Gold World News Flash |

- The Silver Numbers Don’t Add Up, COMEX Break Soon! – David Jensen

- Texas State Gold Depository Another Step Closer To Reality

- President Obama Violated The Law With His Ransom Payment To Iran

- "Markets Are Ripe For A Black Swan Event" - Why Most 'Well Hedged' Funds Won't Survive

- LBMA says banks back its plan to change London gold market

- Torgny Persson: The world's largest precious metals refineries

- World War III could start in Syria's 'crowded skies'

- Financial Armageddon This Year -- Andy Hoffman

- GOVERNMENTS WILL FALL AS THE FINANCIAL SYSTEM FAILS By Gregory Mannarino

- ANONYMOUS - THE NEW WORLD ORDER PLAN FOR TERRORISM 2016 Explained

- Gold Miners Q2 2016 Fundamentals

- Donald Trump Hands Out Supplies to Louisiana Flood Victims 8/19/16

- How to “Crash Proof” Your Portfolio

- RON PAUL - What's Ahead ??

- How Will Brexit Impact the Gold Market? A Historical Perspective

- Rothchilds Buying Gold On “Greatest Experiment†With Money In “History of the Worldâ€

- Rothchilds Buying Gold On “Greatest Experiment” With Money In “History of the World”

- Deutsche Bank whistleblower turning down a multimillion-dollar award

- Moody’s calls bottom on commodity price collapse – but the pain isn’t over

- Breaking News And Best Of The Web

- “Saving Social Security” May End in Dollar Devaluation

| The Silver Numbers Don’t Add Up, COMEX Break Soon! – David Jensen Posted: 19 Aug 2016 11:30 PM PDT from FutureMoneyTrends: |

| Texas State Gold Depository Another Step Closer To Reality Posted: 19 Aug 2016 09:00 PM PDT by Mike Maharrey, Activist Post:

Gov. Greg Abbot signed legislation creating the state gold bullion and precious metal depository in June of 2015. The facility will not only provide a secure place for individuals, business, cities, counties, government agencies and even other countries to to store gold and other precious metals, the law also creates a mechanism to facilitate the everyday use of gold and silver in business transactions. In short, a person will be able to deposit gold or silver – and pay other people through electronic means or checks – in sound money.

The state issued a formal Request for Proposals last month. Companies interested in building and running the facility must have their plans submitted by Sept. 30. According to an article in the Star-Telegram,"state officials want a facility 'with an e-commerce component that also provides for secure physical storage for Bullion in an existing facility or a newly constructed facility.' Officials say plans for a depository should include online services that would let customers accept, transfer and withdraw bullion deposits and related fees. By making gold and silver available for regular, daily transactions by the general public, the new law has the potential for wide-reaching effect. Professor William Greene is an expert on constitutional tender and said in a paper for the Mises Institute that when people in multiple states actually start using gold and silver instead of Federal Reserve notes, it would effectively nullify the Federal Reserve and end the federal government's monopoly on money. |

| President Obama Violated The Law With His Ransom Payment To Iran Posted: 19 Aug 2016 07:30 PM PDT Submitted by Andrew McCarthy via NationalReview.com, The president hoped to camouflage what he knew to be against the law in his dealings with Iran. Did it ever occur to President Obama to ask why he couldn’t just cut a check to the Iranian regime? Outrage broke out this week over the revelation that Obama arranged to ship the mullahs piles of cash, worth $400 million and converted into foreign denominations, reportedly in an unmarked cargo plane. The hotly debated question was whether the payment, which the administration attributes to a 37-year-old arms deal, was actually a ransom paid for the release of American hostages Tehran had abducted. It is a waste of time to debate that point further. The Iranians have bragged that the astonishing cash payment was a ransom — and Obama has been telling us for months that we can trust the Iranians. The hostages were released the same day the cash arrived. One of the hostages has reported that the captives were detained an extra several hours at the airport and told they would not be allowed to leave until the arrival of another plane — inferentially, the unmarked cargo plane ferrying the cash. The reason American policy has always prohibited paying ransoms to terrorists and other abductors is that it only encourages them to take more hostages. And, as night follows day, Iran has abducted more Americans since Obama paid the cash. No matter how energetically the president tries to lawyer the ransom issue, if it looks like a duck, and quacks like a duck... More worth examining is why the transaction took the bizarre form that it did. To cut to the chase, I believe it was to camouflage — unsuccessfully — the commission of felony law violations. The Wall Street Journal has reported that the Justice Department strongly objected to the cash payment to Iran. As we shall see, that should come as no surprise. What is surprising is the Journal’s explanation of Justice’s concerns: Department officials, it is said, fretted that the transaction looked like a ransom payment. I don’t buy that. It is not a federal crime to pay a ransom; just to receive one. Our government’s stated disapproval of paying ransoms is a prudent policy, not a legal requirement. The Justice Department’s principal job is to enforce the laws, not to ensure good policy in foreign relations. It seems far more likely that Justice was worried that the transaction was illegal. If they were, they had good reasons. At a press conference Thursday, Obama remarkably explained, “The reason that we had to give them cash is precisely because we are so strict in maintaining sanctions and we do not have a banking relationship with Iran.” Really Mr. President? The whole point of sanctions is to prohibit and punish certain behavior. If you — especially you, Mr. President — do the precise thing that the sanctions prohibit, that is a strange way of being “so strict in maintaining” them. Now, the sanctions at issue exclude Iran from the U.S. financial system by, among other things, prohibiting Americans and financial institutions from engaging in currency transactions that involve Iran’s government. Contrary to the nuclear sanctions that Obama’s Iran deal (the “Joint Comprehensive Plan of Action” or JCPOA) attempts to undo, the sanctions pertinent here were imposed primarily as a result of Iran’s support for terrorism. That is significant. In pleading with Congress not to disapprove the JCPOA, Obama promised lawmakers that the terrorism sanctions would remain in force. Terrorism-related sanctions against Iran trace back to the early 1980s, shortly after the jihadist regime overthrew the shah, stormed the American embassy, took hostages, and triggered Hezbollah’s killing sprees. But the sanctions most relevant for present purposes stem from President Clinton’s 1995 invocation of federal laws that deal with national emergencies caused by foreign aggression. Clinton concluded that Iran had caused such an emergency by, among other things, “its support for international terrorism.” Note that this was even before Iran killed 19 members of the U.S. Air Force in the 1996 Khobar Towers bombing in Saudi Arabia. To this day, Iran remains on our government’s list of state sponsors of terrorism. Clinton’s state-of-emergency declaration has been annually renewed ever since. Let that sink in: Notwithstanding Obama’s often shocking appeasement of Tehran, he has been renewing the state of emergency since 2009 — most recently, just five months ago. Indeed, it is worth noting what the Obama State Department’s latest report on “State Sponsors of Terrorism” has to say about Iran. This is from the first paragraph:

It is due to this atrocious record that Congress pressed Obama to maintain and enforce anti-terrorism sanctions, which the administration repeatedly committed to do. This commitment was reaffirmed by Obama’s Treasury Department on January 16, 2016, the “Implementation Day” of the JCPOA. Treasury’s published guidance regarding Iran states that, in general, “the clearing of U.S. dollar- or other currency-denominated transactions through the U.S. financial system or involving a U.S. person remain prohibited[.]” (See here, p.17, sec. C.14.) I’ve added italics to highlight that it is not just U.S. dollar transactions that are prohibited; foreign currency is also barred. Obama’s cash payment, of course, involved both — a fact we’ll be revisiting shortly. Treasury’s guidance cites to what’s known as the ITSR (Iranian Transactions and Sanctions Regulations), the part of the Code of Federal Regulations that implements anti-terrorism sanctions initiated by President Clinton under federal law. The specific provision cited is Section 560.204, which states:

The regulation goes on to stress that this prohibition may not be circumvented by exporting things of value “to a person in a third country” when one has “knowledge or reason to know that” such things are “intended specifically for supply, transshipment, or reexportation, directly or indirectly, to Iran or the Government of Iran.” To summarize, the anti-terrorism sanctions are still in effect, a fact the administration has touted many times. Obama conceded at his press conference both that these sanctions are still in effect and that they applied directly to his $400 million pay-out to our terrorist enemies. But here’s the president’s problem: While he is correct that the sanctions barred him from sending Iran a check or wire transfer, that is not all they forbid — not by a long shot. They also make it illegal to do what he did. As noted above, the sanctions prohibit transactions with Iran that touch the U.S. financial system, whether they are carried out in dollars or foreign currencies. The claim by administration officials, widely repeated in the press, that Iran had to be paid in euros and francs because dollar-transactions are forbidden is nonsense; Americans are also forbidden to engage in foreign currency transactions with Iran. Obama had our financial system issue U.S. assets that were then converted to foreign currencies for delivery to Iran. Both steps flouted the regulations, which prohibit the clearing of currency of any kind if Iran is even minimally involved in the deal; here, Iran is the beneficiary of the deal. The regs further prohibit supplying things of value to Iran, regardless of whether it is done “directly or indirectly.” Expressly included in the “indirect” category are transfers of assets to another country with knowledge that the other country will then forward the assets, in some form, to Iran. That’s exactly what happened here, with Obama pressing the Swiss and Dutch into service as intermediaries. Although these regulations leave no room for doubt that their point is to prevent and criminalize things like sending $400 million in cash to the world’s leading sponsor of terrorism, the ITSR adds another reg for good measure. Section 560.203 states:

By his own account, President Obama engaged in the complex cash transfer in order to end-run sanctions that prohibit the U.S. from having “a banking relationship with Iran.” The point of the sanctions is not to prevent banking with Iran; it is to prevent Iran from getting value from or through our financial system — the banking prohibition is a corollary. And the point of sanctions, if you happen to be the president of the United States sworn to execute the laws faithfully, is to follow them — not pat yourself on the back for keeping them in place while you willfully evade them. The president’s press conference is better understood as a confession than an explanation. Oh, and there is also Section 560.701, which makes clear that willful violations of the regulations constitute serious felony offenses under federal criminal law — punishable by up to 20 years’ imprisonment. I hope you’re not lawed out, because there are a couple of other criminal statutes to consider. The first is the law against providing material support to terrorists, Section 2339A of the federal penal code. It says that anyone who provides resources — including “currency or monetary instruments” — to a person or entity with knowledge that they are to be used in the preparation or carrying out of terrorism offenses is guilty of a serious felony. I’ve italicized “knowledge” to underscore that intent is not required; to be guilty, you just need to know. As we note above, the Obama administration has just reaffirmed that Iran remains a state sponsor of terrorism. Moreover, as our editors recounted in Friday’s National Review editorial:

No doubt: The IRGC’s Quds Force is a formally designated terrorist organization, as, of course, is Hezbollah, Iran’s forward jihadist militia with which the IRGC colludes. And as Tom Joscelyn recently pointed out, Iran continues to harbor members of al-Qaeda (three of whom were just formally designated as terrorists). In sum, the Obama administration has provided Iran with $400 million under circumstances in which it well knows that at least some of this cash will be used for terrorism. Indeed, as the editors point out, by providing the money in cash, Obama makes it more likely that it will be used for terrorism: Iran likes to deny its complicity in jihadist acts; so now, flush with cash, it can fund atrocities without leaving a paper trail. The second law involves money laundering, criminalized by Congress in Section 1956 of the penal code. There are several prohibited varieties of money laundering. It can be a crime, for example, to conduct a financial transaction involving money used to facilitate unlawful activity. And if money is transferred outside the United States, it can be illegal to use it to promote criminal activity. As we’ve seen, both currency transmissions to Iran and the provision of material support to terrorism are unlawful activities. The administration has conducted a financial transaction (in fact, several transactions: the issuance of the assets, their conversion into foreign currency, and the transmission to Iran) which facilitated both currency transfers to Iran and Iran’s certain use of the money to support terrorism. Plus, the money was shipped outside the United States before being transferred to Iran and before Iran will use it to promote terrorism. Money-laundering cases often boil down to proof of intent; but there clearly are multiple grounds on which to investigate whether the laws have been transgressed. The circumstances of Obama’s enormous cash transfer to our terrorist enemies raise serious questions about whether American policy against paying ransoms to terrorists has been flouted. But that should not obscure a more fundamental issue: The president has violated the law. |

| "Markets Are Ripe For A Black Swan Event" - Why Most 'Well Hedged' Funds Won't Survive Posted: 19 Aug 2016 06:00 PM PDT George Sokoloff, founder and CIO of Carmot Capital, recently explained why typical asset allocation strategies, including those employed by most "sophisticated" hedge fund managers, end up getting slaughtered during market shocks despite perceptions of being "well hedged". One has to look no further than the last "great recession" to get a glimpse of just how well the typical "hedged" portfolios fared during the last "Black Swan" event. Unfortunately, large pools of institutional capital have grown increasingly accustomed to making allocation decisions based on short-term returns and relative performance rather than absolute returns over extended periods of time. Therefore, massive losses are ok as long as everyone is losing money at the same time, right? Absolute returns only matter to the suckers that are actually planning to use those pension assets to retire at some point. And, as for the hedge fund manager, don't worry if your relative returns suffer as that's not such a big deal either...simply shut your fund down...go on a really long vacation then come back and raise even more assets than before. But we digress. In an interview with International Business Times, Sokoloff points out that most investment strategies follow a Taleb distribution that provide the appearance of low risk and steady returns but in reality offer investors a high probability of a small gain and a small probability of a devastating loss. Unfortunately, as Sokoloff points out, the majority of institutional capital across the globe is levered to such strategies. Just like in the "great recession," funds that rely on "diversification" as a hedging strategy have a rude awakening during Black Swan events as correlations converge to 1 and the benefits of such diversification are erased.

Sokoloff uses a very simple analogy to illustrate the risks of typical portfolio allocation strategies by looking at what would have happened to a prudent money manager, based in 1912 Geneva, who constructed a diversified portfolio of developed and emerging market stocks and bonds:

As Sokoloff points out, this "prudent" portfolio would have faced drawdowns of as much as 80% over the next decade. People tend to rely on historically stable relationships between bonds and stocks, and when that relationship breaks down – as often happens in a liquidity event – even complicated strategies involving some arbitrage, essentially blow up. The typical problem with strategies designed to profit during Black Swan events is that funds that are genuinely hedged against systemic risk tend to under-perform during periods of relative market stability due to the costs of hedging. And given the focus on short-term performance in today's market, most institutional capital does not have the patience to stick with fund managers that consistently under-perform during stable markets even if the payoff could be huge during a down cycle. But, Sokoloff notes there are strategies that provide minimal returns during "normal" market periods and stellar returns during "Black Swan" events, strategies which he refers to at the "Holy Grail."

Finally, Sokoloff points out that our current environment is ripe for a Black Swan event while the only thing missing is the proper catalyst.

|

| LBMA says banks back its plan to change London gold market Posted: 19 Aug 2016 03:57 PM PDT ADVERTISEMENT Vanity Signs Option Agreement With Iamgold Company Announcement VANCOUVER, British Columbia, Canada -- Vanity Capital Inc. (TSX VENTURE: VYC) has entered an option agreement with Iamgold Corp. providing for an option to acquire a 100-percent interest in Iamgold's Porcupine Property in the Duparquet Township area of Quebec. The option is exercisable by Vanity spending a minimum of $1.5 million on expenditures for exploration, which isto include the completion of a minimum 5,000 metres of diamond drilling on the property, within 24 months of the option. The option is also subject to Vanity's entering into an agreement to acquire an interest in an adjacent property. Upon Vanity's vesting its interest, Iamgold would retain a 2 percent net smelter royalty. The option also provides Vanity with the right to renegotiate a pre-existing net smelter royalty of 3 percent held by certain third parties. ... ... For the remainder of the announcement: http://www.marketwired.com/press-release/vanity-signs-option-agreement-w... LBMA Says Banks Back Its Plan to Change London Gold Market By Henry Sanderson http://www.ft.com/cms/s/0/b9805af6-653b-11e6-8310-ecf0bddad227.html The body charged with regulating London's $5 trillion a year gold market says banks in the city are backing its plans to bring greater transparency to the market as the London Metal Exchange prepares to launch a gold futures exchange. Ruth Crowell, head of the London Bullion Market Association, said its members, which include some of the world's biggest banks, see an electronic trade repository as the best way to improve transparency and address regulatory pressure that is threatening to drive up costs. "The large majority of the membership have indicated this is what they'd like to do, it's sensible, it's the right approach," she said. Her comments come a week after a consortium — which includes the LME, World Gold Council, and Goldman Sachs — unveiled plans to bring the trading of precious metals in London on to an exchange early next year. The move is the biggest shake-up of the gold market for decades. London is the world's largest physical bullion market with its vaults used by many foreign central banks to hold their reserves. The Goldman-backed consortium faces opposition from HSBC and JPMorgan, the two big bullion banks that want to maintain the current system where gold is traded privately between buyer and seller. The LBMA, which was set up by the Bank of England in 1987 to regulate London's bullion market, is also not involved in the initiative. "We are trying to give members something that helps them grow their business in a more vibrant market place -- not an extra burden," said Mrs Crowell in her first public comments since the rival initiative was announced. The LBMA's own electronic platform is due to be announced at the body's conference in Singapore in late October. It will start as a trade repository that will be able to link to outside clearing houses or exchanges if there is demand, according to Mrs Crowell. "Ultimately we're looking at bringing a lot of services that exchanges offer but we're not looking to become an exchange," she said. A trade repository will also provide more information on the size of the London gold market that can be put before regulators. A lack of granular data had made it difficult for banks to argue gold is a highly liquid market that should not be subject to more onerous rules. Since the financial crisis, policymakers have been pushing for a shift in markets in general towards trading assets on exchanges and clearing transactions through centralised systems. The LBMA, which has 149 members, is lobbying the European Commission and the Basel Committee on Banking Supervision for a reduction in a proposed rule that would force banks to hold higher amounts of capital against their activities in the bullion market. It argues that gold should be treated differently from other commodities because it also acts as a currency. A rise in the ratio to a proposed 85 per cent could cause banks to exit gold trading, said Ms Crowell. Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Torgny Persson: The world's largest precious metals refineries Posted: 19 Aug 2016 02:51 PM PDT ADVERTISEMENT Vanity Signs Option Agreement With Iamgold Company Announcement VANCOUVER, British Columbia, Canada -- Vanity Capital Inc. (TSX VENTURE: VYC) has entered an option agreement with Iamgold Corp. providing for an option to acquire a 100-percent interest in Iamgold's Porcupine Property in the Duparquet Township area of Quebec. The option is exercisable by Vanity spending a minimum of $1.5 million on expenditures for exploration, which isto include the completion of a minimum 5,000 metres of diamond drilling on the property, within 24 months of the option. The option is also subject to Vanity's entering into an agreement to acquire an interest in an adjacent property. Upon Vanity's vesting its interest, Iamgold would retain a 2 percent net smelter royalty. The option also provides Vanity with the right to renegotiate a pre-existing net smelter royalty of 3 percent held by certain third parties. ... ... For the remainder of the announcement: http://www.marketwired.com/press-release/vanity-signs-option-agreement-w... The World's largest Precious Metals Refineries By Torgny Persson There are many precious metals refineries throughout the world, some local to their domestic markets and some international, even global in scale. Many but by no means all of these refineries are on the good delivery lists of gold or silver. These lists are maintained by the London Bullion Market Association and they identify accredited refineries of large (wholesale) gold and silver bars that continue to meet rigorous proficient standards of refining and assaying, and that are, at the same time, financial viable and stable companies. Currently there are 71 refiners on the LBMA's gold good delivery list and 81 refiners on its silver good delivery list, of which just over 50 of these refineries are accredited to both the LBMA's gold and silver lists. But within the top echelons of the world's precious metals refineries, a number of names stand out due to their sheer scale and pedigree, as well as their global brand recognition in the production of a wide range of investment-grade gold and silver bullion bars. These names include PAMP, Argor-Heraeus, Metalor Technologies, Heraeus, Valcambi, Tanaka Kikinzoku Kogyo, and Rand Refinery. ... ... For the remainder of the commentary: https://www.bullionstar.com/blogs/bullionstar/the-worlds-largest-preciou... Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| World War III could start in Syria's 'crowded skies' Posted: 19 Aug 2016 02:00 PM PDT Once Russia is defeated, the new world order is established. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Financial Armageddon This Year -- Andy Hoffman Posted: 19 Aug 2016 12:30 PM PDT Andy Hoffman, CFA joined Miles Franklin, one of America's oldest, largest bullion dealers, as Media Director in October 2011. For a decade, he was a US-based buy-side and sell-side analyst, most notably as an II-ranked oil service analyst at Salomon Smith Barney from 1999 through 2005. Since 2002,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| GOVERNMENTS WILL FALL AS THE FINANCIAL SYSTEM FAILS By Gregory Mannarino Posted: 19 Aug 2016 11:17 AM PDT GOVERNMENTS WILL FALL AS THE FINANCIAL SYSTEM FAILS By Gregory Mannarino The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| ANONYMOUS - THE NEW WORLD ORDER PLAN FOR TERRORISM 2016 Explained Posted: 19 Aug 2016 10:58 AM PDT The Humanity Party is nothing more than Agenda Illuminati NWO. they take out there plans. like Alex Jones he discredits Conspiracy. makes us look crazy. that is the role of this puppets they have to condition the sheeples. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Miners Q2 2016 Fundamentals Posted: 19 Aug 2016 10:33 AM PDT The gold miners’ stocks have skyrocketed this year as investors started returning to this long-abandoned sector. Many have tripled, quadrupled, or even quintupled since mid-January alone! But are such epic gains fundamentally justified? Much insight into this crucial question for investors can be gleaned from the gold miners’ latest quarterly financial and operational results. Their Q2 reports just finished coming in. |

| Donald Trump Hands Out Supplies to Louisiana Flood Victims 8/19/16 Posted: 19 Aug 2016 10:31 AM PDT August 19, 2016: After touring flood damage in Baton Rouge, LA, GOP Presidential nominee Donald Trump helped pass out relief supplies for the flood victims. Donald Trump Passes Out Supplies for Louisiana Flood Victims 8/19/16 The Financial Armageddon Economic Collapse Blog tracks trends... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

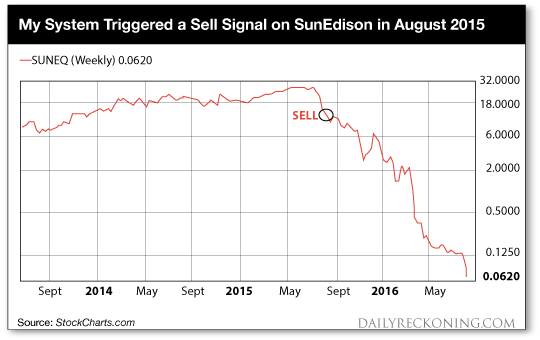

| How to “Crash Proof” Your Portfolio Posted: 19 Aug 2016 09:00 AM PDT This post How to "Crash Proof" Your Portfolio appeared first on Daily Reckoning. Want to hear a great story? It's a modern-day fairytale… It's about SunEdison, a renewable energy company whose shares skyrocketed in recent years. SunEdison was the darling of the world's most successful hedge fund managers, including multibillionaire David Einhorn of Greenlight Capital. They plowed billions into it. The media joined in with the circus hype too. It "reported" that the company was a "magic money machine" whose revolutionary business plan was throwing off hordes of cash. SunEdison was clearly going to make people a boatload of money, especially the hedge fund "Masters of the Universe"… because after all, who knows more about making money in the markets than those guys? Well, it turns out they know a lot about losing money too. You see, SunEdison's fairytale has an unhappy ending. It filed for bankruptcy a few months back. Einhorn and many others got crushed, with losses of more than 90%… all because they ignored one of the core tenets of trend following. Today, I'm going to show you a technique that would have saved them billions… Know When to Fold 'EmEinhorn could have exited SunEdison many times during its brutal decline. But he kept saying things would turnaround. They never did. Even after SunEdison's shares plummeted like a stone from $31 in July 2015, to $7 just a couple of months later, Einhorn still hung on, convinced he was correct. And he ended up losing everything on the trade. Thankfully, the lesson here is a simple one… You can't always be right. Nobody ever is. Not even the best and brightest hedge fund managers on the planet. The key to successful investing is to be prepared for when you're wrong. You must have a process in place to protect your assets when markets move against you. I'm talking about a rules-based trend following investment process that gives you precise exit points before you ever enter into a position. That process allows you to cut losing trades quickly – before they have the opportunity to grow into portfolio-destroying losses. Hedge fund bigwigs like Einhorn may be able to recover from massive drawdowns. But regular investors can't. They will ruin you – guaranteed. Look at how my trend following strategy worked on SunEdison…

As you can see, my system triggered a sell signal when it was clear that SunEdison's share price was trending down, well before the disastrous losses hit. Look, the market is never wrong. Einhorn and other Wall Street elites learned that painful lesson with SunEdison's epic collapse. When the market turns against you, and it will from time to time, you must use a predetermined exit strategy that allows you to keep your hard-earned capital. After all, if you have no capital, you can't play the game. This disciplined approach to cutting your losses is one of the core commandments of trend following. I talk about it in more detail, along with the other trend following commandments, in my most recent podcast, which I have linked for you below. Here's what you'll learn in today's podcast:

Click here to listen to today's podcast. Please send me your comments to coveluncensored@agorafinancial.com. Let me know what you think of today's podcast—the good, the bad and the ugly! Regards, Michael Covel The post How to "Crash Proof" Your Portfolio appeared first on Daily Reckoning. |

| Posted: 19 Aug 2016 08:15 AM PDT Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. Do you want to be informed with Max Keiser, Alex Jones, Gerald Celente, Peter Schiff, Marc Faber, Ron Paul,Jim Willie, V Economist, and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| How Will Brexit Impact the Gold Market? A Historical Perspective Posted: 19 Aug 2016 07:33 AM PDT We know why Britons voted to leave the EU and what the UK’s options outside the EU are. Now, let’s analyze how Brexit could affect the gold market. We covered this topic in the latest edition of the Market Overview, as well as the daily updates of the Gold News Monitor, but today we will examine how the shiny metal performed during the past disintegrations of economic unions. |

| Rothchilds Buying Gold On “Greatest Experiment†With Money In “History of the World†Posted: 19 Aug 2016 07:29 AM PDT The Rothschilds are buying gold through their investment house RIT Capital Partners and Lord Jacob Rothchild is warning about the results of “the greatest experiment in monetary policy in the history of the world”. British investment banker Lord Jacob Rothschild is buying gold. |

| Rothchilds Buying Gold On “Greatest Experiment” With Money In “History of the World” Posted: 19 Aug 2016 05:02 AM PDT gold.ie |

| Deutsche Bank whistleblower turning down a multimillion-dollar award Posted: 19 Aug 2016 04:16 AM PDT Deutsche whistleblower, Bolt | FirstFT The FT's Vanessa Kortekaas highlights the top stories on Friday, including a Deutsche Bank whistleblower turning down a multimillion-dollar award, plans for a post-Brexit deal and Usain Bolt eyeing the 'treble treble' at the Rio Olympics. The... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Moody’s calls bottom on commodity price collapse – but the pain isn’t over Posted: 19 Aug 2016 04:06 AM PDT This posting includes an audio/video/photo media file: Download Now |

| Breaking News And Best Of The Web Posted: 18 Aug 2016 05:37 PM PDT More bad numbers from Japan. More scary predictions from Carl Icahn. Fed officials split on Sept rate hike. Corporations buy back fewer shares, insiders sell more. Money pours into emerging markets. Silver miners gain fans. Trump hires new people, keeps falling in polls. Best Of The Web Negative interest rates – S&P Global World […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| “Saving Social Security” May End in Dollar Devaluation Posted: 18 Aug 2016 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The creation of a state gold depository in Texas represents a power shift away from the federal government to the state, and it provides a blueprint that could ultimately end the Fed. The depository inched closer to reality last month when Texas officials formally called for businesses to submit their plans for building the facility.

The creation of a state gold depository in Texas represents a power shift away from the federal government to the state, and it provides a blueprint that could ultimately end the Fed. The depository inched closer to reality last month when Texas officials formally called for businesses to submit their plans for building the facility.

No comments:

Post a Comment