Gold World News Flash |

- Bill Murphy & Chris Powell – The Gold Cartel Will Have To Retreat Big Time

- Inside 'The 13' - The Most Luxurious Hotel Ever Built

- Upside In Gold and Silver, Price of Silver Will Rise, PM IRA – the Right Way

- Dow 100,000? Marc Faber Warns: Central Banks "Will Monetize Everything... Introduce Socialism"

- China’s Rising Gold ETF Market: A Hybrid

- CBS Caught Editing Clip, Transcript In Which Bill Clinton Says Hillary Fainted "Frequently"

- UPDATE: HILLARY DYING, CENTRAL BANKS BUYING

- Physical Gold Ownership: Advantages over Paper Gold and Government Bonds

- Trump Campaign's Response To Hillary's Collapse (& DNC Leaks)

- The Gold To Housing Ratio As A Valuation Indicator

- GDXJ Gold Stocks - A Diamond in the Rough

- HYPOCRITE BUYS GOLD, IMPENDING INFLATION LOOMS

- Attacks on gold and silver 'more frantic,' Embry tells KWN

- Hillary Clinton Is Humpty Dumpty, Nothing Can Put Her Back together Again

- A Historical Gold Reversal Just Occurred. Here’s What it Means…

- Trumped! A Nation on the Brink of Ruin… And How to Bring It Back

- Gold Daily and Silver Weekly Charts - Central Bank Blather and Stock Option Expiration

- Desperation and death beneath South Africa's City of Gold

- Will North Korea Use Nuclear Weapons?

- China’s Next Move: Trump vs Clinton

- Total Proof Hillary Is Seriously Ill _ Set To Drop Out

- Gold and Silver Prices Volatile on Opposing Views from FED Members

- How Gold Bugs can Have their cake and eat it too by Embracing the trend

- Sorry, You Can’t Have Your Gold - Own Physical, Allocated Gold

- Drill Results Highlight Expansion of Gold Zone at Balmoral's Bug Lake

- This Undervalued Royalty Company Has Room to Grow

- How Gold Bugs can Have Their Cake and Eat...

- The Gold To Housing Ratio As A Valuation ...

- Top Ten Videos — September 13

| Bill Murphy & Chris Powell – The Gold Cartel Will Have To Retreat Big Time Posted: 14 Sep 2016 12:40 AM PDT THE MATTERHORN INTERVIEW – Sept 2016: Bill Murphy & Chris Powell“The Gold Cartel Will Have To Retreat Big Time”In this months’ Matterhorn Interview Bill Murphy and Chris Powell, co-founders of Gata,analyse risks of the monetary system and comment on changes to the London Gold fix procedures and participation, liquidity issues and the difficult relationship between paper (futures) and … Read the rest |

| Inside 'The 13' - The Most Luxurious Hotel Ever Built Posted: 14 Sep 2016 12:00 AM PDT Dubai and Macau are currently locked in a war of outrageously opulent hotels, and Macau recently tossed a Fabergé grenade in the form of The 13, a luxury hotel featuring 200 rooms, each of which over $7 million is being spent on. As The Independent reports, ‘Room’ doesn’t really do it justice and ‘suite’ isn’t customary in Macau parlance, each room is a ‘villa’, apparently, and the largest - Villa de Stephen (named after the man behind the hotel, Stephen Hung) - is 30,000 square foot. To give you a sense of scale in similarly absurd terms, that’s the same size as Mark Wahlberg’s entire Beverly Hills mansion. The “entry-level” villa, if you can call it that, will be the Villa du Comte, which comes with the following:

The hotel, described as a 'gateway to the refined and remarkable' is expected to be opening its presumably solid gold doors summer 2017, with room prices yet to be announced. “This was a labour of love,” Mr. Hung commented. “The team and I put every ounce of creativity and passion we had into this project to ensure every detail was perfect. Our guests, I believe, will find the result truly remarkable and beyond anything they have previously experienced.” * * * So to compete with a nation that is suffering from the economic woes of a prolonged low oil price environment, someone in another nation whose economy is creaking to a halt from a credit-fueled orgy of malinvestment, had the bright idea to build the world's most expensive, crazy, hotel ever... well, at least that wealth will trickle down, right? |

| Upside In Gold and Silver, Price of Silver Will Rise, PM IRA – the Right Way Posted: 13 Sep 2016 11:01 PM PDT Upside in Gold and Silver – Interview with Gary Christenson at Crush The Street *** Guest Post from Steve Hunt of Scottsdale Bullion & Coin Why the Price of Silver Will... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| Dow 100,000? Marc Faber Warns: Central Banks "Will Monetize Everything... Introduce Socialism" Posted: 13 Sep 2016 11:00 PM PDT Submitted by Valentin Schmid via TheEpochTimes.com,

Epoch Times: How long can the central banks manipulate markets? Mr. Marc Faber: This is an issue that will be decided by central bankers and I don’t have control over the manipulation of central banks. Haruhiko Kuroda of the Bank of Japan (BoJ) expressed the view that there is no limit to monetary inflation. That they can keep on buying assets and they can keep on buying equities and real estate. So the madness in the present time may go on. In a manipulated market, it won’t end well, but you don’t know when it will not end well, and how far the manipulation can last. Epoch Times: And then at one point, the central banks own everything. Mr. Faber: They could essentially monetize everything, and then you have state ownership. And through the central banking system, you introduce socialism and communism, which is state ownership of production and consumption. You would have that, yes, that they can do. The BoJ owns more than 50 percent of Japanese ETFs (exchange traded funds), which own large parts of the underlying companies. So indirectly they may own 20 percent of the Japanese companies, and they can go up to a higher level. I don’t think the central bankers are intelligent and smart enough to understand the consequences of their monetary policies at present. They focus on inflation but in my view they shouldn’t do anything. They don’t focus enough on what it does to the average standard of living of the people, to the average household income. Asset Price InflationEpoch Times: If the policies are similar, why haven’t we seen hyperinflation like in Zimbabwe or Venezuela? Mr. Faber: The developed market central banks can go on for quite some time. If Zimbabwe prints money, the pain is more obvious right away because if you are Zimbabwe, and you print money and the others don’t, and the currency collapses, and you feel the pain much sooner. If the major central banks, the Fed, the European Central Bank (ECB), the BoJ, the Bank of England, and the Chinese monetize and print money in concert and agreement with each other, they all talk to each other; then the currencies don’t collapse against each other. There may be fluctuations, but we don’t have a general collapse of a currency. Paper money, in general, can then collapse, and it has to a large extent against asset prices like real estate around the world over the last 30 years, against equity prices, against bond prices—which have been rallying since 1981—and against precious metals since 1999. Asset price inflation is less obvious to the average person in the street. The average American has no money, so he doesn’t care if prices for paintings and real estate go up—until it touches him. It’s nonsense to claim that inflation is only going up 1 percent per year in the United States. The cost of living of a typical family is going up much more than that—insurance, transportation, schooling are all going up. For example, health care premiums for insurance policies [are rising], so the typical household is being squeezed. The central banks don’t care about that; they don’t look at it. I suppose the system will collapse before we become like Venezuela. In the West, if they start to print money, the end game will be brief. Within five years, I expect the system to implode. Epoch Times: How can we avoid a collapse? Mr. Faber: You better ask the bureaucrats what their plans are. They had zero rates since December 2008; soon eight years [passed], and that hasn’t boosted economic activity for the average household, not in Japan nor the United States nor the EU. Now they talk about fiscal spending. We already have large deficits but no deficit is large enough for the interventionist, so they will boost fiscal spending. They will finance deficits by issuing government debt, which the central banks will monetize. The Treasury will issue debt, and then the Fed will buy all these debts. Of course, that will not end well, but it will postpone the problem for a while. Then they will find some academics who will blame wealth inequality on the evil capitalists who made so much money out of asset bubbles. They will blame the economic woes on these people. To some extent this is true. But the rich people did not create the inflated asset values; it was the central banks, by slashing interest rates to zero and negative interest rates in many countries. First, you create mispricings through artificially low rates and negative interest rates and you boost the income and wealth of the super-rich. It’s at best the 0.1 percent that really benefit from asset inflation, at the cost of all the people that have no assets and so you have this rising wealth inequality. So we have to tax the rich people and tax them more. Taking money from the rich is appealing if you go to voters, and you say to them, “Look, the reason the economy is doing so badly, it’s because of the rich people, the billionaires. We have to take 20 percent away from them and give it to you.” You can be sure that everybody will vote for that because the wealthy are a minority. This is what happens after monetary policies completely fail. Some well-connected people will hide their wealth but a lot of people won’t. Even if they take 50 percent from the richest, it’s not going to help. The next step will be to take money from less wealthy people; the interventionists will go all the way. Investment StrategyEpoch Times: How do you invest in this environment? Mr. Faber: Most assets by traditional valuations are overpriced. Now are they overpriced compared to zero interest rates or negative interest rates? If you take the 10-year German bonds or the 10-year Swiss bonds or the 10-year Japanese bonds, you have no or negative yield. But you can buy equities that give you a dividend yield of 2 percent or more. Then you say stocks compared to negative interest rates are a bargain. But they are not cheap by traditional valuation methods. However, I think it’s dangerous for someone to say: “We all agree that it will end badly, so we keep 100 percent of our money in cash.” First, you have to decide which cash. Number two, we don’t know what the time frame until it ends badly is. And in an extreme money-printing environment, the Dow Jones Industrial Average can go to 100,000. It may likely not go up against precious metals, but it can go up in nominal terms endlessly. It’s not going to help the typical household. I have seen many hyperinflating economies, and in each case, the standard of living of average people declined. That will be the case. If I were interventionist—which I’m not, and I do not support the interventionist—if I were a central banker and I said to myself the right policy now is to increase the negativity of interest rates, we go from 0.5 percent negative to 5 percent negative. In this particular instance, the people and companies take the money out of the financial system and store it in cash in a vault. The measure to implement negative 5 percent is not going to work very well, so one way to make it work is to abolish cash. You can still hoard real estate, food, cigarettes, and precious metals, but you can’t hold cash anymore. So that is likely to happen, in my view, if they go all the way. Epoch Times: What about gold? Mr. Faber: I have made a very compelling case for gold in the late 1990s and silver and platinum. I wrote a book, “Tomorrow’s Gold,” which was not about gold but the rise of Asia. The gold price rose very sharply between 1999 and 2011, and it corrected after September 2011. It probably overshot, and the mining shares overshot on the upside, so they corrected. Now, between last October and December, we had major lows in gold stocks and precious metals prices from where the prices will continue to rise. They are going to go up tomorrow or in three to five years, I don’t know. If you keep printing paper money, the supply of money increases and assets that are in short supply or limited supply—whether it’s a Ferrari or a Gaugin painting—they are in tight supply, so they will appreciate. They will not all appreciate at the same time and to the same extent. There will be bubbles in real estate and collectibles; there will be bubbles in equities, as we have had three times since 1999. Epoch Times: But you would not only buy cash and gold mining stocks, right? Mr. Faber: I think holding all your assets in cash is very dangerous. I want to be diversified; I hold some cash, bonds, equities, some real estate, and some precious metals. The moment you diversify, your returns are suboptimal, but it’s likely to preserve your capital. |

| China’s Rising Gold ETF Market: A Hybrid Posted: 13 Sep 2016 08:50 PM PDT by Koos Jansen, Bullion Star:

In 2013 we've witnessed the inception of the Chinese gold ETF market. At first demand for the gold ETFs was neglectable, as investors mostly preferred to buy the physical gold directly at the Shanghai Gold Exchange (SGE) or buy jewelry or investment bars through retail channels. This year, however, there has been a major shift in gold ETF demand in China. The physical holdings of Chinese gold ETFs have surged five-fold from 7 tonnes at the end of January, to 35 tonnes at end of August. The Huaán Yifu Gold ETF, which was holding 23 tonnes in August, entered the global top 15 list.

.  The interest in China's nascent gold ETF market was even mentioned by the World Gold Council in a recent Gold Demand Trends report. In this post, we'll add some texture to China's gold ETF market; how are the gold ETFs constructed and how can they be compared to the largest Western gold ETF, the SPDR Gold Trust. At this moment the market share of Chinese gold ETFs is still small – within China as well as globally, but knowledge about the workings of these ETFs will be valuable when they acquire significant market share in the future. Kindly note, all mechanics and examples presented in this post are simplified. What Is A Gold ETF?ETF is short for Exchange Traded Fund. ETFs trade like stocks and its price usually tracks an underlying asset or index. Like stocks, ETFs have a primary market and a secondary market. The secondary market is the stock exchange where most ETF investors trade. What makes ETFs special is the primary market where ETF shares are created and redeemed. Let us use the SPDR Gold Trust (symbol: GLD) to illustrate how the primary market works. Mainly through the creation and redemption process of shares, the GLD share price tracks the gold price. Primary GLD market participants include (from the prospectus):

GLD is traded on the New York Stock Exchange Arca (NYSE Arca)  If an Authorised Participant (AP) wants to create GLD shares, it needs to deposit gold into the account of the Trust and subsequently the Trustee will provide the AP with GLD shares. The creation application must be made in multiples of 100,000 shares (a block of 100,000 shares is called a basket). Since every GLD share represents approximately 0.1 ounce of gold, in order to create 100,000 GLD shares the AP needs to deposit 10,000 ounces of gold into the account of the Trust. (In reality, 1 GLD share actually represents a little less than 0.1 ounce of gold, the reason for this will be explained later on in this post.) The redemption process works the other way round. If an AP wants to redeem GLD shares, it deposits 100,000 GLD shares at the Trust and subsequently the AP receives 10,000 ounces of gold. The purpose of APs creating and redeeming GLD shares is usually arbitrage. As previously mentioned the gold equivalent of 1 GLD share is roughly 0.1 ounce, nevertheless GLD shares and actual gold are traded in two different markets. As a consequence, the price of 1 GLD share can differ from the price of 0.1 ounce of gold. If the price of GLD and the price of gold diverge, this is where arbitrage comes into play for the APs. Accordingly, the arbitrage by APs through creation and redemption of shares contributes to GLD's price tracking the gold price. Suppose (simplified), the price of 1 GLD share is $110 – caused by supply and demand for GLD shares at the NYSE Arca – while the price of 0.1 ounce of gold is $100 in the gold market. An AP can grasp this opportunity by buying (or first leasing) 10,000 ounces of gold to deposit in the GLD Trust account after which the Trustee will create 100,000 GLD shares for the AP. The new shares created are then sold by the AP on the stock market, which will cause the price of GLD to go down. The arbitrage opportunity will be used by APs until it's closed. |

| CBS Caught Editing Clip, Transcript In Which Bill Clinton Says Hillary Fainted "Frequently" Posted: 13 Sep 2016 08:30 PM PDT For the latest example why much of the US population has lost trust in the mainstream media, consider today's snafu in which CBS News was caught editing a video clip and transcript to remove a Bill Clinton comment that Hillary Clinton "frequently" fainted in the past. Bill Clinton sat down with CBS's Charlie Rose on Monday to try to clear the air around questions regarding his wife's health after she collapsed while getting into a van at a 9/11 memorial ceremony on Sunday. It didn't quite work out as desired. As the Daily Caller reported first, when asked if there was any chance her faintness on Sunday could be a sign of some more "serious" illness, Clinton said he did not believe that was the case. "Well if it is, it's a mystery to me and all of her doctors, because frequently - well not frequently, rarely - but on more than one occasion, over the last many, many years, the same sort of thing happened to her when she got severely dehydrated, and she's worked like a demon, as you know, as secretary of State, as a senator and in the year since." However, the final edit of the "CBS Evening News" version cut Clinton's use of "frequently" out. Furthermore, according to a review by The Hill of the official transcript released by the network shows that Clinton saying "Frequently - well, not frequently," is omitted as well. Oddly, unlike the "CBS Evening News" version, Clinton's use of "frequently" can be heard on a version played on "CBS This Morning." To be sure, the bolded "frequently" section was in itself a particularly embarrassing slip-up: how Clinton can mistake that Hillary "frequently" faints or collapses, before correcting himself to say it "rarely" happened, will remain a mystery. Perhaps the fragment's deletion was the result of Bill realizing precisely this; and while we doubt that there was a subsequent 40 minutes "conversation about grandchildren" on a hot tarmac somwhere to rectify this mistake, what we do know is that when the segment aired, the bolded section was edited out, cutting to a reverse shot of Rose nodding to cover up the jump: As The Hill notes, time constraints unlikely played a role, since it takes less than three seconds for Clinton to say "frequently — well, not frequently." The edited CBS transcript is shown below:

As Mediaite observes, it's not at all uncommon for networks to edit down interviews to fit for broadcast or to clean up an interview subject's response. But, as it points out, "it is interesting that they chose to edit out an error that could have very well been newsworthy by itself." Naturally, there would be no comment from either Clinton, and if anything it would be assigned to the "great alt right conspiracy theory" compost heap, along with everything else that has been said about the Clintons, only to be confirmed the not too distant future. |

| UPDATE: HILLARY DYING, CENTRAL BANKS BUYING Posted: 13 Sep 2016 07:55 PM PDT by SGT, SGT Report.com: Hillary Clinton is dying… of either Parkinson’s or Vascular Dementia, either way both are terminal conditions and both can lead to pneumonia. Meanwhile, Hollywood has some brand new GOLD-related predictive programming prepared for Christmas as several central banks are actively buying up the stocks of the world’s best silver and gold mining companies, positioning themselves for the next, inevitable leg up. RELATED: VASCULAR DEMENTIA: "Hillary Clinton Has 1 Year to Live," says Medical School Professor |

| Physical Gold Ownership: Advantages over Paper Gold and Government Bonds Posted: 13 Sep 2016 07:00 PM PDT by David Levenstein, Mountain Vision:

The weaker-than-expected ISM report comes on the heels of a slightly downbeat U.S. jobs report for August, which was released last Friday that showed that non-farm employment in the U.S. grew by lower-than-expected 151,000 during August. Expectations were for nonfarm payrolls to rise by 175,000 to 185,000, with a jobless rate of 4.8%.

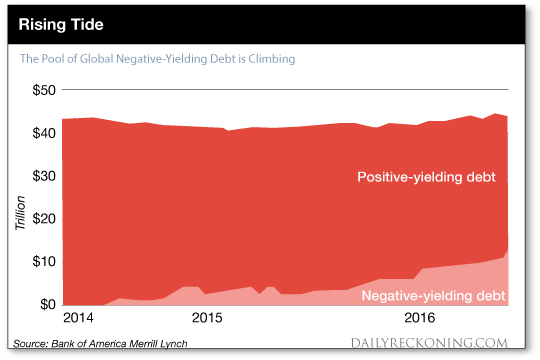

The U.S. non-manufacturing purchasing managers index reading for August was 51.4 versus July's 55.5. A reading of 55.5 was expected for August. That was the lowest reading in six years. Other indicators in the ISM report also missed to the downside of market expectations. The ISM data put very strong downside price pressure on the U.S. dollar index, which in turn gave support to the precious metals markets. This recent U.S. economic data plays right into the hands of the U.S. monetary policy doves, who do not want to see the Federal Reserve raise interest rates any time soon. Such a scenario would also be bullish for the precious metals markets. Market watchers are now awaiting Thursday's meeting of the European Central Bank. The ECB will issue fresh economic forecasts and assessments at this meeting. The consensus for this meeting is that the ECB will make no significant moves on EU monetary policy. While Western main stream media talk of an economic recovery in the US as unemployment falls, some forty million people in the US are living in poverty, surviving on food stamps… and this number is growing daily. And, as infrastructure gradually deteriorates, money that could be used to rebuild the infrastructure is squandered on military intervention, war and the spreading of mayhem. Meanwhile, as countries such as China and India focus on creating a productive economy, the Western world influenced by the US focuses on money supply, forex futures, interest rates, equity and bond markets. Currently, yields on US 10-year government bonds are at their lowest level in American history, British bonds were at a 322 year old low three weeks ago, Japanese bonds are at a record low, German bonds are a record low and so are Italian bonds. The real return on most government bonds today is negative, even in a low inflationary environment. And, bonds from emerging markets that offer a slightly higher return are not worth buying due to the currency risks involved. The total value of all government and corporate bonds in the world as of July 2016 was US$87.69 trillion. The value of negative-yielding bonds swelled to $13.4trillion by the middle of August, as negative interest rates and central bank bond buying rippled through the debt market. |

| Trump Campaign's Response To Hillary's Collapse (& DNC Leaks) Posted: 13 Sep 2016 06:35 PM PDT |

| The Gold To Housing Ratio As A Valuation Indicator Posted: 13 Sep 2016 06:21 PM PDT The Gold to Housing ratio is a quite useful measure for evaluating relative values between real estate and gold, and also has an interesting historical track record for identifying turning points in long-term gold price trends. In light of the surge in gold prices in 2016, and the continuing strength in housing – it is worthwhile revisiting this basic measure, because the results aren't at all what most people likely think they are. |

| GDXJ Gold Stocks - A Diamond in the Rough Posted: 13 Sep 2016 06:10 PM PDT It wasn’t until yesterday that I could draw in a possible bottom rail of a possible diamond pattern on the GDXJ. This potential diamond pattern has been forming since the first of July. As it stands right now the diamond pattern has completed five reversal points which theoretically puts it into a reversal pattern category. With that said the bounce yesterday may have started the all important 6th reversal point to the upside which if completed would make this diamond a consolidation pattern to the upside. Keep in mind this potential diamond is still developing with no resolution either way yet. |

| HYPOCRITE BUYS GOLD, IMPENDING INFLATION LOOMS Posted: 13 Sep 2016 06:00 PM PDT from Junius Maltby: Welcome to todays discussion on the JUNIUS MALTBY channel. Buckle up for a LONG ONE. Today we dive into some signs of economic changes, inflation, bond market troubles and hypocrites buying gold. There is some good material here so TUNE IN! |

| Attacks on gold and silver 'more frantic,' Embry tells KWN Posted: 13 Sep 2016 05:20 PM PDT 8:20p ET Tuesday, September 13, 2016 Dear Friend of GATA and Gold: Sprott Asset Management's John Embry tells King World news today that "the gold and silver markets are being attacked by the usual suspects in an even more frantic and transparent manner." He adds: "The paper gold and silver markets are one of the greatest Ponzi schemes in world history, with hundreds of paper claims on each physical ounce of metal available in the West." An excerpt from the interview is posted at KWN here: http://kingworldnews.com/there-are-now-hundreds-of-paper-claims-on-each-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Hillary Clinton Is Humpty Dumpty, Nothing Can Put Her Back together Again Posted: 13 Sep 2016 04:30 PM PDT Is this the end of Hillary Clinton? Does her collapse at the 9/11 memorial signal the beginning of her collapse in the polls as well? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

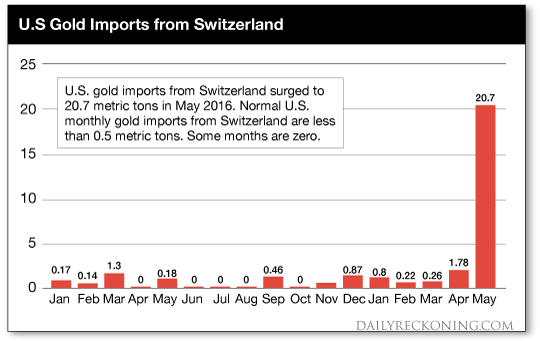

| A Historical Gold Reversal Just Occurred. Here’s What it Means… Posted: 13 Sep 2016 02:46 PM PDT This post A Historical Gold Reversal Just Occurred. Here's What it Means… appeared first on Daily Reckoning. Jim Rickards contact "Goldfinger," a gold industry insider, first clued us into an important gold flow reversal happening. You might recall their live broadcast. In the months just before that meeting in Zurich with Goldfinger, over 170 tons of gold flowed back into London. Instead of coming out of London, into Switzerland, and then heading over to China and India, China and India slowed down their imports and gold starting to flow back into London. Since then, the U.S. has become a significant gold importer, if you can believe it. Gold is flowing from vaults in London, Switzerland and even Dubai to destinations in the U.S. (If you're wondering, there are no gold mines in Dubai; it's all warehouse gold.) In May, the U.S. imported more than 50 times the monthly average amount of gold, as compared to the past. The most interesting thing? This year, investor demand was the largest component of gold demand for two consecutive quarters (Q1 and Q2) – the first time this has ever happened. This means that more and more U.S. investors are diversifying their assets into gold. They are looking for ways to protect themselves from the monetary tricks that central banks are experimenting with around the world.

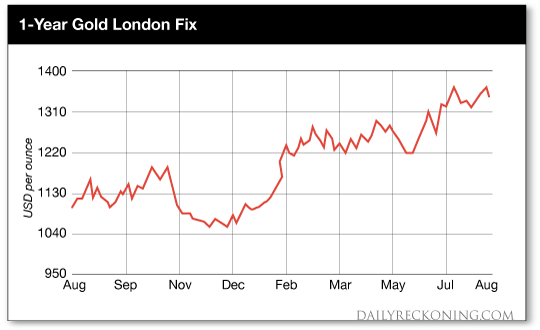

We're familiar with those tricks here at the Daily Reckoning. The biggest two are the war on cash (see yesterday's DR issue on that topic) and negative interest rates. The truth is governments don't want people holding currency on the sidelines of the economy. Governments desperately want people to spend their money as fast as they make it. They know that the global economy is fundamentally weak, even as they try to convince the rest of us otherwise. After a minor, but much-anticipated, Federal Reserve interest rate hike last December — the first rate increase in 7 years — gold prices bottomed. For a moment, the Fed seemed to convince people that the economy was picking up strength, and investors didn't need the safe haven of gold anymore. Then, on January 21, 2016, news broke that the Bank of Japan had adopted a policy of negative interest rates. That hit the market hard and gold prices soared. Not long ago, a study by Merrill Lynch concluded that roughly $13 trillion of government bonds, world-wide, offer negative yield. Here's a chart to show the rapid growth in negative yielding financial instruments.

As bad as this chart looks, however, it doesn't tell the full story. Of that "positive"-yielding debt, about $14.5 trillion pays between 0 and 1%. Overall, about 3/4ths of the world's sovereign bond market trades at 1% or lower. Just over $2 trillion, or 6%, of outstanding government bonds offer coupon rates better than 2%. Once negative interest rates were introduced, gold prices began to climb, and they've been rising steadily ever since. Here's the one-year chart of the London gold fix, showing the progress since last winter:

Seven months ago, gold prices began to move upwards from its December-January low of $1,050 per ounce. This was right around the time the physical gold flows began reversing due to heightened investor demand. Now, more than halfway through summer, gold has solidly broken through a major resistance at $1,300. We could see $1,550 to $1,600 by March 2017, just six months from now. Silver could make a similar climb, moving from the current $20 range to a near-term level of $25 per ounce. Thanks to the strange world of negative interest rate bonds and bumbling central banks, demand for gold and silver is consistently growing. Numbers don't lie. The gold bulls are out in full force. People are buying gold and silver, and putting large amounts of money into small packages of yellow metal. People are finally waking up to the fact that the global economy is not strong. We have sky high bubbles in the markets, and the Fed apparently can't explain it all away with academic-sounding gobbledygook. The bottom line is that our U.S. economy is not recovering — indeed, it's on the brink of a recession. This increases demand for safety. And safety means gold. Yet now, we confront a problem: What about future supply? Not long ago, I was in Yukon Territory, in northern Canada. I was visiting Kaminak, a gold mining company that has worked-up a major new gold prospect which is still a few years away from becoming a mine. Back in May, Goldcorp, one of the largest gold producers in the world, announced that they would buy out Kaminak for $520 million. I spent much of one day on-site with Kaminak and Goldcorp representatives. They were all open and straightforward. And what they told me about gold supply was astounding. According to Goldcorp, there are "significant supply constraints ahead' for future gold production. One main reason is found in what they call the "Peak Gold" approach. Across the world, gold discovery peaked in the 1990s. However, according to one Goldcorp rep, "it takes about 20 years to move a project from discovery to initial production."

It's basic logic that production would trail discovery by a significant period of time — you can't produce what you haven't discovered. But now, as gold discoveries continue to decline, future production will decline as well. Goldcorp management calculates that gold production peaked in 2015. The trends are all downhill from here. Now, if a company wants to remain a major producer, it must grow reserves and invest in new discoveries and production. Goldcorp's preferred method to stay in the gold game is through "brownfield" exploration and expansion. This means that they focus future growth in existing mine districts that host established discoveries and/or developments and production. Along the way, they'll seek partnerships with junior companies that are active in these kinds of areas to cultivate a future production pipeline. But even if more gold discoveries are made today, we still need to wait roughly twenty years for the pace of production to catch up. Meaning the supply of available gold in the world today is declining, just as investor demand for gold is increasing. And as I noted earlier, China and India have slowed their gold imports in recent months. If their demand increases even back to early 2016 levels, there won't be enough gold to go around — at least not at the current price… Let's make the most of this opportunity. Right now, in our Strategic Intelligence model portfolio, we have several gold and silver royalty and streamer companies. We also have an exchange traded fund of gold miners. These ideas offer exposure to the up-side of rising gold-silver prices via capital gains and dividends over time. This is an ideal time to buy the physical metals, too. Jim and I expect that gold and silver prices will climb in the months to come, through the rest of 2016 and into 2017. Still, I understand that you may be reluctant to purchase coins or bullion, due to markups by dealers, storage issues, insurance, and so on. But there are ways for you to buy in at your own pace, without the hassles, yet still have ownership of metal that you purchase. All in all, governments across the world are cracking down on cash. Bonds are a zero-yield play, if not negative. Most stocks are sky-high, and market bubbles everywhere await their needle. You are left with preserving wealth via classical, real money — gold and silver. But as demand builds and the production declines, we expect prices to skyrocket. That's why it's imperative that you start getting a 10% allocation of your investable assets into physical bullion now. If you aren't already building your stash of actual metal, now's the time. Regards, Byron King Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post A Historical Gold Reversal Just Occurred. Here's What it Means… appeared first on Daily Reckoning. |

| Trumped! A Nation on the Brink of Ruin… And How to Bring It Back Posted: 13 Sep 2016 02:17 PM PDT This post Trumped! A Nation on the Brink of Ruin… And How to Bring It Back appeared first on Daily Reckoning. "TRUMPED! A Nation on the Brink of Ruin… And How to Bring It Back," is a book written from a former insider who is now providing analysis from the outside. David Stockman breaks down how more than three decades of financial and political policy, created in the depths of the Washington-Wall Street alliance, has taken the U.S to the disastrous edge. Here's what you should know about TRUMPED!: Who is David Stockman?David Stockman is a former two term U.S Representative from the state of Michigan (1977–1981). He also served in the Ronald Reagan Administration as the Director of the Office of Management and Budget (OMB). After leaving the White House, Stockman spent two decades on Wall Street. While working as an investment banker and private equity investor Stockman can hold direct testimony to America's financial markets that have morphed into the Bubble Finance schemes that got us to where we are today. He also is founder of David Stockman's Contra Corner and David Stockman's Bubble Finance Trader.

Ronald Reagan with David Stockman (on right). (Jeff Taylor/Associated Press)Why was "TRUMPED! A Nation on the Brink of Ruin… And How to Bring It Back" written?According to Stockman the liberation for our current ruinous policy regime has to start somewhere. It has to start with the Republican Party candidate, Donald Trump. The book was written as an "indictment" of the status quo. The conditions that the Federal Reserve has instituted as policy is putting the nation on the edge of an economic disaster. Is "TRUMPED!" an endorsement of the Trump campaign?The book is no cheerleading testament to the Trump campaign. Stockman even highlights that a good amount of what Trump has advocated for in policy he finds misdirected or flat out abhorrent. What the book focuses on is that Trump pushes an agenda where the U.S is not the world's policeman. We are not the indispensable nation. We can push forward an agenda focused on a Main Street political insurrection. What has put America on the brink of ruin?The author points out that the Fed's destructive zero interest-rate policy (ZIRP) and the multiple phases of spending from its quantitative easing (QE) policies have buried Main Street in a web of escalating debt. Stockman puts forth the agenda that elites that are isolated on both coasts have benefited heavily from the massive financial inflation that is the Wall Street machine and has left those in the middle states behind. He highlights that what brought America to the brink is the debt-fueled reach of imperial efforts, Washington's domestic adaptations and global interventions that have spanned throughout the past thirty plus years. What is Flyover America?Stockman uses the term Flyover American in which the everyday worker continues to fall further behind. Flyover America is what is commonly referred to as the Main Street economy. It is a term for the people between the coastal metropolis cities that make up the majority of our working class. The former Washington insider puts forward that they are important because if we were to look at the actual inflationary numbers in America it would also show that real incomes are down 20%. The impact on real people has been sustained and detrimental to their economic futures. In Flyover America saving money has been significantly strained. What is actually saved by the Main Street economy almost always goes to the benefit of Wall Street. We see this problem resurfacing again and again, as exemplified by the sub-prime mortgage loan crisis. The author states that at the heart of this problem is the Federal Reserve. He writes that ultimately, Donald Trump is more likely to take on Wall Street and the Fed, bringing Flyover America back from the brink. What does "TRUMPED!" propose for the U.S political economy?Stockman puts forth that Trump, is a "political outlaw," and someone who has promoted his resume as one of the world's greatest dealmakers. As a reputed dealmaker he would need to "make ten great deals." These deals that Stockman outlines would bring America back from the brink of collapse. Amongst the ten the author highlights are a Super Glass-Steagall Deal, a Peace Deal, a Sound Money Deal, a Jobs Deal, a Liberty Deal and five other deals that could bring the U.S back on course. How has “TRUMPED!” offered new insight into the political status quo?The historic outtake of the campaign Donald Trump has assembled is that regardless of the outcome on November 8, he has shown that the inner connected elites that have been ingrained in the Washington and Wall Street corridors will fracture and come to an immediate halt. What's at stake for Election 2016?The author summates that under a potential Donald Trump presidency there will not be a trigger-happy stimulus plan or an elaborate economic policy "band-aid" set up for the first 100 days coming from Pennsylvania Avenue. The age of the “Imperial City” in Washington will be broken. Stockman believes that in the instance that Hillary Clinton wins the Oval Office, we will see a firmly controlled House of Representatives by the GOP that would nose dive even further into a polarized standstill for any economic actions that the White House might try to engineer. The status quo would attempt to carry on and likely go far beyond the brink. When is the book out?"TRUMPED! A Nation on the Brink of Ruin… And How to Bring It Back" Is available right now, Tuesday September 13 in Kindle Edition on Amazon. It was published by Laissez Faire Books. Regards, Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post Trumped! A Nation on the Brink of Ruin… And How to Bring It Back appeared first on Daily Reckoning. |

| Gold Daily and Silver Weekly Charts - Central Bank Blather and Stock Option Expiration Posted: 13 Sep 2016 01:16 PM PDT |

| Desperation and death beneath South Africa's City of Gold Posted: 13 Sep 2016 01:07 PM PDT By Ed Cropley JOHANNESBURG, South Africa -- When he lost his job as a Johannesburg gardener a month ago, 25-year-old Sibangani Tsikwe did what millions of men have done before him: seek their fortune deep underground in the gold mines that help to define South Africa. The decision has probably cost him his life. Equipped with little more than a head-torch, pick-axe, and nerves of steel, Tsikwe and a group of fellow Zimbabweans descended into the bowels of the earth on Sept. 5 via a derelict shaft at Johannesburg's Langlaagte gold mine. ... Dispatch continues below ... ADVERTISEMENT NewCastle Gold's New CEO, Gerald Panneton, Hits the Ground Running By Tommy Humphreys Mining entrepreneur Gerald Panneton took a few years off after building one of Canada's largest gold miners, Detour Gold. He raced performance cars in his down time, and conducted due diligence on various mining assets to potentially back. This summer, the geologist set his sights on NewCastle Gold (TSXV:NCA), owner of a past-producing gold mine in California with similarities to Detour Gold in its early days. ... ... For the remainder of the report: https://ceo.ca/@tommy/new-newcastle-gold-ceo-gerald-panneton-hits-the-gr... Tsikwe has not been seen since. In the annals of South African mining, Langlaagte looms large as the farm where prospectors first stumbled upon gold in 1886, a discovery that would open up the richest veins of gold-bearing rock mankind has discovered. Since then, the meter-wide seams, or reefs, that stretch for hundreds of kilometers east, west and south across the Witwatersrand Basin have produced more than 2 billion ounces of gold -- roughly half of all the bullion ever mined. In Zulu, Johannesburg is called Egoli, the City of Gold. Yet history was probably the last thing on Tsikwe's mind as he clung to a length of knotted string tied to a tree stump at the shaft entrance and took his first steps down the 30 degree slope into one of the most dangerous workplaces on earth. ... ... For the remainder of the report: http://www.reuters.com/article/us-safrica-mining-idUSKCN11J1M6 Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Will North Korea Use Nuclear Weapons? Posted: 13 Sep 2016 11:10 AM PDT North Korea constantly uses threatening rhetoric against its enemies. However, would they actually use the weapons they posses? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| China’s Next Move: Trump vs Clinton Posted: 13 Sep 2016 07:21 AM PDT This post China's Next Move: Trump vs Clinton appeared first on Daily Reckoning. As the U.S. distracts its population with campaign footage, China could take the next step to overtake the U.S. as the world leader. The non-U.S. International Elites (with China leading the charge) have been pushing to get the yuan addition to the Special Drawing Rights (SDR) in place as scheduled, before the U.S. election. This is no accident. China has been keenly monitoring the events leading up to Nov. 8. and is eager to insulate the Chinese economy from the U.S. dollar, and its new president. As I learned while traveling in China earlier this year, China believes that next U.S. presidential administration will provide it with more impetus to compete with the U.S. for global power. It is watching for any signs of political paralysis that occur during the ongoing campaigns and election. Any perceived weakness in the U.S. will be used to strengthen China's position in the global community. Here is an examination of key positions that China views when examining the U.S. presidential contenders and its Asian regional partners. South China SeaMilitary use and foreign policy are a large part of this shift towards Trump by China. When I was in Shanghai last month, the latest U.S.-China antagonism bubbled up over the situation in the South China Sea and U.S. ships were hovering nearby. China does not want the U.S. involved in what it considers a legitimate dispute in a region to which it believes it has historical jurisdiction, notwithstanding U.S. contention. This situation could see a potential conflict escalation from Clinton. This would revert into isolating China. Clinton has done this multiple times at the UN Security Council and other multilateral institutions. During her time as Secretary of State, Clinton used hawkish military maneuvers to solidify the power of institutions allied with the U.S. In her 2012 auto-biography, Hard Choices, she explained these maneuvers: "The confrontations in the South China Sea in the first two years of the Obama Administration reinforced my belief that our strategy in Asia must include a significant effort to upgrade." She went on to write "I thought China overplayed its hand [in that region]. Instead of using the period of our perceived absence and the [2008] economic crisis to cement good relations with its neighbors, [China] had become more aggressive toward them, and that shift had unnerved the rest of the region." Clinton basically set up the confrontation between the U.S. and China in the South China Sea. Despite all of Trump's loud comments, he is seen as the candidate less likely to get involved in territorial disputes with China. If Trump wins the presidency, the U.S. may take an isolationist military role at the international level, which would reflect the nationalist sentiment he is trying to engage with his campaign. The U.S. could possibly create stronger trade relationship with China under a Trump presidency as well. China’s Regional PositioningThe U.S. has long favored its more-trusted ally Japan over China on currency wars and defense related accusations. Japan is a weaker threat to the U.S. from a super-power perspective. Whenever Japan has been perceived to devalue the yen, it's been considered necessary by the Obama administration, including Treasury Secretaries Tim Geithner and Jack Lew (who both deflected blame for the 2008 financial crisis and resulting economic weakness on China). On the other hand, if China is perceived to be devaluing its currency, the U.S. considers China to be doing so solely to one-up the U.S. — not because it is trying to be more market-oriented (as per U.S. and IMF demands) and thus at the mercy of speculators (like George Soros, who attempted to slam the yuan). Both Trump and Clinton have bashed China, the former more brashly, the latter more consistently. But what they ignore, during the manipulation and stealing jobs conversations, is that China has its own large economy, with four times the U.S. population and about 6 times the growth, to contend with. China wants the Chinese people to have jobs — with Chinese companies if possible. It is becoming more capitalistic from a business perspective. No matter which candidate wins the White House, China stands poised to take advantage of the resulting political sea change or continuation of the status quo. That's why this next step in the power wars is critical. While the election show is in high gear, China is raising its global status as it has taken over as G20 President on Sept. 4, where it hosted President Obama. Now China will ride that momentum into the next presidential administration. To do this, China will increase its presence outside of the U.S. and inside China's financial markets. The strengthening and more prevalent yuan is just one element; the political and economic elements influence each other. But this hinges on China's own population. The Chinese people must be able to afford to buy things. It also needs the population to advance socially, culturally, and academically. As Secretary of State, Clinton used almost every opportunity she could to elevate the idea that the U.S. is morally superior to China. In 2011, while in Zambia, Clinton warned the country and all of Africa about "New Colonialism" threats from China that could come as a result of its expanded economic influence in the continent. "The United States is investing in the people of Zambia, not just the elites, and we are investing for the long run." She said this without irony, despite the fact the Clinton Foundation has been at the receiving end of multiple half million dollar contributions from African elites. The Clinton Foundation has accepted these generous donations while acting on behalf of its own agenda, in Clinton fashion, while in she was in office. Yet she said that, unlike other Asia nations, she did not see Beijing as a political role model. This mix of morality with the economic and political issues at play has helped the U.S. maintain it's position over China in the super-power struggle. Clinton would try to maintain this stance as President. China knows this. In fact, Clinton's behavior as Secretary of State could have partially motivated China's increased investment in its population. On the social, cultural and academic fronts, China is spending lots of attention — and money — unbeknownst to much of the mainstream press. China's people are its strength, and the U.S. focuses on currency moves to deflect attention from this. Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the FREE daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post China's Next Move: Trump vs Clinton appeared first on Daily Reckoning. |

| Total Proof Hillary Is Seriously Ill _ Set To Drop Out Posted: 13 Sep 2016 05:49 AM PDT In this special report Alex Jones breaks down the implications of Hillary's health and just how bad things might get in the near future. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold and Silver Prices Volatile on Opposing Views from FED Members Posted: 13 Sep 2016 05:21 AM PDT Gold Stock Bull |

| How Gold Bugs can Have their cake and eat it too by Embracing the trend Posted: 13 Sep 2016 04:55 AM PDT Executive ability is deciding quickly and getting somebody else to do the work.John G. Pollard Many individuals sit back and look wistfully at the 1st stage of the Gold Bull Market they missed. It is interesting that people focus on what they lost but not what they might miss. Since Gold topped out in 2011, many sectors took off; one could have deployed a portion of one’s funds in any of these sectors and walked away with healthy gains. Instead, the classic Gold bug clung to Gold and let all these opportunities slide away. |

| Sorry, You Can’t Have Your Gold - Own Physical, Allocated Gold Posted: 13 Sep 2016 03:46 AM PDT “Sorry, You Can’t Have Your Gold” by Jeff Thomas via InternationalMan.com In this publication, we warn regularly of the risk involved in storing wealth in banks. They’ve made the removal of your deposits increasingly difficult in addition to colluding with governments to allow them to legally freeze or confiscate your money. To add insult to injury, they’re creating reporting requirements with regard to the contents of safe deposit boxes and restricting what can be stored in them – again, at risk of confiscation. |

| Drill Results Highlight Expansion of Gold Zone at Balmoral's Bug Lake Posted: 13 Sep 2016 01:00 AM PDT Balmoral Resources has announced a "rapid increase in the width of the Bug South gold deposit," leading one analyst following the Canadian exploration and development company to increase his target price. |

| This Undervalued Royalty Company Has Room to Grow Posted: 13 Sep 2016 01:00 AM PDT |

| How Gold Bugs can Have Their Cake and Eat... Posted: 12 Sep 2016 07:02 PM PDT SafeHaven |

| The Gold To Housing Ratio As A Valuation ... Posted: 12 Sep 2016 07:02 PM PDT SafeHaven |

| Posted: 12 Sep 2016 05:01 PM PDT Silver price spike coming. Fiat currencies in trouble. Much more like that The post Top Ten Videos — September 13 appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Gold and silver prices rallied early last week to hit three-week highs after the morning release of a very downbeat U.S. ISM non-manufacturing report for August. The gains extended Friday's price advances after the release of the latest employment report in the US.

Gold and silver prices rallied early last week to hit three-week highs after the morning release of a very downbeat U.S. ISM non-manufacturing report for August. The gains extended Friday's price advances after the release of the latest employment report in the US.

No comments:

Post a Comment