Gold World News Flash |

- Gold & Silver Buying Most Popular in 3 Years

- A Curious Pattern of Comex “Deliveries”

- You Can’t Eat Gold!

- The Looming Financial Crisis Nobody Is Talking About, But Should Be

- Gold Prices Score 3-Week High on Monday; Silver Eyes 2-Year High

- Joel Skousen -- Is The West Planning War With Russia?

- If Voting Made Any Difference, They Wouldn't Let Us Do It

- Will The Reserve Bank Of Australia Cut By 25bps: What Wall Street Thinks And How To Trade It

- The Battle For $20.46 SILVER & Death of the Cartel — ANDY HOFFMAN

- China Moves Forward With SDR Issuance In August

- Price of Gold Closed at $1351.40 up $2.40 or 0.18%

- Gold Daily and Silver Weekly Charts - Deliveries on Paper

- Last chance to save America from long-term fiscal chaos?

- TF Metals Report: A curious pattern of Comex 'deliveries'

- Gold Is an Obvious Trade in This Freaking Fantasyland

- Exclusive Interview With Jim Rogers – Part I

- 3 Ways to Play a Resurgent Bull Market

- 4 Stages of Fiat Monetary Madness

- Gold Monster First Delivery Day For August

- Gold Bull Market or just a Bear Market Rally?

- Gold and Silver Bull Phase 1 : Final Impulse Dead Ahead

- Gold And Silver – Merkel: Example Of How Clinton Is A Globalist Puppet

- Gold Equity Correction Overdue

| Gold & Silver Buying Most Popular in 3 Years Posted: 02 Aug 2016 01:24 AM PDT Bullion Vault | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Curious Pattern of Comex “Deliveries” Posted: 02 Aug 2016 12:00 AM PDT from TF Metals Report:

Even though gold “deliveries” on the Comex are nothing but a charade and shuffle of paper warehouse receipts and warrants, the latest trend is a real eye-opener and appears to be a rather interesting datapoint of extreme demand for gold in all its forms. First of all, some background so that we’re all on the same page… Through the year, the Comex trades futures contracts for every month on the calendar. However, not all months are treated equally. Six of the months are treated as “delivery months” and these are the contracts which carry the majority of the short-term trading interest and volume. These months are February, April, June, August, October and December, The other six months are considered “non-delivery” and are very rarely traded or utilized as physical settlement contracts. These months are January, March, May, July, September and November. A quick look at the current “gold board” reveals that, with the Aug16 contract now in its “delivery” phase, the active front month has become the Dec16. See below: And, as you can see on the next chart, fully 3/4 of the entire Comex gold open interest can now be found in this front month, Dec16 contract: OK? So, when a front month comes “off the board” as the Aug16 did last Thursday, it moves into its “delivery phase”. This is when the entire charade and fraud of “Comex delivery” kicks in, usually characterized by a simple shuffling of paper warehouse receipts back and forth between the various Banks which operate the vaults. We’ve written about this on countless occasions over the past six years so we’re not going to cover all of this again. Suffice it to say that there is very little, actual metal that is ever physically delivered on Comex. The entire process is simply in place to create the illusion of physical delivery in order to give The Bullion Bank Paper Derivative Pricing Scheme some element of legitimacy. That said, what is currently happening on Comex is a shocking trend that requires your attention and consideration. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Aug 2016 11:01 PM PDT I read that I can't eat gold as I munched on my 401(k) sandwich and guzzled my IRA wine, which tastes like a cheap Chardonnay. For a side dish I ate blanched twenty dollar bills and consumed a... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Looming Financial Crisis Nobody Is Talking About, But Should Be Posted: 01 Aug 2016 11:00 PM PDT Submitted by Shaun Bradley via TheAntiMedia.org, The world has been captivated by a continuous stream of disturbing and shocking headlines. Seemingly every other day, different terrorist attacks, police assassinations or political stunts ignite the public into an emotional frenzy. But as fear shuts down critical thinking, banks that control Europe’s financial system are entering a death spiral. Despite what establishment media narratives push, the most dangerous threat to our way of life isn’t a religious ideology or political divide. The real risk is a contagion that is undermining the core of the financial system, and the interconnectedness of the globalized economy we live in makes containing the problem nearly impossible. Concerns that used to be isolated to the failing state of Greece have now engulfed the rest of the PIIGS nations. If these dominos continue to fall in Europe, the momentum could carry the destruction to every corner of the globe. Italian banks are the latest on the chopping block in the wake of Brexit. For years, they have been acknowledged as a weak link in the economic chain, but they now face stress tests that could expose the scope of their internal problems. The oldest bank in the world, Monte Dei Paschi, is at the center of the controversy, with an expected shortfall of over 3 billion euros. Other big names, like UniCredit, are in equally bad shape. Wells Fargo recently found that nearly 15% of all loans held by Italian banks could be at risk of default, a staggering figure to attempt to unwind. Further, England’s departure from the E.U. has sparked questions over the future of the euro — and Italy could be the catalyst for an all out breakdown of confidence. If panic begins to grip the Italian people, things could escalate quickly, potentially triggering bank runs. Mihir Kapadia of Sun Global Investments explained the current situation in a recent article:

The head of the European Central Bank, Mario Draghi, wasted no time reassuring the markets and downplaying the significance of the hurdles ahead. Draghi is a former governor to the Bank of Italy, and he recently came out in full support of a ‘public backstop’ for the toxic loans. The public backstop suggested is the political term for shafting the taxpayer. Governments and banks alike have no problem shifting the responsibility of the debt onto the citizens, all while chastising them about how excessive their entitlement programs are and framing the greed of everyday people as the root of the issue. For the elites, it is much easier to use austerity measures, inflation, and shaming of the public to deflect blame from themselves than it is to take ownership for their own corrupt actions. New regulations passed by the E.U. prevent bailout-style action similar to what the U.S. implemented during the 2008 crisis, meaning the only other option on the table is to use customer accounts to re-capitalize, otherwise known as a bail-ins. We saw a test run of this a few years ago in Cyprus, which led to the confiscation of all personal funds exceeding 100,000 euros. In this trial, the seizures only affected the very wealthy, so there was little major outrage; most accounts over the threshold were also held by foreigners, particularly from Russia. But in such a future scenario, private savings accounts, retirement funds, and IRAs of average citizens could be stolen by the banks — without compensation — to cover their bad investments. Although it would be devastating for Italy to have to implement these tactics to save their failing institutions, the real fireworks would be the effects such a move could have on other key banks and foreign nations. As time passes, red flags continue to emerge that point to a terminal diagnosis for the system as a whole. Deutsche bank is by far the most crucial in the E.U., as it supports the union’s powerhouse economy of Germany. In the last year alone, however, their stock price has plummeted more than 60%, bringing the total decline to 90% since its peak in 2007. The bank also just announced its plan to close over 188 branches and cut 3,000 jobs in the coming months. The rebound in the American financial sector over the last seven years never manifested in Europe; instead, the value of their banks continued to grind lower, perpetuated by political ineptitude and central bank manipulation. Germany is the last strong economy left to prop up the crumbling trade bloc in Europe, and without its stability, this grand experiment is doomed to fall apart at the seams. If those signs aren’t bad enough, Deutsche has also become the poster child for the ominous derivatives bubble. It, alone, has amassed an exposure of over $75 trillion dollars in these risky devices, which is almost equal to theannual GDP of the world. This problem is by no means isolated to the European markets; the U.S. banks also drank the kool-aid, and believe it or not, helped create a quadrillion dollar mess. The empty promises made by financial managers are only as good as the public’s confidence in them. Before the subprime mortgage crisis, it seemed like there wasn’t a care in the world — until everyone got spooked and headed for the exits at once. If a similar stampede occurred today, the implications would be far worse. The amount of money needed to pay out on the outstanding derivative contracts doesn’t even exist, and the CIA’s factbook states that broad money, including all paper currency, coins, checking, savings, and money market accounts, equals just over 80 trillion dollars — a mere fraction of the what it would take to cover the exposure of the banks. Warren Buffet famously referred to these instruments as “financial weapons of mass destruction.” He reiterated his perspective in a more recent interview:

The derivative market is one of the most obscure in all of finance. Instead of buying a share of a company, or a commodity like oil or corn at a future price, a derivative has no value on its own. Its entire worth is derived from the performance of other parts of the market. It is essentially a side bet on the price movements of real assets. If the major banks, like Deutsche, were to go under, all of those derivatives would be wiped out and could light the fuse on this economic time bomb. Even George Soros has commented on the ongoing crisis in the E.U., saying:

The Italian banking crisis and the ballooning derivative market may seem like a trivial issue that is out of sight and out of mind, but the black hole it could open up would destroy our way of life. Thinking about these possibilities can be terrifying, but there are steps that can be taken to ensure individuals at least have an insurance plan in place. Becoming educated on the financial system we’re living in is paramount to having the foresight needed to take action. Developing technologies like Bitcoin and other cryptocurrencies have created an entirely new monetary system that isn’t subject to the corruption of the broken centralized model. These peer-to-peer networks can secure wealth while allowing unprecedented mobility and anonymity. Other forms of stable money, like gold or silver, also play a key role in financial independence. There are few assets with zero counter-party risks, and precious metals allow each individual to become their own central bank. Being self-reliant is also a powerful tool; not being dependent on someone else in a worst-case scenario is crucial to thinking clearly when financial panic breaks out. There is no antidote for the potential chaos bearing down on us, but building strong relationships, obtaining basic skills, and stockpiling the necessities of daily lifecan provide peace of mind and preparedness. A chain of events has been set in motion that will expose the massive fraud world banks and governments have perpetuated on their citizens. When fear porn is being promoted on the major networks, keep in mind the real threats to freedom and security will not be openly announced. The focus on the lone nutjob that kills 20 or the spread of deadly pandemics, for example, is nothing but propaganda aimed at shifting attention to things that are uncontrollable. Ensuring the masses feel helpless and in need of the government’s protection is priority number one for the ruling class. Talking heads and hedge fund managers will be eternally optimistic on the outlook for the future, even as the collapse becomes undeniably obvious. Problems for the European Union will continue to build, and the risk of the disease spreading to other economies increases by the day. Unfortunately, this Ponzi scheme system we built our societies on has left us vulnerable to any well-timed black swan event. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Prices Score 3-Week High on Monday; Silver Eyes 2-Year High Posted: 01 Aug 2016 10:30 PM PDT from KitcoNews: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Joel Skousen -- Is The West Planning War With Russia? Posted: 01 Aug 2016 08:43 PM PDT Why does the West seem hellbent on going to war with Russia, even if it means complete annihilation? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| If Voting Made Any Difference, They Wouldn't Let Us Do It Posted: 01 Aug 2016 07:40 PM PDT Submitted by John Whitehead via The Rutherford Institute,

No, America, you don’t have to vote. In fact, vote or don’t vote, the police state will continue to trample us underfoot. Devil or deliverer, the candidate who wins the White House has already made a Faustian bargain to keep the police state in power. It’s no longer a question of which party will usher in totalitarianism but when the final hammer will fall. Sure we’re being given choices, but the differences between the candidates are purely cosmetic ones, lacking any real nutritional value for the nation. We’re being served a poisoned feast whose aftereffects will leave us in turmoil for years to come. We’ve been here before. Remember Barack Obama, the young candidate who campaigned on a message of hope, change and transparency, and promised an end to war and surveillance? Look how well that turned out. Under Obama, government whistleblowers are routinely prosecuted, U.S. arms sales have skyrocketed, police militarization has accelerated, and surveillance has become widespread. The U.S. government is literally arming the world, while bombing the heck out of the planet. And while they’re at it, the government is bringing the wars abroad home, transforming American communities into shell-shocked battlefields where the Constitution provides little in the way of protection. Yes, we’re worse off now than we were eight years ago. We’re being subjected to more government surveillance, more police abuse, more SWAT team raids, more roadside strip searches, more censorship, more prison time, more egregious laws, more endless wars, more invasive technology, more militarization, more injustice, more corruption, more cronyism, more graft, more lies, and more of everything that has turned the American dream into the American nightmare. What we’re not getting more of: elected officials who actually represent us. The American people are being guilted, bullied, pressured, cajoled, intimidated, terrorized and browbeaten into voting. We’re constantly told to vote because it’s your so-called civic duty, because you have no right to complain about the government unless you vote, because every vote counts, because we must present a unified front, because the future of the nation depends on it, because God compels us to do so, because by not voting you are in fact voting, because the “other” candidate must be defeated at all costs, or because the future of the Supreme Court rests in the balance. Nothing in the Constitution requires that you vote. You are under no moral obligation to vote for the lesser of two evils. Indeed, voting for a lesser evil is still voting for evil. Whether or not you cast your vote in this year’s presidential election, you have every right to kvetch, complain and criticize the government when it falls short of your expectations. After all, you are overtaxed so the government can continue to operate corruptly. If you want to boo, boycott, picket, protest and altogether reject a corrupt political system that has failed you abysmally, more power to you. I’ll take an irate, engaged, informed, outraged American any day over an apathetic, constitutionally illiterate citizenry that is content to be diverted, distracted and directed. Whether you vote or don’t vote doesn’t really matter. What matters is what else you’re doing to push back against government incompetence, abuse, corruption, graft, fraud and cronyism. Don’t be fooled into thinking that the only road to reform is through the ballot box. After all, there is more to citizenship than the act of casting a ballot for someone who, once elected, will march in lockstep with the dictates of the powers-that-be. Yet as long as Americans are content to let politicians, war hawks and Corporate America run the country, the police state will prevail, no matter which candidate wins on Election Day. In other words, it doesn’t matter who sits in the White House, who controls the two houses of Congress, or who gets appointed to the Supreme Court: only those who are prepared to cozy up to the powers-that-be will have any real impact. As Pulitzer Prize-winning journalist Chris Hedges points out:

In other words, voting is not the answer. As I document in my book Battlefield America: The War on the American People, the nation is firmly under the control of a monied oligarchy guarded by a standing army (a.k.a., militarized police. It is an invisible dictatorship, of sorts, one that is unaffected by the vagaries of party politics and which cannot be overthrown by way of the ballot box. “Total continuity” is how Hedges refers to the manner in which the government’s agenda remains unchanged no matter who occupies the Executive Branch. “Continuity of government” (COG) is the phrase policy wonks use to refer to the unelected individuals who have been appointed to run the government in the event of a “catastrophe.” You can also refer to it as a shadow government, or the Deep State, which is comprised of unelected government bureaucrats, corporations, contractors, paper-pushers, and button-pushers who actually call the shots behind the scenes. Whatever term you use, the upshot remains the same: on the national level, we’re up against an immoveable, intractable, entrenched force that is greater than any one politician or party, whose tentacles reach deep into every sector imaginable, from Wall Street, the military and the courts to the technology giants, entertainment, healthcare and the media. This is no Goliath to be felled by a simple stone. This is a Leviathan disguised as a political savior. So how do we prevail against the tyrant who says all the right things and does none of them? How do we overcome the despot whose promises fade with the spotlights? How do we conquer the dictator whose benevolence is all for show? We get organized. We get educated. We get active. If you feel led to vote, fine, but if all you do is vote, “we the people” are going to lose. If you abstain from voting and still do nothing, “we the people” are going to lose. If you give your proxy to some third-party individual or group to fix what’s wrong with the country and that’s all you do, then “we the people” are going to lose. If, however, you’re prepared to shake off the doldrums, wipe the sleep out of your eyes, turn off the television, tune out the talking heads, untether yourself from whatever piece of technology you’re affixed to, wean yourself off the teat of the nanny state, and start flexing those unused civic muscles, then there might be hope for us all. For starters, get back to basics. Get to know your neighbors, your community, and your local officials. This is the first line of defense when it comes to securing your base: fortifying your immediate lines. Second, understand your rights. Know how your local government is structured. Who serves on your city council and school boards? Who runs your local jail: has it been coopted by private contractors? What recourse does the community have to voice concerns about local problems or disagree with decisions by government officials? Third, know the people you’re entrusting with your local government. Are your police chiefs being promoted from within your community? Are your locally elected officials accessible and, equally important, are they open to what you have to say? Who runs your local media? Does your newspaper report on local events? Who are your judges? Are their judgments fair and impartial? How are prisoners being treated in your local jails? Finally, don’t get so trusting and comfortable that you stop doing the hard work of holding your government accountable. We’ve drifted a long way from the local government structures that provided the basis for freedom described by Alexis de Tocqueville in Democracy in America, but we are not so far gone that we can’t reclaim some of its vital components. As an article in The Federalist points out:

To put it another way, think nationally but act locally. There is still a lot Americans can do to topple the police state tyrants, but any revolution that has any hope of succeeding needs to be prepared to reform the system from the bottom up. And that will mean re-learning step by painful step what it actually means to be a government of the people, by the people and for the people. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will The Reserve Bank Of Australia Cut By 25bps: What Wall Street Thinks And How To Trade It Posted: 01 Aug 2016 07:14 PM PDT The ECB, Fed and mostly the BOJ, all did nothing during the recent round of central bank announcements, but hopes are high that the RBA will not disappoint tonight. The Australian central bank is expected by both the market and economists to cut the Daily Cash Rate by 25bps from 1.75% to 1.50% when it announces its decision at 2.30pm AEST. The OIS market assigns 66.7% probability for a 25bp rate cut to 1.5% by RBA tonight; up from 62.5% last week, and up from 16.8% at the beginning of July. Meanwhile economists see 25 bp cut tonight (20 of 25 forecasts), five see no change.

"Monetary policy is really the only swing instrument - the only game in town," said Andrew Ticehurst, an interest-rate strategist at Nomura Holdings Inc. in Sydney. "If we are in a world where fiscal policy is constrained because the government is a bit nervous about getting downgraded; if we are in a world where the Australian dollar is going to continue to trade north of fair value because of very low cash rates elsewhere and capital inflows; and if we are getting no policy assistance from those two levers, then monetary policy is all that's left." A good summary of what will be announced tonight comes from Bloomberg's Daniel Kruger who writes that the "RBA will cut, it has no better choice." As he puts it, the economic problems Australia's facing are familiar across the developed world: falling bond yields, unwanted currency strength, low inflation and the political reality of fiscal restraint.

Other views: According to RBC strategists led by George Davis, expect the RBA to cut rates 25bps after 2Q CPI confirmed inflation is undershooting target.

Alternatively, analysts at Commerzbank expect the RBA to hold

How to trade it:

* * * The RBA is scheduled to release its decision at 2.30pm AEST. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Battle For $20.46 SILVER & Death of the Cartel — ANDY HOFFMAN Posted: 01 Aug 2016 06:49 PM PDT by SGT, SGT Report.com: Andy Hoffman from Planet Ponzi joins me this Monday, August 1st to document the collapse of the current global economic order. Andy notes that there is an epic battle for $20.46 silver which marks silver’s 50 WEEK moving average. And it’s a battle that the cartel is about to lose as their RECORD silver short positions have not been enough to cap silver’s historic run this year. In fact silver is the second best asset of 2016 when priced in USD and the best asset for 2016 when priced in local currencies. “The cartel is going to be defeated and likely in the next six to twelve months,” Andy says. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Moves Forward With SDR Issuance In August Posted: 01 Aug 2016 06:48 PM PDT Submitted by Valentin Schmidt of The Epoch TImes

IMF Managing Director Christine Lagarde speaks at the 40th anniversary When Bloomberg reported late last year that China founded a working group to explore the use of the supranational Special Drawing Rights (SDR) currency, nobody took heed. Now in August of 2016, we are very close to the first SDR issuance of the private sector since the 1980s. Opinion pieces in the media and speculation by informed sources prepared us for the launch of an instrument most people don’t know about earlier in 2016. Then the International Monetary Fund (IMF) itself published a paper discussing the use of private sector SDRs in July and a Chinese central bank official confirmed an international development organization would soon issue SDR bonds in China, according to Chinese media Caixin. Caixin now confirmed which organization exactly will issue the bonds and when: The World Bank and the China Development Bank will issue private sector or “M” SDR in August. The so-called SDR are an IMF construct of actual currencies, right now the euro, yen, dollar, and pound. It made news last year when the Chinese renminbi was also admitted, although it won’t formally be part of the basket until October 1st of this year. How much? Nikkei Asian Review reports the volume will be between $300 and $800 million and some Japanese banks are interested in taking up a stake. According to Nikkei some other Chinese banks are also planning to issue SDR bonds. One of them could be the Industrial and Commercial Bank of China (ICBC) according to Chinese website Yicai.com. The IMF experimented with these M-SDRs in the 1970s and 1980s when banks had SDR 5-7 billion in deposits and companies had issued SDR 563 million in bonds. A paltry amount, but the concept worked in practice. The G20 finance ministers confirmed they will push this issue, despite private sector reluctance to use these instruments. In their communiqué released after their meeting in China on July 24: “We support examination of the broader use of the SDR, such as broader publication of accounts and statistics in the SDR and the potential issuance of SDR-denominated bonds, as a way to enhance resilience [of the financial system].” They are following the advice of governor of the People’s Bank of China (PBOC), Zhou Xiaochuan, although a bit late. Already in 2009 he called for nothing less than a new world reserve currency. “Special consideration should be given to giving the SDR a greater role. The SDR has the features and potential to act as a super-sovereign reserve currency,” wrote Zhou. Seven years later, it looks like he wasn’t joking. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Price of Gold Closed at $1351.40 up $2.40 or 0.18% Posted: 01 Aug 2016 06:06 PM PDT

Markets are still hanging fire, floating on waves of indecision. That won't last. Stocks keep eroding little by little. Dow Industrials average hit its 20 day moving average today, but managed to close above it at 18,404.51, down 27.73 (0.15%). S&P500 is some stronger, but it fell 2.76 (0.13%) to 2,170.84. 20 DMA doesn't lie far below at 2,152.30. MACD indicator for both has turned down. Expect gravity to control the direction of the next big move. US dollar index rose 25 chiseling basis points (0.27%) to 95.75. That don't change a thing. Dollar index is dancing over its 50 DMA (95.59). If it falls through 95.50, next stop is 93 - 92.50. Price of gold and silver advanced, but not decisively. Comes gold price rose $2.40 (0.2%) to $1,351.40. Silver price gained 15.3£ (0.8%) to 2046.5¢. Charts show that 4 days ago both metals broke out of consolidations (flags) upward. Today both trod water. Yes, yes, the advances pleased you, but crossed no milestones. Silver price needs to break above 2100¢ and gold price above $1,377.50 to validate and extend gains already made. Commitments of Traders show very heavy speculator participation. That is hot money, & hot money can get cold feet quickly. But with negative interest rates metastasizing around the globe, and now central banks threatening to throw out Helicopter Money to all & sundry, what will benefit more than silver & gold? Not bonds or stocks. Gold/Silver ratio in July rallied to mid-month, but never could work up grit nor gumption to climb over the 20 DMA. Now the ratio has turned down again. This is a good sign for silver & gold. Don't let the apparent calm fool you. Powerful forces are building behind that mask. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Deliveries on Paper Posted: 01 Aug 2016 01:32 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Last chance to save America from long-term fiscal chaos? Posted: 01 Aug 2016 12:45 PM PDT Web Exclusive: My liberty-loving panel—Katherine Mangu-Ward of Reason, Dan Mitchell of Cato, and FNC contributor Deneen Borelli—shares its hopes for the year ahead. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: A curious pattern of Comex 'deliveries' Posted: 01 Aug 2016 10:01 AM PDT 1p ET Monday, August 1, 2016 Dear Friend of GATA and Gold: The TF Metals Report Turd Ferguson writes today that delivery data for the gold futures contracts on the New York commodities Exchange shows a dramatic increase in purported offtake in recent months, "another datapoint that signals extreme, global demand for gold in all its current forms." Ferguson's analysis is headlined "A Curious Pattern of Comex 'Deliveries'" and it's posted at the TF Metals Report here: http://www.tfmetalsreport.com/blog/7770/curious-pattern-comex-deliveries CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Is an Obvious Trade in This Freaking Fantasyland Posted: 01 Aug 2016 09:48 AM PDT JARED DILLIAN writes: I’m watching the Trump phenomenon with some mix of horror and amusement, like I suspect most people are. I will say up front that I am no fan of Trump. I sincerely wish Gary Johnson would become president, having been a Libertarian long before it was fashionable (and when the candidates were a lot less viable). | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exclusive Interview With Jim Rogers – Part I Posted: 01 Aug 2016 08:24 AM PDT This post Exclusive Interview With Jim Rogers – Part I appeared first on Daily Reckoning. Talk to the average Joe on the street and he'll tell you the world is coming undone… And he's right. There's widespread social unrest… rampant institutional corruption… record numbers of unemployed… pandemic violence and terrorism… and historic levels of global debt that can never be repaid. If stock markets were not at nominal all-time highs, everyone would believe that events are spiraling out of control. Yet even with stocks at highs, people know there's something terribly wrong… and they can't seem to put their finger on why it's happening and what it all means. So I traveled to Singapore recently for an important conversation with someone who can: legendary investor and author Jim Rogers. The Great Global UnravelingRogers is one of the world's most successful investors… After studying at Yale and Oxford, he cut his teeth on Wall Street before starting the Quantum Fund with George Soros in 1973. Quantum became one of the best-performing hedge funds in history. From 1970 to 1980, the fund gained 4,200%, while the S&P advanced about 47%. That's enough to turn a small retirement account of $30,000 into almost $1.3 million… in just one decade. Needless to say, the fund also made Rogers rich… rich enough to retire in 1980. Since then, he's traveled the world and written a host of bestselling books, while also becoming one of the world's most sought after experts on the global economy, markets and Asia. Rogers has seen it all. And his perspective on history and global finance is unmatched. That's why I ventured to see him to get his take on the great global unraveling taking place right before our eyes… Look, the system is broken. The masses are starting to revolt. And the Bubble Finance era pursued for decades by inept central bankers has maxed out. In short, the end game is now plausible. And the current global chaos we're seeing could just be the beginning. How bad can things get? Rogers believes it will be unlike anything we've seen in our lifetime… He shared his thoughts during a 30-minute exclusive interview. We've broken down this conversation into a three-part series. We're publishing them this week in Covel Uncensored. (Click on the screenshot above to see the full video.) Please send me your comments to coveluncensored@agorafinancial.com. Regards, Michael Covel The post Exclusive Interview With Jim Rogers – Part I appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

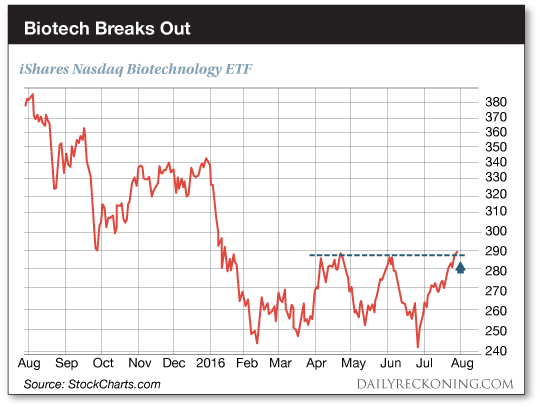

| 3 Ways to Play a Resurgent Bull Market Posted: 01 Aug 2016 06:42 AM PDT This post 3 Ways to Play a Resurgent Bull Market appeared first on Daily Reckoning. Stocks are roaring back to life. We haven't witnessed a trading environment this constructive in more than a year. The major averages are consolidating near their highs. Breakouts are holding. Beaten-down sectors are catching a bid. After months of tough trading, the market's handing us the perfect opportunity to ring the cash register. You can throw darts at stocks during a roaring bull market and you probably won't lose money. But if you want to book repeatable short-term gains, you have to know what stocks to go after when the tide turns in your favor. Every trader worth his salt knows what stocks to avoid when the market's vulnerable. When the major averages were tanking last summer, it was the most speculative names that were hit the hardest. Unless you wanted to end up in the poor house, you were forced to cut these stocks loose while the market threw its temper tantrum. How quickly things change… Today, you're going to learn about three ways to cash in on the market's resurgent speculative plays. These trades are your best opportunity to book double-digit gains as the major averages power to new highs. 1. "Story stocks" When it comes to the stock market, there's never a shortage of compelling stories. We have the speculative biotechs with new and exciting drugs nearing potential approval. Then there are the innovative technology firms that are cranking out futuristic developments we couldn't have dreamed of just a decade ago… Investors toss these story stocks out the window during a bear market. These higher-risk investments take the most punishment as folks run for the exit. When the going gets tough, investors flee to safety by scooping up utility stocks and consumer staples plays. Now it's time for the speculative story stocks to shine once again. Just look at the biotech sector:

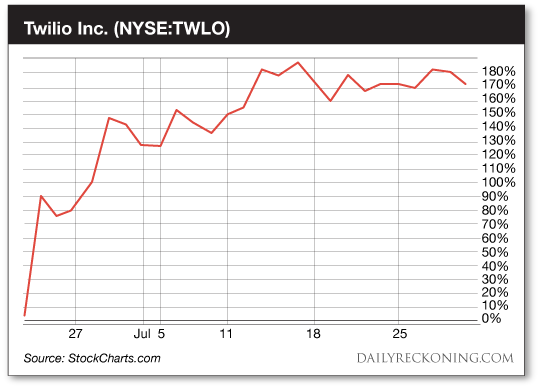

After a disastrous start to the year, biotechs are finally busting loose—and these story stocks aren't even close to attacking their highs. If you're searching for a trade with plenty of room to run, look no further… 2. Recent IPOs If you were tempted by a red-hot initial public offering last year as the market corrected, you probably got burned. Most IPOs are just cash grabs for up-and-coming companies and underwriters—especially in trendy sectors and industries. And when the market starts to crack, investors tend to dump these speculative stocks first. They can fall fast— and hard. Earlier this year, the number of IPOs coming on the market slowed to a trickle. With practically no new stocks to choose from, the few IPOs that are making it to the market are attracting ton of attention. Check out Twilio Inc. (NYSE:TWLO):

This software company debuted on the NYSE just days before the Brexit meltdown. In just a few short weeks, shares have jumped more that 170%. 3. Small stocks We alerted you last week to the fact that small-caps are sneaking back to the front of the pack. The Russell 2000 small-cap index trounced the major averages in July, gaining nearly 6% compared to a gain of about 3.5% for the S&P 500. The Russell 2000 still has to post nearly an 8% rally before it can top its June 2015 highs. In fact, the index just cleared its early December highs a couple of weeks ago. This move should help slingshot small-caps higher while the major averages start to blow off some steam. The bull is back. Stick to our three surging plays and the gains will flow… Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post 3 Ways to Play a Resurgent Bull Market appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 Stages of Fiat Monetary Madness Posted: 01 Aug 2016 05:28 AM PDT There are four stages of fiat money printing that have been used by central banks throughout their horrific history of usurping the market-based value of money and borrowing costs. It is a destructive path that began with going off the gold standard and historically ends in hyperinflation and economic chaos. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Monster First Delivery Day For August Posted: 31 Jul 2016 05:05 AM PDT Nova Scotia offered up 406,700 ounces of gold from their house account for the first delivery day in August. That is the biggest number I have seen in some time. And they sold it at what was close to the low for yesterday at $1,332. That's what one gets when they sell big in an active month which August is for gold. What were they thinking? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bull Market or just a Bear Market Rally? Posted: 31 Jul 2016 03:59 AM PDT While many are touting a new bull market in Gold, and Silver for that matter, history suggests otherwise. When we look back at the history of commodity prices for the past two centuries we observe generally short bull markets followed by longer bear markets. Since Gold was fixed for most of this period a chart going that far back would be of little use. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver Bull Phase 1 : Final Impulse Dead Ahead Posted: 30 Jul 2016 06:51 AM PDT Everything is now aligned for the final upward impulse to complete Phase I of the great bull market in the PM stocks. All the technical work is now done. The backing and filling complete. The final fuel stop taken to fill up on short sellers who will provide the fuel for the final surge powered by short covering. The psychology is properly set with several prominent newsletter writers having kept there subscriber base out and on the sidelines of the market. So let’s take a look at the weekly and daily gold price and see how it has been methodically taking all the healthy steps required to set-up for this rally’s completion. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold And Silver – Merkel: Example Of How Clinton Is A Globalist Puppet Posted: 30 Jul 2016 06:40 AM PDT Americans have faced mass murder tragedies over the last few decades, all home- grown killers: Columbine high school shootings, the Sandy Hook elementary school shooting, [a false flag?], the recent Orlando shooting, to name a few amongst so many others. The taking of innocent lives in such a senseless manner is a heartfelt reaction experienced by the entire nation. It is with empathy that we identify with the terrorist events that occurred in Germany, equally senseless but attributable to a common external trigger: Islamic terrorists. We use the term Islamic to describe the terrorists with no concern to be “politically correct.” The source of the murderers is beyond question. We also feel for the French and what that nation has been suffering as a consequence of allowing foreign Middle East immigrants to freely enter the country. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Equity Correction Overdue Posted: 30 Jul 2016 01:00 AM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment