Gold World News Flash |

- Beware of Junkyard Dogs: “This Isn’t A Really Normal Environment”

- 234 Billion-Dollar-Managing Fund Unclear Why Market Ignoring The Biggest Risk

- Gold, Guns, and the New Silk Road - Rory Hall

- Silver Price Ignition or Money Reasserting: When Silver Investment Demand Merges with Industrial Demand

- SOMETHING BIG HAPPENED IN THE GOLD MARKET: Must See Charts

- US To Seize $1 Billion In Embezzled Malaysian Assets Which Goldman Sachs Helped Buy

- Benjamin Freedman Speech 1961 -- Henry Makow

- Potential Crisis Triggers Continue To Pile Up In 2016

- Russia Bans All its Citizens From Turkey As Massive US-NATO Armada Moves To Attack

- END TIMES SIGNS: LATEST EVENTS (JULY 20TH, 2016)

- CYBERWAR -- Hacking a Car with an Ex-NSA Hacker

- Analyze THIS (technically): We don't need back-door nationalization by central banks

- Watch the Full 2016 Republican National Convention - Day 3

- Epic Alex Jones Anti-Commie Rant

- Gold Price Closed at $1318.80 Down $12.70 or -0.95%

- FALSE FLAG EXPOSED -- NICE TERROR ATTACK LINKED TO U.K GLADIO

- Nigel Farage : Hillary Clinton is a Crook

- Silver Price Ignition or Money Reasserting: When Silver Investment Demand Merges with Industrial Demand

- Gold Daily and Silver Weekly Charts - Risk On, and Shenanigans For Dessert

- Gold Daily Cycle Low Still Several Days Away

- The Next “Lehman Moment”… Coming in 2017?

- Nigel Farage at The RNC on Trump & Brexit

- Press For Truth : Do All Lives Matter?

- U.S. charges HSBC official in FX rigging probe

- Stay Home, Order Take-Out, And Fondle Your Gold

- #ExMuslimBecause France Attacks ,Problem Is Islam

- Europe’s Ticking Time Bomb Is About to Blow

- Turkish Coup was a CIA False Flag Operation

- Economic Collapse -- Inside Venezuela’s Crisis

- China Economic Troubles - Is Kyle Bass Finally Getting His Revenge?

- Bank of England considers cutting commercial banks out of the payments system

- Forex Trading: Investors Await Inside Bar Breakout for Clear Direction in USD/JPY

- Franklin Sanders interviews 'JPMadoff' author Helen Davis Chaitman

- Why Lithium Will See Another Price Spike This Fall

- Breaking News And Best Of The Web

- Is Kyle Bass Finally Getting His Revenge?

- Stoeferle: Helicopter Money Coming and It Will Boost Gold Market to New Highs

- Markets and Black Swans

| Beware of Junkyard Dogs: “This Isn’t A Really Normal Environment” Posted: 21 Jul 2016 01:02 AM PDT

Having spent a chunk of his youth “shopping” them, Jim Croce came to know a thing or two about junkyards. In those youthful days, should his clunker de jour be missing some vital part or parts, a trolling expedition through South Philly’s scrap heaps was always the enterprising Croce’s preferred method of procurement. Amid all of Croce’s parts foraging, it was a universal joint for a ‘57 Chevy and a ‘51 Dodge transmission, two must have and must-be-cheap or, better yet, free, parts that the legendary folk singer still recalled. He also reminisced that junkyards could and would provide a no frills, but highly motivated and easy way to get in some cardio, as in running for your life. “I got to know many junkyards well, and they all have dogs in them,” the late Croce said in a 1973 interview. “They all have either an axle tied around their necks or an old lawnmower to keep ‘em at least slowed down a bit, so you have a decent chance of getting away from them.” So was born the junkyard dog yardstick by which to measure the meanness of one Bad, Bad Leroy Brown, Croce’s hit which landed at the top of the charts 42 years ago this week. As for high yield bond analysts, they aren’t exactly known for catchy turns of phrase. However, in recent weeks, they’ve shed the dry and donned the dramatic, as you’ll soon see. Such is the overheated state of the junk bond market this sweltering summer. In his latest missive, Deutsche Bank’s Oleg Melentyev, arguably the best in class high yield analyst among his sell-side peers, warned of the perils of investing in this “frenzied market.” Legendary high yield investor Marty Fridson shares Melentyev’s concerns and has for some time. By his best estimate, high yield was already in “extreme overvaluation” territory on June 30th, defined as being one standard deviation above fair value. Flash forward two weeks, and he calculates that the standard deviation has doubled. (A quick Statistics 101 refresher: standard deviation tells you how tightly clustered or wide-of-the-center individual components of a given data set are from their mean. Remember the grade bell curve the engineering undergrads blew in business school? When all of the test scores came in on top of each other, the bell curve was super steep; when there was vast divergence, the bell curve was low and wide.) Defining bond valuation also requires one employ “spreads,” which compare the prevailing yields on a given credit to a supposedly risk-free Treasury of a comparable maturity. And that means you have to get down to the nitty-gritty of measuring risk in basis points (bps), or hundredths of a percentage point. In the event your eyes have rolled into the back of your head, listen up! This is important folks, your sweet grandparents could well own junk bonds in their desperate need to generate yield on their atrophying retirement funds! With that preamble posited, on July 15th the option-adjusted spread on Bank of America Merrill Lynch’s High Yield Index was 542 basis points. That compares to 621 bps on June 30th. The lower the spread, the less extra compensation investors are demanding for taking on the added risk of being exposed to, well, junky bonds. Of the compression in spreads, an incredulous Fridson could only characterize the overvaluation which begat more overvaluation as, “more staggering.” Now in light of this, just how did mom & pop investors react to the price increase? Well how else? They poured $4.4 billion into high yield mutual funds, the second highest weekly inflow on record after March 2nd’s $5.3 billion inflow. Bloomberg caught up with yet another stunned strategist: “They’re out there scrounging through the dumpster looking for yield,” worried Karyn Cavanaugh of Voya Capital Management. “When you have artificially low rates, you force people to go out and look for things they normally wouldn’t.” The question is, will investor insouciance ever come back to haunt them? They, as in investors, certainly don’t seem to think so. The Daily Shot is a must-read email proffering just about every graph that’s important for investors in one succinct one-stop shop, and it’s free. The Shot’s editor, the estimable Dr. Lev Borodovsky, is notoriously judicious with his editorial additives. So when he adds a quip, his readers understandably sit up and take note. In Tuesday’s Shot, Borodovsky featured a graph of the VIX Index, the so-called ‘fear gauge,’ which depicts the perceived risk of owning stocks, which have traditionally moved in lockstep with junk bonds. Reflecting extreme complacency, the VIX is sitting at the lowest level since last August. “In the equity markets,” Borodovsky recapped, “the VIX hits a multi-month low. All is well.” Or not. The Shot goes on to depict the price-to-earnings ratio on the S&P 500 at the highest level since at least 2006. “These valuations rely on extremely low long-term rates,” Borodovsky cautioned. As a punctuation mark, as in exclamation, Borodovsky features two charts on the high yield market. At the risk of over-paraphrasing, the high yield market is apparently no longer concerned about energy prices, which have yet to stage the oft-predicted blistering rebound. How so? Despite the defaults that continue to emanate from the oil patch, the performance of high yield bonds has completely divorced itself from that of still-depressed crude prices. The mirror image of this nonchalance is that investors are no longer demanding a premium level of compensation for owning high yield energy issuers vis-à-vis their non-energy brethren. In priceless understatement, Borodovsky concludes that, “High yield is definitely starting to look frothy.” As for Deutsche’s Melentyev, he isn’t bothering to wait for the ink to dry on the clear message written on the wall. In his latest note to clients, he ratchets up his expectations for HY (high yield) defaults to rise this year beyond his worst case initial scenario – and it ain’t just an energy story. “At this point, we have little doubt that our original forecast of a 4% ex-commodity HY default rate will be met by late 2016/early 2017. Moreover, we think there are now enough reasons to believe that defaults could rise to 5%, ex-commodities, sometime over the next year or so. Coupled with our 20% commodity HY default rate forecast, we are looking at 7.25% aggregate default rate sometime around mid-2017.” In the event you’ve fallen off Planet Earth in recent weeks, the global corporate default count, as in companies reneging on their promises to make good on those coupon payments, is at the highest level since 2009. And if your memory’s eye has erased 2009 to prevent permanent scarring, the economy was in a full meltdown state back then. Let’s get this straight. Defaults are going through the roof and investors are flocking to the sector in record numbers? And how. Moody’s Tiina Siilaberg keeps an eagle’s eye on the concessions investors give to issuers in the form of protections they don’t demand. They’re called ‘covenants,’ which Investopedia defines as, “designed to protect the interests of both parties. Restrictive covenants forbid the issuer from undertaking certain activities; positive covenants require the issuer to meet specific requirements.” By Siilaberg’s latest tally, covenant protections are at their weakest level in recorded history. To translate, investors’ collective interests are as vulnerable as they’ve ever been. Though the leveraged loan market remains open for business, Siilaberg is apprehensive about what’s just over the horizon given stretched valuations. “Issuance in the high yield bond market is still relatively weak compared to historic levels,” Siilaberg said. “I worry, though, because refinancing risk for many lower-rated issuers is close to an all-time high.” The culprit? That would be a delusional reliance on what Melentyev refers to as, “the new narrative,” and “its apparent reliance on (a) strong monetary response.” Unconventional monetary policy is delivering, “little tangible benefit.” Overreaching central bankers are in fact doing more harm than good at this juncture. Though small investors may not be wise to the damage being wrought, veterans of financial market warfare are weary to the point of exhaustion. The endless waiting for Godot has apparently worn their resolve down to near nothing…with good reason. For all of central bankers’ Herculean efforts, expectations that U.S. job losses will accelerate are at a two-year high while households’ prospects for the economy over the next year have fallen to a two-year low. Pride will surely precede the fall of the orthodoxy of today’s accepted monetary policy framework. But at what cost? “Everyone in the world needs yield and nothing else matters,” Melentyev laments. “This has never ended in any sort of a problem before, so we can all go back to sleep.” And what happens when we’re abruptly shaken from our slumber? Recognizing the painfully obvious, Voya’s Cavanaugh observed, Thank you Chair Yellen & Co. for rendering snarling, lawn mower toting junk bond dogs cute and cuddly critters to retirees on fixed incomes. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 234 Billion-Dollar-Managing Fund Unclear Why Market Ignoring The Biggest Risk Posted: 21 Jul 2016 12:00 AM PDT "It's unclear why this hasn't been a significant driver of markets across the board... maybe we just haven't hit the threshold," exhorts $234 billion bond fund Invesco's Ray Yu. The head of the firm's macro research told Bloomberg that a general theme of political risks increasing or political risk premium has been prevailing for the last few years and we are now seeing tension between established political regimes and populist movements. But it appears Mr. Yu has had his lightbulb moment, as he adds:

In his view, the safest strategy in a world of this much uncertainty is to buy American, noting that post-Brexit and other risks, "we've gotten a lot more constructive on the dollar." Yu added that a Fed hike later this year would likely be warranted and the market is probably underpricing chance of a move sooner than expected...

Which is ironic as not only is the Yuan tumbling to fresh cycle lows but rate-hike odds are quietly resurgent... | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Guns, and the New Silk Road - Rory Hall Posted: 20 Jul 2016 11:00 PM PDT Sprott Money | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 Jul 2016 10:00 PM PDT Jeffrey Lewis | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SOMETHING BIG HAPPENED IN THE GOLD MARKET: Must See Charts Posted: 20 Jul 2016 09:42 PM PDT by Steve St. Angelo, SRSRocco Report:

I'll get into that in a moment, but wanted to share a few things as it pertains to my views on the precious metals. A few weeks ago I was able to get away on a short vacation with my family. We stayed at a nice Bed & Breakfast and at night I enjoyed listening to several different guests talking about their jobs and past-times. In my experience, I have found out that the majority of people would rather talk about themselves rather than listen to others. This doesn't bother me at all as I get to learn more things with my mouth shut than I do with it open. Regardless, the most interesting chat I had was with the Bread & Breakfast owner's son. He stated to talk about the Presidential race and it moved to different aspects of the economy and finance. It happens that the son went to college to study economics, so this was a huge treat for me as I had a good idea where this would lead. Before I could mention the subject of precious metals, my wife (sitting next to me) asked the son, "If he had a nice chunk of change to invest, what would he invest in?" I knew where my wife was going with this because she knows a lot about gold and silver due to my 15 years of boring her to death with all the details. Anyhow, his answer was quite interesting. He said, "I would buy travel Visa's" I thought that was an interesting answer as I have never heard of it before. He explained why he would invest in that, then I asked him what he thought about the precious metals?? His answer was, "YOU CAN'T EAT GOLD." He did not have anything good to say about the precious metals…. LOLOL. I didn't find this surprising at all, as I've heard that KNEE-JERK response over and over from supposedly intelligent individuals. Actually the next day, I thought it might be a good idea for a promotional precious metals T-SHIRT by having on one side of the shirt printed with, YOU CAN'T EAT GOLD, and on the other side, YOU CAN'T EAT YOUR 401K. YOU CAN'T EAT GOLD… Oh Really?? Anyhow, this is the problem with most Americans. At some point down the line they heard "YOU CAN'T EAT GOLD" from someone and they continue to regurgitate it as if it makes some sort of sense. Well, of course you can't eat gold…. what a stupid statement. On the other hand, humans actually do actually eat a little gold. Have you heard of Goldschlager Schnapps or chocolate cake with gold leaf?

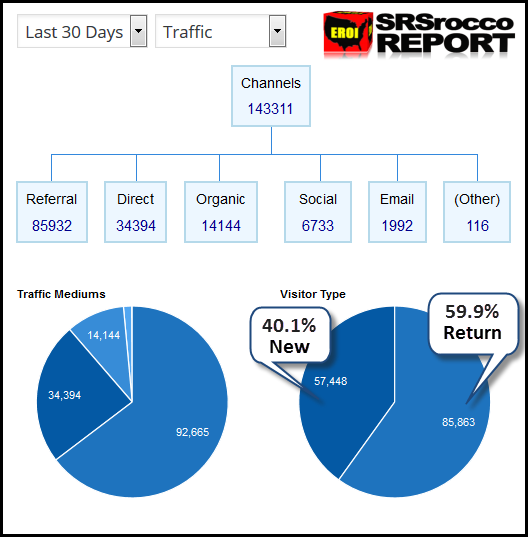

So, people have been consuming gold for quite a while. Now, the question is… who would drink little pieces of their 401K in their schnapps or draped over their birthday cake??? Anyhow, I continue to come across silly or ignorant comments about the precious metals all the time because the individual is either repeating a stupid line they heard, or the person doesn't understand the underlying fundamentals. For example, a reader on another website made a comment about my article on The Fundamental Reason The Silver Price Will Explode Much Higher Than Gold. He said, "Ridiculous. why don't you writers talk about something worthwhile, like the silver basis." First of all, my analysis is NOT BASED on short-term forecasts. Rather, I look to the mid-longer term trends. My analysis on comparing gold and silver scrap supply versus total demand of those metals shows how much more silver is lost in the market than gold. This supply imbalance will translate into a much higher silver percentage gains in the future. I never said this was going to impact the silver price this year. Secondly, many market indicators are becoming less reliable today than they were years ago. This is due to the manipulation of the market by the Fed and Central Banks. Furthermore, the silver or gold basis may be flawed due to precious metal market manipulation. I will discuss this shortly. Lastly, MORE & MORE AMERICANS are finally waking up. I know this because 40% of my visitors are new EYEBALLS to my site each day. Here are the SRSrocco Report site Google Analytic stats for the past 30 days:

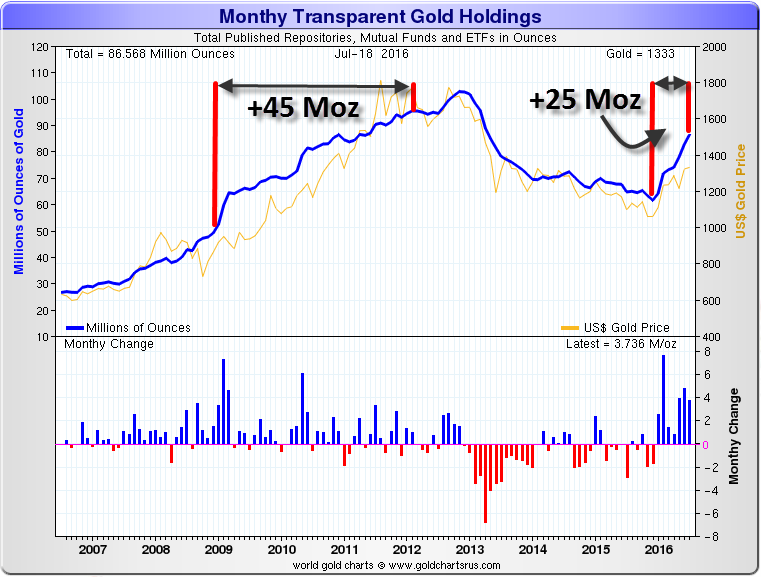

Of the 143,331 individuals who visited my site over the past 30 days, 57,448 were NEW visitors, while 85,863 were RETURNING. That's a lot of new people stopping by the SRSrocco Report in a month. As I have stated over and over, if just 1-2% more of the population moved into physical gold and silver, it would be game over. There just isn't enough metal to go around… only a much higher prices. Okay… let's get back to really interesting information. SOMETHING BIG HAPPENED IN THE GOLD MARKET Most precious metals investors have read about the huge price move in gold and the large flows into Gold ETFs & Funds in the first six months of 2016. However, very few realize just how significant the changes have been in the gold market if we compare it to the past. This chart is the Monthly Change of Transparent Gold Holdings from Sharelynx.com. These holdings represent Gold ETFs, Funds and Repositories, such as the Comex:

From the beginning of 2009 to the end of 2011, these total gold holdings increased approximately 45 million oz (Moz). So, as the price of gold moved up from a low of $780 at the beginning of 2009 to nearly $1,900 in September 2011, total gold holdings increased 45 Moz. Now, compare this to the massive 25 Moz increase of total gold holdings in the first half of the year as the price moved up only $300. The significance of this present change in the gold market can be better seen in the chart below:

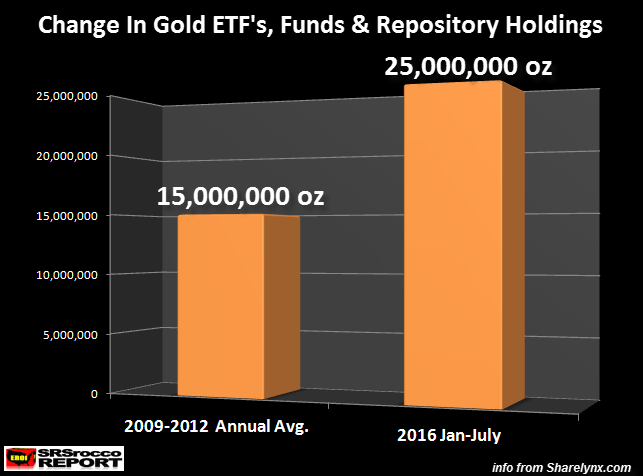

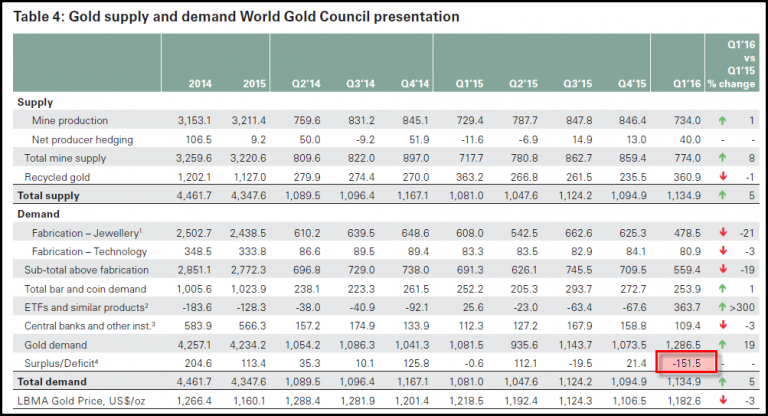

The average annual increase in total gold holdings during the 2009-2012 period was 15 Moz compared to 25 Moz for the first half of 2016!! If demand for gold continues as strong in the second part of the year, we could see upwards of 50 Moz move into these total gold holdings versus 45 Moz for the 2009-2012 period. That being said, I highly doubt these Gold ETF's, Funds and Repositories are receiving all the gold they report. Why? Well, if we look at the Gold Supply-Demand situation, the gold market will experience a large deficit for the first half of the year. According to the World Gold Council, the huge surge in Gold ETF & Fund demand caused a 151 metric ton (4.8 Moz) deficit for Q1 2016:

If we assume total Gold ETF & Fund holdings doubled to 700 metric tons (mt) in the first half of the year (they increased by 363.7 mt Q1 2016, shown in the table above), this will likely push the deficit to over 300 mt or 9 Moz for 1H 2016. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| US To Seize $1 Billion In Embezzled Malaysian Assets Which Goldman Sachs Helped Buy Posted: 20 Jul 2016 07:25 PM PDT The last time we wrote about the long-running saga of the scandalous collapse and constant corruption at the Malaysian state wealth fund, 1MDB, which also happened to be an unconfirmed slush fund for president Najib, was a month ago when we learned that the NY bank regulator was looking into fundraising by the fund's favorite bank, Goldman Sachs. Then overnight, the story which already seemed like it has every possible angle of crime and corruption covered for a series of Hollywood action-adventure blockbusters, got a new twist when the DOJ announced it would seek to seize some $1 billion in assets from individuals affiliated with the fun as part of one of the largest seizures in US history. The expected asset seizures would be the U.S. government's first action tied to the 1MDB investigation. Among the properties the US is looking to confiscate, are Van Gogh paintings, Beverly Hills properties, a private jet, ultra high end real estate in NYC and LA, and the rights to profits from the hit movie The Wolf of Wall Street. The move by U.S. authorities to seize assets tied to an investment fund run by a foreign government would be a major escalation in Washington's global efforts to fight corruption and block allegedly illegally obtained funds, facilitated by Goldman Sachs, from moving through the world's financial system the WSJ adds. The case represents the most detailed and sweeping allegations to be brought in the multinational probe into a global scheme to siphon more than $3.5bn from the Malaysian government fund. As the FT adds, it is also the first time Malay prime minister, Najib Razak, has been officially tied to the scandal, and while he has not been by name in court documents the description of "Malaysian Official 1" matches his biography and job responsibilities. In what may develop into a major diplomatic row, the DOJ states that that "official" received funds misappropriated from 1MDB, prosecutors say. Najib has repeatedly denied any wrongdoing. The actions by U.S. authorities also threaten to upend the country's relationship with Malaysia, a moderate Muslim nation that has long been an important U.S. ally in Southeast Asia, and may force Malaysia to enter China's sphere of influence in exchange for protection from US retaliation. Malaysia has deep ties to the Middle East and has been seen as a bulwark against China, which has increasingly asserted its power across Asia. President Barack Obama cultivated a relationship with Mr. Najib, including playing golf together in Hawaii over the Christmas holidays in 2014, something we reported at the time.

Amid the controversy, the Malaysian leader now was likely to focus on his domestic political survival rather than retaliate against the Obama administration, said James Keith, US ambassador to Malaysia from 2007 to 2010. Malaysia is a key regional partner for the US, backing a proposed trans-Pacific trade deal and hosting a digital centre to counter Islamic State propaganda. "I don't think this is unexpected from Najib's perspective," said Mr Keith. "His approach is: batten down the hatches; we're going to survive this, no matter what. He'll do everything he can just to pretend this didn't happen." * * * Political fallout notwithstanding, the case reveals just how extensive money-laundering by the fund, the Malay prime minister, and a handful of affiliated individuals, often with US bank assistance, has been ever since 1MDB was created in 2009 as a government-owned vehicle to promote economic development through global partnerships and foreign investment. Ironically, it ended up anything but as funds intended to benefit the Malaysian people were instead diverted to buy real estate, works of art and jewellery, pay casino bills and hire musicians and celebrities for the conspirators' "lavish lifestyles", the complaint says. More than $200m was spent on art alone, prosecutors allege. As part of the complaint, US authorities accuse Malaysian officials and business executives with receiving laundered 1MDB funds through banks in Singapore, Switzerland, Luxembourg and New York. The Malaysian officials "treated this public trust as a personal bank account", said Loretta Lynch, US attorney-general. The misappropriation occurred over four years beginning shortly after Mr Najib set up the fund, according to the complaint. According to the suit, in March 2013, $681m in proceeds from a 1MDB bond offering were transferred into an account belonging to the official matching Mr Najib's description. Five months later, $620m of that amount was shifted to a different account to which a 1MDB official was an authorised signatory. Officials at 1MDB and others began diverting money shortly after the fund was created in September 2009 under the guise of investing in a joint venture with a private Saudi oil extraction company, PetroSaudi International. More than $1bn was transferred to a Swiss bank account held by Good Star Ltd, which was owned by Mr Low, prosecutors allege. Andrew McCabe, deputy director of the FBI, told reporters in Washington: "The Malaysian people were defrauded on an enormous scale." There is more in the full complaint, and it revolves around the three main players who, aside from the prime minister, were instrumental in the perpetuation of this grand fraud, including, Riza Aziz, stepson of Malaysian Prime Minister Najib Razak; Jho Low, a Malaysian financier; and Khadem Al Qubaisi, a former Abu Dhabi managing director of a sovereign-wealth fund. Details about their involvement can be found in the WSJ. * * * Much of the above was already known, or implied, however this is the first official confirmation of just how vast the money-laundering scheme was and that it stretched to the very top. What is now also confirmed, is that at the heart of the fundraising operation was none other than Goldman Sachs. According to the complaint, in 2012, 1MDB officials and others fraudulently diverted $1.4bn in proceeds from two bond offerings arranged by Goldman Sachs, according to the complaint. Representing almost 40 per cent of the total raised, the funds were transferred to a Swiss account controlled by a British Virgin Islands entity called Aabar Investments PJS Limited. Aabar had been named to suggest a relationship with an Abu Dhabi company, Aabar Investments PJS, an investment arm of the Abu Dhabi government. But funds diverted to the Swiss account ultimately ended up in a Singapore bank account. In 2013, several officials including those from 1MDB diverted nearly $1.3bn from another $3bn Goldman bond offering. The money was supposed to be used to finance a joint venture known as the Abu Dhabi Malaysia Investment Co but was instead funnelled into a Singapore account controlled by Mr Low's associate, the complaint says. Where it becomes clear that Goldman had a special arrangement with the complicit issuer and the prime minister, is that Goldman earned $192.5m or nearly 11 per cent of the principal amount on one of the 2012 bond deals, a $1.75bn offering, according to court documents, which also said that the offering circular "contained misleading statements and omitted materials facts". Considering that a typical fee for an emerging market sovereign or quasi-sovereign bond offering between $1bn-$5bn would be between 0.1 per cent and 0.3 per cent, according to Dealogic, this is nothing short of kickback to Goldman, and raises questions about why Goldman wilfully accepted such an overblown fee for a deal which any of its competitor banks would have done for a fraction of the cost. This being Goldman, of course, the bank was not accused of any wrongdoing in today's action. It may be in the future as per the DOJ's parallel prove whether Goldman violated the Bank Secrecy Act in its handling of the proceeds of the securities offerings, but somehow the FBI was unable to link the bank to any crime conducted by the same people who were paying it exorbitant fees to keep the money flowing. * * * So once Goldman's fundraising skills allowed corrupt Malaysian politicians and selected shady middlemen to have access to billion which they would then embezzle, what did they spend the money on? Perhaps a better question is what did they not spend on: among the purchases were Van Gogh paintings, a private jet, the rights to profits from the hit movie The Wolf of Wall Street, and real estate. Lots and lots of ultra high end real estate. Here are some of the details from WSJ: The properties allegedly bought with funds misappropriated from a Malaysian investment fund would make for a stunning house tour of high-end real estate in New York and Los Angeles. Besides flashy real estate, the U.S. government alleges that money from the fund, known as 1Malaysia Development Bhd. or 1MDB, was used to buy a $35 million private jet and a stake in EMI Music Publishing. The assets that the government is trying to seize were purchased by three men who had close ties to 1MDB: Jho Low, a Malaysian deal maker; Riza Aziz, the stepson of Malaysian Prime Minister Najib Razak, and Khadem Al Qubaisi, a former Abu Dhabi managing director of a sovereign-wealth fund, and occasionally the men sold or gave assets to one another. The properties range from a Beverly Hills mansion with a 120-foot-long pool to a string of Manhattan condos, including a seven-bedroom, five-bathroom duplex overlooking Central Park that cost $35 million. The complaints paint a picture of lavish spending on casinos and private jets and a taste for high-end real estate—an asset that has been an increasingly popular place for the world's wealthy to stash their cash outside the banking system and inside stable countries. Mr. Low declined to comment. A representative for Mr. Al Qubaisi didn't reply to requests for comment. Red Granite Pictures, a company owned by Mr. Aziz, said it and Mr. Aziz "did nothing wrong." Mr. Aziz's New York duplex is by far the most expensive property in the Park Laurel building, a prominent luxury address near Lincoln Center and overlooking Central Park. Mr. Aziz has stayed in the apartment when he visits New York, according to a doorman there. A home bought by Mr. Low is located in the so-called Bird Streets in Los Angeles's Hollywood Hills—a quiet enclave of narrow, twisting roads named after different types of birds. The property on Oriole Drive is a 6-bedroom, 5-bathroom home with a swimming pool, spa and wine cellar, which Mr. Low bought in 2012 for $39 million, according to records. A tall, white wall surrounds the house. The Los Angeles home owned by Mr. Aziz on North Hillcrest Road— a winding street just off Sunset Boulevard—was purchased in 2010 for $17.5 million. Security guards on the site Wednesday said that they had no idea who owned the property and that no federal agents had visited. The Viceroy L'Ermitage Beverly Hills, the hotel Mr. Low purchased in 2009 through his family's trust, sits discreetly on a tree-lined, residential street and features a rooftop pool and 116 newly renovated suites. Hotel staff said they hadn't noticed any unusual activity Wednesday morning. Mr. Low owns a majority stake in the Park Lane Hotel, a trophy property overlooking New York's Central Park. He put up about $240 million of the $400 million of equity provided by the investors who bought the 46-story property in 2013 in a deal that valued it at about $850 million. The investor group, led by New York developer Steve Witkoff, planned at the time to continue running the Park Lane as a hotel while studying the possibility of redeveloping the hotel into condominiums or a mixed-use property. But when news broke that Mr. Low was under investigation, those plans were stymied. Such a plan would require approval from the New York state attorney general's office, an unlikely event when the property's majority owner was being investigated. * * * And that kind of magnificent organized crime, dear New Yorkers, is why real estate in Manhattan has never been more expensive. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Benjamin Freedman Speech 1961 -- Henry Makow Posted: 20 Jul 2016 07:00 PM PDT Makow & Rense ~ Benjamin Freedman Speech 1961 Henry Makow & Jeff Rense, January 17, 2006. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Potential Crisis Triggers Continue To Pile Up In 2016 Posted: 20 Jul 2016 07:00 PM PDT Submitted by Brandon Smith via Alt-Market.com, We are a little over half way through 2016 and, at the current rate, it will be a miracle if the year finishes without outright catastrophe in half the nations of the world. Some might call these events “Black Swans,” some might call them completely engineered threats, others might call it all a simple “coincidence” or a tragedy of errors. I stand strictly by the position that most of the dangers we see today have been deliberately escalated, if not strategically implemented. Here is the problem; international financiers and globalist nut-jobs are clearly operating on a timeline with the end goal of creating enough general chaos to convince the masses that complete centralized authority over every aspect of our lives is preferable to constant fear. For a more in-depth analysis on the schemes of the elites, see my articles Are Globalists Evil Or Just Misunderstood and Globalists Are Now Openly Demanding New World Order Centralization. In order to elicit this kind of thinking from the public, crisis events are required that will cause many human beings to act, for the most part, like rabid animals. How would this be accomplished? Well, what does history tell us about that which inspires people to sometimes sacrifice their moral code or to bow down to tyrants? Usually a loss of necessities is required — including a lack of employment, lack of production, lack of serviceable shelter, lack of ample food and clean water, lack of medical care, lack of overall security and a sense of safety, etc. The question often arises: “Why would the elites need to create crisis at all; don’t they already have control of the world?” The answer is no, not yet they don’t, and if you read my recent article The Reasons Why The Globalists Are Destined To Lose, you can see why they never will have total control. That said, just because the globalist plan for complete centralization is doomed to fail does not mean they will not do everything in their power to make the attempt. Changes in mass psychology that might take decades to achieve can be accomplished in only a few short years if the public is placed under the right amount of duress. I find that younger people (and isolated people who spend all their time on the web) in particular just don’t understand how this works. Look at it this way; you may not think crisis would be all that useful in pushing the globalist agenda forward until you find your family threatened, your children at risk or your parents in dire need. Fear of losing those we love can open the door to great collective evils, even more so than the fear of harm to ourselves. Those who have no concept of self defense or the will to prepare and fight are the easiest to manipulate in this way. Pacifists are an effortless meal for dedicated despots. Hell, for some folks the simple threat of losing day-to-day comforts can cause them to make terrible choices and support destructive leaders and policies. Chaos is NOT the end game, it is only a tool by which the elites gain psychological leverage over the masses so that people willingly give up their rights to self determination and hand more power to the establishment. A perfect example would be the recent Brexit referendum, the effects of which have not even begun to rise to the economic surface yet. In light of this event, numerous political puppets and banking moguls have declared an outright need for financial centralization of all nations in order to avoid a calamity. Investors have been lured into a false sense of safety as equities do not yet reflect the fiscal downturn taking place in every other sector of the global economy, but time grows short nonetheless. The political can negatively affect the financial and vice versa. Here are just a few of the latest trigger events that are piling up atop an already precarious year…

The overall purpose of these events, I believe, is first to conjure mass confusion. The globalists are turning up the heat on the citizenry much faster than ever before, and it is time to take stock of our position and response. The best defense, as I have always stated, is personal preparedness and self sufficiency, organization with friends and family, then organization of the like-minded within your neighborhood and if possible your town. Most people are self-isolated and thus weak in their defensive position. Anyone effectively organized will have far reaching advantages in the midst of social breakdown. Anyone who is organized with solid planning will become the point to which everyone else gravitates. You can either be a pillar of strength or a victim, it is your choice. Rest assured, there is more shock and awe to come in 2016. Now is the time to prepare if you have not done so already. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Russia Bans All its Citizens From Turkey As Massive US-NATO Armada Moves To Attack Posted: 20 Jul 2016 06:30 PM PDT Russia Bans All its Citizens From Turkey As Massive US-NATO Armada Moves To Attack. US-NATO vessels were there for military exercises. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| END TIMES SIGNS: LATEST EVENTS (JULY 20TH, 2016) Posted: 20 Jul 2016 06:00 PM PDT end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| CYBERWAR -- Hacking a Car with an Ex-NSA Hacker Posted: 20 Jul 2016 05:00 PM PDT Ex-NSA hacker Charles Miller demonstrates to Ben Makuch the dangers of hacking a car, and explains the cyber vulnerabilities of machines we use in our everyday lives. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Analyze THIS (technically): We don't need back-door nationalization by central banks Posted: 20 Jul 2016 04:41 PM PDT Central Banks Must Realise the Last Thing We Need Is Nationalisation by the Back Door By Matthew W. Lynn http://www.telegraph.co.uk/business/2016/07/20/central-banks-must-realis... Would you feel comfortable lending money to the mining conglomerate Glencore, a company that only last year came perilously close to imploding? Or Telecom Italia, with its massive exposure to the weakest major economy in the world? Or to Lufthansa, a lumbering beast of an airline just waiting to be eaten alive by new and aggressive low-cost carriers? Well, perhaps you would, and perhaps you wouldn't. If you are part of the eurozone, however, you don't have any choice. This week we learned that the European Central Bank (ECB) has been buying bonds in all those companies as part of its latest round of quantitative easing. It is far from alone in pumping money directly into corporations. Over the last few years, the Bank of Japan has been buying equities so furiously it is now one of the biggest stakeholders in Japan Inc. All it will take is one downturn, and it would be no surprise if the Bank of England and the Federal Reserve followed suit. ... Dispatch continues below ... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: But is that really wise? Central banks, which are owned by the state, are going to end up controlling huge swathes of private industry. That is sold as a way of stimulating growth. But it could end up as nationalisation by the back door -- and everything we know about economic history tells us that always ends in disaster. Having exhausted just about every other way of stimulating some life into the moribund eurozone economy, the ECB has now resorted to pumping cash directly into the corporate sector. It tried loading the banks up with cash, but they are so reluctant to lend it out that the ECB has now started buying corporate bonds instead. It is currently doing so at a rate of 300 million euros a day -- serious money even for the ECB. Earlier this week it published details of what it has been buying. Most of the major eurozone corporations are there. So are companies from elsewhere, which are eligible so long as the debt is issued through a unit within the euro area. Such is the scale of the programme that prices are dropping and it is getting a lot easier for big corporations to tap the markets for money. The ECB is far from alone. The Bank of Japan has been buying equities on a massive scale for several years now. It is now a Top 10 shareholder in 90 percent of the companies listed on the Nikkei 225. It is a Top 10 holder of Fast Clothing, which owns the Uniqlo chain, and a Top 3 holder of Yamaha, one of the world's biggest instrument makers. Plenty of economists will tell you that is simply a clever way of stimulating the economy when interest rates are already zero. The trouble is this, however. Even though the central banks claim they will be completely neutral with their holdings, it is hard to see how that can be true. In fact, there are two problems. First, what happens in a crisis? Some of the bonds come with what the market makers call "event risk," and the rest of us would describe as "terrible stuff about to happen at any moment." For example, the ECB now owns bonds in Volkswagen. As we know, the German car maker is still embroiled in a scandal over cheating on diesel emissions. Where will that end up, and can the business withstand the potential legal costs? No one yet knows. But one thing is clear. If it runs into serious trouble, then the bondholders will end up taking control. And yet the ECB has no mandate to get involved in sorting out VW or any other company. Next, surely the ECB's choice of purchases is a form of intervention. If it buys a Lufthansa bond, it lowers the cost of capital for that company. That gives it an advantage over its rivals -- say, another EU-based airline such as Ryanair. In many industries, such as airlines or utilities, cheap capital is one of the most crucial factors in whether the business is a success or not. Whether it likes it or not, the ECB is favouring one or another. Even worse, over time it opens up the bank to cronyism. How long before French or Italian politicians demand that some tottering conglomerate be propped up with cheap cash? It will probably happen before Christmas. State control of the economy has always been a bad idea. It distorts the playing field, favours political lobbying over competitive excellence, and stops the market from allowing the best-managed businesses with the best products to flourish. Central banks are pushing it through the back door. They argue they are doing so to help revive demand and keep the economy alive. But as with so many of their recent innovations, from zero rates to printing money, the medicine is starting to look a lot worse than the disease. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Watch the Full 2016 Republican National Convention - Day 3 Posted: 20 Jul 2016 04:30 PM PDT Watch complete, gavel-to-gavel coverage of the 2016 Republican National Convention. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Epic Alex Jones Anti-Commie Rant Posted: 20 Jul 2016 04:00 PM PDT Alex Jones goes off on the communist scum who assaulted and can't understand how Communism has failed. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1318.80 Down $12.70 or -0.95% Posted: 20 Jul 2016 03:52 PM PDT

Before I forget for the third day running, falling premiums need mentioning. Premium on US 90% silver coin, at $5 an ounce over spot at wholesale last August, has fallen to 20¢ over spot. That makes 90%, my favorite form of holding silver, the cheapest way to buy silver. In gold coins, the Austrian 100 corona (0.9802 oz) yesterday was about $2 UNDER spot at wholesale. The US $5 commemoratives (0.241875 troy ounce) costs only $2 over spot at wholesale, ridiculously cheap for a fractional US coin. Why does it make a difference? OVER TIME, PREMIUM ALWAYS DISAPPEARS. Gold is gold. Therefore, we always want to buy the lowest cost per ounce coin. Buy gold, not premium, and, yes, I mean to prefer these low premium coins over the gold American Eagles, and 90% coin over silver American Eagles. Back in August 2015 we advised our customers to SWAP US 90% coin for silver bullion because they could realize a roughly 20% gain in ounces. Now that the premium has vanished on 90% coin, it wouldn't be a bad idea to swap bullion back into 90%. Why? One day that premium will return, and besides, US 90% coin has potentially the greatest utility of any physical silver. TODAY silver broke out of that pennant, proving it was an even-sided triangle instead of a pennant. Or did it? Silver dropped 39.3¢ (2%) to 1958.2¢. Gold tumbled $12.70 (1%) to $1,318.80 on Comex. I repeat: silver is more volatile than gold, upside and downside. Here's the Silver chart, http://schrts.co/mAsOa7 Silver punched through the lower boundary of that pattern, but didn't quite reach its 20 day moving average below at 1934¢. Low came at 1944¢. That heavy blue line holding everything up is the current uptrend line. If this is simply a shallow correction, silver will touch that 20 DMA & reverse. It might be a deeper correction, in which case it must not breach that heavy blue uptrend line, tomorrow about 1860¢. Yes, redrawing that pennant into a flat bottomed falling triangle does make me nervous. Those patterns have a habit of breaking down. None of this terrorizes me because (1) gold & silver needed some correction to shake out the optimists, and (2) the gold chart is just fine. Take a look, http://schrts.co/Eyyuq1 Gold could have dropped as low as $1,350 today & remained within that bullish flag. Actual low came at $1,313.30. Maximum possible low tomorrow to stay within the flag is $1,309. Gold adds this complication, that it is smack on the uptrend line, so the bottom boundary of that flag becomes that uptrend line. Gold pierced its 20 DMA ($1,331.09) today. Good. Volume rose some, but not markedly, nor did silver's. On the upside watch $1,340 and 2025¢. Closes above that signal an upside breakout. No, I don't know how many days this correction might continue, but gold's chart says not more than three or four. I should have heeded the gold/silver ratio's warning yesterday. It gapped up & ended the day up 1%. Surely headed for the 20 DMA overhead (68.99). View the chart here, http://schrts.co/kh9gOy US dollar index today built on yesterday's gains by adding 15 basis points (0.15%) to 97.26. Clearly intends to move higher. Euro followed through on yesterday's downside break out, but ended at $1.1009, only 0.9% lower. Yen, however, busted its 50 DMA (94.18) today & lost a huge 1%. Stocks rose again. Dow added 36.02 (0.19%) to 18,595.03. S&P500 grabbed 9.24 (0.43%) to end at 2,173.02. The power of central banking lies. I am beat. Pulled grass out of flowerbeds on Saturday, & Monday the chiggers started showing up. Now my chiggerbites have chiggerbites. Scratching like I've got fleas. Thank God for lavender oil! - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FALSE FLAG EXPOSED -- NICE TERROR ATTACK LINKED TO U.K GLADIO Posted: 20 Jul 2016 03:30 PM PDT NICE TERROR ATTACK LINKED TO U.K GLADIO. - FALSE FLAG EXPOSED Nice terror attack exposed! #falseflag The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nigel Farage : Hillary Clinton is a Crook Posted: 20 Jul 2016 02:30 PM PDT its as if Farage is the only real politician there and everyone else is just an agent from corporation... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 Jul 2016 01:42 PM PDT A long time reader and forum member posted the following with a question regarding silver industrial demand: “The question that begs an answer, is how will this ultimately effect the monetary value of Silver and does that foretell a change in investment strategies?” (Full comment below). | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Risk On, and Shenanigans For Dessert Posted: 20 Jul 2016 01:20 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily Cycle Low Still Several Days Away Posted: 20 Jul 2016 01:16 PM PDT Some analysts were expecting gold to form an early Daily Cycle Low. I’ve been warning that gold needs to break the cycle trend line before the DCL can bottom and to beware of a fake out. It turns out I was correct to be patient. I doubt gold will form the DCL until right before, or on the FOMC statement next week. More patience. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Next “Lehman Moment”… Coming in 2017? Posted: 20 Jul 2016 01:00 PM PDT This post The Next "Lehman Moment"… Coming in 2017? appeared first on Daily Reckoning. The implosion of Bear Stearns was just the tip of the iceberg… At the time, the full extent of the damage to the housing market was unknown. No one had an accurate sense of how broken the banks really were. And no one had any idea that the global economy was about to crack under all of the pressure. But Bear Stearns' collapse and the market reaction made it crystal clear that all was not well. The signal that Bear Stearns was sending was not "All clear"… it was "Look out below!" But few were paying close attention. This critical warning was ignored until it couldn't be anymore. And then just months later, the world blew up with the collapse of Lehman Bros. Following the Lehman bankruptcy, we saw a period of extreme volatility touching off the global financial crisis — a crisis we still feel today. Bear Stearns was the event that should have alerted us to severe problems in the financial system. But it took an event like Lehman to trigger our fall over the cliff. Today, I fear we may have another Bear Stearns-type event that investors are again ignoring at their peril… And that's Brexit. The Brits' recent vote to leave the EU created short-term panic in the markets. And like Bear Stearns, Brexit signaled that there are deep problems in the financial system. Now all that's necessary to send the world spiraling out of control is another Lehman-like trigger. Leading up to the Brexit vote on Thursday, June 23, the Eurocrats and their allies in the media told us that a U.K. vote to leave the EU and restore its popular sovereignty would lead to financial Armageddon. And the fear mongering worked for a time. Stock markets around the world plummeted the Friday after the Brits voted to leave. European stocks closed Friday with huge losses, with some seeing the steepest drop since 2008. Stocks in Asia and the U.S. also fell sharply, with the Dow Jones industrial average sinking 610 points. And more than $2 trillion of global stock market value was wiped out. But the central bank planners made sure we knew that their nanny-state safety nets were there to cushion us. Bank of England chief Mark Carney pledged to provide an extra $345 billion to the financial system. European Central Bank head Mario Draghi said the ECB was "ready for all contingencies" after the Brexit referendum. And Fed Chair Janet Yellen said Brexit would justify a "cautious" approach to interest rate policy (i.e., no rate hike, with all options on the table). Investors recognized their backstops were in place. And markets recovered quickly. And now the S&P 500 index is making new all-time highs. We've received an "all-clear" signal yet again. But like Bear Stearns in 2008, this post-Brexit market rebound is masking massive underlying problems. And this time the canary in the coal mine is European banks… It's no surprise that most European Union countries are trapped in an environment of negative growth, massive debt and sky-high unemployment. As Matthew Lynn of MarketWatch writes: "Italy's economy is smaller now than it was way back in 2000. Spain has been close to the edge of bankruptcy, and has seen unemployment soar past 20% of the workforce. France is stuck in endless recession, and struggling to maintain competitiveness against Germany." But the biggest problem is in the financial sector… The EU's largest banks that anchor its economy, like Deutsche Bank, are basically insolvent. Deutsche Bank has startling leverage of 40 times. Leverage is the proportion of debts that a bank has compared with its equity/capital. That means Deutsche has 40 times more debt than equity/capital. Keep in mind that Lehman Bros. was only 31 times leveraged when it imploded in 2008 and sparked the worst global financial crisis since the Great Depression. Europe's banking crisis also extends to smaller banks. In Italy, 17% of bank loans are bad, for a total of $360 billion. During the worst of the 2008–09 financial crisis, only 5% of U.S. bank loans were bad. Indeed, events have become so bad that Deutsche Bank chief economist David Folkerts-Landau has called for a continent-wide $166 billion bailout for European banks… similar to the Troubled Asset Relief Program (TARP) in the U.S. in 2008–09. And not surprisingly, European bank stocks are being decimated by the crisis. Italy's UniCredit has lost nearly 70% of its value. Royal Bank of Scotland has declined more than 55%. Credit Suisse, Deutsche Bank and Barclays have seen their shares decline by 50%. No doubt the European Central Bank will step forward with new Ponzi schemes to bail these banks out. That might prevent a major collapse in the short term. But there's one event that's going to be too big even for central banks to fix… Britain's decision to Brexit has emboldened anti-EU parties throughout Europe. Pro-EU governments are under fire in almost every member state. In fact, a shocking Pew poll taken recently finds that even EU-centric countries like Germany, Spain and the Netherlands show nearly 50% of their populations holding a negative opinion of the EU. That means the Germans, Spanish and Dutch are just as unhappy with the EU as the British were before Brexit. But the most shocking result of all was that 61% of the French have an unfavorable view of the EU. France was the country that laid the foundations for the European Union post-World War II. And now they want out the most. That sentiment will likely increase with the recent attacks in Nice, as many in France want more restrictive immigration policies than the EU allows. In fact, before the attacks, nearly 60% of French people wanted less immigration. That number will rise after Nice, as will the desire to get out from under the EU's open border and uncontrolled immigration policies. France's clear discontent with the EU can't be overstated. The EU might survive Brexit. But a French divorce from the EU would be cataclysmic, both financially and politically. It would mark the official end of the EU. Of course, we're told by "experts" that Frexit will never happen. Brexit wasn't going to happen either… until it did. The fact is the French have the wind in their sails following Brexit. And the French opinion of the EU is more negative than the British. Add that to the fact that Marine Le Pen, leader of the French far-right National Front, pledges to hold an immediate referendum on France's EU membership if she becomes president next April. And she's surging in the polls! Bottom line, the future of the European Union is in doubt. What Happens if the EU Breaks Up? There's no doubt that an event of this magnitude could trigger an even greater global collapse than Lehman Bros. did. While there are far too many variables to predict, an EU breakup would certainly cause extreme volatility and dysfunction in all global markets. And a potential Frexit is the catalyst. If a vote to Frexit appeared likely, you'd see market panic even before the first vote was cast. Bank runs would spread as consumers sought the safety of cash well before the actual earth-shattering event took place. It would start in French banks… and the knock-on effects would spread to other European banks that have relationships with French banks. This would create a huge decline in confidence, leading to a European-wide decline in bank lending. And these bank runs would spread into a more widespread financial crisis in the global financial sector. Non-eurozone financial institutions in the U.S. and Asia would come under immense pressure because they too have heavy exposure to European banks. An EU crackup would also mean the end of the euro. And that would mean new currencies would have to be established. The uncompetitive currencies in southern member states like Spain would quickly lose value. Others in economic powerhouses, like Germany in the north, would skyrocket. That means exports would be cheap for some countries and expensive for others. And that means the imposition of tariffs to make things "fair." Trade wars, anyone? In less-competitive EU countries, investors would lose trust in the value of their money, since they are no longer backstopped by the EU. This would lead to massive inflation spikes and buying power erosion. Countries with weakened currencies and bank failures would see sovereign defaults on an epic scale. This would further imperil the banking system across our globalized economy. Also, existing EU business contracts, trade deals and financial transactions would have to be established in entirely new currencies. And the legal validity of existing euro-denominated deals would be unknowable. A breakup of the EU would lead to finance and trade across Europe and the world disrupted en masse. And I've only laid out a handful of possible best-case scenarios. In short, an EU breakup would unleash a massive liquidity crisis and a global recession that would make 2007–09 look like a walk in the park. Look, I'm not here telling you this because I'm certain it will happen. I'm not making a prediction and betting all of my chips on it. Investment success is not about making the right predictions. It's all about preparation. Are you prepared for the scenario I have described? The point is that an EU breakup would launch fears of these kinds of chaotic events in investors' minds. And markets loathe chaos. After the Bear Stearns implosion and subsequent market panic and recovery in 2008, the "geniuses" on Wall Street and in the financial media said all was well. Bear Stearns was just a minor hiccup in the road to everlasting prosperity and double-digit returns in the stock market. Sound familiar? But that wasn't a true reflection of the conditions underlying the global economy and financial system at the time. The enormous mortgage market fraud and the massive vat of bubbling poison it produced were still there. The fact is that conditions were ripe for a collapse long before the Bear warning shot was first fired. All it took was a cataclysmic event like Lehman Bros.' demise for the dominoes to fall. And they fell quickly. We find ourselves in a similar place today. Brexit was our warning shot that our financial system and markets aren't sound. But Brexit wasn't the trigger for a major collapse. That's because our central bank planners rode to the rescue with trillion-dollar assurances that they will make everything nice when things get messy. But this corrupt system doesn't rest on a solid foundation of high productivity, low debt and robust savings and investment. Those are the things that produce sound economic growth and stable economies. Instead, we have a rigged and unsustainable edifice built on money printing and debt. It's just a matter of time before it blows wide open. And our monetary overlords have run out of tools to deal with the next crisis. QE, ZIRP and NIRP have all failed. We're worse off than we were before 2008. Sure, they may try "helicopter money." But that's a sign that central banks have lost all control. It would only spread more fear and panic in the markets. Look, I believe a major collapse is coming. And all it's going to take is a catalyst just like Lehman. Once the stress of a major trigger like a potential Frexit vote and a potential EU crackup hits, the collapse will be sudden as everyone heads for the exits all at once. When that happens, the ECB, Federal Reserve and the other central banks will contort themselves into pretzels trying to come up with new schemes to prolong the bubble. But there will be no bullets left in their chambers. You can only do so much to preserve a fundamentally flawed financial foundation. Every game ends at some time. And this one has been going on a really long time. Regards, Michael Covel Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post The Next "Lehman Moment"… Coming in 2017? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nigel Farage at The RNC on Trump & Brexit Posted: 20 Jul 2016 12:30 PM PDT Nigel Farage Full Interview + Q&A at the RNC - Donald Trump Brexit Nigel Farage interview at the Republican National Convention in Cleveland answering questions about Donald Trump and Brexit. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Press For Truth : Do All Lives Matter? Posted: 20 Jul 2016 11:59 AM PDT In this video Dan Dicks of Press For Truth interviews an all lives matter activist to learn more about their position. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. charges HSBC official in FX rigging probe Posted: 20 Jul 2016 10:09 AM PDT By Tom Schoenberg and Patricia Hurtado Federal agents surprised an HSBC Holdings executive as he prepared to fly out of New York's Kennedy airport late Tuesday, arresting him for an alleged front-running scheme involving a $3.5 billion currency transaction, according to three people familiar with the matter. Mark Johnson, HSBC's global head of foreign exchange cash trading in London, was held in a Brooklyn jail overnight and will appear in court Wednesday, one of the people said, asking not to be identified because the details of his arrest aren't public. The U.S. unsealed charges against him and Stuart Scott, the bank's former head of currency trading in Europe, making them the first individuals to be charged in the long-running probe. The arrest and charges are a coup for the Justice Department, which has struggled to build cases against individuals in its investigation into foreign-exchange trading at global banks. U.S. prosecutors once had so much confidence in the quality of evidence they were gathering thanks to undercover cooperators that in September 2014, then-Attorney General Eric Holder said he expected charges against individuals within months. The U.K. Financial Conduct Authority also found it difficult to make cases against currency traders and announced in March that it was dropping its efforts. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-07-20/hsbc-official-said-to-... ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stay Home, Order Take-Out, And Fondle Your Gold Posted: 20 Jul 2016 09:55 AM PDT For an example of how far we've fallen from the old days of free-range First World entitlement, consider the fact that investment analysts are now judging companies by how well they cater to the needs of the terrified: Papa John's upgraded on belief civil unrest is encouraging more pizza delivery (MarketWatch) – Papa John's International […] The post Stay Home, Order Take-Out, And Fondle Your Gold appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| #ExMuslimBecause France Attacks ,Problem Is Islam Posted: 20 Jul 2016 09:30 AM PDT Islamic Ideology must be banished..#ExMuslimBecause compassion has no religion. Compassion is universe. Welcome to the future. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe’s Ticking Time Bomb Is About to Blow Posted: 20 Jul 2016 09:00 AM PDT This post Europe's Ticking Time Bomb Is About to Blow appeared first on Daily Reckoning. Brexit's over… and markets are breathing a sigh of relief. But they shouldn't be. That's because a new crisis is looming in Europe… The size and scope of the damage it may cause is inconceivable. And if it isn't contained quickly, it will destroy the European Union. The Italian JobThe current European sickness can be traced back to an Italian virus… As the Wall Street Journal reports… In Italy, 17% of banks' loans are sour. That is nearly 10 times the level in the U.S., where, even at the worst of the 2008-09 financial crisis, it was only 5%. Among publicly traded banks in the eurozone, Italian lenders account for nearly half of total bad loans. The Italian financial system is on life support right now. More than $400 billion of Italian bank loans are worthless paper. Of course, the first recommendation from elite cronies is a massive bailout. In other words, taxpayers bend over yet again to make sure wealthy bankers and investors are kept whole. But there's one massive problem… The EU passed "bail-in" laws in 2014 that prohibit such a bailout unless the banks' shareholders and junior bondholders are wiped out first. Italian politicians don't like the idea of hitting investors first because that would tick off hundreds of thousands of Italian voters who own those stock and bonds. So they're threatening to flout EU regulations and bailout the banks anyway. And that has Eurocrats in Brussels drinking more than normal at lunchtime… The Beginning of the End?If Italy presses forward with a bailout it would blow up EU banking rules. That would pave the way for other eurozone countries to do the same… undermining the EU's entire banking authority. But is the alternative even worse? If steps aren't taken to shore up Italian banks right away and they fail, a malignant poison will spread like a financial Zika… That's because there's a toxic link between eurozone banks in countries such as Italy, Portugal and Spain and the huge amount of sovereign debt they hold. Standard & Poor’s reports that eurozone bank-owned home country debt is valued at 118% of total capital. In the U.S, domestic banks' equivalent exposure to U.S. Treasurys is only 14% of total capital. Bottom line, Italian banks are leveraged to the hilt with Italian government debt. If Italian banks implode, panicked investors will sell Italian government bonds en masse. That will cause an epic meltdown in the Italian financial system, economy and government. Basically, Italy would financially cease to exist. But the damage won't stop there… Crippling ContagionThe knock on effects to other European banks with exposure to Italian debt would be crippling… French banks own roughly $300 billion of Italian debt. German banks have $100 billion worth of this garbage. And Spanish banks have over $70 billion of worthless notes. What happens to those banks once those losses hit? And what happens to the sovereign debt holdings of French, German and Spanish banks when they start to fail? There will be no stopping the contagion. And that's what has the feckless bureaucrats in Brussels melting down. As trend followers, we won't worry with them. We're positioned to prosper no matter what happens next in the eurozone's financial soap opera. Just know that what happens in Italy in the coming weeks will alter the course of Europe forever. The European Union will never be the same. I can't predict what will happen next. But chaos is the best bet. Stay tuned… Please send me your comments to coveluncensored@agorafinancial.com. Regards, Michael Covel The post Europe's Ticking Time Bomb Is About to Blow appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Turkish Coup was a CIA False Flag Operation Posted: 20 Jul 2016 08:47 AM PDT Turkey's failed coup attempt was a staged operation for Turkish President Recep Tayyip Erdogan to eliminate the opponents of his government, according to an American author and radio host. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Economic Collapse -- Inside Venezuela’s Crisis Posted: 20 Jul 2016 07:31 AM PDT From above, Caracas' skyline still hints at the opulence that once characterised oil-rich Venezuela, but at ground level there's no hiding today's reality: people are queuing all night for food and medicine; inflation is with over 700 percent the highest in the world; and murders and kidnappings... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Economic Troubles - Is Kyle Bass Finally Getting His Revenge? Posted: 20 Jul 2016 07:22 AM PDT One of America's most prominent hedge fund managers is betting the farm that China's economic troubles are far from over. His bet centers around the U.S. dollar and by extension several Asian currencies. What happens to the dollar from here will determine whether this man's epic trading positions pays off, and China suffers a major setback, and whether his worst case scenario for the global economic outlook is merely a mirage. If he's right, the outcome of his bet will also affect the commodities market and perhaps even the equities market. | ||||||||||||||||||||||||||||||||||||||||||||||||||||