Gold World News Flash |

- Evaluating The “Rally”: How Long To Get To $10,000/oz?

- DOES THE DOLLAR HOLD THE SAME FATE AS THE REICH’S BANK NOTE

- As Her Health Declines, Hillary’s Body Double REVEALED! Breaking News

- Wells Fargo and Other Banks Now Just Outright Stealing People's Money

- The World Is Turning Ugly As 2016 Winds Down

- 1 In 5 CEOs Are "Successful Psychopaths"

- Venezuela's "Death Spiral" - A Dozen Eggs Cost $150 As Hyperinflation Horrors Hit Socialist Utopia

- The Gold To Housing Ratio As A Valuation Indicator

- Not Everyone Went Down With The Titanic

- Gold: The Best Performing Asset of the 21st Century - Rory Hall

- Desperately Poor Teens In America's Impoverished Inner Cities Are Trading Sex For Food

- Prophecy Update End Time Headlines 9/14/16

- Who is Donald Trump?

- Gold Daily and Silver Weekly Charts - Blast Radius

- Jesse Ventura on Trump, Hillary, and the Broken System

- Look to the Junior Gold Miners For Outsized Gains To Precious Metals

- ANONYMOUS Message About the New World Order 2016 System Failure EXPOSED!

- Global Oil Could Make A Hit On U.S Dollar

- GATA's Murphy and Powell interviewed by Lars Schall for Gold Switzerland

- We are in Deep Trouble - Tech Giants Are Uniting, Creating Group to Self-Police

- Wells Fargo and Other Banks Now Just Outright Stealing People’s Money

- Have Central Banks Lost Control - 14 Sept 16

| Evaluating The “Rally”: How Long To Get To $10,000/oz? Posted: 14 Sep 2016 10:01 PM PDT by Jeff Nielson, Sprott Money:

The rally started almost precisely on the first day of the year (nothing suspicious about that). In the 8 ½ months since then, the price of gold has risen by roughly $250, or a little below $30/month. For convenience, let's say that the price has been advancing by about $1 per day.

For the sake of argument, let's pretend that this is a real rally, and see how long it would take to reach any rational price targets. Let's start with a big target: a fair and rational price for gold – today . A previous commentary pegged that fair price at $10,000/oz, calculated in relation to a fair price for silver, today: $1,000/oz. The 10:1 price ratio between the two metals (rather than the historic ratio of 15:1) is based upon the fact that most of the world's silver stockpiles have been literally consumed, thus the supply ratiobetween gold and silver has not been this low in at least 500 years. How long would it take the price of gold to get to $10,000/oz, with the price advancing by $1/day? With the price differential between the current price ($1325/oz US) and the fair price for gold a little less than $8,700, it would take a little less than 8,700 days for the market to reach that price level. The "rally" in the gold market would have to continue for roughly 25 years, just for the price of gold to reach a level which it should already be at – today. Some readers will find this metric unconvincing. They have been deluged with mainstream media propaganda for so long that they cannot even conceive of a fair price for gold. So let's move to a lower target. Gold is a monetary metal . As such its price must precisely reflect changes in the monetary base. Between 2009 and 2014; the Federal Reserve quintupled the U.S. monetary base – the infamous Bernanke Helicopter Drop . At the time the Helicopter Drop began, the price of gold was at roughly $800/oz. Thus if we ignore all of the other positive fundamentals of the gold market, and we pretend that the price of gold at the end of 2008 ($800/oz) was a fair price, the price of gold had to rise to at least $4,000/oz, by the end of 2014. Of course the Federal Reserve's conjuring of mountains of funny-money is only one of many positive fundamentals for the gold market. The price of $800/oz at the end of 2008 was not a fair price. It was absurdly low, due to the serial price-manipulation of which all informed readers are very familiar. Thus a price for gold of $4,000/oz – at the end of 2014 – would also have been absurdly low. How long would it take for the price of gold to reach this low, 2014 price-target, at the pathetic pace of today's Fake Rally ? We're now dealing with a price differential of a little less than $2,700, meaning a little less than 2,700 days to reach a somewhat fair price for gold – in 2014. Eight more years. It would take nearly eight more years of this pseudo-rally for the price of gold to reach an absurdly low price target, which it should have already hit, in 2014. This would make the total length of this hypothetical rally a little over 8 ½ years, with the price advancing from a sub-$1,100/oz price up to $4,000 – a total move of roughly 370%. Now let's compare this to the ten-year bull market from 2001 to 2011. During that period, the price of gold moved from roughly $300/oz to nearly $2,000/oz. That's a move of approximately 670%, and this significant advance in price came despite the fact that the manipulation of the price of gold was, in some respects, more extreme during those years than what we see today. Back then, Western central banks were still pounding the market with their official gold-dumping: 500 tonnes per year. But Western central banks have long since run out of gold to dump, and now central banks in other parts of the world having been buying gold – at a pace not seen in more than 30 years. The 500 tonnes per year of gold-dumping has nearly been reversed , a positive differential of nearly 1,000 tonnes per year in supply/demand fundamentals. |

| DOES THE DOLLAR HOLD THE SAME FATE AS THE REICH’S BANK NOTE Posted: 14 Sep 2016 09:20 PM PDT from Money and Trading:

What would the person holding this note in 1922 have to share with the people around the world today? Was this one of the Reichs bank notes stacked next to a fireplace to keep a home warm? Did the wheelbarrow this currency was sitting in get stolen, or did it just end up in the street when it was deemed utterly worthless?

This is what the end of fiat currency looks like. At least back then, the money had to physically be printed. "When Money Dies" by Adam Fergusson, gives insight on what an economy goes through when monetary policy is out of control. Today there are trillions of dollars on computers screens. Zeros can be added at warp speed. Most of the currency from the bailouts is still sitting on bank balance sheets. When these dollars start to move into the US economy, prices will start to rise. This may signal the beginning of the end. In 1792, the death penalty was issued to those who counterfeited money. The founding fathers lived through the collapse of the continental dollar, and did not want their heirs to experience the same problem. When a country debases its money, and goes to a paper currency, the currency always goes to zero. Bill Bonner asked Addison Wiggin to list all of the fiat currencies throughout history, and what happened to each of them. As he got through the letter A and half way through the letter B, Addison discovered the first 600 fiat currencies all went to zero. Fiat currencies going to zero is the norm, not the exception. Things are good today and will continue to be good for the short term. When economies begin to head south, it's important the people understand these problems were not caused by government officials, the rich, or capitalism. Undoubtedly, this is where the media will try to place the blame. The real culprit is having a money supply backed by nothing, otherwise known as fiat currency. |

| As Her Health Declines, Hillary’s Body Double REVEALED! Breaking News Posted: 14 Sep 2016 08:20 PM PDT by Kosar, The Political Insider:

In less than one hour, Hillary Clinton went from fainting to appearing before the press looking well. How did she recover so quickly? On Google, a search for "Hillary's body double" is trending, after a handful of strange events. After the fainting video went viral, her movements seemed seizure-like and far worse than the pneumonia her campaign just admitted to. Her bizarre actions have caused people to think Hillary Clinton has a body double. Reporters were getting upset at Hillary's spokesman Nick Merill, as he kept them in the dark about what happened to her after the serous collapse. As Breitbart explains:

The campaign went to great lengths to ensure no one from the media followed them. Politico reported on the coverup: "[A]ccording to Politico Playbook quoting USA Today's Eliza Collins – Clinton's pool reporter on Sunday – 'the campaign kept her in the dark about Clinton's whereabouts." Reports are surfacing that husband Bill Clinton encouraged Hillary Clinton to go to the hospital. But the media was informed she would be appearing outside of Chelsea's apartment. What happened? The Hillary that appeared looked younger and thinner, which is why people on social media started asking questions.

Then, in a very staged event, Hillary Clinton hugged a young girl, even though she supposedly has pneumonia. What's going on! As it turns out, Hillary Clinton really does have body doubles. One of them is named Teresa Barnwell. She's 61, and after professionally training to act like Hillary, has been impersonating her since the 1990s during the Clinton White House years. The similarities are uncanny:

Read More @ ThePoliticalInsider.com MUST HEAR RELATED: Hillary Clinton Death Rumor Debunked — Rick Wiles |

| Wells Fargo and Other Banks Now Just Outright Stealing People's Money Posted: 14 Sep 2016 07:30 PM PDT Get free from Central Powers/Control by using peer-to-peer cryptographically secure decentralized systems like Bitcoin, The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The World Is Turning Ugly As 2016 Winds Down Posted: 14 Sep 2016 07:15 PM PDT Submitted by Brandon Smith via Alt-Market.com, I have to say that the negative reverberations in our current economic and political environment are becoming so strong that it is impossible for people to not feel at least some uneasiness in their gut. I imagine this is the same kind of sensation many felt from 1914 to 1918 during World War I and the terrible birth of communism, or perhaps in the early 1930s at the onset of the Great Depression and the rise of fascism. Some global changes are so disturbing that they send shockwaves through the collective unconscious before they ever hit the mainstream. People know that something is about to happen, even if they cannot yet clearly define it. At the beginning of August in my article “2016 Will End With Economic Instability And A Trump Presidency” I stated that:

Unfortunately, it would seem so far that this prediction was correct. Currently global markets have crossed into severe volatility with a vengeance after around three months of eerie calm. Why? Well, as I warned in the same article linked above as well as numerous others since the beginning of this year, the Federal Reserve is determined to continue raising interest rates into a recessionary environment as they almost always do, and equities markets addicted to cheap debt cannot tolerate even one additional rate hike from the central bank. So far all evidence suggests that the Fed plans to raise rates again soon; I believe at the end of this month. The only seemingly "anti-hike" voice at the Fed so far has been board member Lael Brainard, but even her statements promote a false narrative that a America is on track to "recovery". Many normally “dovish” members of the Fed have openly suggested that now is the time to hike. Voting members at the Fed have been vocal about a shift in policy. The latest example being head of the Bank of Cleveland, Loretta Mester. She argues that rates have remained “too low for too long,” and rejected notions that lower rates are necessary to maintain stability. This is the same kind of language Fed members used right before the rate hike in December 2015, the first rate hike in around a decade. And, to add to the fervor, even JP Morgan Chase head Jamie Dimon is calling for interest rates to rise. Get ready folks, because all the naysayers that claimed another rate hike is “impossible" are probably about to be proven wrong yet again. My warning on an accelerating Trump campaign being blamed for weak stock markets has also come true. Already, Bloomberg is launching the meme that the idea of Hillary Clinton losing the election to Trump “because of her health” is a “landmine for vulnerable markets.” This is some incredible spin by the elitist controlled media, but again, very predictable. The globalists are setting the stage to blame the economic collapse they created on conservative movements. Clinton’s “health issues” are being set up as the scapegoat for a Trump win, which conjures additional social unrest as many on the Left will argue (in the event of a Trump win) that Trump prevailed on a technicality. That is to say, the extreme Left will argue that Trump’s presidency is not legitimate. Another scenario is also possible but I think less likely — the potential for Clinton to bow out of the election due to her health, causing a rationale for a postponed election. I do not think a postponed election really serves the interests of the elites, but it would certainly trigger massive chaos if it occurred. Only in the strangest of any election year in American history could this even be thought of as a legitimate danger. Another global indicator, oil, is tumbling yet again as all the jawboning from OPEC on a “production freeze” has failed to boost crude prices for more than a week at a time. Frankly, no one is buying the hype anymore. Those who bet on the WTI index shooting past $50 to $60 a barrel this year should have been paying more attention to alternative analysts. The only other factor that has kept oil from crashing down into the $30 range has been random inventory draws. These reports, though, are little more than a stop gap. Companies have been shifting crude to different facilities in order to create the illusion of inventory draws and higher demand. But usually within a week the reports catch up to the real supply and an inventory spike sends oil crashing down again. Add to this the latest news that Congress has passed a bill allowing the families of 9/11 victims to sue the Saudi government for their part in the attack, and you have a recipe for a dumping of the dollar as the world’s petrocurrency. Even if Obama vetoes the bill, I believe a two-thirds majority of congress will override that veto. A catastrophe in oil markets is inevitable. Whether in oil markets or other sectors of finance and social stability, make no mistake, catastrophe is exactly what national governments are preparing for. This is most obvious today in the European Union. The German government in their first revision of their civil defense plan since the cold war has warned the public to prepare for an unspecified event by stockpiling at least 10 days worth of food and five days worth of water. Germany is also debating the idea of placing troops on the streets to “protect against ISIS.” And Germany is not alone. French presidential candidate Nickolas Sarkozy has made some highly disturbing statements on security in a recent interview, outlining measures he believes will best protect the public from “militants.” From Reuters:

Even in the face of Islamic extremism and terrorism, the concept of “detention facilities” where people are held without charge and without trial on the mere suspicion of being a danger to society should horrify anyone with any sense. The fact of the matter is, these violations of personal freedom and of due process are NEVER used for only one group of people. Totalitarian governments ALWAYS use one group as an excuse for the police state, then over time they expand the police state outwards to oppress everyone. This is the kind of rhetoric that liberty movement activists in the U.S. fought against in the National Defense Authorization Act (NDAA); but it is making a resurgence in Europe and in America as well. If you think Sarkozy is a marginal example, I recommend you re-watch this interview with Gen. Wesley Clark, who argues that “radicalized people” who are disloyal to the U.S. government should be placed in internment camps. He suggests that Britain, Germany and France need to take similar measures. It would appear that they are doing just that. Never forget that “radicalism” is an arbitrary designation, and the label can be applied to just about anyone for any reason. A trend in police state language is growing in the mainstream in the name of fighting terrorism, but the abrupt urgency in Europe is rather odd. Only a few months ago, EU leaders were using some outrageous mental gymnastics in order to avoid confronting the notion of Islamic terrorism. Now, they are suddenly concerned? Why? I believe Europe is about to witness a catalyst for financial crisis, and they are using terrorism as an excuse to preposition martial law resources before this event takes place. They don’t care about stopping ISIS, but they do care about locking down and controlling an angry citizenry in the wake of an economic downturn. If a few more terrorist attacks occur in the meantime, then hey, that only helps the elites in their efforts to pacify the public for the sake of “security.” Official preparedness warnings from Germany, for example, are of little use to the public. A supply of a mere ten days of food and five days of water is useless during any sizable crisis. But, the German government can now say that they “tried to warn people.” Sarkozy’s statements are the most blatant call for a police state I have yet seen from an establishment puppet politician, and this should worry people. The fact that he is being so open and honest about the end game indicates to me that a dangerous shift is imminent. It would appear, according to EU government behavior, that whatever is about to happen globally is going to hit hardest in Europe first and then spread to the U.S. and the rest of the world. I recommend readers watch the EU very carefully over the next few months. If you have any financial or survival preparations you have been putting off, I suggest you take care of them before the end of this year. From what I see so far, geopolitically and economically the global situation is only going to become more unstable in the near term. |

| 1 In 5 CEOs Are "Successful Psychopaths" Posted: 14 Sep 2016 06:50 PM PDT

That is the cunning plan of Australian psychologists following a study that found that about one in five corporate executives are psychopaths – roughly the same rate as among prisoners. As The Telegraph reports,

The global financial crisis in 2008 has prompted researchers to study workplace traits that may have allowed a corporate culture in which unethical behaviour was able to flourish... ironic indeed as Wells Fargo CEO Stumpf blames 5300 of his employees for 'nasty' behavior and is unable to see any top-down ethical collapse as behind the systemic fraud. To help CEOs "self-identify" as psychopaths, here is a quick test... How to tell if your boss is psychopathic, Machiavellian, a narcissist or – even worse – all three.

|

| Venezuela's "Death Spiral" - A Dozen Eggs Cost $150 As Hyperinflation Horrors Hit Socialist Utopia Posted: 14 Sep 2016 06:35 PM PDT Submitted by Susan Warner via The Gatestone Institute,

For many Venezuelans, by every economic, social and political measure, their nation is unravelling at breakneck speed. Severe shortages of food, clean water, electricity, medicines and hospital supplies punctuate a dire scenario of crime-ridden streets in the impoverished neighborhoods of this nearly failed OPEC state, which at one time claimed to be the most prosperous nation in Latin America. Today, a once comfortable middle-class Venezuelan father is scrambling desperately to find his family's next meal -- sometimes hunting through garbage for salvageable food. The unfortunate 75% majority of Venezuelans already suffering extreme poverty are reportedly verging on starvation. Darkness is falling on Hugo Chavez's once-famous "Bolivarian revolution" that some policy experts, only a short time ago, thought would never end. In a 2007 study on the Chavez years for the Washington, DC-based Center for Economic and Policy Research, Mark Weisbrot and Luis Sandoval wrote:

While it was not so long ago that many people heralded Venezuela as Latin America's successful utopian Socialist experiment, something has gone dreadfully wrong as the revolution's Marxist founder, Hugo Chavez, turned his Chavismo dream into an economic nightmare of unimaginable proportions. The question of whether Socialism can be an effective economic system was famously raised when Margaret Thatcher said of the British Labor Party:

In short: "The trouble with Socialism is that eventually you run out of other people's money." When President Nicolas Maduro inherited the Venezuelan Socialist "dream", in April of 2013, just one month after Chavez died, he was facing a mere 53% inflation rate. Today the Venezuelan bolivar is virtually worthless, and inflation is creeping to 500% with expectations of much more. A recent Washington Post report stated:

Chavez had the good fortune to die just before the grim reaper showed up on Venezuela's doorstep. According to policy specialist Jose Cardenas:

Maduro is doubling down on the failed Chavismo economic and social policies that have contributed to an inflationary crisis not seen since the days of the 1920's Weimar Republic in Germany, when the cost of a loaf of bread was a wheelbarrow full of cash. Demonstrations and public cries for food are the unpleasant evidence of a once-prosperous society being torn apart by the very largess that marked its utopian ideals less than a decade ago. There are dire reports of people waiting in supermarket lines all day, only to discover that expected food deliveries never arrived and the shelves are empty. In desperation, some middle class families have organized online barter clubs as helpless citizens seek to trade anything for diapers and baby food, powdered milk, medicines, toilet paper and other essentials missing from store shelves or available only on the black market for double and triple already impossibly inflated prices.. There are horrific tales of desperate people slaughtering zoo animals to provide their only meal of the day. Even household pets are targeted as a much-needed source for food. This is a desperate time for a desperate people. As things continue to worsen, President Maduro, unfortunately, is doubling down on the proven failed policies and philosophies of "Bolivarian Socialism," while diverting attention away from the crisis -- pointing fingers at so-called "enemies" of Venezuela such as the United States, Saudi Arabia and others. Efforts to convince Maduro to enlist help from outside have failed, according to a report in the Catholic magazine, Crux:

In what some economists have been calling a "death spiral", the government's failed economic policies are at the same time causing and trying to stem a runaway inflation with price-fixing policies which, in turn, are triggering shortages. Maduro is strongly urging businesses and farmers to sell their goods at severe losses, forcing shut-downs when the cost of doing business becomes prohibitive. According to a recent Bloomberg report, the black market is thriving because goods are unavailable at prices fixed by the government. There are reports of ordinary people quitting inadequate-paying jobs to set up black market operations, hoping to be able to make enough to sustain life. A dozen eggs was last reported to cost $150, and the International Monetary Fund "predicts that inflation in Venezuela will hit 720% this year. That might be an optimistic assessment, according to some local economic analysts, who expect the rate to reach as high as 1,200%." According to a Bloomberg report from April:

In the midst of this galloping cataclysm, there is no shortage of pundits who simplistically assert that the catastrophe is caused solely by the international collapse of oil prices. However, according to Justin Fox at Bloomberg:

Cronyism and corruption prevailed under Chavez when oil was selling at almost $200 a barrel -- at a time when Venezuela could have put some money away for the inevitable rainy day. But President Hugo Chavez and successor president Maduro, were busy buying votes and consolidating power with free giveaways, according to Michael Klare in The Nation. Behind the doom and gloom Venezuela's collapse is the continuing specter of street crime and murder, according to Time.com in a May 2016 report:

Venezuela's crime rate is one of the highest in the world. Called the world's most homicidal nation, Venezuela has more than street crime, thuggery and murder. Drug cartels, black marketeers, narcoterrorists, white collar criminals and money launderers are unfortunate hallmarks of the Chavez/Maduro legacy. The ruin of this once prosperous, oil-rich nation might be a harbinger for other nations, such as the United States, which may be tempted into believing that Socialist giveaway policies actually can provide the promise of a free lunch for longer than the next election cycle. Or might that be all many politicians need or want?

Venezuela's food shortages, hyperinflation, black marketeers, narcoterrorists and money launderers are unfortunate hallmarks of the legacy of Presidents Chavez (left) and Maduro (right). |

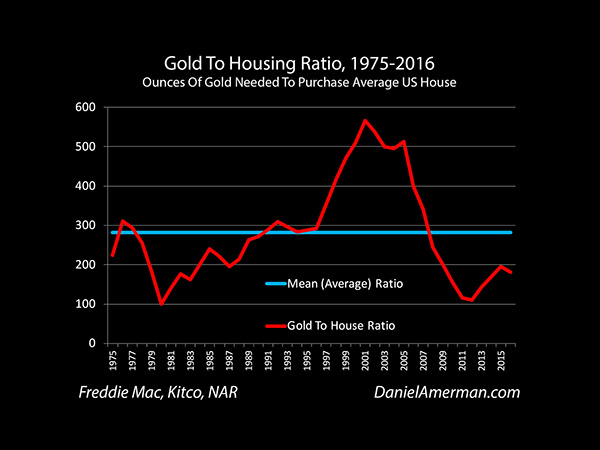

| The Gold To Housing Ratio As A Valuation Indicator Posted: 14 Sep 2016 06:20 PM PDT by Daniel R. Amerman, Gold Seek:

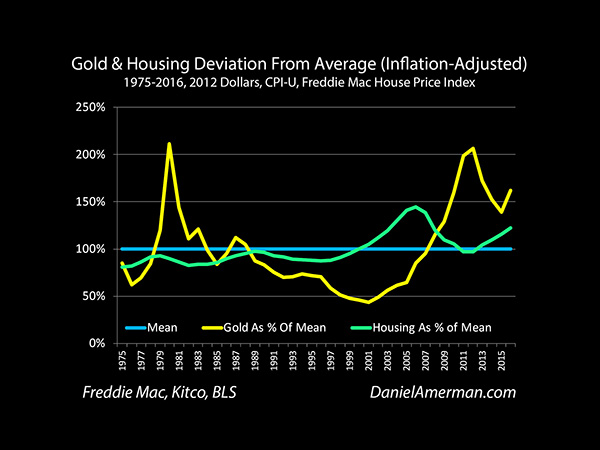

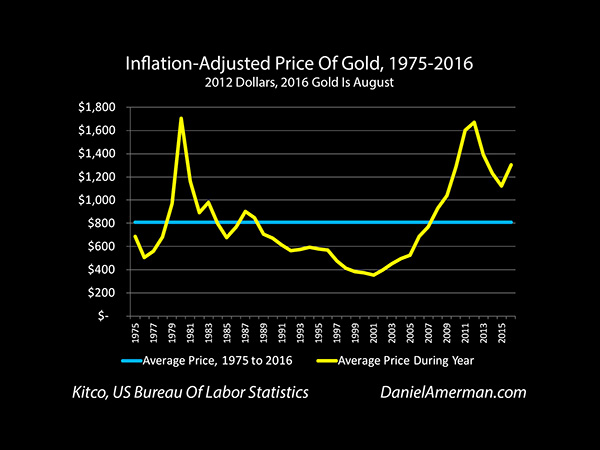

The Gold to Housing ratio is a measure of relative value between gold and real estate. It is the number of ounces of gold required to purchase an average single family home in the United States. Now people often buy gold and real estate as alternative investments, either because they are seeking fundamental diversification from financial assets such as stocks and bonds, or they are concerned about inflation. However, while real estate and gold are each tangible assets and can be powerful inflation hedges – they don’t tend to move together in real terms.

This can be clearly seen when we adjust historical prices for inflation, as shown above. Both investments do oscillate up and down around long term averages over the 40+ years, but they so in quite different cycles, with their peaks and valleys occurring in different years. When we take the $243,301 current median national price for an existing single family home and divide it by the $1,350 price per ounce of gold as of August 18, 2016, we come up with a Gold to Housing ratio of 180, meaning it takes 180 ounces of gold to purchase an average single family home (detailed methodology notes are available here). Key Current Analysis Results Below is a quick summary of 15 key points about the Gold to Housing ratio in 2016. I have been writing about these subjects for some years now, and for long-time readers I specifically point to the investment implications within that much larger body of work. The great majority of the information should still be clearly understandable for a first time or recent reader. I have been writing about these subjects for some years now, and for long-time readers I specifically point to the investment implications within that body of work. The great majority of the information should still be clearly understandable for a first time or recent reader. 1) Gold and housing are each above their long term averages in inflation-adjusted terms, with gold being much higher relative to its average valuation than we see with housing. 2) Both gold and housing have risen sharply in price in 2016 – but the increase in gold prices is much greater, on a percentage basis.

3) Gold is not acting as a “stable store of value”, because that is a myth in modern times. Instead gold has been acting as something much rarer and more desirable – which is as a contra-cyclical crisis hedge. This can be clearly seen with the two spikes in value that correspond to crisis and perception of crisis, and led to gold valuations in inflation-adjusted terms that were more than four times as high as the lowest annual average. However, this can be problematic for buy and hold strategies at current price levels, when people think they are buying a stable store of value, particularly when inflation taxes are taken into account. |

| Not Everyone Went Down With The Titanic Posted: 14 Sep 2016 05:35 PM PDT Submitted by Nick Giambruno via InternationalMan.com, It’s one of the most dangerous myths most people believe… Boobus Americanus thinks cash he deposits into a bank is a personal asset he owns. But that’s not true. Once a deposit is made at the bank, it’s no longer your property. It’s the bank’s. What you own instead is a promise from the bank to repay. It’s an unsecured liability. That’s a very different thing from owning physical cash stuffed under your mattress. Yet, 99.9% of people conflate the two. Cash deposited into the bank technically makes you a creditor of the bank. You’re liable to get burned should the bank make a bad bet and get into trouble. The risk is not insignificant. Most banks gamble with their customer deposits on risky investment fads like mortgage-backed securities. Government deposit insurance schemes are a false sense of security. With their current reserves, they could only cover less than half a penny for every dollar they supposedly insure. People in Cyprus had to find all this out the hard way a few years ago. People awoke on an otherwise normal Saturday morning to the horror that the cash in their bank accounts had vanished. It was perhaps the most potent, recent example of the risk of being totally dependent on a single country that suddenly found itself in financial trouble. It also shows why I am such a fan of owning hard assets outside the immediate reach of your government. You probably already know it’s a bad idea to put all of your asset eggs in one investment basket. The same goes for holding all of your assets in one country. But how much thought have you put into political diversification? International diversification frees you from absolute dependence on any one country. Achieve that freedom, and it becomes very difficult for any group of bureaucrats to control you. The results can be life changing. While everyone in the world should aim for political diversification, it’s exponentially more critical for those who live under a government sinking hopelessly deeper into financial trouble. That means most Western governments and the U.S., in particular. This brings up an uncomfortable truth for North Americans and Europeans. The way the political and economic winds are blowing, things are about to get much worse. Central banks around the globe have created the biggest financial bubble the world has ever seen. Interest rates are the lowest they’ve ever been in 5,000 years of recorded history. In some parts of the world, they’re even negative. We’re living in a financial Alice in Wonderland. I think the social and political implications of this bubble bursting are even more dangerous than the financial consequences. An economic depression and currency inflation (perhaps hyperinflation) are very much in the cards. These things rarely lead to anything but bigger government, less freedom, and shrinking prosperity. Sometimes, they lead to much worse. We’re already getting a small preview of what is to come… It seems like each week, there’s a new attack or mass shooting. Racial tensions are on the rise. Europe is experiencing a migrant crisis that’s tearing the continent apart. There’s no doubt the world has become a crazier place in the past couple of years. Unfortunately, I think it is only going to get worse… There’s really only one way to remove yourself from all of this unpleasantness. |

| Gold: The Best Performing Asset of the 21st Century - Rory Hall Posted: 14 Sep 2016 05:00 PM PDT Sprott Money |

| Desperately Poor Teens In America's Impoverished Inner Cities Are Trading Sex For Food Posted: 14 Sep 2016 04:45 PM PDT Submitted by Michael Snyder via The Economic Collapse blog, When people get hungry enough, they will do just about anything for some food. According to brand new research that was just released this week from Feeding America and the Urban Institute, there are millions of teenagers in America that live in “food insecure” households, and researchers were stunned to learn what some of these teens are willing to do to feed themselves. Some resort to shoplifting, others deal drugs, and there were a surprising number of participants in the study that actually admitted to trading sex for food. It wouldn’t be a shock to hear that these kinds of things are going on in an economically-depressed nation such as Venezuela, but this is the United States of America. We are supposed to be the wealthiest nation on the entire planet. Sadly, even while the stock market has been soaring in recent years, poverty in America has been on the rise. For those on the low end of the economic scale, things have gone from bad to worse since the end of the last recession, and millions of children are deeply suffering as a result. Let’s start with some of the hard numbers. The following comes directly from the Urban Institute website…

The researchers already knew that lots of young people were hungry in America. But what surprised them were the lengths that many of these youngsters said that they would go to in order to get food…

Could you imagine your daughter or your granddaughter exchanging her body for food? For most of us that is absolutely unthinkable, but the truth is that this is taking place on the streets of America every single day. And this wasn’t just some blind random phone survey. The researchers conducted personal interviews with focus groups, and what these kids were willing to admit doing was absolutely astounding. Here is another excerpt directly out of the report…

Many of these young people understand that what they are doing is wrong. Just consider what some of them told the researchers…

When I read the information in this report, I was stunned. Yes, I write about our economic decline and the rise in poverty all the time, but I didn’t know that things were this bad. And the researchers were surprised by what they were hearing as well. One of them said that the fact that girls are trading their bodies for food “was really shocking to me”, and she believes that things are “just getting worse over time”…

But aren’t we being told that things are getting better? Aren’t we being told that our leaders “fixed” the economy? Of course the truth is that America is mired in a long-term economic decline that stretches back for decades. With each passing year the middle class gets smaller as a percentage of the population, and poverty continues to grow. Last year the middle class became a minority of the population for the first time ever, and a lot of formerly middle class Americans are now among those that aren’t sure that they are going to have enough food to eat this month. Hunger in America is a major crisis and it is growing. Just because you may live in a comfortable home in a wealthy neighborhood does not mean that this problem is not real. Tonight there are millions of Americans that do not know where their next meal is going to come from, and they deserve our love and compassion. |

| Prophecy Update End Time Headlines 9/14/16 Posted: 14 Sep 2016 04:10 PM PDT A fast paced highlight and review of the major news stories and headlines that relate to Bible Prophecy and the End Times… The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 14 Sep 2016 03:46 PM PDT From reality TV to the top of the GOP, Donald Trump has been in the spotlight for decades. What do we know about his past that gives hints to where he wants to lead the country in the future? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Daily and Silver Weekly Charts - Blast Radius Posted: 14 Sep 2016 02:27 PM PDT |

| Jesse Ventura on Trump, Hillary, and the Broken System Posted: 14 Sep 2016 12:15 PM PDT Governor Jesse Ventura (actor and author) joins Dave Rubin to discuss his views on Trump, Hillary, Bernie, Immigration, and conspiracy The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Look to the Junior Gold Miners For Outsized Gains To Precious Metals Posted: 14 Sep 2016 11:37 AM PDT

Now 40 months later the junior miner announces in this week’s news release, “We are very encouraged by the results from Hole AV-02…This is the second Carlin-type gold system we have confirmed on the property. It is at the same depth as Barrick Gold’s multi-million ounce Goldrush deposit just 9 km to the northwest”. The company is now a retail and institutional favorite making long term readers observe gains of 400%+. Since I first wrote about NuLegacy in March of 2013, this junior has soared more than 400% while the Junior Gold Miners Index is still way below 2013 levels. This demonstrates the importance of sticking to the top management teams that have a track record of success and the creation of value that arises from a new discovery.

Many pundits love gold now, but be careful as those very same talking heads were some of the people short gold last year. The reward goes to the ones like my readers who find the discarded junior mining gems during the bear market and wait until the bull market in gold returns to take profit. The times to have been accumulating junior gold miners was during the bear market especially near the end when the Venture was hitting all time lows. Now investors should look to pullbacks to the upward trend like the 50 and 200 day moving average to add or initiate positions. During the bear market although the odds are against you its still possible to find the big winners by finding quality assets in mining friendly jurisdictions led by top technical teams. Look for sales and discounts on these juniors in the form of pullbacks and corrections. Avoid chasing them higher during breakouts. Look at this new featured company in Quebec which I just highlighted last week that is now pulling back to its upward trend and 50 Day Moving Average. It has all the making of a triple or quadruple like NuLegacy with similar features such as great management with an exciting asset. The team has a successful track record running juniors as well as working with the producers such as Placer Dome. They own an asset in Quebec, a jurisdiction which is getting a lot of interest after the value created by Osisko and another formerly featured company Integra Gold (ICG.V or ICGQF). I believe this little junior with top management has the potential to grow a major resource in Quebec and hit high grade gold when they start drilling. The share structure is still extremely tight with less that 60 million shares fully diluted. I expect for this company to have some trenching results by October with a drilling program to begin in 2017. By that time this company should be well known throughout the junior mining sector. One of our favorites in 2016 has been Sandspring Resources (SSP.V or SSPXF) as it owns 100% of one of the largest marquis mines in the World in Guyana, a jurisdiction which relies on mining and where there have been some success stories such as Guyana Goldfields (GUY.TO) Guyana is a $9 stock in production and that could be the price where Sandspring is one day once they publish a Feasibility Study, Finance and Construct the mine and start production. This is a long way away from the price it currently trades around $.70 CAD. Sandspring is actually the most oversold its been since the beginning of its rally in 2016 falling below the 50 Day Moving Average. These are the high quality stories that should be looked at when there is some profit taking. The stock has had an amazing run so pullbacks are normal and healthy in a new secular bull market in gold. I think gold could make a run to push through $1400 to possibly $1550 by the 1st quarter of 2017. This price rise could definitely make Sandspring’s huge asset that much more valuable especially as we head towards a production shortfall by the major producers in 2018. Remember there are very few assets worldwide which could produce 200k ounces plus annually and has 5+ million ounces of gold like Sandspring. Sandspring’s pullback is quite restorative as many investors may have been waiting for a pullback to take an initial or secondary position in this highly leveraged to gold price play. However, I wouldn’t be surprised that in this new gold exploration environment if Sandspring looks to make additional discoveries or acquire some top notch properties in Guyana that have been left behind by other distressed juniors. You always have to look at the people behind the company especially strategic partners such as Silver Wheaton and insiders such as Mining Entrepreneur Frank Giustra who has one of the top track records in the mining business. I am optimistic that this could be one of the premier gold districts for a major producer in the coming years. Disclosure: Please assume I have a conflict of interest, I own securities in these featured companies (NUG.V, SSP.V, GIS.V) and that these companies are website sponsors. Owning securities and receiving compensation is a direct conflict of interest as I could personally benefit from a price/volume increase. Please do your own due diligence as this is not financial advice! See my full disclosure by clicking on the following link: http://goldstocktrades.com/blog/featured-companies-on-gold-stock-trades/ Investing in stocks is risky and could result in losing money. Buyer Section 17(b) provides that: "It shall be unlawful for any person, by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication, which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof." I am biased towards my sponsors (Featured Companies) and get paid in either cash or securities for an advertising sponsorship. You must do your own due diligence and realize that small cap stocks is an extremely high risk area. Please do your own due diligence! _______________________________________________________ Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements.

|

| ANONYMOUS Message About the New World Order 2016 System Failure EXPOSED! Posted: 14 Sep 2016 11:04 AM PDT ANONYMOUS Message About the New World Order 2016 System Failure EXPOSED!We are Anonymous.We are Legion.We do not forgive.We do not forget.Expect us. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Global Oil Could Make A Hit On U.S Dollar Posted: 14 Sep 2016 09:53 AM PDT This post Global Oil Could Make A Hit On U.S Dollar appeared first on Daily Reckoning. In the early and mid-1970s, the North Sea was coming online as a major world oil province. One of the great oilfields of the time, located in the British sector, was named Brent. Atop the Brent oilfield was a series of platforms and wells that yielded hundreds of thousands of barrels of "Brent" oil per day. The price for oil from Brent soon transformed into the regional benchmark for daily oil price-discovery. Brent set the price for Europe. Eventually, Brent became the benchmark for many other global oil trades as well. Brent was the price-discovery and price-setting mechanism for much of the globe. Oil contracts in the Middle East, Africa, Latin America and even Asia were posted against the daily "Brent quote." This quote was set by a group called Platts. Today, if you follow oil trading and prices, you'll still constantly see reference to the "Brent quote" for oil prices. Platts keeps a running 60-day tally of oil trade contracts from a variety of North Sea oilfields, and averages the numbers into a daily quote for a typical barrel. It has almost nothing to do with the minimal amount of oil flowing from actual Brent platforms. Meanwhile, the 60-day tally by Platts ensures that no short-term issue, such as bad weather or a pipeline accident, can spike oil prices for the entire world. But here's the odd part: Britain's old Brent oilfield yields almost no oil at all anymore. It's nearly drained. So how can a depleted oilfield set the global price? In recent years, Russian energy representatives have raised this very question. If Russia Controls Global Oil… I've been at conferences and heard Russian energy reps make the (valid) point that their nation exports nearly 3 million barrels of oil per day into European markets. It's far more than the tiny Brent number, Russians point out; and far more than the entire North Sea number when you compare volumes. Russian political-energy interests maintain that their "Urals blend" of exported oil should become the European — and by extension, the world — price benchmark. It hasn't happened yet, but… Along came Brexit. In the aftermath of the Brexit vote, Britain is on the outs with the EU. And there's renewed interest in examining whether a cobbled-together average of North Sea barrel prices should still control global oil prices. Let's suppose that more and more parties reject the Brent quote as an accurate daily price quote for oil. Then what happens? Suppose Russia simply began posting prices for Urals blend oil in a basket of global currencies, distinctly shunning the U.S. dollar as the measure. It's not hard to imagine. Russian president Vladimir Putin has stated many times that he wants to move away from the U.S. dollar in trade, and strengthen ties with China, the new power player in the energy game, as Nomi Prins has explained. Global oil buyers would soon fall into line and begin "paying" that basket price. After all, Russia has the oil; Britain/Brent is nearly irrelevant in terms of global supply. If the Brent oil quote falls apart in the Europe region— replaced by Urals blend quote— then what happens to all the other oil contracts across the world that refer to Brent? I suspect that their half-lives would run out quickly. It would be a true body blow to the U.S. dollar. Regards, Byron King Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post Global Oil Could Make A Hit On U.S Dollar appeared first on Daily Reckoning. |

| GATA's Murphy and Powell interviewed by Lars Schall for Gold Switzerland Posted: 14 Sep 2016 08:20 AM PDT 11:19p ET Wednesday, September 14, 2016 Dear Friend of GATA and Gold: GATA Chairman Bill Murphy and your secretary/treasurer recently were interviewed about the prospects for gold and silver by Lars Schall for Matterhorn Asset Management's Gold Switzerland Internet site. The interview covers the risks of the world monetary system, changes in the procedures of the daily gold price fixing in London, the use of the derivative market to control monetary metals prices, and the refusal of mainstream financial news organizations to report central bank intervention in the markets. Audio and a transcript of the interview can be found at Gold Switzerland here: https://goldswitzerland.com/bill-murphy-chris-powell-the-gold-cartel-wil... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Gold Standard Continues to Expand North Dark Star High-Grade Deposit Company Announcement VANCOUVER, British Columbia, Canada -- Gold Standard Ventures Corp. (TSXV: GSV; NYSE MKT:GSV) today announced assay results from two holes, DS16-21 and DS16-04, at the recently discovered North Dark Star oxide gold deposit on its fully-owned and controlled Railroad-Pinion Project in Nevada's Carlin Trend. Results from DS16-21 have increased the width of the deposit and, more importantly, have confirmed that higher-grade oxide mineralization projects up-dip to more shallow depths to the east of DS16-08. The primary objective of this year's drill program at North Dark Star was to expand the high-grade zone discovered in core hole DS15-13 (15.4 meters of 1.85 gold grams per tonne and 97 meters of 1.61 gold grams per tonne) at the end of last year's drill program. ... ...For the remainder of the announcement: https://goldstandardv.com/news/2016/expansion-gold-standards-north-dark-... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| We are in Deep Trouble - Tech Giants Are Uniting, Creating Group to Self-Police Posted: 14 Sep 2016 08:15 AM PDT Computers are a bigger danger than nukes. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Wells Fargo and Other Banks Now Just Outright Stealing People’s Money Posted: 14 Sep 2016 02:58 AM PDT Centuries ago banks actually stored real money (gold) and gave their customers paper receipts which made transferring and transporting easier. Then as time went by, banks just began storing currency. Unbacked fiat paper is not money. In those days the term “bank robbery” used to mean a man with a gun would come in and steal the currency from the bank. |

| Have Central Banks Lost Control - 14 Sept 16 Posted: 14 Sep 2016 02:28 AM PDT Have Central Banks Lost Control - 14 Sep 16 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

There's a "rally" in the gold market right now, and (to a lesser extent) in silver. We're told this by the mainstream media – in between its salvos of gold-bashing. Sadly, we have also seen this parroted by numerous Alternative Media commentators. So let's examine this "rally" yet again.

There's a "rally" in the gold market right now, and (to a lesser extent) in silver. We're told this by the mainstream media – in between its salvos of gold-bashing. Sadly, we have also seen this parroted by numerous Alternative Media commentators. So let's examine this "rally" yet again. Sitting on the table next to me is $50,000, 1922 Reichs bank note. The man with his face on the note looks a little grumpy. Maybe it's his bad haircut, or the goofy hat, or maybe he knows the currency with his face on it is going to be valued as nothing.

Sitting on the table next to me is $50,000, 1922 Reichs bank note. The man with his face on the note looks a little grumpy. Maybe it's his bad haircut, or the goofy hat, or maybe he knows the currency with his face on it is going to be valued as nothing.  Hillary Clinton's 2016 presidential campaign is imploding. After a serious collapse on September 11th in New York where staff had to carry her into the van, questions are being raised after a trip that was supposed to be to a hospital ended up at Chelsea's Clinton's apartment.

Hillary Clinton's 2016 presidential campaign is imploding. After a serious collapse on September 11th in New York where staff had to carry her into the van, questions are being raised after a trip that was supposed to be to a hospital ended up at Chelsea's Clinton's apartment.

The Gold to Housing ratio is a quite useful measure for evaluating relative values between real estate and gold, and also has an interesting historical track record for identifying turning points in long-term gold price trends. In light of the surge in gold prices in 2016, and the continuing strength in housing – it is worthwhile revisiting this basic measure, because the results aren’t at all what most people likely think they are.

The Gold to Housing ratio is a quite useful measure for evaluating relative values between real estate and gold, and also has an interesting historical track record for identifying turning points in long-term gold price trends. In light of the surge in gold prices in 2016, and the continuing strength in housing – it is worthwhile revisiting this basic measure, because the results aren’t at all what most people likely think they are.

No comments:

Post a Comment