Gold World News Flash |

- "Things Are Worse" - Dollar Stores' Startling Admission: Half Of US Consumers Are In Dire Straits

- $1.5 Billion Paper Gold Dumped Day before Janet Yellen’s Speech – Andy Hoffman

- Tips for Safeguarding Your Precious Metals

- 2016 Silver News August Edition

- Silver and Gold May Muddle in August But Fall Could Tell a Different Tale

- WikiLeaks Julian Assange IT IS TIME

- Risks Of Loose Money - Exposing The Link Between Monetary Policy And Social Inequality

- Are the Chinese About to Go On a Lithium Battery Buying Spree?

- U.S-Russia Relations: Entering a New Thaw

- The Deep State V. Trump

- The New Power Elite Part I: The U.S. and China Escalate Energy War

- These Olympian Gold Royalty Companies are Insanely Attractive

- Need-to-Know Tips for Safeguarding Your Precious Metals

- A Zombie Financial System, Black Swans and a Gold Share Correction

- Azure Minerals Strikes Silver and Gold in Mexico

| "Things Are Worse" - Dollar Stores' Startling Admission: Half Of US Consumers Are In Dire Straits Posted: 26 Aug 2016 12:52 AM PDT If there was any confusion about how the lower half of the US consumer class is doing these days, it was quickly lifted following today's distressing earnings calls of dollar store titans, Dollar General and Dollar Tree. Discount retailer Dollar General said it was cutting prices on its most popular items such as bread, eggs and milk, intensifying a price war among already commoditized products with retail giant Wal-Mart Stores to win back falling market share. It shares fell the most on record, plunging by 18% after the company missed on revenue, blaming aggressive competition, lower food prices and reduction in SNAP, or food stamp, coverage in 20 key states.

It's larger ultra-discount rival Dollar Tree Inc also reported lower-than-expected sales, sending its shares down 10%, the biggest dollar drop decline since going public in 1995.

Dollar General, whose product selection prices are already among the lowest in the country, cut prices by 10% on average on about 450 of its best-selling items across 2,200 stores during the quarter, CEO Todd Vasos said on a conference call. It's just the beginning: quoted by Reuters, he said the company expects to extend the price reductions to more product categories and markets. One factor for the declining operations is the aggressive cost-cutting by retail giant, Wal-Mart, which recently reported better than expected results. It now appears WMT solid performance was mostly on the back of margin reductions and major cost-cuts in an attempt to win market share from its lowest-priced competitors. As Reuters notes, Wal-Mart's strategy of cutting prices has helped the world's largest retailer to boost sales in the latest two quarters. "Wal-Mart's been doing better lately, lowering prices, and that's been a concern that (it) could impact dollar stores," Edward Jones analyst Brian Yarbrough said. "Historically, it hasn't as much but maybe we are seeing something different here." Retailers are also grappling with a drop in grocery prices, further cutting into margins. Dollar General said prices for milk were down about 8% and for eggs over 50 %. But the biggest factor by far impacting the performance of both dollar stores was the sharp, adverse turn in the purchasing power of the lower half of US consumers. Both Dollar General and Dollar Tree said pressures on their core lower-income shoppers contributed to the same-store sales misses that both retailers reported. On today's conference call, Dollar General CEO Todd Vasos said that he was surprised to admit that while on the surface things are supposed to be getting better, the reality is vastly different for low-income US consumers:

Making matters worse, he added that the company's core consumers base, 65% of which is comprised of lower-income shoppers, has been impacted by the recent reduction or elimination in foodstamps: "now couple that in upwards of 20 states where they have reduced or eliminated the SNAP benefit, and it has really put a toll on [the core consumer]." He elaborated that the reduction in foodstamps benefits promptly filtered through the entire business model, and culminated with Dollar General being forced to cut prices to remain competitive. This is what he said:

Dollar Tree, which said that fewer than 5% of its customers were SNAP recipients, echoed its competitor when explaining the stress being felt by its own shopper base. As CEO Robert Sasser said on the call, "the consumer is still seeing a lot of pressure on cost increase with rent and just food and healthcare and taxes and all the things. So we see them as still being under pressure. I think that's the number one issue that we see out there." But back to the Dollar General call, where analysts were incredulous and were wondering if the deterioration in spending may have been the result of, wait for it, the recovery and broader consumer improvement, leading to "trading-up" to higher price point competitors. The exchange was amusing:

And then there are soaring healthcare and rental costs:

The punchline:

We wonder if this particular tearful customer would also be accused by the president of peddling fiction. |

| $1.5 Billion Paper Gold Dumped Day before Janet Yellen’s Speech – Andy Hoffman Posted: 25 Aug 2016 11:30 PM PDT from FutureMoneyTrends: |

| Tips for Safeguarding Your Precious Metals Posted: 25 Aug 2016 11:01 PM PDT A guest post from Clint Siegner! By Clint Siegner, Originally Published at Money Metals Exchange Gold and silver investors have strong opinions about third-party storage of metals. Privacy, the lack... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| 2016 Silver News August Edition Posted: 25 Aug 2016 08:57 PM PDT In 2016, touch screens are ubiquitous. The idea of a smartphone or tablet not equipped with a touch-sensitive, ‘swipeable’ screen is almost unthinkable. While the technology itself is well-established and reliable, there are a couple of issues that may limit future iterations of the much-used touch screen. |

| Silver and Gold May Muddle in August But Fall Could Tell a Different Tale Posted: 25 Aug 2016 06:40 PM PDT from The Daily Bell:

Fed Worries Are Crushing Gold and Silver Stocks … Gold slumped today, finishing at its lowest level in a month after investors grew worried that the Fed would signal that interest rates would rise when it meets this week. – Motley Fool Strange that the US central bank can preach increased prosperity at a time when some 90-100 million potential workers in the US don't seek formal, mainstream employment. On top of this, as Ron Paul wrote recently (here), the numbers that do issue from fedgov regarding employment are untrue. The most recent employment numbers featured an increased amount of service jobs. But even that wasn't really true as the numbers were "adjusted" upward by fedgov itself. In this case the word "adjusted" means that the numbers were simply arbitrarily enlarged. Because this number is so "good," the Federal Reserve is now contemplating a rate increase, presumably one of .25% In fact nothing has changed. The quasi-depression that afflicts the US and the world remains. The impatience of central bankers also remains. It is a matter of control. The Fed needs higher rates in order to move them back down. Going negative in the US is probably a difficult proposition, one that would arouse considerable media controversy, which the Fed probably doesn't want at this time. So it really doesn't matter what the "real" numbers are. The Fed needs to move rates up in order to move them back down. |

| WikiLeaks Julian Assange IT IS TIME Posted: 25 Aug 2016 06:25 PM PDT Assange is a hero, God bless him! May he stay entirely safe & secure, & live out a long & great life. Prayers for him, all his colleagues, friends & family! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Risks Of Loose Money - Exposing The Link Between Monetary Policy And Social Inequality Posted: 25 Aug 2016 06:25 PM PDT Submitted by Claudio Grass via GoldandLiberty.com, It has been almost eight years since former U.S. President George W. Bush warned the world that “ without immediate action by Congress, America could slip into a financial panic and a distressing scenario would unfold.” The government’s response to the crisis was a USD700 billion rescue package that would prevent U.S. banks from collapsing and encourage them to resume lending, which was soon to be followed by a series of Quantitative Easing (QE) packages injecting money into the economy. The rationale of government intervention was to boost spending, restore confidence in the market and revamp economic growth to everyone’s benefit – but did it succeed in doing so? QE: Faith-based monetary policyWith QE still ongoing (albeit tapered), it is no longer part of a “rescue” package – it has now become the new normal – despite a complete lack of positive results. Since end-2007, the Federal Reserve’s balance sheet expanded from about USD890 billion to more than USD4.5 trillion! And yet, U.S. growth rates have remained in the vicinity of 2% since 2010 (see chart below). Europe is no different. The European Central Bank (ECB), which first embarked on QE in March 2015, raised the monthly amount for asset purchases from EUR60 billion to EUR80 billion, and expanded the range of assets to include corporate bonds – but despite that, the growth outlook remains dim with 1.4% in 2016, and 1.7% in 2017 (source: Bloomberg). So why are governments still clinging to an approach that simply doesn’t deliver?

“All present-day governments are fanatically committed to an easy money policy, ” Ludwig von Mises observed in 1949 in “Human Action”, and to this day, little seems to have changed. Ever since governments, represented by their central banks, monopolized the production of money, and accordingly fractional reserve banking – our markets have never been free from government intervention. Monetary expansion happens all the time, not just in crises. In fact, the world has grown accustomed to this monetary policy, the new normal – and here is why:

The false promises of QE – a monopoly only has one winnerEven though Keynesians and other opponents of free market economics say there is no such thing as a “trickle-down effect”, the very assumption of QE is that it will trickle down to revamp the economy by boosting spending. But with low growth rates, weak currencies, and zero-to-negative interest rates, one wonders: who stands to gain from this monetary policy direction? Our economies have been dominated by the financial sector. Compared to the 1960s, the share of the financial sector has more than doubled from 4% to about 10% today, according to Forbes. This can be attributed to the closure of the gold window back in 1971, where the American administration looked for an easy way to finance its warfare-welfare state. The American citizen was deluded into thinking that the higher spending is because of the better performance of the economy, when in reality the government is printing its way out of the debt burden with an unbacked currency. However, inflation does not affect everyone equally. There are those who are wealthy and well-connected to the banking system who benefit from inflation, because they are the first to receive the newly-created money. The lower you go down the socio-economic pyramid, the more adverse the effects, as money begins circulating and loses value. The fiat money system in a way protects a certain strata of society: the financial sector (and those connected to it) and central banks. Everyone else, is impoverished by the system, and what is worse, becomes dependent on it. Also, you will find that those familiar with the system may know what to do to hedge against the risks of any deterioration in the economy and its currency. But others, like middle class professionals and the working class, they just don’t have access to the intricate higher levels of the financial markets. They are more likely to go to the bank to deposit their savings. But even then – the system hits them once again with negative interest rates. Our system penalizes saving and encourages reckless spendingOn the surface, negative interest rates imposed by central banks aim to encourage lending and stimulate spending. But in reality, because banks are required to pay for keeping their reserves at the central depository, they will end up charging money for accounts, lower interest rates on savings, and possibly even deny opening accounts for lower income clients. These will ultimately discourage depositors with limited means of income from keeping money in banks altogether and thereby increase the number of the “unbanked”, which in the U.S. amounts to about 7% of households (about 25 million people). And what if banks do not actually pass on the negative rates on the deposit side? Then, the ironic outcome is that they will end up charging more on loans, by introducing higher fees even on credit cards, or interest rate floors on variable loans, as already seen in German banks (Bloomberg). The whole idea of imposing this policy to make loans easier and cheaper has completely boomeranged and created the opposite effect. And so, what we are looking at is a flawed system that penalizes saving and encourages reckless spending and printing money. Although we all appear to be stuck in the same environment that combines negative interest rates and price inflation, we have the lower strata of society that is doomed to lose, as they end up spending more, discouraged by negative rates, and instead accumulate debt to keep up with the increasing prices. And then we have the “winners”, who know how to take advantage of the system and thrive in it. Doesn’t that look like entrapment to you? All this is “justified” by a government monopoly on money production. Conversely, are we to assume that a free market environment, free from government intervention, would ensure social equality? The fact is that, realistically, there is no such guarantee, nor was there such a utopian promise ever made. But as my friend Philip Bagus said in a recent interview:

The longer we wait, the worse the hitThe truth is, that our government officials have not solved the problem. They merely prolonged the downfall and generally poisoned the investment environment. If they had really addressed the root causes, they would have left the bubble explode. Yes, it is a harsh experience to endure. Bush wanted to spare his citizens from a great deal of misery – true, but the economy has not exactly flourished since then. In fact, our monetary policy direction has been prolonging the slowdown since 2008. The longer we wait, the worse the hit we will take. We are going from one bubble to another and are just postponing the inevitable. In a normally functioning business cycle we have a boom and bust. Yes, not everyone suffers equally from the bust: the working class is the most vulnerable to recessions. But under our current system, which has stripped them from their savings, they are exposed to greater risks than ever before. |

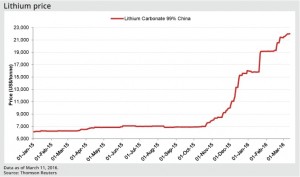

| Are the Chinese About to Go On a Lithium Battery Buying Spree? Posted: 25 Aug 2016 01:10 PM PDT The lithium market which has been in consolidation after a major upward move earlier this year may be ready to start its next move. News being reported by Reuters states that a big Chinese battery maker is in advanced stages of negotiations to buy a piece of Sociedad Quimica y Minera (SQM) one of the world’s largest lithium producers. Could the Chinese be looking at junior lithium explorers as well? This move by the Chinese reaffirms our long term commitment to the lithium battery sector which I was in way years before it started catching on. We may be ready to witness the next move higher which could even be greater that what we saw in the past.

Despite the recent rise of the lithium sector over the past year, the rising demand of electric vehicles could make lithium mining quite profitable over the next decade. The value could be in the companies making new lithium discoveries.

Here is a sneak peek to a few positions which I own and are current website sponsors. 1)Junior graphite company on verge of publishing Preliminary Economic Assessment in 3rd Qtr raises $1.3 million in oversubscribed offering. They own the largest large flake graphite deposit in the United States. 2)This Lithium battery technology company received a $2 million commercialization grant. They received the first of four installments which will allow the construction of a pilot plant that could be completed in early 2017. I wouldn’t be surprised if some Chinese battery entities get interested in this technology over the next few months. 3)This junior lithium prospect generator announced that they paid all the annual BLM fees for all seven of their lithium properties in Nevada. The prospect generator model allows the company to diversify the risk by Joint Venturing with other junior explorers. This allows them to make some money through cash and marketable securities hopefully minimizing dilution. We are pleased to report that our Project Generator Model has grossed over USD $300,000, as well as a portfolio of marketable securities. These earnings have helped to offset the annual BLM Maintenance Fees as well as a portion of the Company's general operating costs." 4)Keep a close eye on this junior trading for pennies which may be acquiring an exciting lithium property in Nevada. The area has a ton of interest as another comparable company owns a neighboring land position but sports a market cap almost ten times larger. 5)Don’t forget their are some great lithium deposits that coexist as a byproduct with uranium. Lithium prices are soaring into new highs while uranium prices are depressed at multiyear lows. However, both are critical for carbon free energy and oil independence. Their are two juniors in Peru advancing these uranium lithium deposits. They may come back into favor when uranium rebounds and follows lithium and graphite as the critical clean energy metals. Disclosure: I own securities in these five stocks that I linked to. They are also website sponsors. Owning securities and receiving compensation is a conflict of interest as I could personally benefit from a price/volume increase. Please do your own due diligence as this is not financial advice! See my full disclosure by clicking on the following link: http://goldstocktrades.com/blog/featured-companies-on-gold-stock-trades/ Investing in stocks is risky and could result in losing money. Buyer Beware! Section 17(b) provides that: "It shall be unlawful for any person, by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication, which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof." I am biased towards my sponsors (Featured Companies) and get paid in either cash or securities for an advertising sponsorship. I own shares in all sponsored companies. You must do your own due diligence and realize that small cap stocks is an extremely high risk area. Please do your own due diligence! _______________________________________________________ Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements.

|

| U.S-Russia Relations: Entering a New Thaw Posted: 25 Aug 2016 12:00 PM PDT This post U.S-Russia Relations: Entering a New Thaw appeared first on Daily Reckoning. U.S. relations with Russia have run hot and cold for the past ten years. New intelligence shows that relations are coming out of the deep-freeze and entering a new thaw. In March 2009, shortly after the Obama administration first came into office, Hillary Clinton met with Russian Foreign Minister Sergei Lavrov in Geneva. It was her first meeting with Lavrov since Clinton had become secretary of state. Relations between Russia and the United States had been under stress because of Russia's invasion of Georgia in 2008 during the George W. Bush administration. Obama and Clinton wanted to reset the relationship and move into a less adversarial posture. As a goodwill gesture, Clinton asked her aides to create a large red reset button (similar to the "easy" buttons used in the old Staples advertising campaign) with the word "reset" in Russian. The button was put in a case and presented to Lavrov as a gift at the Geneva summit. There was only one problem. State Department experts used the Russian word "перегрузка" on the button for the English "reset." Lavrov looked at the gift and politely informed Secretary Clinton thatперегрузка actually means, "overcharge." Oops. Clinton and Lavrov pushed the button anyway for the cameras. Russian-U.S. relations have been downhill ever since. When Obama and Clinton came into office, the President of Russia was Dmitry Medvedev. At the time, Vladimir Putin was Prime Minister. Putin had been president from May 2000 to May 2008, but was subject to term limits. Medvedev and Putin simply switched roles with Medvedev becoming president and Putin becoming prime minister. Technically this made Medvedev the chief executive and commander-in-chief in Russia. Yet, few doubted that Putin still controlled Russia from his slightly subordinate position. This de facto relationship was confirmed in May 2012 when Putin again assumed the role of president. Medvedev stepped aside and assumed his former role as prime minister. It was a complicated game of musical chairs, which gave Putin the presidency until at least 2020. Nevertheless, Obama and Clinton found Medvedev (who was president in 2009) to be more to their liking than Putin. Medvedev is more diplomatic and has a more global outlook than Putin, who is a staunch Russian nationalist. From 2009 to 2011, Russian – U.S. relations warmed slightly, notwithstanding the red button gaffe. In 2012, Russian-U.S. relations were again strained due to U.S. plans to put an anti-missile shield in Poland. During the 2012 U.S. election cycle, Obama distanced himself further from Russia because he was appealing for ethnic votes from anti-Russian Poles, and other Eastern Europeans living in the U.S. Still, Obama wanted to keep lines of communication open and looked forward to diplomatic deals with Russia. On March 26, 2012, just seven months before the U.S. election, Obama was caught on camera at a summit conference whispering to Medvedev that he would have "more flexibility" after the election. Medvedev promised to pass that message to Putin who was about to replace Medvedev as president. Russian-U.S. relations had another thaw early in 2013 after Obama's reelection, but it was short-lived. On the night of November 21, 2013, demonstrations broke out in Independence Square (Maidan Nezalezhosti) in Kiev against the Russian-backed government of Viktor Yanukovych. The protests peaked in February 2014. Yanukovych and his cronies fled the Ukraine. Putin suspected that the Maidan protests were secretly funded by the British intelligence agency MI6, and the CIA. In order to secure Russian interests in Ukraine, Putin invaded Crimea, and began supporting anti-Kiev ethnic Russians in eastern Ukraine. In response, the U.S. and its NATO allies imposed harsh economic sanctions on Russia. The sanctions included a ban on major Russian companies (such as Gazprom and Rosneft) refinancing their euro-denominated debt in western capital markets. Since Russian companies could not refinance their debts, they began to draw on central bank hard currency reserves to retire the debt. In turn, this began to deplete Russia's reserves and force higher interest rates and a devaluation of the ruble. The ruble sank like a stone beginning in March 2014. It fell from about 28 rubles to the dollar to 70 rubles to the dollar by early 2015 when relations were at their worst. (On an inverted RUB/USD scale, this fall would be from $0.035 to $0.014). The ruble regained some strength to the 50:1 level ($0.020) when it became clear that the Russian economy, although weakened, was more resilient than U.S. financial warriors had expected. Then Russia got whacked a second time with the collapse in oil prices. This collapse began in mid-2014 around the time of the Ukraine crisis. It reached its most intense phase in mid-2015 when oil fell below $40 per barrel on its way to $29.00 per barrel by early 2016. Russia is the world's third largest oil producer (after the U.S. and Saudi Arabia), and second largest oil exporter (after Saudi Arabia). The damage to the Russian fiscal situation was immediate and led to a recession in the world's ninth largest economy. This second blow to the Russia economy pushed the ruble to 81:1 ($.012) by January 2016. The Russian economy was in crisis.

Then a confluence of factors emerged to cause a rally in the ruble and a turnaround in the Russian economy. These factors fit smoothly into the analytic methodology. I use a centuries-old applied mathematical technique called causal inference (also known as Bayes' Theorem, after a formula first discovered by Thomas Bayes). The formula looks like this in its mathematical form:

In plain English, the formula says that by updating our initial understanding through unbiased new information, we improve our understanding. I learned this method in the CIA, and have seen it used at top-secret weapons laboratories to solve some of the most difficult problems imaginable. (I can't say more about these exercises because the discussions were classified). The left side of the equation is our estimate of the probability of an event occurring. New information goes into right hand side of the equation. If it confirms our estimate, it goes into the numerator (which increases the odds of our expected outcome). If it contradicts our estimate, it goes into the denominator (which lowers the odds of our expected outcome). The odds are continually updated as new information arrives. In my premium research service, Rickards' Intelligence Triggers, we use the same method to find actionable trading recommendations. Current indications are that Russian-U.S. relations are entering a new period of thaw after two years in the deep-freeze. This new era of cooperation between the U.S. and Russia centers mainly on joint efforts by President Obama and President Putin to bring an end to hostilities in Syria, and remove Syrian President Bashar al-Assad from office.  President Obama and President Vladimir Putin of Russia have discovered they can do business despite some strong disagreements, and damaged relations on issues such as Crimea and eastern Ukraine. Their main area of cooperation today involves Syria and efforts to remove Syrian President Bashar al-Assad from office. What are the other factors that enter the equation and allow us to estimate the direction of the Russia economy and the ruble with a high degree of confidence? There is an extensive list of material factors that grows longer by the day:

In short, all of the factors that were working against Russia from 2014 to 2016 (cheap oil, strong dollar, sanctions, and low commodity prices) are now working in Russia's favor. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away.

The post U.S-Russia Relations: Entering a New Thaw appeared first on Daily Reckoning. |

| Posted: 25 Aug 2016 12:00 PM PDT This post The Deep State V. Trump appeared first on Daily Reckoning. Donald Trump has the establishment scared out of their establishment minds. That's exciting. I love it. Look at their reaction to his plan to reduce the national debt, which re released this spring. The Washington Post, which is owned by a Deep State member, said it was "reckless." Wall Street blowhards called it "absurd." And a former senior U.S. Treasury Department official called it "insane." I just referred to a "Deep State member." What do I mean by the term "Deep State?" It's a massive conglomerate of insiders comprising government bureaucrats, lobbyists, crony capitalists, Wall Street "banksters" and national security agents. It's basically a shadow network of institutions that run the country no matter who is in the White House… and without the consent of voters. So what exactly did Trump propose to get assorted card-carrying members of the Deep State so worked up? In an interview with Deep State mouthpiece CNBC, Trump said he'd be open to negotiating the U.S. national debt down. He proposed cutting a deal with debt holders so that they take less than the full amount they are owed. Critics whine his plan is a de facto U.S. debt default that will cause a global economic calamity. That's the story the media is breathlessly reporting. But, as usual, the true story is buried deeper. And it explains why the establishment wants to destroy Trump with all deliberate speed. So why did the dealmaker Trump look to cut the deal of his lifetime with the national debt? Because he's focused on something that the Deep State's candidate, Hillary Clinton, won't say in public… even though she knows it's a ticking economic time bomb. Here's what Trump told CNBC: "We're paying a very low interest rate [on the debt]," he said. "What happens if that interest rate goes two, three, four points up? We don't have a country. I mean, if you look at the numbers, they're staggering." To make Trump's point, consider… In 2015, the U.S. spent $223 billion on interest on the national debt. That's with rates at zero. Historically, interest rates for U.S. government debt have ranged between 4 to 6%. Just before the Great Recession they were between 4.5 and 5.25%. If interest rates returned to those normal levels, the cost of servicing the debt would rise to roughly $1 trillion per year. That's basically the entire U.S. discretionary budget in 2015. If rates go up to historically normal levels, just paying interest on our debt would cost as much as we spend on the U.S. Departments of Defense, State, Health and Human Services, Education, Homeland Security, Housing and Urban Development, Justice — the list goes on. And because the government borrows the money to make interest payments, this starts a vicious chain reaction of paying interest on money borrowed to pay interest. Analysts estimate this spiral would cause the national debt to increase more than $60 trillion in less than 20 years. In other words, we'd be penniless peasants deployed to work on Deep State-owned rice farms. So Trump wants to kick the Deep State in the teeth, so to speak. Now, let me be clear… This isn't an endorsement of Donald Trump. And it's not an endorsement of his proposal to deal with our massive debt problem. My analysis is to help you see beyond hyperventilating headlines that the establishment feeds you daily. They want you afraid. Scared. They want you to only think that Trump is outrageous. Remember when they used to portray Ron Paul as a lunatic? They're trying to do the same thing with Trump… just because he's anti-establishment. They want you to think that anything beyond Deep State control is damaging to you. But, whatever your current understanding, make sure you pay attention to the real issue: debt is the lifeblood of the Deep State… They get rich and powerful while they bankrupt our nation. The last thing they want is to reduce the addiction to debt. They don't care if our exploding debt ends up ruining millions of Americans in an epic financial collapse. Productive industry has been replaced by the financial sector's rise, which has led to trillions in new debt and risky financial derivatives as far as the eye can see — fattening the wallets of the well connected members of the Deep State… but doing little for the rest of us. That's why Trump's statement is viewed as blasphemy. And that's why the Deep State will do whatever it can to make sure Trump doesn't get in the White House. For the past few decades, it hasn't really mattered who was in the White House. Presidents are mere marionettes controlled by the Wall Street bankers, the big corporations and the military industrial complex. That's no conspiracy, just fact. They give orders. Our elected "representatives" obey… then check their bank accounts for their snack money. In recent decades, this incestuous relationship has produced scores of new regulations, subsidies, privileges and payoffs that ignore the needs of average people while benefiting the elites. And as each year has passed, more money and influence has flowed from the productive working classes to the Deep State. So Trump isn't just up against Hillary. He's also up against the immensely powerful Deep State. The establishment would rather have Hillary in the White House. She's a safe bet for the shadow government. Even noted libertarian Charles Koch is touting her. She has been vetted by the Deep State and has amassed a massive fortune for her loyalty. Trump is a wild card. Nobody knows if he will take orders from the Deep State. And the powers that be are clearly concerned Trump might take their power levers. And now many Americans are finally waking up. The American people know the game is rigged, which is why Trump has been filling arenas across the country. His message strikes at the heart of the rigged system. And millions of Americans are listening closely. They want to tear it all down. But they're up against very powerful forces fully invested in getting Hillary elected. And if the Deep State wins? With the "devil" as the President, we can expect to keep piling trillions of debt on top of debt with no end in sight, until it all comes tumbling down. Then they take what you have left in the name of saving the country. Don't you find it strange that the mainstream media never reports on how much money Hillary has been paid by the Deep State? It's $153 million and counting over the last 15 years. Don't you find it odd that if you were the United States Secretary of State and left national secrets on an email server stored in a bathroom that could easily be hacked from Romania, you would be in jail for life… yet she's on the cusp of becoming President? Even little kids know this is wrong. They know it's crooked. And yet, the media focuses the majority of its time on how irresponsible and non-presidential Trump is. So next time you hear hyperventilating voices from the Deep State railing against Trump and his "dangerous" ideas, just remember… they're right. Trump's ideas are very dangerous… to the wealth and power of the Deep State. And that's why they want him stopped. Regards, Michael Covel Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post The Deep State V. Trump appeared first on Daily Reckoning. |

| The New Power Elite Part I: The U.S. and China Escalate Energy War Posted: 25 Aug 2016 11:00 AM PDT This post The New Power Elite Part I: The U.S. and China Escalate Energy War appeared first on Daily Reckoning.

I've been in China meeting with members of the International Monetary Fund (IMF) and the New Development Bank (NDB, launched by the BRICS). Here's what I found out: Green is the new black.

Nomi Prins and Dr. Raphael Lam, resident representative of China for the IMF. July 2016 As Jim Rickards has explained, the shift away from the dollar as the world's reserve currency creates an opening for a new global superpower. Other countries are making their moves to fill that spot, and none is moving more quickly than China. China has two big moves lined up, and the first one is happening at the G20 meeting on Sept. 4. Jim Rickards says that this will be the day the dollar dies. This will also be the day China shows that it is an equal to the U.S. and any other country vying for world supremacy. A massive part of world dominance is control over energy. Before, that meant oil. Now, it means green energy. The U.S. and China are racing to control green energy. For China, that's how they can clinch the title of new world superpower. For the U.S., it's a last-ditch effort to hold their ground. Why Green Energy MattersAt one point, having a significant oil stock reserve was a national security priority for White House administrations. Now, sustainable energy is. Why? Because if other nations open avenues of renewable energy sources to run their economies, global reliance on oil and fossil fuels will face competition as a sector. Countries that were once deemed energy resource deficient see a light at the end of the tunnel. This is their chance to break away from the dependency curse that has riddled so many into a debtors' prison. Nations with more control over oil flow or supply (like the U.S.) will face diminishing political power as the forms of energy used shift toward sustainability (like in China). It's not just currency wars, but energy wars now, too. The effect of the changing power dynamic isn't just confined to your opinion on climate change, but to how the money and power behind going green relates to your investment portfolio or your next career. The ramifications of this new power are global. The IMF reports that "even sectors that are resource intensive can maintain employment when energy and raw material costs increase." It notes "executive power and investment banking will continue to seek the greatest areas to expand influence, regardless of negative or positive influences." The downside here is that the elite are gunning for clean energy control. The upshot is more job creation and (eventually) lower energy costs for people (and a healthier planet.) Regardless of political elections and candidates' beliefs about climate change, these pioneering facilities create green jobs. They also aren't as affected by extraneous factors like economic crises or wars. The wind will always blow. The sun will always shine. Millions of jobs have been lost in the fossil fuel industry, particularly in coal. In contrast, over the last year, the solar industry added jobs 12 times faster than the rest of the economy — more than the jobs created by the oil and gas extraction and pipeline sectors combined. Nations with less access to their own oil are either buying access or investing in alternative forms of energy. China sees huge opportunity in gaining dominance from new power. China doesn't have the "Old Power" of the petrodollar and doesn't have its own oil. The NDB, headquartered in Shanghai, has shaped its mission statement to support sustainable energy infrastructure projects, giving Chinese (and China's emerging markets partners) companies the funding they need to stay ahead in the race. To fuel its growth, China needs control over as much energy as possible. The sun and wind offer a way. Meanwhile, the New Power Elite from Silicon Valley have mega operations, are involved in multiple government national security contracts, and have increased presence in Washington. The power supply they use to energize their businesses is the power they can access more cleanly, ultimately more cheaply, and in which they can lead the way innovatively. Wall Street is going where the money goes, so we'll find some of the usual crowd mixed in as we explore the key players on the U.S. side of the energy wars. First, here's a look at where power is now and a short overview of how it arrived there: The Rise of Old Power and What it Means for the New EliteAt the turn of the 20th century, old money and old power expanded from billionaire industrialists, like the Carnegies and Rockefellers, to include billionaire bankers, the Stillmans and Morgans of the world. Their control over the country's political and economic affairs was built on control of financial and energy resources (More of this in my most recent book). Take the Rockefeller fortune, for example. It was built largely on the success of the Standard Oil Co. in the late 1800s. The Morgan family's wealth relied on the global reach and domestic influence of the Morgan Bank and the spread of financial capitalism. In the late 1800s, the Morgans funded governments during financial panics. In the 1900s, they helped finance two world wars. The Rockefellers retained their power by achieving industrial, financial and political influence. As the Morgans and Rockefellers grew their profits, they, like other elites, looked to expand their power. They pursued making money from money, rather than from supplying energy to industrial pursuits and physical innovations. Bankers grew more powerful as they expanded their existing empires. This happened in tandem with the United States becoming a major superpower, a role solidified after World Wars I and II. To maintain its superpower status, the U.S. increasingly relied on its control over the dollar as the dominant currency and oil as the dominant energy source. The notion of the petrodollar in the 1970s, or linking petroleum and the U.S. dollar, was politically and financially motivated. Winthrop Aldrich, Chase chairman since 1933, was fixated on the Middle East. His sister had married a Rockefeller, and he believed true power would come from combining oil-related banking and finance activities. The petrodollar was based, in part, on the Rockefeller family aligning Chase with U.S. ambition to become a global superpower. From Aldrich to his successor, John McCloy (lawyer and major establishment operator of the Rockefeller and Seven Sister oil companies), to David Rockefeller (who ran Chase in the 1970s and 1980s), global growth was fueled by oil. The power of these families and banks was enhanced by the petrodollar as a tool of America's global power. Nothing Happens Without Wall StreetThe reason this history matters to us now is because, as Shakespeare wrote: "What's past is prologue." The Old Power Elite preserved their fortunes in relation to their involvement in oil as the prevalent source of energy. Now, the New Power Elite are taking the stage. Wall Street smells real money after years of profiting from a high market share in trading commodities. During the era of Old Power, the winning combination of power was finance and oil. We're watching the transition to finance and sustainable energy as the next power couple right now. That's why in November 2015, Goldman Sachs announced it would finance and invest $150 billion in clean technology and renewable energy projects over the next decade, quadrupling its prior goal. As far back as early 2014, the banking community began sticking their fingers into the sustainable energy pie. That was when a consortium of the usual players banded together to kick-start the green bond market. A "green bond" is a tax-exempt bond issued by federally qualified organizations or by municipalities for clean energy development. Bank of America Merrill Lynch, Citi, JPMorgan Chase, BNP Paribas, Deutsche Bank, Goldman Sachs, and HSBC are all part of the effort. Last fall, Wells Fargo, the fourth-biggest U.S. bank, said it would cut back lending to coal-mining companies. In June 2016, it announced increasing support for building efficiency startups through the next round of its $10 million philanthropic Innovation Incubator program, administered by the U.S. Department of Energy's (DOE) National Renewable Energy Laboratory. Morgan Stanley also pledged to reduce its exposure to coal-mining. Citigroup announced it would earmark $100 billion over 10 years for "lending, investing and facilitating" activities focused on mitigating climate change and other sustainability solutions. The money is in green energy. The companies who will benefit from Wall Street's support aren't necessarily the usual suspects. Stay Tuned for The New Power Elite: Silicon Valley – Part II Regards, Nomi Prins Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post The New Power Elite Part I: The U.S. and China Escalate Energy War appeared first on Daily Reckoning. |

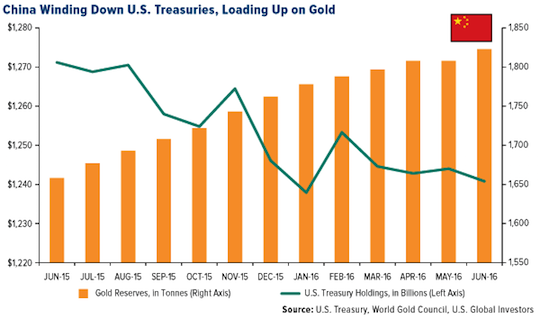

| These Olympian Gold Royalty Companies are Insanely Attractive Posted: 25 Aug 2016 08:00 AM PDT This post These Olympian Gold Royalty Companies are Insanely Attractive appeared first on Daily Reckoning. In a note last week, UBS echoed its earlier assessment that gold has indeed "entered a new bull run," as I shared with you last month. The precious metal had a spectacular first half of the year, with total global demand reaching 2,335 tonnes, the second-highest on record, according to the World Gold Council (WGC). Despite this, gold is still under-owned, accounting for only 3 percent of total ETF assets under management, UBS writes. The group adds there is room for new or returning market participants who might have cleared out their gold positions during the recent bear market. Driving the bull run, according to the group, are "a prolonged period of depressed real yields" and "elevated macro uncertainty." These are themes I've returned to many times in the past six months, with global government bond yields continuing to drop below zero and economic and geopolitical unrest advancing following the Brexit referendum and ahead of the U.S. presidential election this November. Confidence in monetary policy and appetite for government debt continues to erode. According to Zero Hedge, foreign central banks dumped a record $335 billion in U.S. Treasuries during the last year. The top seller in June was China, which cleared $28 billion in Treasuries off its balance sheet. Over the same period, the world's second-largest economy added to its official gold reserves—500,000 ounces in June alone—in an effort to diversify its holdings.

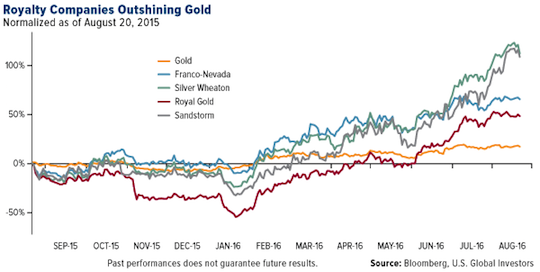

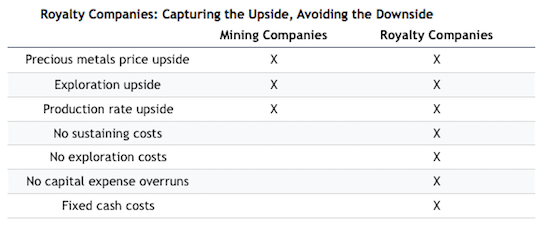

Investors should take heed of the fact that even central banks have become net buyers of gold. It's always been my recommendation to maintain a 10 percent weighting in your portfolio—5 percent in gold bullion, another 5 percent in gold stocks. A Superior Way To Gain Exposure To GoldOne of the best ways to play gold, I believe, is royalty and streaming companies. As a reminder, these companies serve as specialized financiers to explorers and producers. In return for upfront financing, they can receive one of two different types of payments. In one way, they can receive a royalty, or percentage, on whatever future sales the debtor company makes during the life of the mine. In another way, they can buy a stream of precious metals at a low, fixed price. Discounts on gold, for instance, could be as much as 75 percent. This has typically been the preferred method for paying back the royalty company. Some of our favorite names in this space include Franco-Nevada Mining, Silver Wheaton, Royal Gold and Sandstorm Gold, all of which have outperformed underlying gold for the 12-month period.

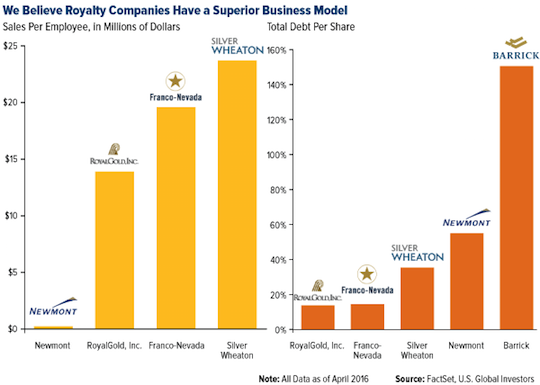

Better Allocations Of CapitalInterestingly, they all employ a small group of technically skilled mining geologists, engineers, metallurgists and financial mining executives to analyze and monitor their investments. Because they're not responsible for buying mining machinery and building, operating and maintaining mines, they have a much lower total cash cost per ounce of gold than miners do. (In this context, cash cost refers to operational expenses that are paid using cash, rather than credit.) Their overhead is kept at a minimum, and they have some of the highest sales per employee in the world. As you can see below, their debt per share is much lower than senior miners Newmont Mining and Barrick Gold — the Army to royalty companies' more agile and tactical Navy SEALs. Last year, Barrick cut $3.1 billion in debt last year and is on track to pay down an additional $2 billion this year.

Their margins have typically been much larger than traditional explorers and producers, allowing them to remain profitable even during gold bear markets. Take Sandstorm, one of the younger royalty companies. Its second-quarter cash cost per ounce of gold was a mere $261, giving it operating margins of $994 per ounce. Compare this to Barrick, the world's largest gold producer. Barrick reported cash costs of $578 per ounce, nearly double that of Sandstorm—and Barrick has some of the lowest costs compared to other miners, according to Motley Fool.

Investors like royalty companies because they're a skilled team of former miners and mining executives who generate substantially greater gross margins and have materially fewer employees, with less general and administrative expense. Further, they offer spectacular optionality. They often buy an asset with a payload over 10 years. However, these deposits often extend for 30 years, so they have potential for a much bigger payback. If the mining company expands production, it's free additional cash flow, and if they make a large discovery near the producing mine, the royalties have free upside growth. For further reading, one of the strongest overviews of royalty companies is Streetwise Reports' "Precious Metal Royalties: The New Landscape." A New EntrantJust as there still might be ample scope for gold investors to participate in the market, one CEO is betting there's still room for another entrant into the precious metals royalty company space. Long-time precious metals commentator David Morgan recently helped found Lemuria Royalties, which reported in June that it had acquired its first silver royalty from a Peruvian mine operated by a subsidiary of Fortuna Silver Mines. In January of this year, Morgan summed up his reasoning for establishing a new royalty company: "We favor the streaming and royalty companies a great deal because the risk is very low relative to, let's say, an exploration company or even a producing company." This is precisely why we continue to find the royalty business model very attractive. Regards, Frank Holmes P.S. This article was originally posted at U.S. Global Investors. To view the full article, click here. The post These Olympian Gold Royalty Companies are Insanely Attractive appeared first on Daily Reckoning. |

| Need-to-Know Tips for Safeguarding Your Precious Metals Posted: 25 Aug 2016 07:45 AM PDT Gold and silver investors have strong opinions about third-party storage of metals. Privacy, the lack of counterparty risk, and precious metals’ role as “crisis money” are among the most attractive features of physical bullion. So it is no surprise that many investors are totally committed to storing metals at home or someplace else that is both private and accessible 24/7. We wholeheartedly agree with that sentiment and always recommend personal possession when it comes to at least some of your metals. However, there are a number of circumstances where third-party storage makes a heck of a lot of sense. Let’s take a look at the most common… |

| A Zombie Financial System, Black Swans and a Gold Share Correction Posted: 25 Aug 2016 01:40 AM PDT Bob Moriarty of 321Gold says that since the crash of 2008, the financial system has become a zombie, and he urges investors to pay attention to when they take some money off the table. |

| Azure Minerals Strikes Silver and Gold in Mexico Posted: 25 Aug 2016 01:00 AM PDT Azure Minerals Ltd. (AZS:ASX), an Australian company developing two precious metal projects in Mexico, has caught the attention of a pair of analysts and the Mining Journal. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment