Gold World News Flash |

- Trump 57.5% Likely to Win

- Gold Price Closed at $1319.50 Down $3.50 or -0.27%

- The US Dollar's Impact on Gold and Silver

- How would you invest money you didn't need for ten years?

- Ex member of the Opus Dei questions cern’s and the Vatican’s motives

- DNC Day 1: Debbie Doesn't Do Philly But Bernie Meets Michelle - Live Feed

- Lee Ann McAdoo Talks Secret Weapon To Bring Down Hillary

- Baltimore's Tax System Takes From the Poor to Give to the Rich

- Events are against monetary metals this week, Turk tells KWN

- STAGED Terror Tour in France Continues: Truck Attack Footage Brought To You By ISRAELI INTELLIGENCE

- Is China About to Shock the Market?

- Gold Daily and Silver Weekly Charts - Option Expiry and FOMC

- Sir Philip Green: I'm 'sad and sorry' over the collapse of BHS, but MPs' report is biased against me

- What you are not being told about The Wave of Terror in Germany

- Lawrie Williams: Swiss gold stats show continuing flows back to West

- Paul Mylchreest: Standoff in gold between speculators and price-suppressing banks

- Is This the Next Mobile Phone Movement?

- Mike Kosares: In Bankrate survey, 1 in 6 choose gold for 10-year investment

- IMF chief LAGARDE to stand trial over 400 million euro state payout

- Ann Coulter: In Trump We Trust

- Underpriced Silver Is the “Rip Van Winkle†Metal

- Hubris, Instability and Entertainment - The Only Thing That Grows Is Debt

- BREAKING : Massive Shooting In Florida 2 Dead 16 Wounded -- America Falling Apart!!!!

- Dinesh D’Souza: Clintons don’t play by the rules; they never have

- GERALD CELENTE - Stop The World War Anthem

- The Greenback Fires a Warning Shot: Are Commodities in Trouble?

- Silver Manipulation – Because They Needed the Eggs

- Silver Manipulation – Because They Needed the Eggs

- Remembering Gold's Bullish Set-Up on Dec. 1, 2015

- Breaking News And Best Of The Web

- Top Ten Videos — July 25

- Martin Armstrong: Throw Out the Fundamentals—Negative Rates Could Push the Dow Up to 40,000

- Silver Market COT Stuns: What's Going On Here?

- Gold Demand Remains Stable During Sector Weakness

- Stock Market Has Topped; GDX Continues Down

| Posted: 26 Jul 2016 02:00 AM PDT from Bill Still: Famed statistician, Nate Silver, has for the first time predicted that Donald Trump will become the next President of the United States. Silver, in his "Now-cast" election model says that if ballots were cast today, Trump has a 57.5% chance of winning. Clinton has only a 42.5% chance. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1319.50 Down $3.50 or -0.27% Posted: 25 Jul 2016 11:38 PM PDT

July is such a precious, peaceful month. I think we ought to ban political activity and news coverage the whole month, just so we could get some peace & refreshment. If y'all could drive through Robinson Branch with me where it's cool and the green sunlight trickles through the leaves, you'd vote for peace & refreshment, too. I woke up this morning thinking about gold & silver, something I don't usually do. It occurred to me that we will probably see metals moving sideways through at least half of August. If y'all had been through as many Augusts with gold & silver as I have, you'd be expecting them to begin rallying in the latter half of August. Markets are hesitating like a baseball flung in the air, just before it turns and starts down. US dollar index sustained its habits of slovenly weakness and lost 20 basis points (0.21%) to 97.32. Broke out of the triangle, but won't follow through. Still makes no sense. You'd have to be one speculatin' FOOL to sell dollars for euros now. I'm sorry, call me a tick-bitten, chigger-riddled, one-gallus hick, I just can't make a lick of sense out of the scrofulous dollar. Who would buy euros? Euro is one of the best arguments I know for owning gold. Well, it rose today 0.16% to $1.0993. Looking at that six month chart, it looks like the Nice Government Men are letting it down slowly. See what you think. http://schrts.co/HcRUv0 Yen has gotten snagged in its 50 DMA, & so far that's stopped its roll down the hill. Gained 0.3% today to 94.52. D'yall ever push an upright piano out a window? Once you get it on the window sill, you can just inch it out a little bit at a time & its weight is still mostly on your side or balanced. Right the second it gets overbalanced, that whole thing turns casters up in the air and falls 4 stories to the sidewalk. That's what this chart reminds me of: http://schrts.co/vtdPMb Yep, it's the S&P500. Today it lost another 6.55 (0.3%) trading sideways & closed 2,168.43. Dow looks the same. Lost 77.79 (0.42%) to 18,493.06. They're pushing further & further out that window, & one day they'll get overbalanced. OIL (WTIC) is trying to break down. http://schrts.co/vtdPMb Closed today below the lower channel line. On rising volume. Gold lost $3.60 (0.3%) to $1,319.50 on Comex. Silver subtracted 4.2¢ (0.2%) to 1961.5¢. Gold chart is right here, http://schrts.co/pI1ZgR You have to be patient enough to let any pattern work itself out, but gold has now traded into the nosecone formed by the bullish flag boundaries and the uptrend line from June. Bumped into the uptrend line today, but didn't close there. Unless it closes higher tomorrow, it runs the risk of breaking that uptrend line and falling back to the 50 DMA at $1,291. Silver's here, http://schrts.co/n7iIb4 Silver has traded out into the nose of a triangle and has about one more day before it will be squeezed out. Closed today right on the 20 DMA. I'm gonna get in trouble if I keep trying to say something when I've said all I had to say, so I'll say Good Night! Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The US Dollar's Impact on Gold and Silver Posted: 25 Jul 2016 10:25 PM PDT Technical analyst Jack Chan charts a breakout of the U.S. dollar and comments on its implications for gold and silver. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| How would you invest money you didn't need for ten years? Posted: 25 Jul 2016 10:19 PM PDT One in six investors chose gold as the best place to park money they wouldn't need for more than ten years – the same number that chose stocks, according to a recent Bankrate survey. Another 6% chose bonds, while 25% chose real estate, and 23% said they would simply bank the money. To the typical Wall Streeter, these results represent a world turned upside down. CNBC's Jim Cramer took one look and lamented, "As someone who has lived and breathed stocks for most of my life, this is a horrendous finding. But it's not surprising." | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ex member of the Opus Dei questions cern’s and the Vatican’s motives Posted: 25 Jul 2016 08:00 PM PDT Ex member of the Opus Dei questions cern's and the Vatican's motives The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| DNC Day 1: Debbie Doesn't Do Philly But Bernie Meets Michelle - Live Feed Posted: 25 Jul 2016 07:05 PM PDT After the turmoil of last week's RNC, this week' Democratic Nation Convention is off to an even more chaotic start (no matter what the surrogates desperately try to say). Wasserman Schultz resignation and decision not to 'gavel in' the convention is over-shadowed by the increasingly loud voices of Bernie (who will speak tonight) supporters booing any mention of Clinton-Kaine, but according to the mainstream media, Michelle Obama's headline speech tonight will bring the party together.

Live Feed (due to start at 4pmET) * * * Hillary better hope for a Convention bounce because she is starting to lag Trump notably...

* * * Or do voters know something else? Did Jane Sanders just drop a huge hint at what comes next? While almost inaudible, some have suggested she says: "They don't know your name is being put in nomination..." Source: MichaelPRamirez.com * * * Full order of business (via NJ.com): The list of speakers released by the Democratic National Committee is incomplete. Clinton's running mate, Virginia Sen. Tim Kaine, has yet to be added to the schedule, as well as many of the federal and state elected officials,who were announced as speakers on Thursday. Here is the current schedule: Monday, July 25 Session begins at 4 p.m.

Tuesday, July 26 The session begins at 4 p.m.

Wednesday, July 27 The session will begin at 4:30 p.m.

Thursday, July 28 The session begins at 4:30 p.m.

Finally, there is one 'unified' group that Hillary can rely upon... | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lee Ann McAdoo Talks Secret Weapon To Bring Down Hillary Posted: 25 Jul 2016 07:00 PM PDT Infowars reporter Lee Ann McAdoo and Margaret Howell discuss how the American people can bring down Hillary Clinton. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Baltimore's Tax System Takes From the Poor to Give to the Rich Posted: 25 Jul 2016 03:30 PM PDT An analysis of tax data by Maryland Public Policy Visiting Fellow Louis Miserendino reveals how the tax structure actually makes poverty worse and punishes poor residents to benefit wealthy developers The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Events are against monetary metals this week, Turk tells KWN Posted: 25 Jul 2016 03:06 PM PDT 6:04p ET Monday, July 25, 2016 Dear Friend of GATA and Gold: Events are against the monetary metals this week, GoldMoney founder and GATA consultant James Turk tells King World News today. Turk adds that if the metals show any strength at all this week, it will be a sign that governments are losing control of the market. An excerpt from the interview is posted at KWN here: http://kingworldnews.com/alert-james-turk-issues-warning-about-action-in... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| STAGED Terror Tour in France Continues: Truck Attack Footage Brought To You By ISRAELI INTELLIGENCE Posted: 25 Jul 2016 03:00 PM PDT Every American needs to question as to why is our government so infested by so many people with dual US/Israeli citizenship? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is China About to Shock the Market? Posted: 25 Jul 2016 02:39 PM PDT This post Is China About to Shock the Market? appeared first on Daily Reckoning. Did the U.S. just double-cross China under the Shanghai Accord? If so, China will act on its own to devalue the Chinese yuan. In that case, the Dow Jones Industrial Average could plunge to 16,450, and the S&P 500 could plunge to 1,925 in a matter of weeks, wiping out trillions of dollars of investor wealth. This is not guesswork. Plunges of over 10% in U.S. stock indices happened twice in the past year. Both times it was because of a combination of a stronger dollar and weaker yuan. It's happening again. And you need to understand the dynamics both to avoid losses and reap big gains by positioning ahead of the meltdown.

At The Great Wall of China in 1991. This visit was not long after the Tiananmen Square Massacre of June 4, 1989. Few Americans visited China at the time. Trade and investment relations were strained because of U.S. sanctions related to the massacre. I have visited China many times in the twenty-five years since my first visit and developed a network of contacts among government officials, private investors and academics to inform my investment analysis. Readers of Currency Wars Alert are familiar with the background of these currency gyrations and the Shanghai Accord. Here's a quick synopsis:

From early March to mid-May 2016, the Shanghai Accord worked like a charm. The yuan was stable against the dollar, and the dollar got weaker against the yen and euro. U.S. stocks staged a major rally from around 16,000 to almost 18,000 on the Dow Jones Industrial Index. It seemed that all was right with the world. Unfortunately, the Fed could not leave well enough alone. Instead of celebrating this truce in the currency wars, the Fed reneged on its weak dollar promise in May, and began talking about interest rate hikes possibly in June or July. The hawkish tone was expressed by several regional reserve bank presidents, notably James Bullard, Loretta Mester, and Esther George. The dollar rallied almost 4% in a few weeks. That's a huge move in currencies where changes are usually registered as small fractions of 1%. At that point, China felt double-crossed by the U.S. and began its third devaluation against the U.S. dollar. The first devaluation was the "shock" devaluation of August 10, 2015 where the yuan was devalued 3% overnight. The second devaluation was the "stealth" devaluation from December 2015 to January 2016. It was a stealth devaluation because China moved in small increments every day instead of one huge devaluation in a single day. The third devaluation is called the "cheater" devaluation because it reflected China's view that the U.S. was cheating on the Shanghai Accord. The cheater devaluation started in mid-May and continues today. The shock devaluation and the stealth devaluation both took place while the dollar was getting stronger in anticipation of U.S. rate hikes. Under the Shanghai Accord, the dollar got weaker, as agreed, and the yuan was relatively stable against the dollar. Finally, the Fed reneged and starting talking about rate hikes. The result was the dollar strengthened and the cheater devaluation began. What do all of the currency wars moves have to do with U.S. stocks? The answer is the USD/CNY cross-rate may be a more powerful determinant of stock prices than traditional barometers such as earnings, stock multiples or economic growth. This relationship is starkly illustrated in the chart below. As of mid-July, the Dow Jones Industrial Index (DJIA) hit all-time high of 18,533.05 and the S&P 500 also reached an all-time high of 2,166.89. But, those indices were close to those levels on two previous occasions, August 10, 2015 and December 16, 2015. Both times China began to devalue and both times U.S. stock markets sank like a stone. The DJIA dropped 11% (Aug. 10 to Aug. 25, 2015), and 12% (Dec. 16, 2015 to Feb. 11, 2016). If history repeats, DJIA could drop to 16,450 or lower, and the S&P could drop to 1,925 or lower. As the chart shows, that process of a new crash had already started in early June, but the crash was "saved by Brexit." The Brexit vote caused an immediate collapse in sterling and the euro and led to a "risk off" flight to quality in dollars, gold and U.S. stocks. Now that the Brexit bounce is over and stocks are at nosebleed levels, the question is will history repeat itself, or will this time be different?

At Currency Wars Alert, we use our proprietary IMPACT method to spot the next moves in major currency pairs. IMPACT is a method I learned in my work for the U.S. intelligence community including the CIA, and the Director of National Intelligence. It's based on what the intelligence community calls "indications and warnings." Even in the absence of perfect information, you can tell where you're going by unique signposts along the way. What are the indications and warnings we see on CNY/USD? Currency pairs don't move in a vacuum. They move in response to interest rate policy including forward guidance about policy. To a great extent, interest rates and exchange rates are reciprocals. If interest rates are higher, or expected to go higher, the currency will strengthen as capital flows in to take advantage of higher yields. If interest rates are lower, or expected to go lower, the currency will weaken as capital flows out in search of higher yields elsewhere. The knowledge that currency rates reflect trade deficits and surpluses is mostly obsolete. Capital flows dominate trade flows in the determination of exchange rates. When China devalued the yuan in August 2015, capital outflows surged. Once the yuan stabilized against the dollar in early 2016, the capital outflows were greatly reduced. Capital outflows from China will be one of the main indications and warnings we'll be watching in the months ahead to judge the impact of this latest Chinese devaluation. In the short-run, U.S. stocks are headed for a fall based on renewed tough talk by some Fed officials. The Fed is concerned that U.S. stocks are in bubble territory. They suggest that the easier financial conditions caused by higher stock prices make this a good time to raise interest rates. The rate hike talk then makes the dollar stronger and prompts China to weaken the yuan. The weak yuan triggers capital flight, which causes a spillover liquidity crunch, which in turn leads to a correction in U.S. stocks. Once the correction takes place, the Fed can rescue the stock market again with more dovish signals. This will weaken the dollar, stabilize the yuan, and reinstate the Shanghai Accord. Until then, the risks are that the Fed has not learned from its past mistakes and will ignore its responsibilities under the Shanghai Accord. August 2016 could be a replay of August 2015. Fasten your seatbelts. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post Is China About to Shock the Market? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Option Expiry and FOMC Posted: 25 Jul 2016 01:54 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sir Philip Green: I'm 'sad and sorry' over the collapse of BHS, but MPs' report is biased against me Posted: 25 Jul 2016 01:35 PM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| What you are not being told about The Wave of Terror in Germany Posted: 25 Jul 2016 12:59 PM PDT Imagine if right-wing extremist neo-nazi skinheads had spent the last 8 months carrying out the same amount of terror that Islamists are responsible for. Do you think the media would try to hide the hateful ideology behind it? The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lawrie Williams: Swiss gold stats show continuing flows back to West Posted: 25 Jul 2016 12:24 PM PDT 3:23p ET Monday, July 25, 2016 Dear Friend of GATA and Gold: Lawrie Williams, market analyst for the Sharps Pixley bullion house in London, writes today that the flow of gold out of Asia and back into Switzerland and London is continuing, apparently because of demand in the West for metal represented by shares of exchange-traded funds. Williams' commentary is headlined "June Swiss Gold Statistics Highlight Continuing Reverse Gold Flows" and it's posted at Sharps Pixley's Internet site here: http://news.sharpspixley.com/article/lawrie-williams-june-swiss-gold-sta... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paul Mylchreest: Standoff in gold between speculators and price-suppressing banks Posted: 25 Jul 2016 12:10 PM PDT 3:09p ET Monday, July 25, 2016 Dear Friend of GATA and Gold: Market analyst Paul Mylchreest of ADM Investor Services International in London -- -- writes in the firm's Equity & Cross Asset Strategy letter today that there's a standoff in the gold futures market between the bullion banks and speculators; that the banks appear to have increased their naked shorting of gold to contain the price, anticipating that they will smash the price, panic the speculators into selling, and cover their shorts, as they often have done; but that there were three episodes during gold's bull market from 2001 through 2011 when this tactic of the banks failed and gold "went parabolic." Mylchreest adds that speculators in recent months have been "far more resolute." Mylchreest's letter is headlined "Gold Futures -- Critical Days in the Battle (Not the War)" and with his kind permission it's posted in PDF format at GATA's Internet site here: http://www.gata.org/files/MylchreestReport-07-25-2016.pdf CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:

This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is This the Next Mobile Phone Movement? Posted: 25 Jul 2016 12:00 PM PDT This post Is This the Next Mobile Phone Movement? appeared first on Daily Reckoning. Trends are born. They grow and mature. Eventually, they reach old age and die. My research leads me to conclude we're on the cusp of a "clean phone" trend. This is when you want to catch a trend for the chance at the largest wealth — right at the start. As you'll see, this emerging trend is similar to the "clean food" trend that helped Whole Foods grow into a $10.6 billion company. The foundations of these two trends are also similar. Consumers knew chemically treated food was bad. They demanded clean food. Today, emerging research suggests cellphone use could be detrimental to your health. As the research compounds, consumers will demand clean phones too. Today, what I call "clean phone" tech is still in technology's womb. Those who act on the firms giving birth to this multibillion-dollar market segment could make enormous market gains. In trend forecasting, all things are connected. I call it Globalnomic. One trend impacts and feeds another, all the way around the world. To understand the market dynamics and growth potential of "clean phones" is to recognize the connection to "clean foods," a term I coined way back in 1993. How the Rise of Clean Phone Tech Will Mirror "Clean Food"For most millennials, it's ancient history. But for baby boomers and Gen X, when you went to the supermarket in the 1980s, the array of fruits and vegetables was limited. With lettuce, it was iceberg. Romaine, red leaf, Boston… forget about it. If you wanted variety and yearned for organic, the only place you'd find it in those pre-Trader Joe's and pre-Whole Foods days was in small health-food stores in the low-rent section of town. By the early 1990s, this began to change. The organic trend blossomed. Why? Despite claims by chemical companies such as DuPont that "used correctly, there should be negligible risk to human beings… chemicals that fight weeds, fungus and pests provide a major benefit in producing abundant, affordable food supply," a wide spectrum of an educated society began to make the connection. That connection was simple. Eating foods laced and produced with multiple combinations of chemicals and pesticides posed high health risks. Scientific evidence eventually confirmed the spectrum of ill effects of processed, chemically laden foods. Large-scale food producers could no longer deny the evidence. And as I predicted, a robust, growing countertrend parallel industry was born. While still a minority of the total food market, the $43 billion organic/clean food sector has steadily grown. Many of the small startups back then are now owned by corporate giants who were losing market share due to pay-more-to-stay-healthy consumers. "Clean Phones" Are ComingJust as I predicted the birth of the clean-food movement, we predict the rise of "clean phones" for essentially the same reason: A large market sector is ready to put its money where its health is. The world is wireless. And the smartphone and its comparable cousins are now the sources of numerous studies showing that radiation from the devices may be tied to brain cancer and other ailments. The health risk list keeps growing. In fact, initial findings of a study released in May by the federal National Toxicology Program found that radiation from radio-frequency exposure caused tumors in lab rats. Therefore, as evidence grows and public awareness regarding health risks of chronic cellphone use increases, particularly among children, the same market segment that pays for clean food will swiftly gravitate to "clean phones." Thus, safer cellphone devices that are effective and marketed with a "clean phone" theme and brand will corner a market with rich and growing potential. Till next time, Gerald Celente

The post Is This the Next Mobile Phone Movement? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mike Kosares: In Bankrate survey, 1 in 6 choose gold for 10-year investment Posted: 25 Jul 2016 11:56 AM PDT By Michael Kosares One in six investors chose gold as the best place to park money they wouldn't need for more than 10 years -- the same number that chose stocks, according to a recent Bankrate survey. Another 6 percent chose bonds, while 25 percent chose real estate and 23 percent said they would simply bank the money. To the typical Wall Streeter, these results represent a world turned upside down. CNBC's Jim Cramer took one look at the results and lamented, "As someone who has lived and breathed stocks for most of my life, this is a horrendous finding. But it's not surprising." ... ... For the remainder of the commentary: http://www.usagold.com/publications/NewsViewsAug2016SPECREPT.html ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| IMF chief LAGARDE to stand trial over 400 million euro state payout Posted: 25 Jul 2016 10:30 AM PDT France's highest appeals court has ruled that Christine Lagarde, the head of the International Monetary Fund, must stand trial for her role in a 400 million euro state payout to Bernard Tapie, a French businessman. The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ann Coulter: In Trump We Trust Posted: 25 Jul 2016 10:00 AM PDT Ann Coulter speaks with Alex Jones about the state of the GOP and Donald Trump. : People Have To Get Comfortable With The Idea Of Trump The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Underpriced Silver Is the “Rip Van Winkle†Metal Posted: 25 Jul 2016 09:58 AM PDT Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason. Coming up we’ll hear a fantastic interview with Dr. Chris Martenson of PeakProsperity.com, author of the Crash Course and now his wonderful new book Prosper. Chris will give us his amazing insights on a range of topics, including the real reasons behind the recent and surprising stock market rally, what to expect in the precious metals markets in the weeks and months ahead and the steps you can take to protect yourself in the face of ever-growing domestic and global chaos. You simply do not want to miss a must-hear interview with Chris Martenson coming up after this week’s market update. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hubris, Instability and Entertainment - The Only Thing That Grows Is Debt Posted: 25 Jul 2016 09:48 AM PDT John McDonnell, UK Shadow Chancellor of the Treasury (at least it sounds important) appealed to his -Labour- party on Sunday morning TV to “stop trying to destroy the party”, and of course I’m thinking NO, please don’t stop, keep at it, it’s so much fun. When you watch a building collapse, you want it to go all the way, not stop somewhere in the middle and get patched up with band-aids. It’s alright, let it crumble, it’s had its day. And if it’s any consolation, you’re not alone. Nor is that some freak coincidence. ‘Labour’-like parties (the ‘formerly left’) all over the world are disintegrating. Which is no surprise; they haven’t represented laborers for decades. They’ve become the left wing -and even that mostly in name only- of a monotone bland centrist political blob. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING : Massive Shooting In Florida 2 Dead 16 Wounded -- America Falling Apart!!!! Posted: 25 Jul 2016 09:11 AM PDT Paul Begley "Massive Shooting In Florida 2 Dead 16 Wounded" America Falling Apart!!!! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dinesh D’Souza: Clintons don’t play by the rules; they never have Posted: 25 Jul 2016 08:30 AM PDT Dinesh D'Souza, creator/producer of 'Hillary's America', on the DNC email scandal. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| GERALD CELENTE - Stop The World War Anthem Posted: 25 Jul 2016 08:00 AM PDT "US stocks close at record highs", "American exports to China sink further" and the US has released the Saudi documents regarding 9/11. 15 out of 19 who reportedly launched attacks on the World Trade Center were Saudis". The Financial Armageddon Economic Collapse Blog tracks trends... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

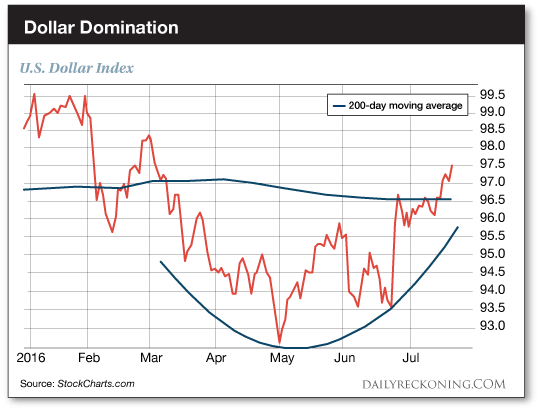

| The Greenback Fires a Warning Shot: Are Commodities in Trouble? Posted: 25 Jul 2016 06:58 AM PDT This post The Greenback Fires a Warning Shot: Are Commodities in Trouble? appeared first on Daily Reckoning. The U.S. dollar has fired a warning shot across the bow of the commodities market. Anyone exposed to metals, miners, and oil plays needs to heed the dollar's threat. If the greenback continues to press higher, we can expect more short-term pain in the commodity space. Let me set the scene for you… For the first half of 2016, the U.S. Dollar Index drifted lower. But in early May is where things really get interesting. The buck tripped and fell flat on its face, tumbling below its 2015 lows. The dollar was quite literally teetering on the brink. It was threatening to give back most of its 2014-2015 rally. But the big breakdown never happened. Instead, the dollar ripped higher. Last week, it staged a massive breakout that could snap the greenback out of a 16-month funk—and unleash hell on the commodities market.

The dollar has reversed its fortunes and is now firmly above its 200-day moving average thanks to last week's breakout. Now, it's pushing toward its March highs. Many commodities are reacting negatively to the dollar's renewed strength. We've already seen the effects of a resurgent dollar on crude. Oil topped out at $51 in early June and slowly slipped lower ever since. It's now 14% off its highs and breaking below critical levels:

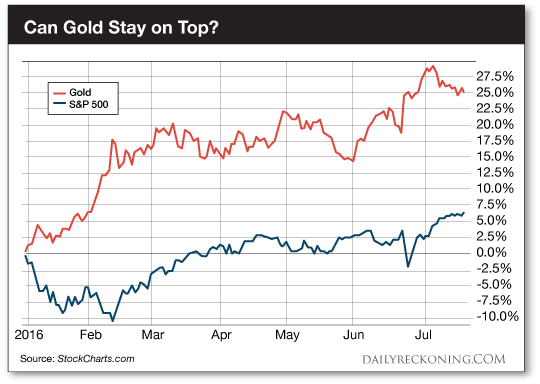

Crude's down another 1% early this morning. The selling pressure doesn't look like it's going to let up anytime soon. If oil settles in the red today, it will have closed lower five out of the past six trading days… Of course, energy isn't the only group feeling the heat of a strong dollar. Gold and other precious metals are in a precarious spot this morning as they fight to remain above critical levels. It's no secret that gold has dominated the market this year. Gold futures have trounced the major averages. The metal is up 25% year-to-date, compared to gains of a little more than 6% for the S&P 500. Gold miners have showered traders with even bigger gains. The VanEck Vectors Gold Miners ETF (NYSE:GDX) has returned 110% so far this year. Not bad for a group of stocks that went nowhere but down for five straight years…

So far during this dollar rally, gold and other precious metals have held up much better than oil. Gold's only about 4% off its highs. But it's quickly nearing an important support zone. If gold is going to maintain even a fraction of the momentum from its recent breakout, it's going to need to stay above $1,290. That's the level you should watch closely… Of course, all of this action is happening smack in the middle of central bank meetings. We have FOMC and the Bank of Japan potentially throwing wrenches in the gears this week. Both could utter a few magic words that could sharply extend the dollar's rally. Keep a tight leash on your commodity plays this week. If the greenback continues to rip higher, we could see more pain throughout the sector… Sincerely, Greg Guenthner P.S. Crush the commodities rally — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post The Greenback Fires a Warning Shot: Are Commodities in Trouble? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Manipulation – Because They Needed the Eggs Posted: 25 Jul 2016 02:58 AM PDT “It reminds me of that old joke- you know, a guy walks into a psychiatrist's office and says, hey doc, my brother's crazy! He thinks he's a chicken. Then the doc says, why don't you turn him in? Then the guy says, I would but I need the eggs. I guess that's how I feel about relationships. They're totally crazy, irrational, and absurd, but we keep going through it because we need the eggs.” - Woody Allen While there is no question of government enabling, (by decree or inaction), market manipulations haven’t really changed all that much in character over the centuries. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Manipulation – Because They Needed the Eggs Posted: 25 Jul 2016 02:50 AM PDT Jeffrey Lewis | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Remembering Gold's Bullish Set-Up on Dec. 1, 2015 Posted: 25 Jul 2016 01:00 AM PDT Precious metals expert Michael Ballanger compares the Dec. 1, 2015 Gold COT Report with the latest one; the contrasts could not be greater. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 24 Jul 2016 06:44 PM PDT Stocks correct. Britain’s economy is shrinking, China’s debt is soaring, Japan’s trade is plunging. Gold corrects; several analysts see a top here. Oil falls hard. Several more terrorist attacks. Trump makes long, dark acceptance speech, very well-received by Republicans. Clinton picks Tim Kaine for VP. Wikileaks sends DNC into turmoil. Best Of The Web […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jul 2016 05:15 PM PDT Jim Rickards, Egon von Greyerz, and Ronald-Peter Stoeferle on gold. Craig Hemke on negative interest rates. Brexit remains an issue, stocks are headed for a fall, and the Clinton Foundation is accused of corruption. The post Top Ten Videos — July 25 appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Martin Armstrong: Throw Out the Fundamentals—Negative Rates Could Push the Dow Up to 40,000 Posted: 24 Jul 2016 05:00 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Market COT Stuns: What's Going On Here? Posted: 24 Jul 2016 03:47 AM PDT Let's start this off with a broad overall look at the various players in the silver market. Silver CoT Futures and Options Combined, Disaggregated Report | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Demand Remains Stable During Sector Weakness Posted: 24 Jul 2016 03:41 AM PDT My favorite indicator for real time Gold demand is the amount of Gold in the GLD and its fluctuations over time. As we wrote in our book , the driving force for Gold is investment demand which is driven by changes in real interest rates. Western-based investment demand from big money (i.e Stan Druckenmiller and George Soros) shows up mostly in the ETFs and specifically, GLD. The amount of Gold in GLD has risen steadily even as Gold consolidated a few months back and has been stable in recent weeks even as Gold and gold stocks correct their Brexit breakouts. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock Market Has Topped; GDX Continues Down Posted: 24 Jul 2016 03:25 AM PDT The signs of a stock market top came on July 22 when the SPX made a truncated pseudo 5th wave failure at 2175. There were many astro/cyclical signs pointing to a July 19/20th top. My thinking regarding a continuation higher for the stock market is now not warranted. GDX is about to break an important uptrend line and the technical/cyclical read is down hard next week to near $25 +/- .20. Gold and silver could make a final bottom in early August. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment