Gold World News Flash |

- ITS COMING FOR AMERICA VENEZUELA FOOD CRISIS – Zoos Being Raided for Food. Collapse

- On This "Atom Bomb"-Anniversary, You're Being Lied To About Hiroshima (And Much More..)

- Visualizing 31 Incredible Facts About Gold

- Harry Dent Global Economic Collapse is Near 2016-2017 Crash Report

- The Coming Global Economic Crash Is Just A Matter Of Time

- Why Oil Under $40 Will Bring It All Down Again: That's Where SWFs Resume Liquidating

- Hillary Clinton: "I May Have Short-Circuited The Truth" About The Email Scandal

- The Kennedy Assassination | Declassified

- Is Economic Collapse Inevitable? | Mike Maloney and Stefan Molyneux

- MF Global 5 Years Later: PWC Set To Take The Fall As Corzine Still Untouched

- Pew Research Survey Points to Widespread Angst About How the EU is Handling the Refugee Crisis

- Gold And Silver Charts

- Revealing the Real Rate of Inflation Would Crash the System

- Gerald Celente Globalists Are Going To Collapse World Economy

- Turkey to increase gold-storage capacity to become regional hub

- Breaking News And Best Of The Web

| ITS COMING FOR AMERICA VENEZUELA FOOD CRISIS – Zoos Being Raided for Food. Collapse Posted: 06 Aug 2016 09:00 PM PDT ITS COMING FOR AMERICA VENEZUELA FOOD CRISIS – Zoos Being Raided for Food. Collapse The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| On This "Atom Bomb"-Anniversary, You're Being Lied To About Hiroshima (And Much More..) Posted: 06 Aug 2016 07:25 PM PDT

It is the anniversary of dropping an atom bomb on Hiroshima. But the Hiroshima narrative is a lie. We’ve reported at considerable length about how the whatever was dropped on Hiroshima and Nagasaki didn’t have the kind of immediate destructive impact that is portrayed. Crawford Sams who ran the Atomic Bomb Casualty Commission in Japan had this to say about the bombing of Hiroshima and Nagasaki (Transcript HERE.) :

We’ve reported that a squadron of 66 bombers were launched on August 6th (666) to bomb the municipality of Imabari, even though Imabari. had been bombed already, twice. This bombing squadron may well have fire-bombed Hiroshima instead, as Hiroshima was not far away. HERE is a video on the squadron and also a narrative from a book by Edwin Hoyt entitled Inferno, the Firebombing of Japan. Here is some narrative from a PERTINENT PAGE in the actual book.

The attacks on Hiroshima and Nagasaki were horrible and tragic. But whether they were results of “atom” bombs (certainly in the sense that people understand them today) is at least seriously questionable. More from the Post:

Visiting Hiroshima and Nagasaki won’t etch anything into your heart but lies. And the sickening falsehoods allow politicians a faux rhetorical nobility that they don’t deserve. Whatever happened at Hiroshima and Nagasaki is nothing like what is being recited today. Bikini Atoll, where additional atomic bombs were tested following the Hiroshima and Nagasaki attacks, was repopulated by 1968, even though radiation estimates suggested the island would be uninhabitable for a thousand years. The actual bomb blasts seem to have been faked. Two years ago, the controversial but prolific investigator Miles Mathis – an artist and mathematician – published a debunking HERE entitled, The Bikini Atoll Nuclear Tests were Faked.”

Why would Bikini Island tests have been faked if the bombs dropped on Hiroshima and Nagasaki were real? Did the US suddenly run out of bombs? And what about Russia? How did the USSR make nuclear bombs while the Pentagon was faking theirs? Mathis writes some photographs of USSR nuclear explosions appear fake. When did the USSR get the “bomb?” And even more importantly, when did the US finally create the weapons of mass destruction that so frighten us today? When did the Cold War really start? Did both sides know that nuclear weapons were not as powerful as advertised? Or maybe that they didn’t exist at all as described? Hiroshima and Nagasaki themselves are thriving small cities and there is no appreciable difference in radiation between these two municipalities and other cities in Japan. Additional issues (See sources at the end of this article.):

The narrative of the bombings was surely shaped just as the Pentagon and its controllers wished for it to be. It was acquiesced to by the Japanese government that had its own reasons for promoting nuclear untruths. Whatever happened at Hiroshima and Nagasaki has not been accurately reported. In fact, it is probably not too strong to say that what has been reported may constitute (in aggregate) one of the most profound lies of the 20th century. It calls into question further “truths” about Western society that we live with to this day. Nuclear weapons are a perfect propaganda for the state.

Modern Western society is a virtual tissue of lies designed to make you believe you are living in a “civil society” (no, it’s not civil) faced by life-threatening challenges that only Western governments and the shadowy powers behind them can overcome. The world is not running out of food, nor water. It’s not going to burn to a cinder because the air is clogged with “carbon.” The economic disasters we face are purely man-made. Absent monopoly central banking, they would not exist. Now we are facing “radical Islam” – another false narrative put in place by the same banking elite that has tortured the West for centuries. This follows on the heels of numerous, serial US wars and the obscene, manufactured Hell of World Wars One and Two. Thank goodness for the Internet and what we have called the Internet Reformation. Thanks to information that has emerged from secret recesses (and the patterns they portray), we know more about the Way the World Really Works than any single group of individuals in recorded history. Conclusion: It has been a great privilege to live in these unusual times. However, please take note: The reality of the world has revealed a titanic struggle between good and evil. Which side are you on? And just as importantly, what are you going to do about it? * * * Some Nuclear Anomalies and Sources Pertaining to Questionable Hiroshima and Nagasaki Events

There are other disturbing elements to the Nagasaki and Hiroshima bombings, and if you are interested, you can see more documents calling many elements of the attacks into question HERE. See information on an alternative theory regarding nuclear weapons HERE: Additional DB Nuclear Articles to Share (With Links) North Korea Nuclear Hoax Heightens Alternative Media Skepticism March 10 The Trillion Dollar Nuclear Weapons Fraud April 15 NASA and Nuclear Activities: More Scrutiny Needed May 25 NY Times Uses Hiroshima to Justify Gun Control, Even as More Evidence Questions A-Bomb Scenario June 15 NY Times: Hiroshima Mushroom Cloud Actually ‘Smoke from Raging Firestorm’ June 20 Brexit’s Modern Manipulation and Its A-Bomb Beginnings June 29 Pentagon’s Not Properly Funding Its Trillion-Dollar Nuclear Costs July 1 |

| Visualizing 31 Incredible Facts About Gold Posted: 06 Aug 2016 05:40 PM PDT No metal can claim a legacy comparable to gold. As VisualCapitalist's Jeff Desjardins notes, gold has been used to show affectionate love, but it has also represented power, status, and riches for the greatest kings of antiquity. Gold’s history is truly legendary, ripe with colorful tales and anecdotes from people ranging from William Shakespeare to Christopher Columbus. But gold doesn’t just “talk the talk”. Gold also walks the walk, because its grandeur is backed up by impressive chemical properties and uses. As we documented in our extensive Gold Series, it’s been used as a monetary metal for thousands of years by ancient civilizations such as the Lydians, Greeks, Chinese, and Romans. It’s the most malleable and ductile metal, and it doesn’t tarnish or corrode. Over time, these properties have helped people to associate gold with concepts such as immortality or royalty. Even today, people are still finding new uses for gold that are impressive in their own right. For example, scientists recently discovered a gold alloy that is four times tougher than titanium. Without further ado, here are 31 incredible facts about gold... Courtesy of: Visual Capitalist |

| Harry Dent Global Economic Collapse is Near 2016-2017 Crash Report Posted: 06 Aug 2016 05:21 PM PDT Harry S. Dent Harry S. Dent Jr. The Great Depression Ahead Harry S. Dent, Jr. is the Founder and President of the H. S. Dent Foundation, whose mission is "Helping People Understand Change". Using exciting new research developed from years of hands-on business experience, Mr. Dent offers a... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The Coming Global Economic Crash Is Just A Matter Of Time Posted: 06 Aug 2016 04:44 PM PDT Easy money policies can't last forever. And any attempt to prolong these artificially low interest rates will result in hyperinflation, which will amount to a complete breakdown of the US financial system, not to mention social chaos. The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Why Oil Under $40 Will Bring It All Down Again: That's Where SWFs Resume Liquidating Posted: 06 Aug 2016 04:30 PM PDT After several months of aggressive selling of stocks in late 2015 and early 2016, the culprit for the indiscriminate liquidation and concurrent market swoon was revealed when it emerged that the seller was not only China (which was forced to sell USD-denominated reserves to offset a surge in capital outflows following the Yuan devaluation), but also Sovereign Wealth Funds belonging to oil-exporting countries, who were dumping billions in risk assets to offset the collapse of the price of oil, which in turn exacerbated current account and budget deficits. Among the prominent sellers was Norway and Saudi Arabia, arguably the biggest casualties of the death of the Petrodollar to date, as well as Abu Dhabi, Kuwait and most other SWFs, listed on the tabel below.

As JPM calculated back in January, the SWF equity selling was inversely proportional to the price of oil: according to the bank, SWF's would liquidate some $75 billion in equities in 2017 assuming oil at $31 per barrel. Needless to say, the lower oil goes, the more selling there would be. "This prospective $75bn of equity selling by SWFs in 2016 is not huge but becomes significant after taking into account the potential swing in equity fund flows," JPM continued, in an attempt to discuss the impact this will have on markets. "Last year retail investors bought $375bn of equity funds globally. This year we expect an amount between 0 and $200bn. Subtracting $75bn of selling from SWFs would leave the overall equity flow from Retail+SWF investors barely positive for 2016." Then starting in February, oil - which had just tumbled to the low-$20s, its lowest price in over a decade - underwent a miraculous surge catalyzed by erroneous, if constantly reiterated, narrative of an imminent OPEC supply cut, a short squeeze, an algo stop hunt, an unprecedented Chinese importing spree to replenish its now almost full Strategic Petroleum Reserve, and even speculation of central bank intervention to prop up the "black gold." In fact, just a few months after February, oil had doubled, reaching $50 even as we and many others warned, that there simply is not enough demand and far too much supply to sustain such a price. No matter the cause, the biggest benefit of this oil surge is that the same SWFs which were actively selling stocks in early late 2015 and early 2016 put their liquidation on hold as oil rose above $40. And in this illiquid, low volume market, the absence of a determined seller is all that it took to push the S&P to all time highs, and as of Friday's close, just shy of 2,200, a level which even sellside brokers such as Goldman believe is effectively in bubble territory and in the 99% percentile of all overvalued metrics. However, just a few weeks later we are now back in a crude bear market, with oil briefly dipping under $40, on the back of concerns about a gasoline glut and fears that the resurgent dollar will further pressure oil. Worse, with oil returns back to the $40 range and threatens to accelerate the move to the downside, it also brings back with it the specter of SWF liquidations, because as JPM's Nikolaos Panigirtzoglou points out in his latest weekly note, that's where the wealth fund selling returns. Here is why as oil approaches $40, the price of crude suddenly matters a lot to equity bulls:

Indeed: the lower the price of oil drops, the faster what until recently had been a paradoxical disconnect (and even a negative correlation between oil and risk assets as we showed earlier), will recouple. And it's not just the SWF selling: recall that earlier this week, JPM's head quant Marko Kolanovic warned that should oil return back to the $30s, it would also trigger program selling of stocks.

To summarize, if oil were to drop back under $40, not only would it precipitate even more selling of oil as momentum strategies flip, but it would catalyze a liquidation by those SWFs who thought they were done selling equities, leading to a return of the same sellers that pushed the S&P back to the low 1,900s a short 6 months ago. So for all those curious where stocks are going next, the simple answer is: keep an eye on what oil does next. |

| Hillary Clinton: "I May Have Short-Circuited The Truth" About The Email Scandal Posted: 06 Aug 2016 04:10 PM PDT One of the biggest surprises over the past week was Donald Trump's dramatic meltdown, and subsequent escalation, with the family of Humayun Khan, the US Muslim captain killed in Afghanistan in 2014, who during the DNC, tangentially accused Trump and his potential policies of being responsible for their son's death (he wasn't). What is most striking is that instead of ignoring this attempt to bait the Republican candidate in public, to which he most gladly obliged, he should have simply moved on and stayed on the offensive, pressing Hillary over the recent Wikileaks disclosure revealing the cronyism and corruption within the Democratic Party, as well push the familiar narrative of her email scandal. Conveniently, Hillary helped him do just that yesterday, when she acknowledged on Friday afternoon that she may have "short-circuited" when she claimed in recent interviews that FBI Director James Comey said she was "truthful" about her use of a private email server as secretary of state. In doing so Hillary once again shifted the news spotlight away from Trump and back on to herself, as she once again revealed that the only consistent thing about Hillary Clinton are the constant lies. Following a heavily covered interview with Fox News' Chris Wallace, Hillary stated that Comey had found her statements "truthful" and "consistent" with what she has said publicly. Clinton's lying led The Atlantic to publish an article titled " Why Can't Hillary Clinton Stop Lying?" and the Washington Post's fact checker Glenn Kessler awarded her four "Pinocchios", adding that "Clinton is cherry-picking statements by Comey to preserve her narrative about the unusual setup of a private email server. This allows her to skate past the more disturbing findings of the FBI investigation." Notably, the NYTimes did not publish anything related to this flop and it took the Public Editor, whose job it to be the readers' advocate at The NYT, to write an op-ed titled The Clinton Story You Didn't Read Here. After an almost universally bad week for her opponent Donald Trump, Hillary went out of her way once again to explain away her home-brew server, only this time it led to a less than favorable outcome. Clinton insisted in two televised interviews aired this week, including one with Fox News' Chris Wallace aired Sunday, that Comey had found her statements "truthful" and "consistent" with what she has said publicly. The Democratic nominee, speaking at a joint convention for African-American and Hispanic journalists, remarked that she was "pointing out in both of those instances that the Director Comey had said that my answers in my FBI interview were truthful." She then reiterated the "truthful" assessment in an interview with a Colorado television station later in the week. According to Politico, Hillary stressed that "that's really the bottom line here. And I have said during the interview and many other occasions over the past months, that what I told the FBI, which he said was truthful, is consistent with what I have said publicly," Clinton explained Friday. "So I may have short-circuited it and for that, I, you know, will try to clarify because I think, you know, Chris Wallace and I were probably talking past each other because of course, he could only talk to what I had told the FBI and I appreciated that." "But I do think, you know, having him say that my answers to the FBI were truthful and then I should quickly add, what I said was consistent with what I had said publicly. And that's really sort of in my view trying to tie both ends together," she added.

Notice the difference between her original statement and revision. In the first one, James Comey confirmed her statements about her email setup were consistent and truthful. In her revision, the FBI director confirmed that what she told the FBI was truthful. Perhaps because lying to the FBI is a crime but lying to the American population is not? Her word choice of "short-circuiting" confirms what many voters in this election feel about Hillary. Her answers are memorized, poll tested and scrutinized by hundreds of staffers, almost in a robotic fashion, to ensure she does not "bend" the truth. This is why Hillary does a press interview every 240 days at best Finally, having finally found a new opening to dig itself out of the hole it has found itself in, Donald Trump's campaign laced into Clinton over her latest "pretzel-like response."

Now the only question is whether Trump can keep his mouth shut long enough to give Hillary more chances to stick her foot in hers, and do to her own polling what Trump has been so eager to do to his over the past two weeks. |

| The Kennedy Assassination | Declassified Posted: 06 Aug 2016 04:00 PM PDT Learn everything you need to know about The Kennedy Assassination in this Declassified episode. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Is Economic Collapse Inevitable? | Mike Maloney and Stefan Molyneux Posted: 06 Aug 2016 03:30 PM PDT Is an economic collapse inevitable? Mike Maloney joins Stefan Molyneux to discuss the precarious state of the modern banking system, what they don't tell you about the cycle of inflation/deflation, the negative impact of current monetary policies on the poor and much much more! Michael Maloney is... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| MF Global 5 Years Later: PWC Set To Take The Fall As Corzine Still Untouched Posted: 06 Aug 2016 03:19 PM PDT Jon Corzine, former Governor of New Jersey and CEO of Goldman Sachs, took over the helm of MF Global in March 2010. When revenue at the bank failed to live up to expectations, Corzine developed a scheme to place a massive $6BN bet on the sovereign debt of the aptly named PIIGS (Portugal, Italy, Ireland, Greece, Spain) through a financial structure known as a "Repo to Maturity". To summarize the strategy for all you aspiring CEO's, when you find it difficult to generate organic revenue growth sometimes the better option is to just bet your entire firm on a single, massively-levered trade on the sovereign debt of countries on the verge of insolvency. Well, not so much. Deterioration of the Eurozone economies in mid-2011 resulted in massive margin calls on Corzine's trade and a liquidity crisis at MF Global. By the time the dust settled there was $1.6BN of cash "missing" from customer accounts which should have been segregated. And with that, less than 2 years after Mr. Corzine took the CEO seat, MF Global filed for bankruptcy protection on October 31, 2011 in the Southern District of New York. We know what you're thinking...sounds reckless to risk an entire firm on the highly volatile sovereign debt of a group of countries labeled the "PIIGS", right? Well apparently it's not that big of a deal unless you're the scapegoat accountants. Yesterday, U.S. District Court Judge Victor Marrero of New York denied PwC's motion for dismissal of a $1 billion professional malpractice suit filed by MF Global against the accounting firm saying that the administrator had "presented sufficient evidence to create a material factual dispute" as to whether advice from PwC ultimately played a role in the bankruptcy filing. According to the WSJ:

For its part, PwC has maintained that reckless trading decisions and "adverse market conditions" were the real cause of the bankruptcy filing, not faulty accounting of the trades.

Lesson learned. If you commit a murder it's the gun's fault, if you gain 20 lbs it's the fork's fault and if you place a massively levered trade that blows up your firm then it's the accountant's fault. After all, it's not the losses of a failed trade that caused the liquidity crisis at MF Global but rather the timing of the realization of those losses that are truly to blame. As for Jon Corzine, last we heard he was trying to raise capital for a new hedge fund (one which may have trouble getting a primary dealer designation) and we are confident he will succeed for two reasons. Reason #1:

And Reason #2:

* * * For those interested, the full decision can be read below: |

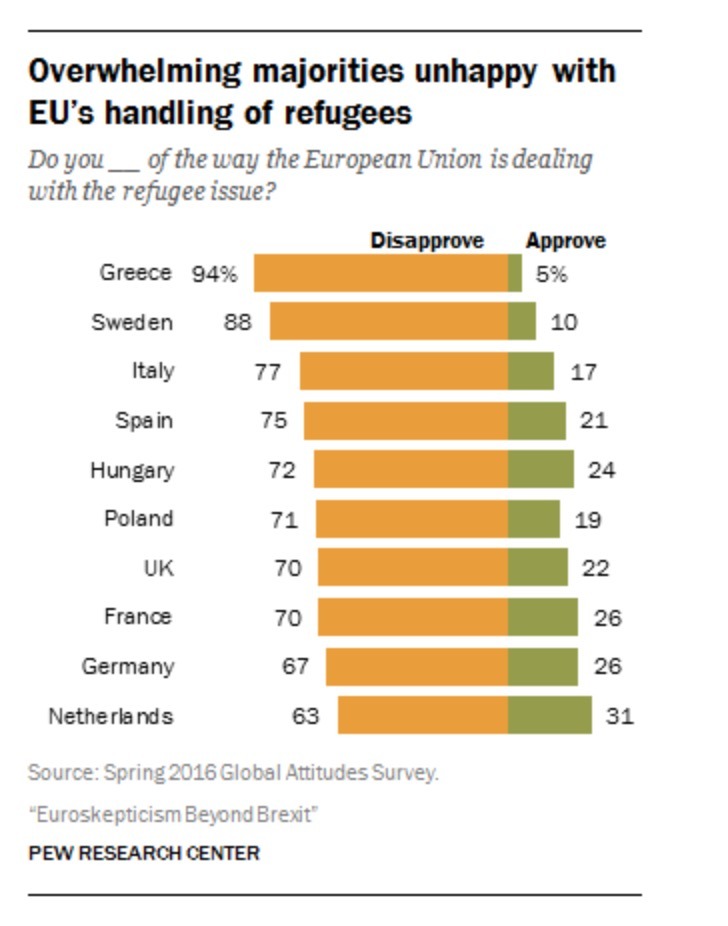

| Pew Research Survey Points to Widespread Angst About How the EU is Handling the Refugee Crisis Posted: 06 Aug 2016 03:00 PM PDT by Michael Krieger, Liberty Blitzkrieg:

Although I knew many millions across the eurozone were irate about how the refugee crisis was being handled, I had no idea how irate they were until I read the results of a recent survey by the Pew Research Center. Below are some of the shocking findings.

Now here's the chart for a wider sampling of EU nations. Conclusion: No one is happy.

|

| Posted: 06 Aug 2016 08:45 AM PDT Our pace for posting commentaries will slow down for August by design over the next few weeks, and for the last week of August, there will be no posting due to vacation time. This week, focus will be solely on the charts. There is so much going on in the world and with the Bread and Circuses election in the United States, the sum of which is enough to send the price of precious metals considerably higher, but the reality is price is still under the control of Chinese buying at bargain prices while the West’s central bankers try to keep alive the Ponzi scheme facade regarding gold and silver. The globalists behind the fiat curtain have been exposed for their financial and political chicanery to keep the vastly underwater banking system “alive and well,” yet the public has no unified voice to be so shocked by the extreme theft by the bankers and their political hacks, so the game plays on. |

| Revealing the Real Rate of Inflation Would Crash the System Posted: 06 Aug 2016 08:00 AM PDT This post Revealing the Real Rate of Inflation Would Crash the System appeared first on Daily Reckoning. Our real-world experience tells us the official inflation rate doesn’t reflect the actual cost increases of everything from burritos to healthcare. In our household, we measure inflation with the Burrito Index: How much has the cost of a regular burrito at our favorite taco truck gone up? Since we keep detailed records of expenses (a necessity if you're a self-employed free-lance writer), I can track the real-world inflation of the Burrito Index with great accuracy. The cost of a regular burrito from our local taco truck has gone up from $2.50 in 2001 to $5 in 2010 to $6.50 in 2016. That's a $160% increase since 2001; 15 years in which the official inflation rate reports that what $1 bought in 2001 can supposedly be bought with $1.35 today. This enormous loss of purchasing power is not reflected in the official measure of inflation, which claims inflation is subdued (1% or so annually). If the Burrito Index had tracked official inflation, the burrito at our truck should cost $3.38 — up only 35% from 2001. Compare that to today’s actual cost of $6.50 — almost double what it "should cost" according to official inflation calculations. Since 2001, the real-world burrito index is 4.5 times greater than the official rate of inflation — not a trivial difference. Between 2010 and now, the Burrito Index has logged a 30% increase, more than triple the officially registered 10% drop in purchasing power over the same time. My Burrito Index is a rough-and-ready index of real-world inflation. To insure its measure isn't an outlying aberration, we also need to track the real-world costs of big-ticket items such as college tuition and health insurance, as well as local government-provided services. When we do, we observe results of similar magnitude. The takeaway? Our money is losing its purchasing power much faster than the government would like us to believe. According to official statistics, inflation has reduced the purchasing power of the dollar by a mere 6% since 2011: barely above 1% a year. We've supposedly seen our purchasing power decline by 27% in the 12 years since 2004 — an average rate of 2.25% per year. But our real-world experience tells us the official inflation rate doesn't reflect the actual cost increases of everything from burritos to healthcare. The grim reality is that real inflation is 7+% per year. What would happen if the real rate of inflation was revealed? The entire status quo would immediately implode. Consider the immediate consequences to Social Security, interest rates and the cost of refinancing government debt. Unbiased private-sector efforts to calculate the real rate of inflation have yielded a rate of around 7% to 13% per year, depending on the locale — many multiples of the official rate of around 1% per year. So what happens if the status quo accepted the reality of 7+% inflation? Here are a few of the consequences: 1. Social Security beneficiaries would demand annual increases of 7+% instead of zero or near-zero annual increases. The Social Security system, which is already distributing more benefit payments that it is receiving in payroll tax revenues, would immediately go deep in the red. (Please don’t claim the SSA Trust Fund will be solvent for decades. I’ve dismissed the fraud of the illusory Trust Fund many times. The reality is the federal government has to borrow every dollar of deficit spending by Social Security by selling more Treasury bonds, just as it borrows every other dollar of deficit spending.) The Social Security system would be revealed as unsustainable if real inflation (7+% annually) were made public. 2. Global investors might start demanding yields on Treasury bonds that are above the real rate of inflation. If inflation is running at 7%, then bond buyers would need to earn 8% per year just to earn a real return of 1%. Central states are only able to sustain their enormous deficit spending because interest rates and bond yields are near-zero or even below zero. If the federal government suddenly had to pay 8% to roll over maturing government bonds, the cost of servicing the existing debt — never mind the cost of borrowing an additional $400 billion or more every year — would skyrocket, squeezing out all other government spending and triggering massive deficits just to pay the ballooning interest on existing debt. Bond yields of 8+% would collapse the status quo of massive government deficit spending. 3. Private-sector interest rates would also rise, crushing private borrowing. How many autos, trucks and homes would sell if buyers had to pay 8% interest on new loans? A lot less than are being sold at 1% interest auto loans or 3.5% mortgages. 4. Any serious decline in private and state borrowing would implode the entire system. Recall that a very modest drop in new borrowing very nearly collapsed the global financial system in 2008-09, as the whole system depends on a permanently monstrous expansion of new borrowing to fund consumption, student loans, taxes, etc. The grim reality is that real inflation is 7+% per year, and this reality must be hidden behind bogus official calculations of inflation as this reality would collapse the entire status quo. Super-wealthy elites earning 10+% yields on stock, bond and real estate portfolios aren’t particularly impacted by 7% inflation; their real wealth continues to expand nicely. Who’s being destroyed by 7+% real inflation? Everyone whose income has stagnated and everyone who depends on wages rather than assets to get by — in other words, the bottom 95%. How come we haven't heard about that this election season? Regards, Charles Hugh Smith Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE.

The post Revealing the Real Rate of Inflation Would Crash the System appeared first on Daily Reckoning. |

| Gerald Celente Globalists Are Going To Collapse World Economy Posted: 06 Aug 2016 04:12 AM PDT Gerald Celente Globalists Are Going To Collapse World Economy About Gerald Celente : Founder of The Trends Research Institute in 1980, Gerald Celente is a pioneer trend strategist. He is author of the national bestseller Trends 2000: How to Prepare for and Profit from the Changes... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Turkey to increase gold-storage capacity to become regional hub Posted: 06 Aug 2016 03:25 AM PDT Turkey to Increase Gold-Storage Capacity to Become Regional Hub By Daily Sabah Staff with Anadolu Agency Borsa Istanbul Stock Exchange Chairman Himmet Karadağ said the gold-storing facilities that would ould increase Turkey's current capacity for storage of hidden gold ten-fold with a capacity to hold up to 1,600 tons of gold and silver will soon begin operating near Kuyumcukent in Istanbul. "As in London, where gold bars of foreign countries are kept safe, [Turkey] aspires to have the same capacity [for gold storing] as well," Karadağ said. ... Dispatch continues below ... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Speaking to Anadolu Agency, Karadağ emphasized that market capital and the stock exchange should be strengthened in terms of volume and product diversity, including Islamic finance within that scope. The chairman said that establishment of an International Advisory Council is crucial for drawing Gulf capital to Turkey, attracting Islamically sensitive investors and increasing product diversity. Karadağ noted that they would pave the way for not only participating banks but also non-affiliated banks that stand to benefit from the council, which would set standards to aid in the production of Islamic financial products, as well as conducting audits of those standards. ... ... For the remainder of the report: http://www.dailysabah.com/economy/2016/08/06/turkey-to-increase-gold-sto... Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Breaking News And Best Of The Web Posted: 05 Aug 2016 06:44 PM PDT Good US jobs report — on the surface. Gold plunges, stocks jump. Oil hovers around $40. Bank of England cuts rates, UK bond yields plunge. European banks have investors running scared. Japan begins new round of stimulus. The Trump campaign may be collapsing. Swiss central bank keeps buying stocks. Best Of The Web A […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

When the history books are finally written, I believe the tone-deaf handling of the refugee crisis by EU bureaucrats will be seen as one of the primary catalysts in the ultimate disintegration of the European Union.

When the history books are finally written, I believe the tone-deaf handling of the refugee crisis by EU bureaucrats will be seen as one of the primary catalysts in the ultimate disintegration of the European Union.

No comments:

Post a Comment