Gold World News Flash |

- Gold Price Closed at $1339.70 Up $2.50 or 0.19%

- 'Angry' Davids Vs. 'Complacent' Goliaths: Social Revolution Looms

- Russian Foreign Ministry Responds To US Accusations: "The Real Barbarism Is What You Did In Libya and Iraq"

- Will Deutsche Bank’s Collapse Be Worse Than Lehman Brothers?

- Incredible Mainstream Avoidance of Hillary Debate Collapse

- Debate Post-Mortem: Rematch Required As Commentators Split On Debate Winner, Markets Give Hillary Nod

- Wells Fargo Or The Fed: Who’s The Bigger Fraud?

- P2P Meltdown Continues: LoanDepot's CDO Collapses Just 10 Months After Issuance

- Fulford’s White Dragons Go Full Tilt Anti-Trump, Pro-North America Union, 50% Dollar Devaluation?

- Wells Fargo Or The Fed: Who's The Bigger Fraud?

- An Update from Max Porterfield of Callinex Mines

- Foreign Buying Plummets In Vancouver: Sales To Foreigners Crash 96%

- Options expiration is prime time for monetary metals suppression, Turk cautions

- Debates Live- #TrumpVsHillary and Protest Coverage

- The World in 2017: Prophetic Events are Happening Worldwide!

- Trump Betting Odds Narrow Going into 1st Presidential Debate Suggesting Trump Win

- Gold Daily and Silver Weekly Charts - Flight to Safety, Bread and Circuses

- The Shanghai Accord Returns With Weak Dollar Ahead

- NSA WHISTLEBLOWER: SPY GRID IS PART OF WORLD GOVERNMENT TAKEOVER

- Germany will rescue Deutsche Bank if necessary, Allianz exec says

- The Italian Dilemma: Weak banks pose risk to already faltering domestic demand

- Gold’s Moving Averages and Long-Term Outlook

- Never Worry About the Stock Market Ever Again…

- Tumbling rouble powers profits at Highland Gold

- Jordan Maxwell - Hillary Made a Deal With The Devil

- This Past Week in Gold

- Charting the Continuing Gold Market Correction

| Gold Price Closed at $1339.70 Up $2.50 or 0.19% Posted: 27 Sep 2016 01:22 AM PDT Monday, September 26, 2016

FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||

| 'Angry' Davids Vs. 'Complacent' Goliaths: Social Revolution Looms Posted: 27 Sep 2016 12:30 AM PDT Submitted by Adam Taggart via PeakProsperity.com, Largely out of the headlines, the ongoing protest on Standing Rock is shining a bright light on how the big-moneyed interests with political clout steamroll the disadvantaged in order to get what they need. But in a rare David-vs-Goliath standoff, the Sioux tribespeople of Standing Rock Reservation are learning that they are not powerless. Their refusal to roll over and allow an oil pipleline to be built on their lands is growing into one of the largest resistance movements in recent years, drawing supporters from all over the country, and forcing the discussion of "Where do we draw the line?" in regards to our pursuit of depleting natural resources. Activist Mark Morey joins the podcast this week to provide context on this unfolding conflict:

Click the play button below to listen to Chris' interview with Mark Morey (41m:55s). | ||||||||||||||||||||||||||||||||

| Posted: 26 Sep 2016 11:43 PM PDT The war of words between the US and Russia escalated dramatically today, when in response to an accusation by Samantha Power, the US envoy to the UN, on Sunday that "What Russia is sponsoring and doing [in Syria] is not counter-terrorism, it is barbarism", the Russian foreign ministry - through an FB post by its spokesperson Maria Zakharova - responded that there is "nothing more barbaric in modern history" than what the US has done in Iraq and Libya. As noted earlier, Samantha Power delivered an emotional speech before the UN, accusing Russia and Syria of attacks on aid workers, civilian infrastructure and residential areas; she omitted that armed groups, including Al-Qaeda offshoot Al-Nusra Front which is now directly supported by the US coalition following its public "reverse merger" with the terrorist organization, are in control of large parts of Aleppo and are using its population as human shields. In any event, it was Russia's turn to respond to the accusations which it did today, when Power's use of the term 'barbarism' drew sarcastic remarks from Russian Foreign Ministry spokesperson Maria Zakharova. "Historically speaking... a barbarian is someone not belonging to an empire, and we have only one of those today," she noted on her Facebook page. "As for the imagery... the world has seen nothing more barbaric in modern history than Iraq and Libya done the Washington way." As with Lavrov, Zakharova said that she believes Power's remarks were meant to draw attention from the American attack on Syrian troops near Deir ez-Zor, which happened amid the ceasefire and almost resulted in the Syrian Army's positions being overrun by ISIS troops which the US is supposedly seeking to eradicate. While the US blames Russia for the collapse of the ceasefire after Russia allegedly attacked a UN convoy last weekend, Moscow blames the US for the failed truce, saying it was incapable of reining in rebel groups who would not commit to it, and would not agree to designating them as legitimate targets for counter-attacks. As RT notes, Power, who received her current appointment in 2013, was among the most vocal supporters of the concept of "humanitarian interventionalism" – the use of military force on humanitarian grounds. The invasion of Saddam Hussein's Iraq and the toppling of Muammar Gaddafi in Libya are both examples of such actions. In both cases, interventions meant to prevent human suffering actually caused huge tragedies in the long run. | ||||||||||||||||||||||||||||||||

| Will Deutsche Bank’s Collapse Be Worse Than Lehman Brothers? Posted: 26 Sep 2016 10:00 PM PDT by Graham Summers, GoldSeek:

The only other day in which the $USD rallied more was on the day of BREXIT, a black swan event that featured EXTREME currency volatility. This move tells us something BIG is afoot "behind the scenes" in the financial system. I believe that something is a banking crisis in the EU. The clear signal is coming from Deutsche Bank (DB). DB is the proverbial "canary in the coalmine" for Europe. Perched atop the largest derivatives book in Europe, DB has ties to most major financial institutions in the region. Which is why as soon as DB starts nose-diving, you know something big is up. DB shares are down 16% since September 15th and nearly 20% from September 9th. Put another way, this bank has lost a FIFTH of its market cap in less than two weeks. | ||||||||||||||||||||||||||||||||

| Incredible Mainstream Avoidance of Hillary Debate Collapse Posted: 26 Sep 2016 09:30 PM PDT from The Daily Bell:

Inside the Final Hours of Debate Prep for Hillary Clinton and Donald Trump … After more than a year of wall-to-wall campaigning, the outcome of the 2016 election could hinge on 90 unpredictable minutes Monday night in Hempstead, N.Y. The first presidential debate between Hillary Clinton and Donald Trump is expected to be the most watched in history, with perhaps 100 million viewers tuning in for a showdown with the power to upend an increasingly close race. -TIME How does Hillary manage to stay healthy and on her feet for three debates? That's the big question but incredibly you won't find it asked in mainstream media articles anywhere. As of a few hours before the debate, the Guardian, TIME, New York Times and myriad other publications have weighed in regarding the debates and what the candidates need to do to win.

The consensus seems to be that Trump has to restrain his instinct to make informal comments that seem "un-presidential." And Hillary surely has to avoid droning on. But there is only one fundamental question that needs to be asked from what we can tell: Will Hillary have a seizure or collapse onstage? We found plenty of alternative media speculation on this issue. WND published an article speculating that Hillary had epilepsy. ZeroHedge speculated about Hillary's stamina during the debates. Infowars, The Conservative Treehouse and other alternative publications focused on Hillary's health as a main debate issue. But not the mainstream. More, From TIME: | ||||||||||||||||||||||||||||||||

| Posted: 26 Sep 2016 08:01 PM PDT From "big, fat, ugly bubbles" to "trumped-up trickle-down" economics, tonight's debate had something for everyone. One-liners and soundbites were dropped like confetti with strange facial gestures, delicate coughs, and direct jabs flying left, right, and center. As far as the results go, it's anyone's guess: Lester Holt was soundly beaten by everyone online; the markets (S&P Futs and the Mexican Peso) both suggested a Trump loss, Trump won Twitter, online (and unscientific) polls were undecided with a slight nod to a Trump victory, as commentators were mixed, most siding with their ideological bias. As Bloomberg reports, after a little more than 90 minutes of debate (full transcript here), here are the key takeaways from tonight's event:

Behind their glazed eyes...

Some key ExcerptsClash of the Titans...

Then Hillary struck...

Quickly followed by Trump...

And...

Trump on 'birtherism'

Trump on his temperament

Trump on taxes

Clinton on her emails

How rich?

Trump Won Twitter:

Polls were mixed:Drudge - as expected - big trump win, suggesting whoever was for Trump before, remained with Trump:

NJ.com - Trump win.

Time.com - Hillary win. Fortune.com - Small Trump win.

On the other hand, judging by the market's reaponse, Trump lost:

Judging by the surge in futures and the Mexican peso. markets judged the first of three U.S. presidential debates a win for Hillary Clinton: U.S. stock index futures reversed losses, while Mexico’s peso rebounding from a record low and haven assets including the yen and gold fell. S&P 500 futs gained 0.4 percent as shares in Asia pared losses. Mexico’s peso rose as much as 1.5 percent, although rolled over toward the end of the debate. * * * She Said...

He Said...

* * * The bottom line.

So, as Obama would say after his first unfortunate debate in 2012, on to the rematch. | ||||||||||||||||||||||||||||||||

| Wells Fargo Or The Fed: Who’s The Bigger Fraud? Posted: 26 Sep 2016 07:35 PM PDT by Ron Paul, Zero Hedge:

What Wells Fargo employees who opened these accounts engaged in was nothing more than fraud and theft, and they should be punished accordingly. But how much larger is the fraud perpetrated by the Federal Reserve System and why does the Fed continue to go unpunished? For over 100 years the Federal Reserve System has been devaluing the dollar, siphoning money from the wallets of savers into the pockets of debtors. Where is the outrage? Where are the hearings? Why isn't Congress up in arms about the Fed's malfeasance? It reminds me of the story of the pirate confronting Alexander the Great. When accused by Alexander of piracy, he replies"Because I do it with a small boat, I am called a pirate and a thief. You, with a great navy, molest the world and are called an emperor." Over two thousand years later, not much has changed. Wells Fargo will face more scrutiny and perhaps more punishment. There will undoubtedly be more calls for stricter regulation, notwithstanding the fact that regulators failed to detect this fraud, just as they have failed to detect every fraud and financial crisis in history. And who will suffer? Why, the average account-holder of course. Any penalties assessed against Wells Fargo will be made up by increasing fees on account-holders. Clawbacks of bonuses, if they occur, will likely face resistance from the beneficiaries of those bonuses, leading to protracted and costly lawsuits. Even if the Wells Fargo CEO and top executives of Wells Fargo step down, the culture at Wells Fargo is unlikely to change anytime soon. As one of the largest banks in the world, Wells Fargo knows that it is not only too big to fail, but also too big to prosecute. At the end of the day, no matter how much public posturing there is, Wells Fargo and the regulators will remain best buddies. And those regulators who failed to catch this fraud will be rewarded with more power and larger budgets, courtesy of the US taxpayer. | ||||||||||||||||||||||||||||||||

| P2P Meltdown Continues: LoanDepot's CDO Collapses Just 10 Months After Issuance Posted: 26 Sep 2016 06:50 PM PDT We first noted Wall Street's misguided plan to feed its securitization machine with peer-to-peer (P2P) loans back in May 2015 (see "What Bubble? Wall Street To Turn P2P Loans Into CDOs"). Obviously we warned then that the voracious demand for P2P loans was a direct product of central bank policies that had sent investors searching far and wide for yield leaving them so desperate they were willing to gamble on the payment streams generated by loans made on peer-to-peer platforms. In addition to the pure lunacy of using unsecured, low/no-doc, micro-loans as collateral for a CDO, we pointed out that the very nature of P2P loans meant that borrower creditworthiness likely deteriorated as soon as loans were issued. The credit deterioration stemmed from the fact that many borrowers were simply using P2P loan proceeds to repay higher-interest credit card debt. That said, after paying off that credit card, many people simply proceeded to max it out again leaving them with twice the original amount of debt. And, sure enough, it only took about a year before the first signs started to emerge that the P2P lending bubble was bursting. The first such sign came in May 2016 when Lending Club's stock collapsed 25% in a single day after reporting that their write-off rates were trending at 7%-8% or roughly double the forecasted rate (we wrote about it here "P2P Bubble Bursts? LendingClub Stock Plummets 25% After CEO Resigns On Internal Loan Review"). Now, signs are starting to emerge that Lending Club isn't the only P2P lender with deteriorating credit metrics. As Bloomberg points out, less than year after wall street launched the P2P CDO, one of the first such securities backed by loans from LoanDepot has already experienced such high default and delinquency rates that cash flow triggers have been tripped cutting off cash flow to the lowest-rating tranches. The $140mm private security, called MPLT 2014-LD1, was issued by Jefferies in November 2015 and, less than 1 year after it's issuance, cumulative losses rose to 4.97% in September, breaching the 4.9% "trigger" for the structure. And sure enough, the deal was sold to a group of investors that included life insurance company, Catholic Order of Foresters. But, as Bloomberg noted, the LoanDepot deal wasn't the only one to breach covenants in less than a year. Two other Jefferies securitizations backed by loans made by the online startups CircleBack Lending and OnDeck Capital have also breached triggers. For some reason the following clip from the "Big Short" comes to mind..."short everything that guy has touched." | ||||||||||||||||||||||||||||||||

| Fulford’s White Dragons Go Full Tilt Anti-Trump, Pro-North America Union, 50% Dollar Devaluation? Posted: 26 Sep 2016 06:45 PM PDT from The PHASER:

CIA and Pentagon sources are now both saying neither Hillary Clinton nor Donald Trump will become the next president of the United States. However, they disagree on who will become president, showing that the issue is still up for grabs. US based CIA sources are still insisting Vice President Joe Biden will become President only to be quickly replaced by VP candidate Tim Kaine | ||||||||||||||||||||||||||||||||

| Wells Fargo Or The Fed: Who's The Bigger Fraud? Posted: 26 Sep 2016 06:25 PM PDT Submitted by Ron Paul via The Ron Paul Institute for Peace & Prosperity, The Wells Fargo bank account scandal took center stage in the news last week and in all likelihood will continue to make headlines for many weeks to come. What Wells Fargo employees did in opening bank accounts without customers' authorization was obviously wrong, but in true Washington fashion the scandal is being used to deflect attention away from larger, more enduring, and more important scandals. What Wells Fargo employees who opened these accounts engaged in was nothing more than fraud and theft, and they should be punished accordingly. But how much larger is the fraud perpetrated by the Federal Reserve System and why does the Fed continue to go unpunished? For over 100 years the Federal Reserve System has been devaluing the dollar, siphoning money from the wallets of savers into the pockets of debtors. Where is the outrage? Where are the hearings? Why isn’t Congress up in arms about the Fed’s malfeasance? It reminds me of the story of the pirate confronting Alexander the Great. When accused by Alexander of piracy, he replies “Because I do it with a small boat, I am called a pirate and a thief. You, with a great navy, molest the world and are called an emperor.” Over two thousand years later, not much has changed. Wells Fargo will face more scrutiny and perhaps more punishment. There will undoubtedly be more calls for stricter regulation, notwithstanding the fact that regulators failed to detect this fraud, just as they have failed to detect every fraud and financial crisis in history. And who will suffer? Why, the average account-holder of course. Any penalties assessed against Wells Fargo will be made up by increasing fees on account-holders. Clawbacks of bonuses, if they occur, will likely face resistance from the beneficiaries of those bonuses, leading to protracted and costly lawsuits. Even if the Wells Fargo CEO and top executives of Wells Fargo step down, the culture at Wells Fargo is unlikely to change anytime soon. As one of the largest banks in the world, Wells Fargo knows that it is not only too big to fail, but also too big to prosecute. At the end of the day, no matter how much public posturing there is, Wells Fargo and the regulators will remain best buddies. And those regulators who failed to catch this fraud will be rewarded with more power and larger budgets, courtesy of the US taxpayer. Through all of this, the Federal Reserve will continue its policy of low interest rates and easy money. Retirees who hoped to be able to live off the interest on their investments will find themselves squeezed by continued low interest rates. Those living on fixed incomes will see their monthly checks buying less and less as the prices of food staples continue to rise. The fat cats on Wall Street will continue to have access to cheap and easy money while those on Main Street will face a constantly declining quality of life. It is well past time for the Federal Reserve to face the same music as Wells Fargo and the bad actors on Wall Street. It is, after all, the Federal Reserve's creation of money out of thin air that enables all of this fraudulent behavior in the first place, so why should the Fed remain untouchable? Let's hope that someday Congress wakes up, hauls the Federal Reserve in for questioning, and puts as much pressure on the Fed as it does on private sector fraudsters. | ||||||||||||||||||||||||||||||||

| An Update from Max Porterfield of Callinex Mines Posted: 26 Sep 2016 06:20 PM PDT by Turd Ferguson, TF Metals Report:

And it has been a heck of a year in base metals, particularly the zinc that is the primary product of Callinex. So in this conversation, we spend some time discussing zinc…its fundamental uses and its intriguing set of supply/demand dynamics. But we also take some time to discuss copper, gold and silver as all three are by-products of zinc mining. I think you’ll find this to be a very interesting interview as it covers some topics that we don’t regularly discuss here at TFMR. Click HERE to Listen | ||||||||||||||||||||||||||||||||

| Foreign Buying Plummets In Vancouver: Sales To Foreigners Crash 96% Posted: 26 Sep 2016 05:40 PM PDT from ZeroHedge:

According to data released by British Columbia's Ministry of Finance on Thursday, foreign investors officially disappeared from Vancouver's property market last month after the local government imposed a 15% surcharge to curb a record-shattering surge in home prices. Overseas buyers accounted for a paltry 0.7% of the C$6.5 billion of residential real estate purchases in August in Metro Vancouver; this represents a 96% plunge from the seven weeks prior, when foreigners were responsible for 16.5% of transactions by value. According to the latest data overseas buyers snapped up C$2.3 billion of homes in the seven weeks before the tax was imposed, and less than C$50 million in the next four weeks. The government began collecting data on citizenship in home purchases on June 10. The ministry said auditors are checking citizenship or permanent residency declarations made by buyers and also reviewing transactions to determine if any were structured to avoid tax (spoiler alert: most of them were). Across the province, the participation of foreigners dropped to 1.4% of transactions by value in August, from 13% in the preceding seven weeks.

rior to the new real estate tax home prices were almost double the national average of C$473,105; however we expect a sharp corretion in the coming weeks – as we pointed out at the beginning of September, the average price of detached Vancouver properties promptly crashed following the news tax, dropping 17% on the month, and 0.6% on the year, to C$1.47 million ($1.13 million) in August, wiping away one year of gains in a few weeks.

As Bloomberg notes, the plunge in foreign participation joins other signs of a slowdown in Canada's most expensive property market. The silver lining is that while transactions may have ground to a halt, the government did pick up some extra tax revenues: British Columbia has raised C$2.5 million in revenue from the new levy since it took effect. Budget forecasts released last week indicated that the Pacific coast province expects foreign investors to scoop up about C$4.5 billion of real estate through March 2019. That may prove optimistic, because as reported two weeks ago as Chinese buyers wave goodbye to Vancouver, they have set their sights on another Canadian city: Toronto. According to the Star, sales of $1-million-plus Toronto-area single-family homes rose 83% year over year in July and August. That's 3,026 homes, with 55 per cent of them inside Toronto's borders. That's not entirely surprising given that the average cost of a detached home in Toronto was about $1.2 million, said Sotheby's CEO Brad Henderson. "While $1 million is still a considerable amount of money, it's difficult to find a single-family home in the city of Toronto for less than $1 million and it is not uncommon to find homes in the $2-million, $3-million or even $4-million-plus range," he said. Sotheby's says sales of homes in the $4-million-and-up category rose 74 per cent in the region and 58 per cent in the city in July and August. Sotheby's said it expects Toronto's luxury market to take the lead among Canada's cities, outpacing Montreal, which probably will become a target for investors from Europe, China and the Middle East. "What the (Vancouver) tax introduced is . . . some uncertainty as to what other policy issues the city or the province may introduce, which would adversely affect investors," Henderson said, adding that investors are looking elsewhere, including cities outside Canada. "But, if they are looking in Canada, we believe Toronto will be the most logical place for people to consider. Montreal and Calgary will probably also get a look-see," Henderson said. Or maybe not. | ||||||||||||||||||||||||||||||||

| Options expiration is prime time for monetary metals suppression, Turk cautions Posted: 26 Sep 2016 05:35 PM PDT 8:34p ET Monday, September 26, 2016 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk tells King World News today that monetary metals prices are likely to weaken this week because of futures market options expiration, prime time for price suppression by central banks and their bullion bank agents. An excerpt from the interview is posted at KWN here: http://kingworldnews.com/james-turk-issues-warning-for-gold-silver-bull-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Gold Standard Continues to Expand North Dark Star High-Grade Deposit Company Announcement VANCOUVER, British Columbia, Canada -- Gold Standard Ventures Corp. (TSXV: GSV; NYSE MKT:GSV) today announced assay results from two holes, DS16-21 and DS16-04, at the recently discovered North Dark Star oxide gold deposit on its fully-owned and controlled Railroad-Pinion Project in Nevada's Carlin Trend. Results from DS16-21 have increased the width of the deposit and, more importantly, have confirmed that higher-grade oxide mineralization projects up-dip to more shallow depths to the east of DS16-08. The primary objective of this year's drill program at North Dark Star was to expand the high-grade zone discovered in core hole DS15-13 (15.4 meters of 1.85 gold grams per tonne and 97 meters of 1.61 gold grams per tonne) at the end of last year's drill program. ... ...For the remainder of the announcement: https://goldstandardv.com/news/2016/expansion-gold-standards-north-dark-... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||

| Debates Live- #TrumpVsHillary and Protest Coverage Posted: 26 Sep 2016 05:34 PM PDT Debates Live- #TrumpVsHillary and Protest Coverage Watch the exclusive #TrumpVSHillary video feeds The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||

| The World in 2017: Prophetic Events are Happening Worldwide! Posted: 26 Sep 2016 03:00 PM PDT Prophetic Events from Around the World: The Past Week (2016-2017) Something is Going On Worldwide World News Current Events Signs of the Times Donald Trump Hillary Clinton Debate 2016 first presidential debate The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||

| Trump Betting Odds Narrow Going into 1st Presidential Debate Suggesting Trump Win Posted: 26 Sep 2016 02:15 PM PDT The 1st of 3 presidential debates will be held in a few hours time going into which Hillary leads across a wide spectrum of indicators from polling, political pundits, electoral college forecasters such as Nate Silver who give Hillary a 60% probability of winning the election, and of course the bookmakers who have Hillary Clinton as the clear favourite with Donald Trump as a 2-1 outsider. | ||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Flight to Safety, Bread and Circuses Posted: 26 Sep 2016 01:14 PM PDT | ||||||||||||||||||||||||||||||||

| The Shanghai Accord Returns With Weak Dollar Ahead Posted: 26 Sep 2016 01:11 PM PDT This post The Shanghai Accord Returns With Weak Dollar Ahead appeared first on Daily Reckoning. From late February to mid-August 2016, the yen staged a historic rally against the dollar, going from 114 to 99 yen to the dollar. Since then, the yen has backed off to 104. Now the pundits are predicting another round of yen weakness. Don't believe it. The yen rally has far to run. To understand where the yen is going, a little background is needed… From late 2012 to early 2016, Japan engaged in a deliberate policy of cheapening the yen against the dollar, euro and Chinese yuan. This was an effort to stimulate exports and cause inflation in the form of higher import prices, especially oil. This cheap yen policy was one of the "three arrows" of Abenomics (named after Prime Minister Abe), which were announced in December 2012. The intent was to give Japan a boost while it pursued more long-term structural and fiscal reforms. This was all part of a larger effort to lift Japan out of its 25-year depression of weak growth and periodic deflation along with multiple technical recessions. Unfortunately, Japan wasted the opportunity. It relied entirely on the cheap yen and did nothing of substance in terms of structural reform or fiscal policy. The cheap yen policy became Japan's one-trick pony when it came to stimulating growth.  Your correspondent in front of the Japanese National Diet Building in Tokyo during a recent visit to Japan. Despite calls from politicians for more monetary ease, nothing will be done. The Bank of Japan is prevented from rejoining the currency wars by the U.S. and China and must deal with the resulting strong yen. Part of the international community's support for Japan's weak yen was the belief that U.S. growth would reach a self-sustaining "liftoff" as a result of more quantitative easing, which was started by the Fed in September 2012. (This was the famous "QE3" experiment by Ben Bernanke.) The Fed was so confident that QE3 would work that they announced an intention to "taper" money printing in May 2013, and actually began the taper in December 2013. By November 2014, the taper was complete and Fed money printing by QE was officially over. (The Fed continues to print money to maintain its balance sheet at the current size by replacing maturing assets, but it is not expanding the balance sheet.) As usual, the Fed's analysis proved completely defective. After QE3 ended, the U.S. economy did not achieve self-sustaining growth. In fact, U.S. growth has stagnated exactly the way it did after the end of QE1 and QE2. By the way, this strongly suggests the Fed will have to launch a QE4 policy in 2017 to keep the U.S. economy from going into recession. By early this year, the U.S. was stuck in a rut of 1.25% annual growth. That was well below Fed expectations of 2.5% and even further from U.S. potential growth of 3.5%. The world's second-largest economy, China, was also slowing dramatically. Suddenly, it was time to pass the baton in the currency wars. Japan would no longer have the luxury of a cheap currency. It was time for the U.S. and China to reap some of those benefits. However, the problem with currency wars is that they are a zero-sum game. If one currency goes down, some other currency has to go up. It can't be any other way. If the U.S. and China were going to have cheaper currencies, then Europe and Japan would have to have stronger currencies. China, the U.S., Europe and Japan make up about 70% of global GDP. Together, they make up a potent G-4 inside the larger G-20 group of countries. Their currencies — the yuan, dollar, euro and yen — are the only ones that really matter in the global currency wars. All of the others are like small mammals dodging large predators. Sometimes they are nimble enough to escape, and sometimes they are roadkill. This consensus on a weaker yuan and dollar was the genesis of what became known as the "Shanghai Accord." This was an agreement reached on the sidelines of the G-20 central bankers and finance ministers meeting in Shanghai on Feb. 26. One important facet of the Shanghai Accord was that the peg between the Chinese yuan and U.S. dollar would be maintained. China had attempted unilateral devaluation in August 2015 and December 2015. Both times, U.S. stocks fell more than 10% in subsequent weeks. If China was going to devalue, it would have to be in lock step with the dollar against the yen and euro. That way, the yuan-dollar peg could be preserved and U.S. equities would not be threatened. The Shanghai Accord worked brilliantly. The yen rallied from 114 to the dollar at the inception of the Shanghai Accord to 99 to the dollar by mid-August 2016. The problem with manipulating complex systems such as capital markets is that a manipulation in one dimension may cause unexpected and unintended consequences in other dimensions. The weak U.S. economy and the weak dollar policy resulting from the Shanghai Accord meant that the Fed was unable to raise interest rates at its March, April, June and July FOMC meetings. As recently as last December, the Fed said it intended to raise rates four times in 2016, but so far there have been no rate increases at all. The U.S. stock market took the Fed's easy money policy as a kind of "all clear" signal and resumed its risk-on rally. The Dow Jones industrial average rose from 15,660 on Feb. 11, just before the Shanghai Accord, to 18,636 on Aug. 15. That's a spectacular rally of almost 20% in six months on the back of the Fed's weak-dollar policy. Now the Fed had a new problem. Stocks were pushing into bubble territory. Corporate earnings had been declining for over a year, and U.S. growth and productivity were dropping also. There was no fundamental reason for a stock market rally except easy money. The Fed was worried that the stock market bubble would burst and destroy confidence for years to come, especially after stock market bubbles burst in 2000 and 2008. The Fed sent out a host of regional reserve bank presidents and Fed governors to talk down the markets with threats of imminent rate hikes. The jawboning worked. Stocks stalled out in mid-August and the dollar rallied. As a result, the yen rally ended and the yen sank from 99 to 104 to the dollar. Now the Fed faced another problem. The reality will not match their rhetoric. It may have been "mission accomplished" for the Fed in terms of spooking stock investors, but the new stronger dollar would choke U.S. growth at the worst possible time. At Currency Wars Alert, we look at currency moves from all angles, including capital flows, central bank policy and terms of trade. The most powerful indications and warnings right now are that weak U.S. growth will necessitate a weaker U.S. dollar to provide some stimulus. In effect, the Shanghai Accord was laid to one side from mid-August to mid-September so that the Fed could cool off the stock markets. Now it's crunch time. The Fed did not raise rates at its Sept. 21 meeting. A rate hike at the Nov. 2 meeting is also off the table — it's too close to Election Day, on Nov. 8. That means no rate hikes until Dec. 14 at the earliest, and probably not even then. The Fed's tough talk will be revealed for a sham. The reality of easy money will return. The dollar will weaken, and the yen will strengthen in tandem. The Shanghai Accord will be back in full force very soon. This time, the yen will crash through the 100 barrier on its way higher to 95, or possibly even 90. That's what it will take to weaken the dollar enough to help the U.S. out of its recessionary trajectory. The much stronger yen is bad news for Japan. That's the problem with currency wars. For every winner, there's a loser. The G-4 have decided that the U.S. and Chinese economies need a boost, and that will come at Japan's expense. Japanese politicians can't stop the yen's rise, and the Bank of Japan won't lift a finger, because the U.S. Treasury and the IMF have warned them off. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post The Shanghai Accord Returns With Weak Dollar Ahead appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||

| NSA WHISTLEBLOWER: SPY GRID IS PART OF WORLD GOVERNMENT TAKEOVER Posted: 26 Sep 2016 11:10 AM PDT Infowars Reports The endgame of the National Security Agency is to obtain total information awareness on a global scale, NSA whistleblower and former Technical Director William Binney said on the Alex Jones Show Thursday. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||

| Germany will rescue Deutsche Bank if necessary, Allianz exec says Posted: 26 Sep 2016 10:27 AM PDT By Esteban Duarte The German government will have to bail out Deutsche Bank AG if its financial situation gets bad enough, Allianz Global Investors AG Chief Investment Officer Andreas Utermann said. "I don't buy at all what's coming out of Germany in terms of Germany not wanting to step in ultimately if Deutsche Bank was really in trouble," Utermann said today in a Bloomberg Television interview with Francine Lacqua and Tom Keene. "It's too important for the German economy." ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-09-26/germany-will-rescue-de... ADVERTISEMENT Gold Standard Continues to Expand North Dark Star High-Grade Deposit Company Announcement VANCOUVER, British Columbia, Canada -- Gold Standard Ventures Corp. (TSXV: GSV; NYSE MKT:GSV) today announced assay results from two holes, DS16-21 and DS16-04, at the recently discovered North Dark Star oxide gold deposit on its fully-owned and controlled Railroad-Pinion Project in Nevada's Carlin Trend. Results from DS16-21 have increased the width of the deposit and, more importantly, have confirmed that higher-grade oxide mineralization projects up-dip to more shallow depths to the east of DS16-08. The primary objective of this year's drill program at North Dark Star was to expand the high-grade zone discovered in core hole DS15-13 (15.4 meters of 1.85 gold grams per tonne and 97 meters of 1.61 gold grams per tonne) at the end of last year's drill program. ... ...For the remainder of the announcement: https://goldstandardv.com/news/2016/expansion-gold-standards-north-dark-... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||

| The Italian Dilemma: Weak banks pose risk to already faltering domestic demand Posted: 26 Sep 2016 10:17 AM PDT Source : http://www.focus-economics.com/blog/the-italian-dilemma-weak-banks-pose-risk-to-already-faltering-domestic-demand The sudden panic about a potentially imminent Italian banking sector collapse back in July has somewhat subsided for now, but sooner or later the issue will inevitably rear... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||

| Gold’s Moving Averages and Long-Term Outlook Posted: 26 Sep 2016 09:16 AM PDT Gold moved about $30 last week and many investors view this fact as a bullish sign and indication that much higher gold prices are likely to follow. Is this really the case? Let’s take a look at the gold charts (charts courtesy of http://stockcharts.com): | ||||||||||||||||||||||||||||||||

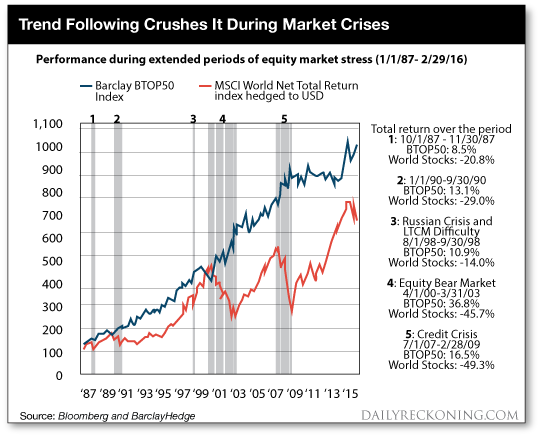

| Never Worry About the Stock Market Ever Again… Posted: 26 Sep 2016 09:08 AM PDT This post Never Worry About the Stock Market Ever Again… appeared first on Daily Reckoning. It seems like the world is going to hell in a handbasket… We have a gargantuan credit bubble: $230 trillion in global debt—three times the amount we had during the 2008-09 crisis. Deutsche Bank, the epicenter of European finance, is on the brink of collapse and about to bring the EU and the global economy with it. And fearing that global central banks have lost control, investors are starting to panic. Last week, we saw the largest outflow of money from equity funds in the last three months. It's a frightening time to be a mainstream "I trust the Fed to tuck me in bed at night" investor. But if you're a trend follower, it's time to put your feet up, relax and enjoy the ride… And the Winner Is…Look, I get it. I know why people are worried. We've been here before… Our recent history is filled with global financial crises, bubbles bursting, corporate collapses and hedge fund blow-ups. And the media narratives from these meltdowns have always concentrated on the losers… the investors who got burned… the retirees who lost everything. The press is fascinated with losers. And the public follows the lead of the press. And that's a major reason why mainstream investors freak out at times likes these. But during market crises, there are winners too. The press doesn't spend its time focusing on them. Yet they do exist. Have a look at the chart below… It compares MSCI World Stock Index versus the Barclay TOP50 Index, which replicates the overall composition of the managed futures industry that have trend following strategies at their core.

As you can see, during times of extreme market stress in recent decades, trend following strategies annihilated equity market performance. It's not even close. Historically, trend followers have been the biggest winners during crisis periods—so regular is trend following success during black swans that after 20 years it still shocks me. No Need to FearLook, I bring you my spin on world-changing developments because I want you to be aware of the things that are shaping your world and creating the trends you can profit from. The purpose isn't to instill fear. As trend followers, we don't let these developments change our strategy. My trend following decision-making doesn't involve the things that cause you to make mistakes during times of crisis, like prediction, discretion, guesses, gut feelings, or hunches. We don't do any of that, so you don't have to worry. And you don't have to fear the 24-hour news cycles or be concerned about daily turbulence or sensational hype. You can just let go and let my system work. So don't get caught up in the negativity from the next end of the world headline you see. As trend followers, we have our stops in place to protect us from ruinous downside moves. And our system is constantly tracking the markets for profitable trends in up or down markets to offset any losses. Keep that in mind the next time you find yourself getting tense from current events. It will help bring your heart rate down. But if you're not a trend follower, I leave you with this: What the hell are you waiting for? Please send your comments to me at coveluncensored@agorafinancial.com. Let me know what you think of today's issue. Regards, Michael Covel Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post Never Worry About the Stock Market Ever Again… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||

| Tumbling rouble powers profits at Highland Gold Posted: 26 Sep 2016 05:55 AM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||

| Jordan Maxwell - Hillary Made a Deal With The Devil Posted: 26 Sep 2016 02:15 AM PDT Jeff Rense & Jordan Maxwell - Hillary Made a Deal With The Devil Clip from September 05, 2016 - guest Jordan Maxwell on the Jeff Rense Program The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||

| Posted: 24 Sep 2016 01:00 AM PDT Technical analyst Jack Chan charts the last week's movements in gold. | ||||||||||||||||||||||||||||||||

| Charting the Continuing Gold Market Correction Posted: 24 Sep 2016 01:00 AM PDT Technical analyst Jack Chan plots the continuing correction in the gold and silver markets. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Few analysts noted it, but the $USD actually staged its second strongest day of the year the Friday before last.

Few analysts noted it, but the $USD actually staged its second strongest day of the year the Friday before last.

The Wells Fargo bank account scandal took center stage in the news last week and in all likelihood will continue to make headlines for many weeks to come. What Wells Fargo employees did in opening bank accounts without customers’ authorization was obviously wrong, but in true Washington fashion the scandal is being used to deflect attention away from larger, more enduring, and more important scandals.

The Wells Fargo bank account scandal took center stage in the news last week and in all likelihood will continue to make headlines for many weeks to come. What Wells Fargo employees did in opening bank accounts without customers’ authorization was obviously wrong, but in true Washington fashion the scandal is being used to deflect attention away from larger, more enduring, and more important scandals.

Multiple, reliable sources inside the world's intelligence agencies and secret societies are predicting major changes in the world's power structure in October. The struggle is centering on who will control the United States and its military industrial complex, the sources agree.

Multiple, reliable sources inside the world's intelligence agencies and secret societies are predicting major changes in the world's power structure in October. The struggle is centering on who will control the United States and its military industrial complex, the sources agree.

It was late April when we first introduced you to Max Porterfield and Callinex Mines. A few days ago, I had the opportunity to visit with Max again in order to get an update on their base and precious metal business.

It was late April when we first introduced you to Max Porterfield and Callinex Mines. A few days ago, I had the opportunity to visit with Max again in order to get an update on their base and precious metal business. China’s favorite offshore money laundering hub is officially no longer accepting its money.

China’s favorite offshore money laundering hub is officially no longer accepting its money.

No comments:

Post a Comment