saveyourassetsfirst3 |

- Literal Photo Bomb: Watch Syrian Rebel Accidentally Blow Himself Up While Taking Selfie

- Weekend at Hillary’s (It’s Officially Over)

- NYC Man Destroys 19 Red Light Cameras, Sends the Video to CBS

- Jim Willie Warns US Dollar Faces 30% Devaluation As BRICS Prepare Return of Gold Standard!

- Fund Manager On Wall Street’s Next Ticking Time Bomb

- Smash Time: Gold & Silver Head into Options Expiry – Harvey Organ

- Did THIS Just Mark the End of the 30 Year Bull Market in Bonds?

- 2-Headed Beast: H.W. Bush Endorses Hillary

- Unintended Consequences: Eric Sprott On Gold & Silver’s BIG MOVE

- Putin Plans to “Revive the KGB”

- Gold Price at Risk of Breaking Down

- Central Bank Non-Transparency

- Ignore Yellen and Buy the Dip in Precious Metals

- A Bit More Downside Potential in Gold Stocks

| Literal Photo Bomb: Watch Syrian Rebel Accidentally Blow Himself Up While Taking Selfie Posted: 23 Sep 2016 01:00 PM PDT … We Hope You’re Enjoying Your Virgins… Submitted by Mac Slavo, SHTFPlan: We're not quite sure if these are the good guys, the bad guys or this week's allies du jour, but the video below is a lesson in how not to take a selfie with a random mobile device picked up from a table […] The post Literal Photo Bomb: Watch Syrian Rebel Accidentally Blow Himself Up While Taking Selfie appeared first on Silver Doctors. |

| Weekend at Hillary’s (It’s Officially Over) Posted: 23 Sep 2016 12:00 PM PDT The Hillary Clinton Campaign Is Officially OVER… 2016 30th Anniversary Proof Silver Eagles Available Now at SD Bullion! Secure Your PR 69 and PR 70 Graded Coins Before They're Gone! The post Weekend at Hillary’s (It’s Officially Over) appeared first on Silver Doctors. |

| NYC Man Destroys 19 Red Light Cameras, Sends the Video to CBS Posted: 23 Sep 2016 11:05 AM PDT “This is ILLEGAL AND UNCONSTITUTIONAL! All it took was a Pair of Balls, and a Painter’s extension rod! I just saved people about $10,000 a day with this camera.” Luke Rudkowski interviews the man who single-handedly just demolished one of New York City’s biggest illegal profit generators in an EPIC night of civil disobedience… 2016 30th […] The post NYC Man Destroys 19 Red Light Cameras, Sends the Video to CBS appeared first on Silver Doctors. |

| Jim Willie Warns US Dollar Faces 30% Devaluation As BRICS Prepare Return of Gold Standard! Posted: 23 Sep 2016 11:01 AM PDT A 30% Devaluation Out of the Gate!?! Submitted by Jim Willie, Golden Jackass: The Fascist Business Model incorporates all the worse elements of Keynesian economics, a broken fallacious school of thought. The model also integrates a vast system of economic heresy, put forth as public address dogma. All their messages are wrong. They […] The post Jim Willie Warns US Dollar Faces 30% Devaluation As BRICS Prepare Return of Gold Standard! appeared first on Silver Doctors. |

| Fund Manager On Wall Street’s Next Ticking Time Bomb Posted: 23 Sep 2016 11:00 AM PDT This is also one of the primary reasons that the Fed can not raise interest rates… Submitted by PM Fund Manager Dave Kranzler, IRD: Make no mistake, the criminality and fraud of most, if not all, DC politicians that is being exposed now is also occurring in corporate America and at pension funds, especially […] The post Fund Manager On Wall Street's Next Ticking Time Bomb appeared first on Silver Doctors. |

| Smash Time: Gold & Silver Head into Options Expiry – Harvey Organ Posted: 23 Sep 2016 09:30 AM PDT GOLD AND SILVER RALLY BUT WE ARE COMING INTO OPTIONS EXPIRY WEEK AND THE CROOKS ALWAYS WHACK… RIOTS IN CHARLOTTE NC/POOR USA ECONOMIC REPORTS: CHICAGO FED NATIONAL MFG INDEX FALTERS;EXISTING HOME SALES FALL; POOR CONFIDENCE REPORT: CONSUMER COMFORT INDEX FALTERS Gold $1340.40 up $13.50 Silver 20.02 up 33 cents In the access market 5:15 […] The post Smash Time: Gold & Silver Head into Options Expiry – Harvey Organ appeared first on Silver Doctors. |

| Did THIS Just Mark the End of the 30 Year Bull Market in Bonds? Posted: 23 Sep 2016 09:00 AM PDT This may, just may, happen to mark the top of the great bond bull run that started as far back as the early 1980s. Submitted by Tim Price, Sovereign Man: "There is no simple, painless solution. The world has to reduce debt, shrink the financial part of the economy, and change the destructive incentive structures […] The post Did THIS Just Mark the End of the 30 Year Bull Market in Bonds? appeared first on Silver Doctors. |

| 2-Headed Beast: H.W. Bush Endorses Hillary Posted: 23 Sep 2016 08:15 AM PDT Keeping it all in the family: George H. W. Bush just announced he is endorsing Hillary Clinton for president, supposedly in an "unprecedented" snub of Republican candidate Donald Trump. by Melissa Dykes, The Daily Sheeple. In case you hadn't heard, George H. W. Bush just announced he is endorsing Hillary Clinton for president, supposedly […] The post 2-Headed Beast: H.W. Bush Endorses Hillary appeared first on Silver Doctors. |

| Unintended Consequences: Eric Sprott On Gold & Silver’s BIG MOVE Posted: 23 Sep 2016 07:41 AM PDT Is the next MAJOR BULL RALLY in gold and silver prices underway? The Admiral of the Silver Market Eric Sprott explains: The Unintended Consequences have OVERWHELMED the Central Banks… From SprottMoney: 2016 30th Anniversary Proof Silver Eagles Available Now at SD Bullion! Secure Your PR 69 and PR 70 Graded Coins Before They're […] The post Unintended Consequences: Eric Sprott On Gold & Silver’s BIG MOVE appeared first on Silver Doctors. |

| Putin Plans to “Revive the KGB” Posted: 23 Sep 2016 07:30 AM PDT OK, we all know the KGB never really "went away." But now it’s coming back out of the closet in style according to Putin’s plans… Submitted by Mac Slavo, SHTFPlan: OK, we all know the KGB never really "went away." But now it is coming back out of the closet in style. Russia just […] The post Putin Plans to "Revive the KGB" appeared first on Silver Doctors. |

| Gold Price at Risk of Breaking Down Posted: 30 Aug 2016 10:47 AM PDT |

| Posted: 29 Aug 2016 04:19 AM PDT Just a quick post on Jan Nieuwenhuijs/Koos Jansen's article on the refusal of the Dutch Central Bank to publish a bar list. The reason given was that "the conversion of internal lists to documents for publication would create too many administrative burdens." I find this excuse weak when gold ETFs can produce bar list in the thousands of pages, and do so without creating any security issue. Even if the custodians where they have the gold have given them a pdf bar list that for some reason contains information that could be a security risk, it should not be a problem to ask that custodian to modify the report/query on their inventory database to exclude such information, or output only the relevant fields of data as a csv file or spreadsheet. If the problem with doing that is that the custodian does not operate an electronic inventory system then we have some serious questions about the control and safety of that custodian's operations. I think the real reason for not wanting to disclose the bar list is as some have noted in the comments to the article - when a central bank leases gold out, they get different bars back (see here on why this is case) and thus the changing bar numbers on the list would reveal what percentage of the central bank's gold was lent to bullion banks during the year. For a central bank who follows correct accounting rules and show leases separately to physical gold (see here regarding Reserve Bank of Australia) a bar list should not be an issue (although see here for blogger Bullion Baron's problems getting a bar list out of the RBA, which it seems was more of a case of interference from the BoE and a lack of courage by the RBA to stand up to them) but for a central bank who reports physical gold and leased gold as "gold" the bar list would raise questions like "why didn't you disclose the difference, how can you pretend that leased and physical are the same" or questions about the risk the central bank is taking and whether the return they got was worth the risk. Whilst I haven't met central bankers personally, I'm guessing they don't take too kindly to having their actions or judgements questioned. Hence the stonewalling. |

| Ignore Yellen and Buy the Dip in Precious Metals Posted: 27 Aug 2016 06:30 AM PDT  Investors worldwide have been on pins and needles in eager anticipation of a speech from our economic overlords. Friday morning FED chair Yellen finally opened her mouth and said a whole lot of nothing. Markets didn’t know exactly how to react to her nothingness. Stocks were up and then down. Gold was down and then up. […] Investors worldwide have been on pins and needles in eager anticipation of a speech from our economic overlords. Friday morning FED chair Yellen finally opened her mouth and said a whole lot of nothing. Markets didn’t know exactly how to react to her nothingness. Stocks were up and then down. Gold was down and then up. […] |

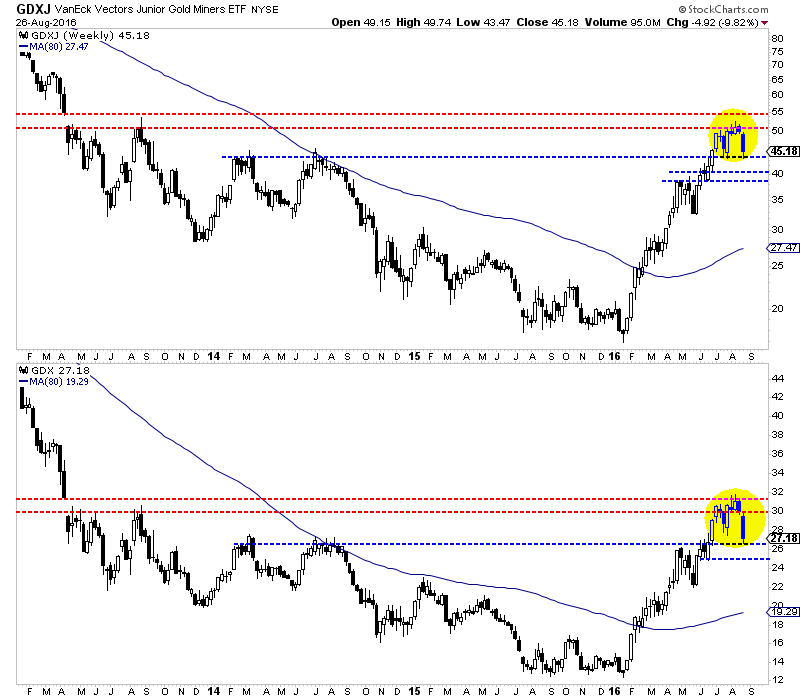

| A Bit More Downside Potential in Gold Stocks Posted: 26 Aug 2016 02:39 PM PDT Last week we projected 5% to 10% downside in the gold stocks. Well, not to butter my own bread but GDX and GDXJ both lost 9% on the week. That being said, I believed that the weakness would be limited and miners could rebound to new highs in September. While that possibility remains, there is a chance this correction could go a bit deeper and perhaps last longer. The weekly candle charts below show that the miners are correcting after failing to break into a "thin zone" of resistance. GDX has broken below its July lows and corrected as much as 16%. It has support at $25-$26 and that includes the Brexit gap. Also, the 38% retracement of its entire rebound is just below $25. Meanwhile, GDXJ has yet to break its July low in the $43s. It has corrected as much as 17% but could end up testing $39-$41. The 38% retracement of its entire rebound is a hair below $39.

GDXJ, GDX Weekly Candles

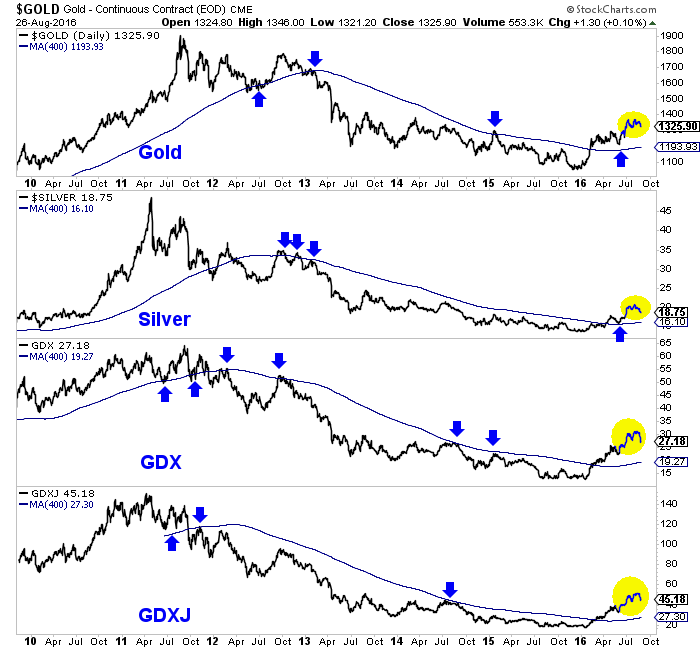

Whether the correction lasts longer or evolves into a long consolidation, precious metals will remain in a bull market. It is hard to argue against the chart below. We plot Gold, Silver, GDX and GDXJ along with the 400-day moving average which is an excellent indicator of the primary trend. The sector sits comfortably above the 400-day moving averages which are sloping upward for the first time in years.

While we expected this correction, we did not anticipate there would be a chance for a larger correction. If you believe we are in a new bull market, as I do, then the path to financial success is buying and holding and buying weakness. (Our guidance for selling, we'll get to another time). If I were holding too much cash or missed the epic rebound, I would be taking advantage of further weakness. Buying 20% to 25% weakness in a bull market (especially one that is only months old) will likely payoff in the long run. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA

|

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment