Gold World News Flash |

- Gold Investment Demand Reaches Record In First Half 2016 On “Perfect Storm”

- Silver and Inflation

- After 40% Rally, Silver Still Has Room To Move – Mining CEO

- What Do They Know That We Don’t? World’s Billionaires Are Stockpiling Cash: “Taking Money Off the Table”

- Gold Price Closed at $1342.50 Down $1.80 or -0.13%

- Will the “End Game” Commence September 30th?

- One Simple Reason Why Gold Can Still Jump 50%

- Full Speech: Donald Trump Rally in Kissimmee, FL 8/11/16

- Why Donald Trump's "Sound Money" Stance Scares The Mainstream

- Brazil On Precipice Of Collapse As Rio Olympics Force People Out Of Homes & Leaves Country In Debt

- Who Controls America?

- TF Metals Report: TED spread hints at stock fall, gold rise

- Gold Daily and Silver Weekly Charts - Late Day Selloff - Risk On But Stronger Dollar

- Last Warning To America - Dollar Will Collapse 100% on 27 September 2016

- The 3-letter Time Bomb in Your Portfolio

- Rush Limbaugh : Hillary Clinton Is "FULL OF CRAP!"

- Bix Weir Economic Collapse in Aug Sept

- More Proof: US Economy Terminal Decline Is Accelerating. By Gregory Mannarino

- Solar Slammed! Here’s What Happens Next…

- The Last Known Gold Deposit

- Investment surpasses jewelry as source of most demand for gold

- Benn Steil: Adopt a gold-backed dollar? This is what happened the last time we tried

- Gold 2.0: How to Profit from the Current Gold Bull Market

- Smashed Silver Snaps Back into Ferocious Bull Market

- This Suggests That Silver Will Soon Spike Significantly Higher

| Gold Investment Demand Reaches Record In First Half 2016 On “Perfect Storm” Posted: 12 Aug 2016 01:00 AM PDT by Mark O'Byrne, GoldCore:

Western investors especially in Europe saw the greatest increase in gold investment demand and Europe was the "largest market for gold bars and coins in Q2." Gold investment in Germany remained very robust and UK demand rise significantly from low levels as smart money diversified into gold ahead of the Brexit referendum. Japan also saw continuing robust demand due to concerns about the outlook for the Japanese economy, the debasement of the yen and negative interest rates in Japan. U.S. gold investment demand also rose very significantly:

The World Gold Council said that geopolitical risks including the U.S. election, "the slowing pace of U.S. interest rate hikes" and ultra loose monetary policies led to a perfect storm for gold and gold investment: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 12 Aug 2016 01:00 AM PDT Silver Analysis | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| After 40% Rally, Silver Still Has Room To Move – Mining CEO Posted: 12 Aug 2016 12:30 AM PDT from KitcoNews: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 12 Aug 2016 12:00 AM PDT by Mac Slavo, SHTFPlan:

And with enormous fortunes being made – and destroyed – overnight. The world's billionaires have shifted into stockpiling an average of 22% of their income in cash because they are terrified the economy could crash. Many of these people literally helped to build the system we all now rely upon, and now they are holding cash, gold and other assets our of fear that stocks will crash and digital instruments of wealth could be undermined, compromised or have their balance destroyed.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1342.50 Down $1.80 or -0.13% Posted: 11 Aug 2016 11:08 PM PDT

Franklin Sanders Daily commentary is now only available via email. FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will the “End Game” Commence September 30th? Posted: 11 Aug 2016 06:36 PM PDT by Andy Hoffman, Miles Franklin:

Today, not a thing has changed – except my Precious Metal portfolio, comprising roughly 90% of my liquid assets, is 100% physical metal, with my only "financial asset" being a 1% position in Bitcoin. Thus, the stress I feel during today's Cartel attacks – which per the "manipulation mantra" I coined circa 2005, "each day worse than the last," has not let up one bit – is more muted. But just a little, as after 14½ years of watching the government – er, Cartel – attack my net worth, livelihood, and sanity, I've built up a lifetime's worth of anger. Consider, for example, that not only have we been forced to endure "Sunday Night Sentiment" attacks in 152 of the past 158 weeks, but 28 of 30 this year, when Precious Metals have been the world's best performing asset class. Not to mention, "2:15 AM" raids on 87% of all trading days over the past three years – which I assure you, is no lower a percentage this year. As well as relentless "caps and attacks" each and every day – such as yesterday's prototypical "Cartel Herald"-catalyzed raid, at the "key attack time #1" of 10:00 AM EST (when global physical markets close). When – what do you know – silver approached its 50-month moving average of $20.45/oz. Which, as I have been noting for weeks, is the Cartel's "ultimate line in the sand." However, in large part due to my decision to switch my investment to physical metal – partly in 2008, and wholly by 2011; plus perseverance, belief, and survival instinct – I've slept the "sleep of the just," in not just my investment decisions, but how I've communicated my beliefs to the PM community. Many of you, too, have survived the worst – each of you, in your own personal way – and for that, I salute you. And for those new to the game, congratulations on not only joining history's greatest bull market in its still early stages, but having missed the vast majority of the aforementioned "manipulation stress." As, in my view, the "end game" of an all-out loss of Cartel – and generally speaking, "powers that be" – control is approaching rapidly, no matter how hard they try to subvert reality. Which, per today's provocative title, I'll get to momentarily. As first, I'd like to present a brief list of topics from yesterday alone; each one of which, has the potential to "break the Cartel's back" under the right circumstances. Let alone, the "September 30th event I'll end today's article with. Like, for instance…

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| One Simple Reason Why Gold Can Still Jump 50% Posted: 11 Aug 2016 06:25 PM PDT Submitted by Simon Black via SovereignMan.com,

She’s right. It is madness.

These risks are even worse for major “institutional” investors like pension funds. Big investors have far fewer investment options than regular people like us. They need extremely large markets to deploy their capital. Think about it like this: if you have $100 billion to manage, you wouldn’t even be able to consider a small investment, like a $200,000 town home. $200,000 is just .0002% of your portfolio. It’s far too small to even think about. A senior investment manager at one of China’s sovereign wealth funds once told me they only consider deals that are at least $1 billion or more. Anything else is just too small, no matter how attractive. This is why it’s so great to be a smaller investor. We have recommended unique investments to members of our premium services, for example, that generate anywhere from 5% to 12% in very safe returns that are fully backed at a substantial margin by real assets (including gold). But the market size for these investments is only around $20 million. If you had $20,000, $200,000, or even $2 million to invest, your portfolio is the perfect size for these types of investments. But if you had $200 billion to manage, you wouldn’t be able to consider them. The investments are simply too small. That’s why large investors end up buying government bonds: the market is enormous. The market for US Treasuries, for example, is $19 trillion. So even if you’re managing $200 billion, the market size for US government bonds is big enough that you could easily snap up Treasuries. It’s the same with stocks. Wal Mart, Apple, Toyota, Samsung… the market size of large public companies is worth tens of trillions of dollars, big enough for major funds to invest. But again, that’s precisely the problem. Almost every single market and asset class that’s big enough for major institutional investors is at/near its all-time high. The yields on government bonds are at the lowest levels in recorded history (and in many cases even negative). Stocks are at record highs at a time when corporate profits are in decline. Many funds around the world (especially in Europe) have been jumping into the US market as a “safe haven” against all the Brexit uncertainty. Yet they’re doing so at a time when the US dollar is at a multi-decade high, and both US stocks and bonds are at all-time highs. It’s generally not the greatest investment strategy in the world to buy assets at their all-time highs… you’re taking on a LOT of risk. But major funds and institutions have very few options available. Simply due to their massive size, they’re chained to these risky asset classes. Even doing nothing and holding money in the bank could mean paying negative interest. But there is one very big exception: gold. The total market size for gold, as estimated by the World Gold Council, is more than $7 trillion. That’s a big market, more than sufficient for institutional investors to deploy billions, even tens of billions. Central bankers have been doing it themselves, snapping up hundreds of tons of gold in recent years. (The Chinese bought tens of billions of dollars worth of gold in the last year.) Yet unlike stocks and bonds, gold is NOWHERE NEAR its all-time high, at least in US dollar terms. In fact gold can still appreciate nearly 50% before it breaks its previous price record. This means that GOLD is about the only major asset class that isn’t anywhere close to its all-time high, but still a big enough market for institutional investors. Stocks are very expensive. Bonds are insane. Bank rates are negative for many large investors. But gold is still historically inexpensive despite having appreciated substantially this year. So gold should become much more attractive to large investors, especially since there will likely be more debt, more money printing, more capital controls, and more monetary insanity in the future. These trends are pretty clear. And if you understand them, the case for owning at least a small amount of gold is obvious. Don’t fall in love with gold. Don’t maintain a religious devotion to it. And don’t dive in headfirst with your entire life’s savings. Accumulate slowly. But do recognize that there’s no other global, highly liquid asset that increases in value as governments and central banks decline. So having even just a little bit of gold can be an excellent insurance policy. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full Speech: Donald Trump Rally in Kissimmee, FL 8/11/16 Posted: 11 Aug 2016 06:03 PM PDT Thursday, August 11, 2016: Full replay of the Donald Trump for President rally in Kissimmee, FL at Silver Spurs Arena. Full Speech: Donald Trump Rally in Kissimmee, FL 8/11/16 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Donald Trump's "Sound Money" Stance Scares The Mainstream Posted: 11 Aug 2016 05:35 PM PDT Authored by Judy Shelton, originally posted Op-Ed via The Wall Street Journal, The source of trade anxiety is a broken global monetary system that distorts price signals with sharp currency moves. The surest way to become alienated from Donald Trump supporters is to invoke the word “global” with regard to trade or economic interests. Even if you embrace the Trump economic agenda for enhancing U.S. competitiveness by lowering taxes and easing regulation, even if you support an “America First” approach for tackling domestic shortcomings from education to infrastructure - there is still a negative stigma attached to proposing any kind of global economic initiative. Yet by insisting that the U.S. Treasury label China a “currency manipulator” and by promoting trade that is both free and “fair,” Mr. Trump may be laying the groundwork for a significant breakthrough in international monetary relations - one that could ultimately validate the rationale for an open global marketplace and restore genuine free trade as a vital component of economic growth. The notion that something good might come out of a Trump policy elicits guffaws in certain economic circles. And questioning whether today’s exchange-rate regime serves the cause of beneficial cross-border commerce is tantamount to advocating protectionism. Nevertheless, Mr. Trump’s emphasis on currency manipulation brings into focus the shortcomings of our present international monetary system—volatility, persistent imbalances, currency mismatches—which testify to its dysfunction. Indeed, today’s hodgepodge of exchange-rate mechanisms is routinely described as a “non-system.” Or, as former International Monetary Fund chief Jacques de Larosière termed it at a Vienna conference in February 2014, an “anti-system.” If monetary scholars once diligently sought to explain the relative virtues of fixed-versus-flexible exchange rates on global economic performance, they have largely abdicated any responsibility for the escalating political backlash against trade that blames currency manipulation for lost business. No serious economist would claim today that the “dirty float” intervention tactics practiced by numerous countries would be remotely acceptable within the freely flexible exchange-rate system envisaged by Nobel Laureate Milton Friedman. Nor would anyone suggest that any coherent mechanism exists comparable with the fixed-rate system anchored by a gold-convertible dollar that reigned in the decades following World War II. Nobel Laureate Robert Mundell has consistently argued for the restoration of a system of formally maintained exchange rates to reduce uncertainty and promote growth. Yet the lack of willingness among the great majority of economists to recognize the imperative for global monetary reform to avoid a breakdown in global trade relations has left policy makers in the lurch. Faced with mounting demands to address currency manipulation through “strong and enforceable provisions”—i.e., tariffs—those who support free trade are being forced to consider the broader implications of a sluggish world economy that has become overly reliant on central banks. Is it more egregious when governments deliberately intervene in foreign-exchange markets to manipulate currencies to gain an export advantage—or when central banks seek to accomplish the same thing through monetary policy? The point is that today’s free-for-all approach to international monetary relations permits nations to pursue any exchange-rate policy they wish. Relative currency values are thus vulnerable not only to the manipulative tactics of government authorities, but also to the speculative maneuvering of foreign-exchange traders—the most active of which, in a market that averages $4.9 trillion in daily volume, are the world’s largest banks. No wonder so many workers employed by U.S. companies that manufacture products requiring substantial capital investment—automobiles and tractors, computer and electronic equipment—have become disenchanted with the supposed long-term benefits of free trade. It is one thing to lose sales to a foreign competitor whose product delivers the best quality for the money; it’s another to lose sales as a consequence of an unforeseen exchange-rate slide that distorts the comparative prices of competing goods. To brand trade skeptics as sore losers is to malign them unfairly. To resent being victimized by currency movements is not the same as being opposed to free trade, nor does it signal an eagerness to engage in protectionist retaliation. It’s simply an honest response to incongruity: We need to reconcile global monetary arrangements with global trade aspirations. As former Federal Reserve Chairman Paul Volcker has observed:

Mr. Trump’s forceful rhetoric may help put an end to the politically correct attitude so prevalent among economists that breezily dismisses what was once accepted as a truism: Stable exchange rates foster long-term prosperity by maximizing the productive use of economic resources and financial capital. Why continue to passively accept the negative economic consequences of global monetary disorder? Why permit legitimately earned profits from business operations and investments in foreign countries to be wiped out by unpredictable currency losses? Why hold global economic growth prospects hostage to antiquated exchange-rate arrangements? It’s time to end the intellectual vacuum and focus on serious initiatives for global monetary reform. The goal is to maximize prosperity by harnessing the power of free-market signals across borders. Monetary clarity is the key to reconciling the principles of free trade with the promised benefits of an open global marketplace. By focusing on currency manipulation as an unfair trade practice, Mr. Trump has not only identified the crux of the economic dilemma, he has also spotlighted the social and political tensions its consequences have fostered. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brazil On Precipice Of Collapse As Rio Olympics Force People Out Of Homes & Leaves Country In Debt Posted: 11 Aug 2016 05:00 PM PDT Josh Sigurdson talks with author and economic analyst John Sneisen about the countless problems plaguing Brazil and the Brazilian economy as inflation goes rampant, poverty strikes vast numbers of people and the Rio Olympics much like the 2014 World Cup force people out of their homes, into... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 11 Aug 2016 04:00 PM PDT they push communism and anti family atheist savagery with the left, and push Zionist christian KKK terrorism with the right. ITs like King Faisal of Saudi Arabia said before he was assassinated, Zionism and communism are together. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: TED spread hints at stock fall, gold rise Posted: 11 Aug 2016 03:19 PM PDT 6:18p ET Thursday, August 11, 2016 Dear Friend of GATA and Gold: The TF Metals Report's Turd Ferguson observes tonight that the spread between U.S. Treasury bill interest rates and interest rates on eurodollar futures -- the TED spread -- is widening, traditionally a signal of growing credit risk. The indicator, Ferguson adds, also correlates with declines in the stock market and rises in gold. Ferguson's commentary is headlined "An Interesting Development for Gold and All Other Markets" and it's posted at the TF Metals Report here: http://www.tfmetalsreport.com/blog/7794/interesting-development-gold-and... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Gold Standard Intersects 126.2 Meters of 3.95gpt Gold Company Announcement VANCOUVER, British Columbia, Canada -- Gold Standard Ventures Corp. (TSXV: GSV; NYSE MKT:GSV) today announced assay results from the first three step-out core holes at the recently discovered North Dark Star oxide gold deposit on its fully owned and controlled Railroad-Pinion Project in Nevada's Carlin Trend. The results significantly increase the size of the North Dark Star deposit while also enhancing its prospective grade and establishing the orientation of a favorable trend supporting the potential for further expansion of the higher-grade zone. The primary objective of this year's drill program at North Dark Star was to find a continuation of the high-grade zone discovered in core hole DS15-13 (15.4 meters of 1.85 grams of gold per tonne and 97 meters of 1.61 grams per tonne) at the end of last year's drill program. Hole DS16-08 located 100 meters south of DS15-13 returned multiple, significant, oxidized intercepts containing gold values above the cutoff grade established in the Dark Star NI43-101 resource estimate announced on March 3, 2015. Hole DS16-08 returned a 126.2-meter section grading 3.95 grams per tonne including higher-grade intervals of 44 meters of 4.70 grames per tonne, 17.9 meters of 5.6 grams per tonne, and 7.9 meters of 10.7 grames per tonne. To see section maps and the drill plan: http://goldstandardv.com/lp/north-dark-star-drill-results ... For the complete announcement: http://goldstandardv.com/gold-standard-intersects-126-2m-of-3-95-g-aut-a... Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Late Day Selloff - Risk On But Stronger Dollar Posted: 11 Aug 2016 02:01 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Last Warning To America - Dollar Will Collapse 100% on 27 September 2016 Posted: 11 Aug 2016 02:00 PM PDT This collapse will be global and it will bring down not only the dollar but all other fiat currencies,as they are fundamentally no different. The collapse of currencies will lead to the collapse of ALL paper assets. The repercussions to this will have incredible results worldwide and each... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The 3-letter Time Bomb in Your Portfolio Posted: 11 Aug 2016 01:21 PM PDT This post The 3-letter Time Bomb in Your Portfolio appeared first on Daily Reckoning. After the stock market got off to its worst annual start ever, it's ticking off record highs again. The world was apparently falling apart after Brexit. But that's yesterday's news. Good times are here again. The perma bulls are luring the lemmings back into the market. A cynic might dismiss this exuberance as merely the usual Wall Street cheerleading. After all, you can't sell stock, ETFs and other financial products to investors when you are projecting a down market. And so they never do. Yet chalking it all up to salesmanship would be to underestimate the magnitude of the coming crash. The truth of the matter is that Wall Street gamblers have lived in the bubble for so long that they no longer grasp how artificial and unsustainable the entire financial system is. For the better part of three decades, the financial system in the U.S. has been expanding at nearly twice the rate of GDP. Even a basic familiarity with the laws of compound arithmetic reminds us that this ever-widening gap between economic output and the market value of stock and debt obligations can't continue. The weakening performance of the U.S. economy during the last two decades did not warrant the drastic increase in the capitalization rate. In reality, equities and debt must ultimately be supported by interest and dividends extracted from national income (GDP). Historically, the stable U.S. financial capitalization rate — the combined value of debt and equity outstanding — had been about 2X national income. But beginning with Greenspan's conversion to money printing after the financial meltdown of October 1987, the capitalization rate begin to steadily climb and never looked back. Now it amounts to nearly 5.4X national income. Yet this has occurred during a period when the trend growth rate of the U.S. economy has been cut in half — from more than 3.0% per annum to less than 1.3% during the eight years. Measured in dollar totals, the sum of equity and debt outstanding in the U.S. in 1987 was $11trillion. Today it exceeds $93 trillion! But that's also why they are heading for a humungous fall. As the post-bubble epoch of global recession and financial deflation and liquidation unfolds, the $93 trillion U.S. financial bubble shown below will contract sharply. So will its equivalent worldwide total of $300 trillion.

So we are looking at tens of trillions of financial asset shrinkage in the years ahead. And nowhere will that implosion be more dramatic than in the ETF sector. The number of these entities has grown from about 600 to 5,000 in the last 12 years, and assets under management (AUM) has exploded from $450 billion to $3 trillion. That's a 21% compound rate of growth since 2005. Even more significantly, almost all of that growth occurred after the 2008 financial crisis. Prior to Greenspan's dotcom bubble, ETFs did not even exist, and they would never thrive on an honest free market. That's because their fundamental appeal is to professional speculators and traders and to homegamers who like to bet the financial ponies. By contrast, there is no reason why real long-term investors would want to own a huge, assorted basket of banking stocks or energy stocks. Or the likes of what's in the biotech ETF portfolio. The latter (IBB) includes 150 different stocks, including nearly 100 start-ups whose science is extremely difficult to assess. Their profit and loss statements (P&Ls) are also largely non-existent. The sole purpose of the IBB was to enable speculators to pile on to the momentum trade in biotech stocks, which began about 2012. This momentum trend was then turbo-charged by the inflow of speculative capital into this sector through IBB and other ETF's. The same thing happened with the energy ETFs. One of the major ETF baskets in this sector is called XLE and it includes 40 energy companies. These range from giant integrated producers like Exxon to refiners like Valero, to oilfield services companies like Halliburton, to small E&P companies like Newfield Exploration. The iShares equivalent is called IXC and it is even more diversified, with 96 companies spread among an even greater diversity of sizes, specializations and geographies. No long-term investor would possibly believe that such a hodgepodge of industries can be rationally analyzed at the company specific level. After all, the whole point of competitive markets is to sort out the winners, losers at the sector, industry and sub-industry level. So buying the entire industry in a single stock amounts to embracing self-cancelling financial noise. That undoes all the hard work Mr. Market performs at the operating performance level. Exchange traded funds, at bottom, are products of the financial casinos, not the free market.They offer traders and speculators the chance to "bet on black" for just hours, days or weeks at a time, based on little more than headlines and momentum. Not surprisingly, the XLE has now completed a round trip to nowhere during the last five years as the oil bubble re-erupted and then collapsed. The massive amount of trading that occurred continuously up and down along this trip to nowhere was economically pointless. It was a playpen for speculators and robo-machines. It didn't allocate capital efficiently or add market liquidity to the real enterprise of American capitalism. The implication is straightforward. The ETF boom functioned as a market accelerator on the way up. Speculative capital poured into these proliferating funds, and then was transformed by Wall Street market makers into demand for the thousands of individual stocks that comprise them. This magnifying effect is important to understand because it highlights the artificiality and instability of today's stock markets. Every time an ETF started trading above the net asset value of the underlying stocks due to speculator buying, fund providers issued new ETF shares to market makers. These market makers, in turn, bought up a basket of shares on the stock exchanges representing the asset mix of the fund. They then swapped them for the ETF shares. I call this the Big Fat Bid that helped undermine the two-way market forces that ordinarily keep speculation in check. But now that the worldwide financial bubble is set to crack, I believe the dynamic will begin playing out in reverse. That is, ETFs will now become the Big Fat Offer that takes the market down at an accelerating pace. The reason is straightforward. The $3 trillion world of ETFs is not an investor marketplace. It is a casino where the fast money moves in and out of short term rips, bubbles and flavors of the moment; and also a dangerous place where naïve retail investors have been lured to roll the dice on their home trading stations. So as the global economy and financial markets slide into the long, deflationary cycle ahead, the hot money will flee sinking ETFs at an accelerating pace. Homegamers will be shocked to find that they have been fleeced by Wall Street yet again. Retail level panic will ensue, causing a thundering implosion of the ETF sector. What lies ahead for retail investors is probably worse. That's because ETFs inherently embody a liquidity mismatch. Almost invariably the underlying stocks are not as liquid as the ETF shares which represent them. This means that retail investors may be faced with painful episodes in which ETF shares gap down violently to deep discounts relative to their net asset value. Accordingly, if shareholders have attempted to protect their portfolios with stop orders, they may be handed sharp losses. Or they may just panic and sell. The market plunge on August 26th last year provided a foretaste. In today's markets, "trading halts" occur when a stock moves up or down too quickly relative to the trading range contained in market circuit breakers. Ordinarily, about 40 such trading halts occur each day, but during the August 26th plunge there were almost 1,300 such occurrences. And 78% involved ETFs, not individual stocks. This is crucial because ordinarily only one-third of trading halts involved ETF shares. Stated in round numbers, there are ordinarily about 15 ETF trading halts per day, but on August 26th that number soared to 1,000. Moreover, during this trial panic, the risk of large pricing gaps was painfully evident. The Vanguard consumer staples ETF called VDC, for example, plunged 32% that day while the underlying holdings of the fund dropped by only 9%. Retail investors who panicked or who were sold out by stop loss orders were taken to the cleaners by the market makers. The point here is not a plea for SEC regulation. Far from it! Instead, the implication is that after a few more such episodes during this unfolding bear market — which must inexorably happen due to the liquidity mismatch — retail investors will become thoroughly disgusted with ETFs. They will then head for the hills right behind the fast money on Wall Street. ETFs are one of the many FEDs (financially explosive devices) that have been fostered by our rogue central bankers. Wait until $700 trillion of financial derivatives start living up to the name Warren Buffett gave them before he went all in using them ("financial WMDs"). The day of reckoning draws ever closer. Regards, David Stockman Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away.

The post The 3-letter Time Bomb in Your Portfolio appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rush Limbaugh : Hillary Clinton Is "FULL OF CRAP!" Posted: 11 Aug 2016 11:48 AM PDT Rush Hudson Limbaugh III is an American entertainer, radio talk show host, writer, and conservative political commentator. Since he was 16, Limbaugh has worked a series of disc jockey jobs. Wikipedia The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bix Weir Economic Collapse in Aug Sept Posted: 11 Aug 2016 11:03 AM PDT IN THIS INTERVIEW: - Will America unify behind one presidential ticket? ►0:54 - Collapse coming in August, September time-frame ►2:30 - There is no chance of unifying the country ►4:39 - Why is the economy so fragile right now? ►6:03 - Gold and silver market rigging ►8:24 - Will gold and silver... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| More Proof: US Economy Terminal Decline Is Accelerating. By Gregory Mannarino Posted: 11 Aug 2016 09:07 AM PDT By OVERWHELMING demand, for just the next 48 hours I am making The Evolution System available again. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

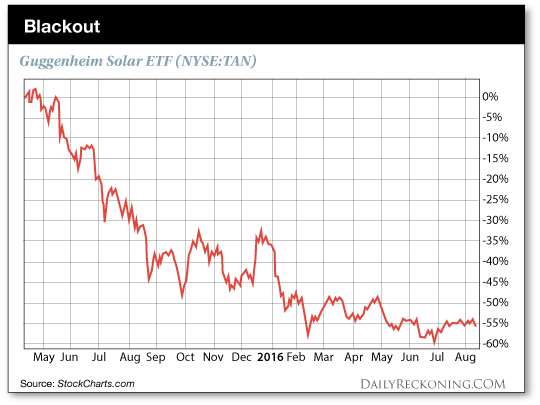

| Solar Slammed! Here’s What Happens Next… Posted: 11 Aug 2016 08:43 AM PDT This post Solar Slammed! Here's What Happens Next… appeared first on Daily Reckoning. The stock market is hitting for the cycle. Instead of singles, doubles, and triples, investors are knocking a different sector out of the park almost every single trading day. That's bullish, by the way. What we're seeing is a market of stocks emerging. Instead of every sector marching lockstep up and down in an endless chop, we're seeing genuine breakouts pop up left and right. We bid a fond farewell to the utilities safety trade just two weeks ago. The Utilities Select Sector SPDR (NYSE:XLU) rolled over, while big breakouts in small-caps and other riskier assets started to stick. Biotechs broke out one day. Chinese ADRs took the baton next. Even third-rate social media stocks got in on the action. But with a market of stocks environment, we also have to deal with some losers. It comes with the territory. Today, we have to jettison some of these anchors from our portfolio before they drag us deeper into the abyss. I'm talking about solar stocks. Solar has been the biggest gut-punch of the rally. While almost every other industry has enjoyed at least a couple of days in the sun, the skies have turned black for solar stocks. After topping out 15 months ago, the Guggenheim Solar ETF (NYSE:TAN) has remained trapped in a nasty downtrend. Since mid-2015, this solar ETF has lost more than half its value…

Back in the winter, the solar industry had to deal with the sudden bankruptcy of hedge-fund favorite SunEdison. This week, another meltdown is sending shockwaves through every solar stock on the market… "SunPower Corp. dropped a 'guidance bomb' that's dragging down shares of solar manufacturers," Bloomberg reports. "The second-largest U.S. panel producer told analysts Tuesday night that it expects to lose as much as $175 million this year, a shift from May when it expected to earn as much as $50 million. The shares plunged the most in more than seven years." SunPower Corp. (NASDAQ:SPWR) was at the very top of our solar comeback list. The stock appeared to have bottomed out after a final gut-wrenching move that dropped shares below $14 from their April highs of $22. Some bullish action in July pushed shares above their May lows, sparking a small breakout that we were prepared to ride to double-digit gains. That's when the "guidance bomb" hit… SunPower's flop kills any hope that a solar rally will appear anytime soon. The stock nose-dived more than 30% yesterday. But the SUNE bankruptcy and SunPower's collapse have taken their toll on the industry. This week's action has crushed any progress made at putting in a bottom over the past month. It's no fun getting punched in the face by a trade gone sour. But we have to take what the market gives us. It's worth repeating that we haven't witnessed a trading environment this constructive in more than a year—and we'll be sure to continue to take advantage of all the setups we can get our hands on. Better days (and bigger gains) are on the way… Greg Guenthner P.S. We're seeing genuine breakouts pop up left and right. –sign up for my Rude Awakening e-letter, for FREE, right here. Don't miss one breakout move. Click here now to sign up for FREE. The post Solar Slammed! Here's What Happens Next… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

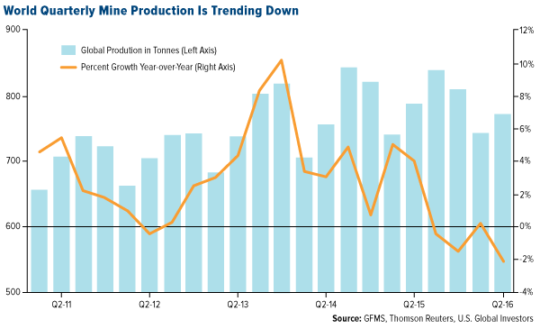

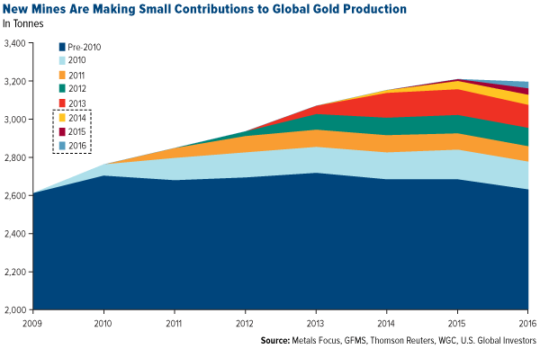

| Posted: 11 Aug 2016 08:00 AM PDT This post The Last Known Gold Deposit appeared first on Daily Reckoning. Gold is one of the rarest elements in the world, making up roughly 0.003 parts per million of the earth's crust. (For some perspective, one part per million, when converted into time, is equivalent to one minute in two years. Gold is even rarer than that.) If we took all the gold ever mined—all 186,000 tonnes, from the bullion at Fort Knox to India's bridal jewelry to King Tut's burial mask—and melted it down to a 20.5 meter-sided cube, it would fit snugly within the confines of an Olympic-size swimming pool. The yellow metal's rarity, of course, is one of the main reasons why it's so highly valued across the globe and, for most of recorded history, recognized and used as currency. Unlike fiat money, of which we can always print more, there's only so much recoverable gold in the world. And despite the best efforts of alchemists, we can't recreate its unique chemistry in a lab. The only way for us to acquire more is to dig. But for how much longer? Goldman Sachs analyst Eugene King took a stab at answering this question last year, estimating we have only "20 years of known mineable reserves of gold." The operative word here is "known." If King's projection turns out to be accurate, and the last "known" gold nugget is exhumed from the earth in 2035, that won't necessarily spell the end of gold mining. Exploration will surely continue as it always has—though at a much higher cost. (In fact, our insatiable pursuit of gold might one day soon take us to space, as President Barack Obama signed legislation in November that permits commercial mineral extraction on asteroids and the moon. Many near-Earth asteroids are said to contain trillions of dollars' worth of precious metals and other minerals. But that's a discussion for another time.) We'll probably see a surge in mergers and acquisitions, as I told Kitco News' Daniela Cambone last week. I think that as long as they have reliable output, mid-cap companies could be gobbled up by the Barricks and Newmonts of the world. Another consequence of recovering the last known nugget? The gold price could spike dramatically to levels only imagined. My colleague Jim Rickards, in his book "The New Case for Gold," puts it at $10,000 an ounce. GoldMoney founder James Turk says it's closer to $12,000. There's really no way of knowing how high gold could go. Did Gold Production Peak in 2015?What we do know is that global gold output has been contracting since 2013. Last year might have been the tipping point, however, in line with Goldcorp CEO Chuck Jeannes' prediction that peak gold was within spitting distance. "There are just not that many new mines being found and developed," he told the Wall Street Journal in 2014, adding that this was "very positive" for the gold price going forward. This year, second-quarter mine supply was 2 percent less than the same period in 2015, according to preliminary estimates made by Thomson Reuters GFMS. Some analysts now expect global production to fall 3 percent in 2016, after seven straight years of growth.

What's more, few new projects and expansions are expected to come online this year, writes Thomson Reuters, "and those in the near-term pipeline are generally fairly modest in scale, hence our view that global mine supply is set to begin a multiyear downtrend in 2016." Indeed, if we look at projects that opened in just the last two or three years, we see that they're of lower grade, meaning they don't produce nearly as much as older, easy-to-mine gold deposits.

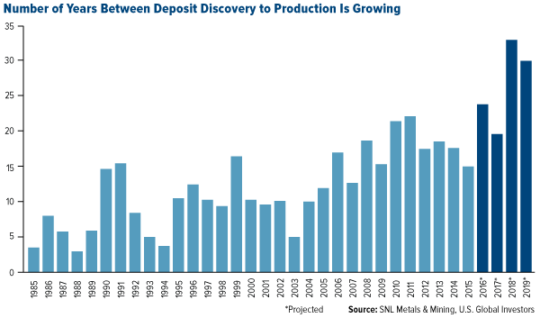

The truth of the matter is, when it comes to discovering new gold deposits, the low-hanging fruit has likely already been picked. Gone are the days when someone could stumble upon an exposed hunk of gold at the bottom of a riverbed, as James Marshall did in 1848, setting off the California Gold Rush. Every year, the pursuit of gold becomes increasingly more challenging—not to mention more expensive—requiring ever more sophisticated tools and technology, including 3D seismic imaging, direction drilling and airborne gravimetry. (A satisfactory "gold fracking" method, however, seems unlikely to become reality any time soon.) Compounding the issue is the fact that the number of years between discovery of a new major deposit and production is widening, due to the increase in feasibility assessments, compliance, licenses and more—and that's all before nugget one can be extracted. The average lead time for gold mines worldwide is close to 20 years, though it can sometimes be more, depending on the jurisdiction. This highlights the need for worldwide policy reform to remove many of the barriers that obstruct responsible mining.

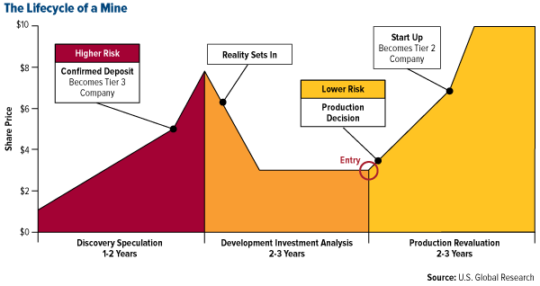

In The Goldwatcher, the book I co-wrote with John Katz, I expressed the importance of knowing which developmental stage of a mine's lifecycle a project currently falls into, as this has a strong influence on stock performance. Investing, like life, is all about managing expectations.

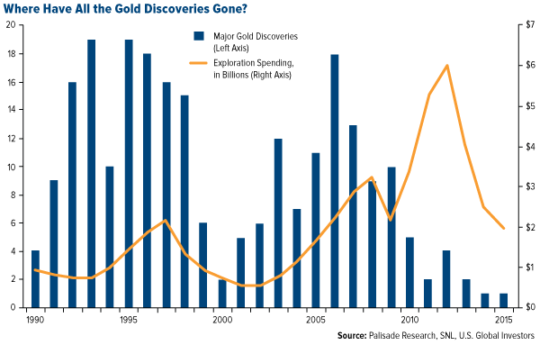

Few New Mines as Companies DeleverageWhat all of this means is we'll probably continue to see fewer and fewer major discoveries, or those that yield more than a million ounces. As you can see below, new gold discoveries peaked in 1995. Exploration spending peaked nearly 20 years later when the price per ounce averaged $1,600.

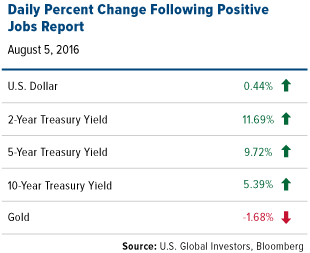

With gold now trading above $1,340 an ounce, up 26 percent for the year, many investors expect producers to begin lifting spending on exploration and production (or dividends). Instead, most companies are in cost-cutting mode, using this opportunity to pay down debt and liquidate assets. According to Reuters, North American gold producers have managed to lower their debt levels 30 percent since late 2014. Speaking to Mining.com, Newmont Mining CEO Gary Goldberg said his company, the second-largest gold producer in the world, is one of the few that's currently building new mines—specifically the Merian project in Suriname and Long Canyon in Nevada. Because of the lack of new mines being built, he sees supply falling 7 percent between now and 2021. Demand for the yellow metal, on the other hand, should remain strong during this period, helping to support prices even more. Massive Inflows into Gold FundsIn the meantime, gold continues to find support from global monetary policy and low to negative government bond yields. Last week the Bank of England cut rates as part of a stimulus package, which both weakened the British pound 1.5 percent and gave the yellow metal a jolt. These gains were erased, however, following Friday's better-than-expected U.S. jobs report, which sparked a rally in Treasuries. This contributes to the narrative that gold and government debt are inversely related, a key component of the Fear Trade.

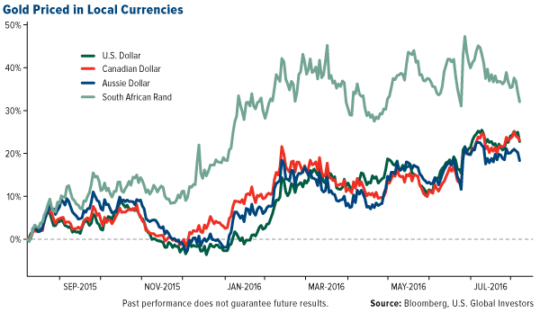

When priced in the local currencies of the U.S., Canada, South Africa or Australia—four of the largest gold-producing countries—bullion is up, which has boosted miners' profits. Gold stocks, as measured by the NYSE Arca Gold Miners Index, have appreciated 128.92 percent in the last 12 months.

For the first half of 2016, inflows into commodities have been the strongest since 2009. Gold and other precious metals account for about 60 percent of the new money, which has pushed commodity assets under management above $235 billion. Barclays believes 2016 could be the best year on record for gold-related ETFs and other funds, with many big-name hedge fund managers, from Stan Druckenmiller to Paul Singer to Bill Gross, singing the praises of the yellow metal. Regards, Frank Holmes P.S. This article was originally posted at U.S. Global Investors. To view the full article, click here. The post The Last Known Gold Deposit appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment surpasses jewelry as source of most demand for gold Posted: 11 Aug 2016 04:39 AM PDT By Catherine Boyle Investors' rabid appetite for gold is showing no signs of abating, as figures from the World Gold Council show record investment in the first half of 2016. The trend for exchange-traded funds to pile in to the precious metal, a classic safe haven amid uncertainty in the global economy and the search for yield, sent the price of gold soaring by 25 percent in the first half of the year, the biggest price rise since 1980. For the first time ever, investment, rather than jewelry, was the largest component of gold demand for two consecutive quarters. Demand by investors set a record of 1,064 tons during the first six months of 2016. For comparison, this was 16 percent higher than in the first half of 2009, when the financial crisis raged. ... ... For the remainder of the report: http://www.cnbc.com/2016/08/11/gold-bug-youre-not-alone-as-gold-demand-s... ADVERTISEMENT Gold Standard Intersects 126.2 Meters of 3.95gpt Gold Company Announcement VANCOUVER, British Columbia, Canada -- Gold Standard Ventures Corp. (TSXV: GSV; NYSE MKT:GSV) today announced assay results from the first three step-out core holes at the recently discovered North Dark Star oxide gold deposit on its fully owned and controlled Railroad-Pinion Project in Nevada's Carlin Trend. The results significantly increase the size of the North Dark Star deposit while also enhancing its prospective grade and establishing the orientation of a favorable trend supporting the potential for further expansion of the higher-grade zone. The primary objective of this year's drill program at North Dark Star was to find a continuation of the high-grade zone discovered in core hole DS15-13 (15.4 meters of 1.85 grams of gold per tonne and 97 meters of 1.61 grams per tonne) at the end of last year's drill program. Hole DS16-08 located 100 meters south of DS15-13 returned multiple, significant, oxidized intercepts containing gold values above the cutoff grade established in the Dark Star NI43-101 resource estimate announced on March 3, 2015. Hole DS16-08 returned a 126.2-meter section grading 3.95 grams per tonne including higher-grade intervals of 44 meters of 4.70 grames per tonne, 17.9 meters of 5.6 grams per tonne, and 7.9 meters of 10.7 grames per tonne. To see section maps and the drill plan: http://goldstandardv.com/lp/north-dark-star-drill-results ... For the complete announcement: http://goldstandardv.com/gold-standard-intersects-126-2m-of-3-95-g-aut-a... Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Benn Steil: Adopt a gold-backed dollar? This is what happened the last time we tried Posted: 11 Aug 2016 04:30 AM PDT By Benn Steil "The dollar and gold are synonymous," Harry Dexter White, the architect of the Bretton Woods international monetary system, told Congress in 1945. "There is no likelihood that ... the United States will, at any time, be faced with the difficulty of buying and selling gold at a fixed price freely." Under the Bretton Woods system, currencies were tied to the U.S. dollar at a fixed rate, and the dollar was in turn tied to gold GCZ6, -0.04% at $35 an ounce. Today there is much nostalgia about Bretton Woods -- a belief that the quarter-century from 1946 to Aug. 15, 1971 (when the system collapsed) was a golden era of monetary stability. But the reality was very different. ... Dispatch continues below ... ADVERTISEMENT Gold Standard Intersects 126.2 Meters of 3.95gpt Gold Company Announcement VANCOUVER, British Columbia, Canada -- Gold Standard Ventures Corp. (TSXV: GSV; NYSE MKT:GSV) today announced assay results from the first three step-out core holes at the recently discovered North Dark Star oxide gold deposit on its fully owned and controlled Railroad-Pinion Project in Nevada's Carlin Trend. The results significantly increase the size of the North Dark Star deposit while also enhancing its prospective grade and establishing the orientation of a favorable trend supporting the potential for further expansion of the higher-grade zone. The primary objective of this year's drill program at North Dark Star was to find a continuation of the high-grade zone discovered in core hole DS15-13 (15.4 meters of 1.85 grams of gold per tonne and 97 meters of 1.61 grams per tonne) at the end of last year's drill program. Hole DS16-08 located 100 meters south of DS15-13 returned multiple, significant, oxidized intercepts containing gold values above the cutoff grade established in the Dark Star NI43-101 resource estimate announced on March 3, 2015. Hole DS16-08 returned a 126.2-meter section grading 3.95 grams per tonne including higher-grade intervals of 44 meters of 4.70 grames per tonne, 17.9 meters of 5.6 grams per tonne, and 7.9 meters of 10.7 grames per tonne. To see section maps and the drill plan: http://goldstandardv.com/lp/north-dark-star-drill-results ... For the complete announcement: http://goldstandardv.com/gold-standard-intersects-126-2m-of-3-95-g-aut-a... Although the International Monetary Fund was inaugurated in 1946, the first nine European countries to meet the requirements of its Article VIII -- that their currencies be freely convertible into dollars at a fixed rate -- didn't do so until 1961. And by then, the system was already coming under enormous strain, as the U.S. -- contrary to White's assurances -- was losing gold reserves. The fundamental problem was that the United States couldn't simultaneously keep the world adequately supplied with dollars and sustain the large gold reserves required by its gold-convertibility commitment. The logic was laid bare by economist Robert Triffin in his now-famous 1960 congressional testimony. There were, he explained, "absurdities associated with the use of national currencies as international reserves." It constituted a "'built-in destabilizer' in the world monetary system." The European dollar-convertibility pledges, far from representing the final critical step into a new monetary era, "merely return[ed] the world to the unorganized and nationalistic gold exchange standard of the late 1920s." ... ... For the remainder of the commentary: http://www.marketwatch.com/story/bring-back-the-gold-standard-this-is-wh... Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold 2.0: How to Profit from the Current Gold Bull Market Posted: 11 Aug 2016 01:00 AM PDT After five years of a brutal bear market, gold and gold miners are finally having a huge rebound, and investor Chen Lin, writer of the popular newsletter What is Chen Buying? What is Chen Selling?, sees the parallels to 2009. He highlights nearly a dozen mining companies that have weathered the downturn and are in position to ride the wave higher. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Smashed Silver Snaps Back into Ferocious Bull Market Posted: 10 Aug 2016 07:58 AM PDT The silver bull is back. After five long, frustrating years of price smashes followed by one failed rally attempt after another, silver prices have decisively broken out to the upside. The question facing precious metals investors now is: How sustainable is the uptrend? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Suggests That Silver Will Soon Spike Significantly Higher Posted: 10 Aug 2016 07:50 AM PDT The silver price and the US Dollar/South African Rand exchange rate (USD/ZAR) have a very interesting relationship that goes back a long way. Basically, in the long run, the two move in opposite directions. When the USD/ZAR rate is moving up, then the silver price is moving down, and vice versa. Furthermore, when the USS/ZAR rate is making a top, then a bottom in silver is normally very close (before or after the USD/ZAR peak). |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Gold investment demand surged to a record in the first half of 2016 and overtook the previous high seen during the 2009 financial crisis on a "perfect storm" for gold according to the 'Gold Demand Trends Q2 2016' report which was released by the World Gold Council today.

Gold investment demand surged to a record in the first half of 2016 and overtook the previous high seen during the 2009 financial crisis on a "perfect storm" for gold according to the 'Gold Demand Trends Q2 2016' report which was released by the World Gold Council today. When things risk going wrong, cash is king… and kings have cash.

When things risk going wrong, cash is king… and kings have cash. Last week, "Admiral Sprott" was asked what the Precious Metal bull market was like in 2000-11. He replied that it was as painstaking as today, with the Cartel seemingly "winning" more days than it lost. Having been fully invested in the sector since mid-2002, I concur 100% – as even during the "best of times," it was sheer torture. Of course, until 2008, my portfolio was entirely comprised of highly volatile mining shares – largely, exploration and/or development companies – so the stresses of Cartel-created volatility were that much more powerful.

Last week, "Admiral Sprott" was asked what the Precious Metal bull market was like in 2000-11. He replied that it was as painstaking as today, with the Cartel seemingly "winning" more days than it lost. Having been fully invested in the sector since mid-2002, I concur 100% – as even during the "best of times," it was sheer torture. Of course, until 2008, my portfolio was entirely comprised of highly volatile mining shares – largely, exploration and/or development companies – so the stresses of Cartel-created volatility were that much more powerful.

No comments:

Post a Comment