Gold World News Flash |

- Gold: Be Afraid, Be Very Afraid! - Rory Hall

- #FreeMilo / #FreeMiloNow

- Dinesh D'Souza Destroys The Young Turks Host Cenk Uygur At Politicon 2016

- Gold, Silver Is Best Way For Average Investor To Own Real Wealth

- Cenk Uygur of Young Turks & Alex Jones FIGHT@RNC

- NOW — A Perfect Storm: Expect Stocks To Fall, Gold To Rise, Yields To Fall

- Alex Jones almost gets into a fight with Cenk Uygur after crashing The Young Turks set at the RNC

- Nigel Farage on How Donald Trump can win

- Farage Offers Trump Advice on Beating the Establishment

- Milo Yiannopoulos Confronts Twitter At The RNC

- Milo Yiannopoulos Responds To Orwellian Twitter Ban

- END TIMES SIGNS: LATEST EVENTS (JULY 21ST, 2016)

- The magic charts of technical analysis can't penetrate central bank trading rooms

- Gold Daily and Silver Weekly Charts - Comex Options Expiry and FOMC Next Week

- Get On The “Gold Wagon” To $10,000

- Gold: Plan B

- TURKEY HIJACKS U.S. NUKE BASE, STAGES FAKE COUP - BLOWS UP OWN PARLIAMENT BUILDING

- Not Everything Is Bullish for Gold

- The Pope has a SHOCKING plan for 2016

- Vindicating GATA, academic study says central banks rig markets with gold lending

- Alasdair Macleod: The real message from asset inflation is currency collapse

- "Pokemon Go" Opens Portals Into Hell...

- TF Metals Report: A timeline for the next rally in gold

- Economic Collapse -- Venezuela's descent into Chaos

- Silver – Caught Inside

- EUROPEAN FINANCIAL SYSTEM NEARING GLOBAL CALAMITY

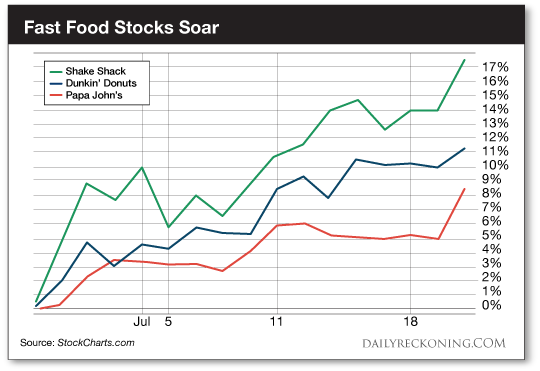

- Gluttons Win Again! How a “Junk Food Breakout” Will Fatten Your Wallet…

- Silver – Caught Inside

- Gold Price Time For A Bounce, But Probably Not A Bottom Yet

- Did Oil Kill The Dinosaurs?

- US Dollar's Rise Spells the End of Commodities' Run

- Breaking News And Best Of The Web

- Gold Investment Slows, Soft Summer 'Risks $1300' But Bond Defaults 'Will Spike' as Japan, Eurozone Deny Fresh Stimulus

- Silver Price Ignition or Money Reasserting: When Silver Investment Demand Merges with Industrial Demand

- Gold Daily Cycle Low Still Several Days Away

- China Economic Troubles - Is Kyle Bass Finally Getting His Revenge?

| Gold: Be Afraid, Be Very Afraid! - Rory Hall Posted: 21 Jul 2016 10:30 PM PDT Sprott Money | ||||

| Posted: 21 Jul 2016 09:00 PM PDT Sargon of Akkad Talking about Milo Yiannopolous' ban from Twitter. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Dinesh D'Souza Destroys The Young Turks Host Cenk Uygur At Politicon 2016 Posted: 21 Jul 2016 07:30 PM PDT "Hillary's America" opens nationwide July 22! Get your tickets now: http://www.hillarysamericathemovie.com! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Gold, Silver Is Best Way For Average Investor To Own Real Wealth Posted: 21 Jul 2016 07:20 PM PDT from KitcoNews: | ||||

| Cenk Uygur of Young Turks & Alex Jones FIGHT@RNC Posted: 21 Jul 2016 07:00 PM PDT Young Turks Cenk Uygur Fights Alex Jones & Roger Stone @RNC Members of The Young Turks media organization had a meltdown at the RNC Thursday after being challenged to a debate by radio host Alex Jones. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| NOW — A Perfect Storm: Expect Stocks To Fall, Gold To Rise, Yields To Fall Posted: 21 Jul 2016 06:40 PM PDT from GregoryMannarino: | ||||

| Alex Jones almost gets into a fight with Cenk Uygur after crashing The Young Turks set at the RNC Posted: 21 Jul 2016 06:30 PM PDT Alex Jones and Cenk Uygar almost fight after Infowars crashed The Young Turks set at the RNC. (7/21/2016) The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Nigel Farage on How Donald Trump can win Posted: 21 Jul 2016 06:00 PM PDT Nigel Farage talks about how Donald Trump can become the next President. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Farage Offers Trump Advice on Beating the Establishment Posted: 21 Jul 2016 05:00 PM PDT Nigel Farage Offers Trump Advice on Beating the Establishment The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Milo Yiannopoulos Confronts Twitter At The RNC Posted: 21 Jul 2016 04:00 PM PDT In this video Milo Yiannopoulos goes to Twitter in the pressroom of the RNC and confronts employees of the social media organization about being permanently banned after making critical comments about the Ghostbusters movie. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Milo Yiannopoulos Responds To Orwellian Twitter Ban Posted: 21 Jul 2016 02:45 PM PDT Breitbart tech editor Milo Yiannopoulos discusses his permanent Twitter ban and the chilling effect this will have on libertarian and conservative free speech. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| END TIMES SIGNS: LATEST EVENTS (JULY 21ST, 2016) Posted: 21 Jul 2016 01:50 PM PDT end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| The magic charts of technical analysis can't penetrate central bank trading rooms Posted: 21 Jul 2016 01:37 PM PDT 4:42p ET Thursday, July 21, 2016 Dear Friend of GATA and Gold: With his commentary written yesterday, "Damn Manipulators," posted today at GoldSeek and Gold-Eagle -- http://news.goldseek.com/GoldSeek/1469110080.php http://www.gold-eagle.com/article/damn-manipulators -- was Elliott Wave Trader's Avi Gilburt sneering about GATA? Gilburt wrote of yesterday's trading: "As the metals market dropped today, I am quite certain that the evil manipulators have become the talk of the town once again. No one speaks of them when we are rising, because that is how the market is supposed to move (cough, cough). But now that we have dropped, it is 'clear' that it must be manipulation." Gilburt adds that yesterday's smashing of gold and silver was ordinary market action predicted by his magic charts of technical analysis -- and maybe it was. But how does he or anyone outside central banking know that the market action had nothing to do with government intervention? Can Gilburt's charts penetrate the trading rooms of the Federal Reserve Bank of New York, the Bank of England in London, the Banque de France in Paris, the International Monetary Fund in Washington, and the Bank for International Settlements in Basle? ... Dispatch continues below ... ADVERTISEMENT NuLegacy Reports First Set of 2016 Drill Results Company Announcement RENO, Nevada -- NuLegacy Gold Corp. is pleased to report assay results for the first 10 holes of the 40-plus hole (10,000-meter) 2016 exploration program on its 100-percent-owned Iceberg oxide gold deposit. The primary target is the shallow Carlin-style oxidized gold mineralization within the 3-kilometer-long and half-kilometer-wide Iceberg gold deposit in the Cortez gold-trend of north-central Nevada. Eight of the 10 holes were drilled to expand the footprint of the 90-110 million-tonne exploration target of 0.9 to +1.1 grams of gold per tonne within the Iceberg deposit -- four into the central zone and four into the north zone, while two were scout holes. Dr. Roger Steininger comments: "Holes RHB-72 and 73 have encountered some of the longest intervals of continuous gold mineralization on the property to date, and indicate the potential for a distinct gold deposit of sizable dimensions to the west of and down dip from the central zone." ... ... For the remainder of the announcement: http://nulegacygold.com/s/News.asp?ReportID=756708 Of course GATA has no entree into those trading rooms either. But we have compiled some documents from the institutions that run the trading rooms, confirming that they are heavily and surreptitiously intervening in the gold market or in facilitating the surreptitious intervention of other central banks and government agencies: http://www.gata.org/node/14839 According to the director of market operations for the Banque de France, Alexandre Gautier, this surreptitious trading occurs "nearly on a daily basis": http://www.gata.org/node/13373 Since central banks have the power to create infinite money, why would they bother holding and trading gold, except as has been confirmed candidly by the annual reports of the Reserve Bank of Australia -- "primarily to facilitate policy operations in the foreign exchange market"?: http://www.rba.gov.au/publications/annual-reports/rba/2015/pdf/2015-repo... Gilburt is mistaken again when he writes that "no one" speaks about gold market manipulation when the price is rising. For many years, with the price rising and the price falling, GATA has addressed the possibility of an upward revaluation of gold by central banks, another form of market manipulation. For example, since 2007 GATA often has called attention to the 2006 paper on this subject by the Scottish economist Peter Millar, who argued that central banks will have to revalue gold upward by as much as 700 percent to avert a catastrophic debt deflation: We also often have called attention to the 2012 study by the American economists and fund managers Paul Brodsky and Lee Quaintance, who maintain that the major central banks are engaged in redistributing world gold reserves among themselves in advance of such an upward revaluation: http://www.gata.org/node/11373 And we often have called attention to the 2008 appearance on Business News Network in Canada by former Federal Reserve Governor Lyle Gramley, in which he asserted that the Fed might reliquefy itself by upwardly revaluing gold: Yes, manipulation of the gold market by central banks can be up as well as down, and since it defeats free markets either way, it's objectionable either way. Odds are that since they are the biggest participants in the gold market, central banks know a lot more about the origin of yesterday's price smash than Gilburt's magic charts know. The central banks aren't telling and Gilburt isn't asking them and making a point of their refusal to answer, since it might be very bad for his newsletter business if anyone outside central banking knew exactly how central banks were intervening at any moment. For then people also would know that the data Gilburt is analyzing is no more genuine than Pokemon characters. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Gold Daily and Silver Weekly Charts - Comex Options Expiry and FOMC Next Week Posted: 21 Jul 2016 01:31 PM PDT | ||||

| Get On The “Gold Wagon” To $10,000 Posted: 21 Jul 2016 01:05 PM PDT This post Get On The "Gold Wagon" To $10,000 appeared first on Daily Reckoning. Between 1999, when gold bottomed at $250, and the 2011 peak at $1,920 there was only one major correction lasting 8 months in 2008. The ensuing correction from the 2011 top at $1,920 of almost $900 seemed to take an eternity until it finally finished in December 2015. During those four years it was always clear to me that the uptrend in the precious metals was still intact although I must admit that I did not expect a correction of that duration. But after a long life in markets, patience becomes a virtue that is absolutely essential. If your investment decisions are based on sound principles at the outset, there is no reason to change your opinion because the market takes longer to accomplish what it must do. We bought gold for our own account and for our clients back in 2002 at $300. At that time gold was unloved and undervalued. That is of course the best time to get into a long term strategic investment. But it was never our intention to buy gold as an investment. No, we bought gold because we had evaluated economic and financial risk in the world economy and come to the conclusion that it was unlikely that the system would survive without major defaults, both sovereign and in the banking system. And as we know, the financial system almost went under in 2007-9. With $25 trillion of printed money, credit and guarantees the system was given a temporary stay of execution. But these $25 trillion was just the initial package. Since 2006 global debt has increased by $90 trillion plus unfunded liabilities and derivatives of several hundred trillion dollars. This explosion of debt has confirmed the risks that we saw already back in 2002. Now in July of 2016, I am absolutely certain that the financial system cannot survive intact. Global debt has gone from $20 trillion to $230 trillion, a more than 10 times increase in the last 25 years and none of this debt can be repaid with real money. Governments and central banks have totally run out of ammunition. In their desperate attempts to save the financial system, they have manipulated every single market and financial instrument. They print money, they set false interest rates (now negative), they buy their own debt, they support stock markets and they also sell gold in the paper market. All of this action or deceitful manipulation is just creating bigger bubbles that will eventually lead to a total implosion of the financial system and all the bubble assets such as stocks, bonds and property. In addition, bank stocks in Europe are now showing all the signs of going to zero. Most major banks are down 70-90% since 2006 and many have fallen 25% in the last few days. The European banking system is on the way to bankruptcy. And many U.S. banks like Bank of America and Citigroup are showing the same signs. The coming months will be extremely volatile and disruptive in world financial markets. The problem is that no one is prepared for the coming shock. The world believes that the Shangri-La state that central bankers, led by the Fed, have created in the last 100 years will last forever. A privileged few have accumulated unreal wealth. Most normal people in the West believe that they are better off, not realising that their higher standard of living is based on government debt and deficit spending as well as a massive increase in personal debt. But before the financial system implodes, there will be the most massive money printing program that the world has ever seen. They will need to print money in a final and futile attempt to save the bankrupt banks. With $1.5 quadrillion in derivatives outstanding, the printing presses (or the computers) will run hot. With Deutsche Bank's derivatives at $75 trillion and JP Morgan at almost $100 trillion, only those two banks need support at 2.5 times global GDP. It is of course not just the financial system that will need support. Governments will run out of any significant tax revenue and will need to print money for all their expenditure. Remember that Japan, for example, already today prints 50% of its annual expenditure. All of this printing will result in global hyperinflation of at least similar proportions to the Weimar republic or Zimbabwe with the dollar, euro, yen and pound all reaching their intrinsic value of zero. Can I be wrong in my outlook with first hyperinflation and then a deflationary implosion? Well, I sincerely hope that I will be wrong because this outcome would be devastating for the world. But maybe it is necessary for the debt to implode so that the world can start afresh again based on sound economic principles and with no or little debt. So even if the outcome will not be as dire as I fear, we know that the risks are of a magnitude that has never existed in history before. And this is why the few privileged people who have capital or savings too would be wise to prepare for these risks. Throughout history, gold (and sometimes silver) has been the only money that has survived. Every paper or fiat currency has always been destroyed by governments through deficit spending and money printing. In the last 100 years all major currencies have declined 97-99% against gold. It is virtually guaranteed that they will go down the final 1-3% to zero. But it must be remembered that this decline means a 100% fall from here. This final decline of the currencies will be reflected in the gold and silver prices. I am still convinced that we will see gold at $10,000 and silver at $500 and possibly in the next 5 years and that those levels will be reached even with normal inflation. But if we get hyperinflation, we could add quite a few zeros to the price. So from a wealth protection or insurance point of view, it is absolutely essential to own gold and some silver. And although I said that precious metals are primarily for a privileged few, this is actually not the case. In India, virtually everyone owns gold and many of the Chinese save in gold. Any ordinary person can buy, say, one gram gold or more a month. One gram is $40, which many people could afford to save monthly. Gold at $1,330 and silver at $19 is a bargain. But the metals will not stay at these low levels for very long. With the correction finished and the next uptrend in place, we could soon see the metals accelerate very fast. The problem is that there is very little physical gold available in the world and we have reached peak gold from a production point of view. With the massive outstanding paper gold position in the system, we will soon see the paper shorts running for cover. Once demand increases, it can only be satisfied by much higher prices. So now is the time to jump on the goldwagon to $10,000. Regards, Egon von Greyerz Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away.

The post Get On The "Gold Wagon" To $10,000 appeared first on Daily Reckoning. | ||||

| Posted: 21 Jul 2016 12:32 PM PDT SafeHaven | ||||

| TURKEY HIJACKS U.S. NUKE BASE, STAGES FAKE COUP - BLOWS UP OWN PARLIAMENT BUILDING Posted: 21 Jul 2016 12:30 PM PDT If this is starting to sound like the Reichstag fire, rest assured that's not the only similarity... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Not Everything Is Bullish for Gold Posted: 21 Jul 2016 11:39 AM PDT There are quite a few bearish indications that suggest lower precious metals prices are just around the corner. Let's take a look at a few of them (charts courtesy of http://stockcharts.com). | ||||

| The Pope has a SHOCKING plan for 2016 Posted: 21 Jul 2016 11:30 AM PDT The Pope's shocking Illuminati Agenda Exposed (2016). Today we travel to Washington D.C. to find out! Beware of the Vatican. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Vindicating GATA, academic study says central banks rig markets with gold lending Posted: 21 Jul 2016 11:02 AM PDT 2:10p ET Thursday, July 21, 2016 Dear Friend of GATA and Gold: Dirk Baur, formerly a finance professor at the University of Technology in Sydney, now professor of accounting and finance at the University of Western Australia in Perth, this month updated his 2013 study about gold market manipulation -- http://www.gata.org/node/13045 -- and has incorporated much of GATA's documentation. With that documentation in hand, Baur cites GATA and vindicates GATA's work, concluding that secret gold lending by central banks has become their primary mechanism of controlling the gold market. ... Dispatch continues below ... ADVERTISEMENT NuLegacy Reports First Set of 2016 Drill Results Company Announcement RENO, Nevada -- NuLegacy Gold Corp. is pleased to report assay results for the first 10 holes of the 40-plus hole (10,000-meter) 2016 exploration program on its 100-percent-owned Iceberg oxide gold deposit. The primary target is the shallow Carlin-style oxidized gold mineralization within the 3-kilometer-long and half-kilometer-wide Iceberg gold deposit in the Cortez gold-trend of north-central Nevada. Eight of the 10 holes were drilled to expand the footprint of the 90-110 million-tonne exploration target of 0.9 to +1.1 grams of gold per tonne within the Iceberg deposit -- four into the central zone and four into the north zone, while two were scout holes. Dr. Roger Steininger comments: "Holes RHB-72 and 73 have encountered some of the longest intervals of continuous gold mineralization on the property to date, and indicate the potential for a distinct gold deposit of sizable dimensions to the west of and down dip from the central zone." ... ... For the remainder of the announcement: http://nulegacygold.com/s/News.asp?ReportID=756708 Baur's study is titled "Central Banks and Gold" and he concludes it this way: "The theoretical arguments for central bank gold price management are based on the connection of gold with fiat currency. Gold reserves are designed to build confidence in fiat currency. This confidence would be jeopardized if the price of gold increased by too much, which is the theoretical basis for control and management of the price. "There is also an incentive for central banks to control the downside of gold prices and thus preserve the value of their gold reserves. "The Central Bank Gold Agreement is clear acknowledgement of central banks' potential price impact and evidence of coordinated and mostly hidden price and reserves management. In addition, the European Central Bank's gold reserves and recent increases of emerging market central banks' gold reserves are further evidence of the role of gold in central bank monetary policy beyond the 'legacy' gold holdings of the United States and many, mostly European central banks. "Furthermore, the gold lending activities of central banks implicit in the gold leasing rate establish a link between central banks, bullion banks, and gold mining companies and imply an indirect and transferred gold price management. Gold lending is the basis for the gold carry trade, which is profitable in stable gold price regimes and provides market-based incentives to stabilize or control the gold price. "In other words, the gold carry trade represents a market-driven suppression of the gold price based on the gold lending of central banks. "Whilst there are strong economic arguments for central bank gold price management following the high inflation episode and the rising price of gold in the late 1970s, it is less clear why central banks would have ended such strategies rather abruptly in the 2000s. "In contrast, the unwinding of the gold carry trade in the early 2000s offers an explanation for the significant price change between 2003 and 2011. Remarkably, whilst central bank gold lending can stabilize gold prices and the gold carry trade is creating a self-sustaining environment, gold lending is not effective in rising gold price regimes as in such regimes there is no market-based borrowing demand and the creation of such a demand would be too costly. "This asymmetry in the ability to influence the price of gold does not only apply to gold lending but also to actual gold reserve sales and purchases. The empirical analysis of global central bank gold reserves changes illustrates that central banks can enforce a price floor but not enforce a price ceiling. "There is also an explanation for the apparent lack of transparency regarding central bank gold reserve management including gold lending. If central banks disclosed planned gold reserve changes or gold lending activities, they would provide signals to the market that would make the changes more costly or increase the volatility and uncertainty in the gold market. The disclosure of the Bank for International Settlements about a gold swap in 2010 and a subsequent fall in the price of gold is a good example for the effects of such announcements. "This study demonstrated that central banks have an economic interest in gold prices and directly and indirectly influence the price of gold. It also illustrated that central banks can only stabilize a falling gold price but not a rising gold price and that the stabilization can work only if it is hidden from the public and coordinated among central banks." Baur's study is posted at the Social Science Research Network's Internet site here -- http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2326606 -- and has been copied onto GATA's Internet site here: http://www.gata.org/files/Baur-CentralBanksAndGold-07-20-2016.pdf Your secretary/treasurer will send Baur's study to major financial news organizations so it can be added to the long list of market-rigging documentation they suppress in order to ingratiate themselves with governments and financial institutions, thereby disgracing journalism and subverting democracy. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:

This posting includes an audio/video/photo media file: Download Now | ||||

| Alasdair Macleod: The real message from asset inflation is currency collapse Posted: 21 Jul 2016 10:01 AM PDT By Alasdair Macleod The earliest signs are developing of hyperinflation, more correctly described as a collapse of the purchasing power of all the major government currencies. Central bankers are almost certainly unaware of this danger, partly because their chosen statistics fail to capture it, but mostly because conventional monetary economic theory is lacking in this regard. This article draws on the evidence of extreme overvaluations in equities and bonds worldwide, and concludes the explanation lies increasingly in a greater perception of risk against holding cash, or bank deposits. Risk relationships between cash and assets are inverting, due to failing monetary policies and escalating counterparty risk with the banks. ... ... For the remainder of the commentary: https://www.goldmoney.com/research/goldmoney-insights/the-real-message-f... ADVERTISEMENT NuLegacy Reports First Set of 2016 Drill Results Company Announcement RENO, Nevada -- NuLegacy Gold Corp. is pleased to report assay results for the first 10 holes of the 40-plus hole (10,000-meter) 2016 exploration program on its 100-percent-owned Iceberg oxide gold deposit. The primary target is the shallow Carlin-style oxidized gold mineralization within the 3-kilometer-long and half-kilometer-wide Iceberg gold deposit in the Cortez gold-trend of north-central Nevada. Eight of the 10 holes were drilled to expand the footprint of the 90-110 million-tonne exploration target of 0.9 to +1.1 grams of gold per tonne within the Iceberg deposit -- four into the central zone and four into the north zone, while two were scout holes. Dr. Roger Steininger comments: "Holes RHB-72 and 73 have encountered some of the longest intervals of continuous gold mineralization on the property to date, and indicate the potential for a distinct gold deposit of sizable dimensions to the west of and down dip from the central zone." ... ... For the remainder of the announcement: http://nulegacygold.com/s/News.asp?ReportID=756708 Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| "Pokemon Go" Opens Portals Into Hell... Posted: 21 Jul 2016 10:00 AM PDT "Pokemon Go" Opens Portals Into Hell... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| TF Metals Report: A timeline for the next rally in gold Posted: 21 Jul 2016 09:47 AM PDT 12:46p ET Thursday, July 21, 2016 Dear Friend of GATA and Gold: Patterns of futures market manipulation, the TF Metals Report's Turd Ferguson writes today, suggest a resumption of gold's upward trends in another week or two. Ferguson's commentary is headlined "A Timeline for the Next Rally in Gold" and it's posted at the TF Metals Report here: http://www.tfmetalsreport.com/blog/7751/timeline-next-rally-gold CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT NuLegacy Reports First Set of 2016 Drill Results Company Announcement RENO, Nevada -- NuLegacy Gold Corp. is pleased to report assay results for the first 10 holes of the 40-plus hole (10,000-meter) 2016 exploration program on its 100-percent-owned Iceberg oxide gold deposit. The primary target is the shallow Carlin-style oxidized gold mineralization within the 3-kilometer-long and half-kilometer-wide Iceberg gold deposit in the Cortez gold-trend of north-central Nevada. Eight of the 10 holes were drilled to expand the footprint of the 90-110 million-tonne exploration target of 0.9 to +1.1 grams of gold per tonne within the Iceberg deposit -- four into the central zone and four into the north zone, while two were scout holes. Dr. Roger Steininger comments: "Holes RHB-72 and 73 have encountered some of the longest intervals of continuous gold mineralization on the property to date, and indicate the potential for a distinct gold deposit of sizable dimensions to the west of and down dip from the central zone." ... ... For the remainder of the announcement: http://nulegacygold.com/s/News.asp?ReportID=756708 Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Economic Collapse -- Venezuela's descent into Chaos Posted: 21 Jul 2016 09:30 AM PDT Venezuela: On the Edge (part 1) - People & PowerWhat is behind Venezuela's descent into chaos and the bitter ideological struggle dividing the nation? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Posted: 21 Jul 2016 09:04 AM PDT Jeffrey Lewis | ||||

| EUROPEAN FINANCIAL SYSTEM NEARING GLOBAL CALAMITY Posted: 21 Jul 2016 08:30 AM PDT Sputnik News reports The European Central Bank purchased €85.1 billion ($94.8 billion) of debt in June as it increased its asset-purchase program, Bloomberg reported. The asset-purchase program is part of the ECB's quantitative easing plan. The Financial Armageddon Economic Collapse... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Gluttons Win Again! How a “Junk Food Breakout” Will Fatten Your Wallet… Posted: 21 Jul 2016 06:31 AM PDT This post Gluttons Win Again! How a “Junk Food Breakout” Will Fatten Your Wallet… appeared first on Daily Reckoning. Do you think you could add some more cheese to your diet? A few weeks ago, the Wall Street Journal reported that the cheese surplus in America has reached epic proportions. Farmers have goosed production so much that every person in the country would need to eat three extra pounds of cheese this year to get rid of the glut. So could you do your part to help eat away at the surplus? No? I don't believe you… I know you're packing a few extra pounds these days. I'd also wager you're looking forward to sinking your teeth into an extra-large brick of cheddar. The stats don't lie. According to the latest numbers, more than three-quarters of American adults are overweight or obese. But I don't need to dig up statistics from the Centers for Disease Control to guess that you could probably stand to lose a few pounds. One look at the stock market tells me everything I need to know… Greed always wins on Wall Street. But on Main Street, gluttony takes the gold. That's why junk food stocks are soaring. Pizza, burgers, and donuts—these stocks are breaking out right and left.

Since the Brexit bottom, trendy burger joint Shake Shack has seen its shares jump almost 18%. Dunkin' Donuts stock is up more than 11%. And Papa John's shares are up more than 8%. Papa John's stock was lucky enough to catch an upgrade yesterday thanks to some curious reasoning from a Wall Street analyst. Customers are more likely to order in due to the numerous civil and political disruptions we've experienced this year, the analyst says. Or maybe we're just lazy… This bull market in bad pizza is not a new phenomenon. In fact, we alerted you to the streaking pizza stocks last year—just as Dominos rolled out the latest in pizza ordering technology. Now, even the laziest glutton can order his favorite pizza by tweeting a pizza emoji directly to Dominos. At the time, I noted that the emoji ordering system wasn't the stupidest thing I had ever read in my life. But it's close. Frankly, I'm not sure why anyone would want to eat Domino's at all—whether it's ordered thru emoji or the old-fashioned way. But that can't stop the pizza bull. And you could be looking at big gains over the next several months if this trend continues. Bottom line: Thanks to some constructive breakouts, these greasy stocks have a lot more room to run. The fact is, folks are ordering in and eating out in record numbers. And these cheap fast food joints are a great way to play the trend. So skip the delivery and the pizza emojis on you smart phone. Order up some of these hot shares instead… Sincerely, Greg Guenthner P.S. Make money in a falling market — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post Gluttons Win Again! How a “Junk Food Breakout” Will Fatten Your Wallet… appeared first on Daily Reckoning. | ||||

| Posted: 21 Jul 2016 05:59 AM PDT Most short term investors know better. At worst, silver is a survival story. At best it is an investment for the ages. Some place in between it is an intermediate investment, albeit a very emotional and volatile one. Current financial conditions mandate survival as the primary focus. And the essence of financial survival is return of investment. | ||||

| Gold Price Time For A Bounce, But Probably Not A Bottom Yet Posted: 21 Jul 2016 05:53 AM PDT Sentiment got a little too bearish and price is bouncing off the 38% Fibonacci retracement. Ideally though I’d like to see one more lower low next week to break the cycle uptrend line before trying to call a bottom. I’d like to see a bit more bearish sentiment and some panic selling. DCL’s should create fear and cause traders to think price is rolling over. That usually requires a trend line break to get technical traders on the wrong side of the market before price resumes the uptrend. | ||||

| Posted: 21 Jul 2016 02:13 AM PDT What killed the dinosaurs? It's a question as old as – well the dinosaurs themselves, and one that everyone from school children to scientists have been asking for decades. Movies like Jurassic Park and the Land Before Time only heighten that sense of wonder and raise the stakes behind that question. Now according to a new scientific study, it seems that black gold may have been the source of the dinos' demise. | ||||

| US Dollar's Rise Spells the End of Commodities' Run Posted: 21 Jul 2016 02:08 AM PDT A steady stream of strengthening fundamentals are driving the U.S. dollar higher. Healthier data from jobs, consumer spending and housing have put a tailwind on the greenback. Moreover, America's economy is outperforming the weaker economies aboard. And this is setting a backdrop for improved prospects for another rate hike in the months ahead. | ||||

| Breaking News And Best Of The Web Posted: 20 Jul 2016 06:44 PM PDT Central banks making big promises, which traders seem to like. Gold corrects then recovers; several analysts see a top here. Brexit is slowing world economy, European hedge funds struggling, Italian banks hopeless. More terrorist attacks, the latest with an ax. GOP convention off to contentious start. Best Of The Web The world is taking […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||

| Posted: 20 Jul 2016 05:00 PM PDT | ||||

| Posted: 20 Jul 2016 09:42 AM PDT A long time reader and forum member posted the following with a question regarding silver industrial demand: “The question that begs an answer, is how will this ultimately effect the monetary value of Silver and does that foretell a change in investment strategies?” (Full comment below). | ||||

| Gold Daily Cycle Low Still Several Days Away Posted: 20 Jul 2016 07:16 AM PDT Some analysts were expecting gold to form an early Daily Cycle Low. I’ve been warning that gold needs to break the cycle trend line before the DCL can bottom and to beware of a fake out. It turns out I was correct to be patient. I doubt gold will form the DCL until right before, or on the FOMC statement next week. More patience. | ||||

| China Economic Troubles - Is Kyle Bass Finally Getting His Revenge? Posted: 20 Jul 2016 05:22 AM PDT One of America's most prominent hedge fund managers is betting the farm that China's economic troubles are far from over. His bet centers around the U.S. dollar and by extension several Asian currencies. What happens to the dollar from here will determine whether this man's epic trading positions pays off, and China suffers a major setback, and whether his worst case scenario for the global economic outlook is merely a mirage. If he's right, the outcome of his bet will also affect the commodities market and perhaps even the equities market. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment