Gold World News Flash |

- Martin Armstrong On "The Coming Dark Age"

- ANOTHER HUGE “PAPER” WITHDRAWAL OF GOLD FROM THE GLD/HUGE SPREAD IN GOLD AT THE SHANGHAI GOLD FIX/LOAN DEMAND FALLS DRAMATICALLY IN CHINA:

- Ray McGovern “The Ceasefire Collapse In Syria Could Push The US & Russia To The Brink!”

- The ‘Emerging Art Bubble’ Has Burst

- U.S. Big Banks: A Culture of Crime

- Donald and the “Maestro”

- Weekly Metals Report: Critical Juncture

- Gold Price Closed at $1313.70 Up $0.20 or $0.02

- Who Really Rules The United States -- Edward Snowden

- WEB BOT UPDATE: Body Doubles? CGI Hillary? Is Hillary Dead? WHAT IS GOING ON HERE?

- Storage cost argument against gold now applies to cash, McEwen notes

- Do you know where those gold maples have been? Canadian Mint doesn't either

- Infographic: The Indian Gold Market

- Dollar to Weaken on Central Bank Meetings

- Dollar Collapse & WW3 Obama vs Putin New Video

- Gold Daily and Silver Weekly Charts - Modern Monetary Madness

- Japan's problems foreshadow the West's, Embry tells King World News

- U.S. Mint Telegraphs Major Market Move

- Silver Returns to Its Historic Role

- Swiss gold exports down 7% on year to 160 metric tonnes in August, four-month low

- Gold, Fed Rate Hikes & the Return of Big Deficit Spending

- Gold Fever

- URGENT: "Trump And Clinton Talk National Security"

- Gold vs. Stocks and Commodities, Pre-FOMC

- European banks may be more important than the Fed this week

- Gold, Silver, Stocks and Bonds Grand Ascension or Great Collapse?

- Four Under-the-Radar Investment Picks in Canada

| Martin Armstrong On "The Coming Dark Age" Posted: 21 Sep 2016 01:00 AM PDT Submitted by Martin Armstrong via ArmstrongEconomics.com, Question:

Answer:Hillary is just corrupt and rotten to the core. She represents everything that is wrong with our political economy. Politicians no longer care about the people. Every election promises “change” in some variation. That is admitting something is broken, but it always comes down to the same thing – it’s just about them. Indeed, it was Mark Twain who put it best during the last century: “If voting made any difference, they wouldn’t let us do it.” We must understand that this has been an age old battle between the rulers and the people. In Athens where Democracy was born, they constantly fought to seize power back and even made Pericles stand trial. Government has always sought to bribe the people creating a welfare state. The Romans knew that the way to power was to promise everything but give them bread and circuses (sport games) and they could maintain power. It was Decimus I?nius Iuven?lis, commonly known as Juvenal, who was a Roman poet active in the late 1st and early 2nd century AD that wrote that phrase: … Already long ago, from when we sold our vote to no man, the People have abdicated our duties; for the People who once upon a time handed out military command, high civil office, legions — everything, now restrains itself and anxiously hopes for just two things: bread and circuses […] iam pridem, ex quo suffragia nulli / uendimus, effudit curas; nam qui dabat olim / imperium, fasces, legiones, omnia, nunc se / continet atque duas tantum res anxius optat, / panem et circenses. […] (Juvenal, Satire 10.77–81) Nothing has changed. Many people can name every person on some sports team but cannot name their political minister, congressman, or whatever lofty title they call themselves. The judge in a courtroom demands to be called “honorable” as do all public servants. They make a mockery of the very word. We are approaching the grave danger of a Dark Age beginning from the aftermath of 2032. Hopefully, I will be gone by then and will not have to face this horrible event. Yet Dark Ages are reoccurring events throughout history and in all cultures. The Greeks endured their between the Homeric Age that marked the end of the Mycenaean civilization around 1100 BC, to the first signs of the Greek cities (poleis) rising again in the 6th century BC (508–322 BC). It was during the 9th century BC (900-801BC) that we begin to see the rise of great cities outside of Greece including Carthage, which was founded by the Phoenicians. Japan went through its Dark Age, which also lasted about 600 years and the same impact was endured in Europe with the collapse of Rome in 476AD. Dark Ages seem to come in units of 3 so they are 300 or 600 years. The cause is always political corruption. In the case of Japan, each new emperor devalued the money in circulation with a decree that it was worth 10% of his new coins. There was no intrinsic value since they were bronze or iron. This process led people NOT to hoard money. Chinese coins were sought after since they would not be devalued. Eventually, nobody would accept Japanese coins and they ceased to be issued for 600 years. People used Chinese coins or bags of rice. The Roman Monetary Crisis that saw silver vanish by 268AD, was naturally followed by an attempt to restore the monetary system. A new bronze coin was introduced in 295AD known as the Follis. Again, one 52 year cycle saw its collapse from over 16 grams to under just 2 grams. By the time you come toward the very end of the Roman Empire, you rarely find any bronze and when you do, it is less than an American penny. Coinage is debased because of the corruption in government. Those who think restoring the gold standard would do anything are wrong. Such monetary reforms appear repeatedly throughout history with little lasting impact. The system as we know it is always doomed to failure simply because we are satisfied as a whole with bread and circuses and let politicians run wild in their greed. Hillary is the example for everyone to see. I will gather all the accounts and this is on my bucket-list of books to complete. We do have a choice. We can understand what is coming and WHY, and perhaps take that first step out of darkness and move into the light of a realistic political system that ends the bribing of citizens and this eternal battle of political corruption. We need a REAL democracy without career politicians. Only then can we hope to advance as a society. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Sep 2016 12:00 AM PDT from Harvey Organ:

The Shanghai fix is at 10:15 pm est and 2:15 am est The fix for London is at 5:30 am est (first fix) and 10 am est (second fix) Thus Shanghai's second fix corresponds to 195 minutes before London's first fix. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Ray McGovern “The Ceasefire Collapse In Syria Could Push The US & Russia To The Brink!” Posted: 20 Sep 2016 09:40 PM PDT from The Richie Allen Show: | |||||||||||||||||||||||||||||||||||||||||||||||||

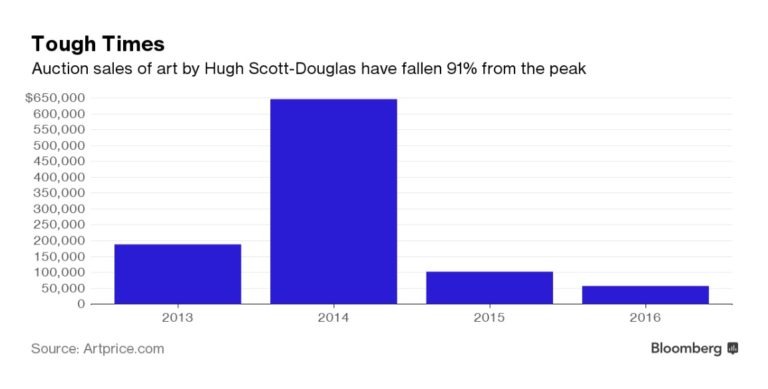

| The ‘Emerging Art Bubble’ Has Burst Posted: 20 Sep 2016 09:00 PM PDT by Michael Krieger, Liberty Blitzkrieg:

Bloomberg reports: Art dealer and collector Niels Kantor paid $100,000 two years ago for an abstract canvas by Hugh Scott-Douglas with the idea of quickly reselling it for a tidy profit. Instead, he is returning the 28-year-old artist's work to the market this week at an 80 percent discount.

While interesting in its own right, the reason I flagged this article is because it comes on the heels of reports of plunging sales figures in the ultra luxury segments of various real estate markets including Aspen, Miami, Manhattan, the Hamptons and Greenwich, CT. All of which followed a weakening London's high end real estate sector last year, which proved to be the perfect leading indicator. | |||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Big Banks: A Culture of Crime Posted: 20 Sep 2016 08:37 PM PDT

U.S. Big Banks: A Culture of Crime

Organized crime. This phrase is now a precise synonym for big-banking in the United States. These Big Banks commit big crimes; they commit small crimes. They cheat their own clients; they swindle outsiders. They break virtually every financial law on the books. What do all these crimes have in common? The Big Banks commit all these crimes again and again and again – with utter impunity. These fraud factories commit their serial mega-crimes, year after year, because the Big Banks know that they will never, ever be punished. On rare occasions, their crimes have been so egregious that U.S. 'justice' officials could no longer pretend to be oblivious to them. In such cases, there was a token prosecution, there was a settlement where the law-breaking banks didn't even have to acknowledge their own criminality, and there was a microscopic fine – which didn't even force the felonious financial institutions to disgorge all of their profits from these crimes. Criminal sanctions, by definition, are supposed to deter criminal conduct. The token prosecutions against U.S. Big Banks didn't deter Big Bank crime, they encouraged it. But even these wrist-slaps were becoming embarrassing for this crime syndicate, so they dealt with this problem. The Big Bank crime syndicate told its lackeys in the U.S. 'justice' department that they were not allowed to prosecute one of its tentacles, ever again. The lackeys, as always, obeyed their Masters, and issued a new proclamation. The U.S. 'Justice' Department would never prosecute a U.S. Big Bank ever again – no matter what crimes it committed, no matter how large the crimes, no matter how many times the same Big Banks committed the same crimes. Complete, legal immunity; totally above the law. A literal culture of crime. What happens when you create a culture of crime in (big) banking? Not only the banks break laws – with impunity – their bank employees do so as well. Case in point: Warren Buffett's favorite Big Bank – Wells Fargo. Wells Fargo employees came up with a good idea for boosting their salaries: stealing money directly out of the accounts of the bank's clients. Consider how large this crime became, in just one of these tentacles of organized crime. L.A City Attorney Mike Feuer announced a $185 million settlement reached with Wells Fargo, after thousands of bank employees siphoned funds from their customers to open phony checking and savings accounts raking in millions in fraudulent fees. [emphasis mine] Thousands of bank employees stealing millions of dollars from bank customers, in tiny, little increments, again and again and again. But the story gets much worse. Why was a lowly city attorney involved with the prosecution of this organized crime? So where is the FBI? Where is the Department of Justice? How about California Attorney General Kamala Harris? Too busy campaigning for the Senate to notice? How about L.A. District Attorney Jackie Larry? Only City Attorney Mike Feuer took action, and he only has the authority to prosecute misdemeanors… There are only two ways in which the non-action of the U.S. pseudo-justice system can be explained:

Take your pick. The U.S. pseudo-justice system is used to seeing so many multi-billion dollar mega-crimes being committed by these fraud factories that the systemic crime at Wells Fargo (which was 'only' in the $millions) didn't even attract their attention. Or, the entire U.S. pseudo-justice system is completely bought-off and corrupt – and they refuse to prosecute Big Bank organized crime. A culture of crime. It gets still worse. Thousands of Wells Fargo employees stole millions of dollars, from countless clients. They were caught. But not even one banker was sent to jail. In a real justice system, systemic crime of this nature would/could only be prosecuted in one of three ways. Either every Wells Fargo criminal would be prosecuted to the full extent of the law (given the egregious nature of the crime), or Wells Fargo management would be prosecuted – because they would have/should have known about this crime-wave. Or else both. Bankers stealing money, directly and brazenly, right out of customer accounts, but no one goes to jail? A culture of crime. Understand that endemic, cultural changes of this nature don't originate at the bottom of the corporate ladder. They originate at the top. In the case of the Wall Street crime syndicate; we already know that their management personnel are criminals, because they have admitted to being criminals. Many Wall Street executives says [sic] wrongdoing is necessary: survey If the ancient Greek philosopher Diogenes were to go out with his lantern in search of an honest man today, a survey of Wall Street executives on workplace conduct suggests he might have to look elsewhere. A quarter of Wall Street executives see wrongdoing as a key to success, according to a survey by whistleblower law firm Labaton Sucharow released on Tuesday. In a survey of 500 senior executives in the United States and the UK [New York and London], 26 percent of respondents said they had observed or had firsthand knowledge of wrongdoing in the workplace, while 24 percent said they believed financial services professionals may need to engage in unethical or illegal conduct to be successful… [emphasis mine] One-quarter of Big Bank management admitted that they "need" to commit crimes. A culture of crime. More needs to be said about the rampant, disgusting criminality among upper management in the Big Banks of the U.S. (and UK). A known whistleblower was conducting a public survey, asking known criminals how many of them were engaging in criminal behavior. What percentage of respondents would lie when answering such a survey? Three-quarters sounds about right. One-quarter of Wall Street executives admitted that committing crimes was a way of life. The other three-quarters lied about their criminal acts. Monkey see; monkey do. The lower level foot soldiers see their Bosses breaking laws, with impunity, on a daily basis. Their reaction, at Wells Fargo? "Me too." Most if not all of the Wall Street fraud factories conduct detailed "personality testing" on their bank personnel. Are they looking to weed-out those with criminal (if not psychopathic) inclinations? Of course not. They conduct this personality testing to find which employees have no reservations about engaging in criminal conduct – so they can be fast-tracked for promotion. There is no other way in which the systemic criminality of senior banking personnel can be reconciled with the detailed personality-testing in which they participated, in order to reach that level of management. The Wall Street fraud factories look for the most amoral criminals which they can find. And with the exorbitant, ludicrous "compensation" they award to these criminals for their systemic crimes, they end up with (literally) the best criminals that money can buy. A culture of crime. As a final note; the U.S. system of pretend-justice already has a powerful weapon in its arsenal to fight organized crime: the "RICO" act. This anti-racketeering statute was created for one, precise purpose: to not merely prosecute/punish organized crime, but to literally dismantle the crime infrastructure which supports the organized crime. Not only does the statute confer strong (almost limitless) powers in gathering evidence of organized crime, it also permits mass seizures of assets – anything/everything connected to the organized crime of the entity(ies) in question. In the case of the Big Bank crime syndicate, where all of its operations are directly/indirectly tied into criminal operations of one form or another, if RICO was turned loose on these fraud factories, by the time the dust had settled there would be nothing left. Oh yes. If the U.S. 'Justice' Department ever went "RICO" on U.S. Big Banks, lots and lots and lots of bankers would go to prison, for a very, long time.

Please email with any questions about this article or precious metals HERE

U.S. Big Banks: A Culture of Crime | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 Sep 2016 07:40 PM PDT from Antonius Aquinas:

“We're not in a stable equilibrium. I hope we can all find a way out because this too great a country to be undermined, by how should I say it, crazies.*

Well, if there is anyone who knows how to "undermine" an economy, it is the Maestro, since it was his "crazed" policies that brought about the 2008 financial crisis which ushered in the Great Recession that continues to this very day. In a demonstration of how truly clueless Greenspan is about economic conditions, he cautioned that the U.S. is "headed toward stagflation – a combination of weak demand and elevated inflation." Memo to the Maestro: stagflation is already here and has been for quite a while, especially when real economic gauges are used instead of the phony baloney numbers routinely lied about by the BLS and other corrupt state agencies. The "crazies" that Greenspan refers to are, of course, the "deplorable" Trump supporters and The Donald himself, who the Maestro contends is responsible for "the worst economic and political environment that I've ever been remotely related to." Oh, poor Alan has to suffer through an election where one of the candidates has not been approved by the ruling class. Too bad. Instead of carping about the current state of political affairs which, at least financially, he and his successor, Helicopter Ben Bernanke, largely contributed to, Greenspan should be grateful that he has had no reprisals for the financial crimes, chaos, and misery that he has afflicted upon the world. Instead of significant jail time or worse, Greenspan is free to pontificate on current events, receiving hefty financial remuneration, and just as important for top members of the governing elite, ego-enhancing hosannas! While Ben Bernanke has been a lifelong committed Keynesian and inflationist, Alan Greenspan, at least in his younger days as a member of Ayn Rand's circle, was a free marketer who spoke positively about the efficacy and moral soundness of a gold standard. That he abandoned these beliefs to go over to the Dark Side is further cause for retributive justice. Greenspan's betrayal was similar to those economists of the 1930s (Lionel Robbins most notable) who were followers of the teachings of Mises and Hayek, yet were swept away by the fanciful Keynesian deluge of the day and abandoned their economic senses and conscious for similar allurements which seduced the Maestro. Had these economists as well as Greenspan stuck to their original principles, the world may not be in its current financial mess. | |||||||||||||||||||||||||||||||||||||||||||||||||

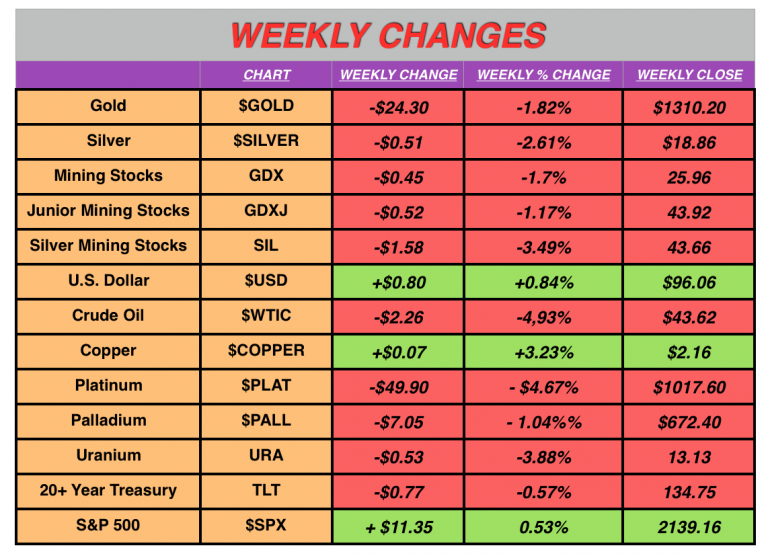

| Weekly Metals Report: Critical Juncture Posted: 20 Sep 2016 07:20 PM PDT by Stephen Penny, FTM Daily:

The metals traded lower last week, once again testing support near $1308 / $18.50and are in clear short-term downtrends. Gold has closed lower 7/8 previous trading sessions and silver 6/8. The only bright spot in the metals complex this week was a rallying copper price, which tends to benefit silver. Once again the dollar rally corresponded with a rise in treasury yields. Recent Treasuries held in Custody (TIC) data showed foreign central banks selling U.S. debt at a record pace. If this trend persists, it will leave the Fed as the "buyer of last resort." The U.S. simply cannot afford to allow interest payments to rise. Consider that, with a $20 Trillion debt burden, each 1% rise in interest rates equates to an additional $200 Billion of interest payments annually. When rates return to levels more in alignment with historical norms, themajority of Federal tax receipts will go towards interest payments on the national debt.Contemplating the implications of that eventual reality is worth serious consideration, and there's no time like the present to begin positioning accordingly. Here is a great place to get started.

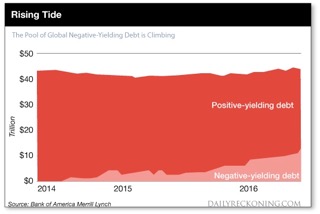

Another wildcard for the metals will be the Bank of Japan meeting this Wednesday, which will coincide with the Federal Reserve meeting the same day. An aid to Prime Minister Abe suggested that negative rates have been beneficial [huh?], which could signal rates going even further negative. Speculation and opinions abound as to whether the Federal Reserve will raise interest rates at their Sept 21st meeting next week, and the outcome will likely determine the short-term direction of the metals. The heavily short commercial banks would like nothing more than to see initial support levels give way. It's instructive to consider whose interests the Federal Reserve is actually concerned with, when considering its next move. I see several options:

With approximately 75% of the world's debt yielding less than 1%, it's difficult to imagine rates going up anytime soon. In fact, it's very possible that we will see a move towards zero or negative before any type of rate increase. The market is only pricing in a 15% likelihood of an increase next week, but is still placing the odds of a hike by December at 43%. If the Fed relents and it becomes clear that a rate hike is not forthcoming, I view that 43% as potential "fuel" for a short-covering rally in the weeks ahead, as trading positions are realigned. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1313.70 Up $0.20 or $0.02 Posted: 20 Sep 2016 06:41 PM PDT

FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | |||||||||||||||||||||||||||||||||||||||||||||||||

| Who Really Rules The United States -- Edward Snowden Posted: 20 Sep 2016 06:25 PM PDT Who was breaking the law? Edward or the United States government. I would suggest the latter. Disobedience to tyranny is our moral and lawful obligatio The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| WEB BOT UPDATE: Body Doubles? CGI Hillary? Is Hillary Dead? WHAT IS GOING ON HERE? Posted: 20 Sep 2016 06:00 PM PDT from clif high: Discussion about recent Hillary health ‘episodes’, body doubles (more than one of them), CGI Hillary, and bonds and the US dollar as we move through October into November. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Storage cost argument against gold now applies to cash, McEwen notes Posted: 20 Sep 2016 05:40 PM PDT Gold Bull McEwen Sees Prices as High as $1,900 by End of Year By Danielle Bochove and Millie Munshi Robert McEwen, one of the gold's industry's most unabashed bulls, is predicting prices could surge as much as 44 percent by the end of the year as confidence in the economy buckles. The metal could trade in a range of $1,700 an ounce to $1,900 by the end of 2016 as uncertainty builds around the stability of global currencies and sovereign debt, said McEwen, who is so enamored by bullion that he has founded two producers: McEwen Mining Inc. and Goldcorp Inc. Record-low global interest rates will cause a "huge amount of anxiety" for investors, who will turn to gold as a store of value and an alternative asset, he said. ... Dispatch continues below ... ADVERTISEMENT K92 Mining Shows What 'Fast Track' Really Means Company Announcement "Fast-tracking" is an overused phrase in the mining sector. But K92 Mining Inc. (TSX.V: KNT) has demonstrated exactly what that concept means. Less than four months after going public on May 25, the company has completed additional financings totaling $18.5 million. It also refurbished the mill and mine facilities with enhanced processing capacity and has two drills turning onsite. With all this accomplished, production looks to be just days away. "The technical team on site has done an excellent job with the production restart, and we are on schedule and on budget," says Director and Chief Operating Officer John Lewins. "With that focus on track, and with the enhanced financial flexibility resulting from our recent financings, we are now looking to target a resource expansion that we believe exists." K92 has under-promised and over-delivered. ... ... For the remainder of the announcement: http://www.bnn.ca/k92-shows-what-fast-track-really-means-1.568196 Gold "is a currency that doesn't have a liability attached to it," McEwen said today in an interview at a gold conference in Colorado Springs. "A store of value that has gone for millennia. And the big argument against gold used to be it costs you money to store it. Right now it's costing you money to store your cash." ... McEwen is betting big on gold. As the chief executive officer of his eponymous company, he is paid $1 a year and doesn't receive bonuses, wagering that his share holdings will reap him ample rewards. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-09-20/gold-bull-mcewen-sees-... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||

| Do you know where those gold maples have been? Canadian Mint doesn't either Posted: 20 Sep 2016 05:30 PM PDT Canadian Mint Employee Accused of Smuggling $180,000 of Gold in His Rectum By Kelly Egan http://ottawacitizen.com/news/local-news/egan-170k-in-mint-gold-allegedl... An employee of the Royal Canadian Mint allegedly smuggled about $180,000 in gold from the fortress-like facility, possibly evading multiple levels of detection with a time-honored prison trick. Hiding the precious metal up his bum. The case against Leston Lawrence, 35, of Barrhaven concluded in an Ottawa courtroom Tuesday. Justice Peter Doody reserved decision until Nov. 9 on a number of smuggling-for-cash charges, including theft, laundering the proceeds of crime, possession of stolen property, and breach of trust. ... Dispatch continues below ... ADVERTISEMENT NewCastle Gold's New CEO, Gerald Panneton, Hits the Ground Running By Tommy Humphreys Mining entrepreneur Gerald Panneton took a few years off after building one of Canada's largest gold miners, Detour Gold. He raced performance cars in his down time, and conducted due diligence on various mining assets to potentially back. This summer, the geologist set his sights on NewCastle Gold (TSXV:NCA), owner of a past-producing gold mine in California with similarities to Detour Gold in its early days. ... ... For the remainder of the report: https://ceo.ca/@tommy/new-newcastle-gold-ceo-gerald-panneton-hits-the-gr... The "uck!" factor aside, the case was also an illuminating look at security measures inside the Mint, the building on Sussex Drive that produces hundreds of millions of gold coins annually for the federal Crown corporation. "Appalling," was the conclusion of defence lawyer Gary Barnes, who described the Crown's case as an underwhelming collection of circumstantial evidence. "This is the Royal Canadian Mint, Your Honor, and one would think they should have the highest security measures imaginable," Barnes said in his closing submission. "And here the gold is left sitting around in open buckets." Indeed, it was not even the Mint that discovered the alleged theft but an alert bank teller. Court was told that, on multiple occasions, Lawrence took small circular chunks of gold — a cookie-sized nugget called a "puck" — to Ottawa Gold Buyers in the Westgate Shopping Centre on Carling Avenue. Typically, the pucks weighed about 210 grams, or 7.4 ounces, for which he was given cheques in the $6,800 range, depending on fluctuating gold prices, court heard. He then deposited the cheques at the Royal Bank in the same mall. One day a teller became suspicious at the size and number of Ottawa Gold Buyers cheques being deposited and Lawrence's request to wire money out of the country. She then noticed on his account profile that he worked at the Mint. The first red flag was up. Bank security was alerted, then the RCMP, which began to investigate. Eventually, a search warrant was obtained and four Mint-style pucks were found in Lawrence's safety deposit box, court heard. Records revealed 18 pucks had been sold between Nov. 27, 2014 and March 12, 2015. Together with dozens of gold coins that were redeemed, the total value of the suspected theft was conservatively estimated at $179,015. But the defence countered with a couple of important points. The Crown was not able to prove conclusively that the gold in Lawrence's possession actually came from inside the Mint. It had no markings nor, apparently, had any gold been reported missing internally. The Crown was able to show the pucks precisely fit the Mint's custom "dipping spoon" made in-house -- not available commercially -- that is used to scoop molten gold during the production process. Lawrence, who has since been terminated, was an operator in the refinery section. Among his duties was to scoop gold from buckets so it could be tested for purity, as the Mint prides itself on gold coins above the 99 per cent level. The great mystery that went unanswered at trial, however, was this: how did the gold get out of the Mint? Court was told Lawrence set off the metal detector at an exit from the "secure area" with more frequency than any other employee — save those with metal medical implants. When that happened, the procedure was to do a manual search with a hand-held wand, a search that he always passed. (It was not uncommon for employees to set off the detector, court heard.) Investigators also found a container of vaseline in his locker and the trial was presented with the prospect that a puck could be concealed in an anal cavity and not be detected by the wand. In preparation for these proceedings, in fact, a security employee actually tested the idea, Barnes said. Lawrence did not take the stand -- as is his legal right -- and the Crown was not able to definitively establish how the gold pucks made their way out of the facility. "We do have compelling evidence," countered Crown attorney David Friesen, of someone "secreting (gold) on his person and taking it out of the Mint." Barnes implied there were many ways Lawrence could have legitimately obtained the gold -- he could have bought the coins, for instance — and said he made no efforts to be devious with the gold buyers or the bank. Further, Barnes said, the Mint isn't even sure a theft took place. "In fact, I would submit the Mint doesn't even know if anything is missing." In an emailed statement Tuesday evening, a Mint spokeswoman said several security measures had been upgraded, including high definition security cameras in all areas, improved ability to track, balance and reconcile precious metal, and the use of "trend analysis technology." Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||

| Infographic: The Indian Gold Market Posted: 20 Sep 2016 02:47 PM PDT Bullion Star | |||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar to Weaken on Central Bank Meetings Posted: 20 Sep 2016 01:48 PM PDT This post Dollar to Weaken on Central Bank Meetings appeared first on Daily Reckoning. In an otherwise opaque report just released by the Bank for International Settlements (BIS), a central bank organization comprised of more than 60 central banks, it noted that "As rising dollar debt and increased exposure to global financing flows have affected the demand and supply of foreign currency, financial stability has become an increasingly important motive for interventions." Translation: Free money from central banks continues to grow within financial sector coffers. Eventually, investors will look to emerging markets for opportunity.

Tough talk from central bank governors is the norm, but talk is cheap. Their actions, even cheaper. Expect financial liquidity throughout markets to leave interest rates on a path to be altered lower and the dollar to weaken further. The Bank of Japan (BoJ) is anticipated to report on its quantitative easing (QE) and negative interest rate programs together with continued policy decision announcements. It convenes on in Tokyo on September 21, in a double feature with the Federal Reserve's (Fed) September two day meeting in Washington. Watch the BoJWhat does this mean in the face of a potential interest rate hike from the Fed? The likeness is not an aggressive sell off of U.S dollars. But watch the BoJ for clues on what may come for the U.S dollar. In a recent Financial Times piece, economic experts from around the world are puzzled. "Expectations are all over the place," said Frederic Neumann, co-head of Asian economics at HSBC. He said, "the BoJ is at best going to tinker with its existing framework, not introduce a major overhaul." While the BoJ might have some surprises up its sleeve that could come in Wednesday's announcement, watch the dollar for the real story. The U.S dollar has reached its strongest level since July following a report that indicated above-forecast inflation following the Fed meeting this week. The market has been bullish on dollars. Change is in the air. The Fed has already made one interest hike in December 2015, so the possibilities for QE seems to be off the table. Enter into the equation the next best thing… The European Central Bank (ECB) and the BoJ have both come to party. Both the ECB and BoJ have continued policies that are QE extensions, morphs of programs supporting QE or quite literally paying banks to loan money. This type of central bank spending has opened the floodgates on a massive amount of liquidity. The central banks do have an end goal here. The objective is to get domestic investors to go abroad with their liquid investments. Ultimately, they aim to target outflows of currency from the Eurozone and Japan into emerging markets. While the Fed will receive considerable attention in domestic media, the BoJ meeting will be worth paying attention to. It will offer clues on global liquidity and how central banks may look for alternatives to the dollar. World MoneyIn the face of a Federal Reserve and that is constantly pulling the chair out from under domestic and international markets, those looking at monetary policy are left scratching their head. According to Jim Rickards, the International Monetary Fund's (IMF) world money currency, formally known as Special Drawing Rights (SDR), offers a direct threat to "King Dollar." Rickards writes, "The hidden agenda involves the formal transition from a dollar standard to an SDR standard in world monetary affairs. It won't happen overnight, but the elite decisions and seal of approval will take place at these meetings." He goes on to say that, "The SDR is a source of potentially unlimited global liquidity. That's why SDRs were invented in 1969 (when the world was seeking alternatives to the dollar), and that's why they will be used in the imminent future." This world money has an all new member that is being welcomed into its currency club and destined to change the direction of the dollar. China Joins the ClubAt midnight on September 30, China enters the IMF's world money "basket" and will be the fifth member state to be a part of the weighted currency. The U.S dollar, Japanese yen and ECB Euro regional currency are already a part of this exclusive club. This means that dollar supremacy is under a real international peril. Not only will the SDR be the world money threat to the dollar, it will offer a new alternative in the face of the next crisis. This is important because, as the dollar becomes the lesser staple currency and reduced as a primary trade driver, the ECB and Japan could be the catalyst for such movement. As major financial media discuss at length the steepening yield curve (10 year bond dropping), the real storyline is investors taking up alternatives to the dollar. Statements from the BoJ could show where rates, investments and the SDR are headed. Sell the rumors and buy the facts. The market continues to be volatile. World money continues to chip away at the dollar. As the markets continue to shift, the dollar can only drag on so far. Regards, Craig Wilson, @craig_wilson7 Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post Dollar to Weaken on Central Bank Meetings appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar Collapse & WW3 Obama vs Putin New Video Posted: 20 Sep 2016 01:38 PM PDT Stock-market crash of 2016: The countdown begins It's time to start the countdown to the crash of 2016. No, this is not a prediction of a minor correction. Plan on a 50% crash.Most investors don't want to hear the countdown, will tune out. Basic psychology. They'll keep charging ahead with a... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Modern Monetary Madness Posted: 20 Sep 2016 01:28 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||

| Japan's problems foreshadow the West's, Embry tells King World News Posted: 20 Sep 2016 01:18 PM PDT 4:18p ET Tuesday, September 20, 2016 Dear Friend of GATA and Gold: In an interview today with King World News, Sprott Asset Management's John Embry says Japan's problems foreshadow the West's: a "staggering government debt burden in conjunction with a moribund economy as well as a shrinking, aging, xenophobic population." An excerpt from the interview is posted at KWN here: http://kingworldnews.com/john-embry-the-key-to-surviving-the-destruction... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Mint Telegraphs Major Market Move Posted: 20 Sep 2016 01:17 PM PDT This post U.S. Mint Telegraphs Major Market Move appeared first on Daily Reckoning. Today, we're taking a look at silver, the forgotten metal… Silver has done well in 2016. It rose from a low near $14 per ounce in January to over $20 per ounce during the summer (just after Brexit). Silver has currently settled at a little over $19 per ounce. I see a lot more upside with silver — both bullion and mining shares — because its price is ready to move again. And applying the lessons of basic supply and demand, silver could be in for quite a run… Silver demand continues to surge. The U.S. Mint, for example, is continuously breaking all modern records for the number and volume of silver coins it mints and sells. Indeed, last year, the Mint ran out of silver for a time, and had to stop producing new coins. "There's not enough silver," said the Mint director. He should know, right? It's a similar silver story overseas, where investors who can buy metal are carting it away from supply points. A few years ago, for example, I visited a secure vault in Switzerland, in which an entire section, about 10,000 square feet, was stacked with silver bars and bags of silver "shot" (sort of like bee-bees; used in industrial applications). Much of the material was industrial stockpile, because German manufacturers — in this case, the silver owner was one of Germany's largest automakers — simply can't afford to run out of silver feedstock. As demand increases, however, global output (aka "supply") is falling due to mines closing. Not "silver mines," mind you. It's that much of the world's silver comes as a byproduct of mining other commodities, like copper, lead and zinc. We've had a slew of those kinds of base metal mines shut down in the past three years. Now silver supply is thinning, and inventories are depleting. It's a global problem. In 2015, the global silver deficit — more demand than mine supply — was about 130 million ounces, made up by selling stockpiles and inventory. According to French bank Société Générale, silver supply in 2016 is likely to decrease another 9%. So the supply picture will tighten even more. This is why I believe silver is poised to rally. As the magnitude of the problem sinks in — limited supply and rising demand — I expect that more of the planet's big-money players will rush into precious metals. And it'll make for a pricing tsunami. The world's total investment holdings in silver are just over $50 billion in value, as compared to over $3 trillion of value in gold. There's 60-times more "value" tied up in gold, versus silver. Plus, over $2.5 trillion of that $3 trillion is controlled by private players like hedge funds, institutions and investor-backed entities like gold ETFs. If even a small amount of that "gold" money decides to move to silver — let alone if "new" money comes into the market — that $50 billion of silver will simply vanish into the buying ether. Silver prices will skyrocket. Consider also that higher prices will not bring out new supply — not in the short term. Sure, people will take silverware down to the local scrap dealer and sell it for cash. But that won't make up for a massive deficit in overall global demand. The only way to make up the shortfall is with new mines, which require many years and large capital expense to initiate. Thus, as we move ahead, I'm keeping a sharp eye on silver — the metal and miners. Again, "There's not enough," as the director of the U.S. Mint noted. And it's a problem that will not resolve quickly. Regards, Byron King Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post U.S. Mint Telegraphs Major Market Move appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Returns to Its Historic Role Posted: 20 Sep 2016 01:00 PM PDT This post Silver Returns to Its Historic Role appeared first on Daily Reckoning. Do you have a flashlight, spare batteries and some duct tape stashed away for home emergencies like power outages or hurricanes? Of course you do. How about 100 ounces of silver coins? If not, you should. In an extreme social or infrastructure breakdown — where banks, ATMs and store scanners are offline — silver coins might be the only way to buy groceries for your family. This is one of many reasons why sales of silver coins and bullion are set to skyrocket. Once that happens, shortages will appear and the price of silver could soar to $60 per ounce or higher, a 200% gain from current levels of about $20 per ounce. As you know, I write and speak frequently on the role of gold in the monetary system. Yet, I rarely discuss silver. Some assume I dislike silver as a hard asset for your portfolio. That's not true. In fact, in an extreme crisis, silver may be more practical than gold as a medium of exchange. A gold coin is too valuable to exchange for a basket of groceries, but a silver coin or two is just about right.  Here's a photograph of your correspondent inside a highly secure vault in Switzerland. I'm pictured with a pallet of silver ingots of 99.99% purity. The ingots weigh 1,000 ounces each, about 62 pounds. The brown paper hung on the walls behind me is to hide certain security features in the vault that the vault operators did not want to reveal. You may notice the small 1-kilo gold bar by my left hand, worth about $45,000. Silver is more difficult to analyze than gold because gold has almost no uses except as money. (Gold is widely used in jewelry, but I consider gold jewelry a hard asset, what I call "wearable wealth.") Silver, on the other hand, has many industrial applications. Silver is both a true commodity and a form of money. This means that the price of silver may rise or fall based on industrial utilization and the business cycle, independent of monetary factors such as inflation, deflation, and interest rates. Nevertheless, silver is a form of money (along with gold, dollars, bitcoin, and euros), and always has been. My expectation is that as savers and investors lose confidence in central bank money, they will increasingly turn to physical money (gold and silver) and non-central bank digital money (bitcoin and other crypto currencies) as stores of wealth and a medium of exchange. This is why I call silver "the once and future money," because silver's role as money in the future is simply a return to silver's traditional role as money throughout history. Before the Renaissance, world money existed as precious metal coins or bullion. Caesars and kings hoarded gold and silver, dispensed it to their troops, fought over it, and stole it from each other. Land has been another form of wealth since antiquity. Still, land is not money because, unlike gold and silver, it cannot easily be exchanged, and has no uniform grade. In the fourteenth century, Florentine bankers (called that because they worked on a bench or banco in the piazzas of Florence and other city states), accepted deposits of gold and silver in exchange for notes which were a promise to return the gold and silver on demand. The notes were a more convenient form of exchange than physical metal. They could be transported long distances and redeemed for gold and silver at branches of a Florentine family bank in London or Paris. Bank notes were not unsecured liabilities, rather warehouse receipts on precious metals. Renaissance bankers realized they could put the precious metals in their custody to other uses, including loans to princes. This left more notes issued than physical metal in custody. Bankers relied on the fact that the notes would not all be redeemed at once, and they could recoup the gold and silver from princes and other parties in time to meet redemptions. Thus was born "fractional reserve banking" in which physical metal held is a fraction of paper promises made. Despite the advent of banking, notes, and fractional reserves, gold and silver retained their core role as world money. Princes and merchants still held gold and silver coins in purses and stored precious metals in vaults. Bullion and paper promises stood side-by-side. Still, the system was bullion-based. Silver performed a leading role in this system. If gold was the first world money, silver was the first world currency. Silver's popularity as a monetary standard was based on supply-and-demand. Gold was always scarce, silver more readily available. Charlemagne invented quantitative easing, or "QE," in the ninth century by substituting silver for gold coinage to increase the money supply in his empire. Spain did the same in the sixteenth century. Silver has most of gold's attractions. Silver is of uniform grade, malleable, relatively scarce, and pleasing to the eye. After the U.S. made gold possession a crime in 1933, silver coins circulated freely. The U.S. minted 90% solid silver coins until 1964. Debasement started in 1965. Depending on the particular coin – dimes, quarters, or half-dollars – the silver percentage dropped from 90% to 40%, and eventually to zero by the early 1970s. Since then, U.S. coins in circulation contain copper and nickel. From antiquity until the mid-twentieth century, citizens of even modest means might have some gold or silver coins. Today there are no circulating gold or silver coins. Such coins as exist are bullion — kept out of sight. The price of silver has shown great resilience in the face of significant headwinds. Silver has backed off a bit from its recent high of $20.37 per ounce on July 13. But it's still holding tough above $19 today. \This is true despite a bearish commitment of traders report from the COMEX, approaching futures expiration (usually a time for downward price pressure by shorts), reduced Brexit fears, increased COMEX margin requirements, a stronger dollar, and a new round of tough talk from the Fed about rate hikes coming in September. Normally, any one of these factors would be enough to push silver significantly off the recent highs. The fact that silver has been resilient in the face of all six factors at once is a bullish sign. In addition to holding up well in the face of bearish factors, silver is set to get a boost from several bullish factors that have not yet been fully priced in by the markets. Despite the recent strong dollar and tough talk from the Fed, the U.S. economy cannot afford a strong dollar. The strong dollar is deflationary and pushes the Fed further away from its inflation targets. The Fed will not raise rates in September (and probably not for the rest of this year). Once that dovish signal gets priced in by the markets, the dollar will weaken and the dollar price of silver will get a boost. Regardless of which party wins the U.S. presidential election in November, the U.S. is set for a round of helicopter money (fiscal stimulus monetized by the Fed) in 2017. If Hillary Clinton wins, that probably means a pick-up in Senate votes for Democrats and a bipartisan infrastructure spending bill. If Donald Trump wins, he has already promised massive infrastructure spending, starting with "The Wall." Either way, we're looking at more spending, bigger deficits, more money printing and, eventually more inflation. The market's anticipation of this outcome, starting in mid-November, will be a powerful tailwind for silver. Investors should prepare now, before the spike. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post Silver Returns to Its Historic Role appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Swiss gold exports down 7% on year to 160 metric tonnes in August, four-month low Posted: 20 Sep 2016 10:37 AM PDT By George King Cassell Gold exports from Switzerland totaled 160 metric tonnes in August, down 7 percent from 172 metric tonnes a year earlier, Swiss federal customs data showed today. The figure is 17 percent lower than 192 metric tonnes in July, the largest flow out of the country this year. August is also the lowest monthly export total since April. Switzerland is the world's largest refiner and exporter of gold and total exports from the country now stand at 1,197 metric tonnes for the year to date, up 3 percent from 1,160 metric tonnes in the same period of 2015. In a marked change from the traditional flow of physical gold from west to east, the UK continues to be the largest destination for Switzerland's gold this year at 84.6 metric tonnes in August, up 6 percent from July. ... ... For the remainder of the report: http://www.platts.com/latest-news/metals/london/swiss-gold-exports-down-... ADVERTISEMENT Gold Standard Continues to Expand North Dark Star High-Grade Deposit Company Announcement VANCOUVER, British Columbia, Canada -- Gold Standard Ventures Corp. (TSXV: GSV; NYSE MKT:GSV) today announced assay results from two holes, DS16-21 and DS16-04, at the recently discovered North Dark Star oxide gold deposit on its fully-owned and controlled Railroad-Pinion Project in Nevada's Carlin Trend. Results from DS16-21 have increased the width of the deposit and, more importantly, have confirmed that higher-grade oxide mineralization projects up-dip to more shallow depths to the east of DS16-08. The primary objective of this year's drill program at North Dark Star was to expand the high-grade zone discovered in core hole DS15-13 (15.4 meters of 1.85 gold grams per tonne and 97 meters of 1.61 gold grams per tonne) at the end of last year's drill program. ... ...For the remainder of the announcement: https://goldstandardv.com/news/2016/expansion-gold-standards-north-dark-... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Fed Rate Hikes & the Return of Big Deficit Spending Posted: 20 Sep 2016 10:00 AM PDT Bullion Vault | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 Sep 2016 08:40 AM PDT Gold Fever – as in "illness". Gold's bear market has been slow to get started. Rather it has played out as a consolidation since last June. But gold is now testing important support and despite bullish seasonality in September, we expect a breakdown in the metal to be forthcoming. Gold fell $24.30/oz. last week and closed at $1,305.80 on the 89-dma and the December bull trendline. Resistance is at 1,365 (38.2% retracement of the 2011 bear market) and support is near 1,295. | |||||||||||||||||||||||||||||||||||||||||||||||||

| URGENT: "Trump And Clinton Talk National Security" Posted: 20 Sep 2016 08:23 AM PDT Donald Trump and Hillary Clinton trade charges on National Security The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold vs. Stocks and Commodities, Pre-FOMC Posted: 20 Sep 2016 08:22 AM PDT We are well along in the precious metals correction and have downside targets for gold, silver and the miners. In order for that to be a ‘buy’, the sector and macro fundamentals will need to be in order. Some of those are represented by the gold ratio charts vs. various assets and markets. Below are two important ones. Gold vs. Stock Markets has been correcting the big macro change to the upside since leading the entire global market relief phase (potentially out of the grips of global deflation) earlier in the year. A hold of these moving averages, generally speaking, keeps a key gold sector fundamental in play as the implication is that conventional casino patrons are choosing gold over their traditional go-to assets, stocks. A breakdown from the moving averages and it’s back to Pallookaville for the gold “community”. | |||||||||||||||||||||||||||||||||||||||||||||||||

| European banks may be more important than the Fed this week Posted: 20 Sep 2016 06:27 AM PDT It’s like déjà vu all over again. The SPX Premarket has tested the lower trendline of its Orthodox Broadening Top, but pulled back. ZeroHedge observes, “If yesterday one could "explain" the overnight stock levitation due to the move higher in crude oil, today there is no such catalyst with WTI down modestly, and yet the broader push higher across European stocks and US equities has reappeared following yesterday's muted close on Wall Street ahead of key central bank data on deck. Some have attributed the 0.4% rise in futures to the latest dip in the dollar, while a modest bond rally as the countdown to crucial policy decisions by the Bank of Japan and the Federal Reserve entered its final stretch, put taper tantrum concerns on hold if only for the time being.” | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Silver, Stocks and Bonds Grand Ascension or Great Collapse? Posted: 20 Sep 2016 06:20 AM PDT It depends upon your perspective and the markets you follow … Perspective: The global economy is drowning in debt – $230 Trillion and counting – that will not be repaid at current value. Expect hyperinflation or outright default. Negative Interest Rates on $13 Trillion in sovereign debt are a sign of failure by central banks, governments, and Keynesian economists. Pension plans and savers are hurt by low and negative interest rates. They have been sacrificed for the continued levitation in the stock and bond markets. All of the above indicate a correction and possible collapse are coming. Perhaps it began this month, September 2016. The charts of six markets tell the story. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Four Under-the-Radar Investment Picks in Canada Posted: 20 Sep 2016 01:00 AM PDT Bruce Campbell, founder and portfolio manager of StoneCastle Investment Management, focuses on investments in Canada and uses relative strength and earnings growth as investing criteria. In this interview with The Gold Report, Campbell highlights four companies in a wide spectrum of industries that he says are flying under the radar right now. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

THE ONLY GAME IN TOWN IS THE RISING HOUSE PRICES WITH THE ACCOMPANYING SHADOW BANKING LOANS/DEUTSCHE BANK FALLS TO ALL TIME LOWS. ITALY'S RENZI IN A SPARING MATCH WITH GERMANY'S CENTRAL BANKER WEIDMANN

THE ONLY GAME IN TOWN IS THE RISING HOUSE PRICES WITH THE ACCOMPANYING SHADOW BANKING LOANS/DEUTSCHE BANK FALLS TO ALL TIME LOWS. ITALY'S RENZI IN A SPARING MATCH WITH GERMANY'S CENTRAL BANKER WEIDMANN Earlier today, Bloomberg published a fascinating article on the collapse of what is known as the "emerging art market." Namely, a slice of the art world where spraying a canvas with paint from a fire extinguisher had been commanding six figures a pop. Well all of that is now over, as the space has experienced a stunning collapse.

Earlier today, Bloomberg published a fascinating article on the collapse of what is known as the "emerging art market." Namely, a slice of the art world where spraying a canvas with paint from a fire extinguisher had been commanding six figures a pop. Well all of that is now over, as the space has experienced a stunning collapse.

Former Federal Reserve Chairman Alan Greenspan, who was once laudably referred to as "Maestro" for his supposed astute stewardship of U.S. monetary policy, commented last week on the nation's current political and economic climate:

Former Federal Reserve Chairman Alan Greenspan, who was once laudably referred to as "Maestro" for his supposed astute stewardship of U.S. monetary policy, commented last week on the nation's current political and economic climate:

No comments:

Post a Comment