Gold World News Flash |

- Central Banks In A Lose-Lose Situation

- Nikkei whipsaws after BOJ disappointment; yen surges against dollar

- Bank Of Japan Shocks Market, Shuns Government Pressure: Leaves QE, Rates Unchanged, Questions Policy Effectiveness

- BFI Insights: The Zulauf Perspective

- Gold Price Closed at $1332.50 up $5.60 or 0.42%

- IMF admits disastrous love affair with euro, apologizes for immolating Greece

- Barrick puts Super Pit stake on the market

- Gerald Celente -- Panic of 2016 at the Doorstep

- LIVE Stream: Donald Trump Holds Rally in Davenport, IA FULL SPEECH HD STREAM (7-28-16)

- Peter Morici : Obama is Smoking Dope; the Middle Class is Dissolving

- The Unstoppable Economic Collapse Imminent

- WIKILEAKS RELEASES HACKED DNC VOICEMAILS

- Hillary Bald Face Liar Clinton vs Donald True Feelin' Revealin Trump

- Hillary’s Choice: Why Tim Kaine Isn’t a ‘Safe’ Pick

- Gold Daily and Silver Weekly Charts - Helicopter Money - Hope and Change

- Joe Weisenthal: How Donald Trump changed my mind about gold

- U.S. Dollar Bear Market

- The System Cannot Survive, Is Gonna Be Epic When It COLLAPSES !! -- Gregory MANNARINO

- Bernie Voters Going To Trump -- Hillary Is Done

- The End of America in 2017 You Need to See These Events!

- Protect Your Wealth While Earning Income

- END TIMES SIGNS: LATEST EVENTS (JULY 28TH, 2016)

- TD's $230 billion man goes maximum gold as volatility mounts

- Terrorism Isn't What You Think It Is - David Icke

- SPX Premarket is Flat

- Gold Bullion Up 1.6%, Silver Surges 3.7% After Poor U.S. Data and Dovish Fed

- Gold, Silver and the Clueless Federal Reserve - Video

- Breaking News And Best Of The Web

- Still Waiting for a Precious Metals "Correction"? Get Off the Dime and Buy Some Silver

- Zero Percent Mortgages Debut Setting up the Next Stage for this Stock Market Bull

| Central Banks In A Lose-Lose Situation Posted: 29 Jul 2016 12:00 AM PDT by Claudio Grass, Acting Man:

Mr. Stoeferle: I have always considered it impossible to create a "self-sustaining" economic expansion by means of the printing press. By so doing, central bankers only succeeded in suppressing symptoms, but the underlying structural problems that created the 2008 financial crisis in the first place, have only gotten worse. The primary goal, namely to stimulate the economy, has not been achieved. Low interest rates have provided artificial life support for unproductive and highly indebted companies, as well as for states. According to Standard & Poor's, budget deficits in the euro area would on average be 1-2% of GDP higher, if the average level of interest rates between 2001 – 2008 were applicable today. Under normal market conditions, stock prices rise as a result of a fundamental strength in the economy, but in today's reality, the rally in asset prices has only deceived market participants about the fundamental weakness of the economy. The alarming fact is that asset prices will likely collapse if central banks cut the artificial support. High asset prices have become vital to maintaining confidence in the economy, while the majority of stock and real estate investments have been financed by cheap credit. Thus, abandoning the low interest rate policy would likely trigger a severe recession. On the other hand, continuing this policy would distort and corrode the economic structure even more, which would jeopardize the business model of pension funds, insurers and banks, and further inflate the real estate and stock market bubbles. The low interest rate policy has rendered the system profoundly fragile, with central banks virtually in a lose-lose situation.

Claudio Grass: Do you believe central banks still have other options they could resort to or will this be the end of the road for them?

Claudio Grass: Do you believe central banks still have other options they could resort to or will this be the end of the road for them? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nikkei whipsaws after BOJ disappointment; yen surges against dollar Posted: 28 Jul 2016 09:49 PM PDT Japan shares whipsawed and the yen surged after the Bank of Japanthrew markets a smaller-than-expected bone in keenly watched decision on Friday. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Jul 2016 08:54 PM PDT Expectations were extremely high heading into tonight's BoJ decision, and market liquidity disappeared with massive violent swings in FX, rates, and equity markets before Kuroda unleashed his disappointing statement:

But...

Finally, details are emerging of the stimulus package, NHK reporting:

And most fascinatingly...

Raising doubts abouit the whole house of cards. As we noted this afternoon, the worst case for Yen shorts would be if the BOJ simply does what both the ECB and the Fed did in recent days and punts to September.. and sure enough: markets are unahppy...

Yen strength is weighing on US equity futures through the carry trade and gold is jumping... * * * As we detailed earlier, before the statement, 32 of 41 analysts (the most in 3 years) expected an expansion of QQE2 shifting to ETFs (because that worked so well), but surprises will be hard to come by...

2Y JGB yields were screaming for moar....

JGBs had been halted... And FX market liquidity disappeared.. Total chaos. Nikkei Futs crash 600 points instantly... * * * Morgan Stanley economists Robert Feldman, Takeshi Yamaguchi and Shoki Omori, writing in the firm's Global Macro Summer Outlook, say Japan's policy approach is having weak short-term impact:

The spectrum of forecasts includes a boost to government bond buying to as much as 100 trillion yen a year -- up from 80 trillion, quadrupling exchange-traded fund buying and cutting the policy interest rate to -0.3 percent. A more radical option: a pledge to maintain the BOJ’s balance sheet in its forward guidance. Prime Minister Shinzo Abe’s government has added pressure for bolstering monetary stimulus at this meeting. Abe in a surprise announced his economic package on Wednesday, which economists including Daiju Aoki saw as an intention to pressure the central bank by showing the government it is doing what it can to spur growth. Some may see it as a step toward hitting policy limits, with growing concerns about the sustainability of the easing program. There’s a limit to the amount of bonds in the market and the faster the BOJ buys them, the sooner it hits the ceiling. The size of the BOJ’s balance sheet is now more than 80 percent of Japan’s gross domestic product.

Charts: Bloomberg | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| BFI Insights: The Zulauf Perspective Posted: 28 Jul 2016 08:20 PM PDT by Dirk Steinhoff, Mountain Vision:

The recent Brexit vote has brought to light the widespread and growing public discontent with the establishment and presented real challenges and concerns over the future direction of the EU. Additionally, significant risks are arising from China, that could trigger another downturn for the world economy. These factors, combined with geopolitical tensions and systemic problems in Western economic structures, raise concerns that sometime within the next 3-4 quarters, and the years thereafter, we could see another major economic crisis beginning.

Brexit AftermathThe surprising victory of the Leave campaign in the UK referendum was a clear manifestation of the growing disillusionment and discontent of large parts of the population against the establishment, a trend that is also present in most industrialized countries. The Brexit vote, far from being an isolated incident, is in fact part of a process at work: the democratic process, whereby the public can express their disagreement with the direction of the European project. This type of populist movements could persist in years to come, and increasingly affect capital markets. It is therefore important to monitor closely both the institutional and market reactions, as well as the developments in political and economic policy directions. Even after the initial Brexit shock is overcome, the EU will still be faced with an historic challenge: Reevaluating its political and economic strategy and aims, rethinking and reshaping the monetary union into a more sustainable entity and addressing the public's and the market's concerns could be decisive in shaping the future of the EU. Concerns over ChinaIn response to the 2008 crisis, China unleashed a stimulus program of an unprecedented scale that kept the world economy afloat. This move, however, led to a gigantic investment and credit boom, which in turn created an excess, and overcapacity of dramatic proportions. At some point, this will have to be addressed, by supporting restructuring. This policy direction will require substantial liquidity for the banking system to support the necessary write-offs, which could lead to a lower Yuan in the currency markets: that would be seen as a devaluation of the Chinese currency. Since China is the largest exporter in the world, a devaluation would put pressure on earnings of its competitors and on profit margins, and it would increase the deflationary pressure on their economies. Impact of the US Fiscal PolicyUncertainty and doubts are steadily increasing over the promised rate hike that now seems unlikely to be enforced in the coming months. Although new highs in the S&P500 are possible in the short-term, we do not see this move supported by improving fundamentals at the moment. Current valuations are elevated and any further increase carries the seeds of an exhaustion that could lead to a temporary trend reversal and ensuing medium-term correction sometime later this year. Structural problems, however, remain lodged at the core of the American economy; a major restructuring of the tax system, addressing the debt burden, reducing the size of government, would be necessary steps to allow the economy to "breathe". Tackling such issues, however, would without a doubt require fiscal support, which could take the form of government projects and much-needed infrastructure investments. Gold ProspectsLoose monetary policy adopted by all central banks and rising uncertainty over when the monetary direction will be normalized, have contributed to a renewed interest in gold, even after the latest correction. It could trade erratically in the short-term, however, the longer-term expectation is that we will see a gradual upward trend in the gold price, towards our target level of $1400 and later even beyond that. Therefore, a strategic bullish position is recommended: As long as the overall sentiment of unease continues about the monetary excesses by central banks around the world and about the rising political uncertainty, investors are likely to seek refuge, for at least part of their capital, outside of the credit and banking system. Investment ImplicationsOverall, the long-term view is that in the next five years we could see vast changes in the world economy and financial markets. Agility, adaptability and an open mind will be essential tools for investors. In the grim period that lies ahead, it could become increasingly difficult to earn decent returns with traditional assets. It is unlikely that equities will generate returns similar to historic levels without a major technology or innovation boost. Treasury bonds can also no longer be considered the go-to "conservative investment" option that they once were. Bond yields are so low that inevitably they will have to pick up at some point, which would translate as a severe blow to bond holders. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1332.50 up $5.60 or 0.42% Posted: 28 Jul 2016 07:40 PM PDT

Platinum & Palladium do not care what the world thinks, they are rising. Both hit new 2016 highs today, both are challenging post-2011 downtrend lines. Truly, truly, the only thing keeping the US dollar index afloat was the expectation the Fed incompetents would raise interest rates. That hope dashed, today it fell 32 bps (-0.33%) to 96.72, but at its 96.25 low it had punched clean through the 200 DMA & the rising lower boundary of that flat topped triangle it broke out of two weeks ago. Here, http://schrts.co/OkJ5UT Stated shortly, the US dollar index just exxed out its upside breakout & showed itself weak as jail house coffee. Also turned down its MACD indicator. Euro profited from the dollar's woes by rising 0.15% to $1.1078, but still couldn't close above its 200 DMA. Hear my words & watch my lips: the euro is doomed. Do NOT own euros. This is all a central bank sucker play, so stay away. Yen gained 0.1% to 95 even. I would heap up another load of scorn on the yen, but denouncing the euro has emptied my metaphor sack. How in the Sam Hill can you adequately rave about something that on the very face of it is nuttier than a Salvador Dali painting? Stock indices gainsaid each other. S&P500 rose 3.48 (0.16%) to 2,170.06 but the Dow Industrials fell 15.82 (0.9%) to 96.72. Stock weakness today piled up confirmation that the Dow in Gold & Dow in silver have ended their upward correction and turned down again. Not sure what to think about silver & gold today. Comex gold ended up $5.60 (0.4%) at $1,332.30 while silver rose 19.5 (1%) to 2016¢. That's not nearly as good as it sounds. Silver early in the day was trading as high as 2058¢ but around 9:15 sales hit it hard and drove it back. Same happened with gold, but the selling hit from the 9:15-ish $1,344.30. Gold remained below its $1,338.21 twenty day moving average, silver ended above its 20 DMA (1996¢). Yes, yes, this was a little disappointing, but not fatal to yesterday's breakout. Both have cleared those flag patterns & busted out upside. Bull markets climb a wall of worry. I look for higher prices still. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| IMF admits disastrous love affair with euro, apologizes for immolating Greece Posted: 28 Jul 2016 06:50 PM PDT By Ambrose Evans-Pritchard The International Monetary Fund's top staff misled their own board, made a series of calamitous misjudgments in Greece, became euphoric cheerleaders for the euro project, ignored warning signs of impending crisis, and collectively failed to grasp an elemental concept of currency theory. This is the lacerating verdict of the IMF's top watchdog on the Fund's tangled political role in the eurozone debt crisis, the most damaging episode in the history of the Bretton Woods institutions. It describes a "culture of complacency," prone to "superficial and mechanistic" analysis, and traces a shocking breakdown in the governance of the IMF, leaving it unclear who is ultimately in charge of this extremely powerful organisation. The report by the IMF's Independent Evaluation Office (IEO) goes above the head of the managing director, Christine Lagarde. It answers solely to the board of executive directors, and those from Asia and Latin America are clearly incensed at the way EU insiders used the fund to rescue their own rich currency union and banking system. ... In an astonishing admission, the report said its own investigators were unable to obtain key records or penetrate the activities of secretive "ad-hoc task forces". Mrs Lagarde herself is not accused of obstruction. ... ... For the remainder of the story: http://www.telegraph.co.uk/business/2016/07/28/imf-admits-disastrous-lov... ... For the IMF report described here: http://www.ieo-imf.org/ieo/pages/CompletedEvaluation267.aspx ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Barrick puts Super Pit stake on the market Posted: 28 Jul 2016 05:56 PM PDT By Nick Evans Barrick Gold has put on the market its half of Kalgoorlie's iconic Super Pit gold mine, finally confirming it intends to complete its exit from Australia. The sale of its half of Kalgoorlie Consolidated Gold Mines has been mooted since Barrick began selling its Australian gold mines two years ago, and the global gold major handed over operational control of the Super Pit to partner Newmont Mining just over a year ago. But Barrick finally confirmed early this morning in its June quarter production report that it is looking to quit is stake, saying it intends to "initiate a process to explore the sale" of its half-share in the storied mine. ... ... For the remainder of the report: https://au.news.yahoo.com/thewest/wa/a/32175847/barrick-puts-super-pit-s... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gerald Celente -- Panic of 2016 at the Doorstep Posted: 28 Jul 2016 05:02 PM PDT At the beginning of this year, Gerald Celente, the publisher of the Trends Journal, put out a magazine cover that predicted the "Panic of 2016." How close are we to the "panic"? Celente says, "We are at the doorstep, and it's ready to go. Look at gold prices. Look at how they have been going up.... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| LIVE Stream: Donald Trump Holds Rally in Davenport, IA FULL SPEECH HD STREAM (7-28-16) Posted: 28 Jul 2016 04:21 PM PDT Thursday, July 28, 2016: Live stream coverage of the Donald J. Trump for President rally in Davenport, IA at the Adler Theater. Live coverage begins at 4:00 PM ET. LIVE Stream: Donald Trump Holds Rally in Davenport, IA (7-28-16) The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peter Morici : Obama is Smoking Dope; the Middle Class is Dissolving Posted: 28 Jul 2016 04:00 PM PDT Morici: The middle class is absolutely dissolving University of Maryland Economics Professor Peter Morici reacts to President Obama's and Vice President Biden's comments on the economy. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Unstoppable Economic Collapse Imminent Posted: 28 Jul 2016 03:30 PM PDT Financial analyst Gregory Mannarino contends, "We are in uncharted territory. It's occurring right under everybody's nose. Barely anyone is aware of what is going on because it's not getting any media coverage. There is this phenomenon where trillions of dollars of currency are being moved or... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| WIKILEAKS RELEASES HACKED DNC VOICEMAILS Posted: 28 Jul 2016 03:00 PM PDT WIKILEAKS RELEASES HACKED DNC VOICEMAILS. Most were complaints against Bernie Sanders running. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hillary Bald Face Liar Clinton vs Donald True Feelin' Revealin Trump Posted: 28 Jul 2016 02:10 PM PDT I don't report on political matters too much, I hate politics and the people involved. however, I couldn't let this rest without voicing what I see as damaging no matter which of the 2 is the victor. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hillary’s Choice: Why Tim Kaine Isn’t a ‘Safe’ Pick Posted: 28 Jul 2016 02:03 PM PDT This post Hillary's Choice: Why Tim Kaine Isn't a 'Safe' Pick appeared first on Daily Reckoning. Once there was a Democratic senator from Virginia who managed to work across party lines to enact innovative legislation to protect ordinary Americans' savings from bank speculation. That is not the Virginia Democratic senator Hillary Clinton picked to be her running mate. Sen. Tim Kaine (D-VA) is no Carter Glass. Glass represented his fellow Virginians in Congress from 1901 to 1946, first in the House and then in the Senate. During the 1930s, he worked on a bill with Rep. Henry Steagall, an Alabama Democrat, that became the Glass-Steagall Act under Republican President Herbert Hoover. The act they first fashioned in 1932 was a weaker precursor to another one that eventually passed with the support of the Republican banking community under Democratic President Franklin Delano Roosevelt. But it was bold.

Carter Glass, who represented Virginia in Congress from 1901 until his death in 1946, co-authored the law that banned banks from speculating with depositors' funds. It was overturned in 1999. (Photo courtesy of the US Senate Historical Office) Not so Clinton's choice of Kaine. It indicates a degree of tone-deafness to not just the progressives that supported the presidential bid of Sen. Bernie Sanders (I-VT), but to the problems lurking at the core of the current banking system. Worse, it is a wink to JPMorgan Chase, Citigroup and Goldman Sachs to continue with business as usual. Kaine's real job is being the anti-progressive, corporately speaking. Rather than reflecting the "safe" pick that Hillary's supporters argue he is, the selection reveals her desperate need for those last few months of campaign contributions to beat The Donald. She doesn't need the $27 average-citizen contributions that were the cornerstone of Sanders' fundraising machine. She needs Wall Street bucks, and can't afford to tick off any big bank by running with someone vehemently opposed to their current composition. When Sanders on Monday threw his might behind Clinton at the Democratic National Convention, he reassured his supporters that the party platform would now include breaking up the big banks and a 21st-century version of the Glass-Steagall Act. In fact, the wording is much vaguer than that. Here's the relevant section from the Democrats' platform: Democrats will not hesitate to use and expand existing authorities as well as empower regulators to downsize or break apart financial institutions when necessary to protect the public and safeguard financial stability, including new authorities to go after risky shadow-banking activities. Banks should not be able to gamble with taxpayers' deposits or pose an undue risk to Main Street. Democrats support a variety of ways to stop this from happening, including an updated and modernized version of Glass-Steagall as well as breaking up too-big-to-fail financial institutions that pose a systemic risk to the stability of our economy. It's a topsy-turvy world when Donald Trump advocates reinstating the 1933 Glass-Steagall Act to separate people's deposits from speculative transactions first, while Hillary Clinton and her VP pick did not. And will not if they get to the White House. Consensus on Kaine is that he's reliable (read: won't upstage Hillary), checks all the boxes (read: won't rock the political boat) and speaks Spanish (read: has foreign policy credentials). Republicans like him. More importantly for Hillary's mindset, he's no Sanders or Sen. Elizabeth Warren (D-MA) (read: won't derail her mega-fundraising drive, so the Wall Street crowd can now freely open their checkbooks into the homestretch). This is, however, a national financial liability. We are left with two presidential tickets that convolute political rhetoric with economic stability. But consider these three big bipartisan votes: 1) the Glass Steagall Act in 1933, 2) Glass Steagall repeal in 1999, and 3) The Emergency Economic Stabilization Act of 2008 (that brought us TARP). They all share something in common beyond their overt bipartisan complexion: fear. The first reflected the real fear that another major Depression would be caused by banks taking on too much risk in conjunction with their "day jobs" of taking deposits and providing loans. The second perpetuated a trumped-up (sorry) fear that America would be left behind from a "competitive" and "innovated" global banking perspective, as per the arguments of Republican Treasury Secretaries (under Ronald Reagan and George H.W. Bush) Donald Regan and Nicholas Brady and then, more effectively by Democratic Treasury Secretaries (under Bill Clinton) Robert Rubin and Larry Summers. The third was predicated on another visceral, yet concocted, fear that if Congress didn't pony up funds to help the biggest banks survive their own recklessness, the world would collapse (recall this unpleasantly: George W. Bush's Treasury Secretary, Hank Paulson, on his knees before then-House Speaker Nancy Pelosi). The Democrats (perhaps because most Republicans opposed it) went on to support the post-crisis Dodd-Frank Act of 2010, itself the handiwork of lobbyists and ex-bankers. The act passed by a vote of 60 to 39, with just three Republican senators joining 57 Democratic caucus members to push it through. Only former Sen. Russ Feingold (a Wisconsin Democrat who's running to reclaim his old seat this year) opposed it on the grounds that is wasn't tough enough on the banks. He is right. For all the whining about its impact, Dodd-Frank absolutely, unequivocally DOES NOT separate risky bank activities from deposit and lending practices, nor does it dilute the high concentration of trading assets and derivatives held in the hands of a few large banks. If we were talking about airplane safety and Hillary and Tim were our flight attendants, there would be no preflight safety briefing and no emergency landing plan until the nosedive. This April, five of the nation's top eight banks failed both the FDIC's and Federal Reserve's "living will" requirements as described under Dodd-Frank. In theory, these "living wills" are plans designed by the banks for the banks, that renders too-big-to-fail a relic of 2008. Under these wills, big banks provide detailed strategies under various crisis conditions to get out of trouble (if not jail) free of using taxpayer dollars. Two of the banks passed one body's test but failed the other's. The FDIC found Goldman Sachs "not credible" and the Fed felt the same about Morgan Stanley. They couldn't even be bothered to prepare for times of another crisis. Only Citigroup passed both. It is probably sheer coincidence that Obama's current Treasury Secretary, Jack Lew, was a former Citigroup executive in control of one of the least-regulated, most complex divisions there, the Alternative Investments group, and served as Clinton's deputy secretary of state. This amounts to an abject failure by the banks to do the homework they were assigned on behalf of the taxpayers who bailed them out, one of the most basic requests of Dodd-Frank. Seems the banks are too busy to even imagine how they'd get out of the next crisis. But you won't hear any admonishment from Clinton or Kaine. You'll hear that her Wall Street plan is better than reinstating Glass-Steagall, because as she's said, major economists (those that don't appear to fully understand how financial relationships and derivatives work) said so. She will reference shadow-banking problems, which in her alternative universe, have no financing connections to big FDIC-insured banks. Again, probably sheer coincidence that the lion's share of the money backing Clinton's White House bid comes from the securities and investment sector, according to the nonpartisan Center for Responsive Politics. Kaine will fall into line behind her. None of that will deter another bank-led financial crisis. On July 18, Kaine was one of four senators signing a letter sent to a major regulatory trio — the Federal Reserve, FDIC and Office of the Comptroller of the Currency — asking that they exclude large regional banks from the "significant burdens" of reporting risk on a daily, rather than monthly, basis. It also called for them for revisiting the "liquidity coverage ratio," or the amount of capital these banks must hold over a 30-day period to cover emergency situations. The senators' request is clearly deregulatory and irresponsible: SunTrust, one of the banks that would fall under this exclusion, paid $1 billion to settle mortgage fraud allegations. Kaine advocates more leniency for a swath of FDIC-insured banks. Allowing some of the largest banks in the country a pass on risk reporting and prevention is not safe. In general, Kaine advocates more leniency for a swath of FDIC-insured banks. Progressives, conservatives, liberals and libertarians should be worried about a banking system whose very structure (disregarding the minimal tweaks of Dodd-Frank) remains poised to tank the economy. Hillary and Tim would have us believe everything's under control — for now. None of the issues listed on Tim Kaine's official website mention Wall Street or bank regulation. That's a dangerous mistake of judgment. Regards, Nomi Prins Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post Hillary's Choice: Why Tim Kaine Isn't a 'Safe' Pick appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Helicopter Money - Hope and Change Posted: 28 Jul 2016 01:40 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Joe Weisenthal: How Donald Trump changed my mind about gold Posted: 28 Jul 2016 01:29 PM PDT By Joe Weisenthal If you poke around on the internet, you'll find a lot of people who have criticized me for being a "gold hater." Here are two different pieces that took me just a few seconds to find: http://www.bullionbaron.com/2015/08/the-religion-of-gold-hating.html There are plenty of tweets out there saying the same thing. These people have been basically right. Over the years I've said a lot of bad stuff about gold -- how it's a lousy currency, how it's just a rock that shouldn't have any value, how love of it is primitive and irrational, how it has no justifiable basis in the economy. But I'm changing my mind, and it's all due to Donald Trump. The other day Timothy O'Brien published a brilliant photo gallery here on Bloomberg View showing Trump's love of all things gold. Trump's stage at the convention was gold-colored. Trump events often feature pretend miniature gold bars. The logo on Trump Tower is gold-hued. And Trump has lots of gold-plated furniture. ... ... For the remainder of the commentary: http://www.bloomberg.com/view/articles/2016-07-28/how-donald-trump-chang... ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Jul 2016 11:44 AM PDT The first stage in a bear market begins with a severe drop below the 200 day moving average. This serves as the shot across the bow warning. Then there is usually at least one more attempt to recover the 200. When it fails the bear market starts in earnest. The dollar has dropped below the 200 this morning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The System Cannot Survive, Is Gonna Be Epic When It COLLAPSES !! -- Gregory MANNARINO Posted: 28 Jul 2016 10:00 AM PDT Gregory MANNARINO : The System Cannot Survive, Is Gonna Be Epic When It COLLAPSES !! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bernie Voters Going To Trump -- Hillary Is Done Posted: 28 Jul 2016 09:30 AM PDT Hillary Clinton is sinking fast as the DNC begins, Bernie voters are jumping ship and landing on the Trump Train. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The End of America in 2017 You Need to See These Events! Posted: 28 Jul 2016 08:30 AM PDT your government is not your government any more, & there for you must replace your government, befor it take all your rights a way. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

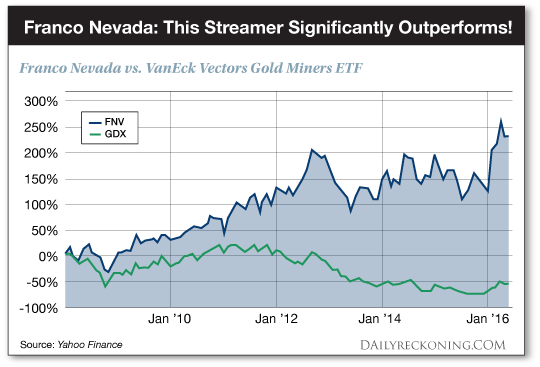

| Protect Your Wealth While Earning Income Posted: 28 Jul 2016 08:00 AM PDT This post Protect Your Wealth While Earning Income appeared first on Daily Reckoning. Want to know how to predict whether a stock is headed higher or lower? It's actually easier than you might think… Many stocks trade in reliable trend patterns. This means trending stocks that are bullish tend to continue higher. And those that are in bear market trends tend to steadily move lower. That doesn't mean your trending stock will move higher each day. But it does mean that over time, a bullish trending stock will have more up days than down days. And over time, you'll make a good amount of money holding this position. The strongest and most reliable trend I've been watching this year is the steady advance in precious metals. In particular, gold and silver have been moving higher all year. On Dec. 31 of last year, gold futures closed at $1,064 per ounce. Today, gold futures are trading near $1,320. That's good for a 24% increase — not bad! Even more impressive is silver's advance. This year, silver futures have logged a 41% increase from $13.93 per ounce at the end of 2015 to a current price of $19.69. Now, it's true that gold and silver prices have slipped over the past two weeks. If you're heavily invested in gold — or in gold mining stocks or other precious metal plays — you might be disappointed with the pullback. But this pullback might actually be one of the best things that could happen since it presents an excellent buying opportunity. There are many reasons to expect gold and silver prices to trend higher once again. With interest rates near zero in the U.S. and rates dropping into negative territory around the world, investors are looking to buy gold and silver hand over fist. Their goal is to preserve wealth instead of allowing the central banks of the world to steal their money through zero or negative interest rates. And since gold and silver can't be created at the stroke of a computer key, supplies can't always keep up with demand. I think buying gold and silver is an excellent way to help protect the value of your wealth. But there's one problem with it… Holding physical gold and silver doesn't give you income that you can use to pay your bills or spend as you please. And gold stocks can be volatile. They can be a great investment if you have some extra cash lying around. But not every investor can afford to speculate with his hard-earned money or has the appetite for a lot of risk. Many investors would like a safer way to invest in precious metals prices without taking on that risk. And I think I have the ideal solution… Last week, I showed you a super-safe way to invest in gold and silver that pays you a nice stream of income — even if their prices fall. Franco-Nevada is a Toronto based streaming company that consists of 340 mining properties in various stages of production. Because of their streaming business model, Franco-Nevada has no operational risk or expensive costs associated with mining. They essentially front the money that miners need in exchange for a stream of precious metals at a fixed rate. This allows Franco-Nevada to remain profitable even when prices of precious metals fall. Just check out their chart below!

Compared to other miners, Franco- Nevada is a top tier investment that sees all of the upside in precious metal rallies and delivers returns even when other miners see steep drops in share price. With low operational costs, Franco-Nevada is a great way to get exposure to gold all while earning a 1.31% divided! If you are looking for income that isn't associated with precious metals, I have an interesting story… I developed a lucrative investing strategy that has helped numerous Americans generate anywhere from a few hundred dollars to over a thousand dollars a month. It was so powerful, one of the most influential financial institutions in America sent me this 4 page threatening letter saying they would take me down. Click here to find out why. Regards, Zach Scheidt The post Protect Your Wealth While Earning Income appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| END TIMES SIGNS: LATEST EVENTS (JULY 28TH, 2016) Posted: 28 Jul 2016 08:00 AM PDT end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon The Financial Armageddon Economic Collapse Blog tracks trends... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TD's $230 billion man goes maximum gold as volatility mounts Posted: 28 Jul 2016 07:33 AM PDT By Eric Lam and Allison McNeely In a world flush with central bank stimulus and swirling with volatility, Bruce Cooper is pushing for the one asset he says he can count on: gold. TD Asset Management's chief investment officer is adopting a more conservative approach to focus on capital preservation. Cooper sees gold as the best bet with the global economy stuck in neutral, and as loose central bank policy, the U.K. Brexit vote, and a looming U.S. presidential election stoke demand for havens. The firm shifted to "maximum overweight" in gold for its portfolios during the second quarter from a "modest overweight," according to Cooper's latest market outlook report. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-07-28/td-s-230-billion-man-g... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terrorism Isn't What You Think It Is - David Icke Posted: 28 Jul 2016 07:26 AM PDT Terrorism Isn't What You Think It Is - David Icke - Hegelian Dialectic - False Flag Terrorism - Problem Reaction Solution - Conspiracy The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Jul 2016 05:38 AM PDT SPX Futures are still on a rollercoaster as the earlier rise in the Premarket is given up to a flat scenario. ZeroHedge reports, “Following yesterday's Fed decision and ahead of tonight's far more important BOJ announcement, European stocks have posted modest declines, Asian shares rise toward 9-month highs, while U.S. equity index futures are fractionally in the green in the aftermath of Facebook's blowout earnings. The dollar has extended on losses after Yellen reiterated a gradual approach to raising interest rates, with the BBDXY down 0.5% in early trading after slipping 0.4% over the previous two sessions.” | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bullion Up 1.6%, Silver Surges 3.7% After Poor U.S. Data and Dovish Fed Posted: 28 Jul 2016 05:33 AM PDT Gold bullion was up 1.6% and silver surged 3.7% yesterday, their second consecutive day of gains, after U.S. durable-goods orders dropped sharply, adding to speculation that Federal Reserve policy makers will maintain ultra loose monetary policies. Gold and silver consolidated on those gains in Asia and in early European trading. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Silver and the Clueless Federal Reserve - Video Posted: 28 Jul 2016 05:30 AM PDT I'm going to be covering a gold and silver today and the Federal Reserve which had its needing a ended yesterday the FOMC meeting so golden silver had good days yesterday we closed and i take the 10 p.m. london time I close gold close at 1339 it was up one and a half percent on the previous day clothes are up 20 bucks so we had a lot of 13 15 around 13 1588 and a high of 1342 silver close three-point-six percent up it closed around twenty thirty four verses 1963 the previous day so up and they had a high of 20 41 this morning gold right now is around 13 42 has been thirteen forty three silvers at 20 28 is down a little bit the has been 2052 and also the heyy index which is the gold bugs index of mining shares was at four point six nine percent and the X EU | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 27 Jul 2016 06:44 PM PDT Fed does nothing, says little. Gold pops, stocks Decline. Japan considers 50-year bonds. Companies report fake numbers. Money pours into corporate bonds as sovereign yields go negative. G-20 commits to more stimulus. Debt keeps soaring while yield curves flatten. Judge rules that bitcoin is not money. Best Of The Web Biggest companies in the […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Still Waiting for a Precious Metals "Correction"? Get Off the Dime and Buy Some Silver Posted: 27 Jul 2016 11:05 AM PDT Over time, charts for a bull market tend to print higher highs and higher lows on the way to the primary top. Two steps forward, one step back, creating a visual stair-step effect. This chart "picture" has been in evidence for gold, silver, and the miners since January. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Zero Percent Mortgages Debut Setting up the Next Stage for this Stock Market Bull Posted: 27 Jul 2016 10:24 AM PDT Although gold dust is precious, when it gets in your eyes it obstructs your vision. Hsi-Tang Economists stated that main trigger for the financial crisis of 2008 was the issuance of mortgages that did not require down payments. The ease at which one could get mortgages in the past is what drove housing prices to unsustainable levels. Post-crisis all banks vowed to end the practice forever, or that is what they wanted everyone to believe. When the credit markets froze, we openly stated that the 1st sign that banks were getting ready to lower the bar again would come in the form of Zero percent balance transfer offers that had all but vanished after 2008. A few years after 2008, banks started to mail these offers out, and now everywhere you look you can find 0 % balance transfer offers ranging from 12 months to 18 months. The next step after that would be for banks to lower the 20% down payment required to something much lower. Currently, Bank of America and a few other banks are offering 3% down mortgages. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Claudio Grass, Global Gold: Ronald, it is a pleasure to have the opportunity to speak with you. We've known each other for a very long time, both on a personal and professional level. Because of our central banks, we find our economies today operating on artificial stimulus and negative interest rates. How would you summarize the consequences of this policy?

Claudio Grass, Global Gold: Ronald, it is a pleasure to have the opportunity to speak with you. We've known each other for a very long time, both on a personal and professional level. Because of our central banks, we find our economies today operating on artificial stimulus and negative interest rates. How would you summarize the consequences of this policy?

… The economy moves in cycles. Currently, the industrialized world and a large part of the Emerging markets are in a down cycle. Government interventions are failing to bring the economy back on a growth track, and the mid-term assessment is that the world will somehow continue to "muddle through" for another few quarters.

… The economy moves in cycles. Currently, the industrialized world and a large part of the Emerging markets are in a down cycle. Government interventions are failing to bring the economy back on a growth track, and the mid-term assessment is that the world will somehow continue to "muddle through" for another few quarters.

No comments:

Post a Comment