Gold World News Flash |

- The "Bomber Harris" Of Central Banks

- Fiction, Fairy Tales, Fiat, Hyperinflationary Collapse

- What Happens if The Current Silver Bull Market Performs Like Previous Ones? This Chart Predicts At Least $164 Silver

- Gold Has Biggest One Day Rally Since Brexit As Elites Rush Into Gold

- Will Deutsche Bank Crash The Global Stock Market?

- It’s Not About Gold, But It’s ALL About Gold

- On the Sidelines in Cash – PM Correction Over – and Fed Manipulations

- The Official Story Is Now The Conspiracy Theory: Paul Craig Roberts Warns "The Tide is Turning"

- Hyperinflation Versus Deflationary Collapse

- Gold Price Closed at $1336.80 Down $7.50 or -0.6%

- Trump to Larry King on Iraq, Hillary and baseball

- Get Ready for “Unencumbered” Interest Rate Policy

- Anonymous : Why The Dollar Will Collapse 100% on 27 September 2016 ?

- Fed urges ban on Wall Street buying stakes in companies and commodities

- Koos Jansen: China's rising gold ETF market -- a hybrid

- Live Fox News channel Presidential Debates Donald Trump vs Hillary Clinton

- Central Banks Desperate, Expect Worldwide Financial Armageddon. By Gregory Mannarino

- The Dollar in Crisis

- Post-Summer Outlook for Metals Investing

- Will Deutsche Bank Collapse the Global Market?

| The "Bomber Harris" Of Central Banks Posted: 08 Sep 2016 11:45 PM PDT By Chris at www.CapitalistExploits.at Market dislocations occur when financial markets, operating under stressful conditions, experience large widespread asset mispricing. Welcome to this week's edition of "World Out Of Whack" where every Wednesday we take time out of our day to laugh, poke fun at and present to you absurdity in global financial markets in all it's glorious insanity.

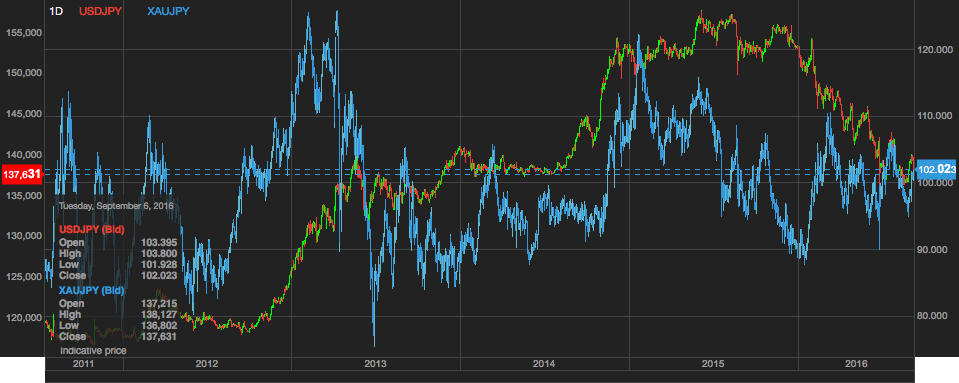

While we enjoy a good laugh, the truth is that the first step to protecting ourselves from losses is to protect ourselves from ignorance. Think of the "World Out Of Whack" as your double thick armour plated side impact protection system in a financial world littered with drunk drivers. Selfishly we also know that the biggest (and often the fastest) returns come from asymmetric market moves. But, in order to identify these moves we must first identify where they live. Occasionally we find opportunities where we can buy (or sell) assets for mere cents on the dollar - because, after all, we are capitalists. In this week's edition of the WOW we're covering the Japanese central bank policies and the recent rise in Japanese interest ratesIt was back in mid 2011 that I first began shorting the yen. Specifically, I was long both XAU/JPY (in blue) and USD/JPY (in green and red).

On the USD/JPY we moved all the way from 72 to 125 in early 2015 which was obviously a profitable run. Gold, on the other hand, went ballistic through late 2012, then proceeded to collapse into 2013 before bouncing back and settling into a trading pattern (albeit a volatile one) which is pretty much where we stand today. I've been trading around these core positions ever since I first poked fun at the BOJ in March of 2011. Then the following year (January of 2012) I wrote a satirical piece, suggesting methods the BOJ could use to entice retail investors into the JGB market. Ironically my satire today looks far more plausible than the methods subsequently taken by the BOJ over the last 4 years. Truth truly is stranger than fiction. Beginning 2016 the USD/JPY positions have experienced significant drawdowns with volatility spiking. Drawdowns only hurt if you're levered, while volatility is important for that portion of any position held in options contracts. You want to be buying volatility when it's cheap and selling it when it's expensive. I mention these things since I've been looking to re-establish and pyramid back in. And so as I sit here today I'm left pondering the BOJ's next move and how much manoeuvrability they have left. Japanese government bond rates have been rising sharply towards the zero mark over the past 6 months. A reversal of the downtrend. We can see this in the 10-year JGB chart below.

This is causing concern amongst the elites at the BOJ. Like market participants such as myself and many of the fund managers (some of the world's most notable and successful) I regularly speak with, the BOJ may be asking the same question we are: is this the invisible hand of the market beginning to repudiate negative interest rates? We'll only know in hind sight and must work with the probabilities in any given scenario. I know of no successful trader or investor who manages risk any other way. What Will the BOJ Do Next?In a recent statement Kuroda-san dismissed ideas of calling a halt to their aggressive monetary policy, and while what a central bank says and what a Central bank does are not always the same thing, we do know that the BOJ is in a bit of a pickle.

The BOJ ConundrumDo you remember the Monty Python skit with Colin "Bomber" Harris self-wrestling where he succeeds by defeating himself? The BOJ is the "Bomber Harris" of the central bank world. It's gotten to the point where it is wrestling with itself and bound to win, and in doing so bound to lose. They've stated their intent purpose is to create inflation. It's not specifically to destroy the yen or further layer the country with ever greater debts. It's to create inflation. They are simply accepting that those are the consequences they must bare. The process which they've used to do so is with a record-setting bond purchase program which has now crept into buying equities and commercial property ETFs. Consider that the former (bond purchasing) was designed to push interest rates down, forcing capital out of the bond market into the equity markets. Forcing people to essentially spend and invest instead of hoard and save, thus stoking the flames of inflation. The latter (buying equities and commercial real estate ETFs) has been a panicked attempt to do what the market has largely refused to do in the size deemed necessary as the 2% inflation target still looks a long way off. This is self-wrestling at its best. As bond yields have plunged below the neckline, destroying the ability of savers to get any sort of return those savers have instead saved more and hoarded money. Deflation is persistent as a result. Many of you will remember my conversation with colleague Grant Williams early this year where we discussed the market reaction to the BOJ going negative. The Nikkei dropped at the open and the yen rallied. Not at all what the BOJ expected or wanted. Wrestling against themselves. As I mentioned in a recent issue of World Out of Whack focused on demographics, consumption changes radically when you're retiring. Needs change and that is a qualitative issue that few seem to grasp, certainly not central bankers. While these policies continue to fail, the debt pile grows and tensions increase. A consequence of enormous debt is the ability to service these debts. Nobody is talking about this anymore. At negative interest rates who cares, right? The Three MusketeersIn a world where central bank policy globally is co-ordinated, negative interest rates don't seem to pose much risk. Provided they're all in it together. One for all and all for one. The ECB, FED, and BOJ are of course the three most important central banks in the world and the only real players when it comes to deep liquid capital markets. It's ironic that the BOJ is using negative interest rates in an attempt to devalue the yen but can only really be successful if they can devalue against the euro and dollar. This means of course that a yen devaluation needs to be met with either no or less devaluation by the ECB and the FED, otherwise it simply doesn't work as they all go down together. And herein lies the conundrum. Co-ordination between these three musketeers is necessary in order for the bond markets to hold together. Breaking ranks could provide a global shock that markets are wholly unprepared for and as the entire ball of wax grows bigger, any divergences become more and more dangerous. Pretty soon the smallest arbitrage will threaten to tear through the increasingly fragile markets. Interestingly this is where the qualitative, not quantitative side to economics becomes really, really important. It's a reason why I've been hammering on about the change in the zeitgeist affecting US politics as well as the changes taking place in European politics. These are qualitative behavioural economics issues which, together with the quantitative, need to be understood (a topic I'll be covering later this week). Rates or Currencies? Take Your PickSo on the one hand we have currency risk and on the other we have interest rate risk. Right now interest rates are negative with the outlier being the US. If the chubby lady hikes, even by 25 basis points (because that's the most they'd dare to do), then the BOJ will get what they want in a depreciating yen. But the consequences to their already falling bond market (rising rates) could get out of hand and quickly. Ironically the easiest way to counter that would be for the Fed to slash rates, bringing rate differentials closer together but that would not have the same depreciating affect on the yen. What is clearer with every passing day is that these guys are less and less data dependent. Monetary policy at the BOJ is now completely reactionary and chaotic. After all, what's the point at looking at data sets anymore when any reference point that may have had any meaning was left miles offshore a long time ago? Understanding where institutional capital will flow is always a pretty useful question and so.. Imagine you're an institution (as some readers are) and have to buy government debt in size...

Cast your vote here and also see what others think Investing and protecting our capital in a world which is enjoying the most severe distortions of any period in mans recorded history means that a different approach is required. And traditional portfolio management fails miserably to accomplish this. And so our goal here is simple: protecting the majority of our wealth from the inevitable consequences of absurdity, while finding the most asymmetric investment opportunities for our capital. Ironically, such opportunities are a result of the actions which have landed the world in such trouble to begin with. - Chris PS: Know anyone that might enjoy this? Please share this with them. "Oh what a tangled web we weave, when first we practice to deceive" - Sir Walter Scott -------------------------------------- Liked this article? Don't miss our future articles and podcasts, and get access to free subscriber-only content here. -------------------------------------- | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fiction, Fairy Tales, Fiat, Hyperinflationary Collapse Posted: 08 Sep 2016 11:01 PM PDT By Guy Christopher, Originally Published on Money Metals Exchange "Today’s best-selling government fairy tale is that debt is actually wealth, that countless trillions in paper and... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||

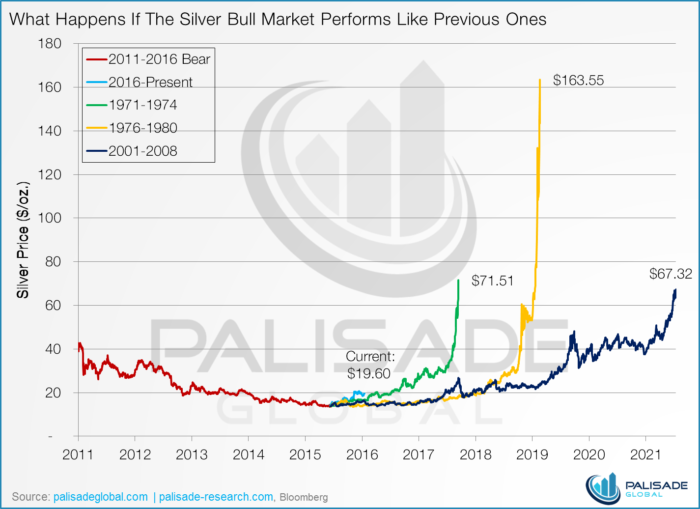

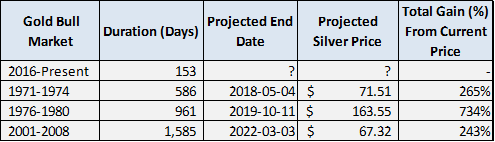

| Posted: 08 Sep 2016 09:40 PM PDT from Mining.com:

Last week we put out the same chart, but for gold prices and received an overwhelming response. We also received many emails asking what would happen if silver performs like its previous bull markets, and not surprisingly, it appears we are entering a similar period of prosperity. Since the beginning of the current bull market, silver is already up 40%. While not enough to get crazy in the Hamptons yet, silver has incredible torque to outperform gold and based on this chart, we predict silver will hit $70 an ounce this cycle.

Silver is a unique commodity with great diversification potential, protection against systematic financial failure, and extreme upside! Coincidentally, Palisade Global Investments is giving away a lot of silver. Our promotion was launched to express our gratitude to our dedicated audience, and we want to continue to share our great content with as many listeners and readers as possible.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Has Biggest One Day Rally Since Brexit As Elites Rush Into Gold Posted: 08 Sep 2016 09:13 PM PDT The multi-day Brexit gold surge back in June was the biggest upward move since 2008 with gold rallying 4.5% the day after the vote. Yesterday, gold had its biggest one-day rally since, rising 1.6%. This came on the back of Goldman Sachs revising its September rate hike odds down to 40% from its previous 55% prediction just a few days earlier, and the release of deteriorating manufacturing numbers. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will Deutsche Bank Crash The Global Stock Market? Posted: 08 Sep 2016 09:04 PM PDT The past year has seen its fair share of worries. From the China slowdown to the Brexit, successive waves of overseas fear have rolled onto our shores since 2015, yet none of them were the Tsunamis the bears had predicted. The latest foreign fear concerns the possibility for a global credit crisis led by the collapse of a major international bank. A simplified summary of this scenario goes something like this: Deutsche Bank is on the brink of bankruptcy and its insolvency could spark a systemic European banking crash. This in its turn could send shockwaves throughout the global financial system, resulting in widespread economic turmoil on par with the previous worldwide crisis. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| It’s Not About Gold, But It’s ALL About Gold Posted: 08 Sep 2016 09:00 PM PDT from SchoonWorks: This is a discussion about today’s paper money with Ralph Terry Foster and Darryl Robert Schoon. Caught between deflation and hyperinflation, paper money’s demise is certain. In its 1,000 year history, no paper money has survived. This discussion was taped at Berkeley Coin and Stamp in August 2016. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| On the Sidelines in Cash – PM Correction Over – and Fed Manipulations Posted: 08 Sep 2016 07:00 PM PDT by Gary Christenson, Deviant Investor:

A year ago at this time, it was hard for investors to find available inventory for the most popular silver products – as well as some gold coins. Premiums for the silver American Eagle reached nearly $6.00 per coin. Mints and refiners couldn't keep up with demand, and long lead times became par for the course across the silver product line. Today, retail buying of physical silver has slowed considerably. There is lots of inventory in dealer vaults and the number of bullion investors looking to sell is on the rise. Demand slowed even though nothing has changed the underlying fundamentals of metals markets. The world financial system is even more rickety today than it was in 2007, just before the last crisis. Bullion premiums are at the low end of their range. And prices finally appear to have bottomed and turned up. Yet bullion investors are largely sitting on sidelines.

Let's take a look at why… For starters, uncertainty rules the day, and not just in the precious metals. Retail investors aren't buying the economic recovery story and the record high prices in the stock markets either. Year to date they have pulled roughly $100 billion from U.S. equity exchange traded funds (ETFs). Much of that was diverted into bond funds. If that statistic makes you wonder just how stock prices manage to keep moving higher, the answer lies in corporate share buy-backs and bank prop trading desks playing with unlimited quantities of near-zero-interest-rate Fed cash. Uncertainty Has Led to ParalysisThen there are the questions surrounding this year's presidential election. Investors aren't merely uncertain. They are profoundly nervous when it comes to whether "The Donald" or Hillary will win and what that victory might mean. Regardless of which candidate wins, it appears at least half of the country will be very unhappy and gloomy about the national prospects. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Official Story Is Now The Conspiracy Theory: Paul Craig Roberts Warns "The Tide is Turning" Posted: 08 Sep 2016 07:00 PM PDT Authored by Paul Craig Roberts, In a few days it will be the 15th anniversary of 9/11, and this November 22 will be the 53rd anniversary of the assassination of President John F. Kennedy in Dallas, Texas. These two state crimes against democracy destroyed American democracy, accountable government, and the Constitution’s protections of civil liberty. Years after the damage done by these events the American people no longer believe the official stories. Neither does the government, but the government will never validate the distrust that Americans now share of the oligarchs’ government by acknowledging the truth. The official explanation of the assassination of President Kennedy never made any sense. Videos of the assassination contradicted the official story, as did witnesses, and many credible people challenged the government’s story. The CIA was faced with the official explanation becoming unglued and launched its media program stigmatizing doubters as “conspiracy theorists.” The CIA’s psych warfare against the public succeeded at the time and for a number of years during which witnesses had mysterious deaths and the trail grew cold. But by the late 1970s there was so much public skepticism of the official story that the US Congress took the risk of being labeled “conspiracy kooks.” The House Select Committee on Assassinations reopened the inquiry into JFK’s murder. The House Committee concluded that the Warren Commission’s investigation was seriously flawed, that there was more than one person firing at President Kennedy and that there was a conspiracy to assassinate JFK. The corrupt US Department of Justice (sic) contradicted the House Select Committee’s report. However, the American people believed the Select Committee and not the corrupt Justice (sic) Department, which never tells the truth about anything. By 2013 polls showed that most Americans are “conspiracy kooks” who do not believe the official government line on JFK’s assassination. So with regard to JFK’s assassination, the “conspiracy theorists” are in the majority. The minority are the Americans who cannot escape their brainwashing. In a few days it will be the 15th anniversary of the alleged al Qaeda attack on the World Trade Center and Pentagon, and we are witnessing the fading protection that the charge of “conspiracy theorist” provides for the officlal government story. Indeed, the official 9/11 story is collapsing before our eyes. Europhysics, the respected publicaton of the European physics community has pubished an article by scientists who conclude that “the evidence points overwhelmingly to the conclusion that all three [World Trade Center] buildings were destroyed by controlled demolition.” Few American scientists can admit this, because their careers depend on US government and military/security complex research contracts. Independent scientists in the US are a vanishing breed, an endangered species. The scientists say that in view of their findings, “it is morally imperative” that 9/11 “be the subject of a truly scientific and impartial investigation by responsible authorities.” So now we are faced with a peculiar situation. The scientifically ignorant two-bit punk American presstitutes claim to know more than the editors of the journal of the European physics community and the scientists who did the investigation. Don’t you think it farfetched that ignorant, corrupt, and cowardly American journalists who lie for money know more than physicists, chemists, 2,700 high-rise architects and structural engineers who have called on the US Congress to launch a real investigation of 9/11, firefighters and first responders who were on the WTC scene, military and civilian pilots and former high government officials, all of whom are on record challenging the unbelievable and physically impossible official story of 9/11? What kind of a dumbshit moron does a person have to be to believe that the United States government and its media whores know better than the laws of physics? The ability of the presstitutes to influence Americans seems to be on the decline. The media ganged up on Donald Trump during the Republican primaries, intending to deny Trump the nomination. But the voters ignored the presstitutes. In the current presidential campaign, Hillary is not the run-away winner that the presstitutes are trying to make her. And despite the propaganda ministry, the legs under the official 9/11 story are wobbly, to say the least. Indeed, the official 9/11 story already has lost credibility with the American public. Last April a Rasmussen Poll found that “Americans doubt they’ve been told all the facts about the September 11, 2001 terrorist attacks on the United States and strongly believe the government should come clean.” A YouGov poll in 2013 found that 50 percent of Americans “have doubts about the government’s account of 9/11,” which shows that the public is far more intelligent and less corrupt than the presstitutes who are paid to lie to the public. This poll also found that as a consequence of the cover-up job performed by the American presstitutes, 46 percent of Americans were not even aware that a third WTC building, Building 7, collapsed on September 11. After viewing films of WTC 7’s collapse, 46 percent saw it as a controlled demolition. By a margin of two to one, poll respondants support a new investigation of Building 7’s collapse. So, in America today “conspiracy kooks” outnumber those who believe the official lies. As the official lies are themselves conspiracy theories, Americans who disbelieve the official conspiracy theories outnumber Americans who believe official conspiracy theories. The question is: who are the real conspiracy kooks, the majority who disbelieve the official lies or the minority who believe the official lies? It is curious that the CIA’s psych-op mind-controll has broken down in the cases of the JFK assassination and 9/11, but is still effective in more recently orchestrated events, such as San Bernardino, Orlando, Paris, and Nice. Perhaps this is because not enough time has passed for the public to pay attention to the vast difference between the stories and the evidence. The Internet offers many refutations of the official accounts. With regard to Nice, France, the Nice police officials themselves are having problems with the official story. The French Anti-Terrorist Sub-Directorate in Paris has ordered the public authorities in Nice to delete the video recordings from security cameras of the “Nice Terror Truck Attack.” The Nice authorities refused on the grounds that this would be destruction of criminal evidence. This story has disappeared from the news. I have asked friends in France how this conflict was resolved and have not heard anything. The French like to live life well and faced with the refugees from Washington’s wars, they seem to be focused on living life well while it can be done. If I hear anything, I will pass it on. Apparently, the order to delete the video evidence of the “attack” was not sufficient for the French Ministry of the Interior. According to a senior Nice police officer, Sandra Bertin, the Interior Ministry pressured her to falsify her police report on the Nice “truck massacre.” Officer Bertin told the Journal du Dimanche that “he ordered me to put in [the report] the specific positions of the national police which I had not seen on the screen.” The Interior Minister, Bernard Cazeneuve is suing the Nice police official for “defamation,” as if it is possible to defame any politician anywhere in the corrupt West. Moreover, why would a senior Nice official make up a story about being ordered to change a report? It doesn’t make any sense, does it? Clearly, the central government is trying to hide the evidence against the official story. It seems that the French media is disposing of the Nice police official by branding her a rightwing racist opposed to the current government. Watch this video and ignore the narrator’s four-letter vocabulary. What you will learn is that all those people you saw running in the presstitute TV reports had no idea why they were running. The presstitutes created the impression that they were running away from the truck. However, as the interviews show, they were running because other people were running, because the police told them “terrorists, run,” and because they heard shots (apparently police firing blanks). Those interviewed reported, “You run with them even though you have no idea what you are running from. You can’t help it, you run with them.” None of those running away ever saw a truck. According to the foul-mouthed narrator, the film of the people running away was taken prior to the time the truck allegedly mowed down 185 people, killing 85 of them. The narrator appears to be correct if the time stamps on videos are correct. The narrator says the streets needed to be cleared for the crisis actors to put on their show that is used to control our minds about what happened. I have pointed out that a truck that hit 185 people, killing 85 of them would be covered in blood and that bodies would be splattered all over the street with blood everywhere. Yet, the photos and videos that we are shown show no such evidence. The stopped truck on which police are directing gunfire is as white as snow. Independently of the vast analysis online of the video evidence of the alleged “Nice attack,” I suspect the Nice “terror attack” for the same reason that the Pentagon attack is suspect. Despite all the contrary evidence against the official stories, the authorities refuse to release the video evidence that, if it shows what the authorities claim, would shut up the skeptics and prove the official story. When a government claims it has video evidence that proves its official story but refuses to release it, indeed, demands the destruction of the video evidence, we know for an absolute fact that the video evidence totally contradicts the official story. That is the only possible conclusion. My readers will write to me asking how the government expects to get away with its faked, and in the case of 9/11 false flag, terror orchestrations? The answer, perhaps, is that just as it took a long time for the JFK assassination and 9/11 lies to catch up with the government, the recent orchestrations will also take some time for a slowly awakening public to catch on. In the meantime the orchestrated events will serve the agendas that they are intended to serve, and by the time that the public sees through the orchestrations, a new situation will be in place with new orchestrations. Keep in mind that the public thinks it is shown evidence. Newspapers need photos to give a visual dimension to their coverage, and TV needs videos of the events. News organizations are under a time pressure, and they have to use what they are handed or what is at hand. There is no time to scrutinize the visual material or to raise questions about it. Most of the public thinks that the photos and videos shown to them are evidence or would not be shown and accepts the visual evidence without question. In an earlier column I linked to the vast array of Nice photos provided in the UK Daily Mail. The photos show a calm situation. There are a few people lying in the street without any sign of bodily damage or blood and there are covered objects that the public assumes are dead people. But the streets are devoid of the splattered blood and mangled bodies that would be the consequence of a truck hitting 185 people. Similarly, we have been shown very few videos and their origin is unknown except for the one attributed to Richard Gutjahr who was apparently pre-positioned to film inconclusively both the Nice and German “terror attacks.” Online analysis of the videos shows that the videos are not evidence for the storyline. The real question is why the French Interior Minister has prevented the release and demanded destruction of the security camera videos that filmed the entire event, an order that brought the central government in Paris in conflict with the public authorities in Nice. There has been no US media interest whatsoever in this very strange event. It is not a “conspiracy theory” to ask why the public cannot see the video evidence that shows what actually happened. What agenda is served by the Paris and Nice attacks? This is the question everyone should be asking and the media, if we had one, should be investigating. With the information currently available to me, my answer is this. Of all the peoples of Western Europe, the French are the most independently minded. French independence has taken a number of recent hits from Washington:

The Paris and Nice orchestrated events serve to scare France back into Washington’s arms. Dreams of independence become nightmares when independence leaves the French people at the mercy of both terrorists and Russians. Washington, who owns Sarkozy, who is once again Washington’s candidate for president of France, intends to keep France in NATO. The article in Europhysics pointing out the impossibility of the official 9/11 story could possibly lead to a rebirth of skepticism among Europeans. Only a skeptical media willing to investigate government storylines can bring a halt to the staged terror events that serve secret agendas. Keep in mind that the US government has plentiful video evidence of the 9/11 attack on the Pentagon but refuses to release the evidence that it says support its story. Similarly, the French federal government has prohibited Nice authorities from releasing the security camera videos of the Nice truck attack and has ordered the video evidence destroyed. How can we believe governments that refuse to show us the hard evidence? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hyperinflation Versus Deflationary Collapse Posted: 08 Sep 2016 05:40 PM PDT by Darryl Robert Schoon, Gold Seek:

The relationship between paper money and gold is causal in central banking's collapse. When paper money was backed by gold, it (1) gave the bankers' paper money its value and (2) constrained the ability of governments to print limitless amounts of money, as governments needed money backed by gold to balance trade deficits, i.e. value for value.

The importance of this constraint, i.e. "golden-fetters", became clear when escalating military spending caused the rapid loss of US gold reserves; and in 1971, the US withdrew the gold-backing of the US dollar and the US balance of trade permanently went negative.

With gold no longer limiting how much money governments could print, after 1971 the global money supply exploded.

http://positivemoney.org/how-money-works/how-did-we-end-up-here/ In capitalist economies, because money enters the money supply as loans, the explosive rise in the money supply led to an equally explosive rise in debt.

Today, this is the central bankers' final—and fatal—conundrum: Aggregate levels of debt are now so high, credit can no longer induce sufficient economy expansion to pay off or even service capitalism's constantly compounding debts. Central bankers' efforts to revive economic growth, e.g. quantitative easing, low, zero and negative interest rates, are like pouring more and more gasoline into an already flooded engine hoping the additional gas will cause the stalled engine to go faster. Today, central bankers are trapped by conditions they created. It was their excessive expansion of the money supply after 1971 that lead to the speculative bubbles whose serial collapse resulted in the reawakening of deflationary forces not seen since the Great Depression. To prevent another Great Depression, central bankers desperately tried to revive economic demand and growth by increasing the monetary base to increase the amounts of loans banks could make.

But instead of loaning the money, banks redeposited the excess reserves (AMBSL) with central banks; and the hoped-for increase in circulating money (M1, M2, M3, etc.) and credit and debt (TCMDO)—and growth in economic activity—never occurred. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1336.80 Down $7.50 or -0.6% Posted: 08 Sep 2016 05:00 PM PDT

FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trump to Larry King on Iraq, Hillary and baseball Posted: 08 Sep 2016 04:18 PM PDT Republican presidential nominee Donald Trump tells RT's Larry King that he doesn't dislike Hillary Clinton, but that she's not the person to make America great again – and that their televised duel Wednesday was more fun than baseball. The Financial Armageddon Economic Collapse... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Get Ready for “Unencumbered” Interest Rate Policy Posted: 08 Sep 2016 03:12 PM PDT This post Get Ready for "Unencumbered" Interest Rate Policy appeared first on Daily Reckoning. A promise is a comfort for a fool. ~Proverb Janet Yellen's recent speech at Jackson Hole, Wyoming, was eagerly awaited, and a complete non-event. The headlines were dominated by breathless accounts of Janet Yellen's speech at a Federal Reserve conference in Jackson Hole. The robot scanners read the speech first; it took a while for humans like me to catch-up. But I've since had the chance to digest it. What was striking about the speech was how ordinary it was. As I predicted she would, she threw a bone to the hawks ("the case for an increase in the federal funds rate has strengthened") and then threw another bone to the doves ("as ever, the economic outlook is uncertain, and so monetary policy is not on a preset course"). She also talked about "data dependence," etc., and then went to lunch. The conference at which the speech was delivered was titled "Designing Resilient Monetary Policy Frameworks for the Future." That title at least suggested that some new thinking and new policies might be on display. They weren't. Yellen basically said that interest rate cuts, quantitative easing, interest on excess reserves and forward guidance were sufficient to pull the U.S. economy out of a future recession if needed. In short, Yellen said the Fed's existing toolkit is adequate, and is unwilling to consider more radical tools or remedies. If you like weak growth, money printing and market manipulation, get ready for more of the same. She took negative rates off the table (she said they were "impossible"). She also agreed that "helicopter money" (really fiscal policy supported by Fed bond purchases to finance deficits) could be useful, but made it clear that it was up to Congress to implement that and the Fed would not lead the charge. Investors should ignore Fed noise. But that doesn't stop markets from overreacting to every syllable of Fedspeak. Gold investors just have to live with day-to-day volatility until the world finally realizes that central banks are impotent and can safely be ignored in favor of global macroeconomic fundamentals. Does this mean Jackson Hole was a nonevent for gold investors? Not at all. Yellen was not the only one speaking there. Another major speech was by an economist named Marvin Goodfriend, from Carnegie Mellon University. His speech was called The Case for Unencumbering Interest Rate Policy at the Zero Bound. On its face, the Goodfriend speech was about negative interest rates — and just because Yellen doesn't like them now doesn't mean they're not coming in the future. That negative rate idea has been around for a few years. But Goodfriend's focus was to promote "unencumbered" negative interest rate policy, which means getting rid of things standing in your way. Specifically, the No. 1 thing standing in the way of negative rates is cash. If citizens can go to cash, that makes it difficult to impose negative rates on digital bank accounts. That's also not a new insight. The war on cash has been going on for a while, and prominent economists from Larry Summers to Ken Rogoff have called for an end to cash. Rogoff did so just recently, in a front-page article in the "Review" section of The Wall Street Journal. What is new in all of this are ideas that Goodfriend presented to the Fed to neutralize the role of cash. His preferred way is just to "abolish paper currency," as his paper outlines in Section 5A. But then Goodfriend laments that "the public is likely to resist the abolition of paper currency." He's right about that. So Goodfriend comes up with a new concept called the "flexible market-determined deposit price of paper currency." (Seriously, I'm not making this up; you can find it in Section 5B of his paper.) In plain English, this means the "money" in your bank account and the "money" in your purse or wallet would be like two different kinds of currency. There would be an exchange rate between the two, just as there is an exchange rate between dollars and euros. The Fed could set this exchange rate at whatever level it wanted and would not be obligated to "defend" that rate at any particular level. What this means is if you go to the bank and withdraw $1,000, the bank might only give you $980 in cash because of the "exchange rate" between your bank account and cash. Or if you deposit $1,000 in cash, the bank might only credit your bank account $980 because of the same "exchange rate" between your cash and the bank account balance. In short, it's a way to impose negative interest rates on physical cash. It's true that Goodfriend is an academic, not a policymaker. But Yellen and other Fed bigwigs like William Dudley and Stanley Fischer were sitting in the audience. In my experience, this is how things start. Some ivory-tower academic writes about a policy proposal. A few other ivory-tower academics and beltway think tanks take the idea and run with it. Then one of those academics gets appointed to a policy position. The next thing you know, the policy is in effect. That's how I saw SDRs coming years in advance, and that's how I see the war on cash coming now. That's why I also see a war on gold… Curiously, academic policymakers have spent so many years disparaging gold they seem to have forgotten that gold is money. Once the war on cash heats up — and certainly when that war is in full swing, out in the open — people everywhere will turn to gold as an alternative form of money. And then, once policymakers see the massive shift to gold, they will launch a war on gold also. So my advice to people interested in gold is — get it now while you still can. What are you waiting for? But it's not just the government and the banks that are doing everything they can to make it impossible for you to get your own money in the form of cash. Now they have a new partner — big business! It seems that businesses have their own war on cash. They hate handling it and it's expensive to transport, store and insure. More and more, businesses are refusing to take your cash. This is just another form of discrimination against the poor who may not have banking accounts or who rely on check cashing services and live paycheck to paycheck. It's also aimed at you because it forces you into a digital system where your money can be hit with negative interest rates, service fees, account freezes, bail-in charges and other forms of theft. When pigs are going to be slaughtered, they are first herded into pens for the convenience of the slaughterhouse. When savers are going to be slaughtered, they are herded into digital accounts from which there is no escape. The war on cash may be a losing battle for you and me, but there is still shelter in physical gold, silver, land and other hard assets. The key defensive play is to obtain your gold now, while you still can, before the war on gold begins. As this realization sinks in, it will create more demand for physical gold, which is already in short supply. That demand-driven tail wind for physical gold will take gold mining stocks much higher. These scenarios are more disturbing, and the tempo more rapid, than I imagined just a short time ago. The time to position yourself in gold and gold miners is now; don't wait. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post Get Ready for "Unencumbered" Interest Rate Policy appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Anonymous : Why The Dollar Will Collapse 100% on 27 September 2016 ? Posted: 08 Sep 2016 01:58 PM PDT Anonymous : Why The Dollar Will Collapse 100% on 27 September 2016 ? MUST SEEThis collapse will be global and it will bring down not only the dollar but all other fiat currencies,as they are fundamentally no different. The collapse of currencies will lead to the collapse of ALL paper assets.... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fed urges ban on Wall Street buying stakes in companies and commodities Posted: 08 Sep 2016 12:29 PM PDT By Jesse Hamilton Goldman Sachs Group Inc. would be among banks most affected by recommendations issued today by U.S. banking agencies that seek an end to merchant banking and a limit on Wall Street's ownership of physical commodities. The report -- based on a multi-agency study of banks' investment activities required by the Dodd-Frank Act -- highlighted ways to fix potential risks that the agencies didn't think were handled by the law's Volcker Rule ban on certain trading and investments. Among the Federal Reserve's suggestions was a call that Congress repeal merchant banking powers and the ability of certain banks to engage in physical commodities businesses -- both hallmarks of Goldman Sachs' business. The Office of the Comptroller of the Currency also said it planned to curtail a bank's ability to hold copper and to restrict lenders' holdings of hard-to-value securities. Additional Fed recommendations include repealing exemptions for industrial loan companies, which are lenders generally owned by non-financial firms, that allow them to operate outside of rules that affect banks. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-09-08/u-s-banks-face-series-... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: China's rising gold ETF market -- a hybrid Posted: 08 Sep 2016 11:39 AM PDT 2:38p ET Thursday, September 8, 2016 Dear Friend of GATA and Gold: Gold researcher Koos Jansen today examines the Chinese market in exchange-traded gold funds, concluding that they are growing fast and seem more democratic than Western gold ETFs. His analysis is headlined "China's Rising Gold ETF Market: a Hybrid" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/koos-jansen/chinas-rising-gold-etf-mar... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Live Fox News channel Presidential Debates Donald Trump vs Hillary Clinton Posted: 08 Sep 2016 11:04 AM PDT Fox News Live channel Presidential Debates Donald Trump vs Hillary Clinton The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central Banks Desperate, Expect Worldwide Financial Armageddon. By Gregory Mannarino Posted: 08 Sep 2016 09:32 AM PDT This collapse will be global and it will bring down not only the dollar but all other fiat currencies,as they are fundamentally no different. The collapse of currencies will lead to the collapse of ALL paper assets. The repercussions to this will have incredible results worldwide. dollar collapse... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 08 Sep 2016 07:11 AM PDT This post The Dollar in Crisis appeared first on Daily Reckoning. The conditions that gave rise to a dollar crisis in 1971 are emerging again in 2016, but with a different kind of international monetary system. Since 1980, the world has been on a de facto "dollar standard" in place of the former gold standard. In accordance with the basic insight of Triffin's Dilemma, the U.S. has still had to run large, persistent trade deficits to keep the world well-supplied with dollars in order to finance global growth, trade and investment. The U.S. achieved this worldwide dollar supply by making the dollar a reliable store of value and by making U.S. Treasury debt the largest and most liquid market in the world. Trading partners no longer considered it necessary to convert dollars to gold (either at a fixed price or a market price). They were comfortable building up huge portfolios of Treasury debt. At their heights, the reserve position of China exceeded $4 trillion, while the reserve positions of Japan and Taiwan were approximately $1 trillion each. Oil exporters such as Abu Dhabi and Norway had sovereign wealth funds with assets in excess of $1 trillion each. The overwhelming majority of this vast wealth was invested in U.S. dollar-denominated assets, and most of that took the form of U.S. Treasury debt. The U.S. and its trading partners became co-dependent. The U.S. depended on its trading partners to keep buying Treasury debt, and our trading partners depended on the U.S. to maintain a stable dollar and a liquid Treasury debt market. Meanwhile, the U.S. kept running up trade and budget deficits and our trading partners kept running up trading surpluses and huge reserve positions. This was Triffin's Dilemma on steroids. If these trends persisted, eventually the U.S. would go broke (as it had in 1971). But until then it seemed as if the game could go on indefinitely, and everybody was a winner. However, this new dollar-deficit game began to break down in 2010, and the breakdown accelerated in 2013. Just as the heroes of 1980 were a president and a Fed chairman, Reagan and Volcker, the parties responsible for the breakdown were also a president and a Fed chairman, Obama and Bernanke. Obama's Currency WarThe breakdown started in 2010 when President Obama declared a currency war. The idea was to cheapen the U.S. dollar in order to give the U.S. economy a boost in the aftermath of the financial crisis of 2008, and the severe recession of 2007–09. The theory was that a cheap dollar would stimulate U.S. exports and create exported-related jobs. In addition, the cheap dollar would import inflation to lower real interest rates and help the Fed meet its inflation targets. Part of the rationale for the new currency war was that the U.S. is the world's largest economy and the U.S. needed help. If the U.S. economy sinks, it takes the world with it. Conversely, if the U.S. economy can achieve self-sustaining growth, it can act like an engine to pull the rest of the world out of its slump. A rapid devaluation of the dollar was meant to boost growth in the U.S. and indirectly boost world growth. The effects of the new currency war were immediate and dramatic. The dollar fell 14% in just over a year, from mid-2010 to late-2011, as shown in this chart: As is usually the case when academic economists get involved in policy roles, the White House theory turned out completely different in reality. The U.S. did not achieve significant progress toward self-sustaining growth as a result of a cheaper dollar. And the rest of the world suffered slower growth (China, Japan and Korea) and a sovereign debt crisis (Greece, Spain, Portugal and Ireland). The currency war weapon had misfired. The world was not better off. But there was an important piece of collateral damage. Suddenly confidence in the dollar began to wane. The carefully constructed "dollar standard" that had been engineered by Volcker and Reagan and then continued by James Baker and Robert Rubin as Treasury secretaries (under presidents Bush 41 and Clinton) started to fail. It was around this time that Russia and China dramatically increased their purchases of gold. It was also around this time that the IMF began laying the foundations for a new monetary standard based on its "world money" called the special drawing right, or SDR. The world was looking for an alternative to the dollar since the U.S. was no longer committed to upholding the dollar's value. The second blow to the dollar standard came from Ben Bernanke and the Federal Reserve. After Japanese and European growth were hurt by the weak dollar in 2011, Bernanke decided to engineer a strong dollar beginning in 2012. The thinking was that the U.S. economy was robust enough to bear a strong currency, while Japan and Europe would benefit from a weaker yuan and weaker euro. Japan moved first in December 2012 with Prime Minister Abe's "three arrows" plan, also known as Abenomics. The three arrows were a weaker yen, fiscal stimulus and structural reform. In fact, only one of the three arrows was ever used at the time. Fiscal stimulus was not used until July 2016. Structural reform was not used at all. The only arrow used from the start was the weak yen. Then it was Europe's turn. Mario Draghi, head of the European Central Bank, famously said on July 26, 2012, that he would do "whatever it takes" to support the euro. He followed up in June 2014 with negative interest rates, and then followed up again in January 2015 with euro QE. Source: EuroNews The yen and the euro both crashed once the Fed agreed to this about-face. The USD/JPY cross rate dropped from 79.50 just before Abenomics to 125.50 in June 2015. The EUR/USD cross rate went from $1.45 in August 2011 to $1.05 in November 2015. The Fed assisted the process of weakening the yen and the euro by tightening monetary policy in the U.S., beginning in May 2013. This tightening came mostly in the form of forward guidance and the manipulation of market expectations, but it was effective nonetheless. In May 2013, Bernanke suggested the end of quantitative easing in his famous "taper talk" speech. In December 2013, the Fed began the actual taper by reducing purchases of long-term assets such as 10-year Treasury notes. By November 2014, the taper was complete. In March 2015, Bernanke's successor, Janet Yellen, ended forward guidance by removing the word "patient" from the FOMC statements. Finally, in December 2015, the Fed achieved "liftoff" by actually raising rates 0.25%. All of these moves were steps in the continuous process of tightening U.S. monetary policy. By January 2016, the weak euro, weak yen, strong dollar and Fed tightening were all in place. There was only one problem. The Fed, as usual, had grossly miscalculated the underlying strength of the U.S. economy. Now, in late 2016, the dollar shortage has started to morph into a debt crisis and potential liquidity crisis. For the second time in 50 years, Triffin's dilemma has come into play. The world was fine as long as the U.S. supplied dollars through its monetary and fiscal policies. But, as soon as the U.S. exercised discipline with tighter monetary or fiscal policy, the dollar shortage hit home and the world began to contract. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post The Dollar in Crisis appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Post-Summer Outlook for Metals Investing Posted: 08 Sep 2016 01:00 AM PDT Precious metals expert Michael Ballanger explains his strategy for playing the gold-to-silver ratio and discusses the post-summer outlook for metals investment. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will Deutsche Bank Collapse the Global Market? Posted: 07 Sep 2016 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

In the world of phenomena, everything has a beginning and an end; and today, the bankers' endgame is moving closer to its inevitable resolution and demise. The question is no longer if, it is when and how.

In the world of phenomena, everything has a beginning and an end; and today, the bankers' endgame is moving closer to its inevitable resolution and demise. The question is no longer if, it is when and how.

No comments:

Post a Comment