Gold World News Flash |

- How Serious Is Sweden's Fight Against Islamic Terrorism And Extremism?

- No Token Solutions Exist – Failure to Create a New Financial System Now Will Mean War

- Jim’s Mailbox

- Politically Incorrect Insights

- BREAKING Donald Trump officially as Republican Party GOP Nominee July 20 1016

- Gold Price Needs to Close above $1,340 to Convince Investors it has Truly Broken out Toward the Heavens

- Prominent Gold Skeptic Willem Buiter Says "Gold Looks Pretty Good"

- WARNING: “Black Swan” Spotted

- Paul Craig Roberts 2016 : Massive Social Instability, Warns Of Economic Collapse

- Paul Craig Roberts : Best Interview Economic Collapse JULY 2016

- Patriots converge on anti-American mob at RNC

- Gold Daily and Silver Weekly Charts - Summer Wind

- BMG commercial exposes weakness of 'paper gold'

- Deleveraging in Motion - Believe It or Not, Our Money Velocity Sucks!

- Waiting on the Euro to Bottom

- SPX Challenges the Upper Trendline

- "OBAMA HAS OFFICERS' BLOOD ON HIS HANDS" • POLICE UNION CHIEF SAYS

- How To Invest In Gold And Have It Pay You Income

- Will Trump Defy The Jewish Lobby?

- There Is Only One Bank That Controls Everything: Jeff Nielson

- The Brightest Comeback of 2016 Starts Here…

- More on the ‘Breadth Thrust’ and Stock Market Internals

- The Broad Market, Helicopters and Gold

- Climbing Gold and Silver’s Wall of Worry

- Ups and Downs in Gold and Crude Oil Price

- Breaking News And Best Of The Web

- Top Ten Videos — July 19

| How Serious Is Sweden's Fight Against Islamic Terrorism And Extremism? Posted: 20 Jul 2016 01:00 AM PDT Submitted by Nima Gholam Ali Pour via The Gatestone Institute,

Like all other European countries, Sweden is trying to fight against jihadists and terrorists, but it often seems as if the key players in Sweden have no understanding of what the threats are or how to deal with them. In 2014, for instance, the Swedish government decided to set up a post called the "National Coordinator Against Violent Extremism." But instead of appointing an expert as the national coordinator, the government appointed the former party leader of the Social Democrats, Mona Sahlin. Apart from Sahlin having a high school degree, she is mostly known for a corruption scandal. As a party leader of the Social Democrats, she lost the 2010 election, and as a minister in several Socialist governments, she has not managed to distinguish herself in any significant way. Göran Persson, who was Prime Minister of Sweden from 1996 to 2006, described Mona Sahlin this way:

With such a background, it was no surprise that she was ineffective as National Coordinator Against Violent Extremism. But the fact that she used her high government agency to help her friends came as a shock to the Swedish public. Sahlin had hired her former bodyguard for a position at her agency and signed a false certificate that he earned $14,000 dollars monthly, so that he could receive financing to purchase a $1.2-million-dollar home. Sahlin also gave the man's relative an internship, even though the application had been declined. Before Sahlin resigned in May 2016, she said, "I help many of my friends." Despite the fact that Sweden has a Ministry of Justice responsible for issues that would seem far more related to violent extremism, Sweden has, for some reason, placed the agency to combat violent extremism under the Ministry of Culture. While the U.S sees the fight against Islamic extremism as a security issue, Sweden evidently believes that combating violent extremism should be placed in a ministry responsible for issues such as media, democracy, human rights and national minorities. With such a delegation of responsibility, the government seems either to be trying to hamper efforts to combat violent extremism, or it does not understand the nature of the threat. The lack of understanding of violent extremism, combined with politicizing the problem, has been evident, for instance, in Malmö, Sweden's third largest city. After the November 2015 terrorist attacks in Paris, the city councilor responsible for safety and security in Malmö, Andreas Schönström, said that European right-wing extremism is a bigger threat than violent Islamism. And on June 5, 2016, Jonas Hult, Malmö's security manager, wrote: "The right-wing forces in Malmö are the biggest threat." With such statements, one would think that perhaps Malmö is a city filled with neo-Nazi gangs. Not so. Malmö is a city that usually ends up in the news because of Islamic anti-Semitism or extremist activists working to destroy Israel. There have been no reports of any neo-Nazi movements in Malmö in the recent past. When supporters of Pegida (an anti-Islamic migration political movement in Europe) came to Malmö, they had to be protected by the police due to thousands of extremist activists and Muslims protesting the presence of Pegida. Of Malmö's residents, 43.2% were either born abroad or their parents were. Further, the Social Democrat politicians have held local municipal power in Malmö since 1919. To say that Malmö is somehow a place where right-wing extremism is a threat is simply not based on facts. Instead of seriously combating violent extremism, many in Sweden have chosen -- possibly imagining it easier -- to politicize the problem. Sweden also has not yet reached the point where the authorities distance themselves from violent extremism. The association Kontrakultur (a cultural and social association in Malmö), receives about $37,000 annually from the municipal cultural committee of Malmö. On its website, Kontrakultur writes that it cooperates with an organization called Förbundet Allt åt alla ("The Association Everything for Everyone"). This organization, in turn, according to the National Coordinator Against Violent Extremism, consists of violent extremist activists. The idea that municipal funds should in no way go to organizations that cooperate with violent extremists is something not yet rooted in Sweden. In June 2016, for example, a 46-year-old Islamic State jihadi arrived in Malmö. He was taken into custody by the police for speedy deportation. But when he applied for asylum, the Swedish Migration Agency took over the matter to examine his asylum application, and ordered the deportation stopped. Inspector Leif Fransson of the border police described the situation:

In August 2015, the Swedish government submitted a document to Parliament outlining the Swedish strategy against terrorism. Among other things, the document stated:

Under the headline "Gender Perspective" in a committee directive from the Swedish government on the mission of the National Coordinator Against Violent Extremism you can observe:

Perhaps the Swedish government has a secret plan to convince jihadists to become feminists? But as usual, Swedish politicians have chosen to politicize the fight against extremism and terrorism, and address the issue as if it were about parental leave instead of Sweden's security.

There is no evidence that "gender perspective" is relevant or useful in the fight against extremism and terrorism, yet we see that the Swedish government, in several documents related to terrorism and extremism, evidently believes that "gender perspective" is what should be used in the fight against those threats. This gives just some idea of how strenuously Sweden wants to disregard the problem, or even ask experts for help. One might argue that this is because Sweden has never been exposed to Islamic terrorism or that extremism is not something that concerns the nation. Sweden has, however, had experience in facing Islamic terrorism. On December 11, 2010, a jihadist blew himself up in central Stockholm. Taimour Abdulwahab did not manage to hurt anyone, but Sweden got a taste of Islamic terrorism and has every reason to want to defend itself against more of it. Islamic extremism is, unfortunately, becoming more widespread, especially in Sweden's major cities. Gothenburg, for example, has been having major problems with it. In November 2015, there were reports that 40% of the 300 Swedish jihadists in Syria and Iraq came from Gothenburg. The only country that has, per capita, more of its citizens as jihadists in Iraq and Syria than Sweden, is Belgium. As facts accumulate, there is much information indicating that Sweden has huge problems dealing with Islamic extremism and jihadism. The Swedish Security Service (Säpo), in the beginning of 2015, published a press release using the words "historic challenge" to describe the threat from violent Islamism. Already in May 2015 the head of Säpo, Anders Thornberg, expressed doubts that the agency could handle the situation if the recruitment of jihadists in Sweden continued or increased. Experts in Sweden's security apparatus have clearly expressed that violent Islamism is a clear and present danger to the security of Sweden, but the politicized debate about Islamic terrorism and extremism does not seem capable of absorbing this warning. This general politicization, combined with the failure to prioritize the fight against terrorism and extremism, is the reason Sweden is, and continues to be, a magnet for extremists and terrorists. Jihadists who come to Sweden know that there are many liberal politicians looking for invisible "right-wing extremists", and that there are feminists who think what is really important is using "gender perspective" in the fight against extremism and terrorism. Jihadists also know that there are large gaps in the Swedish bureaucracy and legislation that can be exploited. These are the policies that have been created by Swedish politicians. One can therefore only question if Sweden seriously wants to fight the threats of terrorism and extremism. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| No Token Solutions Exist – Failure to Create a New Financial System Now Will Mean War Posted: 20 Jul 2016 12:00 AM PDT from LaRouchePAC:

The fact that both the Republican and Democratic parties have placed passage of Glass-Steagall into their electoral platforms has sent Wall Street into conniptions, terrified that, as Barrons reports, “there is an unappreciated risk that Glass-Steagall could be reimposed in 2017 or 2018, regardless of who wins.” The fact is, the momentum for Glass-Steagall is not coming from the already failed candidates, nor from the failed parties they represent, but from a shift in thinking in the population in the direction of the LaRouche movement’s decades long fight for Glass Steagall. The same is true of the release of the 28 pages on the Saudi role in international terrorism, a fight led by the LaRouche movement. The population had been lulled to sleep about the danger of Bush and Obama’s overt support for terrorists to achieve their “regime change” objectives, and also about the reality of the economic disintegration of the entire western financial system under the casino approach to banking. Now that neither can be covered up, the truth is finally in the public eye. As the emergency statement of July 12 by Helga Zepp-Larouche states about the pending collapse of Deutsche Bank, there must be “an immediate reorientation of the bank, back to its tradition which prevailed until 1989 under the leadership of Alfred Herrhausen.” Mrs. LaRouche emphasized Monday that Herrhausen was assassinated in 1989 because he was responding to the unfolding collapse of the Soviet Union with a new policy, based on a higher concept of Man and Mankind’s common aims. He posed an immediate mobilization of the Western economies to launch infrastructure and industrial reconstruction in Poland, and eventually across Eurasia — precisely as Lyndon LaRouche had identified in his famous Kempinsky Hotel press conference in Berlin in October 1988. The British Empire and its satrapies could not tolerate that new paradigm, and with Herrhausen’s elimination, launched the transformation of Europe into a centralized dictatorship under the 1992 Maastricht Treaty, under a banking system which put profit maximization through speculation ahead of human development, while provoking endless wars. That process has now brought the entire system to ruin. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 19 Jul 2016 10:15 PM PDT Jim/Bill, I guess we know what to expect come November. "While there are certain benefits, it sounds better to have a strong dollar than in actuality it is." Says Trump. The $ will not “Trump” our President. But gold will “Trump” everything else. CIGA Wolfgang Rech Why the U.S. Strong-Dollar Policy Is Relic of Long-Gone... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Politically Incorrect Insights Posted: 19 Jul 2016 10:00 PM PDT by Gary Christenson, Deviant Investor:

The US official national debt doubles approximately every eight years. Debt in November 2016 will be about $20 Trillion, and debt in 2040 will grow to about $160 Trillion if the trend from the past 100 years merely continues, instead of accelerates. Unfunded liabilities are much larger than the official debt and will also grow much faster. This suggests the purchasing power of the dollar will accelerate its multi-decade decline. ($100 for a cup of coffee … ?) Social Security payments are funded by contributions (taxes) from current workers. Ponzi scheme payouts are funded by contributions (investments) from current investors. Ponzi schemes are illegal and always fail. What does that suggest regarding Social Security? The crisis of 2008 was mostly about excess unpayable debt and insolvency. The "solution" was more debt – about $70 trillion globally since then. Clearly more debt was not a solution but an "extend and pretend" scam encouraged by the financial elite for their benefit. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING Donald Trump officially as Republican Party GOP Nominee July 20 1016 Posted: 19 Jul 2016 07:30 PM PDT BREAKING Donald Trump @realDonaldTrump officially nominated as Republican Party GOP Presidential candidate July 20 1016 News The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 19 Jul 2016 06:43 PM PDT

'Twas a day of resolution, and a day of irresolution. The resolute US dollar index resolved upwards out of that flat-topped rising triangle. And it did so persuasively, levitating 52 basis points (0.54%) to 97.11, well above the triangle's upper boundary. http://schrts.co/OkJ5UT This rising dollar helps explain gold's timidity today, but I still observe that gold rose in the teeth of a rising dollar. New game, folks. The euro resolved downside out of the even-sided triangle it has been trapped in. Yes, it needs another close below that line, but no doubt you'll see it, soon. http://schrts.co/HcRUv0 Yen jiggled up 0.06% to 94.22. Jiggled. Stumbling trying to fall through the 50 day moving average. Firmly astride the down escalator. As if they didn't even believe their rally themselves, stock indices irresolutely gainsaid each other. The Dow rose 25.96 (0.14%) to 18,559.01 while the S&P500 fell 3.11 (01.4%) to 2,163.78. When markets that ought to speak together in harmony contradict each other, confusion abounds. So also silver & gold acted irresolutely. Gold gained $3.10 (0.2%) to $1,331.50 on Comex, but silver turned the other way, losing 6.9¢ (0.3%) to 1997.5¢. Both metals are trading sideways & directionless on their 5 day charts. Was I therefore wrong yesterday when I pointed out the pennant/flags on their charts? Newp. Flags abide there still, and were not violated or negated today. Start with silver, http://schrts.co/BE3yxz Today the low on the pennant's bottom boundary was 1977¢, & tomorrow will be about 1982¢. Upside cap tomorrow is 2013¢, and Thursday will find silver all the way out in the far nose of the pennant, forcing silver's hand. A close above 2013¢ breaks out of the pennant, but that needs to take place with drama and rise above 2025¢. Tomorrow the bottom line of gold's [presumptive] bullish flag is $1,305, the upper line $1,331. In other words, it might fall as low as $1,305 & rise as high as $1,331 tomorrow without violating or breaking out of that flag. Really gold price needs to close above $1,340 to convince investors it has truly broken out toward the heavens. http://schrts.co/Vbp2I8 Despite today's irresolution, there will be no irresolution when they break out. Up or down, it will be an enthusiastic move. Of course, those flags point to upside breakouts. Gold/silver ratio is a nasty fly in that ointment, however. http://schrts.co/kh9gOy After a long, gappy downward skid, it may be turning up. That doesn't bode well for higher silver & gold prices. So many charts, so many indicators, so many signs -- who can choose? Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prominent Gold Skeptic Willem Buiter Says "Gold Looks Pretty Good" Posted: 19 Jul 2016 04:28 PM PDT Back in November 2014, Willem Buiter, who has so far been wrong in his recent gloomier forecasts about the fallout from the Eurozone mess, or his predictions about a global economy, decided to become a commodity expert and announced that "Gold Is A 6,000 Year Old Bubble." The irony is that while virtually every other asset class in the span of these 6,000 years has risen, risen more, in many cases indeed formed a bubble, burst, fallen, and ultimately turned to dust and forgotten, gold remains and furthermore has seen its value in recent years soar. What is interesting is that almost two years later, Buiter may have realized just that, and in an interview with the Epoch Times' Valentin Schmid, the Citi strategist admits that he "would hold gold" due to the global tidal wave of negative interest rates:

Looks like we have another post-conversion Alan Greenspan on our hands. Here is his full interview, courtesy of the Epoch Times. * * * Citigroup's Willem Buiter Says 'Would Hold Gold' Famous gold skeptic says gold wins against fiat currencies in negative rate environment In the books of most gold lovers, Citigroup's chief economist Willem Buiter is noted down as the man who thinks gold is a "6,000 year bubble." However, in a recent interview with Epoch Times [Skip to 38:00 in the video], he presented a much more nuanced position and said he would even own gold as part of a diversified portfolio of currencies. "It competes with other fiat currencies, the dollar, the yen, the euro. And if these currencies now yield negative interest rates or are at risk of negative yields in the U.K. and the United States, then the currency that at least has a zero interest rate, looks better."

He still maintains that gold is a fiat commodity that has limited intrinsic value because it doesn't have many industrial uses, and only has value because people say so. But he admits this is true of all paper currencies and bitcoin as well and gold may even have an advantage right now. "I will never argue with a six thousand-year-old bubble. So gold, in times of uncertainty and especially in days of uncertainty laced with negative rates looks pretty good," he said.

His definition of a bubble is also interesting and he again includes all fiat currencies in this category.

Citigroup Chief Economist Willem Buiter at an interview with Epoch Times "The fundamental value of an intrinsically valueless good is zero. For every fiat currency if it's value is positive, it's a bubble. There are good bubbles when they are stable. There are bad bubbles when they are exploding upwards and downwards." And he says there is some positive value to having fiat money or gold for transactional purposes. "There is nothing wrong with a bubble. Fiat money as a positive value is a very beneficial bubble. It's much more efficient of course to produce paper money without cost if it can be managed well, rather than the costly way to extract and store gold. But bubbles are the essence of fiat money economies." Maybe what Buiter means is exactly what Scottish economist John Law explained in his work "Money and Trade Considered" in 1705. Instead of calling gold, paper money, or silver a "beneficial bubble" Law simply stated that precious metals (in this case silver) have value because they are the best at being money, not because they are used as a metal in industrial processes. "The additional use [as] money silver was apply'd [sic] to would add to its value, because as money it remedied the disadvantages and inconveniences of barter, and consequently the demand for Silver encreasing [sic], it received an additional value equal to the greater demand its use as money occasioned," writes Law. This is true of gold and paper money as well with the notable difference that paper money gains superior value as money by government decree (fiat) and because people are forced to use it. Gold and silver have been in use as money because of their natural properties (scarcity, malleability, divisibility, and durability). Out of the 118 elements in the periodic table, gold and silver win as monetary instruments according to University College London chemistry professor Andrea Sella. The have just the right degree of scarcity and a low enough melting point to make them into coins he told the BBC. Another advantage: "Gold is unbelievably beautiful." Willem Buiter agrees: "You can't increase [the supply], maybe an advantage for those who like it … It is costly to store and all that but yes, you can put it in your nose and that makes it good." | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 19 Jul 2016 03:09 PM PDT This post WARNING: "Black Swan" Spotted appeared first on Daily Reckoning. God doesn't play dice with the universe, Einstein famously opined. But does He play dice with the stock market? It's Monday, Oct. 19, 1987 — "Black Monday." The stock market plunged a nightmare 22.6%, its largest one-day drop in history. And by all that's holy, it never should have happened. No, not just in the sense that regulators were snoozing at their desks or some gasket blew from poor maintenance. It literally… never should have happened. It was almost statistically impossible. According to one Charlie Bilello, director of research at Pension Partners LLC, that event was such a one-off, such a purple unicorn, it was "simply not ever supposed to happen, in the history of the universe." Flip a coin 1,000 times. It should turn up heads about half the time. If it's heads 537 times, say, it represents a standard deviation from the average. 618 times is another. But what if it's heads 969 times out of 1,000? Then you're in the Twilight Zone. You're so many standard deviations from the average, you may conclude God "loaded the dice," to stick with Einstein. Bilello says the likelihood of even a five-standard deviation event is "essentially zero" on any given day, based upon probability theory. So… if the chance of a five-standard deviation event is "essentially zero," then what in blazes do we make of a 17-standard deviation event? That was Black Monday. Seventeen standard deviations means it never should have happened once in 4.6 billion years. But it did on that October day in 1987. Was God out for mischief that day? Or are markets somehow more susceptible to "black swans" than the laws of chance suggest? Maybe the latter… Again, Bilello: "[Markets] operate in the world of fat tails, exhibiting large skewness… This is a fancy way of saying extreme events (high-standard deviation or "sigma" moves) are much more likely to occur than a normal distribution would predict." Jim Rickards pioneered the study of complexity theory and its applications to markets. His conclusion? Markets are indeed more susceptible to "black swans" as their complexity increases: One formal property of complex systems is that the size of the worst event that can happen is an exponential function of the system scale. This means that when a complex system's scale is doubled, the systemic risk does not double; it may increase by a factor of 10 or more… This kind of sudden, unexpected crash that seems to emerge from nowhere is entirely consistent with the predictions of complexity theory. Increasing market scale correlates with exponentially larger market collapses… As systemic scale is increased by derivatives, systemic risk grows exponentially. Jim points out the skunk in the woodpile: derivatives. Derivatives are securities based on — "derived" from — the value of an underlying asset. A stock option is a derivative, for example, because its value is derived from the underlying stock. They're used to hedge investments or to speculate. When enough of these bets go wrong, the entire financial system can collapse. The outstanding global derivatives market is over $700 trillion — 10 times global GDP. And amazingly, one bank, Deutsche Bank, owns about $75 trillion of those derivatives. That's roughly 13% of all outstanding global derivatives. And Deutsche Bank is in trouble… With its tentacles extended throughout the world like a global grapevine, Deutsche Bank presents "systemic risk." In fact, the IMF declared last month that Deutsche Bank poses the greatest risk to global financial stability. Consider that Lehman Bros. was leveraged 31-to-1 before its 2008 collapse. Deutsche Bank is now leveraged over 40-to-1. TheStreet's Chris Vermeulen warns the next time "could be exponentially larger than Lehman’s." Jim Rickards sees that black swan through his binoculars: "Deutsche Bank is in trouble. They're not quite at the stage where they need to be bailed out yet. But they might be getting uncomfortably close." Derivatives expert Idan Levitov goes so far to call Deutsche Bank a "ticking time bomb": [One] institution that is… a ticking time bomb due to its extreme derivatives exposure is Deutsche Bank. As one of several very large global and systemically important multinational banks, Deutsche Bank's balance sheet has more of what Warren Buffett decried as 'financial weapons of mass destruction' than any other bank on the planet. Meanwhile, the global bond bubble now is a staggering $100 trillion. And over $500 trillion in derivatives trade is based upon bond yields. If that bond bubble bursts…Today the global derivatives market is much larger than it was in 2008. And with Jim Rickards' "complexity multiplier," could it be that the risk is not just higher… but exponentially higher? "Globalization… creates interlocking fragility," says author and statistician Nassim Nicholas Taleb, "while reducing volatility and giving the appearance of stability. In other words, it creates devastating Black Swans. We have never lived before under the threat of a global collapse." Now we do. And thanks to derivatives, the threat looms larger than ever. Below, Jim Rickards shows you why derivatives are "an avalanche waiting to come down." Read on. Regards, Brian Maher Editor's note: Britain's exit from the European Union could trigger a $500 trillion derivatives meltdown, by some estimates. Jim Rickards has warned that the aftereffects of Brexit are still playing out… and that the story is far from over. New data in the past two weeks have confirmed his view. Click here now to see Jim's urgent update. Markets and Black SwansBy Jim RickardsI began studying complexity theory as a consequence of my involvement with Long-Term Capital Management, LTCM, the hedge fund that collapsed in 1998 after derivatives trading strategies went catastrophically wrong. After the collapse and subsequent rescue, I chatted with one of the LTCM partners who ran the firm about what went wrong. I was familiar with markets and trading strategies, but I was not expert in the highly technical applied mathematics that the management committee used to devise its strategies. The partner I was chatting with was a true quant with advanced degrees in mathematics. I asked him how all of our trading strategies could have lost money at the same time, despite the fact that they had been uncorrelated in the past. He shook his head and said, "What happened was just incredible. It was a seven-standard deviation event." In statistics, a standard deviation is symbolized by the Greek letter sigma. Even non-statisticians would understand that a seven-sigma event sounds rare. But, I wanted to know how rare. I consulted some technical sources and discovered that for a daily occurrence, a seven-sigma event would happen less than once every billion years, or less than five times in the history of the planet Earth! I knew that my quant partner had the math right. But it was obvious to me his model must be wrong. Extreme events had occurred in markets in 1987, 1994 and now 1998. They happened every four years or so. Any model that tried to explain an event, as something that happened every billion years could not possibly be the right model for understanding the dynamics of something that occurred every four years. From this encounter, I set out on a ten-year odyssey to discover the proper analytic method for understanding risk in capital markets. I studied, physics, network theory, graph theory, complexity theory, applied mathematics and many other fields that connected in various ways to the actual workings of capital markets. In time, I saw that capital markets were complex systems and that complexity theory, a branch of physics, was the best way to understand and manage risk and to foresee market collapses. I began to lecture and write on the topic including several papers that were published in technical journals. I built systems with partners that used complexity theory and related disciplines to identify geopolitical events in capital markets before those events were known to the public. Finally I received invitations to teach and consult at some of the leading universities and laboratories involved in complexity theory including The Johns Hopkins University, Northwestern University, The Los Alamos National Laboratory, and the Applied Physics Laboratory. In these venues, I continually promoted the idea of inter-disciplinary efforts to solve the deepest mysteries of capital markets. I knew that no one field had all the answers, but a combination of expertise from various fields might produce insights and methods that could advance the art of financial risk management. I proposed that a team consisting of physicists, computer modelers, applied mathematicians, lawyers, economists, sociologists and others could refine the theoretical models that I and others had developed, and could suggest a program of empirical research and experimentation to validate the theory. These proposals were greeted warmly by the scientists with whom I worked, but were rejected and ignored by the economists. Invariably top economists took the view that they had nothing to learn from physics and that the standard economic and finance models were a good explanation of securities prices and capital markets dynamics. Whenever prominent economists were confronted with a "seven-sigma" market event they dismissed it as an "outlier" and tweaked their models slightly without ever recognizing the fact that their models didn't work at all. Physicists had a different problem. They wanted to collaborate on economic problems, but were not financial markets experts themselves. They had spent their careers learning theoretical physics and did not necessarily know more about capital markets than the everyday investor worried about her 401(k) plan. I was an unusual participant in the field. Most of my collaborators were physicists trying to learn capital markets. I was a capital markets expert who had taken the time to learn physics. One of the team leaders at Los Alamos, an MIT-educated computer science engineer named David Izraelevitz, told me in 2009 that I was the only person he knew of with a deep working knowledge of finance and physics combined in a way that might unlock the mysteries of what caused financial markets to collapse. I took this as a great compliment. I knew that a fully-developed and tested theory of financial complexity would take decades to create with contributions from many researchers, but I was gratified to know that I was making a contribution to the field with one foot in the physics lab and one foot planted firmly on Wall Street. My work on this project, and that of others, continues to this day. I think it's important to know that no two crises are ever exactly the same. But we can learn a lot from history, and there are some elements today that do resemble prior crises. Right now today, as we sit here in 2016, the damage of 2008 is still fresh in a lot of people's minds. It was eight years ago but there's nothing like the experience of being wiped out and a lot of people saw their 401(k)s erased. It wasn't just stock prices but real estate, housing, unemployment and students graduating with loans that were not being able to get jobs. There was a lot of trauma and distress. That's still clear in people's minds, even though it was, as I say, eight years ago. But what's going on right now, in my view, more closely resembles that 1997–1998 crisis than it does the one in 2007–2008. Let's skip over the dotcom bubble in 2000 because that was clearly a bubble with an associated market crash but not a severe recession. We had a mild recession around that time, and then of course that played into the volatility due to 9/11. It was painful if you were in some of those dotcom stocks, but that wasn't a real global financial crisis of the kind we saw in 1998 and again in 2008. What was interesting about that time was that the crisis had started over a year earlier — July 1997 in Thailand. It ended up in my lap at LTCM in September 1998 in Greenwich, Connecticut. That was fifteen months later and about halfway around the world. How did a little problem that started in 1997 in Thailand end up in Greenwich, Connecticut fifteen months later as ground zero? The answer is because of contagion. Distress in one area of financial markets spread to other seemingly unrelated areas of financial markets. It's also a good example of how crises take time to play out. I think that's very important because with financial news, the Internet, the web, and Twitter, Instagram, Facebook, chat and email, there's a tendency for people to focus on the instantaneous and ignore trends. In fact, the mathematics of financial contagion are exactly like the mathematics of disease or virus contagion. That's why they call it contagion. One resembles the other in terms of how it's spread. An equilibrium model like Fed uses in its economic forecasting basically says that the world runs like a clock. Every now and then, according to the model, there's some perturbation, and the system gets knocked out of equilibrium. Then, all you do is you apply policy and push it back into equilibrium. It's like winding up the clock again. That's a shorthand way of describing what an equilibrium model is. Unfortunately, that is not the way the world works. Complexity theory and complex dynamics tell us that a system can go into a critical state. I've met any number of governors and senior staff at the Federal Reserve. They're not dopes. A lot of people like to ridicule them and say they're idiots. They're not idiots, though. They've got the 160 IQs and the PhDs. Every year, however, the Fed makes a one-year forward forecast. In 2009 they made a forecast for 2010. In 2010 they made a forecast for 2011 and so on. The Fed has been wrong seven years in a row by orders of magnitude. I just laugh. How many years in a row can you be wrong and still have any credibility? But they're not dopes — they are really smart people. I don't believe they're evil geniuses trying to destroy the world. I think they're dealing in good faith. If they're so smart and they're dealing in good faith, though, how can they be so wrong for so long? The answer is they've got the wrong model. If you've got the wrong model you're going to get the wrong result every single time. The Federal Reserve, policymakers, finance ministers and professors around the world use equilibrium models. But the world is a complex system. What are examples of the complexity? Well, there are lots of them. One of my favorites is what I call the avalanche and the snowflake. It's a metaphor for the way the science actually works but I should be clear, they're not just metaphors. The science, the mathematics and the dynamics are actually the same as those that exist in financial markets. Imagine you're on a mountainside. You can see a snowpack building up on the ridgeline while it continues snowing. You can tell just by looking at the scene that there's danger of an avalanche. It's windswept… it's unstable… and if you're an expert, you know it's going to collapse and kill skiers and wipe out the village below. You see a snowflake fall from the sky onto the snowpack. It disturbs a few other snowflakes that lay there. Then, the snow starts to spread… then it starts to slide… then it gains momentum until, finally, it comes loose and the whole mountain comes down and buries the village. Question: Whom do you blame? Do you blame the snowflake, or do you blame the unstable pack of snow? I say the snowflake's irrelevant. If it wasn't one snowflake that caused the avalanche, it could have been the one before or the one after or the one tomorrow. The instability of the system as a whole was a problem. So when I think about the risks in the financial system, I don't focus on the "snowflake" that will cause problems. The trigger doesn't matter. Once a chain reaction begins it expands exponentially, can "go critical" (as in an atomic bomb) and release enough energy to destroy a city. However, most neutrons do not start nuclear chain reactions just as most snowflakes do not start avalanches. In the end, it's not about the snowflakes or neutrons, it's about the initial critical state conditions that allow the possibility of a chain reaction or avalanche. These can be hypothesized and observed at large scale but the exact moment the chain reaction begins cannot be observed. That's because it happens at a minute scale relative to the system. This is why some people refer to these snowflakes as "black swans", because they are unexpected and come by surprise. But they're actually not a surprise if you understand the system's dynamics and can estimate the system scale. It's a metaphor but really the mathematics behind it are the same. Financial markets today are huge, unstable mountains of snow waiting to collapse. You see it in the gross notional value derivatives. There are $700 trillion worth of swaps. These are derivatives off balance sheets, hidden liabilities in the banking system of the world. These numbers are not made up. Just go to the Bank of International Settlements (BIS) annual report and it's right there in the footnote. Well, how do you put $700 trillion into perspective? It's ten times global GDP. Take all the goods and services in the entire world for an entire year. That's about $70 trillion when you add it all up. Well, take ten times that and that's how big the snow pile is. That's the avalanche that's waiting to come down. Regards, Jim Rickards P.S. It's not just Deutsche Bank that's in trouble. Italian banks are also in crisis after Brexit, and if they fail, the contagion will spread to the rest of Europe, and then far beyond. It could sweep through U.S. markets like wildfire and devastate your portfolio. Brexit might have been the snowflake that starts the avalanche. Don't be a victim. Click here now to learn how my system can let you protect your wealth against what's coming. The post WARNING: "Black Swan" Spotted appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paul Craig Roberts 2016 : Massive Social Instability, Warns Of Economic Collapse Posted: 19 Jul 2016 02:00 PM PDT Dr. Paul Craig Roberts Assistant Secretary of the US Treasury Dr. ... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paul Craig Roberts : Best Interview Economic Collapse JULY 2016 Posted: 19 Jul 2016 01:39 PM PDT Dr. Paul Craig Roberts Assistant Secretary of the US Treasury Dr. ... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Patriots converge on anti-American mob at RNC Posted: 19 Jul 2016 01:30 PM PDT If those protestors changed their riot creed from kill whitey and the cops to Delete the elite we white people would join them The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Summer Wind Posted: 19 Jul 2016 01:25 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| BMG commercial exposes weakness of 'paper gold' Posted: 19 Jul 2016 11:30 AM PDT 2:28p ET Tuesday, July 19, 2016 Dear Friend of GATA and Gold: In the end it's a commercial for gold dealer Bullion Management Group in Canada, but getting there is half the fun as it makes the point that "paper gold" really isn't gold at all. "In case of fire," the commercial asks, "which would you rather have -- a fire extinguisher or a picture of one?" The commercial is 3 minutes and 48 seconds long and it's posted at YouTube here: https://www.youtube.com/watch?v=3vAGG6ghUvA CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Camino Minerals Options the Los Chapitos Project in Peru Company Announcement VANCOUVER, British Columbia, Canada -- Camino Minerals Corp. (COR:TSX-V) announces the signing of the final agreement with Minas Andinas SA, pursuant to which Camino can acquire through a wholly owned subsidiary, Camino Resources SAC, a 100-percent interest in the Los Chapitos project. The property has been expanded by the company and now consists of 10 claims, totaling 12,300 acres and is located 15 kilometers north of the coastal city of Chala, Department of Arequipa, Peru. Los Chapitos is located in the Peruvian iron oxide copper-gold belt and hosts two mineralized trends. On the western side of the property, small-scale mining was active in the 1940s and '50s that produced high-grade copper oxide mineralization from the Atajo zone. These historical surface workings define a strike length of at least 400 meters. The company completed two chip sample lines across the middle of the zone that returned a length weighted average of 2.10 percent copper and 9.4 grams-per-tonne silver over 38 meters, and 1.57 percent copper and 3.5 grams per tonne silver across 64 meters. The Atajo zone is open along strike and at depth. ... ... For the remainder of the announcement: http://finance.yahoo.com/news/camino-minerals-signs-agreement-option-100... Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deleveraging in Motion - Believe It or Not, Our Money Velocity Sucks! Posted: 19 Jul 2016 10:02 AM PDT Dr. Lacy Hunt has been featured more than any outside speaker at our IES conferences. Why? Because he’s the only classical economist I fully admire and he is a successful bond investment manager in the real world that understands the trend towards deflation, despite unprecedented money-printing. I love the gold bugs for being realistic and honest about the debt and financial asset bubble we’re in, especially when most mainstream economists and analysts are blind to it. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 19 Jul 2016 09:40 AM PDT I’m just waiting for the euro to confirm a final intermediate cycle bottom. It’s now very late in the timing band at 33 weeks. So the bottom could occur at any time. My best guess is the euro will bottom and the dollar will top on, or the day before, the FOMC meeting next week. The intermediate trend line has been broken. This needs to happen during cycle lows to get technical traders on the wrong side of the market. We are waiting for the trend line to break in gold. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SPX Challenges the Upper Trendline Posted: 19 Jul 2016 09:37 AM PDT SPX appears to have made its high on Friday at 2169.05, 17.2 days from its June 27 low. This morning, the Premarket is challenging the upper trendline of the Orthodox Broadening Top at 2160.00. Once a reversal beneath the trendline is evident, I will comment on what may be expected next. ZeroHedge reports, “After a head-scratching S&P500 rally - which not even Goldman has been able to justify - pushed stocks to new all time highs with seemingly daily record highs regardless of fundamentals or geopolitical troubles, overnight US equity futures dipped modestly, tracking weak European stocks as demand for safe haven assets including U.S. Treasuries and gold rises. Asian stocks outside Japan fall. Crude oil trades near $45 a barrel. “ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| "OBAMA HAS OFFICERS' BLOOD ON HIS HANDS" • POLICE UNION CHIEF SAYS Posted: 19 Jul 2016 08:30 AM PDT "OBAMA HAS OFFICERS' BLOOD ON HIS HANDS" • POLICE UNION CHIEF SAYS The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

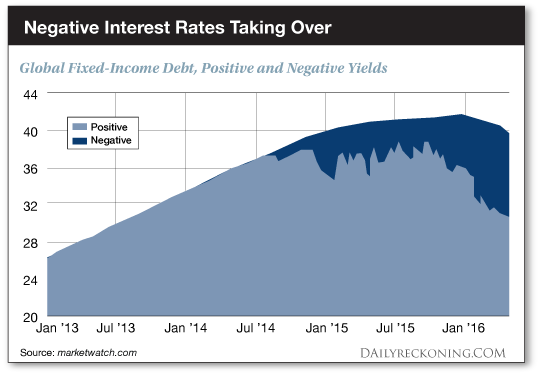

| How To Invest In Gold And Have It Pay You Income Posted: 19 Jul 2016 08:00 AM PDT This post How To Invest In Gold And Have It Pay You Income appeared first on Daily Reckoning. Since early 2016, gold has been one of the hottest-performing commodities in the market. Gold is up nearly 25% year to date, and the reasons why should not be a surprise. But before I get into the bullish case for gold, I must make one thing clear. Longtime readers know that I am no basement-dwelling gold bug. I don't hide bars in my backyard waiting for the Apocalypse, and I don't consider gold a good long-term investment. Simply put, when it comes to investing, I look for well-run companies and nice fat dividends. That's where physical gold falls short. It doesn't pay a dividend. I do, however, find one subniche in gold to be a great way to make short- and medium-term profits. And in a moment, I'll share the details. But before we get to that, I want to make sure you're caught up to speed on the basic case for gold. Most investors are familiar with the basic arguments for gold — it serves as an inflation and currency hedge, performs well in low-interest environments and is a store of value in times of uncertainty. Right now, all of these factors are at play, creating an incredibly bullish environment for the Midas metal. One of the largest drivers for gold is that negative interest rates have become the go-to policy for countries around the world. Japan, Switzerland, Sweden and Denmark are just a few of the countries issuing debt that require the lender to pay interest. It's a backward concept, but these negative interest rates are causing investors to flock from government bonds into hard assets such as gold. Why buy a bond and lose principal to begin with or store money in a bank account and pay interest on your deposit when you can buy gold and maintain your wealth? The amount of negative-yielding assets has grown exponentially since 2014. Right now, close to a quarter of all the fixed-income assets in the world have a negative yield. Just check out the chart below!

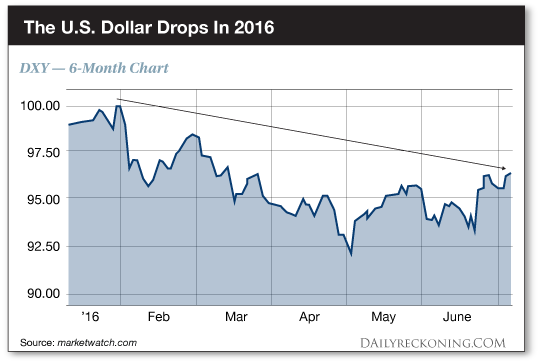

When looking at the increase in negative yield assets, it is no wonder hard assets have seen such a spike in demand. Now you might be thinking…Why didn't gold rise in 2014 or 2015, when negative rates started becoming the norm? Well, there is another factor we need to bring in here — the value of the U.S. dollar. When the dollar is strong, gold is weak. In 2014 and 2015, the dollar became strong. This acted against the price of gold, even though negative interest rates were becoming popular. It wasn't until 2016, when the dollar became weaker, that gold started to gain value.

When the dollar began to fall, investors started scooping up gold. With added uncertainties from the global economy, such as the Brexit and other tensions between countries, investors began looking for safety by purchasing precious metals. It is always important to remember the many forces working on the price of gold. Right now, the biggest factors are the following:

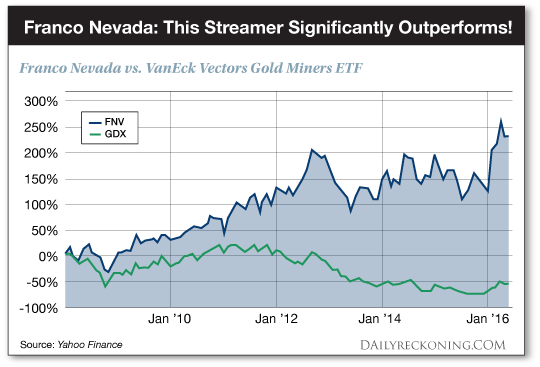

Even though gold has been one of the hottest commodities in 2016, I believe there is further room for growth considering all of the uncertainties in the world economy. Here is my favorite way to get exposure to gold while earning an income payment on the side! How to Play the Modern-Day Gold Rush — and Get Paid! The best way to gain exposure to gold is not by holding gold bars or bullion but rather by purchasing this unique type of company that specializes in precious metals. If you are thinking of gold miners, you are on the right track, but this type of company is better, and I'll show you why! There is a little-known way that gold mining companies raise money without contacting banks, venture capitalists or other big-name miners. They are a special type of company that gives miners the money they need in return for a large percentage of the gold they excavate from the ground. These types of companies are some of the most profitable businesses you can invest in because of the way they keep costs low while receiving precious metals at an extremely discounted rate. They are called "streaming" companies (or said another way, these are precious metal royalty plays). And over the past few years, they gave investors decent returns even while the price of gold was down. The secret behind streaming companies is they merely finance the miners and do not take on any operational risks associated with mining. They don't worry about environmental permits or disasters, purchase new bulldozers or tend to faulty blasting situations. They are simply a front office with a few desks that collect receipts for the mine's haul for the day. Streaming companies are a great investment for individual investors interested in precious metals because of their low risk profile and ability to generate returns even if the price of the underlying asset begins to fall. Say you are interested in a certain mine because you have reason to believe there are large deposits in the ground. This particular mine is owned by Barrick Gold but was financed by a streamer. When it comes time to invest, you can put your money in Barrick OR you can invest in the streaming company that provided the funding for Barrick to start the mine. No matter which company you choose, you will see returns associated from the mine you are interested in. However, the streamer makes the better choice for a couple of reasons. The biggest benefit in buying the streamer is that you are protected in case Barrick files for bankruptcy. Remember, the streaming company provided the funding for Barrick in terms of debt, which means that the streamer is first in line for any collateral in case of bankruptcy. As a shareholder of the streaming company, the collateral from Barrick's bankruptcy would contribute to the bottom line of the streaming company's financial statements. On the other hand, if you owned shares of Barrick, you would most likely lose all of your money. You can see why streaming companies are so valuable! Here's My Favorite Streaming Play Right Now One of the best streaming companies out there is Franco Nevada Corp. (NYSE: FNV), based out of Toronto, Canada. Their portfolio consists of approximately 340 properties in various stages of development — from exploration to production. This includes geologists searching for the best places to mine, the construction of the mine itself and actual excavation. Compared with the biggest-name gold miners in the world, Franco Nevada has significantly outperformed even when the price of gold was on a steady decline. Take a look at the chart below.

As you can see, Franco Nevada was not affected by the fall in the price of gold that started in 2011, like the other major miners were. The VanEck Vectors Gold Miners ETF is a collection of the largest gold mining companies in the world, and their trend represents the typical pattern for big-name companies such as Barrick Gold and Goldcorp. An investment in Franco Nevada during that time would not only have saved you from losing money but would have also brought significant returns. Again, this is due to the streaming business model. While most miners are currently posting negative returns and margins, Franco Nevada remains profitable for shareholders. They are a $13.3 billion company with little debt and only 29 full-time employees — a handful of geologists, financial analysts and a management team. With low operational costs, Franco Nevada makes a great choice for investing in gold. Best of all, they pay a 1.31% dividend! Whether or not gold rises in value, streaming companies make a great investment if you want exposure to precious metals. Their low-cost business model and access to cheap precious metals make them extremely profitable and allow for the redistribution of cash to shareholders — all while appreciating in value! If you are keen on gold, this is my favorite way to play it. It's a nice way to get exposure to gold and get paid at the same time! Here's to growing your income, Zach Scheidt The post How To Invest In Gold And Have It Pay You Income appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will Trump Defy The Jewish Lobby? Posted: 19 Jul 2016 08:00 AM PDT "Once we squeeze all we can out of the United States it can dry up and blow away."-Benjamin Nathan Yahu said upon leaving U.S. double agent Johnathan Pollards Jail cell. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| There Is Only One Bank That Controls Everything: Jeff Nielson Posted: 19 Jul 2016 07:34 AM PDT Today's Guest: Jeff Nielson Websites: Bullion Bulls Canada The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

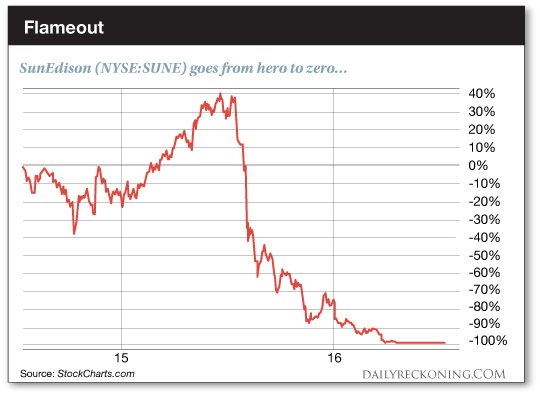

| The Brightest Comeback of 2016 Starts Here… Posted: 19 Jul 2016 06:58 AM PDT This post The Brightest Comeback of 2016 Starts Here… appeared first on Daily Reckoning. Sometimes, all it takes for a group of stocks to blow up is some ill-timed news during a market correction. That's exactly what happened to the solar industry earlier this year. But solar's not all doom and gloom. In fact, we're beginning to see some signs of a comeback that could net you quick gains of 20% or more. More on this opportunity in just a minute. Let me get you up to speed… Solar stocks were humming along in January. While the major averages were tanking, stocks like First Solar Inc. (NASDAQ:FSLR) were quickly approaching 3-year highs. But the party didn't last long. Just a few weeks into the new year, a little solar company called SunEdison (NYSE:SUNE) crashed the party. SUNE was a hedge fund favorite in 2015. But it all came crashing down a few months ago… A dustup between SUNE and solar panel installer Vivint Solar (NYSE:VSLR) got the ball rolling. A $2.2 billion deal where SunEdison agreed to acquire Vivint fell through and folks started questioning the company's financial health. VSLR tanked 20% on the news. And SunEdison was soon fighting for its life as shares dropped below $2. SUNE declared bankruptcy just a few short weeks later. A massive $11 billion debt load effectively caused the collapse of the world's largest renewable energy firm. In less than one year, SunEdison went from one of the best investments in the space to a complete disaster…

In the blink of an eye, SunEdison helped dismantle any hint of strength in solar stocks. During the SUNE debacle, you were better off owning just about anything else on the market. But there's also the brighter side of the solar story. "The U.S. solar industry installed a record 7.3 Gigawatts (GW) of solar photovoltaic in 2015, and that volume is poised to grow 119% in 2016, with installations projected to reach 16 GW," MarketWatch reports. "China added 7.1 GW of new solar capacity in the first quarter of 2016 alone." That's a lot of solar panels… No, solar power isn't going anywhere. The dark clouds are clearing—and the best companies in the solar sector are shaping up in a hurry. Take SolarCity, for example. Earlier this year, the company won a contract from Whole Foods to retrofit up to 100 stores with rooftop solar. The solar systems are expected to make Whole Foods one of the top 25 U.S. solar customers, according to CNBC. Even with Elon Musk trying to orchestrate Tesla's bid to acquire his solar venture behind the scenes, the stock is carving out a nice bottom. SolarCity isn't the only stock in the industry that's beginning to look interesting. Industry stalwart First Solar Inc. (NASDAQ:FSLR) is currently down 27% year-to-date. But it also looks like its bottoming out and readying for a comeback move. It's not perfect. But if FSLR can find a little momentum here, it could easily jet back toward its 2016 highs. Everyone pounded the solar "sell" button earlier this year. With a several constructive charts and some positive news events, there are plenty of tailwinds in place to get these stocks moving in the right direction once again. Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post The Brightest Comeback of 2016 Starts Here… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| More on the ‘Breadth Thrust’ and Stock Market Internals Posted: 19 Jul 2016 03:09 AM PDT NFTRH 404 deviated from the usual format of widespread, in-depth coverage of US and global markets, precious metals and commodities in order to focus on two main themes. One was a view of building short-term risks in the gold market [possibly pending new rally highs] and the other of a developing bullish phase in the US stock market. We reproduce part of that segment here… | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Broad Market, Helicopters and Gold Posted: 19 Jul 2016 03:00 AM PDT The Gold Report | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Climbing Gold and Silver’s Wall of Worry Posted: 19 Jul 2016 01:37 AM PDT Confidence is slippery, even when you are a metals investor sitting atop the best performing assets of 2016. It doesn’t help when 4 years of a miserable bear market remains fresh in our memories. Any weakness in prices and it can feel like markets are getting ready to plunge right back to $13 silver and $1,000 gold. That feeling is called the “Wall of Worry”, and bulls are going to have to climb it by staying in the market even if their emotions are telling them to bail. Let’s review the last 6 weeks because they are quite instructional. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ups and Downs in Gold and Crude Oil Price Posted: 19 Jul 2016 01:32 AM PDT Technical analyst Jack Chan charts a major buy signal in oil and a possible correction in gold. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 18 Jul 2016 06:44 PM PDT Helicopter money is coming. Attempted coup fails in Turkey. Stocks recover on promise of massive new stimulus from Japan and UK and suspiciously good growth numbers from US and China. Gold corrects and interest rates rise. Banks report pretty good earnings, trucking firms and oil companies not so much. Another big terrorist attack in France […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 18 Jul 2016 05:15 PM PDT Chaos coming, with Venezuela the template for much of the rest of the world. Silver will soar. The story of debt and the market’s flawed premise. The FBI rolls over for Hillary. Nigel Farage says goodbye; the EU says good riddance. The post Top Ten Videos — July 19 appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The European leadership is panicked about the rapid collapse of the banking system. Italy is blaming Germany and Deutsche Bank, Germany is blaming Italy, while Wall Street complains about the Europeans undermining the fake “recovery.” This is dangerous and psychotic nonsense. We are experiencing the breakdown of the entire trans-Atlantic banking system, not just some part of it, and no solution exists outside of the immediate creation of laws in Europe and the US to facilitate a new, Hamiltonian financial and economic order. The $2 quadrillion in derivative gambling debt must be written off, and the commercial banking system recapitalized to do its legitimate job, directing credit into reconstructing the world economy.

The European leadership is panicked about the rapid collapse of the banking system. Italy is blaming Germany and Deutsche Bank, Germany is blaming Italy, while Wall Street complains about the Europeans undermining the fake “recovery.” This is dangerous and psychotic nonsense. We are experiencing the breakdown of the entire trans-Atlantic banking system, not just some part of it, and no solution exists outside of the immediate creation of laws in Europe and the US to facilitate a new, Hamiltonian financial and economic order. The $2 quadrillion in derivative gambling debt must be written off, and the commercial banking system recapitalized to do its legitimate job, directing credit into reconstructing the world economy.

No comments:

Post a Comment