Gold World News Flash |

- Pound languishes below $1.30 amid warnings it could hit 'parity with dollar' if post-Brexit political turmoil is not resolved

- Pound languishes below $1.30 amid warnings it could hit 'parity with dollar' if post-Brexit political turmoil is not resolved

- Revelation: Secret Government Warehouses Stockpiling $7 Billion Worth of Medical Supplies

- “Italian Government Collapse More Than Just A Possibility”

- A Furious Italian Prime Minister Slams Deutsche Bank As Europe's Most Insolvent Bank

- Gold Continues to Move Higher : Stunning GLD Demand

- Globalists Are Now Openly Demanding New World Order Centralization

- #Brexit - Project FEAR aka Project FAIL compilation

- Gold Price Closed at $1364.90 Up $8.50 or 0.63%

- Sins Of The World - July 2016 (Part 1) Strange End Times Signs

- CON GAME COLLAPSING, SILVER SOARING

- Economic Collapse 2016 -- EU Banks Are In Trouble, Central Bankers Are Blaming The BREXIT As The Catalyst

- Koos Jansen: Chinese gold demand 973 tonnes in first half of 2016

- BREAKING: Ukraine Prepares NATO Into War With Russia?

- “It’s Starting to Feel Like 2008”

- China's Silk Road said to consider offer for $2 billion Glencore mine

- TF Metals Report: The deepening fraud of Comex silver

- Gold Daily and Silver Weekly Charts - PMs Looking Good With Peak Bonds and Dodgy Stocks

- Gold Heading Toward $1,400 As Bull Run Commences

- Lord Rothschild Demands Britain Stay In Europe

- The New World Order - Fall of the Republic 2016 Freedom or Slavery

- Post Brexit -- Niger Farage Press Conference at the EU parliament

- Hillary Beats the Rap!

- Ghosts of 2008: 3 Charts to Watch as World Markets Crumble

- CLINTON & THE LAWLESS OLIGARCHY

- Forget Brexit -- China's currency is falling again

- UBS States; “Gold Has Entered a New Phase “

- Why This Money Manager Is Going Long on Gold Equities

- Gold Heading Toward $1,400 As Bull Run Commences

- Breaking News And Best Of The Web

- Chinese Day Traders Fuel Rally in Silver Says Saxo Bank

| Posted: 07 Jul 2016 02:04 AM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Jul 2016 01:48 AM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revelation: Secret Government Warehouses Stockpiling $7 Billion Worth of Medical Supplies Posted: 06 Jul 2016 09:30 PM PDT by David Gutierrez, Natural News:

The Centers for Disease Control and Prevention (CDC) maintains six warehouses stockpiled billions of dollars worth of medical supplies to be used to respond to any national medical emergency, including a flu pandemic or terrorist attack. Both the contents and locations of the warehouses are kept secret by law. “If everybody knows exactly what we have, then you know exactly what you can do to us that we can’t fix,” said Greg Burel, who directs the program, known as the Strategic National Stockpile. The Strategic National Stockpile was launched in 1999, with a $50 million budget. The value of the stockpile now exceeds $7 billion. Enormously expensive projectThe warehouses are enormous; Burel describes them as two Super Walmarts side-by-side, without the drop ceiling. Nell Greenfieldboyce of National Public Radio, who recently became the first reporter allowed to visit one of the warehouses, said that “shelves packed with stuff stand so tall that looking up makes me dizzy.” Although the specific contents of the stockpile are classified, the CDC says that, in general terms, the stockpiles contain millions of vaccine doses (for both pandemic and bioterrorist events), radiation treatments, antidotes to chemical weapons, and standard medical supplies such as antibiotics, IV fluid and wound care supplies. Greenfieldboyce writes of an entire caged, locked section of the warehouse that she was told contain addictive painkillers, and a giant freezer for the storage of more perishable drugs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| “Italian Government Collapse More Than Just A Possibility” Posted: 06 Jul 2016 08:54 PM PDT Submitted by Mish Shedlock of MishTalk

Four new polls show comedian Beppe Grillo’s Five Star Movement (M5S) ahead of prime minister Matteo Renzi’s Democratic Party (PD) were an election held today. The next election will be no later than May 23, 2018. Renzi promised to step down if he fails a constitutional reform referendum later this year. The reform referendum will likely be held no later than this October.

Beppe Grillo – Comedian Founder of Five Star Movement Renzi Rocked Yet Again Please consider Renzi Rocked as Five Star Surges in Polls.

Credibility of the Italian Political Class at Stake. Renzi asked voters to stick with him and promised an aggressive campaign in favor of the referendum. His rationale is laughable: “The referendum is not crucial for the destiny of an individual, but for the future credibility of the Italian political class,” said Renzi. Are voters really supposed to rally around the notion of saving the credibility of the ruling political class? Wow! The statement is so ridiculous one has to wonder if Renzi secretly wants the referendum defeated. 40% the New Majority The referendum would shrink the Italian senate and give a majority of parliament to any political party that could achieve 40% of the vote in national elections. If no party achieved 40%, a runoff would take place and the winner would automatically receive a majority of parliament. Curiously, M5S is against this reform although it may the best way for Grillo to get the vote he seeks on leaving the Euro. Renzi Stung in Mayoral Elections In recent mayoral elections Renzi’s party went down in defeat in in Rome, Turin, Naples and Trieste. Rome and Turin went to the Five Star Movement. For mayoral details and details of the constitutional referendum, please see Stinging Defeat of Renzi in Italian Mayoral Elections; 40% the Proposed New Majority Italian Banking System Near Collapse Monte dei Paschi, the oldest bank in the world, and Italy’s third largest is so woefully undercapitalized that even the ECB recognizes that fact. On July 4, I commented the ECB Triggers Another Bank Shares Selloff, Tells Monte dei Paschi to Shed More Assets. German Chancellor Angela Merkel and the ECB are at odds with Renzi over how to fix €360 billion in nonperforming loans in the Italian banking system. Merkel rebuffed Renzi’s request for state sponsored bank bailouts on four occasions. On June 30, I asked Italy’s Zombie Banks on Death Bed, Bail-Ins Coming? Merkel chastised Renzi, “We wrote the rules for the credit system, we cannot change them every two years.” Under a bail-in scheme bondholders and depositors will take a huge hit. Voters are already angry over the bail-in of bondholder of much smaller Banca Etruria last December. In Italy, individual investors own close to €200 billion in Italian bank bonds. Imagine the anger should they lose even a portion of their investments. This is why Italy Threatens to Defy Merkel, Brussels Over bank Bailouts. Italy on the Euro What has the Euro done for Germany vs. Italy?

Voters Hold the Key Yesterday I asked Can the EU Survive as a Prison? Who Has the Keys? The short answer is voters hold the key, and they are already mad as hell. If bail-ins happen, it will be the end of the Renzi government for sure. Renzi Slams Deutsche Bank ZeroHedge has an excellent article out today on the state of Deutsche Bank through the eyes of Renzi. Please consider A Furious Italian Prime Minister Slams Deutsche Bank As Europe’s Most Insolvent Bank

Also see Diving Into Deutsche Bank’s “Passion to Perform” Balance Sheet. This kind of insanity is precisely why the euro is doomed. Get Out Now! I repeat my warning from last December: Get Your Money Out of Italian Banks Now! | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Furious Italian Prime Minister Slams Deutsche Bank As Europe's Most Insolvent Bank Posted: 06 Jul 2016 07:30 PM PDT Several years ago, we were the first to point out the true "elephant in the room", namely Deutsche Bank's $75 trillion in derivatives which as we said at the time was about 20 times bigger than Germany's GDP, and 5 times bigger than the entire economic output of the Eurozone."

This was largely ignored by the "experts" because why bring attention to something which is fundamentally a devastating break in the narrative that "Europe is fine" and the financial crisis is now contained. Fast forward to today when Europe is once again not fine, only this time one can't blame Europe's problems on Greece (instead the same "experts" are trying to blame everything in Brexit), when in a surprising admission of reality, none other than Italy's prime minister Matteo Renzi, "went there" and slammed Deutsche Bank as the true "derivative problem" facing Europe. To be sure, Renzi has his own problems, chief among which is how to pass a banking bail out of his insolvent banks without implementing the dreaded bail in mechanism unveiled in 2016 as the only permitted European bank resolution mechanism. Alas, in his push to bail out rather than bail in Italian banks, Renzi has faced stiff resistance from the Germans, namely Angela Merkel and Wolfgang Schauble who have both strongly opined against this kind of backtracking. Just today, Wolfgang Schaeuble, speaking at a news conference in Berlin (just hours after Italy hinted once again at an imminent bailout of Monte Paschi), said his Italian counterpart Pier Carlo Padoan told him that Italy intends to stick to the banking-union rules. Perhaps not. So it is not surprising that when faced with stiff resistance from the Germans, Renzi decided to call a spade a spade when, as Reuters reports, he said that the difficulties facing Italian banks over their bad loans are miniscule by comparison with the problems some European banks face over their derivatives. One look at the chart above and it becomes clear just who he was referring to. As Reuters adds, speaking at a joint news conference with Swedish Prime Minister Stefan Lofven, Renzi said other European banks had much bigger problems than their Italian counterparts. "If this non-performing loan problem is worth one, the question of derivatives at other banks, at big banks, is worth one hundred. This is the ratio: one to one hundred," Renzi said So just like that the Mutually Assured Destruction doctrine is activated, because now that Deutsche Bank's dirty laundry has been exposed for all to see, Renzi's gambit is clear: if Merkel does not relent on bailing out Italian banks, the collapse of Italian banks will assure the failure of Deutsche Bank in kind. And since in a fallout scenario of that magnitude DB's derivative would not net out, there will be no chance to save the German banking giant, bail out, in, or sideways. And now the ball is in Germany's court: to be sure, traders everywhere will be curious to see just how this diplomatic escalation in which the fingerpointing at insolvent banks is only just beginning concludes, and most of all, they will follow every word out of Merkel's mouth to see if the Chancellor will relent and give in to what is the first tacit case of financial - and factual - blackmail. Ironically, even the best possible outcome, namely another bailout of every insolvent European bank, will merely accelerate the same populist anger that catalyzed the Brexit-driven schism in the first place, and lead to even more anger at what will, inevitably, be yet another banker bailout until ultimately the war of words between the classes becomes all too literal. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

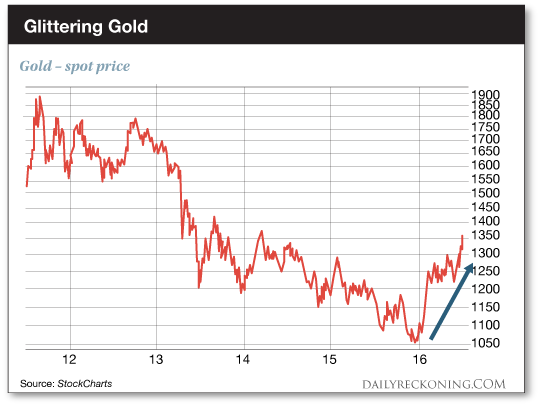

| Gold Continues to Move Higher : Stunning GLD Demand Posted: 06 Jul 2016 07:30 PM PDT from TraderDan:

Gold pushed up towards last week's high and in the process pushed through yet another overhead resistance level in the $1345-$1350 level. Based on what I can see from this chart, there appears to be little resistance in its path until closer to the $1385 level. Above that lies psychologically significant $1400. The real kicker for today however was the massive surge in reported GLD holdings. A whopping 28.8 tons of gold were reportedly added to GLD. I have not gone back to check my database but I suspect this might be very close to a record one day total or if not, a new record in itself. Gold holdings are now at 982.7 tons, the highest level since June 2013. This is absolutely phenomenal demand. In my view, this is all traceable to the collapse in interest rates. The yield curve is growing flatter and has broken into yet another new low. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Globalists Are Now Openly Demanding New World Order Centralization Posted: 06 Jul 2016 07:15 PM PDT Submitted by Brandon Smith via Alt-Market.com, I have said it many times in the past - when elitist criminals start openly admitting to their schemes it means that they are ready to pull the plug on the current system. They simply don’t care anymore who knows their plans because they think that victory is inevitable. There have been more subtle and less prominently published calls for a "new world order" in the past, to be sure. However, at no other time have I seen international financiers and their puppet political mouthpieces so brazen about calling for global centralization than in the wake of the successful Brexit referendum. It is as if the Brexit flipped a switch in the existing narrative and set loose a flood of new propaganda, all aimed at convincing the general public that central banks must combine forces and act as one institution in order to combat an economic crisis that isn’t even visible to laymen yet. Though I predicted the activation of this propaganda campaign in my article “Brexit: Global Trigger Event, Fake Out Or Something Else?,” published before the referendum vote took place, the speed at which it is developing is truly astonishing. Now, under the current circumstances of the previous week’s market rally post-Brexit (driven by hopes of central bank intervention and extremely low trading volume) one would think that the globalist calls for total centralization of financial policy management don't make much sense. Where is this “crisis” that the bankers keep warning about? As I outlined in great detail in recent articles, I believe the Brexit to be a partial trigger event for a future market disaster that has been engineered for many years. That is to say, a worldwide financial calamity has been deliberately staged in advance, and the Brexit is meant to act as a scapegoat for it. The fundamentals of the global economy have been increasingly negative since 2008, and the only "indicator" left to appear positive has been stocks. There are plenty of people out there who assume that equities have escaped without consequence after the UK referendum because of the pre-4th of July rally. However, I would suggest they not get too comfortable with the hollow low volume spike in stocks at this early stage. These kinds of rallies should not be a surprise. They were common during the derivatives and credit crash that struck in 2008 after Bear Sterns and Lehman. Ultimately, stocks are an irrelevant faith driven indicator, and the fundamentals will always win in the end. As Forbes notes in a surprisingly honest analysis — the “Lehman moment” of 2008 was not really a “moment” at all. The derivatives crash was driven by numerous frailties within the debt bubble structure; Lehman was just a higher profile element of a more chaotic mess. When Lehman’s bankruptcy went public, equities took a considerable dive, rather similar in velocity to that which occurred right after the Brexit referendum. But, only a week later stocks had rallied back near the exact highs seen before Lehman had folded. The psychology of market investors is to always first go with what they are familiar with and what they have been conditioned to do, much like Pavlovian dogs. Investors today, as then, were conditioned to “buy the dip no matter what”. Of course, once reality and the fundamentals set in, stocks were back in free-fall only two weeks later. The Brexit is not going away, and the negative effects it heralds are still barely visible to the mainstream. This process is going to be actively weighing on the markets for months as investors continue to lose their blind faith in the system. We haven’t even begun the party yet, and this is assuming there are no other catalyzing moments around the corner. Beyond the mechanics of the economy, the elites themselves are often a good litmus test for predicting what is about to take place within the stock casino and outside the stock casino. The fact that the mainstream financial media is now awash in calls for extreme measures in central bank coordination and numerous elites warning of greater crisis should be of some concern to the public. Just as the Bank of International Settlements (BIS) and International Monetary Fund (IMF) warned of a crash back in 2007 and early 2008 and were proven “correct,” they have also been warning of a crash in 2016. Post-Brexit, the chorus of “warnings” from the elites has exploded. They are rarely wrong about economic crisis exactly because they are the people that create the conditions for crisis in the first place. George Soros continues to claim that the Brexit has “accelerated a financial-market crisis” even after the latest stock rally. Bloomberg, in support of European Central Bank President Mario Draghi, published an article titled “Draghi Wishes For A New World Order Populists Will Love To Hate.” Bloomberg later removed the word “New” from the title. The article repeats a rising call by central bankers around the world to stop concerning themselves with “domestic” policies and problems and start coordinating globally to deal with “global problems.” The BIS ALREADY controls the policy making decisions of all other central banks as admitted in the infamous Harpers expose on the BIS titled “Ruling The World Of Money.” But this is never mentioned by Draghi or Bloomberg. Interestingly, the BIS is now arguing not only for global policy coordination, but also GLOBAL RULES for all central banks. If the BIS already controls the policy decisions of the Federal Reserve, the ECB, and every other central bank member, then why do they want “global rules” put in place for those same central banks? They are doing this because the goal, the end game, is for the general masses to accept and even demand a global central bank, either in the form of the BIS or the IMF, or perhaps both of them combined into a single entity. Once again, the elites are using the Hegelian problem-reaction-solution strategy to manipulate the public into wanting globalist control. The BIS has been building up to this moment for quite some time. In May, for example, BIS chief economist Claudio Borio argued that a "new global monetary order" was needed to replace the dollar system. This new system would prevent crisis by reigning in all national central banks under rules which would force them to act in a coordinated fashion, apparently under the administration of the BIS itself. Now it would seem the central bankers have the beginnings of their "crisis" which they clearly plan to put to good use. In yet another recent article Bloomberg calls for central banks to “kiss their domestic bias goodbye”; arguing that national economies are now so “intertwined” that central banks all need to work off a single set of guidelines in support of the global economy rather than individual national economies. On the day after the Brexit vote, China stated its desire for the Asian Infrastructure Investment Bank (AIIB) to work closely with World Bank. For years I have been pointing out that the Chinese never had any intention for the AIIB to become a counter-system to the IMF or World Bank and that the Chinese were working with the globalists, not against them. Now we have open confirmation. The Chinese premier also warned of a “butterfly effect” leading to crisis after the Brexit, and called for “enhanced coordination” among all the economies of the world. European Union officials are going for broke as they suggest the formation of a European “super state” in the wake of the UK referendum. This system would essentially erase political boundaries and sovereign borders to make the EU a single entity in every capacity up to and including a single European army. The amplified calls for total centralization and a “New World Order” go on and on, and I believe they are a blaring signal that something very ugly is about to happen. Consider this: Central banks will never gain public support for globally centralized policy or a global economic authority unless they are proven right and a crash does indeed take place. The crash does not necessarily need to be immediate and “total”, as some liberty movement activists assume. It is more likely to be gradual and micromanaged, though still resulting in a level of suffering in certain regions not seen since the Great Depression. More bank coordination requires more chaos and examples of “conflicting policies,” which will probably take the form of “currency wars” among certain nations. The elites must conjure a theater in which some central banks work at cross purposes and muck up any potential recovery. They can then argue to the public that a single internationally recognized and obeyed global banking authority is needed to prevent this sort of thing from ever happening again. The concept of central banks “working globally” rather than domestically could only be sold to the masses if a fiscal disaster was triggered on a global scale that outmatched the needs of any single nation state. Each central banker initiative suggested after the Brexit requires a financial implosion in order to be justified. In my next article I will be listing the many reasons why I believe the globalist plan for centralization and a NWO is destined to fail. This does not mean, though, that extensive effort and sacrifice will not be necessary in the near future on our part. For now, vigilance is our best defense. The elites are telling us exactly what is about to happen through their very behavior and statements. It is time for those who are aware of the bigger picture to start listening if they are not already, and prepare accordingly. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| #Brexit - Project FEAR aka Project FAIL compilation Posted: 06 Jul 2016 07:00 PM PDT Compilation of remain campaigners using Project fear to intimidate voters in the EU referendum. Including David Cameron, Tony Blair, Barack Obama and Sadiq Kahn. Brexit The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1364.90 Up $8.50 or 0.63% Posted: 06 Jul 2016 06:03 PM PDT

'Tis worth remembering that when gold hit $1,900 in August & September 2011, a European bank problem was the main driver. Well, looky here: we've got a European bank problem again! Mark also that a rising dollar has not deterred rising silver & gold prices. If the present situation were to transmogrify into a full-blown financial panic, it is NOT unrolling as 2008 did. In March 2008 gold peaked at $1,003, made a secondary peak in July, collapsed into September, rallied, and then the bottom fell out to $681 intraday in October. Point is, gold's price never benefitted from the panic as it has done this year & since Brexit. Note also that 2008 did not come after a five year bear phase had wrung all the excess out of gold's price. All this applies to silver as well. A change of investor behavior has occurred. They are treating precious metals as currencies alternative to and safer than central bank currencies. Not everybody, but the shift has begun. Another reason silver may have gone hog-wild the last few days: the Chinese are big gamblers looking for the next casino, as witnesseth what happened in Chinese iron and base metals markets earlier this year. Day traders bent them all out of shape -- not to be desired for silver. I am so suspicious I'm ashamed of myself. I signed up for the STOXX 600 financials index, which includes the biggest European banks. I wanted to check the index. Today I got an "Information Update" from STOXX that "Due to technical issues" that index & several others just weren't working. Made me wonder whether the mass of traffic trying to watch those indices had glitched the system, or whether some NGM might have pulled the plug to limit panic. Why am I so suspicious? I reckon because I've been lied to so often by so many experts and official spokes things. Stocks lifted their heads up from their sickbeds -- in that sense they "rose." Dow gained 78 (0.44%) to 17,918.62 while the S&P500 added 11.18 (0.54%) to 2,099.73. Just like I used to tell my kids about popping each other with towels: "This will end badly." US dollar index just can't establish a winning streak. Lost 14 basis points today (0.14%) to 96.12. Poked up into the 200 day moving average overhead, then tucked tail & ran. Meanwhile, the 30 year US bond is at an all time price high and the 10 year note ain't far from it. Lessee, somebody's buying so many bonds (denominated in US dollars) that they have pushed the price to all time highs, but the dollar is dropping? Don't make no sense, & when things don't make no sense, there's usually a Nice Government Man hiding behind the curtain. Gold gobbled up another $8.50 (0.6%) today to $1,364.90. Highest close since March, 2014. Chart's here, go look, http://schrts.co/Vbp2I8 This chart does NOT look like it's going to stop any time soon. It has broken through and closed above its overhead channel line three days running. Is it overbought? Worse than loud perfume at an old ladies' convention, but it can get overboughter still. Fixin' to hit that downtrend line from the 2011 high about $1,450. Don't y'all lift your eyebrows at me. Gold can very well make it that far. I'm not studying any correction till it does, either. Silver climbed 29.4¢ (1.5%) to 2016¢. Highest close since August 2014. Behold the chart, hammering through the overhead channel line, http://schrts.co/tMtr8R Let me throw all coyness to the winds: Silver & gold will go much higher from here. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sins Of The World - July 2016 (Part 1) Strange End Times Signs Posted: 06 Jul 2016 05:00 PM PDT I can't believe ANYONE still believes anything they hear in the news. Where do you these (always labelled 'so called') 'ISIS' get their tanks, ammunitions and desert storm style uniforms? USA and UK The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| CON GAME COLLAPSING, SILVER SOARING Posted: 06 Jul 2016 04:55 PM PDT by SGT, SGT Report.com: JS Kim, author, writer and founder of SmartKnowledgeU.com/ joins me to discuss the collapse of the international banksters’ con game, the derivatives Ponzi the surging price of silver and the bleak future for the petrodollar. Kim says the precious metals ate still in “a recovery phase” and says, “We are truly only in the initial stages of the next leg higher. Gold and silver are still highly, highly underpriced in US Dollars.” | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Jul 2016 04:49 PM PDT Italy's retail sector declines. Spain's social security system will implode within 2 years. There is no rebound, economic indicators are heading down. Domestic trade is imploding, class 8 trucking is declining. UBS has said that gold has hit a new trend. EU banks are insolvent and they are... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: Chinese gold demand 973 tonnes in first half of 2016 Posted: 06 Jul 2016 04:32 PM PDT By Koos Jansen Chinese wholesale gold demand, as measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), reached a sizable 973 metric tonnes in the first half of 2016, down 7 percent compared to last year. Although Chinese gold demand year to date at 973 tonnes is slightly down from its record year in 2015 -- when China in total net imported over 1,550 tonnes and an astonishing 2,596 tonnes were withdrawn from SGE designated vaults -- appetite from the mainland is still the greatest of all single nations. At the same time the mainstream consultancy firms (World Gold Council, GFMS, Metals Focus) continue portraying Chinese gold demand to be roughly half of SGE withdrawals, as these firms measure "gold demand" merely at the retail level, which excludes any direct purchases at the SGE by institutional and individual investors. But to reassure you, Chinese wholesale gold demand still equals SGE withdrawals. ... ... For the remainder of the report: https://www.bullionstar.com/blogs/koos-jansen/chinese-gold-demand-973t-i... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING: Ukraine Prepares NATO Into War With Russia? Posted: 06 Jul 2016 04:04 PM PDT Is Ukraine leading NATO into war with Russia and is President Obama on board The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| “It’s Starting to Feel Like 2008” Posted: 06 Jul 2016 02:35 PM PDT This post "It's Starting to Feel Like 2008" appeared first on Daily Reckoning. Dear Reader, Nearly everywhere on the planet the giant financial bubbles created by the central banks during the last two decades are fracturing. The latest examples are the crashing bank stocks in Italy and elsewhere in Europe and the sudden trading suspensions by three UK commercial property funds. If this is beginning to sound like August 2007 that's because it is. And the denials from the casino operators are coming in just as thick and fast. Back then, the perma-bulls were out in full force peddling what can be called the "one-off" snake oil. That is, evidence of a brewing storm was spun as just a few isolated mistakes that had no bearing on broad market trends because the "goldilocks" economy was purportedly rock solid. Thus, the unexpected collapse of Countrywide Financial and the collapse of the Bear Stearns mortgage funds were just one-off events. So all the experts said "nothing to see here." Just move along and keep buying. In fact, after reaching a peak of 1550 on July 18, 2007, the S&P 500 stumbled by about 9% during the August crisis. But the dip-buyers kept coming back in force on the one-off assurances of the sell-side "experts." By October 9 the index was back up to the pre-crisis peak and then drifted lower in sideways fashion until September 2008. The assurances were false, of course. Upon the Lehman event the fractures exploded, and the hammer dropped on the stock market in violent fashion. During the next 160 days, the S&P 500 plunged a further 50%. Altogether, more than $10 trillion of market cap was erased. The supreme irony of the present moment is that the perma-bulls insist that there is no lesson to be learned from the Great Financial Crisis. That's because the single greatest risk asset liquidation of modern times, it turns out, was also, purportedly, a one-off event. It can't happen again, we are assured. After all, the major causes have been rectified and 100-year floods don't recur, anyway. In that vein it is insisted that U.S. banks have all been fixed and now have "fortress" balance sheets. Likewise, the housing market has staged a healthy recovery, but remains stable without any signs of bubble excesses. And stock market PE multiples are purportedly within their historic range and fully warranted by current ultra-low interest rates. This is complete daytraders' nonsense, of course. During the past year, for example, the core consumer price index (CPI) has increased 2.20% while the 10-year treasury has just penetrated its all-time low of 1.38%. So the real yield is effectively negative 1%. The claim that you can capitalize the stock market at an unusually high PE multiple owing to ultra-low interest rates, therefore, implies that deep negative real rates are a permanent condition, and that governments will be able to destroy savers until the end of time. The truth of the matter is that interest rates have nowhere to go in the longer-run except up, meaning that the current capital rates are just plain absurd. Indeed, after last's week's "bre-lief" rally the S&P 500 was trading at 24.3X Last Twelve Months (LTM) reported earnings. Moreover, the $87 per share reported for the period ending in March was actually down 18% from the $106 per share peak recorded in September 2014. So in the face of falling earnings and inexorably rising interest rates, the casino punters are being urged to close their eyes and buy the dip one more time. And that's not the half of it. This time is actually different, but not in a good way. Last time around the post-August 2007 dead-cat bounce was against $85 per share of S&P LTM earnings, meaning that on the eve of the 2008 crash the trailing multiple was only 18.4X. That's right. After the near-death experience of 2008–2009 and a recovery so weak as to literally scream that the main street economy is broken, the casino gamblers have dramatically upped the valuation ante yet again. There is a reason for such reckless persistence, however, that goes well beyond the propensity of Wall Street punters to stay at the tables until they see blood on the floor. Namely, their failure to understand that the current central banking regime of Bubble Finance inherently and inexorably generates financial boom and bust cycles that must, and always do, end in spectacular crashes. Bubble Finance is based on the systematic falsification of financial prices. That's the essence of ZIRP and NIRP. It's also the inherent result of massive QE bond-buying with central banks credits conjured from thin air. And it's the purpose of the wealth effects doctrine and stock market puts. The latter are designed to inflate stock prices and net worths, thereby encouraging households to borrow (against rising collateral values) and spend on the expectation of permanently higher real wealth. The trouble is, financial prices cannot be falsified indefinitely. They ultimately become the subject of a pure confidence game. The risk of shocks and black swans arise that even the central banks are unable to offset. Then the day of reckoning arrives in traumatic and violent aspect. And that brings us to the father of Bubble Finance, former Fed Chairman Alan Greenspan. In a word, he systematically misused the power of the Fed to short-circuit every single attempt at old-fashion financial market corrections and bubble liquidations during his entire 19-year tenure in the Eccles Building. That includes his inaugural panic in October 1987 when he flooded the market with liquidity after Black Monday. Worse still, he also sent the New York Fed out to demand that Wall Street houses trade with parties they knew to be insolvent and to prop up stock prices that were wholly unwarranted by the fundamentals. Greenspan went on to make a career of countermanding market forces and destroying the process of honest price discovery in the capital and money markets. The crash of 2008–2009 was but the inexorable outcome of Greenspan's policy of financial asset price falsification — a policy that his successor, Bubbles Ben, doubled down upon when the crisis struck. So as we sit on the cusp of the next Bubble Finance crash, now comes Alan Greenspan to explain once again that he knows nothing about financial bubbles at all. According to the unrepentant ex-Maestro, it's all due to the irrationalities of "human nature." Why, central banks have nothing to do with it at all! Greenspan's claim, therefore, that earlier bubble collapses did not cause GDP to falter gives sophistry an altogether new definition. In fact, the Fed just rolled one bubble into the next, making the eventual payback all the more traumatic and destructive. Yet at the time, Greenspan even applauded the exploding and unstable leveraging of household balance sheets. He actually bragged about how he had induced higher consumption expenditures and GDP by encouraging American families to refinance their castles and then spend the MEW (mortgage equity withdrawal) on a new car or trip to Disneyland. Household leverage nearly doubled during Greenspan's destructive MEW campaign. Does he really think that the nearly parabolic rise of the leverage ratio during his tenure to nearly double the stable historic average was due to the irrationalities of human nature? It's not about human nature at all. It is the consequence of central bank policies that first drove the household sector to an unsustainable balance sheet condition of Peak Debt, and has now left it high and dry under a crushing debt burden of $14.5 trillion. In short, by its very nature Bubble Finance impregnates the system with FEDs (financial explosive devices). And worse still, what Greenspan started in the U.S. has been exported to the rest of the world. Now it's beginning to feel like August 2007 all over again. Regards, David Stockman Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post "It's Starting to Feel Like 2008" appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China's Silk Road said to consider offer for $2 billion Glencore mine Posted: 06 Jul 2016 01:56 PM PDT By Vinicy Chan China's Silk Road Fund, a $40 billion pool set up to invest along the nation's ancient trade routes with Central Asia, is discussing a joint bid for Glencore Plc's gold mine in Kazakhstan, people with knowledge of the matter said. The Silk Road Fund is partnering with state-owned China National Gold Group Corp. on a possible joint offer for the Vasilkovskoye mine, which could fetch about $2 billion, according to the people. The group is in discussions with Glencore, though there's no certainty it will win the bidding, the people said, asking not to be identified as the information is private. The Beijing-based fund may compete with Chinese gold producers Shandong Gold Mining Co. and Zijin Mining Group Co., which are also potential suitors for the asset, people familiar with the matter said last month. Chinese companies have announced $9.6 billion of mining acquisitions this year as commodity prices started to recover, a 36 percent jump from the same period in 2015, data compiled by Bloomberg show. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-07-06/silk-road-fund-said-to... ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: The deepening fraud of Comex silver Posted: 06 Jul 2016 01:35 PM PDT 4:30p Wednesday, July 6, 2016 Dear Friend of GATA and Gold: Bullion banks trading silver futures on the New York Commodity Exchange are getting more leveraged short even as Comex vault inventories of silver fall sharply, the TF Metals Report discloses today. This, the TF Metals Report adds, may require the banks to undertake a do-or-die attack on longs such as occurred in May 2011. The analysis is headlined "The Deepening Fraud of Comex Silver" and it's posted here: http://www.tfmetalsreport.com/blog/7721/deepening-fraud-comex-silver CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - PMs Looking Good With Peak Bonds and Dodgy Stocks Posted: 06 Jul 2016 01:08 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Heading Toward $1,400 As Bull Run Commences Posted: 06 Jul 2016 12:47 PM PDT Gold's post-Brexit vote surge continues unabated, with Bloomberg reporting today that the price of the safe haven commodity has risen for six consecutive days. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lord Rothschild Demands Britain Stay In Europe Posted: 06 Jul 2016 12:12 PM PDT Lord Rothschild has urged the British public to steer clear of a Brexit vote and remain part of the European Union, in a threatening open letter for The Times. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The New World Order - Fall of the Republic 2016 Freedom or Slavery Posted: 06 Jul 2016 10:00 AM PDT The corrupt Rothschild federal central reserve bank cartels is the biggest Ponzy scheme ever devised to fool the masses into believing their worthless paper has value which will be the downfall of america and all other countries under the Ponzy scheme. america is doomed to collapse under such... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Post Brexit -- Niger Farage Press Conference at the EU parliament Posted: 06 Jul 2016 09:39 AM PDT EU Press conference with Nigel Farage "The people voted for freedom" - Brexit Niger Farage takes questions from the press at the EU parliament. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Jul 2016 09:00 AM PDT This post Hillary Beats the Rap! appeared first on Daily Reckoning. The Clintons are back, baby! After the FBI let Hillary off the hook yesterday for illegally keeping classified material on her personal servers, Arkansas' first family of con artists are strutting around like O.J. after beating his murder rap. They're untouchable now… and they know it. They've beaten impeachment, the Vince Foster mess, Whitewater, Travelgate, Filegate, Pardongate, the Asian fundraising scandal, the cattle futures scandal, Bubba flying around on the "Lolita Express," Benghazi… and now the State Department email scandal. This was the one that many thought would finally snag them. But they walked yet again. And that means we're in store for at least four years of debauchery and lawlessness come January… No Longer a Nation of LawsLet's face it: The rule of law is for the little people of this world. Consider that Federal code 18 U.S.C Sec. 793(f) makes it unlawful to send or store classified information on personal email. And that's just what Hillary did. FBI Director James Comey confirmed this in his press conference. He said the FBI found vast amounts of classified information on Hillary's private servers and personal devices. He also confirmed that Hillary didn't hand over thousands of her State Dept. emails, even though she swore under penalty of perjury she had done so. You do those things and you're wearing an orange jumpsuit making license plates for a decade. That's what the law dictates. But this isn't happening for a Clinton under Obama's Attorney General. That's because there are two separate versions of American jurisprudence. One version is reserved for Deep State members like her. The other is served cold to the peasant class. Just ask Bryan Nishimura, a former Naval reservist who was charged with having classified material on his personal device—the same as Clinton. He pled guilty to unauthorized removal and retention of classified materials. He was fined and his security clearance was stripped. For Hillary's "carelessness," she'll get a promotion to President and an upgraded security clearance. Bottom line: It's not a proud day to be an American. Many honest people on both sides of the aisle are sad and angry. But with the system hijacked, we are all bystanders to the slow-motion implosion of the United States of America. Party Time!What can we expect from the Clintons now that they know they're completely unconstrained by law and loaded up with a $153 million dollar "speaking fee" fortune? At the very least more of the same when they last occupied the White House. And that could mean having to teach the kids about Bill's new definition of sex. Nothing will surprise me, for it will be party time again at 1600 Pennsylvania Avenue. And the White House will be open again for serious "get the Clintons richer" business too. But no small-scale renting of the Lincoln Bedroom like last time. Through their "foundation," the Clintons have gone global with their "pimp out the country" prostitution. They've perfected pay-for-play influence-peddling on such an epic scale that "House of Cards" scriptwriters must be seething with jealousy that the Clinton script is better than their fiction. Let me be blunt: This means the power and prestige of the United States of America is for sale for the right price to Third World dictators. You say, "No way!" I say, "Who's going to stop them from getting paid?" Look, yesterday, the Director of the United States Federal Bureau of Investigation said, "there is evidence of potential violations of the statutes regarding the handling of classified information." And Hillary still walked. He also said: "It is possible that hostile actors gained access to Secretary Clinton’s email account." Possible? Do you really think it's "possible" with the full force of the FBI investigating that they couldn't figure out exactly whether or not a foreign hostile actor gained access to her server? Comey knows. You know he knows. He knows he knows. But the game is rigged. Sadly, none of this will change until there is an implosion. I can't tell you exactly when or how that cleansing unfolds, but we all know the behavior personified by two grifters from Arkansas can't win out in the long run if our country is to survive. Please send me your comments to coveluncensored@agorafinancial.com. I want to know what you think of today's article. Regards, Michael Covel The post Hillary Beats the Rap! appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

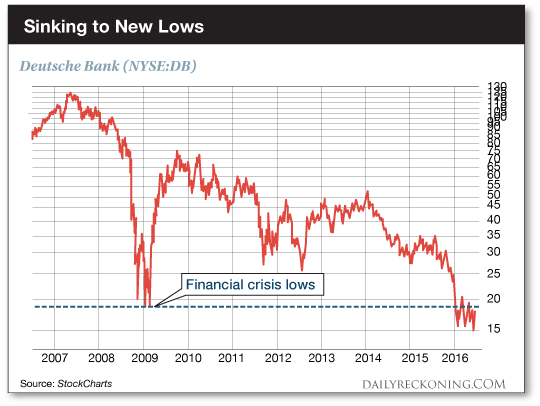

| Ghosts of 2008: 3 Charts to Watch as World Markets Crumble Posted: 06 Jul 2016 08:27 AM PDT This post Ghosts of 2008: 3 Charts to Watch as World Markets Crumble appeared first on Daily Reckoning. Trading rules can make you rich. "It's starting to feel like 2008," London money manager John Anderson tells Bloomberg News. "Government bond yields are telling you something very nasty is about to happen." Spooky. Are the ghosts of 2008 rattling their chains? Just one week after investors began drunkenly buying everything in sight, Brexit fears are shaking world markets once again. Hung-over speculators have dropped their bottles and are now desperately punching the "sell" button as the bad news continues to roll in… The Dow Jones Industrial Average shed more than 100 points to start the week. This morning, futures are off another hundred points as Asian and European markets continue to slide even further into the red. And what about those pesky bonds? "Yields on 10-year U.S. government paper fell to an all-time low of 1.367% on Tuesday and continued to drop on Wednesday to 1.350%," MarketWatch reports. "In Japan, the yield on 20-year government bonds turned negative for the first time, in another sign of investors fleeing to safe havens." It gets worse… Banks are coming under renewed pressure, sparking talk of another potential Lehman moment in the works. Bad debt at Italian banks was this week's first boogeyman to come storming out of the closet: "Italy's banking crisis could spread to the rest of Europe and rules limiting state aid to lenders should be reconsidered," Bloomberg reports. Just how bad is it for the banks right now? "Switzerland's Credit Suisse Group and German lenders Deutsche Bank and Commerzbank were heading to their lowest share-price closes on record," MarketWatch reports. Behold this long-term Deutsche Bank chart in all its terrifying glory…

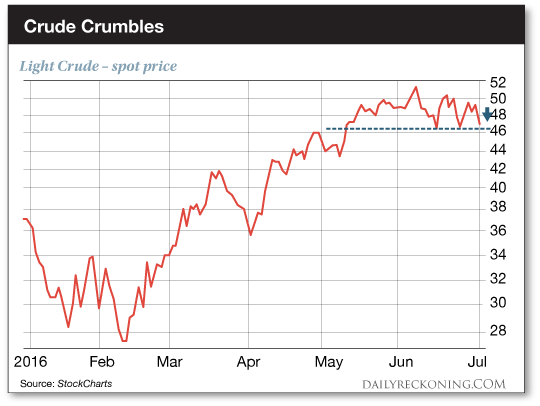

That's not a good look. Not to be outdone, oil's comeback rally is beginning to unravel as well. Crude dropped nearly 5% yesterday. This morning, oil is creeping closer to $46. This breakdown could signal the end of oil's ferocious rally that began all the way back in February—the same rally that helped spur stocks higher off their 2016 lows…

As world markets continue to take a dive, precious metals are soaring. Gold is posting its third straight day of gains. The yellow metal is hitting $1,375 this morning—a two-year high. After punching through $1,300 (and area that acted as major resistance) back in June, gold hasn't looked back. Turning to a longer-term chart, you can easily see how gold has broken free from the powerful downtrend that has been in place since late 2011…

Late last week, we alerted you to another precious metal breakout. Silver's ready to make a run at $20 for the first time in nearly two years, we said. Just two trading days later, our preliminary target has already been hit. Silver has rocketed from the low $18.30s on Thursday to more than $20 in early trade this morning. That's a 10% in less than five trading days. If investors continue to pile into safety trades, we could see this incredible run extend even further… Sincerely, Greg Guenthner P.S. Make money in a falling market — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post Ghosts of 2008: 3 Charts to Watch as World Markets Crumble appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| CLINTON & THE LAWLESS OLIGARCHY Posted: 06 Jul 2016 05:00 AM PDT CLINTON & THE LAWLESS OLIGARCHY: This "Republic" is officially dead. The criminal international banksters RULE this country. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Forget Brexit -- China's currency is falling again Posted: 06 Jul 2016 04:22 AM PDT By Jethro Mullen Turmoil triggered by Brexit may have masked a more troubling market move -- China's currency is falling again. Since British voters' shock decision to leave the European Union, the yuan has lost 1.3 percent against the dollar. That's small compared with the 12 percent plunge in the British pound since the EU referendum, but it contributed to the yuan's biggest quarterly loss on record against the dollar -- down nearly 3 percent in the three months to June 30. The yuan was trading around 6.67 to the dollar on Tuesday, its lowest level since December 2010. China still tries to manage its currency, and significant moves in the past year have roiled global markets. Investors are watching warily. ... ... For the remainder of the report: http://money.cnn.com/2016/07/05/investing/china-brexit-yuan-dollar-curre... ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UBS States; “Gold Has Entered a New Phase “ Posted: 06 Jul 2016 03:40 AM PDT With gold prices having risen by 24% in dollar terms already this year, UBS analyst Joni Teves declared in a note to clients yesterday that “gold has entered a new phase”. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why This Money Manager Is Going Long on Gold Equities Posted: 06 Jul 2016 01:40 AM PDT The Gold Report | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Heading Toward $1,400 As Bull Run Commences Posted: 06 Jul 2016 01:00 AM PDT Gold's post-Brexit vote surge continues unabated, with Bloomberg reporting today that the price of the safe haven commodity has risen for six consecutive days. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 05 Jul 2016 06:44 PM PDT Stocks fall globally on renewed Brexit fears and the apparent collapse of Italy’s banking system. Great Bill Fleckenstein interview. Gold generates massive buzz. US growth subdued, Japan growth nonexistent. Lots of speculation about the end of the EU. UK in turmoil post-Brexit as Labour votes to oust leader, Boris Johnson drops out of PM race, […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chinese Day Traders Fuel Rally in Silver Says Saxo Bank Posted: 05 Jul 2016 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Is it “crazy” and “paranoid” to stockpile supplies against the possibility of widespread social collapse? Not according to the federal government.

Is it “crazy” and “paranoid” to stockpile supplies against the possibility of widespread social collapse? Not according to the federal government.

Safe haven gold continues its strong showing as plummeting interest rates and shaky global equity markets are creating a strong bid in this market.

Safe haven gold continues its strong showing as plummeting interest rates and shaky global equity markets are creating a strong bid in this market.

No comments:

Post a Comment