Gold World News Flash |

- Sorry, You Can’t Have Your Gold

- Something Strange Is About To Happen

- Russia’s Armata Tank vs America’s M-1 Abrams and TOW Missile: Who Wins?

- Nassim Taleb Exposes The World's "Intellectual-Yet-Idiot" Class

- The Best Work Gloves For Preparedness

- Massive Sinkhole Opens In Florida Releasing Millions Of Gallons Of "Slightly Radioactive" Water

- Global Elites Prepare Underground Cities

- Robert Kiyosaki Last warning to america 100 dollar will collapse end of 2016

- Book Review: The New Case For Gold

- Gold Daily and Silver Weekly Charts - FOMC Next Week - Little Finger and Cersei

- The Video Hillary Clinton Doesn't Want Seen! (2016-2017)

- End Times Headline News - September 16th, 2016

- MARINE LE PEN : "THIS IS A FUNERAL" FOR THE EU

- Why Has Gold Stalled?

- Trump or HIlary? Which Presidents Have Been Best for the Gold Market?

- Do You Want to Retire Rich? Then Read This…

- CME Group plans more futures to shift money from metal to paper

- Gold Is The Ultimate Wealth Preservation Against Reckless Governments

- Bullion Star's informational graphic about the Indian gold market

- Fed Rate Rise? Gold Price Goes Up Says History

- Deutsche Bank Initiates Coverage of Silver Wheaton

- War is Peace, Silver is Plentiful, and Other Misconceptions

- Another Billionaire Warns of Catastrophic Depths Not Seen in 5,000 Years – and Emphasizes Gold

| Sorry, You Can’t Have Your Gold Posted: 16 Sep 2016 10:01 PM PDT from Strategic Wealth Protection:

More and more, banks are becoming one of the more risky places to store wealth in any form. Not surprising, then, that many people are returning to those facilities that treat wealth storage the way the first banks did, millennia ago – vault facilities that store your wealth for a fee, but engage in no other banking activities.

But, in suggesting to our readers that such facilities are a better bet, I've also repeatedly warned readers that many such facilities don't store actual, physical gold. They instead provide a contract to you that states that they will deliver an agreed-upon amount of gold upon demand. The trouble with this idea is that it becomes tempting for such facilities to sign such a contract with you and collect the purchase price, but never actually purchase and store any gold. It's been estimated that the total worldwide value of such contracts equals 150 times the amount of gold in existence in the world. Oh-oh. This is why it's imperative that you purchase only physical, allocated gold. And another caution: I've repeatedly stated that, although many of the most secure facilities in the world are located in North America and Europe, these jurisdictions are on the cusp of economic crisis, a fact that suggests that, if and when the crisis arrives, the rule book will be thrown out the window. Governments and facilities alike may prove untrustworthy and, at some point, you may drop by the facility to withdraw your gold and be told, "Sorry, we're unable to provide delivery." There could be a multitude of reasons given, hoops to jump through and endless red tape to deal with. And still, in the end, you may never be able to take delivery. It's for these reasons that we advise that, although nothing in life is guaranteed, you should always protect your wealth by choosing the least risky option. This means that you should follow two simple rules – Rule #1: Select the jurisdiction with the best laws and reputation. Rule #2: Make sure there's a reputable storage facility in that jurisdiction that has a Class III vault and a contract that meets your needs. But, am I being overly cautious when I so frequently offer this advice? Unfortunately, no. I've predicted that, in the future, as we get closer to a monetary crisis, banks and storage facilities that are located in countries that are likely to be heavily affected, will work ever-harder to avoid releasing either money on deposit (in the case of banks) and precious metals (in the case of storage facilities). |

| Something Strange Is About To Happen Posted: 16 Sep 2016 08:30 PM PDT by Richard Sauder, Event Horizon Chronicle:

I say that the Democratic Party “knowingly” nominated Hillary Clinton,because it is impossible that the party leadership can be unaware of her very grave medical condition. They have probably known for a period of years now that she is in declining health. Even the non-medically trained, casual observer can see that she is not well. Her chronic head nodding, multiple, serious bouts of coughing when giving press conferences or speeches, and obvious bodily weakness and debility all speak to her physical decline. What to speak of the man who is frequently hovering nearby, a syringe in his hand, seemingly ready to give her an emergency injection, if the need arises.

Dr. Ted Noel at Vidzette.com makes a plausible, even a compelling case that Hillary Clinton is in an advanced stage of Parkinson’s disease. And yet she continues to campaign for the presidency of the USSA, albeit that she is completely unqualified for health reasons alone to hold any position or office of great responsibility. And she knows it. But there’s much more. In addition to her extreme medical issues, which are more and more pronounced., she also has a growing problem with her long trail of tens of thousands of official and classified e-mails that she routed through her private e-mail server when she was Secretary of State, instead of using secure government communications channels. Wikileaks will imminently be revealing more incriminating Hillary e-mails that unnamed whistle blowers have anonymously dumped to them. Julian Assange has said that they will be released, probably starting next week. Additionally, new information is coming to light about the Clinton Foundation which reveals it not to be a charitable organization, but rather amulti-billion dollar charity fraud that serves primarily to obscenely enrich the Clintons and their political cronies. In other words, the Clinton Foundation would be better understood as a massive, very lucrative money laundering machine, with sprawling, international tentacles that reach all over the world. So What Does It All Mean? In sum, Hillary Clinton is in deep trouble. She has obvious, debilitatingmedical issues and serious legal issues, related to the Mafia-like machinations of the fraudulent Clinton Foundation and also to her illegal use of a private e-mail server for conducting official and classified correspondence while she was Secretary of State. The first of the presidential debates with Donald Trump is on the 26th of September, just 19 days from today. Given her many, prolonged, recent coughing spells, her obvious physical weakness, her multiple episodes of loss of control of her head and eyes andher difficulty standing for extended periods, she probably is not physically capable of doing three nationally televised debates with Donald Trump, in front of a live audience. It is doubtful that she could go toe to toe with averbally aggressive opponent such as Trump for an hour and a half without physically cracking under the pressure. Hillary herself knows this. The leadership of the Democratic Party knows this. Hillary’s personal handlers and assistants know this. Donald Trump and his camp are certainly aware of her medical issues. Growing numbers of the public at large are also becoming aware of this. But even if she were physically capable of participating in three challenging debates with Donald Trump, which it increasingly appears she is not, her legal problems related to the ongoing e-mail scandal when she was Secretary of State, coupled with growing attention to the multi-billion dollar money laundering under the fraudulent guise of alleged “charitable” activities at the Clinton Foundation, open the way for Trump to make political mincemeat out of Hillary in front of the watching nation. Read More @ Eventhorizonchronicle.blogspot.com addendum: I very much need your donations for support of my writing. I depend on your contributions and donations to help me continue living and writing in exile in Ecuador. If you find personal value or meaning in this or any of my other blog articles won’t you please support my continued work? Contact me at: dr.samizdat1618@gmail.com for how to donate. |

| Russia’s Armata Tank vs America’s M-1 Abrams and TOW Missile: Who Wins? Posted: 16 Sep 2016 06:20 PM PDT from Russia Insider:

While early reports concerning the new tank seem to indicate some strong capabilities, how would the new Russian vehicle perform on the battlefield? Would it dominate against the competition or is it simply a paper tiger? And then we have the obvious question: how would it perform against America’s best tank, the popular M1 Abrams? Would the Abrams be able to win a fire fight against the new Russian tank? Or would Moscow hold the advantage? Then there is the question of how Moscow’s new weapon of war would do against various anti-tank weapons, for example, the TOW missile. To answer some of these questions, below for your reading pleasure, we have packaged together Dave Majumdar and Sebestian Roblin’s latest work on this subject together, published several months ago, for your reading pleasure. Let the debate begin. *** With the end of the Cold War and the collapse of the Soviet Union, the spectre of a massive armored Red Army juggernaut smashing its way through the Fulda Gap is long past, but Russia has continued to develop new tanks and armored vehicles. Meanwhile, the United States has continued to rely on upgraded versions of the Cold War–era M1 Abrams and Bradley fighting vehicle. Russia's Armata family of armored combat vehicles is a departure from the previous Soviet practice of developing relatively simple, inexpensive but specialized platforms. In fact, the Armata comes in many versions as was envisioned for the U.S. Army's now-defunct Future Combat System program. There is a tank, infantry-fighting vehicle, a self-propelled artillery piece and a host of other variants. The most prominent of these is the T-14 main battle tank Armata variant. The T-14 is a complete departure from previous Soviet and Russian tanks, all of which take their design cues from the lessons the Red Army learned fighting the Wehrmacht during the Second World War. Soviet tanks were relatively simple, extremely rugged and produced in mass quantities. Soviet tanks placed less emphasis on matching Western tanks one for one and more on overwhelming the adversary using sheer numbers—crew survivability was a secondary concern. Every Russian tank, including the T-90, followed this basic design philosophy. The T-14, from all appearances, seems to have abandoned the traditional Russian way of designing armored vehicles. Instead of a relatively simple design, the T-14 is fitted with a number of very advanced features that have never been implemented in an operational tank anywhere else in the world. Moreover, for the first time, the Russian military seems to have placed a premium on crew survivability. That could be a result of Russia's push to professionalize its military and possibly due to the country's declining demographics. What immediately sets the Armata apart from any other operational tank is that it has an unmanned turret. The advantage is that the crew compartment is physically separated from the ammunition. Further, the tank is equipped with passive laminated armor combined with reactive armor and an active protection system. The Afghanit active protection system allegedly includes millimeter-wave radars to detect, track and intercept incoming rounds. Taken in aggregate, the Armata offers much-better crew survivability than any previous Russian or Soviet tank—assuming all of these features work. While the unmanned turret offers much better crew survivability, it also has some drawbacks. The crew has to entirely rely on their sensors for situational awareness and targeting. That's not a huge drawback normally, but it could be a problem if the tank is hit and its sensors or electronics are knocked out. That might mean even a glancing blow to the turret results in a mission kill where the tank is drivable, but unable to shoot back. Versus the M1A2 SEP v2 or the follow-on M1A3, it's an open question as to which is the better tank. The Abrams is a proven, reliable design that is still being upgraded. The forthcoming M1A3 will be somewhat lighter and more mobile. The U.S. Army also plans to replace the 120mm M256 smoothbore gun with a lighter version. New guided projectiles might also enable the Abrams to hit targets as far away as 12,000m. But Russian tanks are also equipped to fire anti-tank guided missiles via their main gun—it's really a question of who sees the other first. Much of how the Armata will perform on the battlefield will depend on how much progress Russia has made in developing the tank's sensors and data-networks. The tank that sees the enemy first almost always wins the fight. The Armata is a new design, and it will inevitably have teething problems as it matures. Further, there is the question of whether the T-14 can be produced in numbers—that's very much a factor, given the state of Russia's economy. Ultimately, it could prove to be a formidable weapon. *** Time to consider matchmaking Russia's favorite new Armata tank with America's ex-favorite antitank missile, the TOW! Yes, you heard that last part right, the TOW has been sold all over the world—but America's starry eyes of antitank love have wandered to greener pastures. Ever since the United States military began deploying the top-attack Javelin missile in the mid-1990s, it's been handing them out like alcopops at a bachelorette party to its frontline troops—nearly every infantry squad has a few it can call its own. |

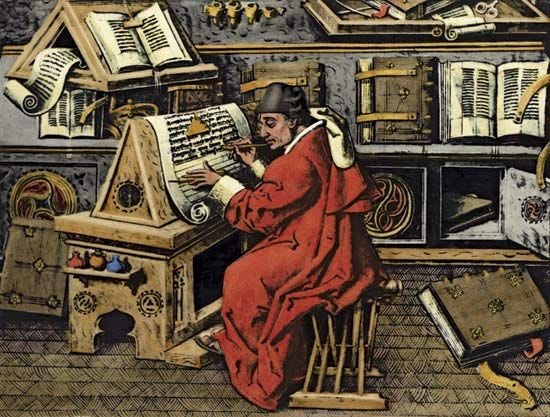

| Nassim Taleb Exposes The World's "Intellectual-Yet-Idiot" Class Posted: 16 Sep 2016 06:10 PM PDT Authored by Nassim Nichaolss Taleb via Medium.com, What we have been seeing worldwide, from India to the UK to the US, is the rebellion against the inner circle of no-skin-in-the-game policymaking “clerks” and journalists-insiders, that class of paternalistic semi-intellectual experts with some Ivy league, Oxford-Cambridge, or similar label-driven education who are telling the rest of us 1) what to do, 2) what to eat, 3) how to speak, 4) how to think… and 5) who to vote for. But the problem is the one-eyed following the blind: these self-described members of the “intelligenzia” can’t find a coconut in Coconut Island, meaning they aren’t intelligent enough to define intelligence and fall into circularities?—?but their main skills is capacity to pass exams written by people like them. With psychology papers replicating less than 40%, dietary advice reversing after 30 years of fatphobia, macroeconomic analysis working worse than astrology, the appointment of Bernanke who was less than clueless of the risks, and pharmaceutical trials replicating at best only 1/3th of the time, people are perfectly entitled to rely on their own ancestral instinct and listen to their grandmothers (or Montaigne and such filtered classical knowledge) with a better track record than these policymaking goons. Indeed one can see that these academico-bureaucrats wanting to run our lives aren’t even rigorous, whether in medical statistics or policymaking. They cant tell science from scientism?—?in fact in their eyes scientism looks more scientific than real science. (For instance it is trivial to show the following: much of what the Cass-Sunstein-Richard Thaler types?—?those who want to “nudge” us into some behavior?—?much of what they call “rational” or “irrational” comes from their misunderstanding of probability theory and cosmetic use of first-order models.) They are prone to mistake the ensemble for the linear aggregation of its components as we saw in the chapter extending the minority rule. The Intellectual Yet Idiot is a production of modernity hence has been accelerating since the mid twentieth century, to reach its local supremum today, along with the broad category of people without skin-in-the-game who have been invading many walks of life. Why? Simply, in many countries, the government’s role is ten times what it was a century ago (expressed in percentage of GDP). The IYI seems ubiquitous in our lives but is still a small minority and rarely seen outside specialized outlets, social media, and universities?—?most people have proper jobs and there are not many opening for the IYI. Beware the semi-erudite who thinks he is an erudite. The IYI pathologizes others for doing things he doesn’t understand without ever realizing it is his understanding that may be limited. He thinks people should act according to their best interests and he knows their interests, particularly if they are “red necks” or English non-crisp-vowel class who voted for Brexit. When Plebeians do something that makes sense to them, but not to him, the IYI uses the term “uneducated”. What we generally call participation in the political process, he calls by two distinct designations: “democracy” when it fits the IYI, and “populism” when the plebeians dare voting in a way that contradicts his preferences. While rich people believe in one tax dollar one vote, more humanistic ones in one man one vote, Monsanto in one lobbyist one vote, the IYI believes in one Ivy League degree one-vote, with some equivalence for foreign elite schools, and PhDs as these are needed in the club.

More socially, the IYI subscribes to The New Yorker. He never curses on twitter. He speaks of “equality of races” and “economic equality” but never went out drinking with a minority cab driver. Those in the U.K. have been taken for a ride by Tony Blair. The modern IYI has attended more than one TEDx talks in person or watched more than two TED talks on Youtube. Not only will he vote for Hillary Monsanto-Malmaison because she seems electable and some other such circular reasoning, but holds that anyone who doesn’t do so is mentally ill. The IYI has a copy of the first hardback edition of The Black Swan on his shelves, but mistakes absence of evidence for evidence of absence. He believes that GMOs are “science”, that the “technology” is not different from conventional breeding as a result of his readiness to confuse science with scientism. Typically, the IYI get the first order logic right, but not second-order (or higher) effects making him totally incompetent in complex domains. In the comfort of his suburban home with 2-car garage, he advocated the “removal” of Gadhafi because he was “a dictator”, not realizing that removals have consequences (recall that he has no skin in the game and doesn’t pay for results). The IYI is member of a club to get traveling privileges; if social scientist he uses statistics without knowing how they are derived (like Steven Pinker and psycholophasters in general); when in the UK, he goes to literary festivals; he drinks red wine with steak (never white); he used to believe that fat was harmful and has now completely reversed; he takes statins because his doctor told him so; he fails to understand ergodicity and when explained to him, he forgets about it soon later; he doesn’t use Yiddish words even when talking business; he studies grammar before speaking a language; he has a cousin who worked with someone who knows the Queen; he has never read Frederic Dard, Libanius Antiochus, Michael Oakeshot, John Gray, Amianus Marcellinus, Ibn Battuta, Saadiah Gaon, or Joseph De Maistre; he has never gotten drunk with Russians; he never drank to the point when one starts breaking glasses (or, preferably, chairs); he doesn’t know the difference between Hecate and Hecuba; he doesn’t know that there is no difference between “pseudointellectual” and “intellectual” in the absence of skin in the game; has mentioned quantum mechanics at least twice in the past 5 years in conversations that had nothing to do with physics; he knows at any point in time what his words or actions are doing to his reputation. But a much easier marker: he doesn’t deadlift.  Not a IYI |

| The Best Work Gloves For Preparedness Posted: 16 Sep 2016 05:40 PM PDT by Ken Jorgustin, Modern Survival Blog:

Long, long ago I learned the difference between the so called 'cheap' work gloves and those that you pay more for. The cheap gloves will tear up quickly while the best work gloves will provide much better protection for a much longer time. I'll bet that most all of you have at least one pair of ordinary work gloves. However for those of you who are into preparedness, just imagine how much more hard laborious work you will be doing if and when your preparedness plans go into action. You will need at least several pairs of good heavy duty work gloves. And if a true SHTF collapse comes your way, you may need even more than that – depending on the longevity of the collapse. I must say, when researching good or 'best' work gloves, you will discover that there are LOTS of choices out there. Even when looking on Amazon, there are seemingly a zillion of them. I suppose that one wouldn't really know what's truly best for them unless they tried them all! While it would be impossible to sample every work glove out there, at least you can go by the old 'rule of thumb'… 'you get what you pay for'. Personally, I have been using Wells Lamont work gloves as my 'go to' pair – of which I have many Massive Sinkhole Opens In Florida Releasing Millions Of Gallons Of "Slightly Radioactive" Water Posted: 16 Sep 2016 03:55 PM PDT Floridians are no strangers to massive sinkholes opening up in their porous terrain often resulting in damage to surface infrastructure built on what was thought to be stable ground. But, for the latest massive sinkhole that just opened up in Mulberry, Florida, the problem isn't what damage was caused on the surface but rather what was allowed to leak into the Floridan aquifer. Measuring in at a massive 40 feet in diameter, the latest Florida sinkhole opened up directly underneath a gypsum stack at Mosaic's phosphate fertilizer producing New Wales facility about 30 miles east of Tampa. According to local news reports, the retention pond was holding 215 millions of gallons of contaminated water that drained into the Floridan Aquifer. The water was described by Mosaic employees to be contaminated with phosphoric acid and is thought to be "slightly radioactive." As long as it's only "slightly radioactive" then it's probably OK.

Of course, per NBC, despite taking a week to discover the sinkhole and admitting they have no idea where the contaminated water flowed once underground, Mosaic has assured nearby homeowners, many of whom rely on well water, that there is no cause for concern. Mosaic even offered to test the water of worried homeowners, free of charge. Isn't that incredibly nice?

Mosaic also confirmed to the Tampa Bay Times that the "sinkhole reaches the Floridan aquifer" but maintained that they have found "no off-site impact from the water loss."

Yes, we too have "little" doubt that Mosaic was able to recover all of the contaminated water before it spread elsewhere in the massive interconnected Floridan aquifer which is just the "largest, oldest, and deepest aquifer in

Mosaic's New Wales facility is located in about 30 miles directly east Tampa and produces phosphate fertilizer and animal feed ingredients with finished products including Diammonium Phosphate (DAP), Monoammonium Phosphate (MAP) and Powdered MAP (PMAP); and feed ingredients: Biofos, Dynafos and Multifos.

The retention pond on the southwest corner of Mosaic's property was the one that drained completely into the Floridan aquifer.

As if the complete collapse of farming incomes in the U.S. wasn't putting enough pressure on Mosaic's stock, now they have to contend with massive sinkholes opening up under their plants? |

| Global Elites Prepare Underground Cities Posted: 16 Sep 2016 03:10 PM PDT society is an illusion.. presidents .. government.. in officials.. all bullshit! wake up! money I not real! it has no worth! it's an illusion..wake up..you need no leaders.. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Robert Kiyosaki Last warning to america 100 dollar will collapse end of 2016 Posted: 16 Sep 2016 02:50 PM PDT Robert Toru Kiyosaki is an American businessman, investor, self-help author, educator, motivational speaker, activist, financial commentator, and radio personality. Wikipedia The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Book Review: The New Case For Gold Posted: 16 Sep 2016 02:09 PM PDT This post Book Review: The New Case For Gold appeared first on Daily Reckoning. Book Review: The New Case For Gold – James Rickards Jim Rickards book The New Case For Gold came out in April 2016. Since then, its analysis and message has given light to the financial monetary system that continues to play out today. The book continues to be a global bestseller. Below is a visual review of Rickards’ book with insightful commentary. Nick Wright does a fantastic video review of the book and the diverse range of topics it covers. If you are interested in reading more check out The New Case For Gold here. Regards, Craig Wilson Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post Book Review: The New Case For Gold appeared first on Daily Reckoning. |

| Gold Daily and Silver Weekly Charts - FOMC Next Week - Little Finger and Cersei Posted: 16 Sep 2016 01:51 PM PDT |

| The Video Hillary Clinton Doesn't Want Seen! (2016-2017) Posted: 16 Sep 2016 01:24 PM PDT Hillary Clinton's Strange Behavior: WHAT IS GOING ON? Shocking Video clinton works like a demon bill clinton faints 911 memorial bizarre interview hillary clinton president presidential race 2016 2017 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| End Times Headline News - September 16th, 2016 Posted: 16 Sep 2016 12:30 PM PDT End of the week and its a mess in the world. The Bible has predicted all of this and this is it. These are your end times headline news from across the world. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| MARINE LE PEN : "THIS IS A FUNERAL" FOR THE EU Posted: 16 Sep 2016 12:02 PM PDT Joe Barnes for the Express UK reports MARINE LE PEN has dealt a crippling blow to the European Union by promising she will hold a referendum to decide whether France remains in the Union if she becomes president. The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 16 Sep 2016 10:53 AM PDT Gold’s young bull market has totally stalled out in the past couple months. This major loss of momentum following gold’s powerful surges in 2016’s first half is really souring sentiment and vexing traders. They are trying to figure out if gold’s recent consolidation drift is the dawn of a new bearish trend or a healthy pause within an ongoing bull. The likely answer comes from understanding what’s causing gold’s high consolidation. Back in mid-December right after the Fed’s first rate hike in 9.5 years, gold slumped to a miserable new 6.1-year secular low. That was driven by heavy gold-futures selling from speculators, who were utterly convinced higher rates are gold’s mortal nemesis. But with bearishness so extraordinary and investors’ gold allocations so low, a mighty mean reversion higher for gold was very likely in 2016 as I wrote in late December. |

| Trump or HIlary? Which Presidents Have Been Best for the Gold Market? Posted: 16 Sep 2016 10:41 AM PDT In previous articles, we have examined the gold’s performance in different election cycle years. Now, we deepen our analysis and investigate the behavior of the shiny metal in each presidential cycle in more detail. We analyze how gold performed under each President and which governing party (or whether the new President is an incumbent or a newcomer) affects the gold market the most. The first cycle ran from 1973 to 1976, when Richard Nixon (who in 1971 closed a gold window), and later, after the Watergate scandal, Gerald Ford were in office. As the gold standard was abandoned, while inflation and uncertainty surged, it was a good period for the shiny metal, which rallied 114.27 percent. |

| Do You Want to Retire Rich? Then Read This… Posted: 16 Sep 2016 09:00 AM PDT This post Do You Want to Retire Rich? Then Read This… appeared first on Daily Reckoning. Mutual fund managers messed the bed again… A not-so-surprising new study released by S&P Global reveals that 9 out of 10 U.S. equity funds failed to beat the market over the past year. Those billions in management fees investors paid to Ivy League-educated fund managers to outperform the market? Complete waste of money. Alas, this is nothing new. For the past 14 years, most U.S. equity fund managers have underperformed all benchmarks – an organized fraud that is perhaps the single biggest scam ever pushed onto ordinary people and their savings. And that's why millions of average investors have abandoned managed mutual funds for passive index funds – a smart move… or so they thought. But what most investors don't realize is that when they make this shift, they're going from the frying pan into the fire. And the results will destroy your retirement. The Wrong RemedyIt's plain as day: Managed equity mutual funds are getting crushed… The Financial Times reports that roughly $330 billion flowed out of actively managed U.S. mutual funds through July 31. And July was a record month for outflows. During this same time period, $400 billion has flowed into passive funds that simply track an index. That's a freaking massive shift in assets. You can't blame investors. Fund managers are paid to add value and provide downside protection. But they clearly have no skill. They're only in the game to wring fees from the ignorant masses. No one should settle for this type of abuse. But the big problem here is that the passive index funds remedy proactive investors are seeking is pure disaster. Sure, passive index funds may outperform actively managed mutual funds. But if you're holding index funds when the next meltdown strikes… when the next black swan swims in… you'll still be screwed. How to Avoid a Devastating MistakeJust as investors were "sold" the benefits of active management, they have now been "sold" the benefits of passive management. Huge marketing campaigns have pitched low-fee index funds that track overall stock market performance and "buy and hold on" for the long term as the solution to managed underperformance. This marketing strategy works great when markets go up and the bull looks like it will live forever. But we've seen two 50% drops on the S&P in the last 15 years. The only reason the third has not yet appeared is due to QE, ZIRP, NIRP, and other central bank shenanigans that have unfolded in the shadows. Consider this real-life scenario… Imagine you've decided to retire at 65 years old. You've saved $1 million, which seems like enough to support you and your loved ones throughout your retirement years. Suddenly, financial markets crap-out much like the 2008 crash, or even worse. And your retirement account loses 50% of its value in a matter of weeks or months. Now you're down to $500,000. And you begin withdrawing $60,000 a year to cover living expenses. Even if we assume a generous growth rate of 8% a year (and what "buy and hold" model can guarantee that?), your portfolio won't last too long. You'll run out of money by the time you're about 80 years old! What happens if you live another 10 or 20 years? You have no source of income. You're dead broke. Look, if you invest in stocks over a long period of time, you will experience market drops of 50% or more. Take that to the bank. And it can be far worse than that. Remember the Nasdaq after the dotcom bubble? It dropped 77%. The market has historically suffered a downturn of at least 50% every ten years or so. That means we are due… And this could become a huge problem if those losses happen when you're close to retirement with decent-sized nest egg. That's because withdrawals will reduce the size of the account ongoing, making it impossible to catch up. Think of it this way too: If the market drops 50%, your account will have to rise 100% just to go back to break even. And if you're withdrawing money to cover expenses, then the market will have to go even higher for you just to find break even. Bottom line: Unless you expect to live forever (and have enough time to recover from downturns), buying and holding passive index funds is like taking free candy from the Devil. Sadly, most people do not ask critical questions when it comes to money and markets. Many simply accept that you can't beat the market and "buy and hold" is like Grandma's soup – good for you. That's exactly how investors were drilled between the eyes with devastating losses in 2008. Trend followers don't think that way. We don't settle for misery. Don't just accept the propaganda that major media and government hacks bombard you with. Question all assumptions. And know this: You really can outperform the passive index market world and protect your capital during market meltdowns. Actively managed mutual funds and "buy and hold" are your worst options. If you have a pulse, if you are still not fully brainwashed by the zeitgeist of government mind slavery, and if you still really want the chance to get rich and cover your retirement, trend following is not the only way to go – but it's the damn best way. Please send your comments to me at coveluncensored@agorafinancial.com. Let me know what you think of today's issue. Michael Covel The post Do You Want to Retire Rich? Then Read This… appeared first on Daily Reckoning. |

| CME Group plans more futures to shift money from metal to paper Posted: 16 Sep 2016 07:52 AM PDT CME to Seize on Popularity of Gold/Silver Ratio with New futures By Tom Jennemann The gold/silver ratio has been a fashionable topic in analyst reports and financial blogs for the past several years but trading the ratio has been complicated. The CME Group is looking to remedy this problem. On Oct. 23 the exchange will launch precious metals spread and ratio futures contracts for gold/silver, gold/platinum, and platinum/palladium. "This is a real example of our basic strategy going forward. We want to solve people's problems using the liquidity that we already have," Miguel Vias, CME Group head of precious metals, told FastMarkets. "The gold/silver ratio is something that I used to trade frequently when I was a trader but it was relatively cumbersome to do on the OTC market. This will make it very easy to do. It will also be sized in a way that's accessible to a myriad of market participants. So it's just not meant for intuitional investors," he added. ... ... For the remainder of the report: https://www.fastmarkets.com/base-metals-news/base-metals/focus-cme-to-se... ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold Is The Ultimate Wealth Preservation Against Reckless Governments Posted: 16 Sep 2016 07:49 AM PDT Gold Is The Ultimate Wealth Preservation Against Reckless Governments |

| Bullion Star's informational graphic about the Indian gold market Posted: 16 Sep 2016 07:06 AM PDT 10:05a ET Friday, September 16, 2016 Dear Friend of GATA and Gold: Bullion Star proprietor Torgny Persson today presents an informational graphic about the gold market in India, where government long has waged war against gold and where the people can't get enough of it anyway. The graphic is posted at Bullion Star here: https://www.bullionstar.com/blogs/bullionstar/infographic-the-indian-gol... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT NewCastle Gold's New CEO, Gerald Panneton, Hits the Ground Running By Tommy Humphreys Mining entrepreneur Gerald Panneton took a few years off after building one of Canada's largest gold miners, Detour Gold. He raced performance cars in his down time, and conducted due diligence on various mining assets to potentially back. This summer, the geologist set his sights on NewCastle Gold (TSXV:NCA), owner of a past-producing gold mine in California with similarities to Detour Gold in its early days. ... ... For the remainder of the report: https://ceo.ca/@tommy/new-newcastle-gold-ceo-gerald-panneton-hits-the-gr... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Fed Rate Rise? Gold Price Goes Up Says History Posted: 16 Sep 2016 06:13 AM PDT Bullion Vault |

| Deutsche Bank Initiates Coverage of Silver Wheaton Posted: 16 Sep 2016 02:32 AM PDT Citing a strong balance sheet and a large portfolio of diverse gold and silver streaming assets worldwide, Deutsche Bank has initiated coverage of Silver Wheaton with a Buy rating. |

| War is Peace, Silver is Plentiful, and Other Misconceptions Posted: 16 Sep 2016 12:30 AM PDT The urgency for owning a financial put against the stupidity of central planners and politicians grows by the minute. We continue to witness a multifaceted array of failure heaped upon failure while repeating history on a dramatic scale. One of the great new wonders of the modern world is the credibility given to high profile economists. |

| Another Billionaire Warns of Catastrophic Depths Not Seen in 5,000 Years – and Emphasizes Gold Posted: 16 Sep 2016 12:21 AM PDT In past issues, we’ve documented increasingly concerned billionaires warning of dangerous economic times. Many have favored gold as an alternative allocation in a world where $13 trillion-worth of debt is negative yielding, interest rates are artificially suppressed and we’re on the brink of major wars. The newest addition to this gold-loving billionaire’s club, is none other than hedge-fund manager Paul Singer. At CNBC’s Delivering Alpha Investors Conference this week, the founder of the $27-billion Elliott Management Fund, the 17th largest hedge fund in the world, mentioned that at current prices gold is “undervalued” and “underrepresented in many portfolios as the only … store of value that has stood the test of time.” |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

In this publication, we warn regularly of the risk involved in storing wealth in banks. They've made the removal of your deposits increasingly difficult, in addition to colluding with governments to allow them to legally freeze or confiscate your money. To add insult to injury, they're creating reporting requirements with regard to the contents of safe deposit boxes and restricting what can be stored in them – again, at risk of confiscation.

In this publication, we warn regularly of the risk involved in storing wealth in banks. They've made the removal of your deposits increasingly difficult, in addition to colluding with governments to allow them to legally freeze or confiscate your money. To add insult to injury, they're creating reporting requirements with regard to the contents of safe deposit boxes and restricting what can be stored in them – again, at risk of confiscation. We have not seen anything like the meltdown of Hillary Clinton in USSA politics in many years, perhaps never. I certainly cannot recall either the Republican or Democratic party ever knowingly nominating a candidate as profoundly ill as Hillary Clinton to represent the party in the presidential election contest.

We have not seen anything like the meltdown of Hillary Clinton in USSA politics in many years, perhaps never. I certainly cannot recall either the Republican or Democratic party ever knowingly nominating a candidate as profoundly ill as Hillary Clinton to represent the party in the presidential election contest. Much has been written when it comes to Russia’s new supposed super tank, the Armata T-14. To be clear, the T-14 is actually part of something called “The Armata Universal Combat Platform.” This consists of the T-14 main battle tank, the T-15 heavy infantry fighting vehicle and the T-16 armored recovery vehicle, among a host of other vehicles.

Much has been written when it comes to Russia’s new supposed super tank, the Armata T-14. To be clear, the T-14 is actually part of something called “The Armata Universal Combat Platform.” This consists of the T-14 main battle tank, the T-15 heavy infantry fighting vehicle and the T-16 armored recovery vehicle, among a host of other vehicles.

The best work gloves for preparedness will be those designed for general everyday wear, and will be made from quality heavy-duty materials that hold up to the test of time.

The best work gloves for preparedness will be those designed for general everyday wear, and will be made from quality heavy-duty materials that hold up to the test of time.

No comments:

Post a Comment