Gold World News Flash |

- "The Financial Crisis Has Morphed Into A Growth Crisis" - Rogoff Warns "Cash Is Not Forever, It's A Curse"

- Hillary's Health: NBC Asks 9 Unanswered Questions

- STOCKS SOAR AND GOLD & SILVER REBOUND ON FED’S BRAINARD DOVISH SPEECH MONDAY

- SITUATION CRITICAL: A DEBT MARKET MELTDOWN MAY BE UPON US

- Turk explains why Fed isn't likely to raise interest rates

- US Think Tank Warns That Australia Is About 6 Weeks Away From Housing Collapse

- Supervisor Of "Massive Fraud" At Wells Fargo Leaves Bank With $125 Million Bonus

- Tent Cities Full Of Homeless People Are Booming In Cities All Over America As Poverty Spikes

- Silver: The Metal That Operates Our World – Keith Neumeyer

- Gold Boom! End Game Nears As Central Banks Buying Up Gold Mining Companies!

- Central Banks Able to Get “Trading Machines†to Pump Up Markets, for Now…

- Correction in Gold and Silver Markets Continues

- Track All Of Bankrupt Hanjin's "Ghost Ships" In Real Time

- Gold and United States Imported Oil

- Silver Will Be A Top Performing Asset In The Next Financial Crisis

- How I Remember September 11, 2001

- Gold and Silver Pulling Back To Support, Could Fed Meeting Next Week Boost Junior Miners?

- LIVE Stream: Donald Trump Rally in Asheville, NC 9/12/16

- Global Stocks, Bonds Fall Sharply - Gold Consolidates After Two Weeks Of Gains

- Leeb describes how China will use gold to gain control of world's monetary system

- Ted Butler explains why he thinks Morgan is controlling silver

- Dirty Money & the Clean New Fiver

- Stocks Sell Off: Here’s What You Need to Know

- The Debt Riddle That Elites Are Trying To Solve

- Why the Greater Recession Will be Dollar Bearish

- BonTerra Resources Swings for a Double

- Gold, Stock Market Down: Now What?

| Posted: 13 Sep 2016 12:30 AM PDT Submitted by Christoph Gisiger via Finanz und Wirtschaft,

Professor Rogoff, you are proposing to get rid of cash. Why?

So why do you argue for government intervention since the trend is already going towards a natural phase out of cash?

But if it’s so simple, why didn’t we get rid of cash a long time ago?

What kind of amounts are we talking about here?

And what’s the other reason for the slow progress to phase out large bills?

But many people are just concerned with respect to their privacy.

Then again, criminals could just switch to Bitcoins.

Do you think that getting rid of big bills should be based on a democratic vote?

Nevertheless, critics say that the true intention of your proposal is just to make it easier for central banks to push through with unconventional policies like negative interest rates.

Yet, so far negative interest rates seem to scare the financial markets.

And what would you say to a pensioner for example who is worried about her savings because of negative rates?

It’s now almost eight years since the outbreak of the financial crisis. Why is the economy still not gaining steam? Is this historically a typical syndrome after severe shocks to the financial system which you have written about with your colleague Carmen Reinhart in the bestseller «This Time is Different»?

So nothing’s different this time?

How bad is this situation?

What would be your solution?

What are the consequences of that?

And what’s your take when you look at the rest of the world?

What are the ramifications for the global economy?

|

| Hillary's Health: NBC Asks 9 Unanswered Questions Posted: 12 Sep 2016 11:45 PM PDT Last week, NBC News faced heavy criticism from the Hillary campaign for daring to have the audacity to write about Hillary's coughing fit at a rally in Cleveland, Ohio. After writing about the coughing fit, which NBC described as "one of the most aggressive she's had during her 2016 run (which happens to be accurate), Andrew Rafferty received the following snarky tweet from Hillary's traveling press secretary, Nick Merrill.

Now NBC has guaranteed its Clintonian wrath in perpetuity by posing the following 9 questions:

Clinton's core vulnerability is that most Americans don't find her honest or trustworthy. Will voters now feel like they've been misled about her health? Or will the vulnerability of the illness make Americans empathize more with someone who often has difficulty connecting. Very "alt-rightish" of you NBC. How dare you continue with these baseless questions about Hillary's health in an apparent attempt to perpetuate the endless conspiracy theories of her political foes. Who among us has never fallen ill with a cold and subsequently lost all motor functions while being dragging into a van? This is not news...get a life. And while everyone has turned their attention to Hillary and her health issues, no one has taken the time to question how the virus that recently took up residence in her lungs might actually be feeling about the whole situation. Luckily the infectious agent recently opened up to The Onion, and it's terrified.

|

| STOCKS SOAR AND GOLD & SILVER REBOUND ON FED’S BRAINARD DOVISH SPEECH MONDAY Posted: 12 Sep 2016 11:00 PM PDT from Harvey Organ:

The Shanghai fix is at 10:15 pm est and 2:15 am est. The fix for London is at 3 am est (first fix) and 10 am est (second fix) Thus Shanghai's second fix corresponds to 45 minutes before London's first fix. And now the fix recordings: Shanghai morning fix Sept 9 (10:15 pm est last night): $1330.61 |

| SITUATION CRITICAL: A DEBT MARKET MELTDOWN MAY BE UPON US Posted: 12 Sep 2016 09:00 PM PDT from Gregory Mannarino: |

| Turk explains why Fed isn't likely to raise interest rates Posted: 12 Sep 2016 08:49 PM PDT 11:50p ET Monday, September 12, 2016 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk today tells King World News why he thinks the Federal Reserve won't raise interest rates any time soon. First, Turk says, the presidential election will discourage it, and second, the U.S. government could not bear the increased interest expense. The interview is excerpted at KWN here: http://kingworldnews.com/james-turk-how-to-survive-the-coming-financial-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| US Think Tank Warns That Australia Is About 6 Weeks Away From Housing Collapse Posted: 12 Sep 2016 08:00 PM PDT Over the past couple of months, we have written frequently about the impact of Chinese money laundering operations on home prices in a couple of large cities around the globe. So far, the Vancouver market has seemingly been the hardest hit with homes prices collapsing over 20% in one month after the city passed a 15% property tax on foreign buyers on July 25, 2016 (see "As The Vancouver Housing Market Implodes, The "Smart Money" Is Rushing To Get Out Now"). Now, a U.S. based think tank, International Strategic Studies Association (ISSA), is warning that similar efforts to restrict Chinese investment in Australian real estate could send prices tumbling there as well. In speaking with news.com.au, Greg Copley, President of ISSA, predicted that Australia has about 6 weeks before real estate prices start to collapse.

Real estate prices in Australia's largest housing markets have soared over the past couple of years fueled, in no small part, by demand from Chinese buyers looking for offshore locations to park cash. The Sydney and Melbourne markets have been the largest beneficiaries of foreign capital with real estate prices up 53% and 51%, respectively, since 2012. That said, based on data from the Australian Bureau of Statistics it looks like home prices in Australia have already started their descent.

Back in the spring, Australian banks began cracking down on foreign purchasers of residential properties due to concerns of increasing fraud and money laundering activites. New rules enacted required borrowers to be Australian citizens and/or legal residents with a valid visa. Per ISSA, these new restrictions on lending will likely result in many foreign buyers being forced to default on new residential properties. He argues that many foreign buyers placed down payments on properties under the old banking regulations but now won't be able to secure financing to close once the properties are actually completed. Efforts to restrict lending, came in addition to taxes imposed by many Australian cities after foreign demand was found to be pricing local buyers out of many residential markets and killing the “Great Australian Dream” of owning property. In fact, Sydney prices have risen to record levels and currently rank second only to Hong Kong in terms of major cities with the world’s least-affordable housing. With Vancouver and Australia now cracking down on Chinese money laundering operations the only question that remains is where the next bubble will spring up to take it's place? |

| Supervisor Of "Massive Fraud" At Wells Fargo Leaves Bank With $125 Million Bonus Posted: 12 Sep 2016 07:40 PM PDT There was a burst of righteous populist anger anger last week, when it emerged that Wells Fargo had engaged in pervasive, "massive" fraud since at least 2011, including opening credit cards secretly without a customer's consent, creating fake email accounts to sign up customers for online banking services, and forcing customers to accumulate late fees on accounts they never even knew they had. For this criminal conduct, Wells was fined $185 million (including a $100 million penalty from the CFPB, the largest penalty the agency has ever issued). In all, Wells opened 1.5 million bank accounts and "applied" for 565,000 credit cards that were not authorized by their customers. As "punishment" Wells Fargo told CNN that it had fired 5,300 employees related to the shady behavior over the last few years. The firings represent about 1% of its workforce and took place over several years. The fired workers went to far as to create phony PIN numbers and fake email addresses to enroll customers in online banking services, the CFPB said. What was hushed away is that not a single employee will go to prison, and that ultimately it will be Wells Fargo's shareholders - such as Warren Buffett - who will end up footing the bill. What Wells did not disclose publicly to anyone is that the head of the group responsible for Wells' biggest consumer fraud scandal in years, is quietly leaving the bank with a $125 million bonus, a bonus which as Fortune's Stephen Gandel writes today will not see even one cent clawed back as part of the dramatic revelations. According to Gandel, Carrie Tolstedt, the Wells Fargo executive who was in charge of the unit where employees opened more than 2 million largely unauthorized customer accounts—a seemingly routine practice that employees internally referred to as "sandbagging"— is leaving the giant bank with an enormous pay day, some $124.6 million. Tolstedt is walking away from Wells Fargo with a very full bank account, and praise: in the July announcement of her exit, which made no mention of the soon-to-be-settled case, Wells Fargo's CEO John Stumpf said Tolstedt had been one of the bank's most important leaders and "a standard-bearer of our culture" and "a champion for our customers." In light of the record fine levied by the CFPB for the unit which Tolstedt headed, we wonder if Stumpf would like to retract his statement. What is just as troubling is that despite beefed-up "clawback" provisions instituted by the bank shortly after the financial crisis, "it does not appear that Wells Fargo is requiring Tolstedt, the Wells Fargo executive who was in charge of the unit where employees opened more than 2 million largely unauthorized customer accounts—a seemingly routine practice that employees internally referred to as "sandbagging"—to give back any of her nine-figure pay." As a reminder, on Thursday, Richard Cordray, the head of the CFPB, said, "It is quite clear that [the actions of Tolstedt's unit] are unfair and abusive practices under federal law. They are a violation of trust and an abuse of trust." However, cited by Gandel, a spokesperson for Wells Fargo said that the timing of Tolstedt's exit was the result of a "personal decision to retire after 27 years" with the bank. The spokesperson declined to comment on whether the bank was considering clawing back Tolstedt's back pay.

In other words, this has become yet another instance where bank subordinates were engaged in activity that seemingly none of their supervisors was - mysteriously - aware of, a pattern observed in virtually every major crackdown against a prominent sellside bank, from Goldman's Fab Tourre to the Libor conspiracy. While Fortune writes that it is not clear how closely Tolstedt was responsible for or even aware of the widespread abusive tactics at the bank, it is a fact that Tolstedt ran the community banking division of the bank, which included its retail banking and credit card divisions, during the entire period in which the customer abuse was alleged, which goes back to 2011. The CFPB said about three quarters of the unauthorized accounts opened by employees of Wells Fargo were bank deposit accounts. Another 565,000 were unauthorized credit card applications. Tolstedt took over the division in 2008, after Wells Fargo merged with Wachovia during the financial crisis. Ironically, Tolstedt was a regular on Fortune's Most Powerful Women list. She was replaced on this year's list by Mary Mack, who is taking over her job at the bank.

However later in 2015, the L.A. City Attorney's office sued the bank because of its sales tactics, saying that many of the abusive practices came from intense pressure on Wells Fargo's employees to get customers to open up numerous accounts. A separate class action of former employees alleges they were fired for not meeting cross-selling goals, or going along with the aggressive sales tactics. Meanwhile, the awards for Toldstedt continued piling in, and earlier in 2016, when Wells Fargo released its annual proxy statement, it once again said that in order to justify her multimillion dollar bonus, Tolstedt's division had "achieved a number of strategic objectives." But this time, for the first time in years, cross-selling wasn't listed as one of them. While one can speculate if Tolstedt decided to leave in advance of the CFPB crackdown on her division, one thing that is certain is how much money she is taking with her: according to Gendell, when Tolstedt leaves Wells Fargo later this year, on top of the $1.7 million in salary she has received over the past few years, she will be walking away with $124.6 million in stock, options, and restricted Wells Fargo shares. Some of that hasn't vested yet. But Tolstedt gets to keep all of it because she technically retired. Had she been fired, Tolstedt would have had to forfeit at least $45 million of that exit payday, and possibly more. It is safe to assume that had she waited until after the CFPB settlement, that her parting present may have been one third smaller, and that she could have been the bank's scapegoat, fired to placate regulators. Alas, now we will never know what "could"have happened, which means that the only recourse Wells and its shareholders have - if they feel like bothering - is to try to recoup some of her ill-gotten bonus. As Fortune concludes, "the bank's proxy statement says that the bank has "strong recoupment and clawback policies," and that the bank will revoke bonus pay if it is found that the conduct of an executive resulted in representational harm to the bank, or that the executive was not able to "identify or manage" risks in his or her division. But there is no sign that Wells Fargo is going to ask Tolstedt to return even a sliver of her stock jackpot." As we pointed out last week, when we observed that yet again nobody is going to prison, Gandel's parting assessment is similar: "on Wall Street, the carrots are still widely handed out. The sticks, however, remain out of sight." This also means that the biggest crime on Wall Street remains a more prosaic one: getting caught. |

| Tent Cities Full Of Homeless People Are Booming In Cities All Over America As Poverty Spikes Posted: 12 Sep 2016 07:30 PM PDT by Michael Snyder, The Economic Collapse Blog:

Just like during the last economic crisis, homeless encampments are popping up all over the nation as poverty grows at a very alarming rate. According to the Department of Housing and Urban Development, more than half a million people are homeless in America right now, but that figure is increasing by the day. And it isn't just adults that we are talking about. It has been reported that that the number of homeless children in this country has risen by 60 percent since the last recession, and Poverty USAsays that a total of 1.6 million children slept either in a homeless shelter or in some other form of emergency housing at some point last year. Yes, the stock market may have been experiencing a temporary boom for the last couple of years, but for those on the low end of the economic scale things have just continued to deteriorate. Tonight, countless numbers of homeless people will try to make it through another chilly night in large tent cities that have been established in the heart of major cities such as Seattle, Washington, D.C. and St. Louis. Homelessness has gotten so bad in California that the L.A. City Council has formally asked Governor Jerry Brown to officially declare a state of emergency. And in Portland the city has extended their "homeless emergency" for yet another year, and city officials are really struggling with how to deal with the booming tent cities that have sprung up…

But of course it isn't just Portland that is experiencing this. The following list of major tent cities that have become so well-known and established that they have been given names comes from Wikipedia…

Most of the time, those that establish tent cities do not want to be discovered because local authorities have a nasty habit of shutting them down and forcing homeless people out of the area. For example, check out what just happened in Elkhart, Indiana…

If they can't live on "public property", where are they supposed to go? They certainly can't live on somebody's "private property". This is the problem – people don't want to deal with the human feces, the needles, the crime and the other problems that homeless people often bring with them. So the instinct is often to kick them out and send them away. Unfortunately, that doesn't fix the problem. It just passes it on to someone else. As this new economic downturn continues to accelerate, our homelessness boom is going to spiral out of control. Pretty soon, there will be tent cities in virtually every community in America. |

| Silver: The Metal That Operates Our World – Keith Neumeyer Posted: 12 Sep 2016 07:00 PM PDT from The Daily Coin: |

| Gold Boom! End Game Nears As Central Banks Buying Up Gold Mining Companies! Posted: 12 Sep 2016 06:20 PM PDT When you watch mainstream media or listen to central bankers, gold is constantly deemed to be the redheaded stepchild of the investment industry. Just that alone, is unbelievable, considering that gold has been one of the best performing investments of the 21st century. On December 31st, 1999, gold closed at $290.25. As of today it is trading at $1327.80. |

| Central Banks Able to Get “Trading Machines†to Pump Up Markets, for Now… Posted: 12 Sep 2016 06:11 PM PDT Mike Gleason: It is my privilege now to welcome in Craig Hemke of the TF Metals Report. Craig runs one of the most highly respected and well known blogs in the industry and has been covering the precious metals for close to a decade now and puts out some of the best analysis on banking schemes, the flaws of Keynesian economics and evidence of manipulation in the gold and silver markets. Craig it's great to have you back and thanks again for joining us today. Welcome. Craig Hemke: Hey Mike, it's always a pleasure. Thanks for the invite. |

| Correction in Gold and Silver Markets Continues Posted: 12 Sep 2016 06:07 PM PDT Technical analyst Jack Chan charts the latest moves in the multiweek correction in the gold and silver markets. |

| Track All Of Bankrupt Hanjin's "Ghost Ships" In Real Time Posted: 12 Sep 2016 06:00 PM PDT After two weeks of impenetrable legal limbo, there was some good news for owners of cargo stuck in the bowels of container ships belonging to the recently bankrupt South Korean shipping giant, Hanjin Shipping. As Bloomberg reported according to the insolvent shipper, at least some vessels are in line to unload cargo at Long Beach port in California after a U.S. court Friday granted bankruptcy protection, easing a gridlock that disrupted delivery of goods. Three more Hanjin ships are waiting at the port to clear their freight once Hanjin Greece, which is currently offloading, clears early Sept. 12 local time, Hanjin said in response to a query. Truck drivers probably will begin moving containers from the Greece on Monday while the vessel prepares to leave late in the day for the Port of Oakland, said Teamsters spokeswoman Barbara Maynard and shipping traffic controllers, cited by Reuters. Port workers began taking Hanjin Greece's cargo ashore at 8 a.m. local time Sunday, and the Hanjin Gdynia will follow, Noel Hacegaba, chief commercial officer of the Port of Long Beach, said in a telephone interview Sunday. However, the Greece, and its two peer ships, carry only a fraction of the $14 billion in goods on dozens of ships owned or leased by the world's seventh-largest container carrier. Worse, while some of Hanjin's ships would be free to offload their cargo once they obtain the needed funding, the fate of many other ships is unknown. Charter owner Seaspan has three ships under charter with Hanjin - the Hanjin Buddha, Hanjin Namu and Hanjin Tabul – which are all due to hit the U.S. West Coast within the next few days. Chief executive Gerry Wang said he was confident the South Korean government would provide sufficient funds to pay port operators and Seaspan by the time those ships arrived to ensure they were unloaded.

Alas, it may be, if only for the time being: as Reuters notes, creditors have sought an arrest warrant against the Seaspan Efficiency, a ship hauling cargo for Hanjin that was due to arrive in Savannah. In the meantime, two weeks after the bankruptcy was filed, most of the company's "ghost ships" remain in limbo: it is not clear when port operators will bring others to berths in Southern California and elsewhere. One Hanjin ship off Long Beach, the Hanjin Montevideo, is under the supervision of a court-ordered custodian after two fuel companies obtained an arrest warrant for it over unpaid bills. Hanjin and the fuel providers are trying to work out an arrangement to release the vessel. It's no less chaotic around the globe: in Hong Kong, the Hanjin Belawan arrived from Shanghai on Monday loaded with containers and was anchored a short distance from the city's Kwai Chung Container Terminal. Terminal operator Hongkong International Terminals, a unit of Hutchison Port Holdings Trust controlled by tycoon Li Ka-shing, has outraged local cargo owners by charging fees of between HK$10,000–HK$15,000 per Hanjin container to release them at the port. The delays have concerned importers like Alex Rasheed, president of Pacific Textile and Sourcing Inc in Los Angeles, which has a shipment of clothing in 16 containers on Hanjin ships off Long Beach. "We're already starting to run out of some colors and some sizes," Rasheed said, noting Hanjin's collapse comes as U.S. retailers prepare for the all-important holiday shopping season. In Singapore, cargo owner AP Oil International said it had been sending replacement cargos on urgent orders. "On the procurement side, we do also face some issues to receiving raw materials shipped on Hanjin vessels, which of course we are adjusting our supply chain and production to meet and replace the cargo due to the uncertainty of the situation now" Group Chief Executive Ho Chee Hon said. * * * In total, Hanjin said that as of this morning, it had 93 vessels, including 79 container ships, stranded at 51 ports in 26 countries. Readers who wish to track the fate of Hanjin's "ghost ships" in real time - as it looks likely that many of them will remain stuck in legal and financial limbo for a long time - can do so courtesy of the following Platt's interactive map. |

| Gold and United States Imported Oil Posted: 12 Sep 2016 05:56 PM PDT The US has imported crude oil for many decades. The following data (1970 – 2015) comes from the Energy Information Administration of the US government. This data shows reported barrels of crude oil imported into the US. (Note: This is not a comprehensive analysis of imported energy, nor does it compensate for exports of crude oil, imports or exports of coal, natural gas or other energy sources.) |

| Silver Will Be A Top Performing Asset In The Next Financial Crisis Posted: 12 Sep 2016 05:43 PM PDT The much awaited Jackson Hole speech by the Fed Chair Janet Yellen – and the subsequent nonfarm payrolls data failed to ignite the prospects of a rate hike this September of 2016. The market now forecasts only a 21% probability of a rate hike in this month, according to the CME FedWatch Tool. The probability of a rate hike in December of 2016 stands at just above 50%. Time and again, I have explained why the Fed cannot hike rates in 2016. Contrary many market experts, my view has stood the test of time and has come to fruition. According to my research, the chances of a rate hike in December of 2016 are also very bleak. Nonetheless, the Fed speakers will continue to “jawbone” the dollar, the way they have been doing for the whole year. |

| How I Remember September 11, 2001 Posted: 12 Sep 2016 04:40 PM PDT by Michael Krieger, Liberty Blitzkrieg:

I remember 9/11 like it was yesterday. I was one year into my Wall Street career. I got up that morning just like every other morning and headed toward Union Square station to get on the subway down to 3 World Financial Center, the headquarters of Lehman Brothers. I had just purchased breakfast in the cafeteria when I saw one of the human resources folks from my floor yelling to evacuate. I was confused but I got my ass downstairs fast. When I got down there I joined the hundreds of others staring in awe skyward at the gaping hole in the North Tower of the World Trade Center. People speculated that a helicopter had hit the building, but I said no way. It looked like a bomb went off to me. Shortly afterward, the ground started shaking and I heard an enormous explosion and saw fire and debris shooting out from behind the North Tower. The herd starting running and I was trampled on. We all retreated to safer ground, at which point I ran into some co-workers. I mentioned that I was a bit worried these things could fall, but I was ensured by a higher-up at the firm that this was impossible. It was at that point that some co-workers and I decided to take the long walk home to my apartment on east 12th street. As we walked, we saw people jumping from the buildings, and ultimately we saw the first one collapse in front of our eyes as we traversed through Soho. In the days following the collapse, all I wanted was for the towers to be rebuilt just like before. I wanted the skyline back to what I had know since the day I came into this earth at a New York City hospital to be restored exactly as I had always known it. Career-wise, I felt I should leave Wall Street. I thought about going back to graduate school for political science, or maybe even join the newly created Department of Homeland Security (yes, the irony is not lost on me). I read a lengthy tome on Osama Bin Laden and al-Qaeda. I was an emotional and psychological mess, and it was when I was in this state of heightened distress that my own government and the military-industrial complex took advantage of me. It wasn't just me of course. It was an entire nation that was callously manipulated in the aftermath of that tragedy. The courage and generosity exhibited by so many New Yorkers and others throughout the country and indeed the world was rapidly transformed into terrifying fear. Fear that was intentionally injected repeatedly into our daily lives. Fear that translated into pointless wars and countless deaths. Fear that was used to justify the destruction of our precious civil rights. Fear that was used to initiate a gigantic power grab and the source of tremendous profits for the corporate-statists and crony-capitalsits. Unfortunately, that is the greatest legacy of 9/11. While all of the above is true, I now see a very bright silver lining. Although it took me an embarrassingly long time, I did wake up from the deep haze of propaganda and am now able to see things for what they really are. Of course, I am only one of millions globally who now recognize how badly we have been duped and are working to restore all of the precious things we have lost. So let's take 9/11 to remember all the people that were lost on that day, as well as all of those to whom we have done injustice in the name of the Orwellian never-ending "War on Terror." Let's strengthen our resolve to right all of these wrongs and make us proud of these United States once again. That is how I remember September 11, 2001. |

| Gold and Silver Pulling Back To Support, Could Fed Meeting Next Week Boost Junior Miners? Posted: 12 Sep 2016 02:46 PM PDT Stocks have been in an uptrend for more than five years and the Dow Jones Industrial Average has more than tripled since 2008 lows. Smart investors are getting nervous as they realize that no market goes straight up forever. The question now is not if but when will the next bear market in equities occurs. It does not take a PhD rocket scientist to observe the record gains in the US stock market for a lengthy period of time without any major corrections. It begs the question is any of this through the use of record low interest rates and quantitative easing since the start of the credit crisis to achieve this? I am concerned that these gains are overinflated and pumped higher through these policies of the Central Bankers and stocks are way overvalued and extremely overbought, not reflecting the real economy which to me is the worst it has been in a long time. Unemployment still remains high, small business growth is almost non existent and government spending remains out of control. Interest rates are going negative and the appetite for precious metals is rising. Because we have not seen a meaningful correction in the Dow in more than seven years, the chance of a significant bear market remains higher than ever. I believe the US stock markets are at dangerous overbought levels and we should now be hedged with precious metals and mining stocks which are generally considered counter cyclical to equities. I believe the Dow-Gold ratio is about to turn in favor of precious metals in a big way. I am focussed on mining companies that are backed with assets rather than pipe dreams like so many tech stocks. While the lemmings were chasing stocks in 2015 I continued to build positions in deeply discounted mining companies with near term production, top notch management teams and in mining friendly jurisdictions. Now in 2016 although stocks remain high, the miners have outperformed. This may be just the beginning because I expect even greater capital rotation into precious metals and junior miners when stocks begin crashing. The Fed raising rates could be good for precious metals as investors may finally rotate out of overvalued stocks in search for equities backed by precious metals or gold silver exploration which has finally turned the corner. Interestingly, since the Fed started raising rates at the end of 2015 the junior miners have had a huge uptick in price appreciation indicating a lot of capital coming into the junior miners. I expect great gains especially as we may have ended one of the deepest and longest downturns in the mining sector ever. It appears that gold broke its downtrend and 200 Day Moving Average in early 2016 forming a bullish golden crossover in February. Then in June gold broke 2 year highs and has since consolidated to the breakout point at $1300. Its quite normal after making such bullish breakouts to hold at that level before the next leg higher. This summer gold has taken a breather pulling back to uptrend support. It may still base until the Fed decision next week providing what may be looked back upon as a secondary opportunity for those who missed the Brexit breakout in June. Gold and silver both have rising 50 and 200 day moving averages which are bullish showing an upward trend. Notice rallies have been on increasing volume showing possible accumulation. It broke out into new 2 year highs in June following Brexit and has since consolidated returning to the breakout point. This past week it made a weekly bullish engulfing pattern which may signal a short term reversal to the breakout technical target of $23.50. The move may accelerate higher after the Fed announcement next week. Now during this pullback in the junior miners follow these three companies who may be on the verge of a re-rating either through discovery or development. They could be takeout targets as they move closer to production for a mid tier producer who is falling short on gold reserves. 1)Take a look at this junior gold miner in British Columbia on track to produce a Feasibility Study in early 2017 and start construction by the end of the year. There are very few high quality near term gold producers hitting these results in Canada. More than 65% of the shares are in strong hands led by Osisko and Premier Gold. Their recent results were quite exciting. Highlights from the recent underground drill results include:

2)Another junior gold mining company in British Columbia has a Mine and Mill Complex which they plan on reopening in the near term. They just received a water discharge permit to begin geotechnical test work. New management that came from Goldcorp appears to be rapidly putting together a team for permitting and the eventual restart of the mine and mill. Over $80 million was spent on mine development and expansion from prior companies. For a deep discount this junior acquired 100% of the whole plant, camps, permits, bonds and a estimated tax loss pool of around $50 million. 3)This junior gold miner led by one of the smartest mining executives in the business acquired one of Barrick’s top gold mines at what could be seen one day as the bottom of the bear market in gold mining. They bought it for a huge discount to what Barrick paid. This mine was a prior producer and contains high grade gold. The company announced recently that the re-start process is well advanced, on budget and on time and that they started a drilling program targeted at resource growth. Unlike many junior gold miners this company was fully financed when it started trading but raised an additional $18 million which will allow them to build an underground decline and for expansion drilling. This has led the company to hire full time PhD exploration manager who has experience in the jurisdiction as he worked for some of the majors. Further drilling could be exciting as it is a first class deposit in a jurisdiction which has monster mines. The CEO is well thought of with four decades of mine building experience and has been involved with eight mine restarts. He has sold a prior junior company for billions and worked for the majors. I am quite excited to hear some of the results coming from the drilling at this former Barrick project. Disclosure: Jeb Handwerger owns these three stocks highlighted and the companies are all website sponsors. Owning securities and receiving compensation is a conflict of interest as I could personally benefit from a price/volume increase. Please do your own due diligence as this is not financial advice! See my full disclosure by clicking on the following link: http://goldstocktrades.com/blog/featured-companies-on-gold-stock-trades/ Investing in stocks is risky and could result in losing money. Buyer Section 17(b) provides that: "It shall be unlawful for any person, by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication, which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof." I am biased towards my sponsors (Featured Companies) and get paid in either cash or securities for an advertising sponsorship. You must do your own due diligence and realize that small cap stocks is an extremely high risk area. Please do your own due diligence! _______________________________________________________ Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements. |

| LIVE Stream: Donald Trump Rally in Asheville, NC 9/12/16 Posted: 12 Sep 2016 02:38 PM PDT Monday, September 12, 2016: Live streaming coverage of the Donald J. Trump for President rally in Asheville, NC at U.S. Cellular Center. Live coverage begins at 6:00 PM ET. LIVE Stream: Donald Trump Rally in Asheville, NC 9/12/16 The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

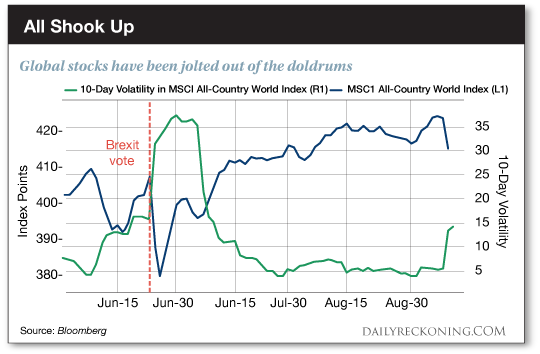

| Global Stocks, Bonds Fall Sharply - Gold Consolidates After Two Weeks Of Gains Posted: 12 Sep 2016 11:49 AM PDT Global stocks and bonds fell the most since the Brexit panic today as recently dormant volatility came back with a vengeance. There are deepening concerns that global central banks’ ultra loose monetary policies have been ineffectual and may indeed be creating asset bubbles in stock, bond and indeed property markets internationally. |

| Leeb describes how China will use gold to gain control of world's monetary system Posted: 12 Sep 2016 11:07 AM PDT 2:05p ET Monday, September 12, 2016 Dear Friend of GATA and Gold: In commentary posted at King World News, fund manager Stephen Leeb describes how he thinks China is maneuvering to gain control of the world's monetary system, making a big and ever-growing place for gold in the International Monetary Fund's currency, Special Drawing Rights. But, Leeb adds, China wants gradual developments, not sudden shocks. Leeb's commentary is posted at KWN here: http://kingworldnews.com/the-coming-crash-will-create-an-economic-tsunam... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Ted Butler explains why he thinks Morgan is controlling silver Posted: 12 Sep 2016 11:01 AM PDT 2p ET Monday, September 12, 2016 Dear Friend of GATA and Gold: In an interview with Jim Cook of Investment Rarities, silver market analyst Ted Butler explains why he thinks JPMorganChase is controlling the silver market, being long real metal and short futures contracts, and is waiting for the best chance to let the price fly. The interview is headlined "Jim Cook Interviews Ted Butler" and it's posted at GoldSeek's companion site, SilverSeek, here: http://www.silverseek.com/commentary/jim-cook-interviews-ted-butler-1593... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT NewCastle Gold's New CEO, Gerald Panneton, Hits the Ground Running By Tommy Humphreys Mining entrepreneur Gerald Panneton took a few years off after building one of Canada's largest gold miners, Detour Gold. He raced performance cars in his down time, and conducted due diligence on various mining assets to potentially back. This summer, the geologist set his sights on NewCastle Gold (TSXV:NCA), owner of a past-producing gold mine in California with similarities to Detour Gold in its early days. ... ... For the remainder of the report: https://ceo.ca/@tommy/new-newcastle-gold-ceo-gerald-panneton-hits-the-gr... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Dirty Money & the Clean New Fiver Posted: 12 Sep 2016 10:23 AM PDT Bullion Vault |

| Stocks Sell Off: Here’s What You Need to Know Posted: 12 Sep 2016 07:30 AM PDT This post Stocks Sell Off: Here’s What You Need to Know appeared first on Daily Reckoning. Volatility is back! A summer of quiet trading is over. The stock market screamed to life on Friday after treading water for more than a month. The tight trading range that had trapped the major averages for weeks was snapped by a sharp move lower. The Dow coughed up almost 400 points. The S&P 500 and Nasdaq dropped 2.5%. Commodities fell. Gold finished the day in the red. Gains were nowhere to be found… September has been a downright terrible month for decades. As we noted at the very beginning of the month, September has posted an average drop of more than 1% over the past century—the only month of the year that has averaged a loss. And Friday's big move lower doesn't look like it will be an isolated incident. World markets continue to swoon this morning. S&P futures are falling to levels we haven't seen since right before the Brexit vote. The quiet trading we experienced in August has turned out to be the calm before the storm.

Investors are now worked up over the possibility of a rate hike. The financial media has already declared that the market moved sharply lower on Friday due to rate hike concerns. Prepare your eyes and ears for a deluge of rising rates chatter and speculation as we limp toward the September Fed meeting. Of course, making guesses about interest rate policy isn't the best way to pull short-term gains out of the markets. If you want to trade, you have to stick to the facts. Here's what we know—and what it might tell us as we head into a volatile trading week… On Friday, market components moved lower together. No group of stocks was spared. Just two names in the S&P 500 moved higher by more than 1% on Friday: Wynn Resorts (NASDAQ:WYNN) and Met Life (NYSE:MET). Highly correlated markets mean there's nowhere to hide as stocks drop. Turning to the charts, the S&P 500 has knifed below its 50-day moving average. That sets up potential support near its June/November highs. If these levels are broken, look out below…

Finally, the stocks and sectors that were setting up for positive moves just a few days ago are now leading the market lower. On Thursday, we showed you three potential trades that were outperforming the major averages are ready to blast higher. After Friday's rout, all three of these outperformers immediately went from leaders to laggards. Small-cap stocks, biotechs, and financials all led the market lower to finish up the trading week. That's not bullish action. Smaller, speculative stocks like biotechs can give us a good idea as to how much risk investors are willing to take. With the sector plummeting nearly 4% on Friday, it's safe to say that risk is abruptly "off" for the time being… The most important thing you can do during this sudden market turmoil is to pay attention to the market's cues and obey your stop losses. There's no sense in hanging onto any trades that have triggered a sell just because they looked good last week. Keep a close eye on your open positions as we enter a potentially volatile trading week… Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Never miss another buy signal. Click here now to sign up for FREE. The post Stocks Sell Off: Here’s What You Need to Know appeared first on Daily Reckoning. |

| The Debt Riddle That Elites Are Trying To Solve Posted: 12 Sep 2016 06:59 AM PDT This post The Debt Riddle That Elites Are Trying To Solve appeared first on Daily Reckoning. The biggest problem confronting the global monetary elite is sovereign debt. There's too much of it, it's growing fast and it cannot possibly be paid off in real terms. A default larger than any in history with trillions of dollars in losses for investors is coming sooner rather than later. The only question is what form the default will take. Once the form of the default is ascertained, it's easy to estimate the winners and losers and the approximate timing. The first myth that needs to be busted is the idea that the world "learned its lesson" in the 2008 crisis and the system has been made safer since then. It's not true. In fact, debt has been piled on debt since 2008. All that happened since the 2008 crisis is that government debt has been used to substitute for some private debt, while private debt has continued to grow on its own. These charts are for loans and securities only. They do not include interbank lending or derivatives. There's nothing inherently wrong with debt subject to two conditions: The debt is used for productive purposes and your capacity to repay the debt is growing faster than the debt itself. In other words, are you borrowing for good reasons, and can you afford to pay it back? Unfortunately, governments have failed both conditions. Much of the money borrowed on sovereign debt markets since 2008 has been wasted. The U.S. used most of its $800 billion "stimulus" plan in 2009 to subsidize government and union salaries. China used trillions of dollars in bank debt to build "ghost cities" that will never be occupied.

It's true that some jobs were saved or created, but debt-to-GDP ratios kept climbing, and the productive capacity of the major economies did not grow fast enough to cover the debt. The world is one big Ponzi scheme, and now creditors are beginning to ask, "Where's my money?" There are three ways to repay sovereign debt: default, growth and inflation. Obviously, growth is the best way, but it's not happening. The U.S. has been stuck with sub-2% growth for the past 10 years. Europe and Japan are even worse. China's growth has been higher, but much of that is smoke and mirrors because of wasted investment. Default is another way out of debt. That's the usual path chosen by developing economies such as Argentina and now Venezuela. But for economies that can print money, default is unnecessary. The U.S. can print dollars, the ECB can print euros and the Bank of Japan can print yen. China has a problem because much of its debt is in dollars, which it cannot print. But China has a $3.3 trillion war chest of dollar reserves it can use. Now that the Chinese yuan is a "reserve currency" (designated by the IMF in late 2015), it's possible for the People's Bank of China and the U.S. Federal Reserve to do "currency swaps" where the Fed gives China dollars in exchange for yuan. (These swaps are arranged behind the scenes and kept secret in order not to spook markets.) These swaps can also help China deal with its dollar-denominated debt. Of course, all of this money printing eventually leads to inflation. That's the third way out of the debt — just inflate the currency. You still pay the debt in nominal terms, but the money's not worth as much. That's a good deal for the debtors (like the U.S., China, Japan and Europe) and a bad deal for the creditors (which could be you). Regards, Jim Rickards Ed. Note: Check out below an incredible visual of the U.S. National Debt. Brought to you by Jeff Desjardins at Visual Capitalist.

Source: Visual Capitalist via Jeff Desjardins.

P.S. Sign up for your FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post The Debt Riddle That Elites Are Trying To Solve appeared first on Daily Reckoning. |

| Why the Greater Recession Will be Dollar Bearish Posted: 12 Sep 2016 03:46 AM PDT The Great Recession of 2008 provided markets with an interesting irony: As the US economy was collapsing under the weight of crumbling home prices, investors curiously flocked to the US dollar under the guise of “The Safety Trade.” But the truth is that investors weren’t running into the dollar for safety, what they were actually doing was unwinding a carry trade. In a carry trade an investor borrows a depreciating currency that offers a relatively low interest rate and uses those funds to purchase an appreciating currency that offers the potential for higher returns on its sovereign debt and stock market. The trade’s objective is to capture the difference between rates, while also benefitting from the currency that is rising in value against the borrowed (shorted) funds. |

| BonTerra Resources Swings for a Double Posted: 12 Sep 2016 01:00 AM PDT With the rise in gold shares since the first of the year, good stories are harder to come by. Bob Moriarty of 321 Gold profiles BonTerra Resources, which he believes has home-run potential. |

| Gold, Stock Market Down: Now What? Posted: 12 Sep 2016 12:44 AM PDT Last I wrote, I was expecting a stock market top early in the week with the late week dropping. We had gone short on Thursday, but late screwy wave action had me pull out to neutral (to my chagrin). I had been looking for a 10 week low within this general time frame and I believe we are there. A move down to challenge the SPX 1994-2100 area would not surprise me on Monday. This should be a great buying area for one more move to new highs by early October at the latest before we see the expected autumn swoon. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

SHANGHAI GOLD FIX CONTINUES TO HAVE A PREMIUM OF $3.00 OVER LONDON/NY GOLD/THE 10 YR REPO FAILS AGAIN AS COLLATERAL IS SCARCE/ANOTHER MEDICAL EPISODE FOR HILLARY

SHANGHAI GOLD FIX CONTINUES TO HAVE A PREMIUM OF $3.00 OVER LONDON/NY GOLD/THE 10 YR REPO FAILS AGAIN AS COLLATERAL IS SCARCE/ANOTHER MEDICAL EPISODE FOR HILLARY

I

I

No comments:

Post a Comment