Gold World News Flash |

- Migrant Problems Still Threaten Europe

- Brexit: Worst Case Scenario For EU; Armageddon Promise Now Exposed As Pack Of Lies

- Silver Is in a Different World, Report 21 August, 2016

- ALERT: Germany Tells Public to STOCK UP ON FOOD & WATER… What Do They KNOW??

- Economic Collapse Confirmed! Most Credible Video Ever!

- Paul Craig Roberts Warns US is Completely Busted, Non Delivery of Gold Crash the System 2016

- HARDCORE EVIDENCE: Hyperinflationary COLLAPSE is Coming!

- HARDCORE EVIDENCE: Hyperinflationary COLLAPSE is Coming!

- Gold Will Explode In Value Well Beyond What Jim Rickards Forecasts

- Gold & Silver Miners Set To EXPLODE 1,000%…?

- New Government Analysis Shows Fed Policies Have Deepened Downturn for Many

- Silver Analysis : 22 Augst 2016

- Multipolar World Order: Economics Vs. Politics

- Olympic Gold Medals Have Almost Zero Gold In Them

- King Tut Silver 5 Oz Coin Unboxing

- Silver Is in a Different World

- Deutsche Bank: The only way to fix the economy is for the stock market to 'collapse'

- Peter Schiff Why The Dollar Will Collapse Surely on August

- How Clinton Gangsterism Will Be Applied In The White House

- GERALD CELENTE'S DEVASTATING PREDICTION FOR THE FUTURE OF EUROPE AFTER THE DEUTSCHE BANK COLLAPSE

- Join GATA at the New Orleans conference because you can't lose

- Another Billionaire Goes All In On The “Barbarous Relic†Gold While Mainstream Media Remains Silent

- Breaking News And Best Of The Web

| Migrant Problems Still Threaten Europe Posted: 22 Aug 2016 01:00 AM PDT Submitted by George Igler via The Gatestone Institute,

Chaotic scenes have erupted on the coastal Mediterranean frontier between Italy and France. On August 4, for instance, hundreds of migrants, chiefly from Eritrea, Ethiopia and the Sudan sought to storm the crossing in their attempts to make it to Northern Europe. "Both the Italian and French forces at the border were taken by surprise," remarked Giorgio Marenco, a police commander in Ventimiglia, where tear gas was used to disperse the migrants. Others merely braved the choppy waters of the sea to breach the crossing by swimming towards their goal. The Italian town contains the last train station in Italy near the border. The besieged terminus lies three miles from the French Riviera. It has been a gathering point for the predominantly Muslim migrants since June 2015. A fractious tent city for migrants has sprung up, mirroring others spread across Italy. The capital of the French holiday district is Nice, which experienced a jihadist massacre on July 14. Although mercifully free from mass terrorist outrages this year, Italy has already endured several alarming scenes of disorder and protest resulting from the pressure of accepting increasing illegal migrants. On May 7, violent attempts by "open borders" activists took place, aimed at forcing open the frontier between Italy and Austria. On May 21, various groups in Rome organized mass demonstrations against Italy's "invasion" by migrants. Apparently the prevalence of populist politics in the country has created movements which do not lie within the usual "Left-Right" political spectrum in which analysts usually classify parties. The chief example is the presence in Italy of the Five Star Movement, founded in 2009 by the comedian Beppo Grillo, and now considered Italy's second largest political force. Having taken a back seat after frequently being condemned for his "Islamophobic" anti-mass immigration rhetoric, Grillo's party nevertheless helped to elect Virginia Raggi, in July, as the new mayor of Rome. Despite the assurances of Angelino Alfano, the Italian Interior Minister, that Ventimiglia would not turn into "our Calais" -- a reference to migrants amassed at the French channel port who are seeking illegal entry into the United Kingdom -- the challenges faced by Italy lie not merely in numbers.

Italy's terror alert status remains at "Level Two" -- the second highest in its security index. On March 30, the Rome-based journalist, Barbie Latza Nadeu, seriously asked whether the country was "enabling the ISIS invasion of Europe." After the collapse of Libya -- occasioned in 2011 by military intervention masterminded by then French President Nicolas Sarkozy and then UK Prime Minister David Cameron -- the North African nation has become the gathering point for those on the continent farther south, who possess the will or resources to push into Europe. Two separate governments are currently attempting to wrest control from each other in Libya, a former colony of Italy, while ISIS forces also maintain their foothold. It is through this seemingly unresolvable ongoing chaos that people-smugglers ply their lucrative trade. Waves of migrants heading into Europe, primarily through a corridor beginning in Turkey and resulting in short crossings to nearby Greek islands, are still stranded in the so-called Western Balkan route into the continent. After the widely derided imposition by the Prime Minister of Hungary of a razor-wire border fence on his country's southern frontier, other nations nearby, that were subjected to migrant pressure, soon followed suit. Remaining conscious of Hungarian Prime Minister Viktor Orbán's analysis, that only half a year's total migrants come to Europe between January and October, with the other half arriving through the remainder of the year, the steady focus in 2016 is likely to be on Europe's "soft underbelly" -- a term Winston Churchill used during the Second World War to refer to the susceptibility of Italy being invaded by sea -- as opposed the susceptibility of the Balkans. The enthusiasm of the present government of Chancellor Angela Merkel to import Muslims into Germany apparently remains undiminished. As reported by Markus Mahler, a succession of migrant flights into Germany from Turkey are now taking place – in one instance, more than 11 planes landed during the same night at Cologne-Bonn airport – as some analysts predicted last year. In September 2015, a Canadian lawyer and broadcaster, Ezra Levant, suggested that what Europe was experiencing, was not primarily an influx of "refugees" fleeing conflict, but rather a new Gold Rush, in which young men from the Muslim world were seeking to improve their fortune at Europe's expense. Sea crossings from Africa into Italy, which initially targeted the small Italian island of Lampedusa, had begun in 1996. Since then, they have magnified in number year on year, considerably aided between 2013-2014 by the Mare Nostrum program of the Italian navy, which picked up stranded vessels and brought their occupants to Italy, rather than returning migrants to their countries of origin. This program was then superseded by Operation Triton, run by the European Union's border agency, Frontex. It is often simpler for migrant ships to send a distress signal while near Italian coastal waters, as happened in January 2015 with the ship Ezadeen, abandoned by its crew of smugglers, after they set the ship on autopilot pointed towards Italy's southern shore. The ship's 450 migrant passengers were towed to harbor by a Frontex ship from Iceland. Profits in the people-smuggling business often flow to terrorist-backed gangs operating in Italy. The numbers drowning in the Mediterranean continue to mount. Successful migrants from Africa usually then traverse Italy, but can remain stranded if their attempts to penetrate further into Europe become frustrated. That situation frequently leads to violence at migrant camps and outrage at local government level as the migrants are then distributed across the country. Despite the swelling number of illegal sea crossings, there seems little interest in curtailing them by force, given the existence of international refugee conventions and European legislation on human rights, which some migrants appear to be exploiting. During four days in July alone, 10,000 illegally crossed by sea into Italy. As in 2015, the vast majority looking for "asylum seeker" status in Europe are military-aged Muslim males seeking eventual European citizenship. Meanwhile, relations between Italians and their existing established Muslim communities seem to be rapidly eroding. The introduction of gay marriage into Italy on June 5, against fierce opposition in the home of the Roman Catholic Church, has had unforeseen consequences. As a reciprocal gesture in the spirit of "civil rights," Hamza Piccardo, the founder of the Union of Islamic Communities and Organizations in Italy, has demanded the legalization of polygamy. As the pressures grow on the Euro, the currency which binds 19 European nations together both politically and economically, the long-term future of Italy's banking system has already been called into question. The picture drawn by the present migration into Europe may fundamentally undermine the "Refugees Welcome" narrative that dominated news reports last year, but the continent-wide economic ramifications of its effects on a country such as Italy, already subject to considerable political tumult, should not be underestimated. | |

| Brexit: Worst Case Scenario For EU; Armageddon Promise Now Exposed As Pack Of Lies Posted: 21 Aug 2016 11:00 PM PDT Submitted by Michael Shedlock via MishTalk.com, Project Fear predicted economic meltdown if Britain voted leave. Where are the devastated high streets, job losses and crashing markets? In other Brexit news, Sweden warns the UK about cutting corporate taxes. How should the UK respond? Who is in control? What Happened to Promised Armageddon? The Guardian reports Brexit Armageddon was a Terrifying Vision – but it Simply Hasn’t Happened.

Pack of Lies Clearly Visible Armageddon fears were purposely over-hyped from the beginning. Now reality has set in. Project fear backfired. People can easily see what liars David Cameron and the nannycrats in Brussels were. Project Remain: Where are the admissions “We were wrong?” Worst Case Scenario for EU That the UK has gone on as normal has to be one of the worst fears for the nannycrats in Brussels. There is life, not death after Brexit. What country will be next to figure that out? Some rough times are likely ahead for the global economy, including the UK. But in the long run, Brexit will be a good thing for the UK, which means it will be a bad thing from the point of view of Brussels. Sweden Warns U.K. Against Aggressive Tax Cuts Amid Brexit Talks The nannycrats are now worried that the UK will do something smart, like lower corporate taxes again. Today, Sweden Warns U.K. Against Aggressive Tax Cuts Amid Brexit Talks.

Stellar Opportunity for UK to Set Example for the World By all means the UK should precisely make things more difficult. Everyone says, Brexit terms need to be negotiated. Actually, the UK can pick up its marbles and go home. Who could stop the UK from doing just that? On July 11, I wrote Stellar Opportunity for UK to Set Example for the World. In that post I proposed among other things a recommendation “The UK should preemptively stick it to the EU by slashing its corporate tax rate to 10%, lower than any country in the EU.” I was unaware at the time that UK chancellor George Osborne had already decided to cut taxes, but by a lesser amount than I suggested. Precise Way to Start Negotiations with EU Mules: Get France to Piss and Moan In a follow-up post I wrote Precise Way to Start Negotiations with EU Mules: Get France to Piss and Moan.

Negotiation Progress

I suggest the UK cram it straight down their throats by lowering taxes to 10% right now. This will set proper the negotiation tone and inform the nannycrats in Brussels who calls the shots. France and Germany threatened to make things difficult for the UK. But as I have stated all along, the UK, not the EU, has the upper hand in these negotiations. Import/export math proves the point. The UK imports more from the the EU than it exports to them. For details, please see “No Cherry Picking” Says Merkel; Risk of Global Trade Collapse says Mish. The more the EU pisses and moans, the more successful Brexit will be for the UK. | |

| Silver Is in a Different World, Report 21 August, 2016 Posted: 21 Aug 2016 09:17 PM PDT Measured in gold, the price of the dollar hardly budged this week. It fell less than one tenth of a milligram, from 23.29 to 23.20mg. However, in silver terms, it's a different story. The dollar became more valuable, rising from 1.58 to 1.61 grams. Most people would say that gold went up $6 and silver went down 43 cents. We wonder, if they were on a sinking boat, tossing about in stormy seas, if they would say "that lighthouse went up 5 meters." To our point last week, what would be the utility of a lighthouse that you measured from your boat which is going down and up, but mostly down? Would you wonder if lighthouses had another purpose, any other use? If you could make money betting against other sailors, on the lighthouse's next position, would you care? "Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head." – Warren Buffet Of course, what Buffet doesn't mention is that we're forced to use paper certificates of government debt as if it were money. This debt is losing value as the government racks up ever more implausible amounts of it ($19.5T at the moment). Meanwhile, lenders are offered lower and lower interest rates to finance this growing monument to economic insanity. Surely anyone from Mars would be scratching his head at this, too. Unfortunately, Nixon's gold default almost exactly 45 years ago to the day removed the extinguisher of debt. When you pay off a debt usinggold, the debt goes out of existence. When you pay a debt using dollar, the debt is merely shifted. So the debt grows—must necessarily grow—at an exponential rate. Also unfortunately, Nixon's gold default also unhinged the rate of interest. It began to shoot the moon. It eventually peaked at an insane high (and historically unprecedented) level in 1981. Since then, it has been falling and now it keeps hitting insane low (and unprecedented) levels. You can get yourself out of the loop by buying gold, but you cannot effect the debt, interest rate, or banking system. You are disenfranchised. Instead, we have monetary policy administered the way the Soviet Union had food prices set by bureaucratic diktat. The problem is not that gold cannot have any utility. It had it, once. The problem is that the government has locked up gold's utility. What's left gold is just betting on the price action in the casino. Sooner or later, that price action is going to come to an ignominious end. Contra the Quantity Theory of Money, the value of the dollar will go to zero. This will not be because its quantity rises to infinity. It will be because gold owners no longer wish to risk holding dollars, for fear of counterparty default. About the best we can say is that today is not that day. Read on for the only the only true picture of the supply and demand fundamentals that ultimately drive the price action. But first, here's the graph of the metals' prices. The Prices of Gold and Silver Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It rose significantly this week. The Ratio of the Gold Price to the Silver Price For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red. Here is the gold graph. The Gold Basis and Cobasis and the Dollar Well, well, well. Look at that. The abundance of gold (i.e. the basis, the blue line) falling all week, and the scarcity rising. Indeed, we see now this pattern has been going since the end of June. The same pattern holds true for farther-out contracts. This means that someone, or millions of someones—do not get too caught up in the fallacy of famous market players—is buying physical gold metal. In that time, speculators have not been eager to buy more. So the net result is that the fundamentals have nearly caught up to the price. The Gold Price and Fundamental The gold market may not be screaming "buy" yet—today is not that day—but it's no longer screaming "danger". It is interesting to see that the speculators—who are really betting against the dollar, even if they don't always know it—sometimes go their own way. Perhaps they see a central banker in the news, or the jobs report disappoints. Buy, buy! No animal species can survive by cannibalism—by members eating other members. And speculators cannot drive the market by continually buying from one another, giving them both profits (as they reckon it, in dollars) and ever-rising price. Eventually either the fundamentals change and the speculators are proven right. Or the speculators give up, or get flushed out. This time, the speculators are proven right. They put their dollars in harm's way, particularly since the end of April when the softening fundamentals fell below the market price. They continued to fall all the way through late June. But the market price did not follow this trajectory. The Silver Basis and Cobasis and the Dollar Price Silver is in a different world. We do see a falling basis and rising cobasis this week. However, it's just tracking price. That is rising dollar price (i.e. falling silver price) corresponds with rising cobasis. As speculators reduce their positions, the price falls a bit. It has a long way farther to fall, before it catches down to the fundamentals.

© 2016 Monetary Metals | |

| ALERT: Germany Tells Public to STOCK UP ON FOOD & WATER… What Do They KNOW?? Posted: 21 Aug 2016 09:03 PM PDT by Bix Weir, Road to Roota, SGT Report.com:

So when the German government tells their people to stock up on 10 days of food and water because of potential “terrorist strikes” my mind immediately goes to my BS Meter which says…HIGH! It’s not terrorist attacks they need to stock up for…it’s the take down of the monetary system!!!

REUTERS: Germany to tell People to Stockpile Food and Water For the first time since the end of the Cold War, the German government plans to tell citizens to stockpile food and water in case of an attack or catastrophe, the Frankfurter Allgemeine Sonntagszeitung newspaper reported on Sunday. Germany is currently on high alert after two Islamist attacks and a shooting rampage by a mentally unstable teenager last month. Berlin announced measures earlier this month to spend considerably more on its police and security forces and to create a special unit to counter cyber crime and terrorism. “The population will be obliged to hold an individual supply of food for ten days,” the newspaper quoted the government’s “Concept for Civil Defence” – which has been prepared by the Interior Ministry – as saying. The paper said a parliamentary committee had originally commissioned the civil defense strategy in 2012. END If Germany is telling their people to hold 10 days of food and water then YOU should be holding 2 MONTHS worth of food and water!! There’s no more time to waste on preparing for the monetary crash. May The Road you choose be the Right Road. Bix Weir | |

| Economic Collapse Confirmed! Most Credible Video Ever! Posted: 21 Aug 2016 09:00 PM PDT There shall be a massive transfer of wealth ...wiping out the 99% to major austerity.There shall be a major currency reset...aka human depopulation...since all money in circulation is counter fiat/feit ..humans (resources) aka fuel that drives the economy via their birth certificates which are... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |

| Paul Craig Roberts Warns US is Completely Busted, Non Delivery of Gold Crash the System 2016 Posted: 21 Aug 2016 08:30 PM PDT Dr. Paul Craig Roberts Assistant Secretary of the US Treasury Dr. ... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |

| HARDCORE EVIDENCE: Hyperinflationary COLLAPSE is Coming! Posted: 21 Aug 2016 08:06 PM PDT This one is a MUST LISTEN. Michael Oliver from Momentum Structural Analysis and writer David Jensen join me to provide the latest evidence of global economic collapse. The biggest bubble in the history of the world is about to pop, and as it does, interest rates will rise quickly causing the... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |

| HARDCORE EVIDENCE: Hyperinflationary COLLAPSE is Coming! Posted: 21 Aug 2016 07:57 PM PDT by SGT, SGT Report.com: This one is a MUST LISTEN. Michael Oliver from Momentum Structural Analysis and writer David Jensen join me to provide the latest evidence of global economic collapse. The biggest bubble in the history of the world is about to pop, and as it does, interest rates will rise quickly causing the whole house of cards to fall. Michael explains, “The liquidity created by the central banks, instead of going into stocks as it has been, is shifting. the river of flow is shifting into commodities. We are about to have commodity price inflation.” “We are living through the end phase of a global credit bubble which has been created by short circuiting the gold and silver markets, forcing interest rates down in a secular manner over 35 years. When you have credit tightening in a credit bubble, you have the recipe for the collapse,” David warns. And as the Bond market bubble pops, inflation will quickly turn into hyperinflation, destroying life as we know it. Buckle up. | |

| Gold Will Explode In Value Well Beyond What Jim Rickards Forecasts Posted: 21 Aug 2016 07:35 PM PDT by Steve St. Angelo, SRSRocco Report:

Jim Rickards has written several best-selling books such as, Currency Wars, The Death Of Money and more recently, The New Case For Gold. Rickards is a big believer in owning gold to protect against the collapse of the highly leveraged derivatives based financial industry. Rickards has gone on record in stating that his technical target for the price of gold posted in the article, Gold "Chart of the Decade" – Math Suggests $10,000 Per Ounce Says Rickards:

Rickards as well as legendary gold trader, Jim Sinclair both believe the value of gold will rise due to backing all the outstanding U.S. Dollars with physical gold. Thus, Rickards mathematical formula for arriving at that $10,000 per ounce figure is based upon the outstanding fiat currency in the system. Rickards believes for the U.S. Dollar to continue to function as a currency after the coming financial collapse, it will have to be backed by gold. While I applaud Rickards for coming out against the anti-gold Wall Street financial establishment, he fails to mention the most important reason to own gold going forward. Furthermore, Rickards suggests a 10% ownership in gold as "INSURANCE" in the case of a financial and economic collapse. Rickards explains about gold insurance in his article, Gold: The Ultimate Insurance:

As Rickards suggests, gold will act as insurance protecting your wealth during an economic and financial collapse. His rational here is that even if your portfolio suffers from huge declines during a stock market crash, the individual's gold holdings will multiplying in value, offsetting loses in stocks and even bonds. Before I get into the most important factor that Rickards fails to consider in owning gold, I'd like to mention that I respect the work he is doing. If only 2% more of investors in the world decided to allocate 10% of their portfolio to gold, the price of gold would skyrocket on that MOVE alone. So, by Rickards going out and publicly stating investors should own gold through interviews and his new book, The New Case For Gold, he's providing excellent advice. However, his recommendation for owning only 10% of one's portfolio in gold is DRASTICALLY TOO LOW. This is where I differ from Rickards on gold and silver ownership. Gold & Silver Will Explode In Value Well Beyond What Rickards Forecasts As I have mentioned in several articles and interviews, the value of gold and silver will explode in value due to the permanent collapse of the U.S. and Global Markets. This goes well above and beyond anything that Rickards demonstrates in either his interviews or books. According to Rickards, the next financial and economic collapse will be just another BIG BUMP in the road. Most precious metals analysts, Jim Rickards included, suggest the importance of owning gold to protect wealth during this next financial and economic calamity. Unfortunately, the most important factor they leave out is the "PERMANENT COLLAPSE DUE TO FALLING ENERGY PRODUCTION." I just had an interview with Doc and Eric Dubin at SilverDoctors on Thursday on this very subject. I believe that will be posted this weekend. I must say, I was a bit passionate about new energy information and why the U.S. and Global Markets are going to be in much more serious trouble than individuals realize. That being said, the U.S. (world included) was able to pull itself out of the Great Depression of the 1930's as well as other economic and financial shocks due to the GROWTH OF WORLD OIL PRODUCTION. This will no longer be the case going forward. I wrote about this upcoming collapse which was detailed in my article, The Coming Breakdown Of U.S. & Global Markets Explained: What Most Analysts Miss:

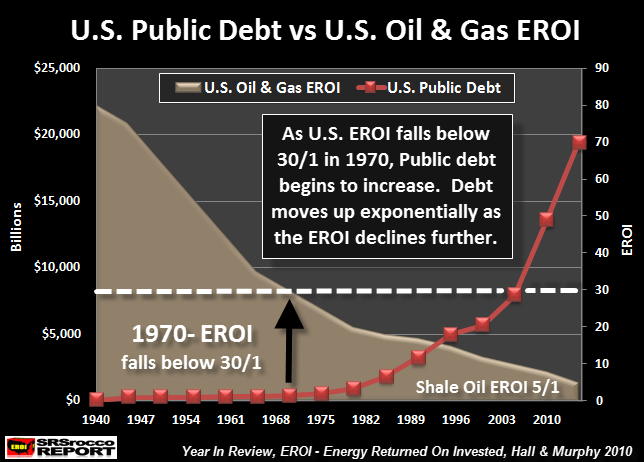

The reason I believe this collapse will be different than anything in the past is due to the Falling EROI- Energy Returned On Invested. This is shown in the following chart:

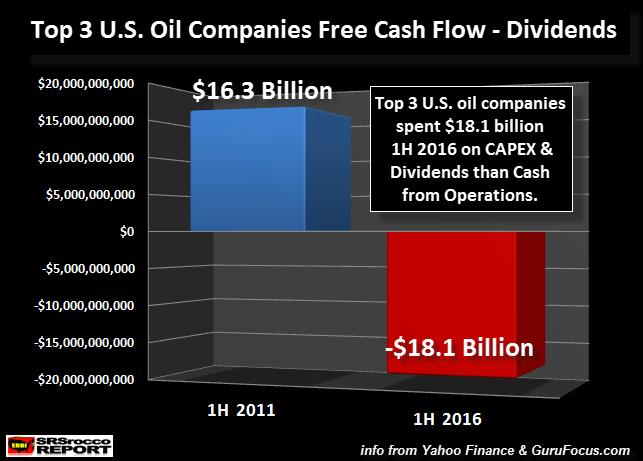

I don't want to get into too many details here (as they were explained in the article linked above), however, the massive increase in U.S. public debt is directly tied to the falling EROI of U.S. oil and gas energy production. In 1970, the U.S. enjoyed an EROI of 30/1. Thus, we had 29 profitable barrels of oil for the energy cost of each barrel to maintain and grow our modern society. In addition, a high EROI allows oil companies to remain profitable and to continue future exploration. Unfortunately, the EROI of U.S. Shale oil production is 5/1… thus, it only provides four profitable barrels. Nearly half of U.S. total oil production is from shale oil fields. Thus, the overall EROI of U.S. oil and gas energy production has fallen considerably and is now below the MINIMUM REQUIREMENT of 20/1 EROI to sustain our modern society (source found on linked article above). This is why we are experiencing runaway Health Care, Education, Food and etc costs. We just don't have enough profitable barrels of oil anymore to pay for it all. So, to try and continue business as usual, we add a lot more debt to the system as costs continue to increase. Sure, government and corporate corruption are partly to blame for rising costs, but overall, the falling EROI is destroying everything in its path. For example the major U.S. Oil companies are hemorrhaging under the low price of oil as they had to fork out an additional $18.1 billion 1H 2016 to cover their capital expenditures and dividends that they didn't make from their operations:

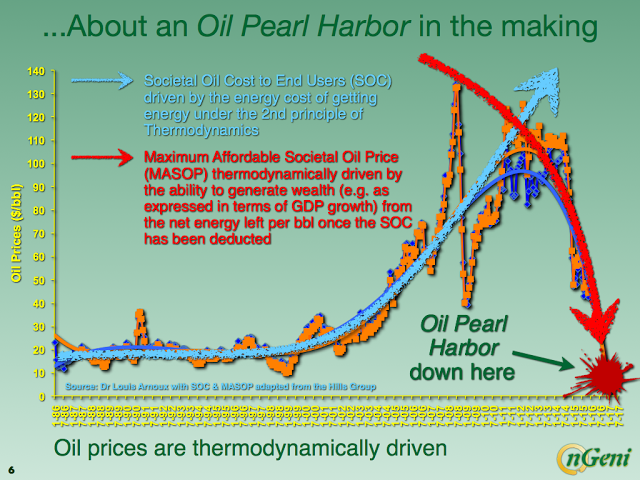

Some folks believe that when much higher oil prices arrive, the oil companies will tap into more expensive reserves and production will grow. While this is a NEAT IDEA, new information points to a "Thermodynamic Collapse" of oil due to the rapidly falling EROI:

This chart was put together by the work of the Hills Group (oil engineers and project managers) and Louis Arnoux. Instead of seeing much higher oil prices in the future, they forecast the price will head back much lower as the AVAILABLE NET ENERGY for society continues to decline. Basically, they believe the price will fall because the value of the oil will diminish. Even though someone might want to pay a higher price for energy, the society as a whole will be only able to afford a much lower price due to the collapse of NET OIL SUPPLIES to the economy. This ENERGY FACTOR is not even spoken about by Jim Rickards. I imagine Rickards is a very smart guy and it would surprise me if he didn't understand this information. If Rickards understood this energy information, it may not go over well to talk about this to the majority of investors who buy his books. I am not criticizing Rickards here, I just realize this topic is well beyond DOOM & GLOOM. It changes everything going forward.. and rather quickly. | |

| Gold & Silver Miners Set To EXPLODE 1,000%…? Posted: 21 Aug 2016 07:32 PM PDT by SGT, SGT Report.com: Dex, the founder of the Pulsescan72 channel on You Tube, home of the Vulcan Report joins me to discuss the nearly unprecedented move of gold and silver mining stocks in 2016. Dex says the GDX, GDXJ and SILJ charts look “extraordinary” and are so powerful that he thinks the mining stock indexes are probably going 1000% higher – and Dex thinks that might be “low balling” it. “The charts are telling us that there is something wrong, something is broken and the price is factoring this in… this thing is going to take off like a rocket.” Do yourself a favor and SUBSCRIBE to Dex’s channel for daily updates. | |

| New Government Analysis Shows Fed Policies Have Deepened Downturn for Many Posted: 21 Aug 2016 07:30 PM PDT from The Daily Bell:

This analysis helps prove a point we've been making for years: Fed stimulation provided by too-low interest rates does NOT stimulate industry only finance and speculation. The Congressional Report doesn't seem to mention central banking, so in this article we will rectify the omission. The entire justification for central banking is that it helps policymakers produce prosperity. But it doesn't. We don't need a government analysis to confirm this but it's useful to have because it illustrates once more the truth of what's occurring in terms of economic manipulation. The entire apparatus of monetary leadership, and its influence on the marketplace itself, does not deliver what it is supposed to. The idea is that the Fed provides additional liquidity as necessary. But this is a form of price-fixing. In a normal economy where the government itself was not involved in "adjusting¨ the value and volume of currency, the value would be provided by the market itself. This is the way it has traditionally worked throughout history. The last century has been one enormous experiment. But the consequences are obvious. Say an economy utilizes gold as money. When too much gold circulated in the marketplace, the value relative to what could be purchased would likely decline. As the value declined, less gold would be produced and circulated. Mines would close, etc. | |

| Silver Analysis : 22 Augst 2016 Posted: 21 Aug 2016 07:03 PM PDT | |

| Multipolar World Order: Economics Vs. Politics Posted: 21 Aug 2016 06:50 PM PDT Submitted by Frederico Pieraccini via Stratgic-Culture.org, International tensions have in recent years often led to conflicts between nations, leaving countries to face complicated choices. The world is under constant change, and the most direct results are political instability over vast areas of the globe combined with economic, cultural and often military confrontations. The economic priorities of cooperation and development are increasingly being sacrificed on the altar of protection of geopolitical interests. It is a return to the past where strategic interests prevailed over the economic model prescribed by modern capitalism. Nations like Russia, China and Iran have in recent years accelerated their rise on the global arena, expanding vital aspects of this in such areas as energy supply, transit of goods, the type of currency used in trade, defense of national borders, the granting of use of airspace, military-industrial cooperation with other nations, the joint fight against terrorism, and a general defense of the principle of national sovereignty. Washington has tried in every way to prevent this growing multipolarity, desperately trying to prolong its two-decade-old unipolar world. It is in this general climate that Beijing, Moscow and Tehran have had to engage with Western economic reactions in the process of defending their strategic interests. As a result, we have increasingly witnessed in recent years a conflict between economic convenience and politically driven policy decisions. The most difficult challenge faced by these challengers of the status quo lies increasingly in the complicated question of how to manage a situation where geopolitical interests have to fit into a global financial system largely managed and manipulated by Europeans and Americans. Currently the international financial system, as I have written many times before, is an American affair. The dollar stands as the dominant currency in relation to other financial institutions, and the whole global economic system is mainly conducted through the American currency. But the paradigm is changing, especially in recent years, thanks to supra-national entities like the AIIB and BRICS. Inevitably the IMF’s currency basket will have to incorporate the yuan, starting the process of the slow erosion of the dollar's dominance. The IMF, after years of wasting time trying to delay this event, will welcome from the October 1st, 2016, Beijing as an integral part of the reserve-currency system. Of course one of the most critical aspects is still the private banking sector and how the SWIFT payment system will work, given that it currently lies within the Euro-American orbit. Altogether this blend of public and private sector produces a situation where it is easy to see that the global economic system and its rules are often decided in Washington (IMF, World Bank), New York (Wall Street, FED), London (LSE), Basel (BIS) and Frankfurt (ECB), excluding all the other nations. The financial system is dominated by central banks, international bodies and the huge conglomerate of private banks, all strictly of a North Atlantic orientation. It is easy to understand that nations not aligned with Western interests suffer retaliation, threats and damage from a financial system that is controlled by Euro-American interests. The pressure imposed on nations like Iran, Russia and China in recent years has increased significantly, jeopardizing global stability. The real possibility of proposing an alternative economic system that is not so easily manipulable by the West has allowed not only Beijing, but especially Moscow and Tehran, to respond in a very effective manner to Western geopolitical intimidation. The Western reaction to the development of the Iranian nuclear program, as well as the Crimean issue, demonstrated clearly the consequences that come with defending strategic interests. Initially it was Iran. With the acquired nuclear capability, Israel poses a direct strategic threat to the existence of the Islamic Republic. Tehran has decided to give priority to its own national interests by developing its own nuclear program. The objective is the production of a nuclear device to use as a deterrent, effectively creating a balance of power. Of course the decision sparked a vehement response from the West, and once the military option was discarded, an economic strangulation of the country commenced. Iran’s expulsion from the global banking system (SWIFT), as well as international sanctions, especially in 2007-2013, have had serious repercussions for the Iranian state in terms of profits from imports and exports, especially in the area of oil and gas. The economic burden has been high, the country facing difficulties financing internal growth. This pushed Tehran to try and change the situation to their advantage by bypassing impediments and penalties. This decision forged important partnerships, especially with Russia, China and India, and strongly contributed to the implementation of an alternative economic channel. Tehran's move was strongly appreciated in the region by small countries seeking opportunities for mutual gains. Important Chinese and Indian investments in the Islamic Republic, Moscow’s constant military exports to Iran, and the selling and buying of gas and oil in different currencies rather than the dollar created a context in which, for the first time, the international economic pressure fueled by Washington was not able to change the course of events. Iran, thanks to the assistance and financial support of its main allies, managed to render irrelevant the sanctions and banking restrictions imposed on it. It is this aspect more than any other that led to the nuclear negotiation process initiated by the West. Iran was found in the revolutionary situation of being able to pursue its strategic objectives (nuclear weapons as a deterrent to a nuclear Israel) without succumbing to economic pressure. The importance of this outcome can never be stressed enough. For the first time in a long time, a nation not aligned with Western wishes was able to defend its strategic interests without suffering the negative effects of an adverse international system, with its arsenal of speculation, penalties, or simply illegal actions like the removal from the SWIFT system. When confronting geopolitical and economic interests, it is hard not to mention the two giants such as China and Russia. Both countries, as global superpowers, necessarily need to constantly balance strategic objectives, often geopolitical, with international economic cooperation. The Ukrainian coup, with the reunification of Crimea, or the construction on the “Spratly Islands” in the South China Sea, are two forward-looking examples of how geopolitical interests have become a main priority for Beijing and Moscow. The power that China has accumulated in economic terms gives it a great advantage: Western nations are unable to apply economic aggression. This leaves China free to pursue its main political objectives, such as establishing security on its maritime boundaries, enforcing national integrity, and expanding its influence and commercial facilities across the continent, without fear of incurring economic punishment. The West is already unable to sanction China let alone apply any vetoes from the private banking sector, or even worse, a possible embargo. China is the factory of the world, and any economic pressure would end up producing unacceptable losses for the West. After years of disagreements over Chinese territorial claims in the South China Sea, all that Washington managed to do was obtain an irrelevant judgment from an international tribunal thousands of miles away from the disputed area. China pursues its claims without much caring for the actions and rhetoric of the West, focusing instead on ensuring its strategic focal points. The coup in Ukraine, and the subsequent reunification of Crimea, showed unequivocally how Russia’s nuclear weapons deter American aggression. The possibility of NATO actively participating in the war Kiev started against the east of the country amounted to zero, due to the conventional military power of the Russian Federation. Nevertheless in such a scenario, we cannot overlook the effect of sanctions, and the attempts of international isolation, that Russia is subjected to. Moscow, during the Ukrainian crisis, took the difficult but necessary decision to preserve its geopolitical interests at the expense of its economic interests. The stakes were too high to be able to give preference to financial calculations. Sevastopol and the Black Sea Fleet are fully part of the strategic deterrent that has saved the world from a possible confrontation between NATO and Russia in Ukraine. In such a scenario, even the collapse in oil prices has not affected Moscow’s decisions even as it is damaging to the Russian economy. Like with Iran, for Russia the choice to defend at all costs its national interests has forced a policy of “looking towards the east”. The multiple, all-encompassing agreements with Beijing have proven that Western economic power is increasingly frail and can be ignored. The events involving Iran, China and Russia are an epilogue in international relations. They convey an uplifting message to countries with less capacity to resist Western military aggression or withstand financial aggression. It is still too early to appreciate the effects of this change on small nations and their policies, since they are still reliant on assistance from their strong allies. In scenarios like this, the economic impact is not negligible and is often the decisive factor in balancing priorities. It is difficult to imagine a country that places geopolitical interest ahead of the nation's economy. Some recent examples of this Western arrogance can be seen in energy transit through pipelines. The Middle East suffered untold death and destruction in Iraq and Syria because of plans to disrupt the construction of a pipeline connecting Iran and Europe that passed through Syria and Iraq. A similar situation was seen in the discussed links between South Stream, North Stream or Turkish Stream. In this case all the transit countries (Bulgaria, Greece, Hungary, Serbia and Slovenia) had enormous problems fulfilling their agreements. Unfortunately, it is in such circumstances that Western economic blackmail reaches its peak, often managing to block or slow down such strategically important gas or oil corridors. Smaller countries are forced to give up important sources of development in order to avoid running the gamut of economic restrictions or even international sanctions. One way to resist international finance is through a national economic system that is in many respects highly independent. This is how the world should view the alternative international systems of the likes of the BRICS Bank and the Asian Infrastructure Investment Bank (AIIB). In the near future, countries vulnerable to international speculative attacks will be able to embark on politically favorable projects through the AIIB or BRICS Bank. The multipolar future is not just for superpowers like China and Russia but also represents a huge opportunity to raise Third World countries up from unacceptable levels of poverty. The aim of Sino-Russian relations is nothing less than providing the necessary tools to other nations to resist international pressures from traditional financial channels (World Bank, IMF). Allowing these nations to pursue their own national strategic interests opens possibilities that only a multipolar world can offer. The transition from a unipolar to a multipolar reality has already changed many aspects of international relations. Military options for superpowers against one another have become a less viable option thanks to economic ties and the nuclear balance. Some of the ultimate tools to influence events, namely manipulation and financial terrorism, have less and less effect on superpowers and tend to actually favor the creation of an alternative economic system. The evolution of these events is easily predictable. With more integration of the world’s nations, the dollar's influence will gradually be reduced, but the decline of the United States’ unipolar moment will accelerate. The effects will be increasing international cooperation and a transformation that will guide our world toward a full multipolar age. A revolution that will change everything like nothing in recent history is taking place, forever altering the delicate balance upon which international relations hitherto rested. | |

| Olympic Gold Medals Have Almost Zero Gold In Them Posted: 21 Aug 2016 06:11 PM PDT The 2016 Rio Summer Olympic Games are already 51% over budget, with the total cost expected to be in the $4.6 billion range. With that in mind, Visual Capitalist's Jeff Desjardins notes that the organizers have tried their best to cut costs. One area of compromise? The Olympic gold medals, which weigh 500g (1.1 lbs) and are 85mm (3.3 in) in diameter, are gold in name only. OLYMPIC GOLD MEDALS HAVE ALMOST ZERO GOLD IN THEM Today’s infographic comes from JM Bullion and it shows the real amount of metal in gold, silver, and bronze medals, along with the hypothetical cost of awarding solid gold to winning athletes. Courtesy of: Visual Capitalist and JMBullion | |

| King Tut Silver 5 Oz Coin Unboxing Posted: 21 Aug 2016 06:00 PM PDT from SalivateMetal: | |

| Silver Is in a Different World Posted: 21 Aug 2016 05:21 PM PDT Monetary Metals | |

| Deutsche Bank: The only way to fix the economy is for the stock market to 'collapse' Posted: 21 Aug 2016 03:47 PM PDT The US economy and financial system is a mess of contradictions right now. Bond yields are hitting record lows while the stock market is hitting record highs. The labor market is signaling full employment, but GDP growth remains lackluster. According to the fixed-income research team at... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |

| Peter Schiff Why The Dollar Will Collapse Surely on August Posted: 21 Aug 2016 03:05 PM PDT Peter Schiff : " Why The Dollar Will Collapse Surely on Aug interview Economic Collapse " Peter Schiff is a well-known commentator appearing regularly on CNBC, TechTicker and FoxNews. He is often referred to as "Doctor Doom" because of his bearish outlook on the economy and the U.S. Dollar... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |

| How Clinton Gangsterism Will Be Applied In The White House Posted: 21 Aug 2016 01:43 PM PDT Without a doubt...my nightmares...precisely...Clinton Gangsterism Will Be Applied In The White House The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |

| GERALD CELENTE'S DEVASTATING PREDICTION FOR THE FUTURE OF EUROPE AFTER THE DEUTSCHE BANK COLLAPSE Posted: 21 Aug 2016 01:15 PM PDT Deutsche Bank could cut up to 35,000 jobs by the year 2020 and shutting down branches all over Germany. Gerald Celente joins Gary franchi to reveal his forecast for the Eurozone after the fall of Deutsche Bank. The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |

| Join GATA at the New Orleans conference because you can't lose Posted: 21 Aug 2016 09:14 AM PDT 12:15p ET Sunday, August 21, 2016 Dear Friend of GATA and Gold: Will you join GATA Chairman Bill Murphy and your secretary/treasurer at the New Orleans Investment Conference in the last week of October? Conference director Brien Lundin notes in the letter below that you really can't lose. He guarantees that if, as a result of what you learn at the conference, you don't at least quadruple your registration fee, your fee will be refunded. Having participated in the conference for many years, GATA can say that nothing surpasses it for financial and political insight and, thanks to the city itself, plain old fun. I don't mean the cliched honky-tonkiness of Bourbon Street. (Anyone in the monetary metals sector learns early how to drink plenty just staying home.) I mean the history, geography, culture, climate, and of course the restaurants of the city. At this conference there is always so much to learn inside -- many of the speakers are GATA favorites -- and to explore outside. So please read Lundin's letter below and if you're persuaded to consider attending, use the link at the bottom of his letter to find out more about the conference and register for it. The conference has kindly offered GATA a commission for every GATA supporter who uses the link to register. Hoping to see you there. CHRIS POWELL, Secretary/Treasurer * * * Your Guarantee that You Can't Lose at the New Orleans Investment Conference By Brien Lundin Gold and silver are soaring. Negative interest rates are spreading across the world like a wildfire. The economy is slowing. Stocks are peaking while the presidential election promises to roil global markets. This is the riskiest -- and potentially most profitable -- investment opportunity in decades. And there's only one way to play it that guarantees a four-for-one profit. My message is simple: You can't afford to miss this opportunity. That's because the best place to be in a gold bull market is the New Orleans Investment Conference. More than four decades of history have proven this, time and time again. It's where the top metals and mining stock experts and most successful investors gather every year. It's where the most powerful investment strategies are detailed. It's where the hottest new opportunities are unveiled. And as I said, the results speak for themselves: The stock picks given out at the New Orleans Conference often multiply five, 10, even 20 or more times over after the event. How reliable and profitable are these results? Enough so that we can guarantee you'll quadruple your investment in the event ... or get your entire registration fee back. The only way you can lose is not attend. And there are plenty of reasons to come. With our amazing agenda this year, coupled with the remarkable turn the markets have made in our favor, you're going to learn more, profit more, and just have more fun than you could anywhere else. Don't cheat yourself -- click on the link below to learn why this year's New Orleans Conference is going to be the event of the decade: http://neworleansconference.com/wp-content/uploads/2016/08/2016_Powell.h... ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVD recordings of the proceedings of our London conference in August 2011 or our Dawson City, Yukon Territory, conference in August 2006: http://www.goldrush21.com/order.html Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |

| Posted: 21 Aug 2016 08:35 AM PDT Billionaire Crispin Odey recently released a management letter to his hedge fund clients praising gold and explaining gold products constituted the next, great investment wave. He is yet another in a wave of billionaires who have all, suddenly, been moving massive portions of their portfolio into gold… with one of the latest being George Soros, who moved a significant amount of his portfolio into gold just a few months ago. | |

| Breaking News And Best Of The Web Posted: 20 Aug 2016 05:37 PM PDT European banks deteriorating. Negative interest rates getting a lot of attention. More scary predictions from George Soros. Citi loads up on derivatives. Fed officials predicting Sept rate hike. Corporations buy back fewer shares, insiders sell more. Money pours into emerging markets. Silver miners gain fans. Trump hires new people, keeps falling in polls. Best […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Germany holds one the triggers to the collapse the system. They have had it since 2012. I talked about it when they held meetings about trying to get their gold back from the US Fed. Their power lies in pulling the derivative time bomb held at Deutsche Bank.

Germany holds one the triggers to the collapse the system. They have had it since 2012. I talked about it when they held meetings about trying to get their gold back from the US Fed. Their power lies in pulling the derivative time bomb held at Deutsche Bank. While Jim Rickards explains many reasons why it is important to own gold, he leaves out the most important factor. Jim has become one of the more prominent names in the precious metals community due to his strong opinion on owning gold even though he worked on Wall Street (the anti-gold financial establishment) for 35 years.

While Jim Rickards explains many reasons why it is important to own gold, he leaves out the most important factor. Jim has become one of the more prominent names in the precious metals community due to his strong opinion on owning gold even though he worked on Wall Street (the anti-gold financial establishment) for 35 years.

Wealthy Have Nearly Healed From Recession; the Poor Haven't … The Great Recession and the subsequent recovery from it have deepened the wedge between the very wealthy and everyone else in America, plunging the poor deeper into debt and wiping out two-fifths of the wealth held by families in the heart of the middle class. The wealthiest Americans, meanwhile, appear close to regaining all their losses over the same period, according to an analysis released last week by the Congressional Budget Office. – Washington Post

Wealthy Have Nearly Healed From Recession; the Poor Haven't … The Great Recession and the subsequent recovery from it have deepened the wedge between the very wealthy and everyone else in America, plunging the poor deeper into debt and wiping out two-fifths of the wealth held by families in the heart of the middle class. The wealthiest Americans, meanwhile, appear close to regaining all their losses over the same period, according to an analysis released last week by the Congressional Budget Office. – Washington Post

No comments:

Post a Comment