Gold World News Flash |

- Government Study Admits Fed Policies Have Deepened Downturn For Many

- Is Portugal The Next "Shoe To Drop" In Europe?

- Four More Mega-Banks Join The Anti-Dollar Alliance

- Central Banks Biggest US Dollar Selloff since 1978

- UNLOCKING GOLD’S TRUE VALUE: The Economic Code – Finally Revealed

- The Bizarre Mockingbird Media Blackout Of Hacked George Soros Documents

- More minimum wage anti-logic

- Globalism Is A Barbaric Relic - Voluntary Tribalism Is The Future

- Look At This Shocking Undervaluation In The Gold & Silver Markets

- China's "Answer To LendingClub" Plunges Most On Record After Regulator Imposes Peer-To-Peer Caps

- Just wait until it's hypothecated into 145 tonnes

- Hillary Clinton: Class President of a Failed Generation

- Gold Daily and Silver Weekly Charts - Comex Option Expiration Tomorrow

- Anonymous - WW3 Update

- Stagnant economy won't support high stock, bond, real estate prices, Embry says

- Will The US Dollar Begin It's Collapse This Fall

- Rickards: Brexit is NOT the End of the EU

- The Gold Standard and Debt Jubilee - Jeff Nielson

- Nobody sells gold like this except to drive the price down in full view

- Rusoro says it has been awarded $1.2 billion over Venezuelan seizure

- Breaking News And Best Of The Web

- Top Ten Videos — August 24

- A Zombie Financial System, Black Swans and a Gold Share Correction

| Government Study Admits Fed Policies Have Deepened Downturn For Many Posted: 25 Aug 2016 12:30 AM PDT

This analysis helps prove a point we’ve been making for years: Fed stimulation provided by too-low interest rates does NOT stimulate industry only finance and speculation. The Congressional Report doesn’t seem to mention central banking, so in this article we will rectify the omission. The entire justification for central banking is that it helps policymakers produce prosperity. But it doesn’t. We don’t need a government analysis to confirm this but it’s useful to have because it illustrates once more the truth of what’s occurring in terms of economic manipulation. The entire apparatus of monetary leadership, and its influence on the marketplace itself, does not deliver what it is supposed to. The idea is that the Fed provides additional liquidity as necessary. But this is a form of price-fixing. In a normal economy where the government itself was not involved in “adjusting¨ the value and volume of currency, the value would be provided by the market itself. This is the way it has traditionally worked throughout history. The last century has been one enormous experiment. But the consequences are obvious. Say an economy utilizes gold as money. When too much gold circulated in the marketplace, the value relative to what could be purchased would likely decline. As the value declined, less gold would be produced and circulated. Mines would close, etc. When less gold was produced, demand would build. The competitive marketplace itself would define the value of “money” and thus the contraction or expansion of money stock. This does not seem to be a complex point. It is generally admitted that the only way to set a valid price is to allow the market itself to produce the value. But somehow, not when it comes to money. Then it seems to be universally acknowledge by power brokers in the US and abroad that a monopoly facility (a central bank) is necessary to adjust the price. It makes no sense. And furthermore it is an example of what we call an elite dominant social theme. It is paradigm circulated throughout the world that is so prevalent and fundamental that the mainstream media simply doesn’t question it. Global warming is such a theme (here). Vaccines are such a theme (here). These themes and many others constitute the propaganda launched by governments – and shadowy power brokers – to reinforce and justify authoritarianism. Every dominant social theme has two parts. The first part is the problem. Fear is to be raised and deepened whenever possible. That’s why so many elite memes focus on scarcity. The world is running out of water, food, air, etc. The solution is always to be found in government – the bigger the better. The idea is to justify and advance global government (via the UN) whenever possible. This is one reason that we are suspicious of the “nuclear weapons” narrative that we have been concentrating on of late. It fits perfectly into the fear-based elite paradigm. Nuclear weapons exist and can destroy the world. Only government can stop their spread and usage. The same paradigm can be spotted when it comes to central banking. The world is ever in danger of recessions and depressions. And only monopoly central banking – the control of the money supply by an elite, technocracy – can save us from poverty. Questions do arise of course. But always they have to do with the “job” a given central bank is doing. They are policy questions pertaining to the competence of a monopoly money-printing facility. But the basic functionality is almost never questioned in the Kabuki ritual that passes for establishment dialogue. But it should be. Unfortunately, as with so many articles in the mainstream media and Washington Post in particular, when something substantive is presented, the analysis is lacking. The article presents the information but then leaves it lying there like a dead thing. No fundamental explanation is offered. Here:

Of course Sanders has the answer! He doubtless wants MORE government interference so that the problem government has created with its monetary price fixes can be cured by yet more meddling. When central banks provide more money to the economy than necessary (and there is no way to prove how much IS necessary), the extra cash flows into the hands of the wealthy closest to the central bank money spigot. Often this money is “invested” in securities exchanges and more money is made. This money doesn’t necessarily translate into industrial stimulation. The wealthy make more money from central bank processes. But workers are left out of the process. This is a simple and clear result of monopoly money printing. Price fixing never provides us with expected results. It always damages certain groups at the expense of others. Over time, monopoly central banking has increasingly impoverished the people it supposedly seeks to help. And gradually in this Internet era, workers are realizing it. The Fed, for instance, just launched a Facebook page (here). It is already bombarded with negative, nasty comments. People, more and more of them, do understand the impossibility of improving the economy by giving a handful of people the power to expand or contract the money stock at will. In simplest terms it is a ridiculous idea. It can’t work. It doesn’t work. And this analysis is further proof. We’ve been reporting on the gradual decline of central bank – and Federal Reserve – credibility for about a decade now here at DB. Nothing that we have seen leads us to conclude that central banking is held in higher esteem than before. In other words, the trend is down. And sooner or later the current system will not have the necessary popular support to survive. While this will be a good development for the prosperity of many, we also know the corollary difficulty that will emerge. At this point those who stand behind central banking have long-ago concluded the system is not viable. But that doesn’t mean they will cooperate with removing it. What they will inevitably suggest is that because the current system doesn’t work, a larger, global system is necessary. The groundwork is already being laid for this global system. Just yesterday we pointed out that both the ruble and the yuan were being positioned to compete with the dollar. And yet the positioning elements – the IMF and World Bank – were being provided by the West! The upcoming currency crisis is being manipulated by Western programmatic elements. The solution is to be some sort of increasingly globalized (world) government. And as this conversation proceeds in the mainstream media, you will find little or no analyses of the price-fixing that inevitably accompanies monopoly central banking at any level. It will be proposed that global price-fixing will somehow ameliorate the problems coming from regional price fixing of money. Conclusion: But it won’t. The only path to prosperity is to privatize money and let the market itself calculate its value and volume. This should be done as soon as possible. The disease of central banking should be cured by the application of free-market solutions. We eagerly await this outcome and confidently expect its application within the better part of, hm-mm … a thousand years? |

| Is Portugal The Next "Shoe To Drop" In Europe? Posted: 24 Aug 2016 11:45 PM PDT The fate of Portugal rests in the hands of DBRS, the last remaining credit rating agency assigning an investment grade rating to its sovereign debt (Fitch, Moody's and S&P have all lowered the country's debt rating to junk). Due to a requirement that participant countries have an IG rating from at least 1 rating agency, the DBRS rating is literally the only thing allowing Portugal's bonds to remain eligible for the European Central Bank's 1.7 trillion euro bond buying program. DBRS is set to update its Portugal rating on October 21 and investors in Portugal sovereign risk are starting to get a little nervous.

Until last week there seemed to be little worry about a potential downgrade among investors. That changed when the release of 2Q 2016 GDP showed minimal growth. Fergus McCormick, head of sovereign ratings at DBRS, recently noted in an interview with Reuters that although Portugal's debt carries a "stable" rating that the situation appears to be deteriorating.

The socialist minority government that came to power in November 2015 has not helped the situation by raising the minimum wage, increasing the number of public holidays and reversing other key reforms, that will make it more difficult for the country to meet its EU fiscal targets. To be sure, the collapse in oil prices have indirectly taken a toll on Portugal as well with exports to it's 4th largest trading partner, Angola, falling by 42% in the first half of 2016. As we said yesterday in a post entitled "Something "Unexpected" Happened When Seattle Raised The Minimum Wage":

Seems that politicians will stick to their narratives even when faced with the collapse of their country's economic well-being. |

| Four More Mega-Banks Join The Anti-Dollar Alliance Posted: 24 Aug 2016 11:00 PM PDT Submitted by Simon Black via SovereignMan.com, That was fast. Yesterday I told you how a consortium of 15 Japanese banks had just signed up to implement new financial technology to clear and settle international financial transactions. This is a huge step. Right now, most international financial transactions must pass through the US banking system’s network of correspondent accounts. This gives the US government an incredible amount of power… power they haven’t been shy about using over the last several years. 2014 was one of the first major watershed moments when the Obama administration fined French bank BNP Paribas $9 billion for doing business with countries that the US doesn’t like– namely Cuba and Iran. It didn’t matter that this French bank wasn’t violating any French laws. Nor did it matter that only months later the President of the United States inked a sweetheart nuclear deal with Iran and flew down to Cuba to attend a baseball game with his new BFFs. BNP had to pay up. A French bank paid $9 billion because they violated US law. And if they didn’t pay, the US government threatened to kick them out of the US banking system. $9 billion hurt. But being kicked out of the US banking system would have been totally crippling. Big international banks in particular cannot function if they don’t have access to the US banking system. As long as the US dollar remains the world’s dominant reserve currency, major banks must able to clear and settle US dollar transactions if they expect to remain in business. This means having access to the US banking system… the gatekeeper of the US dollar. But having watched BNP Paribas get blackmailed into paying an absurd $9 billion fine to the US government, the rest of the world’s mega-banks knew instantly that their heads could be next ones on the chopping block. So they started working on contingency plans. Blockchain technology provided an elegant solution. Instead of passing funds through the US banking system’s costly and inefficient network of correspondent accounts, blockchain technology provides an easy way for banks to send payments directly to one another. I cannot understate how important this technology is. Blockchain may very well be what neutralizes the US government’s domination of the global financial system. And while there’s been a lot of momentum in this direction (hence yesterday’s letter to you), even I’m surprised at how fast it’s moving. Today, four of the world’s largest banks announced a brand new joint venture to create a new financial settlement protocol built on blockchain technology. Deutsche Bank from Germany, UBS from Switzerland, Santander from Spain, and Bank of New York Mellon have joined together to launch what they’re naming the very un-sexy “utility settlement coin”. Like Ripple, Setl, Monetas, and several other competing technologies, Utility Settlement Coin has the potential to end the reliance on the US banking system for cross-border payments and financial transactions. Banks will be able to send payments to one another directly without having to transit through the Wall Street financial toll plaza. (Global consulting firm Oliver Wyman estimates that the cost of clearing and settling international financial transactions at up to $80 billion annually.) This has enormous implications, especially for US banks. The Federal Reserve, for example, has already warned that financial technology could pose stability risks to the US financial system. And they’re right. If foreign banks are able to transact directly with one another without having to go through the US banking system, then why would they need to park trillions of dollars in the United States? They wouldn’t. Adoption of this technology could cause a gigantic vacuum of deposits out of the US banking system. US banks would take a big hit. And the US government would have far fewer foreign buyers to sell its ever-expanding piles of debt. Make no mistake, the adoption of this technology is a game-changing development with far-reaching implications. And it’s happening very quickly. If these mega-banks can hit their milestones, they’ll launch commercially in eighteen months. Mark it on your calendar– that may be the end of peak US financial dominance. |

| Central Banks Biggest US Dollar Selloff since 1978 Posted: 24 Aug 2016 10:10 PM PDT Central Banks Sell U.S. Dollar at Fastest Pace Since 1978! This is What They're Buying Global central banks dump U.S. debt at record pace - Aug. 16, 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| UNLOCKING GOLD’S TRUE VALUE: The Economic Code – Finally Revealed Posted: 24 Aug 2016 09:22 PM PDT by Steve St. Angelo, SRSRocco Report:

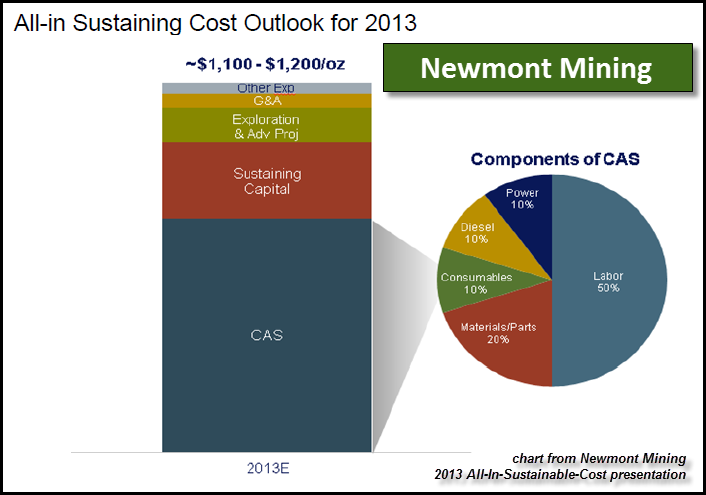

It has taken me years of research and reflection to understand GOLD's TRUE VALUE. Unfortunately, the majority of economists and precious metal analysts look at gold in a very specialized way. While precious metals analysts see gold as real money versus the Keynesian view of a Fiat Dollar System, both fail to grasp gold's true value. Gold is more than a precious metal based on supply and demand. Furthermore, the Austrian School of Economics looks at gold as a foundation of money in the procurement of goods and services. However, gold's real value comes from energy in all forms and in all stages in its production I am going to repeat it one more time…. gold's real values comes from ENERGY in ALL FORMS and IN ALL STAGES in its production. I have been saying this in interviews and writing about it for years, but I still believe a lot of people just don't get it. So, now I am going to break it down in a simple chronological way. The Foundation Of Gold Money: ENERGY = GOLD = MONEY To understand this principle, I have decided to use one of the largest gold producers in the world as an example, Newmont Mining. According to Newmont's 2013 All-In-Sustaining-Cost for producing gold, they provided the following chart:

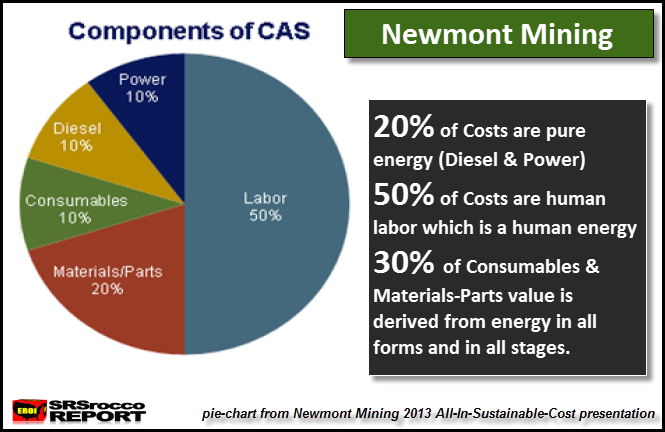

Now, this was a few years ago when the price of oil (energy) was higher, so with lower energy prices, costs have come down since then. Regardless, this still provides us with a list of costs. The main part of Newmont's sustaining costs are shown as CAS – Cost Of Sales. That's the blue part of the bar chart, which is broken down on the right, in the circle pie-chart. If we look at the pie-chart by itself, we see that energy comprises 20% of the total costs. Of course, the knee-jerk reaction from a typical precious metals analyst is that energy is only 20% of Newmont's cost to produce gold. The analyst only sees 20% energy cost because his mind has been trained to look in a superficial and specialized way. We are going to change that limited viewpoint HERE & NOW. Here is a breakdown of the CAS -Cost Of Sales pie-chart:

As we can see, diesel at 10% and power (electricity) at 10% comprises 20% of pure energy for Newmont's gold cost. However, we must realize that labor at 50%, is also a form of energy…. it's HUMAN ENERGY. People need to understand that science breaks down labor into work or energy. The term Horsepower was developed from the energy of horses performing work. Thus, human labor is a form of work, and is also a form of energy. Now, some of the labor force gets paid more because their labor contains more experience and specialization. For example, an experienced mechanic working on the huge earth moving machines gets paid more than another working doing regular manual labor because of the TIME & ENERGY invested in the mechanic's trade. The mechanic spent years doing work and education which consumed one hell of a lot of energy in different forms to have 20 years experience. Thus, the energy in labor for years of work has provided him that experience. Which means, the amount of work-energy the mechanic has done for 20 years allows him to be paid a higher rate. |

| The Bizarre Mockingbird Media Blackout Of Hacked George Soros Documents Posted: 24 Aug 2016 09:20 PM PDT from Investors

Not if it involves leftist billionaire George Soros. In this case, the mainstream press couldn’t care less. On Saturday, a group called DC Leaks posted more than 2,500 documents going back to 2008 that it pilfered from Soros’ Open Society Foundations’ servers. Since then, the mainstream media have shown zero interest in this gold mine of information.

We couldn’t find a single story on the New York Times, CNN, Washington Post, CBS News or other major news sites that even noted the existence of these leaked documents, let alone reported on what’s in them. Indeed, the only news organization that appears to be diligently sifting through all the documents is the conservative Daily Caller, which as a result has filed a series of eye-opening reports. So what could possibly explain the mainstream media’s disinterest? Is the problem that the material is too boring or inconsequential? Hardly. As we noted in this space on Monday, the leaked documents show how Soros’ far-flung international organizations attempted to manipulate Europe’s 2014 elections. The “List of European Elections 2014 Projects” details over 90 Soros efforts he had under way that year. The documents reveal that Soros has poured nearly $4 million into anti-Israel groups, with a goal of “challenging Israel’s racist and anti-democratic policies.” Here at home, they show that Soros proposed paying the Center for American Politics $200,000 to conduct a smear campaign against conservative activists. More recently, an October 2015 document came to light showing that Soros’ Open Society U.S. Programs had donated $650,000 to “invest in technical assistance and support for the groups at the core of the burgeoning #BlackLivesMatter movement.” Since then, several BLM protests have turned violent. That same document details how this group successfully used its “extensive networks” to pressure the Obama administration into increasing the number of refugees it would take to 100,000, despite concerns that Islamic terrorists could use the refugee program to infiltrate the U.S. A separate memo details how Soros tried to use his clout to sway Supreme Court justices into approving President Obama’s unilateral effort to rewrite immigration law. “Grantees are seeking to influence the Justices (primarily via a sophisticated amicus briefs and media strategy) in hopes of securing a favorable ruling in U.S. v Texas,” the memo, dug up by the Daily Caller, states. Anyone with this much power and influence demands close media scrutiny. Particularly when he has extremely close ties to the would-be next president of the United States. |

| Posted: 24 Aug 2016 08:20 PM PDT by Jeff Nielson, Bullion Bulls:

Either deliberately or accidentally, most other commentators do not understand how to correctly apply the rules of causality. One of the most common errors in their reasoning is to incorporate ASSUMPTIONS in their reasoning process — but never explicitly acknowledge those assumptions. The problem, from an analytical standpoint, is that these implicit assumptions — when they are incorrect — sabotage the reasoning process, and any/all conclusions from that reasoning are invalid. Before I get to the current subject of the minimum wage, let me illustrate this point with a different but parallel example: the gold standard. There are a number of astute commentators who are against the gold standard, even though we already have the confession of one of the leaders of these Financial Criminals that we must have a gold standard. In the absence of a gold standard, there is no way to protect savings from confiscation through inflation. – Alan Greenspan, 1966 We either have a gold standard, or the central bank criminals will (over time)STEAL ALL OUR WEALTH through the “inflation” of their money-printing. The Gold Standard and Debt Jubilee But the objection of these other commentators isn’t theoretical, it’s practical (at least supposedly). What they observed is that in the final decades of our TRUEgold standard — before the Bretton Woods agreement — that our economies experienced fairly frequent monetary disruptions. The chain of reasoning flows as follows: a) We had a gold standard. What is the implicit assumption which is left out of this chain of logic? That we had a FREE-MARKET ECONOMIC SYSTEM. It is only in a world of free markets that we could legitimately assume that any “problems” in our monetary system could be attributed to the gold standard itself. The problem is that we don’t have free-market economies today, and we didn’t have them 100 years ago. In our own era; regular readers are very familiar withthe One Bank, the crime syndicate which rules over us with an iron fist. Among its systemic crimes is the serial/permanent suppression of precious metals prices. Competitive Devaluation and Rising Precious Metals Prices This same crime syndicate already exerted near-complete control over the West a hundred years ago. This is the conclusion of Charles Lindbergh Sr., a career prosecutor and two-term Congressmen, who lived during that era. "Shortly after the [American] Civil War a group of men formed a selfish plan to rule the world by the manipulation of finances." The Economic Pinch, pg. 22 These gold-hating bankers had only one obstacle in their way to prevent them from their Holy Grail: stealing-by-inflation, as Greenspan warned us. It was the gold standard itself. So these banking oligarchs sabotaged the gold standard, at every opportunity. Eventually, enough weak-minded and/or corrupt politicians “blamed” the gold standard for the economic terrorism perpetrated by the One Bank. |

| Globalism Is A Barbaric Relic - Voluntary Tribalism Is The Future Posted: 24 Aug 2016 08:00 PM PDT Submitted by Brandon Smith via Alt-Market.com, I have been writing rather extensively about the ideology of globalism in recent months, primarily because the battle lines between sovereignty and global centralization have never been more defined than they are in 2016. In the past, globalists have often hidden the true motives of their cult; namely the goal of erasing national borders and all remaining vestiges of self governance. Normally, they would only pronounce the great advantages of globalization while dancing around the fact that millions of people will not accept it. Today, however, the globalists have come out in direct confrontation with supporters of sovereignty. After the Brexit referendum, a new tone appears to have been set. The elites have now entered the mainstream media to state in essence that yes, they are globalists, they want total centralization and they are here to fight a philosophical and/or physical battle with those they call “populists” (also known as conservatives and sovereigns). When they have discussed globalization in previous years, it has always been presented as some kind of natural progression of events rather than an agenda. The first secret of elitist propaganda is their constant assertion that globalism is “inevitable;” that it is foolish to fight against it because it is the unavoidable future evolution of mankind. The fact is that if globalism is so inevitable, the elites would not need to expend trillions in capital and decades of energy trying to fool the masses into accepting it. If globalism is inevitable, couldn’t the elites simply lay back in their pool-side cabanas, sip their dry martinis and just watch it all unfold on its own? Instead, the elites have foisted globalism upon the shoulders of the public, and are by some indications preparing for outright war in order to force us “populists” into compliance. The second secret of elitist propaganda is their strategy to disguise centralization as decentralization. For instance, the new globalist claim is that a shift away from a system in which the dollar is the world reserve currency into a system in which a basket of currencies becomes the world reserve is a move towards a “multi-polar world.” Nothing could be further from the truth. In reality, the basket currency system the elites are pushing for falls under the umbrella of the IMF’s Special Drawing Rights. Meaning a switch away from the dollar into the SDR will result in even MORE centralized power for the elites. That is not a multi-polar world; it is a uni-polar one. It is schemes like this that expose the great weakness of globalism as an ideal — the elites cannot accomplish it without using deception and force against innocents. Such a philosophy is a failure by default. The third secret of globalist propaganda is that they present the system as if it is a “new” idea. This is yet another lie. Globalism is merely another expanded form of centralization (or collectivism), and centralization has been the prevailing tool of cultural control for ages. If anything, the freely elected governments and voluntary tribalism of constitutional Republics is the newest and most advanced social concept in all of human history. Such systems present the potential for lasting decentralization, as long as participants remain vigilant to co-option by globalists. Sadly, the people of America and the rest of the West have NOT been vigilant for quite some time, and today our experiment in sovereignty is being twisted, eroded and overrun. Some seem to find new hope in the rise of conservative activism like the U.K.’s Brexit movement. As I explained in my pre-referendum article 'Brexit — Global Trigger Event, Fake Out Or Something Else?', these movements are a step in the right direction, but they have a tendency to underestimate the globalist strategy. I suspect according to the evidence outlined in the article linked above, as well as the behavior of elites ever since the U.K. referendum passed, that a plan is underway to ALLOW conservatives and sovereign activists marginal victories. Ultimately, in order for the elites to achieve the long-game of total centralization, they need to fully demonize and destroy their philosophical opponents. That is to say, they need to make conservatives and freedom fighters out to be historical monsters, and themselves out to be the heroes of the day. The ONLY way for the elites to win is to fool the masses into accepting and even demanding globalization while casting out conservative principles as dangerous or evil. But how would they make this possible? It’s simple, really. They have already set the stage for an international economic and political crisis of epic proportions. Why not let conservatives and sovereigns take over as captains of an already sinking ship, then blame them when there aren’t enough lifeboats to save the passengers? Following this line of thinking was how I was able to correctly predict the success of the Brexit vote, it is the reason why I have consistently argued that the Fed will continue to raise interest rates in 2016 despite multiple signs of a recessionary downturn, and why I believe Donald Trump will be the next president. Once instability has run its course, and once the damage is done and the “populists” are blamed, the elites plan to swoop in with globalism as the fix-all. The question then arises, if this is the strategy being implemented by the globalists, what can be done about it? As with most conundrums, the problem is often the source identifier of the solution. That is to say, if centralization and the elites behind it is the problem, then decentralization and the removal of those elites from power is the most effective solution. If forced globalization is leading to the ruination of man, then voluntary tribalism may be the cure. The issue actually has more to do with individual psychology than geopolitics. Human beings have two inherent psychological qualities that can work together, or they can conflict; the need for individual liberty, and the need for community. We are social creatures. We can accomplish great feats by working together, but the ideas for these feats are always born in the imaginations of individual minds. Without the group, the success of the individual can be greatly hindered. Without individual minds, the success of any group is impossible. The elites would have us believe that individual success and community success are mutually exclusive; that we cannot have both. This is simply not true. Globalists assert that if the individual focuses on his own success, then he cannot focus on the success of the group. This “conceited” self interest, they claim, will sabotage society as a whole and lead to humanity’s destruction. Therefore, under globalism, the individual must sacrifice his freedom of choice and association; he must sacrifice his right to apply his labors how he wishes, so that the group can supposedly thrive. I would assert the opposite. Because all ideological groups are abstractions and not cultural facts, they are completely dependent on the success of the individual in order to thrive. While the individual may need help from others, he must be allowed to CHOOSE who those people are. He also must be able to CHOOSE how his ideas and efforts are realized. Otherwise, the ideas have no steward, no protector. Under globalism/collectivism, ideas immediately become the property of the group if they are even acknowledged at all, and the group does not think; the group is not capable of thinking. The group only has merit as long as the individuals within it have merit. The group is not real. And so, under the control of a vaporous collective, good ideas usually die. With globalism as the dominant ideology, individual accomplishment falls and thus, the system itself will eventually fall. This does not mean that the solution is to end all group interaction or organization so that individuals can go off to to form their own one-man, mini-nation states. If that is what an individual wishes to do then that is all well and good, but failure is just as likely in that scenario as it would be under globalism. Instead, the answer may be a return to tribalism, of a voluntary variety. Our inherent needs for individual freedom as well as community interaction can in fact work together. The group does not need to supplant the individual to succeed, each member of the group just needs to share the same goals and understand the merits of those goals. If a person does not understand or respect the goals of that group, then he can easily leave, or refuse to join. As long as it is unacceptable for any group to use force to compel an individual to participate, then there can be no loss of individual liberty. Under this model, we could see the rise of numerous tribes, and tribes within tribes. Some of them fleeting, some of them long lasting. Of course certain universal truths would have to be respected. The most common argument against tribalism, whether voluntary or not, is the argument that it will lead to so many conflicting interests that chaos and violence is inevitable. Wars over resources and property will erupt, some claim, or society will falter into a dog-eat-dog survival of the strongest Mad Max scenario.

The idea of voluntary community is so foreign to the public today that it would probably need a catastrophe before such a system is ever adopted. But, since the global elites have already taken it upon themselves to create the catalysts for an economic and political crisis, we might as well take advantage and rebuild from the ashes with voluntary community in mind. The elites never let a good crisis go to waste, maybe we should use the same strategy. This, of course, requires that the liberty minded not only survive the catastrophe, but also fight back and remove the elites from the picture. There can be no voluntary tribes with the globalists in control of the mechanisms of power. They are themselves, in effect, a bastardization of a tribe that has been allowed through lack of vigilance to subversively and systematically destroy all other tribes. They have convinced much of the world through chicanery that their tribe is the ONLY tribe with merit. The propaganda only works to a point, however. During any breakdown in normal social order, people invariably create their own social order, and they usually do this by forming small tribes. Families come together, neighborhoods come together, towns come together and so on, and they do this voluntarily, without being aggressively compelled by others. The natural default of human beings is freedom and tribalism; two things which do not necessarily have to conflict. Our natural default has never been to pursue globalism or utter collectivism at the expense of the individual; those kinds of machines are products of the treachery of a power-mad minority. In the end, globalism is doomed to crash in a ball of flames, but not before the globalists attempt to take everyone else down with them. It would behoove us to start constructing our tribes now, rather than after the situation has become grim in the absolute. Through localized production, alternative trade models, local organization for mutual aid and defense, and the principles of liberty, America could become a network of tribes within a tribe; a self reliant system built around redundancy rather than interdependency. The globalists? Well, they will try to stop us. But at least at that point the sides will be drawn more clearly. I cannot think of a better war to fight than a war to stop the barbaric trespasses of the global elites. And when it is all over, I look forward to a more complex and “chaotic” society where collectivist streamlining is abandoned for a wild west of voluntary associations. A land where tribes roam free. |

| Look At This Shocking Undervaluation In The Gold & Silver Markets Posted: 24 Aug 2016 07:45 PM PDT |

| China's "Answer To LendingClub" Plunges Most On Record After Regulator Imposes Peer-To-Peer Caps Posted: 24 Aug 2016 07:28 PM PDT Over the years, China has valiantly struggled to convince the international public it will end its debt addiction any minute now, with the Politburo vowing year after year that it would if not delever in the immediate future, then surely limit the issuance of household loans. So far, every such attempt has been a failure, for one simple reason: as goes China's debt, so goes the most important asset in China's economy, its housing stock. So while there are ample reasons to be skeptical, overnight China's Banking Regulatory Commission unveiled its latest attempt to halt the country's relentless debt load when it imposed limits on lending by peer-to-peer platforms to individuals and companies in an effort to curb risks in one part of the loosely-regulated shadow-banking sector. An individual can borrow as much as 1 million yuan ($150,000) from P2P sites, including a maximum of 200,000 yuan from any one site, the CBRC said in Beijing on Wednesday. Corporate borrowers are capped at five times those levels. The regulator added, in what we doubt was an attempt to reassure industry watchers, that China had found problems in 1,778 online lending platforms, accounting for 43.1% of total. China's authorities are rightfully concerned about defaults and fraud among the nation's 2,349 online lenders. In December, the country's biggest Ponzi scheme was exposed after Ezubo, which until then had been China's largest P2P lender, defrauded more than 900,000 people out of the equivalent of $7.6 billion and promptly folded (the response was hardly enthusiastic, as we revealed in a clip from February.)

The measures will probably leave about 200-300 P2P platforms by this time next year, said James Zheng, chief financial officer of Lufax, the top lending platform in China. "That's okay because they're cracking down on all the bad guys," he said at a conference in Hong Kong. "What doesn't kill will make you stronger. That's the case for us." Good luck. Under the new rules, P2P lenders are barred from taking public deposits or selling wealth-management products and must appoint qualified banks as custodians and improve information disclosure. "The P2P business is not very strictly regulated yet, but you can see the regulator is taking a step forward," said Xu Hongwei, chief executive officer of Shanghai-based Yingcan Group, which tracks the industry. Products offered by P2P platforms in China can include anything from loans for weddings, guaranteed against the cash gifts that couples expect to receive, to high-yield lending for risky property or mining projects. As Bloomberg notes, China's P2P industry brokered 982 billion yuan of loans in 2015, almost quadruple the amount in 2014 and an approximately 10-fold increase from 2013, according to Yingcan. P2P firms attracted more than 3.4 million investors and 1.15 million borrowers in July, with loans extended at an average interest rate of 10.3 percent, according to Yingcan. Still, despite its torrid growth, P2P lending is still a tiny fraction of the overall loan market, and certainly of the broadest Total Social Financing universe, which infamously saw $1 trillion dollar in aggregate new loans created in the first quarter of 2016, providing a global credit impulse, which has since faded. In any case, it appears that in this particular case, China is eager to halt this problem before it becomes too big. In April, China's cabinet launched a campaign to clean up illicit activities in Internet finance, focusing on areas such as third-party payments, peer-to-peer lending, crowdfunding and online insurance. It suspended the registration of all new companies with finance-related names. And we have our doubts that this latest "debt cap" will last, because earlier today, Peer 2 Peer lender Yirendai, the company which Bloomberg has dubbed "China's answer to LendingClub" plunged 22%, the most on record since its December 2015 IPO, on massive volume, following yesterday's imposed P2P limits. For a sense of scale, YRD created some $680 million in loans in Q2, up 118% Y/Y, with net revenue more than doubling to $110 million, or 140% Y/Y. Needless to say, the company acts, and is priced like, a growth stock. The problem, as the chart below shows, is that the growth suddenly stopped.

Furthermore, if the company is indeed China's answer to the recently devastated LendingClub, this is just the beginning, as the bubble has now popped with a little help from the government. So will the CBRC relent, and lift the caps? It depends on just one thing, the only thing that the politburo is more worried about than asset bubbles - social unrest. If enough people protest, get angry or downright violent as a result of the collapse in P2P stocks, and eventually, the entire industry, or simply are unable to obtain loans elsewhere should the industry falter, then Beijing will promptly undo what it has done. Until then, however, keep an eye on risk levels in China, where suddenly the most permissive marginal source of lending - and this risk asset upside - was just advised ordered to go into a state of near hibernation. |

| Just wait until it's hypothecated into 145 tonnes Posted: 24 Aug 2016 06:04 PM PDT Australian Prospector Unearths 145-Ounce Gold Nugget By Timna Jacks At first glance the small lump in the earth looked like worthless scrap. On closer examination, the prospector guessed it was the tip of an old horseshoe. He dug deep into the soil -- unearthing 30 centimetres -- before finding the unthinkable: Gold -- 145 ounces of it -- valued at more than A$250,000. "I really couldn't believe my eyes," said the prospector, who wanted to remain anonymous. "It's like catching a big fish and not knowing what to do with it. Where do we put it? I washed it in water, covered it in aluminum foil, and kept it in my oven on the first night." The hobbyist found the "colossal" nugget while scouring Victoria's Golden Triangle on Friday. ... ... For the remainder of the report, including a photograph of the "nugget": http://www.theage.com.au/victoria/i-couldnt-believe-my-eyes-victorian-pr... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Hillary Clinton: Class President of a Failed Generation Posted: 24 Aug 2016 01:41 PM PDT This post Hillary Clinton: Class President of a Failed Generation appeared first on Daily Reckoning. Hillary Clinton has always been at the head of her class. That includes being among the leading edge of the 80-million strong baby boom generation that first started arriving in 1946–47. She did everything they did: Got out for Barry Goldwater in high school; got upwardly mobile to Wellesley and social liberation during college; got "Clean for Gene" and manned the anti-war barricades in the late 1960s; got to Washington to uplift the world in the 1970s; got down to the pursuit of power and position in the 1980s; joined the ruling class in the 1990s; and has helped make a stupendous mess of things ever since. The baby boom generation which started with so much promise when it came of age in the 1960s has ended up a colossal failure. It has turned America into a bloody imperial hegemon aboard and a bankrupt Spy State at home where financialization and the 1% thrive, half the population lives off the state and real main street prosperity has virtually disappeared from the land. Quite a deplorable legacy, that. And all the while Hillary has been our class president. God help the world if she becomes our nation's President. She has betrayed all that was right about the baby boomers in the 1960s. And has embraced all the wrong they did during their subsequent years in power. It starts during our defining moment when peace finally had a chance in the spring of 1968. We drove a sitting President from office, and, one whose megalomaniacal will-to-power was terrifying. We called bull on the cold war hysteria that had once put us under our desks at school and now claimed that peasants in far off rice paddies threatened our security. We stopped the Vietnam War cold, dented the Cold War deep and put the whole Warfare State apparatus on the run — the Pentagon, CIA, the generals and admirals, the military-industrial complex. Within a few years the warfare state budget was down by 40% in constant dollars. So it was a rare chance to break the deadly cycle of war that had started a half-century earlier in the bloody trenches of northern France during the Great War. Then the vengeful folly of Versailles led to WWII. And finally we had the nightmare of the Cold War. True enough, the defeat and retreat of the American Imperium by the idealism and defiance of the baby boomers was interrupted by the Reagan defense and Cold War revival. But that historical error is what makes the Clintons all the more culpable… It was their job as the first baby boom co-Presidents to finish the work of 1968, and by the time they entered the White House it was a lay-up. The Soviet Union was no more and China's Mr. Deng had just declared that to get rich is glorious. The Clintons' job in 1993 was to have at least the vision of Warren G. Harding. After all, Harding demobilize the U.S. war machine completely, eschewed the imperial pretensions of Woodrow Wilson and actually launched a disarmament movement which resulted in the melting down of the world's navies and the Kellogg-Briand treaty to outlaw war. Yet the opportunity at the Cold War's end was even more compelling. There was absolutely no military threat to American security anywhere in the world. The Clintons could have drastically reduced the defense budget by mothballing much of the navy and air force and demobilizing the army. They should have cancelled all new weapons programs and dismantled the military-industrial complex. They could have declared "mission accomplished" with respect to NATO and made good on Bush's pledge to Gorbachev to not expand it "by an inch" by actually disbanding it. And they were positioned to lead a global disarmament movement and to end the arms export trade once and for all. That was their job — the unfinished business of peace. But they blew it in the name of political opportunism and failure to recognize that the American public was ready to end the century of war, too. And you can't let Hillary off the hook on the grounds that she had the health care file and Bill the bombs and planes. On becoming Senator she did not miss a stride betraying the opening for peace that had first broken through in 1968. She embraced Bush's "shock and awe" campaign in Iraq and was thereby complicit in destroying the artificial nation created by Sykes-Picot in 1916. So doing, Clinton helped unleash the furies of Islamic sectarian conflict that eventually led to the mayhem and brutality of the Shiite militias and the rise of the ISIS butchers. Tellingly, Hillary Clinton made a beeline for the Senate Armed Services Committee, the domain of the Jackson war democrats, not the Foreign Affairs Committee, where Frank Church had exposed the folly of Vietnam and the treacherous deeds of the CIA. Undoubtedly, this was to burnish her commander-in-chief credentials, but it spoke volumes. By the time Hillary got to the seat of power, the idealism and defiance of the warfare state that had animated her and the baby boomers of 1968 had dissipated entirety. For her and most of them, it was now all and only about getting and keeping power. In that respect, Hillary's term at the State Department was a downright betrayal. Whether by accident or not, Obama had actually been elected as the "peace candidate" by echoing the rhetoric of 1968 that he had apparently read in a book but had been too young to actually hear. What this untutored and inexperienced idealist needed to hear from his Secretary of State was a way forward for peace and the dismantlement of a war machine that had rained havoc on the world, left behind 4 million damaged and disabled veterans who had sacrificed for no good reason and a multitrillion-dollar war tab that had bloated the national debt. What he got was Hillary The Hawk. When Obama took Bush's already bloated $650 billion war budget (2005$) to a level that was almost 2X the level Eisenhower thought adequate at the peak of the cold war and upon his parting speech warning of the military-industrial complex, Hillary was completely on board. When Obama was bamboozled into a "surge" of forces in the god forsaken expanse of the Hindu Kush, Hillary busied herself rounding up NATO support. When her neocon and R2P (responsibility to protect) advisers and Administration compatriots urged making peace by starting wars in Syria, Libya and the Ukraine, Hillary lead the charge. All of them have been disasters for their citizens and a stain on America's standing in the world. When the Deep State began lining up the next enemy, Hillary joined the gumming brigade, warning about the China threat. My god, were the red capitalists of Beijing to actually bomb 4,000 Wal-Marts in America their system would collapse in six months and their heads would be hung from the rafters in the nearest empty Foxcon/Apple factory. Here's the thing. Hillary Clinton's sell-out to the Warfare State is not just about war and peace — even as it fosters the former and precludes the latter. It's also about the nation's busted fiscal accounts, its languishing main street economy and the runaway gambling den that has taken over Wall Street. After all this time, however, Hillary doesn't get any of this. She thinks war is peace; deficits don't matter; the baby boom is entitled to the social insurance they didn't earn; and that the Fed's serial bubble machine is leading the nation back to prosperity. Actually, it's leading to the greatest financial bubble in human history. After 90 months of ZIRP and a decade of Wall Street coddling and subsidization by the Fed, the windfalls to the 1% have become unspeakable in their magnitude and illegitimacy. Soon 10,000 people will own a preponderant share of the wealth; 10 million people will live grandly off the droppings; 150 million will live off the state; and the rest of America will be left high and dry waiting for the house of cards to collapse. Hillary rose to fame delivering an idealistic commencement address at Wellesley at the beginning of her career. But like the generation she represents, she has betrayed those grand ideals over a lifetime of compromise, expediency, self-promotion and complacent acquisition of power, wealth and fame. She doesn't deserve another stint at the podium — let alone the bully pulpit. Regards, David Stockman Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post Hillary Clinton: Class President of a Failed Generation appeared first on Daily Reckoning. |

| Gold Daily and Silver Weekly Charts - Comex Option Expiration Tomorrow Posted: 24 Aug 2016 01:11 PM PDT |

| Posted: 24 Aug 2016 12:48 PM PDT Anonymous - WW3 Update - Part 2 (2016) We are anonymous. We are legion. We do not forgive. We do not forget. Expect us. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Stagnant economy won't support high stock, bond, real estate prices, Embry says Posted: 24 Aug 2016 09:45 AM PDT 12:45p ET Wednesday, August 24, 2016 Dear Friend of GATA and Gold: Sprott Asset Management's John Embry tells King World News today that the "deep state" is striving to suppress the price of the monetary metals while supporting stocks, bonds, and real estate. But, Embry adds, a stagnant economy won't support the latter valuations forever. His remarks are excerpted at KWN here: http://kingworldnews.com/john-embry-warns-the-deep-state-shadow-governme... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Will The US Dollar Begin It's Collapse This Fall Posted: 24 Aug 2016 09:00 AM PDT Cisco cut around 20,000 jobs. Retail giants slash earnings, their explanation is that the something is changing in the economy. Red warning signs that the real estate market is coming apart. Global central banks are dumping treasury bonds. The World bank has just approves China to issue the SDR.... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Rickards: Brexit is NOT the End of the EU Posted: 24 Aug 2016 08:33 AM PDT This post Rickards: Brexit is NOT the End of the EU appeared first on Daily Reckoning. I do not believe that Brexit means that the European Union is going to break up. Or that it spells the end of the euro as a currency. I've been very bullish on Europe and the Euro in the past. Even if the currency fluctuates, all these currencies are fluctuating, and the Euro did trade down from around the 140 level in late 2013, all the way down to 105 in January 2015, and people said, "Oh, it's going to parity." I said, "No, it's not going to parity," and it didn't. It bounced back to 105 a couple times, back up around 110 today, $1.10. Now the important thing to understand is the European Union is not primarily an economic project. Does it have a lot of economic problems? Absolutely, from Greece to Portugal, now Italian banks, et cetera, but it is a political project. The way to think about the European Union, ask yourself, "Does the political will exist to keep it together?" Clearly, in the U.K., it didn't. They left, but I could write a separate book on why the U.K. was never a good fit with the E.U. to begin with. Look, if the Brexit had been the Netherlands or Italy or Spain or someone like that, I would have a much more pessimistic or dire outlook for Europe, but it wasn't. It was the U.K., and the U.K. has always been different. The U.K. was the exceptionFirst of all, they never joined the Euro. The U.K. is Europe's biggest economy by far, and it did not to join the Euro. The other countries in line who have not joined the Euro are either on the periphery or they're trying to join but haven't met the criteria yet. There are some special circumstances. The U.K. was the exception. They were the big country and the E.U. member that did not join, and they were the only one that kind of fit that. That's because the U.K. was never a good fit with Europe to begin with. I would go back to the difference culturally and in terms of legal systems, not just geographically, although geography plays a role of course, but on the continent the legal was different. Obviously, Germany, France, Spain,Netherlands, Italy and others large countries have a legal system goes all the way back to the end of the Roman Empire, or to code of Justinian, Charlemagne, through to the Napoleonic code in the late 18th, early 19th century. It's what's called a code-based system of law. Contrast that with the U.K., which has the common law, and the common law is what was exported to the United States, Australia, Canada, New Zealand and sort of the English-speaking world. Common law and code law are completely different. It's not just that the rules are different, it's the mindset is different. In a code system, which is what you have in the E.U., the idea is if you have a problem, write a rule. If the rule doesn't fix it, write another rule. If that doesn't fix it, write another rule and keep going. Keep writing as many rules as you need until you fix the problem, and if it's not fixed, write another rule. That's the view of the E.U. Common law is different. Yes, there are laws, rules and regulations in common law. We probably have too many, but judges have equitable powers, and common law has a lot more scope for an ad hoc decision-making designed to achieve justice. You can have a case where under the strict law of contract, somebody should lose. A judge will look at it and say, "You know, that's not really fair. Yeah, I know what the law says, but that's not the right result. That's really unjust, unconscionable." Judges have scope to kind of make things up to get the right result. In Europe, you would never do that. In Europe, you would write another rule. You'd say, "If something bad happens, let's write a rule." This is actually a good way to understand the ECB, because when Janet Yellen talks about the dual mandate of the fed, employment and price stability, it's lip service. They've got their own agenda, their own economic goals, et cetera. When Mario Draghi talks about his mandate, it's not lip service. He takes it literally. He's a legalist, and they will stick to it, and they will not do certain things, because they're not permitted under the charter. That divide between the common law and equity and discretion on the one hand, and rules, on the other, is a big deal. It runs right down the middle of the English Channel, and it's one of the reasons that the U.K. subjects rebelled against the European Union; too many rules. Immigration was a big part of it. The immigration issue in the U.K. was not about Syrian refugees. It was about Poles. It was about people from Poland taking jobs as nannies, shopkeepers, domestic help and landscapers or a lot of other things, and at entry-level positions. That was the immigration issue. It wasn't Syrians, it was Poles. That comes from a European rules-based culture. Europe is solid. The U.K. leaving is a big deal economically. It's a big deal for the U.K., and it will cause aftershocks, which we're watching. One of the aftershocks will not be the breakup of the European Union. It will not be the end of the Euro. In fact, I expect the Euro to get stronger from here, again going back to the Shanghai Accord. If you're asking if there will be crises, yes, there will be crises. Go back to Greece. With Greece in 2011 and 2012, Krugman, Stiglitz, Roubini, Zero Hedge, what were they all saying? "Europe's breaking up. Spain's leaving. Greece is getting kicked out. Germany is going their own way." I said, "Nonsense, none of that is going to happen," and it didn't happen. London hates the Euro. The Brits don't understand the Europeans much better than the Americans do, for the reasons I mentioned. You really have to go to Germany, to Italy, to Spain, to the Netherlands and talk to those people. Talk to the people on the ground, talk to elites and others, and read the local papers, see if you can get them in translation, or if you read the languages, and that's how you learn about Europe. My forecast for Europe; there will be crises. There will absolutely be crises, coming in the Italian banking system, probably Deutsche Bank. We're probably going to be hearing more about Portugal. We're probably going to be hearing about Greece again, because Greece never goes away. I'm not denying any of that. That will come, that will cause volatility. When somebody looks at that and says, "A-ha, Europe's falling apart," don't believe it. I have been asked, "If a bailout of the Italian banking system would truncate any crisis, or if you see spillover possibilities going out of control, beyond anybody in Europe's control to truncate?" The answer is yes, there is that, there's always that possibility. I guess the way I would explain that, what will happen is conditional or contingent. This is important to understand in terms of the best way to do forecasting, and how we do forecasting at our publications. It's not as if the outcome is set in stone, and we just don't know it. A lot of people think, there's a certain outcome out there, and your job as an analyst is to work really, really hard to figure out what the outcome is. That is not the correct way to think about it, and it's not how we do things. What we say is, there's a range of possible outcomes. One is that everything comes in for a soft landing, it's all good. It gets ugly and there's some bad headlines, but they're able to truncate it. The next is they try and it's too little too late, and it just spins out of control and all of a sudden, we're back to 2008. I would say that all three possibilities are in play, all three of them. The way you do analysis, and this is what we do in my premium research services Currency Wars Alert in particular, it's called indications and warnings. The way you do analysis is to wake up every day, or in my case sometimes I'm up until 3 in the morning, and keep looking at data points to help you figure out which path you're on, and recognizing that you could have these phase transitions where you pass from one path to the other very quickly. The simple way to explain it, I happen to be in Connecticut, and I happen to know that all the roadside restaurants to Boston are all McDonald's, and all the restaurants to Philadelphia are all Burger Kings. I don't know why that is, but it's true. If you blindfold me and take me in a car and let me peek, and I see a McDonald's, I know I'm going to Boston. I know I'm not going to Philadelphia. The point is, if you know what the Burger King/McDonald's situation is, you don't have to get to Philly or Boston to know where you're going. You can figure it out along the way. To answer the reader' question, does this have the potential to spin completely out of control and end up like 2008? The answer is yes. That's not my forecast right now and I'm not forecasting that. I'm saying that's on the table. That's the reason to get fully allocated to ten percent gold, have more cash than usual, and pay close attention to what's going on. The expected case would be that this gets worse, there's more headlines, there's more ugliness, between the Italian prime minister and the German chancellor. It's not going to get quite as bad as Greece, but it's going to kind of look that way, and accusations are going to fly back and forth. Remember, a lot of these accusations are just for show. They're just for the newspapers, because you've got a local political constituency. The Italian prime minister can't look like a doormat for the German chancellor, and the German chancellor can't look like she's not taking a hard line. When they get behind closed doors or meet in the hall or whatever, they work things out as we saw in the case of Greece. I would expect some ugly headlines, and some more volatility, and some more danger signs coming out of the Italian banking crisis. At the end of the day, I would expect that they will truncate this … "Truncate" is a very good word. Truncation, that's the difference between an avalanche and a financial crisis. I've said the dynamics are the same and the math is the same, which they are. Analytically, you can look at the start of one. It's exactly the same systems dynamic. You can't stop a natural disasterThe difference is that in natural systems, it just goes. You can't stop it. In a tsunami or an earthquake; nobody runs out in the middle of an earthquake and says, "I'm going to stop this thing." You run for your life. You try to get to safety, but nobody runs out and tries to stop an earthquake in the middle. You can't stop an avalanche. I've been close enough to them, you don't want to be standing there on a mountain saying, "Hold on, stop." You can't stop a natural disaster. You can truncate a man-made disaster, meaning something capital markets, something in the stock markets, et cetera, a banking crisis. The question is, do you act too late? Do you see it coming? Do you have the right policy? Do you act in time, or do you act too late? Those are the variables, but you can snuff a systemic crisis in the financial world, if you have enough power, or if it's not bigger than your balance sheet. Part of my thesis about the next really major global financial crisis is something bigger than 2008, and that's not what I'm forecasting right this minute, but I do see it out there, is that it actually would be bigger than the central banks. It wasn't bigger than the central banks in 2008. They did truncate it with 10 trillion dollars of guarantees, money printing and currency swaps. The next one will be bigger than that, but we're not there yet. Short answer; does the Italian banking crisis have the potential to spin completely out of control, worse than 2018? The answer is yes. I'm watching that, but I don't expect that. I expect that they will be able to truncate it, meaning bail in, bail out. It probably is a mix, but the absolute biggest banks will probably get bailed out, and some small sacrificial lambs will probably get bailed in. We'll see how that plays out. Merkel's going to have to give to the Italian prime minister, because she can't defend Deutsche Bank. You can't tell the Italians they have to bail in, if you're standing by to bail out Deutsche Bank. The Italians are going to say, "If you bail out your biggest bank, we're going to bail out our biggest bank, so don't tell us we can't do that." I would expect volatility, nasty headlines, but at the end of the day, they'll bring it in for a soft landing. Brexit is not the end of Europe or the EuroIt will not be the end of Europe or the Euro, but it will mean volatility, and it could mean a draw-down in U.S. stocks. It could look ugly, like August 2015, or go back to 2011, for that matter, when the Greek thing first popped up. It's what I call non-directional volatility, or NDV, where you have, it goes down, the stock market goes down seven or eight percent, then it rallies back ten percent. It's not really going anywhere. It's like being on a roller coaster. Your stomach's in your throat practically, but you end up back where you started. That's kind of how the stock markets will look. I don't think this will spin out of control, but it absolutely has the potential. It's like quantum mechanics, thinking of everything in conditional space, where you've got two or three outcomes, and you don't really know which it is until you take more observations. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post Rickards: Brexit is NOT the End of the EU appeared first on Daily Reckoning. |

| The Gold Standard and Debt Jubilee - Jeff Nielson Posted: 24 Aug 2016 08:30 AM PDT Sprott Money |

| Nobody sells gold like this except to drive the price down in full view Posted: 24 Aug 2016 07:45 AM PDT See Zero Hedge's report, headlined "Someone Just Puked $1.5 Billion of Notional Gold," here: http://www.zerohedge.com/news/2016-08-24/someone-just-puked-15-billion-n... ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Rusoro says it has been awarded $1.2 billion over Venezuelan seizure Posted: 24 Aug 2016 07:26 AM PDT By Jim Finkle Canada's Rusoro Mining Ltd said Tuesday it has been awarded more than $1.2 billion by a World Bank tribunal that ruled that Venezuela had unlawfully seized the company's gold assets four years ago. Shares in the Vancouver-based mining firm, which is backed by Russia's Agapov family, more than doubled on Tuesday, trading for as much as 32 cents -- their highest level since Venezuela's asset seizure. Rusoro, whose shares had a market value of C$83 million (US$64 million) prior to Tuesday's rally, was one of about 20 Canadian miners and other international firms that filed complaints with the World Bank's International Center for Settlement of Investment Disputes over Venezuela's action. Rusoro, which was the largest gold miner operating in the South American country before the asset seizure, said the World Bank agency determined that Venezuela had unlawfully expropriated the company's investments without paying compensation. ... ... For the remainder of the report: http://www.reuters.com/article/rusoro-mining-lawsuit-idUSL3N1B43Z6 ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Breaking News And Best Of The Web Posted: 23 Aug 2016 05:37 PM PDT Stocks, gold, oil fall ahead of Yellen speech. Other Fed officials predicting Sept rate hike. US manufacturing, home sales disappoint. Negative interest rates getting a lot of attention, mostly critical. Europe doesn’t seem fixable. Trump hires new people, keeps falling in polls. Best Of The Web Eight! – FOFOA These Olympian gold royalty companies […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Posted: 23 Aug 2016 05:01 PM PDT Noland, Icahn, Keen, Maloney, many more on gold, silver, inflation and the coming crisis. The post Top Ten Videos — August 24 appeared first on DollarCollapse.com. |

| A Zombie Financial System, Black Swans and a Gold Share Correction Posted: 23 Aug 2016 01:00 AM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The true value of gold is much higher than the spot price quoted in the market. This is due to several factors, but the most important reason is misunderstood by just about every economist and monetary scientist in the world today. Those who are able to understand the information in this article, will finally be able see the value of gold (money) in a totally different way.

The true value of gold is much higher than the spot price quoted in the market. This is due to several factors, but the most important reason is misunderstood by just about every economist and monetary scientist in the world today. Those who are able to understand the information in this article, will finally be able see the value of gold (money) in a totally different way.

Scandal: Leaked documents released a few days ago provide juicy insider details of how a fabulously rich businessman has been using his money to influence elections in Europe, underwrite an extremist group, target U.S. citizens who disagreed with him, dictate foreign policy, and try to sway a Supreme Court ruling, among other things. Pretty compelling stuff, right?

Scandal: Leaked documents released a few days ago provide juicy insider details of how a fabulously rich businessman has been using his money to influence elections in Europe, underwrite an extremist group, target U.S. citizens who disagreed with him, dictate foreign policy, and try to sway a Supreme Court ruling, among other things. Pretty compelling stuff, right?

No comments:

Post a Comment