saveyourassetsfirst3 |

- This Development Suggests Gold and Silver Prices Are Going to Plow Higher – James Turk

- Silver Bull Faces Correction

- Stage is Set for a WILD AUGUST! – Harvey Organ

- Gold Demand Remains Stable During Sector Weakness

- Gold Demand Remains Stable During Sector Weakness

- A Timeline For The Next Rally In Gold Prices

- Breaking News And Best Of The Web

- The Gold Wars

- Alasdair Macleod’s Market Report: Game On For the Bulls?

- The US Dollar's Impact on Gold and Silver

- Video: Gold & Gold Stocks Starting Correction…?

| This Development Suggests Gold and Silver Prices Are Going to Plow Higher – James Turk Posted: 24 Jul 2016 12:00 PM PDT Long term, We’ve had major developments this year. To me, the most significant one is that the 5 year down trend in silver has been broken to the upside. It suggests that precious metals are going to PLOW higher into the end of the year… Numbered Rim, Only 2,500 Minted! From Craig Hemke, TFMetals Report: Among […] The post This Development Suggests Gold and Silver Prices Are Going to Plow Higher – James Turk appeared first on Silver Doctors. |

| Posted: 24 Jul 2016 09:00 AM PDT Silver's young bull market got off to a typically-slow start, lagging gold's own new bull. But recently the white metal surged to catch up in a record summer rally. That left silver very overbought and facing near-term correction risks led by a record futures selling overhang and weak late-summer seasonals. But this strengthening bull still […] The post Silver Bull Faces Correction appeared first on Silver Doctors. |

| Stage is Set for a WILD AUGUST! – Harvey Organ Posted: 24 Jul 2016 08:09 AM PDT HUGE INCREASE IN AMOUNT OF GOLD STANDING AT THE COMEX FOR JULY AT 20 TONNES: SETS THE STAGE FOR A WILD AUGUST! OPEN INTEREST RISES TO A RECORD 221,246 FOR THE ENTIRE COMPLEX/COT VERY BULLISH FOR GOLD AS COMMERCIALS TRY AND REIN IN THEIR SHORTS/IN SILVER COT, COMMERCIALS ARE TRAPPED!/BRITISH POUND PUMMELED AS PMI […] The post Stage is Set for a WILD AUGUST! – Harvey Organ appeared first on Silver Doctors. |

| Gold Demand Remains Stable During Sector Weakness Posted: 24 Jul 2016 07:11 AM PDT The Daily Gold |

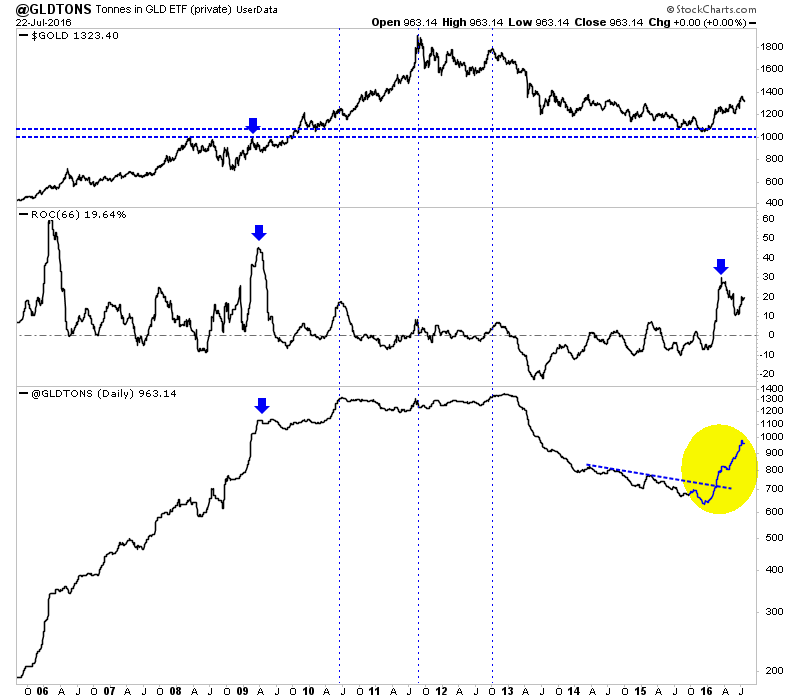

| Gold Demand Remains Stable During Sector Weakness Posted: 23 Jul 2016 11:15 PM PDT My favorite indicator for real time Gold demand is the amount of Gold in the GLD and its fluctuations over time. As we wrote in our book, the driving force for Gold is investment demand which is driven by changes in real interest rates. Western-based investment demand from big money (i.e Stan Druckenmiller and George Soros) shows up mostly in the ETFs and specifically, GLD. The amount of Gold in GLD has risen steadily even as Gold consolidated a few months back and has been stable in recent weeks even as Gold and gold stocks correct their Brexit breakouts. The chart below includes the price of Gold, the amount of Gold in GLD (bottom) and the rolling quarterly change in the amount of Gold in GLD. Even as Gold consolidated for several months in the spring, the amount of Gold in GLD increased. Over the past few weeks Gold has retreated by $65/oz yet the GLD has only lost 2% of its Gold. Moreover, note that the recent demand surge (quarterly change) is the second strongest of the past 10 years.

Tonnes in GLD Trust

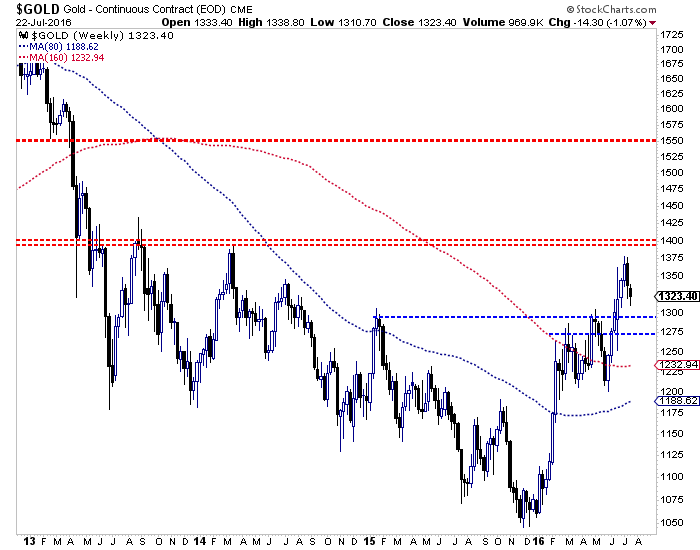

Note how strong demand for Gold was from 2006 to the middle of 2010. Even though Gold corrected 30% during the financial crisis, GLD only experienced minor outflows of Gold. After Gold bottomed in October 2008, demand exploded. Interestingly, demand peaked in the middle of 2010 and went sideways for a few years before succumbing to the bear market. That lack of strong demand in 2011 while Gold surged, in hindsight was a warning sign. In short, this data (amount of Gold in GLD) can be somewhat of a leading indicator for the sector. It has been in the past and it has worked well so far this year. Unless we see huge outflows from the GLD then there isn't much reason to be concerned with the current correction in Gold and gold stocks. Turning to the technicals, we find that Gold appears headed for a test of support at $1275 to $1300. That would be a retest of the area from which Gold exploded in the wake of Brexit. It also marks previous resistance. Gold's primary trend remains bullish as it holds comfortably above key long-term moving averages shown in the chart (which are equivalent to the 20-month and 40-month moving averages).

Gold Weekly Candle Chart

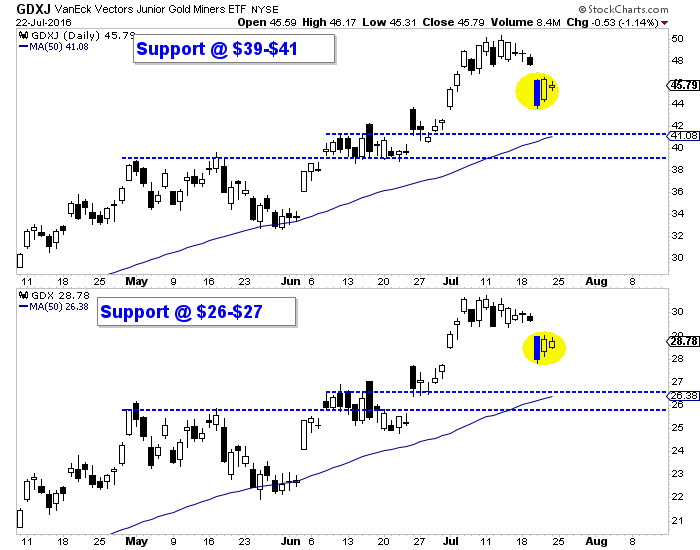

Like Gold, the gold miners and junior gold stocks could be retesting their Brexit breakout. The stocks may be forming a bear flag (yellow) which would lead to another move lower. If that plays out then look for a test of the support points shown, including the 50-day moving averages.

GDX, GDXJ

While Gold and gold shares are correcting now, the real time data coming from GLD suggests Gold demand is and should remain firm. Traders and investors are advised to monitor flows in and out of GLD in order to keep tabs on real time investment demand for Gold. This is one of the many things we monitor to stay in tune with market trends. The short-term trend is down and further weakness would bring about a good buying opportunity in select companies. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA Jordan@TheDailyGold.com

|

| A Timeline For The Next Rally In Gold Prices Posted: 23 Jul 2016 09:01 PM PDT Look at the gold price action while “deliveries” were taking place this year. During the calendar months of February, April and June, the gold price has soared anywhere from 7% to 12%! Could August be setting up for a similar move? Submitted by Craig Hemke, TFMetals: We’ve been watching for two weeks as prices […] The post A Timeline For The Next Rally In Gold Prices appeared first on Silver Doctors. |

| Breaking News And Best Of The Web Posted: 23 Jul 2016 06:44 PM PDT The cycle of central planning and civil unrest. Central banks making big promises, which traders seem to like. S&P 500 near all-time high. Britain’s economy is shrinking, China’s debt is soaring. Gold corrects; several analysts see a top here. Oil falls for the week. Another terrorist attack, this time at a German shopping mall. Trump […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Posted: 23 Jul 2016 04:00 PM PDT Gary North |

| Alasdair Macleod’s Market Report: Game On For the Bulls? Posted: 23 Jul 2016 03:00 PM PDT The consolidation of June's price rises for gold and silver continues. Predictably, technical analysts are now talking prices down. This is a bold call, but it could be "Game On" for the bulls… Lowest Priced US Mint Silver Eagles From Alasdair Macleod, GoldMoney: The consolidation of June's price rises for gold and silver continues. Predictably, technical […] The post Alasdair Macleod’s Market Report: Game On For the Bulls? appeared first on Silver Doctors. |

| The US Dollar's Impact on Gold and Silver Posted: 23 Jul 2016 01:00 AM PDT |

| Video: Gold & Gold Stocks Starting Correction…? Posted: 12 Jul 2016 05:53 PM PDT Are gold and gold stocks starting a correction? We discuss that probability and highlight support targets in Gold, GDX and GDXJ.

|

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment