Gold World News Flash |

- Buy Signals in Place for Gold, Silver, Oil

- Gold, Platinum, and Silver Speak To Us!

- Gold and Silver Continue to Sizzle as Timing Is Right

- The Government Is Coming For Your 401k/IRA As Silver Soars

- July 2016 Web Bot Summary: US Dollar Empire Implodes, Chinese Demand Drives Bitcoin into $1,000’s, $20 Dollar/Day Price Moves in Silver, $500/Day Moves in Gold Coming

- Robert Kiyosaki Warns 2016 Jubilee Year Collapse Going To Make A Lot of Poor Dads

- Brexit!!! Silver!!! Bonds!!! Deflation!!!

- Brexit | Trump as Next USA President | Saudi Arabia Turmoil | Sheikh Imran Hosein July 5 ,2016

- "China Is Headed For A 1929-Style Depression"

- Three Charts Show How Precious Brexit Is for Gold and Silver

- Just making sure currency markets stayed free and unmanipulated (by anyone else)

- Nigel Farage Q&A

- Ronan Manly: Bullion coin sales boost revenues of world's largest mints

- Something Huge Is Coming From Japan

- Gold has outperformed currencies and stocks, von Greyerz tells KWN

- NWO TO CRASH AMERICA BACK TO THE STONE AGE

- George Galloway explains Brexit

- Judge Napolitano: Hillary Indictment Odds Up Dramatically After Lynch Clinton Meeting

- END TIMES SIGNS: LATEST EVENTS (JULY 4TH, 2016)

- Silver Price Independence Day Breakout

- China buyers drive silver prices higher

- Nigel Farage Resignation Speech

- END TIMES SIGNS: LATEST EVENTS (JULY 4TH, 2016)

- Gold to hit record in 18 months as bond yields crash, Swiss Asia Capital's Kiener says

- The 500 tons of gold that show global rise in investor angst

- Hyper Trump Inflation

- The Attempted Assassination of Donald Trump

- Gold Stocks INDEPENDENCE DAY -> HELL TO PAY !!

- Brexit Bombshell: Too Late to Buy Gold?

- Fresnillo tops FTSE 100 leaderboard as silver prices rise

- Buy Signals in Place for Gold, Silver, Oil

- Breaking News And Best Of The Web

- Top Ten Videos — July 4

- David Nicoski: Dollar Direction Will Drive Markets Going Forward

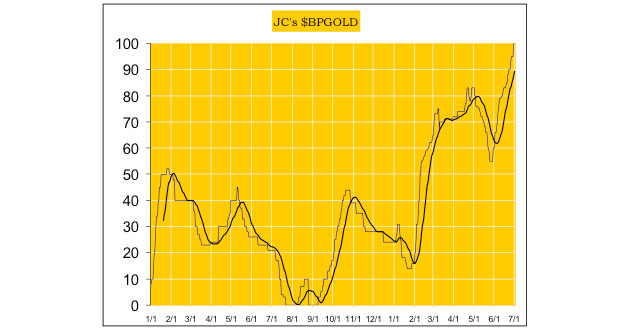

| Buy Signals in Place for Gold, Silver, Oil Posted: 05 Jul 2016 12:30 AM PDT from The AU Report:

Gold in on a new major buy signal. Silver is also on a new major buy signal. Summary A bull market in gold and silver is now confirmed, but for risk management, we shall wait for the next cycle bottom to begin accumulating positions for the long term.

A new major buy signal is now confirmed. Summary With a new major buy signal in place, investors can cost average in on oil stocks and/or ETFs, and hold for the long term. |

| Gold, Platinum, and Silver Speak To Us! Posted: 04 Jul 2016 11:01 PM PDT The prices of gold, platinum and silver are important and communicate valuable insights. Consider the price of monthly gold for 20 years – log scale below. Ignore the daily and weekly gyrations,... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| Gold and Silver Continue to Sizzle as Timing Is Right Posted: 04 Jul 2016 08:30 PM PDT from The Daily Bell:

Gold and silver are having great runs now that the monetary manipulation has eased a bit. That's our take anyway, following Deutsche Bank's admission of guilt and willingness to testify against other metals manipulators. We're told it was Chinese short-covering. Or the result of a growing lack of regarding Brexit. Do gold buyers – especially investors – really think that way? This seems like a larger move, though you won't read that in the mainstream media. The journalistic manipulation is just as pervasive as the monetary, maybe moreso right now. Notice how Bloomberg reports the news about gold, above. It leads with gold sliding to a two-week low "as Brexit fears abate." Here's a more natural lead that comes farther down in the text: "Spot gold rose about 1 percent at one point to touch a session best of $1,357.60 per ounce." But so much of Bloomberg's editorial energy is spent on ensuring that as few people as possible understand the histeorical benefits of gold and silver. These benefits go back to pre-history and vanish into the mists time. |

| The Government Is Coming For Your 401k/IRA As Silver Soars Posted: 04 Jul 2016 07:40 PM PDT by Dave Kranzler, Investment Research Dynamics:

The Government is going to "herd" retirement funds into funding U.S. Treasury debt. – SGT Report About 12 years ago I said to friends and colleagues that the elitists would hold up the system with printed money for as long as it took to sweep every last crumb of middle class wealth off the table and into their pockets. If you don't have enough spare cash laying around to buy your own Federal level politician, you're middle class by definition. |

| Posted: 04 Jul 2016 07:20 PM PDT from jsnip4: purchase the full copy of this webbot report at http://www.halfpasthuman.com |

| Robert Kiyosaki Warns 2016 Jubilee Year Collapse Going To Make A Lot of Poor Dads Posted: 04 Jul 2016 07:02 PM PDT Already in Jubilee 2016, we’ve seen incredible volatility. Brexit is just one example. Within a matter of minutes the British pound soared (when Bremain had the early lead in results) and then had its worst crash in history a few minutes later. The British stock market fell 5.6% quickly after Brexit and has now moved up dramatically in the last week. Volatility in the markets is just like volatility in real life. Your car rides fine for thousands of miles and then, suddenly,begins to shake madly: A wheel is in danger of falling off, and if you don’t stop quick enough it ends up in a crash. |

| Brexit!!! Silver!!! Bonds!!! Deflation!!! Posted: 04 Jul 2016 06:58 PM PDT It’s a funny title for a segment, but it is appropriate. I don’t want to be too flippant with dismissals of inflammatory market events like ‘Brexit’ as simply hype. There is very real macro fundamental shifting going on behind the hype. But in market management, macro fundamentals play out over long stretches of time and nobody knows exactly how all the moving parts are going to affect the subject of the hype (in this case Britain and the EU), let alone the asset markets we are tasked to invest in, trade or avoid. |

| Brexit | Trump as Next USA President | Saudi Arabia Turmoil | Sheikh Imran Hosein July 5 ,2016 Posted: 04 Jul 2016 06:30 PM PDT Brexit | Trump as Next USA President | Saudi Arabia vs Iran Proxy W.| Sheikh Imran Hosein July 5 ,2016 Sheikh Imran Hosein Latest Lecture Saudi Arabia Security Issues with 4 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| "China Is Headed For A 1929-Style Depression" Posted: 04 Jul 2016 06:05 PM PDT Authored by Sue Chang via MarketWatch.com, Andy Xie isn’t known for tepid opinions. The provocative Xie, who was a top economist at the World Bank and Morgan Stanley, found notoriety a decade ago when he left the Wall Street bank after a controversial internal report went public. Today, he is among the loudest voices warning of an inevitable implosion in China, the world’s second-largest economy. Xie, now working independently and based in Shanghai, says the coming collapse won’t be like the Asian currency crisis of 1997 or the U.S. financial meltdown of 2008. In a recent interview with MarketWatch, Xie said China’s trajectory instead resembles the one that led to the Great Depression, when the expansion of credit, loose monetary policy and a widespread belief that asset prices would never fall contributed to rampant speculation that ended with a crippling market crash.

China in 2016 looks much the same, according to Xie, with half of the country’s debt propping up real-estate prices and heavy leverage in the stock market — indicating that conditions are ripe for a correction. “The government is allowing speculation by providing cheap financing,” Xie told MarketWatch. China “is riding a tiger and is terrified of a crash. So it keeps pumping cash into the economy. It is difficult to see how China can avoid a crisis.” A longtime critic of Chinese economic growthXie’s viewpoints have at times attracted unwelcome attention. In 2006, when he was a star Asia economist at Morgan Stanley, a leaked email to colleagues in which he said money laundering was bolstering growth in Singapore led to his abrupt departure from the bank. In early 2007, he termed China’s surging markets a “bubble” that could lead to a banking crisis,” and in 2009 he likened them to a “Ponzi scheme.” Xie, who is from China but was educated at — and earned a Ph.D. from — Massachusetts Institute of Technology, has said Chinese authorities have tried to characterize him as an American spy sent to disrupt their markets after his 2007 prediction. China’s consulate general in San Francisco and its embassy in Washington did not reply to requests for comment. While he now works independently, Xie’s opinions on Asian affairs remain influential. He writes regularly for the South China Morning Post, among other publications, in May saying China is running a “gigantic monetary bubble that has corrupted virtually every corner of the economy.” Xie “is a respected economist,” said Huawei Ling, managing editor of Caixin Weekly and a John S. Knight Journalism Fellow at Stanford University. “I appreciate his consistency and his analysis on China’s economic issues,” she said. His 2007 forecast, meanwhile, turned out correct. Soon after his prediction, the Shanghai Composite Index started plunging. After hitting a peak of 6,092 on Oct. 19, 2007, it fell below 2,000 over the next 12 months.

Years before hedge-fund managers like Kynikos Associates founder Jim Chanos turned bearish and George Soros predicted a hard landing, Xie was a dissenting voice amid a chorus of prognosticators enamored with China’s late 20th Century emergence from poverty. In an interview with this reporter more than a decade ago, Xie warned of a lack of depth in China’s dazzling rise, saying the rapid growth on the country’s coastal cities masked the fact that many inner areas of the country were stuck in the “Stone Age.” Concerns about China’s economy are more commonplace now. Two camps have formed in 2016: those like Templeton Emerging Markets Group Executive Chairman Mark Mobius, who believe a resilient China is experiencing temporary growing pains, and those who, like Soros, foresee an imminent collapse. Xie is firmly in the latter camp. “China grew too fast,” Xie said. “The government is using its power to stop the unraveling but not address the issue. It is just buying more time.” Fresh worries about China after the Brexit voteXie’s criticism coincides with fresh worries about China after the U.K.’s vote to quit the European Union, which triggered an across-the-board selloff in risky assets as investors sought cover in safe-haven assets. Global markets have rebounded somewhat, but uncertainty remains. Subsequent strength in the U.S. dollar has prompted analysts to predict an accelerated weakness in the Chinese yuan. The yuan slumped to a nearly six-year low against the greenback this week, according to FactSet. More broadly, fissures have started to appear in the world’s second largest economy. After years of expanding at a blistering pace. China’s gross domestic product grew 6.9% in 2015, its slowest pace in a quarter-century. For 2016, Beijing has set a GDP target of 6.5% to 7%; The latest spate of global uncertainties prompted Bank of America Merrill Lynch and Deutsche Bank to trim their forecasts to 6.4% and 6.6%, respectively. The export sector, long a driver of Chinese growth, is sputtering due to global saturation and household consumption is barely 30% of China’s GDP, Xie said. In the U.S., household consumption accounted for more than 68% of GDP in 2014, according to the World Bank. China’s stock market last year dove in June, losing more than 30% in a month as regulators tightened margin-trading and short selling rules, making it more difficult for investors to borrow money to invest in stocks. A belief that the government was not properly responding to the economic slowdown also weighed on sentiment. Then in August, authorities unexpectedly devalued the yuan in a bid to support the flagging economy, sparking unprecedented capital flight. Xie and other observers say the surest way to get China out of its rut is to boost consumption, marking a deliberate turn away from a manufacturing-focused economy. Efforts are under way to move China in that direction, but analysts say the process could take years or even decades — during which China could reach a breaking point. Total social financing, a broad measure of funds secured by households and nonfinancial companies, topped $22 trillion in March, more than twice China’s $10.4 trillion GDP, according to official data. There’s no equivalent metric in the U.S., but household debt stood at $14.3 trillion while nonfinancial debt totaled $13 trillion at the end of the first quarter, according to the Federal Reserve. The combined tally of $27.3 trillion is roughly 1.5 times the U.S. GDP. Torsten Slok, chief international economist at Deutsche Bank said in May that China’s credit bubble is worse than the U.S. subprime buildup that led to the last financial crisis. “It is clear that in China in recent years more and more capital has been misallocated and not resulted in higher GDP growth,” said Slok.  Kyle Bass of Hayman Capital Management, who was among the few on Wall Street to correctly predict the subprime mortgage crisis, shorted the Chinese yuan earlier this year, warning investors in a 13-page February letter that China is making the same mistakes the U.S. did 10 years ago. “The unwavering faith that the Chinese will somehow be able to successfully avoid anything more severe than a moderate economic slowdown by continuing to rely on the perpetual expansion of credit reminds us of the belief in 2006 that U.S. home prices would never decline,” Bass wrote. Xie, meanwhile, says he is doubtful of the Communist’s Party’s ability to manage and grow China’s economy — but believes that, if they become more hands-off, the country could become the world’s leading economic force. At the core of Xie’s concerns about China is the contention that the government is doing more harm than good. “If government takes a step back instead of dominating the economy so much, China can be twice as big as the U.S. in 20 years,” he said. ‘The Communist Party isn't compatible with the future of China’Today’s regime in China recalls the U.S.-backed Chinese National Party, or Kuomintang, that ruled the country until its defeat at the hands of the Communist rebels in 1949, according to Xie. The Nationalists, he says, flooded the economy with easy money to support speculation that led to runaway inflation. That, in turn, shifted public sentiment in favor of the Communists, who drove the Nationalists out of the country. “It was very similar to what is going on right now,” said Xie. “If you keep on printing money to use for speculation, you will have hyperinflation and a currency crash,” he said. “The Communist Party isn't compatible with the future of China.” Xie’s criticism of the government hasn't resulted in his arrest although he was not certain whether that will not change in the future. Chinese officials have started to muzzle analysts and journalists who have published pessimistic reports on the economy, The Wall Street Journal has reported. And his research reports are not currently distributed in China. “There are safety mechanisms to stop someone like me reaching the ordinary people,” said Xie. Despite his frustration, however, he occasionally belies immense pride in his country and bemoans the fact that the global community may be underestimating China’s potential. “The economists in the West who say that China isn't very important are wrong,” he said. “China isn't an emerging economy. It is the only country that caught up with the West, and it will shape the path of the global economy in the future.” |

| Three Charts Show How Precious Brexit Is for Gold and Silver Posted: 04 Jul 2016 05:00 PM PDT Gold and silver have been the standout winners in the fallout from Britain's decision to leave the European Union according to Bloomberg. They have compiled three charts showing how "precious" Brexit is for gold and silver. Investors seeking a haven from volatile currencies and equities pushed prices of the metals to a two-year high. With central banks pledging more stimulus to prop up markets (the Bank of England may cut interest rates within months and traders have reduced odds on the Federal Reserve raising rates), the appeal of owning non-yielding assets like precious metals has increased. Gold has climbed 6.2 percent and silver 11 percent since the June 23 referendum, outperforming global stocks, bonds and currencies, including those also often bought as a haven. "Macroeconomic risk and geopolitical risk were already setting gold and silver up for a good year – the Brexit fall out has just been the icing on the cake," said Mark O'Byrne, a director at brokerage GoldCore Ltd. in Dublin. "These metals will continue to outperform as market conditions remain unstable." See full article here

Gold and Silver News Best And Worst Performing Assets In June And Q2 (Zerohedge) Gold Prices (LBMA AM) Silver Prices (LBMA) Recent Market Updates |

| Just making sure currency markets stayed free and unmanipulated (by anyone else) Posted: 04 Jul 2016 04:32 PM PDT Analyze THIS, technically. * * * Banks Saw Unprecedented Step Up in Market Supervision Around UK Vote By Patrick Graham LONDON -- Central banks raised oversight of currency markets to an unprecedented degree around Britain's shock vote to leave the European Union, demanding detailed updates from major trading desks every six hours throughout last week, industry sources said on Monday. One senior banker with a major global bank said the calls, never before conducted as often or consistently, had been seen as a sign that officials were worried an "Out" vote could trigger the sort of financial sector problems not seen since the collapse of Lehman Brothers in 2008. The U.S. Federal Reserve, the Bank of England, and the European Central Bank all declined to comment on the calls, their conduct, content, and aims. But some officials pointed to a general promise by the Bank of England and others to increase supervision of markets around the vote and said the calls were chiefly evidence of greater -- and so far successful -- coordination of regulatory efforts by the world's big central banks. ... ... For the remainder of the report: http://www.reuters.com/article/us-britain-eu-centralbanks-idUSKCN0ZK1SU ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 04 Jul 2016 04:32 PM PDT Nigel Farage takes questions from the media following his resignation. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Ronan Manly: Bullion coin sales boost revenues of world's largest mints Posted: 04 Jul 2016 03:54 PM PDT By Ronan Manly The world's major precious metals mints are riding high on the back of extremely strong global bullion coin demand and relatively buoyant gold and silver prices. These mints are predominantly run as commercial enterprises. The sheer scale of revenues that the U.S. Mint, Royal Canadian Mint, Perth Mint, and Austrian Mint have been generating over the last number of years is eye-opening. Not surprisingly, due to their high value nature, revenues from bullion coin sales account for the lion's share of total revenues for each institution and have been a core driver of their overall profitability. ... ... For the remainder of the report: https://www.bullionstar.com/blogs/bullionstar/bullion-coin-sales-boost-r... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Something Huge Is Coming From Japan Posted: 04 Jul 2016 03:10 PM PDT Submitted by John Rubino via DollarCollapse.com, Pretend, for a minute, that your country responds to the bursting of a credit bubble by borrowing unprecedented amounts of money and using it to prop up banks and construction companies. This doesn’t work, so you create record amounts of new money and push interest rates into negative territory in an attempt to devalue your currency. But this - amazingly - doesn’t work either. Your currency soars and the inflation you’d hoped to generate never materializes. Now what? Is there even anything left to try, or is it simply time to stand back and let the current system melt down? Those are the questions facing Japan, and the answers are not obvious. Here, for instance, is its inflation rate two years into the largest major-country money creation binge since Wiemar Germany: Deflation is to be expected and even desired in a well-run country where debt is minimal, money is sound and rising productivity makes things continuously cheaper. But in an over-indebted financial system, deflation is death because it magnifies the debt burden and raises the odds of an existentially threatening financial crisis. To continue to borrow money under such circumstances is to court disaster. And yet Japan is still at it: What we’re witnessing, in short, is a catastrophic loss in the currency war. Contrary to every mainstream economic theory, debt monetization and full-throttle currency creation have resulted in a rising yen and falling prices. Here’s an excerpt from a recent — and really gloomy — Financial Times analysis of Japan’s situation:

So what happens — and doesn’t happen — now? Several things: The bad stuff gets worse. Post-Brexit Europe will be a source of anxiety and therefore capital flight for years. See What is Frexit: Will France leave the EU next? That means more money looking for a place to hide, some of which will choose yen-denominated bonds. So Japan’s already-negative interest rates will fall even further, which is catastrophic news for the Japanese banks and pension funds now suffocating under the current yield curve. Regime change — but not yet. In upcoming elections the ruling party looks likely to hold its legislative majority. Longer term, though, Japan will find itself in pretty much the same boat as every other major democracy, with inept incumbents having handed lethal ammo to opposition parties more than willing to pull the trigger. New leaders won’t be able to fix the problem (which is by now unfixable) but the uncertainty surrounding a contested election will raise the odds of a crisis of involving currencies, debt, banks or any number of other things. Plunging US rates. Eventually, hundreds of trillions of yen will have to find a new home with more hospitable returns. And 30-year Treasuries yielding 2% will look pretty tasty in a relative if not absolute sense. Rising foreign demand will push down Treasury yields, killing off numerous US banks, pension funds and insurance companies but giving the remaining solvent Americans a chance to refinance their mortgages at 1%. Governments become the biggest stock market players. This is already happening, as Japan, China and (probably) the US buy equities and ETFs to blunt natural corrections in share prices. But with nothing else left to try, expect these programs to be ramped up virtually everywhere. This will prop up stock prices until it doesn’t, and then look out below. Soaring gold. Everything that happens these days points to higher precious metals prices. I’m thinking of writing a piece of boilerplate to that effect for placement at the end of every future article. |

| Gold has outperformed currencies and stocks, von Greyerz tells KWN Posted: 04 Jul 2016 03:08 PM PDT 6:07p ET Monday, July 4, 2016 Dear Friend of GATA and Gold: Swiss gold fund manager Egon von Greyerz, interviewed today by King World News, says that for many years gold has been outperforming both currencies and stocks and that, indeed, stock appreciation has been illustory. An excerpt from von Greyerz's interview is posted at KWN here: http://kingworldnews.com/legend-warns-what-is-coming-will-totally-devast... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| NWO TO CRASH AMERICA BACK TO THE STONE AGE Posted: 04 Jul 2016 02:11 PM PDT Former Clinton insider warns of global elite getting ready to crash the economy and send america back to the stone age. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| George Galloway explains Brexit Posted: 04 Jul 2016 10:30 AM PDT A few hours before the conclusion of the Britain referrendum The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Judge Napolitano: Hillary Indictment Odds Up Dramatically After Lynch Clinton Meeting Posted: 04 Jul 2016 10:00 AM PDT Air Date: July 1st, 2016 Judge Napolitano: Hillary Indictment Odds Up Dramatically After Lynch Clinton Meeting The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| END TIMES SIGNS: LATEST EVENTS (JULY 4TH, 2016) Posted: 04 Jul 2016 09:12 AM PDT end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Silver Price Independence Day Breakout Posted: 04 Jul 2016 07:40 AM PDT The spot prices scream loud. The Silver breakout will be one to behold in the history books. Silver has broken the shackles of the vile banker cabal. Silver has begun its historic run-up. Silver will capture the world's attention. The equivalent of the 1980 Hunt Brothers breakout in today's terms would be $200 per oz. The fundamentals for Silver look better than almost every commodity on earth. Silver has declared independence from the control rooms and their paper gimmicks. The Silver imbalance is monstrous. Gold has broken the gates down with the British Exit vote, pushing its price over the tough stubborn $1300 resistance line. In the following days it has been adding to its gains. But Silver has emerged amidst the political smoke and deceptive din to ride hard through the gate. |

| China buyers drive silver prices higher Posted: 04 Jul 2016 07:25 AM PDT By Rhiannon Hoyle SYDNEY, Australia -- The price of silver surged to a two-year high on Monday as buyers in China made bold bets in the futures market and scooped up vast volumes of physical metal. Spot silver, the price paid for immediate delivery, rose as much as 6.9 percent to an intraday peak of $21.132 a troy ounce, its highest value since July 2014, as the Shanghai-traded benchmark futures and physical silver contracts reached their limit. On the Shanghai Futures Exchange, the most actively traded silver futures contract jumped for a fourth straight session on Monday, hitting its 6-percent daily maximum at opening to reach 4,419 yuan ($663) a kilogram. Monday's moves were buoyed by investors seeking haven assets and speculation about further monetary easing worldwide. ... ... For the remainder of the report: http://www.wsj.com/articles/china-buyers-drive-silver-prices-higher-1467... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Nigel Farage Resignation Speech Posted: 04 Jul 2016 07:14 AM PDT (4TH JUL 2016) Subscribe for more UKIP and Nigel Farage content. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| END TIMES SIGNS: LATEST EVENTS (JULY 4TH, 2016) Posted: 04 Jul 2016 06:30 AM PDT end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold to hit record in 18 months as bond yields crash, Swiss Asia Capital's Kiener says Posted: 04 Jul 2016 06:13 AM PDT By Huileng Tan Gold prices may hit all-time highs in the next 18 months amid low to negative global bond yields, said a fund manager on Monday, joining a chorus of bullish calls on the safe haven commodity. Despite being a non-interest bearing asset with holding costs, gold was attractive in the current climate where there was little trust in the establishment and its policies as demonstrated by the June 23 referendum in the U.K. when voters chose to leave the European Union, said Swiss Asia Capital's Singapore managing director and chief investment officer, Juerg Kiener. The continued cratering of bond yields has also blunted the advantage fixed income instruments held over their shiny counterpart. "This fall-off in trust is resulting in people looking at different ways to invest, particularly in an environment when the government controls the whole fixed-income market, which is negative. At least (in gold), you don't have negative yields, there is no new supply ... and falling production," he told CNBC's "Squawk Box." ... ... For the remainder of the report and a video excerpt: http://www.cnbc.com/2016/07/03/gold-prices-will-hit-record-high-in-next-... ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| The 500 tons of gold that show global rise in investor angst Posted: 04 Jul 2016 06:04 AM PDT By Ranjeetha Pakiam Global gold holdings have expanded by more than 500 metric tons since bottoming in January in a signal of investors' rising concern about slowing growth, a Federal Reserve that's probably on hold, and the ructions caused by Britain's vote to quit the European Union. Assets in bullion-backed exchange-traded funds rose 6.6 tons to 1,959.1 tons on Friday, up from 1,458.1 tons on Jan. 6, according to data compiled by Bloomberg. The holdings increased 37 tons last week as investors reacted to the U.K.'s vote, and swelled in five months out of six in the first half. Bullion prices climbed to the highest level in more than two years in June as investors absorbed the implications of the U.K. result, adding to a rally that's been driven by the Fed's hesitation in raising borrowing costs and the spread of negative rates in Europe and Japan. Banks including Goldman Sachs Group Inc. raised their outlooks for gold after the vote, while yields on 10- and 30-year U.S. Treasuries have touched record lows. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-07-04/the-500-tons-of-gold-t... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 04 Jul 2016 06:00 AM PDT Hyper Trump Inflation The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The Attempted Assassination of Donald Trump Posted: 04 Jul 2016 05:27 AM PDT Radical left-wing lunatic attempts to assassinate Trump. I called it. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Stocks INDEPENDENCE DAY -> HELL TO PAY !! Posted: 04 Jul 2016 03:33 AM PDT Imagine the anger and angst if you were a baby abandoned this way. Fig 1 (Aug 28, 2013) |

| Brexit Bombshell: Too Late to Buy Gold? Posted: 04 Jul 2016 02:44 AM PDT Bullion Vault |

| Fresnillo tops FTSE 100 leaderboard as silver prices rise Posted: 04 Jul 2016 02:08 AM PDT This posting includes an audio/video/photo media file: Download Now |

| Buy Signals in Place for Gold, Silver, Oil Posted: 04 Jul 2016 01:00 AM PDT Technical analyst Jack Chan charts major buy signals for gold, silver and oil. |

| Breaking News And Best Of The Web Posted: 03 Jul 2016 06:44 PM PDT Great Bill Fleckenstein interview. Gold generates massive buzz. US growth subdued, Japan growth nonexistent. Lots of speculation about the end of the EU. UK in turmoil post-Brexit as Labour votes to oust leader and Boris Johnson drops out of PM race. Stocks recover worldwide as Brexit fears wane. Interest rates continue to fall while central […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Posted: 03 Jul 2016 05:15 PM PDT Brexit from every possible angle. The new gold/silver bull market and why it’s just beginning. The post Top Ten Videos — July 4 appeared first on DollarCollapse.com. |

| David Nicoski: Dollar Direction Will Drive Markets Going Forward Posted: 03 Jul 2016 05:00 PM PDT Though Brexit has put nearly everyone on a reactionary footing, David Nicoski CMT, Director of Research at Vermilion Technical Research, LLC, sees a scenario unfolding where the US dollar's direction will determine capital flows in world markets. This time on Financial Sense, he gives his opinion on various asset classes and sectors and discusses what he thinks the dollar's trajectory will take us. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Our proprietary cycle indicator reached 100% this week, which is the highest level ever. It cannot go higher, but prices can remain firm at current levels.

Our proprietary cycle indicator reached 100% this week, which is the highest level ever. It cannot go higher, but prices can remain firm at current levels. Gold eases off near two-year high, silver crosses $21/oz … Gold slides to two-week low as Brexit fears abate … Gold eased off a near two-year high, while silver breached the $21 level for the first time since July 2014 in highly volatile trade on Monday, prompted by a burst of short-covering in China. – Bloomberg

Gold eases off near two-year high, silver crosses $21/oz … Gold slides to two-week low as Brexit fears abate … Gold eased off a near two-year high, while silver breached the $21 level for the first time since July 2014 in highly volatile trade on Monday, prompted by a burst of short-covering in China. – Bloomberg “It depends on how cynically you want to look at this but I think the most cynical interpretation is the correct interpretation.” – IRD on SGT Report

“It depends on how cynically you want to look at this but I think the most cynical interpretation is the correct interpretation.” – IRD on SGT Report

No comments:

Post a Comment