Gold World News Flash |

- Unsound Money Has Destroyed The Middle Class

- Japan Has Sent A Massive Monetary Shock Wave Across the Planet: “Will Create A Big Upward Price Adjustment In Gold And Silver”

- PRINT BABY PRINT: Global Central Banks Are All-In: QE Running At Record $180 Billion Per Month (And Rising)

- END TIMES SIGNS: LATEST EVENTS (JULY 26TH, 2016)

- WHAT’S GOING ON??? Record Swiss Gold Flow Into The United States

- Judge Rules Bitcoin Isn't Money Because It "Can't be Hidden Under A Mattress"

- Mining CEO: Silver in a Sweet Spot - Peter Schiff

- BREAKING -- Black Lives Matter Protesters Drag Burnt American Flag

- Wikileaks Emails Bring New Attention to Hillary Victory Fund “Money Laundering” Charges

- Economic Collapse causes environmental disaster in Venezuela

- Help Alex Jones Awaken The Sleeping Giant

- France has a Problem & Could ISIS Bring on Martial Law In The US?

- Gold Daily and Silver Weekly Charts - Quiet Option Expiry, FOMC Tomorrow

- Nick Barisheff: Gold and pork bellies

- 'Impending gold production cliff' may deliver a jolt to prices

- ISIS knifemen gave Arabic sermon after murdering priest on camera

- BREAKING: "ISIS Terrorist Murder Catholic Priest During Mass In France"

- Decision Time for Silver Investors?

- Remembering Golds Bullish Set-Up on Dec. 1, 2015

- Central Banks Will Create A Historical Gold Rush

- Derivatives Are Now 15 Times World GDP But Here Is An Even More Frightening Problem

- Breaking News And Best Of The Web

- “It’s Just a Question of When…”

| Unsound Money Has Destroyed The Middle Class Posted: 27 Jul 2016 01:00 AM PDT Authored by Bonner & Partners' Bill Bonner, (Annotated by Acting-Man's Pater Tenebrarum), Duped and DistortedWhen you start thinking about what money is and how it works, you face isolation, shunning, and possible incarceration. The subject is so slippery – like a bead of mercury on a granite countertop – you become frustrated… and then… maniacal.

What thinking about money can do to you Illustration by Jhonen Vasquez

You begin talking to yourself, because no one else will listen to you. If you are not careful, you may be locked up among the criminally insane. We’ve been thinking about money for the last couple of months. It has become our favorite subject. That is why people edge away from us at parties. Our family finds novel ways to change the subject. “Whoa… sorry to interrupt, Dad… but isn’t that a flying saucer?” Undaunted, we press on. We think we’re onto something important. We have come so far; we might as well go the whole way. Economist George Gilder’s new book, The Scandal of Money, came as an unexpected reinforcement. He has been thinking about money, too. But he seemed fairly normal in Las Vegas last week. No facial tics. No babbling or paranoid delusions. Gilder has come to much the same conclusions from a different direction. It is not real money. It only pretends to be. It has duped the entire world – and distorted the entire global economy.

Neither Cash nor GoldWe’ve already connected most of the dots. Today, we draw a new line from this new dollar to the impoverishment of the middle class. It explains why even Donald J. Trump – a man with none of the qualities you would normally look for in a chief executive – is the Republican presidential nominee. The phenomenon is teased up for us by one of our own dear readers, who writes:

Yes, exactly. Money is not wealth. It only measures the stuff that you can buy with it. No stuff? Then money is worthless. Imagine a man at the North Pole. He is starving and freezing to death. You give him a Ben Franklin. What is it worth? Zero. Give him a gold coin? Same thing. Good money honestly measures output. It is the output that is the real wealth. And if you want wealth, you have to produce. That is the meaning of Say’s Law: You buy stuff with stuff, not money. Bad money, however, tricks up the whole system.

Believe it or not, France was once home to numerous great economists, and Jean-Baptiste Say was one of them (by contrast, nowadays the country’s most prominent economists tend to be Marxists like Thomas Pikkety). A major implication of Say’s law is that if one wants to consume, one must first produce. Today’s economic planners are as a rule trying to put the cart before the horse and keep being surprised that it doesn’t work. Engraving via Wikimedia Commons

Populist RageHow badly the system has been tricked up was the unintended subject of a recent article in the Financial Times. “Populist rage puts global elites on notice,” writes the ever-elite, Parasitocracy mouthpiece Mr. Martin Wolf. Poor Mr. Wolf. He conveniently misses the real cause of the “rage” – the phony money system put in place by the elite. He shows no interest in our perverse money system, but has begun foaming at the mouth anyway.

Establishment mouthpiece Martin Wolf, who ironically has been screaming for more money printing at every opportunity (for a few examples over the years, see e.g. “The Helicopter Wolf at the Door”, “The Money Cranks are Loose” or “Establishment Quacks Call for More Money Printing”). It has been known since the publication of Richard Cantillon’s seminal treatise Essai sur la Nature du Commerce en Général that introducing additional money created ex nihilo into the economy will (among other things) lead to wealth redistribution, as new money doesn’t reach all economic actors evenly or simultaneously (the essay can be read for free here). Written in 1730, and considered “the cradle of political economy” by Jevons, it somehow seems to have escaped the attention of the FT’s chief economics commentator – who, not to put too fine a point to it, is a complete money crank. Allegedly he once said that there was a “need for new ideas”, but the economic recipes he himself promotes have produced nothing but failure for ages. In fact, the crude inflationism supported by Mr. Wolf and a whole host of modern-day central planners is just about the hoariest economic idea there is. Its practical implementation predates the misguided economic theories trying to provide it with a “scientific” fig leaf by many centuries. Let us not forget, inflationism inter alia brought down the Roman Empire. If Mr. Wolf wants to save his precious elites, he should actually consider refraining from calling for more of the same. Photo credit: Financial Times

The gist of Mr. Wolf’s warning is that the elites had better take notice. “Real income stagnation over a longer period than any since 1945 is a fundamental fact,” he continues. During the most recent end of that period – from 2005 to 2014 – for example, almost 100% of Italian households have seen their real incomes fall or remain flat. In the U.S., 80% of households have experienced the same fate. Britain, France, and the Netherlands are only slightly better. Since 1980, employment in manufacturing – the source of good wages for the middle and lower classes – has fallen in all the major developed economies, including Germany and Japan. In most of them, it has been roughly cut in half. We’re not sure if it were these facts themselves, or the dreaded populist rage… but after reciting them, poor Mr. Wolf begins eating the rug:

Now we know who did this! A linguistic aside: according to Jonathon Green’s Dictionary of Slang, the expression “chewing the carpet” is 1950s US slang, defined as ‘to lose emotional control, to have a temper tantrum‘. It is thought that Hitler was actually the source of the expression, as he displayed very odd behavior at times, which testified to his highly imbalanced state of mind. According to John Toland’s Hitler biography, incidents of Hitler literally chewing the edge of a carpet in a blind rage were indeed witnessed by several members of his inner circle at the “Eagle’s Nest” near Berchtesgaden in Bavaria (if you see someone doing that, try to make sure he doesn’t come to power). |

| Posted: 27 Jul 2016 12:00 AM PDT ShtfPlan |

| Posted: 26 Jul 2016 08:05 PM PDT from Zero Hedge:

As Jamie McGeever reports, The European Central Bank and Bank of Japan arebuying around $180 billion of assets a month, according to Deutsche Bank, a larger global total than at any point since 2009, even when the Federal Reserve’s QE programme was in full flow.

And if market consensus proves accurate, that total is about to rise by billions more — with the ECB, BOJ and even Bank of England all expected to expand their QE programmes soon to try and bolster fragile growth and lift stubbornly low inflation. The $180 billion total is roughly split down the middle between the ECB and BOJ, according to Deutsche, and is measured on a rolling 12-month basis. But against GDP, Japan is the biggest ‘loser’…

And that is why stock markets around the world have soared since February amid a collapse in everything fundamental… |

| END TIMES SIGNS: LATEST EVENTS (JULY 26TH, 2016) Posted: 26 Jul 2016 08:00 PM PDT end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| WHAT’S GOING ON??? Record Swiss Gold Flow Into The United States Posted: 26 Jul 2016 07:50 PM PDT by Steve St. Angelo, SRSRocco Report:

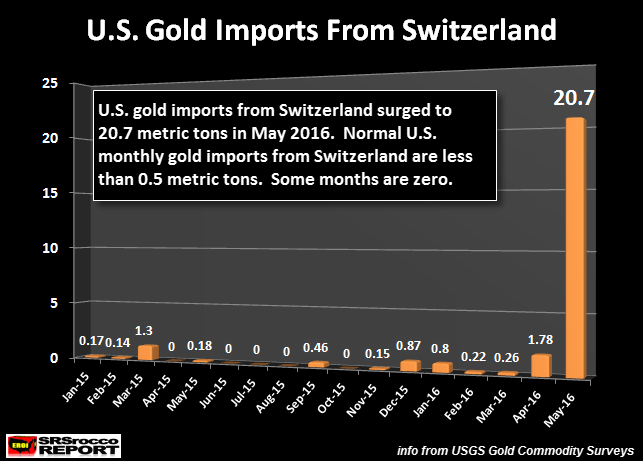

How much gold? A lot. The Swiss exported 50 times more gold in May than their monthly average (0.4 mt) since 2015: As we can see, the Swiss gold exports to the United States are normally less than 0.5 metric ton a month. And for many months there weren't any gold exports. However, something big changed in May as Swiss gold exports surged to 20.7 mt (665.500 oz). The overwhelming majority of gold flows from the U.S. have been exports to Switzerland and the United Kingdom (U.K.):

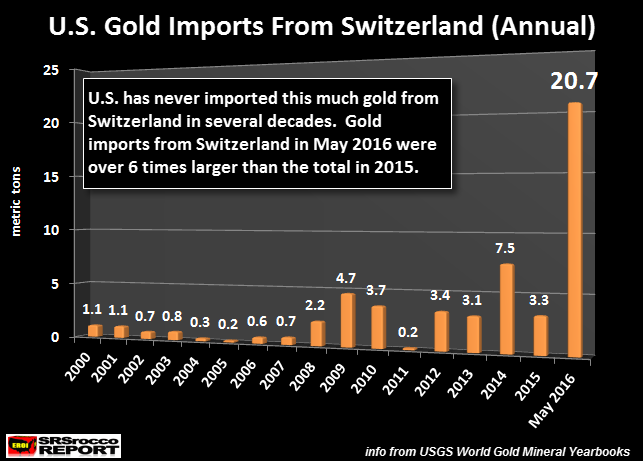

Furthermore, as I have mentioned in precious articles, the U.S. has been exporting more gold than it produces and imports. However, this changed in May as the Swiss exported more gold to the U.S. in one month than they have every year going back until 2000:

Why the big change? Could this have had something to do with the huge gold price since the beginning of 2016, or maybe was it due to political changes such as the upcoming BREXIT vote in June? Of course the BREXIT vote is now history as the British citizens voted to leave the European Union. However, something motivated this huge trend change in normal gold movements to Switzerland. Moreover, total U.S. gold imports in may shot up to 50 metric tons, almost double the 26.5 mt figure in April. In addition, total U.S. gold exports hit a low May as only 20.2 mt were shipped to foreign countries. Total U.S. gold exports Jan-May 2016 of 139 mt are down 28% compared to 195 mt exported during the same period in 2015. So what's going on here? Why the declining U.S. gold exports or surging gold imports from Switzerland? Are foreign countries demand less gold?? I doubt it. Or how about the massive increase in supposed gold flows into the Global Gold ETFs & Funds?? While there is no way of knowing how much gold these Gold ETFs & Funds hold, something seriously changed in May as the Swiss exported more gold to the U.S. in one month than they have every year for several decades. Are wealthy Americans finally acquiring a lot more gold? |

| Judge Rules Bitcoin Isn't Money Because It "Can't be Hidden Under A Mattress" Posted: 26 Jul 2016 07:40 PM PDT Submitted by Everett Numbers via TheAntiMedia.org, In a landmark decision, a Florida judge dismissed charges of money laundering against a Bitcoin seller on Monday following expert testimony showing state law did not apply to the cryptocurrency. Michell Espinoza was charged with three felony charges related to money laundering in 2014, but what appears to have helped to clear him of any and all wrongdoing was testimony given just a few weeks ago by an economics professor.

Evans was given $3,000 in Bitcoin by defense attorneys for sharing his expertise, the newspaper reported. Judge Pooler found the cryptocurrency, which is based on verified encrypted transactions that are recorded on a public ledger, did not constitute “tangible wealth” and“cannot be hidden under a mattress like cash and gold bars,” reported the Herald. Pooler added that Bitcoin was not codified by government, nor backed by any bank.

Espinoza, 33, was charged after undercover detectives bought $1,500 worth of Bitcoin from him, claiming they would use the currency to purchase stolen credit card numbers. However, Judge Pooler found the Florida law prosecutors based their case upon to be too “vague.” Another man, Pascal Reid, was arrested in tandem with Espinoza. Reid took an early plea deal, pleading guilty to acting as an unlicensed money broker. The deal required him to serve a probation sentence and educate law enforcement on the workings of Bitcoin. While Monday’s ruling comes as a relief to Espinoza, it remains to be seen what comes next in Bitcoin regulation. States continue to grapple with the issue, and at the federal level, regulation has stalled. But Bitcoin enthusiasts have recently been more optimistic about a price surge, so the powers that be may move quickly if the virtual currency’s popularity resurges. |

| Mining CEO: Silver in a Sweet Spot - Peter Schiff Posted: 26 Jul 2016 07:21 PM PDT |

| BREAKING -- Black Lives Matter Protesters Drag Burnt American Flag Posted: 26 Jul 2016 06:48 PM PDT Killing cops, burning flags...gee why would anyone mistake them for a terrorist organization? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Wikileaks Emails Bring New Attention to Hillary Victory Fund “Money Laundering” Charges Posted: 26 Jul 2016 06:40 PM PDT by Pam Martens and Russ Martens, Wall Street On Parade:

The leaked emails have cost Debbie Wasserman Schultz her job as Chair of the DNC but other top DNC officials captured in devious plots against Sanders in the email exchanges still have their jobs – or at least no official firings have been announced. This makes the conspiracies seem more like a DNC business model.

The DNC's own charter demands that it treat all Democratic primary candidates fairly and impartially, but top DNC officials made a mockery of that mandate. In addition to conjuring up ways to smear Clinton challenger Bernie Sanders during the primary battles, the leaked emails show a coordinated effort to cover up what the Sanders camp called "money laundering" between the Hillary Victory Fund and the DNC. Despite the fact that the Sanders campaign had no such active arrangement with the DNC, the DNC agreed to participate in the Hillary Victory Fund, a joint fundraising committee that sluiced money to both Hillary's main candidate committee, Hillary for America, as well as into the DNC. To a much tinier degree, funds also went to dozens of separate State Democratic committees. On May 2 of this year, the Sanders campaign released a statement charging Clinton with "looting funds meant for the state parties to skirt fundraising limits on her presidential campaign," and exploiting "the rules in ways that let her high-dollar donors like Alice Walton of Wal-Mart fame and the actor George Clooney and his super-rich Hollywood friends skirt legal limits on campaign contributions." |

| Economic Collapse causes environmental disaster in Venezuela Posted: 26 Jul 2016 05:01 PM PDT Oil smuggling brings environmental disaster to Venezuela's economic ruin The economic disaster in Venezuela caused by tumbling petrol prices — oil production is the main industry — is also behind an environmental one. Lake Maracaibo, which sustains the Añu indigenous group, is being... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Help Alex Jones Awaken The Sleeping Giant Posted: 26 Jul 2016 04:30 PM PDT What you can do to help fight the Infowar and take Infowars itself to the next level. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| France has a Problem & Could ISIS Bring on Martial Law In The US? Posted: 26 Jul 2016 04:05 PM PDT Could ISIS Bring on Martial Law In The US? TheBlaze's Jason Buttrill Joins Dana The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Daily and Silver Weekly Charts - Quiet Option Expiry, FOMC Tomorrow Posted: 26 Jul 2016 01:46 PM PDT |

| Nick Barisheff: Gold and pork bellies Posted: 26 Jul 2016 12:57 PM PDT The former is always money, the latter is breakfast. * * * By Nick Barisheff Many investors and their financial advisors consider gold to be a commodity, which makes gold no different than copper, timber, pork bellies, or orange juice. They do not understand, or simply are unaware, that gold has been successfully used as money for more than 3,000 years. Although some people think gold is an archaic relic, the facts don't support this view. So, what is money? Gold is traded on the currency desks of all major banks and brokerages, along with dollars, euros, yen, and pounds, and not on the commodity desks along with other commodities. The foreign exchange traders know gold is money. On the balance sheets of all central banks, gold is classified as a monetary asset, along with their foreign currency reserves. The central bankers know gold is money. Central banks do not hold any other commodity as part of their reserves. Alan Greenspan knows gold is money, as he laid out in his famous article "Gold and Economic Freedom," written in 1966 before he became chairman of the Federal Reserve. ... ... For the remainder of the commentary: http://bmgbullion.com/gold-pork-bellies/ ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| 'Impending gold production cliff' may deliver a jolt to prices Posted: 26 Jul 2016 12:48 PM PDT Assuming, of course, that buyers want actual metal instead of "paper gold." * * * By Myra P. Saefong Gold discoveries peaked in 2007 and production will soon follow, strengthening the value of the yellow metal and possibly fueling a boom in mergers and acquisitions in the gold-mining sector, according to Sprott Asset Management. Discoveries of gold has collapsed since then, "despite exploration budgets increasing by 250 percent from 2009 to 2012," Sprott's gold team said in a recent note. ... ... For the remainder of the report: http://www.marketwatch.com/story/impending-gold-production-cliff-may-del... ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| ISIS knifemen gave Arabic sermon after murdering priest on camera Posted: 26 Jul 2016 11:19 AM PDT Horrific details emerge of how ISIS knifemen murdered elderly priest, 84, on camera then gave 'Arabic sermon' before they were shot dead by police - as Hollande says 'France is at war with ISIS' The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| BREAKING: "ISIS Terrorist Murder Catholic Priest During Mass In France" Posted: 26 Jul 2016 09:00 AM PDT Two Radical Islamic Terrorist from ISIS murder an 84 year old Catholic Priest and injured another person during Mass in France as they shouted "Allahu Akbar" The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Decision Time for Silver Investors? Posted: 26 Jul 2016 03:43 AM PDT the Silver Analyst |

| Remembering Golds Bullish Set-Up on Dec. 1, 2015 Posted: 26 Jul 2016 03:40 AM PDT The Gold Report |

| Central Banks Will Create A Historical Gold Rush Posted: 26 Jul 2016 03:32 AM PDT Central Banks Will Create A Historical Gold Rush |

| Derivatives Are Now 15 Times World GDP But Here Is An Even More Frightening Problem Posted: 26 Jul 2016 03:00 AM PDT Derivatives Are Now 15 Times World GDP |

| Breaking News And Best Of The Web Posted: 25 Jul 2016 06:44 PM PDT G-20 commits to more stimulus. Stocks and gold up slightly while oil falls again. Debt keeps soaring while yield curves flatten. Dutch roll out negative interest rates. Judge rules that bitcoin is not money. Several more mass killings, the latest in Japan. Trump makes long, dark acceptance speech, very well-received by Republicans. Clinton picks Tim […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| “It’s Just a Question of When…” Posted: 25 Jul 2016 01:00 AM PDT This post "It's Just a Question of When…" appeared first on Daily Reckoning. "It's a question of when, and it looks like it's coming pretty close…” "It" being the titanic Chinese banking and currency crisis. Trees don't grow to the sky, and neither do economies. But debt does… China's 25-year growth spurt is winding down. Now it's staring up the sheer of a Great Wall of Debt… and stuffed to its nose holes with excess industrial capacity. That's why Kevin Smith, CEO of Crescat Capital, thinks China's massive overcapacity and nonperforming loans have the country on collision course with "a twin currency and banking crisis," reports Reuters. Here's the big deal: Smith says that would bring a 20% decline in the yuan against the dollar. Big deal? China devalued only 4% last August. But its effect on U.S. markets was… dramatic. The Dow closed 508 in the red on Monday, Aug. 24, after plummeting 1,089 points to open the day. It was the index's eighth-worst single-day crash in its history. And after the previous Friday's carnage, it marked the first time the Dow had fallen more than 500 points on consecutive days. Thanks to heavenly intervention — or the Fed's (how can you tell these days) — stocks managed to grab the railing on the way down. But it was a damn close-run thing, as the Duke of Wellington said about Waterloo. China devalued again this January. Less than 2% this time. That was still enough to kick the stock market off to its worst annual start… ever. Janet of Arc stormed in on the white horse to save the day, but the lesson was clear: China devalues, stocks crater. Devaluations of a few percent were enough to do it each time. So… What happens if China devalues to the sweet tune of 20%? Hugh Hendry, founding partner of Eclectica Asset Management, has an answer. And no sugar on this one: “[If] tomorrow we wake up… and China has devalued by 20%, the world is over." A gust of rhetoric? Perhaps. The world survived Hitler, Stalin and Barry Manilow. But even if he's only half-right. “The amount of debt that China has taken in the last five–seven years is unprecedented,” says Morgan Stanley’s emerging-markets honcho, Ruchir Sharma, quoted in Reuters. “No developing country in history has taken on as much debt as China has taken on on a marginal basis.” China's got the printing presses going each and every hour of the twenty-four, all seven days. And its money supply now stands at a Himalayan-high 149 trillion yuan. That's 73% higher than the United States, if such a thing is possible. And all that new money just isn't producing any more bang for the buck. The powder's spent. Reuters: From 2003–2008, when annual growth averaged more than 11%, it took just one yuan of extra credit to generate one yuan of GDP growth, according to Morgan Stanley calculations. It took two for one from 2009–2010, when Beijing embarked on a massive stimulus program to ward off the effects of the global financial crisis. The ratio had doubled again to four for one in 2015, and this year, it has taken six yuan for every yuan of growth, Morgan Stanley said, twice even the level in the United States during the debt-fueled housing bubble that triggered the global crisis. The Keynesian multiplier, hard at work. That Sharma fellow says when you couple those rapidly diminishing returns with rising defaults and nonperforming loans, you've got “fertile [ground] for some accident to happen.” Jim Rickards thinks the ground's plenty fertile: The China credit situation is another bubble waiting to pop. It won't take much to start this new avalanche. And when it starts, it will be unstoppable… U.S. stocks may be living on borrowed time. You should get ready for another 10% correction coming soon. And here's something to reflect upon of a lazy summer day… We've mentioned it before in these reckonings. But our eyes still glaze over… a look of vacant, no-dial-tone idiocy crosses our features every time we ponder it… China poured more concrete between 2011 and 2013 than the United States did during the entire 20th century! Some think China will be able to avoid a hard landing. But it's hard to imagine a soft landing when the entire place is blanketed in concrete. Regards, Brian Maher Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post "It's Just a Question of When…" appeared first on Daily Reckoning. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The monetary policy beatings will continue until morale improves. Eight long years after monetary policy experimentation went extreme,

The monetary policy beatings will continue until morale improves. Eight long years after monetary policy experimentation went extreme,

There was a huge trend change in U.S. gold investment in May. Something quite extraordinary took place which hasn't happened for several decades. While Switzerland has been a major source of U.S. gold exports for many years, the tables turned in May as the Swiss exported a record amount of gold to the United States.

There was a huge trend change in U.S. gold investment in May. Something quite extraordinary took place which hasn't happened for several decades. While Switzerland has been a major source of U.S. gold exports for many years, the tables turned in May as the Swiss exported a record amount of gold to the United States.

The problem with conspiracy theorists is that, quite frequently, the theorists lack adequate imagination. That seems to be the case when it comes to the

The problem with conspiracy theorists is that, quite frequently, the theorists lack adequate imagination. That seems to be the case when it comes to the

No comments:

Post a Comment