saveyourassetsfirst3 |

- Gold/Silver Rally to EXPLODE into Hyperdrive September 2016!

- War On Cash Intensifies As Gold And Silver Head Into Strongest Months

- “Ready to Explode”: GOLD, SILVER & THE BIG PICTURE FOR 2016 – Bo Polny

- Doc’s Deals: Last Day For Free Survival Food at SD Bullion!

- They’re Trapped! We’re About to See T-Bond Managers RUNNING SCARED – Jim Willie

- Silver Miners’ HOT Fundamentals

- Oathkeeper

- Breaking News And Best Of The Web

- An Important Low for Gold and Gold Stocks?

- What to Consider as Gold Correction Continues

- Putting Gold Miners into Proper Perspective

- Gold against Foreign Currencies Update

| Gold/Silver Rally to EXPLODE into Hyperdrive September 2016! Posted: 04 Sep 2016 01:00 PM PDT Are Gold and Silver Set Up to Go VERTICAL in September? Bo Polny Claims the New Gold and Silver Rally Is About to EXPLODE… Buy 5 oz Silver ATB Coins Lowest Price Online The post Gold/Silver Rally to EXPLODE into Hyperdrive September 2016! appeared first on Silver Doctors. |

| War On Cash Intensifies As Gold And Silver Head Into Strongest Months Posted: 04 Sep 2016 09:43 AM PDT |

| “Ready to Explode”: GOLD, SILVER & THE BIG PICTURE FOR 2016 – Bo Polny Posted: 04 Sep 2016 09:00 AM PDT TO ALL YOUR READERS: As you and I know, both gold and silver are in a Bull Market and gold and silver are getting ready to explode much higher. I truly hope all your reader have been paying close attention to the work of www.GATA.org and ignoring all the "Nay Sayers", as gold and silver […] The post “Ready to Explode”: GOLD, SILVER & THE BIG PICTURE FOR 2016 – Bo Polny appeared first on Silver Doctors. |

| Doc’s Deals: Last Day For Free Survival Food at SD Bullion! Posted: 04 Sep 2016 07:03 AM PDT On Sale At SD Bullion This Week Only… *These deals end 9/5/2016 The post Doc’s Deals: Last Day For Free Survival Food at SD Bullion! appeared first on Silver Doctors. |

| They’re Trapped! We’re About to See T-Bond Managers RUNNING SCARED – Jim Willie Posted: 04 Sep 2016 07:00 AM PDT In This Special Holiday Edition, Jim Willie Joins Us For A Crucial Market Update, A Systemic Lehman Event is IN PROGRESS, the Chinese are Ready to Launch a Gold-Backed Yuan, and Warns We’re About to See A Run On Treasury Bonds… We’re About to See the Managers of Treasury Bonds Running Scared… From Craig Hemke, TFMetals: […] The post They’re Trapped! We’re About to See T-Bond Managers RUNNING SCARED – Jim Willie appeared first on Silver Doctors. |

| Silver Miners’ HOT Fundamentals Posted: 03 Sep 2016 09:01 PM PDT The silver miners' stocks have enjoyed an epic year, skyrocketing higher with silver's new bull market. At best since mid-January alone, some of these elite stocks had actually septupled! The bottom line is the major silver miners just reported an amazing Q2'16, with silver's young new bull fueling radically-higher operating earnings. The great inherent leverage […] The post Silver Miners’ HOT Fundamentals appeared first on Silver Doctors. |

| Posted: 03 Sep 2016 08:01 PM PDT A peaceful valley in the mountains of Colorado becomes a battleground pitting the federal government against a rural sheriff's department. Sheriff Bear Ellison finds himself increasingly isolated as he is forced to decide between risking his life protecting a local hero, or reneging on his oath and handing him over to federal prosecutors… Oathkeeper, […] The post Oathkeeper appeared first on Silver Doctors. |

| Breaking News And Best Of The Web Posted: 03 Sep 2016 05:37 PM PDT US jobs, factory orders disappoint, lowering odds of September rate hike and sending stocks, oil, gold higher. Japan preparing major new stimulus, Europe considering it. The war on cash heats up. Central bankers losing credibility while buying equities. Major shipping company collapses. Trump visits Mexico, confusing everyone. Clinton emails remain major problem. Best Of […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

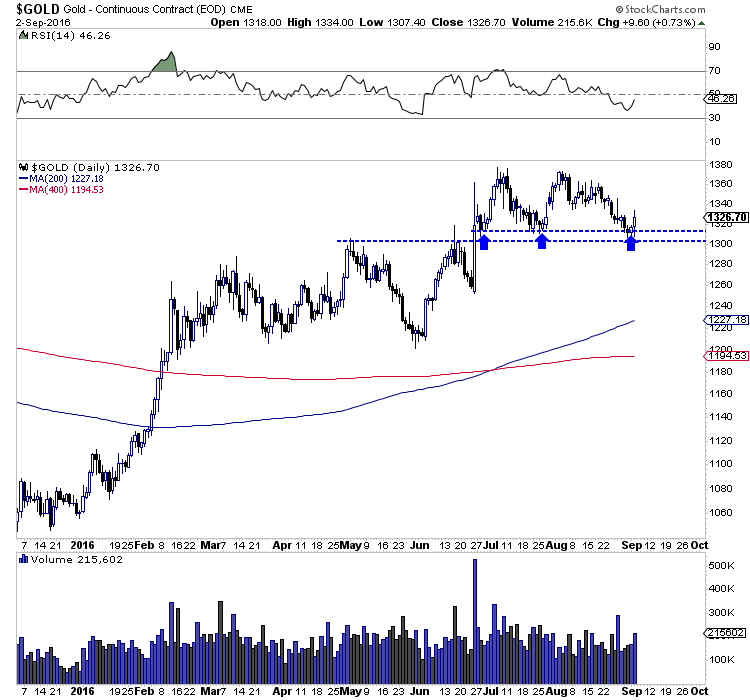

| An Important Low for Gold and Gold Stocks? Posted: 02 Sep 2016 04:24 PM PDT Gold and gold stocks bounced to end the week thanks to an oversold condition coupled with a softer than expected jobs report which likely delays Fed action until December. At one point this past week the market had priced in a 64% chance of a single rate hike by December and a 42% chance of a rate hike this month. A single rate hike is not going to derail the young bull market in precious metals and as long as the lows of this week hold then the bull market is in position to grow stronger by the end of the year. Gold this week was able to successfully hold $1300 to $1310 for the third time in the past two months. The daily candle chart below shows how resistance in the spring has become support in the late summer. If Gold can retake $1350 on a weekly basis and $1360 on a daily basis then it would be setup for the next leg to new highs for 2016. Note how the recent two month consolidation held support and did not even test the 50% retracement of the previous advance.  Gold, Daily Candles

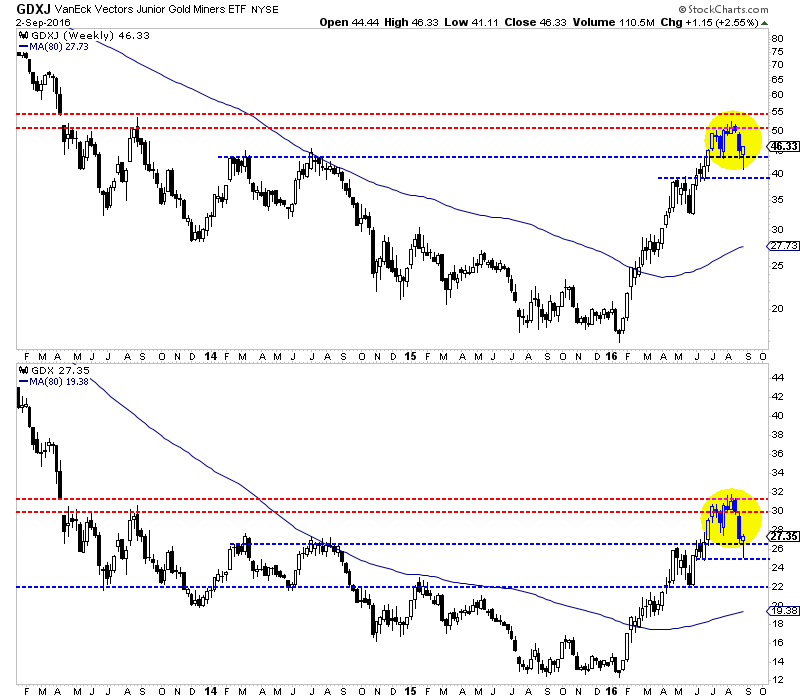

Turning to the miners, we see that they closed the week above a key support level, the 2014 highs. Both GDX and GDXJ, which declined 21% and 22% from their highs closed the week forming bullish reversal patterns (hammers). Miners could continue to rebound towards immediate resistance at GDX $30 and GDXJ $50. That resistance should hold on the first test.  GDXJ, GDX Weekly Candles

Last week we noted that buying 20% to 25% weakness in a young bull market is likely to payoff in the long run. Traders and investors had that opportunity the middle of this past week. Look for this rebound to continue towards the aforementioned resistance targets. It is too early to say if precious metals are ready to immediately launch higher again. I would not rule out a retest of these lows but at the same time, we should in any case give the benefit of the doubt to the young bull market. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA

|

| What to Consider as Gold Correction Continues Posted: 02 Sep 2016 04:00 PM PDT The Gold Report |

| Putting Gold Miners into Proper Perspective Posted: 15 Aug 2016 01:00 AM PDT |

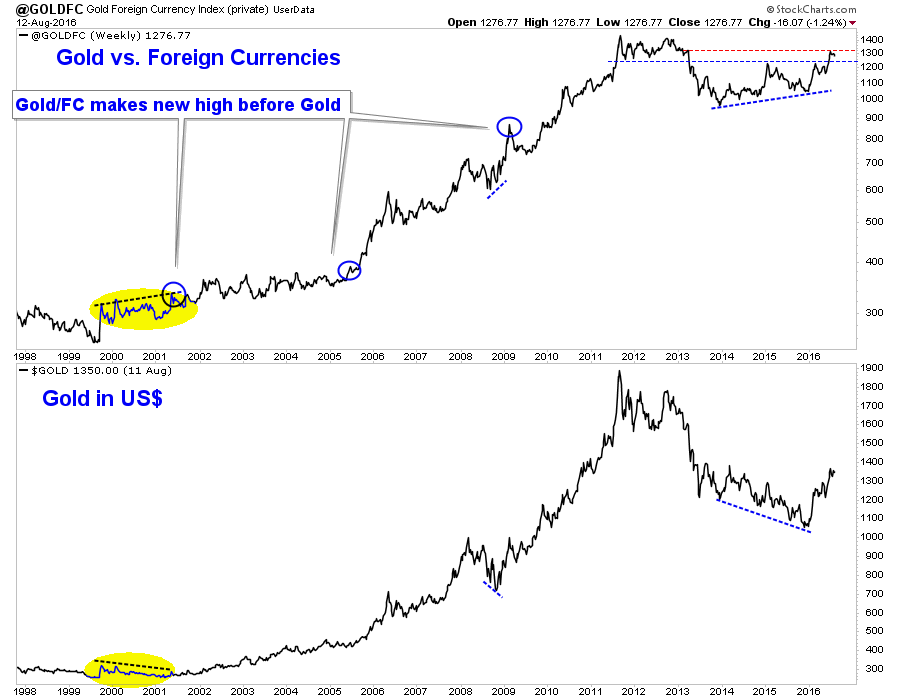

| Gold against Foreign Currencies Update Posted: 12 Aug 2016 06:40 PM PDT It is the dog days of summer. The metals are trading below their recent highs while the miners continue to be on the cusp of their next leg higher. In any event we remain bullish as we expect the next big move to be higher not lower. One reason, among many is Gold remains strong against foreign currencies and that often is a leading indicator for the sector at large. This is something we track often and we wanted to provide an update during the slowest period of the year. In the chart below we plot Gold against foreign currencies and Gold in normal, US$ terms. To be clear Gold against foreign currencies (Gold/FC) is Gold against the currency basket that comprises the US$ index. Since the new millennium Gold/FC has been an excellent leading indicator for the sector. Note that Gold/FC has made new highs ahead of Gold and made positive divergences before the three most important lows of the past 16 years (2016, 2008, 2001). In fact, the action from 2014-2015 shows strong similarities to 1999-2000. Moreover, note that at its peak a few weeks ago, Gold/FC was within 8% of its all time high. That is the equivalent of nearly $1750/oz in US$ terms.  Gold, Gold vs. Foreign Currencies

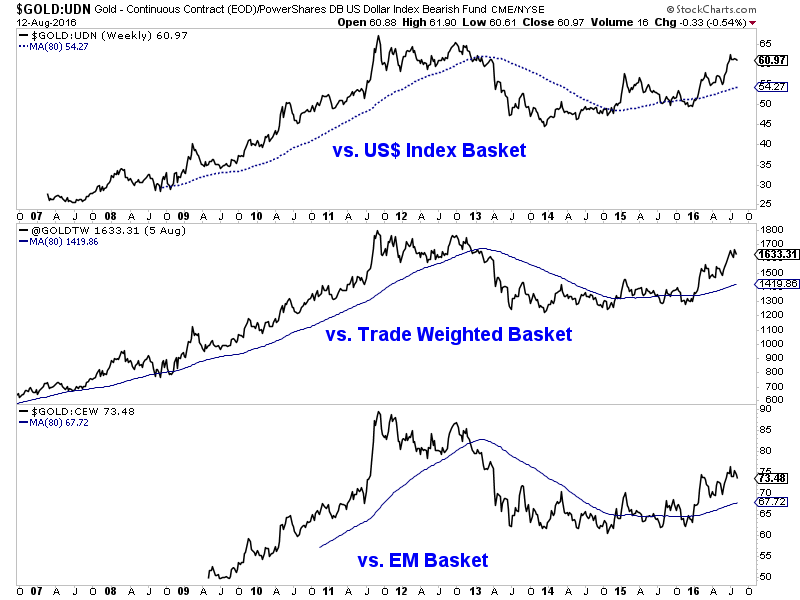

In the next chart we look at different iterations of Gold against foreign currencies. The top plot is the same version shown above while the middle plot shows Gold against the US$ trade weighted basket. The bottom plot shows Gold against emerging market currencies. In every case Gold remains firmly in bull market territory and stronger than Gold in US$'s.  Gold vs. Foreign Currencies

Tracking Gold's performance against foreign currencies is essential as we can glean quite a bit more information about what is really going on in the market. Many newsletters purporting to be analysts fear monger over the stability of the US$ as a reason for people to buy Gold. However, note that the US$ index is essentially flat compared to 10 and 20 years ago while Gold denominated in any and every currency is much higher. In other words, if Gold is going up only because of a falling US$, that is a US$ bear market, not a Gold bull market. A Gold bull market is Gold rising against the majority of currencies. In the same vein, a Gold bear market is Gold falling against the majority of currencies. The charts show that actually ended well before the final low at the end of 2015. On the mining side, most Gold and Silver comes from outside of the USA and many (but not all) companies are exposed to foreign or local currencies and not the US Dollar. Many companies in Canada and Australia bottomed a full year ahead of the sector because the Gold price in those currencies was very strong (even though Gold in US$ had yet to bottom). Summing it up, Gold's strength in foreign currencies confirms its global bull market status and provides a hint that more gains for Gold in US$ terms are likely ahead. We view any weakness in the weeks ahead as a buying opportunity. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA

|

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment