Gold World News Flash |

- 45th Anniversary Of Nixon Ending The Gold Standard

- Another FOMC Blitz

- GoldMoney — Gold Always Wins

- Why You Should Ignore Federal Reserve Policy Statements in Your Wealth Preservation Strategy

- Michael Oliver Updates T-Bonds & Gold Markets

- How The Globalists Will Attempt To Control Populations Post-Collapse

- Brazil Escalates: Authorities Pull 2 US Olympic Swimmers From Rio Flight

- The Bankers’ silly lies-and-games with gold prices

- Carl Icahn Turns Apocalyptic: “I Am More Hedged Than Ever, A Day Of Reckoning Is Coming”

- Help Koos Jansen pry Fort Knox audit info from Treasury Department

- 'Chaotic fall' in dollar is likely, Embry tells King World News

- Did Canada Sell Its Gold to Prepare for the North American Union?

- Gold Price Closed at $1342.70 Down $7.80 or -0.58%

- Jim Willie WARNING AUGUST 2016 The Global Money War & The Ecomonic Meltdown

- Michael Savage Donald Trump Interview - August 17, 2016

- Uranium Market Bottoming Five Years After Fukushima as World Heats Up From Carbon Emissions

- Koos Jansen: GFMS keeps wildly underestimating Chinese gold demand

- There are One Billion Like Planet Earth just in our Galaxy -- Michio Kaku

- It’s Time to Get Into This Hated Sector…

- 45th Anniversary Of Nixon Ending The Gold Standard

- Rep. Marino: The establishment is afraid of Trump

- Trump Prepares For Clash with Milwaukee Rioters

- Top Ten Videos — August 17

- Gold In UK Pounds Collapses 38% Versus Gold and 56% Versus Silver Year To Date

| 45th Anniversary Of Nixon Ending The Gold Standard Posted: 18 Aug 2016 01:30 AM PDT by Mark O'Byrne, GoldCore:

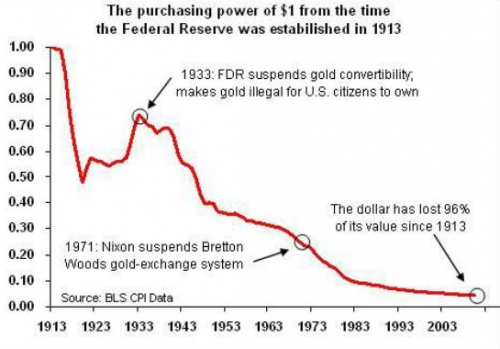

The dramatic announcement by 'Tricky Dicky' is a must watch and you can see it here: "Your dollar will be worth just as much tomorrow as it is today… " This was one of the most important events in modern financial, economic and monetary history and is a seminal moment in the creation of the global debt crisis which has confronted the U.S., Europe and the world in recent years and continues to this day.

Nixon ushered in an era of floating fiat currencies not backed by gold or silver but rather deriving value through government "fiat," diktat or order of the government. While Nixon justified the "technical" and "temporary" move as necessary to combat malign "international money speculators" who were "waging an all out war on the American dollar." The real reason for the move was that the U.S. , then as today, was living way beyond its means with the Vietnam war and rapidly escalating military spending leading to large budget deficits and inflation. Imperial overstretch had begun… | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 18 Aug 2016 12:30 AM PDT from TF Metals Report:

I don’t know about you, but ole Turd is sure getting sick and tired of these FOMC statements being some sort of be-all-end-all for the “markets”. And with gold UP nearly $300 or 30% since The Fed raised the Fed Funds rate back in December, maybe we should all be pulling for higher rates anyway? But, man, this crap is getting old. The FOMC rolls out a statement (the Fedlines) at the conclusion of each meeting and then releases the actual minutes of the meeting three weeks later. First of all, why the delay? I can understand not having the complete minutes available right at the conclusion of the meeting but we’re supposed to believe that The United States Federal Reserve actually needs three full weeks for some clerk to cobble together the minutes for public release? That’s freaking absurd! Or look at it this way…We’re supposed to believe that the BLS can come up with an uncannily accurate assessment of the amount of jobs added in any month within 2-3 days of the end of that month…BUT…The Fed needs three full weeks to spit out the minutes of its most recent meeting. GIVE ME A BREAK!

At this point, you should begin to realize what a scam this is. Do you recall the meeting of April 27 and the alleged minutes that were released on May 18. The Fedlines of April 27 were considered “dovish” and gold shot $65 higher over the next three days. However, by the time the minutes were released in May 18, a completely different picture emerged. The dovishness was gone, replaced by talk of “June rate hikes” and “live meetings”. In turn, gold was smashed $82 over the next nine days. Here’s the complete summary from ZeroHedge follwoing the release of the minutes on May 18: http://www.zerohedge.com/news/2016-05-18/fomc-minutes-show-cornered-fed-likely-hike-rates-june As ZH and many other wondered, how in the heck could the minutes vary so much from the stated Fedlines of just three weeks earlier? Well isn’t it clear what your answer is?? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 Aug 2016 11:00 PM PDT from Peter Schiff: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why You Should Ignore Federal Reserve Policy Statements in Your Wealth Preservation Strategy Posted: 17 Aug 2016 09:19 PM PDT Later today, at 2PM New York time, US Federal Reserve bankers will release minutes from their last meeting and traders may move some markets sharply in a knee-jerk reaction to what is contained in these minutes, but don't let any irrational responses to Federal Reserve bankers steer your focus away from reality. I've been discussing the absurdity of planning an investment and wealth preservation strategy around Federal Reserve banker policy statements for a long time now. Just check out my entry here from nearly a year ago, in which I discussed how Federal Reserve bankers absurdly rehashed the same statement for six straight years without ever stating anything new, and then in 2015, started placing interest rate hikes on the table again, but again, absurdly have since issued identical statements with slightly different language that virtually state nothing. Just visit their website and pull any of the archived statements from the past two years and you will encounter, in every statement, language that discusses "possible" interest rate hikes if sufficient progress has been demonstrated in the US economy towards their realized and expected objectives of "full employment and 2% inflation".

If the Fed Reserve bankers really desired (1) fundamental growth in the economy, (2) sustainable stock market growth instead of artificial bubbles comprised of grossly distorted stock prices, (3) inflation that was really 2% or lower, and (4) anything close to full employment (none of which exist by the way), they would have voluntarily dissolved themselves in 1913 and let free markets set interest rates instead of artificially manipulating interest rates for Machiavellian purposes ever since. In fact, I also posted commentary a year ago about how one can insulate oneself against falling victim to the lies of Central Bankers in their production of absurd "official" inflation and unemployment rates. In any event, in the absence of the liberating dissolution of Central Banks worldwide and allowing free market interest rates to exist, if Fed Reserve bankers were sincere about any of their proclaimed objectives of low inflation, full employment, sustainable economic growth, etc., they would have needed to start raising interest rates many moons ago. But they haven't.

In terms of silver and gold assets, we were consistent last year in stating that prices would continue to fall all year after a January spike to $1,308 an ounce gold and $18.50 an ounce silver, and because of our year-long negative outlook on gold and silver in 2015, we entered and quickly exited after short runs higher, and we were still able to return a positive, healthy 31.6% yield on our junior gold and silver mining stocks in our Platinum portfolio despite huge losses in the HUI gold bugs index of more than 50% from January 2015 to January 2016. In fact, you can follow this link to see how I warned back then, after the January gold and silver spike in 2015, that "even though gold [was] above $1211 an ounce now and silver ha[d] risen 1.96%...don't get too excited, because Western bankers [were] waiting nearby to hammer gold back below $1,200 again later [that] month." However, unlike last year, I have been likewise consistent in our belief that this year would produce a year-long rising gold and silver price trend, and instead of selling all gold and silver price spikes, as I advocated in 2015, I believe that all dips in PM asset prices should be bought this year, even those dips that may be created by absurd Central Banker policy statements.

For example, this past June, I explicitly stated that "much higher gold and silver prices [were] still ahead" and immediately after I wrote that article, in less than two weeks, gold surged 8.4% and and silver rocketed higher by 23.5%. Since then, both PMs have been consolidating in price, but whereas it was my belief in 2015 that all price spikes in gold and silver stocks should be sold, it is my belief that in 2016, all dips in gold and silver stocks should be bought. In fact, I reiterated this belief in this 26 July article I released after gold had fallen $67 an ounce in and silver had fallen $1.87 an ounce that month, by stating that the fall in gold and silver prices back then would "prove to be just a temporary lull in a strong continuing uptrend" that started at the end of last year, and discussed, how gold and silver stocks were still in a state of undervaluation last month. (In fact, you may visit that link to see that 18 of the stocks in our Platinum portfolio have surged by 100% to 400%+ by mid-year this year and also that we were able to duplicate similar returns in our Platinum junior mining stock portfolio in 2010. Despite this, we still feel that the largest gains in this asset class are ahead of us, after maintaining a negative outlook on the same asset class for all of 2015.)

In conclusion, even if the Federal Reserve bankers raise interest rates again at some point in the future, as the title of my article states, we have traveled well beyond the point of no return for a long time now regarding interest rate policy solutions, and any knee-jerk reactions of immediate falling gold and silver prices in response to more hollow "hawkish" Federal Reserve minutes or even too-little, too-late, actual small interest-rate increases should be completely disregarded, with all eyes kept firmly on the big picture of the inevitable continuing fiat currency purchasing power destruction. No matter if Central Bankers raise interest rates or not in the future, they have firmly set the course for further and inevitable fiat currency purchasing power destruction, and this should be the unwavering focus of one's wealth preservation strategy.

About SmartKnowledgeU: To learn when to buy the dips that develop during this continuing gold and silver price uptrend for all gold and silver assets, including gold and silver stocks, consider our Crisis Investment Opportunities newsletter and our Platinum Membership. Special 24-hour flash sale, today only. Visit smartknowledgeu.com for more details about discount Coupon Codes, valid today only, on our annual retail Crisis Investment Opportunities Membership, Limited Edition Platinum Membership, and full Platinum Membership. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Michael Oliver Updates T-Bonds & Gold Markets Posted: 17 Aug 2016 09:00 PM PDT from JayTaylorMedia: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| How The Globalists Will Attempt To Control Populations Post-Collapse Posted: 17 Aug 2016 08:05 PM PDT Submitted by Brandon Smith via Alt-Market.com, There is an interesting disconnect with some people when discussing the concept of global centralization. Naturally, the mind reels in horror at the very idea, because many of us know, deep down at our core, that centralization is the root of tyranny. We know that when absolute power is granted into the hands of an elite few over the lives of the masses, very bad things happen. No small group of people has ever shown itself trustworthy, rational, empathic or wise enough to handle such a responsibility. They ALWAYS screw it up, or, they deliberately take advantage of their extreme position of influence to force a particular ideology on everyone else. This leads to resistance, resistance leads to sociopolitical crackdown and then great numbers of people are imprisoned, enslaved or even murdered. This leads to even more resistance until one of two possible outcomes emerges — chaos and revolution or complete totalitarianism and micro-managed collectivism. There is no way around this eventual conflict. As long as the centralists continue to pursue total power, men and women will gather to fight them and the situation will escalate. The only conceivable way that this fight could be defused is if the elites stop doing what they do. If they suddenly become enlightened and realize the error of their ways, then perhaps we could escape the troubles unscathed. Or, if those same elites all happen to meet an abrupt end and their influence is neutralized, then the world might have a chance to adjust and adapt in a more organic fashion. Unfortunately, there are people who refuse to believe that a fight is unavoidable. They desperately want to believe there is another way, and they will engage in an amazing display of mental gymnastics in order to justify this belief. First, I think it is important to note that I have always argued that the globalists will eventually fail in their pursuit. I find that some folks out there misinterpret my position when I outline the strategies of globalists and they assume I am presenting global centralization as a “sine qua non.” I do not argue that the elites will win the fight, I only argue that there is no way to avoid the fight. Those that want to know my views on why globalist defeat is a certainty can read my article The Reasons Why The Globalists Are Destined To Lose. The rhetorical question always arises: “How could the globalists ever hope to secure dominance over the entire world; isn’t that an impossible task?” I believe according to my knowledge of history and human psychology that it IS an impossible task, but that is NOT going to stop the globalists from trying. This is what the cynics just don’t seem to grasp; we are dealing with a group of narcissistic psychopaths organized around a cult ideology and with nearly unlimited resources at their fingertips. These people think they are rising man-gods, like the Egyptian pharaohs of old. They cannot be persuaded through superior logic or emotional appeal. They will not be deterred by mass activism or peaceful redress. They only understand one thing — the force of arms and the usefulness of lies. Such people are notorious for taking entire civilizations down with them rather than ceding their thrones. It is foolish to plan a response to them on the assumption that a fight can be avoided. When I say that the globalists are “destined to lose,” this is predicated on my understanding that a certain percentage of human beings will always have an inherent capacity for resistance to tyranny. The globalists will be defeated because there is no way to quantify every single threat to their utopian framework. As long as people continue to fight them, physically and with information, regardless of the personal cost, their weaknesses will be found and they will fall. This will not be accomplished, however, without considerable sacrifice. When I talk about "collapse", I am talking about a process. Collapse is not an singular event, it is an ongoing series of events. The U.S. has, for example, been in the middle of a collapse since 2008. The end of this collapse will come when the final economic bubble propping up our system has burst and the process of rebuilding begins. The most important questions is, WHO will do the rebuilding? The globalists with their power agenda, or common people seeking freedom and prosperity? I have outlined in numerous articles the reality that an ongoing destabilization of large portions of the global economic framework will be used by the elites as leverage to convince the public that greater centralization is necessary, including global economic management through the IMF and BIS, a global currency using the IMF’s Special Drawing Rights as a bridge and global governance through the United Nations or a similar body not yet developed. This plan is becoming more and more openly discussed by globalists within the mainstream media. It’s hardly a secret anymore. Many people will undoubtedly support this centralization out of fear of instability. That said, many people will also refuse to support it. Here is how I believe, according to historical precedence and the globalist’s own writings, that they will attempt to assert global centralization post-collapse and enforce compliance. Resource Management And Distribution As I point out in many of my articles on the necessity for localism, without ample food, water and shelter self-maintained by groups of like minded citizens, no resistance can be mounted against a centralizing force. If you cannot supply your own logistics, then you must resort to stealing them from the enemy. Obviously, it is less risky to supply yourself if possible. Post-collapse, when rule of law in many places has broken down and resources can no longer be transferred safely from region to region, the name of the game will be control of necessities and the producers of necessities. This is also used by totalitarians when the danger of unrest is present. A prime example of this method in action was the Stalinist consolidation of the Soviet Union. The fact is, successful rebellions in occupied nations tend to grow in rural surroundings. Cities are often strongholds for totalitarians because they offer more means of surveillance, a more passive population and, once taken over, they are easier to secure and defend. I call this the “green zone doctrine;” the use of locked down cities as pivot points to launch attacks on rural people. Stalin used this very model, sending troops from controlled cities to plunder resources from outlying farming communities. He then stored these supplies for “redistribution;” the people deemed most useful to the regime were fed, the people deemed not useful or potential threats were not fed. In the end, Stalin killed off many potential rebels simply by denying them food production or food access. The elites do not need to own every inch of ground in order to launch an effective campaign of martial law. All they need to do is own key cities through surveillance technology and troop presence, then use these cities as staging grounds to confiscate resources in surrounding areas from people they do not like. If you think the government would not pursue that kind of tactic in the U.S., I highly suggest you look into Executive Order 13603, signed by Barack Obama in 2012. This order gives the president authority during a “national emergency” to take any private property or resources if it is deemed “necessary to national defense.” It should be noted that starvation as a weapon has been extremely useful for the elites in the past. The Malaysian Model Of Control If the elites are anything, they are rather predictable. This is because they have a habit of consistently using strategies that have worked for them before. In my article When The Elites Wage War On America, This Is How They Will Do It, I examine the writings of Council On Foreign Relations member Max Boot on methods for quelling insurgencies. In the U.S., insurgency is a given post-collapse. The only question is whether it will be a large insurgency or a small one. I do not hold out much hope for most of the rest of the world in terms of generating a useful rebellion. Most citizens in Europe and Asia are unarmed and untrained. Any resistance in these regions will be very small and cell structured if it is going to survive. The methods Max Boot describes tend toward larger threats to the establishment. Boot mentions specifically the great success by the British in Malaysia from 1948-1960 against highly effective communist guerillas and terrorists. This success can be attributed to several factors: 1) The British used large-scale concentration camps to separate production centers from rebel influence. These were massive camps surrounded by barbed wire fences and guard towers, primarily used to house farmers and other workers and their families. This stopped the guerillas from hiding among the working class and recruiting from them. This follows the “green zone doctrine” I described above. 2) The British implemented a sophisticated identification system for all Malaysian citizens including fingerprinting. They then set up numerous checkpoints across the country at which citizens had to produce their paperwork. Anyone who did not have their papers was held on suspicion of being an insurgent. The rebels in Malaysia attempted to counter this by forcefully taking over busy buildings and buses, then burning everyone’s IDs. This would not be a very effective tactic in a digitized world where identification is accomplished through advanced biometrics. 3) Instead of fielding massive lumbering military brigades in a useless effort to cover large stretches of ground, the British used spies and informants to locate rebel strongholds, then sent special forces units in to neutralize them. Again, they did not need to control every inch of ground; they used military assets wherever the rebels were, then left. Their goal was not to control a lot of ground, but to kill rebels. The British used considerable brutality in their efforts, including a mobile gallows that traveled the country, and the public display of rotting corpses to strike fear in the insurgency. 4) The political elites in Britain fought the psychological war by offering promises of peace and prosperity to the Malaysian commoners if they supported the effort against the insurgency. They did not necessarily need to follow through on these promises, all they needed to do was create a few examples of reward for cooperation, and sell this to the public in a convincing manner. Once enough of the population was in the hands of the British, the insurgency lost supply resources and also had to worry about informants. Technology Grid For Tyranny Malaysia was an example of a competent strategy to uproot insurgents, but there were also many failures and pitfalls. The elites are trying to mitigate any future unknown quantities when fighting against rebellions through the use of new technologies. The green zone doctrine could only be successful today with the use of biometric surveillance. Restriction of movement could be accomplished, but only in cities with extensive surveillance grids. The insurgents of a post-collapse future would be hard pressed to infiltrate or exfiltrate from a green zone with currently available facial recognition, gait and walk recognition, retina and thumbprint scanning, etc. Facial recognition has even gone into the realm of thermal imaging; cameras can use the unique heat signature from blood vessels within the human face to identify a person from a relative distance. Make-up and prosthetics would not counter this. Thermal masking would be the only solution. Beyond that, an insurgency would have to be technologically savvy. Cyber warfare would have to be integral to their methodology. This is not something any other rebellion in history has had to deal with. An Uneducated And Bumbling Insurgency The globalist’s strategy to trigger economic and social chaos, then lock down certain regions and offer centralization as a solution to the population, is far easier to accomplish when the opposition they face lacks insight, patience, planning and initiative. The British were partially successful in Malaysia because the guerillas were ignorant of public perception. While they were effective and ruthless fighters, their viciousness resulted in lack of public support. Though wide public support is not needed for victory, it certainly helps. Multiple revolutions against Stalin’s power, some of them very large, were put down because of poor planning. Rebels massed sizable forces in tight areas, such as a single mountain or mountain ranges. Stalin simply dropped poisonous gasses on insurgents that had put all their eggs in one basket and forgot to stockpile gas masks. It is vital to recognize that in a post-collapse world governments and elites may no longer be subject to public scrutiny, and are thus free to act as maliciously as they want. All contingencies have to be considered. Rebels in the Soviet Union also had a bad habit of ignoring logistics. Many were armed with mismatched rifles and a rainbow selection of ammunition instead of arming all their men with the same rifle and the same ammo for redundancy. Rebellions have been lost in the past merely because the fighters armed with too wide an array of weapons ran out of enough ammo to feed any of them. Insurgents have also historically suffered from an inability to strike the leadership centers of the empires they fought. Primarily because they did not know who the real leadership was. Only in our modern era do we have the information available to identify the elites and their organizations. Globalists are often very vocal today in media about who they are and what they want. This is why the elites seek to make the next insurgency the LAST insurgency. Never before have they been so vulnerable. I believe the globalists will use their standard strategy of disinformation and division first to acquire centralization, but eventually they will turn to a Stalin/Malaysian model for control on the ground. I will have to save the specific counter-strategies to these tactics for another article. Some of them I probably cannot legally discuss at all. The most important thing to remember, though, is that the globalists’ job is harder than our job. They have to control people, property, resources, and mass psychology. They have thousands of variables to take into account, and thousands of situations that could go wrong. All we have to worry about is our own local organization, our own moral compass, our own survival and removing the top globalists from the picture. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brazil Escalates: Authorities Pull 2 US Olympic Swimmers From Rio Flight Posted: 17 Aug 2016 07:27 PM PDT It appears Brazilian officials are not simply going to let this one go. With Ryan Lochte reportedly back in the US (and teammate James Feigen unaccounted for) following the Brazilain judge's search-and-seizure warrant, CNN reports that two fellow swimmers involved in the alleged robbery - Jack Conger and Gunnar Bentz - were removed by Brazilian authorities on Wednesday night from their flight before it departed Rio de Janeiro to the United States, according to US Olympic Committee spokesman Patrick Sandusky.

As a reminder, Lochte, a gold-medal winner, said his wallet was stolen as he and three of his American teammates — Bentz, Conger and James Feigen — were returning to Rio’s Olympic Village in a taxi. They said they were robbed by men posing as police officers, adding that the group initially didn’t contact the U.S. Olympic Committee because they were “afraid (they’d) get in trouble.” The story made quick waves Sunday, especially after Lochte, 32, detailed the alleged encounter on the “Today” show. Lochte’s account has come under increased scrutiny since then. Embarrassed Rio police said they have found little evidence to support the accounts, and a police source said they are unable to find the taxi driver or witnesses.

Lochte's lawyer Ostrow said Lochte gave police a statement as representatives from the U.S. State Department, United States Olympic Committee and the FBI observed. Lochte signed the statement to attest to its truthfulness, Ostrow said.

* * * Of course, if one were truly wearing their tin foil hat, one might wonder if this is somehow retribution for Washington's alleged hand in Rousseff's downfall... | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Bankers’ silly lies-and-games with gold prices Posted: 17 Aug 2016 07:20 PM PDT by Jeff Nielson, Bullion Bulls:

However, things have been getting especially ludicrous lately, and I’ve almost written a post like this many times over the past week — until finally the proverbial “straw” hit the Camel’s Back. Look at today’s evidence of crime:

However, neither the evidence or the crime will be fully apparent without also including today’s propaganda narrative: FED SPEAKS, Investors Listen Despite advice from experts to ignore Fed speak and to focus on economic data, markets have reacted to the latest FOMC minutes and investors have now upped their expectations for the next rate hike. Following the release of the latest minutes Wednesday, Gold sold off some $13… www.marketslant.com/articles/fed-speaks-investors-listen

We hear this propaganda over and over and over again. It’s just that most of the mainstream drones don’t write the Script in such a literal (and laughable) manner.The Fed-heads are the Masters of the Universe. When they walk, the ground itself trembles. Look again at the chart above. The Fed “spoke”, and the price of gold went down instantly, but momentarily (via the banksters’ Master Trading Algorithm). The One Bank manipulated the price of gold lower with its near-omnipotent trading algorithm to create the illusion that “investors” were “reacting” to these Masters of the Universe.

But then just as fast as the price went down (i.e. straight down), it went straight up — and it went up farther than it went down. Two points must be made here: 1) There was no time to write the propaganda above, in the millisecond between the price of gold falling $13/oz, and the price going up even farther. 2) The propaganda must have already been written before “the Fed spoke”.Absolute proof that the media drivel was a Script. Absolute proof that the original, momentary decline in price was manipulation. No market ever swings strongly in one direction one moment, and then swings strongly in the OPPOSITE DIRECTION the next moment. Human behavior can never vacillate so instantaneously. So what did happen? Why (and how) did the price of gold reverse so suddenly and dramatically, against the will of the One Bank??? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Carl Icahn Turns Apocalyptic: “I Am More Hedged Than Ever, A Day Of Reckoning Is Coming” Posted: 17 Aug 2016 06:49 PM PDT from ZeroHedge:

“I have hedges on, I’m more hedged than I ever was. [The market] is way overvalued at 20 times the S&P and I’ll tell you why: a lot of it is a result of zero interest rates. That’s going to be hurt. There’s going to be a day of reckoning here. I’ve seen it many times in my life. When things look good, they look great. You go into the sky. But that’s when you have to really pull down and really stop buying.”

We profiled Carl Icahn’s notorious bearishness most recently two weeks ago when we showed that for the second quarter in a row, the billionaire’s hedge fund, Icahn Enterprises had kept on its record short bias, manifesting in a net -149% market exposure.

Unlike other hedge fund managers, however, Icahn does not provide monthly letters explaining his mindset which is why we eagerly watched a expansive, 40 minute interview he gave to Bloomberg’s Erik Shatzker, in which in addition to a detailed discussion of Trump and how the Republican presidential candidate would change the US economy, he shared some much needed insights into his gloomy vision of the market. Below are some of the key excerpts from his discussion of the market: Shatzker: Why is it that the stock market is where it is? That with valuations so high that I noticed in the letter that — or at least in a statement that you made with your son, Bret, earlier this month, that you don’t feel confident making any large investments?

ICAHN: Aabsolutely, Erik. I have hedges on, I’m more hedged than I ever was. I will tell you there’s certainly good companies. [The market] is way overvalued at 20 times the S&P and I’ll tell you why: a lot of it is a result of zero interest rates. It’s just what I said. You have zero interest and a lot of buybacks. Money is not going into capital.

So think of it as a rich family that just decides “we’re just going to have a lot of fun, we’re going to sit around in the pool, and we’ll keep printing up IOUs to the town, we’ve got a good name.” You keep doing it until you go broke. And this is what’s happening in our economy. Zero interest rates are building huge bubbles. You have retirees that saved a million bucks, half a million bucks.

I think the market is at literally very high levels because of zero interest rates, and if you really look at it, the dollar is pretty strong right now, which is going to hurt international earnings. The S&P, they live on international earnings. That’s going to be hurt. There’s going to be a day of reckoning here. I’ve seen it many times in my life. When things look good, they look great. You go into the sky. But that’s when you have to really pull down and really stop buying. That being said, I’m not going to tell you it’s going to happen tomorrow, next week, even next month, even next year possibly. But it’s going to happen, and you have to change the direction of our economy. I can’t say it plainer than that. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Help Koos Jansen pry Fort Knox audit info from Treasury Department Posted: 17 Aug 2016 06:47 PM PDT 9:40p ET Wednesday, August 17, 2016 Dear Friend of GATA and Gold: Our friend gold researcher Koos Jansen needs to raise $3,145 to cover the costs being charged to him by the U.S. Treasury Department for copies of documents involving audits of the gold at Fort Knox. As of this hour a Go Fund Me page on the Internet is about $500 short of raising the money for him. Jansen's work has been of the greatest importance to the cause of transparency in the gold market, so please consider helping him by visiting the Go Fund Me page and making a contribution here: https://www.gofundme.com/2k82ef38?rcid=585dcdd664a911e6bab8bc764e065bc4 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 'Chaotic fall' in dollar is likely, Embry tells King World News Posted: 17 Aug 2016 06:21 PM PDT 9:20p ET Wednesday, August 17, 2016 Dear Friend of GATA and Gold: Economic data in the United States doesn't match the spin being offered by the political authorities, Sprott Asset Management's John Embry tells King World News today. "At any sign of emerging weakness," Embry says, "they trot out some Fed official to talk about an imminent rate increase and then aggressively manipulate the currency and precious metals markets to give credence to the statement." He expects "a chaotic fall" for the dollar, which he considers "over-owned." An excerpt from the interview is posted at KWN here: http://kingworldnews.com/john-embry-the-deep-state-is-desperate-right-no... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Did Canada Sell Its Gold to Prepare for the North American Union? Posted: 17 Aug 2016 06:20 PM PDT from The Daily Bell:

Loonie closes at highest level in more than a month; stock markets pull back … The Canadian dollar continued to ride higher with oil prices Tuesday, as both the currency and a barrel of crude climbed in value for a fourth straight day. The loonie added 0.38 of a cent to 77.80 cents U.S., closing at its highest level in more than a month amid a weakening U.S. dollar. It's never been clear why Canada sold ALL its gold, HERE, but perhaps it has to do with the potential, upcoming North American Union. Just the other day, we wrote that Hillary's plans are obviously to support the creation of the NAU. You can see the article HERE, entitled, "Hillary Plans Steps Toward North American Union If Elected." We've been writing about the resurgence of the NAU for years – and then more recently for months as regards this campaign. Gradually, the alternative media is becoming more aware of how high the stakes really are. Some of our articles are HERE, HERE, HERE and HERE. It is not too strong to say that the future of the United States as a sovereign entity may be decided by this election. The NAU is threnody – the deep dirge – harmonizing many of the arguments over "immigration." One big explosion came when George Bush suggested turning immigrants, legal or not, into eventual citizens, HERE. Bush, who further wrecked America in many ways, disingenuously claimed that his stance was motivated by his "compassionate conservatism." But it was not. Bush secretly advanced the legislative agenda of the NAU through a series of hush-hush meetings with his counterparts in Mexico and Canada. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1342.70 Down $7.80 or -0.58% Posted: 17 Aug 2016 04:33 PM PDT

Franklin Sanders Daily commentary is now only available via email. FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Willie WARNING AUGUST 2016 The Global Money War & The Ecomonic Meltdown Posted: 17 Aug 2016 03:09 PM PDT Jim Willie CB Proprietor, GoldenJackass.com Editor, Hat Trick Letter The man behind the name Jim Willie has experience in three important fields of statistical practice in the 23 years following completion of a PhD in Statistics at Carnegie Mellon University. He spent time since 2001 in a private... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Michael Savage Donald Trump Interview - August 17, 2016 Posted: 17 Aug 2016 02:03 PM PDT Aired on August 17, 2016 - Michael Savage Donald Trump FULL Interview on The Savage Nation The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Uranium Market Bottoming Five Years After Fukushima as World Heats Up From Carbon Emissions Posted: 17 Aug 2016 10:43 AM PDT Many investors are catching onto the gold and silver bug which less than a year ago was completely dormant. Investors who bought those stocks when they were ignored may be sitting on large gains already even in the early stages of a bull market doubles and triples. It may go even further. Unlike gold another yellow metal is ignored by the masses but smart investors are wise to the fact that uranium may be one of the best opportunities out there right now. Uranium is the antidote for global warming which may be one of the biggest immediate threats. Nuclear is the safest, most effective and efficient base load energy source. I’m not alone in this opinion. New York State Governor Cuomo is giving credits to nuclear plants to wean off of fossil fuels. Climate change is a global problem and this is increasing the realization that next generation nuclear is our best option. How do I sense this is beginning to be realized right here in the US? There are five new reactors under construction in Georgia, Tennessee and S. Carolina. Even billionaires such as Microsoft Bill Gates believe in next generation nuclear and the implementation of small modular reactors which are much more affordable then the costly huge forty year old nuclear reactors being used today. What about renewables? I am a big proponent of wind and solar energy but it doesn’t have the capabilities to make a considerable change in carbon emissions like nuclear without huge economic repercussions. Even radical environmentalists who once opposed nuclear are now turning more positive as they realize that just looking at wind and solar is not a viable option. Right now we may be in a bust for the US nuclear sector as there are many old reactors on the verge of being retired despite new reactors under construction. However, like the 1970′s we could have a technical breakthrough and update the old reactors with safer, smaller and more efficient next generation nuclear reactors. We should invest in this forgotten sector when it is dirt cheap and in the midst of a bust as the long term forecast for nuclear is very strong. Climate change and global warming concerns will not go away and I believe America will continue to build and update its nuclear fleet over the next 5-10 years. Investors may wise up to this soon that nuclear is not on its way out, but waiting for a new beginning. The next nuclear renaissance will be with next generation small modular reactors in the battle to fight climate change. One of my holdings and website sponsors Energy Fuels (UUUU or EFR.TO) is continuing to base but I believe it could be turning the corner as it makes a bullish golden crossover of the 50 and 200 day moving average. In my opinion its the best way to invest in a pure play US uranium producer.

"The drill results we are seeing in the wellfield for Header House 9 at Nichols Ranch are very positive, and the uranium grades and thicknesses are significantly exceeding expectations. Indeed, it is quite rare to encounter mineralization in U.S. ISR projects that have grades above 2.0% U3O8 and GT values above 10. Due to the size of the wellfield, expected number of wells, and the quality of mineralization we are encountering, we expect this to be the largest and most productive portion of the wellfield at Nichols Ranch to date. Overall, the Nichols Ranch deposit continues to deliver results that exceed our original expectations. We look forward to producing uranium from this new wellfield beginning later this year." Energy Fuels was an $80 stock back before the Fukushima uranium bust. Now its under $2.50, but if uranium turns it could see similar moves to what we are now seeing in the gold stocks if not possibly bigger as there are not many good uranium companies. All it takes is one black swan from Putin or one mine in the Athabasca to flood to change the interest in Energy Fuels. Technically, the stock appears to be possibly breaking out of a major bottom as the 50 day moving average has crossed above the 200 Day. I am hoping to see some follow through on this move and an eventual change in the long term trend. Energy Fuels tried to make this move back in 2013 but it was a fake out. Could this be the signal of the final bottom five years after Fukushima? Although I may have been early and faked out in the past this technical turnaround must be monitored as the gains could be humongous if uranium transitions from a bear to bull market. Watch to see the 200 Day to flatten out and move higher over the next few weeks. Watch my interview with Energy Fuels (UUUU or EFR.TO) VP of Marketing Curtis Moore by clicking here… https://www.youtube.com/watch?v=vAFMrGzNVfA Disclosure: I own securities in Energy Fuels and they are also a website sponsor. Owning securities and receiving compensation is a conflict of interest as I could personally benefit from a price/volume increase. Please do your own due diligence as this is not financial advice!See my full disclosure by clicking on the Featured Companies link above. Investing in stocks is risky and could result in losing money. Buyer Beware! Section 17(b) provides that:"It shall be unlawful for any person, by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication, which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof." I am biased towards my sponsors (Featured Companies) and get paid in either cash or securities for an advertising sponsorship. I own shares in all sponsored companies.You must do your own due diligence and realize that small cap stocks is an extremely high risk area. Please do your own due diligence! | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: GFMS keeps wildly underestimating Chinese gold demand Posted: 17 Aug 2016 10:27 AM PDT 1:25p ET Wednesday, August 17, 2016 Dear Friend of GATA and Gold: Metals consultancy GFMS and other establishment organs keep wildly underestimating Chinese gold demand and changing their rationalizations for doing so, gold researcher Koos Jansen charges today. Jansen calculates that Chinese demand in 2015 was at least 2,250 tonnes. His analysis is headlined "Spectacular Chinese Gold Demand in 2015 Fully Denied by GFMS and Mainstream Media" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/koos-jansen/spectacular-chinese-gold-d... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| There are One Billion Like Planet Earth just in our Galaxy -- Michio Kaku Posted: 17 Aug 2016 10:26 AM PDT Does Planet Earth have a twin? Theoretical physicist Dr. Michio Kaku on the possibility of other Earth-like planets in outer space. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| It’s Time to Get Into This Hated Sector… Posted: 17 Aug 2016 09:31 AM PDT This post It’s Time to Get Into This Hated Sector… appeared first on Daily Reckoning. Headlines like this drive me nuts… "Emerging markets bear will growl for years." That was written by a prominent Marketwatch columnist and retirement "expert" in late June 2015. In the article, the author tells you to sell any shares of dedicated emerging markets ETFs you own because it will take "years" for EM stocks to recover from their slump. It turns out it only took six months. Emerging markets stocks are up big this year. And if you followed that "expert" advice, you lost out on some serious gains. Yet another example of media noise getting in the way of investors making money in the markets. But today, I have a remedy for you… Emerging Markets Have Taken a BeatingEmerging markets have been beaten down the past five years. Since 2011, emerging market stocks have returned -11%. Here are some reasons why… China, the main driver of emerging market economic growth, has faltered. China has reported growth rates routinely above 8% and as high as 14% in 2007. But those rates have slowed in recent years. And its growth of only 6.8% in 2015 was its slowest rate in 25 years. China accounts for 30% of the economic activity of the emerging economies, so its slowdown has dragged the group down. This includes the emerging markets commodities producers that have supplied China's economy. There have been slowdowns in demand for things like Brazilian steel, Indonesian coal and Chilean copper. And then there's oil… China's declining demand plus the shale oil revolution in the U.S. have helped cause a big decline in energy prices. That's hurt countries like Brazil, Russia, Venezuela and Nigeria that rely heavily on oil and gas revenue. Then throw into the mix instability such as Russia's conflict with Ukraine, massive corruption and political turmoil in Brazil, and the complete collapse of Venezuela. The bottom line is there's been heavy downward pressures on emerging markets. But this year, EMs have shown signs of strength… Reversal of FortuneEmerging market stocks have been on a tear this year… The iShares MSCI Emerging Markets ETF (NYSE:EEM) is up 17% year-to-date. Here are some reasons why… Massive across-the-board interest-rate cuts and central bank bond buying in developed countries have forced investors into higher-yielding emerging markets. Why get negative yields when you can get 6% in emerging markets? The price of oil has also recovered. Oil was at $28 per barrel in January. Today, it's at $46 per barrel. And more recently, U.S. dollar weakness has boosted developing countries. A weaker dollar makes it easier for emerging market countries to service debt, which is mostly denominated in U.S. dollars. Plus, a depreciating dollar helps support prices for raw materials, of which many emerging market countries are large exporters. These factors have given a boost to emerging market stocks. And it appears there's more room for them to run… My trend following system shows that emerging markets are still in an uptrend. Remember, trends always go farther than we can imagine or know. The important thing is to remain focused on price action, not opinion or speculation. And always, protect your downside with stops. We always need chips to play the game! Please send me your comments to coveluncensored@agorafinancial.com. Let me know what you think about today's issue. Regards, Michael Covel The post It’s Time to Get Into This Hated Sector… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 45th Anniversary Of Nixon Ending The Gold Standard Posted: 17 Aug 2016 05:02 AM PDT gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rep. Marino: The establishment is afraid of Trump Posted: 17 Aug 2016 04:53 AM PDT Representative Tom Marino (R-PA) on the FBI handing over Clinton email probe materials to congress. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trump Prepares For Clash with Milwaukee Rioters Posted: 17 Aug 2016 02:45 AM PDT InfoWars reporter Joe Biggs on the scene at the Trump Rally just outside Milwaukee, Wisconsin where Black Lives Matter protesters plan a revenge campaign in defense of the latest thug gunned down by police. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 Aug 2016 05:15 PM PDT Mike Maloney, James Grant, Steve Keen and Bill Murphy on gold, inflation and the coming debt jubilee. Four Horsemen, the documentary. Clinton Cash, the movie. The post Top Ten Videos — August 17 appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold In UK Pounds Collapses 38% Versus Gold and 56% Versus Silver Year To Date Posted: 16 Aug 2016 05:03 AM PDT gold.ie |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

This week 45 years ago, August 15th 1971 to be exact, President Nixon suddenly declared the end of the Gold Standard. He ushered in the modern monetary system based on fiat paper and digital currency that works so poorly for us today and led to the global financial crisis.

This week 45 years ago, August 15th 1971 to be exact, President Nixon suddenly declared the end of the Gold Standard. He ushered in the modern monetary system based on fiat paper and digital currency that works so poorly for us today and led to the global financial crisis.

This is a subject which could be covered literally every single day, and with plenty of new material each day. Why don’t I do this? I don’t want to bore people out of their minds, since I have exposed a lot of similar nonsense over the years.

This is a subject which could be covered literally every single day, and with plenty of new material each day. Why don’t I do this? I don’t want to bore people out of their minds, since I have exposed a lot of similar nonsense over the years.

No comments:

Post a Comment