agency to help people after storms who don't have insurance or cars to drive out of emergency areas or even money for a bus ticket. The Federal government has become just something unique that will be studied for a long time. What is 'balkanization' - simply, a term meaning the unwinding of USA as an entity, in its current form - such that we could see many countries or 'states' - US states are called 'states' but actually a 'state' is a COUNTRY. France, is a STATE. Although, France is part of the European Union. The EU was significantly more properly organized as a Federation, as they had an example of USA and UK, and technology, and other tools at their disposal. The EU is perfect example of why a superstate doesn't work, or if you want a failed example, how about Yugoslavia? A great idea, and while Tito was alive - worked great! But, then the jackals emerged and the situation 'balkanized' - which is what's happening now in America. Take a look at Texas secession voting polls as example: Note the * - and this was conducted in August, before all recent events. An angry critical mass could easily push this sentiment well above 50%, and remember these polls are of the politicians, the people probably already feel 80% about secession. Trump uses good example of Obamacare and drawing lines around the states. People in Texas, don't care to be part of USA. The republic of Texas will be happy to be out. And New York, finally will say 'we don't want them, in OUR America' - which will not include of course, the South (The Deep South) - and Mormon controlled Utah, California off in its own LALA land, and it remains to be seen how the midwest can partner with New England in this regard - possibly this can be the 'real America' - New England west until North Dakota line, including the upper Mississippi region, Wisconsin, Michican, Ohio, Illinois, Indiana, etc. Is it so far fetched - is it such a bad thing? Driving around in this new "Many America's" one wouldn't know the difference. Anyway, few Americans now even know who the president is NOW. We aren't fighting anymore for Democracy, we're fighting over who gets what. What energy companies will get tax breaks. Where the next Amazon factory will be built. In South Carolina? Or in Mexico? Or Canada? Or .. not? Balkanization of USA can be a good thing, it will be good for the markets, good for business - so those who are worried about such a scenario - don't be! It can be like living in Europe - only we'll all speak English. Well, if you've ever been to the Deep South, or Boston, you can say that it's not easy to clearly understand native Americans from all parts of USA. Revolution - will lead to balkanization. Because states will react, to protect their interests. Big business will fall back on the local government when the Feds fail. It will be amazing how quickly interest pulls out of Washington and back into counties, cities, and states - when they see it doesn't work. There's one huge PLUS in the current pay for play - lobbying system in Washington today. The 'real owners' of USA - Corporations, UHNWi, foreign governments, special interests, and others - they can pull the plug at any time. Without their support, Washington would be like a wet noodle. Yes, the Army has nukes - but Facism has taken over so exclusively, nearly 60% of the CIA operations are OUTSOURCED! That means a rogue general, without the support of Raytheon, Lockheed, and Boeing, would be a target not only of the Army but of foreign armies as well. Unlike previous times, war cannot be started by assasinating the Archduke. But - going back to the original point - the powers to be have gone so far in this election to push this system to the brink of collapse - an Illegal HRC victory can break the system. People can simply lose faith. Not go to work. Not buy coca-cola. Throw their garbage on the street. Park their cars on interstate highways. Throw TVs out of windows. Stop drinking beer. Don't pay taxes. Don't take loans. Learn foreign languages. Create free puppet shows. Write books. Use their local libraries. Stop driving on interstate highways. Stop using social media. Deleting bad files from their computers. Digging gardens. Reforming land for use. Painting pictures. Creating art with 3d printers. The world is such a big, interesting place - this whole debate doesn't deserve our time. Who cares if Trump is a bad person, an egoist, whatever. He's not in prison. He represents what America REALLY IS - like it or not. If he loses fair and square, we can wait another 8 years. But if HRC is elected due to voting fraud, machines that will ONLY vote for HRC (as we saw in the 2000 presidential election, and countless local elections) - we can expect huge social fallout, and probably, most likely, the beginning of America's own BREXIT, where states will one way or another drop out of this "USA" system. US taxpayers spend hundreds of billions of dollars paying taxes to keep this system going, by blind faith. USA is a modern religion. If only a small fraction of that tax money was spent on useful things, such as planting trees, building roads or paving roads, building schools and other various buildings, planting crops for consuming, heck even making beer - would be better than giving it to the federal government - economically speaking (you should always pay your taxes!). Take a look at this overlay of a new 'potential' America, overlay on Federal Reserve 'districts' - interesting why the Fed has these 'districts' isn't it, 12 of them.. how biblical of them...

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Susan Sanders, wife of monetary metals advocate Franklin Sanders, dies Posted: 11 Oct 2016 06:53 PM PDT 9:54p ET Tuesday, October 11, 2016 Dear Friend of GATA and Gold: Former U.S. Housing and Urban Development Assistant Secretary and former GATA board member Catherine Austin Fitts today reports the death of Susan Sanders, wife of bullion dealer, financial letter writer, monetary metals advocate and resistance leader, and pastor Franklin Sanders at their home in Westpoint, Tennessee: https://solari.com/blog/a-message-from-franklin-our-beloved-susan-sander... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market Slant: What happens next in antitrust suit against London gold fix banks Posted: 11 Oct 2016 05:55 PM PDT 8:56p ET Tuesday, October 11, 2016 Dear Friend of GATA and Gold: Market Slant, which last week broke the story about the advancement of the antitrust lawsuit against the banks involved with the daily London gold fix, today examines the discovery procedures ahead as the plaintiffs pry evidence out of the defendants, a process that could take a long time but also produce much incriminating evidence. Market Slant's report is headlined "Gold Fix: ScotiaBank Ordered to Produce Internal Documents" and it's posted here: http://www.marketslant.com/articles/gold-fix-scotiabank-ordered-produce-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT K92 Mining Begins Gold Production at Kainantu Mine Company Announcement K92 Mining Inc. is pleased to announce that gold production has commenced from the Irumafimpa gold deposit. Ian Stalker, K92 Chief Executive Officer, says: "This milestone is highly significant for our company, and for this region of Papua New Guinea. A great deal of thanks goes to the entire team on site in PNG in achieving production ahead of schedule and on budget. The rehabilitation of the Irumafimpa gold mine, process plant, and associated infrastructure commenced in late March and is now complete. As an enhancement of the processing facility, we are also pleased to note that the installation of a new drum scrubber is also nearing completion and commissioning of this will be completed by the end of the month. ..." ...For the remainder of the announcement: http://www.k92mining.com/2016/10/6077/ Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| America’s “Ungovernable” Future Posted: 11 Oct 2016 03:09 PM PDT This post America's "Ungovernable" Future appeared first on Daily Reckoning. In yesterday's reckoning, David Stockman said the election's over. Hillary wins. The media sketched Trump as some hell-sent fee-fo-fum with his "locker room" comments about the fairer sex. And voters are running away, screaming. Reader response to David's piece was… robust. Above the initials M.H. we were dealt with as follows: "Shame on you for publishing such a rant of garbage from Stockman. He's entitled to his opinions, but I expect objective facts from this publication, not obviously biased rants." "You’re dead wrong on Donald losing," writes another reader. "Nov. 8 will be a 'Brexit' day, as voters freeze on pulling the Hillary lever." "[Copulate] you, Stockman," screams another reader, sending us to the fainting couch, clutching our pearls. "You delivered yet another kick to the proverbial [rhymes with walls] of those who still BELIEVE in freedom and the foundation of morals and values this country was built on." Harsh words. But let the minutes show David's for Trump — not Hillary. We present the following as proof thereof, straight from the accused: "God help the world if she becomes our nation's president." And God's in for a good hard sweat if He takes the job. The Daily Reckoning's Charles Hugh Smith: "The only way to govern successfully is to actually solve the underlying systemic problems, but doing that requires overthrowing a corrupt, self-serving elite… Regardless of who wins the election, the U.S. will be ungovernable in a period of self-reinforcing crises." Smith argues that whomever voters elect, "an increasing number of Americans are coming to understand that their oppressors are not foreign 'terrorists' but homegrown elites who have become wealthier and thus more powerful in the past seven years of 'prosperity.'" Smith argues the current system — the 1% in the penthouse, the rest in the outhouse — is beyond hope. The foundation's rotten: Our status quo — the pyramid of wealth and power dominated by the few at the top — has failed and is beyond reform. This failure is not rooted in superficial issues such as politics or governmental regulations; the failure is structural. The very foundation of the status quo has rotted away, and brushing on another coat of reformist paint will not save our societal house from collapse. It's possible one more good recession could shake the "societal house" off its foundation. And history says it's overdue… The current economic expansion — and here we grade on a cheater's curve — is 88 months and running. Expansions have averaged a far less handsome 61 months since the end of World War II. It seems history — with its kindergarten math — must have its say. And possibly soon. That's why David Stockman thinks it's a "virtual certainty that another recession lies dead ahead." Recession or no, some now argue past levels of economic growth are gone… for good. "Secular stagnation" is the term. Get used to a 1% world, not the 3.5% of the post-WWII go-go years, they say. A couple percentage points don't seem much. But extend it down the track a stretch and you've got a train crash unfolding at a turtle's pace. Michael J. Hicks, Ph.D., is director of the Center for Business and Economic Research and professor of economics at Ball State University. He puts it this way: Since World War II, the economy has expanded at an average rate of 3.5% annually. We'll be lucky to average 1.5% in the decade after the Great Recession. This sounds like a small difference, but it is not. At current population growth rates, 3.5% economic growth will cause the standard of living to double in 25 years. At 1.5%, it'll take a whopping 88 years for the standard of living to double. Eighty-eight years to double living standards… compared with 25. So much for the American dream, if true. Nice while it lasted. Is it any wonder someone like Trump came along? And what's next? Charles Hugh argues only structural reform can restore the hearty growth of yesteryear, not more monetary wonderworks. So does Jim Rickards: "The problem with the post-2007 world is that we are not in a cyclical recovery; we are in a structural depression, defined as a sustained period of below-trend growth with no end in sight. The U.S. has caught the Japanese disease. Structural depressions are not amenable to monetary solutions; they require structural solutions." But none are presently on tap. The barmen keep on serving stronger and crazier monetary wine. And the hour grows late. Author Simon Johnson wrote an article called "The Quiet Coup" a few years back. Essential quote: "Recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we're running out of time.” The only question is how much time remains? Regards, Brian Maher Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post America's "Ungovernable" Future appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

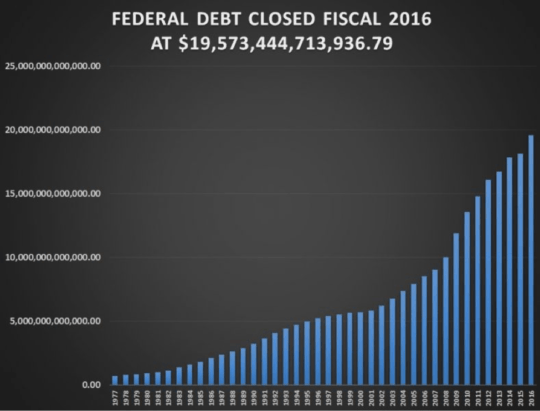

| Why Fiscal Stimulus Won’t Happen This Time Around Posted: 11 Oct 2016 02:55 PM PDT This post Why Fiscal Stimulus Won’t Happen This Time Around appeared first on Daily Reckoning. It's a virtual certainty that another recession lies dead ahead. But what is truly startling is that the market is giving no recognition whatsoever to the fact that the nation’s fiscal situation is very rapidly going to hell in a handbasket. And that there is virtually no prospect of another massive shovel-ready stimulus like the Obama $800 billion plan this time around. The warning signs of the impending fiscal paralysis are readily evident. The budget deficit in the year just ended soared by 37% — from $438 billion last year to just under $600 billion for FY 2016. But the outcome was actually worse due to various kinds of budget gimmickry addressed below. In fact, the total public debt rose by $1.4 trillion during FY 2016, and will almost surely cross the $20 trillion mark soon after the next president is sworn to office.

Needless to say, there will be no budget headroom at all for fiscal stimulus or the kind of huge infrastructure packages that both Hillary and Trump have bloviated about. Whichever candidate enters the White House — and it looks like Hillary — is going to be shocked by the news that its first full year budget (FY 2018) will exhibit a $1 trillion deficit based on current tax and spending laws. And that's before even a single dime of stimulus can be lobbed at a recessionary economy. This upcoming shock is not merely a matter of academic or even “political” interest. To the contrary, Wall Street is so confident of the latter that it has actually “priced-in” a fiscal rescue — a rinse and repeat version of the 2009 borrow-and-spend spree. Au contraire! We are in a new ballgame, and there are no bailout fireman at the ready. This time there will be no quick stock market rebound like in 2002 and 2009. And after a period of recessionary stasis and no massive stimulus from Washington, the remaining punters in the casino will really panic. That will catalyze a second leg down unlike anything since the 1930s. The Fed is completely out of dry powder and that there will be no post-crash reflation of financial assets owing to monetary stimulus. Indeed, even the mainstream commentariat is rapidly pivoting to the proposition that the central banks have shot their wad, and it now time for fiscal policy to pick-up the ball. This is a will-o-wisp. Indeed, my level of confidence that fiscal stimulus is dead in the water is immensely bolstered by the sheer complacency that characterizes both ends of the Wall Street/Washington axis at the moment. Kicking-the-budget-can has been such a deceptively effective strategy that everyone expects the game to continue. For instance, between December 2008 and the present, the public debt exploded from $10.7 trillion to the $19.6 trillion figure displayed in the graph above. That means that on Obama's watch, and during a period in which the economy was rebounding from the worst recession in modern times, new public debt was issued equal to 83% of the total public debt created during the entire prior 220 years of the republic and the tenure of 43 presidents. The point is that $9 trillion eruption of the public debt happened during the so-called “good times” of the business cycle. Yet the sleepwalking politicians of the Imperial City did not even notice it happening. The Democrats are actually crowing about their accomplishment in taming the deficits and the Trump campaign doesn't give the soaring national debt nearly enough attention. But now it is going to get much worse, and rapidly so. Even by the Congressional Budget Office's (CBO's) Keynesian scorekeepers, the budget deficit will hit $ 1.4 trillion and 5% of GDP by 2026 under current policy. This means that another $10 trillion is already baked into the fiscal cake and would be added to the public debt during the next decade as a whole. Yet that assumes, no recession for 17 years and a rate of nominal GDP and wage growth 65% higher than during the last decade. Imagine what will happen in the real world when the Red Ponzi finally crumbles in China and the global economy plunges into a prolonged deflationary recession. What will occur, in fact, is that the public debt will rise by at least $15 trillion in the decade ahead under even a halfway-decent economic scenario. Add that to the $20 trillion which the next president will inherit and you have a $24 trillion GDP lugging around a $35 trillion public debt. Yet Trump says he is going to rebuilt the military, launch a $500 billion infrastructure program and not touch medicare or social security. Worse still, Hillary is now humping Bernie’s playbook, promising to lower the Medicare age to 50 years, provide free college tuition and a goodly amount of other free stuff. The larger point is that the Fed's massive repression of interest rates has spawned a fiscal culture of unspeakable deception, duplicity, lies and dysfunctionality on Capitol Hill. On the one hand, it means that the current $19.6 trillion of national debt can be serviced on the cheap — currently at a weighted average yield of about 1.8%. Accordingly, debt service costs which would be upwards of $1 trillion under normalized interest rates (5%) are currently only about $350 billion. So the politicians — even self-proclaimed fiscal hawks like Speaker Paul Ryan — have felt no financial pressure, and became accustomed to kicking the can. At the same time, Washington’s moveable fiscal scam has resulted in an utterly deceptive 10-year deficit forecasts — even after funding the national debt on the cheap. The CBO's so-called baseline projections show out-year spending far lower than what is actually built into the system. And not merely due to the deceptive rosy-scenario economic forecasts that assume the business cycle has been abolished and that the U.S. economy will dwell in the nirvana of Keynesian full employment without interruption and forever. The long-term deficit outlook is further understated owing to the phony entitlement reforms that CBO is required by Congress to credit. That's right. Congress has no intention of allowing these future-year fiscal curtailments to become effective, but still insists on counting them when summing up completely phony 10-year savings totals. Yet when the "out-years” become the current year, they are simply suspended, deferred or covered up with new offsetting out-year savings gimmicks like those in last year's omnibus appropriations bill. By the same token, baseline revenues are projected to be far higher than will actually materialize under current policy. That's due to the operation of the same kind of moveable scam on the income side of the budget ledger. There are literally hundreds of billions per year of tax incentives, subsidies and loopholes that have been in the IRS code for years or even decades that are made to artificially and abruptly expire a year or two down the road. Accordingly, CBO scores a commensurate increase in the out-year revenue base, thereby contributing to the appearance that the long-term deficit is shrinking. But when we get to the statutory expiration dates, these provisions never happen and the huge revenue drains continue. The culprit is something called that annual "tax extender" bill, which mostly just rolls forward the expiration dates by a year or two so that the CBO can keep projecting sunny fiscal skies ahead. This was evident in spades in the $680 billion worth of so-called tax-extenders also contained in last year's omnibus budget bill. One of the most egregious cases of this kind of double shuffle pertains to the three Obamacare taxes, which were “deferred” by several years at an alleged cost of $28 billion. In truth it's more like $260 billion. Here's why. Recall that the true cost of Obamacare was in the trillions, but it was outrageously disguised as a deficit reducer through a series of huge gimmicks, such as changing the student loan program from an entitlement to a direct loan. And also through a series of stiff taxes on insurers, medical devices and so-called Cadillac medical plans. However, these so-called "pay fors" were back-loaded into the middle of this decade in order to pacify the intense political opposition to them and to assemble the razor-thin partisan majority by which the program was enacted in 2010. In particular, core Democrat constituencies like the labor unions were violently opposed to the so-called "Cadillac tax" on expensive, gold-plated employer health plans. That was even after the threshold plan value was raised to $27,000 per year for family coverage before the 40% tax kicks in. So the inception date was deferred into the distance future — to 2018. Well, the distant future is now getting closer, and like with almost everything else in Obamacare that created intensive political opposition, such as the employer mandate, the time had come time to kick the can. So the same omnibus bill deferred the Cadillac tax two years until 2020. That's right. They had the audacity to say they “paused” the very thing that they never intend to become effective. In that same vein, the health-insurers tax that pays for part of the Obamacare subsidies to families up to 3X the median income was also paused for a year. The plain fact of life is that none of these out-year Obamacare taxes will ever be collected. If Trump wins, they will be repealed; if Clinton wins they will be deferred. Accordingly, the real hit to future deficits is in the order of one quarter trillion dollars over the next 10 years due to the Obamacare taxes alone. There is an underlying moveable fiscal scam at work — a systematic process by which future spending growth is disguised and future revenue collections vastly exaggerated. Accordingly, if you eliminate the phony out-year reductions that are still embedded in the CBO baseline, spending would be about $1 trillion higher after you factor in the carried interest. In short, an election-minded Congress produced a $2.5 trillion budget buster! So here's the truth. When you add back the trillions of phony spending cuts and revenue increase that are built into the current budget baseline and throw-in the next recession, I've estimated that the real world addition to the national debt will be at least $15 trillion during the next ten years. And that will be piled on top of the $20 trillion of public debt that will be in place by the time of the 2017 inauguration. Can this nation manage a $35 trillion public debt at the very time that the baby boom is retiring at a rate of 10,000 per day? That's not likely under any circumstances — but one thing is quite certain. When the Imperial City is faced with the next recession it will descend into unprecedented partisan acrimony and conflict over an exploding public debt that will scare the daylights out of even the spendthrift politicians of Capitol Hill. They have been in a dreamlike trance ever since the 20098-09 financial scare was suddenly ended by the Fed’s printing presses. When the coming recession rudely awakens them, they will have no place to run and no basis for agreement on any kind of conventional fiscal stimulus whatsoever. And when that scenario begins to unfold, the Wall Street punters will truly give-up the ghost. Now is the time to get ready. Regards, David Stockman Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post Why Fiscal Stimulus Won’t Happen This Time Around appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Susan Sanders, passed suddenly into the arms of Jesus this morning Posted: 11 Oct 2016 02:47 PM PDT Dear Friends: My beloved wife of nearly 49 years, Susan Sanders, passed suddenly into the arms of Jesus this morning. She had her heart mitral valve repaired in 2008, replaced in 2012, and she had a pacemaker. Death held no fear for her. She had long ago made peace with death, and looked forward with certain faith to Jesus' embrace and hearing, "Well done, good & faithful servant! Enter into the joy of thy Lord." Susan died as she had always lived, serving God and others. She had gone outside to feed the dogs and was coming back into the kitchen to fetch her oatmeal and collapsed. I ran to her but she was gone so quickly. As Susan loved to say, she is now "Dancing with the angels." Susan was always joyful, always hopeful, always loving, and had to be bringing up seven children. Even in the depths of our federal trial in the early 1990s, I never heard a word of complaint escape her lips. Her favorite psalm was Psalm 103. The Lord gave, the Lord hath taken away. Blessed be the name of the LORD! Susan's funeral will take place Saturday at 1:00 p.m. at Christ Our Hope Reformed Episcopal Church in Westpoint, Tennessee. http://christourhoperec.com/ Please forgive us our slowness to respond in the next few day, understanding that our hearts and minds are wholly occupied with our loss. But we honor Susan by imitating her devotion to God and her duty, and will take care to fulfill all our obligations. It goes without saying, I will not be publishing a daily commentary until next week at the earliest. Please pray for me, for our seven children, and for our 15 grandchildren as we mourn the loss of our beloved, and rejoice in her rest and salvation. INTO thy hands, O merciful Savior, we commend the soul of thy servant, Susan, departed from the body. Acknowledge, we humbly beseech thee, a sheep of thine own fold, a lamb of thine own flock, a sinner of thine own redeeming. Receive her into the arms of thy mercy, into the blessed rest of everlasting peace, and into the glorious company of the saints in light. Amen. Franklin Sanders - The Money Changer Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - La Douleur du Monde Posted: 11 Oct 2016 02:01 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Understanding gold begins with realizing that its market isn't normal Posted: 11 Oct 2016 12:52 PM PDT 4:06p ET Tuesday, October 11, 2016 Dear Friend of GATA and Gold: When he's not touting mining stocks in which he has invested, 321Gold's Bob Moriarty is assuring his readers that everything in the monetary metals markets is perfectly normal and that anyone who expresses contrary suspicion is not merely mistaken but stupid, a charlatan, and a scam artist. So it is again with Moriarty's commentary published today at The Gold Report, "The Wolves Get the Golden Fleece as the Sheep Get Shorn One More Time": http://www.theaureport.com/pub/na/the-wolves-get-the-golden-fleece-as-th... "The gold and silver markets," Moriarty writes, "are filled with wolves that want nothing more than to get your money in exchange for feeding your fantasies. At every market low they are whining about how the bullion banks are manipulating the gold price and keeping it suppressed. At every high they are suggesting a Comex default is about to happen and prices are going to skyrocket. Or the market is about to have a 'commercial signal failure.' Of course they just made it up. ... Dispatch continues below ... ADVERTISEMENT ..... BEAT THE BANKERS AT THEIR OWN GAME ..... A free Webinar gives you all the details. Just click here: http://tinyurl.com/z4dj89k "Comex can't default; there are provisions in every commodity market for cash settlement." Yet legal as it may be, "cash settlement" is exactly what many people mean by a default -- the failure of a counterparty to deliver what was promised and expected. Moriarty knows very well that this is how his adversaries define default and indeed how the readers of his adversaries understand it. If there were no provisions for cash settlement, Moriarty adds, "anyone with pockets deep enough could force every commodity market into failure." Indeed, and anyone with pockets deep enough can control any commodity futures market. But Moriarty has not the slightest curiosity about the surreptitious intervention by governments and central banks -- which have the deepest pockets -- in the commodity futures markets, intervention documented by filings with the U.S. Commodity Futures Trading Commission and the Securities and Exchange Commission: http://www.gata.org/node/14385 http://www.gata.org/node/14411 Moriarty continues: "We hear about how the shorts are into 'naked short selling' one more time even though there is no such thing." Yet even the lowliest trader working out of his parents' basement can open a commodity futures trading account and, having posted a certain amount of earnest money, sell a contract for a commodity he does and may never own. "Some of these fools," Moriarty writes, "want to convince their readers that the central banks are behind a 'gold takedown,' but if you go to Google and put in 'central banks buying gold' you can find dozens of articles showing that, contrary to the con men, actually the central banks are buying gold." Yes, a few central banks outside North America and Europe lately have reported buying gold. Most central banks lately have not reported buying gold, even as the Bank for International Settlements, the central bank of the central banks, recently reported reviving its gold swap operations and the director of market operations for the Banque de France, another central bank that has not reported adding to its gold reserves, told the London Bullion Market Association meeting in Rome three years ago that his bank is secretly trading gold for itself and other central banks "nearly on a daily basis": http://www.gata.org/node/16704 http://www.gata.org/node/13373 That is, there is a lot more activity by central banks in the gold market than the occasional purchase announcements cited by Moriarty. Moriarty goes on: "Yet another writer on one of those single-string banjo-playing web sites said he doubted the central banks had half the gold they claim, but through Google we now know that not only have the central banks been buying gold, they have been buying gold stocks with both hands." But even the International Monetary Fund has admitted that central banks have done a lot of gold "leasing," which means that certain gold reserves are, to put it politely, impaired, and that doubts about those reserves are well-founded: http://www.gata.org/node/12016 As for central banks "buying gold stocks with both hands," the most we can find on this point is Zero Hedge's report a month ago that two central banks, Norway's and Switzerland's, lately have bought gold stocks: http://www.zerohedge.com/news/2016-09-08/switzerland-and-norway-begin-ma... Maybe other central banks have bought gold stocks too, but if such purchases have been reported, GATA has missed them and maybe Google has missed them too. At least GATA is a little less credulous than Moriarty, as we concede that Google is not the final word, that Google doesn't know everything, in part because central banks don't tell Google everything. Back to Moriarty: "One word the experts, the gurus, and all the other fools never use is 'correction.' All markets go up and down. It's the way of the world. A market enters a bull phase but it will correct. A market enters a bear phase but it corrects. If you are reading anyone taking about naked short sales or Comex defaults or gold takedowns and you never hear the word 'correction,' either the writer is a fool or you are. And in the greatest bull market in history, you are going to lose all your money because at the very top they are going to be telling you to buy." But Moriarty is the one always telling people to buy -- to buy the stocks he already has bought. Fools and charlatans as we may be, GATA is telling people that 1) central banks have been surreptitiously manipulating the gold market for longstanding policy reasons involving the defense of their currencies and bonds, manipulating markets so much lately that it's barely surreptitious anymore; 2) that this manipulation is destroying market economies and doing great injustice around the world; 3) that justice, if and when it comes, will be a cosmic correction made endurable only by a form of money without counterparty risk, the ultimate money, the money whose market central banking has always sought to control -- gold; and 4) there is no understanding the gold market and the world financial system generally without discerning what central banks are doing with the gold market -- that the gold market is not the normal market Moriarty likes to imagine. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dr PAUL CRAIG ROBERTS - Putin Says We Are On The Brink Of WW3 Posted: 11 Oct 2016 11:52 AM PDT The "Empire of Chaos" has Russia backed into a corner and Putin says we are on the brink of WWIII. Darrin McBreen talks to Dr. Paul Craig Roberts about NATO's deployment of anti-missile systems surrounding Russia. Economic collapse and financial crisis is rising any moment. Getting informed... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Federal Reserve’s Telltale Sign of Insanity Posted: 11 Oct 2016 11:40 AM PDT This post The Federal Reserve’s Telltale Sign of Insanity appeared first on Daily Reckoning. "Exceptional fighting was shown by all forces and all ships participating in this operation," states the dry prose of a Japanese after-action combat report, captured in Tokyo in 1945 and translated by the U.S. Strategic Bombing Survey. "Because of it," the Japanese report continued, "severe damages (sic) were inflicted on the enemy." This is how Japanese commanders described the Battle of Midway, fought at sea northwest of Hawaii, June 4–7, 1942. On the third day, the U.S. Navy sank four aircraft carriers of the Imperial Japanese Navy (IJN) in one afternoon. In addition to the large ships, Japan lost hundreds of aircraft and thousands of sailors. It was an epic defeat, by which American combat power broke the back of Japanese naval power in the Pacific. However, after the battle, Japanese leaders denied the reality of their predicament, and conducted a thorough effort to mask the scope of defeat. Official Japanese deception involved the civilian population, as well as Japanese authorities. For example, commanders isolated many Midway survivors for several months, and then reassigned these personnel to distant posts around the fleet and across the South Pacific. Japan kept one of its sunken aircraft carriers, Akagi, on its naval registry for well over a year, despite the ship lying on the deep seafloor. Japanese admirals didn't even inform the Emperor of the losses. In summarizing the losses at Midway in their after-action report, Japanese commanders engaged in a near-ritualistic aspect of their culture, using the concepts of honne and tatemae. These two Japanese words describe the contrast between a person's true sentiments and understanding (本音 hon'ne, "true sound") and the behavior and opinions one displays in public (建前 tatemae, "built in front" or "façade").  IJN carrier Hiryu abandoned, burning before sinking at Midway. Tatemae is what is expected or required according to one's position and circumstances. After Midway, Japanese commanders avoided admitting that the destiny of their empire was about to change radically. Culturally, they were simply unable to say the truth and describe the obvious scope of their military disaster. In this quick retelling of the Battle of Midway, it's apparent that, post battle, Japanese leadership drew a dark curtain over their shattering loss. Rooted in hon'ne and tatemae, the IJN — a critical institution within a mighty nation — convinced themselves (and large sections of the population) to ignore the facts of a major defeat during war. Today, Western culture commonly uses the term "denial." How else can we describe a situation where a person or group simply will not accept reality? This Midway story illustrates an important lesson of national governance and stewardship. It's one thing to mask events, issue propaganda and work to sway public opinion, in peace or in wartime; but past some point — like a defeat on the scale of the Battle of Midway — self-delusion on behalf of a major national effort is insane. The Federal Reserve – Descent to MadnessThis piece of history illustrates the problem we see now with the Federal Reserve (Fed), and its long-term refusal to face reality. One of the topics at the recent Jackson Hole meeting was "designing resilient monetary policy frameworks for the future." This title is tatemae, the behavior and sounds bites the Fed supplies because it is expected to. The hon'ne, the truth of the matter, is that the Fed doesn't have any monetary policy frameworks that will be effective at present or in the future. It's all a charade. Under Federal Reserve stewardship of monetary policy, we've suffered through near-zero interest rates for over seven years. This has robbed people and businesses that subscribe to quaint old virtues like frugality and thrift of nearly all return on savings. It's bad economics, and bad social policy. In addition, for over two decades we've watched serial bubbles inflated by the Federal Reserve, such as tech (a few times), housing (ditto), stock market, and even assets like art (to include bad art). More recently, we've seen waves of quantitative easing (QE). All along, Fed policy is in thrall to a stable of high strung, monetarist stallions, such as Harvard professor Kenneth Rogoff, who recently published a book entitled The Curse of Cash. In essence, per Rogoff, if you hold cash, you must be a terrorist, drug dealer, tax dodger or some other species of desperado. Rogoff wants to eliminate cash and channel all funds through electronic accounts — as if we've never had an electric grid failure or electromagnetic pulse (EMP). His new tome is the latest salvo of a long-term, trans-national, bankers' effort to shepherd all forms of exchange into the corral of government oversight. Somehow, this tight control will better enable central planning of the economy, and keep the business cycle tame, despite the mispricing of credit and collateral that has unfolded during the past decade. Looking back, central banks bailed out private bankers in 2008 and 2009. Now, most central banks across the world are over-extended, none more so than the Federal Reserve. The Fed is out of ideas, and headed full-speed towards needing its own bailout. As Nomi Prins has written, "The Fed remains in denial about the true state of the domestic and global economies. In its realm of hubris, it has no idea of the steps other central banks are taking, or want to take, to reduce their exposure and reliance on not just the U.S. dollar, but on U.S. political, monetary, financial and regulatory policy in general." Nomi's description exactly reflects an organization that is under the influence of hon'ne and tatemae. Its failures are obvious, and the way forward isn't visible, yet the Federal Reserve monetarists boldly sail into the storms of disaster. Prepare for RealityAs the Fed increasingly loses room to act, as Jim Rickards has outlines, as well as its credibility and international respect, as Nomi Prins has explained, what options are left for us? For most mere mortals, the key to preserving wealth is owning gold and gold miners, as well as silver assets. Gold-silver are real assets, and when you own physical metal, it's no one else's liability. Own gold, own silver; take delivery. It'll retain value as central banks fail and currencies reset across the globe in months and years to come. Regards, Byron King Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post The Federal Reserve’s Telltale Sign of Insanity appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deutsche Bank Is On The Verge Of Collapse Andrew Hoffman Posted: 11 Oct 2016 09:35 AM PDT Extortion and blackmail by US against Germany. Do as we say (align against the USSR) or we will punish you. I just don't see any other logical explanation. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Current ECONOMIC CRASH and COLLAPSE OCT News !!! Posted: 11 Oct 2016 08:38 AM PDT The Illuminati and Rothschild own the banks, after Brexit there probably be a crash in October so do your Christmas shopping early this year! Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold fix banks will have to reveal correspondence for antitrust lawsuit Posted: 11 Oct 2016 07:16 AM PDT Scotia Will Have to Reveal Internal Correspondence in Gold Fixing Case, Lawyer for Plaintiffs Says By Barbara Shecter http://business.financialpost.com/news/fp-street/scotia-will-have-to-rev... Large global banks targeted in a lawsuit alleging price fixing in the gold market, including Canada's Bank of Nova Scotia, will have to turn over internal emails and other correspondence spanning several years as the case moves ahead, says Daniel Brockett, the New York lawyer who is spearheading the U.S. lawsuit. "They have to produce all the relevant emails and chat-room instant messages, however they communicated with each other," Brockett said in an interview after Valerie Caproni, a judge in the U.S. District Court for the Southern District of New York, ruled this past week that a portion of the case can move forward. ... Dispatch continues below ... ADVERTISEMENT K92 Mining Begins Gold Production at Kainantu Mine Company Announcement K92 Mining Inc. is pleased to announce that gold production has commenced from the Irumafimpa gold deposit. Ian Stalker, K92 Chief Executive Officer, says: "This milestone is highly significant for our company, and for this region of Papua New Guinea. A great deal of thanks goes to the entire team on site in PNG in achieving production ahead of schedule and on budget. The rehabilitation of the Irumafimpa gold mine, process plant, and associated infrastructure commenced in late March and is now complete. As an enhancement of the processing facility, we are also pleased to note that the installation of a new drum scrubber is also nearing completion and commissioning of this will be completed by the end of the month. ..." ...For the remainder of the announcement: http://www.k92mining.com/2016/10/6077/ Caproni reduced the class period to six years ending in 2012 and dismissed a claim of unjust enrichment, but Brockett said the "core" claims were maintained in the ruling that rejected the banks' motion to have the case dismissed. "The ruling is a major victory for the plaintiffs because it upholds the core anti-trust claim against the five fixing banks and the statutory commodity manipulation claim against the five fixing banks," said Brockett, a senior litigation partner at Quinn Emanuel Urquhart & Sullivan LLP. Investors behind the lawsuit allege Scotia, Barclays PLC, HSBC Holdings PLC, Societe Generale, and Deutsche Bank PLC conspired to manipulate the price of gold through twice-daily meetings where the small group of banks convened to set the spot price. None of the allegations have been proven. The plaintiffs will now seek documents from the banks during a discovery period, which Brockett expects to last between 18 months and two years. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

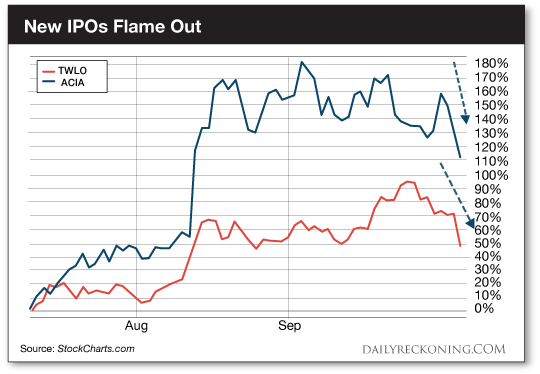

| Posted: 11 Oct 2016 07:15 AM PDT This post The IPO Bear Market Ends Now appeared first on Daily Reckoning. Plenty of green on the screen to start the week… The Dow jumped triple-digits yesterday. Crude rocketed higher by nearly 3%. Even gold got off the mat and enjoyed a nice little rally. But there was one small group of stocks that couldn't keep up with the pack… I'm talking about a couple of formerly smokin' IPOs. You probably recall two of the best performing new stocks of the summer: Acacia Communications (NASDAQ:ACIA) and Twilio Inc. (NYSE:TWLO). The last time we wrote to you about these stocks in late August, ACIA was up nearly 400% and TWLO had gained only 260% since it hit the market in late June. Traders had an enormous appetite for shares of these new offerings. Until Monday… ACIA slid more than 7%, dropping below key support. TWLO fared much worse. The former high-flier dipped more than 14% before the closing bell. While the rest of the market hummed along, these recent IPOs took a bath.

Do these breakdowns mean you've missed your shot at lightning fast IPO gains this year? Nope. In fact, the IPO market is just starting to come out of hibernation. You might recall that 2016 has been a downright terrible year for initial public offerings. Business Insider reports that 2016 has been the worst year for initial public offerings since the height of the financial crisis. Let's go to the numbers: "There were only 73 IPOs in the first three quarters of the year, according to FactSet. That’s down 45% from last year and the lowest total since 2009," Business Insider reports. "The tech space was even less active, with only a handful of small companies having gone public so far this year." So it's no surprise to see greedy speculators bid up shares of TWLO and ACIA to ridiculous heights, only to jettison these same stocks just a few short months later. That's how a typical early-stage IPO operates. You get a huge rally out of the gate, followed by an equally impressive crash as the new public companies return to the market to raise funds or fail to live up to unrealistic expectations. You know this story all too well if you were tempted by a red-hot initial public offering last year as the broad market corrected. Most IPOs are just cash grabs for up-and-coming companies and underwriters—especially in trendy sectors and industries. And when the market starts to crack, investors tend to dump these speculative stocks first. They can fall fast— and hard. But TWLO and ACIA have served an important purpose. With practically no new stocks to choose from, the few IPOs that are making it to the market have attracted a ton of attention. As a result, the IPO market is finally beginning to heat up again. CEOs and underwriters are seeing there's a renewed appetite for fresh meat—and they're ready to deliver. Even big-name tech companies like Snapchat are preparing to cash in. Its IPO is expected early next year… In the meantime, you can find a few other quality new issues to sharpen your trading teeth. Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Never miss another buy signal. Click here now to sign up for FREE. The post The IPO Bear Market Ends Now appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FT laments the lack of the gold market information it won't report Posted: 11 Oct 2016 05:16 AM PDT 8:15a ET Tuesday, October 11, 2016 Dear Friend of GATA and Gold: An editor and columnist for the Financial Times, Dan McCrum, writes today in commentary briefly excerpted below that the price of gold can never be explained by anything other than fashion because there is no relevant information about gold pricing. But if so, who is more at fault for that than the FT itself? For as far as GATA can determine, the newspaper has never put a critical question to any central bank about its surreptitious activity in the gold market and reported the results of such inquiry, though GATA often has provided the newspaper with extensive documentation of that activity, documentation summarized here: http://www.gata.org/node/14839 McCrum's biography for the FT -- http://ftalphaville.ft.com/meet-the-team/dan-mccrum/ -- says: "Send him ideas or even call him up. He'll write about almost anything (except gold)." Now that he has waived that rule once, he should try waiving it again, this time attempting journalism. CHRIS POWELL, Secretary/Treasurer * * * Gold Can Only Ever Be a Fashion Victim By Dan McCrum A polite suggestion when the price of bullion shifts erratically up and down: read what follows, then never speak of gold again. Why? Promotion, trading, conversation and analysis of the precious metal loved by talk radio hosts represents pretty much every weakness in the modern system of extracting fees from those with savings to invest. Indeed, gold is the perfect medium for pseudo-analysis and the posture of investment authority because there is only ever one piece of relevant information -- the price at which gold is bought and sold today. What this means is attempts to debunk any particular argument about the direction of that price are part of a larger failure. Engagement, even with noble motives, legitimises the sense there is serious discussion taking place, that with a bit more thought or insight it might be possible to predict the future price of gold. There is no overarching theory, however. Every argument, every correlation with inflation, growth, bond prices or albatross sightings is only good for a while before it breaks down. ... Instead there is only fashion. ... ... For the remainder of the commentary: https://www.ft.com/content/a2ad0ed6-817f-11e6-bc52-0c7211ef3198 ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1257.50 Up $8.60 or 0.69% Posted: 11 Oct 2016 04:42 AM PDT

If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Presidential Election and Bear 'Super-Cycle' Stifle Growth in Markets Posted: 11 Oct 2016 01:28 AM PDT Contrary to what a number of gold bugs have observed, other experts believe recent drops in the gold price are not a bull market correction, but rather reflect a market stuck in a commodity bear "super-cycle." Coupled with a gloomy end-of-year outlook for stock markets, precious metals and miners could be in for a rough Q4. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What in the World Happened to Gold and Silver Prices Last Week? Posted: 11 Oct 2016 01:03 AM PDT By Clint Siegner : Gold and silver prices charged higher during the first 6 months of the year. They fell into a rut over the summer, and then hit the skids last Tuesday. Lots of bullion investors are wondering what in the world happened. There are three primary factors driving this price correction. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 10 Oct 2016 07:37 PM PDT Corporate earnings continue to decline. Several banks now predicting recession. Deutsche Bank still trying to negotiate a lower fine with the US, may have to raise capital on extremely unfavorable terms. British pound plunges. Global debt soars. Gold and silver down slightly as speculator longs unwind. Trump threatens to jail Clinton if he wins. […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Oct 2016 05:01 PM PDT The hidden secrets of money, the big reset, and the slow burn. Why gold and silver are headed much higher and Trump is funny. The post Top Ten Videos — October 11 appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment