Gold World News Flash |

- Their Day Has Come,— And Gone!

- THE SUBPRIME U.S. ECONOMY: Disintegrating Due To Subprime Auto, Housing, Bond & Energy Debt

- America Needs A Good, Old-Fashioned Economic Depression

- Top 10 Inexpensive Food Items That Can PREVENT Nearly Every Disease and Disorder Known to Mankind

- How Trump Will Stop World War 3

- Gold Price Closed at 1323.10 Down $7.40 or -0.6%

- LIVE from Munich Following Olympia shopping mall attack

- Does Popeye know best?

- Gold Daily and Silver Weekly Charts - Grinding Slowly

- This “Market” Discounts Nothing Except Monetary Cocaine

- BREAKING -- At Least 3 Different Shooters in Munich Germany

- BREAKING! Police Confirm 3 Killed At Mall Shooting In Munich Germany

- Obama Muslim Brotherhood Caliphate Conspiracy

- 7 Signs That the Gold Market Remains Resilient

- Gold Bull Meets Black Swans Meet Daffy Duck

- Signs In The Heavens And On Earth: END TIMES SIGNS Pt.22

- Silver Bull Faces Correction

- David Duke Announces for US Senate

- The Trading Secret the Media Won’t Tell You…

- "Alex Jones Crashes The Young Turks TV Show" Gets Ugly...

- Gold miner Acacia jumps to top of FTSE 250 as performance glitters

- Breaking News And Best Of The Web

- Not Everything Is Bullish for Gold

- Silver – Caught Inside

- Gold Price Time For A Bounce, But Probably Not A Bottom Yet

| Their Day Has Come,— And Gone! Posted: 23 Jul 2016 01:00 AM PDT from LaRouchepac:

And don’t believe that Tony Blair was merely the “poodle” of the non-functional George W. Bush. In fact, he instigated Bush on behalf of the British Queen who was really giving the orders. For example, the documentation Chilcot released included a note from Blair to Bush on Sept. 12, 2001, urging him to act immediately on “weapons of mass destruction.” Although he did not yet single out Iraq in particular, Blair wrote,”Some of this will require action that some will balk at. But we are better to act now and explain and justify our actions than let the day be put off until some further, perhaps even worse catastrophe occurs. And I believe this is a real possibility.” [emphasis in original] Their fifteen years of wars based on lies, their fifteen years of terrorism, have been a Dark Age of civilization. It is time to discard all of this; it is time to institute a human direction of human affairs, even if there are only a few people who actually know what it is to be human, and actually conceive themselves as human beings rather than as smart talking animals. At this moment, at the time of the threatened breakout of an uncontrollable financial collapse, perhaps beginning with Germany’s Deutsche Bank, Lyndon LaRouche has put forward an emergency initiative to forestall that collapse by fostering the productivity of labor, which is human creative discovery, or true humanity. He has proposed an emergency rescue of Deutsche Bank, on condition that it immediately and drastically alter its policy back to that of its former Chairman Alfred Herrhausen, who was murdered by still-unidentified killers on Oct. 30, 1989. At that moment, Herrhausen was one of those, like Lyndon LaRouche and his wife, Helga Zepp-LaRouche, who were moving to insure that the then-ongoing fall of the Communist system, lead to high-technology, high-productivity joint development of the countries which had been on both sides of the so-called “Iron Curtain.” In October, 1988, Lyndon LaRouche already know that the Berlin Wall would fall, and Germany could be reunified, before virtually anyone else did. At that time, he spoke publicly in Berlin to urge that Germany assist in the agro-industrial development of Poland, to launch such a unified East-West process of development. Within three months, LaRouche was framed and thrown in prison by George H.W. Bush. One year later, Herrhausen, in his turn, was assassinated five days before he was scheduled to give a speech to precisely the same effect, calling for the establishment of a development bank for Poland, modeled | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE SUBPRIME U.S. ECONOMY: Disintegrating Due To Subprime Auto, Housing, Bond & Energy Debt Posted: 22 Jul 2016 08:39 PM PDT

By the SRSrocco Report, The U.S. financial system continues to disintegrate even though most Americans hardly notice. The system is being gutted from the inside out... much the same way a chronic disease weakens a patient even before any symptoms are felt. However, we are already experiencing painful symptoms as U.S. economic indicators continue to weaken. Here are just a few of the recent headlines: Energy Giant Schlumberger Fires Another 8,000 As "Market Conditions Worsen" in Q2 The Financial System Is Breaking Down At An Unimaginable Pace Potential Crisis Triggers Continue To Pile Up In 2016 Just In Time—–Big Wall Street Housing Investors Cashing-Out On Housing Bubble 2.0 Corporate Bond Defaults Hit Highest Rate Since Financial Crisis These are just some of the recent headlines pointing to BIG TROUBLE AHEAD. However, the U.S. financial system is in dire shape due to the SUBPRIMING of the entire economy. Today, anyone can purchase a car for little or nothing down and finance it for 84 months. The U.S. housing market is also in the same predicament. According to the article, Are We Heading for Another Housing Crisis?, published on May 12th this year:

So, here we are heading down the same path as we did prior to the 2008 U.S. Investment Banking and Housing collapse. However, this time around its both a Subprime Auto & Housing problem. But, that is just part of the Subprime mess. As most of you already know, many of the world's sovereign bonds have negative yields. According to the article, The Financial System Is Breaking Down At An Unimaginable Pace:

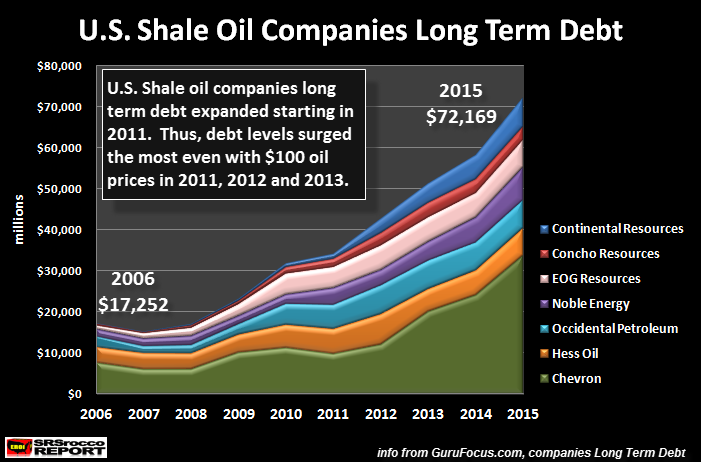

To see total world negative-yielding debt doubling to $13 trillion in just the past six months is a BLINKING RED LIGHT. So, not only do we have Subprime Auto & Housing... we also have to include Subprime Govt Bonds. While U.S. Treasuries and bonds are not yet negative-yielding, I believe it is just a matter of time. As we can see, the U.S. is now becoming a massive SUBPRIME ECONOMY. Unfortunately, it gets much worse. The factor that most analysts have not yet factored into the subprime disaster is energy. I would like to remind my readers and new followers that it takes energy to run the Auto, Housing & Bond markets. Yes, it takes the burning of energy to allow the global bond markets to function. Basically, Treasuries and Bonds are nothing more than claims on future economic activity. My sympathy goes out to anyone holding onto 20-30 year bonds until maturity. I highly doubt these bonds will ever make it to maturity. That being said, let's look at the catastrophe taking place in the U.S. Subprime Energy Industry. U.S. Shale Oil Companies Saddled With Debt Up To Their Eyeballs I discussed the big trouble with the U.S. Shale Energy Industry in my recent interview with Dan at Future Money Trends. If you haven't yet checked it out, I highly recommend it: During the interview I spoke about the following chart below. These are some of the top U.S. Shale oil companies. I included Chevron, not because it is a large shale oil producer, but because it is one of the three major oil companies in the United States:

In 2006, these seven U.S. oil companies held $17.2 billion in combined long-term debt. However, by 2015... this ballooned to $72.1 billion. Basically, their debt increased four times in a decade. Now, the interesting thing to understand about this chart is that their long-term debt really started to increase in 2011. Why is this significant? Because, the price of U.S. oil (West Texas Crude) was nearly $100 for 2011, 2012 and 2013. Which means, the high oil price did nothing to help these companies pay down their debt. Rather, their long-term debt more than doubled in just the past four years. I hope anyone reading this will realize, SHALE OIL IS SUBPRIME ENERGY that really wasn't economic unless we had zero interest rates and monetary printing. Even though the U.S. Shale Oil Industry brought on a lot of oil in the past decade, they really didn't make any money... they just saddled their balance sheets with debt. Let's take a look at the most recent data from the top four shale oil fields in the United States. According to the U.S. EIA Drilling Productivity Report released on July 18, the Bakken and Eagle Ford shale oil fields are estimated to suffer large declines in August:

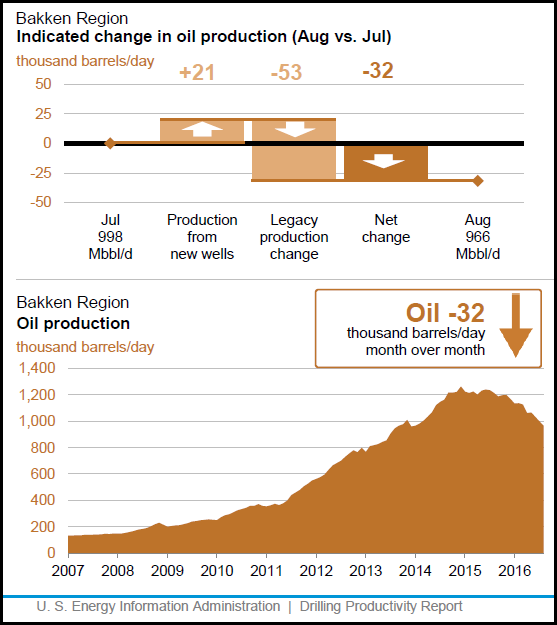

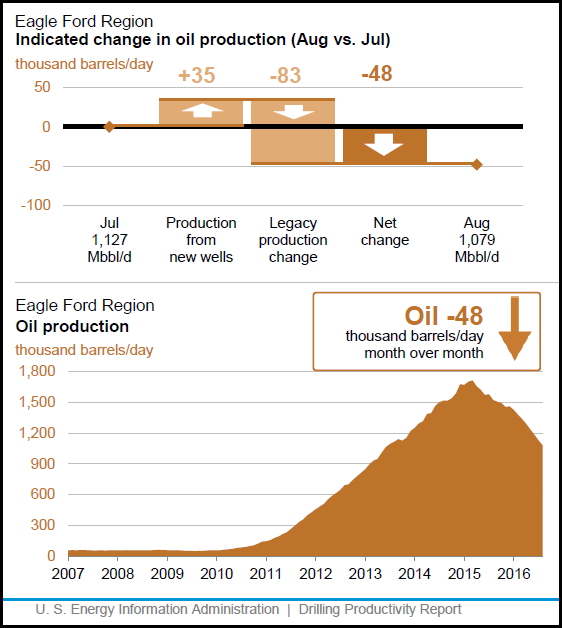

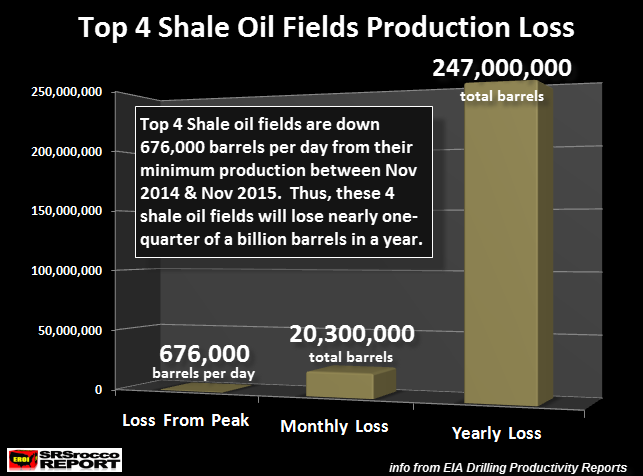

The EIA forecasts that the Bakken and Eagle Ford will lose 80,000 barrels per day in just August. These are BIG NUMBERS. If we look at the actual production figures for the top four shale oil fields, here is the result:

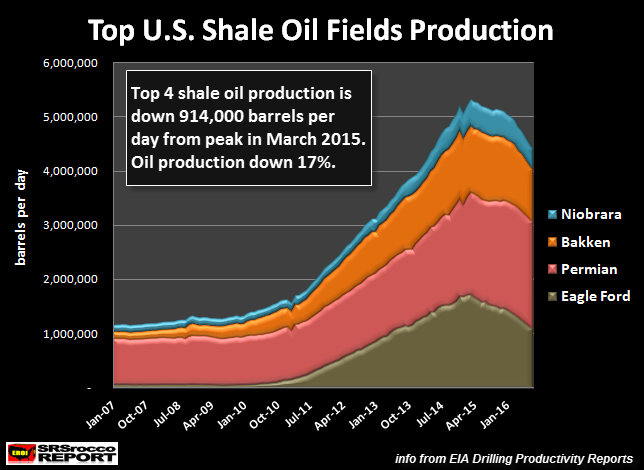

Oil production from the top four shale oil fields has declined 914,000 barrels per day (bd) since the peak in March 2015. This translates to a 17% decline in oil production from these four fields in just 16 months. However, the impact on the U.S. economy is even worse when we look at the figures on a monthly and annual basis. This next chart shows the combined loss of oil production from these top four shale oil fields based upon the minimum production from Nov 2014 to Nov 2015. Let me explain. In Nov 2014, these shale fields produced 5,027,000 bd, peaked in March 2015 at 5,304,000 bd and then fell back to 5,106,000 bd in Nov 2015. So between Nov 2014 & Nov 2015, these fields produced a minimum of 5,067,000 barrels per day. In August, the Bakken, Eagle Ford, Niobrara & Permian oil fields will be producing approximately 4,390,000 barrels per day. This is a 676,000 barrel per day decline from the minimum production these four fields produced for a year during that Nov 2014-2015 time period. The reason why I decided to do it this way is to show that these four fields produced at least 5,067,000 barrels per day for an entire year. To show the decline from the high peak is disingenuous because it was only for a brief one month period. This means, these top four fields will lose 20.3 million barrels of oil in a month and a stunning 247 million barrels in a year:

However, it will be much worse than this going forward as U.S. Shale oil production continues to decline. How bad will it be? Well, if these companies received $50 a barrel for oil, it turns out to be a loss of $13.7 billion in a year. But, as I stated, it will be worse as oil production continues to decline. I published this chart in a previous article, but it's important to see again:

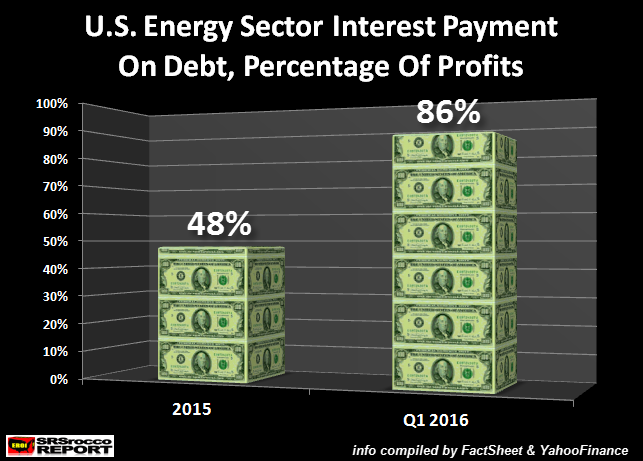

The U.S. Energy Sector is saddled with $370 billion in debt. In 2015, the U.S. Energy Sector paid 48% of their operating profits just to pay the interest on their debt. This ballooned to 86% in Q1 2016 when the oil price fell to $33. If the oil price remains between $40-$50, the U.S. Energy Sector will likely have to fork out 60-70% of its operating income just to service its debt in 2016. And of course... IT'S EVEN WORSE THAN THAT... LOL. We must remember, for most of 2015, the top shale oil fields were producing 676,000 barrels per day more than they will be this year. Thus, they will have less revenues due to falling oil production. So, the billion dollar question is this... how will the U.S. Energy Sector survive with low oil prices and falling production??? Welcome to SUBPRIME USA. Unfortunately, the coming collapse of the U.S. economic and financial system will be orders of magnitude greater than what took place in 2008. Why? Because we just had a subprime housing market in 2008, whereas the entire U.S. economy today is SUBPRIME.... Subprime Auto, Housing, Bonds & Energy. Lastly, while some precious metals investors have become a bit frustrated by the low gold and silver prices or the ongoing manipulation of the markets by the Fed and Central Banks, the current system is not sustainable. The doubling of world debt with negative yielding debt in the past six months is a bad sign indeed. Owning physical gold and silver will provide a lot more options during the next economic and financial collapse than most of the paper assets 99% of the world is invested. IMPORTANT NOTICE: Here is the link to register for the SRSrocco Report Precious Metals Webinar taking place on Tuesday, August 2nd at 6 pm EST - Eastern Standard Time: SIGNUP For SRSrocco Precious Metals Webinar Lastly, if you haven't checked out our new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page, I highly recommend you do. Check back for new articles and updates at the SRSrocco Report. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| America Needs A Good, Old-Fashioned Economic Depression Posted: 22 Jul 2016 07:00 PM PDT Submitted by Jay Kawatsky via The National Interest, Artificial measures to stave off a downturn will only make it much worse. Describing what he called the “crack-up boom”, Ludwig von Mises, the great Austrian economist, said:

Although it would be the wiser policy, there is no evidence that the world’s central bankers have the wisdom, either individually or collectively, to select the second alternative. More specifically, they lack “the courage to act” (as Ben Bernanke’s recent, self-congratulatory memoir was so ironically titled); they and their political, big finance and big business cronies are afraid to swallow the “d-pill”, the economic medicine named “depression”. A good, old-fashioned, pre-1929 depression (like the short-lived, eleven-month depression in 1920-1921, before the days of “modern” central banking and “enlightened” Keynesian intervention “cures”) is the only tonic that can clear out the malinvestment built up since the beginning of the fiat money era. That era began in August of 1971. That is when Richard Nixon, informed that U.S. gold reserves were precipitously declining as a result of President Johnson’s March 1968 action to reduce the gold reserve ratio from 25 percent to zero, “temporarily” suspended the convertibility of the U.S. Dollar into gold. That “temporary” measure has been in effect for forty-five years. Finally freed from the constraints of what they could not print (i.e., gold), central bankers and their cronies in government, finance and big business were given a license to debase all formerly hard currencies. (Such currencies were “hard”, as they were linked, via the Bretton Woods arrangement, to the dollar, which was backed by gold.) And debase they did: they replaced real investment capital (i.e. actual savings) with cheap, invented credit; they replaced market-derived price (of money) discovery, i.e., market-derived interest rates, with central-bank-proclaimed interest rates. The actions of central bankers to suppress real price discovery (i.e., market-derived interest rates) now has led to nearly $12 trillion of sovereign debt having been issued with interest rates below zero (“NIRP”, or “negative interest rate policy”). That means that more than one third of all sovereign debt worldwide now carries negative interest rates. That nearly $12 trillion total includes $3.2 trillion of short-term sovereign debt and $8.5 trillion of long-term sovereign debt. The total NIRP debt is up $1.3 trillion from the end of May. Even more astounding is that the total amount of negative-yielding debt with maturities of seven years or longer has ballooned to $2.6 trillion. That is nearly double just since April of this year. In fact, all of the debt issued by the Swiss government - every borrowed franc, even Swiss fifty-year bonds - now carries a negative yield. All of the debt issued by the Japanese government (JGBs) with maturities up to twenty years now carries a negative yield. Imagine lending money to anyone, even the Swiss government, for fifty years, ultimately getting back less than you loaned … and paying for the privilege! What such an investor has to believe, in order to make such a loan, is that inflation over the next fifty years will be substantially negative (i.e., a great, and long-lasting deflation), with the result that the purchasing power of the Swissie will increase substantially over the next fifty years. But every major currency on the planet, including the US dollar, the British pound, the Japanese yen and the Euro/DM, has lost purchasing power over the last forty-five years (since the end of Bretton Woods). Without some form of scarce commodity backing (e.g., precious metals) for currencies, why would anyone, particularly sovereign bond investors, believe that currency units, which can be conjured at will from thin air (not a scarce commodity) by desperate governments, will be worth more, not less, over the next fifty years? But believe it they do, proving that, at least with respect to high finance (better named low-IQ finance?), you can fool all of the people (the investment public) all of the time. NIRP simply never could exist in a real-money world, where credit, like all commodities, is scarce and must be rationed by the market. But European Central Bank chief Mario Draghi, with the implicit and explicit assent of all the world’s central bankers and the urging of their cronies in government, finance and big business who get “first crack” at the conjured money, has reiterated over and over that there would be “no limits” to what he and the ECB might do with respect to printing money and further reducing interest rates. (No wonder the workaday citizens of Great Britain voted overwhelmingly for Leave.) ZIRP and NIRP certainly have well served the central banks and their crony political, finance and big business elite masters (the top 1 percent of the top 1 percent). Money printed by central banks ex nihilo (out of nothing) has poured into the world’s stock markets, fueling stock buybacks that enrich big-business management via soaring stock-options values. Money printed by central banks has fueled an auto-loan bubble, with total auto debt now more than $1 trillion. Money printed by central banks has fueled the rapid increase in student debt that either will enslave American youth, preventing most from participating in the “American Dream” of home ownership and a reasonable retirement, or turn them into rabid supporters of socialist politicians (e.g., Bernie Sanders) who promise to absolve them of their unpayable debts. But the central bankers’ ability to defy economic gravity may, at long last, be coming to an end. Even the radical Keynesian, Richard Koo has recognized the outrage of NIRP, which he recently described as “an act of desperation born out of despair over the inability of quantitative easing and inflation targeting to produce the desired results… the failure of monetary easing symbolizes crisis in macroeconomics." The failure of ZIRP, QE and now NIRP is easy to see from recent corporate earnings reports and associated PE multiples: As of close of trading on Friday, July 1, 2016, the S&P 500 was trading at 24.3 times earnings over the last twelve months, close to an historical record high PE multiple. Generally (meaning before fiat money), elevated PE multiples were notched during times of increasing earnings. But for the first fiscal quarter of 2016 (FQE 3/31), S&P 500 earnings per share were only $87. That is 18 percent less than the $106-per-share earnings peak reported for the third quarter (FQE 9/30) of 2014. If money printing and central-bank-dictated interest rates were the saviors of the real economy, and if the United States were actually experiencing a real economic recovery, corporate earnings would be increasing, not declining precipitously. Interestingly, the first quarter 2016’s $87 per share earnings were eerily equivalent to the $85 earnings per share for the last twelve months just preceding the 2008 crash. And the S&P 500 multiple was only 18.4 at that time. So stocks have a long way to fall from their elevated current levels, levels only reached as a result of share buybacks (artificially increasing earnings per outstanding share and increasing per share prices), which buybacks were (and continue to be) fueled by relentless near-ZIRP maintained by the U.S. Federal Reserve, as well as so-called “carry-trade” borrowings in currencies with NIRP (such as the Japanese yen). The failure of ZIRP, QE and now NIRP also is easy to see from recent corporate sales reports: According to the most recently updated Inventories to Sales Ratio compiled by the Federal Reserve Bank of St. Louis, the inventory to sales ratio is hovering at 1.35, just below the highest recorded (1.41 in January of 2009) in over twenty years. That ratio exploded higher (meaning unsold goods are piling up) every quarter since the end of the second quarter of 2014. If money printing and central bank-dictated interest rates were the saviors of the real economy, and if the United States were actually experiencing a real economic recovery, inventories would not be languishing unsold on the shelves of suppliers and merchants. Workers with higher pay checks would be consuming them. Which brings us to perhaps the easiest way to understand the failure of ZIRP, QE and now NIRP: the labor market. Contrary to the claims of the Obama administration’s Bureau of Labor Statistics’ headline unemployment numbers (which counts job slots, so that a part-time gig is the equivalent of a forty-hour-per-week career job paying over $50,000 per year), there is not more work being done in America. There actually is less, as former full time jobs (with benefits) have been, and continue to be, replaced with more part-time, lower paying jobs (without benefits). Indeed, as former OMB chief David Stockman has instructed, the number of what can be called “breadwinner jobs”, which are jobs that can support a family of four, is now almost one million below the number of such jobs in the year 2000. If money printing and central bank-dictated interest rates were the saviors of the real economy, and if the United States were actually experiencing a real economic recovery, there would be more “breadwinner jobs” now than in 2000, when the population was considerably lower. The crack-up boom, fueled by fiat money, QE, ZIRP and now NIRP, is coming. It will hit on a global scale, and “rock the casbah” (and all points north, south, east and west thereof). It will make the Great Depression look like a picnic party in the park. Why will it be worse? Consider just two simple facts: first, supply chains are much longer and considerably more intricate than eighty-five years ago. As they fail (due to bankruptcies and business failures of those in the chain), basic necessities will not get to those in need of them. Second, compared to eighty-five years ago, the world has billions more mouths to feed, and many fewer people, including millions fewer farmers, who actually know how to produce the basic necessities. Yes, central bankers can print currency units, but not food, energy or other commodities necessary for sustaining life. As basic commodities become more scarce or are priced out of the reach of average folks, wars, riots, rebellions, diseases and repressive governments will result. All of this human suffering will be the progeny of ZIRP, QE and NIRP, which in turn are the progeny of the replacement of the gold standard by the Ph.D standard. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Top 10 Inexpensive Food Items That Can PREVENT Nearly Every Disease and Disorder Known to Mankind Posted: 22 Jul 2016 05:40 PM PDT by S. D. Wells, Natural News:

In America, people have been brainwashed by the medical industrial complex into believing that food can’t prevent or cure anything, but just the opposite is true. In fact, there’s a natural cure for every health ill under the sun, and the secret “recipe” involves taking a couple of 5 dollar bills out of your purse or wallet, buying the item, opening the package and putting the remedy in your mouth. It’s a super simple process that seems too easy, and that’s exactly why so many people fail to have the faith required to actually walk the walk, so they won’t have to spend hundreds or even thousands of dollars at doctor’s offices and hospitals – those dreadful places where health problems often get much, much worse. The best advice in the world is free, so get ready to get smart and stay healthy. Here are the top 10 most inexpensive food (and supplement) items that can prevent and usually heal nearly every disease and disorder known to mankind: #1. Oil of oregano (most popular in capsules or tincture form): Nature’s most reliable antibiotic (also anti-fungal and antibacterial) kills pollen allergies fast, helps with sinus problems and respiratory infections, and can defend against those “throwing up” viruses kids bring home from school. How? One of the active agents in oregano, rosmarinic acid, is a powerful antioxidant that supports immune power. One supplement helping of oil of oregano gives you the antioxidant punch of eating 42 apples! Oregano oil also has anti-inflammatory properties, because it contains beta-caryophyllin (E-BCP), which can be beneficial for people suffering from osteoporosis, arteriosclerosis and metabolic syndrome. So much for those expensive prescriptions! Ask your Naturopath. #2. Licorice root (often sold in supplement capsule form): This natural remedy has a wonderful list of benefits, and may be the most often overlooked of all natural remedies. Got asthma, canker sores, coughs, or emphysema? Check out licorice root. Got heartburn, fungal infections or liver troubles? What about a sore throat, arthritis, or yeast infections? The glycyrrhizic acid in licorice root even helps with nervousness, anxiety and depression, by encouraging proper functioning of the adrenal glands. #3. Hemp seeds and hemp seed oil: The oil from these seeds is amazing at promoting heart health and preventing heart disease and strokes, thanks to its three-to-one ratio of omega 3 and omega 6 fatty acids. It also nourishes hair, skin and nails. It can be used topically or mixed in your smoothies. It’s got a nutty flavor that’s rich in DHA (docosahexaenoic acid), which is amazing for cognitive function and eye health. Talk about Alzheimer’s prevention! Plus, hemp seed oil is mercury free, unlike many fish oils. #4. Coconut oil: Ever heard of oil pulling? Dentists won’t mention it, unless they’re holistic, because you won’t be suffering any more cavities. Just swish a tablespoon of coconut oil around in your mouth for 10 minutes after brushing and flossing, and wave bye-bye to those cavities. Amazing for brain health and skin health, and even great for cooking, coconut oil is another great source of omega 3s and a defender against Alzheimer’s and cancer. Trader Joe’s brand tastes amazing and is quite inexpensive. #5. Aloe: Looking to fix constipation, heartburn or stomach aches? Want to regulate blood sugar, detoxify the colon, lose weight, burn more calories, improve circulation, strengthen immunity, regulate blood pressure and reduce inflammation, all in one fell swoop? Get out a couple of 5 dollar bills and hit the health food store, or just buy an aloe plant and keep it growing while you use the juice! #6. Lemon juice: Want a daily superfood tonic that contains cancer-fighting compounds and is super cheap? Combine lemon juice and baking soda with filtered water. Raise that body pH with a natural remedy that outperforms chemo drugs! #7. Kombucha: Oh yes! “The immortal health elixir” of the ancient Chinese has been a health anecdote for more than two millennia. Made from a fermented sweet tea, this fizzy symbiotic colony of good bacteria will forever replace that soda! #8. Ginger: Ginger root’s benefits are too long to list; you could write an encyclopedia. Start off by fighting cancer, helping with IBS, protecting against Alzheimer’s and reducing fat accumulation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Trump Will Stop World War 3 Posted: 22 Jul 2016 05:15 PM PDT The Republican party is stunned after Donald Trump put forward policy that didn't try to push America and the rest of the world into a war with Russia. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at 1323.10 Down $7.40 or -0.6% Posted: 22 Jul 2016 05:09 PM PDT

'Twas a laborious, toilsome week for silver & gold. Gold ended the week little damaged, but silver lost 2.3%. Platinum couldn't break higher & ended only a tadge lower while palladium surged 5.6%. Stocks kept eking out gains, but not enthusiastically. US dollar index finally added a bit of fat, but only today. I won't dwell on it, but y'all had better be paying attention to the banking mess in Europe. The banks are busted, and only because they are banks are they still standing, propped up by government. More: criminal kamikaze-Keynesian central bankers have blown up the greatest bubble in world history in government bonds. Count on it: there will be a default. You don't want to be a creditor in a default. Remember The Moneychanger's Rule For Staying Out of Bar Fights: leave the bar before the fight begins. I don't know when, but soon enough, the bust to end all busts will hit. And now, a word about Long Spindly Rising Wedges (LSRW. Gaze upon the Dow chart, http://schrts.co/Q6KUW0 and the S&P500 chart, http://schrts.co/vtdPMb Both charts show LSRWs. The chart depicts a goosed market running out of fuel. Daily ranges become tighter and tighter, volume dwindles, upward momentum ceases, & the market plunges out of the wedge, or trades sideways & THEN plunges out of the wedge. S&P500 today rose 53.62 (0.29%) to 18,570.85. SI&P500 inched out a new high at 2,175.03, up 9.86 (0.46%) from yesterday. LSRW. Precious metals' weakness this week in the face of continuing stock strength has raised the Dow in Gold and Dow in Silver. Dow in gold ended today at 14.03 oz, above the 50 day moving average, an argument for the end of the move. Dow in silver closed at 943.21 oz, just above the 20 DMA and a propitious place to turn 'round. US dollar index displays a rising flat topped triangle with an upside breakout. Chart's at http://schrts.co/OkJ5UT The breakout targets 98.3, but the dollar continues sluggish. I imagine the rest of the globe harbors abounding reasons to sell wherever their local fiat chips are and buy dollars, given the sorry state of their economies. That applies particularly to Europe and the developing world. Thus it continues to baffle me why the dollar isn't rising faster. Stocks seem to have profited well from the same motive in the last four weeks. Why not the dollar? If it weren't for the Nice Government Men slowing the avalanche, the euro would have no future at all Look at this chart, http://schrts.co/HcRUv0 Euro broke down Tuesday from an even-sided triangle, languishes below its 200 DMA, and today spent the entire day below the triangle. Has not near-about stopped falling. Couldn't rouse that thing to life with a heavy duty set of jumper cables & a marine battery. Japanese yen is foot-stepping & tripping over its 50 day moving average, well & truly broken down since the high early this month. Bank of Japan head talking it down as hard as he can, & more Abenomics coming, i.e., lots more yen printing, depreciation, & economic & market interference. A toxic cocktail. Silver & gold "sort of" gainsaid yesterday's rise by falling back today. Comex gold lost $4.70 (0.6%) to $1,323.10. Silver backed up 12.7¢ (0.6%) to 1965.7¢. Keep in the back of your mind that today is Friday, & traders like to close out positions before the weekend. Also keep in mind that today's lows in both metals were generously higher than yesterday's (1962¢ against 1927¢ & $1,319.40 against $1,310.70. Actually, I DON'T think I am grasping at straws. Look at gold's chart, http://schrts.co/Eyyuq1 What was required of gold? Do NOT break down through the short term uptrend line from the $1,201.50 June low. So far, gold has nicely fielded that ball. Next, gold needs to rise above the top boundary of that bullish flag, if that's what it really is. Well, did that today, and even closed right on the line. As long as gold doesn't crack that uptrend, at $1,314 on Monday, it will survive jes' fine. Remember, gold is in an uptrend. Expect strength, expect surprises, expect surprising strength. What about silver? Well, look, http://schrts.co/2mPkwE First thing I notice is that volume shrank today, on a down day, gainsaying that direction. Next I notice silver is above its 20 DMA (1958¢) & spent the whole day there. And it punched into the overhead downtrend line, if it failed to close up there. So while metals might not take off running out of Monday's gate, they aren't about to collapse. To prove they have resumed their rally, silver still needs to close above 2010¢ and gold must conquer $1,335. Here's a little favour I ask of y'all. If you have bought or sold gold & silver with us and were pleased with our services, would you please recommend us to your friends? If we didn't please you, call me on Monday & I'll straighten it out. Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LIVE from Munich Following Olympia shopping mall attack Posted: 22 Jul 2016 03:10 PM PDT RUPTLY is LIVE from Munich after a shooting rampage at the Olympia Shopping Mall that killed at least 6 people on Friday, July 22. Reports of three separate shooters are as of yet unconfirmed by police. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2016 01:45 PM PDT You can't beat something with nothing, Gary North has said repeatedly, and I think he's right in the realm of ideas. Bad ideas, once entrenched, hang around until a crisis brings the roof down. Even then the guilty will be standing in the wreckage pointing fingers elsewhere, usually toward anything that hints at freedom. Evil systems eventually break down [North writes]. We have seen this in our day: the three-day disintegration of the Communist Party of the Soviet Union, and the Soviet Union itself: August 19-21, 1991. Impossible, we would have said in early 1991. Our goal is to promote positive change at a local level while we wait for today's evil systems to break down. This waiting goes on for years. Then, without warning, the transformation comes in short order. It is our job to be ready to accept responsibility and then implement local changes in terms of the ideas we profess to be true. We can't beat something with nothing. But when it comes to elections, "nothing" may be a very sane option to take — as in choose A, B, a minor party candidate, or none of the above. As we know the last choice is not found on the ballot. Ever wonder why? For every voter terrified that Hillary will win there's at least one voter apoplectic over a possible Trump victory. But voters aren't the only ones suffering. If someone wants less government, there are no realistic choices. He stays home on Election Day. He figures the federal government will grow until it collapses, and his vote won't stop that from happening. Worse: His vote will provide much-needed legitimacy to state expansion. There are those who take the Atlas Shrugged approach — voting for the candidate most likely to bring about the collapse first — but that's a crap shoot. Voters have no way of knowing what the candidate will do after the election. People who refuse to vote know a more authoritarian government is on the way regardless of who wins. Their only hope is gridlock. Whether you're a voter or nonvoter, this is an exceedingly dangerous state of affairs. It's also embarrassing to educated adults with healthy IQs. Especially in today's world, what kind of thinking validates the existence of a monopoly that routinely lies, murders, and steals and calls itself civilized and the leader of the free world? Is there nothing that can be done? Boycott I have never seen a movement consisting of nonvoters, meaning people who refuse to be complicit in government's activities by not voting. Nonvoters have always outnumbered voters but they've never been organized. What if they decided to call a convention to bring the futility and danger of voting to a high pitch? What if the attendees proudly wore T-shirts or other attire or jewelry advertising their position throughout the election season? What if they're tired of waiting for the eventual collapse? What if they want to live free soon, not someday? What if, as Popeye might say, they've had all they can stands? What if instead of hammering one another over which of two statist candidates is the less evil, the people in this territory called the United States boycotted the election? What if they decided two bad choices is no choice at all? What if they decided they didn't want to live under the opposition's candidate? Or their candidate, for that matter? What if the boycott united them as much as political parties do now? What if people didn't want alphabet bureaucracies lording over their existence? What if they want to be the decider of the money they wish to use, rather than be forced into an impoverishing scam where a monopoly cartel can counterfeit currency for its favored clients while the rest of us suffer the consequences? What if they don't want to be considered guilty by virtue of being a person who may sometimes do things a criminal or a terrorist might do, such as withdraw a large amount of cash from their bank account? What if they want to live free, and at the very least demand that government back the hell off to pre-1913 status? What if they eventually decide that the free market can provide all their legitimate needs, including the country's defense? Isn't it about time people rejected the choices they're given and stood up for themselves? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Grinding Slowly Posted: 22 Jul 2016 01:36 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This “Market” Discounts Nothing Except Monetary Cocaine Posted: 22 Jul 2016 01:00 PM PDT This post This "Market" Discounts Nothing Except Monetary Cocaine appeared first on Daily Reckoning. The U.S. stock market, making a string of recent record highs, "doesn't make much sense," distressed debt specialist Marc Lasry told CNBC Monday. He shares the view of fellow billionaire investment titan Larry Fink. "Everyone is a bit surprised," said Lasry, co-founder of Avenue Capital, which has $11.3 billion of assets under management. "But the market is telling us what's going to happen next year [or] the next two years." While questioning the advance in stocks, Lasry said on "Squawk Box" the market may be signaling a stronger-than-expected U.S. economy, with a growth rate somewhere in the 2–3% range…." Ah, the old myth of a market that processes information, discovers price and discounts the future. Apparently, no one told Lasry that a market based on these fundamentals no longer exists. The outlook for economic growth or corporate profits haven't improved since the market's post-Brexit low. The market's new highs are just another party in the casino after the latest batch of monetary cocaine — helicopter money — was passed all around. But these revelers are going to need something stronger than the hope for "helicopter money" to avoid annihilation when the long-running central bank con job finally collapses. Indeed, that ending lies directly ahead because helicopter money is a bridge too far. There is really nothing to it except more of the same aggressive monetization of the public debt that has been going on for nearly two decades. That is, whether the central banks buy public debt from the inventories of the 23 prime dealers and other market speculators, or directly from the U.S. Treasury, makes no technical difference whatsoever. The end state of "something for nothing" finance is the same in both cases. In fact, "helicopter money" is just a desperate scam emanating from the world's tiny fraternity of central bankers who have walked the financial system to the brink, and are now trying to con the casino into believing they have one more magic rabbit to pull out of the hat. They don't. That's because it takes two branches of the state to tango in the game of helicopter money. The unelected monetary central planners can run the digital printing presses at whim, and continuously "surprise" and gratify the casino gamblers with another unexpected batch of the monetary drugs. That has been exactly the pattern of multiple rounds of QE and the unending invention of excuses to prolong ZIRP into its 90th month. The resulting rises in the stock averages, of course, were the result of fresh liquidity injections and the associated monetary high, not the discounting of new information about economics and profits. By contrast, helicopter money requires the people's elected representatives to play. That is, the Congress and White House must generate large incremental expansions of the fiscal deficit — so that the central bankers can buy it directly from the U.S. Treasury's shelf, and then credit the government's Fed accounts with credits conjured from thin air. To be sure, the cynics would say — no problem! When have politicians ever turned down an opportunity to borrow and spend themselves silly, and to than be applauded, not chastised, for the effort? But that assumes we still have a functioning government and that today's politicians have been 100% cured of their fears of the public debt. Alas, what is going to cause helicopter money to be a giant dud — at least in the U.S. — is that neither of these conditions exist. Regardless of whether the November winner is Hillary or the Donald, there is one thing certain. There will be no functioning government come 2017. Washington will be the site of a deafening and paralyzing political brawl — like none in modern U.S. history, or ever. The existing budget deficit will end the current year at more than $600 billion. That's baked into the cake already, based on the recent sharp slowdown in revenue collections. And means that the FY 2016 deficit will be one-third higher than last year's $450 billion. Moreover, when the new Congress convenes next February the forward budget projections will make a scary truth suddenly undeniable. That is, the nation is swiftly heading back toward trillion dollar annual deficits under existing policy, even before the impact of a serious recessionary decline. The reality of rapidly swelling deficits even before enactment of a massive helicopter money fiscal stimulus program will scare the wits out of conservative politicians, and much of the electorate, too. And the prospect that the resulting huge issuance of Treasury bonds will be purchased directly by the Fed will only compound the fright. What fools like Bernanke haven't reckoned with is that sheer common sense has not yet been driven from the land. In fact, outside of the groupthink of few dozen Keynesian academics and central bankers, the very idea of helicopter money strikes most sensible people as preposterous, offensive and scary. Even if Wall Street talks it up, there will be massive, heated, extended and paralyzing debate in Congress and the White House about it for months on end. There is virtually no chance that anything which even remotely resembles the Bernanke version of helicopter money could be enacted into law and become effective before 2018. Will the boys and girls still in the casino after the upcoming election gong show patiently wait for their next fix from a beltway governance process that is in sheer pandemonium and indefinitely paralyzed? Then again, why would anyone think the stock market is actually expecting an economic recovery? Reported last twelve month (LTM) earnings of the S&P 500 are $87 per share, and even if there is no further deterioration from this quarter's 5% decline during the balance of the year, 2016 earnings will come in at barely $89 per share. That means the market closed today at about 24X the S&P 500's prospective earnings for 2016. So what, therefore, if GDP grows at 2–3% next year? Even if that were to happen, and notwithstanding the headwinds in China, Japan, the eurozone, the middle east, the faltering oil market and countless more, how does that cause an earnings rebound? Barring some massive breakout in profit margins, there is no way for next year's earnings to hit even $95 per share, which is still 23X. Yet that would still be discounting what would be a 102 month old business expansion by year-end 2017. Even that unlikely outcome, given that the business cycle has now been outlawed, would absolutely end in recession and a cyclical collapse in earnings not long thereafter. But here's the thing. There is no "discounting" involved in the madness currently swirling in the stock market because there is not a remote chance of a break-out that could possibly compensate for the tepid growth of GDP and sales. In short, the market is not trading on a rebound in GDP, revenue growth or a breakout of already elevated profit margins. It's just high on one more dose of monetary cocaine that in short order will prove to have been not even that. Regards, David Stockman Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post This "Market" Discounts Nothing Except Monetary Cocaine appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING -- At Least 3 Different Shooters in Munich Germany Posted: 22 Jul 2016 12:48 PM PDT BREAKING German Police Say They Don't Know Where Munich Mall Attackers Are! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING! Police Confirm 3 Killed At Mall Shooting In Munich Germany Posted: 22 Jul 2016 12:16 PM PDT Terrorist scum or PSYOP agents once again targeting innocent civilians who cannot defend themselves The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Obama Muslim Brotherhood Caliphate Conspiracy Posted: 22 Jul 2016 12:08 PM PDT THE OBAMA MUSLIM BROTHERHOOD...2016 And The sad thing is, is that 75% of Americans don't even know what's going on. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 Signs That the Gold Market Remains Resilient Posted: 22 Jul 2016 12:00 PM PDT Gold Stock Bull | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bull Meets Black Swans Meet Daffy Duck Posted: 22 Jul 2016 12:00 PM PDT Bullion Vault | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Signs In The Heavens And On Earth: END TIMES SIGNS Pt.22 Posted: 22 Jul 2016 11:00 AM PDT Events are happening on a daily basis that prove we are in the End Times. Time Is Running out, repent before its too late! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2016 09:56 AM PDT Silver’s young bull market got off to a typically-slow start, lagging gold’s own new bull. But recently the white metal surged to catch up in a record summer rally. That left silver very overbought and facing near-term correction risks led by a record futures selling overhang and weak late-summer seasonals. But this strengthening bull still has a long ways higher to run yet before silver prices reflect prevailing gold levels. Silver is something of an enigma. By the global supply-and-demand numbers, it’s inarguably another industrial metal. According to the venerable Silver Institute which gathers the world’s best fundamental data, industrial fabrication accounted for 50.3% of total demand last year. That was followed by coins and bars at 25.0% and jewelry at 19.4%. Most of the silver mined is consumed, not hoarded for investment. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| David Duke Announces for US Senate Posted: 22 Jul 2016 09:25 AM PDT David Duke Announces for US Senate David Duke for U.S. senate! You have my vote Mr. Duke, please do everything possible against the cultural marxists and Israeli pro-war lobby! NO MORE WARS FOR ISRAEL! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Trading Secret the Media Won’t Tell You… Posted: 22 Jul 2016 09:00 AM PDT This post The Trading Secret the Media Won't Tell You… appeared first on Daily Reckoning. Be afraid… be very afraid… That's the headline from CNN, Reuters and Bloomberg. They say we're about to see the weakest global growth since the 2009 financial crisis… That sounds ominous for the markets. May be time to head to the high country, get the rifles and lock down for end times. But how do they know? Well, the PhDs from the International Monetary Fund released their latest prophecies. The world's so-called "brightest" economists at the IMF went into a dark room, held hands, crunched their data and ran their complex models… And what they came up with is worth as much as Hillary Clinton pledging to tell the truth, the whole truth and nothing but the truth. Monkey BusinessHere's what has the financial media so frightened… The IMF recently downgraded its global growth forecast. And it included a "severe" prediction that worldwide growth could decline to 2.8% for the year. That would push growth below 3% for the first time since the global financial crisis. But it could get even worse than that, says CNN: The IMF said it was difficult to predict the fallout from Brexit, and warned that its revised forecast may be way too optimistic, saying more negative outcomes are “a distinct possibility." You know what else is a distinct possibility? That the IMF bean counters have no freaking idea what the hell they're doing or talking about. Have a look at this chart that compares actual global GDP growth versus forecasts from IMF economists over the past seven years.

As you can see, the IMF's global growth predictions have been so wrong you immediately wonder if it's all on purpose. Seriously, your kid or grandkid flipping a coin is more accurate. And the IMF's economic forecasting ineptitude gets even worse the farther you go back… Consider this excerpt from the Economist. Over the period [1999-2014], there were 220 instances in which an economy grew in one year before shrinking in the next. In its April forecasts the IMF never once foresaw the contraction looming in the next year. Even in October of the year in question, the IMF predicted that a recession had begun only half the time. A blind chimp with learning disabilities would beat that record. Never Trade Bad DataLook, I get it. News reporters need to pay their rent. They get paid to write front page stories with catchy headlines. Whether they know which end is up is immaterial to them. And IMF economists with pedigree degrees must justify their existence and paychecks by purporting to do complex research and then formulating newsworthy forecasts. Sure, their headlines might grab attention. And their research might seem legit to the uninitiated. But nothing they offer will help you make money in the markets. Will global growth slow? Maybe. Maybe not. Nobody knows. The one thing we do know is that the IMF's models won't give you the correct answer on any consistent basis. But you won't get my truth of the situation from the mainstream media hacks. As an investor, why would you pay any attention to what they tell you, except unless you're so unsure and scared that you will trust any suit that comes on the tube? Look, you can't successfully trade using IMF fundamental data—whether it's good or bad. That's why trend following relies only on one kind of "good" data… and that's price data. As trend followers, we identify developing price trends and then trade in the direction of those trends as they unfold. That's it. No fancy stories, no misleading headlines and no sophisticated economic models ever enter into the trend following trading equation. Just reliable price data that shows us exactly what any market is doing right now. Trend following is not sexy. It won't make you sound smart as you try to B.S. your friends and family about which way you think stocks, gold, the dollar or whatever market will go. But trend following is the one methodology that time and time again has produced the world's most successful investment performance in bull, bear and surprise markets. When the proverbial "you know what" hits the fan, trend following is always standing there with a preset plan of action. No guessing, no panic, simply follow your investment rules checklist—just like a surgeon follows a checklist of what do in the operating room. Now that's the best front page story any investor could ever hope to see in the mainstream media. Sadly, for the millions of investors that need this truth, I am one of the few publicly saying it. Please send me your comments to coveluncensored@agorafinancial.com. Regards, Michael Covel The post The Trading Secret the Media Won't Tell You… appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Alex Jones Crashes The Young Turks TV Show" Gets Ugly... Posted: 22 Jul 2016 08:30 AM PDT Alex Jones Crashes the gates of "The Young Turks TV Show" and it gets ugly Fast The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold miner Acacia jumps to top of FTSE 250 as performance glitters Posted: 22 Jul 2016 04:50 AM PDT This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 21 Jul 2016 06:44 PM PDT Central banks making big promises, which traders seem to like. Gold corrects; several analysts see a top here. Brexit is slowing world economy, European hedge funds struggling, Italian banks hopeless. More terrorist attacks, the latest with an ax. Trump makes long, dark acceptance speech. Best Of The Web The central planning virus mutates – […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not Everything Is Bullish for Gold Posted: 21 Jul 2016 09:39 AM PDT There are quite a few bearish indications that suggest lower precious metals prices are just around the corner. Let's take a look at a few of them (charts courtesy of http://stockcharts.com). | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Jul 2016 03:59 AM PDT Most short term investors know better. At worst, silver is a survival story. At best it is an investment for the ages. Some place in between it is an intermediate investment, albeit a very emotional and volatile one. Current financial conditions mandate survival as the primary focus. And the essence of financial survival is return of investment. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Time For A Bounce, But Probably Not A Bottom Yet Posted: 21 Jul 2016 03:53 AM PDT Sentiment got a little too bearish and price is bouncing off the 38% Fibonacci retracement. Ideally though I’d like to see one more lower low next week to break the cycle uptrend line before trying to call a bottom. I’d like to see a bit more bearish sentiment and some panic selling. DCL’s should create fear and cause traders to think price is rolling over. That usually requires a trend line break to get technical traders on the wrong side of the market before price resumes the uptrend. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

That is the meaning of the two releases this month, the one of Britain’s long-delayed Chilcot report into Tony Blair’s criminal responsibility for the illegal Iraq war, and the other of the

That is the meaning of the two releases this month, the one of Britain’s long-delayed Chilcot report into Tony Blair’s criminal responsibility for the illegal Iraq war, and the other of the

Nothing’s more true than the old adage, “An ounce of prevention is better than a pound of cure.” Not only does that ounce of prevention save you the nightmare of being sick, probably missing work and most likely accumulating medical bills, but that same “ounce” of prevention may only literally weigh an ounce and cost less than 15 bucks.

Nothing’s more true than the old adage, “An ounce of prevention is better than a pound of cure.” Not only does that ounce of prevention save you the nightmare of being sick, probably missing work and most likely accumulating medical bills, but that same “ounce” of prevention may only literally weigh an ounce and cost less than 15 bucks.

No comments:

Post a Comment