Gold World News Flash |

- Dollar Collapse Starts Sept 30? Gold Bull Will Rage — David Morgan

- OBAMA BLOCKS 9/11 BILL!

- As Euro, Yen And Dollars Fall Investors Will Turn To Gold

- "Eight Election Trades For November 8th"

- Harry Dent September 2016 HOT Why The Stock Market will Crash

- U.S. Imports Record Amount Of Gold From Switzerland In July

- Foreign Buying Plummets In Vancouver: Sales To Foreigners Crash 96%

- We Are Stuck In Depression Until The Legend Of The "Maestro" Finally Dies

- Stefan Molyneux On Why Democrats Don't Care That Hilary Clinton Is A Half Dead Criminal

- Gold Price Closed at $1337.20 Up $31.40 or 2.4% for the Week

- BREAKING: "Netanyahu Meetings With Trump & Clinton"

- Ultimate Market Crash Starting NOW - Sep 23 Biblical Prophecy

- Anonymous - The TRUTH about WW3 II

- Dollar Collapse Starts Sept 30? Gold Bull Will Rage | David Morgan

- OBAMA IS PLANNING SOMETHING VERY BAD -- Martial Law, Fema Camps, NWO -- September 2016

- MARTIAL LAW...WHAT WILL YOU DO, IF THIS HAPPENS

- Janet Yellen “Did the Right Thing”

- Me and Manager Dan

- Gold and Gold Stocks Corrective Action Continues Despite Dovish Federal Reserve

- Russia Continues to Accumulate Gold, While China Prepares for a Major Announcement - Nathan McDonald

| Dollar Collapse Starts Sept 30? Gold Bull Will Rage — David Morgan Posted: 24 Sep 2016 08:00 PM PDT from The Morgan Report: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Sep 2016 07:00 PM PDT Barrack Obama has vetoed a bill that would allow families of the 9/11 victims to sue Saudi Arabia. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| As Euro, Yen And Dollars Fall Investors Will Turn To Gold Posted: 24 Sep 2016 05:30 PM PDT by Egon Von Greyerz, Gold Switzerland:

We also talk about the European banking system and Deutsche bank whose market cap is 1% of its balance sheet. I explain why there won't be bail-ins in any of the major banks and much more: "As we get ready to enter the final quarter of 2016, today the man who has become legendary for his predictions on QE, historic moves in currencies, and major global events, just spoke with King World News about the roadmap to $10,000 gold and $1,000 silver. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Eight Election Trades For November 8th" Posted: 24 Sep 2016 05:28 PM PDT No matter the outcome of the presidential election, according to BofA's Chief Investment Strategist, Michael Hartnett, 2017 will likely be a year of small absolute returns as the bank expects higher rates will collide with high bond and equity valuations, but it will be a year of big rotations "as investors shift from ZIRP winners like bonds, US, growth stocks to ZIRP losers like commodities, banks and Japan", where BofA forecasts 20,000 on Nikkei, although for that to happen the currency would have to implode in what may be a terminal loss of faith in the central bank. Still, with all attention now focused on the key risk event until a potential December rate hike, namely the November 8 presidential election, BofA provides 8 specific election trades for the election. In a note titled "Eight election trades for Nov 8th", Hartnett shares a variety of trade ideas, some "election-specific and some result-dependent: long VIX futures; long AUDUSD vol; long TIPS; long global E-commerce, short fast restaurants (inequality); long US materials and largecap banks (fiscal); long US small caps, short emerging markets (Trump protectionist); long gold, short EU banks (Trump geopolitics); long Mexican peso (Clinton victory)." This is what he says: On November 8th, the US Presidential election will take place. Below we list eight trades, all specific to the election, some applicable to whoever wins, some dependent on the election result: Long VIX futures. It seems an obvious trade, but the election is likely to be close (see latest projected electoral college result - Chart 4). There could even be a statistical tie in the Electoral College if Trump wins FL, OH, NC, WI, IA, and Clinton wins PA, VA, CO, NV, MI, NH, arguably the most volatility-inducing event of all. VIX futures are the most liquid expression of volatility, and ahead of the first Presidential debate, the cost of a Nov'16 hedge has fallen to the 19th percentile vs. the past year. Long AUDUSD volatility. One way to invest in a risk-off scenario in the event of a Trump victory is long AUDUSD volatility. In our most recent FMS, a Republican victory was seen as a much greater "tail risk" for markets than a Democratic win. Trump has a more protectionist stance, and has threatened import tariffs against China, a stance that would unsettle Asian FX markets. David Woo recommends buying AUDUSD volatility to hedge election uncertainty. AUDUSD volatility is correlated with quant-fund selloffs: it is a top hedge for our BofAML MAST index. Long TIPS. Populism is on the rise across the globe and both candidates have redistributive policies targeted at raising wages and reducing inequality. This could lead to higher inflation. It could lead to stagflation. Either way, it will likely be positive for TIPS. Long Main Street, short Wall Street. Both candidates want to boost Main Street rather than Wall Street and thus propose higher minimum wages, paid family leave and higher taxation on the rich. This would be positive for US municipal bonds (U0A0). Main Street-Wall Street pair trades: long global E-commerce (BIGECOM), short fast restaurants (BINAFCRC); long mass retailers (BRUSMASS), short luxury goods makers (SPGLGUP). Long fiscal stimulus. Best way to leverage fiscal stimulus under either president is via infrastructure spending and defense spending. Clinton has proposed $1.65tn of additional fiscal spending and Trump has proposed $2tn, according to the justreleased Committee for a Responsible Federal Budget report; Congress-approved budgets are likely to be significantly lower. Nonetheless, the direction is clearly toward more fiscal stimulus. Long US aerospace & defense (S5AEROX), US materials (S5MATR), and large-cap banks (S5BANKX). Fiscal stimulus is the primary reason our rates strategists see higher US bond yields in 2017. Protectionism pair-trade: anti-globalization is on the rise, and Trump has a more isolationist/protectionist agenda; our economists believe that the Trans-Pacific Partnership is at greater risk under Trump; a reduction in global trade would likely be most negative for EM and the mercantilist economies of Germany and Japan; should US protectionism lead to a bout of inflation in the US, we think US small caps would benefit from inflation and have less foreign exposure. In our view, the best protectionist pair trade: long US small caps (RTY), short emerging markets (MXEF). Geopolitical pair-trades: a Trump win could mean lower capital flows to the US, a rise in Treasury yields, and a weaker US dollar, all of which would be positive for gold. A Trump victory would also raise expectations that populist parties in Europe in 2017 could rise to power and increase the European Union disintegration risk premium. Long gold, short European banks (SX7E). Short USD/MXN on a Clinton victory as MXN appears 15% undervalued after better Trump polls. Long health care services (SPSIHPTR), short biotech (XNBI). Best way to leverage a Clinton win, with promised tax break for health care services versus higher pharmaceutical regulation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Harry Dent September 2016 HOT Why The Stock Market will Crash Posted: 24 Sep 2016 05:11 PM PDT Alex Jones : The Biggest Economy Bubble Will Burst In 2017 Expert economist Harry Dent predicts the worst collapse in modern history is coming in 2017 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Imports Record Amount Of Gold From Switzerland In July Posted: 24 Sep 2016 04:30 PM PDT by Steve St. Angelo, SRSRocco Report:

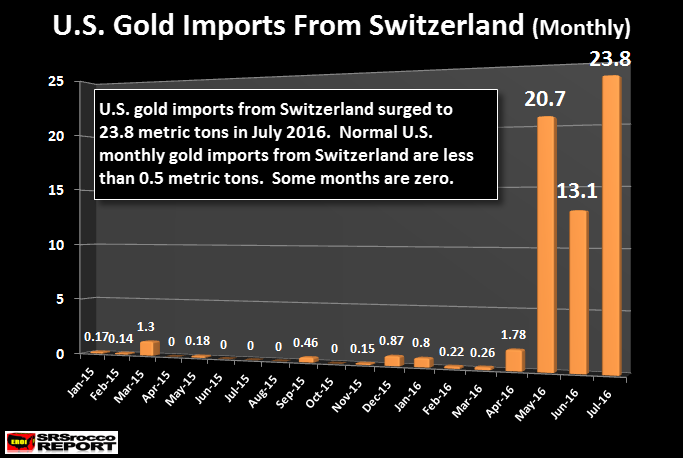

However, something has changed in the market dynamics as the U.S. imported a record 23.8 mt of gold from Switzerland in July: As I stated in my previous article, WHAT'S GOING ON?? Record Swiss Gold Flow Into The United States: the Swiss exported 20.7 mt of gold in May 2016, up considerably from its monthly average 0.4 mt. Even though gold imports from Switzerland declined the next month to only 13.1 mt in June, they were still much higher than their monthly average going back until Jan. 2015. But, as we can see… U.S. gold imports from Switzerland jumped 82% in July to 23.8 mt compared to June. There has been speculation in the precious metals community as to why the Swiss are now exported gold to the United States. While many theories seem plausible, the one that makes the most sense is that investors in Europe who have their gold stored in Switzerland are moving it to the United States to protect it from the implications of negative interest rates. Furthermore, after the Brexit vote for the U.K. to leave the European Union (In June), it has also put a lot of stress on investors holding assets within the E.U. countries. For whatever reason, gold bullion is now flowing into the United States from Switzerland in record volume for the first time in many years. This next chart shows the annual imports of gold from Switzerland going back until 2000:

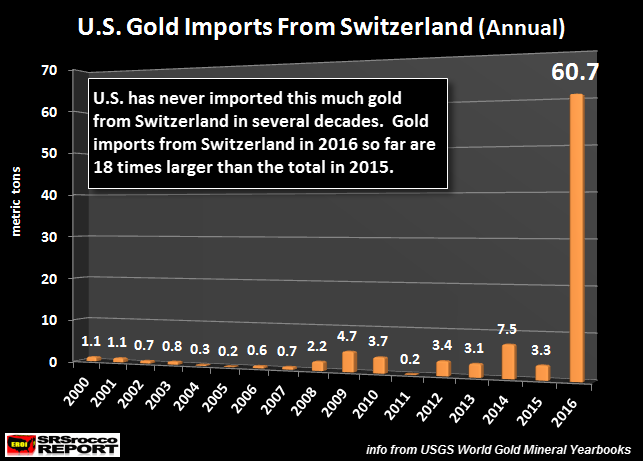

As we can see, Switzerland's gold exports to the U.S. are already 60.7 mt in 2016, up more than 18 times the volume in 2015. Again, for whatever reason, Swiss gold is heading into the United States in record volume. In addition, this is the first year the U.S. has imported more gold than it has exported in several years:

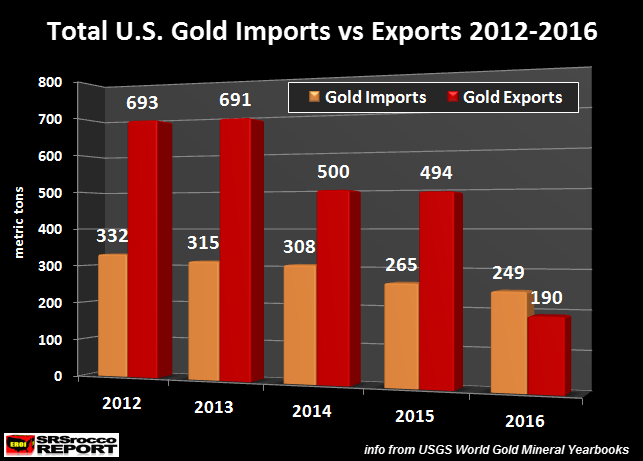

In 2012, the United States exported a record 693 mt of gold, while imports were only 332 mt. Even though the volume of U.S. gold exports declined in 2014 and 2015, they were still much higher than imports (62% & 86% respectively). However, this has changed in the first seven months of 2016, as the U.S. has imported 249 mt of gold versus exports of only 190 mt. The majority of the increase of U.S. gold imports came from Switzerland. Of the 249 mt of U.S. gold imports Jan-July 2016, Switzerland accounted for 60.7 mt, compared to only 3 mt in 2015. With the upcoming Chinese Yuan into the IMF SDR (Special Drawing Rights) on Oct 1st, the situation for the U.S. Dollar going forward will come under increased stress as global trade moves more into Chinese Yuan currency. This will negatively impact the U.S. Treasury holdings by foreigners as they move into owning more Chinese Yuan for trade. The days of the U.S. Dollar Reserve currency status is coming to an end. It is no surprise that Russia and China continue to add a great deal of gold to their official holdings. Lastly, I will be publishing a very important article on the precious metals next week. It will provide analysis on the top four precious metals (Gold, Platinum, Palladium and Silver) that most investors have not seen before. It will be out either Monday or Tuesday next week. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign Buying Plummets In Vancouver: Sales To Foreigners Crash 96% Posted: 24 Sep 2016 04:28 PM PDT China's favorite offshore money laundering hub is officially no longer accepting its money. According to data released by British Columbia's Ministry of Finance on Thursday, foreign investors officially disappeared from Vancouver's property market last month after the local government imposed a 15% surcharge to curb a record-shattering surge in home prices. Overseas buyers accounted for a paltry 0.7% of the C$6.5 billion of residential real estate purchases in August in Metro Vancouver; this represents a 96% plunge from the seven weeks prior, when foreigners were responsible for 16.5% of transactions by value. According to the latest data overseas buyers snapped up C$2.3 billion of homes in the seven weeks before the tax was imposed, and less than C$50 million in the next four weeks. The government began collecting data on citizenship in home purchases on June 10. The ministry said auditors are checking citizenship or permanent residency declarations made by buyers and also reviewing transactions to determine if any were structured to avoid tax (spoiler alert: most of them were). Across the province, the participation of foreigners dropped to 1.4% of transactions by value in August, from 13% in the preceding seven weeks. Prior to the new real estate tax home prices were almost double the national average of C$473,105; however we expect a sharp corretion in the coming weeks - as we pointed out at the beginning of September, the average price of detached Vancouver properties promptly crashed following the news tax, dropping 17% on the month, and 0.6% on the year, to C$1.47 million ($1.13 million) in August, wiping away one year of gains in a few weeks. As Bloomberg notes, the plunge in foreign participation joins other signs of a slowdown in Canada's most expensive property market. The silver lining is that while transactions may have ground to a halt, the government did pick up some extra tax revenues: British Columbia has raised C$2.5 million in revenue from the new levy since it took effect. Budget forecasts released last week indicated that the Pacific coast province expects foreign investors to scoop up about C$4.5 billion of real estate through March 2019. That may prove optimistic, because as reported two weeks ago as Chinese buyers wave goodbye to Vancouver, they have set their sights on another Canadian city: Toronto. According to the Star, sales of $1-million-plus Toronto-area single-family homes rose 83% year over year in July and August. That's 3,026 homes, with 55 per cent of them inside Toronto's borders. That's not entirely surprising given that the average cost of a detached home in Toronto was about $1.2 million, said Sotheby's CEO Brad Henderson. "While $1 million is still a considerable amount of money, it's difficult to find a single-family home in the city of Toronto for less than $1 million and it is not uncommon to find homes in the $2-million, $3-million or even $4-million-plus range," he said. Sotheby's says sales of homes in the $4-million-and-up category rose 74 per cent in the region and 58 per cent in the city in July and August. Sotheby's said it expects Toronto's luxury market to take the lead among Canada's cities, outpacing Montreal, which probably will become a target for investors from Europe, China and the Middle East. "What the (Vancouver) tax introduced is . . . some uncertainty as to what other policy issues the city or the province may introduce, which would adversely affect investors," Henderson said, adding that investors are looking elsewhere, including cities outside Canada. "But, if they are looking in Canada, we believe Toronto will be the most logical place for people to consider. Montreal and Calgary will probably also get a look-see," Henderson said. Or maybe not. As CBC reported earlier this week, economist Benjamin Tal of CIBC said that Ontario will have little choice but to copy Vancouver and implement a tax on foreign house buyers. In a recent note to clients, the economist said the biggest problem facing policymakers with regard to hot housing markets in Toronto and Vancouver is a limit on the supply of new homes. "The main reason behind higher prices in the [Greater Toronto Area] is a policy-driven lack of land supply," Tal said. "And with no change on that front, policymakers have to use demand tools to deal with what is essentially a supply problem." Tal doesn't speculate how much of a tax could be under consideration for Toronto, nor does he have any insight as to when and how it might be implemented. A foreign buyer tax is not the only possible response to the problem of high house prices. Among other possibilities, Tal cites:

Tal says Toronto's housing market has been inflated by cheap lending to people who would have no business getting a mortgage if rates returned to more typical levels. Of course, if Toronto does what Vancouver did and tries to spook away foreign buyers, the housing bubble will simply keep jumping city to city, first in Canada, then in move to the US, and back over to Europe, until soon the entire world makes it clear that China's $30 some trillion in deposits that are just itching to be parked offshore are no longer welcome, forcing the Chinese government to finally deal with the alarming consequences of its own unprecedented monetary injections, which now amount to some $4 trillion in new money creation mostly by way of bank "loans" (and thus deposits) every single year. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| We Are Stuck In Depression Until The Legend Of The "Maestro" Finally Dies Posted: 24 Sep 2016 04:00 PM PDT Submitted by Jeffrey Snider via Alhambra Investment Partners, Alan Greenspan is confused – again. The man who admitted to the world a decade ago he didn’t know much if anything about interest rates is now trying to change that reputation by suggesting yet again interest rates are set to rise. In testimony before Congress in February 2005, the then-Chairman of the Federal Reserve actually said:

To an economist, it was a “conundrum” especially where econometrics and statistics and take the dominant view (if it can be called that). That is one facet to the Greenspan story that is so odd yet so compelling in all the wrong ways. Though he was an economist by schooling, he had more practical experience in the “real” world. He served on boards of such illustrious companies as Alcoa, General Foods, even Mobil. But he was also a director for JP Morgan and Morgan Guaranty. He should have known better, as his infamous 1966 essay on gold reveals. Thus, we can reasonably assume that what transformed his worldview was not economics (small “e”) but rather power. Not only had he been appointed to major corporate boards, he was heavily involved in politics, including the kinds that are the stuff of conspiracy theories. By 1995, as Fed Chairman, Greenspan was widely and wildly credited as guiding the US economy through what he claimed was an existential crisis with the Savings & Loan industry bust. Though George HW Bush would blame Greenspan’s Fed in part for his 1992 election lost because of the first “jobless recovery” (a major clue no economist or policymaker investigated honestly), by the middle 1990’s it was believed he had created the recovery itself and then tamed it when he raised rates in 1994 and engineered what many still call a “soft landing.” There have been many who have been dubbed the “bond market king”, but for a long time Dr. Greenspan’s status in that regard was a cut above. His confusion and “conundrum” in the 21st century belies the reputation that had been given him in the 20th. The US (and global) economy of the middle 1990’s didn’t bother about rate hikes because there were other processes at work, especially with the S&L’s no longer a further restraint on finance (yes, restraint). With traditional banking all but relegated to second tier status, wholesale finance of the eurodollar had been given an unrestricted path to all marginal growth – money as well as credit. And Alan Greenspan knew it, or at least he knew of it and what it was doing. Many times during this period he would acknowledge the changing nature of money including in his “irrational exuberance” speech. By the dawn of the new millennium, that’s all there was – eurodollars were the dominant setting. The real world got a close look at what it was doing first with the dot-com bubble and then the mania of the coincident housing bubble. Overseas, the eurodollar system was financing the EM “miracles” in what might fairly be called the third major bubble (the one yet to be fully reckoned with, though in some places like Brazil it has started to be). By the middle 2000’s, monetary behavior was no longer as economists had come to expect and what they had encoded in their econometric models. In trying to reconcile the bond market with those models, Greenspan had his conundrum which Ben Bernanke put into the concept of a “global savings glut.” It was the final signal that economics, especially mainstream monetary economics, had lost all connection with actual, operative finance. Because, however, his pedigree and credentials remain impeccable, his opinion still carries some weight; that is the world we live in, especially where the media is concerned. It doesn’t matter how much you failed, it matters where you went to school and what jobs you held while you failed. Appearing on BloombergTV yesterday Dr. Greenspan claimed yet again that the treasury bull market is over with, and once more demonstrating his confusion.

I doubt there was any mention of his other such “calls” between his “conundrum” and now, including one just last year. Speaking at a private conference in DC in May 2015 before “global turmoil” erupted globally (it was only “overseas turmoil” at that time), Greenspan said:

He made that proclamation as interest rates were, in fact, rising. In late January, the 10-year UST yield had fallen all the way below 1.70%; but from that point through the spring interest rates had been increasing again as Janet Yellen’s “transitory” theme seemed to gain evidence. By the time Greenspan spoke of this next “tantrum”, the 10s had moved back up in yield to around 2.30%. Rather than continue toward 3.30% as he was suggesting, the benchmark bond yield would be nearly 1.30% by this July and proving yet again he is nothing more than an empty suit with a filled out resume. It’s not just that he has been wrong about the direction of interest rates, it is why he has been wrong but more so because it perpetuates this same, very basic financial misunderstanding. In putting together the story on Greenspan’s BloombergTV appearance, the article’s authors clearly share the former Fed Chair’s muddled misunderstanding.

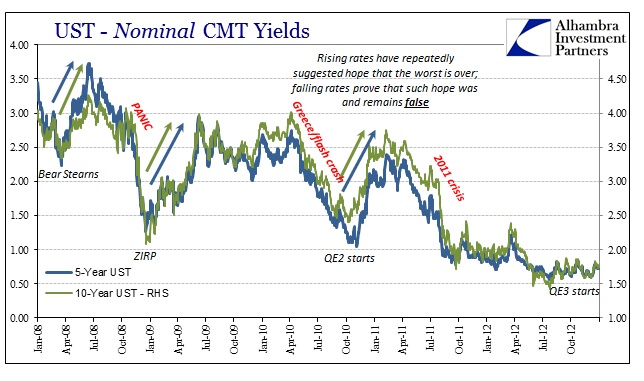

This is all demonstrably false and backward. The bond market hasn’t sold off because it is just now losing faith in central banks; bond rates have been falling for years as that market no longer has any faith in them whatsoever. The history of UST yields since 2007 is, pardon the pun, unyielding on this score. Bond rates rose in the aftermath of the panic because of ZIRP and all throughout QE1 as bond market participants didn’t understand what QE actually was. Believing it to be actual money printing, bond rates reflected both increased inflation and economic growth that were judged likely to result – only to stumble into shocking illiquidity in early 2010.

To that, the Fed responded with QE2 and the process started all over again. Treasury rates rose once more, not fell, while the Fed was purchasing UST’s – only to stumble all over again into even more shocking illiquidity in the middle of 2011 that finally registered as the realization of this eurodollar chasm between money and the actual role of bank reserves. Yet, despite all that, the bond market gave the Fed one more chance, though this time it was after QE3 and QE4, waiting to act in the same manner only when the Fed was willing to taper them. In other words, the bond market on the third try demanded some confirmation first that QE had worked before reflecting expectations of inflation and growth. The idea of taper itself was that confirmation; thus, the “tantrum” of 2013 wasn’t that the Fed was no longer buying bonds (at least as far as the treasury market was concerned) but that the bond market judged the success of QE at that point in time the most likely.

It didn’t last, of course, and ever since the bond market no longer has much faith in “stimulus”, harkening back to the questions about money and balance sheet expansion exposed by the 2011 crisis. Declining yields and a flattening curve leave no doubt as to the scenario that has been expected, one that has already been proved true. These periodic, almost regular selloffs that occur are not “growing skepticism” of global monetary policy, rather they are the brief and comparatively subdued flirtations with renewed faith that policy might achieve some results. And, as usual, those hopes are dashed in relatively quick fashion by reality. Economists view everything in finance through the filter of monetary policy, and therefore attribute all results to that perspective no matter how illogical and strained. That is why their view of the world is so often upside down and/or backward. It is the legacy of the myth of the “maestro.” There is no reason, however, for that to have become and further remain the mainstream view propagated through the media. Greenspan’s credentials say nothing; his track record is all that should matter when judging the worth of his opinions. He doesn’t know what he is talking about and there is a mountain of evidence, including his own words, that show that he never did. We are stuck in this economic depression not just because of his past tenure, but more so now because constant reverence prevents acceptance of these facts. The recovery doesn’t start until the “maestro’s” legend dies, and with it all the confusion and misconstruction about how markets and the economy actually work. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stefan Molyneux On Why Democrats Don't Care That Hilary Clinton Is A Half Dead Criminal Posted: 24 Sep 2016 03:57 PM PDT The Clinton Crime Family knows no limits to their treachery and malfeasance. Hillary Clinton's High Crimes and Sordid Scandals, Financial Fiascos and Political Debacles The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1337.20 Up $31.40 or 2.4% for the Week Posted: 24 Sep 2016 03:42 PM PDT

Subscribe to:

Post Comments (Atom)

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In my King World News audio interview early this week I discussed with Eric King how investors will flee from the major currencies into gold as the currencies start reflecting the imminent major money printing spree.

In my King World News audio interview early this week I discussed with Eric King how investors will flee from the major currencies into gold as the currencies start reflecting the imminent major money printing spree.

It seems as if the tide has changed as the U.S. imported a record amount of gold from Switzerland in July. Normally, the flow of gold from the United States has been heading toward Switzerland. For example, when the U.S. exported a record 691 metric tons (mt) of gold in 2013, Switzerland received 284 mt, which accounted for 41% of the total. Compare that to the paltry 3 metric tons of gold imported from Switzerland that very same year.

It seems as if the tide has changed as the U.S. imported a record amount of gold from Switzerland in July. Normally, the flow of gold from the United States has been heading toward Switzerland. For example, when the U.S. exported a record 691 metric tons (mt) of gold in 2013, Switzerland received 284 mt, which accounted for 41% of the total. Compare that to the paltry 3 metric tons of gold imported from Switzerland that very same year.

No comments:

Post a Comment