Gold World News Flash |

- USDU - An Important Perspective on the US Dollar

- Europe Has Two Options: Revolution Or Elections

- Does The Precious Metal Market Need Another Derivatives Exchange?

- America: You Will Go Insane Because Of What Your Eyes Will See

- SGT REPORT NEWS BRIEF & ‘SILVER: The Tide Has Turned’ w/ David Morgan

- Gold Closed at $1350.50 Up $10.20 or 0.76%

- Not a Conspiracy: FBI’s Comey Has Been Covering the Clintons’ A**es for Decades

- Hyperinflation is nigh so gold will go high

- Bank Of Japan Buying Sends Nikkei 225 To Richest Since Dot-Com Crash

- Global Economic Bellwether Cisco Reportedly Fires 20% Of Workforce

- This Week In 1971: President Nixon Closes the Gold Window

- Banks look for cheap way to store cash piles as rates go negative

- Rickards details the 'paper gold' fraud and speculates on its demise

- Doug Hagmann : Soros Too corrupt to Fail, Will bring Elites Down With Him

- Gold In UK Pounds Near Post-Brexit Highs As Sterling Falls 38% Year To Date

- HYPERINFLATION IS NIGH SO GOLD WILL GO HIGH

- The Day The Dollar Died, Part II

- Donald Trump Makes Campaign Stop in Milwaukee, WI

- Gold Daily and Silver Weekly Charts - De Trop - The Great Gold Hoax

- The Gold Price And Global Flows. The UK Net Imported 152 tonnes In June.

- Rise of the ANTICHRIST

- Anonymous - A Message to This President And To The Next

- How a Heinous “Food Crime” Will Line Your Pockets with Cash…

- Peter Grandich: Why the mother of all gold bull markets has begun

- Koos Jansen: Gold falls when China imports it, rises when West imports it

- SOMETHING BIG IS ABOUT TO HAPPEN WORLD WIDE? 2016

- END TIMES SIGNS: LATEST EVENTS (AUGUST 16, 2016)

| USDU - An Important Perspective on the US Dollar Posted: 17 Aug 2016 01:29 AM PDT We started following this US dollar index about a year or so ago which has a more equal weighting of different currencies than the $USD. Even though I don’t post it much this Alternative US dollar index has some very interesting Chartology on it which may be giving us an important clue as to the intentions of the Dollar . If you recall the Standard US dollar index ($USD) was testing a major inflection point in May around the 92 area earlier this year. It did finally bottom but left some unfinished business behind. This is the daily chart I was following at the time for the USDU which shows the H&S top in place and the decline that took the price action down to the low at the 25.50 area. From that low the USDU began a decent rally but couldn’t trade above the neckline extension line at reversal point #2 before the bears took charge again. The bulls were able to stop the decline at reversal point #3 and a laborious rally took the USDU back up to the top of the trading range where the neckline extension line came into play again along with the 200 day moving average. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe Has Two Options: Revolution Or Elections Posted: 17 Aug 2016 01:00 AM PDT Authored by Charles Gave, Chairman Gavekal Capital; originally posted via MauldinEconomics.com, In A Study of History, the great Arnold Toynbee explained that the role of “elites” in any society is to handle challenges that allow the group to survive and move on to the next phase of their shared journey. If bad solutions are offered up, then problems will intensify, and pressure will arise for a change in the elite. This can happen in various ways: through elections in a best case scenario; a change of regime as with France’s Fourth Republic which failed to properly handle decolonization; a collapse in the political structure such as befell the Austrian empire at the end of WWI; or, most dramatically, the overthrow of a civilization as in South America with the arrival of the Spaniards or in Egypt when the Muslims took over. In Europe, the main problem for a century or more was the internecine rivalry between Germany and France, which led to three wars that became progressively more destructive. By the time Europe’s exhausted elites reached 1945, it was obvious that war was not going to solve anything and hence a new solution was tried in the shape of “political” Europe. The plan worked to such an extent that new challenges were spawned such as the handling of Germany's reunification, managing the effects of an aging population, and integrating lots of immigrants from a genuinely different civilization. New problems, old solutionsThese new challenges required new solutions, and yet the elites responded with solutions used to handle the previous challenge with the forced integration of Europe into a single political and economic construct. Unsurprisingly, the old solutions have not worked and indeed their application is making Europe’s various problems worse. The interesting thing is that members of the elite are starting to openly admit this:

Our “experts” (the brilliant men of Davos) have thus been shown to protect their own particular tribal interests, rather than the common good. These testimonies are part of a revelatory exercise in Europe which must accelerate a collapse in the legitimacy of both know-better technocrats and the trans-national institutions, which have been all over the European project since 2011 with such deleterious effects. As such, not only the IMF but the European Commission and the European Central Bank have all seen their credibility decimated. The really worrying thing with these demonstrably incompetent institutions is their continued power grab without any proper authority. Such hubris has seen them break pretty much every agreed rule of national economic management that existed prior to the crisis (it seems a quaint detail now that the ECB was not supposed to buy government bonds) in a bid to sustain a project which is manifestly pushing European economies toward a disaster. So where does this leave us? Historically, when an unelected “mafia” has seized control of the political domain, the two remedial options available to the citizenry have been elections, and failing that a revolution. As usual, the British moved first—through an election (England’s last revolution was in 1688). The Brits’ decision to break free should not have been that surprising, given that in the normal course of events the EU system had been rigged to stop the genius “elites” from being fired democratically. Yet for all the significance of the Brexit vote, the UK is not part of the eurozone and so could leave without dooming the system. Italy, Greece, the Netherlands, Portugal, and Finland, by contrast, are subjected to that straitjacket. And getting out of the euro implies exiting the EU. For this reason, the next exit (Italy looks like a prime candidate) is going to be far more momentous, with very clear investment implications. The savings of the problematic countries will likely move to Frankfurt (in expectation of the deutschemark coming back), London, or New York on the basis of a slightly revised Gresham’s law that bad currency will chase out the good ones. The result will be a big rise in German M1 and a banking crisis in the weak countries, with banks being bled dry of their deposits. The value of the pound and the US dollar can be expected to appreciate. Since it appears that Europe’s banking crisis is already under way, my advice would be to watch these variables very closely. If the pound and the dollar start to rise against the euro, it will probably mean that German M1 is rocketing upwards. And at that point the advice would be to adopt the brace position. * * * If you wonder what the future might hold for the US and global economies and stock markets, get answers in the free Q&A session “When the Future Becomes Today” with John Mauldin and his colleagues Patrick Watson and Robert Ross, on Aug. 23, 2:00 PM EDT. Click here to register for the call and to submit your questions. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Does The Precious Metal Market Need Another Derivatives Exchange? Posted: 16 Aug 2016 11:30 PM PDT from GoldAndLiberty:

London's role as a major precious metal trading center harkens back to the 17th century but volumes have recently eroded as major banks pulled out of London precious metal trading due to increased regulatory scrutiny since the financial crisis and accusations of past market misconduct. The local precious metal market has an annual turnover of $5 trillion per year. The 139 yr old LME has traditionally focused on the industrial metals with the exception of a brief and unsuccessful 3 yr foray into gold during the 1980's. In 2014, the LME lost the bid to administer the important London gold benchmark fixing to one of its major rivals, the Intercontinental Exchange (ICE). The London precious metal market is administered by the London Bullion Market Association (LBMA) and dominated by privately negotiated (OTC) off exchange transactions. Listed trades have historically flowed to the U.S. COMEX exchange but have gravitated in recent years towards the Shanghai exchange as physical gold demand in Asia continues to outpace that of the U.S. and Europe combined. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| America: You Will Go Insane Because Of What Your Eyes Will See Posted: 16 Aug 2016 10:35 PM PDT by Michael Snyder, The Economic Collapse Blog:

On Monday, Wisconsin Governor Scott Walker declared a state of emergency in Milwaukee, and the National Guard was brought in but not deployed after another night of chaos made headlines all over the globe. According to Fox News, 11 police officers have been injured by the violence so far…

It has also been reported that another police vehicle was set on fire late Monday night. Authorities are desperate to avoid a third night in a row like this, and so a strict curfew has been put in place…

And that is one of the saddest things about this latest round of violence. So much of it is being done by youngsters that are just kids. Their minds have been poisoned, their emotions have been stirred up, and they are committing random acts of violence that would have been unthinkable for American teens to commit just a couple generations ago. Racial tensions are constantly being fueled by many of our politicians and by the big mainstream news networks. As a result, instead of coming together as a country and learning to love people no matter where they are from or what they look like, we have entered a time when people are literally becoming fearful of being around others that don't have the same skin color that they do. Just check out this quote from CNN…

Just two days ago, I delivered an address down at Morningside that was all about love. As a society, we have got to learn to love one another or we are simply not going to make it. Since I am the publisher of several major websites, I get to review comments that people leave on the various articles. Many of those comments never get published on my websites, and in a lot of those instances this is because they contain some of the most hateful racist language imaginable. Every single person, no matter who they are, where they are from or what they look like, is of immense value. When we decide to believe otherwise, we are making an absolutely tragic mistake. It isn't just in Milwaukee that violence is rising. Over in Chicago, we just witnessed the deadliest day in more than a decade. As I recently detailed on The Most Important News, there are at least 150,000 gang members living in Chicago today, and only about 13,000 law enforcement officers of all types to deal with them. That means that the police are outnumbered by a more than 10 to 1 margin, and at this point shootings are up about 50 percent compared to the same time last year…

The ironic thing is that Chicago has some of the strictest gun laws in the entire nation. Obviously, what the liberal politicians have been attempting to do is not working. The following comes from the New York Times…

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SGT REPORT NEWS BRIEF & ‘SILVER: The Tide Has Turned’ w/ David Morgan Posted: 16 Aug 2016 10:33 PM PDT by SGT, SGT Report.com: This is a SGT report news brief and bonus interview with David Morgan from The Morgan Report. Thanks for tuning in. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Closed at $1350.50 Up $10.20 or 0.76% Posted: 16 Aug 2016 08:12 PM PDT

FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not a Conspiracy: FBI’s Comey Has Been Covering the Clintons’ A**es for Decades Posted: 16 Aug 2016 07:40 PM PDT by James Holbrooks, Underground Reporter:

The Clinton Foundation's main offices are in New York, and the move to work with local prosecutors there is a departure from the FBI's previous, centralized investigations, which coordinated with the Department of Justice. A senior law enforcement official, who has intimate knowledge of FBI activity, told the Daily Caller that the involvement of the U.S. Attorney's Office in the Southern District of New York "would be seen by agents as a positive development as prosecutors there are generally thought to be more aggressive than the career lawyers within the DOJ." New York's Southern District counts Wall Street within its jurisdiction, and the man who heads that office, Preet Bharara, has built a reputation on targeting big money players awash in fraud and corruption. Bharara has in the past gone after big banks — such as Citibank and Bank of America — and politicians, like State Assembly Speaker Sheldon Silver. Such efforts have garnered him much praise, as highlighted by the Daily Mail: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hyperinflation is nigh so gold will go high Posted: 16 Aug 2016 07:02 PM PDT This coming autumn, we are likely to see the beginning of the hyperinflationary phase of the sovereign debt crisis. Hyperinflation normally hits an economy very quickly and unexpectedly and is the result of the currency collapsing. Hyperinflation does not arise as a result of increasing demand for goods and services. The course of events in a hyperinflationary scenario can be summarised as follows: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank Of Japan Buying Sends Nikkei 225 To Richest Since Dot-Com Crash Posted: 16 Aug 2016 06:30 PM PDT Having noted the farcical share ownership of The Bank of Japan (biggest shareholder in 55 companies) as Kuroda's ETF-buying goes to '11', we thought it interesting that the distortion caused by these "pick a winner" purchases has sent Japan's Nikkei 225 to its richest relative to Japan's Topix index in 17 years. As Bloomberg notes, Japan’s two major equity benchmarks have moved mostly together over the years. That changed this month following the latest meeting by the Bank of Japan, which boosted its purchases of exchange-traded funds as part of its easing program. The BOJ’s heavier allocation to ETFs tracking the Nikkei 225 has helped push the gauge to its highest level versus the Topix index in 18 years.

Which - as we noted previously - leaves one big question... just how will the BOJ ever unwind its unprecedented holdings of not only bonds, which are now roughly 100% of Japan's GDP, but also of stocks, without crashing both the bond and the stock market. And then we remember, that the BOJ will simply never unwind any of its "emergency" opertions just because nobody actually thought that far, plus the whole point of the exercise is hyperinflation or bust, as the sheer lunacy of Japan's authorities is exposed for the entire world to see, leading to the terminal collapse of faith in the local currency. With every passing day, we get that much closer to said terminal moment. "probably nothing" | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global Economic Bellwether Cisco Reportedly Fires 20% Of Workforce Posted: 16 Aug 2016 06:06 PM PDT It's easy to shrug off the sharpest productivity decline in 40 years and the worst non-recessionary industrial production contraction in US history because... well it's the new economy, stupid and you just don't get it. But when 'new economy' networking giant Cisco is reportedly set to announce it is laying off a record number of employees - 14,000 representing 20% of its global workforce - surely it is time to question the "everything is awesome" narrative.

The excuse for the heavy cuts, which sources said will range between 9,000 and 14,000 employees worldwide, is that they stem from Cisco’s transition from its hardware roots into a software-centric organization...

Cisco declined to comment, and is set to announce its fourth fiscal quarter results after the market closes tomorrow.

But this massive layoff is the company's largest ever...

And, as everyone who has traded markets and followed global economic trends knows, Cisco is among the clearest global economic recession indicators (combining the real economy and imaginary-tech economy) there is... and this is the biggest collapse in Cisco's headcount... ever. Cisco is trading back at its highest since Nov 2007... Charts: Bloomberg | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Week In 1971: President Nixon Closes the Gold Window Posted: 16 Aug 2016 06:00 PM PDT Submitted by Paul-Martin Foss via The Mises Institute, 45 years ago this week, on August 15, 1971, President Richard Nixon officially closed the gold window. While US citizens had been forbidden from owning gold or from redeeming their gold certificates for gold coins since the early 1930s, foreign governments still had the privilege of redeeming their dollars for gold. Due to the Federal Reserve’s inflationary monetary policy during the 1960s, foreign governments began to redeem more and more dollars for gold. Attempts to encourage other governments (especially France) not to redeem their dollar holdings were unsuccessful, and there was a very real threat that US gold holdings might eventually be exhausted. So President Nixon decided to close the gold window, thus severing the final link between the US dollar and gold.

The removal of the restraint of gold redemption freed the Federal Reserve to engage in more inflationary monetary policy than ever. The effects of that on money supply and official price inflation figures are readily apparent. The demonetization of silver in the Coinage Act of 1873 was widely assailed by its critics as the “Crime of ’73.” Isn’t it about time that Nixon’s closing of the gold window be known as the Crime of ’71? * * * Bonus Video... sound familiar? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Banks look for cheap way to store cash piles as rates go negative Posted: 16 Aug 2016 05:45 PM PDT By Claire Jones and James Shotter FRANKFURT, Germany -- The idea of keeping piles of cash in high security vaults may sound like something from an old movie plot, but some banks and insurers have recently started considering the idea as interest rates sink below zero across much of Europe. Europe's highways are not yet jammed with heavily guarded trucks transporting money to top-secret locations, but if it becomes financially sensible for banks to hoard cash as rates are cut even further, the practice could undermine central banks' ability to use negative rates to boost growth. ... Dispatch continues below ... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. After the European Central Bank's most recent rate cut in March, private-sector banks are paying what amounts to an annual levy of 0.4 percent on most of the funds they keep at the eurozone's 19 national central banks. This policy, which has cost banks around E2.64 billion since ECB rates became negative in 2014, is intended to spark economic growth by giving banks the incentive to lend money to businesses instead of holding on to it. European central bankers say they could cut rates again should economic conditions worsen, but private bankers and insurers are already thinking of creative ways to avoid those charges altogether. One way is by turning the electronic money they keep at central banks into cold, hard cash. Munich Re has experimented successfully with storing a double-digit million sum of euros in cash at what the insurer describes as a manageable cost. A few other German banks, including Commerzbank, the country's second-biggest lender, have also considered taking the step. But when a Swiss pension fund attempted to withdraw a large sum of money from its bank in order to store it in a vault, the bank refused to provide the cash, according to local media reports. ... ... For the remainder of the report: http://www.ft.com/cms/s/0/e979d096-5fe3-11e6-b38c-7b39cbb1138a.html Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rickards details the 'paper gold' fraud and speculates on its demise Posted: 16 Aug 2016 04:35 PM PDT 7:39p ET Tuesday, August 16, 2016 Dear Friend of GATA and Gold: In a new promotional video for his financial letter Strategic Intelligence, fund manager and geopolitical strategist James G. Rickards wonderfully exposes the fraud of "paper gold" and "paper silver" and speculates on the circumstances that will cause their demise and the explosion in the price of real metal. More than 90 percent of gold and silver investments are not backed by real metal, Rickards says, and their owners won't have metal when they most want it. In the video Rickards interviews someone he says is an expert in the Swiss gold refinery business who concurs about the paper gold hoax and whose identity is withheld and whose face is obscured by fuzzing of the video. What the supposed expert asserts is only what GATA has been telling people for years, but the effect is theatrical and dramatic. While GATA has followed a policy of strict attribution and has abjured anonymous sources in the belief that this is necessary for credibility, a high principle of honest journalism, maybe GATA Chairman Bill Murphy and your secretary/treasurer would have been more persuasive all this time if we had put paper bags over our heads. (We'd probably have had more luck in dating anyway.) But anything that truthfully impugns what Rickards calls the great gold hoax is perfectly jake, so while it's a commercial promotion, his video is still a great service. It's about a half hour long and can be watched at the Agora Financial Internet site here: http://pro.agorafinancial.com/AWN_goldhoax_0816/EAWNS8CK CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Doug Hagmann : Soros Too corrupt to Fail, Will bring Elites Down With Him Posted: 16 Aug 2016 04:28 PM PDT Alex Jones talks with former federal prosecutor Doug Hagmann about the latest leaks and what it shows about George Soros. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold In UK Pounds Near Post-Brexit Highs As Sterling Falls 38% Year To Date Posted: 16 Aug 2016 03:39 PM PDT Gold in UK pounds neared its post-Brexit high overnight as sterling fell sharply on currency markets due to concerns about rising inflation as shown in data today and the outlook for the UK economy. Gold is up nearly 4% in sterling terms in August and by a whopping 38% year to date. ‘Sterling silver’ has surged by even more this year and is now 56% higher in sterling terms year to date. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| HYPERINFLATION IS NIGH SO GOLD WILL GO HIGH Posted: 16 Aug 2016 02:59 PM PDT Hyperinflation is nigh so gold will go high | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Day The Dollar Died, Part II Posted: 16 Aug 2016 02:26 PM PDT This post The Day The Dollar Died, Part II appeared first on Daily Reckoning. There is a concept, advanced by a philosopher named Karl Popper. Karl Popper decades ago called piecemeal engineering. What he meant by this is if you're one of the power elites in the world — a political leader, finance minister or head of a globalist institution who wants to run the world or tell other people how to live their lives — you can't do it all at once. Many have tried. Caesar, Napoleon, Hitler, the great dictators in history have tried to do everything at once. But they were all defeated because they invite retaliation and pushback of various kinds. Popper said that if you want to change the world, you must do it slowly, one piece at a time, in ways that people don't notice. An analogy is something called the ratchet. A ratchet tool is a tool that only turns one way. You can turn it one way… but you can't turn it back. It's an irreversible process. Now let's take that concept of piecemeal engineering and apply it to the elimination of the U.S. dollar and the rise of the special drawing right (SDR), because that's what we are looking at in the future. The SDR was invented in 1969 and there were a number of issues of SDRs in the 1970s. During the '70s we had massive liquidity crisis, borderline hyperinflation, a quadrupling of oil prices, and a stock market crash. The dollar almost collapsed between 1977 and in 1981. The situation was so bad that in 1977, the United States Treasury borrowed money in Swiss francs. Nobody wanted U.S. dollars, at least not at an interest rate the U.S. was willing to pay. That was when the IMF issued SDRs to provide liquidity to the world at a time when the dollar was collapsing. That was the last time prior to 2009 when the IMF issued SDRs. But it moved the ratchet forward. Then there was a 30-year period from roughly 1980 to 2010 which has been described as the age of King Dollar. They didn't need SDRs because the banking system was doing its job. But in 2009-2010 two things happened. First, in 2009 the IMF issued SDRs for the first time in almost 30 years. That was in response to the global liquidity crisis when it looked like the world's central banks couldn't act fast enough. So the IMF issued over $100 billion of SDRs. Few people are even aware it happened. But it moved the ratchet forward once again. At the time, I went on CNBC and said, "What they're doing is testing the plumbing." The SDR hadn't been used since 1980. The IMF needed to make sure the system still functioned, like an air-conditioning or plumbing system that hasn't been used in years. It did, and the system worked perfectly. Now they know the system works. And we won't be seeing anymore 30-year gaps of the kind we had between 1980 and 2009. In January 2010, the IMF issued another paper really speculating on the rise of the SDR as world money or a global currency. It was really a blueprint for the permanent establishment of the SDR. In other words, not a special, temporary SDR issue in case of emergency — but making the SDR a permanent global reserve currency. But there's a problem. In order to be a global reserve currency, the IMF can't just print money to hand out. To create a reserve currency it needs to create an SDR-denominated bond market. The reason the dollar is the world's leading reserve currency is because there's a very large liquid dollar-denominated bond market. Investors can go buy 30-day 10-year, 30-year Treasury notes, etc. The point is, there's a deep, liquid dollar-denominated bond market to invest in that creates a lock-in effect. There is currently no equivalent bond market in SDRs. It will need to create one before SDRs can be considered a global reserve currency. Well, last July, the IMF published a technical paper introducing the concept of a private SDR market… In the IMF's vision, private companies and corporations can issue bonds denominated in SDRs. Who are the logical issuers of the bonds? Probably multinational or multilateral organizations like the Asian Development Bank and maybe big corporations like IBM and General Electric. Who would buy these SDR-denominated bonds? Mostly sovereign wealth funds. China will be substantial buyers. The point is, these issues are coming. Now the deployment of the SDR is coming closer to fruition… The SDR has been composed of four currencies — the U.S. dollar, British pound sterling, the euro and the Japanese yen. But that's about to change… At midnight on September 30, the IMF will include the Chinese yuan in its basket of currencies. That will be a major event in monetary history. The IMF is welcoming China to the club. For many people in the West, Americans in particular, this is just some technical IMF procedure. But that's not how the Chinese look at the world. The Chinese are all about saving face and gaining face. One way to gain face in the Chinese concept is by gaining prestige. Being included in the IMF's exclusive club of currencies affords them that prestige, even though westerners tend to think of it as a mere technical readjustment. Yesterday I said September 4, 2016 could well go down as the day the dollar died. Why did I pick that date instead of September 30, the official date when the yuan is included in the IMF's basket of currencies? Because September 4 is when the leaders of the world's larger economies will gather in Hangzhou, China for the G20 annual summit. This will be China's coming-out party. This is China saying, "We are an equal partner, maybe more than the equal partner of the United States of America and Europe. They will no longer dictate the world's financial system." The symbolism and the visuals at the upcoming meeting will be spectacular. The IMF is essentially told what to do by the G20. If you think of the IMF as the central bank of the world, think of the G20 as the Board of Directors of the central bank of the world. It's the committee that runs the world. This is not a conspiracy theory. It's a fact. And it's important to realize that one G20 memo calls for "expanding the role of the IMF's SDR (Special Drawing Rights)." The pace is really picking up. The SDR bond issues I mentioned above are probably going to happen within the next couple of weeks. Between now and Labor Day we'll see announcements about multibillion SDR bond issuance coming from the Asian Development Bank, some major Chinese commercial banks, the Asian Infrastructure Investment Bank, etc. The point is, so these issues are coming. And over time, the SDR market will grow. It will not compete with the dollar-denominated bond market anytime soon, but the groundwork is being laid. Every time an institution invests in SDRs, they'll be indirectly supporting the yuan. And it'll help move the world that much further away from the dollar. This will have vast implications for anyone who holds their wealth in dollars. The mechanics are too far along, the piecemeal social engineering was too well thought out, the ratchet is locked in place. It won't be reversed. The next time there is a financial crisis, which I expect sooner than later, it's not going to be the Fed that bails us out. It's going to the IMF and the SDRs. Then the ratchet effect will be completed. In 10 years many people are going to look back and point at September 2016 as the point in time the dollar era ended. They can't see it now. But we do. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post The Day The Dollar Died, Part II appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Donald Trump Makes Campaign Stop in Milwaukee, WI Posted: 16 Aug 2016 02:23 PM PDT Donald Trump Makes Campaign Stop in Milwaukee, WI (8/16/2016) The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - De Trop - The Great Gold Hoax Posted: 16 Aug 2016 01:30 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price And Global Flows. The UK Net Imported 152 tonnes In June. Posted: 16 Aug 2016 11:56 AM PDT Bullion Star | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 Aug 2016 11:27 AM PDT Dig deeper...research and you will see the truth. You will learn the meaning of life and where everything leads to. You will want to drastically change your life after finding out the truth that's hidden right before your own eyes! The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Anonymous - A Message to This President And To The Next Posted: 16 Aug 2016 10:54 AM PDT Anonymous - A Message to This President And To The NextWe are anonymous.We are legion.We do not forgive.We do not forget.Expect us. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| How a Heinous “Food Crime” Will Line Your Pockets with Cash… Posted: 16 Aug 2016 08:31 AM PDT This post How a Heinous “Food Crime” Will Line Your Pockets with Cash… appeared first on Daily Reckoning. Call the authorities! Our nation's fast food peddlers are committing a record number of heinous food crimes right now. If the Feds allow these activities to persist, we're all going to die early of obesity related complications. But there is some good news… You have a unique opportunity for some serious war profiteering as the fast food superpowers expand their arsenals. Double-digit gains are in your future—even if you are banking at the expense of the Great American Eater. The latest volley in the fast food wars comes from industry giant Taco Bell. The company is partnering with Frito-Lay to make a burrito filled with rice, meat, queso, sour cream and… Cheetos. You can't make this stuff up. Take a look for yourself:

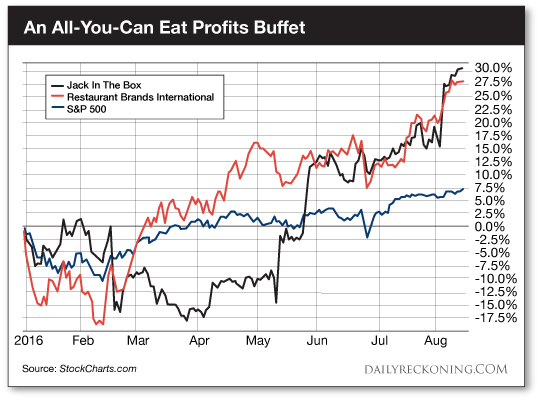

I'm not going to lie to you—I would eat this monstrosity. Would I hate myself afterwards? Absolutely. But the concoction is too crazy to pass up. It's as if Taco Bell's head of product development is that weird kid from middle school who used to mash up all the food on his lunch tray into a giant blob before he ate it… As it turns out, this Taco Bell creation is just the latest in Cheeto-branded fast food abominations. "Earlier this summer, Cheetos fans were blessed with Mac n' Cheetos," MarketWatch reports. "The Mac n' Cheetos concoction sells at Burger King and is reminiscent of a mozzarella stick sprinkled with Cheeto dust and stuffed with Mac n' Cheese rather than mozzarella cheese." Sure. Why not? Gotta get your daily recommended allotment of orange coloring, right? From fried macaroni covered in Cheetos dust to pizza crust stuffed with hot dogs, all of the major fast food players are throwing shame out the window in favor of some wild Frankenfoods. Not to be outdone, Burger King is also offering a Whopperito this summer, which appears to be the entire contents of a Whopper hamburger tossed in a blender before being mushed into a flour tortilla. And it's been great for their stock… At the Fast Food Olympics, gluttony takes the gold. That's why junk food stocks are soaring. Pizza, burgers, and donuts—we told you late last month that these stocks have been breaking out right and left. These greasy stocks have a lot more room to run. The fact is, folks are ordering in and eating out in record numbers. And these cheap fast food joints are a great way to play the trend.

After yesterday's gain, Jack In The Box Inc. (NYSE:JACK) is now up more than 30% year-to-date. Restaurant Brands International (NYSE:QSR)—parent company of Burger King—is right on Jacks' tail with a year-to-date gain of more than 28%. For reference, the S&P 500 is up about 7% so far this year. In this market, the strongest stocks are extending their gains. So peel yourself off the couch and pick up some shares today for a trade… Sincerely, Greg Guenthner P.S. Make money in a falling market –sign up for my Rude Awakening e-letter, for FREE, right here. Never miss another signal. Click here now to sign up for FREE. The post How a Heinous “Food Crime” Will Line Your Pockets with Cash… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peter Grandich: Why the mother of all gold bull markets has begun Posted: 16 Aug 2016 07:37 AM PDT 10:36a ET Tuesday, August 16, 2016 Dear Friend of GATA and Gold: Market analyst and former mining company adviser Peter Grandich can't quite stay out of the business, writing today that while the financial industry and mainstream news media will always be hostile to gold, there are many reasons to think that "the mother of all bull markets" for gold has begun. Grandich's commentary is posted at his Internet site here: http://www.petergrandich.com/gold-the-mother-of-all-bull-markets-has-onl... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: Gold falls when China imports it, rises when West imports it Posted: 16 Aug 2016 07:31 AM PDT 10:30a ET Tuesday, August 16, 2016 Dear Friend of GATA and Gold: Reviewing international trade data, gold researcher Koos Jansen writes today that the gold price can go down when China is importing it but goes up when the West is importing it instead of exporting it. "China was able to buy the tonnages they did because of the willingness of the West to supply the metal," Jansen writes, adding: "Exactly who in the West was so eager to supply the metal is another story." Maybe that's GATA's story, a story Western central banks refuse to tell. Jansen's analysis is headlined "The Gold Price and Global Flows -- the UK Net Imported 152 Tonnes in June" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/koos-jansen/the-gold-price-and-global-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SOMETHING BIG IS ABOUT TO HAPPEN WORLD WIDE? 2016 Posted: 16 Aug 2016 04:00 AM PDT SOMETHING BIG IS ABOUT TO HAPPEN WORLD WIDE? 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| END TIMES SIGNS: LATEST EVENTS (AUGUST 16, 2016) Posted: 16 Aug 2016 02:55 AM PDT end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon, wars and rumors of wars The Financial Armageddon Economic Collapse... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Precious metals have significantly outperformed all other asset classes with year to date gains of 44% in Silver, 31% in Platinum, 28% in Palladium, and 26% in Gold. 2016 marks the highest recorded annual gain for gold in 36 years. Investment demand for the metal is 16% higher this year than the previous recorded high reached in 2009. Attempting to capitalize on this growing investment interest, the London Metal Exchange (LME) announced this week its plans to launch a gold and silver London based listed derivatives exchange in the first half of 2017. The new exchange will compete directly with the existing London over-the-counter market (OTC) system, the listed COMEX exchange in the U.S, and the Shanghai exchange in China. Contract sizes will be identical to those traded on the COMEX exchange.

Precious metals have significantly outperformed all other asset classes with year to date gains of 44% in Silver, 31% in Platinum, 28% in Palladium, and 26% in Gold. 2016 marks the highest recorded annual gain for gold in 36 years. Investment demand for the metal is 16% higher this year than the previous recorded high reached in 2009. Attempting to capitalize on this growing investment interest, the London Metal Exchange (LME) announced this week its plans to launch a gold and silver London based listed derivatives exchange in the first half of 2017. The new exchange will compete directly with the existing London over-the-counter market (OTC) system, the listed COMEX exchange in the U.S, and the Shanghai exchange in China. Contract sizes will be identical to those traded on the COMEX exchange. A cloud of madness is descending on America, and most of us are completely unprepared for the chaos that will be unleashed during the months ahead. This morning, I was reading through Deuteronomy when I came to a phrase that really resonated with me. In the

A cloud of madness is descending on America, and most of us are completely unprepared for the chaos that will be unleashed during the months ahead. This morning, I was reading through Deuteronomy when I came to a phrase that really resonated with me. In the  Last Thursday, the Daily Caller broke the

Last Thursday, the Daily Caller broke the

No comments:

Post a Comment